App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

[url=http://peketec.de/trading/viewtopic.php?p=1668781#1668781 schrieb:greenhorn schrieb am 03.03.2016, 15:18 Uhr[/url]"]wie hieß der Graphit-"Tanker", der so stark angestiegen ist im ersten Hype?

ZEN

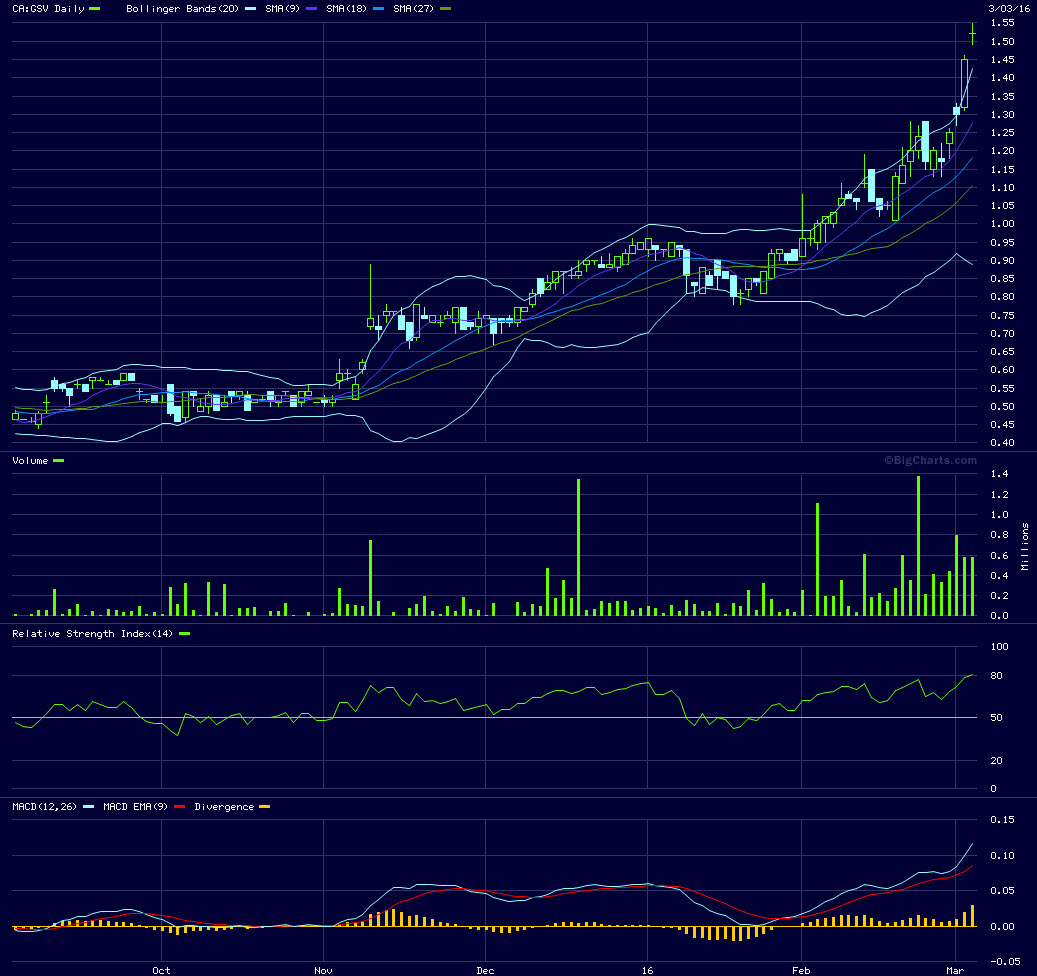

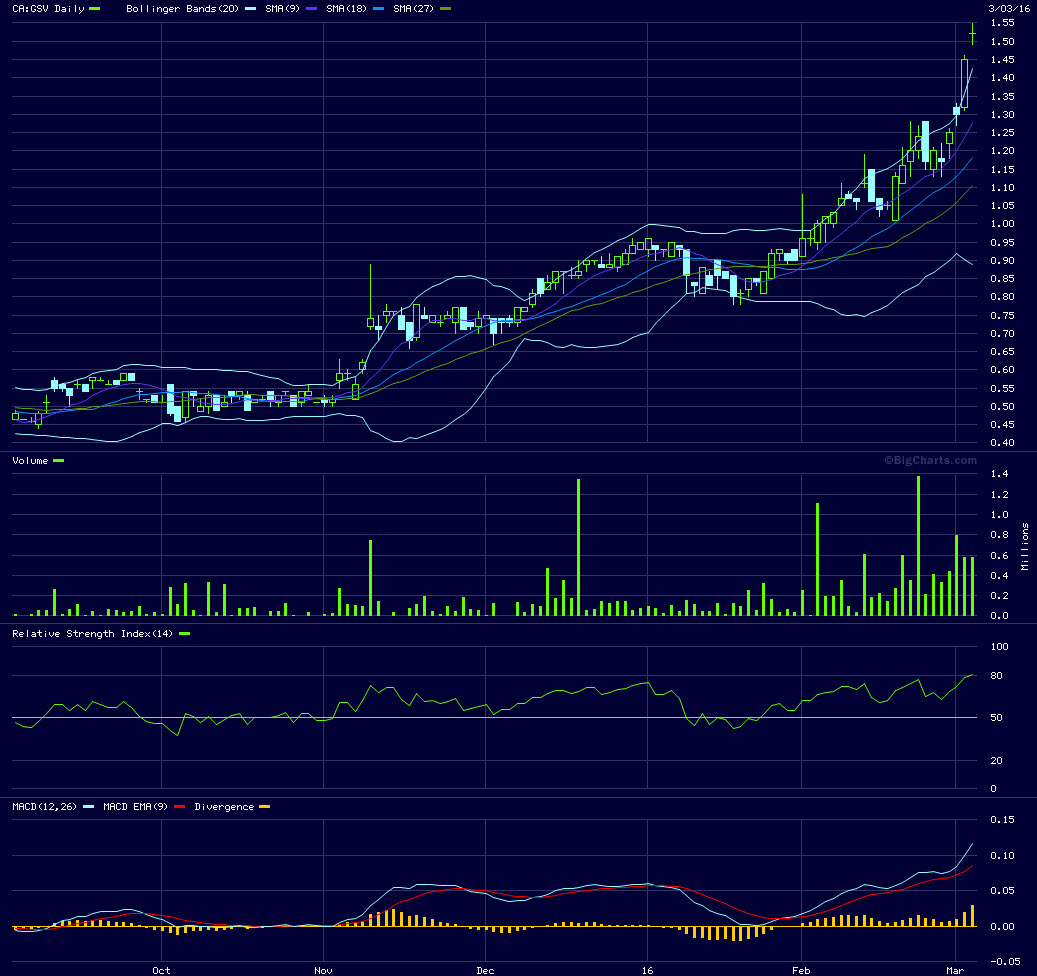

Lonely warrior im Chart. Könnte eine kleine Korrektur andeuten bei GSV.

[url=http://peketec.de/trading/viewtopic.php?p=1668768#1668768 schrieb:Rookie schrieb am 03.03.2016, 14:29 Uhr[/url]"]wird spannend wie die "guten Daten" aus USA wieder aufgenommen werden, oder GSV koppelt sich völlig ab?

[url=http://peketec.de/trading/viewtopic.php?p=1668749#1668749 schrieb:

hat noch ein Gap bei 0,65

[url=http://peketec.de/trading/viewtopic.php?p=1668802#1668802 schrieb:dukezero schrieb am 03.03.2016, 16:10 Uhr[/url]"]Lonely warrior im Chart. Könnte eine kleine Korrektur andeuten bei GSV.

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1668768#1668768 schrieb:Rookie schrieb am 03.03.2016, 14:29 Uhr[/url]"]wird spannend wie die "guten Daten" aus USA wieder aufgenommen werden, oder GSV koppelt sich völlig ab?

[url=http://peketec.de/trading/viewtopic.php?p=1668749#1668749 schrieb:

[url=http://peketec.de/trading/viewtopic.php?p=1668800#1668800 schrieb:dukezero schrieb am 03.03.2016, 16:08 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1668781#1668781 schrieb:greenhorn schrieb am 03.03.2016, 15:18 Uhr[/url]"]wie hieß der Graphit-"Tanker", der so stark angestiegen ist im ersten Hype?

ZEN

War eventuell für den neuen Vorstand "geblockt "

War ein Cross-Trade von 392.000 über Haywood.

War ein Cross-Trade von 392.000 über Haywood.

[url=http://peketec.de/trading/viewtopic.php?p=1668812#1668812 schrieb:600 schrieb am 03.03.2016, 16:34 Uhr[/url]"]Bei RD der dicke Block auf der 0,37 weggeknabbert...

S9A - mit Geduld sieht man demnächst wohlmöglich die 3,75 Euro  8)

8)

4Q 2015:

Highlights

Revenue of $959 million

EBITDA of $513 million

93% economic utilization

Reported Net Income of $279 million and diluted earnings per share of $0.58

Cash and cash equivalents of $1.04 billion

The Seadrill Group achieved 95% economic utilization

Seadrill Group orderbacklog of approximately $10.7 billion

Commenting today, Per Wullf, CEO and President of Seadrill Management Ltd., said:

"During the fourth quarter we experienced our best operational quarter of the year, while continuing to reduce our cost base. Safe and efficient operations remain at the heart of what we do as we continue to drive down costs.

In the face of the severe downturn in our industry our priorities for 2016 are to conserve cash and address our financing needs. We have a modern competitive fleet, a proven track record in operations and every intention to position ourselves for a recovery in the sector.

Our 2016 liquidity is good and we aim to communicate our funding plans during the first half of the year."

4Q 2015:

Highlights

Revenue of $959 million

EBITDA of $513 million

93% economic utilization

Reported Net Income of $279 million and diluted earnings per share of $0.58

Cash and cash equivalents of $1.04 billion

The Seadrill Group achieved 95% economic utilization

Seadrill Group orderbacklog of approximately $10.7 billion

Commenting today, Per Wullf, CEO and President of Seadrill Management Ltd., said:

"During the fourth quarter we experienced our best operational quarter of the year, while continuing to reduce our cost base. Safe and efficient operations remain at the heart of what we do as we continue to drive down costs.

In the face of the severe downturn in our industry our priorities for 2016 are to conserve cash and address our financing needs. We have a modern competitive fleet, a proven track record in operations and every intention to position ourselves for a recovery in the sector.

Our 2016 liquidity is good and we aim to communicate our funding plans during the first half of the year."

[url=http://peketec.de/trading/viewtopic.php?p=1654033#1654033 schrieb:greenhorn schrieb am 11.01.2016, 14:16 Uhr[/url]"]2.Posi zu 2,50 MischEK bei 3,06

[url=http://peketec.de/trading/viewtopic.php?p=1648871#1648871 schrieb:greenhorn schrieb am 14.12.2015, 12:46 Uhr[/url]"]Seadrill - S9A Long zu 3,61

Löppt an!

[url=http://peketec.de/trading/viewtopic.php?p=1668402#1668402 schrieb:Fischlaender schrieb am 02.03.2016, 12:44 Uhr[/url]"]http://www.dundeeprecious.com/English/news-and-events/news-releases/NewsDetails/2016/Dundee-Precious-Metals-Announces-Sale-of-Kapan-for-US25-Million-and-a-2-Net-Smelter-Return-Royalty/default.aspx

DPM verkauft die Kapan Mine in Armenien an Polymet Mining (LSE:POLY) fuer (alle Angaben in USD)

10mio Cash

15mio Aktien

2% NSR (capped at 25mio)

Da Kapan nur 15% zu Au und 5% zu Cu Produktion DPM's beitraegt und ausserdem die hoeheren AISC hatte, insgesamt ein guter Verkauf.

Praesentation ist bereits aktualisiert: http://s1.q4cdn.com/019834511/files/presentation/2016r/DPM_BMO_FINAL-March-1_EXCLUDING-KAPAN.pdf

[url=http://peketec.de/trading/viewtopic.php?p=1668064#1668064 schrieb:greenhorn schrieb am 01.03.2016, 14:18 Uhr[/url]"]halten ausserdem 12% an Sabina Silver

[url=http://peketec.de/trading/viewtopic.php?p=1668056#1668056 schrieb:Fischlaender schrieb am 01.03.2016, 14:03 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1668014#1668014 schrieb:trader500 schrieb am 01.03.2016, 12:16 Uhr[/url]"]Glänzende Aussichten: Die besten Goldaktien fürs Depot http://www.boerse-online.de/nachric...-Die-besten-Goldaktien-fuers-Depot-1001063451

DPM auf Platz 1 bei denen, na gut, dass ich die letzte Woche gekauft hab...

Aber im Ernst, die ist noch Null gelaufen, AISC usw sind gut bis ok und dann haben die Schwe....hunde meine Avala Resources fuer'n Appel und Ei ausgekauft!!! Und Avala hat sehr interessante Projekte in Ost- und Suedserbien, u.a. das Timok Gold-Projekt mit mehr als 2mio Oz nachgewiesen in MI&I und ein JV mit Rio Tinto in relativer Naehe zum Cukari Peku Worldclass JV Freeport/Reservoir, da bohrt Rio gerade ein 1.000m Loch.

Demnaechst fahr ich da hin und schau mir das an! 8)

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Perth, Australia - Crusader Resources Ltd. (ASX:CAS) (OTCMKTS:CHLXF) ("Crusader" or "the Company") is excited to announce that veteran fund manager James Beeland "Jim" Rogers Jr, has been appointed a non-executive director of the Company.

Mr Rogers was the co-founder of the highly successful Quantum Fund, which during 1970 - 1980 gained 4200% while the S&P advanced approximately 47%. The Quantum Fund was recognised as one of the first truly international funds.

In 1998, Mr Rogers founded the Rogers International Commodity Index. In 2007, the index and its three sub-indices were linked to exchange-traded notes under the banner ELEMENTS. The notes track the total return of the indices as an accessible way to invest in the index.

In addition to his unparalleled success in funds management, Mr Rogers has also written numerous best-selling investment focused books and is a highly respected financial commentator.

Commenting on Jim Rogers' appointment to the Crusader Board, Chairman Stephen Copulos said, "The Board of Crusader is pleased to have attracted one of the most respected global fund managers to our team. We strongly believe, with the wealth of Jim's experience and popularity as a fund manager, Author and regular speaker of global economies and financial markets, that this appointment is a testament to the value that can be created in Crusader as we develop our suite of assets in Brazil."

Mr Rogers has a Bachelor degree in History from Yale University and a BA degree in Philosophy, Politics and Economics from Oxford University. Since 1980, he has been an occasional guest Professor of Finance at the Columbia Business School.

The appointment of Mr Rogers comes at a key time for Crusader, with the Company recently completing a A$5.5m capital raising, providing sufficient funding to rapidly advance its Brazilian suite of assets. Interest for this raising came primarily from investors in North America, Asia and Europe.

Crusader has a strong portfolio of resources projects with a focus on Brazil. Crusader's assets are diversified across a range of commodities including gold, iron ore and lithium. Crusader is currently producing iron ore from its Posse mine and is developing two advanced gold projects.

With gold in Brazilian Reals recently reaching all-time highs, Crusader's shareholders are exposed to a portfolio of assets which have significant growth potential.

About Crusader Resources Limited:

Crusader Resources Ltd. (ASX:CAS) (Crusader) is a minerals company focussed on the identification, acquisition, development and operation of projects in Brazil. Crusader believes that Brazil is a vastly underexplored country with high potential for the discovery of world class mineral deposits. The company has already acquired a diverse portfolio of projects including gold, iron ore, tin, tungsten and uranium and continues to utilise its strong networks in Brazil to identify new opportunities.

http://www.minenportal.de/artikel.php?sid=159676&lang=en#Crusader-Resources-Ltd.-Veteran-Fund-Manager-Jim-Rogers-Joins-Board

Mr Rogers was the co-founder of the highly successful Quantum Fund, which during 1970 - 1980 gained 4200% while the S&P advanced approximately 47%. The Quantum Fund was recognised as one of the first truly international funds.

In 1998, Mr Rogers founded the Rogers International Commodity Index. In 2007, the index and its three sub-indices were linked to exchange-traded notes under the banner ELEMENTS. The notes track the total return of the indices as an accessible way to invest in the index.

In addition to his unparalleled success in funds management, Mr Rogers has also written numerous best-selling investment focused books and is a highly respected financial commentator.

Commenting on Jim Rogers' appointment to the Crusader Board, Chairman Stephen Copulos said, "The Board of Crusader is pleased to have attracted one of the most respected global fund managers to our team. We strongly believe, with the wealth of Jim's experience and popularity as a fund manager, Author and regular speaker of global economies and financial markets, that this appointment is a testament to the value that can be created in Crusader as we develop our suite of assets in Brazil."

Mr Rogers has a Bachelor degree in History from Yale University and a BA degree in Philosophy, Politics and Economics from Oxford University. Since 1980, he has been an occasional guest Professor of Finance at the Columbia Business School.

The appointment of Mr Rogers comes at a key time for Crusader, with the Company recently completing a A$5.5m capital raising, providing sufficient funding to rapidly advance its Brazilian suite of assets. Interest for this raising came primarily from investors in North America, Asia and Europe.

Crusader has a strong portfolio of resources projects with a focus on Brazil. Crusader's assets are diversified across a range of commodities including gold, iron ore and lithium. Crusader is currently producing iron ore from its Posse mine and is developing two advanced gold projects.

With gold in Brazilian Reals recently reaching all-time highs, Crusader's shareholders are exposed to a portfolio of assets which have significant growth potential.

About Crusader Resources Limited:

Crusader Resources Ltd. (ASX:CAS) (Crusader) is a minerals company focussed on the identification, acquisition, development and operation of projects in Brazil. Crusader believes that Brazil is a vastly underexplored country with high potential for the discovery of world class mineral deposits. The company has already acquired a diverse portfolio of projects including gold, iron ore, tin, tungsten and uranium and continues to utilise its strong networks in Brazil to identify new opportunities.

http://www.minenportal.de/artikel.php?sid=159676&lang=en#Crusader-Resources-Ltd.-Veteran-Fund-Manager-Jim-Rogers-Joins-Board

[url=http://peketec.de/trading/viewtopic.php?p=1660669#1660669 schrieb:Kostolanys Erbe schrieb am 03.02.2016, 21:55 Uhr[/url]"]

AU:CAS

ASX RELEASE 3 Feb 2016

Highlights

Crusader to exploit lithium in Brazil by establishing Strategic Joint Venture (JV) with Lepidico Ltd (Lepidico)

Crusader has identified significant lithium potential from rock chip sampling on its 100% owned Manga prospectlocated in central Brazil, which will be transferred to the JV

Memorandum of Understanding (MOU) to establish the JV, signed with Lepidico, an Australian exploration and mineral processing technology company that owns “L‐Max”, a patented technology to extract lithium from mica ores

MOU contemplates the establishment of a 50/50 JV to pursue a wide range of lithium opportunities in Brazil commencing with the Manga prospect

Historic sampling and mapping at Manga has described lithium‐rich mica (zinnwaldite) and lithium muscovite with whole rock results of up to 1.8% Li2O

Rock chip samples taken by Crusader in previous field seasons at Manga (targeting tin and indium) returned values of up to 1.3% Li2O

Specific analysis in academic papers of Manga’s zinnwaldite (Li‐rich mica) and the Li‐muscovite minerals, returned results of up to 3.6% and 2.3% Li2O respectively (these are not whole rock analyses)

JV will have exclusive rights in Brazil to Lepidico’s “L‐Max” technology, and access to Lepidico mineral identification techniques for exploring for lithium.

In addition to lithium, the L‐Max technology generates sulphate of potash (SOP) as a salable by‐product, which presents opportunities to generate a potential future revenue streams from the Brazilian agricultural sector.

Crusader and Lepidico have already identified a significant mineralogical association between lithium mineralization and selected other elements, allowing for re‐interpretation of Crusader’s extensive in‐country database.

Crusader’s Managing Director Rob Smakman commented,

“Crusader remains focused on its gold and iron assets, specifically the development of the Juruena Gold project. The MOU provides the opportunity to partner with Lepidico’s technical team, access their patented L‐Max technology and allow the Manga lithium project to be advanced through a joint venture structure.

In addition to the Manga project, the JV will hold exclusive rights to the L‐Max process technology within Brazil. Given this opportunity, we are reviewing the other known lithium projects in Brazil, many of which may be appropriate to LMax.

We are pleased with this collaboration, matching Crusaders in‐country expertise, with technical expertise specific to the processing of lithium and potentially potash in Brazil. Future actions of the partnership will seek to maximize the benefit

to the shareholders of both JV parties.”

.....

http://www.crusaderresources.com/wp-content/uploads/2016/02/030216-CAS-confirms-Li-potential-at-Manga.-Signs-MOU-with-Lepidico-Ltd-FINAL.pdf

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Leider senkt FRU die monatliche Dividende, weiter Kosten gesenkt!

Freehold loses $4.08-million in 2015

2016-03-03 17:57 ET - News Release

Mr. Matt Donohue reports

FREEHOLD ROYALTIES LTD. ANNOUNCES 2015 FOURTH QUARTER RESULTS AND YEAR-END RESERVES, ADJUSTS DIVIDEND

Freehold Royalties Ltd. has released its 2015 fourth-quarter results and reserves as at Dec. 31, 2015.

Results at a Glance

Three Months Ended Twelve Months Ended

December 31 December 31

----------------------------------------------------

FINANCIAL ($000s, except

as noted) 2015 2014 Change 2015 2014 Change

----------------------------------------------------------------------------

Gross revenue 33,833 43,631 -22% 135,664 199,850 -32%

Net income (loss) (7,423) 11,082 -167% (4,080) 66,447 -106%

Per share, basic and

diluted ($) (0.08) 0.15 -153% (0.05) 0.94 -105%

Funds from operations(1) 25,509 30,774 -17% 103,820 138,447 -25%

Per share, basic

($)(1) 0.26 0.41 -37% 1.15 1.95 -41%

Operating income(1) 29,186 37,584 -22% 115,152 175,192 -34%

Operating income from

royalties (%) 89 80 11% 87 78 12%

Acquisitions (143) 60,566 -100% 411,352 248,274 66%

Capital expenditures 5,607 13,500 -58% 22,295 33,701 -34%

Dividends declared 20,747 31,353 -34% 90,139 119,788 -25%

Per share ($)(2) 0.21 0.42 -50% 1.00 1.68 -40%

Net debt obligations(1) 146,949 135,810 8% 146,949 135,810 8%

Shares outstanding,

period end (000s) 98,940 74,919 32% 98,940 74,919 32%

Average shares

outstanding (000s)(3) 98,731 74,545 32% 90,505 71,029 27%

OPERATING

----------------------------------------------------------------------------

Average daily production

(boe/d)(4) 11,815 9,836 20% 10,945 9,180 19%

Average price

realizations ($/boe)(4) 30.34 47.46 -36% 33.20 58.91 -44%

Operating netback

($/boe)(1) (4) 26.85 41.54 -35% 28.83 52.30 -45%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) See Additional GAAP Measures and Non-GAAP Financial Measures.

(2) Based on the number of shares issued and outstanding at each record

date.

(3) Weighted average number of shares outstanding during the period, basic.

(4) See Conversion of Natural Gas to Barrels of Oil Equivalent (boe).

Dividend Announcement

Reflecting continued weakness in commodity prices, Freehold's Board of Directors has approved an adjustment to its monthly dividend to $0.04 per share from $0.07 per share. The Board of Directors has declared a dividend of Cdn. $0.04 per common share to be paid on April 15, 2016 to shareholders of record on March 31, 2016. Including the April 15 payment, our 12-month trailing cash dividends total $0.91 per share. This dividend is designated as an eligible dividend for Canadian income tax purposes.

The dividend reduction aligns with a lower for longer commodity outlook. Freehold's goal is not to pay dividends with debt, thus maintaining strength within our balance sheet and ensuring the long term success of our business model. Freehold will continue to evaluate dividend levels on a quarterly basis, with the expectation to increase dividend levels as funds from operations improve.

2015 Fourth Quarter Highlights

Freehold delivered strong operational results in the fourth quarter of 2015. Some of the highlights included:

-- Production for Q4-2015 averaged 11,815 boe/d, a 20% increase over Q4- 2014 and a 5% increase over Q3-2015.

-- Royalties accounted for 89% of operating income and 78% of production, reinforcing our royalty focus.

-- Royalty production was up 26% compared to Q4-2014 averaging 9,249 boe/d. Growth in volumes was associated with a combination of production acquired through the year, new production from drilling on our royalty lands and a strong quarter from our audit function, including compensatory royalties on our mineral title lands, largely responsible for approximately 500 boe/d of prior period adjustments.

-- Working interest production averaged 2,566 boe/d for the quarter, up 2% when compared to the same period last year.

-- Funds from operations totalled $25.5 million ($0.26/share) in Q4-2015, down 17% from the same period last year owing to continued weakness in oil and natural gas prices.

-- Though average commodity price realizations decreased 36% reduced revenues were partly offset by the increase in production volumes, resulting in a 22% decrease in gross revenue compared to Q4-2014.

-- Q4-2015 net loss was $7.4 million (Q4-2014 net income $11.1 million) primarily due to a non-cash impairment charge of $8.0 million in our southeast Saskatchewan working interest area, as a result of the continued drop in expected future commodity prices. Lower revenues and higher depletion and depreciation also contributed to the difference.

-- Dividends declared for Q4-2015 totalled $0.21 per share, down from $0.42 per share one year ago due to the reduction in funds from operations resulting from lower commodity prices.

-- Average participation in our dividend reinvestment plan (DRIP) was 13% (Q4-2014 - 35%). DRIP proceeds for 2015 totalled $17.2 million.

-- Net capital expenditures on our working interest properties totalled $5.6 million over the quarter.

-- Basic payout ratio (dividends declared/funds from operations) for 2015 totalled 87% while the adjusted payout ratio (cash dividends plus capital expenditures/funds from operations) for the same period was 95%.

-- At December 31, 2015, net debt totalled $146.9 million, down $2.1 million from $149.0 million at September 30, 2015. This implies a net debt to 12-month trailing funds from operations ratio of 1.4 times (excluding the proforma effects of acquisitions).

Guidance Update

The table below summarizes our key operating assumptions for 2016.

-- Despite lower spending on our working interest and royalty lands, we have not revised our 2016 production forecast (9,800 boe/d). Volumes are expected to be weighted approximately 62% oil and natural gas liquids (NGLs) and 38% natural gas. We continue to maintain our royalty focus with royalty production accounting for 78% of forecasted 2016 production and 94% of operating income.

-- Continuing negative momentum in the commodity environment has resulted in a downward revision to our price assumptions. Through 2016, we are now forecasting WTI and WCS prices to average US$35.00/bbl and $31.00/bbl, respectively (previously US$50.00/bbl and $47.00/bbl). Our AECO natural gas price assumption has also been revised downwards to $2.00/mcf (previously $2.75/mcf).

-- The Canadian/U.S. exchange rate has been adjusted downwards to $0.72 (previously $0.76), reflecting the recent declining valuation of the Canadian dollar relative to the United States dollar.

-- Operating costs have been reduced to $4.75/boe from $5.00/boe representing an increasing portion of our production coming from royalties, which have no operating costs.

-- We have revised our general and administration expense to $2.65/boe from $2.85/boe, as a result of cost reduction initiatives.

-- Our capital spending budget has been reduced from $15 million to $7 million reflecting the weaker commodity outlook. A large percentage of our capital expenditures program is non-operated and the exact capital is difficult to predict. We expect to have additional information on the spending of our partners as we move through the year.

2016 Key Operating Assumptions

Guidance Dated

2016 Annual Average Mar. 3, 2016 Nov. 12, 2015

----------------------------------------------------------------------------

Daily production boe/d 9,800 9,800

WTI oil price US$/bbl 35.00 50.00

Western Canadian Select (WCS) Cdn$/bbl 31.00 47.00

AECO natural gas price Cdn$/Mcf 2.00 2.75

Exchange rate Cdn$/US$ 0.72 0.76

Operating costs $/boe 4.75 5.00

General and administrative costs (1) $/boe 2.65 2.85

Capital expenditures $ millions 7 15

Dividends paid in shares (DRIP) (2) $ millions 8 13

Weighted average shares outstanding millions 100 100

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Excludes share based and other compensation.

(2) Assumes average 15% participation rate in Freehold's dividend

reinvestment plan, which is subject to change at the participants'

discretion.

............

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aFRU-2351752&symbol=FRU®ion=C

Freehold loses $4.08-million in 2015

2016-03-03 17:57 ET - News Release

Mr. Matt Donohue reports

FREEHOLD ROYALTIES LTD. ANNOUNCES 2015 FOURTH QUARTER RESULTS AND YEAR-END RESERVES, ADJUSTS DIVIDEND

Freehold Royalties Ltd. has released its 2015 fourth-quarter results and reserves as at Dec. 31, 2015.

Results at a Glance

Three Months Ended Twelve Months Ended

December 31 December 31

----------------------------------------------------

FINANCIAL ($000s, except

as noted) 2015 2014 Change 2015 2014 Change

----------------------------------------------------------------------------

Gross revenue 33,833 43,631 -22% 135,664 199,850 -32%

Net income (loss) (7,423) 11,082 -167% (4,080) 66,447 -106%

Per share, basic and

diluted ($) (0.08) 0.15 -153% (0.05) 0.94 -105%

Funds from operations(1) 25,509 30,774 -17% 103,820 138,447 -25%

Per share, basic

($)(1) 0.26 0.41 -37% 1.15 1.95 -41%

Operating income(1) 29,186 37,584 -22% 115,152 175,192 -34%

Operating income from

royalties (%) 89 80 11% 87 78 12%

Acquisitions (143) 60,566 -100% 411,352 248,274 66%

Capital expenditures 5,607 13,500 -58% 22,295 33,701 -34%

Dividends declared 20,747 31,353 -34% 90,139 119,788 -25%

Per share ($)(2) 0.21 0.42 -50% 1.00 1.68 -40%

Net debt obligations(1) 146,949 135,810 8% 146,949 135,810 8%

Shares outstanding,

period end (000s) 98,940 74,919 32% 98,940 74,919 32%

Average shares

outstanding (000s)(3) 98,731 74,545 32% 90,505 71,029 27%

OPERATING

----------------------------------------------------------------------------

Average daily production

(boe/d)(4) 11,815 9,836 20% 10,945 9,180 19%

Average price

realizations ($/boe)(4) 30.34 47.46 -36% 33.20 58.91 -44%

Operating netback

($/boe)(1) (4) 26.85 41.54 -35% 28.83 52.30 -45%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) See Additional GAAP Measures and Non-GAAP Financial Measures.

(2) Based on the number of shares issued and outstanding at each record

date.

(3) Weighted average number of shares outstanding during the period, basic.

(4) See Conversion of Natural Gas to Barrels of Oil Equivalent (boe).

Dividend Announcement

Reflecting continued weakness in commodity prices, Freehold's Board of Directors has approved an adjustment to its monthly dividend to $0.04 per share from $0.07 per share. The Board of Directors has declared a dividend of Cdn. $0.04 per common share to be paid on April 15, 2016 to shareholders of record on March 31, 2016. Including the April 15 payment, our 12-month trailing cash dividends total $0.91 per share. This dividend is designated as an eligible dividend for Canadian income tax purposes.

The dividend reduction aligns with a lower for longer commodity outlook. Freehold's goal is not to pay dividends with debt, thus maintaining strength within our balance sheet and ensuring the long term success of our business model. Freehold will continue to evaluate dividend levels on a quarterly basis, with the expectation to increase dividend levels as funds from operations improve.

2015 Fourth Quarter Highlights

Freehold delivered strong operational results in the fourth quarter of 2015. Some of the highlights included:

-- Production for Q4-2015 averaged 11,815 boe/d, a 20% increase over Q4- 2014 and a 5% increase over Q3-2015.

-- Royalties accounted for 89% of operating income and 78% of production, reinforcing our royalty focus.

-- Royalty production was up 26% compared to Q4-2014 averaging 9,249 boe/d. Growth in volumes was associated with a combination of production acquired through the year, new production from drilling on our royalty lands and a strong quarter from our audit function, including compensatory royalties on our mineral title lands, largely responsible for approximately 500 boe/d of prior period adjustments.

-- Working interest production averaged 2,566 boe/d for the quarter, up 2% when compared to the same period last year.

-- Funds from operations totalled $25.5 million ($0.26/share) in Q4-2015, down 17% from the same period last year owing to continued weakness in oil and natural gas prices.

-- Though average commodity price realizations decreased 36% reduced revenues were partly offset by the increase in production volumes, resulting in a 22% decrease in gross revenue compared to Q4-2014.

-- Q4-2015 net loss was $7.4 million (Q4-2014 net income $11.1 million) primarily due to a non-cash impairment charge of $8.0 million in our southeast Saskatchewan working interest area, as a result of the continued drop in expected future commodity prices. Lower revenues and higher depletion and depreciation also contributed to the difference.

-- Dividends declared for Q4-2015 totalled $0.21 per share, down from $0.42 per share one year ago due to the reduction in funds from operations resulting from lower commodity prices.

-- Average participation in our dividend reinvestment plan (DRIP) was 13% (Q4-2014 - 35%). DRIP proceeds for 2015 totalled $17.2 million.

-- Net capital expenditures on our working interest properties totalled $5.6 million over the quarter.

-- Basic payout ratio (dividends declared/funds from operations) for 2015 totalled 87% while the adjusted payout ratio (cash dividends plus capital expenditures/funds from operations) for the same period was 95%.

-- At December 31, 2015, net debt totalled $146.9 million, down $2.1 million from $149.0 million at September 30, 2015. This implies a net debt to 12-month trailing funds from operations ratio of 1.4 times (excluding the proforma effects of acquisitions).

Guidance Update

The table below summarizes our key operating assumptions for 2016.

-- Despite lower spending on our working interest and royalty lands, we have not revised our 2016 production forecast (9,800 boe/d). Volumes are expected to be weighted approximately 62% oil and natural gas liquids (NGLs) and 38% natural gas. We continue to maintain our royalty focus with royalty production accounting for 78% of forecasted 2016 production and 94% of operating income.

-- Continuing negative momentum in the commodity environment has resulted in a downward revision to our price assumptions. Through 2016, we are now forecasting WTI and WCS prices to average US$35.00/bbl and $31.00/bbl, respectively (previously US$50.00/bbl and $47.00/bbl). Our AECO natural gas price assumption has also been revised downwards to $2.00/mcf (previously $2.75/mcf).

-- The Canadian/U.S. exchange rate has been adjusted downwards to $0.72 (previously $0.76), reflecting the recent declining valuation of the Canadian dollar relative to the United States dollar.

-- Operating costs have been reduced to $4.75/boe from $5.00/boe representing an increasing portion of our production coming from royalties, which have no operating costs.

-- We have revised our general and administration expense to $2.65/boe from $2.85/boe, as a result of cost reduction initiatives.

-- Our capital spending budget has been reduced from $15 million to $7 million reflecting the weaker commodity outlook. A large percentage of our capital expenditures program is non-operated and the exact capital is difficult to predict. We expect to have additional information on the spending of our partners as we move through the year.

2016 Key Operating Assumptions

Guidance Dated

2016 Annual Average Mar. 3, 2016 Nov. 12, 2015

----------------------------------------------------------------------------

Daily production boe/d 9,800 9,800

WTI oil price US$/bbl 35.00 50.00

Western Canadian Select (WCS) Cdn$/bbl 31.00 47.00

AECO natural gas price Cdn$/Mcf 2.00 2.75

Exchange rate Cdn$/US$ 0.72 0.76

Operating costs $/boe 4.75 5.00

General and administrative costs (1) $/boe 2.65 2.85

Capital expenditures $ millions 7 15

Dividends paid in shares (DRIP) (2) $ millions 8 13

Weighted average shares outstanding millions 100 100

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Excludes share based and other compensation.

(2) Assumes average 15% participation rate in Freehold's dividend

reinvestment plan, which is subject to change at the participants'

discretion.

............

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aFRU-2351752&symbol=FRU®ion=C

[url=http://peketec.de/trading/viewtopic.php?p=1668445#1668445 schrieb:Kostolanys Erbe schrieb am 02.03.2016, 15:52 Uhr[/url]"]

Freehold exceeds guidance; to release results March 3

2016-03-02 09:40 ET - News Release

Mr. Matt Donohue reports

FREEHOLD ROYALTIES LTD. EXCEEDS 2015 PRODUCTION GUIDANCE

Freehold Royalties Ltd. has exceeded its 2015 production guidance of 10,600 barrels of oil equivalent per day with volumes averaging 10,945 barrels of oil equivalent per day for the year. Fourth quarter 2015 volumes averaged 11,815 barrels of oil equivalent per day.

Freehold will be reporting its fourth quarter and year-end 2015 operating and financial results after market on March 3, 2016.

Freehold's primary focus is on acquiring and managing oil and gas royalties. The majority of production comes from royalty interests (mineral title and gross overriding royalties). Freehold's common shares trade on the Toronto Stock Exchange in Canada under the symbol FRU.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aFRU-2351199&symbol=FRU®ion=C

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1668354#1668354 schrieb:greenhorn schrieb am 02.03.2016, 10:13 Uhr[/url]"]FRU - ist mir untergegangen, sorry - hab aber die letzten Tage nun doch eine kleine Posi mir ins LongDepot gekauft, um 10,30 - 10,50 CAD

an Kosto für den Hinweis/Vorstellung

[url=http://peketec.de/trading/viewtopic.php?p=1665101#1665101 schrieb:greenhorn schrieb am 18.02.2016, 10:01 Uhr[/url]"]war gestern zu geizig.....sind ja ordentlich gesprintet

[url=http://peketec.de/trading/viewtopic.php?p=1664710#1664710 schrieb:greenhorn schrieb am 17.02.2016, 09:35 Uhr[/url]"]liest sich gut, und solche Werte sind auch in Zukunft gefragt

Dividende + Option auf steigende Ölpreise

[url=http://peketec.de/trading/viewtopic.php?p=1664624#1664624 schrieb:Kostolanys Erbe schrieb am 17.02.2016, 00:00 Uhr[/url]"]Nach dem ich hier im Board schon Valeura Energy vorgestellt habe, möchte ich heute einen weiteren Ölwert vorstellen.

Freehold Royalties Ltd

Hier steht mehr der Fokus Langfristinvestment in Öl!

Das Unternehmen zahlt monatlich eine Dividende von 0,07 CAD$, was aktuell eine Dividendenrendite von ca. 7,8% entspricht!

Und niedrige Kosten!

» zur Grafik

http://www.freeholdroyalties.com/index.php?page=about_us

Freehold Royalties Ltd. is a dividend-paying oil and gas company based in Calgary, Alberta. Our royalty interests are a major contributor to our operating and financial performance and are not subject to expenses such as operating and capital costs. Our assets generate income from crude oil, natural gas, natural gas liquids, and potash. Growth is achieved through ongoing development activity on our extensive land base spanning approximately three million gross acres, and through acquisitions.

Freehold has no employees. Day-to-day operations are managed by a wholly owned subsidiary of Rife Resources Ltd. To learn more about Rife visit www.rife.com.

Freehold's shares are listed for trading on the Toronto Stock Exchange under the trading symbol FRU.

Zu Rife:

Welcome to the Rife Resources Ltd. Website

Rife is a private exploration and production company, wholly-owned by the CN Pension Trust Funds, the pension fund for employees of the Canadian National Railway Company.

Our people have expertise in geology, geophysics, petroleum engineering, land administration, finance, audit and accounting. We have interests in 610,000 gross acres of land in western Canada. Our focus areas are Lloydminster, Deep Basin, and Southeast Saskatchewan.

We also manage, through our subsidiary Rife Resources Management Ltd. the operations of Canpar Holdings Ltd. (3.8 million gross acres) and Freehold Royalties Ltd. (3.2 million gross acres). These two companies have a profitable niche of owning oil and gas royalties and mineral titles.

http://www.rife.com/

Factsheet Rife:

http://www.rife.com/upload/media_element/32/08/2958---rife-fact-sheet-march2015-f-webnocrops.pdf

Aktuelle Präsentation von Freehold:

http://www.freeholdroyalties.com/en/powerpoint/freehold_investor_presentation_february_2016.pdf

» zur Grafik

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

In Rezessionen soll man Aktien kaufen...

Immer schön antizyklisch !!!

Kennt jemand ein paar interessante Werte aus Brasilien?

PBR - petrobras

GGB - Gerdau (Stahl)

BRFS - Brasil Foods (Konsum)

Für ein paar interessante Picks wäre ich dankbar!

[url=http://peketec.de/trading/viewtopic.php?p=1668773#1668773 schrieb:greenhorn schrieb am 03.03.2016, 14:43 Uhr[/url]"]Brasilien - da würde hier die Hütte brennen, Dax bei 0 oder so.........

Bruttoinlandsprodukt (BIP) (YoY)

Aktuell -5.9%

Prognose -6.0%

Vorherige -4.5%

Zusammengesetzter PMI Markit

Aktuell 39.0

Prognose 44.6

Vorherige 45.1

Markit-Einkaufsmanagerindex für Dienstleistungen

Aktuell 36.9

Prognose 43.8

Vorherige 44.4

zu Solgold/CGP

The Prospector Resource Investment News

March/April 2016 edition http://theprospectornews.com/wp-content/uploads/2016/03/MAR2016-TheProspectorMagazine_Web_single_pages.pdf

Auszug Seite 5:

"Drill results to date have identified an extremely large (and still growing) area which one particular world-renowned expert on such porphyries believes could be perhaps THE biggest new such discovery in the world, let alone in the Andes."

und:

"Beyond the fairly widely-held belief of both government and private sector people I spoke with that Cascabel may well prove to contain the next world-class, development ready metals deposit in Ecuador (following up Fruta del Norte), Cascabel is a microcosm of the broader story that Ecuador is retelling the global mining and investment community."

The Prospector Resource Investment News

March/April 2016 edition http://theprospectornews.com/wp-content/uploads/2016/03/MAR2016-TheProspectorMagazine_Web_single_pages.pdf

Auszug Seite 5:

"Drill results to date have identified an extremely large (and still growing) area which one particular world-renowned expert on such porphyries believes could be perhaps THE biggest new such discovery in the world, let alone in the Andes."

und:

"Beyond the fairly widely-held belief of both government and private sector people I spoke with that Cascabel may well prove to contain the next world-class, development ready metals deposit in Ecuador (following up Fruta del Norte), Cascabel is a microcosm of the broader story that Ecuador is retelling the global mining and investment community."

[url=http://peketec.de/trading/viewtopic.php?p=1667690#1667690 schrieb:Fischlaender schrieb am 29.02.2016, 11:23 Uhr[/url]"]Mal zu CGP,

das ist ja nur eine indirekte Investition in Solgold. Und die machen eine fantastische Arbeit. So eine IR habe ich noch nie gesehen. All paar Tage kommen Updates, Videos, exzellente Karten usw. Das Solgold Management hat mehrere Millionen in SolGold investiert, Executive Director Nicholas Mather alleine mehr als 3mio. Schaut euch die HP an http://solgold.com.au/ und dazu dann auch die iii Solgold Seite, dort sind auch immer die neuesten IR Videos verlinkt http://www.iii.co.uk/research/LSE:SOLG

Cascabel wird ein Monster, das steht jetzt schon fest. Die entscheidende Frage wird sein, ob Solgold genuegend Zeit bekommt das so oeffentlich zu beweisen, dass die MK robust gegen eine Uebernahme ist?

Am besten waere ein JV mit einem Major der mehrere Dutzend Millionen an Explorationsgeldern zusagt.

Solgold nimmt jedenfalls langsam Fahrt auf, bei ueber 840mio Aktien ist das allerdings ein muehsames Unterfangen.

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Stock&symb=UK%3ASOLG&time=8&startdate=1%2F4%2F1999&enddate=2%2F29%2F2016&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=4&style=350&size=2&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=9&x=67&y=7

[url=http://peketec.de/trading/viewtopic.php?p=1659923#1659923 schrieb:Fischlaender schrieb am 01.02.2016, 16:08 Uhr[/url]"]OBM bewegt sich (noch) nix, wieder raus mit bisserl mehr als Spesenverlust.

K paar AVZ 0,045 (drilling Speku JV mit Rio Tinto)

Zukauf CGP 0,02 und damit jetzt 7-stellig im Depot. Sobald ich 1% der Bude halte mach ich ein Fass auf.

[url=http://peketec.de/trading/viewtopic.php?p=1659916#1659916 schrieb:Fischlaender schrieb am 01.02.2016, 16:00 Uhr[/url]"]V SEA 9,11

[url=http://peketec.de/trading/viewtopic.php?p=1659255#1659255 schrieb:Fischlaender schrieb am 28.01.2016, 21:47 Uhr[/url]"]SEA sieht relativ stark aus, v.a. bei dem heutigen Markt.

» zur Grafik

um 8,50 CAD herum ist auch scheint's eine nette Unterstützung, die ev. jetzt greift

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1659217#1659217 schrieb:Fischlaender schrieb am 28.01.2016, 17:52 Uhr[/url]"]K SEA 8,52 CAD

K OBM 1,04 CAD

Moin Kosto!

Wenn mich nicht alles täuscht hat duke ganz gute Connections nach Brasilien.

Eventuell hat er da paar konkrete Unternehmen die "nette" Kennzahlen haben.

Ich selbst finde es schwer brasilianische Mittelstands Unternehmen bzw. Companies in Wachstumsbranchen etc. nachhaltig zu bewerten und zu analysieren. Die Gefahr dass ich da nen Rohrkrepierer erwische wäre hoch

Ich hab nen Fonds und nen ETF auf Watch (arbeiten gerade an ner Bodenbildung):

JPM Brazil Equity Fund A - USD [WKN: A0MZM6 / ISIN: LU0318934535]

iShares MSCI Brazil (DE) UCITS ETF [WKN: A0HG2M / ISIN: DE000A0HG2M1]

Wenn mich nicht alles täuscht hat duke ganz gute Connections nach Brasilien.

Eventuell hat er da paar konkrete Unternehmen die "nette" Kennzahlen haben.

Ich selbst finde es schwer brasilianische Mittelstands Unternehmen bzw. Companies in Wachstumsbranchen etc. nachhaltig zu bewerten und zu analysieren. Die Gefahr dass ich da nen Rohrkrepierer erwische wäre hoch

Ich hab nen Fonds und nen ETF auf Watch (arbeiten gerade an ner Bodenbildung):

JPM Brazil Equity Fund A - USD [WKN: A0MZM6 / ISIN: LU0318934535]

iShares MSCI Brazil (DE) UCITS ETF [WKN: A0HG2M / ISIN: DE000A0HG2M1]

[url=http://peketec.de/trading/viewtopic.php?p=1668991#1668991 schrieb:Kostolanys Erbe schrieb am 04.03.2016, 10:17 Uhr[/url]"]

In Rezessionen soll man Aktien kaufen...

Immer schön antizyklisch !!!

Kennt jemand ein paar interessante Werte aus Brasilien?

PBR - petrobras

GGB - Gerdau (Stahl)

BRFS - Brasil Foods (Konsum)

Für ein paar interessante Picks wäre ich dankbar!

[url=http://peketec.de/trading/viewtopic.php?p=1668773#1668773 schrieb:greenhorn schrieb am 03.03.2016, 14:43 Uhr[/url]"]Brasilien - da würde hier die Hütte brennen, Dax bei 0 oder so.........

Bruttoinlandsprodukt (BIP) (YoY)

Aktuell -5.9%

Prognose -6.0%

Vorherige -4.5%

Zusammengesetzter PMI Markit

Aktuell 39.0

Prognose 44.6

Vorherige 45.1

Markit-Einkaufsmanagerindex für Dienstleistungen

Aktuell 36.9

Prognose 43.8

Vorherige 44.4

Zu Petrobras kann ich was suchen! Ansonsten kenne ich nur Wein + Cachaca Betriebe!

[url=http://peketec.de/trading/viewtopic.php?p=1669004#1669004 schrieb:Ollinho schrieb am 04.03.2016, 10:35 Uhr[/url]"]Moin Kosto!

Wenn mich nicht alles täuscht hat duke ganz gute Connections nach Brasilien.

Eventuell hat er da paar konkrete Unternehmen die "nette" Kennzahlen haben.

Ich selbst finde es schwer brasilianische Mittelstands Unternehmen bzw. Companies in Wachstumsbranchen etc. nachhaltig zu bewerten und zu analysieren. Die Gefahr dass ich da nen Rohrkrepierer erwische wäre hoch

Ich hab nen Fonds und nen ETF auf Watch (arbeiten gerade an ner Bodenbildung):

JPM Brazil Equity Fund A - USD [WKN: A0MZM6 / ISIN: LU0318934535]

iShares MSCI Brazil (DE) UCITS ETF [WKN: A0HG2M / ISIN: DE000A0HG2M1]

[url=http://peketec.de/trading/viewtopic.php?p=1668991#1668991 schrieb:Kostolanys Erbe schrieb am 04.03.2016, 10:17 Uhr[/url]"]

In Rezessionen soll man Aktien kaufen...

Immer schön antizyklisch !!!

Kennt jemand ein paar interessante Werte aus Brasilien?

PBR - petrobras

GGB - Gerdau (Stahl)

BRFS - Brasil Foods (Konsum)

Für ein paar interessante Picks wäre ich dankbar!

[url=http://peketec.de/trading/viewtopic.php?p=1668773#1668773 schrieb:greenhorn schrieb am 03.03.2016, 14:43 Uhr[/url]"]Brasilien - da würde hier die Hütte brennen, Dax bei 0 oder so.........

Bruttoinlandsprodukt (BIP) (YoY)

Aktuell -5.9%

Prognose -6.0%

Vorherige -4.5%

Zusammengesetzter PMI Markit

Aktuell 39.0

Prognose 44.6

Vorherige 45.1

Markit-Einkaufsmanagerindex für Dienstleistungen

Aktuell 36.9

Prognose 43.8

Vorherige 44.4

nicht schön, aber die Position ist ausbaufähig

sollte sich Öl weiter stabilisieren werden Sie auch wieder mehr Geld verdienen und ausschütten

sollte sich Öl weiter stabilisieren werden Sie auch wieder mehr Geld verdienen und ausschütten

[url=http://peketec.de/trading/viewtopic.php?p=1668887#1668887 schrieb:Kostolanys Erbe schrieb am 04.03.2016, 02:29 Uhr[/url]"]Leider senkt FRU die monatliche Dividende, weiter Kosten gesenkt!

Freehold loses $4.08-million in 2015

2016-03-03 17:57 ET - News Release

Mr. Matt Donohue reports

FREEHOLD ROYALTIES LTD. ANNOUNCES 2015 FOURTH QUARTER RESULTS AND YEAR-END RESERVES, ADJUSTS DIVIDEND

Freehold Royalties Ltd. has released its 2015 fourth-quarter results and reserves as at Dec. 31, 2015.

Results at a Glance

Three Months Ended Twelve Months Ended

December 31 December 31

----------------------------------------------------

FINANCIAL ($000s, except

as noted) 2015 2014 Change 2015 2014 Change

----------------------------------------------------------------------------

Gross revenue 33,833 43,631 -22% 135,664 199,850 -32%

Net income (loss) (7,423) 11,082 -167% (4,080) 66,447 -106%

Per share, basic and

diluted ($) (0.08) 0.15 -153% (0.05) 0.94 -105%

Funds from operations(1) 25,509 30,774 -17% 103,820 138,447 -25%

Per share, basic

($)(1) 0.26 0.41 -37% 1.15 1.95 -41%

Operating income(1) 29,186 37,584 -22% 115,152 175,192 -34%

Operating income from

royalties (%) 89 80 11% 87 78 12%

Acquisitions (143) 60,566 -100% 411,352 248,274 66%

Capital expenditures 5,607 13,500 -58% 22,295 33,701 -34%

Dividends declared 20,747 31,353 -34% 90,139 119,788 -25%

Per share ($)(2) 0.21 0.42 -50% 1.00 1.68 -40%

Net debt obligations(1) 146,949 135,810 8% 146,949 135,810 8%

Shares outstanding,

period end (000s) 98,940 74,919 32% 98,940 74,919 32%

Average shares

outstanding (000s)(3) 98,731 74,545 32% 90,505 71,029 27%

OPERATING

----------------------------------------------------------------------------

Average daily production

(boe/d)(4) 11,815 9,836 20% 10,945 9,180 19%

Average price

realizations ($/boe)(4) 30.34 47.46 -36% 33.20 58.91 -44%

Operating netback

($/boe)(1) (4) 26.85 41.54 -35% 28.83 52.30 -45%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) See Additional GAAP Measures and Non-GAAP Financial Measures.

(2) Based on the number of shares issued and outstanding at each record

date.

(3) Weighted average number of shares outstanding during the period, basic.

(4) See Conversion of Natural Gas to Barrels of Oil Equivalent (boe).

Dividend Announcement

Reflecting continued weakness in commodity prices, Freehold's Board of Directors has approved an adjustment to its monthly dividend to $0.04 per share from $0.07 per share. The Board of Directors has declared a dividend of Cdn. $0.04 per common share to be paid on April 15, 2016 to shareholders of record on March 31, 2016. Including the April 15 payment, our 12-month trailing cash dividends total $0.91 per share. This dividend is designated as an eligible dividend for Canadian income tax purposes.

The dividend reduction aligns with a lower for longer commodity outlook. Freehold's goal is not to pay dividends with debt, thus maintaining strength within our balance sheet and ensuring the long term success of our business model. Freehold will continue to evaluate dividend levels on a quarterly basis, with the expectation to increase dividend levels as funds from operations improve.

2015 Fourth Quarter Highlights

Freehold delivered strong operational results in the fourth quarter of 2015. Some of the highlights included:

-- Production for Q4-2015 averaged 11,815 boe/d, a 20% increase over Q4- 2014 and a 5% increase over Q3-2015.

-- Royalties accounted for 89% of operating income and 78% of production, reinforcing our royalty focus.

-- Royalty production was up 26% compared to Q4-2014 averaging 9,249 boe/d. Growth in volumes was associated with a combination of production acquired through the year, new production from drilling on our royalty lands and a strong quarter from our audit function, including compensatory royalties on our mineral title lands, largely responsible for approximately 500 boe/d of prior period adjustments.

-- Working interest production averaged 2,566 boe/d for the quarter, up 2% when compared to the same period last year.

-- Funds from operations totalled $25.5 million ($0.26/share) in Q4-2015, down 17% from the same period last year owing to continued weakness in oil and natural gas prices.

-- Though average commodity price realizations decreased 36% reduced revenues were partly offset by the increase in production volumes, resulting in a 22% decrease in gross revenue compared to Q4-2014.

-- Q4-2015 net loss was $7.4 million (Q4-2014 net income $11.1 million) primarily due to a non-cash impairment charge of $8.0 million in our southeast Saskatchewan working interest area, as a result of the continued drop in expected future commodity prices. Lower revenues and higher depletion and depreciation also contributed to the difference.

-- Dividends declared for Q4-2015 totalled $0.21 per share, down from $0.42 per share one year ago due to the reduction in funds from operations resulting from lower commodity prices.

-- Average participation in our dividend reinvestment plan (DRIP) was 13% (Q4-2014 - 35%). DRIP proceeds for 2015 totalled $17.2 million.

-- Net capital expenditures on our working interest properties totalled $5.6 million over the quarter.

-- Basic payout ratio (dividends declared/funds from operations) for 2015 totalled 87% while the adjusted payout ratio (cash dividends plus capital expenditures/funds from operations) for the same period was 95%.

-- At December 31, 2015, net debt totalled $146.9 million, down $2.1 million from $149.0 million at September 30, 2015. This implies a net debt to 12-month trailing funds from operations ratio of 1.4 times (excluding the proforma effects of acquisitions).

Guidance Update

The table below summarizes our key operating assumptions for 2016.

-- Despite lower spending on our working interest and royalty lands, we have not revised our 2016 production forecast (9,800 boe/d). Volumes are expected to be weighted approximately 62% oil and natural gas liquids (NGLs) and 38% natural gas. We continue to maintain our royalty focus with royalty production accounting for 78% of forecasted 2016 production and 94% of operating income.

-- Continuing negative momentum in the commodity environment has resulted in a downward revision to our price assumptions. Through 2016, we are now forecasting WTI and WCS prices to average US$35.00/bbl and $31.00/bbl, respectively (previously US$50.00/bbl and $47.00/bbl). Our AECO natural gas price assumption has also been revised downwards to $2.00/mcf (previously $2.75/mcf).

-- The Canadian/U.S. exchange rate has been adjusted downwards to $0.72 (previously $0.76), reflecting the recent declining valuation of the Canadian dollar relative to the United States dollar.

-- Operating costs have been reduced to $4.75/boe from $5.00/boe representing an increasing portion of our production coming from royalties, which have no operating costs.

-- We have revised our general and administration expense to $2.65/boe from $2.85/boe, as a result of cost reduction initiatives.

-- Our capital spending budget has been reduced from $15 million to $7 million reflecting the weaker commodity outlook. A large percentage of our capital expenditures program is non-operated and the exact capital is difficult to predict. We expect to have additional information on the spending of our partners as we move through the year.

2016 Key Operating Assumptions

Guidance Dated

2016 Annual Average Mar. 3, 2016 Nov. 12, 2015

----------------------------------------------------------------------------

Daily production boe/d 9,800 9,800

WTI oil price US$/bbl 35.00 50.00

Western Canadian Select (WCS) Cdn$/bbl 31.00 47.00

AECO natural gas price Cdn$/Mcf 2.00 2.75

Exchange rate Cdn$/US$ 0.72 0.76

Operating costs $/boe 4.75 5.00

General and administrative costs (1) $/boe 2.65 2.85

Capital expenditures $ millions 7 15

Dividends paid in shares (DRIP) (2) $ millions 8 13

Weighted average shares outstanding millions 100 100

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Excludes share based and other compensation.

(2) Assumes average 15% participation rate in Freehold's dividend

reinvestment plan, which is subject to change at the participants'

discretion.

............

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aFRU-2351752&symbol=FRU®ion=C

[url=http://peketec.de/trading/viewtopic.php?p=1668445#1668445 schrieb:Kostolanys Erbe schrieb am 02.03.2016, 15:52 Uhr[/url]"]

Freehold exceeds guidance; to release results March 3

2016-03-02 09:40 ET - News Release

Mr. Matt Donohue reports

FREEHOLD ROYALTIES LTD. EXCEEDS 2015 PRODUCTION GUIDANCE

Freehold Royalties Ltd. has exceeded its 2015 production guidance of 10,600 barrels of oil equivalent per day with volumes averaging 10,945 barrels of oil equivalent per day for the year. Fourth quarter 2015 volumes averaged 11,815 barrels of oil equivalent per day.

Freehold will be reporting its fourth quarter and year-end 2015 operating and financial results after market on March 3, 2016.

Freehold's primary focus is on acquiring and managing oil and gas royalties. The majority of production comes from royalty interests (mineral title and gross overriding royalties). Freehold's common shares trade on the Toronto Stock Exchange in Canada under the symbol FRU.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aFRU-2351199&symbol=FRU®ion=C

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1668354#1668354 schrieb:greenhorn schrieb am 02.03.2016, 10:13 Uhr[/url]"]FRU - ist mir untergegangen, sorry - hab aber die letzten Tage nun doch eine kleine Posi mir ins LongDepot gekauft, um 10,30 - 10,50 CAD

an Kosto für den Hinweis/Vorstellung

[url=http://peketec.de/trading/viewtopic.php?p=1665101#1665101 schrieb:greenhorn schrieb am 18.02.2016, 10:01 Uhr[/url]"]war gestern zu geizig.....sind ja ordentlich gesprintet

[url=http://peketec.de/trading/viewtopic.php?p=1664710#1664710 schrieb:greenhorn schrieb am 17.02.2016, 09:35 Uhr[/url]"]liest sich gut, und solche Werte sind auch in Zukunft gefragt

Dividende + Option auf steigende Ölpreise

[url=http://peketec.de/trading/viewtopic.php?p=1664624#1664624 schrieb:Kostolanys Erbe schrieb am 17.02.2016, 00:00 Uhr[/url]"]Nach dem ich hier im Board schon Valeura Energy vorgestellt habe, möchte ich heute einen weiteren Ölwert vorstellen.

Freehold Royalties Ltd

Hier steht mehr der Fokus Langfristinvestment in Öl!

Das Unternehmen zahlt monatlich eine Dividende von 0,07 CAD$, was aktuell eine Dividendenrendite von ca. 7,8% entspricht!

Und niedrige Kosten!

» zur Grafik

http://www.freeholdroyalties.com/index.php?page=about_us

Freehold Royalties Ltd. is a dividend-paying oil and gas company based in Calgary, Alberta. Our royalty interests are a major contributor to our operating and financial performance and are not subject to expenses such as operating and capital costs. Our assets generate income from crude oil, natural gas, natural gas liquids, and potash. Growth is achieved through ongoing development activity on our extensive land base spanning approximately three million gross acres, and through acquisitions.

Freehold has no employees. Day-to-day operations are managed by a wholly owned subsidiary of Rife Resources Ltd. To learn more about Rife visit www.rife.com.

Freehold's shares are listed for trading on the Toronto Stock Exchange under the trading symbol FRU.

Zu Rife:

Welcome to the Rife Resources Ltd. Website

Rife is a private exploration and production company, wholly-owned by the CN Pension Trust Funds, the pension fund for employees of the Canadian National Railway Company.

Our people have expertise in geology, geophysics, petroleum engineering, land administration, finance, audit and accounting. We have interests in 610,000 gross acres of land in western Canada. Our focus areas are Lloydminster, Deep Basin, and Southeast Saskatchewan.

We also manage, through our subsidiary Rife Resources Management Ltd. the operations of Canpar Holdings Ltd. (3.8 million gross acres) and Freehold Royalties Ltd. (3.2 million gross acres). These two companies have a profitable niche of owning oil and gas royalties and mineral titles.

http://www.rife.com/

Factsheet Rife:

http://www.rife.com/upload/media_element/32/08/2958---rife-fact-sheet-march2015-f-webnocrops.pdf

Aktuelle Präsentation von Freehold:

http://www.freeholdroyalties.com/en/powerpoint/freehold_investor_presentation_february_2016.pdf

» zur Grafik

Warum dann in CGP investieren und nicht gleich in Solgold?

[url=http://peketec.de/trading/viewtopic.php?p=1668997#1668997 schrieb:Fischlaender schrieb am 04.03.2016, 10:25 Uhr[/url]"]zu Solgold/CGP

The Prospector Resource Investment News

March/April 2016 edition http://theprospectornews.com/wp-content/uploads/2016/03/MAR2016-TheProspectorMagazine_Web_single_pages.pdf

Auszug Seite 5:

"Drill results to date have identified an extremely large (and still growing) area which one particular world-renowned expert on such porphyries believes could be perhaps THE biggest new such discovery in the world, let alone in the Andes."

und:

"Beyond the fairly widely-held belief of both government and private sector people I spoke with that Cascabel may well prove to contain the next world-class, development ready metals deposit in Ecuador (following up Fruta del Norte), Cascabel is a microcosm of the broader story that Ecuador is retelling the global mining and investment community."

[url=http://peketec.de/trading/viewtopic.php?p=1667690#1667690 schrieb:Fischlaender schrieb am 29.02.2016, 11:23 Uhr[/url]"]Mal zu CGP,

das ist ja nur eine indirekte Investition in Solgold. Und die machen eine fantastische Arbeit. So eine IR habe ich noch nie gesehen. All paar Tage kommen Updates, Videos, exzellente Karten usw. Das Solgold Management hat mehrere Millionen in SolGold investiert, Executive Director Nicholas Mather alleine mehr als 3mio. Schaut euch die HP an http://solgold.com.au/ und dazu dann auch die iii Solgold Seite, dort sind auch immer die neuesten IR Videos verlinkt http://www.iii.co.uk/research/LSE:SOLG

Cascabel wird ein Monster, das steht jetzt schon fest. Die entscheidende Frage wird sein, ob Solgold genuegend Zeit bekommt das so oeffentlich zu beweisen, dass die MK robust gegen eine Uebernahme ist?

Am besten waere ein JV mit einem Major der mehrere Dutzend Millionen an Explorationsgeldern zusagt.

Solgold nimmt jedenfalls langsam Fahrt auf, bei ueber 840mio Aktien ist das allerdings ein muehsames Unterfangen.

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Stock&symb=UK%3ASOLG&time=8&startdate=1%2F4%2F1999&enddate=2%2F29%2F2016&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=4&style=350&size=2&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=9&x=67&y=7

[url=http://peketec.de/trading/viewtopic.php?p=1659923#1659923 schrieb:Fischlaender schrieb am 01.02.2016, 16:08 Uhr[/url]"]OBM bewegt sich (noch) nix, wieder raus mit bisserl mehr als Spesenverlust.

K paar AVZ 0,045 (drilling Speku JV mit Rio Tinto)

Zukauf CGP 0,02 und damit jetzt 7-stellig im Depot. Sobald ich 1% der Bude halte mach ich ein Fass auf.

[url=http://peketec.de/trading/viewtopic.php?p=1659916#1659916 schrieb:Fischlaender schrieb am 01.02.2016, 16:00 Uhr[/url]"]V SEA 9,11

[url=http://peketec.de/trading/viewtopic.php?p=1659255#1659255 schrieb:Fischlaender schrieb am 28.01.2016, 21:47 Uhr[/url]"]SEA sieht relativ stark aus, v.a. bei dem heutigen Markt.

» zur Grafik

um 8,50 CAD herum ist auch scheint's eine nette Unterstützung, die ev. jetzt greift

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1659217#1659217 schrieb:Fischlaender schrieb am 28.01.2016, 17:52 Uhr[/url]"]K SEA 8,52 CAD

K OBM 1,04 CAD

Das kenn ich so langsam auch, bin zwar erst 34 aber die Falten auf der Stirn ... mein Güte, das kannte ich so gar nicht

[url=http://peketec.de/trading/viewtopic.php?p=1669015#1669015 schrieb:greenhorn schrieb am 04.03.2016, 10:54 Uhr[/url]"]Guten Morgen!

schon wieder Arzttermin gehabt.......älterwerden ist anstrengend

bei mir sinds leider nicht nur Falten auf der Stirne......die hab ich seit einigen Jahren Rohstoff"trading"........

[url=http://peketec.de/trading/viewtopic.php?p=1669023#1669023 schrieb:PerseusLtd schrieb am 04.03.2016, 11:08 Uhr[/url]"]Das kenn ich so langsam auch, bin zwar erst 34 aber die Falten auf der Stirn ... mein Güte, das kannte ich so gar nicht

[url=http://peketec.de/trading/viewtopic.php?p=1669015#1669015 schrieb:greenhorn schrieb am 04.03.2016, 10:54 Uhr[/url]"]Guten Morgen!

schon wieder Arzttermin gehabt.......älterwerden ist anstrengend

sieht nach 1300 demnächst aus

[url=http://peketec.de/trading/viewtopic.php?p=1668776#1668776 schrieb:dukezero schrieb am 03.03.2016, 14:55 Uhr[/url]"]» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1669015#1669015 schrieb:greenhorn schrieb am 04.03.2016, 10:54 Uhr[/url]"]Guten Morgen!

schon wieder Arzttermin gehabt.......älterwerden ist anstrengend

Ist ja nur der Ohrenarzt!

+20% gestern - stark!

[url=http://peketec.de/trading/viewtopic.php?p=1668871#1668871 schrieb:Fischlaender schrieb am 03.03.2016, 20:39 Uhr[/url]"]Löppt an!

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1668402#1668402 schrieb:Fischlaender schrieb am 02.03.2016, 12:44 Uhr[/url]"]http://www.dundeeprecious.com/English/news-and-events/news-releases/NewsDetails/2016/Dundee-Precious-Metals-Announces-Sale-of-Kapan-for-US25-Million-and-a-2-Net-Smelter-Return-Royalty/default.aspx

DPM verkauft die Kapan Mine in Armenien an Polymet Mining (LSE:POLY) fuer (alle Angaben in USD)

10mio Cash

15mio Aktien

2% NSR (capped at 25mio)

Da Kapan nur 15% zu Au und 5% zu Cu Produktion DPM's beitraegt und ausserdem die hoeheren AISC hatte, insgesamt ein guter Verkauf.

Praesentation ist bereits aktualisiert: http://s1.q4cdn.com/019834511/files/presentation/2016r/DPM_BMO_FINAL-March-1_EXCLUDING-KAPAN.pdf

[url=http://peketec.de/trading/viewtopic.php?p=1668064#1668064 schrieb:greenhorn schrieb am 01.03.2016, 14:18 Uhr[/url]"]halten ausserdem 12% an Sabina Silver

[url=http://peketec.de/trading/viewtopic.php?p=1668056#1668056 schrieb:Fischlaender schrieb am 01.03.2016, 14:03 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1668014#1668014 schrieb:trader500 schrieb am 01.03.2016, 12:16 Uhr[/url]"]Glänzende Aussichten: Die besten Goldaktien fürs Depot http://www.boerse-online.de/nachric...-Die-besten-Goldaktien-fuers-Depot-1001063451

DPM auf Platz 1 bei denen, na gut, dass ich die letzte Woche gekauft hab...

Aber im Ernst, die ist noch Null gelaufen, AISC usw sind gut bis ok und dann haben die Schwe....hunde meine Avala Resources fuer'n Appel und Ei ausgekauft!!! Und Avala hat sehr interessante Projekte in Ost- und Suedserbien, u.a. das Timok Gold-Projekt mit mehr als 2mio Oz nachgewiesen in MI&I und ein JV mit Rio Tinto in relativer Naehe zum Cukari Peku Worldclass JV Freeport/Reservoir, da bohrt Rio gerade ein 1.000m Loch.

Demnaechst fahr ich da hin und schau mir das an! 8)

war klar........

[url=http://peketec.de/trading/viewtopic.php?p=1669046#1669046 schrieb:dukezero schrieb am 04.03.2016, 12:22 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1669015#1669015 schrieb:greenhorn schrieb am 04.03.2016, 10:54 Uhr[/url]"]Guten Morgen!

schon wieder Arzttermin gehabt.......älterwerden ist anstrengend

Ist ja nur der Ohrenarzt! » zur Grafik