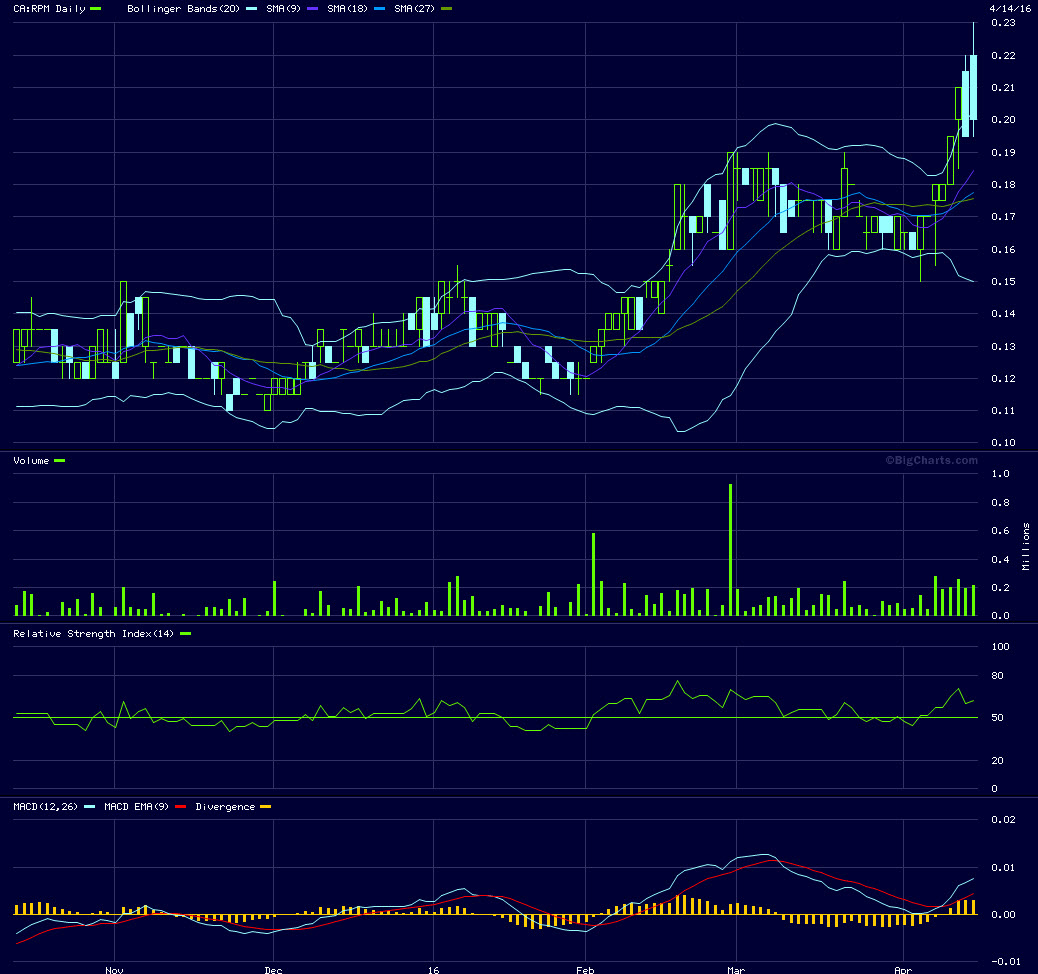

Mal ein paar Long, Marktkap. 1 Mio., vielleicht wird die auch noch gespielt.

ALIX ACQUIRES JACKPOT LITHIUM PROPERTY WITH HISTORICAL RESOURCE

Alix Resources Corp. has acquired the Jackpot lithium property located about 140 kilometres north-northeast of Thunder Bay, Ont., from arm's-length vendors.

Historical resources at Jackpot, on just the dike No. 2 pegmatite zone, were reported as two million tonnes at 1.09 per cent lithium oxide estimated in 1956 by Ontario Lithium Co. Ltd.* The No. 2 pegmatite dike, which was discovered by diamond drilling, was intersected at intervals of 30 to 100 metres over a strike length of 215 metres and at intervals of 30 to 60 metres over a distance of 365 metres across strike. Dike No. 2 is four to 20 metres thick, averaging 11 metres.

The Jackpot property is located in the Georgia Lake area, situated approximately 12 km by air from the TransCanada Highway (Hwy 11) and the main railway, which connects to the port town of Nipigon, on Lake Superior.

Lithium was first discovered near Georgia Lake in 1955 within granitic pegmatites. The current Jackpot property covers the Jackpot lithium deposits, described in a 1965 report by E.G. Pye published by the Ontario Department of Mines. The Jackpot deposits were tested by a total of 32 diamond drill holes in 1955 by Ontario Lithium Co. Ltd., an associated company of Conwest Exploration Co. Ltd. The drilling confirmed the presence of at least two spodumene-bearing granitic pegmatite bodies, one at the surface (dike No. 1) and a second body (dike No. 2) lying beneath the dike No. 1.

Dike No. 1 is a six-to-nine-metre-thick flat-lying body occurring as outcrops and further exposed by historic trenching. A review of Ontario government assessment files suggests little drilling was completed on dike No. 1 as efforts appear to have been focused on the larger (No. 2) dike. The 1955 drill logs extracted from archived files indicate assaying from only one drilled section within the No. 1 dike, even if spodumene is identified in several drill logs. Records from DDH 428 intersected 1.47 weight per cent Li2O over 3.96 m from the surface. The company has not verified the reported assays. The No. 1 dike represents a readily accessible target for trenching and bulk sampling and to acquire sufficient material for metallurgical testing.

The dike No. 2 is not exposed at the surface and was discovered by diamond drilling. Dike No. 2 has been described by Pye (1965) as follows, "Historical drill intercepts include 1.52 per cent Li2O over 10.6 metres (drill hole 411) and 1.17 per cent Li2O over 21.2 metres from drill hole 407." All drill intercepts reported are historical in nature and are taken from assessment files available at the Ontario Ministry of Northern Development and Mines. The assay results have not been verified by the company.

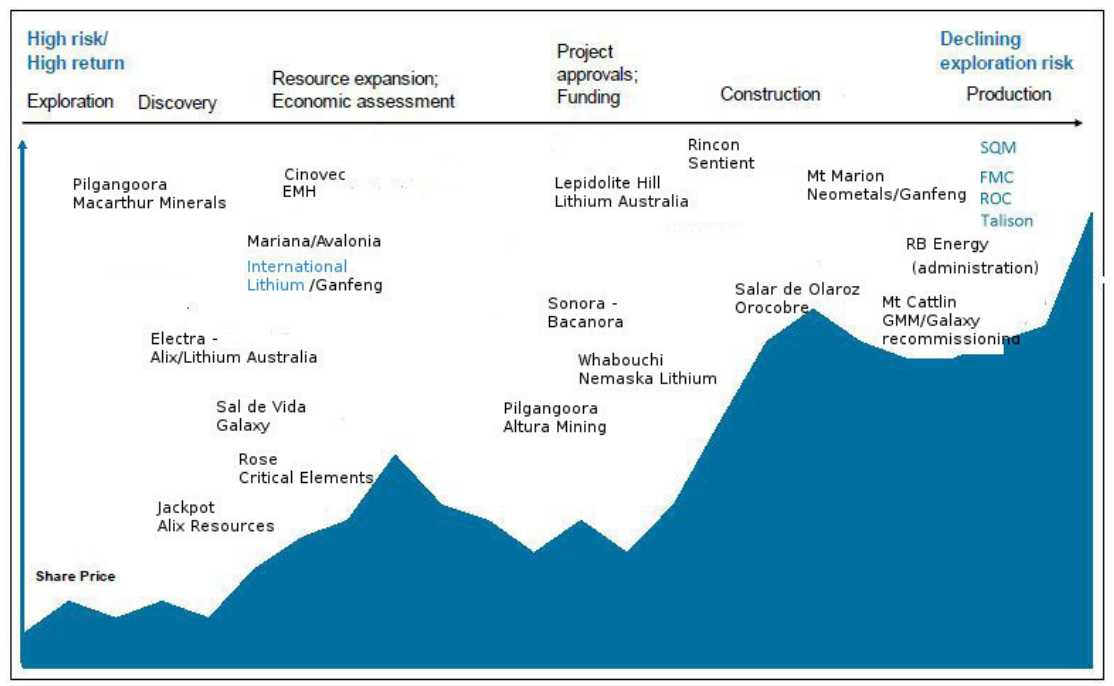

President and chief executive officer Michael England commented: "We are pleased to add the Jackpot lithium property to expand Alix's portfolio of lithium projects and to be at the forefront of the incoming demand for developing sustainable energy solutions. Alix now has lithium projects in Mexico and Canada and will continue to seek and, if warranted, acquire quality lithium assets for its growing portfolio."

Cumulative terms of the deal call for Alix to issue 2.4 million shares plus cause expenditures of $350,000 on the property over a two-year period. In addition a 1.5-per-cent net smelter return (NSR) will be granted to the vendors with the company able to purchase back 1 per cent for $1-million.

A finder's fee may be payable on this transaction. This transaction is subject to TSX Venture Exchange approval.

The technical contents of this release were approved by Dr. Michel Boily, PhD, PGeo, a qualified person as defined by National Instrument 43-101. The properties have not been the subject of a National Instrument 43-101 report.

ALIX ACQUIRES JACKPOT LITHIUM PROPERTY WITH HISTORICAL RESOURCE

Alix Resources Corp. has acquired the Jackpot lithium property located about 140 kilometres north-northeast of Thunder Bay, Ont., from arm's-length vendors.

Historical resources at Jackpot, on just the dike No. 2 pegmatite zone, were reported as two million tonnes at 1.09 per cent lithium oxide estimated in 1956 by Ontario Lithium Co. Ltd.* The No. 2 pegmatite dike, which was discovered by diamond drilling, was intersected at intervals of 30 to 100 metres over a strike length of 215 metres and at intervals of 30 to 60 metres over a distance of 365 metres across strike. Dike No. 2 is four to 20 metres thick, averaging 11 metres.

The Jackpot property is located in the Georgia Lake area, situated approximately 12 km by air from the TransCanada Highway (Hwy 11) and the main railway, which connects to the port town of Nipigon, on Lake Superior.

Lithium was first discovered near Georgia Lake in 1955 within granitic pegmatites. The current Jackpot property covers the Jackpot lithium deposits, described in a 1965 report by E.G. Pye published by the Ontario Department of Mines. The Jackpot deposits were tested by a total of 32 diamond drill holes in 1955 by Ontario Lithium Co. Ltd., an associated company of Conwest Exploration Co. Ltd. The drilling confirmed the presence of at least two spodumene-bearing granitic pegmatite bodies, one at the surface (dike No. 1) and a second body (dike No. 2) lying beneath the dike No. 1.

Dike No. 1 is a six-to-nine-metre-thick flat-lying body occurring as outcrops and further exposed by historic trenching. A review of Ontario government assessment files suggests little drilling was completed on dike No. 1 as efforts appear to have been focused on the larger (No. 2) dike. The 1955 drill logs extracted from archived files indicate assaying from only one drilled section within the No. 1 dike, even if spodumene is identified in several drill logs. Records from DDH 428 intersected 1.47 weight per cent Li2O over 3.96 m from the surface. The company has not verified the reported assays. The No. 1 dike represents a readily accessible target for trenching and bulk sampling and to acquire sufficient material for metallurgical testing.

The dike No. 2 is not exposed at the surface and was discovered by diamond drilling. Dike No. 2 has been described by Pye (1965) as follows, "Historical drill intercepts include 1.52 per cent Li2O over 10.6 metres (drill hole 411) and 1.17 per cent Li2O over 21.2 metres from drill hole 407." All drill intercepts reported are historical in nature and are taken from assessment files available at the Ontario Ministry of Northern Development and Mines. The assay results have not been verified by the company.

President and chief executive officer Michael England commented: "We are pleased to add the Jackpot lithium property to expand Alix's portfolio of lithium projects and to be at the forefront of the incoming demand for developing sustainable energy solutions. Alix now has lithium projects in Mexico and Canada and will continue to seek and, if warranted, acquire quality lithium assets for its growing portfolio."

Cumulative terms of the deal call for Alix to issue 2.4 million shares plus cause expenditures of $350,000 on the property over a two-year period. In addition a 1.5-per-cent net smelter return (NSR) will be granted to the vendors with the company able to purchase back 1 per cent for $1-million.

A finder's fee may be payable on this transaction. This transaction is subject to TSX Venture Exchange approval.

The technical contents of this release were approved by Dr. Michel Boily, PhD, PGeo, a qualified person as defined by National Instrument 43-101. The properties have not been the subject of a National Instrument 43-101 report.