App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

HAMMER!!!! und ich bin fast ganz unten rein und wenig höher wieder raus, aber so iss eben

[url=https://peketec.de/trading/viewtopic.php?p=1779732#1779732 schrieb:

EFL - trotz gestrigem Seitwärtsschritt nun ein zaghaftes Kaufsignal im Chart

[url=https://peketec.de/trading/viewtopic.php?p=1779066#1779066 schrieb:greenhorn schrieb am 12.09.2017, 14:13 Uhr[/url]"]ich weiß es nicht genau, vermute aber am Anfang einen Speku-Hype mit dem die reale Entwicklung nicht Gleichschritt halten konnte....und dann gehen viele wenn es Geduld braucht

http://electrovaya.com/wp-content/uploads/2017/08/EVCP20170816.pdf

Produktportfolio ist sehr umfassend und in Germany vertreten - Kamenz, dort wo auch die deutsche Autoindustrie in Batterienwerke investieren möchte

[url=https://peketec.de/trading/viewtopic.php?p=1779050#1779050 schrieb:marcovich schrieb am 12.09.2017, 13:09 Uhr[/url]"]Stimmt, Chart sieht interessant aus über 1,25 CAD, kann mich jmd kurz aufklären, warum die so runtergekommen ist? hat immerhin im Laufe der letzten 12 Monate 70% verloren .. aktuell könnte eine Bodenbildung sein .. Danke für INfo wenn sie jmd parat hat

[url=https://peketec.de/trading/viewtopic.php?p=1778966#1778966 schrieb:greenhorn schrieb am 12.09.2017, 09:39 Uhr[/url]"]EFL - sehe ich als Chance, sieht auch vom Chart interessant aus

[url=https://peketec.de/trading/viewtopic.php?p=1778941#1778941 schrieb:greenhorn schrieb am 12.09.2017, 08:47 Uhr[/url]"]http://www.n-tv.de/wirtschaft/VW-schwenkt-um-auf-Elektro-Autos-article20027897.html

"....Wer liefert die Batterien?

Einfach wird die strategische Neuausrichtung auf die Elektromobilität nicht: Um die geplante Menge an Elektroautos mit Akkus ausstatten zu können, benötigt Volkswagen bis 2025 eine Batteriekapazität von mehr als 150 Gigawattstunden pro Jahr. Dafür habe man eines der größten Beschaffungsvolumen in der Geschichte der Industrie ausgeschrieben, erklärte Müller. Seinen Angaben zufolge umfasst das Bündel aus Großaufträgen insgesamt eine Summe von mehr als 50 Milliarden Euro.

Wer die Batterien für die neuen E-VWs liefern soll, ist noch offen: Volkswagen suche dafür noch Partner in China, Europa und Nordamerika, heißt es. Der jährliche Bedarf entspreche der Jahreskapazität von mindestens vier "Gigafactories" für Batteriezellen...."

[url=https://peketec.de/trading/viewtopic.php?p=1778863#1778863 schrieb:dukezero schrieb am 11.09.2017, 20:26 Uhr[/url]"]https://electrek.co/2017/09/11/vw-massive-billion-investment-in-electric-cars-and-batteries/

VW announces massive $84 billion investment in electric cars and batteries

!!!!!!!!!!!!!

http://www.automobilwoche.de/article/20170911/IAA/170919972/1276/vw-elektrooffensive-roadmap-e-vw-steckt--milliarden-ins-batteriegeschaeft--weitere--mrd-in-e-mobilitaet

NMX

September 14, 2017 06:00 ET

Nemaska Lithium Added to S&P/TSX Canadian Indices

http://www.marketwired.com/press-re...-s-p-tsx-canadian-indices-tsx-nmx-2233629.htm

QUÉBEC CITY, QUÉBEC--(Marketwired - Sept. 14, 2017) - Nemaska Lithium Inc. ("Nemaska Lithium" or the "Corporation") (TSX:NMX)(OTCQX:NMKEF) announced today that, effective September 18, 2017, it has been added to S&P/TSX Canadian Indices including: the S&P/TSX SmallCap Index, S&P/TSX Global Mining Index, S&P/TSX Global Base Metals Index and the S&P/TSX Equal Weight Global Base Metals Index.

Guy Bourassa, President and CEO of Nemaska Lithium commented, "Our inclusion in the S&P Dow Jones Indices is a clear recognition of the evolution of Nemaska Lithium as it transitions from exploration into development and lithium production. Assets around the globe are invested products based on these indices and we look forward to the increased market visibility that membership in the S&P/TSX Canadian Indices provides."

September 14, 2017 06:00 ET

Nemaska Lithium Added to S&P/TSX Canadian Indices

http://www.marketwired.com/press-re...-s-p-tsx-canadian-indices-tsx-nmx-2233629.htm

QUÉBEC CITY, QUÉBEC--(Marketwired - Sept. 14, 2017) - Nemaska Lithium Inc. ("Nemaska Lithium" or the "Corporation") (TSX:NMX)(OTCQX:NMKEF) announced today that, effective September 18, 2017, it has been added to S&P/TSX Canadian Indices including: the S&P/TSX SmallCap Index, S&P/TSX Global Mining Index, S&P/TSX Global Base Metals Index and the S&P/TSX Equal Weight Global Base Metals Index.

Guy Bourassa, President and CEO of Nemaska Lithium commented, "Our inclusion in the S&P Dow Jones Indices is a clear recognition of the evolution of Nemaska Lithium as it transitions from exploration into development and lithium production. Assets around the globe are invested products based on these indices and we look forward to the increased market visibility that membership in the S&P/TSX Canadian Indices provides."

Triumph Gold Announces Completion of its 2017 Field Campaign and Discovery of the Tinta Hill Vein Structure up to 1.17 Km to the NW of its Previous Known Extent

TSX.V: TIG

PR # 17-11 OTCMKTS: NFRGF

Frankfurt: 8N61

VANCOUVER, Sept. 14, 2017 /CNW/ - Triumph Gold Corp., (TSX-V: TIG) (OTCMKTS: NFRGF) ("Triumph Gold" or the "Company") announces the completion of its 2017 field season. The 2017 exploration campaign began in late May and focused on the Company's 100% owned, road accessible, Freegold Mountain property, located approximately 80 kilometres northwest of Carmacks, Yukon Territory, Canada. Work on the property included thirty-five diamond drill holes totaling 12,904 metres in the Revenue and Nucleus areas, over 600 metres of trenching and collection of 993 soil samples at Tinta Hill, and reconnaissance work on a dozen other showings and prospects. In addition to work conducted by Triumph Gold, geological mapping of the property and surrounding area was supported by the Yukon Geological Survey and conducted by researchers at the Mineral Deposit Research Unit (MDRU) of the University of British Columbia. Triumph Gold geologists also conducted reconnaissance mapping and sampling on their 100% owned Severance (YT), Tad/Toro (YT), and Andalusite Peak (BC) properties.

Geochemical results from the 2017 field season have been considerably delayed compared to previous years due to the exceptionally high volume of samples being produced in Yukon. During the second half of the exploration program samples were shipped to Thunder Bay rather than Whitehorse for more expedient processing. Geochemical results from drilling and other sampling programs will be released in the upcoming weeks as the data are received and reviewed.

...

https://ceo.ca/@newswire/triumph-gold-announces-completion-of-its-2017-field

TSX.V: TIG

PR # 17-11 OTCMKTS: NFRGF

Frankfurt: 8N61

VANCOUVER, Sept. 14, 2017 /CNW/ - Triumph Gold Corp., (TSX-V: TIG) (OTCMKTS: NFRGF) ("Triumph Gold" or the "Company") announces the completion of its 2017 field season. The 2017 exploration campaign began in late May and focused on the Company's 100% owned, road accessible, Freegold Mountain property, located approximately 80 kilometres northwest of Carmacks, Yukon Territory, Canada. Work on the property included thirty-five diamond drill holes totaling 12,904 metres in the Revenue and Nucleus areas, over 600 metres of trenching and collection of 993 soil samples at Tinta Hill, and reconnaissance work on a dozen other showings and prospects. In addition to work conducted by Triumph Gold, geological mapping of the property and surrounding area was supported by the Yukon Geological Survey and conducted by researchers at the Mineral Deposit Research Unit (MDRU) of the University of British Columbia. Triumph Gold geologists also conducted reconnaissance mapping and sampling on their 100% owned Severance (YT), Tad/Toro (YT), and Andalusite Peak (BC) properties.

Geochemical results from the 2017 field season have been considerably delayed compared to previous years due to the exceptionally high volume of samples being produced in Yukon. During the second half of the exploration program samples were shipped to Thunder Bay rather than Whitehorse for more expedient processing. Geochemical results from drilling and other sampling programs will be released in the upcoming weeks as the data are received and reviewed.

...

https://ceo.ca/@newswire/triumph-gold-announces-completion-of-its-2017-field

ausgestoppte Pos noachmals zu 36,80 long stop TT

[url=https://peketec.de/trading/viewtopic.php?p=1779596#1779596 schrieb:

Hälfte raus zu 37,60 somit verlust von gestern wieder drin rest belibt mal mit stop einsatnd

[url=https://peketec.de/trading/viewtopic.php?p=1779808#1779808 schrieb:Sltrader schrieb am 14.09.2017, 15:37 Uhr[/url]"]ausgestoppte Pos noachmals zu 36,80 long stop TT

[url=https://peketec.de/trading/viewtopic.php?p=1779596#1779596 schrieb:

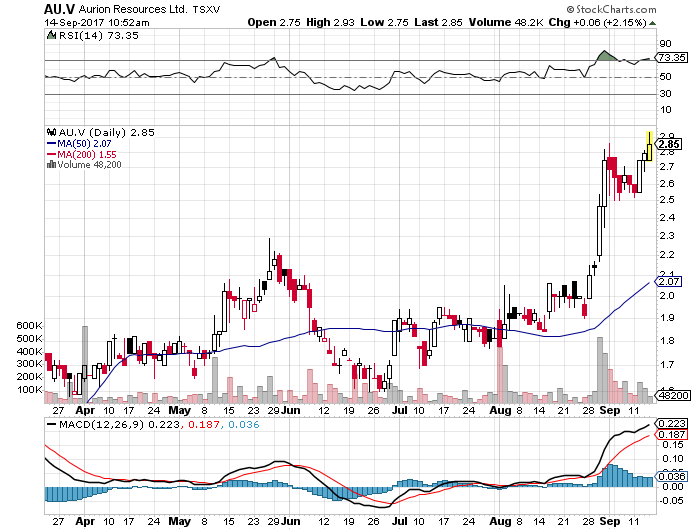

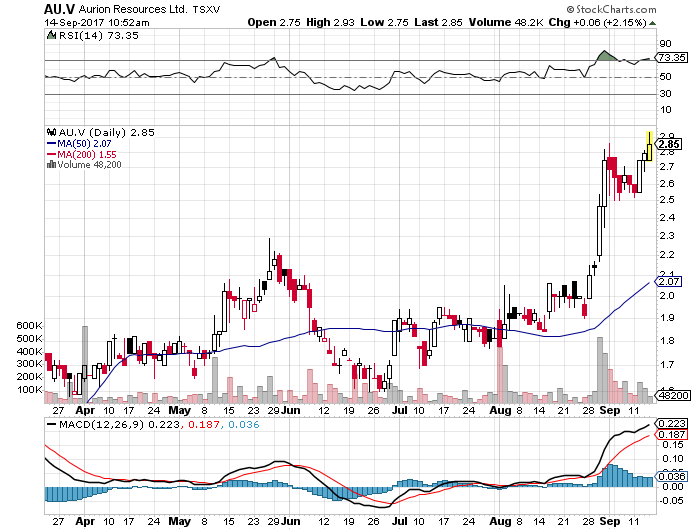

Aurion Starts Drilling at Aamurusko and Identifies New Gold Zones

V.AU | 41 minutes ago

ST. JOHN’S, Newfoundland, Sept. 14, 2017 (GLOBE NEWSWIRE) -- Aurion Resources Ltd. (“Aurion”) (TSX VENTURE:AU) is pleased to report that drilling has begun at the Aamurusko prospect on its 100% owned Risti Project in Northern Finland. A total of 21 diamond drillholes are proposed over a distance of approximately 1.1 km along a Northeast-Southwest trending 1.0 km wide corridor. Within this corridor a total of 717 quartz vein blocks have assayed from nil to 2520 grams per tonne (g/t) Au and average 32.97 g/t Au with 102 assaying >31 g/t Au (one ounce per tonne – “Opt”). Aurion has also made several new high grade gold discoveries along regional unconformities southwest, northwest and east of Aamurusko. Further details are provided below.

Highlights:

21 diamond drillholes (3400 metres) are proposed over 1.1 km strike length

717 quartz blocks average 32.97 g/t Au within core 1.4 by 1.0 km trend

102 (14%) quartz blocks assayed greater than 1 ounce per tonne (opt) Au

Channel sampling of quartz blocks assayed as high as 43.3 g/t Au over 1.65 m

2232 rock samples across Risti Project average 11.8 g/t Au.

Multiple new high grade gold discoveries regionally

Read more at http://www.stockhouse.com/news/press-releases/2017/09/14/aurion-starts-drilling-at-aamurusko-and-identifies-new-gold-zones#jB2fdgiro8trBDvT.99

V.AU | 41 minutes ago

ST. JOHN’S, Newfoundland, Sept. 14, 2017 (GLOBE NEWSWIRE) -- Aurion Resources Ltd. (“Aurion”) (TSX VENTURE:AU) is pleased to report that drilling has begun at the Aamurusko prospect on its 100% owned Risti Project in Northern Finland. A total of 21 diamond drillholes are proposed over a distance of approximately 1.1 km along a Northeast-Southwest trending 1.0 km wide corridor. Within this corridor a total of 717 quartz vein blocks have assayed from nil to 2520 grams per tonne (g/t) Au and average 32.97 g/t Au with 102 assaying >31 g/t Au (one ounce per tonne – “Opt”). Aurion has also made several new high grade gold discoveries along regional unconformities southwest, northwest and east of Aamurusko. Further details are provided below.

Highlights:

21 diamond drillholes (3400 metres) are proposed over 1.1 km strike length

717 quartz blocks average 32.97 g/t Au within core 1.4 by 1.0 km trend

102 (14%) quartz blocks assayed greater than 1 ounce per tonne (opt) Au

Channel sampling of quartz blocks assayed as high as 43.3 g/t Au over 1.65 m

2232 rock samples across Risti Project average 11.8 g/t Au.

Multiple new high grade gold discoveries regionally

Read more at http://www.stockhouse.com/news/press-releases/2017/09/14/aurion-starts-drilling-at-aamurusko-and-identifies-new-gold-zones#jB2fdgiro8trBDvT.99

Rest raus zu 38,40 das war nett

[url=https://peketec.de/trading/viewtopic.php?p=1779831#1779831 schrieb:Sltrader schrieb am 14.09.2017, 16:05 Uhr[/url]"]Hälfte raus zu 37,60 somit verlust von gestern wieder drin rest belibt mal mit stop einsatnd

[url=https://peketec.de/trading/viewtopic.php?p=1779808#1779808 schrieb:Sltrader schrieb am 14.09.2017, 15:37 Uhr[/url]"]ausgestoppte Pos noachmals zu 36,80 long stop TT

[url=https://peketec.de/trading/viewtopic.php?p=1779596#1779596 schrieb:

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Freehold Royalties to pay five-cent dividend

2017-09-13 17:21 ET - News Release

Mr. Matt Donohue reports

FREEHOLD ROYALTIES LTD. DECLARES DIVIDEND FOR SEPTEMBER 2017

Freehold Royalties Ltd. has declared a dividend of five cents per common share to be paid on Oct. 16, 2017, to shareholders of record on Sept. 30, 2017.

These dividends are designated as "eligible dividends" for Canadian income tax purposes.

Freehold's primary focus is on acquiring and managing oil and gas royalties. The majority of production comes from royalty interests (mineral title and gross overriding royalties).

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aFRU-2505579&symbol=FRU®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Euro Sun hires SRK, Ausenco for Rovina Valley BFS

2017-09-14 05:18 ET - News Release

Mr. G. Scott Moore reports

EURO SUN AWARDS BANKABLE FEASIBILITY STUDY FOR THE ROVINA VALLEY PROJECT TO SRK CONSULTING AND AUSENCO ENGINEERING

Euro Sun Mining Inc. has awarded the bankable feasibility study contract for its Rovina Valley gold and copper project to SRK Consulting (Canada) Inc. and Ausenco Engineering Canada Inc.

SRK has been selected to provide expertise in geology, mining and financial modelling, and will also oversee the geochemical and geotechnical work, as well as metallurgical test programs. Ausenco will be responsible for completing the design engineering for the project.

G. Scott Moore, president and chief executive officer of Euro Sun Mining, commented: "The award of the feasibility study marks an important milestone as we focus on advancing the development of the Rovina Valley project. Our technical team will work closely with SRK and Ausenco, two experienced international mining engineering firms, to deliver a mine development scenario that will encompass leading environmental standards without the use of cyanide. We will continue to target a low-capital-intensity project that outlines the simple open-cut mining and flotation processing at Rovina without the use of wet tailings impoundment."

About Euro Sun Mining Inc.

Euro Sun is a Toronto Stock Exchange-listed mining company focused on the exploration and development of its 100-per-cent-owned Rovina Valley gold and copper project located in west-central Romania. The property hosts 10.84 million gold equivalent ounces (7.19 million ounces of gold grading 0.55 gram per tonne and 1.42 million pounds of copper grading 0.16 per cent*), making it the second-largest gold deposit in Europe.

* Notes related to the mineral resource estimate

Gold equivalent ounces are determined by using a gold price of $1,370 (U.S.) per ounce and a copper price of $3.52 (U.S.) per pound. These prices are the three-year trailing average as of July 10, 2012. Metallurgical recoveries are not taken into account for AuEq. The base-case cut-off used are 0.35 g/t gold equivalent for the Colnic deposit and 0.25 per cent copper equivalent for the Rovina deposit, both of which are amenable to open-pit mining, and 0.65 g/t AuEq for the Ciresata deposit, which is amenable to underground bulk mining. For the Rovina and Colnic porphyries, the resource is an in-pit resource derived from a Whittle shell model using gross metal values of a $1,350-per-ounce-gold price and $3-per-pound-copper price, net of payable amounts after smelter charges and royalty for net values of $1,313 (U.S.) per ounce Au, $2.57 (U.S.) per pound Cu for Rovina and $2.27 (U.S.) per pounce Cu for Colnic. Rounding of tonnes as required by reporting guidelines may result in apparent differences between tonnes, grade and contained metal content.

Qualified person

The mineral resources stated in this press release have been reviewed and approved by Pierre Desautels, PGeo, principal resource geologist of AGP, who served as the independent qualified person as defined by National Instrument 43-101, responsible for preparing the Mineral resource estimate and technical report dated Aug. 30, 2012.

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aESM-2505665&symbol=ESM®ion=C

[url=https://peketec.de/trading/viewtopic.php?p=1776212#1776212 schrieb:Kostolanys Erbe schrieb am 30.08.2017, 16:15 Uhr[/url]"]Nun gab es 2 weitere News von ESM.....

Was mir überhaupt nicht gefällt ist das gepusheauf der W:O Seite mit dem link

http://miningstocks.expert/esm2/

Euro Sun appoints Rogers to advisory board

2017-08-30 00:35 ET - News Release

Mr. Stan Bharti reports

EURO SUN REPORTS THAT JIM ROGERS HAS JOINED ITS ADVISORY BOARD

Renowned commodities expert Jim Rogers has joined the advisory board of Euro Sun Mining Inc.

Mr. Rogers is a respected author and speaker, actively promoting commodity investments globally. In 1973, Mr. Rogers, along with George Soros, founded the Quantum Fund. The Quantum Fund was one of the first truly international funds with the portfolio gaining 4,200 per cent while the S&P advanced about 47 per cent from 1970 to 1980. In 1980, Mr. Rogers decided to retire and spent some of his time travelling on a motorcycle around the world.

Mr. Rogers is also a prolific writer and contributes frequently to The Washington Post, The New York Times, Forbes, Fortune and The Wall Street Journal. One of his other interests is teaching, and he has served as a professor of finance at the Columbia University Graduate School of Business.

Stan Bharti, chairman of Euro Sun Mining, stated: "We are very pleased to have Jim officially join Euro Sun as an adviser. Rovina is a world-class gold-copper project and will be a significant contributor to the Romanian economy. Jim's expertise in precious and base metals, particularly in Asia, will be of great assistance as we move towards production at Rovina."

About Euro Sun Mining Inc.

Euro Sun is a Toronto Stock Exchange-listed mining company focused on the exploration and development of its 100-per-cent-owned Rovina Valley gold and copper project located in west-central Romania. The property hosts 10.84 million gold equivalent ounces (7.19 million ounces of gold grading 0.55 gram per tonne and 1.42 million pounds of copper grading 0.16 per cent), making it the second-largest gold deposit in Europe.

Qualified person

The scientific and technical information pertaining to the metallurgical studies presented in this press release has been reviewed and approved by Joseph C. Milbourne, vice-president, technical services, for Euro Sun, who is a qualified person as defined by National Instrument 43-101.

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aESM-2501273&symbol=ESM®ion=C

Euro Sun appoints Popitiu manager of public relations

2017-08-29 02:42 ET - News Release

Mr. Scott Moore reports

EURO SUN REPORTS THAT IT HAS RECRUITED ADVISOR TO THE PRESIDENT OF THE NATIONAL AGENCY OF MINERAL RESOURCES

Eugen Popitiu, former adviser to the president of the Romanian National Agency for Mineral Resources (NAMR) since January, 2016, has agreed to join Euro Sun Mining Inc. as manager of public relations, effective Sept. 1, 2017.

Mr. Popitiu is a graduate of the University of Bologna, with a degree in political science and international relations. Prior to acting as adviser to the past two presidents of NAMR, he was adviser to the Minister of Energy, in small and medium enterprises and business environment.

A passionate professional about both public and business sectors, he brings strong experience with business development, brand communication, sales strategy and leadership in the oil and gas and mineral resource industry.

Scott Moore, president and chief executive officer of Euro Sun Mining, stated: "We are very pleased to have Eugen join our team at Euro Sun Mining. His experience within NAMR and the Romanian government is ideally suited for the company as we seek to raise the profile of Euro Sun Mining and the Rovina Valley project. As the first non-state-owned entity to have been issued a mining licence, we are committed to developing the Rovina Valley project as an example of responsible mining to the highest environmental standards and, in the process, provide meaningful economic impact to our local community partners and to the Romanian state."

About Euro Sun Mining Inc.

Euro Sun is a Toronto Stock Exchange-listed mining company focused on the exploration and development of its 100-per-cent-owned Rovina Valley gold and copper project located in west-central Romania. The property hosts 10.84 million gold equivalent ounces (7.19 million ounces of gold grading 0.55 gram per tonne and 1.42 million pounds of copper grading 0.16 per cent), making it the second-largest gold deposit in Europe.

Qualified person

The scientific and technical information pertaining to the metallurgical studies presented in this press release has been reviewed and approved by Joseph C. Milbourne, vice-president, technical services, for Euro Sun, who is a qualified person as defined by National Instrument 43-101.

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aESM-2499736&symbol=ESM®ion=C

[url=https://peketec.de/trading/viewtopic.php?p=1774439#1774439 schrieb:Kostolanys Erbe schrieb am 21.08.2017, 00:18 Uhr[/url]"]Ohne News am letzten Freitag aufwärts!

» zur Grafik

[url=https://peketec.de/trading/viewtopic.php?p=1772414#1772414 schrieb:Kostolanys Erbe schrieb am 10.08.2017, 00:02 Uhr[/url]"]

Euro Sun Mining to hold call re Rovina permit today

2017-08-09 09:51 ET - News Release

Mr. Stan Bharti reports

EURO SUN TO HOST INVESTOR CONFERENCE CALL WEDNESDAY, AUGUST 9TH, 2017, AT 11:00 A.M. ET

Euro Sun Mining Inc. invites you to participate in a conference call to be held Wednesday, Aug. 9, 2017, at 11 a.m. Eastern Time to discuss the recent news regarding the permit process and a general corporate update. The call will be hosted by Stan Bharti, chairman, Scott Moore, president and chief executive officer, and Brad Humphrey, vice-president of corporate development. A question-and-answer period will follow the call.

The conference call details are as follows.

Date: Aug. 9, 2017

Time: 11 a.m. ET

Local and international: 1-647-427-2311

North American toll-free: 1-866-521-4909

Participation code: 68496890

The Romanian National Agency for Mineral Resources (NAMR) has issued an official notice to the company announcing that the ratification process related to the mining licence of its Rovina Valley project granted in May, 2015, has been initiated. This notice follows the successful public audience held by NAMR on June 26, 2017 (see press releases from June 14 and June 26, 2017, for details).

As stated in the notice issued by the president of NAMR, Aurel Gheorghe, "... please be informed that following an analysis of the proposals raised in the public debate of June 26, 2017, in connection with the draft Government Decision on the approval of the Concession License under discussion, the Explanatory Memorandum has been finalized, which will be posted on the website of the National Agency for Mineral Resources in the course of the next week.

"Following the lapse of the 30 statutory days after the posting date, the Licence and the Explanatory Memorandum will be forwarded for endorsement to the competent institutions, in view of approving License no. 18174/2015 by Government Decision, according to the applicable legislation."

The mining licence for the exploitation of the company's Rovina Valley project requires the signatures of the Minister of Economy, Minister of Environment, Minister of Justice and Minister of Finance. Once these signatures are obtained, the mining licence will be sent to the Secretary General of Parliament and to the Prime Minister for final signatures, before being published in the official government gazette.

About Euro Sun Mining Inc.

Euro Sun is a Toronto Stock Exchange-listed mining company focused on the exploration and development of its 100-per-cent-owned Rovina Valley gold and copper project located in west-central Romania. The property hosts 10.84 million gold equivalent ounces (7.19 million ounces of gold grading 0.55 gram per tonne and 1,420 million pounds of copper grading 0.16 per cent), making it the second-largest gold deposit in Europe.

Qualified person

The scientific and technical information pertaining to the metallurgical studies presented in this press release has been reviewed and approved by Joseph C. Milbourne, vice-president technical services for Euro Sun, who is a qualified persons as defined by National Instrument 43-101.

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aESM-2493213&symbol=ESM®ion=C

» zur Grafik

[url=https://peketec.de/trading/viewtopic.php?p=1772134#1772134 schrieb:Kostolanys Erbe schrieb am 08.08.2017, 21:12 Uhr[/url]"]

Euro Sun to hold call Aug. 9 re Rovina Valley permit

2017-08-08 13:33 ET - News Release

Mr. Stan Bharti reports

EURO SUN TO HOST INVESTOR CONFERENCE CALL WEDNESDAY, AUGUST 9TH, 2017, AT 11:00 A.M. ET

Euro Sun Mining Inc. is inviting you to participate in a conference call to be held on Wednesday, Aug. 9, 2017, at 11 a.m. Eastern Time, to discuss the recent news regarding the permit process and a general corporate update. The call will be hosted by Stan Bharti, chairman; Scott Moore, president and chief executive officer; and Brad Humphrey, vice-president of corporate development. A question-and-answer period will follow the call.

The conference call details are as follows:

Date: Aug. 9, 2017

Time: 11 a.m. ET

Local and international: 1-647-427-2311

North American toll-free: 1-866-521-4909

Participation code: 68496890

The Romanian National Agency for Mineral Resources (NAMR) has issued an official notice to the company, announcing that the ratification process related to the mining licence of its Rovina Valley project granted in May, 2015, has been initiated. This notice follows the successful public audience held by NAMR on June 26, 2017 (see press releases from June 14 and June 26, 2017, for details).

As stated in the notice issued by the president of NAMR, Aurel Gheorghe: "Please be informed that following an analysis of the proposals raised in the public debate of June 26, 2017, in connection with the draft government decision on the approval of the concession licence under discussion, the explanatory memorandum has been finalized, which will be posted on the website of the National Agency for Mineral Resources in the course of the next week.

"Following the lapse of the 30 statutory days after the posting date, the licence and the explanatory memorandum will be forwarded for endorsement to the competent institutions, in view of approving licence no. 18174/2015 by government decision, according to the applicable legislation."

The mining licence for the exploitation of the company's Rovina Valley project requires the signatures of the minister of economy, minister of environment, minister of justice and minister of finance. Once these signatures are obtained, the mining licence will be sent to the secretary general of parliament and to the prime minister for final signatures, before being published in the official government gazette.

About Euro Sun Mining Inc.

Euro Sun is focused on the exploration and development of its 100-per-cent-owned Rovina Valley gold and copper project in west-central Romania. The property hosts 7.19 million ounces of gold grading 0.55 gram per tonne and 1,420 million pounds of copper grading 0.16 per cent.

Qualified person

The scientific and technical information pertaining to the metallurgical studies presented in this press release has been reviewed and approved by Joseph C. Milbourne, vice-president, technical services, for Euro Sun, a qualified person as defined by National Instrument 43-101.

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aESM-2492845&symbol=ESM®ion=C

[url=https://peketec.de/trading/viewtopic.php?p=1771348#1771348 schrieb:Kostolanys Erbe schrieb am 03.08.2017, 20:31 Uhr[/url]"]

Euro Sun's Rovina Valley ratification process initiated

2017-08-03 13:39 ET - News Release

Mr. Scott Moore reports

EURO SUN'S ROVINA VALLEY PROJECT MINING LICENCE ENDORSED BY THE ROMANIAN NATIONAL AGENCY FOR MINERAL RESOURCES; RATIFICATION PROCESS INITIATED WITH REQUIRED MINISTERS FOR LICENCE APPROVAL

The Romanian National Agency for Mineral Resources (NAMR) has issued an official notice to Euro Sun Mining Inc. announcing that the ratification process related to the mining licence of its Rovina Valley project granted in May, 2015, has been initiated. NAMR has completed their review and recommendations in the form of an explanatory memorandum following the successful public audience held at their offices on June 26, 2017 (see press releases from June 14 and June 26, 2017, for details), which will be forwarded to the required ministers for endorsement.

An excerpt from the official translation of the notice issued by the President of NAMR, Mr. Aurel Gheorghe, states, "...please be informed that following an analysis of the proposals raised in the public debate of June 26, 2017, in connection with the draft Government Decision on the approval of the Concession License under discussion, the Explanatory Memorandum has been finalized, which will be posted on the website of the National Agency for Mineral Resources in the course of the next week.

Following the lapse of the 30 statutory days after the posting date, the Licence and the Explanatory Memorandum will be forwarded for endorsement to the competent institutions, in view of approving License no. 18174/2015 by Government Decision, according to the applicable legislation."

The Mining Licence for the exploitation of the Company's Rovina Valley Project requires the signatures of the Minister of Economy, Minister of Environment, Minister of Justice and Minister of Finance. Once these signatures are obtained, the Mining Licence will be sent to the Secretary General of Parliament and to the Prime Minister for final signatures, before being published in the official government Gazette.

Scott Moore, President and CEO of Euro Sun Mining, stated, "We are very pleased to see the process to ratify our mining license begin, following our successful public audience in June. Once ratification is completed we will progress with the initiation of our Environmental Impact Study. We would like to thank NAMR for their support of this important project for Euro Sun and for Romania. As the first non-state-owned entity to have been issued a Mining Licence, we are committed to developing the Rovina Valley Project as an example of responsible mining to the highest environmental standards, and in the process, provide meaningful economic impact to our local community partners and to the Romanian State."

About Euro Sun Mining Inc.

Euro Sun is a Toronto Stock Exchange listed mining company focused on the exploration and development of its 100%-owned Rovina Valley gold and copper project located in west-central Romania. The property hosts 10.84 million gold equivalent ounces (7.19 million ounces of gold grading 0.55 g/t and 1,420 million pounds of copper grading 0.16%), making it the second largest gold deposit in Europe.

Qualified Person

The scientific and technical information pertaining to the metallurgical studies presented in this press release has been reviewed and approved by Joseph C. Milbourne, Vice President Technical Services for Euro Sun, who is a Qualified Persons as defined by National Instrument 43-101.

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aESM-2492069&symbol=ESM®ion=C

[url=https://peketec.de/trading/viewtopic.php?p=1764170#1764170 schrieb:Kostolanys Erbe schrieb am 27.06.2017, 21:29 Uhr[/url]"]Noch mal die letzte news:

Euro Sun completes public meeting re Rovina licence

2017-06-26 10:41 ET - News Release

Mr. Scott Moore reports

EURO SUN SUCCESSFULLY COMPLETES PUBLIC MEETING RELATED TO ITS MINING LICENCE

In accordance with Romania's public administration transparency laws, the National Agency for Mineral Resources (NAMR) hosted a public meeting to discuss the draft government decision approving the mining licence of Euro Sun Mining Inc.'s Rovina Valley project at its headquarters today, June 26, 2017, beginning at 11 a.m. The meeting was originally scheduled for three hours to allow all interested associations and Romanian citizens to provide their comments; however, it concluded in one hour.

The mining licence, issued to the company in 2015, must be ratified by the Minister of Economy, the Minister of Water and Forests, the Minister of Justice, the Minister of Public Finance, and the Vice-Prime Minister and Minister of the Environment before being published in the government gazette.

G. Scott Moore, president and chief executive officer of Euro Sun Mining, commented: "We are pleased that this important step requested by NAMR has been successfully concluded, and we look forward to a swift formal ratification by the Romanian state. The Rovina Valley project represents a multigenerational project utilizing the highest environmental standards and without the use of cyanide. It will provide stable, high-paying employment and substantial economic benefits to the Romanian state."

About Euro Sun Mining Inc.

Euro Sun is a Toronto Stock Exchange-listed mining company focused on the exploration and development of its 100-per-cent-owned Rovina Valley gold and copper project located in west-central Romania. The property hosts 10.84 million gold-equivalent ounces (7.19 million ounces of gold grading 0.55 gram per tonne and 1,420 million pounds of copper grading 0.16 per cent), making it the second-largest gold deposit in Europe.

Qualified person

The scientific and technical information pertaining to the metallurgical studies presented in this press release has been reviewed and approved by Joseph C. Milbourne, vice-president of technical services for Euro Sun, who is a qualified persons as defined by National Instrument 43-101.

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aESM-2482620&symbol=ESM®ion=C

Die Aktie ist im Vorwege ja schon gestiegen. Wenn aber alles ratifiziert ist, sollte das Projekt

Rovina Valley

PROJECT HIGHLIGHTS

• Rovina Valley is 100% owned by Euro Sun Mining

• 10.84M ounces of gold equivalent in the M&I category

• Mining licence granted in May 2015

• PEA completed in March 2010

• Scalable project with excellent mineral growth potential

• $51 million spent on the project to date

bzw. das Unternehmen deutlich höher bewertet werden....Zeitpunkt???

[url=http://peketec.de/trading/viewtopic.php?p=1764136#1764136 schrieb:The Bull schrieb am 27.06.2017, 19:11 Uhr[/url]"]ESM jetzt wieder runter!!!

ich habe mir da etwas mehr erhofft!!!

AOI - gestern recht schwunghafter Handel, steifendes Volumen, offenes GAP bei 1,90 CAD

[url=https://peketec.de/trading/viewtopic.php?p=1779730#1779730 schrieb:Sltrader schrieb am 14.09.2017, 10:53 Uhr[/url]"]» zur Grafik

[url=https://peketec.de/trading/viewtopic.php?p=1779727#1779727 schrieb:greenhorn schrieb am 14.09.2017, 10:49 Uhr[/url]"]kann den Chart nicht reinstellen - stehen aber kurz vorm Kaufsignal 8)

[url=https://peketec.de/trading/viewtopic.php?p=1778337#1778337 schrieb:Sltrader schrieb am 08.09.2017, 11:22 Uhr[/url]"]die hab ich mal recht eifrige im bereich 7-8 Dollar gehandlt :shock:

[url=https://peketec.de/trading/viewtopic.php?p=1778300#1778300 schrieb:greenhorn schrieb am 08.09.2017, 10:27 Uhr[/url]"]AOI - mal ne Kleinigkeit Long zu 1,17 Euro

[url=https://peketec.de/trading/viewtopic.php?p=1778189#1778189 schrieb:Kostolanys Erbe schrieb am 07.09.2017, 22:23 Uhr[/url]"]Africa Oil Receives One Year License Extension in Ethiopia’s Rift Basin Block

Rift Basin Block operator Africa Oil has announced that the Ethiopian Ministry of Mines, Petroleum and Natural Gas has awarded the Canadian company a one year extension to the block license which will now expire in February 2018.

The extension is intended to allow the operator time to pursue its drilling options after completing 2D seismic acquisition of a 600 kilometer land and lake survey in the third quarter of 2015 which identified source rock outcrops and oil slicks on the lakes in the block where there was previously no existing seismic or wells.

The seismic also identified Ngamia-style structures reachable from shore as well as large structures offshore could provide materiality once basin is ‘proven’.

The explorer is also expected in the meantime to seek for a joint venture partner following the departure of American explorer Marathon Oil which had acquired a 50% interest in the Rift Basin Area in 2014.

This is the second extension after the Government of Ethiopia granted a twelve month extension to the initial exploration period last year, which expired in February 2017.

The Rift Basin Area covers 42,519 square kilometres and is on trend and extending to the northeast of the highly prospective blocks in the Tertiary rift valley including the South Omo Block, and Kenyan Blocks 10BA, 10BB, 13T, and 12

http://www.oilnewskenya.com/africa-oil-receives-one-year-license-extension-ethiopias-rift-basin-block/

DNT - am Ende sogar über 1 Mio bekommen!  und sehr wenig Finders Fee

und sehr wenig Finders Fee

Candente Copper completes $1.04M private placement

https://www.stockwatch.com/News/Item.aspx?bid=Z-C:DNT-2506089&symbol=DNT®ion=C

2017-09-14 17:27 ET - News Release

Ms. Joanne Freeze reports

CANDENTE COPPER COMPLETES PRIVATE PLACEMENT RAISING $1.04M

Candente Copper Corp. has completed its previously announced and oversubscribed non-brokered private placement (see company's news releases No. 094 and No. 095, dated Aug. 24 and 30, 2017) raising $1,042,360.

In closing, the company has issued 11,581,779 units at a price of nine cents per unit. Each unit comprises one common share of the company and one-half of a share purchase warrant, with each whole share purchase warrant being exercisable for two years to purchase an additional common share at a price of 15 cents per share, subject to an acceleration provision. If at any time after Jan. 30, 2018, the company's common shares have a closing price on the Toronto Stock Exchange at or above a price of 30 cents per share for a period of 10 consecutive trading days, the company may give notice by news release that expiration of the warrants will be accelerated to 40 days from the date of providing such notice. All shares will be subject to a four-month hold period.

Joanne C. Freeze, chief executive officer and director, and John Black, director, collectively subscribed for a total of 883,334 units.

The company has relied upon exemptions from the valuation and minority shareholder approval requirements contained in Section 5.5(a) and Section 5.7(1)(a) of Multilateral Instrument 61-101 -- Protection of Minority Security Holders in Special Transactions.

Finders' fees totalling $37,187 were paid with respect to the private placement.

The gross proceeds will be used for working capital and general corporate purposes including community initiatives in Peru.

© 2017 Canjex Publishing Ltd. All rights reserved.

Candente Copper completes $1.04M private placement

https://www.stockwatch.com/News/Item.aspx?bid=Z-C:DNT-2506089&symbol=DNT®ion=C

2017-09-14 17:27 ET - News Release

Ms. Joanne Freeze reports

CANDENTE COPPER COMPLETES PRIVATE PLACEMENT RAISING $1.04M

Candente Copper Corp. has completed its previously announced and oversubscribed non-brokered private placement (see company's news releases No. 094 and No. 095, dated Aug. 24 and 30, 2017) raising $1,042,360.

In closing, the company has issued 11,581,779 units at a price of nine cents per unit. Each unit comprises one common share of the company and one-half of a share purchase warrant, with each whole share purchase warrant being exercisable for two years to purchase an additional common share at a price of 15 cents per share, subject to an acceleration provision. If at any time after Jan. 30, 2018, the company's common shares have a closing price on the Toronto Stock Exchange at or above a price of 30 cents per share for a period of 10 consecutive trading days, the company may give notice by news release that expiration of the warrants will be accelerated to 40 days from the date of providing such notice. All shares will be subject to a four-month hold period.

Joanne C. Freeze, chief executive officer and director, and John Black, director, collectively subscribed for a total of 883,334 units.

The company has relied upon exemptions from the valuation and minority shareholder approval requirements contained in Section 5.5(a) and Section 5.7(1)(a) of Multilateral Instrument 61-101 -- Protection of Minority Security Holders in Special Transactions.

Finders' fees totalling $37,187 were paid with respect to the private placement.

The gross proceeds will be used for working capital and general corporate purposes including community initiatives in Peru.

© 2017 Canjex Publishing Ltd. All rights reserved.

[url=https://peketec.de/trading/viewtopic.php?p=1776342#1776342 schrieb:greenhorn schrieb am 31.08.2017, 09:21 Uhr[/url]"]DNT - Candente Corp.

die gute alte Candente, immer noch mit Joanne Freeze als CEO, die auch selbst zeichnet......

da der Kupferpreis aktuell sich ordentlich entwickelt scheint auch wieder hier das Interesse zu erwachen

Das Projekt in Peru ist wirklich nicht ohne, auf WL

August 30, 2017 17:09 ET

Candente Copper Announces Oversubscription of Financing

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Aug. 30, 2017) -

Candente Copper Corp. (TSX:DNT)(LMA:DNT) ("Candente Copper" and/or the "Company") is pleased to announce that the non-brokered private placement launched on August 24, 2017 (news Release No. 094) (the "Private Placement") is currently over-subscribed. As a result, the size of the offering has been increased from Cdn$500,000 to approximately Cdn$750,000. The gross proceeds will be used for working capital and general corporate purposes including ongoing community initiatives in Peru. Qualified investors are welcome to participate in the Private Placement until 2pm PDT on Friday, September 1, 2017.

The overall size of the Private Placement will be increased to approximately 8.3M units ("Units"). Terms of the financing have not changed: the Units remain priced at Cdn$0.09 per Unit, with each Unit consisting of one common share and one half share purchase warrant. Each full warrant (a "Warrant") entitles the holder to purchase one additional share of the Company's common stock (a "Warrant Share") for two years at a conversion price of Cdn$0.15, subject to an acceleration provision. If at any time after January 30th, 2018, the Company's common shares have a closing price on the TSX Exchange at or above a price of Cdn$0.30 per share for a period of 10 consecutive trading days, the Company may give notice by News Release that expiration of the Warrants will be accelerated to 40 days from the date of providing such notice. Both Unit and Warrant Shares will be subject to a mandatory 4 month hold period commencing the day of closing of the Private Placement.

If aggregate subscriptions for Units under Private Placement exceed the maximum number of Units to be sold, Candente Copper may further increase the size of the Private Placement (subject to compliance with the TSX's pricing rules) or subscriptions will otherwise be accepted on a "first-come, first-served" basis. The Company may pay finder's fees in connection with a portion of the Private Placement.

Joanne Freeze, CEO and a director of the Company, and other directors of the Company are to subscribe for a portion of the Private Placement, which in total will be for less than 25% of Candente Copper's market capitalization. The Company is therefore intending to rely upon exemptions from the valuation and minority shareholder approval requirements contained in sections 5.5(a) and 5.7(1)(a) of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions.

China gibt australischen Lithiumfirmen neuen Schub

Die Ankündigung Chinas, den Automobilsektor komplett von Verbrennungs- auf Elektromotoren umstellen zu wollen, hat den australischen Lithiumgesellschaften gestern einen kräftigen Schub gegeben.

Aktien wie die Lithiumproduzenten Galaxy Resources (WKN A0LF83) oder Neometals (WKN (WKN A12G4J) legten zweistellig zu und setzten diesen Trend auch heute fort. Auch der Projektentwickler Kidman Resources (A1CV96) und Altura Mining (WKN A0YFNJ) konnten deutlich zulegen, da die Anleger den jüngsten Grund für einen positiven Ausblick für die Branche als Grund für ein verstärktes Engagement bewerteten. Und für Pilbara Minerals (WKN A0YGCV) geht es heute in Australien um 12% nach oben. Die Kauflaune erstreckt sich aber auch auf Lithiumexplorer wie AVZ Minerals (WKN A0MXC7), die heute um fast 8% steigt.

Chinas Vizeminister für Industrie und Informationstechnologie Xin Guobin hatte am Wocheende verkündet, dass die Volksrepublik eine Deadline für den Verkauf von Automobilen, die ausschließlich mit Benzin oder Diesel betrieben werden, festlegen werde. Damit will China seine schwerwiegenden Umweltprobleme in Angriff nehmen.

Ein genauer Zeitpunkt wurde nicht genannt, aber die Aussicht, dass einer der größten und am schnellsten wachsenden Automobilmärkte weltweit auf Elektromobile umschwenken könnte, hat offensichtliche, positive Auswirkungen für den Lithiumsektor.

Großbritannien und Frankreich hatten bereits vor einiger Zeit erklärt, ab 2040 Benziner und Dieselfahrzeuge zu verbieten. Und auch die Fahrzeughersteller positionieren sich einer nach dem anderen für die anstehende Veränderung. So erklärte zuletzt BMW (WKN 519000), bis 2022 elektrische oder Hybridversionen seiner Modelle anbieten zu wollen und Volvo erklärte, schon 2019 komplett auf Elektromobile setzen zu wollen.

All das verspricht einen weiteren Anstieg der Nachfrage nach Lithium – und den anderen Rohstoffen, die zur Herstellung von Lithium-Ionen-Batterien benötigt werden wie Kobalt, Graphit, Nickel oder Kupfer – und damit noch bessere Chancen für die Produzenten und jene, die es einmal werden wollen.

Die Ankündigung Chinas, den Automobilsektor komplett von Verbrennungs- auf Elektromotoren umstellen zu wollen, hat den australischen Lithiumgesellschaften gestern einen kräftigen Schub gegeben.

Aktien wie die Lithiumproduzenten Galaxy Resources (WKN A0LF83) oder Neometals (WKN (WKN A12G4J) legten zweistellig zu und setzten diesen Trend auch heute fort. Auch der Projektentwickler Kidman Resources (A1CV96) und Altura Mining (WKN A0YFNJ) konnten deutlich zulegen, da die Anleger den jüngsten Grund für einen positiven Ausblick für die Branche als Grund für ein verstärktes Engagement bewerteten. Und für Pilbara Minerals (WKN A0YGCV) geht es heute in Australien um 12% nach oben. Die Kauflaune erstreckt sich aber auch auf Lithiumexplorer wie AVZ Minerals (WKN A0MXC7), die heute um fast 8% steigt.

Chinas Vizeminister für Industrie und Informationstechnologie Xin Guobin hatte am Wocheende verkündet, dass die Volksrepublik eine Deadline für den Verkauf von Automobilen, die ausschließlich mit Benzin oder Diesel betrieben werden, festlegen werde. Damit will China seine schwerwiegenden Umweltprobleme in Angriff nehmen.

Ein genauer Zeitpunkt wurde nicht genannt, aber die Aussicht, dass einer der größten und am schnellsten wachsenden Automobilmärkte weltweit auf Elektromobile umschwenken könnte, hat offensichtliche, positive Auswirkungen für den Lithiumsektor.

Großbritannien und Frankreich hatten bereits vor einiger Zeit erklärt, ab 2040 Benziner und Dieselfahrzeuge zu verbieten. Und auch die Fahrzeughersteller positionieren sich einer nach dem anderen für die anstehende Veränderung. So erklärte zuletzt BMW (WKN 519000), bis 2022 elektrische oder Hybridversionen seiner Modelle anbieten zu wollen und Volvo erklärte, schon 2019 komplett auf Elektromobile setzen zu wollen.

All das verspricht einen weiteren Anstieg der Nachfrage nach Lithium – und den anderen Rohstoffen, die zur Herstellung von Lithium-Ionen-Batterien benötigt werden wie Kobalt, Graphit, Nickel oder Kupfer – und damit noch bessere Chancen für die Produzenten und jene, die es einmal werden wollen.

grundsätzlich finde ich die Entwicklung aber i.O. - nur die gesetzten Jahreszahlen z.T. sehr optimistisch

Mit 8 Gramm Thorium ohne aufzutanken 100 Jahre fahren

Die amerikanische Firma Laser Power Systems (LPS) aus Connecticut entwickelt eine neue Antriebsmethode für Fahrzeuge unter Verwendung eines der dichtesten Materialien der Natur: Thorium. Dies geht aus einem Bericht von Industry Tap hervor. Die Firma experimentiert mit kleinen Thorium-Blocks. Die abgegebene Hitze des Materials wird für einen Laser genutzt, der Wasser erhitzt und mit dem Wasserdampf eine Mini-Turbine versorgt. Die Turbine erzeugt wiederum den elektrischen Strom, mit dem das Fahrzeug angetrieben wird. Der Antrieb erzeugt dabei keinerlei Schadstoff-Emissionen.

Thorium – die vergessene Alternative

Flüssigfluorid-Thorium-Reaktoren: Was zuerst arg chemisch und gefährlich klingt, ist in Wirklichkeit ein revolutionäres Reaktorkonzept, das ich im Folgenden etwas genauer vorstellen möchte. Thorium-Reaktoren verwenden als Brennstoff nicht Uran, sondern Thorium. Dieses Element ist in der Erdkruste rund drei Mal häufiger als Uran, so dass auch bei einem flächendeckenden, weltweiten Einsatz die Vorräte für Jahrhunderte gesichert wären. Zudem ist es in der natürlich vorkommenden Form praktisch nicht radioaktiv (im Gegensatz zum Uran, das in den natürlich vorkommenden Erzen wie Pechblende radioaktiv ist), die Halbwertszeit des einzigen, natürlich vorkommenden Isotops Thorium-232 beträgt über 14 Milliarden Jahre. Um dieses Isotop des Thoriums überhaupt erst spaltbar zu machen, muss es mit Neutronen beschossen werden – dann wandelt es sich in Thorium-233 um, das wiederum in wenigen Minuten zu Proactinium-233 zerfällt. Dieses muss nun von einem weiteren Neutroneneinfang geschützt werden, so dass es – in rund 27 Tagen – zu Uran-233 zerfallen kann.

Uran-233 wiederum ist ein hervorragender Kernreaktor-Brennstoff, mit dem sich eine Kettenreaktion aufrecht erhalten lässt: unter Neutronenaufnahme setzt Uran-233 weitere Neutronen frei, die weiteres Uran-233 zur Spaltung anregen – und nebenbei weiteres Thorium-232 zu Thorium-233 umwandeln, womit sich der Kreislauf schliesst. Die Spaltprodukte von Uran-233 sind wesentlich kurzlebiger: Der radioaktive Abfall würde bereits nach rund 300 Jahren nicht mehr gefährlich strahlen. Längerlebige radioaktive Nuklide werden nur in sehr geringen Mengen produziert. Zudem ist die totale Menge an radioaktiven Abfällen pro nutzbare Energie um etwa den Faktor 1000 kleiner. Dies liegt vor allem daran, weil rund 98% des Brennstoffs auch tatsächlich verbrannt wird, im Gegensatz zu Uran-Brennstoffen, wo die Brennstäbe nach rund 2-5% Verbrennung (je nach dem, ob aufbereitet wird oder nicht) als Abfälle entsorgt werden müssen.

Warum wurde nicht schon früher auf Thorium gesetzt?

Das Positive ist, dass diverse Länder wie Norwegen, China und Indien endlich damit anfangen Thorium-Reaktoen zu bauen. Die Technologie wurde in den USA bereits in den 60er Jahren erforscht. Da sie aber keinen Plutoniumabfall produziert, wurde sie sehr rasch wieder fallen gelassen. Der militärisch-industrielle Komplex, der mitunter auch den Energiemarkt kontrolliert, brauchte das Plutonium um seine A-Bomben zu bauen. Aus diesem Grund wurde das hocheffiziente und umweltfreundliche Thorium zu Gunsten des Urans fallengelassen. Traurig aber wahr ...

Thorium ist darüber hinaus ziemlich günstig. Um den ganzen Strom aus den Schweizer Kernkraftwerken durch Thorium-Reaktoren zu ersetzen, wären pro Jahr etwa drei Tonnen Thorium nötig. Bei einem Weltmarktpreis von 60 Dollar pro Kilogramm könnte damit mit rund 200'000 Franken die Schweiz für ein Jahr versorgt werden. Uran ist im Gegensatz dazu rund fünf mal teurer (zudem braucht die Erzeugung der gleichen Menge Strom mehr Uran, wegen der geringeren Umwandlungseffizienz), Tendenz steigend.

Fazit: Thorium ist im Gegensatz zu Uran sauber, effizient und billig. Es ist zu gut um in unserem System marktfähig zu werden. Dennoch argumentieren immer noch viele Menschen damit, dass wir Fortschritt und Wohlstand unserem System verdanken würden. Dieses naive Argument wird am Beispiel des Thoriums widerlegt. Unser System ist weder an den Menschen noch an deren Komfort und Wohlstand interessiert. In einem anderen System, wie der ressource-based Economy, gäbe es kein Welthungerproblem und sehr wahrscheinlich auch keine Ressourcenkriege.

In diesem Zusammenhang möchte ich auch noch darauf hinweisen, dass es noch andere hocheffiziente und saubere Energiequellen gibt, die uns von der Elite bis heute vorenthalten werden. Knappheit und Mangel werden künstlich erzeugt, um uns auf "Trab" zu halten.

Die amerikanische Firma Laser Power Systems (LPS) aus Connecticut entwickelt eine neue Antriebsmethode für Fahrzeuge unter Verwendung eines der dichtesten Materialien der Natur: Thorium. Dies geht aus einem Bericht von Industry Tap hervor. Die Firma experimentiert mit kleinen Thorium-Blocks. Die abgegebene Hitze des Materials wird für einen Laser genutzt, der Wasser erhitzt und mit dem Wasserdampf eine Mini-Turbine versorgt. Die Turbine erzeugt wiederum den elektrischen Strom, mit dem das Fahrzeug angetrieben wird. Der Antrieb erzeugt dabei keinerlei Schadstoff-Emissionen.

Thorium – die vergessene Alternative

Flüssigfluorid-Thorium-Reaktoren: Was zuerst arg chemisch und gefährlich klingt, ist in Wirklichkeit ein revolutionäres Reaktorkonzept, das ich im Folgenden etwas genauer vorstellen möchte. Thorium-Reaktoren verwenden als Brennstoff nicht Uran, sondern Thorium. Dieses Element ist in der Erdkruste rund drei Mal häufiger als Uran, so dass auch bei einem flächendeckenden, weltweiten Einsatz die Vorräte für Jahrhunderte gesichert wären. Zudem ist es in der natürlich vorkommenden Form praktisch nicht radioaktiv (im Gegensatz zum Uran, das in den natürlich vorkommenden Erzen wie Pechblende radioaktiv ist), die Halbwertszeit des einzigen, natürlich vorkommenden Isotops Thorium-232 beträgt über 14 Milliarden Jahre. Um dieses Isotop des Thoriums überhaupt erst spaltbar zu machen, muss es mit Neutronen beschossen werden – dann wandelt es sich in Thorium-233 um, das wiederum in wenigen Minuten zu Proactinium-233 zerfällt. Dieses muss nun von einem weiteren Neutroneneinfang geschützt werden, so dass es – in rund 27 Tagen – zu Uran-233 zerfallen kann.

Uran-233 wiederum ist ein hervorragender Kernreaktor-Brennstoff, mit dem sich eine Kettenreaktion aufrecht erhalten lässt: unter Neutronenaufnahme setzt Uran-233 weitere Neutronen frei, die weiteres Uran-233 zur Spaltung anregen – und nebenbei weiteres Thorium-232 zu Thorium-233 umwandeln, womit sich der Kreislauf schliesst. Die Spaltprodukte von Uran-233 sind wesentlich kurzlebiger: Der radioaktive Abfall würde bereits nach rund 300 Jahren nicht mehr gefährlich strahlen. Längerlebige radioaktive Nuklide werden nur in sehr geringen Mengen produziert. Zudem ist die totale Menge an radioaktiven Abfällen pro nutzbare Energie um etwa den Faktor 1000 kleiner. Dies liegt vor allem daran, weil rund 98% des Brennstoffs auch tatsächlich verbrannt wird, im Gegensatz zu Uran-Brennstoffen, wo die Brennstäbe nach rund 2-5% Verbrennung (je nach dem, ob aufbereitet wird oder nicht) als Abfälle entsorgt werden müssen.

Warum wurde nicht schon früher auf Thorium gesetzt?

Das Positive ist, dass diverse Länder wie Norwegen, China und Indien endlich damit anfangen Thorium-Reaktoen zu bauen. Die Technologie wurde in den USA bereits in den 60er Jahren erforscht. Da sie aber keinen Plutoniumabfall produziert, wurde sie sehr rasch wieder fallen gelassen. Der militärisch-industrielle Komplex, der mitunter auch den Energiemarkt kontrolliert, brauchte das Plutonium um seine A-Bomben zu bauen. Aus diesem Grund wurde das hocheffiziente und umweltfreundliche Thorium zu Gunsten des Urans fallengelassen. Traurig aber wahr ...

Thorium ist darüber hinaus ziemlich günstig. Um den ganzen Strom aus den Schweizer Kernkraftwerken durch Thorium-Reaktoren zu ersetzen, wären pro Jahr etwa drei Tonnen Thorium nötig. Bei einem Weltmarktpreis von 60 Dollar pro Kilogramm könnte damit mit rund 200'000 Franken die Schweiz für ein Jahr versorgt werden. Uran ist im Gegensatz dazu rund fünf mal teurer (zudem braucht die Erzeugung der gleichen Menge Strom mehr Uran, wegen der geringeren Umwandlungseffizienz), Tendenz steigend.

Fazit: Thorium ist im Gegensatz zu Uran sauber, effizient und billig. Es ist zu gut um in unserem System marktfähig zu werden. Dennoch argumentieren immer noch viele Menschen damit, dass wir Fortschritt und Wohlstand unserem System verdanken würden. Dieses naive Argument wird am Beispiel des Thoriums widerlegt. Unser System ist weder an den Menschen noch an deren Komfort und Wohlstand interessiert. In einem anderen System, wie der ressource-based Economy, gäbe es kein Welthungerproblem und sehr wahrscheinlich auch keine Ressourcenkriege.

In diesem Zusammenhang möchte ich auch noch darauf hinweisen, dass es noch andere hocheffiziente und saubere Energiequellen gibt, die uns von der Elite bis heute vorenthalten werden. Knappheit und Mangel werden künstlich erzeugt, um uns auf "Trab" zu halten.

http://www.taz.de/!5170129/

Absage von Norwegens Strahlenschutzbehörde

Thorium ist auch keine Lösung

Norwegen gibt Pläne zum Bau eines Thorium-Reaktors auf, nachdem eine Studie gezeigt hat: Sicher und sauber wird Atomkraft auch mit dem nichtspaltbaren Brennstoff nicht.

Thorium statt Uran? Keine effiziente Lösung - die Nachteile überwiegen. Bild: dpa

Dass man von Thorium-Reaktoren die Finger lassen sollte, weiß man in Deutschland spätestens seit dem kostspieligen Fiasko mit dem Thorium-Hochtemperaturreaktor (THTR) im westfälischen Hamm. Jetzt ist auch Norwegen so weit. Die dortige Strahlenschutzbehörde Statens Strålevern erteilt allen Plänen für den Bau eines Thorium-Reaktors eine Absage. Sowohl Umweltminister Erik Sohlheim als auch Wirtschaftsministerin Sylvia Brustad schließen sich dem an.

Die rot-grüne Regierung in Oslo hatte 2007 bei Statens Strålevern eine Untersuchung in Auftrag gegeben. Damals hatte die starke Thorium-Lobby eine Debatte über die vermeintlichen Vorteile dieser Technik gestartet, die auch die staatliche Elektrizitätsgesellschaft Statkraft veranlasste, Interesse für einen Reaktor zu signalisieren. Norwegen verfügt vermutlich über die drittreichsten Thorium-Vorkommen der Welt.

Nach geltender Rechtslage wäre ein solcher Bau allerdings nicht möglich. Das norwegische Parlament hat den Bau von Atomkraftwerken vor 30 Jahren gesetzlich verboten. Und dabei dürfte es nach dem jetzigen Urteil der Strahlenschutzbehörde wohl auch bleiben. In ihrem Rapport untersucht Statens Strålevern den gesamten Thorium-Brennstoffkreislauf von der Gewinnung bis zur Atommülllagerung. Ergebnis: "Konventionelle Reaktoren, gleich ob sie auf Uran- oder Thorium-Brennstoff beruhen, führen zu einer radioaktiven Belastung von Luft und Wasser, in beiden Fällen besteht ein erhebliches Unglücksrisiko, speziell im Hinblick auf unkontrollierte Kettenreaktionen und im schlimmsten Fall eine Kernschmelze."

Reaktoren, die mit Thorium betrieben werden, hätten damit vergleichbar schädliche Umweltkonsequenzen und ein ähnliches Gefahrenpotenzial wie solche mit Uranbrennstoff. Von Thorium-Befürwortern wird gerade die vermeintliche Sicherheit vor einer Kernschmelze als Argument ins Feld geführt. Das aus dem Mineral Thorit gewonnene radioaktive Metall Thorium ist nicht spaltbar. Thorium als Brennstoff müssen daher von außen Neutronen zugeführt werden, um die Energie produzierende Kettenreaktion zu starten und in Gang zu halten. Wird diese eingestellt, stoppt auch die Reaktion.

Laut Strahlenschutzbehörde bedeutet das aber keinesfalls, dass es kein Unfallrisiko bis hin zu einer Kernschmelze gibt. Auch für die Nachwärmeabfuhr seien funktionierende Kühlsysteme erforderlich: "Die Wahrscheinlichkeit einer Kernschmelze ist bei Uran- oder Thoriumbrennstoff gleich zu beurteilen."

Ein Thorium-Reaktor produziere zwar weniger und weniger langlebigen Atommüll als ein AKW mit Uranbrennstäben. Dieser sei auch stabiler als konventioneller Atommüll. Dafür strahle er stärker, was Transport und Lagerung kompliziert.

Entscheidend sei aber, so die Studie, dass auch die Thorium-Technik das Atommüllproblem nicht löse. Hinzu komme auch beim Betrieb des Reaktors eine viel stärkere radioaktive Strahlung. Auch sicherheitstechnisch biete die Thorium-Nutzung kaum Vorteil: Zwar fielen nur geringe Mengen Plutonium an, und dieses sei auch für die Produktion von Atomwaffen nicht besonders interessant. Doch in der Hand von Terroristen könne auch ein Thorium-Reaktor für "nichtfriedliche Zwecke" benutzt werden.

Nicht viel besser fällt das Urteil für das bislang nur auf dem Papier bestehende Thorium-Konzept Accelerator Driven System (ADS), eine Kombination aus einem Teilchenbeschleuniger und einem bleigekühlten Reaktor, aus. Zwar sei die Gefahr einer Kernschmelze hier tatsächlich gering, heißt es. Die 8.000 bis 10.000 Tonnen Metall seines Bleikühlsystems könnten die Nachwärme aus dem Kern vermutlich absorbieren. Doch sei eine solche Konstruktion aufgrund der Kombination mit einem Teilchenbeschleuniger insgesamt störungsanfälliger. Zugleich komme es zu einer radioaktiven Verstrahlung des gesamten Kühlsystems. Zudem ist auch völlig unklar, ob diese Technik in 20 oder 30 Jahren zu ökonomisch vertretbaren Kosten verwirklicht werden könnte.

"Die Thorium-Debatte dürfte nun ein abgeschlossenes Kapitel sein", glaubt Nils Bøhmer, Atomexperte bei der Umweltschutzorganisation Bellona: "Hoffentlich beschäftigt sich die Politik jetzt mit wirklichen Lösungen der Klimaproblematik."

Absage von Norwegens Strahlenschutzbehörde

Thorium ist auch keine Lösung

Norwegen gibt Pläne zum Bau eines Thorium-Reaktors auf, nachdem eine Studie gezeigt hat: Sicher und sauber wird Atomkraft auch mit dem nichtspaltbaren Brennstoff nicht.

Thorium statt Uran? Keine effiziente Lösung - die Nachteile überwiegen. Bild: dpa

Dass man von Thorium-Reaktoren die Finger lassen sollte, weiß man in Deutschland spätestens seit dem kostspieligen Fiasko mit dem Thorium-Hochtemperaturreaktor (THTR) im westfälischen Hamm. Jetzt ist auch Norwegen so weit. Die dortige Strahlenschutzbehörde Statens Strålevern erteilt allen Plänen für den Bau eines Thorium-Reaktors eine Absage. Sowohl Umweltminister Erik Sohlheim als auch Wirtschaftsministerin Sylvia Brustad schließen sich dem an.

Die rot-grüne Regierung in Oslo hatte 2007 bei Statens Strålevern eine Untersuchung in Auftrag gegeben. Damals hatte die starke Thorium-Lobby eine Debatte über die vermeintlichen Vorteile dieser Technik gestartet, die auch die staatliche Elektrizitätsgesellschaft Statkraft veranlasste, Interesse für einen Reaktor zu signalisieren. Norwegen verfügt vermutlich über die drittreichsten Thorium-Vorkommen der Welt.

Nach geltender Rechtslage wäre ein solcher Bau allerdings nicht möglich. Das norwegische Parlament hat den Bau von Atomkraftwerken vor 30 Jahren gesetzlich verboten. Und dabei dürfte es nach dem jetzigen Urteil der Strahlenschutzbehörde wohl auch bleiben. In ihrem Rapport untersucht Statens Strålevern den gesamten Thorium-Brennstoffkreislauf von der Gewinnung bis zur Atommülllagerung. Ergebnis: "Konventionelle Reaktoren, gleich ob sie auf Uran- oder Thorium-Brennstoff beruhen, führen zu einer radioaktiven Belastung von Luft und Wasser, in beiden Fällen besteht ein erhebliches Unglücksrisiko, speziell im Hinblick auf unkontrollierte Kettenreaktionen und im schlimmsten Fall eine Kernschmelze."

Reaktoren, die mit Thorium betrieben werden, hätten damit vergleichbar schädliche Umweltkonsequenzen und ein ähnliches Gefahrenpotenzial wie solche mit Uranbrennstoff. Von Thorium-Befürwortern wird gerade die vermeintliche Sicherheit vor einer Kernschmelze als Argument ins Feld geführt. Das aus dem Mineral Thorit gewonnene radioaktive Metall Thorium ist nicht spaltbar. Thorium als Brennstoff müssen daher von außen Neutronen zugeführt werden, um die Energie produzierende Kettenreaktion zu starten und in Gang zu halten. Wird diese eingestellt, stoppt auch die Reaktion.

Laut Strahlenschutzbehörde bedeutet das aber keinesfalls, dass es kein Unfallrisiko bis hin zu einer Kernschmelze gibt. Auch für die Nachwärmeabfuhr seien funktionierende Kühlsysteme erforderlich: "Die Wahrscheinlichkeit einer Kernschmelze ist bei Uran- oder Thoriumbrennstoff gleich zu beurteilen."

Ein Thorium-Reaktor produziere zwar weniger und weniger langlebigen Atommüll als ein AKW mit Uranbrennstäben. Dieser sei auch stabiler als konventioneller Atommüll. Dafür strahle er stärker, was Transport und Lagerung kompliziert.

Entscheidend sei aber, so die Studie, dass auch die Thorium-Technik das Atommüllproblem nicht löse. Hinzu komme auch beim Betrieb des Reaktors eine viel stärkere radioaktive Strahlung. Auch sicherheitstechnisch biete die Thorium-Nutzung kaum Vorteil: Zwar fielen nur geringe Mengen Plutonium an, und dieses sei auch für die Produktion von Atomwaffen nicht besonders interessant. Doch in der Hand von Terroristen könne auch ein Thorium-Reaktor für "nichtfriedliche Zwecke" benutzt werden.

Nicht viel besser fällt das Urteil für das bislang nur auf dem Papier bestehende Thorium-Konzept Accelerator Driven System (ADS), eine Kombination aus einem Teilchenbeschleuniger und einem bleigekühlten Reaktor, aus. Zwar sei die Gefahr einer Kernschmelze hier tatsächlich gering, heißt es. Die 8.000 bis 10.000 Tonnen Metall seines Bleikühlsystems könnten die Nachwärme aus dem Kern vermutlich absorbieren. Doch sei eine solche Konstruktion aufgrund der Kombination mit einem Teilchenbeschleuniger insgesamt störungsanfälliger. Zugleich komme es zu einer radioaktiven Verstrahlung des gesamten Kühlsystems. Zudem ist auch völlig unklar, ob diese Technik in 20 oder 30 Jahren zu ökonomisch vertretbaren Kosten verwirklicht werden könnte.

"Die Thorium-Debatte dürfte nun ein abgeschlossenes Kapitel sein", glaubt Nils Bøhmer, Atomexperte bei der Umweltschutzorganisation Bellona: "Hoffentlich beschäftigt sich die Politik jetzt mit wirklichen Lösungen der Klimaproblematik."

[url=https://peketec.de/trading/viewtopic.php?p=1780168#1780168 schrieb:Rooky schrieb am 15.09.2017, 12:54 Uhr[/url]"]Mit 8 Gramm Thorium ohne aufzutanken 100 Jahre fahren

[...]

http://www.terrestrialenergy.com/imsr-technology/

IMSR® Technology

Advanced Reactor power plant based on proven molten salt reactor technology

How it Works

The fundamental engineering challenge of nuclear fission-reactor design is the safe dissipation of fission heat in every conceivable set of circumstances. The fundamental economic problem with solid-fuel reactors, which have been used for the past 60 years, is that a solid-fuel solution to this central challenge leads to a nuclear plant that is too complex and too challenging to finance and build. It is time to revisit this fundamental challenge of heat dissipation with different technology choices and with 21st century energy-market needs in mind.

The IMSR® is a liquid-fuel reactor system, rather than a solid-fuel system, as is used exclusively in conventional reactors. The IMSR® dissipates heat using a molten salt. Salts are thermally stable and excellent heat-transfer fluids, ideal for dissipating heat from the fission process simply and safely. In a molten salt reactor (MSR), salt provides a fluid medium to carry a nuclear fuel—in the case of the IMSR®, a low-enriched-uranium fluoride salt. The IMSR® provides simple, safe, and natural mechanisms for heat dissipation. It is a far superior system for the simple passive dissipation of fission heat. The use of a molten salt is at the heart of many engineering and commercial virtues of the IMSR®.

An IMSR® power plant generates 400 MWth of thermal energy (190 MWe) with a thermal -spectrum, graphite-moderated, molten-fluoride-salt reactor system, fueled by low-enriched uranium (less than 5% 235U). It incorporates the approach to MSR design and operation researched, demonstrated and proven by the ARE and MSRE test reactors at Oak Ridge National Laboratory (ORNL); these were further developed under the DMSR program.

The IMSR® improves upon the earlier ORNL MSR designs through various innovations that are pragmatic and commercial. The key challenge to MSR commercialization is graphite’s limited lifetime in a reactor core, which is a function of reactor power. Commercial power reactors require high core energy densities to be economical, but high power densities significantly reduce the lifetime of the graphite moderator requiring its replacement; this is challenging to do simply, safely and economically in an industrial environment. The key IMSR® innovation is an elegant solution to this challenge – the integration of the primary reactor components, including the graphite moderator, into a sealed and replaceable reactor core, the IMSR® Core-unit, which has an operating lifetime of 7 years. The IMSR® Core-unit is simple and safe to replace, it supports high utility factors for IMSR® power plants and high capital efficiency. It also ensures that the materials’ lifetime requirements of all other reactor core components are met; the challenge of achieving these requirements is often cited as an impediment to immediate commercialization of MSRs. The result is a power plant that delivers the combination of high energy output, simplicity and ease of operation, and cost-competitiveness essential for widespread commercial deployment. IMSR® power plants are a new clean energy alternative.

IMSR® Technology

Advanced Reactor power plant based on proven molten salt reactor technology

How it Works

The fundamental engineering challenge of nuclear fission-reactor design is the safe dissipation of fission heat in every conceivable set of circumstances. The fundamental economic problem with solid-fuel reactors, which have been used for the past 60 years, is that a solid-fuel solution to this central challenge leads to a nuclear plant that is too complex and too challenging to finance and build. It is time to revisit this fundamental challenge of heat dissipation with different technology choices and with 21st century energy-market needs in mind.

The IMSR® is a liquid-fuel reactor system, rather than a solid-fuel system, as is used exclusively in conventional reactors. The IMSR® dissipates heat using a molten salt. Salts are thermally stable and excellent heat-transfer fluids, ideal for dissipating heat from the fission process simply and safely. In a molten salt reactor (MSR), salt provides a fluid medium to carry a nuclear fuel—in the case of the IMSR®, a low-enriched-uranium fluoride salt. The IMSR® provides simple, safe, and natural mechanisms for heat dissipation. It is a far superior system for the simple passive dissipation of fission heat. The use of a molten salt is at the heart of many engineering and commercial virtues of the IMSR®.

An IMSR® power plant generates 400 MWth of thermal energy (190 MWe) with a thermal -spectrum, graphite-moderated, molten-fluoride-salt reactor system, fueled by low-enriched uranium (less than 5% 235U). It incorporates the approach to MSR design and operation researched, demonstrated and proven by the ARE and MSRE test reactors at Oak Ridge National Laboratory (ORNL); these were further developed under the DMSR program.

The IMSR® improves upon the earlier ORNL MSR designs through various innovations that are pragmatic and commercial. The key challenge to MSR commercialization is graphite’s limited lifetime in a reactor core, which is a function of reactor power. Commercial power reactors require high core energy densities to be economical, but high power densities significantly reduce the lifetime of the graphite moderator requiring its replacement; this is challenging to do simply, safely and economically in an industrial environment. The key IMSR® innovation is an elegant solution to this challenge – the integration of the primary reactor components, including the graphite moderator, into a sealed and replaceable reactor core, the IMSR® Core-unit, which has an operating lifetime of 7 years. The IMSR® Core-unit is simple and safe to replace, it supports high utility factors for IMSR® power plants and high capital efficiency. It also ensures that the materials’ lifetime requirements of all other reactor core components are met; the challenge of achieving these requirements is often cited as an impediment to immediate commercialization of MSRs. The result is a power plant that delivers the combination of high energy output, simplicity and ease of operation, and cost-competitiveness essential for widespread commercial deployment. IMSR® power plants are a new clean energy alternative.

[url=https://peketec.de/trading/viewtopic.php?p=1780197#1780197 schrieb:CCG-Redaktion schrieb am 15.09.2017, 13:49 Uhr[/url]"]http://www.taz.de/!5170129/

Absage von Norwegens Strahlenschutzbehörde

Thorium ist auch keine Lösung

[...]

[url=https://peketec.de/trading/viewtopic.php?p=1780168#1780168 schrieb:Rooky schrieb am 15.09.2017, 12:54 Uhr[/url]"]Mit 8 Gramm Thorium ohne aufzutanken 100 Jahre fahren

[...]

ELD - Eldorado Gold, mit den Genehmigungen scheint es nun auch für ELD eine Wende zu geben

Eldorado Gold squeezes more permits out of Greek gov't

https://www.stockwatch.com/News/Item.aspx?bid=Z-C:ELD-2506195&symbol=ELD®ion=C

2017-09-15 06:30 ET - News Release

Mr. George Burns reports

ELDORADO GOLD RECEIVES FURTHER OLYMPIAS PERMITS

Eldorado Gold Corp. has received the approval of the technical study for the Old Olympias mine closure and the installation permit for the paste plant at Olympias.

At this time, remaining outstanding is the issuance of the amended electromechanical installation permit for the Skouries flotation plant as well as other matters, including, but not limited to, the relocation of antiquities at the Skouries site.

Upon receipt of the required Skouries permit and the Greek government being willing to engage with the company in constructive discussions, the company will then be in a position to reassess its investment options in Greece.

George Burns, president and chief executive officer for Eldorado Gold, said: "This is another positive step forward; however, we are still waiting on the other matters, which we continue to believe can be resolved through good faith negotiations. We again invite the ministry to engage with us to resolve these matters."

About Eldorado Gold Corp.

Eldorado is a leading mid-tier gold producer with mining, development and exploration operations in Turkey, Greece, Romania, Serbia, Canada and Brazil. The company's success to date is based on a highly skilled and dedicated work force, safe and responsible operations, a portfolio of high-quality assets, and long-term partnerships with the communities where it operates.

We seek Safe Harbor.

© 2017 Canjex Publishing Ltd. All rights reserved.

Eldorado Gold squeezes more permits out of Greek gov't

https://www.stockwatch.com/News/Item.aspx?bid=Z-C:ELD-2506195&symbol=ELD®ion=C

2017-09-15 06:30 ET - News Release

Mr. George Burns reports

ELDORADO GOLD RECEIVES FURTHER OLYMPIAS PERMITS

Eldorado Gold Corp. has received the approval of the technical study for the Old Olympias mine closure and the installation permit for the paste plant at Olympias.

At this time, remaining outstanding is the issuance of the amended electromechanical installation permit for the Skouries flotation plant as well as other matters, including, but not limited to, the relocation of antiquities at the Skouries site.

Upon receipt of the required Skouries permit and the Greek government being willing to engage with the company in constructive discussions, the company will then be in a position to reassess its investment options in Greece.

George Burns, president and chief executive officer for Eldorado Gold, said: "This is another positive step forward; however, we are still waiting on the other matters, which we continue to believe can be resolved through good faith negotiations. We again invite the ministry to engage with us to resolve these matters."

About Eldorado Gold Corp.

Eldorado is a leading mid-tier gold producer with mining, development and exploration operations in Turkey, Greece, Romania, Serbia, Canada and Brazil. The company's success to date is based on a highly skilled and dedicated work force, safe and responsible operations, a portfolio of high-quality assets, and long-term partnerships with the communities where it operates.

We seek Safe Harbor.

© 2017 Canjex Publishing Ltd. All rights reserved.

1/3 raus zu 2,42

[url=https://peketec.de/trading/viewtopic.php?p=1779593#1779593 schrieb:Sltrader schrieb am 13.09.2017, 20:12 Uhr[/url]"]TSX: ELD NYSE: EGO

VANCOUVER, Sept. 13, 2017 /PRNewswire/ - Eldorado Gold Corporation ("Eldorado" or the "Company") confirms that it has today received the Olympias Operating Permit and the modified Electromechanical Installation Permit for the tailings management facility at Kokkinolakkas from the Ministry of Energy and Environment. The Olympias Operating Permit is valid for a period of three years from the date of issue.