[url=http://peketec.de/trading/viewtopic.php?p=1716841#1716841 schrieb:dukezero schrieb am 24.10.2016, 14:56 Uhr[/url]"]BBI

http://seekingalpha.com/article/4013806-pipestone-montney-heating-investing-win-blackbird-energy-encana-nuvista

plus 8%

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

[url=http://peketec.de/trading/viewtopic.php?p=1716841#1716841 schrieb:dukezero schrieb am 24.10.2016, 14:56 Uhr[/url]"]BBI

http://seekingalpha.com/article/4013806-pipestone-montney-heating-investing-win-blackbird-energy-encana-nuvista

[url=http://peketec.de/trading/viewtopic.php?p=1716870#1716870 schrieb:dukezero schrieb am 24.10.2016, 16:05 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1716841#1716841 schrieb:dukezero schrieb am 24.10.2016, 14:56 Uhr[/url]"]BBI

http://seekingalpha.com/article/4013806-pipestone-montney-heating-investing-win-blackbird-energy-encana-nuvista

plus 8%

[url=http://peketec.de/trading/viewtopic.php?p=1716841#1716841 schrieb:dukezero schrieb am 24.10.2016, 14:56 Uhr[/url]"]BBI

http://seekingalpha.com/article/4013806-pipestone-montney-heating-investing-win-blackbird-energy-encana-nuvista

[url=http://peketec.de/trading/viewtopic.php?p=1715828#1715828 schrieb:Sltrader schrieb am 19.10.2016, 19:32 Uhr[/url]"]zweites drittel zu 8,10 raus.... mal schauen ob ich es schaff den rest bis ca. 9 zu halten

[url=http://peketec.de/trading/viewtopic.php?p=1715779#1715779 schrieb:Sltrader schrieb am 19.10.2016, 17:16 Uhr[/url]"]1/3 raus zu 7,95

[url=http://peketec.de/trading/viewtopic.php?p=1715550#1715550 schrieb:Sltrader schrieb am 18.10.2016, 17:35 Uhr[/url]"]KLG long zu 7,75

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1714707#1714707 schrieb:greenhorn schrieb am 13.10.2016, 12:16 Uhr[/url]"]KLG - gutes Quartalsergebnis, RSI bei 20...........könnte was gehen!

October 12, 2016 19:33 ET

Kirkland Lake Gold Announces Record Gold Production and Costs for the Third Quarter 2016

http://www.marketwired.com/press-re...-costs-third-quarter-2016-tsx-klg-2166140.htm

- Q3/16 production of 77,274 ounces of gold, up 13% over the previous quarter; and YTD gold production of 207,886 ounces

- Q3/16 gold sales of 76,339 ounces at an average realized price of US$1,321/oz(1) (based on revenue of C$131.6 million); YTD gold sales of 217,793 ounces at an average realized price of US$1,249/oz(1) (based on revenues of C$359.5 million)

- Preliminary operating costs(1) during the quarter of US$540/oz (based on operating costs of C$53.8 million) an improvement of 19% over the previous quarter; and US$591/oz (based on operating costs of C$169.6 million) YTD

- Preliminary All-in sustaining costs ("AISC")(1) of US$966/oz during the quarter and US$939/oz YTD

- Cash and bullion sold(2) increased by C$61.1 million in the quarter to $226.2 million as at September 30, 2016

- On track to meet the full year production guidance of between 270,000 - 290,000 ounces

[url=http://peketec.de/trading/viewtopic.php?p=1716931#1716931 schrieb:600 schrieb am 24.10.2016, 18:37 Uhr[/url]"]Solgold +10%, CGP -10%

[url=http://peketec.de/trading/viewtopic.php?p=1716548#1716548 schrieb:Kostolanys Erbe schrieb am 21.10.2016, 21:02 Uhr[/url]"]

Präsentation (link aus CEO.CA kopiert !)

http://cdn.ceo.ca.s3-us-west-2.amazonaws.com/1c0g680-WPC%20Lupin%20Ulu%20and%20Hood.pdf

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1716490#1716490 schrieb:600 schrieb am 21.10.2016, 17:11 Uhr[/url]"]Auf WPQ achten, zieht an!

[url=http://peketec.de/trading/viewtopic.php?p=1716943#1716943 schrieb:Rookie schrieb am 24.10.2016, 18:58 Uhr[/url]"]Mit der Zeit kommt die bestimmt nach

[url=http://peketec.de/trading/viewtopic.php?p=1716931#1716931 schrieb:600 schrieb am 24.10.2016, 18:37 Uhr[/url]"]Solgold +10%, CGP -10%

[url=http://peketec.de/trading/viewtopic.php?p=1717150#1717150 schrieb:Rookie schrieb am 25.10.2016, 11:20 Uhr[/url]"]Golden Dawn

http://rockstone-research.com/index.php/de/research-reports/1939-Renommiertes-Analystenhaus-Zacks-sieht-Golden-Dawn-bei-0,85-Dollar

[url=http://peketec.de/trading/viewtopic.php?p=1716899#1716899 schrieb:Sltrader schrieb am 24.10.2016, 17:02 Uhr[/url]"]Rückkauf 1/3 zu 7,91

[url=http://peketec.de/trading/viewtopic.php?p=1715828#1715828 schrieb:Sltrader schrieb am 19.10.2016, 19:32 Uhr[/url]"]zweites drittel zu 8,10 raus.... mal schauen ob ich es schaff den rest bis ca. 9 zu halten

[url=http://peketec.de/trading/viewtopic.php?p=1715779#1715779 schrieb:Sltrader schrieb am 19.10.2016, 17:16 Uhr[/url]"]1/3 raus zu 7,95

[url=http://peketec.de/trading/viewtopic.php?p=1715550#1715550 schrieb:Sltrader schrieb am 18.10.2016, 17:35 Uhr[/url]"]KLG long zu 7,75

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1714707#1714707 schrieb:greenhorn schrieb am 13.10.2016, 12:16 Uhr[/url]"]KLG - gutes Quartalsergebnis, RSI bei 20...........könnte was gehen!

October 12, 2016 19:33 ET

Kirkland Lake Gold Announces Record Gold Production and Costs for the Third Quarter 2016

http://www.marketwired.com/press-re...-costs-third-quarter-2016-tsx-klg-2166140.htm

- Q3/16 production of 77,274 ounces of gold, up 13% over the previous quarter; and YTD gold production of 207,886 ounces

- Q3/16 gold sales of 76,339 ounces at an average realized price of US$1,321/oz(1) (based on revenue of C$131.6 million); YTD gold sales of 217,793 ounces at an average realized price of US$1,249/oz(1) (based on revenues of C$359.5 million)

- Preliminary operating costs(1) during the quarter of US$540/oz (based on operating costs of C$53.8 million) an improvement of 19% over the previous quarter; and US$591/oz (based on operating costs of C$169.6 million) YTD

- Preliminary All-in sustaining costs ("AISC")(1) of US$966/oz during the quarter and US$939/oz YTD

- Cash and bullion sold(2) increased by C$61.1 million in the quarter to $226.2 million as at September 30, 2016

- On track to meet the full year production guidance of between 270,000 - 290,000 ounces

[url=http://peketec.de/trading/viewtopic.php?p=1717252#1717252 schrieb:

[url=http://peketec.de/trading/viewtopic.php?p=1717249#1717249 schrieb:

[url=http://peketec.de/trading/viewtopic.php?p=1717191#1717191 schrieb:Kostolanys Erbe schrieb am 25.10.2016, 12:52 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1717150#1717150 schrieb:Rookie schrieb am 25.10.2016, 11:20 Uhr[/url]"]Golden Dawn

http://rockstone-research.com/index.php/de/research-reports/1939-Renommiertes-Analystenhaus-Zacks-sieht-Golden-Dawn-bei-0,85-Dollar

Wurden doch auch schon 2015 von user TimLuca auf W:O gepusht...

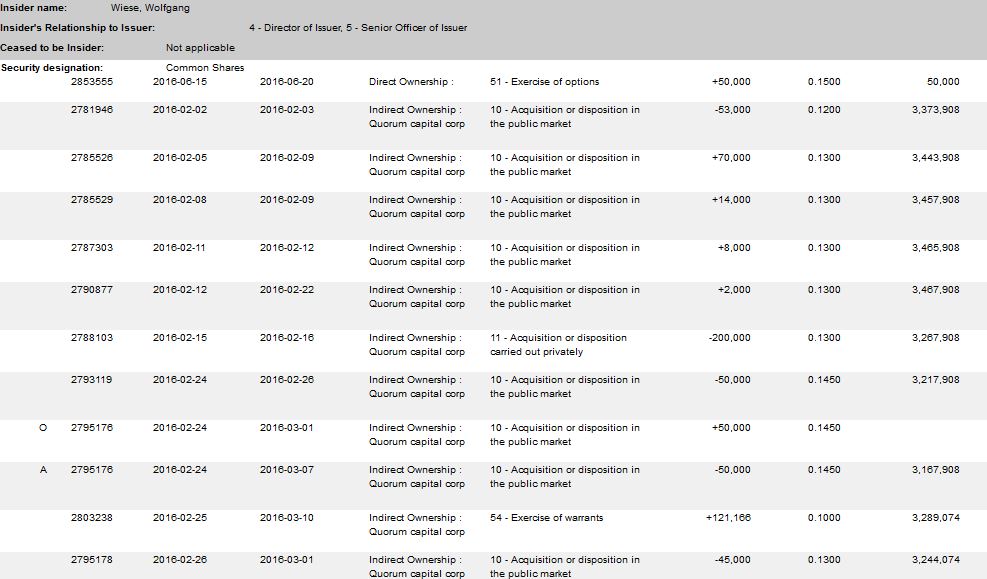

Nur der eigene CEO muss wohl noch von seinem Unternehmen

Überzeugt werden ...

https://m.canadianinsider.com/company?menu_tickersearch=Gom

[url=http://peketec.de/trading/viewtopic.php?p=1717293#1717293 schrieb:The Bull schrieb am 25.10.2016, 19:29 Uhr[/url]"]BBI hart umkaempft auf der 0.48 und 0.485 da geht grosse blocked weirder

Wie Schauen da das order ich aus.

Bin mal rein zu 0.48

[url=http://peketec.de/trading/viewtopic.php?p=1716314#1716314 schrieb:Rookie schrieb am 21.10.2016, 09:26 Uhr[/url]"]bin auch mal wieder reingesprungen allerdings erst bei 0,12 CAD. War beim ersten grossen Anstieg dabei und hoffe es gibt nochmal einen guten Upmove

[url=http://peketec.de/trading/viewtopic.php?p=1716145#1716145 schrieb:Fischlaender schrieb am 20.10.2016, 16:13 Uhr[/url]"]Nein, die erste Tranche ist bereits durch (letzte Woche), bis morgen soll der Rest geschlossen werden.

[url=http://peketec.de/trading/viewtopic.php?p=1716132#1716132 schrieb:Sltrader schrieb am 20.10.2016, 16:02 Uhr[/url]"]die erste Tranche

[url=http://peketec.de/trading/viewtopic.php?p=1716125#1716125 schrieb:600 schrieb am 20.10.2016, 15:55 Uhr[/url]"]Morgen wird das PP geschlossen.[url=http://peketec.de/trading/viewtopic.php?p=1716109#1716109 schrieb:

Wir verwenden Cookies, die für das Funktionieren dieser Website unerlässlich sind, und optionale Cookies, um Ihr Erlebnis zu verbessern.

Lese weitere Informationen und konfiguriere deine Einstellungen