App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

AUY Yamana Announces Filing of Preliminary Prospectus Relating to Brio Gold Purchase Rights and Qualification of Brio Shares

TORONTO, ONTARIO--(Marketwired - Oct. 17, 2016) - YAMANA GOLD INC. (TSX:YRI) (NYSE:AUY) ("Yamana" or "the Company") is pleased to announce that its wholly owned subsidiary, Brio Gold Inc. ("Brio Gold"), has filed a preliminary prospectus with the securities regulatory authorities in each of the provinces and territories of Canada in connection with qualifying a secondary offering (the "Offering") of Brio Gold common shares held by Yamana (the "Brio Shares"), which will be transferred to purchasers through and subject to the exercise of purchase rights (the "Purchase Rights"). Yamana intends to distribute the Purchase Rights to its shareholders (the "Yamana Shareholders") as a dividend in-kind. The Purchase Rights shall provide Yamana Shareholders with an opportunity to purchase from Yamana a portion of its Brio Shares. The exercise price will be determined in the context of the market prior to the filing of a final prospectus. The effect of the Offering will be to spin-off Brio Gold as a standalone public company on the closing of the Offering (the "Spin-Off").

The Spin-Off is being undertaken for the benefit of Yamana Shareholders and is the final stage of a plan that the Company implemented beginning in 2014 to surface value from certain non-core properties in Brazil. Completion of the Spin-Off will also enable Yamana to better focus on its portfolio of six, soon to be seven, producing mines in top mining jurisdictions and on its organic growth pipeline. In particular, Yamana will be better positioned to focus on recent exploration success, optimization initiatives, and on advancing Canadian exploration and near-term development opportunities.

Yamana will maintain exposure to Brio Gold through a retained equity interest following completion of the Spin-Off. The Purchase Rights allow Yamana Shareholders who choose to exercise their Purchase Rights to have more direct exposure to Brio Gold, while allowing those Yamana Shareholders that do not exercise their Purchase Rights to benefit through the sale of the Purchase Rights and through exposure to Brio Gold via Yamana's retained interest.

Proceeds from the exercise of the Purchase Rights and any direct sales of Brio Shares will support the Company's net debt reduction initiatives and thereby increase the Company's financial flexibility to pursue its business plan and strategic objectives. Brio Gold will not receive any proceeds from the Offering. The preliminary prospectus also qualifies the secondary offering of Brio Shares to provide further public distribution of the Brio Shares, as required.

Yamana has retained CIBC World Markets Inc., National Bank Financial Inc., Canaccord Genuity Corp. and Cormark Securities Inc. to act as managing dealers and to solicit, on a commercially reasonable efforts basis, the exercise of the Purchase Rights.

Offering Details

Under the proposed Offering, Yamana Shareholders will be distributed Purchase Rights on the basis of a fraction of a Purchase Right for each Yamana common share held. Each whole Purchase Right will entitle the holder to purchase one (1) Brio Share upon payment of an exercise price. The Purchase Rights entitlement, exchange basis and exercise price will all be determined in the context of the market.

Subject to applicable law, a notice to shareholders, a Purchase Rights certificate and a final prospectus will be mailed to each Yamana Shareholder of record as of a record date to be set following the settlement of the final prospectus. It is expected that the exercise period for holders of Purchase Rights to acquire Brio Shares will be open for 21 days from the date of the mailing of the final prospectus to Yamana Shareholders, after which period any unexercised Purchase Rights will expire and become void and of no value. Yamana Shareholders who do not wish to exercise their Purchase Rights to acquire Brio Shares under the Offering will have the option of selling their Purchase Rights.

Yamana Shareholders who fully exercise their Purchase Rights will be entitled to purchase additional Brio Shares, if available, as a result of any unexercised portion of Purchase Rights prior to the expiry of the exercise period, subject to certain limitations set out in Brio Gold's preliminary prospectus.

The preliminary prospectus contains important information relating to the Purchase Rights and the Brio Shares and is still subject to completion or amendment. A copy of the preliminary prospectus is available under Brio Gold's profile on SEDAR at www.sedar.com. There will not be any distribution of Purchase Rights or transfer of Brio Shares until a receipt for the final prospectus has been issued. Yamana will also send to Yamana Shareholders a notice setting out the details of the Offering.

CST Trust Company has been appointed as the Subscription Agent for the Offering. Laurel Hill Advisory Group is acting as the Information Agent for the Offering.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the Purchase Rights or common shares of Brio Gold in the United States or in any other jurisdiction in which such offer, solicitation or sale would be unlawful. The common shares issuable upon exercise of the Purchase Rights have not been registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), and such securities may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements thereunder.

The Purchase Rights may only be exercised in the United States by "Qualified Institutional Buyers" ("QIBs") within the meaning of Rule 144A under the U.S. Securities Act. The Purchase Rights may not be resold in the United States, but may be resold outside of the United States in accordance with the requirements of Regulation S under the U. S. Securities Act. A trading market in the Purchase Rights may not develop.

TORONTO, ONTARIO--(Marketwired - Oct. 17, 2016) - YAMANA GOLD INC. (TSX:YRI) (NYSE:AUY) ("Yamana" or "the Company") is pleased to announce that its wholly owned subsidiary, Brio Gold Inc. ("Brio Gold"), has filed a preliminary prospectus with the securities regulatory authorities in each of the provinces and territories of Canada in connection with qualifying a secondary offering (the "Offering") of Brio Gold common shares held by Yamana (the "Brio Shares"), which will be transferred to purchasers through and subject to the exercise of purchase rights (the "Purchase Rights"). Yamana intends to distribute the Purchase Rights to its shareholders (the "Yamana Shareholders") as a dividend in-kind. The Purchase Rights shall provide Yamana Shareholders with an opportunity to purchase from Yamana a portion of its Brio Shares. The exercise price will be determined in the context of the market prior to the filing of a final prospectus. The effect of the Offering will be to spin-off Brio Gold as a standalone public company on the closing of the Offering (the "Spin-Off").

The Spin-Off is being undertaken for the benefit of Yamana Shareholders and is the final stage of a plan that the Company implemented beginning in 2014 to surface value from certain non-core properties in Brazil. Completion of the Spin-Off will also enable Yamana to better focus on its portfolio of six, soon to be seven, producing mines in top mining jurisdictions and on its organic growth pipeline. In particular, Yamana will be better positioned to focus on recent exploration success, optimization initiatives, and on advancing Canadian exploration and near-term development opportunities.

Yamana will maintain exposure to Brio Gold through a retained equity interest following completion of the Spin-Off. The Purchase Rights allow Yamana Shareholders who choose to exercise their Purchase Rights to have more direct exposure to Brio Gold, while allowing those Yamana Shareholders that do not exercise their Purchase Rights to benefit through the sale of the Purchase Rights and through exposure to Brio Gold via Yamana's retained interest.

Proceeds from the exercise of the Purchase Rights and any direct sales of Brio Shares will support the Company's net debt reduction initiatives and thereby increase the Company's financial flexibility to pursue its business plan and strategic objectives. Brio Gold will not receive any proceeds from the Offering. The preliminary prospectus also qualifies the secondary offering of Brio Shares to provide further public distribution of the Brio Shares, as required.

Yamana has retained CIBC World Markets Inc., National Bank Financial Inc., Canaccord Genuity Corp. and Cormark Securities Inc. to act as managing dealers and to solicit, on a commercially reasonable efforts basis, the exercise of the Purchase Rights.

Offering Details

Under the proposed Offering, Yamana Shareholders will be distributed Purchase Rights on the basis of a fraction of a Purchase Right for each Yamana common share held. Each whole Purchase Right will entitle the holder to purchase one (1) Brio Share upon payment of an exercise price. The Purchase Rights entitlement, exchange basis and exercise price will all be determined in the context of the market.

Subject to applicable law, a notice to shareholders, a Purchase Rights certificate and a final prospectus will be mailed to each Yamana Shareholder of record as of a record date to be set following the settlement of the final prospectus. It is expected that the exercise period for holders of Purchase Rights to acquire Brio Shares will be open for 21 days from the date of the mailing of the final prospectus to Yamana Shareholders, after which period any unexercised Purchase Rights will expire and become void and of no value. Yamana Shareholders who do not wish to exercise their Purchase Rights to acquire Brio Shares under the Offering will have the option of selling their Purchase Rights.

Yamana Shareholders who fully exercise their Purchase Rights will be entitled to purchase additional Brio Shares, if available, as a result of any unexercised portion of Purchase Rights prior to the expiry of the exercise period, subject to certain limitations set out in Brio Gold's preliminary prospectus.

The preliminary prospectus contains important information relating to the Purchase Rights and the Brio Shares and is still subject to completion or amendment. A copy of the preliminary prospectus is available under Brio Gold's profile on SEDAR at www.sedar.com. There will not be any distribution of Purchase Rights or transfer of Brio Shares until a receipt for the final prospectus has been issued. Yamana will also send to Yamana Shareholders a notice setting out the details of the Offering.

CST Trust Company has been appointed as the Subscription Agent for the Offering. Laurel Hill Advisory Group is acting as the Information Agent for the Offering.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the Purchase Rights or common shares of Brio Gold in the United States or in any other jurisdiction in which such offer, solicitation or sale would be unlawful. The common shares issuable upon exercise of the Purchase Rights have not been registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), and such securities may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements thereunder.

The Purchase Rights may only be exercised in the United States by "Qualified Institutional Buyers" ("QIBs") within the meaning of Rule 144A under the U.S. Securities Act. The Purchase Rights may not be resold in the United States, but may be resold outside of the United States in accordance with the requirements of Regulation S under the U. S. Securities Act. A trading market in the Purchase Rights may not develop.

Golden Arrow Announces C$2 Million Program at Antofalla & Provides Corporate Update

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Oct. 17, 2016) - Golden Arrow Resources Corporation (TSX VENTURE:GRG)(OTCQB:GARWF)(FRANKFURT:GAC)(WKN:A0B6XQ) ("Golden Arrow" or the "Company") is pleased to announce that it has initiated its first exploration program at the recently optioned Antofalla silver-gold-base metal project in the province of Catamarca. With a cash balance of approximately C$8 million, Golden Arrow has outlined a C$2 million program that includes remote sensing, IP/Resistivity geophysics, and geochemical sampling to delineate targets that will be tested with an estimated 3000 metre drill program. Historic work at Antofalla includes 18 metres averaging 128 g/t silver, 0.23 g/t gold and 0.88% lead in a drill hole and two metres averaging 9.2 g/t gold, 52 g/t silver and 5% lead in historic trench samples. The 8,760 hectare Antofalla project has strong geologic similarities to the Company's flagship Chinchillas silver project, where a development decision is expected at the end of the year.

Chinchillas Pre-Development Program

The pre-development work is advancing at the Chinchillas Silver Project in Jujuy, Argentina. In particular, Golden Arrow is continuing its diligent community relations efforts to establish secure and lasting social license for the project. Exploitation permitting for the project is proceeding routinely, with the critical Environmental Report having been submitted to the mining authorities in September. A drilling program is underway to support mine planning, and the prefeasibility study work is expected to be complete by the end of the year.

Corporate Update

"With the recent softness in the overall market we are gratified to see continued high trading volume for Golden Arrow. We are confident that a return to market strength will lead to a further increase of our market capitalization, and in the meantime we will continue to build and advance our strong asset base," commented Joseph Grosso, President and CEO of Golden Arrow.

Golden Arrow's strategy is to maximize value in all market conditions by maintaining a pipeline of strong mineral project assets from exploration to development stage. In addition to Chinchillas and Antofalla, the Company's technical team is reviewing dozens of orphaned projects for acquisition, and continuing the evaluation of the existing portfolio of over 214,000 hectares of well-located properties in Argentina.

Qualified Persons

This technical content of this news release has been reviewed and approved by Brian McEwen, P.Geol., VP Exploration and Development to the Company, a Qualified Person as defined in National Instrument 43-101.

About Golden Arrow:

Golden Arrow Resources is a Vancouver-based exploration company focused on creating value by making precious and base metal discoveries and advancing them into exceptional deposits. The Company is currently focused on its Chinchillas Silver Project located in the mining-friendly Province of Jujuy, Argentina. Exploration has progressed rapidly since the acquisition of the project in late 2011. The innovative transaction announced October 1st 2015, positions the Company to maximize shareholder value by fast-tracking Chinchillas to production and becoming a 25% owner of the Pirquitas silver mine.

ON BEHALF OF THE BOARD

Mr. Joseph Grosso

Executive Chairman, President, CEO and Director

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Oct. 17, 2016) - Golden Arrow Resources Corporation (TSX VENTURE:GRG)(OTCQB:GARWF)(FRANKFURT:GAC)(WKN:A0B6XQ) ("Golden Arrow" or the "Company") is pleased to announce that it has initiated its first exploration program at the recently optioned Antofalla silver-gold-base metal project in the province of Catamarca. With a cash balance of approximately C$8 million, Golden Arrow has outlined a C$2 million program that includes remote sensing, IP/Resistivity geophysics, and geochemical sampling to delineate targets that will be tested with an estimated 3000 metre drill program. Historic work at Antofalla includes 18 metres averaging 128 g/t silver, 0.23 g/t gold and 0.88% lead in a drill hole and two metres averaging 9.2 g/t gold, 52 g/t silver and 5% lead in historic trench samples. The 8,760 hectare Antofalla project has strong geologic similarities to the Company's flagship Chinchillas silver project, where a development decision is expected at the end of the year.

Chinchillas Pre-Development Program

The pre-development work is advancing at the Chinchillas Silver Project in Jujuy, Argentina. In particular, Golden Arrow is continuing its diligent community relations efforts to establish secure and lasting social license for the project. Exploitation permitting for the project is proceeding routinely, with the critical Environmental Report having been submitted to the mining authorities in September. A drilling program is underway to support mine planning, and the prefeasibility study work is expected to be complete by the end of the year.

Corporate Update

"With the recent softness in the overall market we are gratified to see continued high trading volume for Golden Arrow. We are confident that a return to market strength will lead to a further increase of our market capitalization, and in the meantime we will continue to build and advance our strong asset base," commented Joseph Grosso, President and CEO of Golden Arrow.

Golden Arrow's strategy is to maximize value in all market conditions by maintaining a pipeline of strong mineral project assets from exploration to development stage. In addition to Chinchillas and Antofalla, the Company's technical team is reviewing dozens of orphaned projects for acquisition, and continuing the evaluation of the existing portfolio of over 214,000 hectares of well-located properties in Argentina.

Qualified Persons

This technical content of this news release has been reviewed and approved by Brian McEwen, P.Geol., VP Exploration and Development to the Company, a Qualified Person as defined in National Instrument 43-101.

About Golden Arrow:

Golden Arrow Resources is a Vancouver-based exploration company focused on creating value by making precious and base metal discoveries and advancing them into exceptional deposits. The Company is currently focused on its Chinchillas Silver Project located in the mining-friendly Province of Jujuy, Argentina. Exploration has progressed rapidly since the acquisition of the project in late 2011. The innovative transaction announced October 1st 2015, positions the Company to maximize shareholder value by fast-tracking Chinchillas to production and becoming a 25% owner of the Pirquitas silver mine.

ON BEHALF OF THE BOARD

Mr. Joseph Grosso

Executive Chairman, President, CEO and Director

GOLD / FUTURES / COT / ETF - Marktkommentar Weinberg, CoBa "Gold handelt am Morgen leicht fester bei 1.260 USD bzw. 1.145 EUR je Feinunze. Der Abbau der Netto-Long-Positionen bei Gold von über 106 Tsd. Kontrakten in den letzten beiden Berichtswochen entspricht dem Verkauf von 331 Tonnen Gold - wenn auch nur auf dem Papier. Dies ist dennoch eine beachtliche Menge: Es entspricht zum Beispiel der weltweiten Goldminenproduktion von 5½ Wochen. Und es zeigt, wieviel Gold über den Futures-Markt bewegt werden kann. Denn die physisch hinterlegten Gold-ETFs verzeichneten im Beobachtungszeitraum lediglich Zuflüsse von 14,4 Tonnen.

Legt man den durchschnittlichen ETF-Tageszufluss von bislang 3 Tonnen in diesem Jahr zugrunde, müssten die ETF-Anleger 112 Handelstage oder gut fünf Monate lang Gold kaufen, um den Verkauf am Futures-Markt in den beobachteten zwei Wochen aufzuwiegen. Auch ein weiterer Vergleich zeigt eindrucksvoll die Relationen: So lagen die monatlichen Goldimporte der beiden weltweit größten Nachfrageländer, China und Indien, in diesem Jahr im Durchschnitt bei 70 Tonnen (Netto-Goldimporte China aus Hongkong) bzw. 37 Tonnen (Indien). Beide Länder zusammen bräuchten also drei Monate, um die jüngsten Verkäufe zu absorbieren.

Der Verkaufsdruck seitens der spekulativen Finanzanleger sollte unseres Erachtens aber nachlassen. Und der Goldpreis scheint sich knapp unterhalb der charttechnisch wichtigen 200-Tage-Linie zu stabilisieren. Heute richtet sich der Fokus auf die US-Inflationsdaten. Eine steigende (Kern-)Inflation würde Argumente für eine Fed-Zinserhöhung im Dezember liefern und damit den Goldpreis belasten." ...

Legt man den durchschnittlichen ETF-Tageszufluss von bislang 3 Tonnen in diesem Jahr zugrunde, müssten die ETF-Anleger 112 Handelstage oder gut fünf Monate lang Gold kaufen, um den Verkauf am Futures-Markt in den beobachteten zwei Wochen aufzuwiegen. Auch ein weiterer Vergleich zeigt eindrucksvoll die Relationen: So lagen die monatlichen Goldimporte der beiden weltweit größten Nachfrageländer, China und Indien, in diesem Jahr im Durchschnitt bei 70 Tonnen (Netto-Goldimporte China aus Hongkong) bzw. 37 Tonnen (Indien). Beide Länder zusammen bräuchten also drei Monate, um die jüngsten Verkäufe zu absorbieren.

Der Verkaufsdruck seitens der spekulativen Finanzanleger sollte unseres Erachtens aber nachlassen. Und der Goldpreis scheint sich knapp unterhalb der charttechnisch wichtigen 200-Tage-Linie zu stabilisieren. Heute richtet sich der Fokus auf die US-Inflationsdaten. Eine steigende (Kern-)Inflation würde Argumente für eine Fed-Zinserhöhung im Dezember liefern und damit den Goldpreis belasten." ...

läuft weiter

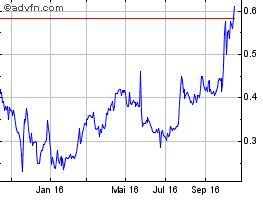

[url=http://peketec.de/trading/viewtopic.php?p=1713047#1713047 schrieb:Rookie schrieb am 05.10.2016, 16:05 Uhr[/url]"]Ich weiss ... Ausnahme da ich glaube das das Ding läuft.

[url=http://peketec.de/trading/viewtopic.php?p=1713032#1713032 schrieb:scotti321 schrieb am 05.10.2016, 15:50 Uhr[/url]"]Ist doch nur ein Mantel und kein Rohstoff 8)

[url=http://peketec.de/trading/viewtopic.php?p=1713006#1713006 schrieb:Rookie schrieb am 05.10.2016, 14:17 Uhr[/url]"]fängt an zu laufen

http://www.wallstreet-online.de/nachricht/8975523-biodel-naht-aeusserst-bedeutsamer-zusammenschluss

http://www.advfn.com/stock-market/NASDAQ/BIOD/chart/streaming

[url=http://peketec.de/trading/viewtopic.php?p=1701742#1701742 schrieb:Rookie schrieb am 28.07.2016, 19:42 Uhr[/url]"]gekauft zu 0,33 EUR, hopp oder top.

http://www.wallstreet-online.de/nachricht/8800624-biodel-volumen-spike-vorbote

[url=http://peketec.de/trading/viewtopic.php?p=1701449#1701449 schrieb:Rookie schrieb am 27.07.2016, 19:41 Uhr[/url]"]Ist jemand bei dem Zock Biodel dabei?

Der dicke Össi hat halt einige Lemminge

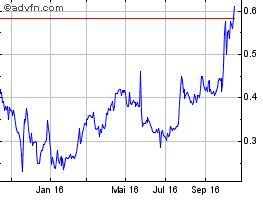

[url=http://peketec.de/trading/viewtopic.php?p=1715539#1715539 schrieb:Rookie schrieb am 18.10.2016, 16:54 Uhr[/url]"]Hab vor ein paar Tagen Hawkeye gekauft, just for fun.

Entwickelt sich heute gut, weiss garnicht warum

» zur Grafik

Wen meinst Du? den Wert hatte mir vor ein paar Tagen jemand zugeflüstert.

Daraufhin habe ich einige wenige Stücke gekauft.

Daraufhin habe ich einige wenige Stücke gekauft.

[url=http://peketec.de/trading/viewtopic.php?p=1715546#1715546 schrieb:scotti321 schrieb am 18.10.2016, 17:19 Uhr[/url]"]Der dicke Össi hat halt einige Lemminge [url=http://peketec.de/trading/viewtopic.php?p=1715539#1715539 schrieb:Rookie schrieb am 18.10.2016, 16:54 Uhr[/url]"]Hab vor ein paar Tagen Hawkeye gekauft, just for fun.

[url=http://peketec.de/trading/viewtopic.php?p=1715539#1715539 schrieb:Rookie schrieb am 18.10.2016, 16:54 Uhr[/url]"]Hab vor ein paar Tagen Hawkeye gekauft, just for fun.

Entwickelt sich heute gut, weiss garnicht warum

» zur Grafik

KLG long zu 7,75

[url=http://peketec.de/trading/viewtopic.php?p=1714707#1714707 schrieb:greenhorn schrieb am 13.10.2016, 12:16 Uhr[/url]"]KLG - gutes Quartalsergebnis, RSI bei 20...........könnte was gehen!

October 12, 2016 19:33 ET

Kirkland Lake Gold Announces Record Gold Production and Costs for the Third Quarter 2016

http://www.marketwired.com/press-re...-costs-third-quarter-2016-tsx-klg-2166140.htm

- Q3/16 production of 77,274 ounces of gold, up 13% over the previous quarter; and YTD gold production of 207,886 ounces

- Q3/16 gold sales of 76,339 ounces at an average realized price of US$1,321/oz(1) (based on revenue of C$131.6 million); YTD gold sales of 217,793 ounces at an average realized price of US$1,249/oz(1) (based on revenues of C$359.5 million)

- Preliminary operating costs(1) during the quarter of US$540/oz (based on operating costs of C$53.8 million) an improvement of 19% over the previous quarter; and US$591/oz (based on operating costs of C$169.6 million) YTD

- Preliminary All-in sustaining costs ("AISC")(1) of US$966/oz during the quarter and US$939/oz YTD

- Cash and bullion sold(2) increased by C$61.1 million in the quarter to $226.2 million as at September 30, 2016

- On track to meet the full year production guidance of between 270,000 - 290,000 ounces

AEM raus mit knapp 2 EUR

[url=http://peketec.de/trading/viewtopic.php?p=1713748#1713748 schrieb:Sltrader schrieb am 07.10.2016, 18:39 Uhr[/url]"]Vorher AEM 300 Stück gekauft Gebühr 3 Usd-Dollar

[url=http://peketec.de/trading/viewtopic.php?p=1713742#1713742 schrieb:Ollinho schrieb am 07.10.2016, 18:17 Uhr[/url]"]:shock: Oh das ist heftig!

Um dein Beispiel aufzugreifen. Bei 5000 EDR zahle ich beim Direktkauf an der TSE 30-35 Can $! Aber IB bzw. Lynxbroker hat verschiedene Konditionierungen. Kommt auf Einlagenhöhe und Aktivität an. Ich habe diese Konditionen seit 2014 deswegen macht ein weiterer Brokerwechsel keinen Sinn da die Gebühren mMn nach einigen Vergleichen ok sind.

[url=http://peketec.de/trading/viewtopic.php?p=1713740#1713740 schrieb:Sltrader schrieb am 07.10.2016, 18:10 Uhr[/url]"]also als Bsp. Handel auch über IB: EDR kosten bei 5000 Stück zwischen 50-75 CAD

EXK in USD zahl ich nur 25 Dollar

[url=http://peketec.de/trading/viewtopic.php?p=1713737#1713737 schrieb:Ollinho schrieb am 07.10.2016, 18:06 Uhr[/url]"]Ich kaufe über IB direkt in Canada. Gebühren sind identisch niedrig. Aber in vielen Werten speziell an der TSX-Venture Börse ist ein deutlich liquiderer Handel

[url=http://peketec.de/trading/viewtopic.php?p=1713736#1713736 schrieb:Sltrader schrieb am 07.10.2016, 18:03 Uhr[/url]"]@ Ollinho: Warum kaufst du die Werte nicht in USA, da sind doch die Gebühren viel günstiger

Kennt jemand Golden Dawn? Push oder etwas Werthaltiges?

Golden Dawn Signs Binding LOI -- Acquires Major Greenwood Area Land Position

http://www.bloomberg.com/press-releases/2016-10-18/golden-dawn-signs-binding-loi-acquires-major-greenwood-area-land-position

Golden Dawn bewegt sich schnell in Richtung Reaktivierung der Produktion im Greenwood-Minendistrikt

Golden Dawn schließt Erwerb der Minen und Verarbeitungsanlage für Greenwood ab

Golden Dawn unterzeichnet Finanzierungsvereinbarung in Höhe von bis zu 5 Mio. USD

Golden Dawn Signs Binding LOI -- Acquires Major Greenwood Area Land Position

http://www.bloomberg.com/press-releases/2016-10-18/golden-dawn-signs-binding-loi-acquires-major-greenwood-area-land-position

Golden Dawn bewegt sich schnell in Richtung Reaktivierung der Produktion im Greenwood-Minendistrikt

Golden Dawn schließt Erwerb der Minen und Verarbeitungsanlage für Greenwood ab

Golden Dawn unterzeichnet Finanzierungsvereinbarung in Höhe von bis zu 5 Mio. USD

Das neue Gold? Lithium elektrisiert die Autobranche und Investoren (News mit Zusatzmaterial)

http://www.boerse-online.de/nachrichten/aktien/DGAP-News-Das-neue-Gold-Lithium-elektrisiert-die-Autobranche-und-Investoren-News-mit-Zusatzmaterial-1001461952

http://www.boerse-online.de/nachrichten/aktien/DGAP-News-Das-neue-Gold-Lithium-elektrisiert-die-Autobranche-und-Investoren-News-mit-Zusatzmaterial-1001461952

Kauf 3. Position PG zu 3,15 Can $ MK 3,25 Can $

[url=http://peketec.de/trading/viewtopic.php?p=1715334#1715334 schrieb:Ollinho schrieb am 17.10.2016, 19:13 Uhr[/url]"]Kauf 2.Position PG zu 3,27 Can$ MK 3,33 Can$

[url=http://peketec.de/trading/viewtopic.php?p=1713739#1713739 schrieb:Ollinho schrieb am 07.10.2016, 18:09 Uhr[/url]"]Kauf Tradingposition PG zu 3,39 Can $

PG

Premier announces Q3 production of 30,228 ounces of gold

18.10.2016 | CNW

THUNDER BAY, ON, Oct. 18, 2016 /CNW/ - Premier Gold Mines Ltd. ("Premier" or "The Company") (TSX:PG) is pleased to announce third quarter ("Q3/16") production results from its 40% ownership in the South Arturo Mine located in Carlin, Nevada. The mine is a joint venture between Premier and Barrick Gold Corp.'s wholly-owned subsidiary Barrick Gold Exploration Inc. ("Barrick"), and has delivered solid operating results since achieving commercial production on August 1, 2016.

The following table provides Q3/16 production statistics for South Arturo:

Table 1: South Arturo – Q3/16 Operational Statistics (100% Basis)

OPERATIONAL STATISTICS

Q3/16 ACTUAL

Total Gold Production (ounces)

75,570

PROCESSING

Tons Processed

Contained Ounces

Ounces Produced

Grade Processed (oz/t)

Recovery Rate

322,614

83,605

75,570

0.259

90.4%

Attributable to Premier on a 40% basis, a total of approximately 129,000 tons of ore was processed at South Arturo during Q3/16 producing 30,228 ounces of gold. The South Arturo Mine, which was brought into production on time and under budget, has exceeded Q3/16 production guidance by approximately 50% YTD owing to revised scheduling of ore through the roaster. Recoveries have also been slightly higher (90.4% actual vs. 86.4% budget) due to grade processed. The Company is currently targeting between 100,000 and 110,000 ounces of gold production for 2016 from its operations at South Arturo and the recently acquired Mercedes Mine in Sonora, Mexico. Approximately 80% of targeted production is anticipated during the fourth quarter.

"We are extremely pleased with the performance achieved to date by Barrick, the operator of our joint venture at South Arturo" stated Ewan Downie, President and CEO of Premier, in the company's C-Suite Blog https://www.premiergoldmines.com/news/c-suite-blog/all, "South Arturo is one of the highest grade open pit operations brought into production in 2016 and based on the strong initial performance achieved, we remain on track to meet or exceed our production guidance for the year".

Also at South Arturo, the joint venture is advancing two additional mining opportunities on the property: the El Nino underground project and the Dee pit expansion project (Phases 1&3). A Plan of Operations for the construction of a ramp at El Nino to access high-grade mineralization down-dip of the current pit has been submitted for approval with Nevada regulatory authorities. Drilling in H1 2017 will focus on the further definition of the ore zones from surface to infill previous surface exploration programs.

Drilling and bulk sampling are in process for the Dee pit expansion, a potential run-of-mine heap leach operation located to the west of the current Phase 2 pit. Updated metallurgical recoveries and optimized capital and operating assumptions will be used for a revised economic assessment for this potential second pit operation prior to making a construction decision.

In Mexico, our Mercedes Mine is also expected to produce 90,000 to 100,000 ounces of silver during the fourth quarter. Production estimates for 2016 are derived from life of mine operating plans prepared on the basis of mineral reserves associated with each property. Material factors and assumptions underlying 2016 gold production estimates for South Arturo and Mercedes, as derived from the respective mine plans are as follows: (1) a realized gold price of $1,100; (2) average cash costs of $429 and $672 per ounce; and (3) all in sustaining costs of $444 and $819 per ounce. Material factors and assumptions underlying 2016 silver production estimates for Mercedes are: (1) a realized silver price of $17.00; (2) average cash costs of $8.80 per ounce; and (3) all in sustaining costs of $9.05 per ounce.

Stephen McGibbon, P. Geo., is the Qualified Person for the information contained in this press release and is a Qualified Person within the meaning of National Instrument 43-101.

Premier Gold Mines Limited is a gold producer and respected exploration and development company with a high-quality pipeline of precious metal projects in proven, accessible and safe mining jurisdictions in Canada, the United States, and Mexico.

Premier announces Q3 production of 30,228 ounces of gold

18.10.2016 | CNW

THUNDER BAY, ON, Oct. 18, 2016 /CNW/ - Premier Gold Mines Ltd. ("Premier" or "The Company") (TSX:PG) is pleased to announce third quarter ("Q3/16") production results from its 40% ownership in the South Arturo Mine located in Carlin, Nevada. The mine is a joint venture between Premier and Barrick Gold Corp.'s wholly-owned subsidiary Barrick Gold Exploration Inc. ("Barrick"), and has delivered solid operating results since achieving commercial production on August 1, 2016.

The following table provides Q3/16 production statistics for South Arturo:

Table 1: South Arturo – Q3/16 Operational Statistics (100% Basis)

OPERATIONAL STATISTICS

Q3/16 ACTUAL

Total Gold Production (ounces)

75,570

PROCESSING

Tons Processed

Contained Ounces

Ounces Produced

Grade Processed (oz/t)

Recovery Rate

322,614

83,605

75,570

0.259

90.4%

Attributable to Premier on a 40% basis, a total of approximately 129,000 tons of ore was processed at South Arturo during Q3/16 producing 30,228 ounces of gold. The South Arturo Mine, which was brought into production on time and under budget, has exceeded Q3/16 production guidance by approximately 50% YTD owing to revised scheduling of ore through the roaster. Recoveries have also been slightly higher (90.4% actual vs. 86.4% budget) due to grade processed. The Company is currently targeting between 100,000 and 110,000 ounces of gold production for 2016 from its operations at South Arturo and the recently acquired Mercedes Mine in Sonora, Mexico. Approximately 80% of targeted production is anticipated during the fourth quarter.

"We are extremely pleased with the performance achieved to date by Barrick, the operator of our joint venture at South Arturo" stated Ewan Downie, President and CEO of Premier, in the company's C-Suite Blog https://www.premiergoldmines.com/news/c-suite-blog/all, "South Arturo is one of the highest grade open pit operations brought into production in 2016 and based on the strong initial performance achieved, we remain on track to meet or exceed our production guidance for the year".

Also at South Arturo, the joint venture is advancing two additional mining opportunities on the property: the El Nino underground project and the Dee pit expansion project (Phases 1&3). A Plan of Operations for the construction of a ramp at El Nino to access high-grade mineralization down-dip of the current pit has been submitted for approval with Nevada regulatory authorities. Drilling in H1 2017 will focus on the further definition of the ore zones from surface to infill previous surface exploration programs.

Drilling and bulk sampling are in process for the Dee pit expansion, a potential run-of-mine heap leach operation located to the west of the current Phase 2 pit. Updated metallurgical recoveries and optimized capital and operating assumptions will be used for a revised economic assessment for this potential second pit operation prior to making a construction decision.

In Mexico, our Mercedes Mine is also expected to produce 90,000 to 100,000 ounces of silver during the fourth quarter. Production estimates for 2016 are derived from life of mine operating plans prepared on the basis of mineral reserves associated with each property. Material factors and assumptions underlying 2016 gold production estimates for South Arturo and Mercedes, as derived from the respective mine plans are as follows: (1) a realized gold price of $1,100; (2) average cash costs of $429 and $672 per ounce; and (3) all in sustaining costs of $444 and $819 per ounce. Material factors and assumptions underlying 2016 silver production estimates for Mercedes are: (1) a realized silver price of $17.00; (2) average cash costs of $8.80 per ounce; and (3) all in sustaining costs of $9.05 per ounce.

Stephen McGibbon, P. Geo., is the Qualified Person for the information contained in this press release and is a Qualified Person within the meaning of National Instrument 43-101.

Premier Gold Mines Limited is a gold producer and respected exploration and development company with a high-quality pipeline of precious metal projects in proven, accessible and safe mining jurisdictions in Canada, the United States, and Mexico.

Gold übr 1270

[url=http://peketec.de/trading/viewtopic.php?p=1715677#1715677 schrieb:Sltrader schrieb am 19.10.2016, 11:26 Uhr[/url]"]bei stabilem Gold und Silber Preis sollte es bei so einigen werten nach oben gehen....

Charts sehen bei den meisten Werten lecker aus.

GOLD / SMA200 / FED / ETF - Marktkommentar Weinberg, CoBa "Gold ist gestern mit dem Versuch gescheitert, die charttechnisch wichtige 200-Tage-Linie wieder zu überschreiten, handelt heute Morgen mit gut 1.260 USD je Feinunze aber weiterhin in unmittelbarer Nähe dieser Marke. Unterstützung erhielt der Goldpreis gestern durch verhaltene Inflationsdaten aus den USA für September, woraufhin die Wahrscheinlichkeit für eine Zinserhöhung der US-Notenbank Fed laut Fed Fund Futures nochmals leicht gesunken ist.

Auch die Rendite 10-jähriger US-Staatsanleihen ist wieder etwas zurückgegangen, was die Opportunitätskosten von Gold verringert. Darüber hinaus verzeichneten die Gold-ETFs gestern den fünften, wenn auch moderaten, Tageszufluss in Folge. Wie am Rande der LBMA-Konferenz in Singapur bekannt wurde, erwartet der World Gold Council (WGC) in diesem Jahr für China eine Goldnachfrage von 900-1.000 Tonnen.

Die starke Investmentnachfrage würde demnach die schwächelnde Schmucknachfrage auffangen. Auch die erwartete weitere Abwertung der chinesischen Währung würde zur höheren Goldnachfrage beitragen. Im nächsten Jahr soll sich die chinesische Goldnachfrage laut WGC wieder dem Niveau von 2015 annähern (984,5 Tonnen)." ...

Auch die Rendite 10-jähriger US-Staatsanleihen ist wieder etwas zurückgegangen, was die Opportunitätskosten von Gold verringert. Darüber hinaus verzeichneten die Gold-ETFs gestern den fünften, wenn auch moderaten, Tageszufluss in Folge. Wie am Rande der LBMA-Konferenz in Singapur bekannt wurde, erwartet der World Gold Council (WGC) in diesem Jahr für China eine Goldnachfrage von 900-1.000 Tonnen.

Die starke Investmentnachfrage würde demnach die schwächelnde Schmucknachfrage auffangen. Auch die erwartete weitere Abwertung der chinesischen Währung würde zur höheren Goldnachfrage beitragen. Im nächsten Jahr soll sich die chinesische Goldnachfrage laut WGC wieder dem Niveau von 2015 annähern (984,5 Tonnen)." ...

Neues Hoch, top Chart, steigendes gutes Volumen  kann gerne so weiter gehen, News fehlen noch ..

kann gerne so weiter gehen, News fehlen noch ..

[/quote][url=http://peketec.de/trading/viewtopic.php?p=1711217#1711217 schrieb:marcovich schrieb am 27.09.2016, 08:13 Uhr[/url]"]1/3 der aktuellen Position zu 0,49 AUD verloren,geht mir fast bisserl zu schnell, aber Umsatz sehr gut, starke Performance .. da müssten eigentlich bald positive News folgen, so aus der Erfahrung

[url=http://peketec.de/trading/viewtopic.php?p=1710306#1710306 schrieb:marcovich schrieb am 21.09.2016, 10:26 Uhr[/url]"]Teilverkauf zu 0,405 AUD wurde ausgeführt.Positionsgröße jetzt wieder komfortabel, bei größeren Rücksetzern trotz positiver News würde ich wieder eine Trade Position eingehen, mittelfristig würde ich den 1 AUD favorisieren

[url=http://peketec.de/trading/viewtopic.php?p=1710143#1710143 schrieb:marcovich schrieb am 20.09.2016, 17:13 Uhr[/url]"]weiterhin sehr schöner Verlauf bei Alkane, mit kleinen Pausen. Heute neues Hoch auf SK Basis, bei gutem Umsatz. Der Bereich 0,40-0,45 AUD könnte ein kleiner Widerstand sein (Zwischenhochs aus 2013-2014), liege hier mit kleinem Teilverkauf, mit positiven News aber sicher zu überwinden.

Der Chart sieht mM nach mehr aus. Positiver Newsflow in der Pipeline? bleibt spannend.

Guten Morgen,

Alkane gefällt mir gut, schön konsolidiert, jetzt wieder am steigen. Stehen auch ein paar News an:

- jegliche Form der ersten Finanzierung (strateg. Partner, Gov. Kredit, etc)

- Ergebnisse der Pilot Plant (bessere Separation, Hafnium Circle etc)

- LOI für mögliche Abnahmen

Govt. hat das Projekt als wichtige Strategische Resource eingestuft

DFS - bei den aktuellen Rohstoff Preisen profitabel und damit als Projekt mit China konkurrenzfähig (REE, HREE, Zirkonium, Hafnium) könnte durch die neuen Ergebnisse der Pilot Plant noch besser werden

[url=http://peketec.de/trading/viewtopic.php?p=1705959#1705959 schrieb:marcovich schrieb am 24.08.2016, 09:22 Uhr[/url]"]Guten Morgen,

Alkane gefällt mir gut, Anstieg immer etwas auskonsolidiert und dann weiter mit neuem Hoch, Volumen auch besser als sonst, habe einen Teil der Stücke aus der kürzlichen KE (0,20 AUD) bei 0,34 AUD gegeben

[url=http://peketec.de/trading/viewtopic.php?p=1704796#1704796 schrieb:marcovich schrieb am 16.08.2016, 09:26 Uhr[/url]"]:D GEIL- Top News. TH bei 0,325 AUD + 22%, schönes Volumen, jetzt Schwung mitnehmen, Finanzierungsnews dürften folgen.. Minchem gehörte übrigens mal zu Rio Tinto.. mit diesen News dürfte die Medienpräsenz von Alkane hoffentlich auch mal zulegen ..

Alkane Resources Ltd signs zirconium marketing and sales Agreement

Alkane Resources Ltd (ASX: ALK) has signed an exclusive worldwide marketing, sales and distribution agreement with Minchem Ltd for all zirconium materials produced by the Dubbo Zirconia Project (DZP). At full capacity the DZP will produce zirconium products worth US$100-US$120 million annually. England-based Minchem is a technical ceramics marketing and manufacturing business that has been involved in zirconium chemicals and zirconium dioxide products for over 40 years. The five year agreement will commence upon production from the DZP and an option will exist to extend the term for an additional five years upon mutual agreement.

The DZP has received all required government approvals, is construction ready with projected annual revenue from the project estimated to be US$430-$470 million. Alkane will become the world’s largest producer of heavy rare earths outside China, with products principally used for rare earth magnets and special ceramics and alloys.

....

The signing of this exclusive agreement with the experienced Minchem is an important step for Alkane as it moves towards securing financing for the DZP.

The agreement significantly de-risks the project and furthermore validates the quality of the project and its US$0.92 billion valuation.

The demonstration pilot plant trials for the DZP are scheduled to commence in August for additional products for customer certification.

The company’s financing strategy targets a combination of export credit agency finance and bank debt, with discussions well advanced.

The DZP has been referred to by market commentators as the most advanced and arguably best rare earth elements and specialty metal project in the world.

....

müsste mal wieder bischen Volumen rein kommen !

[url=http://peketec.de/trading/viewtopic.php?p=1715634#1715634 schrieb:

First Mining Commences Metallurgical Drill Program at Springpole Gold Project

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Oct. 19, 2016) - First Mining Finance Corp. ("First Mining" or the "Company") (TSX VENTURE:FF)(OTCQX:FFMGF) is pleased to announce it has commenced a metallurgical drilling program at its wholly-owned Springpole Gold Project ("Springpole"), located in northern Ontario, Canada.

This program will be comprised of up to four drill holes totaling approximately 1,500 metres of drilling to acquire material for metallurgical testing. The intent of the metallurgical testing program is to determine the optimal grind size and processing flow sheet so as to maximize metallurgical recoveries. The results from this metallurgical testing program are expected to be incorporated into a new Preliminary Economic Assessment ("PEA") for Springpole which is expected to be released in the first half of 2017.

Keith Neumeyer, Chairman of First Mining stated, "We are very excited to have commenced this first step towards adding value to certain key assets in our portfolio such as Springpole. Going forward we intend to undertake additional drill programs, resource estimates and economic studies, as well as other activities intended to enhance the value of the assets we have accumulated over the past year and a half."

ABOUT SPRINGPOLE

Springpole is one of the largest undeveloped gold projects in Canada that has to date had approximately $74 million invested over the past 20 years. The project area covers over 32,000 hectares in northwestern Ontario, approximately 110 kilometres from the Township of Red Lake. The project hosts an NI 43-101 compliant Indicated Resource of 128.2 million tonnes (mt) grading 1.07 grams per tonne (g/t) gold (Au) and 5.7 g/t silver (Ag), containing 4,410,000 ounces (oz.) Au and 23,800,000 oz. Ag. In addition the project hosts an Inferred Resource of 25.7 Mt grading 0.83 g/t Au and 3.2 g/t Ag, containing 690,000 oz. Au and 2,700,000 oz. Ag.

ABOUT FIRST MINING FINANCE CORP.

First Mining is a mineral property holding company whose principal business activity is to acquire high quality mineral assets with a focus in the Americas. The Company currently holds a portfolio of 25 mineral assets in Canada, Mexico and the United States with a focus on gold. Ultimately, the goal is to continue to increase its portfolio of mineral assets through acquisitions that are expected to be comprised of gold, silver, copper, lead, zinc and nickel.

ON BEHALF OF THE BOARD OF FIRST MINING FINANCE CORP.

Keith Neumeyer, Chairman

http://www.marketwired.com/press-r...gpole-gold-project-tsx-venture-ff-2167837.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Oct. 19, 2016) - First Mining Finance Corp. ("First Mining" or the "Company") (TSX VENTURE:FF)(OTCQX:FFMGF) is pleased to announce it has commenced a metallurgical drilling program at its wholly-owned Springpole Gold Project ("Springpole"), located in northern Ontario, Canada.

This program will be comprised of up to four drill holes totaling approximately 1,500 metres of drilling to acquire material for metallurgical testing. The intent of the metallurgical testing program is to determine the optimal grind size and processing flow sheet so as to maximize metallurgical recoveries. The results from this metallurgical testing program are expected to be incorporated into a new Preliminary Economic Assessment ("PEA") for Springpole which is expected to be released in the first half of 2017.

Keith Neumeyer, Chairman of First Mining stated, "We are very excited to have commenced this first step towards adding value to certain key assets in our portfolio such as Springpole. Going forward we intend to undertake additional drill programs, resource estimates and economic studies, as well as other activities intended to enhance the value of the assets we have accumulated over the past year and a half."

ABOUT SPRINGPOLE

Springpole is one of the largest undeveloped gold projects in Canada that has to date had approximately $74 million invested over the past 20 years. The project area covers over 32,000 hectares in northwestern Ontario, approximately 110 kilometres from the Township of Red Lake. The project hosts an NI 43-101 compliant Indicated Resource of 128.2 million tonnes (mt) grading 1.07 grams per tonne (g/t) gold (Au) and 5.7 g/t silver (Ag), containing 4,410,000 ounces (oz.) Au and 23,800,000 oz. Ag. In addition the project hosts an Inferred Resource of 25.7 Mt grading 0.83 g/t Au and 3.2 g/t Ag, containing 690,000 oz. Au and 2,700,000 oz. Ag.

ABOUT FIRST MINING FINANCE CORP.

First Mining is a mineral property holding company whose principal business activity is to acquire high quality mineral assets with a focus in the Americas. The Company currently holds a portfolio of 25 mineral assets in Canada, Mexico and the United States with a focus on gold. Ultimately, the goal is to continue to increase its portfolio of mineral assets through acquisitions that are expected to be comprised of gold, silver, copper, lead, zinc and nickel.

ON BEHALF OF THE BOARD OF FIRST MINING FINANCE CORP.

Keith Neumeyer, Chairman

http://www.marketwired.com/press-r...gpole-gold-project-tsx-venture-ff-2167837.htm

1/3 raus zu 7,95

[url=http://peketec.de/trading/viewtopic.php?p=1715550#1715550 schrieb:Sltrader schrieb am 18.10.2016, 17:35 Uhr[/url]"]KLG long zu 7,75

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1714707#1714707 schrieb:greenhorn schrieb am 13.10.2016, 12:16 Uhr[/url]"]KLG - gutes Quartalsergebnis, RSI bei 20...........könnte was gehen!

October 12, 2016 19:33 ET

Kirkland Lake Gold Announces Record Gold Production and Costs for the Third Quarter 2016

http://www.marketwired.com/press-re...-costs-third-quarter-2016-tsx-klg-2166140.htm

- Q3/16 production of 77,274 ounces of gold, up 13% over the previous quarter; and YTD gold production of 207,886 ounces

- Q3/16 gold sales of 76,339 ounces at an average realized price of US$1,321/oz(1) (based on revenue of C$131.6 million); YTD gold sales of 217,793 ounces at an average realized price of US$1,249/oz(1) (based on revenues of C$359.5 million)

- Preliminary operating costs(1) during the quarter of US$540/oz (based on operating costs of C$53.8 million) an improvement of 19% over the previous quarter; and US$591/oz (based on operating costs of C$169.6 million) YTD

- Preliminary All-in sustaining costs ("AISC")(1) of US$966/oz during the quarter and US$939/oz YTD

- Cash and bullion sold(2) increased by C$61.1 million in the quarter to $226.2 million as at September 30, 2016

- On track to meet the full year production guidance of between 270,000 - 290,000 ounces

auch 1/3 zu 3,28 raus

[url=http://peketec.de/trading/viewtopic.php?p=1715569#1715569 schrieb: