App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

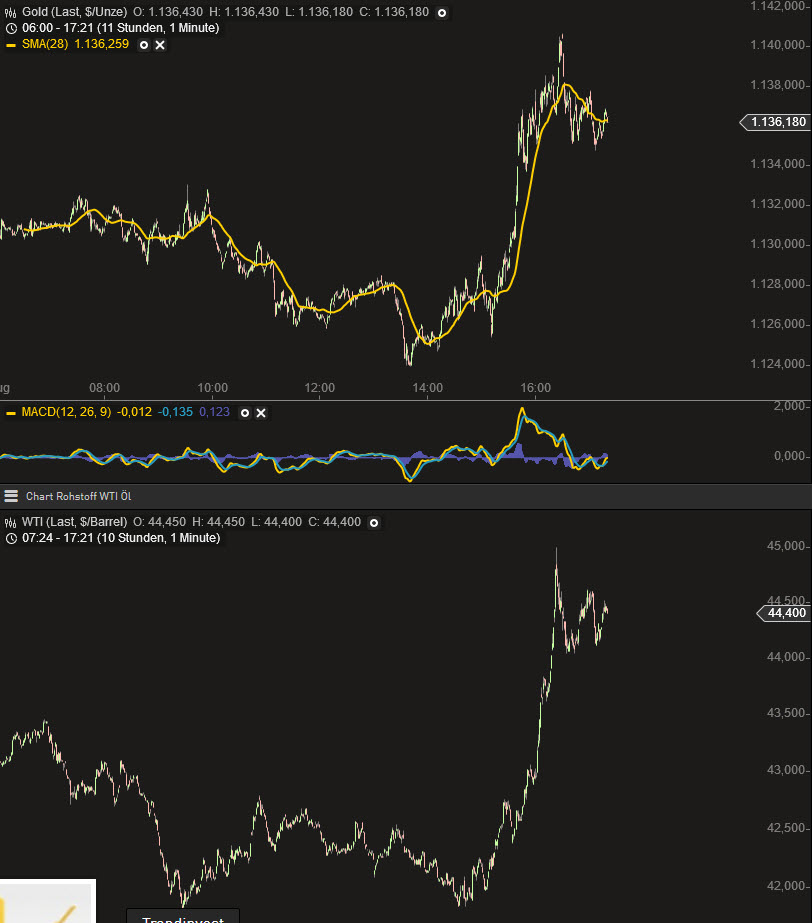

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

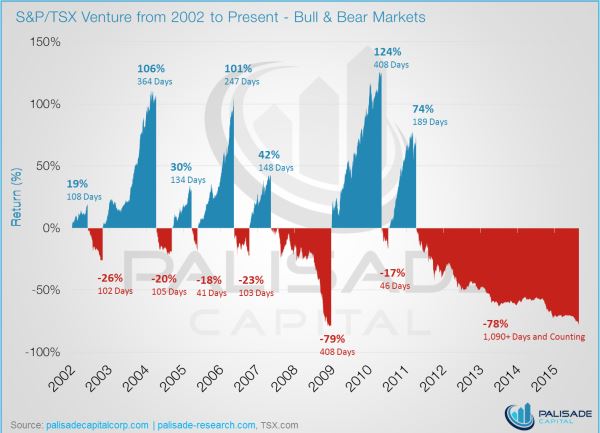

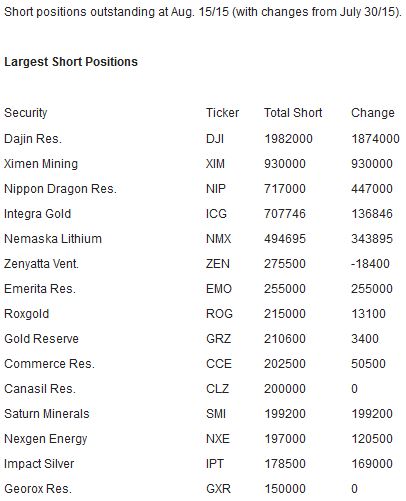

Wenn Öl steigt = steigt Gold

Oder wie war das noch ?!

Oder wie war das noch ?!

[url=http://peketec.de/trading/viewtopic.php?p=1618480#1618480 schrieb:dukezero schrieb am 27.08.2015, 14:33 Uhr[/url]"]Der kleine Ausflug beim Gold hat sich erledigt!

Was sind heutzutage noch Regeln?

Solange die Notenbanken überall eingreifen....

Grosse Mengen an Aktien, die der Staat in China gekauft hat um die Kurse zu stabilisieren. Ist doch alles nur noch Manipulation, hilft nur wie Duke schon immer sagte, auf der Welle mitschwimmen, Long lohnt nicht mehr.

Solange die Notenbanken überall eingreifen....

Grosse Mengen an Aktien, die der Staat in China gekauft hat um die Kurse zu stabilisieren. Ist doch alles nur noch Manipulation, hilft nur wie Duke schon immer sagte, auf der Welle mitschwimmen, Long lohnt nicht mehr.

[url=http://peketec.de/trading/viewtopic.php?p=1618532#1618532 schrieb:Kostolanys Erbe schrieb am 27.08.2015, 16:39 Uhr[/url]"]Wenn Öl steigt = steigt Gold

Oder wie war das noch ?!

[url=http://peketec.de/trading/viewtopic.php?p=1618480#1618480 schrieb:dukezero schrieb am 27.08.2015, 14:33 Uhr[/url]"]Der kleine Ausflug beim Gold hat sich erledigt!

Öl wird auf sehr lange Sicht nicht steigen! Die Kostenstruktur hat sich aufgrund neuer Techniken nach unten revidiert! WTI Öl über 44.03 in einer interessanten Range! Wenn Gold dann nicht zieht, dann war´s das!

[url=http://peketec.de/trading/viewtopic.php?p=1618532#1618532 schrieb:Kostolanys Erbe schrieb am 27.08.2015, 16:39 Uhr[/url]"]Wenn Öl steigt = steigt Gold

Oder wie war das noch ?!

[url=http://peketec.de/trading/viewtopic.php?p=1618480#1618480 schrieb:dukezero schrieb am 27.08.2015, 14:33 Uhr[/url]"]Der kleine Ausflug beim Gold hat sich erledigt!

Graphite Update: Kibaran, Magnis, Syrah, Focus And Stratmin

Summary

Growth in the use of lithium ion batteries, driven partly by increased production of electric vehicles will increase demand for the materials used in battery manufacturing.

Graphite is currently the preferred material for the anode of the li-ion battery and demand for graphite is forecast to increase significantly in the next decade.

China supplies about 70% of the world's graphite, but Chinese supplies are limited, and other sources will be needed if the growth in li-ion battery use follows the forecasts.

In a previous article I looked at some of the junior mining companies that were more likely to provide that new supply.

This article provides an update on some of the recent developments in the industry.

New supplies of graphite will have to be brought on line to meet the growing demand for lithium ion batteries.

A previous article evaluated some of the junior miners who could become suppliers of graphite.This current article provides an update to some of the developments in the graphite mining sector. Readers should refer to the previous article and previous update for more details.

Investors should be aware that many of these companies have market caps below $100 million, and share prices of less than $1. Investments in junior miners can be rewarding, but is highly speculative.

For the Australin based companies, it is best to use the ASX, where trading volumes are reasonable, rather than the US based OTC boards.

Kibaran Resources

Australian based Kibaran Resources recently issued the results of their Bankable Feasibility Study for the Epanko graphite project in Tanzania.

Estimated capital costs for the 40,000 tpa mine and processing plant are $77.5 million, an increase of about 30% from the figure published in the scoping study. Operating costs are estimated at $570/tonne FOB port of Dar es Salaam, versus $489/tonne in the scoping study.

The bankable feasibility used slightly higher graphite prices, primarily driven by higher grades and larger particle size assumptions resulting from ongoing process test-work. The estimated Net Present Value (NPV10) of the project is $197 million (compared to previous estimates of $213 million).

Kibaran has its mining permit in place, and has take-off agreements for 75% of its proposed annual production, including a binding agreement for 10,000 tpa with an un-named European graphite trader, and recently announced an off-take agreement for 20,000 tpa with German conglomerate Thyssen-Krupp who will market the graphite in Korea, Russia and Europe.Thyssen-Krupp is also assisting the company in their efforts to obtain funding for the project.

Kibaran's graphite is very high quality, with a high proportion of large and jumbo flake sizes and a purity that meets or exceeds typical specifications. Tests have indicated that the graphite has superior expansion qualities, and can be upgraded to 99.98% purity with a simple one-step process. It is therefore suitable for both the expandable graphite and the li-ion battery market, two of the fastest growing sectors of the overall graphite market.

A scoping study, published one day before the bankable feasibility study, evaluated the option of upgrading the graphite to produce value added products including battery grade spheroidized graphite. This study estimated a capital cost of $35 million for the upgrading plant, with a pre-tax NPV10 of $115 million and IRR of 51%. Annual production would initially be 6,000 tonnes of battery grade spherical graphite, 5,000 tonnes of expandable graphite and 4,000 tonnes of other purified products. The assumed blended selling price used in the study was $2,550/tonne, and production costs were estimated at $1,350/tonne. The assumed selling price for a 99.98% purity product, including spheroidized battery grade graphite is conservative when compared to studies done by other companies. Zenyatta (OTCQX:ZENYF), for example, has assumed a blended selling price of $7,500/tonne for a product of similar purity.

Kibaran's market cap of $AUS 31 million ($US 22.5 million) is only 11% of the estimated net present value of the Epanko project, and only 7% of the net present value if the upgrading plant is added. This ratio is significantly lower than its peer companies on the Australian exchange (Magnis, Syrah and Triton), who are also developing graphite projects in Africa. Kibaran is proposing a relatively small initial production rate compared to the others, and has negotiated its take-off agreements with European rather than Chinese companies, both factors which I consider positive.

Given the advanced state of the project, the take-off agreements, the high quality product and the low market cap compared to the value of the project, Kibaran should be considered a speculative buy at the current price of $AUS 0.17.

Syrah Resources (OTCPK:SYAAF)

Syrah Resources recently issued a scoping study for the construction of a plant in the USA to produce 25,000 tpa of coated, spherical graphite for the lithium ion battery industry. The obvious target for the product is the Tesla (NASDAQ:TSLA) giga-factory under construction in Nevada. When it reaches full production the Tesla factory is expected to use upwards of 50,000 tpa of battery grade spherical graphite.

Tesla has stated that they intend to source raw materials locally where possible, and there are no producers of battery grade natural graphite in North America. This has led some analysts to conclude that several new graphite mines will be required to supply the Tesla factory. However, this speculation may prove to be false. Tesla car batteries now use synthetic graphite, and may continue to do so, even though natural graphite is a cheaper alternative.

Using raw materials from its Balama graphite project in Mozambique, Syrah estimates that the capital cost of a plant to produce coated, spherical graphite in the USA would be $80 million, and the estimated free cash flow from the operation would be $104 million/year. That equates to an IRR before tax of 130% and an NPV of about $700 million, which at first glance seems like an incredibly good investment. The drawback of course is that outside of Tesla, there is no significant demand for battery grade graphite in the USA.

Most battery makers in Japan and Korea typically buy uncoated spherical graphite from China, and use their own proprietary coating processes. There is very little trade in coated spherical graphite, and the assumed selling price of $7,000/tonne may not hold up in a market that is based on open competition with multiple suppliers. The US based coated spherical graphite plant should be looked on as a future opportunity, but it adds little value without some kind of sales agreement to back it up.

Syrah also announced a share offering to both institutional and retail investors, with the intent of raising $AUS211 million to finance the development of the Balama graphite project. As of August 21st, the institutional component of the offer had raised $AUS166 million, the retail offer closes August 26th

Syrah will very likely be the first of major graphite mines to enter production, but one key question remains to be answered. The proposed annual capacity of the Balama plant is 370,000 tonnes per year which is about 60% of the total world graphite supply and almost 100% of the world's flake graphite supply. Selling 370,000 tonnes per year into the traditional graphite markets is obviously not a viable plan, even allowing for reductions in Chinese supplies and high growth in li-ion battery use.

Presentation materials prepared for the capital raising provide a partial answer to their intent. About 220,000 tonnes per year is targeted to be sold to the iron and steel industry as a recarburizer, where it will compete with calcined petroleum coke as the material of choice. That market is over 3 million tonnes per year. An MOU with European trader Asmelt for 100 to 150,000 tonnes per year is key to that market penetration. An announcement of successful completion of test-work, and conversion of that MOU into a binding agreement is likely to give the share price a boost. However, if that doesn't happen, doubts about the potential volume of sales may well create significant headwinds.

Stratmin Global Resources

Stratmin Global Resources has been struggling for some time to achieve the design production rates and graphite quality at their Loharno graphite mine in Madagascar. The mine and processing plant was built on a shoestring budget, and mistakes were made in the initial design which have proven difficult to remedy.

Stratmin recently teamed up with Indian graphite supplier, Tirupati Carbon and Chemicals, who have provided technical expertise to the project. Production was recently reported to be up to 900 kg/hr, equivalent to about 7,500 tonnes per year. Although not likely to have much of an impact on the graphite market, that level of production will be enough to provide a positive cash flow and a chance to expand in the future using cash flow from the existing operation.

I would not invest in Stratmin until they demonstrate that they can produce the design volumes and quantities at the Loharno mine. However, I am keeping it on my watch list, with an intent to invest when I see proof that they have overcome the technical problems at Loharno.

Focus Graphite (OTCQX:FCSMF)

Focus recently parted company with CEO, Don Baxter, and replaced him with Gary Economo who is also CEO of affiliate company Graphoid. This move was followed by an announcement of two non-binding off-take agreements between Focus and Graphoid for a total of up to 26,000 tonnes per year of production.

I don't think anyone was fooled by this ploy. Focus has been trying desperately to raise financing for the Lac-Knife project since issuing their feasibility study over a year ago. Signing a non-binding agreement with an affiliated company that has no meaningful revenue, and may or may not have a use for the materials is not likely to make any impact with prospective investors.

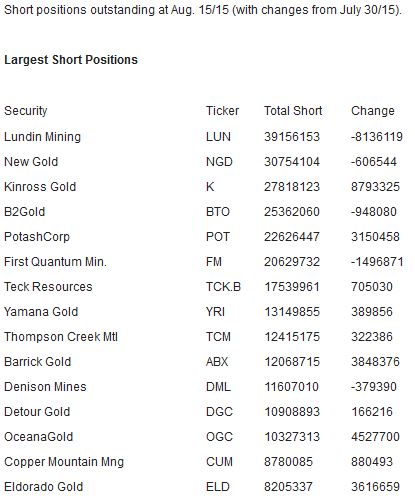

Focus' problems illustrate the difficulty of financing projects on the TSX at the moment. They have a viable graphite deposit, with an acceptable rate of return and a product which is at the high end of the quality spectrum. However, there is simply no money available to advance the project, and all the company can do is raise small amounts of cash to keep itself alive, hoping for a turn-around in fortunes.

I would steer clear of all of the TSX listed graphite juniors, for the same reason.

Magnis Resources (OTC:URNXF)

In a previous article I recommended Magnis Resources as one the better investments in the graphite space. On July 22nd, a positive report in Australian Financial Review generated some interest in the company and the share price has since more than doubled on higher than average volume.

Magnis has also recently achieved up to 99.2% graphite purity in a flotation concentrate, without any chemical upgrading. This means they will be able to produce graphite for higher priced, high purity applications at very low cost.

However, the recent increases in Magnis' stock price has raised its market cap to over $US100 million, and the shares could be significantly diluted in the future by the exercise of a huge number of outstanding 10 cent options.

In view of the recent price increases, I am reducing my holding in Magnis, and using the proceeds to invest in Kibaran.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Summary

Growth in the use of lithium ion batteries, driven partly by increased production of electric vehicles will increase demand for the materials used in battery manufacturing.

Graphite is currently the preferred material for the anode of the li-ion battery and demand for graphite is forecast to increase significantly in the next decade.

China supplies about 70% of the world's graphite, but Chinese supplies are limited, and other sources will be needed if the growth in li-ion battery use follows the forecasts.

In a previous article I looked at some of the junior mining companies that were more likely to provide that new supply.

This article provides an update on some of the recent developments in the industry.

New supplies of graphite will have to be brought on line to meet the growing demand for lithium ion batteries.

A previous article evaluated some of the junior miners who could become suppliers of graphite.This current article provides an update to some of the developments in the graphite mining sector. Readers should refer to the previous article and previous update for more details.

Investors should be aware that many of these companies have market caps below $100 million, and share prices of less than $1. Investments in junior miners can be rewarding, but is highly speculative.

For the Australin based companies, it is best to use the ASX, where trading volumes are reasonable, rather than the US based OTC boards.

Kibaran Resources

Australian based Kibaran Resources recently issued the results of their Bankable Feasibility Study for the Epanko graphite project in Tanzania.

Estimated capital costs for the 40,000 tpa mine and processing plant are $77.5 million, an increase of about 30% from the figure published in the scoping study. Operating costs are estimated at $570/tonne FOB port of Dar es Salaam, versus $489/tonne in the scoping study.

The bankable feasibility used slightly higher graphite prices, primarily driven by higher grades and larger particle size assumptions resulting from ongoing process test-work. The estimated Net Present Value (NPV10) of the project is $197 million (compared to previous estimates of $213 million).

Kibaran has its mining permit in place, and has take-off agreements for 75% of its proposed annual production, including a binding agreement for 10,000 tpa with an un-named European graphite trader, and recently announced an off-take agreement for 20,000 tpa with German conglomerate Thyssen-Krupp who will market the graphite in Korea, Russia and Europe.Thyssen-Krupp is also assisting the company in their efforts to obtain funding for the project.

Kibaran's graphite is very high quality, with a high proportion of large and jumbo flake sizes and a purity that meets or exceeds typical specifications. Tests have indicated that the graphite has superior expansion qualities, and can be upgraded to 99.98% purity with a simple one-step process. It is therefore suitable for both the expandable graphite and the li-ion battery market, two of the fastest growing sectors of the overall graphite market.

A scoping study, published one day before the bankable feasibility study, evaluated the option of upgrading the graphite to produce value added products including battery grade spheroidized graphite. This study estimated a capital cost of $35 million for the upgrading plant, with a pre-tax NPV10 of $115 million and IRR of 51%. Annual production would initially be 6,000 tonnes of battery grade spherical graphite, 5,000 tonnes of expandable graphite and 4,000 tonnes of other purified products. The assumed blended selling price used in the study was $2,550/tonne, and production costs were estimated at $1,350/tonne. The assumed selling price for a 99.98% purity product, including spheroidized battery grade graphite is conservative when compared to studies done by other companies. Zenyatta (OTCQX:ZENYF), for example, has assumed a blended selling price of $7,500/tonne for a product of similar purity.

Kibaran's market cap of $AUS 31 million ($US 22.5 million) is only 11% of the estimated net present value of the Epanko project, and only 7% of the net present value if the upgrading plant is added. This ratio is significantly lower than its peer companies on the Australian exchange (Magnis, Syrah and Triton), who are also developing graphite projects in Africa. Kibaran is proposing a relatively small initial production rate compared to the others, and has negotiated its take-off agreements with European rather than Chinese companies, both factors which I consider positive.

Given the advanced state of the project, the take-off agreements, the high quality product and the low market cap compared to the value of the project, Kibaran should be considered a speculative buy at the current price of $AUS 0.17.

Syrah Resources (OTCPK:SYAAF)

Syrah Resources recently issued a scoping study for the construction of a plant in the USA to produce 25,000 tpa of coated, spherical graphite for the lithium ion battery industry. The obvious target for the product is the Tesla (NASDAQ:TSLA) giga-factory under construction in Nevada. When it reaches full production the Tesla factory is expected to use upwards of 50,000 tpa of battery grade spherical graphite.

Tesla has stated that they intend to source raw materials locally where possible, and there are no producers of battery grade natural graphite in North America. This has led some analysts to conclude that several new graphite mines will be required to supply the Tesla factory. However, this speculation may prove to be false. Tesla car batteries now use synthetic graphite, and may continue to do so, even though natural graphite is a cheaper alternative.

Using raw materials from its Balama graphite project in Mozambique, Syrah estimates that the capital cost of a plant to produce coated, spherical graphite in the USA would be $80 million, and the estimated free cash flow from the operation would be $104 million/year. That equates to an IRR before tax of 130% and an NPV of about $700 million, which at first glance seems like an incredibly good investment. The drawback of course is that outside of Tesla, there is no significant demand for battery grade graphite in the USA.

Most battery makers in Japan and Korea typically buy uncoated spherical graphite from China, and use their own proprietary coating processes. There is very little trade in coated spherical graphite, and the assumed selling price of $7,000/tonne may not hold up in a market that is based on open competition with multiple suppliers. The US based coated spherical graphite plant should be looked on as a future opportunity, but it adds little value without some kind of sales agreement to back it up.

Syrah also announced a share offering to both institutional and retail investors, with the intent of raising $AUS211 million to finance the development of the Balama graphite project. As of August 21st, the institutional component of the offer had raised $AUS166 million, the retail offer closes August 26th

Syrah will very likely be the first of major graphite mines to enter production, but one key question remains to be answered. The proposed annual capacity of the Balama plant is 370,000 tonnes per year which is about 60% of the total world graphite supply and almost 100% of the world's flake graphite supply. Selling 370,000 tonnes per year into the traditional graphite markets is obviously not a viable plan, even allowing for reductions in Chinese supplies and high growth in li-ion battery use.

Presentation materials prepared for the capital raising provide a partial answer to their intent. About 220,000 tonnes per year is targeted to be sold to the iron and steel industry as a recarburizer, where it will compete with calcined petroleum coke as the material of choice. That market is over 3 million tonnes per year. An MOU with European trader Asmelt for 100 to 150,000 tonnes per year is key to that market penetration. An announcement of successful completion of test-work, and conversion of that MOU into a binding agreement is likely to give the share price a boost. However, if that doesn't happen, doubts about the potential volume of sales may well create significant headwinds.

Stratmin Global Resources

Stratmin Global Resources has been struggling for some time to achieve the design production rates and graphite quality at their Loharno graphite mine in Madagascar. The mine and processing plant was built on a shoestring budget, and mistakes were made in the initial design which have proven difficult to remedy.

Stratmin recently teamed up with Indian graphite supplier, Tirupati Carbon and Chemicals, who have provided technical expertise to the project. Production was recently reported to be up to 900 kg/hr, equivalent to about 7,500 tonnes per year. Although not likely to have much of an impact on the graphite market, that level of production will be enough to provide a positive cash flow and a chance to expand in the future using cash flow from the existing operation.

I would not invest in Stratmin until they demonstrate that they can produce the design volumes and quantities at the Loharno mine. However, I am keeping it on my watch list, with an intent to invest when I see proof that they have overcome the technical problems at Loharno.

Focus Graphite (OTCQX:FCSMF)

Focus recently parted company with CEO, Don Baxter, and replaced him with Gary Economo who is also CEO of affiliate company Graphoid. This move was followed by an announcement of two non-binding off-take agreements between Focus and Graphoid for a total of up to 26,000 tonnes per year of production.

I don't think anyone was fooled by this ploy. Focus has been trying desperately to raise financing for the Lac-Knife project since issuing their feasibility study over a year ago. Signing a non-binding agreement with an affiliated company that has no meaningful revenue, and may or may not have a use for the materials is not likely to make any impact with prospective investors.

Focus' problems illustrate the difficulty of financing projects on the TSX at the moment. They have a viable graphite deposit, with an acceptable rate of return and a product which is at the high end of the quality spectrum. However, there is simply no money available to advance the project, and all the company can do is raise small amounts of cash to keep itself alive, hoping for a turn-around in fortunes.

I would steer clear of all of the TSX listed graphite juniors, for the same reason.

Magnis Resources (OTC:URNXF)

In a previous article I recommended Magnis Resources as one the better investments in the graphite space. On July 22nd, a positive report in Australian Financial Review generated some interest in the company and the share price has since more than doubled on higher than average volume.

Magnis has also recently achieved up to 99.2% graphite purity in a flotation concentrate, without any chemical upgrading. This means they will be able to produce graphite for higher priced, high purity applications at very low cost.

However, the recent increases in Magnis' stock price has raised its market cap to over $US100 million, and the shares could be significantly diluted in the future by the exercise of a huge number of outstanding 10 cent options.

In view of the recent price increases, I am reducing my holding in Magnis, and using the proceeds to invest in Kibaran.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Santacruz Silver loses $2.01-million (U.S.) in Q2

2015-08-27 07:06 ET - News Release

Mr. Arturo Prestamo reports

SANTACRUZ SILVER REPORTS SECOND QUARTER 2015 FINANCIAL RESULTS

Santacruz Silver Mining Ltd. has released its financial and operating results for the second quarter of 2015. The full version of the financial statements and accompanying management discussion and analysis can be viewed on the company's website or on SEDAR. All financial information is prepared in accordance with international financial reporting standards, and all dollar amounts are expressed in United States dollars unless otherwise indicated.

Second-quarter highlights:

Silver equivalent payable ounces sold of 247,135;

Revenues of $3.15-million;

Gross profit from mining operations of $130,000;

Cash flow from mining operations of $680,000;

Cash operating cost per silver equivalent ounce sold of $13.01 per ounce;

All-in sustaining cash cost per AgEq ounce sold of $16.86;

Average realized silver price per ounce of $17.00 per ounce from price protection program.

"During the second quarter, the Rosario mine made a solid comeback in terms of operational performance. Head grades are much improved at close to 322 g/t silver equivalent, largely as the result of well-managed dilution control. These improvements, in addition to other cost-control initiatives, have brought our costs down 18 per cent to AISC $16.86 per ounce silver equivalent when compared to the previous full quarter of operations," said Arturo Prestamo, president and chief executive officer. "In addition, we have also identified further cost saving measures that should begin to be reflected in Q3 as we transition from the temporary geo-textile tailings containment system to a permanent dry-stack tailings system that is now fully operational. I am very pleased that we were able to make this significant step forward, especially in these difficult times. Management is committed to working toward more cost control and production efficiencies on a daily basis."

Second-quarter 2015 financial summary (second-quarter 2015 compared with second-quarter 2014)

HIGHLIGHTS

(in thousands of U.S. dollars except per-share amounts)

Q2 2015 Q4 2014

Revenue $3,147 $3,226

Mine operating income (loss) $127 $(292)

Cash flow from mining operations $680 $(12)

Income from price protection program $306 -

Net (loss)* $(2,018) $(4,498)

Basic (loss) per share $(0.02) $(0.04)

* Includes depreciation and amortization of $555,000 and

$282,000 in second-quarter 2015 and fourth-quarter 2014

respectively.

Second-quarter 2015 mine operations summary (second-quarter 2015 compared with fourth-quarter 2014)

HIGHLIGHTS

Q2 2015 Q4 2014

Ore processed (tonnes milled) 26,492 25,099

Silver equivalent production (ounces) (1) 258,089 244,200

Silver equivalent sold (payable ounces) (2) 247,135 263,300

Cash cost per silver equivalent sold ($/oz) (3) $13.01 $15.08

Production cost ($/tonne) (3) $87.23 $116.50

All-in sustaining cost per silver equivalent sold ($/oz) (3) $16.86 $20.68

Average realized silver price ($/oz) (3) $17.00 $16.15

1.Silver equivalent ounces produced for fourth-quarter 2014 are calculated using prices of $20.00 (U.S.) per ounce, $1,250 (U.S.) per ounce, 96 U.S. cents per pound and $90 (U.S.) per pound for silver, gold, lead and zinc, respectively, applied to the recovered metal contained in the lead and zinc concentrates produced at the Rosario mine.

2.Silver equivalent ounces sold in second-quarter 2015 and fourth-quarter 2014 were calculated using realized silver prices of $17.00 (U.S.) per ounce and $16.15 (U.S.) per ounce, respectively, applied to the payable metal content of the lead and zinc concentrates sold from the Rosario mine.

3. The company reports non-IFRS measures. which include cash cost per silver equivalent, production cost, all-in sustaining cost per silver equivalent and average realized silver price. These measures are widely used in the mining industry as a benchmark for performance, but do not have a standardized meaning and may differ from methods used by other companies with similar descriptions.

Operational review

During the second quarter of 2015 the average mill production was 325 tonnes per day. The mill facility capacity is now 450 tonnes per day, which will be increased to 700 tonnes per day after some modest equipment additions and adjustments are made. The Rosario mine is scheduled to produce at a rate of between 400 tonnes per day to 450 tonnes per day, with the head grade averaging above 300 g/t silver equivalent. The improved dilution control resulting in the higher head grade should continue to reduce costs at the Rosario mine. During the second quarter, the company executed an infill drilling campaign of approximately 6,000 metres to better delineate its mining plan for the next 18 months. Throughout the remainder of this year, no additional drilling is planned (once assay results are completed, these will be announced). In addition, the company is investigating the opportunity to acquire third party ore to maximize the underutilized Rosario mill capacity.

The company also announces the resignation of its chief operating officer, Robert Byrd, as he has made the decision to retire. Mr. Byrd will remain as a consultant for the company. The company wishes to thank Mr. Byrd for his contributions during his time with Santacruz. The company has named Cesar Maldonado as its chief operating officer. Mr. Maldonado has more than 30 years experience in the industry and has been with the company for the last three months. Previously, Mr. Maldonado worked for First Majestic Silver Corp. and Minera Frisco SA de CV. Mr. Maldonado has an engineering degree in mining and metallurgy with studies in minerals economics from the University of Chihuahua.

Qualified person

All technical information that is included in this statement has been reviewed and approved by Donald Hulse, PE, of Gustavson Associates LLC. Mr. Hulse is independent of the company and a qualified person, pursuant to the meaning of such terms in National Instrument 43-101 -- Standards of Disclosure for Mineral Projects.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aSCZ-2306086&symbol=SCZ®ion=C

2015-08-27 07:06 ET - News Release

Mr. Arturo Prestamo reports

SANTACRUZ SILVER REPORTS SECOND QUARTER 2015 FINANCIAL RESULTS

Santacruz Silver Mining Ltd. has released its financial and operating results for the second quarter of 2015. The full version of the financial statements and accompanying management discussion and analysis can be viewed on the company's website or on SEDAR. All financial information is prepared in accordance with international financial reporting standards, and all dollar amounts are expressed in United States dollars unless otherwise indicated.

Second-quarter highlights:

Silver equivalent payable ounces sold of 247,135;

Revenues of $3.15-million;

Gross profit from mining operations of $130,000;

Cash flow from mining operations of $680,000;

Cash operating cost per silver equivalent ounce sold of $13.01 per ounce;

All-in sustaining cash cost per AgEq ounce sold of $16.86;

Average realized silver price per ounce of $17.00 per ounce from price protection program.

"During the second quarter, the Rosario mine made a solid comeback in terms of operational performance. Head grades are much improved at close to 322 g/t silver equivalent, largely as the result of well-managed dilution control. These improvements, in addition to other cost-control initiatives, have brought our costs down 18 per cent to AISC $16.86 per ounce silver equivalent when compared to the previous full quarter of operations," said Arturo Prestamo, president and chief executive officer. "In addition, we have also identified further cost saving measures that should begin to be reflected in Q3 as we transition from the temporary geo-textile tailings containment system to a permanent dry-stack tailings system that is now fully operational. I am very pleased that we were able to make this significant step forward, especially in these difficult times. Management is committed to working toward more cost control and production efficiencies on a daily basis."

Second-quarter 2015 financial summary (second-quarter 2015 compared with second-quarter 2014)

HIGHLIGHTS

(in thousands of U.S. dollars except per-share amounts)

Q2 2015 Q4 2014

Revenue $3,147 $3,226

Mine operating income (loss) $127 $(292)

Cash flow from mining operations $680 $(12)

Income from price protection program $306 -

Net (loss)* $(2,018) $(4,498)

Basic (loss) per share $(0.02) $(0.04)

* Includes depreciation and amortization of $555,000 and

$282,000 in second-quarter 2015 and fourth-quarter 2014

respectively.

Second-quarter 2015 mine operations summary (second-quarter 2015 compared with fourth-quarter 2014)

HIGHLIGHTS

Q2 2015 Q4 2014

Ore processed (tonnes milled) 26,492 25,099

Silver equivalent production (ounces) (1) 258,089 244,200

Silver equivalent sold (payable ounces) (2) 247,135 263,300

Cash cost per silver equivalent sold ($/oz) (3) $13.01 $15.08

Production cost ($/tonne) (3) $87.23 $116.50

All-in sustaining cost per silver equivalent sold ($/oz) (3) $16.86 $20.68

Average realized silver price ($/oz) (3) $17.00 $16.15

1.Silver equivalent ounces produced for fourth-quarter 2014 are calculated using prices of $20.00 (U.S.) per ounce, $1,250 (U.S.) per ounce, 96 U.S. cents per pound and $90 (U.S.) per pound for silver, gold, lead and zinc, respectively, applied to the recovered metal contained in the lead and zinc concentrates produced at the Rosario mine.

2.Silver equivalent ounces sold in second-quarter 2015 and fourth-quarter 2014 were calculated using realized silver prices of $17.00 (U.S.) per ounce and $16.15 (U.S.) per ounce, respectively, applied to the payable metal content of the lead and zinc concentrates sold from the Rosario mine.

3. The company reports non-IFRS measures. which include cash cost per silver equivalent, production cost, all-in sustaining cost per silver equivalent and average realized silver price. These measures are widely used in the mining industry as a benchmark for performance, but do not have a standardized meaning and may differ from methods used by other companies with similar descriptions.

Operational review

During the second quarter of 2015 the average mill production was 325 tonnes per day. The mill facility capacity is now 450 tonnes per day, which will be increased to 700 tonnes per day after some modest equipment additions and adjustments are made. The Rosario mine is scheduled to produce at a rate of between 400 tonnes per day to 450 tonnes per day, with the head grade averaging above 300 g/t silver equivalent. The improved dilution control resulting in the higher head grade should continue to reduce costs at the Rosario mine. During the second quarter, the company executed an infill drilling campaign of approximately 6,000 metres to better delineate its mining plan for the next 18 months. Throughout the remainder of this year, no additional drilling is planned (once assay results are completed, these will be announced). In addition, the company is investigating the opportunity to acquire third party ore to maximize the underutilized Rosario mill capacity.

The company also announces the resignation of its chief operating officer, Robert Byrd, as he has made the decision to retire. Mr. Byrd will remain as a consultant for the company. The company wishes to thank Mr. Byrd for his contributions during his time with Santacruz. The company has named Cesar Maldonado as its chief operating officer. Mr. Maldonado has more than 30 years experience in the industry and has been with the company for the last three months. Previously, Mr. Maldonado worked for First Majestic Silver Corp. and Minera Frisco SA de CV. Mr. Maldonado has an engineering degree in mining and metallurgy with studies in minerals economics from the University of Chihuahua.

Qualified person

All technical information that is included in this statement has been reviewed and approved by Donald Hulse, PE, of Gustavson Associates LLC. Mr. Hulse is independent of the company and a qualified person, pursuant to the meaning of such terms in National Instrument 43-101 -- Standards of Disclosure for Mineral Projects.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aSCZ-2306086&symbol=SCZ®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Scheinchen CW2T7E klebt wieder am Lapi...

NFLX könnte charttechnisch um die 117-120 US$ die rechte Schulter einer SKS Formation ausbilden....?! Beobachten !!!

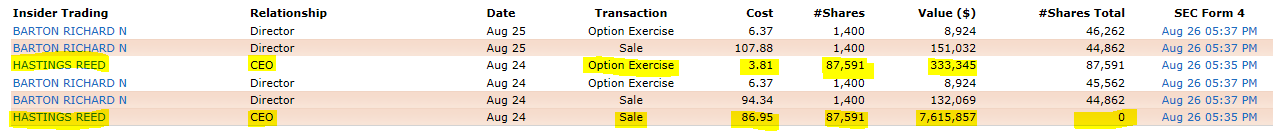

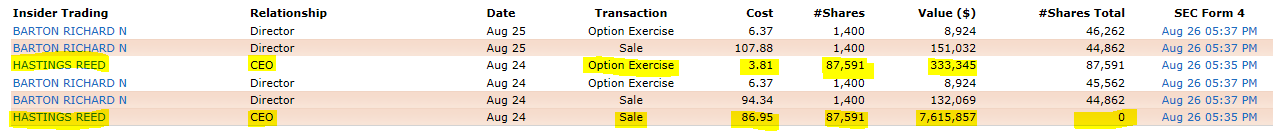

CEO hat schnell noch mal schön abgesahnt und seine Aktienoptionen versilbert...

und hält aktuell nicht mal eine Aktie seines Unternehmens !!!Ganz schön traurig... Wieviel Optionen er noch einlösen kann, weiss ich nicht...

NFLX könnte charttechnisch um die 117-120 US$ die rechte Schulter einer SKS Formation ausbilden....?! Beobachten !!!

CEO hat schnell noch mal schön abgesahnt und seine Aktienoptionen versilbert...

und hält aktuell nicht mal eine Aktie seines Unternehmens !!!Ganz schön traurig... Wieviel Optionen er noch einlösen kann, weiss ich nicht...

[url=http://peketec.de/trading/viewtopic.php?p=1617276#1617276 schrieb:Kostolanys Erbe schrieb am 24.08.2015, 21:16 Uhr[/url]"]@Olli

[url=http://peketec.de/trading/viewtopic.php?p=1616804#1616804 schrieb:Ollinho schrieb am 24.08.2015, 10:24 Uhr[/url]"]GW Kosto!!

[url=http://peketec.de/trading/viewtopic.php?p=1616774#1616774 schrieb:Kostolanys Erbe schrieb am 24.08.2015, 09:40 Uhr[/url]"]Verkauf zu 0,92 € !!!

Börse heisst spekulieren und auch mal Gewinne mitnehmen!

Bin heute Abend mal auf die letzte Handelsstunde in USA gespannt...

[url=http://peketec.de/trading/viewtopic.php?p=1616461#1616461 schrieb:Kostolanys Erbe schrieb am 21.08.2015, 21:30 Uhr[/url]"]Danke @Olli

Scheinchen aktuell bei 0,72 €

https://www.boerse-stuttgart.de/de/boersenportal/wertpapiere-und-maerkte/hebelprodukte/optionsscheine/factsheet/?ID_NOTATION=137310115

NFLX aktuell die 50-Tage-Linie nach unten durchbrochen

Immer noch viel Speck drauf...

Und so langsam werden die die auf Margin debts zocken

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1616040#1616040 schrieb:Ollinho schrieb am 20.08.2015, 22:22 Uhr[/url]"]Sauber Kosto!!!

[url=http://peketec.de/trading/viewtopic.php?p=1616023#1616023 schrieb:Kostolanys Erbe schrieb am 20.08.2015, 21:50 Uhr[/url]"]Mal sehen, ob morgen die Leute Angst haben um ihre Gewinne und der Trend nach unten durchbrochen wird...

200-Tage-Linie bei ca. 75 $ !!!

Scheinchen steht aktuell bei 0,57 €

https://www.boerse-stuttgart.de/de/boersenportal/wertpapiere-und-maerkte/hebelprodukte/optionsscheine/factsheet/?ID_NOTATION=137310115

» zur Grafik

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1615368#1615368 schrieb:Kostolanys Erbe schrieb am 19.08.2015, 11:01 Uhr[/url]"]Kleine Put Speku-Posi CW2T7E zu 0,43€ genommen.

[url=http://peketec.de/trading/viewtopic.php?p=1615208#1615208 schrieb:Kostolanys Erbe schrieb am 18.08.2015, 22:40 Uhr[/url]"]Mich reizt ja irgendwie als Gapi-Freak ein Put (normalen OS / Kein Knock-out-Scheinchen in dieser Situation); Bewertung ist echt krass, irgendwann werden auch mal die von NFLX evtl. ein Quartal enttäuschen

» zur Grafik

Na endlich mal wieder ein Erfolgserlebnis

[url=http://peketec.de/trading/viewtopic.php?p=1615310#1615310 schrieb:Rookie schrieb am 19.08.2015, 09:21 Uhr[/url]"]Pure Energy (PE, TSX-V) conducted a conference call this morning that just concluded within the last 45 minutes or so…it was extremely informative – we suggest investors who may have missed the live call check out the recorded version the company said it will be posting on its website…

Pure Energy has a fabulous zip code – Nevada – to evolve into an important, low-cost North American Lithium brine producer in a highly favorable, friendly jurisdiction where the company is getting strong support from the state government…recently, PE released a NI-43-101 inferred Lithium resource for its Clayton Valley Project…an updated resource estimate could come prior to year-end, and initial work has also commenced on a Preliminary Economic Assessment…recent company visits to Asia and Israel have further demonstrated intense interest in the project as stated in the conference call this morning…

The Clayton Valley Project has an exciting technology component to it in terms of the potential extraction process, a technology that has been developed by a major player…

Pure Energy is also aiming attract a strategic partner and secure a supply agreement that it believes is technically and commercially feasible (keep in mind, Western Lithium reached a $100 million market cap without a supply agreement)…

From a market standpoint, this morning’s call noted the company’s recent increased exposure for Pure Energy in the U.S. due to its OTCQC listing…

Technically, PE showed strong support as expected in the mid-to-upper 30’s recently after retreating from Fib. resistance at 47 cents…it’s unchanged at 39 cents as of 10:35 am Pacific…

[url=http://peketec.de/trading/viewtopic.php?p=1615190#1615190 schrieb:Rookie schrieb am 18.08.2015, 21:32 Uhr[/url]"]http://www.wallstreet-online.de/nachricht/7885734-lithium-boom-kalifornien-verbietet-verbrennungsmotoren

Super Rookie!! Klasse!!

[url=http://peketec.de/trading/viewtopic.php?p=1618957#1618957 schrieb:Rookie schrieb am 28.08.2015, 17:32 Uhr[/url]"]Na endlich mal wieder ein Erfolgserlebnis

» zur Grafik

Jetzt müssen nur noch Cyprium und Inca mal anspringen, bei beiden diese Woche zugeschlagen

[url=http://peketec.de/trading/viewtopic.php?p=1618961#1618961 schrieb:Ollinho schrieb am 28.08.2015, 17:34 Uhr[/url]"]Super Rookie!! Klasse!!

[url=http://peketec.de/trading/viewtopic.php?p=1618957#1618957 schrieb:Rookie schrieb am 28.08.2015, 17:32 Uhr[/url]"]Na endlich mal wieder ein Erfolgserlebnis

» zur Grafik

und raus zu 2,88 CAD[url=http://peketec.de/trading/viewtopic.php?p=1618259#1618259 schrieb:600 schrieb am 26.08.2015, 21:477 Uhr[/url]"]CNL long 2,48

schöne Aktie zum Traden

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Erst mal Richtung Widerstand 50$

[url=http://peketec.de/trading/viewtopic.php?p=1618953#1618953 schrieb:dukezero schrieb am 28.08.2015, 17:24 Uhr[/url]"]» zur Grafik

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Ein Insider freut`s...

Aug 24/15 Aug 21/15 Brown, William Richard Direct Ownership Common Shares 10 - Disposition in the public market -60,000 $0.130

Aug 20/15 Aug 20/15 Brown, William Richard Direct Ownership Common Shares 10 - Disposition in the public market -80,000 $0.100

Mar 24/15 Mar 23/15 Brown, William Richard Direct Ownership Common Shares 10 - Acquisition in the public market 200,000 $0.045 -

https://canadianinsider.com/company?menu_tickersearch=agc#sthash.XYLXA8TS.dpuf

Aug 24/15 Aug 21/15 Brown, William Richard Direct Ownership Common Shares 10 - Disposition in the public market -60,000 $0.130

Aug 20/15 Aug 20/15 Brown, William Richard Direct Ownership Common Shares 10 - Disposition in the public market -80,000 $0.100

Mar 24/15 Mar 23/15 Brown, William Richard Direct Ownership Common Shares 10 - Acquisition in the public market 200,000 $0.045 -

https://canadianinsider.com/company?menu_tickersearch=agc#sthash.XYLXA8TS.dpuf

[url=http://peketec.de/trading/viewtopic.php?p=1616165#1616165 schrieb:Rookie schrieb am 21.08.2015, 09:19 Uhr[/url]"]http://gebert-trade.weebly.com/info.html

BAGGER GOLDSTOCK OF THE WEEK

Amarillo Gold

Location : Brazil

Market cap : 2,7 MIO Euro

Resources : appoximately 2 MIO ounces Gold

Potential : 100 Bagger at Gold 3000 Dollar, 1000 Bagger at Gold 6000 Dollar

Website : http://www.amarillogold.com/

Chart : https://www.boerse-stuttgart.de/de/Amarillo-Gold-Aktie-CA02301T1084

[url=http://peketec.de/trading/viewtopic.php?p=1616047#1616047 schrieb:

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Und das ohne Glaskugel...

Leider ein Aufwärts-Gap gerissen...von daher ist evtl. mit einem einem weiteren Test der 5$ Marke zu rechnen...und dann sehen wir evtl. um die 5$ Marke die W-Formation!

Leider ein Aufwärts-Gap gerissen...von daher ist evtl. mit einem einem weiteren Test der 5$ Marke zu rechnen...und dann sehen wir evtl. um die 5$ Marke die W-Formation!

[url=http://peketec.de/trading/viewtopic.php?p=1614163#1614163 schrieb:Kostolanys Erbe schrieb am 14.08.2015, 01:19 Uhr[/url]"]PBR Gap-Close von April 2015 nun im August und auf der Unterstützungslinie bei 6 $.

Bei weiter schwächeren Ölpreis könnte ein doppelter Test der 5 $ Marke in Betracht kommen.

» zur Grafik

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Focus Graphite arranges $2-million private placement

2015-08-28 16:32 ET - News Release

Mr. Gary Economo reports

FOCUS GRAPHITE ANNOUNCES NON BROKERED OFFERING AND CLOSES FIRST TRANCHE

Focus Graphite Inc. has closed the first tranche of a non-brokered private placement for gross proceeds of $429,829. The company has issued 3,306,381 units at a price of 13 cents per unit, each unit comprising one common share of the company and one common share purchase warrant, each warrant entitling the holder thereof to acquire one additional common share of the company at a price of 17 cents per share until Aug. 28, 2019.

In connection with the closing of the first tranche of the offering, the company paid cash finders' fees totalling $34,386 and issued 264,510 non-transferable warrants, each warrant entitling the holder to acquire one common share of the company at a price of 17 cents per common share until Aug. 28, 2017.

The securities issued in connection with the closing of the first tranche of the offering are subject to a four-month hold period expiring on Dec. 29, 2015. The company expects to proceed shortly with the closing of a second tranche for total gross proceeds (including the first tranche) of up to $2-million (15,384,616 units). The offering is subject to the final approval of the TSX Venture Exchange.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:FMS-2307232&symbol=FMS®ion=C

2015-08-28 16:32 ET - News Release

Mr. Gary Economo reports

FOCUS GRAPHITE ANNOUNCES NON BROKERED OFFERING AND CLOSES FIRST TRANCHE

Focus Graphite Inc. has closed the first tranche of a non-brokered private placement for gross proceeds of $429,829. The company has issued 3,306,381 units at a price of 13 cents per unit, each unit comprising one common share of the company and one common share purchase warrant, each warrant entitling the holder thereof to acquire one additional common share of the company at a price of 17 cents per share until Aug. 28, 2019.

In connection with the closing of the first tranche of the offering, the company paid cash finders' fees totalling $34,386 and issued 264,510 non-transferable warrants, each warrant entitling the holder to acquire one common share of the company at a price of 17 cents per common share until Aug. 28, 2017.

The securities issued in connection with the closing of the first tranche of the offering are subject to a four-month hold period expiring on Dec. 29, 2015. The company expects to proceed shortly with the closing of a second tranche for total gross proceeds (including the first tranche) of up to $2-million (15,384,616 units). The offering is subject to the final approval of the TSX Venture Exchange.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:FMS-2307232&symbol=FMS®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Ohne Worte...würde mich nicht wundern, wenn da bald ein Übernahmeangebot kommt...

[url=http://peketec.de/trading/viewtopic.php?p=1608158#1608158 schrieb:Kostolanys Erbe schrieb am 27.07.2015, 20:36 Uhr[/url]"]Wenn ich mir die Entwicklung bei T:ME - MONETA PORCUPINE anschaue, dann habe ich das Gefühl, das sich im Hintergrund etwas tut. Die ganze Zeit verlieren alle Juniors zig% am Tag die letzten Wochen außer Moneta.

Weiß jemand genaueres oder Kontakt zum Management?

Inca One:

The insider sale was a gypsy swap

August 29, 2015

Inca One Gold’s (IO.V) share price got hammered in the past week after some trigger-happy hands sold a lot of stock on the back of new insider filings showing the main C-level executives of Inca One had sold in excess of a million shares.

However, there was no net sale of any stock. What happened was that some investors wanted to take a sizeable position in the company at 15 cents but were unable to do so on the open market. In such cases a private placement is the best solution to accommodate such investors, but some funds are unable to purchase securities with a mandatory 4 month hold period. A very common solution in this situation is the company sourcing and providing a block of free-trading shares to those investors, whilst the sellers of that block will participate in the private placement to obtain a zero net effect.

In Inca One’s case, it was the management team which provided the large block of freely tradeable shares to those (European) investors, and the market mistakenly seems to have interpreted this as Inca One’s management team selling out by dumping their stock. Meanwhile, Inca One has closed a private placement, raising C$600,000 at C$0.15 per share, and according to the most recent insider filings, Inca One’s management team has indeed reinvested the funds from selling the freely tradeable stock into the placement. CEO Edward Kelly bought 1.47 million shares, COO George Moen bought 799,200 shares and Vice President Mark Wright bought 342,000 shares, for a total of 2.611M shares and C$400,000. (see Canadian Insider)

As you notice, there has been NO net selling by the insiders. On top of that, they didn’t give themselves a ‘sweet deal’, as the placement was priced at C$0.15 without any warrants at all, so self-enrichment definitely wasn’t the case here, and the only reason to conduct this gypsy swap was to accommodate investors who were unable to accept restricted stock.

Could Inca One have avoided the market crash? Maybe, it could have announced the gypsy swap before it conducted it, but that usually doesn’t happen at all. So it looks like some weak hands sold Inca One stock on the back of the insider sales without realizing the insiders would repurchase the same amount of stock in the private placement. And the C$600,000 cash inflow will help to reduce Inca One’s net debt position and to increase the amount in the piggy bank to purchase more ore for the Chala One plant where the new tailings pond has now been commissioned.

Inca One is currently trading at C$0.12, or 20% below the value where its insiders have acquired more shares, and this smells like a good opportunity.

The insider sale was a gypsy swap

August 29, 2015

Inca One Gold’s (IO.V) share price got hammered in the past week after some trigger-happy hands sold a lot of stock on the back of new insider filings showing the main C-level executives of Inca One had sold in excess of a million shares.

However, there was no net sale of any stock. What happened was that some investors wanted to take a sizeable position in the company at 15 cents but were unable to do so on the open market. In such cases a private placement is the best solution to accommodate such investors, but some funds are unable to purchase securities with a mandatory 4 month hold period. A very common solution in this situation is the company sourcing and providing a block of free-trading shares to those investors, whilst the sellers of that block will participate in the private placement to obtain a zero net effect.

In Inca One’s case, it was the management team which provided the large block of freely tradeable shares to those (European) investors, and the market mistakenly seems to have interpreted this as Inca One’s management team selling out by dumping their stock. Meanwhile, Inca One has closed a private placement, raising C$600,000 at C$0.15 per share, and according to the most recent insider filings, Inca One’s management team has indeed reinvested the funds from selling the freely tradeable stock into the placement. CEO Edward Kelly bought 1.47 million shares, COO George Moen bought 799,200 shares and Vice President Mark Wright bought 342,000 shares, for a total of 2.611M shares and C$400,000. (see Canadian Insider)

As you notice, there has been NO net selling by the insiders. On top of that, they didn’t give themselves a ‘sweet deal’, as the placement was priced at C$0.15 without any warrants at all, so self-enrichment definitely wasn’t the case here, and the only reason to conduct this gypsy swap was to accommodate investors who were unable to accept restricted stock.

Could Inca One have avoided the market crash? Maybe, it could have announced the gypsy swap before it conducted it, but that usually doesn’t happen at all. So it looks like some weak hands sold Inca One stock on the back of the insider sales without realizing the insiders would repurchase the same amount of stock in the private placement. And the C$600,000 cash inflow will help to reduce Inca One’s net debt position and to increase the amount in the piggy bank to purchase more ore for the Chala One plant where the new tailings pond has now been commissioned.

Inca One is currently trading at C$0.12, or 20% below the value where its insiders have acquired more shares, and this smells like a good opportunity.

Tesla und Lithium

Die hatte keiner auf dem Schirm

BACANORA ANNOUNCES SONORA LITHIUM PROJECT SIGNING LITHIUM SUPPLY CONTRACT

Bacanora Minerals Ltd. and Rare Earth Minerals PLC, the owners of the Sonora lithium project (1) in northern Mexico, have finalized a conditional long-term lithium hydroxide supply agreement with Tesla Motors Inc., the maker of electric vehicles and energy storage solutions.

The Sonora lithium project partners are working to develop a mineral-rich, lithium-bearing clay deposit into a planned low-cost, sustainable and environmentally conscious mining operation. It is estimated that the mine and processing facility will have an initial production capacity of approximately 35,000 tonnes of lithium compounds, with the scaling potential of up to 50,000 tonnes per annum. To achieve this, the Sonora lithium project partners will need to raise finances to design and construct a mine and processing facility. It is currently anticipated that lithium hydroxide and lithium carbonate would be among the materials produced by the mine. Lithium hydroxide is a key feedstock material in the manufacture of certain kinds of lithium-ion battery cells.

On the condition that, over the next two years, the Sonora lithium project reaches certain performance milestones and passes product specification qualifications, Tesla -- or its authorized purchasers -- will buy lithium hydroxide to feed the manufacturing of batteries at Tesla's gigafactory in Nevada. One of the key milestones will be the confirmation that the Sonora lithium project will be able to supply lithium hydroxide in accordance with volumes and time frames to be established by Tesla. The supply agreement has an initial five-year term commencing from the date of the first order by Tesla, with an option to extend for a further five years.

During the initial five years, and subject to certain terms and conditions in relation to project execution, product quality, pricing, and timing of delivery, Tesla will purchase agreed minimum tonnages, with estimated forecasted maximum deliveries to be determined following delivery of future production orders from Tesla. Tesla will purchase minimum quantities in accordance with an agreed-upon pricing formula, below current market pricing, with actual prices and volumes that can only be finalized during the development phase in due course. The forecast tonnages and delivery dates are structured to coincide with Tesla's forecasted gigafactory production. This agreement will form a portion of Tesla's anticipated lithium-based feedstock needs, the rest of which is expected to come from other lithium peers.

To meet both Tesla's minimum and forecasted tonnages, timelines, and any other potential market demands, the Sonora lithium project partners will need to design and construct a suitable mining and processing operation. This will require the Sonora lithium project partners to secure significant financing through debt and/or equity. Tesla has the right to participate in any such financing or other capital transactions. Bacanora and REM will be pursuing next steps to raise finances to achieve this goal. There can be no assurance that the conditions to supply product under the supply agreement will be met or that the agreement will prove to be economic.

Development work to be used for the prefeasibility study for the Sonora lithium project is currently being carried out. The PFS, alongside additional studies, will establish a revised estimate of capital and operating costs, taking into account the new product mix that will be required to service Tesla's anticipated demands plus those of any additional potential customers.

Colin Orr-Ewing, chairman of Bacanora, commented: "This supply agreement with Tesla represents a vital and monumental step forwards in the commercialization of the large lithium resources that the company holds, together with its partner REM, in northern Mexico. We anticipate this contract to rapidly accelerate the development of the Sonora lithium project, which we expect will prove to be invaluable in an increasingly lithium-hungry world."

(1) The Sonora lithium project is composed of the following lithium properties: La Ventana lithium concession, which is 100 per cent owned by Bacanora; El Sauz and Fleur concessions, which are held by Mexilit SA de CV; and the Megalit concession, which is held by Megalit SA de CV. Mexilit and Megalit are owned 70 per cent by Bacanora and 30 per cent by REM.

Die hatte keiner auf dem Schirm

BACANORA ANNOUNCES SONORA LITHIUM PROJECT SIGNING LITHIUM SUPPLY CONTRACT

Bacanora Minerals Ltd. and Rare Earth Minerals PLC, the owners of the Sonora lithium project (1) in northern Mexico, have finalized a conditional long-term lithium hydroxide supply agreement with Tesla Motors Inc., the maker of electric vehicles and energy storage solutions.

The Sonora lithium project partners are working to develop a mineral-rich, lithium-bearing clay deposit into a planned low-cost, sustainable and environmentally conscious mining operation. It is estimated that the mine and processing facility will have an initial production capacity of approximately 35,000 tonnes of lithium compounds, with the scaling potential of up to 50,000 tonnes per annum. To achieve this, the Sonora lithium project partners will need to raise finances to design and construct a mine and processing facility. It is currently anticipated that lithium hydroxide and lithium carbonate would be among the materials produced by the mine. Lithium hydroxide is a key feedstock material in the manufacture of certain kinds of lithium-ion battery cells.

On the condition that, over the next two years, the Sonora lithium project reaches certain performance milestones and passes product specification qualifications, Tesla -- or its authorized purchasers -- will buy lithium hydroxide to feed the manufacturing of batteries at Tesla's gigafactory in Nevada. One of the key milestones will be the confirmation that the Sonora lithium project will be able to supply lithium hydroxide in accordance with volumes and time frames to be established by Tesla. The supply agreement has an initial five-year term commencing from the date of the first order by Tesla, with an option to extend for a further five years.

During the initial five years, and subject to certain terms and conditions in relation to project execution, product quality, pricing, and timing of delivery, Tesla will purchase agreed minimum tonnages, with estimated forecasted maximum deliveries to be determined following delivery of future production orders from Tesla. Tesla will purchase minimum quantities in accordance with an agreed-upon pricing formula, below current market pricing, with actual prices and volumes that can only be finalized during the development phase in due course. The forecast tonnages and delivery dates are structured to coincide with Tesla's forecasted gigafactory production. This agreement will form a portion of Tesla's anticipated lithium-based feedstock needs, the rest of which is expected to come from other lithium peers.

To meet both Tesla's minimum and forecasted tonnages, timelines, and any other potential market demands, the Sonora lithium project partners will need to design and construct a suitable mining and processing operation. This will require the Sonora lithium project partners to secure significant financing through debt and/or equity. Tesla has the right to participate in any such financing or other capital transactions. Bacanora and REM will be pursuing next steps to raise finances to achieve this goal. There can be no assurance that the conditions to supply product under the supply agreement will be met or that the agreement will prove to be economic.

Development work to be used for the prefeasibility study for the Sonora lithium project is currently being carried out. The PFS, alongside additional studies, will establish a revised estimate of capital and operating costs, taking into account the new product mix that will be required to service Tesla's anticipated demands plus those of any additional potential customers.

Colin Orr-Ewing, chairman of Bacanora, commented: "This supply agreement with Tesla represents a vital and monumental step forwards in the commercialization of the large lithium resources that the company holds, together with its partner REM, in northern Mexico. We anticipate this contract to rapidly accelerate the development of the Sonora lithium project, which we expect will prove to be invaluable in an increasingly lithium-hungry world."

(1) The Sonora lithium project is composed of the following lithium properties: La Ventana lithium concession, which is 100 per cent owned by Bacanora; El Sauz and Fleur concessions, which are held by Mexilit SA de CV; and the Megalit concession, which is held by Megalit SA de CV. Mexilit and Megalit are owned 70 per cent by Bacanora and 30 per cent by REM.

[url=http://peketec.de/trading/viewtopic.php?p=1619171#1619171 schrieb:greenhorn schrieb am 31.08.2015, 08:48 Uhr[/url]"]Guten Morgen!

so, nun wieder richtig am werkeln..........waren erholsame Tage mit gutem Wetter!

Schlafmuster komplett auf den Kopf gestellt

muss mich nun erst wieder umgewöhnen

Ohne Harfe schläft sichs besser!

Welcome back greeni!!!

[url=http://peketec.de/trading/viewtopic.php?p=1619171#1619171 schrieb:greenhorn schrieb am 31.08.2015, 08:48 Uhr[/url]"]Guten Morgen!

so, nun wieder richtig am werkeln..........waren erholsame Tage mit gutem Wetter!

Schlafmuster komplett auf den Kopf gestellt

muss mich nun erst wieder umgewöhnen

Mon Aug 31, 2015

PREMIER INTERSECTS WIDESPREAD GOLD MINERALIZATION AT HASAGA RED LAKE

http://www.premiergoldmines.com/s/NewsReleases.asp?ReportID=720530

Premier Gold Mines Limited (TSX-PG) is pleased to provide an update of ongoing surface drilling at the Company's 100%-owned Hasaga Project in the Red Lake gold mining district of Northwestern Ontario including assays of up to 0.94 grams per tonne gold (g/t Au) across 305.5 metres. Hasaga is strategically-located proximal to the Balmer-Confederation unconformity, recognized as an important geologic feature at the multi-million ounce past and currently producing Red Lake area mines.

Premier believes that the Hasaga and Gold Shore Mines, which ceased production in the early 1950's, have the potential to host gold mineralization that may be amenable to open pit mining methods in addition to higher grade underground mineable mineralization. Current drill targets include the "Porphyry Zone" which hosts the past-producing Hasaga and Howey Gold Mines (where in excess of 600,000 ounces of gold was produced by underground mining methods) and the "Central Zone" where drilling has delineated widespread gold mineralization in the Dome Stock granodiorite. Table 1 provides a more comprehensive summary of results from the first 8 holes drilled at the Central Zone target which is considered open in all directions.

Completed assaying in the Central Zone target are reporting significant highlight results including:

HLD001 - 0.65 grams per tonne gold (g/t Au) across 170.0 metres (m).

HLD002 - 0.69 g/t Au over 93.0 m including 1.02 g/t Au across 25.0 m.

HLD003 - 0.80 g/t Au over 246.7 m including 2.16 g/t Au across 25.0 m and 1.73 g/t Au across 43.0m.

HLD004 - 0.94 g/t Au over 305.5 m including 1.61 g/t Au across 122.5 m.

HLD005 - 0.98 g/t Au over 118.0 m including 3.08 g/t Au across 14.0 m.

HLD006 - 0.63 g/t Au over 111.0 m, with an additional intercept of 0.52 g/t Au across 279.0 m.

HLD007 - 0.67 g/t Au over 108.0 m including 1.12 g/t Au across 25.0 m.

HLD008 - 0.76 g/t Au over 111.0 m including 1.07 g/t Au across 52.0 m, with an additional intercept of 0.65 g/t Au across 95.0 m.

Central Zone drilling is currently on the sixteenth (16) hole of the program and widespread,disseminated mineralization has been noted in all holes. Additional assays are pending. An update of assay results from drilling in the Porphyry Zone is expected to be released in the near future.

"Several holes drilled in the Central Zone have ended in mineralization, including hole HLD006, the most distant hole drilled to the northeast to have received assay results to date. These early results support our belief that the Central Zone represents a viable open-pit exploration target." stated Stephen McGibbon, Executive Vice-President of Premier.

PREMIER INTERSECTS WIDESPREAD GOLD MINERALIZATION AT HASAGA RED LAKE

http://www.premiergoldmines.com/s/NewsReleases.asp?ReportID=720530

Premier Gold Mines Limited (TSX-PG) is pleased to provide an update of ongoing surface drilling at the Company's 100%-owned Hasaga Project in the Red Lake gold mining district of Northwestern Ontario including assays of up to 0.94 grams per tonne gold (g/t Au) across 305.5 metres. Hasaga is strategically-located proximal to the Balmer-Confederation unconformity, recognized as an important geologic feature at the multi-million ounce past and currently producing Red Lake area mines.

Premier believes that the Hasaga and Gold Shore Mines, which ceased production in the early 1950's, have the potential to host gold mineralization that may be amenable to open pit mining methods in addition to higher grade underground mineable mineralization. Current drill targets include the "Porphyry Zone" which hosts the past-producing Hasaga and Howey Gold Mines (where in excess of 600,000 ounces of gold was produced by underground mining methods) and the "Central Zone" where drilling has delineated widespread gold mineralization in the Dome Stock granodiorite. Table 1 provides a more comprehensive summary of results from the first 8 holes drilled at the Central Zone target which is considered open in all directions.

Completed assaying in the Central Zone target are reporting significant highlight results including:

HLD001 - 0.65 grams per tonne gold (g/t Au) across 170.0 metres (m).

HLD002 - 0.69 g/t Au over 93.0 m including 1.02 g/t Au across 25.0 m.

HLD003 - 0.80 g/t Au over 246.7 m including 2.16 g/t Au across 25.0 m and 1.73 g/t Au across 43.0m.

HLD004 - 0.94 g/t Au over 305.5 m including 1.61 g/t Au across 122.5 m.

HLD005 - 0.98 g/t Au over 118.0 m including 3.08 g/t Au across 14.0 m.

HLD006 - 0.63 g/t Au over 111.0 m, with an additional intercept of 0.52 g/t Au across 279.0 m.

HLD007 - 0.67 g/t Au over 108.0 m including 1.12 g/t Au across 25.0 m.

HLD008 - 0.76 g/t Au over 111.0 m including 1.07 g/t Au across 52.0 m, with an additional intercept of 0.65 g/t Au across 95.0 m.

Central Zone drilling is currently on the sixteenth (16) hole of the program and widespread,disseminated mineralization has been noted in all holes. Additional assays are pending. An update of assay results from drilling in the Porphyry Zone is expected to be released in the near future.

"Several holes drilled in the Central Zone have ended in mineralization, including hole HLD006, the most distant hole drilled to the northeast to have received assay results to date. These early results support our belief that the Central Zone represents a viable open-pit exploration target." stated Stephen McGibbon, Executive Vice-President of Premier.

August 31, 2015 08:00 ET

Alamos Announces Investment in AuRico Metals

http://www.marketwired.com/press-re...vestment-in-aurico-metals-tsx-agi-2051358.htm

TORONTO, ONTARIO--(Marketwired - Aug. 31, 2015) - Alamos Gold Inc. (TSX:AGI)(NYSE:AGI) ("Alamos" or the "Company") today announced the purchase of 8,000,000 common shares (the "Shares") of AuRico Metals Inc. ("AuRico"), representing approximately 6.34% of the outstanding common shares of AuRico (the "Transaction"). The Shares are being acquired by Alamos by way of private placement at a price of C$0.70 per Share.

Prior to the Transaction, Alamos owned directly 5,767,855 common shares of AuRico, which represented approximately 4.8% of the issued and outstanding common shares of AuRico. Upon completion of the Transaction, Alamos will hold 13,767,855 common shares of AuRico, representing approximately 10.92% of the issued and outstanding common shares of AuRico.

Alamos carried out the Transaction for investment purposes and may increase or decrease its investment based on market conditions. AuRico has granted Alamos a right to participate in future financings for a period of two years, subject to certain terms, to maintain its pro-rata interest.

The early warning report, as required under National Instrument 62-103, contains additional information with respect to the foregoing matters and will be filed by the Company on AuRico's SEDAR profile at www.sedar.com. The Transaction remains subject to customary approvals, including the Toronto Stock Exchange.

Alamos Announces Investment in AuRico Metals

http://www.marketwired.com/press-re...vestment-in-aurico-metals-tsx-agi-2051358.htm

TORONTO, ONTARIO--(Marketwired - Aug. 31, 2015) - Alamos Gold Inc. (TSX:AGI)(NYSE:AGI) ("Alamos" or the "Company") today announced the purchase of 8,000,000 common shares (the "Shares") of AuRico Metals Inc. ("AuRico"), representing approximately 6.34% of the outstanding common shares of AuRico (the "Transaction"). The Shares are being acquired by Alamos by way of private placement at a price of C$0.70 per Share.

Prior to the Transaction, Alamos owned directly 5,767,855 common shares of AuRico, which represented approximately 4.8% of the issued and outstanding common shares of AuRico. Upon completion of the Transaction, Alamos will hold 13,767,855 common shares of AuRico, representing approximately 10.92% of the issued and outstanding common shares of AuRico.

Alamos carried out the Transaction for investment purposes and may increase or decrease its investment based on market conditions. AuRico has granted Alamos a right to participate in future financings for a period of two years, subject to certain terms, to maintain its pro-rata interest.

The early warning report, as required under National Instrument 62-103, contains additional information with respect to the foregoing matters and will be filed by the Company on AuRico's SEDAR profile at www.sedar.com. The Transaction remains subject to customary approvals, including the Toronto Stock Exchange.

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Montag, 31.08.2015 - 17:52 Uhr

NETFLIX - Das Gap ruft

http://www.godmode-trader.de/analyse/netflix-das-gap-ruft,4323140

NETFLIX - Das Gap ruft

http://www.godmode-trader.de/analyse/netflix-das-gap-ruft,4323140

[url=http://peketec.de/trading/viewtopic.php?p=1618671#1618671 schrieb:Kostolanys Erbe schrieb am 27.08.2015, 23:28 Uhr[/url]"]Scheinchen CW2T7E klebt wieder am Lapi...

NFLX könnte charttechnisch um die 117-120 US$ die rechte Schulter einer SKS Formation ausbilden....?! Beobachten !!!

» zur Grafik

CEO hat schnell noch mal schön abgesahnt und seine Aktienoptionen versilbert...

und hält aktuell nicht mal eine Aktie seines Unternehmens !!!Ganz schön traurig... Wieviel Optionen er noch einlösen kann, weiss ich nicht...

» zur Grafik

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1617276#1617276 schrieb:Kostolanys Erbe schrieb am 24.08.2015, 21:16 Uhr[/url]"]@Olli

[url=http://peketec.de/trading/viewtopic.php?p=1616804#1616804 schrieb:Ollinho schrieb am 24.08.2015, 10:24 Uhr[/url]"]GW Kosto!!

[url=http://peketec.de/trading/viewtopic.php?p=1616774#1616774 schrieb:Kostolanys Erbe schrieb am 24.08.2015, 09:40 Uhr[/url]"]Verkauf zu 0,92 € !!!

Börse heisst spekulieren und auch mal Gewinne mitnehmen!

Bin heute Abend mal auf die letzte Handelsstunde in USA gespannt...

[url=http://peketec.de/trading/viewtopic.php?p=1616461#1616461 schrieb:Kostolanys Erbe schrieb am 21.08.2015, 21:30 Uhr[/url]"]Danke @Olli

Scheinchen aktuell bei 0,72 €

https://www.boerse-stuttgart.de/de/boersenportal/wertpapiere-und-maerkte/hebelprodukte/optionsscheine/factsheet/?ID_NOTATION=137310115

NFLX aktuell die 50-Tage-Linie nach unten durchbrochen

Immer noch viel Speck drauf...

Und so langsam werden die die auf Margin debts zocken

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1616040#1616040 schrieb:Ollinho schrieb am 20.08.2015, 22:22 Uhr[/url]"]Sauber Kosto!!!

[url=http://peketec.de/trading/viewtopic.php?p=1616023#1616023 schrieb:Kostolanys Erbe schrieb am 20.08.2015, 21:50 Uhr[/url]"]Mal sehen, ob morgen die Leute Angst haben um ihre Gewinne und der Trend nach unten durchbrochen wird...

200-Tage-Linie bei ca. 75 $ !!!

Scheinchen steht aktuell bei 0,57 €

https://www.boerse-stuttgart.de/de/boersenportal/wertpapiere-und-maerkte/hebelprodukte/optionsscheine/factsheet/?ID_NOTATION=137310115

» zur Grafik

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1615368#1615368 schrieb:Kostolanys Erbe schrieb am 19.08.2015, 11:01 Uhr[/url]"]Kleine Put Speku-Posi CW2T7E zu 0,43€ genommen.

[url=http://peketec.de/trading/viewtopic.php?p=1615208#1615208 schrieb:Kostolanys Erbe schrieb am 18.08.2015, 22:40 Uhr[/url]"]Mich reizt ja irgendwie als Gapi-Freak ein Put (normalen OS / Kein Knock-out-Scheinchen in dieser Situation); Bewertung ist echt krass, irgendwann werden auch mal die von NFLX evtl. ein Quartal enttäuschen

» zur Grafik