Rueckkauf TMM 0,22

App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

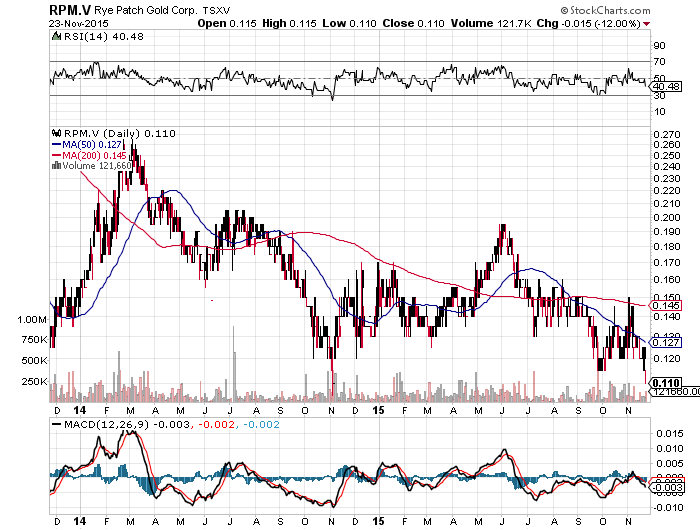

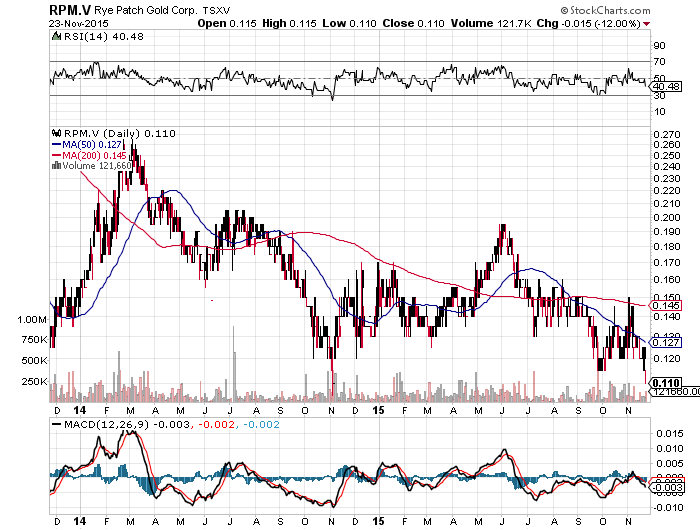

Chart ist aber voll im Eimer

[url=http://peketec.de/trading/viewtopic.php?p=1641804#1641804 schrieb:Fischlaender schrieb am 19.11.2015, 15:50 Uhr[/url]"]Satter Nachkauf LYD 0,25 CAD

Lydian Announces Initial Capital and Operating Cost Reductions From the Amulsar Value Engineering and Optimization Study

TORONTO, Nov. 19, 2015 (GLOBE NEWSWIRE) -- Lydian International Limited (TSX:LYD) ("Lydian" or "the Company") is pleased to announce the results of a value engineering and optimization study for its 100%-owned Amulsar Gold Project in south-central Armenia. Pre-production capital costs decreased by 13% to $370 million and all-in sustaining costs decreased by 17% to $585/oz of gold. All dollar amounts in this news release are presented in U.S. dollars unless otherwise noted.

Howard Stevenson, Lydian's President and CEO, stated, "We set out to reduce capital expenditures without negatively impacting operating costs. This $56 million capital cost reduction met our target. Combining this outcome with a decrease of more than $100/oz in all-in sustaining costs greatly enhances Amulsar's economics. Amulsar will be a very low-cost gold producer of excellent scale. We will produce 2.1 million ounces of gold from the current mine plan, and we see strong opportunity for orebody-growth."

Results of the value engineering program include:

https://www.morningstar.com/news/globe-news-wire/GNW_10156836/lydian-announces-initial-capital-and-operating-cost-reductions-from-the-amulsar-value-engineering-and-optimization-study.html

Bin gestern auch rein zu 0,25$!

Die beiden Studien zur Optimierung der Kennzahlen waren imho ein voller Erfolg.

Initial Capital nun runter auf 370 Mio und AISC unter 600$.

Mal sehen wie sie die Finanzierung stemmen...aber auf dem Niveau allemal ne Speku wert

Die beiden Studien zur Optimierung der Kennzahlen waren imho ein voller Erfolg.

Initial Capital nun runter auf 370 Mio und AISC unter 600$.

Mal sehen wie sie die Finanzierung stemmen...aber auf dem Niveau allemal ne Speku wert

[url=http://peketec.de/trading/viewtopic.php?p=1641804#1641804 schrieb:Fischlaender schrieb am 19.11.2015, 15:50 Uhr[/url]"]Satter Nachkauf LYD 0,25 CAD

Lydian Announces Initial Capital and Operating Cost Reductions From the Amulsar Value Engineering and Optimization Study

TORONTO, Nov. 19, 2015 (GLOBE NEWSWIRE) -- Lydian International Limited (TSX:LYD) ("Lydian" or "the Company") is pleased to announce the results of a value engineering and optimization study for its 100%-owned Amulsar Gold Project in south-central Armenia. Pre-production capital costs decreased by 13% to $370 million and all-in sustaining costs decreased by 17% to $585/oz of gold. All dollar amounts in this news release are presented in U.S. dollars unless otherwise noted.

Howard Stevenson, Lydian's President and CEO, stated, "We set out to reduce capital expenditures without negatively impacting operating costs. This $56 million capital cost reduction met our target. Combining this outcome with a decrease of more than $100/oz in all-in sustaining costs greatly enhances Amulsar's economics. Amulsar will be a very low-cost gold producer of excellent scale. We will produce 2.1 million ounces of gold from the current mine plan, and we see strong opportunity for orebody-growth."

Results of the value engineering program include:

https://www.morningstar.com/news/globe-news-wire/GNW_10156836/lydian-announces-initial-capital-and-operating-cost-reductions-from-the-amulsar-value-engineering-and-optimization-study.html

Viel Feind viel Ehr!

Im Ernst, in der momentanen Situation geb ich auf Charts nicht so viel.

Im Ernst, in der momentanen Situation geb ich auf Charts nicht so viel.

[url=http://peketec.de/trading/viewtopic.php?p=1641808#1641808 schrieb:PerseusLtd schrieb am 19.11.2015, 15:53 Uhr[/url]"]Chart ist aber voll im Eimer

[url=http://peketec.de/trading/viewtopic.php?p=1641804#1641804 schrieb:Fischlaender schrieb am 19.11.2015, 15:50 Uhr[/url]"]Satter Nachkauf LYD 0,25 CAD

Lydian Announces Initial Capital and Operating Cost Reductions From the Amulsar Value Engineering and Optimization Study

TORONTO, Nov. 19, 2015 (GLOBE NEWSWIRE) -- Lydian International Limited (TSX:LYD) ("Lydian" or "the Company") is pleased to announce the results of a value engineering and optimization study for its 100%-owned Amulsar Gold Project in south-central Armenia. Pre-production capital costs decreased by 13% to $370 million and all-in sustaining costs decreased by 17% to $585/oz of gold. All dollar amounts in this news release are presented in U.S. dollars unless otherwise noted.

Howard Stevenson, Lydian's President and CEO, stated, "We set out to reduce capital expenditures without negatively impacting operating costs. This $56 million capital cost reduction met our target. Combining this outcome with a decrease of more than $100/oz in all-in sustaining costs greatly enhances Amulsar's economics. Amulsar will be a very low-cost gold producer of excellent scale. We will produce 2.1 million ounces of gold from the current mine plan, and we see strong opportunity for orebody-growth."

Results of the value engineering program include:

https://www.morningstar.com/news/globe-news-wire/GNW_10156836/lydian-announces-initial-capital-and-operating-cost-reductions-from-the-amulsar-value-engineering-and-optimization-study.html

in Canada bei +53% auf aktuell 2,18 CAD - RIESEN-Gap gerissen........Duke würde sagen "..das sieht sogar Grennie auf seinem 12 Zoll Flatscreen..."

!aber schon in der Presse!

http://www.tagesspiegel.de/berlin/1...t-der-welt-in-botsuana-entdeckt/12612536.html

!aber schon in der Presse!

http://www.tagesspiegel.de/berlin/1...t-der-welt-in-botsuana-entdeckt/12612536.html

[url=http://peketec.de/trading/viewtopic.php?p=1641598#1641598 schrieb:greenhorn schrieb am 19.11.2015, 09:32 Uhr[/url]"]LUC - Lucara mit zwei Topmeldungen........Kurs wird nach oben weggezogen

November 19, 2015 02:00 ET

Lucara Recovers Two More Large Diamonds Including an 813 Carat Stone from the Karowe Mine in Botswana

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Nov. 19, 2015) - Lucara Diamond Corp. (TSX:LUC)(BOTSWANA:LUC)(NASDAQ OMX Stockholm:LUC) ("Lucara" or the "Company") is pleased to announce that two more exceptional white stones have now been recovered through the XRT diamond recovery units. The two white diamonds, an 813 carat stone and a 374 carat stone, have today been added to the roster of incredible diamonds recovered from the prolific south lobe of Lucara's Karowe mine in Botswana. The weights of the stones are subject to change as these stones have not yet been cleaned. Once cleaned, photos will be published on the Lucara website (www.lucaradiamond.com).

William Lamb, President and CEO, commented, "I am truly at a loss for words. This has been an amazing week for Lucara with the recovery of the second largest and also the sixth largest gem quality diamonds ever mined. We are truly blessed by this amazing asset."

November 18, 2015 17:30 ET

Lucara Makes Diamond History; Recovers 1,111 Carat Diamond

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Nov. 18, 2015) - Lucara Diamond Corp. (TSX:LUC)(BOTSWANA:LUC)(NASDAQ OMX Stockholm:LUC) ("Lucara" or the "Company"), the high quality diamond producer with assets in Botswana, is pleased to announce the recovery of a 1,111 carat gem quality, Type IIa diamond. Please see attached photos.

The magnificent stone, which originated from the south lobe of Lucara's Karowe Mine, is the world's second largest gem quality diamond ever recovered and the largest ever to be recovered through a modern processing facility. The stone was recovered by the newly installed Large Diamond Recovery ("LDR") XRT machines. The stone measures 65mm x 56mm x 40mm in size and is the largest ever to be recovered in Botswana.

"Charts im Popo" sind aktuell so viele Werte

eigentlich kannste mit Charttechnik in dem Sektor momentan wirklich nur bedingt arbeiten - allerdings in Extremsituationen funkioniert es trotzdem und bei liquiden Werten

wenn man das Volumen der Edelmetallwerte/markt ggü dem Rest sieht fragt man sich schon warum die tiefsitzende Angst vor steigendem Goldpreis........aber offensichtlich ist die Signalwirkung weiterhin sehr gefürchtet

eigentlich kannste mit Charttechnik in dem Sektor momentan wirklich nur bedingt arbeiten - allerdings in Extremsituationen funkioniert es trotzdem und bei liquiden Werten

wenn man das Volumen der Edelmetallwerte/markt ggü dem Rest sieht fragt man sich schon warum die tiefsitzende Angst vor steigendem Goldpreis........aber offensichtlich ist die Signalwirkung weiterhin sehr gefürchtet

[url=http://peketec.de/trading/viewtopic.php?p=1641817#1641817 schrieb:Fischlaender schrieb am 19.11.2015, 16:05 Uhr[/url]"]Viel Feind viel Ehr!

Im Ernst, in der momentanen Situation geb ich auf Charts nicht so viel.

[url=http://peketec.de/trading/viewtopic.php?p=1641808#1641808 schrieb:PerseusLtd schrieb am 19.11.2015, 15:53 Uhr[/url]"]Chart ist aber voll im Eimer

[url=http://peketec.de/trading/viewtopic.php?p=1641804#1641804 schrieb:Fischlaender schrieb am 19.11.2015, 15:50 Uhr[/url]"]Satter Nachkauf LYD 0,25 CAD

Lydian Announces Initial Capital and Operating Cost Reductions From the Amulsar Value Engineering and Optimization Study

TORONTO, Nov. 19, 2015 (GLOBE NEWSWIRE) -- Lydian International Limited (TSX:LYD) ("Lydian" or "the Company") is pleased to announce the results of a value engineering and optimization study for its 100%-owned Amulsar Gold Project in south-central Armenia. Pre-production capital costs decreased by 13% to $370 million and all-in sustaining costs decreased by 17% to $585/oz of gold. All dollar amounts in this news release are presented in U.S. dollars unless otherwise noted.

Howard Stevenson, Lydian's President and CEO, stated, "We set out to reduce capital expenditures without negatively impacting operating costs. This $56 million capital cost reduction met our target. Combining this outcome with a decrease of more than $100/oz in all-in sustaining costs greatly enhances Amulsar's economics. Amulsar will be a very low-cost gold producer of excellent scale. We will produce 2.1 million ounces of gold from the current mine plan, and we see strong opportunity for orebody-growth."

Results of the value engineering program include:

https://www.morningstar.com/news/globe-news-wire/GNW_10156836/lydian-announces-initial-capital-and-operating-cost-reductions-from-the-amulsar-value-engineering-and-optimization-study.html

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Dejavu !

Unabhängig vom Thread habe ich heute auch im Tagesverlauf

mir die letzte Präsentation und Kurs angeschaut!

War die IRR nicht von einem Goldpreis von 1.250 $ ?

Oder habe ich etwas verpasst?

[url=http://peketec.de/trading/viewtopic.php?p=1641828#1641828 schrieb:greenhorn schrieb am 19.11.2015, 16:18 Uhr[/url]"]"Charts im Popo" sind aktuell so viele Werte

eigentlich kannste mit Charttechnik in dem Sektor momentan wirklich nur bedingt arbeiten - allerdings in Extremsituationen funkioniert es trotzdem und bei liquiden Werten

wenn man das Volumen der Edelmetallwerte/markt ggü dem Rest sieht fragt man sich schon warum die tiefsitzende Angst vor steigendem Goldpreis........aber offensichtlich ist die Signalwirkung weiterhin sehr gefürchtet

[url=http://peketec.de/trading/viewtopic.php?p=1641817#1641817 schrieb:Fischlaender schrieb am 19.11.2015, 16:05 Uhr[/url]"]Viel Feind viel Ehr!

Im Ernst, in der momentanen Situation geb ich auf Charts nicht so viel.

[url=http://peketec.de/trading/viewtopic.php?p=1641808#1641808 schrieb:PerseusLtd schrieb am 19.11.2015, 15:53 Uhr[/url]"]Chart ist aber voll im Eimer

[url=http://peketec.de/trading/viewtopic.php?p=1641804#1641804 schrieb:Fischlaender schrieb am 19.11.2015, 15:50 Uhr[/url]"]Satter Nachkauf LYD 0,25 CAD

Lydian Announces Initial Capital and Operating Cost Reductions From the Amulsar Value Engineering and Optimization Study

TORONTO, Nov. 19, 2015 (GLOBE NEWSWIRE) -- Lydian International Limited (TSX:LYD) ("Lydian" or "the Company") is pleased to announce the results of a value engineering and optimization study for its 100%-owned Amulsar Gold Project in south-central Armenia. Pre-production capital costs decreased by 13% to $370 million and all-in sustaining costs decreased by 17% to $585/oz of gold. All dollar amounts in this news release are presented in U.S. dollars unless otherwise noted.

Howard Stevenson, Lydian's President and CEO, stated, "We set out to reduce capital expenditures without negatively impacting operating costs. This $56 million capital cost reduction met our target. Combining this outcome with a decrease of more than $100/oz in all-in sustaining costs greatly enhances Amulsar's economics. Amulsar will be a very low-cost gold producer of excellent scale. We will produce 2.1 million ounces of gold from the current mine plan, and we see strong opportunity for orebody-growth."

Results of the value engineering program include:

https://www.morningstar.com/news/globe-news-wire/GNW_10156836/lydian-announces-initial-capital-and-operating-cost-reductions-from-the-amulsar-value-engineering-and-optimization-study.html

Die aktuelle IRR Berechnung ist auf der Basis 1150 US$

(Daten aus der zweiten aktuellen Optimierungs-Studie: "After-tax unleveraged IRR of 21.6% and NPV of $338 million based on a discount rate of 5% and a gold price of $1,150 per ounce")

(Daten aus der zweiten aktuellen Optimierungs-Studie: "After-tax unleveraged IRR of 21.6% and NPV of $338 million based on a discount rate of 5% and a gold price of $1,150 per ounce")

[url=http://peketec.de/trading/viewtopic.php?p=1641872#1641872 schrieb:Kostolanys Erbe schrieb am 19.11.2015, 17:57 Uhr[/url]"]

Dejavu !

Unabhängig vom Thread habe ich heute auch im Tagesverlauf

mir die letzte Präsentation und Kurs angeschaut!

War die IRR nicht von einem Goldpreis von 1.250 $ ?

Oder habe ich etwas verpasst?

[url=http://peketec.de/trading/viewtopic.php?p=1641828#1641828 schrieb:greenhorn schrieb am 19.11.2015, 16:18 Uhr[/url]"]"Charts im Popo" sind aktuell so viele Werte

eigentlich kannste mit Charttechnik in dem Sektor momentan wirklich nur bedingt arbeiten - allerdings in Extremsituationen funkioniert es trotzdem und bei liquiden Werten

wenn man das Volumen der Edelmetallwerte/markt ggü dem Rest sieht fragt man sich schon warum die tiefsitzende Angst vor steigendem Goldpreis........aber offensichtlich ist die Signalwirkung weiterhin sehr gefürchtet

[url=http://peketec.de/trading/viewtopic.php?p=1641817#1641817 schrieb:Fischlaender schrieb am 19.11.2015, 16:05 Uhr[/url]"]Viel Feind viel Ehr!

Im Ernst, in der momentanen Situation geb ich auf Charts nicht so viel.

[url=http://peketec.de/trading/viewtopic.php?p=1641808#1641808 schrieb:PerseusLtd schrieb am 19.11.2015, 15:53 Uhr[/url]"]Chart ist aber voll im Eimer

[url=http://peketec.de/trading/viewtopic.php?p=1641804#1641804 schrieb:Fischlaender schrieb am 19.11.2015, 15:50 Uhr[/url]"]Satter Nachkauf LYD 0,25 CAD

Lydian Announces Initial Capital and Operating Cost Reductions From the Amulsar Value Engineering and Optimization Study

TORONTO, Nov. 19, 2015 (GLOBE NEWSWIRE) -- Lydian International Limited (TSX:LYD) ("Lydian" or "the Company") is pleased to announce the results of a value engineering and optimization study for its 100%-owned Amulsar Gold Project in south-central Armenia. Pre-production capital costs decreased by 13% to $370 million and all-in sustaining costs decreased by 17% to $585/oz of gold. All dollar amounts in this news release are presented in U.S. dollars unless otherwise noted.

Howard Stevenson, Lydian's President and CEO, stated, "We set out to reduce capital expenditures without negatively impacting operating costs. This $56 million capital cost reduction met our target. Combining this outcome with a decrease of more than $100/oz in all-in sustaining costs greatly enhances Amulsar's economics. Amulsar will be a very low-cost gold producer of excellent scale. We will produce 2.1 million ounces of gold from the current mine plan, and we see strong opportunity for orebody-growth."

Results of the value engineering program include:

https://www.morningstar.com/news/globe-news-wire/GNW_10156836/lydian-announces-initial-capital-and-operating-cost-reductions-from-the-amulsar-value-engineering-and-optimization-study.html

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

[url=http://peketec.de/trading/viewtopic.php?p=1641873#1641873 schrieb:Ollinho schrieb am 19.11.2015, 18:02 Uhr[/url]"]Die aktuelle IRR Berechnung ist auf der Basis 1150 US$

(Daten aus der zweiten aktuellen Optimierungs-Studie: "After-tax unleveraged IRR of 21.6% and NPV of $338 million based on a discount rate of 5% and a gold price of $1,150 per ounce")

[url=http://peketec.de/trading/viewtopic.php?p=1641872#1641872 schrieb:Kostolanys Erbe schrieb am 19.11.2015, 17:57 Uhr[/url]"]

Dejavu !

Unabhängig vom Thread habe ich heute auch im Tagesverlauf

mir die letzte Präsentation und Kurs angeschaut!

War die IRR nicht von einem Goldpreis von 1.250 $ ?

Oder habe ich etwas verpasst?

[url=http://peketec.de/trading/viewtopic.php?p=1641828#1641828 schrieb:greenhorn schrieb am 19.11.2015, 16:18 Uhr[/url]"]"Charts im Popo" sind aktuell so viele Werte

eigentlich kannste mit Charttechnik in dem Sektor momentan wirklich nur bedingt arbeiten - allerdings in Extremsituationen funkioniert es trotzdem und bei liquiden Werten

wenn man das Volumen der Edelmetallwerte/markt ggü dem Rest sieht fragt man sich schon warum die tiefsitzende Angst vor steigendem Goldpreis........aber offensichtlich ist die Signalwirkung weiterhin sehr gefürchtet

[url=http://peketec.de/trading/viewtopic.php?p=1641817#1641817 schrieb:Fischlaender schrieb am 19.11.2015, 16:05 Uhr[/url]"]Viel Feind viel Ehr!

Im Ernst, in der momentanen Situation geb ich auf Charts nicht so viel.

[url=http://peketec.de/trading/viewtopic.php?p=1641808#1641808 schrieb:PerseusLtd schrieb am 19.11.2015, 15:53 Uhr[/url]"]Chart ist aber voll im Eimer

[url=http://peketec.de/trading/viewtopic.php?p=1641804#1641804 schrieb:Fischlaender schrieb am 19.11.2015, 15:50 Uhr[/url]"]Satter Nachkauf LYD 0,25 CAD

Lydian Announces Initial Capital and Operating Cost Reductions From the Amulsar Value Engineering and Optimization Study

TORONTO, Nov. 19, 2015 (GLOBE NEWSWIRE) -- Lydian International Limited (TSX:LYD) ("Lydian" or "the Company") is pleased to announce the results of a value engineering and optimization study for its 100%-owned Amulsar Gold Project in south-central Armenia. Pre-production capital costs decreased by 13% to $370 million and all-in sustaining costs decreased by 17% to $585/oz of gold. All dollar amounts in this news release are presented in U.S. dollars unless otherwise noted.

Howard Stevenson, Lydian's President and CEO, stated, "We set out to reduce capital expenditures without negatively impacting operating costs. This $56 million capital cost reduction met our target. Combining this outcome with a decrease of more than $100/oz in all-in sustaining costs greatly enhances Amulsar's economics. Amulsar will be a very low-cost gold producer of excellent scale. We will produce 2.1 million ounces of gold from the current mine plan, and we see strong opportunity for orebody-growth."

Results of the value engineering program include:

https://www.morningstar.com/news/globe-news-wire/GNW_10156836/lydian-announces-initial-capital-and-operating-cost-reductions-from-the-amulsar-value-engineering-and-optimization-study.html

eines wieder gelernt....Morgen kann der Kurs noch tiefer sein.....siehe z.B. TV

nun gut........

08:00 - DE Erzeugerpreise Oktober

• 11:00 - EU Zahlungsbilanz 3. Quartal

• 13:30 - CA Verbraucherpreise Oktober

• 13:30 - CA Einzelhandelsumsatz September

alles billig, Fracht,Geld,Rohstoffe,Waren........

wo soll das enden

wo soll das enden

[url=http://peketec.de/trading/viewtopic.php?p=1642063#1642063 schrieb:Ollinho schrieb am 20.11.2015, 10:48 Uhr[/url]"]» zur Grafik

Apropos Charts, ein Techniker, den ich immer ganz gerne lese ist Ronald Rosen. Seiner Meinung nach koennten wir das Tief bei Gold gerade jetzt gesehen haben:

http://www.321gold.com/editorials/rosen/rosen112015.pdf

http://www.321gold.com/editorials/rosen/rosen112015.pdf

PLG macht misch feddisch....

aber wir sitzen da gemeinsam im Boot

[url=http://peketec.de/trading/viewtopic.php?p=1642186#1642186 schrieb:Fischlaender schrieb am 20.11.2015, 17:05 Uhr[/url]"]PLG macht misch feddisch....

TV - heute ordentlich Volumen und sieht nach Erholungstendenzen aus

[url=http://peketec.de/trading/viewtopic.php?p=1641793#1641793 schrieb:greenhorn schrieb am 19.11.2015, 15:36 Uhr[/url]"]1.Posi um 0,33 CAD Long

[url=http://peketec.de/trading/viewtopic.php?p=1641606#1641606 schrieb:greenhorn schrieb am 19.11.2015, 09:42 Uhr[/url]"]SK bei 0,32 CAD auf Tagestief geschlossen.......

[url=http://peketec.de/trading/viewtopic.php?p=1641247#1641247 schrieb:Kostolanys Erbe schrieb am 18.11.2015, 11:13 Uhr[/url]"]Yepp! 0,35 CAN$ ist noch offen!

[url=http://peketec.de/trading/viewtopic.php?p=1641235#1641235 schrieb:greenhorn schrieb am 18.11.2015, 10:46 Uhr[/url]"]gestern TT bei 0,355 CAD - aber ich glaube das die 0,35 CAD sein muss wegen des GAP´s oder was meint unser GAPexperte?

[url=http://peketec.de/trading/viewtopic.php?p=1640908#1640908 schrieb:greenhorn schrieb am 17.11.2015, 17:17 Uhr[/url]"]leider noch ein GAP vom letzten Anstieg bei 0,34/0,35 CAD offen....versuche mal Geduld zu haben und plane dort einen Wiedereinstieg

Glencore im übrigen auch wieder ordentlich zurückgekommen, aktuell bei 1,26 Euro

[url=http://peketec.de/trading/viewtopic.php?p=1640716#1640716 schrieb:greenhorn schrieb am 17.11.2015, 09:40 Uhr[/url]"]TV - leider kleiner Quartalsverlust, aber der Weg ist i.O.

Ausblick Top! müssen nur die Marktpreise mitspielen..........

Production guidance for 2015 from the Company's Santander mine has been increased to approximately:

50-52 million pounds of payable zinc, up from 48-50 million pounds, in concentrate grading approximately 50 per cent Zn and at an average head grade of 4.2 to 4.4 per cent Zn;

29-31 million pounds of payable lead, up from 23-25 million pounds, in concentrate grading approximately 56 to 58 per cent Pb and at an average head grade of 1.8 to 2.1 per cent Pb;

1.00-1.05 million ounces of payable silver, up from 850,000 to 950,000 ounces, at an average head grade of 1.5 to 1.8 ounces per ton Ag.

Cash costs for 2015 are now estimated at approximately US$46 to $48 per tonne milled, down from the previous estimate of US$48 to $51 per tonne milled, given the efficiencies and cost optimizations that have occurred throughout the year to date. (Please see Cautionary Note on Forward Looking Statements at the end of this document).

November 16, 2015 16:17 ET

Trevali Reports Third Quarter 2015 Financial Results and Provides Caribou Commissioning Update

http://www.marketwired.com/press-re...ides-caribou-commissioning-tsx-tv-2074157.htm

Q3 EBITDA(1) $3.9 Million, Revenues $27 Million and Net Loss of $3.4 Million

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Nov. 16, 2015) - Trevali Mining Corporation ("Trevali" or the "Company") (TSX:TV)(LMA:TV)(OTCQX:TREVF)(FRANKFURT:4TI) has released financial results for the three months ("Q3") and nine months ended September 30, 2015, posting a third quarter net loss of $3.4 million ($0.01 per share). Santander Mine operations income for the quarter was $1.5 million on concentrate sales revenue of $27 million.

This release should be read in conjunction with Trevali's unaudited condensed consolidated financial statements and management's discussion and analysis for the three months and nine months ended September 30, 2015, which is available on Trevali's website and on SEDAR. All financial figures are in Canadian dollars unless otherwise stated.

Q3-2015 Highlights:

Santander concentrate sales revenue of $27 million

EBITDA(1) of $3.9 million

Income from Santander mine operations of $1.5 million

Santander Q3 site cash costs(2) of US$0.28 per pound of payable Zinc Equivalent ("ZnEq")(3) produced or US$38.67/tonne milled, ahead of the Company's revised year-end guidance of US$46-48 per tonne milled

Santander Q3 production of 14.8-million payable pounds of zinc, 7.8-million payable pounds of lead and 285,962 payable ounces of silver

Santander Q3 sales of 15.2-million pounds of zinc, 8-million pounds of lead, and 290,228 ounces of silver

Realized selling prices for zinc, lead and silver of US$0.78 per pound, US$0.73 per pound and US$14.80 per ounce respectively at Santander

Santander mill recoveries remain higher than design at 90% for Zn, 89% for Pb and 77% for Ag

Net loss of $3.4 million or ($0.01) per share

"Despite a weak price environment for all commodities, the Santander unit performed strongly during the third quarter posting positive operational income on the back of concentrate sales revenue of $27 million," stated Dr. Mark Cruise, Trevali's President and CEO. "As anticipated the current short-term Zn and Pb pricing environment, which fails to reflect macro-supply fundamentals, has resulted in the announcement of major industry production cuts globally. This coupled with the near-term closure of major Tier-1 zinc mines by end of year (Lisheen & Century) and ongoing destocking of Zn and Pb warehouses should help reinforce the Company's position, as the only primary zinc producer on the TSX, to benefit from any Zn (and Pb) price strengthening into 2016."

Q3-2015 Financial Results Conference Call

The Company will host a conference call and audio webcast at 10:30 a.m. Eastern Time (7:30 a.m. Pacific Time) on Tuesday, November 17, 2015 to review the financial results. Participants are advised to dial in 5-to-10 minutes prior to the scheduled start time of the call.

Conference call dial-in details:

Toll-free (North America): 1-866-223-7781

Toronto and international: 1-416-340-2216

Audio Webcast: www.gowebcasting.com/7099

[url=http://peketec.de/trading/viewtopic.php?p=1631034#1631034 schrieb:greenhorn schrieb am 09.10.2015, 15:00 Uhr[/url]"]Misch-EK bei 0,46 CAD - Verkauf zu 0,55 CAD

Rückkauf geplant wenn heutiges Eröffnungsgap eventuell geschlossen wird

[url=http://peketec.de/trading/viewtopic.php?p=1630862#1630862 schrieb:greenhorn schrieb am 09.10.2015, 09:59 Uhr[/url]"]TV - vom glencore-Einsturz etwas erholt, aber da geht nach den Ergebnissen doch noch deutlich mehr

beide Minen laufen sehr gut ........ agregiert ist Trevali ein mittelschwerer Produzent

Produktionsziele für Santander auch deutlich erhöht

October 08, 2015 10:26 ET

Trevali Reports Record Santander Mine Production for Q3-2015 and Increases 2015 Guidance

September Caribou mine commissioning update - zinc and lead recoveries continue to increase

http://www.marketwired.com/press-re...15-increases-2015-guidance-tsx-tv-2062465.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Oct. 8, 2015) - Trevali Mining Corporation ("Trevali" or the "Company") (TSX:TV)(LMA:TV)(OTCQX:TREVF)(FRANKFURT:4TI) reports preliminary Santander Mine production results for its third quarter ("Q3") ending September 30, 2015 of approximately 14.6 million payable pounds of zinc, 7.6 million payable pounds of lead and 282,108 payable ounces of silver (see Table 1).

Q3-2015 recoveries at Santander averaged 90% for zinc, 89% for lead and 77% for silver. Mill throughput for the quarter was 197,288 tonnes, the highest throughput to date at Santander. Average Q3 head grades were 4.40% Zn, 2.09% Pb and 1.7 oz/ton Ag with production of 15,729 tonnes of zinc concentrate averaging 50% Zn and 6,525 tonnes of lead-silver concentrate averaging 56% Pb and 41.7 oz/ton Ag for the quarter.

"Continued solid production from our Santander unit delivered one of our best quarterly performances to date with record zinc production and mill throughput," stated Dr. Mark Cruise, Trevali's President and CEO. "Based on these strong results, the Company has boosted its 2015 Santander production guidance estimate. In tandem with this Santander continues to react well to the current commodity climate by capturing efficiencies and cost savings on a quarter-to-quarter basis."

[url=http://peketec.de/trading/viewtopic.php?p=1627761#1627761 schrieb:greenhorn schrieb am 28.09.2015, 15:59 Uhr[/url]"]Juten Tach,.......nur kurz die Tage

ich glaube ich ahne warum - Trevali läuft glaube im Schlepptau von Glencore wegen der Abnahmeverträge.......

2.Posi um 0,33 CAD

[url=http://peketec.de/trading/viewtopic.php?p=1627265#1627265 schrieb:greenhorn schrieb am 25.09.2015, 15:13 Uhr[/url]"]September 25, 2015 09:00 ET

High-Grade Zinc-Lead-Silver Mineralization Expands Magistral Central & Fatima Zones at Santander Zinc Mine

Highlights include: 42.1 metres(i) of 8.3% Zn, 1.9% Pb & 3.5 oz/ton Ag at Fatima-Central and 14.8 metres(i) of 9% Zn, 0.5% Pb, 2.0 oz/ton Ag at Fatima

http://www.marketwired.com/press-re...ral-fatima-zones-santander-tsx-tv-2058557.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Sept. 25, 2015) - Trevali Mining Corporation ("Trevali" or the "Company") (TSX:TV)(LMA:TV)(OTCQX:TREVF)(FRANKFURT:4TI) announces results of five drill holes from its 2015 exploration program designed to test the deeper levels of the Fatima and Magistral Central zones at its Santander Zinc Mine in Peru. All five drill holes intersected significant lead-silver-zinc mineralization and remain open for expansion:

[url=http://peketec.de/trading/viewtopic.php?p=1627093#1627093 schrieb:greenhorn schrieb am 25.09.2015, 09:31 Uhr[/url]"]TV - bereitet mir ein Rätsel, die Kursentwicklung kann ich nicht nachvollziehen

wegen der Indexrausnahme, das sollte doch gegessen sein und die Zinkpreis erholen sich

fehlt ein Baustein.......

Trevali Mining deleted from S&P/TSX SmallCap

2015-09-11 20:00 ET - Miscellaneous

S&P Dow Jones Indices Canadian Index Services will make changes in the S&P/TSX SmallCap Index as a result of the annual review of the index. These changes will be effective after the close of trading on Friday, Sept. 18, 2015.

[url=http://peketec.de/trading/viewtopic.php?p=1622036#1622036 schrieb:greenhorn schrieb am 09.09.2015, 17:45 Uhr[/url]"]TV - um die Tragweite der Augustzahlen zu verdeutlichen.......

im 2.Q hat TV 13,7 Mio Pfund Zink produziert........allein im August sind es nun 10 Mio Pfund gewesen; dazu dann noch die Juli+Septemberproduktion

erwarte hier demnächst durchaus positive Analystenkommentare, alles im Gesamtkontext der Weltwirtschaft natürlich

".............

Second quarter 2015 highlights:

Concentrate sales revenue of $30.5-million;

EBITDA (earnings before interest, taxes, depreciation and amortization) of $7.2-million;

Income from Santander mine operations of $5.4-million;

Net income of $200,000, or nil per share;

Second quarter site cash costs of 33 U.S. cents per pound of payable zinc equivalent produced or $44.95 (U.S.) per tonne milled, in line with company's 2015 cost guidance;

Second quarter production of 13.7 million payable pounds of zinc, 8.7 million payable pounds of lead and 290,225 payable ounces of silver;

Second quarter sales of 13.2 million pounds of zinc, 8.7 million pounds of lead and 290,879 ounces of silver;

Realized selling prices for zinc, lead and silver of 95 U.S. cents per pound, 82 U.S. cents per pound and $16.33 (U.S.) per ounce, respectively;

Mill recoveries remained strong at 90 per cent for zinc, 88 per cent for lead and 78 per cent for silver in the second quarter of 2015.

...."

[url=http://peketec.de/trading/viewtopic.php?p=1621950#1621950 schrieb:greenhorn schrieb am 09.09.2015, 15:09 Uhr[/url]"]TV - Trevali, haben ihre Zinkproduktion von Juli knapp 2000 Tonnen im August auf 5000 Tonnen gesteigert!

bisher moderate Erholung von den letzten Tief´s, ähnlich TKO

könnte heute neuen Schub bekommen, hab mal ne MiniPosi zu 0,41 Euro vorab gekauft

September 09, 2015 08:16 ET

Trevali Provides Caribou Zinc Mine Commissioning Update

http://www.marketwired.com/press-re...-mine-commissioning-update-tsx-tv-2053859.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Sept. 9, 2015) - Trevali Mining Corporation ("Trevali" or the "Company") (TSX:TV)(LMA:TV)(OTCQX:TREVF)(FRANKFURT:4TI) provides an August mine and mill commissioning update for its Caribou Zinc Mine in the Bathurst Mining Camp of northern New Brunswick. A detailed description is provided below and progress highlights are as follows (Table 1):

[url=http://peketec.de/trading/viewtopic.php?p=1504660#1504660 schrieb:spatzemann schrieb am 27.08.2014, 09:51 Uhr[/url]"]Könnte Trevali ein Kandidat sein?

Trevali Mining Aktie [WKN: A1H9CE / ISIN: CA89531J1093]

http://www.stock-world.de/analysen/...ancen_bei_einem_unterschaetzten_Rohstoff.html

[url=http://peketec.de/trading/viewtopic.php?p=1504463#1504463 schrieb:Rookie schrieb am 26.08.2014, 20:34 Uhr[/url]"]Zinkzerti oder hast du einen zinkwert auf dem radar?

[url=http://peketec.de/trading/viewtopic.php?p=1504437#1504437 schrieb:dukezero schrieb am 26.08.2014, 17:59 Uhr[/url]"]Zink,Kupfer Defizit!

Arabica Kaffee in Brasilien steht vor einem massiven Einbruch!!

Dito!!

[url=http://peketec.de/trading/viewtopic.php?p=1642204#1642204 schrieb:greenhorn schrieb am 20.11.2015, 17:51 Uhr[/url]"]Schönes Wochenende Euch Allen!

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Nachtrag zu GPM:

GPM samples 1.8% Pb at Walker Gossan

2015-11-19 13:15 ET - News Release

Mr. Patrick Sheridan reports

GPM METALS INC. ANNOUNCES INITIAL EXPLORATION RESULTS FROM THE WALKER GOSSAN PROJECT, NORTHERN TERRITORY, AUSTRALIA

GPM Metals Inc. has released an exploration update and the initial sampling results of the Walker Gossan project (WGP), Arnhem land, Northern Territory, Australia.

The project is a joint venture with Rio Tinto Exploration Pty. Ltd. (see Jan. 27, 2014, press release of the company available on SEDAR).

Title deed, work program and exploration licence (EL) approval was recently granted by the Northern Land Council after a series of meetings and consultations with the traditional land owners (TLOs) and GPM Metals in Numbulwar and Darwin that had been progressing since February, 2014.

The project tenure is held by Rio Tinto Exploration with GPM acting as the operator and manager of exploration, community relations and title grant under an earn-in/joint venture agreement subject to an agreement concluded in January, 2014.

The WGP lies within one of the great metallogenic provinces of the world, the North Australian zinc province (NAZP), which currently provides 30 per cent of the world's zinc production from a number of significant silver, lead, zinc deposits, including the Mt. Isa, George Fisher, McArthur River and Century mines.

To date, the company has flown an airborne magnetics program of 50-metre-line space over the target area as well as an IP (induced polarization) geophysical survey, geological mapping and completed the initial first-pass reconnaissance soil sampling of the primary area of historical interest at the southern portion on EL 24305. The target area on EL 24305 was identified in 1972 and had been held under continual exploration licence application (ELA) by Rio Tinto since that time.

The exploration target is a large, strata-bound, sediment-hosted lead-zinc deposit. Initial soil and rock sampling results have demonstrated a Pb-Zn mineralization over a three-kilometre-length at surface.

Soil results have defined a continuous three-kilometre-by-500-metre corridor of anomalous lead, including a 1,400-metre-long contour of plus 500 parts per million Pb with a maximum of 2,800 ppm. Rock chips have confirmed the soil results with values as high as 1.8 per cent lead.

The initial assessment of the results of the IP survey confirm elevated chargeability associated with the targeted mineralized zone. These results are currently being interpreted, compiled and integrated into the company database to design a drilling program for 2016.

Patrick Sheridan, chief executive officer of GPM Metals, states, "These initial results confirm our belief the WGP may possibly represent a district target of major significance."

Sampling details

A systematic soil sampling program was undertaken on east-west lines. The soil sampling program comprised 767 soil samples which included broad-spaced soil sampling as well as targeted close-spaced sampling. Rock chip sampling was conducted in conjunction with close-spaced soils and on select samples. A total of 64 rock chip samples were taken.

The highest soil assay result is 2,800 ppm Pb. The results have been contoured at 50, 100 and 500 ppm Pb.

The samples comprised 200 grams of minus two-millimetre sieved B horizon soils which were submitted to ALS Laboratories for multielement analysis by method ME-ICP41. This involved an aqua regia digest with analysis by inductively coupled plasma-atomic emission spectroscopy.

Rock chip samples (64) were submitted to ALS Laboratories for multielement analysis by ME-ICP61 which involves a four-acid digest with analysis by inductively coupled plasma-atomic emission spectroscopy.

The highest lead assay was 1.8 per cent Pb in sample 72851. Four other samples assayed above 1 per cent Pb. Of the 44 samples, 18 assayed above 0.5 per cent Pb.

The tabulated assay data and maps will be posted on the GPM Metals website.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aGPM-2327214&symbol=GPM®ion=C

GPM samples 1.8% Pb at Walker Gossan

2015-11-19 13:15 ET - News Release

Mr. Patrick Sheridan reports

GPM METALS INC. ANNOUNCES INITIAL EXPLORATION RESULTS FROM THE WALKER GOSSAN PROJECT, NORTHERN TERRITORY, AUSTRALIA

GPM Metals Inc. has released an exploration update and the initial sampling results of the Walker Gossan project (WGP), Arnhem land, Northern Territory, Australia.

The project is a joint venture with Rio Tinto Exploration Pty. Ltd. (see Jan. 27, 2014, press release of the company available on SEDAR).

Title deed, work program and exploration licence (EL) approval was recently granted by the Northern Land Council after a series of meetings and consultations with the traditional land owners (TLOs) and GPM Metals in Numbulwar and Darwin that had been progressing since February, 2014.

The project tenure is held by Rio Tinto Exploration with GPM acting as the operator and manager of exploration, community relations and title grant under an earn-in/joint venture agreement subject to an agreement concluded in January, 2014.

The WGP lies within one of the great metallogenic provinces of the world, the North Australian zinc province (NAZP), which currently provides 30 per cent of the world's zinc production from a number of significant silver, lead, zinc deposits, including the Mt. Isa, George Fisher, McArthur River and Century mines.

To date, the company has flown an airborne magnetics program of 50-metre-line space over the target area as well as an IP (induced polarization) geophysical survey, geological mapping and completed the initial first-pass reconnaissance soil sampling of the primary area of historical interest at the southern portion on EL 24305. The target area on EL 24305 was identified in 1972 and had been held under continual exploration licence application (ELA) by Rio Tinto since that time.

The exploration target is a large, strata-bound, sediment-hosted lead-zinc deposit. Initial soil and rock sampling results have demonstrated a Pb-Zn mineralization over a three-kilometre-length at surface.

Soil results have defined a continuous three-kilometre-by-500-metre corridor of anomalous lead, including a 1,400-metre-long contour of plus 500 parts per million Pb with a maximum of 2,800 ppm. Rock chips have confirmed the soil results with values as high as 1.8 per cent lead.

The initial assessment of the results of the IP survey confirm elevated chargeability associated with the targeted mineralized zone. These results are currently being interpreted, compiled and integrated into the company database to design a drilling program for 2016.

Patrick Sheridan, chief executive officer of GPM Metals, states, "These initial results confirm our belief the WGP may possibly represent a district target of major significance."

Sampling details

A systematic soil sampling program was undertaken on east-west lines. The soil sampling program comprised 767 soil samples which included broad-spaced soil sampling as well as targeted close-spaced sampling. Rock chip sampling was conducted in conjunction with close-spaced soils and on select samples. A total of 64 rock chip samples were taken.

The highest soil assay result is 2,800 ppm Pb. The results have been contoured at 50, 100 and 500 ppm Pb.

The samples comprised 200 grams of minus two-millimetre sieved B horizon soils which were submitted to ALS Laboratories for multielement analysis by method ME-ICP41. This involved an aqua regia digest with analysis by inductively coupled plasma-atomic emission spectroscopy.

Rock chip samples (64) were submitted to ALS Laboratories for multielement analysis by ME-ICP61 which involves a four-acid digest with analysis by inductively coupled plasma-atomic emission spectroscopy.

The highest lead assay was 1.8 per cent Pb in sample 72851. Four other samples assayed above 1 per cent Pb. Of the 44 samples, 18 assayed above 0.5 per cent Pb.

The tabulated assay data and maps will be posted on the GPM Metals website.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aGPM-2327214&symbol=GPM®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Kilo Goldmines arranges $3-million private placement

2015-11-19 08:52 ET - News Release

Mr. Philip Gibbs reports

KILO GOLDMINES ANNOUNCES PROPOSED NON-BROKERED PRIVATE PLACEMENT

Kilo Goldmines Ltd. intends to proceed with a non-brokered private placement of equity units to raise gross proceeds of $2,002,000 to a maximum of $3,003,000. The units will be offered at a price of seven cents per unit and each unit will consist of one common share and one non-transferable common share purchase warrant of the company. Each warrant will entitle the holder to acquire one additional common share of the company for two years at a price of 9.5 cents. Kilo has been advised that a fund managed by one of the Sprott group of companies intends to subscribe for units in the offering.

The company will use the net proceeds from the offering for working capital and general corporate purposes, and to maintain its Somituri gold property in the Democratic Republic of the Congo.

The company will pay finders' fees to registered dealers in connection with the offering of 7.0 per cent in cash and 5.0 per cent in finders' warrants, each finder's warrant exercisable to acquire one common share of the company at a price of seven cents per share for two years.

Insiders of the company may subscribe for up to 75 per cent of the offering.

The private placement is subject to all necessary regulatory approvals, including approval of the TSX Venture Exchange. All securities issued pursuant to the private placement will be subject to a four-month restricted resale period.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aKGL-2327110&symbol=KGL®ion=C

Nighthawk Gold closes $850,000 private placement

2015-11-20 15:22 ET - News Release

Dr. Michael Byron reports

NIGHTHAWK COMPLETES $850,000 PRIVATE PLACEMENT OF SECURED NOTES

Nighthawk Gold Corp. has completed a private-placement offering of secured notes for a total principal amount of $850,000. The net proceeds from the sale of the notes will be used by the company for working capital and general corporate purposes.

The notes pay interest at a fixed rate of 12 per cent per year, calculated daily and compounded monthly, and interest is payable in cash semi-annually. The notes mature on May 23, 2017, and are secured by general security agreements on the property of the company. The company may prepay the notes at any time prior to the maturity date, without penalty, provided that any interest owed to the date of prepayment that has not already been remitted to the noteholders is also remitted to the noteholders.

In connection with the issuance of the notes, the noteholders were also issued a total of 3.4 million common share purchase warrants. Each warrant entitles the holder to acquire one common share of the company at an exercise price of 15 cents per share until May 23, 2017. However, in accordance with the policies of the TSX Venture Exchange, to the extent the company repays any or all of the notes pursuant to the terms of the notes before Nov. 20, 2016, the expiry time for a pro rata portion of the warrants based on the repayment of the notes will be reduced to the later of Nov. 20, 2016, and 30 days from the reduction or repayment of the notes. The securities issued pursuant to the offering are subject to a hold period expiring on March 21, 2016. In connection with the offering, the company paid a cash finder's fee of $9,000.

Northfield Capital Corp., a related party of the company as a result of its ownership position of greater than 10 per cent of the company's common shares, participated in the offering. Northfield purchased notes in the total amount of $350,000, which has resulted in Northfield receiving 1.4 million warrants issued in connection with the notes. The participation by Northfield is considered a related party transaction for the purposes of Multilateral Instrument 61-101, Protection of Minority Securityholders in Special Transactions. However, Northfield's participation in the offering is not subject to the minority approval and formal valuation requirements under MI 61-101 since there is an applicable exemption from these requirements as neither the fair market value of the subject matter, nor the fair market value of the consideration for the transaction, insofar as it involves Northfield, exceeds 25 per cent of the company's market capitalization. Morris Prychidny, who is a member of the company's board of directors and a director of Northfield abstained from approving Northfield's participation in the offering. The remaining directors are of the view that the offering has been conducted on market terms and was fair to the minority securityholders of the company.

Following the completion of the offering, Northfield now owns and controls 9,125,091 common shares and 2,422,500 common share purchase warrants, representing approximately 15.6 per cent of the issued and outstanding common shares on an undiluted basis and 19 per cent of the issued and outstanding common shares on a partially diluted basis. The issuance of the warrants to Northfield should not represent a material change in its ownership of the company as 1,022,500 common share purchase warrants with an exercise price of 50 cents per share held by Northfield will expire in December, 2015. Once these warrants expire Northfield's interest in the company will drop to 17.6 per cent of the issued and outstanding common shares on a partially diluted basis.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aNHK-2327562&symbol=NHK®ion=C

2015-11-19 08:52 ET - News Release

Mr. Philip Gibbs reports

KILO GOLDMINES ANNOUNCES PROPOSED NON-BROKERED PRIVATE PLACEMENT

Kilo Goldmines Ltd. intends to proceed with a non-brokered private placement of equity units to raise gross proceeds of $2,002,000 to a maximum of $3,003,000. The units will be offered at a price of seven cents per unit and each unit will consist of one common share and one non-transferable common share purchase warrant of the company. Each warrant will entitle the holder to acquire one additional common share of the company for two years at a price of 9.5 cents. Kilo has been advised that a fund managed by one of the Sprott group of companies intends to subscribe for units in the offering.

The company will use the net proceeds from the offering for working capital and general corporate purposes, and to maintain its Somituri gold property in the Democratic Republic of the Congo.

The company will pay finders' fees to registered dealers in connection with the offering of 7.0 per cent in cash and 5.0 per cent in finders' warrants, each finder's warrant exercisable to acquire one common share of the company at a price of seven cents per share for two years.

Insiders of the company may subscribe for up to 75 per cent of the offering.

The private placement is subject to all necessary regulatory approvals, including approval of the TSX Venture Exchange. All securities issued pursuant to the private placement will be subject to a four-month restricted resale period.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aKGL-2327110&symbol=KGL®ion=C

Nighthawk Gold closes $850,000 private placement

2015-11-20 15:22 ET - News Release

Dr. Michael Byron reports

NIGHTHAWK COMPLETES $850,000 PRIVATE PLACEMENT OF SECURED NOTES

Nighthawk Gold Corp. has completed a private-placement offering of secured notes for a total principal amount of $850,000. The net proceeds from the sale of the notes will be used by the company for working capital and general corporate purposes.

The notes pay interest at a fixed rate of 12 per cent per year, calculated daily and compounded monthly, and interest is payable in cash semi-annually. The notes mature on May 23, 2017, and are secured by general security agreements on the property of the company. The company may prepay the notes at any time prior to the maturity date, without penalty, provided that any interest owed to the date of prepayment that has not already been remitted to the noteholders is also remitted to the noteholders.

In connection with the issuance of the notes, the noteholders were also issued a total of 3.4 million common share purchase warrants. Each warrant entitles the holder to acquire one common share of the company at an exercise price of 15 cents per share until May 23, 2017. However, in accordance with the policies of the TSX Venture Exchange, to the extent the company repays any or all of the notes pursuant to the terms of the notes before Nov. 20, 2016, the expiry time for a pro rata portion of the warrants based on the repayment of the notes will be reduced to the later of Nov. 20, 2016, and 30 days from the reduction or repayment of the notes. The securities issued pursuant to the offering are subject to a hold period expiring on March 21, 2016. In connection with the offering, the company paid a cash finder's fee of $9,000.

Northfield Capital Corp., a related party of the company as a result of its ownership position of greater than 10 per cent of the company's common shares, participated in the offering. Northfield purchased notes in the total amount of $350,000, which has resulted in Northfield receiving 1.4 million warrants issued in connection with the notes. The participation by Northfield is considered a related party transaction for the purposes of Multilateral Instrument 61-101, Protection of Minority Securityholders in Special Transactions. However, Northfield's participation in the offering is not subject to the minority approval and formal valuation requirements under MI 61-101 since there is an applicable exemption from these requirements as neither the fair market value of the subject matter, nor the fair market value of the consideration for the transaction, insofar as it involves Northfield, exceeds 25 per cent of the company's market capitalization. Morris Prychidny, who is a member of the company's board of directors and a director of Northfield abstained from approving Northfield's participation in the offering. The remaining directors are of the view that the offering has been conducted on market terms and was fair to the minority securityholders of the company.

Following the completion of the offering, Northfield now owns and controls 9,125,091 common shares and 2,422,500 common share purchase warrants, representing approximately 15.6 per cent of the issued and outstanding common shares on an undiluted basis and 19 per cent of the issued and outstanding common shares on a partially diluted basis. The issuance of the warrants to Northfield should not represent a material change in its ownership of the company as 1,022,500 common share purchase warrants with an exercise price of 50 cents per share held by Northfield will expire in December, 2015. Once these warrants expire Northfield's interest in the company will drop to 17.6 per cent of the issued and outstanding common shares on a partially diluted basis.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aNHK-2327562&symbol=NHK®ion=C

[url=http://peketec.de/trading/viewtopic.php?p=1641246#1641246 schrieb:Kostolanys Erbe schrieb am 18.11.2015, 11:08 Uhr[/url]"]

Hmm bei KGL scheint sich was zu tun...

Vielleicht die nächste Übernahme...jedenfalls stemmt sich

Der Aktienkurs gegen den aktuellen Trend ...

PS:

Gestrige Volumen bei GIX und NHK scheinen sell out Strategien zu sein, egal zu

Welchen Preis...

Jemand eine Meinung zu NHK?

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Nachtrag POE:

Pan Orient Energy earns $2.34-million in fiscal Q3 2015

2015-11-19 09:22 ET - News Release

Mr. Jeff Chisholm reports

PAN ORIENT ENERGY CORP.: 2015 THIRD QUARTER FINANCIAL & OPERATING RESULTS

Pan Orient Energy Corp. has released its third quarter 2015 consolidated financial and operating results.

The corporation is today filing its unaudited consolidated financial statements as at and for the nine months ended Sept. 30, 2015, and related management's discussion and analysis with Canadian securities regulatory authorities. Copies of these documents may be obtained on-line at SEDAR or the corporation's website.

Commenting today on Pan Orient's third quarter 2015 results, president and chief executive officer Jeff Chisholm stated: "We are very pleased with the solid late third quarter and subsequent Thailand production growth that was the result of a number of low-cost workovers. The discovery at Akeh-1 in Indonesia was a positive result and work is currently under way towards progressing this discovery through the government of Indonesia regulatory process with key meetings scheduled to be held in December, 2015."

Third quarter 2015 highlights:

The Akeh-1 exploration well at Batu Gajah production sharing contract (PSC) in Indonesia was drilled during the third quarter and resulted in a natural gas and condensate discovery;

Three successful workovers at the L53G and L53A fields in Thailand concession L53 with production from new reservoir zones. Oil sales net to Pan Orient's 50.01-per-cent interest in the Thailand joint venture increased in the third quarter to 299 barrels of oil per day and further increased in October to 455 bopd as a result of these workovers;

Pan Orient had farmed-out a 51-per-cent participating interest and operatorship of the East Jabung PSC to a subsidiary of Talisman Energy Inc. on June 1, 2015. Planning continues for drilling the first exploration well at the Anggun prospect, for which the farminee is financing the first $5-million (U.S.) of Pan Orient's share of the exploration well. Pan Orient and the operator have approved the East Jabung PSC 2016 work program and budget that includes the drilling of the Anggun-1 well. The company expects an update on the timing of drilling of the well from the operator early in the first quarter of 2016;

Bitumen production at the Sawn Lake, Alberta, steam-assisted gravity drainage (SAGD) demonstration project of Andora Energy Corp. continues to ramp up and averaged 441 bopd on a 100-per-cent basis (221 bopd net to Andora) over the past 15 days with a steam-oil ratio (SOR) of 4.2;

For the third quarter of 2015, net income attributable to common shareholders was $2.3-million and corporate funds flow from operations was $3.4-million;

Strong financial position as at Sept. 30, 2015, with working capital and non-current deposits of $81.1-million, which is mainly held as cash deposits in Canada denominated in U.S. dollars. Pan Orient benefited from the increase in the exchange rate of the U.S. dollar to the Canadian dollar (increased from 1.25 to 1.34 during the third quarter of 2015). Pan Orient has no long-term debt;

Repurchased an additional 544,100 common shares under the normal course issuer bid during the third quarter of 2015, resulting in 54.9 million outstanding Pan Orient shares at Sept. 30, 2015.

Third quarter 2015 operating results

The financial statements reflect that on Feb. 2, 2015, the company sold a 49.99-per-cent equity interest in its subsidiary, Pan Orient Energy (Siam) Ltd., and retained a 50.01-per-cent equity interest. From Feb. 2, 2015, forward the retained 50.01-per-cent equity interest is reclassified as a jointly controlled joint venture, and Pan Orient's 50.01-per-cent equity interest in the working capital, assets, capital expenditures, liabilities and operations of Pan Orient Energy (Siam) are recorded as investment in the Thailand joint venture.

Net income attributable to common shareholders for the third quarter of 2015 of $2.3-million (four cents per share) primarily due to a foreign exchange gain of $3.5-million from the increased value of U.S.-dollar holdings. Net income attributable to common shareholders for the first nine months of 2015 of $33.0-million (59 cents per share) largely from the $38.5-million gain recorded on the sale of a 49.99-per-cent equity interest in its subsidiary, Pan Orient Energy (Siam), during the first quarter of 2015.

For the third quarter of 2015, the company recorded total corporate funds flow from operations of $3.4-million (six cents per share), including the results of the 50.01-per-cent interest in the Thailand joint venture. For the nine months ended Sept. 30, 2015, total corporate funds flow from operations was $2.8-million (five cents per share) and funds flow from sale of the Thailand interest was $48.9-million (89 cents per share).

Pan Orient reports capital expenditures of $8.1-million in the third quarter of 2015, with $7.2-million in Indonesia and $900,000 in Canada at the Sawn Lake SAGD demonstration project of Andora. In addition, Pan Orient's share of the Thailand joint venture capital expenditures was $100,000, which was recorded in investment in the Thailand joint venture. During the first nine months of 2015 capital expenditures were $8.7-million in Indonesia, $100,000 in Thailand prior to Feb. 2, 2015, and $4.0-million in Canada at the Sawn Lake SAGD demonstration project of Andora. In addition, Pan Orient's share of the Thailand joint venture capital expenditures from Feb. 2 to Sept. 30, 2015, was $3.7-million.

During the third quarter of 2015, Pan Orient repurchased an additional 544,100 common shares at prices ranging from $1.14 to $1.35 per share under its normal course issuer bid. To date, Pan Orient has repurchased 1,874,900 common shares at an average price of $1.44 per share.

At Sept. 30, 2015, Pan Orient had $81.1-million of working capital and non-current deposits. Working capital and non-current deposits comprised $71.8-million cash, $3.9-million of non-current deposits, $12.5-million of Canadian taxes receivable, other receivables of $1.7-million and less accounts payable of $8.7-million. There is $1.8-million of equipment inventory at the Batu Gajah PSC in Indonesia for utilization in future drilling operations at the PSC. In addition, Pan Orient's investment in the Thailand joint venture includes $900,000 of Thailand working capital and non-current deposits, and $2.0-million of equipment inventory to be utilized for future Thailand joint venture operations.

Pan Orient had outstanding capital commitments as at Sept. 30, 2015, of $2.1-million in Indonesia associated with the company's 49-per-cent participating interest in the East Jabung PSC. In Canada, there were capital commitments of $300,000 with respect to contracted natural gas pipeline tie-in and tariff charges associated with the Sawn Lake SAGD demonstration project of Andora.

Results net to Pan Orient's 50.01-per-cent interest in the Thailand joint venture for concession L53:

Average oil sales of 299 bopd during the third quarter of 2015 and generated $900,000 in funds flow from operations, or $31.56 per barrel. For the first nine months of 2015, average oil sales of 291 bopd and $2.6-million in funds flow from operations, or $32.63 per barrel;

Per-barrel amounts during the third quarter of 2015 were a realized price for oil sales of $56.61, transportation expenses of $1.60, operating expenses of $13.09, general and administrative expenses of $6.40, and a royalty to the Thailand government of $2.80. Oil sales revenue during this period was allocated 39 per cent to expenses for transportation, operating, and general and administrative, 5 per cent to the government of Thailand for royalties, and 56 per cent to the Thailand joint venture. No Thailand petroleum income taxes or special remuneratory benefit tax was recorded during the quarter;

Oil sales in October, 2015, at concession L53 were 455 bopd;

During the third quarter, Pan Orient completed workovers on two wells at the L53G field and one well at the L53A field to produce from additional reservoir zones. Production from these three wells was approximately 90 bopd prior to the workovers and current production is 345 bopd (with an average of 354 bopd over the past 60 days). The estimated cost of the workover program was $160,000;

The L53-DC1ST1 appraisal well drilled in March, 2015, added eight bopd in the first quarter, 67 bopd in the second quarter and 20 bopd in the third quarter net to Pan Orient. The L53-DEXT1ST2 appraisal well also drilled in March added 12 bopd in the second quarter and third quarters net to Pan Orient;

Capital expenditures were $100,000 in Thailand during the third quarter of 2015. The $3.8-million of Thailand capital expenditures during the first nine months of 2015 at concession L53, including the 50.01-per-cent interest in the Thailand joint venture from Feb. 2, 2015, onward, comprised $3.1-million for the three-well drilling program, $600,000 for workovers and other capital expenditures, and $100,000 for capitalized general and administrative expenses.

Indonesia:

Capital expenditures in Indonesia were $8.7-million during the first nine months of 2015. Capital expenditures of $300,000 at the East Jabung PSC were for permits and fees at the Anggun prospect prior to the farming out of interests, engineering fees, and capitalized G&A. Capital expenditures of $8.4-million at the Batu Gajah PSC were $7.0-million for drilling of the Akeh-1 exploration well and $1.4-million for capitalized G&A.

The Akeh-1 exploration well at Batu Gajah PSC was drilled during the third quarter, and resulted in a natural gas and condensate discovery. The cost of the Akeh-1 exploration well to Sept. 30 was $7.0-million and an estimated additional $2.6-million has been incurred in the fourth quarter to complete drilling and testing of the well. Testing was completed in the third week of October.

On Oct. 6, 2015, the Citarum PSC expired.

Canada:

Andora is the operator and holds a 50-per-cent working interest the Sawn Lake, Alberta, SAGD demonstration project. Andora is a 71.8-per-cent-owned subsidiary of Pan Orient and is consolidated with Pan Orient for reporting purposes.

Capital expenditures for the Sawn Lake demonstration project during the first nine months of 2015 have been $4.0-million. Capital expenditures are related to final construction of the SAGD facility, installation of additional equipment for processing and treating the bitumen production at site, replacement of the electrical submersible pump, purchase of inventory, and capitalization of expenses and revenues of the demonstration project. For the first nine months of 2015, Andora has capitalized $2.2-million of demonstration project expenses less revenues.

The SAGD producing well continues in its ramp-up phase. The steam chamber reached the top of the Bluesky formation sandstone reservoir in October. During the first quarter of 2015, bitumen production averaged 290 bopd (145 bopd net to Andora) with an SOR of 5.6. During the second quarter of 2015, bitumen production averaged 306 bopd (153 bopd net to Andora) with an SOR of 5.6 despite being shut in from April 11 to April 30 due to a problem with the electrical submersible pump. During the third quarter of 2015 there was a temporary shutdown for inspection of pressure vessels and installation of additional metres, and bitumen production averaged 367 bopd (184 bopd net to Andora) with an SOR of 4.6.

Production results to date are not necessarily indicative of long-term performance or of ultimate recovery, and the Sawn Lake demonstration project has not yet proven that it is commercially viable. All related costs and revenues are being capitalized as exploration and evaluation assets until commercial viability is achieved.

Outlook

Indonesia:

Technical data obtained in the drilling and testing of the Akeh-1 exploration well are being used to update the company's understanding of the Akeh prospect and prepare regulatory filings. The next step will be holding discussions with the government of Indonesia in relation to having the Akeh structure released from exploration status as a conclusive discovery. A successful release would allow the commencement of a preplan of development study to determine the likelihood of the commerciality of the Akeh-1 discovery, which would be followed (if commerciality is deemed likely) by the compilation and submission of a plan of development. Readers are cautioned that test results are not necessarily indicative of long-term performance or of ultimate recovery

At the East Jabung PSC, Pan Orient and the operator have approved the 2016 work program and budget which includes the drilling of the Anggun-1 exploration well. The timelines for drilling of the Anggun-1 exploration well will be firmed up early in the first quarter of 2016, by which time all approvals should be in place and the access route selected.

Thailand:

Pan Orient is evaluating the success of the 2015 workover program at concession L53 to determine the workover and drilling program for 2016.

Canada -- Sawn Lake (operated by Andora, in which Pan Orient has a 71.8-per-cent ownership):

The demonstration project continues to confirm that the SAGD process works in the Bluesky formation reservoir, indicates the productivity of the reservoir and indicates the amount of steam injection required to produce the bitumen. These are key components in assessing the potential for commercial SAGD development at Sawn Lake. The Sawn Lake demonstration project is expected to reach its maximum sustained production level in December, 2015.

A regulatory application is being prepared for a potential expansion at the demonstration project site which would increase the operation to eight SAGD well pairs and associated facilities. The application is expected to be submitted by the end of January, 2016, and approval is expected to take approximately 1.5 years. There is no certainty that it will be economically viable to proceed with commercial development. The decision to proceed with an expansion will be considered in the context of a higher-commodity-price environment after regulatory approval is obtained.

FINANCIAL AND OPERATING SUMMARY

(In thousands, except where indicated)

.............

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aPOE-2327123&symbol=POE®ion=C

Pan Orient Energy earns $2.34-million in fiscal Q3 2015

2015-11-19 09:22 ET - News Release

Mr. Jeff Chisholm reports

PAN ORIENT ENERGY CORP.: 2015 THIRD QUARTER FINANCIAL & OPERATING RESULTS

Pan Orient Energy Corp. has released its third quarter 2015 consolidated financial and operating results.

The corporation is today filing its unaudited consolidated financial statements as at and for the nine months ended Sept. 30, 2015, and related management's discussion and analysis with Canadian securities regulatory authorities. Copies of these documents may be obtained on-line at SEDAR or the corporation's website.

Commenting today on Pan Orient's third quarter 2015 results, president and chief executive officer Jeff Chisholm stated: "We are very pleased with the solid late third quarter and subsequent Thailand production growth that was the result of a number of low-cost workovers. The discovery at Akeh-1 in Indonesia was a positive result and work is currently under way towards progressing this discovery through the government of Indonesia regulatory process with key meetings scheduled to be held in December, 2015."

Third quarter 2015 highlights:

The Akeh-1 exploration well at Batu Gajah production sharing contract (PSC) in Indonesia was drilled during the third quarter and resulted in a natural gas and condensate discovery;

Three successful workovers at the L53G and L53A fields in Thailand concession L53 with production from new reservoir zones. Oil sales net to Pan Orient's 50.01-per-cent interest in the Thailand joint venture increased in the third quarter to 299 barrels of oil per day and further increased in October to 455 bopd as a result of these workovers;

Pan Orient had farmed-out a 51-per-cent participating interest and operatorship of the East Jabung PSC to a subsidiary of Talisman Energy Inc. on June 1, 2015. Planning continues for drilling the first exploration well at the Anggun prospect, for which the farminee is financing the first $5-million (U.S.) of Pan Orient's share of the exploration well. Pan Orient and the operator have approved the East Jabung PSC 2016 work program and budget that includes the drilling of the Anggun-1 well. The company expects an update on the timing of drilling of the well from the operator early in the first quarter of 2016;

Bitumen production at the Sawn Lake, Alberta, steam-assisted gravity drainage (SAGD) demonstration project of Andora Energy Corp. continues to ramp up and averaged 441 bopd on a 100-per-cent basis (221 bopd net to Andora) over the past 15 days with a steam-oil ratio (SOR) of 4.2;

For the third quarter of 2015, net income attributable to common shareholders was $2.3-million and corporate funds flow from operations was $3.4-million;

Strong financial position as at Sept. 30, 2015, with working capital and non-current deposits of $81.1-million, which is mainly held as cash deposits in Canada denominated in U.S. dollars. Pan Orient benefited from the increase in the exchange rate of the U.S. dollar to the Canadian dollar (increased from 1.25 to 1.34 during the third quarter of 2015). Pan Orient has no long-term debt;

Repurchased an additional 544,100 common shares under the normal course issuer bid during the third quarter of 2015, resulting in 54.9 million outstanding Pan Orient shares at Sept. 30, 2015.

Third quarter 2015 operating results

The financial statements reflect that on Feb. 2, 2015, the company sold a 49.99-per-cent equity interest in its subsidiary, Pan Orient Energy (Siam) Ltd., and retained a 50.01-per-cent equity interest. From Feb. 2, 2015, forward the retained 50.01-per-cent equity interest is reclassified as a jointly controlled joint venture, and Pan Orient's 50.01-per-cent equity interest in the working capital, assets, capital expenditures, liabilities and operations of Pan Orient Energy (Siam) are recorded as investment in the Thailand joint venture.

Net income attributable to common shareholders for the third quarter of 2015 of $2.3-million (four cents per share) primarily due to a foreign exchange gain of $3.5-million from the increased value of U.S.-dollar holdings. Net income attributable to common shareholders for the first nine months of 2015 of $33.0-million (59 cents per share) largely from the $38.5-million gain recorded on the sale of a 49.99-per-cent equity interest in its subsidiary, Pan Orient Energy (Siam), during the first quarter of 2015.

For the third quarter of 2015, the company recorded total corporate funds flow from operations of $3.4-million (six cents per share), including the results of the 50.01-per-cent interest in the Thailand joint venture. For the nine months ended Sept. 30, 2015, total corporate funds flow from operations was $2.8-million (five cents per share) and funds flow from sale of the Thailand interest was $48.9-million (89 cents per share).

Pan Orient reports capital expenditures of $8.1-million in the third quarter of 2015, with $7.2-million in Indonesia and $900,000 in Canada at the Sawn Lake SAGD demonstration project of Andora. In addition, Pan Orient's share of the Thailand joint venture capital expenditures was $100,000, which was recorded in investment in the Thailand joint venture. During the first nine months of 2015 capital expenditures were $8.7-million in Indonesia, $100,000 in Thailand prior to Feb. 2, 2015, and $4.0-million in Canada at the Sawn Lake SAGD demonstration project of Andora. In addition, Pan Orient's share of the Thailand joint venture capital expenditures from Feb. 2 to Sept. 30, 2015, was $3.7-million.

During the third quarter of 2015, Pan Orient repurchased an additional 544,100 common shares at prices ranging from $1.14 to $1.35 per share under its normal course issuer bid. To date, Pan Orient has repurchased 1,874,900 common shares at an average price of $1.44 per share.

At Sept. 30, 2015, Pan Orient had $81.1-million of working capital and non-current deposits. Working capital and non-current deposits comprised $71.8-million cash, $3.9-million of non-current deposits, $12.5-million of Canadian taxes receivable, other receivables of $1.7-million and less accounts payable of $8.7-million. There is $1.8-million of equipment inventory at the Batu Gajah PSC in Indonesia for utilization in future drilling operations at the PSC. In addition, Pan Orient's investment in the Thailand joint venture includes $900,000 of Thailand working capital and non-current deposits, and $2.0-million of equipment inventory to be utilized for future Thailand joint venture operations.

Pan Orient had outstanding capital commitments as at Sept. 30, 2015, of $2.1-million in Indonesia associated with the company's 49-per-cent participating interest in the East Jabung PSC. In Canada, there were capital commitments of $300,000 with respect to contracted natural gas pipeline tie-in and tariff charges associated with the Sawn Lake SAGD demonstration project of Andora.

Results net to Pan Orient's 50.01-per-cent interest in the Thailand joint venture for concession L53:

Average oil sales of 299 bopd during the third quarter of 2015 and generated $900,000 in funds flow from operations, or $31.56 per barrel. For the first nine months of 2015, average oil sales of 291 bopd and $2.6-million in funds flow from operations, or $32.63 per barrel;

Per-barrel amounts during the third quarter of 2015 were a realized price for oil sales of $56.61, transportation expenses of $1.60, operating expenses of $13.09, general and administrative expenses of $6.40, and a royalty to the Thailand government of $2.80. Oil sales revenue during this period was allocated 39 per cent to expenses for transportation, operating, and general and administrative, 5 per cent to the government of Thailand for royalties, and 56 per cent to the Thailand joint venture. No Thailand petroleum income taxes or special remuneratory benefit tax was recorded during the quarter;

Oil sales in October, 2015, at concession L53 were 455 bopd;

During the third quarter, Pan Orient completed workovers on two wells at the L53G field and one well at the L53A field to produce from additional reservoir zones. Production from these three wells was approximately 90 bopd prior to the workovers and current production is 345 bopd (with an average of 354 bopd over the past 60 days). The estimated cost of the workover program was $160,000;

The L53-DC1ST1 appraisal well drilled in March, 2015, added eight bopd in the first quarter, 67 bopd in the second quarter and 20 bopd in the third quarter net to Pan Orient. The L53-DEXT1ST2 appraisal well also drilled in March added 12 bopd in the second quarter and third quarters net to Pan Orient;

Capital expenditures were $100,000 in Thailand during the third quarter of 2015. The $3.8-million of Thailand capital expenditures during the first nine months of 2015 at concession L53, including the 50.01-per-cent interest in the Thailand joint venture from Feb. 2, 2015, onward, comprised $3.1-million for the three-well drilling program, $600,000 for workovers and other capital expenditures, and $100,000 for capitalized general and administrative expenses.

Indonesia: