App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

[url=http://peketec.de/trading/viewtopic.php?p=1672188#1672188 schrieb:dukezero schrieb am 17.03.2016, 14:35 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1672148#1672148 schrieb:dukezero schrieb am 17.03.2016, 12:32 Uhr[/url]"]Wichtige Hürde im Jahreschart genommen. Open sky bis 12.25 Cad!

» zur Grafik

plus 10%

FR:

Unter sehr hohem Volumen über 9 gezogen! Allerdings einen quasi lonely warrior gebildet. Bei 8 Cad eine Option!!

RSI auch bei 80, aber im Moment ist der Trend stark für God+Silberminen....

[url=http://peketec.de/trading/viewtopic.php?p=1672363#1672363 schrieb:dukezero schrieb am 18.03.2016, 08:56 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1672188#1672188 schrieb:dukezero schrieb am 17.03.2016, 14:35 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1672148#1672148 schrieb:dukezero schrieb am 17.03.2016, 12:32 Uhr[/url]"]Wichtige Hürde im Jahreschart genommen. Open sky bis 12.25 Cad!

» zur Grafik

plus 10%

FR:

Unter sehr hohem Volumen über 9 gezogen! Allerdings einen quasi lonely warrior gebildet. Bei 8 Cad eine Option!!

Montreal (GodmodeTrader.de) - Gold notiert zum Wochenschluss weiterhin in der Nähe seines am 4. März 2016 bei 1.279,70 US-Dollar je Feinunze erreichten 13-Monatshochs, wobei das Edelmetall nach wie vor von den jüngsten Verlautbarungen der Federal Reserve Bank (Fed) bezüglich der Zinsaussichten gestützt wird. Laut aktuellen Fed-Projektionen sind in den USA in diesem Jahr nur noch zwei Zinsanhebungen um 25 Basispunkte zu erwarten, zuletzt waren noch vier Zinsschritte prognostiziert worden.

Auf dem physischen Markt haben sich die indischen Goldkäufer größtenteils vom Markt zurückgezogen, wie das Rohstoffportal „Kitco.com“ unter Berufung auf die Analysten von HSBC berichtet. So hätten sich die Goldbarrenimporte nach Indien im Februar lediglich auf 23,8 Tonnen belaufen. Gegenüber dem Vormonat sei dies ein Einbruch um 61 Prozent, heißt es weiter.

Auf dem physischen Markt haben sich die indischen Goldkäufer größtenteils vom Markt zurückgezogen, wie das Rohstoffportal „Kitco.com“ unter Berufung auf die Analysten von HSBC berichtet. So hätten sich die Goldbarrenimporte nach Indien im Februar lediglich auf 23,8 Tonnen belaufen. Gegenüber dem Vormonat sei dies ein Einbruch um 61 Prozent, heißt es weiter.

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

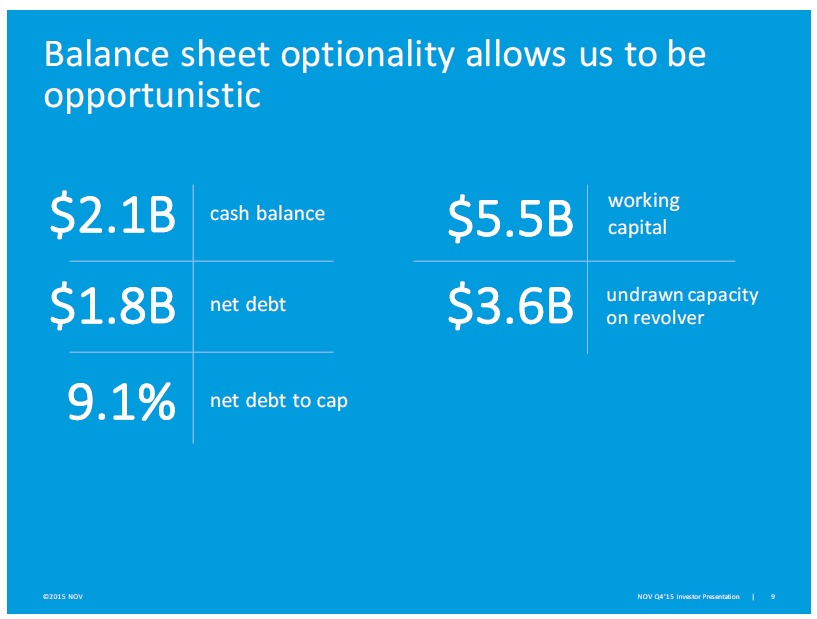

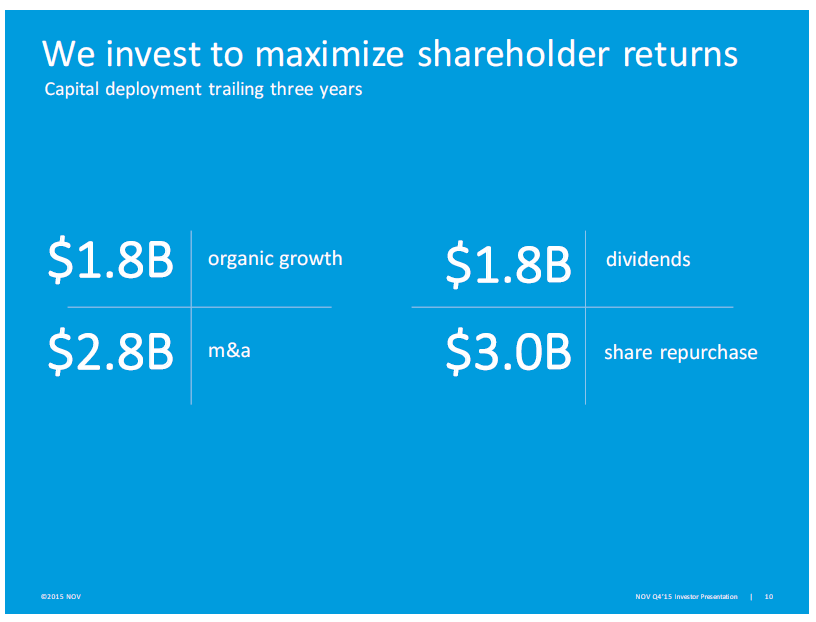

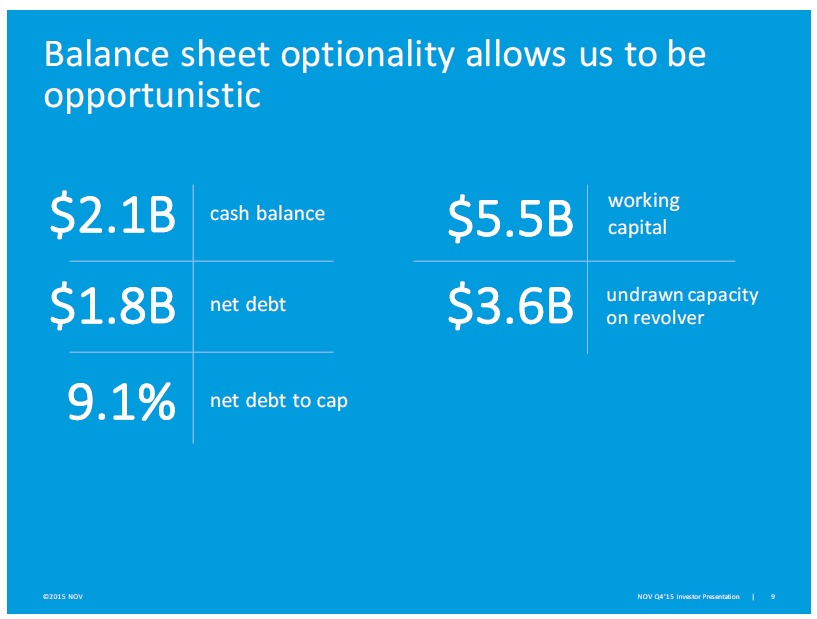

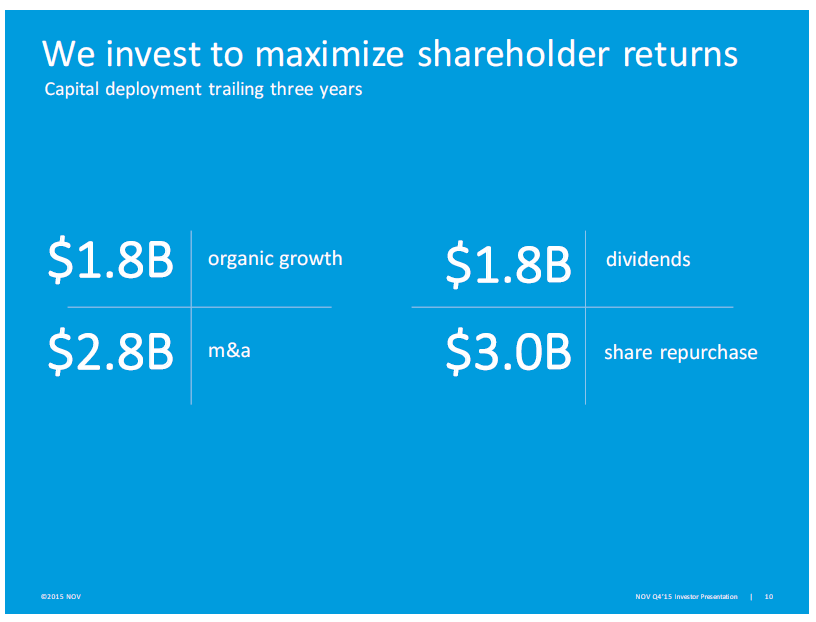

Was hältst Du von NOV - National Oilwell Varco?

[url=http://peketec.de/trading/viewtopic.php?p=1671396#1671396 schrieb:greenhorn schrieb am 15.03.2016, 09:03 Uhr[/url]"]gestern Williams (WKN/ISIN:855451/ US9694571004, WMB) mal eine Posi Long - Dividendenwert, zu 14,40 Euro

schau ich mir mal an - haben ja ein sehr umfangreiches Portfolio

von der Sache änlich wie Seadrill?

von der Sache änlich wie Seadrill?

[url=http://peketec.de/trading/viewtopic.php?p=1672457#1672457 schrieb:Kostolanys Erbe schrieb am 18.03.2016, 12:43 Uhr[/url]"]Was hältst Du von NOV - National Oilwell Varco?

[url=http://peketec.de/trading/viewtopic.php?p=1671396#1671396 schrieb:greenhorn schrieb am 15.03.2016, 09:03 Uhr[/url]"]gestern Williams (WKN/ISIN:855451/ US9694571004, WMB) mal eine Posi Long - Dividendenwert, zu 14,40 Euro

1.Eindruck - haben nicht so viel verloren wie andere, solide Arbeit und Dividende

bissl fehlt mir die große Kursphantasie ggü Seadrill oder anderen

ordentliche Markbewertung

hast du ne aktuelle Dividendenrendite?

ansonsten schicker Chart, denke mit dem Ölpreis geht es auch hier weiter hoch

die Frage ist inwiefern der Rückgang der Aktivitäten auch bei Ihnen durchschlägt

Frackingindustrie und Oldscool

der andere Tipp von hier - FRU entwickelt sich auch, nächste Dividende zwar gekürzt, aber mal sehen wie es für April aussieht

bissl fehlt mir die große Kursphantasie ggü Seadrill oder anderen

ordentliche Markbewertung

hast du ne aktuelle Dividendenrendite?

ansonsten schicker Chart, denke mit dem Ölpreis geht es auch hier weiter hoch

die Frage ist inwiefern der Rückgang der Aktivitäten auch bei Ihnen durchschlägt

Frackingindustrie und Oldscool

der andere Tipp von hier - FRU entwickelt sich auch, nächste Dividende zwar gekürzt, aber mal sehen wie es für April aussieht

[url=http://peketec.de/trading/viewtopic.php?p=1672459#1672459 schrieb:greenhorn schrieb am 18.03.2016, 12:57 Uhr[/url]"]schau ich mir mal an - haben ja ein sehr umfangreiches Portfolio

von der Sache änlich wie Seadrill?

[url=http://peketec.de/trading/viewtopic.php?p=1672457#1672457 schrieb:Kostolanys Erbe schrieb am 18.03.2016, 12:43 Uhr[/url]"]Was hältst Du von NOV - National Oilwell Varco?

[url=http://peketec.de/trading/viewtopic.php?p=1671396#1671396 schrieb:greenhorn schrieb am 15.03.2016, 09:03 Uhr[/url]"]gestern Williams (WKN/ISIN:855451/ US9694571004, WMB) mal eine Posi Long - Dividendenwert, zu 14,40 Euro

Ebenfalls

[url=http://peketec.de/trading/viewtopic.php?p=1672485#1672485 schrieb:greenhorn schrieb am 18.03.2016, 15:12 Uhr[/url]"]werd heute nicht so lange machen, daher schon jetzt mal:

schönes Wochenende !!!

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Pilot spends $2.6M (U.S.) on TV Tower expenses in 2015

2016-03-18 20:15 ET - News Release

Mr. Cal Everett reports

PILOT GOLD REPORTS YEAR-END FINANCIAL AND OPERATING RESULTS

Pilot Gold Inc. has released its financial and operating results for the year ended Dec. 31, 2015. (All amounts are presented in U.S. dollars unless otherwise stated.)

Outlook for 2016

The company has had a strong start to 2016 with the announcement of Cal Everett as president and chief executive officer, successful proof-of-concept drill results from Goldstrike, and the closing of a $4.47-million private placement. Pilot Gold's exploration focus in 2016 is on its U.S. portfolio, including the Goldstrike project in Utah and the Kinsley project in Nevada.

At Goldstrike, last year's drill program validated the exploration model, and this year the company is planning a minimum 10,000-metre infill and step-out drill program targeting the mine trend, phase 1 of which commenced March 2, 2016. The company will also continue surface exploration and drill-target development propertywide, continue refinement and expansion of the 3-D geological model, and complete a plan of operations to enable expanded drilling on the rest of the property.

Company highlights through and subsequent to Dec. 31, 2015:

Appointed Mr. Everett as president and chief executive officer (1);

Closed a $4.47-million private placement (1);

Completed a 2,877-metre, successful proof-of-concept reverse circulation drill program at Goldstrike in December;

Reported an initial resource estimate at Kinsley, including 284,000 indicated ounces at an average grade of 6.04 grams per tonne gold in the Western Flank zone; using multiple cut-offs, the resource estimate delineates (2): A total of 405,000 indicated ounces in 5,529,000 tonnes averaging 2.27 grams per tonne gold;

A total of 122,000 inferred ounces in 3,362,000 tonnes averaging 1.13 g/t gold;

Completed the earn-in to a 60-per-cent controlling interest in TV Tower in March, 2015;

Doubled the size of the mineralized footprint at TV Tower's Hilltop porphyry system to approximately 600 metres by 500 metres, including discovery of a supergene copper zone, yielding assay intervals of up to 4.5 per cent copper (3);

Released a revised preliminary economic assessment for the Halilaga copper-gold porphyry project (4).

Goldstrike, Utah

Goldstrike is host to a past-producing oxide heap-leach mine with an extensive exploration database, a large number of shallow drill holes with unmined oxide gold intercepts and numerous untested gold targets. Gold mineralization on surface and in shallow drill holes has been discovered over the entire property.

The 2015 drill program intersected gold mineralization in all areas tested over a six-kilometre-long corridor, confirming that gold is widespread and predictable within a particular stratigraphic interval. For the year ended Dec. 31, 2015, expenditures incurred at Goldstrike were $990,000 in line with the 2015 budget of $1-million.

Kinsley Mountain

On Dec. 17, 2015, the company filed an NI 43-101 technical report on Kinsley that includes the delineation of a significant high-grade zone at the Western Flank. With other untested targets with the same attributes as the Western Flank, the company believes that this resource represents a stepping stone along the way to realizing the potential of a much larger gold system at Kinsley. From north to south, there are over 12 kilometres of prospective geology, alteration and geochemical targets for the company to explore.

Management adjusted the 2015 exploration program and budget lower, as a reflection of market conditions, and completed 5,400 metres in 13 drill holes that included the discovery of a new mineralized zone located 150 metres east of the high-grade Western Flank zone. The company's share of expenditures from Jan. 1, 2015, to Dec. 31, 2015, totalled $1.70-million. Expenditures and activity through the year included: drilling and assaying ($720,000), salaries ($470,000), and analyses and surveys ($100,000).

Pilot Gold owns approximately 79 per cent of Kinsley. A subsidiary of Nevada Sunrise Gold Corp. holds the remaining 21-per-cent interest in the property. Each entity financed its pro rata share of activity on the property in 2015.

TV Tower

The focus at TV Tower in 2015 was the expansion of the footprint of the two copper-gold porphyry discoveries in the southern part of the property. Management is particularly encouraged with early indications of a zone of supergene copper enrichment at the Hilltop porphyry target.

Although the approved program and budget contemplated up to 20,000 metres of drilling financed pro rata by each partner (Pilot Gold share: $4.55-million), management adjusted the program as a reflection of market conditions and completed 5,315 metres, which culminated in a doubling of the mineralized footprint at the Hilltop porphyry system. The company's share of total expenditures on the project for 2015 was $2.6-million and included: drilling and assay expenses ($690,000), salaries ($540,000), and consultant costs ($470,000), with the rest including camp costs and transportation.

Pilot Gold holds a 60-per-cent interest in TV Tower, and a Turkish subsidiary of Teck Resources Ltd. has the remaining 40-per-cent interest. Pilot Gold is project operator and completed an earn-in to 60 per cent in March, 2015, through sole financing exploration over a 2-1/2-year period.

Moira Smith, PhD, PGeo, vice-president, exploration and geosciences, Pilot Gold, is the company's designated qualified person for this news release within the meaning of National Instrument 43-101 (standards of disclosure for mineral projects) and has reviewed and validated that the scientific and technical information contained in this release is accurate.

Selected financial data

The attached selected financial data are derived from the consolidated financial statements and related notes thereto for the years ended December, 2015, 2014 and 2013, as prepared in accordance with international financial reporting standards. These documents can be found on the company's website or on SEDAR.

SELECTED FINANCIAL DATA

Twelve months ended

Dec. 31,

2015 2014 2013

Attributable to shareholders

Loss for the period $6,974,976 $6,709,098 $9,142,314

Loss and comprehensive loss for

the year $12,989,681 $10,535,641 $12,516,033

Basic and diluted loss per

share $0.07 $0.07 $0.10

Total assets comprise primarily exploration properties and deferred exploration expenditures of $76.65-million and cash, cash equivalents and short-term investments of $7.91-million. The 40-per-cent share of TV Tower owned by Teck is included as a component of the $23.04-million non-controlling interest on the company's statement of financial position. Total assets also include $780,000 in receivables and prepayments, and $5.22-million in value recorded for the company's 40-per-cent interest in the preliminary-economic-assessment-stage Halilaga copper-gold project in Turkey.

The decrease since year-end 2014 in working capital reflects costs incurred toward the 2015 exploration programs of $5.08-million (2014: $7.03-million), cash outflows for operating expenditures of $3.85-million (2014: $5.05-million) and the impact of changing foreign exchange rates of $2.39-million (2014: $940,000).

Total liabilities at Dec. 31, 2015, 2014 and 2013 primarily reflect accounts payable and accruals recorded at period-end arising from continuing activities. Two thousand fifteen also includes a deferred tax liability ($470,000) arising from the impact of foreign exchange on the carrying value of TV Tower. The significant overall decrease over the prior years is a reflection of decreased exploration activities at year-end compared with those years.

The most significant contributors to the losses in the 12 months ended Dec. 31, 2015, were the writedown of the Gold Bug property ($740,000), Viper property ($1.05-million) and Drum property ($300,000), the cost of wages and benefits of $1.72-million (2014: $1.82-million and 2013: $1.73-million), and office and general costs of $1.14-million (2014: $1.21-million and 2013: $1.29-million), as well as non-cash stock-based compensation of $990,000 (2014: $1.22-million and 2013: $2.28-million). The loss per share remained constant at seven cents for each of the years ended 2015 and 2014, a decrease on 10 cents in 2013.

The net other comprehensive loss attributable to shareholders for the year ended Dec. 31, 2015, was $6.01-million compared with $3.83-million and $3.38-million in 2014 and 2013, respectively, driven by exchange differences on translation of foreign currency subsidiaries. The impact from exchange differences will vary from period to period depending on the rate of exchange. In the period between Jan. 1, 2015, and Dec. 31, 2015, the U.S. dollar appreciated 15 per cent relative to the Canadian dollar (2014: 8.3 per cent and 2013: 7.3 per cent).

Unless stated otherwise, information of a scientific or technical nature in this press release regarding the TV Tower, Halilaga or Kinsley Mountain properties is summarized, derived or extracted from the following technical reports: "Independent technical report for the TV Tower exploration property, Canakkale, western Turkey," effective Jan. 21, 2014, and dated Feb. 20, 2014, prepared by Casey M. Hetman, PGeo, with SRK Consulting (Canada) Inc., James N. Gray, PGeo, of Advantage Geoservices Ltd., and Gary Simmons, BSc, metallurgical engineering, of G.L. Simmons Consulting LLC; "Revised preliminary economic assessment technical report, Halilaga project, Turkey," effective Dec. 20, 2014, and dated Feb. 16, 2015, prepared by Gordon Doerksen, PEng, Dino Pilotto, PEng, and Stacy Freudigmann, PEng, of JDS Energy and Mining Inc.; Greg Abrahams, PGeo, and Maritz Rykaart, PEng, of SRK; Mr. Simmons of G.L. Simmons Consulting; Garth Kirkham, PGeo, of Kirkham Geosystems Ltd.; and Mr. Gray, PGeo, of Advantage Geoservices Ltd.; "Updated technical report and estimated mineral resources for the Kinsley project, Elko and White Pine counties, Nevada, USA," effective Oct. 15, 2015, dated Dec. 16, 2015, and prepared by Michael M. Gustin, CPG, Ms. Smith, PhD, PGeo, and Mr. Simmons, BSc, MMSA, and the company's press release, dated Nov. 5, 2015, relating to the resource estimate published for the Kinsley Mountain property. For further detail on TV Tower, Kinsley Mountain or the Halilaga preliminary economic assessment, refer to the respective technical reports filed on the company's website or under Pilot Gold's SEDAR profile.

(1) See press release dated Nov. 12, 2015.

(2) See press release dated Dec. 17, 2015, and related technical report for detailed disclosure.

(3) See press release dated Oct. 20, 2015.

(4) See press release dated Jan. 29, 2015, and related technical report.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aPLG-2355675&symbol=PLG®ion=C

2016-03-18 20:15 ET - News Release

Mr. Cal Everett reports

PILOT GOLD REPORTS YEAR-END FINANCIAL AND OPERATING RESULTS

Pilot Gold Inc. has released its financial and operating results for the year ended Dec. 31, 2015. (All amounts are presented in U.S. dollars unless otherwise stated.)

Outlook for 2016

The company has had a strong start to 2016 with the announcement of Cal Everett as president and chief executive officer, successful proof-of-concept drill results from Goldstrike, and the closing of a $4.47-million private placement. Pilot Gold's exploration focus in 2016 is on its U.S. portfolio, including the Goldstrike project in Utah and the Kinsley project in Nevada.

At Goldstrike, last year's drill program validated the exploration model, and this year the company is planning a minimum 10,000-metre infill and step-out drill program targeting the mine trend, phase 1 of which commenced March 2, 2016. The company will also continue surface exploration and drill-target development propertywide, continue refinement and expansion of the 3-D geological model, and complete a plan of operations to enable expanded drilling on the rest of the property.

Company highlights through and subsequent to Dec. 31, 2015:

Appointed Mr. Everett as president and chief executive officer (1);

Closed a $4.47-million private placement (1);

Completed a 2,877-metre, successful proof-of-concept reverse circulation drill program at Goldstrike in December;

Reported an initial resource estimate at Kinsley, including 284,000 indicated ounces at an average grade of 6.04 grams per tonne gold in the Western Flank zone; using multiple cut-offs, the resource estimate delineates (2): A total of 405,000 indicated ounces in 5,529,000 tonnes averaging 2.27 grams per tonne gold;

A total of 122,000 inferred ounces in 3,362,000 tonnes averaging 1.13 g/t gold;

Completed the earn-in to a 60-per-cent controlling interest in TV Tower in March, 2015;

Doubled the size of the mineralized footprint at TV Tower's Hilltop porphyry system to approximately 600 metres by 500 metres, including discovery of a supergene copper zone, yielding assay intervals of up to 4.5 per cent copper (3);

Released a revised preliminary economic assessment for the Halilaga copper-gold porphyry project (4).

Goldstrike, Utah

Goldstrike is host to a past-producing oxide heap-leach mine with an extensive exploration database, a large number of shallow drill holes with unmined oxide gold intercepts and numerous untested gold targets. Gold mineralization on surface and in shallow drill holes has been discovered over the entire property.

The 2015 drill program intersected gold mineralization in all areas tested over a six-kilometre-long corridor, confirming that gold is widespread and predictable within a particular stratigraphic interval. For the year ended Dec. 31, 2015, expenditures incurred at Goldstrike were $990,000 in line with the 2015 budget of $1-million.

Kinsley Mountain

On Dec. 17, 2015, the company filed an NI 43-101 technical report on Kinsley that includes the delineation of a significant high-grade zone at the Western Flank. With other untested targets with the same attributes as the Western Flank, the company believes that this resource represents a stepping stone along the way to realizing the potential of a much larger gold system at Kinsley. From north to south, there are over 12 kilometres of prospective geology, alteration and geochemical targets for the company to explore.

Management adjusted the 2015 exploration program and budget lower, as a reflection of market conditions, and completed 5,400 metres in 13 drill holes that included the discovery of a new mineralized zone located 150 metres east of the high-grade Western Flank zone. The company's share of expenditures from Jan. 1, 2015, to Dec. 31, 2015, totalled $1.70-million. Expenditures and activity through the year included: drilling and assaying ($720,000), salaries ($470,000), and analyses and surveys ($100,000).

Pilot Gold owns approximately 79 per cent of Kinsley. A subsidiary of Nevada Sunrise Gold Corp. holds the remaining 21-per-cent interest in the property. Each entity financed its pro rata share of activity on the property in 2015.

TV Tower

The focus at TV Tower in 2015 was the expansion of the footprint of the two copper-gold porphyry discoveries in the southern part of the property. Management is particularly encouraged with early indications of a zone of supergene copper enrichment at the Hilltop porphyry target.

Although the approved program and budget contemplated up to 20,000 metres of drilling financed pro rata by each partner (Pilot Gold share: $4.55-million), management adjusted the program as a reflection of market conditions and completed 5,315 metres, which culminated in a doubling of the mineralized footprint at the Hilltop porphyry system. The company's share of total expenditures on the project for 2015 was $2.6-million and included: drilling and assay expenses ($690,000), salaries ($540,000), and consultant costs ($470,000), with the rest including camp costs and transportation.

Pilot Gold holds a 60-per-cent interest in TV Tower, and a Turkish subsidiary of Teck Resources Ltd. has the remaining 40-per-cent interest. Pilot Gold is project operator and completed an earn-in to 60 per cent in March, 2015, through sole financing exploration over a 2-1/2-year period.

Moira Smith, PhD, PGeo, vice-president, exploration and geosciences, Pilot Gold, is the company's designated qualified person for this news release within the meaning of National Instrument 43-101 (standards of disclosure for mineral projects) and has reviewed and validated that the scientific and technical information contained in this release is accurate.

Selected financial data

The attached selected financial data are derived from the consolidated financial statements and related notes thereto for the years ended December, 2015, 2014 and 2013, as prepared in accordance with international financial reporting standards. These documents can be found on the company's website or on SEDAR.

SELECTED FINANCIAL DATA

Twelve months ended

Dec. 31,

2015 2014 2013

Attributable to shareholders

Loss for the period $6,974,976 $6,709,098 $9,142,314

Loss and comprehensive loss for

the year $12,989,681 $10,535,641 $12,516,033

Basic and diluted loss per

share $0.07 $0.07 $0.10

Total assets comprise primarily exploration properties and deferred exploration expenditures of $76.65-million and cash, cash equivalents and short-term investments of $7.91-million. The 40-per-cent share of TV Tower owned by Teck is included as a component of the $23.04-million non-controlling interest on the company's statement of financial position. Total assets also include $780,000 in receivables and prepayments, and $5.22-million in value recorded for the company's 40-per-cent interest in the preliminary-economic-assessment-stage Halilaga copper-gold project in Turkey.

The decrease since year-end 2014 in working capital reflects costs incurred toward the 2015 exploration programs of $5.08-million (2014: $7.03-million), cash outflows for operating expenditures of $3.85-million (2014: $5.05-million) and the impact of changing foreign exchange rates of $2.39-million (2014: $940,000).

Total liabilities at Dec. 31, 2015, 2014 and 2013 primarily reflect accounts payable and accruals recorded at period-end arising from continuing activities. Two thousand fifteen also includes a deferred tax liability ($470,000) arising from the impact of foreign exchange on the carrying value of TV Tower. The significant overall decrease over the prior years is a reflection of decreased exploration activities at year-end compared with those years.

The most significant contributors to the losses in the 12 months ended Dec. 31, 2015, were the writedown of the Gold Bug property ($740,000), Viper property ($1.05-million) and Drum property ($300,000), the cost of wages and benefits of $1.72-million (2014: $1.82-million and 2013: $1.73-million), and office and general costs of $1.14-million (2014: $1.21-million and 2013: $1.29-million), as well as non-cash stock-based compensation of $990,000 (2014: $1.22-million and 2013: $2.28-million). The loss per share remained constant at seven cents for each of the years ended 2015 and 2014, a decrease on 10 cents in 2013.

The net other comprehensive loss attributable to shareholders for the year ended Dec. 31, 2015, was $6.01-million compared with $3.83-million and $3.38-million in 2014 and 2013, respectively, driven by exchange differences on translation of foreign currency subsidiaries. The impact from exchange differences will vary from period to period depending on the rate of exchange. In the period between Jan. 1, 2015, and Dec. 31, 2015, the U.S. dollar appreciated 15 per cent relative to the Canadian dollar (2014: 8.3 per cent and 2013: 7.3 per cent).

Unless stated otherwise, information of a scientific or technical nature in this press release regarding the TV Tower, Halilaga or Kinsley Mountain properties is summarized, derived or extracted from the following technical reports: "Independent technical report for the TV Tower exploration property, Canakkale, western Turkey," effective Jan. 21, 2014, and dated Feb. 20, 2014, prepared by Casey M. Hetman, PGeo, with SRK Consulting (Canada) Inc., James N. Gray, PGeo, of Advantage Geoservices Ltd., and Gary Simmons, BSc, metallurgical engineering, of G.L. Simmons Consulting LLC; "Revised preliminary economic assessment technical report, Halilaga project, Turkey," effective Dec. 20, 2014, and dated Feb. 16, 2015, prepared by Gordon Doerksen, PEng, Dino Pilotto, PEng, and Stacy Freudigmann, PEng, of JDS Energy and Mining Inc.; Greg Abrahams, PGeo, and Maritz Rykaart, PEng, of SRK; Mr. Simmons of G.L. Simmons Consulting; Garth Kirkham, PGeo, of Kirkham Geosystems Ltd.; and Mr. Gray, PGeo, of Advantage Geoservices Ltd.; "Updated technical report and estimated mineral resources for the Kinsley project, Elko and White Pine counties, Nevada, USA," effective Oct. 15, 2015, dated Dec. 16, 2015, and prepared by Michael M. Gustin, CPG, Ms. Smith, PhD, PGeo, and Mr. Simmons, BSc, MMSA, and the company's press release, dated Nov. 5, 2015, relating to the resource estimate published for the Kinsley Mountain property. For further detail on TV Tower, Kinsley Mountain or the Halilaga preliminary economic assessment, refer to the respective technical reports filed on the company's website or under Pilot Gold's SEDAR profile.

(1) See press release dated Nov. 12, 2015.

(2) See press release dated Dec. 17, 2015, and related technical report for detailed disclosure.

(3) See press release dated Oct. 20, 2015.

(4) See press release dated Jan. 29, 2015, and related technical report.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aPLG-2355675&symbol=PLG®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Goldeye, GPM identify 30 conductors at Weebigee

2016-03-17 08:53 ET - News Release

See News Release (C-GGY) Goldeye Explorations Ltd (2)

Mr. Robin Webster of Goldeye reports

GOLDEYE EXPLORATIONS LIMITED: GPM METALS INC. UPDATES PROGRESS AT THE WEEBIGEE PROJECT, SANDY LAKE, ONTARIO

Goldeye Explorations Ltd. and GPM Metals Inc. have received final interpretation reports on the Weebigee project airborne VTEM (versatile time domain electromagnetic)/horizontal gradient magnetics survey. Thirty conductors/areas of interest were identified as moderate to high-priority targets for gold or base metal mineralization. These targets include extensions of known gold and base metal showings, as well as new conductive trends on recently staked claims. A 2016 field program of prospecting, mapping, power stripping and ground geophysics will be used to prioritize the target areas for eventual drill testing.

GPM is the operator of the Weebigee project.

The airborne survey along with the 2015 staking and regional compilation programs have begun to move Weebigee toward a much larger, greenstone-belt-scale project. This more comprehensive approach by GPM recognizes that the 2014 high-grade Au drill intersections (Knoll, Bernadette and RvG4 zones) represent type targets that have the potential to occur throughout the Sandy Lake greenstone belt. GPM's approach also recognizes the base metal potential of the south portion of the belt (Sandborn Bay area).

Block F

The Weebigee project now covers a 35-kilometre-long gold-bearing trend. The western portion of this trend was covered by block F of the airborne survey. Numerous historic gold showings are documented along this trend, hosted within a distinctive sequence of rock units dominated by iron formation and quartz-rich felsic tuff. The block F airborne survey has revealed that a number of iron formation/sediment horizons occur within the northwest arm volcanic package. Winter 2014 drilling of gold showings in the stratigraphy immediately above the southernmost iron formation/sediment horizon returned significant intersections (12.86 grams per tonne gold over 6.85 metres, 12.45 g/t Au over 3.5 metres, 23.25 g/t Au over 3.97 metres). Detailed follow-up of the airborne survey results will target breaks in these iron formation/sediment magnetic and conductive trends that may represent gold-bearing deformation/hydrothermal events.

Block B

South of the gold trend, in the Sandborn Bay area, the geological environment appears favourable for VHMS (volcanic-hosted massive sulphide) deposits. This area was covered by the block B portion of the airborne survey. Known showings include copper (up to 3 per cent), zinc (up to 4.5 per cent) and silver (up to 352 g/t) values associated with cherty felsic tuffs, cordierite alteration (sediments) and talc-antigorite alteration (ultramafics). Numerous conductors and conductive trends were outlined by the block B airborne survey, some of which are coincident to Cu-Zn-Ag-bearing cherty tuff horizons. Several new conductive trends proximal to a felsic intrusion (potential volcanic centre) have also been outlined by the airborne survey. Government mapping shows very little outcrop exposure along these new conductive trends.

The airborne survey consisted of 1,274.5 km of horizontal gradiometer and VTEM data collected over two blocks, B and F, on the western part of the Sandy Lake greenstone belt. The helicopter-based survey was flown by Geotech Ltd. of Aurora, Ont., in September, 2015. Line separation was 200 metres with a mean sensor altitude of 45 metres. Third party consultants interpreting the data reported that the electromagnetic and magnetic configurations of the system were well suited for the geological environment at Sandy Lake and data were of good quality.

GPM and Goldeye wish to thank the first nation communities of Sandy Lake and Keewaywin for their co-operation and logistical support of the continuing mineral exploration programs.

About Weebigee

Weebigee is a gold and base metals project located near Sandy Lake in Northwestern Ontario. The project is approximately 225 km north of Red Lake, one of the world's most prolific gold camps, and 200 km west of Goldcorp's world-class Musselwhite mine. The project comprises a main block of 363 claim units (approximately 6,000 hectares) held 100 per cent by Goldeye subject to an option agreement with GPM and an additional 1,421 claim units (approximately 22,000 hectares) recently staked by GPM, in the highly prospective and underexplored Sandy Lake greenstone belt. Certain of the claims are subject to a 1-per-cent net smelter returns royalty. Weebigee lies within the traditional territory of Sandy Lake First Nation with which Goldeye signed a comprehensive exploration agreement in 2013.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aGPM-2355046&symbol=GPM®ion=C

2016-03-17 08:53 ET - News Release

See News Release (C-GGY) Goldeye Explorations Ltd (2)

Mr. Robin Webster of Goldeye reports

GOLDEYE EXPLORATIONS LIMITED: GPM METALS INC. UPDATES PROGRESS AT THE WEEBIGEE PROJECT, SANDY LAKE, ONTARIO

Goldeye Explorations Ltd. and GPM Metals Inc. have received final interpretation reports on the Weebigee project airborne VTEM (versatile time domain electromagnetic)/horizontal gradient magnetics survey. Thirty conductors/areas of interest were identified as moderate to high-priority targets for gold or base metal mineralization. These targets include extensions of known gold and base metal showings, as well as new conductive trends on recently staked claims. A 2016 field program of prospecting, mapping, power stripping and ground geophysics will be used to prioritize the target areas for eventual drill testing.

GPM is the operator of the Weebigee project.

The airborne survey along with the 2015 staking and regional compilation programs have begun to move Weebigee toward a much larger, greenstone-belt-scale project. This more comprehensive approach by GPM recognizes that the 2014 high-grade Au drill intersections (Knoll, Bernadette and RvG4 zones) represent type targets that have the potential to occur throughout the Sandy Lake greenstone belt. GPM's approach also recognizes the base metal potential of the south portion of the belt (Sandborn Bay area).

Block F

The Weebigee project now covers a 35-kilometre-long gold-bearing trend. The western portion of this trend was covered by block F of the airborne survey. Numerous historic gold showings are documented along this trend, hosted within a distinctive sequence of rock units dominated by iron formation and quartz-rich felsic tuff. The block F airborne survey has revealed that a number of iron formation/sediment horizons occur within the northwest arm volcanic package. Winter 2014 drilling of gold showings in the stratigraphy immediately above the southernmost iron formation/sediment horizon returned significant intersections (12.86 grams per tonne gold over 6.85 metres, 12.45 g/t Au over 3.5 metres, 23.25 g/t Au over 3.97 metres). Detailed follow-up of the airborne survey results will target breaks in these iron formation/sediment magnetic and conductive trends that may represent gold-bearing deformation/hydrothermal events.

Block B

South of the gold trend, in the Sandborn Bay area, the geological environment appears favourable for VHMS (volcanic-hosted massive sulphide) deposits. This area was covered by the block B portion of the airborne survey. Known showings include copper (up to 3 per cent), zinc (up to 4.5 per cent) and silver (up to 352 g/t) values associated with cherty felsic tuffs, cordierite alteration (sediments) and talc-antigorite alteration (ultramafics). Numerous conductors and conductive trends were outlined by the block B airborne survey, some of which are coincident to Cu-Zn-Ag-bearing cherty tuff horizons. Several new conductive trends proximal to a felsic intrusion (potential volcanic centre) have also been outlined by the airborne survey. Government mapping shows very little outcrop exposure along these new conductive trends.

The airborne survey consisted of 1,274.5 km of horizontal gradiometer and VTEM data collected over two blocks, B and F, on the western part of the Sandy Lake greenstone belt. The helicopter-based survey was flown by Geotech Ltd. of Aurora, Ont., in September, 2015. Line separation was 200 metres with a mean sensor altitude of 45 metres. Third party consultants interpreting the data reported that the electromagnetic and magnetic configurations of the system were well suited for the geological environment at Sandy Lake and data were of good quality.

GPM and Goldeye wish to thank the first nation communities of Sandy Lake and Keewaywin for their co-operation and logistical support of the continuing mineral exploration programs.

About Weebigee

Weebigee is a gold and base metals project located near Sandy Lake in Northwestern Ontario. The project is approximately 225 km north of Red Lake, one of the world's most prolific gold camps, and 200 km west of Goldcorp's world-class Musselwhite mine. The project comprises a main block of 363 claim units (approximately 6,000 hectares) held 100 per cent by Goldeye subject to an option agreement with GPM and an additional 1,421 claim units (approximately 22,000 hectares) recently staked by GPM, in the highly prospective and underexplored Sandy Lake greenstone belt. Certain of the claims are subject to a 1-per-cent net smelter returns royalty. Weebigee lies within the traditional territory of Sandy Lake First Nation with which Goldeye signed a comprehensive exploration agreement in 2013.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aGPM-2355046&symbol=GPM®ion=C

[url=http://peketec.de/trading/viewtopic.php?p=1642248#1642248 schrieb:Kostolanys Erbe schrieb am 20.11.2015, 23:24 Uhr[/url]"]Nachtrag zu GPM:

GPM samples 1.8% Pb at Walker Gossan

2015-11-19 13:15 ET - News Release

Mr. Patrick Sheridan reports

GPM METALS INC. ANNOUNCES INITIAL EXPLORATION RESULTS FROM THE WALKER GOSSAN PROJECT, NORTHERN TERRITORY, AUSTRALIA

GPM Metals Inc. has released an exploration update and the initial sampling results of the Walker Gossan project (WGP), Arnhem land, Northern Territory, Australia.

The project is a joint venture with Rio Tinto Exploration Pty. Ltd. (see Jan. 27, 2014, press release of the company available on SEDAR).

Title deed, work program and exploration licence (EL) approval was recently granted by the Northern Land Council after a series of meetings and consultations with the traditional land owners (TLOs) and GPM Metals in Numbulwar and Darwin that had been progressing since February, 2014.

The project tenure is held by Rio Tinto Exploration with GPM acting as the operator and manager of exploration, community relations and title grant under an earn-in/joint venture agreement subject to an agreement concluded in January, 2014.

The WGP lies within one of the great metallogenic provinces of the world, the North Australian zinc province (NAZP), which currently provides 30 per cent of the world's zinc production from a number of significant silver, lead, zinc deposits, including the Mt. Isa, George Fisher, McArthur River and Century mines.

To date, the company has flown an airborne magnetics program of 50-metre-line space over the target area as well as an IP (induced polarization) geophysical survey, geological mapping and completed the initial first-pass reconnaissance soil sampling of the primary area of historical interest at the southern portion on EL 24305. The target area on EL 24305 was identified in 1972 and had been held under continual exploration licence application (ELA) by Rio Tinto since that time.

The exploration target is a large, strata-bound, sediment-hosted lead-zinc deposit. Initial soil and rock sampling results have demonstrated a Pb-Zn mineralization over a three-kilometre-length at surface.

Soil results have defined a continuous three-kilometre-by-500-metre corridor of anomalous lead, including a 1,400-metre-long contour of plus 500 parts per million Pb with a maximum of 2,800 ppm. Rock chips have confirmed the soil results with values as high as 1.8 per cent lead.

The initial assessment of the results of the IP survey confirm elevated chargeability associated with the targeted mineralized zone. These results are currently being interpreted, compiled and integrated into the company database to design a drilling program for 2016.

Patrick Sheridan, chief executive officer of GPM Metals, states, "These initial results confirm our belief the WGP may possibly represent a district target of major significance."

Sampling details

A systematic soil sampling program was undertaken on east-west lines. The soil sampling program comprised 767 soil samples which included broad-spaced soil sampling as well as targeted close-spaced sampling. Rock chip sampling was conducted in conjunction with close-spaced soils and on select samples. A total of 64 rock chip samples were taken.

The highest soil assay result is 2,800 ppm Pb. The results have been contoured at 50, 100 and 500 ppm Pb.

The samples comprised 200 grams of minus two-millimetre sieved B horizon soils which were submitted to ALS Laboratories for multielement analysis by method ME-ICP41. This involved an aqua regia digest with analysis by inductively coupled plasma-atomic emission spectroscopy.

Rock chip samples (64) were submitted to ALS Laboratories for multielement analysis by ME-ICP61 which involves a four-acid digest with analysis by inductively coupled plasma-atomic emission spectroscopy.

The highest lead assay was 1.8 per cent Pb in sample 72851. Four other samples assayed above 1 per cent Pb. Of the 44 samples, 18 assayed above 0.5 per cent Pb.

The tabulated assay data and maps will be posted on the GPM Metals website.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aGPM-2327214&symbol=GPM®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Sicherlich werden die Umsätze zurück gehen, aber mir war bei diesem Wert sehr wichtig, das Sie mehr Geld in der Kasse haben als Schulden!

http://www.natoil.com/

WMB hat aktuell charttechnisch den Abwärtstrend verlassen...

http://www.natoil.com/

WMB hat aktuell charttechnisch den Abwärtstrend verlassen...

[url=http://peketec.de/trading/viewtopic.php?p=1672460#1672460 schrieb:greenhorn schrieb am 18.03.2016, 13:04 Uhr[/url]"]1.Eindruck - haben nicht so viel verloren wie andere, solide Arbeit und Dividende

bissl fehlt mir die große Kursphantasie ggü Seadrill oder anderen

ordentliche Markbewertung

hast du ne aktuelle Dividendenrendite?

ansonsten schicker Chart, denke mit dem Ölpreis geht es auch hier weiter hoch

die Frage ist inwiefern der Rückgang der Aktivitäten auch bei Ihnen durchschlägt

Frackingindustrie und Oldscool

der andere Tipp von hier - FRU entwickelt sich auch, nächste Dividende zwar gekürzt, aber mal sehen wie es für April aussieht

[url=http://peketec.de/trading/viewtopic.php?p=1672459#1672459 schrieb:greenhorn schrieb am 18.03.2016, 12:57 Uhr[/url]"]schau ich mir mal an - haben ja ein sehr umfangreiches Portfolio

von der Sache änlich wie Seadrill?

[url=http://peketec.de/trading/viewtopic.php?p=1672457#1672457 schrieb:Kostolanys Erbe schrieb am 18.03.2016, 12:43 Uhr[/url]"]Was hältst Du von NOV - National Oilwell Varco?

[url=http://peketec.de/trading/viewtopic.php?p=1671396#1671396 schrieb:greenhorn schrieb am 15.03.2016, 09:03 Uhr[/url]"]gestern Williams (WKN/ISIN:855451/ US9694571004, WMB) mal eine Posi Long - Dividendenwert, zu 14,40 Euro

Imho guter Ansatz:

- Tuerkei Assets ruhen lassen und wenn moeglich verkaufen

- Konzentration auf die zwei fortgeschrittenen US Projekte Goldstrike und Kinsley

Die zunaechst 10.000m auf Goldstrike sollten fuer mindestens 50 Loecher gut sein, d.h. da gibt es erstens einen hoffentlich kontinuierlich guten Newsflow und zweitens gegen Ende des Jahres eine erste Resource, die sich im Bereich 1mio Oz bewegen koennte(Goldstrike only).

Auf Kinsley koennten sie aehnlich vorgehen und auch dort bis gegen Ende des Jahres auf 1mio kommen.

Nur bezugnehmend auf dann ev 2mio Oz waere PLG dann allerdings zu momentanen Preisen immer noch nicht billig! Die Phantasie erschliesst sich aus dem, was das Team als "Proof of Concept" bezeichnet, d.h. die ersten Resourcen waeren Teaser fuer in der Ecke active Majors die Projekte zu uebernehmen, aehnlich wie bei Long Canyon.

Am besten waere es, wenn die Tuerkei Assets net versilbert warden koenten, aber dafuer muss der Markt noch ein bischen besser laufen.

- Tuerkei Assets ruhen lassen und wenn moeglich verkaufen

- Konzentration auf die zwei fortgeschrittenen US Projekte Goldstrike und Kinsley

Die zunaechst 10.000m auf Goldstrike sollten fuer mindestens 50 Loecher gut sein, d.h. da gibt es erstens einen hoffentlich kontinuierlich guten Newsflow und zweitens gegen Ende des Jahres eine erste Resource, die sich im Bereich 1mio Oz bewegen koennte(Goldstrike only).

Auf Kinsley koennten sie aehnlich vorgehen und auch dort bis gegen Ende des Jahres auf 1mio kommen.

Nur bezugnehmend auf dann ev 2mio Oz waere PLG dann allerdings zu momentanen Preisen immer noch nicht billig! Die Phantasie erschliesst sich aus dem, was das Team als "Proof of Concept" bezeichnet, d.h. die ersten Resourcen waeren Teaser fuer in der Ecke active Majors die Projekte zu uebernehmen, aehnlich wie bei Long Canyon.

Am besten waere es, wenn die Tuerkei Assets net versilbert warden koenten, aber dafuer muss der Markt noch ein bischen besser laufen.

[url=http://peketec.de/trading/viewtopic.php?p=1672623#1672623 schrieb:Kostolanys Erbe schrieb am 20.03.2016, 20:55 Uhr[/url]"]Pilot spends $2.6M (U.S.) on TV Tower expenses in 2015

2016-03-18 20:15 ET - News Release

Mr. Cal Everett reports

PILOT GOLD REPORTS YEAR-END FINANCIAL AND OPERATING RESULTS

Pilot Gold Inc. has released its financial and operating results for the year ended Dec. 31, 2015. (All amounts are presented in U.S. dollars unless otherwise stated.)

Outlook for 2016

The company has had a strong start to 2016 with the announcement of Cal Everett as president and chief executive officer, successful proof-of-concept drill results from Goldstrike, and the closing of a $4.47-million private placement. Pilot Gold's exploration focus in 2016 is on its U.S. portfolio, including the Goldstrike project in Utah and the Kinsley project in Nevada.

At Goldstrike, last year's drill program validated the exploration model, and this year the company is planning a minimum 10,000-metre infill and step-out drill program targeting the mine trend, phase 1 of which commenced March 2, 2016. The company will also continue surface exploration and drill-target development propertywide, continue refinement and expansion of the 3-D geological model, and complete a plan of operations to enable expanded drilling on the rest of the property.

Company highlights through and subsequent to Dec. 31, 2015:

...

Wie man bei Goldstrike vorgeht ist in einer separaten Praesentation sehr gut beschrieben:

http://www.pilotgold.com/sites/default/files/presentations/SmithPDAC2016GoldstrikeFINALr1%20%282%29.pdf

Auf der Homepage ist ausserdem eine aktuelle Praesentation des Gesamtansatzes zu den fortgeschrittenen Projekten. Nicht vergessen darf man, dass PLG noch einen ganzen Koecher voller Grassroot Exploration Projekten v.a. in Nevada hat:

http://www.pilotgold.com/our-projects/regional-pipeline

http://www.pilotgold.com/sites/default/files/presentations/SmithPDAC2016GoldstrikeFINALr1%20%282%29.pdf

Auf der Homepage ist ausserdem eine aktuelle Praesentation des Gesamtansatzes zu den fortgeschrittenen Projekten. Nicht vergessen darf man, dass PLG noch einen ganzen Koecher voller Grassroot Exploration Projekten v.a. in Nevada hat:

http://www.pilotgold.com/our-projects/regional-pipeline

[url=http://peketec.de/trading/viewtopic.php?p=1672685#1672685 schrieb:Fischlaender schrieb am 21.03.2016, 09:02 Uhr[/url]"]Imho guter Ansatz:

- Tuerkei Assets ruhen lassen und wenn moeglich verkaufen

- Konzentration auf die zwei fortgeschrittenen US Projekte Goldstrike und Kinsley

Die zunaechst 10.000m auf Goldstrike sollten fuer mindestens 50 Loecher gut sein, d.h. da gibt es erstens einen hoffentlich kontinuierlich guten Newsflow und zweitens gegen Ende des Jahres eine erste Resource, die sich im Bereich 1mio Oz bewegen koennte(Goldstrike only).

Auf Kinsley koennten sie aehnlich vorgehen und auch dort bis gegen Ende des Jahres auf 1mio kommen.

Nur bezugnehmend auf dann ev 2mio Oz waere PLG dann allerdings zu momentanen Preisen immer noch nicht billig! Die Phantasie erschliesst sich aus dem, was das Team als "Proof of Concept" bezeichnet, d.h. die ersten Resourcen waeren Teaser fuer in der Ecke active Majors die Projekte zu uebernehmen, aehnlich wie bei Long Canyon.

Am besten waere es, wenn die Tuerkei Assets net versilbert warden koenten, aber dafuer muss der Markt noch ein bischen besser laufen.

[url=http://peketec.de/trading/viewtopic.php?p=1672623#1672623 schrieb:Kostolanys Erbe schrieb am 20.03.2016, 20:55 Uhr[/url]"]Pilot spends $2.6M (U.S.) on TV Tower expenses in 2015

2016-03-18 20:15 ET - News Release

Mr. Cal Everett reports

PILOT GOLD REPORTS YEAR-END FINANCIAL AND OPERATING RESULTS

Pilot Gold Inc. has released its financial and operating results for the year ended Dec. 31, 2015. (All amounts are presented in U.S. dollars unless otherwise stated.)

Outlook for 2016

The company has had a strong start to 2016 with the announcement of Cal Everett as president and chief executive officer, successful proof-of-concept drill results from Goldstrike, and the closing of a $4.47-million private placement. Pilot Gold's exploration focus in 2016 is on its U.S. portfolio, including the Goldstrike project in Utah and the Kinsley project in Nevada.

At Goldstrike, last year's drill program validated the exploration model, and this year the company is planning a minimum 10,000-metre infill and step-out drill program targeting the mine trend, phase 1 of which commenced March 2, 2016. The company will also continue surface exploration and drill-target development propertywide, continue refinement and expansion of the 3-D geological model, and complete a plan of operations to enable expanded drilling on the rest of the property.

Company highlights through and subsequent to Dec. 31, 2015:

...

Guten Morgen, gute Trades Euch.

jetzt mit Zug bitte Richtung Hoch bei ~ 0,25A$ - mein Ziel wäre 0,30 A$ bis Mitte des Jahres

jetzt mit Zug bitte Richtung Hoch bei ~ 0,25A$ - mein Ziel wäre 0,30 A$ bis Mitte des Jahres

[url=http://peketec.de/trading/viewtopic.php?p=1672066#1672066 schrieb:marcovich schrieb am 17.03.2016, 09:20 Uhr[/url]"]Habe mir auch eine Swing Position zu 0,21 A$ reingelegt

[url=http://peketec.de/trading/viewtopic.php?p=1671738#1671738 schrieb:Rookie schrieb am 16.03.2016, 11:46 Uhr[/url]"]Ja, ich bin seit ein paar Wochen drin. bis zum Start der Produktion Mitte 2016 sollte eigentlich noch etwa gehen.

[url=http://peketec.de/trading/viewtopic.php?p=1671724#1671724 schrieb:marcovich schrieb am 16.03.2016, 10:26 Uhr[/url]"]Auch guten Morgen,

hat hier jemand Galaxy Resources GXY auf dem Schirm? habe die seit 0,10A$auf der WL, hinsichtlich Lithium .. jetzt etwas zurückgekommen auf 0,21A$, und an einer interessanten Marke .. Schulden stark reduziert und Produktion und Cashflow sollen jetzt starten .. letzte Woche noch die Meldung einer Abnahme Vereinbarung mit 2 Chinesen für 2016 + 2017 .. allerdings auch nicht mehr ganz günstig.

» zur Grafik

heute wurde auch eine neue Company Presentation veröffentlicht, liest sich ordentlich,

http://www.asx.com.au/asxpdf/20160321/pdf/435z8p3nybmjyk.pdf

http://www.asx.com.au/asxpdf/20160321/pdf/435z8p3nybmjyk.pdf

[url=http://peketec.de/trading/viewtopic.php?p=1672691#1672691 schrieb:marcovich schrieb am 21.03.2016, 09:10 Uhr[/url]"]Guten Morgen, gute Trades Euch.

jetzt mit Zug bitte Richtung Hoch bei ~ 0,25A$ - mein Ziel wäre 0,30 A$ bis Mitte des Jahres

[url=http://peketec.de/trading/viewtopic.php?p=1672066#1672066 schrieb:marcovich schrieb am 17.03.2016, 09:20 Uhr[/url]"]Habe mir auch eine Swing Position zu 0,21 A$ reingelegt

[url=http://peketec.de/trading/viewtopic.php?p=1671738#1671738 schrieb:Rookie schrieb am 16.03.2016, 11:46 Uhr[/url]"]Ja, ich bin seit ein paar Wochen drin. bis zum Start der Produktion Mitte 2016 sollte eigentlich noch etwa gehen.

[url=http://peketec.de/trading/viewtopic.php?p=1671724#1671724 schrieb:marcovich schrieb am 16.03.2016, 10:26 Uhr[/url]"]Auch guten Morgen,

hat hier jemand Galaxy Resources GXY auf dem Schirm? habe die seit 0,10A$auf der WL, hinsichtlich Lithium .. jetzt etwas zurückgekommen auf 0,21A$, und an einer interessanten Marke .. Schulden stark reduziert und Produktion und Cashflow sollen jetzt starten .. letzte Woche noch die Meldung einer Abnahme Vereinbarung mit 2 Chinesen für 2016 + 2017 .. allerdings auch nicht mehr ganz günstig.

» zur Grafik

sind auch nicht viele Explorer im Lithium Bereich, die dieses Jahr zum Produzenten werden, neben Galaxy noch Neometals.

Vielleicht wird es um Prima Diamond noch spannend, die Bohrlöcher existieren noch von der Company, die sie übernommen haben, sind nur mit Zement geschlossen worden.

Vielleicht wird es um Prima Diamond noch spannend, die Bohrlöcher existieren noch von der Company, die sie übernommen haben, sind nur mit Zement geschlossen worden.

[url=http://peketec.de/trading/viewtopic.php?p=1672783#1672783 schrieb:marcovich schrieb am 21.03.2016, 12:14 Uhr[/url]"]heute wurde auch eine neue Company Presentation veröffentlicht, liest sich ordentlich,

http://www.asx.com.au/asxpdf/20160321/pdf/435z8p3nybmjyk.pdf

[url=http://peketec.de/trading/viewtopic.php?p=1672691#1672691 schrieb:marcovich schrieb am 21.03.2016, 09:10 Uhr[/url]"]Guten Morgen, gute Trades Euch.

jetzt mit Zug bitte Richtung Hoch bei ~ 0,25A$ - mein Ziel wäre 0,30 A$ bis Mitte des Jahres

[url=http://peketec.de/trading/viewtopic.php?p=1672066#1672066 schrieb:marcovich schrieb am 17.03.2016, 09:20 Uhr[/url]"]Habe mir auch eine Swing Position zu 0,21 A$ reingelegt

[url=http://peketec.de/trading/viewtopic.php?p=1671738#1671738 schrieb:Rookie schrieb am 16.03.2016, 11:46 Uhr[/url]"]Ja, ich bin seit ein paar Wochen drin. bis zum Start der Produktion Mitte 2016 sollte eigentlich noch etwa gehen.

[url=http://peketec.de/trading/viewtopic.php?p=1671724#1671724 schrieb:marcovich schrieb am 16.03.2016, 10:26 Uhr[/url]"]Auch guten Morgen,

hat hier jemand Galaxy Resources GXY auf dem Schirm? habe die seit 0,10A$auf der WL, hinsichtlich Lithium .. jetzt etwas zurückgekommen auf 0,21A$, und an einer interessanten Marke .. Schulden stark reduziert und Produktion und Cashflow sollen jetzt starten .. letzte Woche noch die Meldung einer Abnahme Vereinbarung mit 2 Chinesen für 2016 + 2017 .. allerdings auch nicht mehr ganz günstig.

» zur Grafik

Hinter Prima Diamond steckt auch Zimtu aka Rockstone Research etc.

Da sollte bald die Pusherei einsetzen ( ist ja bereits getrommelt worden ).

Da sollte bald die Pusherei einsetzen ( ist ja bereits getrommelt worden ).

[url=http://peketec.de/trading/viewtopic.php?p=1672788#1672788 schrieb:Rookie schrieb am 21.03.2016, 12:25 Uhr[/url]"]sind auch nicht viele Explorer im Lithium Bereich, die dieses Jahr zum Produzenten werden, neben Galaxy noch Neometals.

Vielleicht wird es um Prima Diamond noch spannend, die Bohrlöcher existieren noch von der Company, die sie übernommen haben, sind nur mit Zement geschlossen worden.

[url=http://peketec.de/trading/viewtopic.php?p=1672783#1672783 schrieb:marcovich schrieb am 21.03.2016, 12:14 Uhr[/url]"]heute wurde auch eine neue Company Presentation veröffentlicht, liest sich ordentlich,

http://www.asx.com.au/asxpdf/20160321/pdf/435z8p3nybmjyk.pdf

[url=http://peketec.de/trading/viewtopic.php?p=1672691#1672691 schrieb:marcovich schrieb am 21.03.2016, 09:10 Uhr[/url]"]Guten Morgen, gute Trades Euch.

jetzt mit Zug bitte Richtung Hoch bei ~ 0,25A$ - mein Ziel wäre 0,30 A$ bis Mitte des Jahres

[url=http://peketec.de/trading/viewtopic.php?p=1672066#1672066 schrieb:marcovich schrieb am 17.03.2016, 09:20 Uhr[/url]"]Habe mir auch eine Swing Position zu 0,21 A$ reingelegt

[url=http://peketec.de/trading/viewtopic.php?p=1671738#1671738 schrieb:Rookie schrieb am 16.03.2016, 11:46 Uhr[/url]"]Ja, ich bin seit ein paar Wochen drin. bis zum Start der Produktion Mitte 2016 sollte eigentlich noch etwa gehen.

[url=http://peketec.de/trading/viewtopic.php?p=1671724#1671724 schrieb:marcovich schrieb am 16.03.2016, 10:26 Uhr[/url]"]Auch guten Morgen,

hat hier jemand Galaxy Resources GXY auf dem Schirm? habe die seit 0,10A$auf der WL, hinsichtlich Lithium .. jetzt etwas zurückgekommen auf 0,21A$, und an einer interessanten Marke .. Schulden stark reduziert und Produktion und Cashflow sollen jetzt starten .. letzte Woche noch die Meldung einer Abnahme Vereinbarung mit 2 Chinesen für 2016 + 2017 .. allerdings auch nicht mehr ganz günstig.

» zur Grafik

Newmarket Gold Increases Flagship Fosterville Gold Mine Mineral Reserves by 34% With A 25% Increase in Reserve Grade to 6.95 Grams Per Tonne

http://www.marketwired.com/press-re...ral-reserves-34-with-a-25-tsx-nmi-2107501.htm

Fosterville Phoenix & Lower Phoenix Gold System Achieves New Total M&I Mineral Resource Of 673,000 ounces Grading 8.33 Grams Per Tonne

VANCOUVER, BRITISH COLUMBIA--(Marketwired - March 21, 2016) - Newmarket Gold Inc. ("Newmarket" or the "Company") (TSX:NMI) (OTCQX:NMKTF) is pleased to announce the results of the Company's updated 2015 year-end Mineral Reserves and Mineral Resources. The Company's Annual Information Form and Technical Reports prepared in accordance with National Instrument 43-101 supporting the 2015 Mineral Reserve and Mineral Resource estimates will be available today under Newmarket's profile at www.sedar.com (see "Technical Reports" section below).

Year-End 2015 Mineral Resources and Reserves Highlights

Fosterville Gold Mine Mineral Reserves increased 34% to 244,000 ounces of gold, after depletion, as a result of the discovery of the high-grade, visible gold-bearing Eagle Fault Zone which comprises approximately 18% of total Fosterville underground Mineral Reserves. Mineral Reserve grade increased 25% to 6.95 g/t from 5.55 g/t. Excluding stockpiles, Fosterville's in situ Mineral Reserves are 239,000 ounces grading 7.03 g/t.

Fosterville Measured and Indicated Mineral Resources increased 5% to 2.12 million ounces of gold from the previous estimate of 2.0 million ounces. Measured and Indicated Mineral Resource grade increased 13% to 4.39 g/t from 3.89 g/t.

Fosterville's current mining front comprising the Phoenix and Lower Phoenix gold systems, and associated structures, host Measured and Indicated Mineral Resources containing 673,000 ounces grading 8.33 g/t(1). Recent surface-based drilling programs have confirmed the up-plunge and down-plunge potential to expand defined Mineral Resources in the Lower Phoenix gold system. The Lower Phoenix gold system has been traced by development and drilling for over 2 km and remains open for further expansion.

Fosterville's new Eagle Fault Zone hosts Measured and Indicated Mineral Resources of 75,000 ounces grading

11.61 g/t and Inferred Mineral Resource of 37,000 ounces grading 27.21 g/t. Also, newly discovered East Dipper structures host Measured and Indicated Mineral Resources of 166,000 ounces grading 9.79 g/t. The Eagle Fault Zone, East Dippers and other high grade structures in the Lower Phoenix gold system are currently providing mill feed and continue to positively impact mill grades, with 2015 achieving a record 6.11 g/t, a 32% increase over 2014.

Stawell Gold Mine underground Inferred Mineral Resources increased by 55% to 116,400 ounces following positive exploration results on targets including the Aurora B discovery within the East Flank of the Magdala System.

Stawell's new Aurora B discovery resulted in a maiden Inferred Mineral Resource of 30,400 ounces grading 3.5 g/t following three successful exploration programs completed during 2015. The grade of the Aurora B Inferred Mineral Resource is 42% greater than the underground Mineral Reserve grade. A fourth phase of drilling is underway to expand the Inferred Mineral Resource by targeting the along strike potential and to allow for the project to be assessed as a new mining front for the Stawell Mine. The Aurora B Mineral Resource remains open for potential expansion.

Consolidated Proven and Probable Mineral Reserves total 769,000 ounces, a 2.4% improvement from Proven and Probable Mineral Reserves of 751,000 ounces for all sites excluding Maud Creek as at December 31, 2014.

auf Seite 8 der Company Präsentation sieht man zumindest für die an der ASX gelisteten, eine ganz gute Übersicht..stimmt, dort ist Neometals als near termn production markiert.. aber überschaubar der Sektor, bin auf die neue DFS gespannt, soll ja bis Mitte 2016 kommen, mit aktuellen Zahlen, die letzte ist aus 2013, seitdem hat sich der Li Preis mehr als verdoppelt ..

[url=http://peketec.de/trading/viewtopic.php?p=1672791#1672791 schrieb:PerseusLtd schrieb am 21.03.2016, 12:26 Uhr[/url]"]Hinter Prima Diamond steckt auch Zimtu aka Rockstone Research etc.

Da sollte bald die Pusherei einsetzen ( ist ja bereits getrommelt worden ).

[url=http://peketec.de/trading/viewtopic.php?p=1672788#1672788 schrieb:Rookie schrieb am 21.03.2016, 12:25 Uhr[/url]"]sind auch nicht viele Explorer im Lithium Bereich, die dieses Jahr zum Produzenten werden, neben Galaxy noch Neometals.

Vielleicht wird es um Prima Diamond noch spannend, die Bohrlöcher existieren noch von der Company, die sie übernommen haben, sind nur mit Zement geschlossen worden.

[url=http://peketec.de/trading/viewtopic.php?p=1672783#1672783 schrieb:marcovich schrieb am 21.03.2016, 12:14 Uhr[/url]"]heute wurde auch eine neue Company Presentation veröffentlicht, liest sich ordentlich,

http://www.asx.com.au/asxpdf/20160321/pdf/435z8p3nybmjyk.pdf

[url=http://peketec.de/trading/viewtopic.php?p=1672691#1672691 schrieb:marcovich schrieb am 21.03.2016, 09:10 Uhr[/url]"]Guten Morgen, gute Trades Euch.

jetzt mit Zug bitte Richtung Hoch bei ~ 0,25A$ - mein Ziel wäre 0,30 A$ bis Mitte des Jahres

[url=http://peketec.de/trading/viewtopic.php?p=1672066#1672066 schrieb:marcovich schrieb am 17.03.2016, 09:20 Uhr[/url]"]Habe mir auch eine Swing Position zu 0,21 A$ reingelegt

[url=http://peketec.de/trading/viewtopic.php?p=1671738#1671738 schrieb:Rookie schrieb am 16.03.2016, 11:46 Uhr[/url]"]Ja, ich bin seit ein paar Wochen drin. bis zum Start der Produktion Mitte 2016 sollte eigentlich noch etwa gehen.

[url=http://peketec.de/trading/viewtopic.php?p=1671724#1671724 schrieb:marcovich schrieb am 16.03.2016, 10:26 Uhr[/url]"]Auch guten Morgen,

hat hier jemand Galaxy Resources GXY auf dem Schirm? habe die seit 0,10A$auf der WL, hinsichtlich Lithium .. jetzt etwas zurückgekommen auf 0,21A$, und an einer interessanten Marke .. Schulden stark reduziert und Produktion und Cashflow sollen jetzt starten .. letzte Woche noch die Meldung einer Abnahme Vereinbarung mit 2 Chinesen für 2016 + 2017 .. allerdings auch nicht mehr ganz günstig.

» zur Grafik

SEG1 - mal eine kleine Posi Long, liest sich gut

bekannte Nachbarn........

http://www.southernsilverexploratio...sv_corporate_presentation_march_2016_4cb0.pdf

March 21, 2016 09:00 ET

Southern Announces Resource Estimate at Cerro Las Minitas: Indicated: 10.8Mozs Ag, 189Mlbs Pb and 207Mlbs Zn (36.5Mozs AgEq); and Inferred: 17.5Mozs Ag, 237Mlbs Pb and 626Mlbs Zn (77.3Mozs AgEq)

http://www.marketwired.com/press-re...08mozs-ag-189mlbs-tsx-venture-ssv-2107624.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwired - March 21, 2016) - Southern Silver Exploration Corp. (TSX VENTURE:SSV)(FRANKFURT:SEG1)(SSE:SSVCL) ("Southern") reports that Kirkham Geosystems Ltd. ("KGL") has completed an independent Mineral Resource Estimate on the Cerro Las Minitas ("CLM") project in Durango State, Mexico. Electrum Global Holdings L.P. ("Electrum") is financing a broad range of exploration activities to earn a 60% interest in CLM.

The resource estimate provides initial grade and tonnage estimates for three mineral deposits on the property at the Blind, El Sol and Santo Nino zones which have been the focus of much of Southern's exploration activities on the property since 2011, but does not include mineralization from the newly discovered Mina La Bocona zone.

bekannte Nachbarn........

http://www.southernsilverexploratio...sv_corporate_presentation_march_2016_4cb0.pdf

March 21, 2016 09:00 ET

Southern Announces Resource Estimate at Cerro Las Minitas: Indicated: 10.8Mozs Ag, 189Mlbs Pb and 207Mlbs Zn (36.5Mozs AgEq); and Inferred: 17.5Mozs Ag, 237Mlbs Pb and 626Mlbs Zn (77.3Mozs AgEq)

http://www.marketwired.com/press-re...08mozs-ag-189mlbs-tsx-venture-ssv-2107624.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwired - March 21, 2016) - Southern Silver Exploration Corp. (TSX VENTURE:SSV)(FRANKFURT:SEG1)(SSE:SSVCL) ("Southern") reports that Kirkham Geosystems Ltd. ("KGL") has completed an independent Mineral Resource Estimate on the Cerro Las Minitas ("CLM") project in Durango State, Mexico. Electrum Global Holdings L.P. ("Electrum") is financing a broad range of exploration activities to earn a 60% interest in CLM.

The resource estimate provides initial grade and tonnage estimates for three mineral deposits on the property at the Blind, El Sol and Santo Nino zones which have been the focus of much of Southern's exploration activities on the property since 2011, but does not include mineralization from the newly discovered Mina La Bocona zone.

am Freitag unter recht hohem Vol runter -15% auf bis zu 0,19 A$ - wäre mE eine gute Chance gewesen, Begründung liegt wohl darin, dass der ETF REMX (welcher Alkane hält" quartalsweise wohl "rebalanced" wird .. heute wieder 11% hoch. Alles weitere wird wohl an der Finanzierung hängen, lt. Interview CEO, soll eine Teil/Projektbeteiligung bis Mitte 2016 stehen, so dass mit der Construction in der 2. Jahreshälfte begonnen werden kann..hier scheint mittlerweile das Größte Interesse an der Hafnium Produktion vorzuliegen s. Artikel unten, und weniger die Seltenen Erden ..

Zirkonium soll auch interessant sein für "neue" Energiespeicher Möglichkeiten / Batterien .. und wird auch zunehmend aufgrund seiner Eigenschaften als Veredelung der Cases von Smartphones benutzt ..

"Apple has applied for a patent that described how glass or sapphire will be combined with liquidmetal to create a case with no gaps between the two materials, with the metal alloy made up of zirconium, titanium, copper, nickel and aluminum. If rumors are to be believed, this could add a waterproof feature to the iPhone 7"

oder beim neuen Oppo R9

"Zur weiteren Ausstattung gehört ein Fingerabdruckscanner, der wie beim Galaxy S7 (Edge) im Homebutton unter dem Display verbaut ist. Dank einer Zirkonium-Edelstein-Abdeckung soll die Erkennung noch besser funktionieren. Zudem soll das Material robuster als Saphir sein"

scheint zunehmend interessante Anwendungsmöglichkeiten zu geben .. we ll see.

we ll see.

Zirkonium soll auch interessant sein für "neue" Energiespeicher Möglichkeiten / Batterien .. und wird auch zunehmend aufgrund seiner Eigenschaften als Veredelung der Cases von Smartphones benutzt ..

"Apple has applied for a patent that described how glass or sapphire will be combined with liquidmetal to create a case with no gaps between the two materials, with the metal alloy made up of zirconium, titanium, copper, nickel and aluminum. If rumors are to be believed, this could add a waterproof feature to the iPhone 7"

oder beim neuen Oppo R9

"Zur weiteren Ausstattung gehört ein Fingerabdruckscanner, der wie beim Galaxy S7 (Edge) im Homebutton unter dem Display verbaut ist. Dank einer Zirkonium-Edelstein-Abdeckung soll die Erkennung noch besser funktionieren. Zudem soll das Material robuster als Saphir sein"

scheint zunehmend interessante Anwendungsmöglichkeiten zu geben ..

[url=http://peketec.de/trading/viewtopic.php?p=1671697#1671697 schrieb:marcovich schrieb am 16.03.2016, 09:27 Uhr[/url]"]Hatte mir eigentlich mehr erwartet, nach der finalen Genehmigung wieder 10% down .. verstehe ich nicht, aber gut, Volumen insgesamt immer noch sehr gering ..

Interessant auch der Artikel von letzter Woche, hinsichtlich Funding der 1 Mrd für Construction, Gespräche gibt s hier schon seit letztem Jahr:

03/11/2016 Alkane Resources in. $1b pitch for aerospace funding

Mining outfit Alkane Resources is in talks with some of the world’s largest aerospace companies to help finance a $1 billion production facility to extract a rare-earth material that could greatly improve the heat resistance of jet engines.

Perth-based Alkane Resources, a gold producer generating cashflow of $25 million a year, is ready to chase $1bn in funding to make its Dubbo zirconia and rare-earths project the world’s largest producer of hafnium, a rare-earth mineral that can be used to boost the heat resistance of super alloys used in jet engine turbines.

“We are certainly talking to aerospace companies about coming on as strategic partners and investors because these are the guys who have long-term requirement for our products,” Ian Chalmers, an Alkane director since 1986 and its managing director since 2006, told The Australian. “There is potential for these strategic guys to come in on the funding side. We are having those discussions right now.”

Mr Chalmers said Alkane had been talking with the world’s leading aerospace companies including Pratt & Whitney, Lockheed Martin, Honeywell, Rolls-Royce, Airbus and Boeing since last year about taking a strategic position in the company and is prepared to sell two or three large stakes to get funding.

“We have a major deposit here that can produce for the next 80 to 100 years in a relatively stable country. We tick all those boxes for a strategic stake from an aerospace company,” he said. “We’ve spoken to virtually every aerospace company and you can understand their concerns that we are not in production yet.“We’re still two years out from production but when we do come on stream, we will be a big player in the hafnium market and an important partner to these aerospace companies.”

Hafnium is increasingly being sought by the aerospace industry for its use in super alloys, which are used to increase the heat resistance of jet engines, allowing them to run from 1400C to 2000C without loss of structural integrity. Ability to sustain high heat is important for jet engines, particularly as advances in technology increase their thrust and heat output.

“That means better fuel efficiency, more energy output and less emissions,’’ Mr Chalmers said. The Dubbo facility, in central NSW, will also produce other rare-earth elements such as niobium, tantalum and zirconium, in which hafnium is found.

“Almost all hafnium production comes as a byproduct from producing pure zirconium and that’s because the two materials occur in nature together at about a 50:1 ratio,” Mr Chalmers said.

The rare material has been in use since the 1960s, when it made its most famous appearance on the main engines of the Apollo lunar modules, which were composed of 89 per cent niobium, 10 per cent hafnium and 1 per cent titanium. Mr Chalmers said that once the Dubbo operation was at full production (expected to be in the second half of 2018) it would be able to make about 200 tonnes of hafnium a year.

The going rate of hafnium fluctuates between $US1000 and $US1200 a kilogram. Using a $US500 benchmark assumed in its feasibility study revenues for Alkane could earn $US100m a year by 2020.

Located 25km south of Dubbo at Toongi, Alkane’s Dubbo Zirconia Project has been a long time in the making. If funding can be secured, Mr Chalmers expects the mine to more than double the world’s supply of hafnium.

“Because of increasing demand in aerospace applications, particularly in jet engine production, demand is outstripping supply of hafnium that we can produce,’’ he said.

“But when this is up and running at full production we will more than double the world’s supply of hafnium and we will be able to produce without too much difficulty about 200 tonnes a year.”

[url=http://peketec.de/trading/viewtopic.php?p=1671206#1671206 schrieb:marcovich schrieb am 14.03.2016, 13:49 Uhr[/url]"]Big News, war zwar so kommuniziert, dass sie bis Ende März kommen sollte, aber gerade bei Umweltthemen und generell Mining Lizenzen, wartet man mal besser bis sie da sind.

Heute gab es hier einen Trading Halt, mit anschließender News, dass die letzte erforderliche Genehmigung, die EPL - Environment Protection Licence , erteilt wurde. Das sollte der letzte Schritt zur Finanzierung sein, so wurde es zumindest kommuniziert, da niemand ein Projekt finanziert, welches nicht alle finalen und notwendigen Genehmigungen erhalten hat. Heute kein Handel, bin gespannt, wie es sich die kommenden Tage auswirkt ..

14 March 2016 Dubbo Zirconia Project - Environment Protection Licence Granted

DUBBO ZIRCONIA PROJECT (DZP)

Zirconium, hafnium, niobium, yttrium, rare earth elements / Australian Zirconia Ltd (AZL) 100% AZL, a wholly owned subsidiary of the Company, has received notification of granting of the Environment Protection Licence for the Dubbo Zirconia Project.

The NSW Environment Protection Authority (EPA) has granted an Environment Protection Licence (EPL) covering the construction period for the DZP. The EPL specifies the project emission limits to air, land and water, and details environmental

monitoring and reporting requirements. Part of the EPL terms include the payment of a licence fee by AZL to effectively fund the EPA to monitor the project’s compliance. Full terms of the EPL have been published on the EPA register at

http://www.epa.nsw.gov.au/prpoeoapp/ViewPOEOLicence.aspx?DOCID=70860&SYSUID=1&LICID=20702

The news has been welcomed by both Deputy Premier NSW and Member for Dubbo, Troy Grant, and Minister for Industry, Resources and Energy, Anthony Roberts who have issued a joint media release acknowledging the Company has met the rigorous government approval process in place for new mining ventures in NSW:

http://www.resourcesandenergy.nsw.gov.au/__data/assets/pdf_file/0008/597986/Billion‐Dollar‐Dubbo‐Mine‐an‐Economic‐Boon.pdf

The Company has now received the required approvals for the project to proceed:

* Approval from the New South Wales Planning Assessment Commission (PAC), as delegate for the NSW Minister of Planning and Environment (announced 2 June 2015),

* Approval from NSW Department of Industry, Division of Resources and Energy for the granting of the necessary mining lease (announced 21 December 2015), and

* Approval from the EPA covering the construction period of the project.

In addition approval has been granted under the federal Environment Protection and Biodiversity Conservation Act 1999 for the proposed mining of the Toongi deposit (announced 25 August 2015).

This latest consent is the final major step in the approvals process required to enable AZL to Progress with construction, subject to financing.

[url=http://peketec.de/trading/viewtopic.php?p=1664851#1664851 schrieb:marcovich schrieb am 17.02.2016, 15:13 Uhr[/url]"]Hi, zu viel zu tun die letzten Tage, .... hatte noch ein Limit zu 0,18 + 0,19 AUD liegen bei Alkane, zu 0,19 AUD noch eine Tranche bekommen letzte Woche. Die Tage kam der HJ Report. Key Daten für mich: Aktuelle MCap 80 MIO AUD. Net Assets 178 Mio AUD. Cash 15 MIO AUD, rechnen mit einem positiven cashflow aus dem Goldprojekt von ~ 25 Mio AUD. Dazu gab es ein Interview mit dem CEO, welcher davon ausgeht, wenn sie nur das Goldprojekt betreiben würden, der Kurs sicher doppelt so hoch stünde. Das große Projekt Dubbo mit einem NPV von 1,3 Mrd bei den aktuell schwachen Rohstoffpreisen würde sich da kurioser Weise negativ auswirken .. Finanzierungsgespräche fortgeschritten, Strategischer Investor Interesse vorhanden .. usw. und der Goldpreis über 1700 AUD .. Hier das Interview, wenn es jmd interessiert:

http://www.asx.com.au/asxpdf/20160210/pdf/434yn3v8s48qw8.pdf

Grüße

[url=http://peketec.de/trading/viewtopic.php?p=1657110#1657110 schrieb:marcovich schrieb am 21.01.2016, 12:03 Uhr[/url]"]Ich habe hier in AUS nochmal nachgekauft zu 0,21 AUD. Aktuelle MCAP ~70 Mio

Das Goldprojekt läuft und hat aktuelle "hohe" Gesamtkosten von ~1200 AUD, bei einem aktuellen VK Preis in AUD von ~1600 AUD. Bei einer Förderung von ~70.000oz komme ich hier schon auf ~ 25 Mio Cashflow, bei obiger MCAP finde ich sie damit schon günstig bewertet.

Dazu kommt das Dubbo Projekt. Aktuell ist es ruhig geworden, nach der Genehmigung der Mining Lease, jedoch denke ich, dass dies der Finanzierungphase geschuldet ist.

Das Projekt beschreibt sich wie folgt und ist in zahlreichen Medien in AUS bereits vertreten gewesen ..

Project: Dubbo Zirconia Project

Location: Toongi, Dubbo, NSW

Deposit: Zirconium, hafnium, niobium, tantalum, yttrium and rare earth elements.

Years of operation: 1999 – ongoing

The Dubbo Zirconia Project (DZP) is an exciting development project based on one of the world’s largest in-ground resources of rare metals and rare earths. Due to the size of the resource, the mine is expected to process 1,000,000 tonnes of ore throughput per year over a period of 70 years or more. The DZP will produce a strategic and alternative supply of rare metals (zirconium, hafnium, niobium, tantalum), yttrium and rare earth elements to the global market.

A demonstration pilot plant (DPP) at ANSTO has been running since 2008, allowing Alkane to prove the DZP’s technical and financial viability. The DPP has resulted in the development of a working flowsheet and verified resource extraction and processing methods.