App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

Verkauf zu 3,04 CAD - reicht mir erstmal für heute

[url=http://peketec.de/trading/viewtopic.php?p=1360789#1360789 schrieb:greenhorn schrieb am 12.03.2013, 15:32 Uhr[/url]"]ja, weil ich immer Angst vor den Kunstbanausen haben muß.....

[url=http://peketec.de/trading/viewtopic.php?p=1360784#1360784 schrieb:Ollinho schrieb am 12.03.2013, 15:24 Uhr[/url]"]Diese Unruhe kommt vom nervösen Harfenzupfen....

[url=http://peketec.de/trading/viewtopic.php?p=1360781#1360781 schrieb:greenhorn schrieb am 12.03.2013, 15:22 Uhr[/url]"]CSI - keine Ruhe, doch 1.Posi wieder Long zu 2,77 CAD - lieber dabei und Nachkauf bei GAP-Schluß

wenn es heute so bleibt läuft sie in ein fettes Kaufsignal! 8)

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

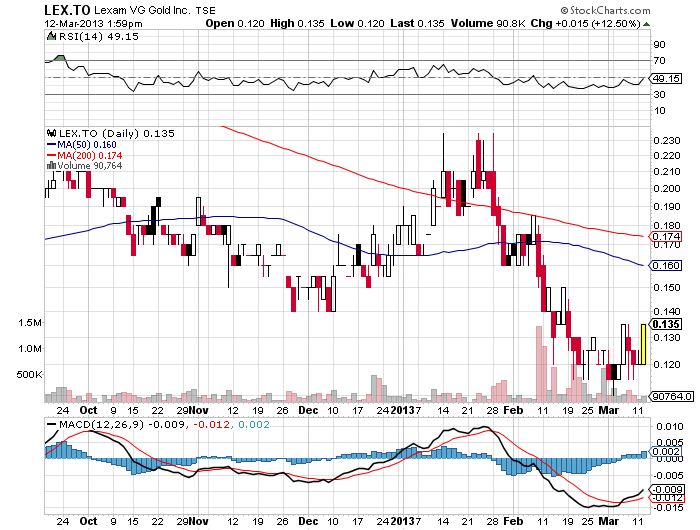

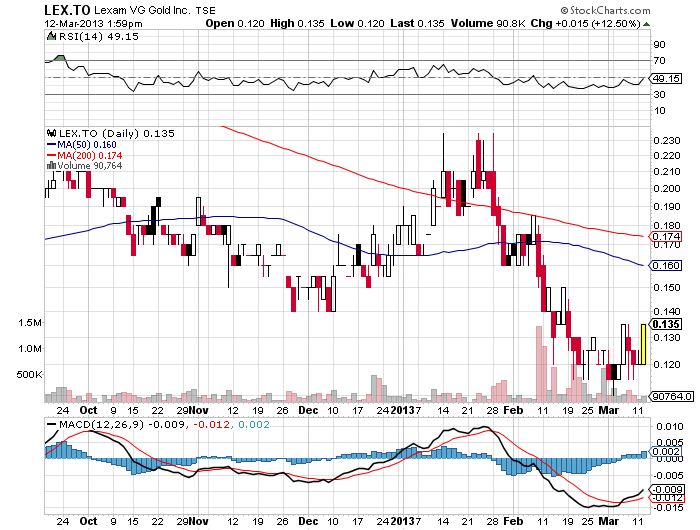

Heute mal ein paar LEX eingesammelt... 8)

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Aureus Mining drills 7.5 m of 10 g/t Au at Weaju

2013-03-12 07:15 ET - News Release

Mr. David Reading reports

AUREUS MINING INC. - WEAJU DELIVERS HIGH GRADE INTERCEPTS FROM FIRST DRILLING PHASE

Aureus Mining Inc. has released the first results from a 62-hole diamond drilling program at the Weaju gold target. Weaju is located within the company's 100-per-cent-owned Bea Mountain mining licence in Liberia and is situated approximately 30 kilometres northeast of Aureus's flagship New Liberty gold project.

Highlights

Results have been received from 47 diamond drill holes (6,143 metres) which form part of a 62-hole (9,000-metre) program designed to test grade and geological continuity of a mineralized system at the Weaju gold target.

Results, which are mainly from shallow intercepts, include:

10 grams per tonne (g/t) over 7.5 metres from 0.2 metre;

6.6 g/t over nine metres from 114.4 metres;

4.6 g/t over 11.3 metres from 13.9 metres;

2.5 g/t over 19 metres from 24 metres;

3.7 g/t over 11 metres from 36 metres;

5.5 g/t over 6.6 metres from 12.9 metres;

3.8 g/t over nine metres from 78 metres;

3.2 g/t over nine metres from 180 metres;

4.7 g/t over 5.9 metres from surface;

5.1 g/t over 4.4 metres from 7.2 metres;

4.4 g/t over five metres from 79.8 metres.

The geological setting at Weaju is very similar to New Liberty.

Current and historic drilling has outlined the potential for approximately one kilometre of gold mineralization, which is open in all directions.

The Main and Ridge zones have a potential strike length of 600 metres.

The North zone has a potential strike length of 400 metres.

The project has a strong southwest-directed plunge of 45 degrees to the mineralization, controlling the orientation of the high-grade pay shoots.

The project has the potential to increase total strike to two kilometres by extensions indicated by detailed soil surveying. Pitting and trenching are under way to define targets for drill testing in this additional strike length.

Assay results for the remaining 15 holes of the 9,000-metre program are expected in April. These results cover the area between the Ridge and Main zones and the deeper extensions of the North zone and the Creek zone.

Resource potential and phase 2 drilling will be assessed once all results have been received. Metallurgical sampling is currently in progress.

Commenting on the Weaju results, David Reading, president and chief executive officer of Aureus Mining, said: "The Weaju drilling and soil sampling results highlight the potential for a large mineralized system covering a two-kilometre strike length. Drilling results to date are very positive and include a number of high-grade, near-surface intercepts. Further work is required to define the potential size, grade and geometry of this deposit. The possibility of a stand-alone mine or trucking high-grade material from Weaju to New Liberty will be investigated."

Diamond drilling programs at Weaju have outlined mineralized zones with a cumulative strike potential of one kilometre.

The Weaju gold target is located under 30 kilometres northeast of the New Liberty gold deposit within the company's Bea Mountain mining licence of 457 square kilometres. Previously, 48 diamond drill holes were drilled at Weaju by former licence holder Mano River during the period 2000 to 2005. Weaju has been subjected to intense artisanal mining activity and in July, 2012, the company announced the settlement of a legacy mining claims issue with a local Liberian company, Weaju Hill Mining Corp. In November, 2012, the company commenced exploration activities at Weaju involving an LIDAR survey, geological mapping, soil geochemistry for gold and a diamond drilling program. At the end of February, 2013, the company had completed a phase one drilling program of 62 holes for approximately 9,000 metres. To date, results have been received for 47 holes from this program.

The geology at the Weaju target consists of a sequence of ultramafic and mafic rocks which have been intruded by various generations of granite and pegmatite. This package of rocks has been subjected to shearing and folding which led to the gold mineralization event. Gold is associated with disseminated sulphides and intense hydrothermal alteration involving silicification and the introduction of phlogopite and sericite. The structure, alteration and mineralization at Weaju are very similar in style to that developed at New Liberty which is located less than 30 kilometres to the southwest, suggesting that both deposits are genetically related.

The gold mineralization occurs on both north and south limbs of an asymmetrical synform (North and Main zones) and within the fold closure (Creek and Ridge zones). The North zone dips steeply at 70 degrees to the south-southwest and the Main zone dips steeply at 60 degrees to the north-northwest. The phase one exploration drilling program at Weaju was designed to confirm the geological model developed from the historic drilling and to test the continuity of mineralization in the four zones.

Drilling has outlined multiple gold intercepts within the four zones and all results from the first 47 holes are presented in the associated table.

WEAJU DRILL HOLE RESULTS

Hole ID From (m) To (m) Intersection length (m) Au grade (g/t)

WJD0049 16.0 19.0 3.0 5.8

and 24.0 43.0 19.0 2.5

WJD0050 3.0 4.0 1.0 3.7

and 33.0 35.0 2.0 1.0

and 64.0 65.0 1.0 2.0

WJD0051 33.0 35.0 2.0 0.5

WJD0057 1.4 10.0 8.6 1.3

and 111.5 112.5 1.0 6.5

WJD0058 4.5 10.3 5.8 1.3

and 93.0 99.0 6.0 1.6

including 93.0 94.0 1.0 4.6

WJD0059 12.9 19.5 6.6 5.5

WJD0060 52.0 54.0 2.0 0.5

WJD0065 107.0 113.0 6.0 1.4

WJD0081 0.2 7.7 7.5 10.0

and 33.6 37.6 4.0 12.7

and 43.6 52.2 8.6 3.5

WJD0082 84.6 87.6 3.0 0.9

and 122.6 125.6 3.0 0.5

WJD0083 87.7 89.7 2.0 2.3

and 106.7 109.7 3.0 0.4

and 116.7 117.7 1.0 9.1

WJD0084 114.4 123.4 9.0 6.6

WJD0085 41.5 42.5 1.0 11.0

and 61.5 63.5 2.0 1.4

and 73.5 75.5 2.0 1.7

and 77.5 79.5 2.0 2.1

and 85.5 90.5 5.0 0.4

and 94.5 99.5 5.0 0.5

and 102.5 104.5 2.0 0.9

and 133.5 134.5 1.0 4.8

WJD0053 36.0 47.0 11.0 3.7

including 41.0 46.0 5.0 8.0

WJD0054 23.2 27.8 4.6 2.5

WJD0055 78.0 87.0 9.0 3.8

WJD0056 97.0 105.0 8.0 1.0

and 108.0 111.0 3.0 1.8

WJD0062 155.0 157.0 2.0 2.0

and 169.0 174.0 5.0 1.0

and 180.0 189.0 9.0 3.2

WJD0068 63.0 68.0 5.0 5.7

WJD0069 6.0 10.0 4.0 5.0

and 15.0 17.5 2.5 1.2

WJD0070 78.0 82.0 4.0 1.0

WJD0072 13.9 25.2 11.3 4.6

WJD0073 0.9 8.3 7.4 1.9

and 18.2 23.0 4.8 0.5

WJD0074 4.6 12.4 7.8 0.9

including 9.4 12.4 3.0 1.2

and 42.0 48.0 6.0 1.1

and 50.0 58.0 8.0 1.5

WJD0075 44.2 47.2 3.0 2.3

and 80.6 91.6 11.0 0.5

WJD0078 28.9 33.1 4.2 1.6

and 63.1 64.1 1.0 2.6

WJD0079 15.3 32.8 17.5 1.3

and 42.8 47.8 5.0 2.4

WJD0086 28.9 32.8 3.9 0.9

and 63.8 64.8 1.0 2.8

and 79.8 84.8 5.0 4.4

and 86.8 87.8 1.0 2.3

and 90.8 94.8 4.0 1.3

and 106.8 107.8 1.0 5.2

WJD0087 86.9 87.9 1.0 5.9

and 95.9 97.9 2.0 0.9

and 103.9 105.9 2.0 1.2

WJD0088 51.5 52.5 1.0 1.6

and 64.7 66.7 2.0 1.1

and 82.7 83.7 1.0 2.8

WJD0089 126.2 127.2 1.0 3.2

and 140.2 143.2 3.0 0.9

and 152.2 157.2 5.0 2.3

WJD0090 9.4 10.7 1.3 1.4

and 19.9 21.1 1.2 4.5

and 24.1 26.1 2.0 0.5

WJD0092 15.9 19.6 3.7 0.6

WJD0093 25.8 30.9 5.1 0.5

51.6 52.6 1.0 1.2

WJD0096 121.8 129.8 8.0 1.0

WJD0061 28.0 29.0 1.0 1.6

and 40.0 41.0 1.0 4.5

WJD0063 0.0 3.0 3.0 1.2

and 6.5 9.5 3.0 1.3

WJD0064 7.2 11.6 4.4 5.1

and 41.0 56.0 15.0 1.3

including 41.0 46.0 5.0 3.2

WJD0066 9.0 16.0 7.0 3.0

including 12.0 16.0 4.0 4.8

WJD0067 95.4 96.4 1.0 1.6

WJD0077 6.0 8.0 2.0 0.4

WJD0080 0.0 7.1 7.1 0.8

WJD0095 0.0 5.9 5.9 4.7

and 17.9 20.9 3.0 0.5

and 43.7 46.7 3.0 4.4

and 51.7 53.7 2.0 1.3

Comprehensive QA (quality assurance) and QC (quality control) procedures and protocols were undertaken on all sampling and assaying. Due to the presence of both coarse and fine gold a proportion of the drill samples were prepared and reanalyzed using screen fire assay and gravimetric finish. The correlation between standard fire assay methods and screened methods was good and confirmed the efficacy of the standard fire assay method for this material and the accuracy and repeatability of the results.

Shallow drilling within the oxide zones often encountered difficult ground conditions and high water inflows which resulted in significant core losses. Approximately 1,000 metres of drilling covering the oxide zones of 14 holes will be repeated in the near future with more advanced drilling technology to ensure better recoveries.

Over all, the drilling results confirm the presence of the North, Main and Ridge zones and suggest a potential cumulative strike of mineralized rock of over one kilometre.

The North zone has been defined with an east-to-west strike continuity of 400 metres and has been drilled down to a depth of 150 metres. It is still open in all directions. Gold intercepts vary in width from one to 18 metres and many holes have multiple intercepts. Higher-grade zones are controlled by a 45-degree plunge to the southwest. Results are still pending from five diamond holes drilled to test depth extensions in the North zone.

Drilling in the Main zone highlights a complex geometry controlled by tight folding which plunges to the west. Mineralized bodies can be traced over a northeast-southwest strike of 200 metres and widths of between one and 19 metres.

The best Main zone grades are located within the shallow oxidized horizon and further drilling is required to trace the higher-grade shoots at depth as structural studies indicate that mineralization plunges to the west and therefore downdip extensions must take cognizance of this structural control.

The Ridge zone has a strike continuity of about 150 metres in a northeast-southwest direction and can be traced down to 80 metres in vertical depth. Results are still pending for three holes from this zone.

Results from holes WJD0083 to 85 suggest the Main zone can be linked to the Ridge zone and this would outline a total potential mineralized strike length of about 600 metres from the northernmost Ridge zone to the southernmost Main zone intersections. Results are still pending for three diamond holes drilled within the gap area between the Main and Ridge zones.

The Creek zone is still poorly understood in terms of geology and grade geometry and results of three holes are still pending from this area.

Some very high historic grades were encountered in shallow oxide material for six of the first 14 historic holes drilled into the Main and North zones in 2000 by Mano River Resources (WJD0001 returned 24 metres grading 33 g/t, WJD0002 returned 22 metres at 4.5 g/t, WJD0005 returned 34 metres at 19.9 g/t, WJD0007 returned four metres at 15.1 g/t, WJD0009 returned 18 metres at 4.5 g/t and WJD0013 returned 12 metres at 10 g/t). Due to extensive pitting and excavating undertaken by artisanal miners since that time a portion of this shallow material has been removed. The exact location of these holes is therefore not known but, where possible, approximate positions have been identified and twin drilling has outlined the same mineralized intervals in holes WJD0049, WJD0081 and WJD0054. Grade differences are attributed to either loss from artisanal mining of a portion of the material or core loss from the current drilling program. Surface trenching is being undertaken to understand grades in these areas and oxide drilling is to be repeated in 14 holes from the current program.

In summary, work to date has confirmed the mineralized systems at the North, Main and Ridge zones. Continuity of mineralization along strike and downdip is well defined in the North zone. In the Ridge and Main zones geological and structural modelling indicates that gold mineralization is controlled by shallow pay shoots which plunge to the southwest. Drilling in the gap between the Main and Ridge zones also highlights the potential for this plunging gold system to extend over at least 600 metres in a northeast-to-southwest direction. The current 62-hole drilling program is not yet complete and results are still pending from 15 holes.

Once all results have been received and repeat oxide drilling has been completed then geological and grade modelling will be undertaken to assess the resource potential of the Weaju target. A metallurgical sampling program is currently in progress to assess the amenability of this material to conventional CIL and gravity metallurgical recovery.

Soil sampling programs for gold outline potential eastern and southwestern extensions to the Weaju target.

The company has completed soil sampling for gold within a 2.8-square-kilometre area surrounding the Weaju target. Gridding was on a line spacing of 100 metres with samples taken at 25-metre intervals on each line, with 1,029 samples analyzed. Results from this work has outlined a 600-metre southwest extension to the Main zone as defined by anomalous gold-in-soil values ranging between 100 parts per billion (ppb) and 1.2 g/t gold. An eastward extension of 200 metres has also been outlined in the fold nose area (Creek and Ridge zones) at similar levels of anomalism. Finally a potential westward extension to the North zone has been identified on two soil lines. The soil results have been successful in outlining the potential size of the Weaju gold project which covers potentially double the area that has been drill tested.

All of the gold-in-soil anomalies are currently the subject of follow-up pitting and trenching programs in order to define targets for drill testing.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aAUE-2048048&symbol=AUE®ion=C

2013-03-12 07:15 ET - News Release

Mr. David Reading reports

AUREUS MINING INC. - WEAJU DELIVERS HIGH GRADE INTERCEPTS FROM FIRST DRILLING PHASE

Aureus Mining Inc. has released the first results from a 62-hole diamond drilling program at the Weaju gold target. Weaju is located within the company's 100-per-cent-owned Bea Mountain mining licence in Liberia and is situated approximately 30 kilometres northeast of Aureus's flagship New Liberty gold project.

Highlights

Results have been received from 47 diamond drill holes (6,143 metres) which form part of a 62-hole (9,000-metre) program designed to test grade and geological continuity of a mineralized system at the Weaju gold target.

Results, which are mainly from shallow intercepts, include:

10 grams per tonne (g/t) over 7.5 metres from 0.2 metre;

6.6 g/t over nine metres from 114.4 metres;

4.6 g/t over 11.3 metres from 13.9 metres;

2.5 g/t over 19 metres from 24 metres;

3.7 g/t over 11 metres from 36 metres;

5.5 g/t over 6.6 metres from 12.9 metres;

3.8 g/t over nine metres from 78 metres;

3.2 g/t over nine metres from 180 metres;

4.7 g/t over 5.9 metres from surface;

5.1 g/t over 4.4 metres from 7.2 metres;

4.4 g/t over five metres from 79.8 metres.

The geological setting at Weaju is very similar to New Liberty.

Current and historic drilling has outlined the potential for approximately one kilometre of gold mineralization, which is open in all directions.

The Main and Ridge zones have a potential strike length of 600 metres.

The North zone has a potential strike length of 400 metres.

The project has a strong southwest-directed plunge of 45 degrees to the mineralization, controlling the orientation of the high-grade pay shoots.

The project has the potential to increase total strike to two kilometres by extensions indicated by detailed soil surveying. Pitting and trenching are under way to define targets for drill testing in this additional strike length.

Assay results for the remaining 15 holes of the 9,000-metre program are expected in April. These results cover the area between the Ridge and Main zones and the deeper extensions of the North zone and the Creek zone.

Resource potential and phase 2 drilling will be assessed once all results have been received. Metallurgical sampling is currently in progress.

Commenting on the Weaju results, David Reading, president and chief executive officer of Aureus Mining, said: "The Weaju drilling and soil sampling results highlight the potential for a large mineralized system covering a two-kilometre strike length. Drilling results to date are very positive and include a number of high-grade, near-surface intercepts. Further work is required to define the potential size, grade and geometry of this deposit. The possibility of a stand-alone mine or trucking high-grade material from Weaju to New Liberty will be investigated."

Diamond drilling programs at Weaju have outlined mineralized zones with a cumulative strike potential of one kilometre.

The Weaju gold target is located under 30 kilometres northeast of the New Liberty gold deposit within the company's Bea Mountain mining licence of 457 square kilometres. Previously, 48 diamond drill holes were drilled at Weaju by former licence holder Mano River during the period 2000 to 2005. Weaju has been subjected to intense artisanal mining activity and in July, 2012, the company announced the settlement of a legacy mining claims issue with a local Liberian company, Weaju Hill Mining Corp. In November, 2012, the company commenced exploration activities at Weaju involving an LIDAR survey, geological mapping, soil geochemistry for gold and a diamond drilling program. At the end of February, 2013, the company had completed a phase one drilling program of 62 holes for approximately 9,000 metres. To date, results have been received for 47 holes from this program.

The geology at the Weaju target consists of a sequence of ultramafic and mafic rocks which have been intruded by various generations of granite and pegmatite. This package of rocks has been subjected to shearing and folding which led to the gold mineralization event. Gold is associated with disseminated sulphides and intense hydrothermal alteration involving silicification and the introduction of phlogopite and sericite. The structure, alteration and mineralization at Weaju are very similar in style to that developed at New Liberty which is located less than 30 kilometres to the southwest, suggesting that both deposits are genetically related.

The gold mineralization occurs on both north and south limbs of an asymmetrical synform (North and Main zones) and within the fold closure (Creek and Ridge zones). The North zone dips steeply at 70 degrees to the south-southwest and the Main zone dips steeply at 60 degrees to the north-northwest. The phase one exploration drilling program at Weaju was designed to confirm the geological model developed from the historic drilling and to test the continuity of mineralization in the four zones.

Drilling has outlined multiple gold intercepts within the four zones and all results from the first 47 holes are presented in the associated table.

WEAJU DRILL HOLE RESULTS

Hole ID From (m) To (m) Intersection length (m) Au grade (g/t)

WJD0049 16.0 19.0 3.0 5.8

and 24.0 43.0 19.0 2.5

WJD0050 3.0 4.0 1.0 3.7

and 33.0 35.0 2.0 1.0

and 64.0 65.0 1.0 2.0

WJD0051 33.0 35.0 2.0 0.5

WJD0057 1.4 10.0 8.6 1.3

and 111.5 112.5 1.0 6.5

WJD0058 4.5 10.3 5.8 1.3

and 93.0 99.0 6.0 1.6

including 93.0 94.0 1.0 4.6

WJD0059 12.9 19.5 6.6 5.5

WJD0060 52.0 54.0 2.0 0.5

WJD0065 107.0 113.0 6.0 1.4

WJD0081 0.2 7.7 7.5 10.0

and 33.6 37.6 4.0 12.7

and 43.6 52.2 8.6 3.5

WJD0082 84.6 87.6 3.0 0.9

and 122.6 125.6 3.0 0.5

WJD0083 87.7 89.7 2.0 2.3

and 106.7 109.7 3.0 0.4

and 116.7 117.7 1.0 9.1

WJD0084 114.4 123.4 9.0 6.6

WJD0085 41.5 42.5 1.0 11.0

and 61.5 63.5 2.0 1.4

and 73.5 75.5 2.0 1.7

and 77.5 79.5 2.0 2.1

and 85.5 90.5 5.0 0.4

and 94.5 99.5 5.0 0.5

and 102.5 104.5 2.0 0.9

and 133.5 134.5 1.0 4.8

WJD0053 36.0 47.0 11.0 3.7

including 41.0 46.0 5.0 8.0

WJD0054 23.2 27.8 4.6 2.5

WJD0055 78.0 87.0 9.0 3.8

WJD0056 97.0 105.0 8.0 1.0

and 108.0 111.0 3.0 1.8

WJD0062 155.0 157.0 2.0 2.0

and 169.0 174.0 5.0 1.0

and 180.0 189.0 9.0 3.2

WJD0068 63.0 68.0 5.0 5.7

WJD0069 6.0 10.0 4.0 5.0

and 15.0 17.5 2.5 1.2

WJD0070 78.0 82.0 4.0 1.0

WJD0072 13.9 25.2 11.3 4.6

WJD0073 0.9 8.3 7.4 1.9

and 18.2 23.0 4.8 0.5

WJD0074 4.6 12.4 7.8 0.9

including 9.4 12.4 3.0 1.2

and 42.0 48.0 6.0 1.1

and 50.0 58.0 8.0 1.5

WJD0075 44.2 47.2 3.0 2.3

and 80.6 91.6 11.0 0.5

WJD0078 28.9 33.1 4.2 1.6

and 63.1 64.1 1.0 2.6

WJD0079 15.3 32.8 17.5 1.3

and 42.8 47.8 5.0 2.4

WJD0086 28.9 32.8 3.9 0.9

and 63.8 64.8 1.0 2.8

and 79.8 84.8 5.0 4.4

and 86.8 87.8 1.0 2.3

and 90.8 94.8 4.0 1.3

and 106.8 107.8 1.0 5.2

WJD0087 86.9 87.9 1.0 5.9

and 95.9 97.9 2.0 0.9

and 103.9 105.9 2.0 1.2

WJD0088 51.5 52.5 1.0 1.6

and 64.7 66.7 2.0 1.1

and 82.7 83.7 1.0 2.8

WJD0089 126.2 127.2 1.0 3.2

and 140.2 143.2 3.0 0.9

and 152.2 157.2 5.0 2.3

WJD0090 9.4 10.7 1.3 1.4

and 19.9 21.1 1.2 4.5

and 24.1 26.1 2.0 0.5

WJD0092 15.9 19.6 3.7 0.6

WJD0093 25.8 30.9 5.1 0.5

51.6 52.6 1.0 1.2

WJD0096 121.8 129.8 8.0 1.0

WJD0061 28.0 29.0 1.0 1.6

and 40.0 41.0 1.0 4.5

WJD0063 0.0 3.0 3.0 1.2

and 6.5 9.5 3.0 1.3

WJD0064 7.2 11.6 4.4 5.1

and 41.0 56.0 15.0 1.3

including 41.0 46.0 5.0 3.2

WJD0066 9.0 16.0 7.0 3.0

including 12.0 16.0 4.0 4.8

WJD0067 95.4 96.4 1.0 1.6

WJD0077 6.0 8.0 2.0 0.4

WJD0080 0.0 7.1 7.1 0.8

WJD0095 0.0 5.9 5.9 4.7

and 17.9 20.9 3.0 0.5

and 43.7 46.7 3.0 4.4

and 51.7 53.7 2.0 1.3

Comprehensive QA (quality assurance) and QC (quality control) procedures and protocols were undertaken on all sampling and assaying. Due to the presence of both coarse and fine gold a proportion of the drill samples were prepared and reanalyzed using screen fire assay and gravimetric finish. The correlation between standard fire assay methods and screened methods was good and confirmed the efficacy of the standard fire assay method for this material and the accuracy and repeatability of the results.

Shallow drilling within the oxide zones often encountered difficult ground conditions and high water inflows which resulted in significant core losses. Approximately 1,000 metres of drilling covering the oxide zones of 14 holes will be repeated in the near future with more advanced drilling technology to ensure better recoveries.

Over all, the drilling results confirm the presence of the North, Main and Ridge zones and suggest a potential cumulative strike of mineralized rock of over one kilometre.

The North zone has been defined with an east-to-west strike continuity of 400 metres and has been drilled down to a depth of 150 metres. It is still open in all directions. Gold intercepts vary in width from one to 18 metres and many holes have multiple intercepts. Higher-grade zones are controlled by a 45-degree plunge to the southwest. Results are still pending from five diamond holes drilled to test depth extensions in the North zone.

Drilling in the Main zone highlights a complex geometry controlled by tight folding which plunges to the west. Mineralized bodies can be traced over a northeast-southwest strike of 200 metres and widths of between one and 19 metres.

The best Main zone grades are located within the shallow oxidized horizon and further drilling is required to trace the higher-grade shoots at depth as structural studies indicate that mineralization plunges to the west and therefore downdip extensions must take cognizance of this structural control.

The Ridge zone has a strike continuity of about 150 metres in a northeast-southwest direction and can be traced down to 80 metres in vertical depth. Results are still pending for three holes from this zone.

Results from holes WJD0083 to 85 suggest the Main zone can be linked to the Ridge zone and this would outline a total potential mineralized strike length of about 600 metres from the northernmost Ridge zone to the southernmost Main zone intersections. Results are still pending for three diamond holes drilled within the gap area between the Main and Ridge zones.

The Creek zone is still poorly understood in terms of geology and grade geometry and results of three holes are still pending from this area.

Some very high historic grades were encountered in shallow oxide material for six of the first 14 historic holes drilled into the Main and North zones in 2000 by Mano River Resources (WJD0001 returned 24 metres grading 33 g/t, WJD0002 returned 22 metres at 4.5 g/t, WJD0005 returned 34 metres at 19.9 g/t, WJD0007 returned four metres at 15.1 g/t, WJD0009 returned 18 metres at 4.5 g/t and WJD0013 returned 12 metres at 10 g/t). Due to extensive pitting and excavating undertaken by artisanal miners since that time a portion of this shallow material has been removed. The exact location of these holes is therefore not known but, where possible, approximate positions have been identified and twin drilling has outlined the same mineralized intervals in holes WJD0049, WJD0081 and WJD0054. Grade differences are attributed to either loss from artisanal mining of a portion of the material or core loss from the current drilling program. Surface trenching is being undertaken to understand grades in these areas and oxide drilling is to be repeated in 14 holes from the current program.

In summary, work to date has confirmed the mineralized systems at the North, Main and Ridge zones. Continuity of mineralization along strike and downdip is well defined in the North zone. In the Ridge and Main zones geological and structural modelling indicates that gold mineralization is controlled by shallow pay shoots which plunge to the southwest. Drilling in the gap between the Main and Ridge zones also highlights the potential for this plunging gold system to extend over at least 600 metres in a northeast-to-southwest direction. The current 62-hole drilling program is not yet complete and results are still pending from 15 holes.

Once all results have been received and repeat oxide drilling has been completed then geological and grade modelling will be undertaken to assess the resource potential of the Weaju target. A metallurgical sampling program is currently in progress to assess the amenability of this material to conventional CIL and gravity metallurgical recovery.

Soil sampling programs for gold outline potential eastern and southwestern extensions to the Weaju target.

The company has completed soil sampling for gold within a 2.8-square-kilometre area surrounding the Weaju target. Gridding was on a line spacing of 100 metres with samples taken at 25-metre intervals on each line, with 1,029 samples analyzed. Results from this work has outlined a 600-metre southwest extension to the Main zone as defined by anomalous gold-in-soil values ranging between 100 parts per billion (ppb) and 1.2 g/t gold. An eastward extension of 200 metres has also been outlined in the fold nose area (Creek and Ridge zones) at similar levels of anomalism. Finally a potential westward extension to the North zone has been identified on two soil lines. The soil results have been successful in outlining the potential size of the Weaju gold project which covers potentially double the area that has been drill tested.

All of the gold-in-soil anomalies are currently the subject of follow-up pitting and trenching programs in order to define targets for drill testing.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aAUE-2048048&symbol=AUE®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Magellan Minerals starts drill program at Coringa

2013-03-12 08:15 ET - News Release

Mr. Alan Carter reports

MAGELLAN COMMENCES DRILLING AT CORINGA AS PART OF FEASIBILITY STUDY

Magellan Minerals Ltd. has commenced diamond drilling at its Coringa project located in the southern part of Para state in Brazil.

The drill program forms part of the continuing feasibility study at Coringa (see press release dated Jan. 15, 2013). The specific objectives of this program are to upgrade the inferred resources at the Serra, Come Quieto and Mae de Leite zones, and expand the total resource base at Coringa. The program will consist of an initial 2,500 metres, with an option to increase the total to 5,000 m. A total of 16 initial holes are planned initially with results anticipated during the second quarter of 2013.

An update on the continuing feasibility study at Coringa is planned for late March, 2013, with an anticipated completion of September/October, 2013.

This press release was reviewed by Guillermo Hughes, BSc, member of AIG and AUSIMM, qualified person in compliance with National Instrument 43-101.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aMNM-2048079&symbol=MNM®ion=C

2013-03-12 08:15 ET - News Release

Mr. Alan Carter reports

MAGELLAN COMMENCES DRILLING AT CORINGA AS PART OF FEASIBILITY STUDY

Magellan Minerals Ltd. has commenced diamond drilling at its Coringa project located in the southern part of Para state in Brazil.

The drill program forms part of the continuing feasibility study at Coringa (see press release dated Jan. 15, 2013). The specific objectives of this program are to upgrade the inferred resources at the Serra, Come Quieto and Mae de Leite zones, and expand the total resource base at Coringa. The program will consist of an initial 2,500 metres, with an option to increase the total to 5,000 m. A total of 16 initial holes are planned initially with results anticipated during the second quarter of 2013.

An update on the continuing feasibility study at Coringa is planned for late March, 2013, with an anticipated completion of September/October, 2013.

This press release was reviewed by Guillermo Hughes, BSc, member of AIG and AUSIMM, qualified person in compliance with National Instrument 43-101.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aMNM-2048079&symbol=MNM®ion=C

[url=http://peketec.de/trading/viewtopic.php?p=1348876#1348876 schrieb:Kostolanys Erbe schrieb am 05.02.2013, 20:51 Uhr[/url]"]Magellan Minerals drills 7.5 m of 2.78 g/t Au at Cuiu

2013-02-05 06:23 ET - News Release

Mr. Alan Carter reports

MAGELLAN REPORTS RESULTS FROM EXPLORATION DRILLING AT CUIU CUIU PROJECT, BRAZIL

Magellan Minerals Ltd. has released the results of eight additional exploration holes recently drilled at the previously untested Ivo, Ratinho South and Ratinho North targets at the Cuiu Cuiu project. Ivo is located 800 metres north of the Moreira Gomes gold deposit (comprising 14 million tonnes at 1.5 grams per tonne of gold for 700,000 ounces in the inferred category). The Ratinho North and Ratinho South anomalies are located nine kilometres north-northwest and 8.5 kilometres northwest of the Central gold deposit, respectively, which comprises 3.4 million tonnes at one gram per tonne of gold for 100,000 ounces in the indicated category and 17 million tonnes at 0.9 gram per tonne of gold for 500,000 ounces in the inferred category.

Highlights include:

The discovery of two additional mineralized zones at Ivo and Ratinho North at the Cuiu Cuiu project;

7.5 metres at 2.78 grams per tonne gold, including 0.5 metre at 38.0 grams per tonne gold, in hole 169, which was drilled in the central part of the Ivo zone;

Numerous other mineralized intervals in hole 169 at Ivo, including 8.8 metres at 1.47 grams per tonne and 4.2 metres at 0.89 gram per tonne gold;

Numerous mineralized intervals in two drill holes completed at the Ratinho North anomaly suggesting the potential for an additional mineralized body.

Ivo

Four reconnaissance holes were drilled at Ivo over a 500-metre east-west strike length and under small surface workings, which returned values of two metres at 104 grams per tonne gold and five metres at 54.8 grams per tonne gold in recently completed channel samples (see press releases dated Oct. 11, 2012, and Oct. 23, 2012). Of the four holes, hole 169 cut the most significant values and intersected a number of mineralized intervals, including 7.5 metres at 2.78 grams per tonne gold from 37.9 to 45.4 metres depth, including 0.5 metre at 38.0 grams per tonne gold from 43.5 to 44.0 metres depth, confirming the presence of high-grade gold mineralization at depth at Ivo. Other intervals intersected in hole 169 include 8.8 metres at 1.47 grams per tonne gold from 81.2 to 90.0 metres depth, 1.9 metres at 1.43 grams per tonne gold from 100.5 to 102.4 metres depth and 4.2 metres at 0.89 gram per tonne gold from 117.9 to 122.1 metres depth.

The other three holes drilled at Ivo also cut numerous mineralized intervals but of generally lower grade and are shown in the table of drill results. These drill results are not dissimilar to the initial drill results returned from the Moreira Gomes deposit located immediately to the south. Further, the Ivo structure is interpreted to trend in a more northwest-southeast direction (see map on website) akin to the deposit at Central and the mineralized zone at Jerimum do Baixo which would explain why mineralization is stronger in hole 169. Hole 170 drilled 100 metres west of hole 169 bottomed in mineralized rock (0.22 gram per tonne gold) which further supports this conclusion.

Further drilling to the northwest and southeast at Ivo will be required to define the limits of the mineralization identified in hole 169.

DRILL HOLE INTERSECTIONS

Hole ID From (m) To (m) Width(i) (m) Gold (g/t)

Ivo

DDH 169 37.9 45.4 7.5 2.78

incl. 43.5 44.0 0.5 38.00

73.1 74.1 1.0 1.26

81.2 90.0 8.8 1.47

100.5 102.4 1.9 1.43

107.7 108.6 0.9 0.59

117.9 122.1 4.2 0.89

DDH 170 76.0 79.4 3.4 0.46

106.6 107.6 1.0 0.62

DDH 171 54.5 58.6 4.1 0.38

76.0 77.2 1.2 1.83

95.8 96.8 1.0 0.53

DDH 172 0.0 2.0 2.0 0.22

9.0 10.4 1.4 0.24

17.0 18.0 1.0 0.42

33.0 34.0 1.0 0.27

39.0 45.0 6.0 0.26

Ratinho South

DDH 173 0.0 3.0 3.0 0.31

55.5 57.5 2.0 0.48

122.4 123.4 1.0 2.55

151.9 153.0 1.1 0.65

DDH 174 37.0 39.0 2.0 0.69

65.5 66.5 1.0 0.31

Ratinho North

DDH 175 10.5 12.0 1.5 0.44

22.0 24.9 2.9 0.39

29.0 31.0 2.0 0.36

53.0 54.0 1.0 1.32

57.5 58.0 0.5 0.59

65.6 66.1 0.5 0.90

136.0 141.0 5.0 0.39

158.0 160.0 2.0 0.67

DDH 176 0.0 10.0 10.0 0.30

27.0 28.0 1.0 1.59

29.0 30.0 1.0 0.7

38.4 40.0 1.6 0.8

48.0 54.5 6.5 0.50

64.8 66.8 2.0 0.70

76.0 77.0 1.0 1.0

All holes were drilled at minus 50 degrees. Dips of the intersected

structures are not known, and intersection widths are not necessarily true

width.

Ratinho North

Two reconnaissance holes, 175 and 176, were drilled at the Ratinho North target over a 150-metre east-west strike length (see map on website). Ratinho North has never been previously drill tested and is a gold-in-soil anomaly which is located approximately nine kilometres north-northwest of the Central gold deposit.

Ratinho North extends in a northwest-southeast direction over approximately four kilometres and is coincident with a major structure and a pronounced magnetic low. Numerous low-grade mineralized intervals were intersected in both drill holes, including 10 metres at 0.30 gram per tonne gold, one metre at 1.59 grams per tonne gold, one metre at 0.7 gram per tonne gold, 1.6 metres at 0.8 gram per tonne gold, 6.5 metres at 0.50 gram per tonne gold, two metres at 0.70 gram per tonne gold and one metre at one gram per tonne gold as well as a number of other lower-grade intervals all within the top 70 metres of hole 176.

The two holes drilled thus far at Ratinho North have tested a very small portion of the four-kilometre-long gold-in soil and coincident magnetic anomaly. The presence of numerous mineralized intervals in both holes strongly suggests the presence of a significant mineralized body at Ratinho North and further drilling is required to fully test this area particularly to the northwest of the current drilling.

Ratinho South

Two additional holes, 173 and 174, were drilled at the Ratinho South target, which has similarly never been previously drill tested. The gold-in-soil anomaly at Ratinho South is located approximately 8.5 kilometres northwest of the Central gold deposit and extends in a northwest-southeast direction over approximately 2.5 kilometres.

The two holes reported here were drilled 100 metres apart and cut only narrow mineralized intervals. The source of the gold-in-soil anomaly at Ratinho South remains unexplained.

The discovery of significant mineralization at the Ivo and Ratinho North targets at Cuiu Cuiu demonstrates the potential for the discovery of additional mineralized bodies within the Cuiu Cuiu project areas and highlights the need for further drilling in order to expand the existing resources.

Holes were drilled at 50 degrees from horizontal. All core samples (HQ diameter) were cut with a diamond saw and one-half of the core placed in bags, numbered and sealed then sent via a secure transport agency to the company's office in Itaituba before shipping via secure transport to ACME preparation laboratory in Itaituba for sample preparation. Core samples were crushed down to two millimetres and a one-kilogram split was pulverized to better than 85 per cent minus 200 mesh. From Itaituba, ACME sent the pulp samples to Santiago, Chile, for assaying. Gold analyses were conducted on 30-gram representative sample cuts using fire assay with an atomic absorption finish. Other sample cuts were subjected to a four-acid digestion and analyzed for silver and an additional 35 elements using inductively coupled plasma mass spectrometry (ICP-MS). ACME is an ISO 9001-registered laboratory and has a quality control program in place which includes the insertion of standard, blank and duplicate samples, as well as conducting repeat analyses.

Magellan's quality assurance/quality control program also includes the insertion of standards, field duplicates and blank material in the sample sequence with the normal core samples to monitor sampling variances, laboratory precision and accuracy.

This press release was reviewed by Guillermo Hughes, BSc, a member of the AIG and the AUSIMM, a qualified person in compliance with National Instrument 43-101.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aMNM-2037493&symbol=MNM®ion=C

[url=http://peketec.de/trading/viewtopic.php?p=1341765#1341765 schrieb:Kostolanys Erbe schrieb am 16.01.2013, 22:50 Uhr[/url]"]Magellan Minerals 6.67-million-share private placement

2013-01-16 16:43 ET - Private Placement

This item is part of Stockwatch's value added news feed and is only available to Stockwatch subscribers.

Here is a sample of this item:

The TSX Venture Exchange has accepted for filing documentation with respect to a non-brokered private placement announced Dec. 13, 2012.

Number of shares: 6.67 million shares

Purchase price: 30 cents per share

Warrants: 3,335,000 share purchase warrants to purchase 3,335,000 shares

Warrant exercise price: 50 cents for a two-year period

Number of placees: Two placees

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aMNM-2032413&symbol=MNM®ion=C

[url=http://peketec.de/trading/viewtopic.php?p=1341287#1341287 schrieb:Kostolanys Erbe schrieb am 15.01.2013, 20:57 Uhr[/url]"]http://canadianinsider.com/node/7?menu_tickersearch=mnm

gestern 95k Insiderkäufe!

Ausserdem sollen im Januar noch Bohrergebnisse kommen....

Magellan Minerals plans FS for Coringa in Brazil

2013-01-15 06:42 ET - News Release

Mr. Alan Carter reports

MAGELLAN ANNOUNCES THE INITIATION OF A FEASIBILITY STUDY FOR THE CORINGA PROJECT, BRAZIL

Magellan Minerals Ltd. has engaged a group of prominent mining industry consultants led by Ausenco to complete a feasibility study on the Coringa gold project in northern Brazil.

Highlights:

Ausenco Solutions Canada Inc. was chosen to lead the study based on its vast process and infrastructure capabilities worldwide, including projects in Brazil, such as the Tucano gold project and the Suraca project. The Ausenco office in Vancouver will be responsible for the work, supported by staff in Belo Horizonte.

Also included as part of the team:

Snowden Mining Industry Consultants of Vancouver, which will be responsible for resource and reserve estimates and mine design;

Terra Meio Ambiente of Belem, Brazil, which will manage the environmental components and permitting aspects of the study. Terra has been involved in previous environmental and permitting work for this project, providing continuity in this critical area;

Kovit Engineering Ltd. of Sudbury and Belo Horizonte, which will design and cost the tailings and backfill components of the project;

Deswik Mining Consultants of Vancouver, which will be responsible for mine layout and scheduling, using its industry-leading mine design software, which may ultimately be used at the Coringa operation should a construction decision be made.

The above group will be supported by Magellan staff in Vancouver and Brazil, and it is expected that the study will be complete near the beginning of the fourth quarter of 2013.

Qualified person

John Kiernan, PEng, Magellan's vice-president, project development, and a qualified person within the definition of that term in National Instrument 43-101, has reviewed the technical information contained in this news release.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aMNM-2031783&symbol=MNM®ion=C

[url=http://peketec.de/trading/viewtopic.php?p=1340264#1340264 schrieb:Kostolanys Erbe schrieb am 11.01.2013, 22:23 Uhr[/url]"]Mal MNM mit Projekten in Brasilien auf WL gesetzt.

Auf diesem Niveau für mich ein Übernahmekandidat!

http://www.magellanminerals.com/

Marketcap. ca. 24 Mio. CAN$

Cash: 2 Mio. CAN$

Top-Management

http://magellanminerals.com/corporate/management/

Resources To Date

Cuiu Cuiu Deposit (last updated Apr 2011)

*0.3 g/t Au cut-off grade

Tonnes (Mt) Gpt Oz Au

Indicated 3.4Mt 1.0 g/t 100,000

Inferred 31Mt 1.2 g/t 1,200,000

Coringa Deposit (last updated March 2012)

*1 g/t Au cut-off grade

Tonnes (Mt) Gpt Oz Au

Measured 1.15Mt 6.8g/t 252,000

Indicated 2.00Mt 4.8g/t 309,000

Inferred 5.50Mt 3.0g/t 534,000

Total Resources 2.4Moz

Dezember-Präsentation:

http://magellanminerals.com/_resources/presentations/CorporatePresentation.pdf

» zur Grafik

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

PNG Gold drills 5.2 m of 29.35 g/t Au at Imwauna Main

2013-03-12 09:43 ET - News Release

Mr. Greg Clarkes reports

PNG GOLD CORPORATION ANNOUNCES DRILL ASSAYS AT THE IMWAUNA MAIN STRUCTURE

http://peketec.de/trading/kostolanys-erbe-rohstoff-thread-t8839desc.html

2013-03-12 09:43 ET - News Release

Mr. Greg Clarkes reports

PNG GOLD CORPORATION ANNOUNCES DRILL ASSAYS AT THE IMWAUNA MAIN STRUCTURE

http://peketec.de/trading/kostolanys-erbe-rohstoff-thread-t8839desc.html

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

March 12, 2013 11:53 ET

Vantex Resumes Drilling on Moriss

LA PRAIRIE, QUEBEC--(Marketwire - March 12, 2013) - The management of Vantex Resources Ltd. (TSX VENTURE:VAX)(FRANKFURT:UD7A)(ALPHA:VAX) announces the start of a 5,000-meter drilling campaign on the Moriss zone, in the west part of the Galloway project. 20 drill holes with lengths between 250 and 350 metres will be drilled in order to test the lateral and depth extensions of this gold zone that is now known over 225 metres on surface and down to 200 metres below surface.

Location of new drill holes : http://media3.marketwire.com/docs/Drill_map.pdf

The Moriss showing forms with the GP and Hendrick showings, the Golden Triangle area.

Many drill holes that took place on the Moriss showing since 2010 outline an important gold system comprised of many zones with high gold grades, namely the Moriss and Moriss North zones. These zones also contain elevated silver grades.

The following table highlights previous drill results from these two zones :

.......

http://www.marketwire.com/press-release/vantex-resumes-drilling-on-moriss-tsx-venture-vax-1767143.htm

Vantex Resumes Drilling on Moriss

LA PRAIRIE, QUEBEC--(Marketwire - March 12, 2013) - The management of Vantex Resources Ltd. (TSX VENTURE:VAX)(FRANKFURT:UD7A)(ALPHA:VAX) announces the start of a 5,000-meter drilling campaign on the Moriss zone, in the west part of the Galloway project. 20 drill holes with lengths between 250 and 350 metres will be drilled in order to test the lateral and depth extensions of this gold zone that is now known over 225 metres on surface and down to 200 metres below surface.

Location of new drill holes : http://media3.marketwire.com/docs/Drill_map.pdf

The Moriss showing forms with the GP and Hendrick showings, the Golden Triangle area.

Many drill holes that took place on the Moriss showing since 2010 outline an important gold system comprised of many zones with high gold grades, namely the Moriss and Moriss North zones. These zones also contain elevated silver grades.

The following table highlights previous drill results from these two zones :

.......

http://www.marketwire.com/press-release/vantex-resumes-drilling-on-moriss-tsx-venture-vax-1767143.htm

[url=http://peketec.de/trading/viewtopic.php?p=1360939#1360939 schrieb:

Das ist genau die Grafik!

Da mausert sich jemand vom Rookie zum Experten!!

Morgäähn

1 Unze Gold in US-$ .............1 Unze Gold in Euro

1 Unze Silber in US-$ .............1 Unze Silber in Euro

1 Unze Gold in US-$ .............1 Unze Gold in Euro

1 Unze Silber in US-$ .............1 Unze Silber in Euro

2/28/2013 Shares547,129 Volumen 240,028 Days 2.279438

Bei ITH müssen am Freitag 547K Aktien gecovered werden!

Sollte der Goldpreis deutlich über 1.600 Dolores gehen kommen die ins Schwitzen!

Die Shortquote bei ITH hat sich halbiert über 4 Monate!

Bei ITH müssen am Freitag 547K Aktien gecovered werden!

Sollte der Goldpreis deutlich über 1.600 Dolores gehen kommen die ins Schwitzen!

Die Shortquote bei ITH hat sich halbiert über 4 Monate!

01:30 - AU Wohnbaufinanzierung Januar

• 01:30 - AU Kreditfinanzierung Januar

• 08:00 - DE Beschäftigte u. Umsatz Dienstleistungen 4. Quartal

• 08:45 - FR Verbraucherpreise Februar

• 10:00 - ES Verbraucherpreise Februar

• 10:00 - FR IEA Internationaler Ölmarktbericht

• 11:00 - ! EU Industrieproduktion Januar

• 12:00 - US MBA Hypothekenanträge (Woche)

• 13:30 US Einzelhandelsumsatz Februar

• 13:30 - ! US Einfuhrpreise Februar

• 13:30 - ! US Ausfuhrpreise Februar

• 15:00 - ! US Lagerbestände Januar

• 15:30 - US EIA Ölmarktbericht (Woche)

• 18:00 - US Auktion 10-jähriger Notes

• 22:45 - NZ Lebensmittelpreise Februar

wegen dem Verfallstag am Freitag? oder gibt es andere Gründe warum die gecovert werden müssen?

[url=http://peketec.de/trading/viewtopic.php?p=1361069#1361069 schrieb:dukezero schrieb am 13.03.2013, 09:06 Uhr[/url]"]2/28/2013 Shares547,129 Volumen 240,028 Days 2.279438

Bei ITH müssen am Freitag 547K Aktien gecovered werden!

Sollte der Goldpreis deutlich über 1.600 Dolores gehen kommen die ins Schwitzen!

Die Shortquote bei ITH hat sich halbiert über 4 Monate!

[url=http://peketec.de/trading/viewtopic.php?p=1361047#1361047 schrieb:dukezero schrieb am 13.03.2013, 08:40 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1360939#1360939 schrieb:

Das ist genau die Grafik!Wo man dann auch den Hebel erkennt!

Da mausert sich jemand vom Rookie zum Experten!!

US-Haushaltsstreit: Republikaner und Demokraten blockieren sich gegenseitig

http://www.spiegel.de/wirtschaft/so...-will-reiche-staerker-besteuern-a-888519.html

REUTERS

US-Präsident Obama: Etatdefizit um 1,85 Billionen Dollar reduzieren

Neue Runde im US-Haushaltsstreit: Die demokratische Partei will Reiche höher besteuern und Ausgaben kürzen. Die Republikaner hingegen sehen Einsparungen in Billionenhöhe, falls Obamas Gesundheitsreform zurückgenommen würde. Nur Optimisten hoffen noch auf konstruktive Gespräche.

Veröffentlichung der Zahlen zur europäischen Industrieproduktion für Januar 2013

aktuell:

Euro-Zone:

Die Industrieproduktion ist im saisonbereinigten Monatsvergleich im Januar um 0,4 % gesunken. Erwartet wurde ein Rückgang um 0,1 %. Im Vormonat war die Produktion der Eurozonen-Industrie um 0,9 % (revidiert von +0,7 %) gestiegen. Im Jahresvergleich hat die Produktion in der Industrie um 1,3 % abgenommen nach zuvor -1,7 %. Damit wurde der für den Vormonat veröffentlichten Anstieg von -2,4 % nach oben revidiert.

EU27:

Die Industrieproduktion ist im saisonbereinigten Monatsvergleich um 0,4 % gefallen nach zuvor +0,8 % (revidiert von 0,5 %). Im Jahresvergleich ist die Produktion in der Industrie aller 27 EU Mitgliedsstaaten um 1,7 % gefallen nach zuletzt -1,8 % (revidiert von -2,3 %).

aktuell:

Euro-Zone:

Die Industrieproduktion ist im saisonbereinigten Monatsvergleich im Januar um 0,4 % gesunken. Erwartet wurde ein Rückgang um 0,1 %. Im Vormonat war die Produktion der Eurozonen-Industrie um 0,9 % (revidiert von +0,7 %) gestiegen. Im Jahresvergleich hat die Produktion in der Industrie um 1,3 % abgenommen nach zuvor -1,7 %. Damit wurde der für den Vormonat veröffentlichten Anstieg von -2,4 % nach oben revidiert.

EU27:

Die Industrieproduktion ist im saisonbereinigten Monatsvergleich um 0,4 % gefallen nach zuvor +0,8 % (revidiert von 0,5 %). Im Jahresvergleich ist die Produktion in der Industrie aller 27 EU Mitgliedsstaaten um 1,7 % gefallen nach zuletzt -1,8 % (revidiert von -2,3 %).

U.a ,darüberhinaus ist der Goldpreis auf dem Sprung.Sollte die sehr hohe Shortquote liquidiert werden müssen könnte Gold + ITH schlagartig nach oben jumpern.70 Dolores bei Gold locker drin. Deswegen schwitzen da alle.

[url=http://peketec.de/trading/viewtopic.php?p=1361088#1361088 schrieb:greenhorn schrieb am 13.03.2013, 09:27 Uhr[/url]"]wegen dem Verfallstag am Freitag? oder gibt es andere Gründe warum die gecovert werden müssen?

[url=http://peketec.de/trading/viewtopic.php?p=1361069#1361069 schrieb:dukezero schrieb am 13.03.2013, 09:06 Uhr[/url]"]2/28/2013 Shares547,129 Volumen 240,028 Days 2.279438

Bei ITH müssen am Freitag 547K Aktien gecovered werden!

Sollte der Goldpreis deutlich über 1.600 Dolores gehen kommen die ins Schwitzen!

Die Shortquote bei ITH hat sich halbiert über 4 Monate!

March 13, 2013 07:00 ET

True Gold Mining Inc.: Kao, Nami Results Complete Karma Metallurgical Drilling Campaign

53.66 g/t gold over 10.0 metres, including 263.0 g/t gold over 2.0 metres at Kao

http://www.marketwire.com/press-rel...drilling-campaign-tsx-venture-tgm-1767420.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 13, 2013) - True Gold Mining Inc. (TSX VENTURE:TGM) ("True Gold" or the "Company") is pleased to report that the recent metallurgical core drilling campaign at the Company's Karma Gold Project ("Karma Project") in Burkina Faso, West Africa is now complete, and samples have been shipped to McClelland Laboratories in Nevada for column leach test work.

The most recent metallurgical drill results were returned from the Kao and Nami deposits, two of the five deposits at the Karma Project. Assay highlights from Kao include:

•53.66 g/t gold over 10.0 metres, including 263.0 g/t gold over 2.0 metres, in KAO-DD-13-187

•2.57 g/t gold over 32.0 metres, in KAO-DD-12-097

•4.73 g/t gold over 16.0 metres, in KAO-DD-12-098

•2.03 g/t gold over 8.0 metres, in KAO-DD-12-099

•1.31 g/t gold over 34.0 metres and 1.65 g/t gold over 14.0 metres, in KAO-DD-13-188

•2.28 g/t gold over 18.0 metres, in KAO-DD-13-189

Assay highlights from Nami include:

•22.50 g/t gold over 2.0 metres, in RMB-DD-13-065

•0.93 g/t gold over 33.5 metres, in RMB-DD-13-067

To see a drill map for Kao, please click here: http://www.truegoldmining.com/sites/default/files/KaoDrillMap1308.pdf

To see a drill map for Nami, please click here: http://www.truegoldmining.com/sites/default/files/NamiDrillMap1308.pdf

For a full table of results related to gold mineralization, please click on this link: http://www.truegoldmining.com/sites/default/files/KaoNamiMetResults1308.pdf

The holes were drilled as part of a comprehensive column leach sampling program to support the Definitive Feasibility Study ("DFS") currently in progress on the Karma Project, and were designed to capture oxide, transition and sulphide material on representative cross sections throughout the Karma Project deposits.

True Gold Mining Inc.: Kao, Nami Results Complete Karma Metallurgical Drilling Campaign

53.66 g/t gold over 10.0 metres, including 263.0 g/t gold over 2.0 metres at Kao

http://www.marketwire.com/press-rel...drilling-campaign-tsx-venture-tgm-1767420.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 13, 2013) - True Gold Mining Inc. (TSX VENTURE:TGM) ("True Gold" or the "Company") is pleased to report that the recent metallurgical core drilling campaign at the Company's Karma Gold Project ("Karma Project") in Burkina Faso, West Africa is now complete, and samples have been shipped to McClelland Laboratories in Nevada for column leach test work.

The most recent metallurgical drill results were returned from the Kao and Nami deposits, two of the five deposits at the Karma Project. Assay highlights from Kao include:

•53.66 g/t gold over 10.0 metres, including 263.0 g/t gold over 2.0 metres, in KAO-DD-13-187

•2.57 g/t gold over 32.0 metres, in KAO-DD-12-097

•4.73 g/t gold over 16.0 metres, in KAO-DD-12-098

•2.03 g/t gold over 8.0 metres, in KAO-DD-12-099

•1.31 g/t gold over 34.0 metres and 1.65 g/t gold over 14.0 metres, in KAO-DD-13-188

•2.28 g/t gold over 18.0 metres, in KAO-DD-13-189

Assay highlights from Nami include:

•22.50 g/t gold over 2.0 metres, in RMB-DD-13-065

•0.93 g/t gold over 33.5 metres, in RMB-DD-13-067

To see a drill map for Kao, please click here: http://www.truegoldmining.com/sites/default/files/KaoDrillMap1308.pdf

To see a drill map for Nami, please click here: http://www.truegoldmining.com/sites/default/files/NamiDrillMap1308.pdf

For a full table of results related to gold mineralization, please click on this link: http://www.truegoldmining.com/sites/default/files/KaoNamiMetResults1308.pdf

The holes were drilled as part of a comprehensive column leach sampling program to support the Definitive Feasibility Study ("DFS") currently in progress on the Karma Project, and were designed to capture oxide, transition and sulphide material on representative cross sections throughout the Karma Project deposits.

Beobachtet mal was passiert! Gestern schon der Goldpreis an der 1.600 geklingelt!

Die BIG BOYS kommen gerade wieder ins Schwitzen!

Die BIG BOYS kommen gerade wieder ins Schwitzen!

[url=http://peketec.de/trading/viewtopic.php?p=1361217#1361217 schrieb:dukezero schrieb am 13.03.2013, 11:56 Uhr[/url]"]U.a ,darüberhinaus ist der Goldpreis auf dem Sprung.Sollte die sehr hohe Shortquote liquidiert werden müssen könnte Gold + ITH schlagartig nach oben jumpern.70 Dolores bei Gold locker drin. Deswegen schwitzen da alle.

[url=http://peketec.de/trading/viewtopic.php?p=1361088#1361088 schrieb:greenhorn schrieb am 13.03.2013, 09:27 Uhr[/url]"]wegen dem Verfallstag am Freitag? oder gibt es andere Gründe warum die gecovert werden müssen?

[url=http://peketec.de/trading/viewtopic.php?p=1361069#1361069 schrieb:dukezero schrieb am 13.03.2013, 09:06 Uhr[/url]"]2/28/2013 Shares547,129 Volumen 240,028 Days 2.279438

Bei ITH müssen am Freitag 547K Aktien gecovered werden!

Sollte der Goldpreis deutlich über 1.600 Dolores gehen kommen die ins Schwitzen!

Die Shortquote bei ITH hat sich halbiert über 4 Monate!

Kurssturz bei Nevsun Resources

Dienstag, 12. März 2013 | 09:52

http://www.investor-sms.de/Boersenbriefe/GOLDINVEST.de/Kurssturz-bei-Nevsun-Resources

Die Aktie von Nevsun Resources (WKN 901340) kam gestern im kanadischen Handel gewaltig unter die Räder. Schlechte Nachrichten gab es aber nicht.

Die Aktie fiel um mehr als 11% bei einem Handelsvolumen von fast 4 Mio. Aktien, während ansonsten „nur" einige Hunderttausend Papiere pro Tag gehandelt werden.

Potenzielle Auslöser für einen solchen Kursrutsch hätte es einige geben können. Nevsun stellt auf seiner Kupfer-, Gold- und Zinkmine Bisha in Eritrea derzeit die Produktion von hauptsächlich Gold auf vorrangig Kupfer um. Bei einem solchen Schritt kann es schon einmal Probleme geben, die den Kurs unter Druck setzen könnten. Aber davon keine Spur derzeit bei Nevsun.

Und auch ein politisches Risiko besteht durchaus. Medienberichten zufolge ereignete sich erst vor kurzem ein fehlgeschlagener Putschversuch in dem nordafrikanischen Staat. Aber auch an dieser Front war alles ruhig.

Was also löste den spektakulären Kursrutsch der Nevsun-Aktie aus? Die Analysten von Haywood Securities haben die Erklärung gefunden. Sie wiesen darauf hin, dass das Papier aus dem Market Vectors Global Junior Gold Miners Index geflogen ist. Kein Wunder eigentlich, denn mit der oben bereits erwähnten Umstellung der Produktion auf vor allem Kupfer ist Nevsun nicht mehr wirklich eine Goldgesellschaft. Und nach dem Kupfer will Nevsun dann Zink abbauen...

Nun, mit der Veränderung bei Market Vectors kamen die Verkäufe. Möglicherweise von einem ETF (Exchange Traded Fund), der den Index abbildet. So orientiert sich beispielsweise Van Ecks Junior Gold Miner's ETF an Market Vectors Index und hält deshalb rund 7% bzw. 14,8 Mio. Nevsun-Aktien. Um den Index weiter abzubilden müssen diese Aktien wohl verkauft werden.

Das würde bedeuten, es stehen in Zukunft noch einige Verkäufe an - beispielsweise wenn die Indexveränderungen am 18. dieses Monats offiziell werden. Die Frage ist nun: Stellen diese Verkäufe Kaufgelegenheiten dar?

Die Analysten von Haywood, die für Nevsun ein Kursziel von 5 CAD pro Aktie aufgerufen haben, warnen zwar, dass 2013 ein Übergangsjahr für Nevsun sein dürfte und als solches volatil. Doch sehen sie in den Verkäufen auf Grund der Indexumstellung eine „offensichtliche" Kaufgelegenheit. Im Prinzip ist es einfach: Glaubt man an die Nevsun-Story und rechnet mit operativen Erfolgen, dann dürfte es sich hier um eine Kaufgelegenheit handeln, da die Verkäufe nichts mit Nevsun als Produzenten zu tun haben. Aber eben nur dann! Das Risiko angesichts der Übergangsphase auf der Bisha-Mine ist durchaus beachtlich.

Dienstag, 12. März 2013 | 09:52

http://www.investor-sms.de/Boersenbriefe/GOLDINVEST.de/Kurssturz-bei-Nevsun-Resources

Die Aktie von Nevsun Resources (WKN 901340) kam gestern im kanadischen Handel gewaltig unter die Räder. Schlechte Nachrichten gab es aber nicht.

Die Aktie fiel um mehr als 11% bei einem Handelsvolumen von fast 4 Mio. Aktien, während ansonsten „nur" einige Hunderttausend Papiere pro Tag gehandelt werden.

Potenzielle Auslöser für einen solchen Kursrutsch hätte es einige geben können. Nevsun stellt auf seiner Kupfer-, Gold- und Zinkmine Bisha in Eritrea derzeit die Produktion von hauptsächlich Gold auf vorrangig Kupfer um. Bei einem solchen Schritt kann es schon einmal Probleme geben, die den Kurs unter Druck setzen könnten. Aber davon keine Spur derzeit bei Nevsun.

Und auch ein politisches Risiko besteht durchaus. Medienberichten zufolge ereignete sich erst vor kurzem ein fehlgeschlagener Putschversuch in dem nordafrikanischen Staat. Aber auch an dieser Front war alles ruhig.

Was also löste den spektakulären Kursrutsch der Nevsun-Aktie aus? Die Analysten von Haywood Securities haben die Erklärung gefunden. Sie wiesen darauf hin, dass das Papier aus dem Market Vectors Global Junior Gold Miners Index geflogen ist. Kein Wunder eigentlich, denn mit der oben bereits erwähnten Umstellung der Produktion auf vor allem Kupfer ist Nevsun nicht mehr wirklich eine Goldgesellschaft. Und nach dem Kupfer will Nevsun dann Zink abbauen...

Nun, mit der Veränderung bei Market Vectors kamen die Verkäufe. Möglicherweise von einem ETF (Exchange Traded Fund), der den Index abbildet. So orientiert sich beispielsweise Van Ecks Junior Gold Miner's ETF an Market Vectors Index und hält deshalb rund 7% bzw. 14,8 Mio. Nevsun-Aktien. Um den Index weiter abzubilden müssen diese Aktien wohl verkauft werden.

Das würde bedeuten, es stehen in Zukunft noch einige Verkäufe an - beispielsweise wenn die Indexveränderungen am 18. dieses Monats offiziell werden. Die Frage ist nun: Stellen diese Verkäufe Kaufgelegenheiten dar?

Die Analysten von Haywood, die für Nevsun ein Kursziel von 5 CAD pro Aktie aufgerufen haben, warnen zwar, dass 2013 ein Übergangsjahr für Nevsun sein dürfte und als solches volatil. Doch sehen sie in den Verkäufen auf Grund der Indexumstellung eine „offensichtliche" Kaufgelegenheit. Im Prinzip ist es einfach: Glaubt man an die Nevsun-Story und rechnet mit operativen Erfolgen, dann dürfte es sich hier um eine Kaufgelegenheit handeln, da die Verkäufe nichts mit Nevsun als Produzenten zu tun haben. Aber eben nur dann! Das Risiko angesichts der Übergangsphase auf der Bisha-Mine ist durchaus beachtlich.

[url=http://peketec.de/trading/viewtopic.php?p=1360302#1360302 schrieb:greenhorn schrieb am 11.03.2013, 14:36 Uhr[/url]"]NSU-Nevsun start mit -10% - gab es News?

March 13, 2013 07:30 ET

McEwen Mining Los Azules Metallurgical Update

Alternative Process Methods Demonstrate Potential for Improved Economic Returns

http://www.marketwire.com/press-rel...les-metallurgical-update-nyse-mux-1767435.htm

TORONTO, ONTARIO--(Marketwire - March 13, 2013) - McEwen Mining Inc. (NYSE:MUX)(TSX:MUX) is pleased to announce new metallurgical studies that confirmed preliminary work and tested alternative process methods at its 100% owned Los Azules Copper Project in San Juan Province, Argentina. The work was performed by Plenge Metallurgical Laboratory in Lima, Peru and supervised by Samuel Engineering of Denver, Colorado. The tests produced positive results in the three areas discussed below, all of which should improve the economic returns associated with the project by reducing operating and capital costs, increasing the amount of material available for processing, and reducing export taxes.

McEwen Mining Los Azules Metallurgical Update

Alternative Process Methods Demonstrate Potential for Improved Economic Returns

http://www.marketwire.com/press-rel...les-metallurgical-update-nyse-mux-1767435.htm

TORONTO, ONTARIO--(Marketwire - March 13, 2013) - McEwen Mining Inc. (NYSE:MUX)(TSX:MUX) is pleased to announce new metallurgical studies that confirmed preliminary work and tested alternative process methods at its 100% owned Los Azules Copper Project in San Juan Province, Argentina. The work was performed by Plenge Metallurgical Laboratory in Lima, Peru and supervised by Samuel Engineering of Denver, Colorado. The tests produced positive results in the three areas discussed below, all of which should improve the economic returns associated with the project by reducing operating and capital costs, increasing the amount of material available for processing, and reducing export taxes.

über 1 CAD seitdem gestiegen....... 8)

[url=http://peketec.de/trading/viewtopic.php?p=1359139#1359139 schrieb:greenhorn schrieb am 07.03.2013, 10:23 Uhr[/url]"]IMG - Iamgold finde ich auch sehr interessant für einen Rebound

» zur Grafik

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

The Junior Miner Train is Leaving the Station

Posted on March 12, 2013 by CEO Technician

Gold rallied less than 1% today, meanwhile, the GDXJ (Market Vectors Junior Gold Miners ETF) gained 3.68% closing at session highs. Every day we hear a lot about how “stocks are the only place to be invested”, as gold and other “uncorrelated assets” have suddenly lost favor among investors. However, there has been no greater time for investors to express a bullish view on gold through the purchase of a basket of gold mining equities, junior miners in particular.

......

http://ceo.ca/the-junior-miner-train-is-leaving-the-station/

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

@Duke

Hast Du bitte mal das Orderbuch von LEX?

Hast Du bitte mal das Orderbuch von LEX?