App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread (Archiv)

- Ersteller Maack

- Erstellt am

- Tagged users Kein(e)

- Status

- Für weitere Antworten geschlossen.

The Company is also pleased to announce that the SRK mine scoping study on the Pampa de Pongo iron deposit is nearing completion. Inclusion of positive, commercial-scale metallurgical work into the Scoping Study is expected to add significant value to the Pampa de Pongo project, which is situated in the Marcona Iron District of southern Peru - in close proximity to major infrastructure, including a deep water port, the Pan American Highway, power and a skilled labour force.

Ein Vögelchen hat mir dazu was gezwitschert!!

Bis Ende Sept. ist der finale Report fertig!

http://media3.marketwire.com/docs/0908cdu.pdf

Capstone Mining Corp.

TSX: CS

Sep 08, 2008 09:13 ETSherwood & Capstone Announce Combination to Create Intermediate Copper Producer

Management Teams to Combine Assets, Skills & Production in a Highly Complementary Transaction

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Sept. 8, 2008) - Sherwood Copper Corporation (TSX VENTURE:SWC)(TSX VENTURE:SWC.DB) and Capstone Mining Corp. (TSX:CS) have entered into a Letter Agreement to combine, by way of a plan of arrangement or other form of business combination, to create a well-funded, low-cost, growth-oriented, copper company with two producing mines in mining friendly jurisdictions in North America. The two companies have agreed to combine on an "at-market" basis whereby each Sherwood shareholder will receive 1.566 shares of Capstone (based on the 20-day volume weighted average share price of the two companies). The boards of directors of Sherwood and Capstone have unanimously approved the terms of the transaction.

Transaction Rationale

Capstone and Sherwood believe this merger will realize significant benefits for each of the company's shareholders, including:

- Significant production growth, with forecast production of 85 million pounds of copper in 2008, increasing to 110 million pounds in 2009, with significant by-products of gold, silver, lead and zinc, as previously disclosed;

- Low cost production with forecast total cash costs of under US$1.00 per pound of payable copper in 2008 and 2009, including all off-site costs and net of by-product credits, generating significant free cash flow to fund corporate growth opportunities;

- An aggressive, growth oriented company focused on maximizing the value of its existing high grade mines, Cozamin and Minto, through sequential increases in resources, reserves and production; the pursuit of value through continual improvements at its operations; the advancement of the high grade Kutcho project towards a production decision and accretive merger and acquisition opportunities.

- Diversification of operational and geographic risk with the high grade open pit Minto copper-gold-silver mine in Canada and the high grade, underground Cozamin copper-silver-zinc-lead mine in Mexico.

- Increased market capitalization that should improve trading liquidity for shareholders of the combined company.

- Continued focus on optimization and cost reduction strategies, with the Cozamin mill throughput set to increase to 3,000 tonnes per day and Minto to 3,200 tonnes per day by the end of 2008. Minto will also reduce exposure to high fuel costs for electrical power generation by connecting to grid power in Q4/08.

- Excellent exploration upside at both the Cozamin and Minto mines, where high grade resources have been increased by 47% and 140%, respectively, over the past two years, exclusive of the results from major exploration programs completed in 2008, many of the results for which are still pending. Sherwood completed 120 holes at Minto and 81 holes at Kutcho in 2008, the results for approximately half of which remain to be reported, while Capstone has completed 7,000m of underground and 25,000m of surface drilling at Cozamin, the results of which are to be incorporated into an updated resource and reserve estimate.

- A combined management team with complementary experience and a proven track record of building and profitably operating mines to create shareholder wealth, supported by a seasoned and experienced board of directors.

- Exposure to the potential development of the high grade Kutcho copper-zinc-gold-silver project in northwestern British Columbia, where a preliminary economic assessment (see Sherwood news release dated June 12, 2008) indicated potential for production of 45 million pounds of payable copper per year at a cash cost of less than $1.00 per pound (net of by-product credits) and outlined several opportunities for further project enhancements.

- Strong balance sheet to support growth strategies.

- Enhanced market exposure for Sherwood's shareholders through access to Capstone's TSX listing and increased weighting in the TSX composite index.

- Broadened research coverage for Capstone's shareholders through Sherwood's analyst coverage, presently at nine firms across the spectrum of Canadian brokerages.

Capstone and Sherwood further believe that their shareholders will benefit from the tax-effective combination of the two companies and allow for participation in the upside from the significantly enhanced business platform.

Board & Management

The board and management structure of the combined company will draw on the expertise of both companies and the board will include four current Sherwood directors, one current director of Capstone and one nominee of Capstone. Colin K. Benner has agreed to serve as non-executive Chairman. Darren Pylot (currently President & CEO of Capstone) will become Vice Chairman and CEO and Stephen Quin (currently President & CEO of Sherwood) will become President & COO of the combined company. Richard Godfrey (currently Chief Financial Officer of Sherwood) will become Chief Financial Officer of the combined company; other senior management from both companies will be integrated into the senior management of the combined company, retaining many of the same responsibilities. Capstone and Sherwood intend to capitalize on the success of their respective strategies for the operation, expansion and exploration of the high grade Cozamin and Minto copper mines, located in Zacatecas, Mexico, and Yukon, Canada.

"Capstone and Sherwood have each looked at numerous merger and acquisition possibilities over the past year and have concluded that this is the most compelling consolidation opportunity in the sector," said Darren Pylot, President & CEO of Capstone. "The combined management teams are a great fit, with complementary skills and experience and a common focus on acquiring and operating high grade, low cost operations in mining-friendly, politically stable jurisdictions. Operationally, the high grade Cozamin and Minto copper mines are tremendous assets, and each is undergoing a third expansion program and, combined, should produce more than 100 million pounds of copper at cash cost of less than a dollar per pound in 2009. These operations provide an excellent platform for future growth."

"The combination of Sherwood and Capstone is a highly complementary transaction," said Stephen Quin, Sherwood's President & CEO. "Capstone's strong cash and investments and modest copper hedging program is complementary to Sherwood's more leveraged balance sheet and larger copper hedging program (through the end of 2011). Both Sherwood and Capstone have production expansion opportunities at their Minto and Cozamin mines, which we aim to advance as soon as practicable, and Sherwood offers significant organic growth potential through continued exploration success at Minto and a high grade development opportunity at its Kutcho copper project."

Transaction

Capstone and Sherwood anticipate that the transaction will be carried out by way of statutory plan of arrangement of Sherwood whereby Capstone would acquire all of the issued shares of Sherwood and Sherwood would become a wholly-owned subsidiary of Capstone (the "Arrangement"). The transaction would be subject to certain standard conditions including that not less than 66 2/3% of the issued and outstanding shares of Sherwood being voted at a shareholders meeting being in favour of the transaction. However, the parties may consider an alternative form of transaction, such as an amalgamation or other form of business combination, as mutually determined by Capstone and Sherwood.

Full details of the offer will be included in the formal Arrangement Agreement and Management Information Circular to be filed with the regulatory authorities and mailed to Sherwood shareholders in accordance with applicable securities laws. Under the Arrangement Capstone will acquire all of the issued and outstanding shares of Sherwood in consideration for the issue of Capstone shares on the basis of 1.566 Capstone shares for every Sherwood share. The Arrangement is an "at market" transaction with no premium to either party, based on the 20-day volume weighted average price of each of Capstone and Sherwood to September 5, 2008. Based on the current Sherwood shares outstanding, the transaction would involve the issuance of approximately 84 million Capstone shares, which equates to 105% of Capstone's shares outstanding.

The proposed transaction is expected to be completed before the end of 2008 and is subject to certain customary conditions, including receipt of all necessary court and shareholder approvals and dissent rights to the Arrangement shall not have been exercised prior to the effective date of the Arrangement by holders of Sherwood shares representing in the aggregate 5% or more of outstanding Sherwood shares at such time. It is anticipated that a special meeting of shareholders of Sherwood (the "Meeting") will be held at a time yet to be determined to approve the proposed transaction.

Under the terms of the Arrangement, each Sherwood shareholder will be entitled to 1.566 Capstone shares for every one Sherwood share held. Sherwood's outstanding options and warrants adjusted in accordance with their terms so that the number of Capstone shares received upon exercise and the exercise price are adjusted proportionately to reflect the exchange ratio described above.

The transaction is subject to the consent of Sherwood's lenders under the provisions of its debt facilities.

Following a change of control event in Sherwood, Capstone must, within 30 days of the occurrence of the change of control, make an offer to redeem all of Sherwood's convertible debentures then outstanding. The offer to purchase must be made at a purchase price equal to 101% of the principal amount of the debentures, plus accrued and unpaid interest thereon, if any, up to but excluding the date set for the completion of the offer to purchase. Capstone has had indications of interests from a financial institution in providing a debt facility up to the amount of the convertible debentures, should Capstone decide it wishes to avail itself of this option.

Capstone has engaged Scotia Capital as its financial adviser and Blake, Cassels & Graydon LLP as its legal advisor in respect of this transaction. Sherwood has engaged Haywood Securities Inc. as its financial advisor and Gowling Lafleur Henderson LLP as its legal advisor in respect of this transaction.

Conference Call

Capstone and Sherwood will hold a conference call at 11:00 AM Toronto time (8:00 AM Vancouver time) on Tuesday September 9, 2008 to allow shareholders, securities analysts and investors the opportunity to hear management discuss the business combination outlined herein. The call can be accessed by dialling (toll free) 1-866-334-3876 or at 416-849-4292. The call will also be webcast by Vcall; the call and presentation can be accessed at Capstone's or Sherwood's websites at www.capstonemining.com or www.sherwoodcopper.com, respectively. The call will also be available for replay by dialling (toll free) 1-866-245-6755 or 416-915-1035 (Passcode 130485) for 14 days.

About Capstone Mining

Capstone is a Canadian based mining company currently operating the 100% owned Cozamin copper-silver-lead-zinc mine located in Zacatecas State, Mexico. The Cozamin Mine produced 6.7 million pounds of copper at a total cash cost of US$0.90 per pound in the three months ended June 30, 2008. Capstone has approximately 80.3 million shares outstanding and is well financed with no bank debt, and approximately US$100 million in working capital and marketable securities as of June 30, 2008, based on current share prices.

Additional information on Capstone Mining and its Cozamin Mine is available on Capstone's website at http://www.capstonemining.com.

About Sherwood Copper

Sherwood Copper owns 100% of the high grade Minto copper-gold mine in Yukon, Canada, which was built on budget and ahead of schedule in 2007. The Minto Mine is one of the highest-grade open pit copper-gold mines in the world, and is forecast to be a low cost producer. With 140% growth in resources in two years, followed by a successful 2008 drilling program, Sherwood plans to evaluate options for further significant production expansions. Sherwood also has a 100% interest in the high grade Kutcho copper-zinc project in BC, Canada, which it is advancing towards production. The Minto Mine produced 12.8 million pounds of copper at a total cash cost of C$0.96 per pound in the three months ended June 30, 2008. Sherwood has approximately 53.8 million shares outstanding and, at June 30, 2008, had approximately $51.7 million in project related debt, $43.6 million in convertible debentures, and $8.1 million drawn against a corporate credit facility, after repaying US$16.9 million in the first six months of 2008.

Additional information on Sherwood and its Minto Mine can be obtained on Sherwood's website at http://www.sherwoodcopper.com.

Accordingly, readers should not place undue reliance on forward looking statements.

Neither the TSX Venture Exchange nor the TSX any accept responsibility for the adequacy or accuracy of this press release.

For more information, please contact

Capstone Mining Corp.

Darren Pylot

President & CEO

(604) 684-8894 or 1-866-684-8894

or

Capstone Mining Corp.

Chris Tomanik

(604) 684-8894 or 1-866-684-8894

or

Capstone Mining Corp.

Mark Patchett

(604) 684-8894 or 1-866-684-8894

Email: info@capstonemining.com

Website: www.capstonemining.com

Sep 08, 2008 10:23 ET

Osisko Announces Updated Resource Estimate for Canadian Malartic

MONTREAL, QUEBEC--(Marketwire - Sept. 8, 2008) - Osisko Mining Corp. (TSX:OSK)(FRANKFURT:EWX) is pleased to announce the updated National Instrument 43-101 compliant resource estimate for its 100%-owned Canadian Malartic gold deposit, located in the Abitibi region of Quebec, Canada. Micon International Limited of Toronto, Canada ("Micon"), independent resource estimate consultants for Osisko, has authorized the release of these estimates. Based on a lower cut-off grade of 0.36 g/t Au, Micon has estimated a global Measured and Indicated ("M&I") resource of 7.69 million ounces gold with an additional 720,000 ounces in the Inferred category. The tables below summarize results of the estimates using different lower cut-off grades:

Global resource estimates, variable lower cut-off grades

------- ------------------- ------------------- ---------------------

Measured Indicated Total Meas+Ind

------- ------------------- ------------------- ---------------------

Cut-off Tonnes Grade Oz Tonnes Grade Oz Tonnes Grade Oz

(g/t) (M) (g/t) (M) (M) (g/t) (M) (M) (g/t) (M)

--------------------------------------------------------------------------

0.30 4.94 1.25 0.20 263.18 0.93 7.87 268.12 0.94 8.07

--------------------------------------------------------------------------

0.36 4.83 1.27 0.20 227.42 1.02 7.49 232.25 1.03 7.69

--------------------------------------------------------------------------

0.40 4.75 1.28 0.20 208.14 1.08 7.26 212.89 1.09 7.45

--------------------------------------------------------------------------

0.50 4.42 1.34 0.19 170.01 1.23 6.71 174.44 1.23 6.90

--------------------------------------------------------------------------

0.60 4.08 1.41 0.18 141.96 1.36 6.21 146.04 1.36 6.40

--------------------------------------------------------------------------

0.70 3.60 1.51 0.17 121.86 1.48 5.80 125.46 1.48 5.97

--------------------------------------------------------------------------

0.80 3.20 1.61 0.16 106.74 1.58 5.43 109.94 1.58 5.60

--------------------------------------------------------------------------

0.90 2.89 1.69 0.16 94.95 1.67 5.11 97.84 1.67 5.27

--------------------------------------------------------------------------

1.00 2.66 1.75 0.15 85.69 1.75 4.83 88.35 1.75 4.98

--------------------------------------------------------------------------

--------------------------------------------

Inferred

--------------------------------------------

Cut-off (g/t) Tonnes (M) Grade (g/t) Oz (M)

--------------------------------------------

0.30 50.16 0.53 0.85

--------------------------------------------

0.36 37.44 0.60 0.72

--------------------------------------------

0.40 31.14 0.64 0.64

--------------------------------------------

0.50 20.02 0.75 0.48

--------------------------------------------

0.60 12.52 0.87 0.35

--------------------------------------------

0.70 6.99 1.04 0.23

--------------------------------------------

0.80 4.92 1.17 0.18

--------------------------------------------

0.90 3.35 1.32 0.14

--------------------------------------------

1.00 2.49 1.45 0.12

--------------------------------------------

Micon, in collaboration with G Mining Services Inc. of Montreal, also estimated an in-pit M&I resource within a Whittle-optimized pit shell using a base case gold price of US$775 per ounce, details with variable in-pit lower cut-off grades of which are shown in the following tables:

Resource estimates within US$775 Whittle pit shell, variable lower cut-off grades

------- ------------------- ------------------- ----------------- -----

Measured Indicated Total Meas+Ind Strip

Ratio

------- ------------------- ------------------- ----------------- -----

Cut-off Tonnes Grade Oz Tonnes Grade Oz Tonnes Grade Oz Waste/

(g/t) (M) (g/t) (M) (M) (g/t) (M) (M) (g/t) (M) Ore

--------------------------------------------------------------------------

0.30 4.63 1.27 0.19 192.15 1.04 6.43 196.78 1.05 6.62 1.43

--------------------------------------------------------------------------

0.36 4.54 1.29 0.19 173.71 1.12 6.23 178.25 1.12 6.42 1.69

--------------------------------------------------------------------------

0.40 4.47 1.31 0.19 163.38 1.16 6.11 167.85 1.17 6.29 1.85

--------------------------------------------------------------------------

0.50 4.16 1.37 0.18 140.52 1.28 5.78 144.68 1.28 5.96 2.31

--------------------------------------------------------------------------

0.60 3.84 1.44 0.18 120.81 1.40 5.43 124.66 1.40 5.61 2.84

--------------------------------------------------------------------------

0.70 3.40 1.54 0.17 105.96 1.50 5.12 109.36 1.50 5.29 3.38

--------------------------------------------------------------------------

0.80 3.04 1.63 0.16 94.20 1.60 4.84 97.24 1.60 5.00 3.93

--------------------------------------------------------------------------

0.90 2.79 1.70 0.15 84.57 1.68 4.57 87.36 1.68 4.73 4.48

--------------------------------------------------------------------------

1.00 2.58 1.76 0.15 76.95 1.75 4.34 79.52 1.76 4.49 5.02

--------------------------------------------------------------------------

--------------------------------------------

Inferred

--------------------------------------------

Cut-off (g/t) Tonnes (M) Grade (g/t) Oz (M)

--------------------------------------------

0.30 5.80 0.74 0.14

--------------------------------------------

0.36 5.03 0.81 0.13

--------------------------------------------

0.40 4.63 0.84 0.12

--------------------------------------------

0.50 3.70 0.94 0.11

--------------------------------------------

0.60 2.75 1.08 0.10

--------------------------------------------

0.70 1.95 1.26 0.08

--------------------------------------------

0.80 1.60 1.37 0.07

--------------------------------------------

0.90 1.32 1.48 0.06

--------------------------------------------

1.00 1.08 1.59 0.06

--------------------------------------------

Based on an updated ore-based cost of US$6.38 per tonne, the corresponding in-pit cut-off grade for the base case US$775/oz Whittle shell is 0.36 g/t gold, giving an in-pit M&I resource of 6.42 million ounces gold with an undiluted grade of 1.12g/t Au, as shown in the following table:

Distribution of Resource Estimates using base Case US$775 Whittle Pit Shell with a 0.36 g/t Au lower cut-off grade

---------- ---------------------------- ---------------------------

Total Meas+Ind Inferred

---------- ---------------------------- ---------------------------

Tonnes (M) Grade (g/t) Oz (M) Tonnes (M) Grade (g/t) Oz (M)

----------------------------------------------------------------------

Global (OK) 232.25 1.03 7.69 37.44 0.60 0.72

----------------------------------------------------------------------

In-Pit 178.25 1.12 6.42 5.03 0.81 0.13

----------------------------------------------------------------------

Out-of-Pit 54.00 0.73 1.27 32.41 0.57 0.59

----------------------------------------------------------------------

This Whittle pit shell is designed to maximize in-pit cash flow at 5% discount rate. The average gold recovery in this shell is 85.9%. Economic valuation within an optimized engineered pit design will be provided in the definitive feasibility study, which is currently under way and is expected to be tabled in Q4 2008. The out-of-pit M&I resource is estimated at 1.27 million ounces gold, and further pit optimizations using modified variables, such as increased pit slopes or gold price, may allow for eventual inclusion of some of this resource within the pit. Additional drilling is required to upgrade the remaining inferred resources.

Sean Roosen, President of Osisko, commented: "We are very pleased with the new global M&I resource estimate, which has achieved a 91% conversion rate and a 12% average grade increase with respect to last year's inferred resource estimate (286.2 Mt @ 0.92 g/t Au for 8.43 M oz gold). The in-pit M&I resource estimate of 6.42 million ounces is based on updated processing and mining costs that are going to be used in the definitive feasibility study. The focus of the latest work has been to optimize head grade throughput and annual gold output in the early years of mine life. The latest in-pit resource represents an 82% conversion rate and a 33% average undiluted grade increase with respect to the resource tabled in the March 2008 Preliminary Assessment Study (287.7 Mt @ 0.84 g/t Au for 7.79 M oz gold).

These are excellent results as we believe that by immediately incorporating the final feasibility mining and processing costs, this should allow for a very high conversion rate to probable reserves in the upcoming feasibility study. We also plan to carry out additional drilling in the hope of converting the remaining in-pit inferred ounces into the M&I category, and pit optimization studies will also be done in order to establish the viability of bringing in additional M&I resources into the pit shell.

I would also like to note that this resource estimate is limited to the main Canadian Malartic deposit and does not include other mineralized zones currently being drilled, particularly the South Barnat Zone, which offers excellent potential for higher grade material and further economic resource development.

To date, our drill programs have covered less than 5 percent of our property holdings in the Malartic area. We are highly encouraged by our progress at Canadian Malartic and we feel that Osisko shareholders can look forward to a very positive future as the Company continues to explore and develop this exceptional property.

Finally, I would like to thank all employees and consultants involved in the project to date, particularly the staff at Cygnus Consulting Inc. who are managing and executing our exploration and drilling program. The hard work and diligence provided by all were critical in allowing Osisko to achieve this important milestone."

Details on the parameters of the resource estimates are as follows:

- The database comprised a total of 228,800 metres of drilling obtained from historical drilling (Canadian Malartic Mines and Lac Minerals) and from approximately 316,200 metres of drilling completed and assayed by Osisko as of the end of April 2008 on a 30 m x 30 m grid.

- The estimates were done using Ordinary Kriging (OK) as the geostatistical interpolation method. Resources were also estimated using Inverse Distance Squared (ID2) interpolation, which produced similar results, generally two to three percent higher than the OK method, depending on the cut-off used.

- All estimates are based on a Parent Cell dimension of 20 metres E, 10 metres N and 10 metres height with estimation parameters determined by variography.

- Calculations are based on 5 metre composites cut to a maximum of 22 g/t Au in the higher grade domains (greater than 1 g/t Au) and cut to a maximum of 7 g/t Au in the lower grade domains. This resulted in an approximate 1 percent reduction in the overall gold content.

- Testing and validation of cut historical Canadian Malartic (CM) drill data using modern (Osisko) drill data revealed negligible bias in the higher grade domains but significant bias (minimum 25%) in the lower grade domains. CM historical data in lower grade domains were therefore discarded for resource estimate and resource classification purposes. CM historical data were used for resource estimate purposes in the higher grade domains but not retained for measured resource classification. Lac Minerals drill core was mostly re-assayed and these data were retained for resource estimate and resource classification purposes.

- The underground void model was adjusted according to new drill interceptions in stopes and drifts. All assays within 1.0 meter of voids were discarded.

- The US$775 Whittle shell has approximate maximum dimensions of 1925 metres in length, 850 metres in width and a vertical depth of 385 metres.

- Base case pit parameters include a maximum 55 degree inter-ramp angle, total operating expenses (OPEX) of $US10.38 per milled tonne. Calculated preliminary OPEX is $US335.60 per recovered ounce before dilution and royalties.

- Sensitivity of the in-pit M&I resource to gold price is as follows (inferred excluded):

--------------------------------------------------------------------------

Tonnes Grade Oz Lower Cut-off Strip Ratio

Gold Price (US$) (M) (g/t) (M) (g/t) (Waste/Ore)

--------------------------------------------------------------------------

$650 149.05 1.23 5.88 0.42 1.88

--------------------------------------------------------------------------

$775 178.25 1.12 6.42 0.36 1.69

--------------------------------------------------------------------------

$900 214.12 1.02 7.00 0.31 1.64

--------------------------------------------------------------------------

$1000 234.14 0.97 7.27 0.28 1.57

--------------------------------------------------------------------------

Osisko Mining Corp. is currently evaluating the Canadian Malartic gold deposit and adjacent areas for a large-scale open pit, bulk-tonnage mining operation. The Company is well-funded with approximately $155 million on hand and is carrying out an aggressive definition drilling and exploration campaign. The complete National Instrument 43-101 compliant report on this resource estimate will be filed on SEDAR within 45 days of the date of this news release. A NI 43-101 compliant Feasibility Study on the main Canadian Malartic gold deposit is scheduled for release in Q4 2008.

Mr. Terry Hennessey , P. Geo. of Micon International Limited, Mr. Elzear Belzile, P. Eng., Mr. Louis-Pierre Gignac, P. Eng. of G Mining Services Inc., and Mr. Robert Wares, P. Geo. and Executive Vice-President of Osisko, are the Qualified Persons who have reviewed this news release and are responsible for the technical information reported herein.

Cautionary Notes Concerning Estimates of Mineral Resources

This news release uses the terms measured, indicated and inferred resources as a relative measure of the level of confidence in the resource estimate. Readers are cautioned that the Canadian Malartic mineral resources are not economic mineral reserves and that the economic viability of resources that are not mineral reserves has not been demonstrated. In addition, inferred resources are considered too geologically speculative to have any economic considerations applied to them. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies or economic studies except for Preliminary Assessment as defined under NI 43-101. Readers are cautioned not to assume that that further work will lead to mineral reserves that can be mined economically.

Osisko Announces Updated Resource Estimate for Canadian Malartic

MONTREAL, QUEBEC--(Marketwire - Sept. 8, 2008) - Osisko Mining Corp. (TSX:OSK)(FRANKFURT:EWX) is pleased to announce the updated National Instrument 43-101 compliant resource estimate for its 100%-owned Canadian Malartic gold deposit, located in the Abitibi region of Quebec, Canada. Micon International Limited of Toronto, Canada ("Micon"), independent resource estimate consultants for Osisko, has authorized the release of these estimates. Based on a lower cut-off grade of 0.36 g/t Au, Micon has estimated a global Measured and Indicated ("M&I") resource of 7.69 million ounces gold with an additional 720,000 ounces in the Inferred category. The tables below summarize results of the estimates using different lower cut-off grades:

Global resource estimates, variable lower cut-off grades

------- ------------------- ------------------- ---------------------

Measured Indicated Total Meas+Ind

------- ------------------- ------------------- ---------------------

Cut-off Tonnes Grade Oz Tonnes Grade Oz Tonnes Grade Oz

(g/t) (M) (g/t) (M) (M) (g/t) (M) (M) (g/t) (M)

--------------------------------------------------------------------------

0.30 4.94 1.25 0.20 263.18 0.93 7.87 268.12 0.94 8.07

--------------------------------------------------------------------------

0.36 4.83 1.27 0.20 227.42 1.02 7.49 232.25 1.03 7.69

--------------------------------------------------------------------------

0.40 4.75 1.28 0.20 208.14 1.08 7.26 212.89 1.09 7.45

--------------------------------------------------------------------------

0.50 4.42 1.34 0.19 170.01 1.23 6.71 174.44 1.23 6.90

--------------------------------------------------------------------------

0.60 4.08 1.41 0.18 141.96 1.36 6.21 146.04 1.36 6.40

--------------------------------------------------------------------------

0.70 3.60 1.51 0.17 121.86 1.48 5.80 125.46 1.48 5.97

--------------------------------------------------------------------------

0.80 3.20 1.61 0.16 106.74 1.58 5.43 109.94 1.58 5.60

--------------------------------------------------------------------------

0.90 2.89 1.69 0.16 94.95 1.67 5.11 97.84 1.67 5.27

--------------------------------------------------------------------------

1.00 2.66 1.75 0.15 85.69 1.75 4.83 88.35 1.75 4.98

--------------------------------------------------------------------------

--------------------------------------------

Inferred

--------------------------------------------

Cut-off (g/t) Tonnes (M) Grade (g/t) Oz (M)

--------------------------------------------

0.30 50.16 0.53 0.85

--------------------------------------------

0.36 37.44 0.60 0.72

--------------------------------------------

0.40 31.14 0.64 0.64

--------------------------------------------

0.50 20.02 0.75 0.48

--------------------------------------------

0.60 12.52 0.87 0.35

--------------------------------------------

0.70 6.99 1.04 0.23

--------------------------------------------

0.80 4.92 1.17 0.18

--------------------------------------------

0.90 3.35 1.32 0.14

--------------------------------------------

1.00 2.49 1.45 0.12

--------------------------------------------

Micon, in collaboration with G Mining Services Inc. of Montreal, also estimated an in-pit M&I resource within a Whittle-optimized pit shell using a base case gold price of US$775 per ounce, details with variable in-pit lower cut-off grades of which are shown in the following tables:

Resource estimates within US$775 Whittle pit shell, variable lower cut-off grades

------- ------------------- ------------------- ----------------- -----

Measured Indicated Total Meas+Ind Strip

Ratio

------- ------------------- ------------------- ----------------- -----

Cut-off Tonnes Grade Oz Tonnes Grade Oz Tonnes Grade Oz Waste/

(g/t) (M) (g/t) (M) (M) (g/t) (M) (M) (g/t) (M) Ore

--------------------------------------------------------------------------

0.30 4.63 1.27 0.19 192.15 1.04 6.43 196.78 1.05 6.62 1.43

--------------------------------------------------------------------------

0.36 4.54 1.29 0.19 173.71 1.12 6.23 178.25 1.12 6.42 1.69

--------------------------------------------------------------------------

0.40 4.47 1.31 0.19 163.38 1.16 6.11 167.85 1.17 6.29 1.85

--------------------------------------------------------------------------

0.50 4.16 1.37 0.18 140.52 1.28 5.78 144.68 1.28 5.96 2.31

--------------------------------------------------------------------------

0.60 3.84 1.44 0.18 120.81 1.40 5.43 124.66 1.40 5.61 2.84

--------------------------------------------------------------------------

0.70 3.40 1.54 0.17 105.96 1.50 5.12 109.36 1.50 5.29 3.38

--------------------------------------------------------------------------

0.80 3.04 1.63 0.16 94.20 1.60 4.84 97.24 1.60 5.00 3.93

--------------------------------------------------------------------------

0.90 2.79 1.70 0.15 84.57 1.68 4.57 87.36 1.68 4.73 4.48

--------------------------------------------------------------------------

1.00 2.58 1.76 0.15 76.95 1.75 4.34 79.52 1.76 4.49 5.02

--------------------------------------------------------------------------

--------------------------------------------

Inferred

--------------------------------------------

Cut-off (g/t) Tonnes (M) Grade (g/t) Oz (M)

--------------------------------------------

0.30 5.80 0.74 0.14

--------------------------------------------

0.36 5.03 0.81 0.13

--------------------------------------------

0.40 4.63 0.84 0.12

--------------------------------------------

0.50 3.70 0.94 0.11

--------------------------------------------

0.60 2.75 1.08 0.10

--------------------------------------------

0.70 1.95 1.26 0.08

--------------------------------------------

0.80 1.60 1.37 0.07

--------------------------------------------

0.90 1.32 1.48 0.06

--------------------------------------------

1.00 1.08 1.59 0.06

--------------------------------------------

Based on an updated ore-based cost of US$6.38 per tonne, the corresponding in-pit cut-off grade for the base case US$775/oz Whittle shell is 0.36 g/t gold, giving an in-pit M&I resource of 6.42 million ounces gold with an undiluted grade of 1.12g/t Au, as shown in the following table:

Distribution of Resource Estimates using base Case US$775 Whittle Pit Shell with a 0.36 g/t Au lower cut-off grade

---------- ---------------------------- ---------------------------

Total Meas+Ind Inferred

---------- ---------------------------- ---------------------------

Tonnes (M) Grade (g/t) Oz (M) Tonnes (M) Grade (g/t) Oz (M)

----------------------------------------------------------------------

Global (OK) 232.25 1.03 7.69 37.44 0.60 0.72

----------------------------------------------------------------------

In-Pit 178.25 1.12 6.42 5.03 0.81 0.13

----------------------------------------------------------------------

Out-of-Pit 54.00 0.73 1.27 32.41 0.57 0.59

----------------------------------------------------------------------

This Whittle pit shell is designed to maximize in-pit cash flow at 5% discount rate. The average gold recovery in this shell is 85.9%. Economic valuation within an optimized engineered pit design will be provided in the definitive feasibility study, which is currently under way and is expected to be tabled in Q4 2008. The out-of-pit M&I resource is estimated at 1.27 million ounces gold, and further pit optimizations using modified variables, such as increased pit slopes or gold price, may allow for eventual inclusion of some of this resource within the pit. Additional drilling is required to upgrade the remaining inferred resources.

Sean Roosen, President of Osisko, commented: "We are very pleased with the new global M&I resource estimate, which has achieved a 91% conversion rate and a 12% average grade increase with respect to last year's inferred resource estimate (286.2 Mt @ 0.92 g/t Au for 8.43 M oz gold). The in-pit M&I resource estimate of 6.42 million ounces is based on updated processing and mining costs that are going to be used in the definitive feasibility study. The focus of the latest work has been to optimize head grade throughput and annual gold output in the early years of mine life. The latest in-pit resource represents an 82% conversion rate and a 33% average undiluted grade increase with respect to the resource tabled in the March 2008 Preliminary Assessment Study (287.7 Mt @ 0.84 g/t Au for 7.79 M oz gold).

These are excellent results as we believe that by immediately incorporating the final feasibility mining and processing costs, this should allow for a very high conversion rate to probable reserves in the upcoming feasibility study. We also plan to carry out additional drilling in the hope of converting the remaining in-pit inferred ounces into the M&I category, and pit optimization studies will also be done in order to establish the viability of bringing in additional M&I resources into the pit shell.

I would also like to note that this resource estimate is limited to the main Canadian Malartic deposit and does not include other mineralized zones currently being drilled, particularly the South Barnat Zone, which offers excellent potential for higher grade material and further economic resource development.

To date, our drill programs have covered less than 5 percent of our property holdings in the Malartic area. We are highly encouraged by our progress at Canadian Malartic and we feel that Osisko shareholders can look forward to a very positive future as the Company continues to explore and develop this exceptional property.

Finally, I would like to thank all employees and consultants involved in the project to date, particularly the staff at Cygnus Consulting Inc. who are managing and executing our exploration and drilling program. The hard work and diligence provided by all were critical in allowing Osisko to achieve this important milestone."

Details on the parameters of the resource estimates are as follows:

- The database comprised a total of 228,800 metres of drilling obtained from historical drilling (Canadian Malartic Mines and Lac Minerals) and from approximately 316,200 metres of drilling completed and assayed by Osisko as of the end of April 2008 on a 30 m x 30 m grid.

- The estimates were done using Ordinary Kriging (OK) as the geostatistical interpolation method. Resources were also estimated using Inverse Distance Squared (ID2) interpolation, which produced similar results, generally two to three percent higher than the OK method, depending on the cut-off used.

- All estimates are based on a Parent Cell dimension of 20 metres E, 10 metres N and 10 metres height with estimation parameters determined by variography.

- Calculations are based on 5 metre composites cut to a maximum of 22 g/t Au in the higher grade domains (greater than 1 g/t Au) and cut to a maximum of 7 g/t Au in the lower grade domains. This resulted in an approximate 1 percent reduction in the overall gold content.

- Testing and validation of cut historical Canadian Malartic (CM) drill data using modern (Osisko) drill data revealed negligible bias in the higher grade domains but significant bias (minimum 25%) in the lower grade domains. CM historical data in lower grade domains were therefore discarded for resource estimate and resource classification purposes. CM historical data were used for resource estimate purposes in the higher grade domains but not retained for measured resource classification. Lac Minerals drill core was mostly re-assayed and these data were retained for resource estimate and resource classification purposes.

- The underground void model was adjusted according to new drill interceptions in stopes and drifts. All assays within 1.0 meter of voids were discarded.

- The US$775 Whittle shell has approximate maximum dimensions of 1925 metres in length, 850 metres in width and a vertical depth of 385 metres.

- Base case pit parameters include a maximum 55 degree inter-ramp angle, total operating expenses (OPEX) of $US10.38 per milled tonne. Calculated preliminary OPEX is $US335.60 per recovered ounce before dilution and royalties.

- Sensitivity of the in-pit M&I resource to gold price is as follows (inferred excluded):

--------------------------------------------------------------------------

Tonnes Grade Oz Lower Cut-off Strip Ratio

Gold Price (US$) (M) (g/t) (M) (g/t) (Waste/Ore)

--------------------------------------------------------------------------

$650 149.05 1.23 5.88 0.42 1.88

--------------------------------------------------------------------------

$775 178.25 1.12 6.42 0.36 1.69

--------------------------------------------------------------------------

$900 214.12 1.02 7.00 0.31 1.64

--------------------------------------------------------------------------

$1000 234.14 0.97 7.27 0.28 1.57

--------------------------------------------------------------------------

Osisko Mining Corp. is currently evaluating the Canadian Malartic gold deposit and adjacent areas for a large-scale open pit, bulk-tonnage mining operation. The Company is well-funded with approximately $155 million on hand and is carrying out an aggressive definition drilling and exploration campaign. The complete National Instrument 43-101 compliant report on this resource estimate will be filed on SEDAR within 45 days of the date of this news release. A NI 43-101 compliant Feasibility Study on the main Canadian Malartic gold deposit is scheduled for release in Q4 2008.

Mr. Terry Hennessey , P. Geo. of Micon International Limited, Mr. Elzear Belzile, P. Eng., Mr. Louis-Pierre Gignac, P. Eng. of G Mining Services Inc., and Mr. Robert Wares, P. Geo. and Executive Vice-President of Osisko, are the Qualified Persons who have reviewed this news release and are responsible for the technical information reported herein.

Cautionary Notes Concerning Estimates of Mineral Resources

This news release uses the terms measured, indicated and inferred resources as a relative measure of the level of confidence in the resource estimate. Readers are cautioned that the Canadian Malartic mineral resources are not economic mineral reserves and that the economic viability of resources that are not mineral reserves has not been demonstrated. In addition, inferred resources are considered too geologically speculative to have any economic considerations applied to them. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies or economic studies except for Preliminary Assessment as defined under NI 43-101. Readers are cautioned not to assume that that further work will lead to mineral reserves that can be mined economically.

[url=http://peketec.de/trading/viewtopic.php?p=474127#474127 schrieb:dukezero schrieb am 08.09.2008, 16:03 Uhr[/url]"]» zur Grafik

Bei AE6 Käufe aus dem ASK auch in Canada.

MMT MART RESOURCES INC 194,846 -1,276,654

RXR REECE ENERGY EXPLORATIONCORP 495,000 -1,112,900

GLW GOLD WHEATON GOLD CORP 1,208,800 -1,055,800

TEN TERRACO GOLD CORP 0 -1,022,000

DNI DUMONT NICKEL INC 0 -950,000

LGOLARGO RESOURCES LTD 749,000 -788,500

IAE ITHACA ENERGY INC125,100 -787,248

RAY RAYTEC METALS CORP 1,103,500 -554,833

PWPANWESTERN ENERGY INC 0 -488,800

AZA ARGENTA OIL & GAS INC1,385,087 -465,913

SST SILVERSTONE RESOURCES CORP 122,900 -442,710

PONPOTASH NORTH RESOURCE CORP 937,381 -380,685

MAA MAGINDUSTRIES CORP702,053 -364,204

CDB CLOUDBREAK RESOURCES LTD45,000 -316,000

CYP CYPRESS DEVELOPMENT CORP 0 -300,000

SLG STERLINGRESOURCES LTD 371,500 -296,400

WCI WARATAH COAL INC 570,400 -292,060MAZ.H MAZARIN INC 0 -290,000

YLL YALE RESOURCES LTD 0 -263,000

RXR REECE ENERGY EXPLORATIONCORP 495,000 -1,112,900

GLW GOLD WHEATON GOLD CORP 1,208,800 -1,055,800

TEN TERRACO GOLD CORP 0 -1,022,000

DNI DUMONT NICKEL INC 0 -950,000

LGOLARGO RESOURCES LTD 749,000 -788,500

IAE ITHACA ENERGY INC125,100 -787,248

RAY RAYTEC METALS CORP 1,103,500 -554,833

PWPANWESTERN ENERGY INC 0 -488,800

AZA ARGENTA OIL & GAS INC1,385,087 -465,913

SST SILVERSTONE RESOURCES CORP 122,900 -442,710

PONPOTASH NORTH RESOURCE CORP 937,381 -380,685

MAA MAGINDUSTRIES CORP702,053 -364,204

CDB CLOUDBREAK RESOURCES LTD45,000 -316,000

CYP CYPRESS DEVELOPMENT CORP 0 -300,000

SLG STERLINGRESOURCES LTD 371,500 -296,400

WCI WARATAH COAL INC 570,400 -292,060MAZ.H MAZARIN INC 0 -290,000

YLL YALE RESOURCES LTD 0 -263,000

Wasn das?

Edit: Shortpositionen?

Edit: Shortpositionen?

[url=http://peketec.de/trading/viewtopic.php?p=474233#474233 schrieb:dukezero schrieb am 08.09.2008, 18:00 Uhr[/url]"]MMT MART RESOURCES INC 194,846 -1,276,654

RXR REECE ENERGY EXPLORATIONCORP 495,000 -1,112,900

GLW GOLD WHEATON GOLD CORP 1,208,800 -1,055,800

TEN TERRACO GOLD CORP 0 -1,022,000

DNI DUMONT NICKEL INC 0 -950,000

LGOLARGO RESOURCES LTD 749,000 -788,500

IAE ITHACA ENERGY INC125,100 -787,248

RAY RAYTEC METALS CORP 1,103,500 -554,833

PWPANWESTERN ENERGY INC 0 -488,800

AZA ARGENTA OIL & GAS INC1,385,087 -465,913

SST SILVERSTONE RESOURCES CORP 122,900 -442,710

PONPOTASH NORTH RESOURCE CORP 937,381 -380,685

MAA MAGINDUSTRIES CORP702,053 -364,204

CDB CLOUDBREAK RESOURCES LTD45,000 -316,000

CYP CYPRESS DEVELOPMENT CORP 0 -300,000

SLG STERLINGRESOURCES LTD 371,500 -296,400

WCI WARATAH COAL INC 570,400 -292,060MAZ.H MAZARIN INC 0 -290,000

YLL YALE RESOURCES LTD 0 -263,000

[url=http://peketec.de/trading/viewtopic.php?p=474254#474254 schrieb:dukezero schrieb am 08.09.2008, 18:19 Uhr[/url]"]Ja,sorry vergessen!

Kein Thema duke

Naja man sieht die Shorts werden gecovert.... aber am Markt (Rohstoffsektor) wird derzeit fast alles in Richtung Buchwert geschossen...unglaublich. Hatte eigentlich ein gutes Gefühl für nen ersten Rebound die Tage aber das sieht wieder nicht wirklich gut aus.

Vancouver - Largo Resources' (LGO-V) hunt for higher grade molybdenum at Northern Dancer appears to be paying off.

Based on drill results from its 2006 and 2007 campaigns Largo Resourcesoutlined an indicated resource of 141 million tonnes grading 0.1%tungsten and 0.026% moly at the Yukon property, 290 km southeast ofWhitehorse by road.

But this summer the company's drills targeted areas where itbelieved higher grade moly and tungsten might be uncovered. Largo hadpreviously noted higher grades of tungsten in the southwest portion ofthe mineralized area and higher grades of moly in the northeast.

"The focus at Northern Dancer has been on defining higher gradeareas of both tungsten and molybdenum, not on increasing the tonnage ofthe mineralized area itself," Largo president and CEO Mark Brennan says.

The first eight holes - most collared in the northeast - from the 38 hole 2008 program look to confirm Largo's instincts.

Starting at a depth of 37 metres hole 101 returned 50 metres grading0.13% tungsten and 0.117 % moly. A couple hundred metres to thesoutheast of that hole, Largo cut 31 near-surface metres in hole 97grading 0.08% tungsten and 0.048% moly and another 75 metres grading0.04% tungsten and 0.063% moly.

And about 100 metres to the west of hole 101 Largo intersected 50metres grading 0.09% tungsten and 0.079% moly starting 98 metres belowsurface.

So far Largo has outlined a mineralized area about 1,500 metreslong, 600 metres wide and to a depth of 500 metres. It is open alongstrike and at depth.

Brennan says a scoping study for the project will be out in the next couple weeks.

As for Largo's other project, the Maracas vanadium property inBrazil, Brennan says Largo continues to seek funding for a mine withcapital costs estimated at $271 million dollars.

Although he says all options are on the table, "the ultimate objective we're looking at is debt financing."

Largo produced a feasibility study on Maracas mid-August which isestimated to hold reserves of 13.1 million tonnes grading 1.34%V<sub>2</sub>O<sub>5</sub>.

On news of the Northern Dancer drill results, Largo's share price gained 0.5¢ to close at 38.5¢.

from Northern Miner, September 5. Some comments from Brennan included.

Based on drill results from its 2006 and 2007 campaigns Largo Resourcesoutlined an indicated resource of 141 million tonnes grading 0.1%tungsten and 0.026% moly at the Yukon property, 290 km southeast ofWhitehorse by road.

But this summer the company's drills targeted areas where itbelieved higher grade moly and tungsten might be uncovered. Largo hadpreviously noted higher grades of tungsten in the southwest portion ofthe mineralized area and higher grades of moly in the northeast.

"The focus at Northern Dancer has been on defining higher gradeareas of both tungsten and molybdenum, not on increasing the tonnage ofthe mineralized area itself," Largo president and CEO Mark Brennan says.

The first eight holes - most collared in the northeast - from the 38 hole 2008 program look to confirm Largo's instincts.

Starting at a depth of 37 metres hole 101 returned 50 metres grading0.13% tungsten and 0.117 % moly. A couple hundred metres to thesoutheast of that hole, Largo cut 31 near-surface metres in hole 97grading 0.08% tungsten and 0.048% moly and another 75 metres grading0.04% tungsten and 0.063% moly.

And about 100 metres to the west of hole 101 Largo intersected 50metres grading 0.09% tungsten and 0.079% moly starting 98 metres belowsurface.

So far Largo has outlined a mineralized area about 1,500 metreslong, 600 metres wide and to a depth of 500 metres. It is open alongstrike and at depth.

Brennan says a scoping study for the project will be out in the next couple weeks.

As for Largo's other project, the Maracas vanadium property inBrazil, Brennan says Largo continues to seek funding for a mine withcapital costs estimated at $271 million dollars.

Although he says all options are on the table, "the ultimate objective we're looking at is debt financing."

Largo produced a feasibility study on Maracas mid-August which isestimated to hold reserves of 13.1 million tonnes grading 1.34%V<sub>2</sub>O<sub>5</sub>.

On news of the Northern Dancer drill results, Largo's share price gained 0.5¢ to close at 38.5¢.

from Northern Miner, September 5. Some comments from Brennan included.

Jep... hab ich bereits gelesen. Auch unglaublich wie die geschlachtet wird.

Bohrergebnisse Maracas stehen an und die Scoping Study zu Northern Dancer soll die Tage kommen. Die letzten Ergebnisse waren mit die besten beim Northern Dancer Projekt. Bringt alles nichts derzeit.....wird auf breiter Front alles rausgehauen.

Bohrergebnisse Maracas stehen an und die Scoping Study zu Northern Dancer soll die Tage kommen. Die letzten Ergebnisse waren mit die besten beim Northern Dancer Projekt. Bringt alles nichts derzeit.....wird auf breiter Front alles rausgehauen.

[url=http://peketec.de/trading/viewtopic.php?p=474288#474288 schrieb:dukezero schrieb am 08.09.2008, 19:03 Uhr[/url]"]Vancouver - Largo Resources' (LGO-V) hunt for higher grade molybdenum at Northern Dancer appears to be paying off.

Based on drill results from its 2006 and 2007 campaigns Largo Resourcesoutlined an indicated resource of 141 million tonnes grading 0.1%tungsten and 0.026% moly at the Yukon property, 290 km southeast ofWhitehorse by road.

But this summer the company's drills targeted areas where itbelieved higher grade moly and tungsten might be uncovered. Largo hadpreviously noted higher grades of tungsten in the southwest portion ofthe mineralized area and higher grades of moly in the northeast.

"The focus at Northern Dancer has been on defining higher gradeareas of both tungsten and molybdenum, not on increasing the tonnage ofthe mineralized area itself," Largo president and CEO Mark Brennan says.

The first eight holes - most collared in the northeast - from the 38 hole 2008 program look to confirm Largo's instincts.

Starting at a depth of 37 metres hole 101 returned 50 metres grading0.13% tungsten and 0.117 % moly. A couple hundred metres to thesoutheast of that hole, Largo cut 31 near-surface metres in hole 97grading 0.08% tungsten and 0.048% moly and another 75 metres grading0.04% tungsten and 0.063% moly.

And about 100 metres to the west of hole 101 Largo intersected 50metres grading 0.09% tungsten and 0.079% moly starting 98 metres belowsurface.

So far Largo has outlined a mineralized area about 1,500 metreslong, 600 metres wide and to a depth of 500 metres. It is open alongstrike and at depth.

Brennan says a scoping study for the project will be out in the next couple weeks.

As for Largo's other project, the Maracas vanadium property inBrazil, Brennan says Largo continues to seek funding for a mine withcapital costs estimated at $271 million dollars.

Although he says all options are on the table, "the ultimate objective we're looking at is debt financing."

Largo produced a feasibility study on Maracas mid-August which isestimated to hold reserves of 13.1 million tonnes grading 1.34%V<sub>2</sub>O<sub>5</sub>.

On news of the Northern Dancer drill results, Largo's share price gained 0.5¢ to close at 38.5¢.

from Northern Miner, September 5. Some comments from Brennan included.

[url=http://peketec.de/trading/viewtopic.php?p=474318#474318 schrieb:dukezero schrieb am 08.09.2008, 19:55 Uhr[/url]"]Ich halte mein Pulver trocken. Das schnellt auf Jahresendsicht so zurück!

Übersetzt du rechnest mit einem massiven Rebound im Sektor zum Jahresende???

Also was da derzeit mit einigen Werten passiert ist eigentlich schon nur noch lachhaft....

[url=http://peketec.de/trading/viewtopic.php?p=474319#474319 schrieb:Ollinho schrieb am 08.09.2008, 19:56 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=474318#474318 schrieb:dukezero schrieb am 08.09.2008, 19:55 Uhr[/url]"]Ich halte mein Pulver trocken. Das schnellt auf Jahresendsicht so zurück!

Übersetzt du rechnest mit einem massiven Rebound im Sektor zum Jahresende???

Also was da derzeit mit einigen Werten passiert ist eigentlich schon nur noch lachhaft....

Habe mir vor einigen Tagen die MKs von einigen Werten angesehen. Das sind derzeit Bewertungen die schlichtweg nicht nachvollziehbar sind. Einziges Szenario ist die Vorstellung, dass weiter massiv von Seiten der Hedgefonds, Fonds, Banken etc. ohne Rücksicht auf Verluste liquidiert werden muss! Könnte dadurch ein Dominoeffekt ausgelöst worden sein, der auf den eh schon grotesken Niveaus ne weitere VK-Welle auslöst usw......

Aber außer eingen Vermutungen bleibt uns eh nichts...

[url=http://peketec.de/trading/viewtopic.php?p=474330#474330 schrieb:dukezero schrieb am 08.09.2008, 20:06 Uhr[/url]"]Einige meiner Werte werden übenommen werden!! Einen massiven Rebound wird es nicht geben,-

aber einen langanhaltenden stetigen.

Welche Gründe legst du dafür zugrunde? Ich habe schon einige Ups and Downs im Sektor mitgemacht aber nicht in diesem "Cocktail" mit der Finanzkrise etc.

Bei Unternehmen, deren interne Entwicklung stimmt und die bereits weit fortgeschritten sind bzw. Produzenten, die profitabel agieren amche ich mir mittel- bis langfristig keine Sorgen. Nur das Timing kann ich derzeit nicht abschätzen.....welche Faktoren ziehst du heran oder reines Bauchgefühl aufgrund der grotesken Marktbewertungen?

OSK und LGO im freien Fall

[url=http://peketec.de/trading/viewtopic.php?p=474384#474384 schrieb:

Schon extrem! Aber das Umfeld ist einfach dermaßen mißerabel für den Sektor dass es nur einen Trend gibt derzeit. Ein Kursniveau wie bei einem uninteressanten Grasroot-Explorer. Wahnsinn und dabei hat man mit Maracas ein verdammt profitables Projekt in der Pipeline.

Bin gespannt wann Largo dreht. Schon heftig wie die Märkte aktuell drauf sind!

Bei Osisko bin ich weniger gut informiert. Greenhorn ist da eher der Fachmann

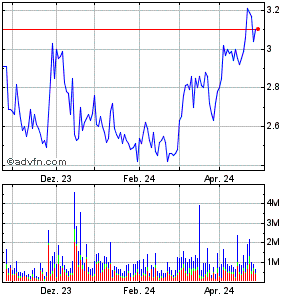

Die Charts sagen mehr als jedes Wort :shock:

Nur wenige Beispiele im Explorermarkt..

LGO

OSK

NG

ADY

TJS

Nur wenige Beispiele im Explorermarkt..

LGO

OSK

NG

ADY

TJS

[url=http://peketec.de/trading/viewtopic.php?p=474384#474384 schrieb:

Da gebe ich dir Recht, die Bewertungen sind jenseits jeglicher Rationalität.

Dazu kommt heute eine unverständiche Devisenreaktion, die XAU und HUI weiter auf Talfahrt schickt. Hier wurde/wird im großen Stil Geld aus den Rohstoffmärkten abgezogen..

Die größten Leidtragenden sind in diesen Zeiten die Smallcaps, was nicht wirklich verwunderlich ist, wenn man sich die finanziellen Unsicherheiten und das enorme Risikokapital in der Branche anschaut.

Was mich hier seit einiger Zeit trotzdem erstaunt, ist, dass wir nicht mal annähernd eine Gegenbewegung sehen, keine technische, keine fundamentale, free fall..

Dazu kommt heute eine unverständiche Devisenreaktion, die XAU und HUI weiter auf Talfahrt schickt. Hier wurde/wird im großen Stil Geld aus den Rohstoffmärkten abgezogen..

Die größten Leidtragenden sind in diesen Zeiten die Smallcaps, was nicht wirklich verwunderlich ist, wenn man sich die finanziellen Unsicherheiten und das enorme Risikokapital in der Branche anschaut.

Was mich hier seit einiger Zeit trotzdem erstaunt, ist, dass wir nicht mal annähernd eine Gegenbewegung sehen, keine technische, keine fundamentale, free fall..

[url=http://peketec.de/trading/viewtopic.php?p=474385#474385 schrieb:Ollinho schrieb am 08.09.2008, 21:43 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=474384#474384 schrieb:

Schon extrem! Aber das Umfeld ist einfach dermaßen mißerabel für den Sektor dass es nur einen Trend gibt derzeit. Ein Kursniveau wie bei einem uninteressanten Grasroot-Explorer. Wahnsinn und dabei hat man mit Maracas ein verdammt profitables Projekt in der Pipeline.

Bin gespannt wann Largo dreht. Schon heftig wie die Märkte aktuell drauf sind!

Bei Osisko bin ich weniger gut informiert. Greenhorn ist da eher der Fachmann.

Jep...harte Zeiten ohne Frage!

Schau Dir 100 Charts aus dem Sektor an und du siehst den selben gnadenlosen Abverkauf!

Werden keine Unterschiede mehr gemacht, fundamentaler Entwicklungsstand, Projektstatus etc. alles uninteressant. Ist schon hart mitanzusehen aber ich kann mir nicht vorstellen, dass das ewig so weitergeht.

Auch bin ich nicht dermaßen bearish in sachen Rohstoffpreisen. Die Charts implizieren ja ne Nachfrage die gegen null geht. Wird sehr interessant sein, wie sich die Märkte die nächsten Wochen und Monate verhalten werden.

Wie ist Deine Einschätzung? Ähnlich wie Duke bzw. welche Erfahrungswerte legst du zugrunde. Mal nen kleinen Sentiment-Test machen....

Schau Dir 100 Charts aus dem Sektor an und du siehst den selben gnadenlosen Abverkauf!

Werden keine Unterschiede mehr gemacht, fundamentaler Entwicklungsstand, Projektstatus etc. alles uninteressant. Ist schon hart mitanzusehen aber ich kann mir nicht vorstellen, dass das ewig so weitergeht.

Auch bin ich nicht dermaßen bearish in sachen Rohstoffpreisen. Die Charts implizieren ja ne Nachfrage die gegen null geht. Wird sehr interessant sein, wie sich die Märkte die nächsten Wochen und Monate verhalten werden.

Wie ist Deine Einschätzung? Ähnlich wie Duke bzw. welche Erfahrungswerte legst du zugrunde. Mal nen kleinen Sentiment-Test machen....

[url=http://peketec.de/trading/viewtopic.php?p=474386#474386 schrieb:golden_times schrieb am 08.09.2008, 21:46 Uhr[/url]"]Die Charts sagen mehr als jedes Wort :shock:

Nur wenige Beispiele im Explorermarkt..

LGO

» zur Grafik

OSK

» zur Grafik

NG

» zur Grafik

ADY

» zur Grafik

TJS

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=474384#474384 schrieb:

[url=http://peketec.de/trading/viewtopic.php?p=474393#474393 schrieb:dukezero schrieb am 08.09.2008, 21:58 Uhr[/url]"]Bei Largo hat man z.b. einen fetten Uptrend gehabt. Hier sind Shorties gegrillt worden. Das wird es auch weiter geben. Grundlage ist,-das richtige Interpretieren von News.

Klar. Siehst du bei Largo ernsthafte Probleme bzw. konntest du aus den letzten Meldungen signifikante fundamentale Negierungen erkennen?

Mir fiel nichts auf. Im Gegenteil haben mich die letzte Bohrergebnisse von ND gar positiv überrascht.

Wobei ich aber mehr wert auf Maracas lege weil da 2010 die Produktion starten könnte und die Studien doch sehr vielversprechend sind.

Mit Ausnahme weniger Werte ist der Markt seit Sommer 2007 sehr schwierig geworden.

Interessant finde ich, dass der Abverkauf der Juniors und Smallcapstocks schon erheblich länger anhält, als der Abverkauf der Producer und Big Player. Hier sahen wir bis Mitte des Jahres noch viele Höchstkurse. In den letzten Wochen haben die großen Rohstoffunternehmen Hand in Hand mit den Edelmetallen und auch den meisten Industriemetallen den downtrend beschleunigt.

Viele dachten der Explorermarkt war Mitte 2008 am Tiefpunkt, seither ist er in weiten Strecken noch erheblich weiter eingebrochen. Es ist keine Seltenheit mehr, dass einige Explorer nahe am Cashwert bewertet sind. Explorer, die bereits weltkonforme Ressourcenbestätigungen vorweisen können und in profitablen Projekten und Projektlplanungen involviert sind, bleiben oft nur noch einige institutionellen Investoren.

Der Markt ignoriert seit vielen Monaten die fundamentalen Daten, das Risiko dieser Investments scheint zu groß zu sein, die Investoren fehlen, das Vertrauen liegt am Tiefpunkt. Dazu haben sicherlich auch die (deutschen) BBs beigetragen, die viele Werte (leider auch einige richtig gute) aufgrund von fernen Spekualtionen gepusht haben, die wenigsten haben sich an den fundamentalen Daten orientiert und ihre Informationen anderen Quellen vorgezogen.

Die meisten Explorer hätten ATHs in diesen Kursregionen ohne diese BBs nie gesehen..

Kann mir gut vorstellen, dass viele Explorer, in erster Linie die unzureichend finanzierten, weiter die jungfräulichen Juniorexplorer, diese Krise nicht überleben werden.

Trotz allem Pessimismus, den eklatanten Bewertungen und diesem großen Abverkauf bin ich für die Rohstoffbranche weiterhin optimistisch. Es mag sein, dass sich die Weltkonjunktur verlangsamen wird und auch die Entwicklungs- und Schwellenländer zurückschrauben müssen, weil sie der akuten Inflation auch trotz scheinbar großem kontinuierlichem Wachstum nicht mehr entgegenwirken können. Eine vllt notwendige Korrektur in einem überhitzten Markt,;wie lange und wie stark diese ausfallen wird, darauf gilt es bestens zu spekulieren..

Mit jedem weiteren schwierigen Tag in der Explorerbranche, wächst die Chance auf eine fulminante Rallye in neue Höhen. Sehe in diesen Zeiten beste Opportunitäten qualitativ ausgewählte Explorer in allen Segmenten sehr lukrativ zu erwerben. Eine Sicherheit für die optisch günstigen Kurse gibt uns niemand, aber deshalb sind wie ja an der Börse, weil wir von der Spekulation leben..

Be patient. & gn8

Interessant finde ich, dass der Abverkauf der Juniors und Smallcapstocks schon erheblich länger anhält, als der Abverkauf der Producer und Big Player. Hier sahen wir bis Mitte des Jahres noch viele Höchstkurse. In den letzten Wochen haben die großen Rohstoffunternehmen Hand in Hand mit den Edelmetallen und auch den meisten Industriemetallen den downtrend beschleunigt.

Viele dachten der Explorermarkt war Mitte 2008 am Tiefpunkt, seither ist er in weiten Strecken noch erheblich weiter eingebrochen. Es ist keine Seltenheit mehr, dass einige Explorer nahe am Cashwert bewertet sind. Explorer, die bereits weltkonforme Ressourcenbestätigungen vorweisen können und in profitablen Projekten und Projektlplanungen involviert sind, bleiben oft nur noch einige institutionellen Investoren.

Der Markt ignoriert seit vielen Monaten die fundamentalen Daten, das Risiko dieser Investments scheint zu groß zu sein, die Investoren fehlen, das Vertrauen liegt am Tiefpunkt. Dazu haben sicherlich auch die (deutschen) BBs beigetragen, die viele Werte (leider auch einige richtig gute) aufgrund von fernen Spekualtionen gepusht haben, die wenigsten haben sich an den fundamentalen Daten orientiert und ihre Informationen anderen Quellen vorgezogen.

Die meisten Explorer hätten ATHs in diesen Kursregionen ohne diese BBs nie gesehen..

Kann mir gut vorstellen, dass viele Explorer, in erster Linie die unzureichend finanzierten, weiter die jungfräulichen Juniorexplorer, diese Krise nicht überleben werden.

Trotz allem Pessimismus, den eklatanten Bewertungen und diesem großen Abverkauf bin ich für die Rohstoffbranche weiterhin optimistisch. Es mag sein, dass sich die Weltkonjunktur verlangsamen wird und auch die Entwicklungs- und Schwellenländer zurückschrauben müssen, weil sie der akuten Inflation auch trotz scheinbar großem kontinuierlichem Wachstum nicht mehr entgegenwirken können. Eine vllt notwendige Korrektur in einem überhitzten Markt,;wie lange und wie stark diese ausfallen wird, darauf gilt es bestens zu spekulieren..

Mit jedem weiteren schwierigen Tag in der Explorerbranche, wächst die Chance auf eine fulminante Rallye in neue Höhen. Sehe in diesen Zeiten beste Opportunitäten qualitativ ausgewählte Explorer in allen Segmenten sehr lukrativ zu erwerben. Eine Sicherheit für die optisch günstigen Kurse gibt uns niemand, aber deshalb sind wie ja an der Börse, weil wir von der Spekulation leben..

Be patient. & gn8

[url=http://peketec.de/trading/viewtopic.php?p=474391#474391 schrieb:Ollinho schrieb am 08.09.2008, 21:55 Uhr[/url]"]Jep...harte Zeiten ohne Frage!

Schau Dir 100 Charts aus dem Sektor an und du siehst den selben gnadenlosen Abverkauf!

Werden keine Unterschiede mehr gemacht, fundamentaler Entwicklungsstand, Projektstatus etc. alles uninteressant. Ist schon hart mitanzusehen aber ich kann mir nicht vorstellen, dass das ewig so weitergeht.

Auch bin ich nicht dermaßen bearish in sachen Rohstoffpreisen. Die Charts implizieren ja ne Nachfrage die gegen null geht. Wird sehr interessant sein, wie sich die Märkte die nächsten Wochen und Monate verhalten werden.

Wie ist Deine Einschätzung? Ähnlich wie Duke bzw. welche Erfahrungswerte legst du zugrunde. Mal nen kleinen Sentiment-Test machen....

[url=http://peketec.de/trading/viewtopic.php?p=474386#474386 schrieb:golden_times schrieb am 08.09.2008, 21:46 Uhr[/url]"]Die Charts sagen mehr als jedes Wort :shock:

Nur wenige Beispiele im Explorermarkt..

LGO

» zur Grafik

OSK

» zur Grafik

NG

» zur Grafik

ADY

» zur Grafik

TJS

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=474384#474384 schrieb:

Sauber geschrieben!!

Gute Nacht!

Gute Nacht!

[url=http://peketec.de/trading/viewtopic.php?p=474397#474397 schrieb:golden_times schrieb am 08.09.2008, 22:27 Uhr[/url]"]Mit Ausnahme weniger Werte ist der Markt seit Sommer 2007 sehr schwierig geworden.

Interessant finde ich, dass der Abverkauf der Juniors und Smallcapstocks schon erheblich länger anhält, als der Abverkauf der Producer und Big Player. Hier sahen wir bis Mitte des Jahres noch viele Höchstkurse. In den letzten Wochen haben die großen Rohstoffunternehmen Hand in Hand mit den Edelmetallen und auch den meisten Industriemetallen den downtrend beschleunigt.

Viele dachten der Explorermarkt war Mitte 2008 am Tiefpunkt, seither ist er in weiten Strecken noch erheblich weiter eingebrochen. Es ist keine Seltenheit mehr, dass einige Explorer nahe am Cashwert bewertet sind. Explorer, die bereits weltkonforme Ressourcenbestätigungen vorweisen können und in profitablen Projekten und Projektlplanungen involviert sind, bleiben oft nur noch einige institutionellen Investoren.

Der Markt ignoriert seit vielen Monaten die fundamentalen Daten, das Risiko dieser Investments scheint zu groß zu sein, die Investoren fehlen, das Vertrauen liegt am Tiefpunkt. Dazu haben sicherlich auch die (deutschen) BBs beigetragen, die viele Werte (leider auch einige richtig gute) aufgrund von fernen Spekualtionen gepusht haben, die wenigsten haben sich an den fundamentalen Daten orientiert und ihre Informationen anderen Quellen vorgezogen.

Die meisten Explorer hätten ATHs in diesen Kursregionen ohne diese BBs nie gesehen..

Kann mir gut vorstellen, dass viele Explorer, in erster Linie die unzureichend finanzierten, weiter die jungfräulichen Juniorexplorer, diese Krise nicht überleben werden.

Trotz allem Pessimismus, den eklatanten Bewertungen und diesem großen Abverkauf bin ich für die Rohstoffbranche weiterhin optimistisch. Es mag sein, dass sich die Weltkonjunktur verlangsamen wird und auch die Entwicklungs- und Schwellenländer zurückschrauben müssen, weil sie der akuten Inflation auch trotz scheinbar großem kontinuierlichem Wachstum nicht mehr entgegenwirken können. Eine vllt notwendige Korrektur in einem überhitzten Markt, wie lange und wie stark diese ausfallen wird, darauf gilt bestens zu spekulieren..

Mit jedem weiteren schwierigen Tag in der Explorerbranche, wächst die Chance auf eine fulminante Rallye in neue Höhen. Sehe in diesen Zeiten beste Opportunitäten qualitativ ausgewählte Explorer in allen Segmenten sehr lukrativ zu erwerben. Eine Sicherheit für die optisch günstigen Kurse gibt uns niemand, aber deshalb sind wie ja an der Börse, weil wir von der Spekulation leben..

Be patient. & gn8

[url=http://peketec.de/trading/viewtopic.php?p=474391#474391 schrieb:Ollinho schrieb am 08.09.2008, 21:55 Uhr[/url]"]Jep...harte Zeiten ohne Frage!

Schau Dir 100 Charts aus dem Sektor an und du siehst den selben gnadenlosen Abverkauf!

Werden keine Unterschiede mehr gemacht, fundamentaler Entwicklungsstand, Projektstatus etc. alles uninteressant. Ist schon hart mitanzusehen aber ich kann mir nicht vorstellen, dass das ewig so weitergeht.

Auch bin ich nicht dermaßen bearish in sachen Rohstoffpreisen. Die Charts implizieren ja ne Nachfrage die gegen null geht. Wird sehr interessant sein, wie sich die Märkte die nächsten Wochen und Monate verhalten werden.

Wie ist Deine Einschätzung? Ähnlich wie Duke bzw. welche Erfahrungswerte legst du zugrunde. Mal nen kleinen Sentiment-Test machen....

[url=http://peketec.de/trading/viewtopic.php?p=474386#474386 schrieb:golden_times schrieb am 08.09.2008, 21:46 Uhr[/url]"]Die Charts sagen mehr als jedes Wort :shock:

Nur wenige Beispiele im Explorermarkt..

LGO

» zur Grafik

OSK

» zur Grafik

NG

» zur Grafik

ADY

» zur Grafik

TJS

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=474384#474384 schrieb:

- Status

- Für weitere Antworten geschlossen.