App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

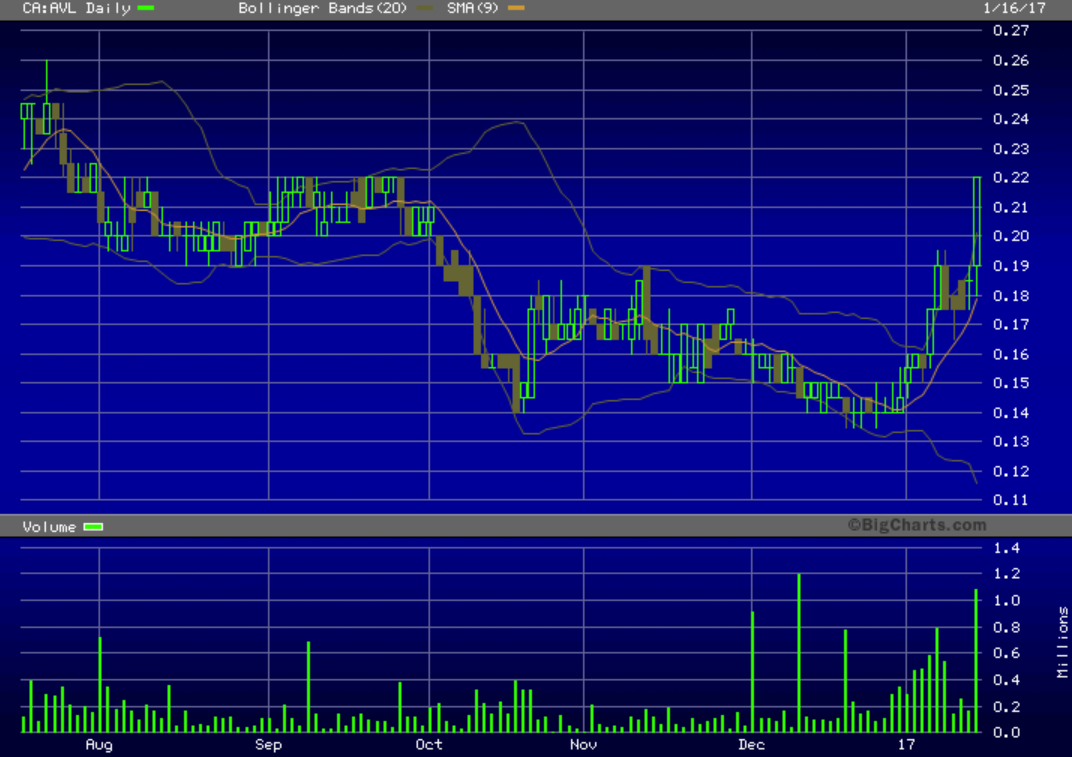

kann ich momentan nicht erkennen

[url=http://peketec.de/trading/viewtopic.php?p=1734302#1734302 schrieb:The Bull schrieb am 16.01.2017, 20:01 Uhr[/url]"]CXO. Sieht irgendwie aus wie auf dem Sprung nach oben😏

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Osisko Mining drills 46.4 m of 2.27 g/t Au at Garrison

2017-01-16 16:42 ET - News Release

Mr. John Burzynski reports

OSISKO INTERSECTS 2.27 G/T AU OVER 46.4 METRES AT GARRISON

Osisko Mining Inc. has released new results from the continuing drill program at its 100-per-cent-owned Garrison gold project located in Garrison township, Ontario. The current 35,000 metre drill program (recently increased from 20,000 metres) is designed to further test the known Jonpol and Garrcon gold zones, with six drill rigs currently active on the property. A total of 22 new holes are reported in this release, with significant assay results presented in the table below.

Significant new results include: 2.27 g/t Au over 46.4 metres in OSK-G16-213X; 2.85 g/t Au over 19.6 metres in OSK-G16-318; 6.66 g/t Au over 6.8 metres in OSK-G16-319; 3.1 g/t Au over 12.0 metres (4.96 g/t Au over 12.0 metres uncut) in OSK-G16-314A; and 3.57 g/t Au over 8.0 metres in OSK-G16-209X.

The new results have demonstrated the potential for expansion of the previously defined Garrcon, Jonpol and 903 mineralized zones at the Garrison project. The ongoing drill program for 2017 will continue to follow new extensions of these mineralized zones to further define the scale of mineralization at Garrison.

Maps and sections showing hole locations and complete drilling results are available at www.osiskomining.com.

......

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:OSK-2436795&symbol=OSK®ion=C

2017-01-16 16:42 ET - News Release

Mr. John Burzynski reports

OSISKO INTERSECTS 2.27 G/T AU OVER 46.4 METRES AT GARRISON

Osisko Mining Inc. has released new results from the continuing drill program at its 100-per-cent-owned Garrison gold project located in Garrison township, Ontario. The current 35,000 metre drill program (recently increased from 20,000 metres) is designed to further test the known Jonpol and Garrcon gold zones, with six drill rigs currently active on the property. A total of 22 new holes are reported in this release, with significant assay results presented in the table below.

Significant new results include: 2.27 g/t Au over 46.4 metres in OSK-G16-213X; 2.85 g/t Au over 19.6 metres in OSK-G16-318; 6.66 g/t Au over 6.8 metres in OSK-G16-319; 3.1 g/t Au over 12.0 metres (4.96 g/t Au over 12.0 metres uncut) in OSK-G16-314A; and 3.57 g/t Au over 8.0 metres in OSK-G16-209X.

The new results have demonstrated the potential for expansion of the previously defined Garrcon, Jonpol and 903 mineralized zones at the Garrison project. The ongoing drill program for 2017 will continue to follow new extensions of these mineralized zones to further define the scale of mineralization at Garrison.

Maps and sections showing hole locations and complete drilling results are available at www.osiskomining.com.

......

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:OSK-2436795&symbol=OSK®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Orosur Mining starts production at San Gregorio West

2017-01-16 06:43 ET - News Release

Mr. Ignacio Salazar reports

OROSUR MINING INC. H1 2017 RESULTS: $3.7M PROFIT, $7.0M CASH FROM OPERATIONS AND NEW SAN GREGORIO UG MINE PUT INTO PRODUCTION

Orosur Mining Inc. has released its results for the first half of its fiscal 2017 and second quarter ended November, 2016, and is providing an update of its exploration and development activities in Uruguay (all amounts are in U.S. dollars).

Operational highlights

The San Gregorio West underground (SGW UG) mine commenced full production from its maiden stope on Nov. 24, 2016;

Project completed on budget and on schedule following a safe and efficient transition of equipment and staff from Arenal;

Construction included over 883 metres of horizontal development and approximately 663 m of infill diamond drilling from 13 underground holes comprising the bulk of the zones to be mined within the existing 2017 SGW mine plan;

An additional 90,000 tonnes at 1.4 grams per tonne gold not previously in the mine plan were produced at Arenal UG mine prior to its planned closure at the end of Q2 2017, deferring higher-grade production from SGW UG;

Production for the quarter of 6,852 ounces was, as previously guided, affected by the transition from Arenal UG to the new SGW UG mine.

Financial highlights

Quarterly cash operating costs were $914/ounce, in line with expectations (Q2 2016: $858/ounce);

Guidance for 2017 remains $800 to $900/ounce;

Additional development capital expenditures related to the contruction of the SGW UG mine in Uruguay resulted in all-in sustaining costs (AISC) for the quarter of $1,345/ounce (Q2 2016: $1,095/ounce);

Transition from Arenal UG to the new SGW UG mine led to an increase of capex to $3.8-million (Q2 2016: $900,000);

Cash generated from operations increased in Q2 2017 to $2.2-million (Q2 2016: $900,000). Total cash balance at period-end of $5.4-million, increased from Q1 2017: $5.0-million and 2016: $4.3-million;

Q2 2017 net profit after tax of $900,000 (Q2 2016: loss of $900,000);

Average gold price for the quarter was $1,252/ounce (Q2 2016: $1,100/ounce).

Outlook

Exploration drilling in and around the San Gregorio UG area has yielded positive results, successfully intersecting gold mineralization in every hole, which are expected to significantly enhance mine economics and increase reserves and resources in the short and medium term. Further drilling is under way.

During the second half of 2017, the company plans to accelerate exploration in open-pit targets around the San Gregorio plant after receiving several permits and to drill seven reverse circulation/diamond drilling holes (1,600 metres) in the Arenal-SG corridor to test the occurrence of what could be a relatively large deposit.

In Colombia, the company is finalizing a geological model of its high-grade Anza gold project project to determine the exploratory potential with the assistance of Mine Development Associates (MDA) of Reno, Nev. The results of this work are expected to be announced shortly.

Ignacio Salazar, chief executive officer of Orosur, said:

"Operations remain healthy and profitable, with $7-million of cash generated in the first half of our fiscal 2017. The successful transition to San Gregorio UG as the company's primary source of ore feed to the plant in Uruguay was a significant achievement for Orosur. The SGW UG mine successfully started production from its first stope on Nov. 24 on time and within budget.

"The transition, achieved in a safe, professional manner, represents a significant technical and operational achievement, and I am pleased with the technical capacity and execution demonstrated by our team. It was financed entirely from operational cash flow helped by the efficient transfer of equipment and staff between the two undergound mines.

"In parallel, more active and aggressive exploration work in Uruguay appears to have a good likelikood of enhancing the San Gregorio underground project and advancing the open-pit projects around the plant. In Colombia, we are making good progress in the geological interpretation and modelling of our high-grade Anza gold project, and expect to be updating the market shortly."

......................

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aOMI-2436588&symbol=OMI®ion=C

2017-01-16 06:43 ET - News Release

Mr. Ignacio Salazar reports

OROSUR MINING INC. H1 2017 RESULTS: $3.7M PROFIT, $7.0M CASH FROM OPERATIONS AND NEW SAN GREGORIO UG MINE PUT INTO PRODUCTION

Orosur Mining Inc. has released its results for the first half of its fiscal 2017 and second quarter ended November, 2016, and is providing an update of its exploration and development activities in Uruguay (all amounts are in U.S. dollars).

Operational highlights

The San Gregorio West underground (SGW UG) mine commenced full production from its maiden stope on Nov. 24, 2016;

Project completed on budget and on schedule following a safe and efficient transition of equipment and staff from Arenal;

Construction included over 883 metres of horizontal development and approximately 663 m of infill diamond drilling from 13 underground holes comprising the bulk of the zones to be mined within the existing 2017 SGW mine plan;

An additional 90,000 tonnes at 1.4 grams per tonne gold not previously in the mine plan were produced at Arenal UG mine prior to its planned closure at the end of Q2 2017, deferring higher-grade production from SGW UG;

Production for the quarter of 6,852 ounces was, as previously guided, affected by the transition from Arenal UG to the new SGW UG mine.

Financial highlights

Quarterly cash operating costs were $914/ounce, in line with expectations (Q2 2016: $858/ounce);

Guidance for 2017 remains $800 to $900/ounce;

Additional development capital expenditures related to the contruction of the SGW UG mine in Uruguay resulted in all-in sustaining costs (AISC) for the quarter of $1,345/ounce (Q2 2016: $1,095/ounce);

Transition from Arenal UG to the new SGW UG mine led to an increase of capex to $3.8-million (Q2 2016: $900,000);

Cash generated from operations increased in Q2 2017 to $2.2-million (Q2 2016: $900,000). Total cash balance at period-end of $5.4-million, increased from Q1 2017: $5.0-million and 2016: $4.3-million;

Q2 2017 net profit after tax of $900,000 (Q2 2016: loss of $900,000);

Average gold price for the quarter was $1,252/ounce (Q2 2016: $1,100/ounce).

Outlook

Exploration drilling in and around the San Gregorio UG area has yielded positive results, successfully intersecting gold mineralization in every hole, which are expected to significantly enhance mine economics and increase reserves and resources in the short and medium term. Further drilling is under way.

During the second half of 2017, the company plans to accelerate exploration in open-pit targets around the San Gregorio plant after receiving several permits and to drill seven reverse circulation/diamond drilling holes (1,600 metres) in the Arenal-SG corridor to test the occurrence of what could be a relatively large deposit.

In Colombia, the company is finalizing a geological model of its high-grade Anza gold project project to determine the exploratory potential with the assistance of Mine Development Associates (MDA) of Reno, Nev. The results of this work are expected to be announced shortly.

Ignacio Salazar, chief executive officer of Orosur, said:

"Operations remain healthy and profitable, with $7-million of cash generated in the first half of our fiscal 2017. The successful transition to San Gregorio UG as the company's primary source of ore feed to the plant in Uruguay was a significant achievement for Orosur. The SGW UG mine successfully started production from its first stope on Nov. 24 on time and within budget.

"The transition, achieved in a safe, professional manner, represents a significant technical and operational achievement, and I am pleased with the technical capacity and execution demonstrated by our team. It was financed entirely from operational cash flow helped by the efficient transfer of equipment and staff between the two undergound mines.

"In parallel, more active and aggressive exploration work in Uruguay appears to have a good likelikood of enhancing the San Gregorio underground project and advancing the open-pit projects around the plant. In Colombia, we are making good progress in the geological interpretation and modelling of our high-grade Anza gold project, and expect to be updating the market shortly."

......................

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aOMI-2436588&symbol=OMI®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

[url=http://peketec.de/trading/viewtopic.php?p=1731339#1731339 schrieb:greenhorn schrieb am 02.01.2017, 08:24 Uhr[/url]"]ist der Hammer! aber wer erwartet sowas auch

trotzdem ein toller Tipp!

[url=http://peketec.de/trading/viewtopic.php?p=1731273#1731273 schrieb:Kostolanys Erbe schrieb am 30.12.2016, 23:13 Uhr[/url]"]

Krass was bei PZE abging ! Nun noch unten offenes Gap!

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1730715#1730715 schrieb:greenhorn schrieb am 23.12.2016, 16:00 Uhr[/url]"]Verkauf um 5,85 Euro, reicht zum Weihnachtsfest - danke an Kosto für den Hinweis/Tipp

[url=http://peketec.de/trading/viewtopic.php?p=1730712#1730712 schrieb:Kostolanys Erbe schrieb am 23.12.2016, 15:56 Uhr[/url]"]Auch gerade gesehen! Geile W-Formation !!!

[url=http://peketec.de/trading/viewtopic.php?p=1730709#1730709 schrieb:greenhorn schrieb am 23.12.2016, 15:39 Uhr[/url]"]gestern kurze Pause und heute wird wieder angeriffen

aktuell 6 USD (5,70 Euro)

[url=http://peketec.de/trading/viewtopic.php?p=1730505#1730505 schrieb:greenhorn schrieb am 22.12.2016, 09:59 Uhr[/url]"]na holla!

[url=http://peketec.de/trading/viewtopic.php?p=1730201#1730201 schrieb:Kostolanys Erbe schrieb am 20.12.2016, 21:46 Uhr[/url]"]Nettes W !!!

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1730193#1730193 schrieb:greenhorn schrieb am 20.12.2016, 21:05 Uhr[/url]"]heute mal richtig Action....mal sehen ob es so bleibt bis zum Handelschluss

[url=http://peketec.de/trading/viewtopic.php?p=1728408#1728408 schrieb:greenhorn schrieb am 12.12.2016, 11:35 Uhr[/url]"]PZE - trotzdem nun mal eine kleine Posi zu Long zu 4,85 Euro, Ölpreis spielt ja mit, eventuell geht was

Kaufsignal auch im Chart, noch etwas zaghaft.....

[url=http://peketec.de/trading/viewtopic.php?p=1726288#1726288 schrieb:Kostolanys Erbe schrieb am 01.12.2016, 11:53 Uhr[/url]"]

Letzte Quartal - Riesenverlust -

Muss mir aber den Bericht erstmal genauer lesen. Leider noch nicht geschafft aus Zeitmangel

http://www.investidorpetrobras.com.br/es/resultados-financieros/holding

Code:https://s3.amazonaws.com/files.investidorpetrobras.com.br/Apresentacao-Webcast-3T16-Português.pdf?response-content-disposition=attachment%3B%20filename%3D%22Apresentacao-Webcast-3T16-Português.pdf%22&response-content-type=application%2Foctet-stream&AWSAccessKeyId=AKIAJJLQG5Z3ZS5XQYNA&Expires=1480675716&Signature=MWIJv1ytZz%2F5Dt2SLY8P8mmpezM%3D

[url=http://peketec.de/trading/viewtopic.php?p=1726256#1726256 schrieb:greenhorn schrieb am 01.12.2016, 09:54 Uhr[/url]"]gestern trotz Sprung beim Ölpreis nochmal runter.......RSI bei 13

hat jemand Hintergründe?

[url=http://peketec.de/trading/viewtopic.php?p=1725712#1725712 schrieb:greenhorn schrieb am 29.11.2016, 09:22 Uhr[/url]"]

trifftige Gründe vorhanden?

[url=http://peketec.de/trading/viewtopic.php?p=1725635#1725635 schrieb:

schaffen wir die 1,65 (rein rethorische Frage  )?

)?

[url=http://peketec.de/trading/viewtopic.php?p=1734372#1734372 schrieb:

Alles sehr dynamisch!!

[url=http://peketec.de/trading/viewtopic.php?p=1734373#1734373 schrieb:Rooky schrieb am 17.01.2017, 09:24 Uhr[/url]"]schaffen wir die 1,65 ?

[url=http://peketec.de/trading/viewtopic.php?p=1734372#1734372 schrieb:

RSI ist aktuell zart über der 70 (73); grundsätzlich ist alles möglich; siehe PZE weiter unten - ich könnte mir vorstellen das wir heute an die 1,60 laufen, eventuell auch drüber und es dann eine kurze Verschnaufpause gibt.

Aber genauso gut kann es auch noch 2-3 Tage weiergehen mit Ziel CAD, wo das letzte Hoch liegt......und dann konsolidiert

Aber genauso gut kann es auch noch 2-3 Tage weiergehen mit Ziel CAD, wo das letzte Hoch liegt......und dann konsolidiert

[url=http://peketec.de/trading/viewtopic.php?p=1734378#1734378 schrieb:dukezero schrieb am 17.01.2017, 09:26 Uhr[/url]"]Alles sehr dynamisch!!

[url=http://peketec.de/trading/viewtopic.php?p=1734373#1734373 schrieb:Rooky schrieb am 17.01.2017, 09:24 Uhr[/url]"]schaffen wir die 1,65 ?

[url=http://peketec.de/trading/viewtopic.php?p=1734372#1734372 schrieb:

für mich spricht sehr vieles für einen steigenden Goldpreis, wie seht ihr das?

Generelle Unsicherheit EU, Frankreich Wahlen, Italien Banken, zukünftige Politik Trump, schwächerer Dollar gewünscht, Handelsstreit mit China, heute Brexit Rede von May, volatile BitCoins, Inflation steigt, uvm. - dagegen stehen lediglich die mini Zinserhöhungen, mehr dürfte auch nicht groß drin sein, außer man würgt alles Stimulanzen gleich wieder ab ..

Generelle Unsicherheit EU, Frankreich Wahlen, Italien Banken, zukünftige Politik Trump, schwächerer Dollar gewünscht, Handelsstreit mit China, heute Brexit Rede von May, volatile BitCoins, Inflation steigt, uvm. - dagegen stehen lediglich die mini Zinserhöhungen, mehr dürfte auch nicht groß drin sein, außer man würgt alles Stimulanzen gleich wieder ab ..

Anhand der COT Analyse steht steigenden Goldpreise nichts entgegen, zumindest mittelfristig.

[url=http://peketec.de/trading/viewtopic.php?p=1734424#1734424 schrieb:marcovich schrieb am 17.01.2017, 11:19 Uhr[/url]"]für mich spricht sehr vieles für einen steigenden Goldpreis, wie seht ihr das?

Generelle Unsicherheit EU, Frankreich Wahlen, Italien Banken, zukünftige Politik Trump, schwächerer Dollar gewünscht, Handelsstreit mit China, heute Brexit Rede von May, volatile BitCoins, Inflation steigt, uvm. - dagegen stehen lediglich die mini Zinserhöhungen, mehr dürfte auch nicht groß drin sein, außer man würgt alles Stimulanzen gleich wieder ab ..

Red Eagle Mining intersects 5 metres at 33 grams gold per tonne

VANCOUVER, Jan. 17, 2017 /CNW/ - Red Eagle Mining Corporation (TSX: R, BVL: ROTCQX: RDEMF) is pleased to announce results from the 2016 ore production stope delineation drilling programme at the San Ramon Gold Mine, Santa Rosa Gold Project, Antioquia, Colombia. The 10,000m programme was drilled from eight pads spaced over 300m of strike length. 107 diamond drill holes (SRD-0001 to SRD-0107) were drilled on approximately 15m centres from near surface to a vertical depth of 160m from surface. The programme only in-fill drilled a portion of the reserves at the San Ramon Gold Mine which overall extend for 2km of strike length and to 250m depth. The deposit is also open both at depth and on strike to the east where exploration drilling is currently underway. Results from the initial 95 holes (SRD-0001 to SRD-0095) were previously announced. Highlights from the programme include intersections:

https://www.ceo.ca/@newswire/red-eagle-mining-intersects-5-metres-at-33-grams-gold

VANCOUVER, Jan. 17, 2017 /CNW/ - Red Eagle Mining Corporation (TSX: R, BVL: ROTCQX: RDEMF) is pleased to announce results from the 2016 ore production stope delineation drilling programme at the San Ramon Gold Mine, Santa Rosa Gold Project, Antioquia, Colombia. The 10,000m programme was drilled from eight pads spaced over 300m of strike length. 107 diamond drill holes (SRD-0001 to SRD-0107) were drilled on approximately 15m centres from near surface to a vertical depth of 160m from surface. The programme only in-fill drilled a portion of the reserves at the San Ramon Gold Mine which overall extend for 2km of strike length and to 250m depth. The deposit is also open both at depth and on strike to the east where exploration drilling is currently underway. Results from the initial 95 holes (SRD-0001 to SRD-0095) were previously announced. Highlights from the programme include intersections:

https://www.ceo.ca/@newswire/red-eagle-mining-intersects-5-metres-at-33-grams-gold

wie können die Ergebnisse interpretiert werden?

gute Grades aber in der Länge nicht berauschend, oder?

gute Grades aber in der Länge nicht berauschend, oder?

[url=http://peketec.de/trading/viewtopic.php?p=1734433#1734433 schrieb:PerseusLtd schrieb am 17.01.2017, 11:43 Uhr[/url]"]Red Eagle Mining intersects 5 metres at 33 grams gold per tonne

VANCOUVER, Jan. 17, 2017 /CNW/ - Red Eagle Mining Corporation (TSX: R, BVL: ROTCQX: RDEMF) is pleased to announce results from the 2016 ore production stope delineation drilling programme at the San Ramon Gold Mine, Santa Rosa Gold Project, Antioquia, Colombia. The 10,000m programme was drilled from eight pads spaced over 300m of strike length. 107 diamond drill holes (SRD-0001 to SRD-0107) were drilled on approximately 15m centres from near surface to a vertical depth of 160m from surface. The programme only in-fill drilled a portion of the reserves at the San Ramon Gold Mine which overall extend for 2km of strike length and to 250m depth. The deposit is also open both at depth and on strike to the east where exploration drilling is currently underway. Results from the initial 95 holes (SRD-0001 to SRD-0095) were previously announced. Highlights from the programme include intersections:

https://www.ceo.ca/@newswire/red-eagle-mining-intersects-5-metres-at-33-grams-gold

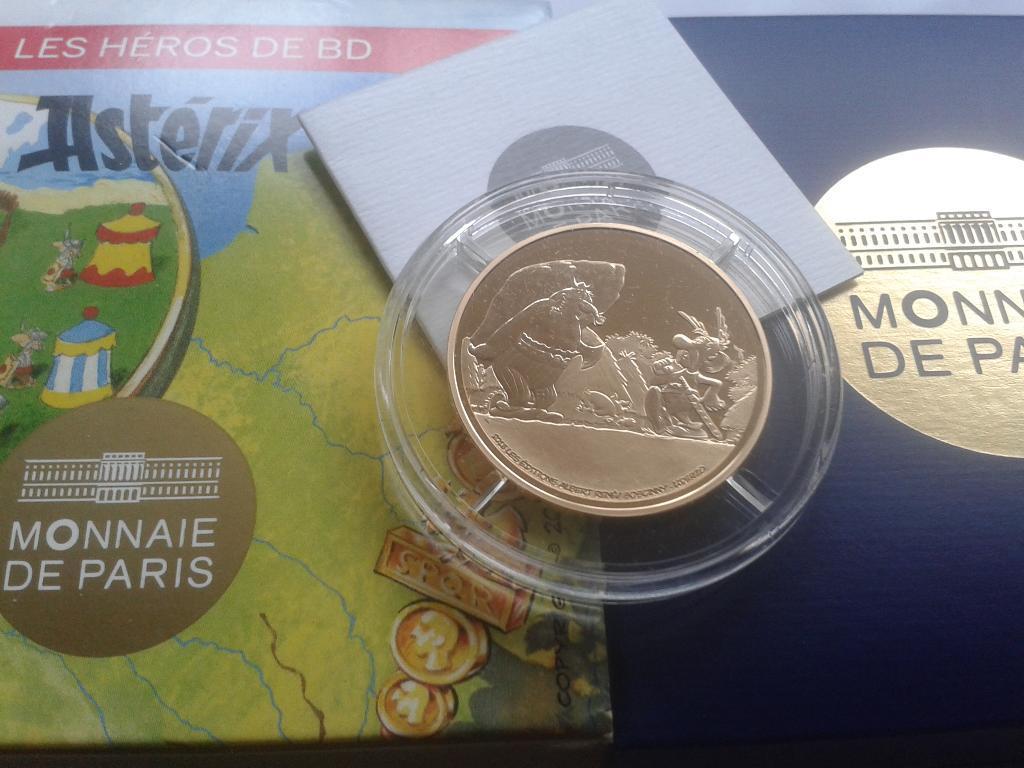

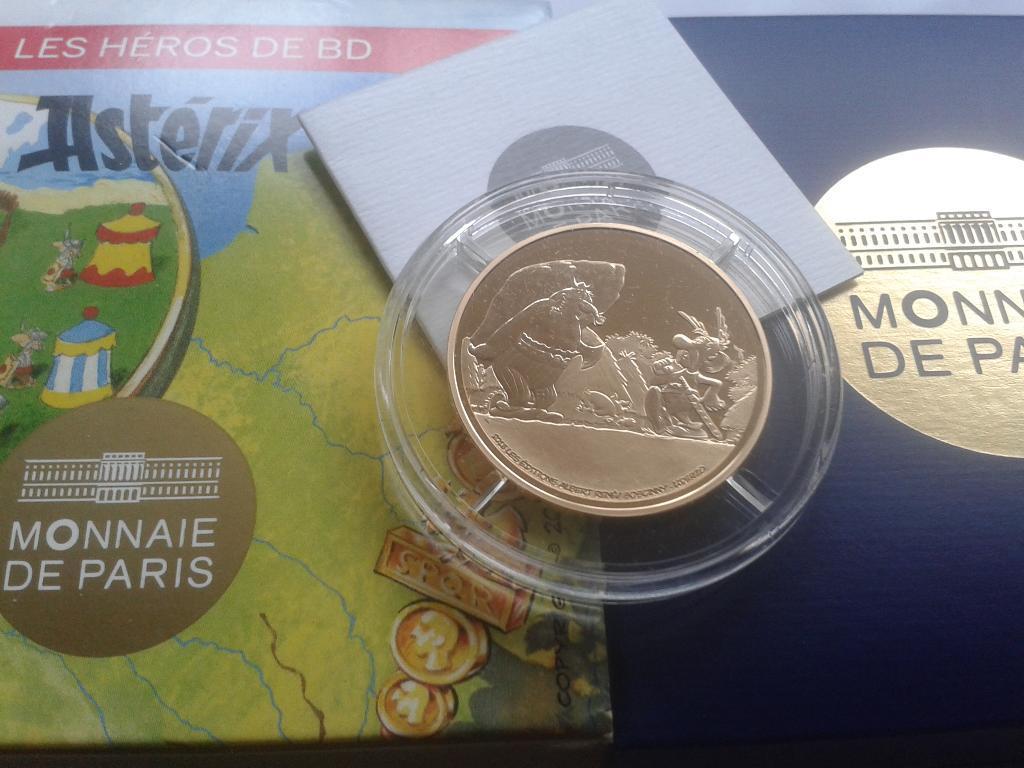

Die neue Währung in Kleinbonum!

[url=http://peketec.de/trading/viewtopic.php?p=1734424#1734424 schrieb:marcovich schrieb am 17.01.2017, 11:19 Uhr[/url]"]für mich spricht sehr vieles für einen steigenden Goldpreis, wie seht ihr das?

Generelle Unsicherheit EU, Frankreich Wahlen, Italien Banken, zukünftige Politik Trump, schwächerer Dollar gewünscht, Handelsstreit mit China, heute Brexit Rede von May, volatile BitCoins, Inflation steigt, uvm. - dagegen stehen lediglich die mini Zinserhöhungen, mehr dürfte auch nicht groß drin sein, außer man würgt alles Stimulanzen gleich wieder ab ..

http://www.marketwired.com/press-release/nemaska-lithium-pursues-drilling-to-further-define-the-doris-zone-tsx-nmx-2188723.htm

[url=http://peketec.de/trading/viewtopic.php?p=1734383#1734383 schrieb:greenhorn schrieb am 17.01.2017, 09:44 Uhr[/url]"]RSI ist aktuell zart über der 70 (73); grundsätzlich ist alles möglich; siehe PZE weiter unten - ich könnte mir vorstellen das wir heute an die 1,60 laufen, eventuell auch drüber und es dann eine kurze Verschnaufpause gibt.

Aber genauso gut kann es auch noch 2-3 Tage weiergehen mit Ziel CAD, wo das letzte Hoch liegt......und dann konsolidiert

[url=http://peketec.de/trading/viewtopic.php?p=1734378#1734378 schrieb:dukezero schrieb am 17.01.2017, 09:26 Uhr[/url]"]Alles sehr dynamisch!!

[url=http://peketec.de/trading/viewtopic.php?p=1734373#1734373 schrieb:Rooky schrieb am 17.01.2017, 09:24 Uhr[/url]"]schaffen wir die 1,65 ?

[url=http://peketec.de/trading/viewtopic.php?p=1734372#1734372 schrieb:

wenn sich mir etwas die letzten Jahre eingeprägt hat - der Goldpreis entwickelt sich nicht nach logischen Rahmenvorgaben.....du hast mit deiner Einschätzung der Lage sicherlich Recht, und danach müßte, hätte, sollte - aber ob wirklich.......wir werden sehen..Chart, HUI etc.,EUR/USD-Entwicklung ist/waren oft ein Kriterium, und vieles andere wird sich "zurechtgebogen" um Entwicklungen zu begründen

[url=http://peketec.de/trading/viewtopic.php?p=1734431#1734431 schrieb:Rooky schrieb am 17.01.2017, 11:43 Uhr[/url]"]Anhand der COT Analyse steht steigenden Goldpreise nichts entgegen, zumindest mittelfristig.

[url=http://peketec.de/trading/viewtopic.php?p=1734424#1734424 schrieb:marcovich schrieb am 17.01.2017, 11:19 Uhr[/url]"]für mich spricht sehr vieles für einen steigenden Goldpreis, wie seht ihr das?

Generelle Unsicherheit EU, Frankreich Wahlen, Italien Banken, zukünftige Politik Trump, schwächerer Dollar gewünscht, Handelsstreit mit China, heute Brexit Rede von May, volatile BitCoins, Inflation steigt, uvm. - dagegen stehen lediglich die mini Zinserhöhungen, mehr dürfte auch nicht groß drin sein, außer man würgt alles Stimulanzen gleich wieder ab ..

Danke, ja klar, logisch ist nichts. habe mich um die 1200 positioniert, bin darunter auch erstmal wieder draussen  könnte mir aber vorstellen Gold long aufzustocken. Auf der anderen Seite bin ich aktuell ziemlich rohstofflastig im Depot:

könnte mir aber vorstellen Gold long aufzustocken. Auf der anderen Seite bin ich aktuell ziemlich rohstofflastig im Depot:

Alkane Gold, REE, Hafnium

Lynas - REE

Nemaska - Lithium

Blackbird Öl

Gold long via KO

Alkane Gold, REE, Hafnium

Lynas - REE

Nemaska - Lithium

Blackbird Öl

Gold long via KO

[url=http://peketec.de/trading/viewtopic.php?p=1734441#1734441 schrieb:greenhorn schrieb am 17.01.2017, 12:07 Uhr[/url]"]wenn sich mir etwas die letzten Jahre eingeprägt hat - der Goldpreis entwickelt sich nicht nach logischen Rahmenvorgaben.....du hast mit deiner Einschätzung der Lage sicherlich Recht, und danach müßte, hätte, sollte - aber ob wirklich.......wir werden sehen..Chart, HUI etc.,EUR/USD-Entwicklung ist/waren oft ein Kriterium, und vieles andere wird sich "zurechtgebogen" um Entwicklungen zu begründen

[url=http://peketec.de/trading/viewtopic.php?p=1734431#1734431 schrieb:Rooky schrieb am 17.01.2017, 11:43 Uhr[/url]"]Anhand der COT Analyse steht steigenden Goldpreise nichts entgegen, zumindest mittelfristig.

[url=http://peketec.de/trading/viewtopic.php?p=1734424#1734424 schrieb:marcovich schrieb am 17.01.2017, 11:19 Uhr[/url]"]für mich spricht sehr vieles für einen steigenden Goldpreis, wie seht ihr das?

Generelle Unsicherheit EU, Frankreich Wahlen, Italien Banken, zukünftige Politik Trump, schwächerer Dollar gewünscht, Handelsstreit mit China, heute Brexit Rede von May, volatile BitCoins, Inflation steigt, uvm. - dagegen stehen lediglich die mini Zinserhöhungen, mehr dürfte auch nicht groß drin sein, außer man würgt alles Stimulanzen gleich wieder ab ..

natürlich hast Du recht, wenn es so einfach wäre, würde jeder reich werden. Aber Tendenzen können damit schon ganz gut erkannt werden.

[url=http://peketec.de/trading/viewtopic.php?p=1734441#1734441 schrieb:greenhorn schrieb am 17.01.2017, 12:07 Uhr[/url]"]wenn sich mir etwas die letzten Jahre eingeprägt hat - der Goldpreis entwickelt sich nicht nach logischen Rahmenvorgaben.....du hast mit deiner Einschätzung der Lage sicherlich Recht, und danach müßte, hätte, sollte - aber ob wirklich.......wir werden sehen..Chart, HUI etc.,EUR/USD-Entwicklung ist/waren oft ein Kriterium, und vieles andere wird sich "zurechtgebogen" um Entwicklungen zu begründen

[url=http://peketec.de/trading/viewtopic.php?p=1734431#1734431 schrieb:Rooky schrieb am 17.01.2017, 11:43 Uhr[/url]"]Anhand der COT Analyse steht steigenden Goldpreise nichts entgegen, zumindest mittelfristig.

[url=http://peketec.de/trading/viewtopic.php?p=1734424#1734424 schrieb:marcovich schrieb am 17.01.2017, 11:19 Uhr[/url]"]für mich spricht sehr vieles für einen steigenden Goldpreis, wie seht ihr das?

Generelle Unsicherheit EU, Frankreich Wahlen, Italien Banken, zukünftige Politik Trump, schwächerer Dollar gewünscht, Handelsstreit mit China, heute Brexit Rede von May, volatile BitCoins, Inflation steigt, uvm. - dagegen stehen lediglich die mini Zinserhöhungen, mehr dürfte auch nicht groß drin sein, außer man würgt alles Stimulanzen gleich wieder ab ..

KL - Kirkland Lake Gold

January 17, 2017 07:30 ET

Kirkland Lake Gold Extends High-Grade Mineralization at Depth on the Lower Phoenix Gold System and Reports a Record High-Grade Drill Result From the Fosterville Gold Mine

http://www.marketwired.com/press-re...-lower-phoenix-gold-system-tsx-kl-2188771.htm

TORONTO, ONTARIO--(Marketwired - Jan. 17, 2017) -

Lower Phoenix Footwall mineralization has demonstrated high-grade continuity and down plunge extension with the return of the following drill intercepts:

1,429 g/t Au(1) over 15.15m, including 21,490 g/t Au(1) over 0.6m in hole UDH1817

356 g/t Au(1) over 7.2m, including 1,339 g/t Au(1) over 1.85m in hole UDH1943

83.9 g/t Au(1) over 3.5m, including 234 g/t Au(1) over 0.65m in hole UDH1941

Eagle high-grade mineralization has been extended down plunge with a recent drill intercept returning:

15.97 g/t Au(1) over 11.35m, including 195 g/t Au(1) over 0.45m in hole UDH1890A

(1) Visible gold present in drill intercept, all drill results are presented in Table 1

Kirkland Lake Gold Ltd. ("KL Gold" or the "Company") (TSX:KL) is pleased to report extensions of high grade mineralization at depth and new high-grade intercepts, including a record high grade drill result in hole UDH1817 from underground drilling at its Fosterville Gold Mine in Australia.

Underground resource definition drilling has continued to target down-plunge extensions of the Lower Phoenix and Harrier South gold systems to assess the potential of Mineral Reserve expansion. Recent drill results returned from 20 underground holes totaling 6,471 meters (m) into extensions of the Lower Phoenix gold system include the highest-grade drill intercept ever recorded at Fosterville. Results continue to demonstrate the continuity of exceptional high-grade visible gold mineralization on both the newly discovered west dipping Lower Phoenix Footwall and Eagle Structures in the Lower Phoenix gold system.

A drill program of 7 holes totaling 2,670m in the Harrier South gold system has reaffirmed the Mineral Reserve conversion potential of this area. Recent drill results continue to support the potential to expand Fosterville's Mineral Resources and Reserves and confirm continuity of high-grade gold mineralization down plunge on the Harrier South gold system.

January 17, 2017 07:30 ET

Kirkland Lake Gold Extends High-Grade Mineralization at Depth on the Lower Phoenix Gold System and Reports a Record High-Grade Drill Result From the Fosterville Gold Mine

http://www.marketwired.com/press-re...-lower-phoenix-gold-system-tsx-kl-2188771.htm

TORONTO, ONTARIO--(Marketwired - Jan. 17, 2017) -

Lower Phoenix Footwall mineralization has demonstrated high-grade continuity and down plunge extension with the return of the following drill intercepts:

1,429 g/t Au(1) over 15.15m, including 21,490 g/t Au(1) over 0.6m in hole UDH1817

356 g/t Au(1) over 7.2m, including 1,339 g/t Au(1) over 1.85m in hole UDH1943

83.9 g/t Au(1) over 3.5m, including 234 g/t Au(1) over 0.65m in hole UDH1941

Eagle high-grade mineralization has been extended down plunge with a recent drill intercept returning:

15.97 g/t Au(1) over 11.35m, including 195 g/t Au(1) over 0.45m in hole UDH1890A

(1) Visible gold present in drill intercept, all drill results are presented in Table 1

Kirkland Lake Gold Ltd. ("KL Gold" or the "Company") (TSX:KL) is pleased to report extensions of high grade mineralization at depth and new high-grade intercepts, including a record high grade drill result in hole UDH1817 from underground drilling at its Fosterville Gold Mine in Australia.

Underground resource definition drilling has continued to target down-plunge extensions of the Lower Phoenix and Harrier South gold systems to assess the potential of Mineral Reserve expansion. Recent drill results returned from 20 underground holes totaling 6,471 meters (m) into extensions of the Lower Phoenix gold system include the highest-grade drill intercept ever recorded at Fosterville. Results continue to demonstrate the continuity of exceptional high-grade visible gold mineralization on both the newly discovered west dipping Lower Phoenix Footwall and Eagle Structures in the Lower Phoenix gold system.

A drill program of 7 holes totaling 2,670m in the Harrier South gold system has reaffirmed the Mineral Reserve conversion potential of this area. Recent drill results continue to support the potential to expand Fosterville's Mineral Resources and Reserves and confirm continuity of high-grade gold mineralization down plunge on the Harrier South gold system.

LAC - Lithium America; ist ein ordentliches Sümmchen!

January 17, 2017 07:25 ET

Lithium Americas Announces US$174 Million Strategic Investment by Ganfeng Lithium

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jan. 17, 2017) - Lithium Americas Corp. (TSX:LAC)(OTCQX:LACDF) ("Lithium Americas" or the "Company") is pleased to announce it has signed an investment agreement (the "Investment Agreement") with GFL International Co., Ltd. ("Ganfeng") for funding to advance the construction of the Cauchari-Olaroz lithium project in Jujuy, Argentina. Pursuant to the Investment Agreement, Ganfeng has agreed to financing terms in an aggregate amount of US$174 million in exchange for 19.9% of the outstanding common shares of Lithium Americas pro-forma (the "Private Placement"); the right to buy a fixed portion of the lithium carbonate production from the Cauchari-Olaroz project (the "Offtake Entitlement"); and a US$125 million project debt facility (the "Project Debt Facility").

Transaction Highlights

Private Placement: Ganfeng has agreed to purchase, by way of a private placement, 75,000,000 common shares at a price of C$0.85 per common share for gross proceeds of C$64 million (US$49 million). Following the close of the Private Placement, Ganfeng will own approximately 19.9% of the Company's issued and outstanding shares;

Project Debt Facility: Ganfeng and the Company have agreed to terms by which Ganfeng will provide to Lithium Americas a US$125 million Project Debt Facility to be used for the funding of Lithium Americas' share of Cauchari-Olaroz construction costs. The Project Debt Facility has a term of six years, with an interest rate of 8.0% for the first three years that increases to 8.5% in year four, 9.0% in year five and 9.5% in year six;

Offtake Entitlement: Ganfeng and the Company have agreed to terms for an Offtake Entitlement in favour of Ganfeng for the purchase of up to 70% of Lithium Americas' share of Cauchari-Olaroz Stage 1 lithium carbonate production at market prices; and

Investor Rights: Ganfeng will be entitled to one nominee on Lithium Americas' board of directors and anti-dilution protection to maintain its proportionate interest in Lithium Americas for a two-year term.

Tom Hodgson, CEO of Lithium Americas, commented: "We are delighted to welcome Ganfeng as a partner and as our largest shareholder. We have long believed that the right partnerships bring important benefits to the Cauchari-Olaroz project, the local communities in Jujuy, and to our shareholders. With this investment from Ganfeng we are now ready with our JV partner, SQM, to begin construction of the Cauchari-Olaroz lithium project."

Li Liang Bin, Chairman and President of Ganfeng, commented: "Ganfeng is pleased to be involved in a project that we believe will be one of the world's largest and lowest cost lithium projects. This investment is fully in line with our resource development strategy. We also look forward to working with Lithium Americas on further collaboration in the lithium industry."

The Ganfeng group is the largest integrated lithium producer in in China, with a total capacity of around 30,000 tonnes per annum of LCE. Ganfeng's products include lithium metal, lithium hydroxide, lithium carbonate, lithium fluoride, and lithium chloride. In Australia, Ganfeng owns a 43.1% interest in the Mount Marion lithium spodumene project with Mineral Resources Ltd. (43.1%) and Neometals Ltd. (13.8%).

Ganfeng was founded in 2000 and trades on the Shenzhen Stock Exchange (SHE: 002460), with a market capitalization of approximately US$3 billion.

January 17, 2017 07:25 ET

Lithium Americas Announces US$174 Million Strategic Investment by Ganfeng Lithium

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jan. 17, 2017) - Lithium Americas Corp. (TSX:LAC)(OTCQX:LACDF) ("Lithium Americas" or the "Company") is pleased to announce it has signed an investment agreement (the "Investment Agreement") with GFL International Co., Ltd. ("Ganfeng") for funding to advance the construction of the Cauchari-Olaroz lithium project in Jujuy, Argentina. Pursuant to the Investment Agreement, Ganfeng has agreed to financing terms in an aggregate amount of US$174 million in exchange for 19.9% of the outstanding common shares of Lithium Americas pro-forma (the "Private Placement"); the right to buy a fixed portion of the lithium carbonate production from the Cauchari-Olaroz project (the "Offtake Entitlement"); and a US$125 million project debt facility (the "Project Debt Facility").

Transaction Highlights

Private Placement: Ganfeng has agreed to purchase, by way of a private placement, 75,000,000 common shares at a price of C$0.85 per common share for gross proceeds of C$64 million (US$49 million). Following the close of the Private Placement, Ganfeng will own approximately 19.9% of the Company's issued and outstanding shares;

Project Debt Facility: Ganfeng and the Company have agreed to terms by which Ganfeng will provide to Lithium Americas a US$125 million Project Debt Facility to be used for the funding of Lithium Americas' share of Cauchari-Olaroz construction costs. The Project Debt Facility has a term of six years, with an interest rate of 8.0% for the first three years that increases to 8.5% in year four, 9.0% in year five and 9.5% in year six;

Offtake Entitlement: Ganfeng and the Company have agreed to terms for an Offtake Entitlement in favour of Ganfeng for the purchase of up to 70% of Lithium Americas' share of Cauchari-Olaroz Stage 1 lithium carbonate production at market prices; and

Investor Rights: Ganfeng will be entitled to one nominee on Lithium Americas' board of directors and anti-dilution protection to maintain its proportionate interest in Lithium Americas for a two-year term.

Tom Hodgson, CEO of Lithium Americas, commented: "We are delighted to welcome Ganfeng as a partner and as our largest shareholder. We have long believed that the right partnerships bring important benefits to the Cauchari-Olaroz project, the local communities in Jujuy, and to our shareholders. With this investment from Ganfeng we are now ready with our JV partner, SQM, to begin construction of the Cauchari-Olaroz lithium project."

Li Liang Bin, Chairman and President of Ganfeng, commented: "Ganfeng is pleased to be involved in a project that we believe will be one of the world's largest and lowest cost lithium projects. This investment is fully in line with our resource development strategy. We also look forward to working with Lithium Americas on further collaboration in the lithium industry."

The Ganfeng group is the largest integrated lithium producer in in China, with a total capacity of around 30,000 tonnes per annum of LCE. Ganfeng's products include lithium metal, lithium hydroxide, lithium carbonate, lithium fluoride, and lithium chloride. In Australia, Ganfeng owns a 43.1% interest in the Mount Marion lithium spodumene project with Mineral Resources Ltd. (43.1%) and Neometals Ltd. (13.8%).

Ganfeng was founded in 2000 and trades on the Shenzhen Stock Exchange (SHE: 002460), with a market capitalization of approximately US$3 billion.

TV - Trevali; ein Hammer 4.Quartal!  :D

:D

January 17, 2017 08:48 ET

Trevali reports record Q4-2016 and 2016 annual zinc production

2016 Santander zinc production exceeds annual guidance

http://www.marketwired.com/press-re...016-annual-zinc-production-tsx-tv-2188855.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jan. 17, 2017) - Trevali Mining Corporation ("Trevali" or the "Company") (TSX:TV)(LMA:TV)(OTCQX:TREVF)(FRANKFURT:4TI) reports preliminary fourth quarter ("Q4") 2016 production results from its two operating zinc mines, the Caribou Mine in New Brunswick, Canada and the Santander Mine in Peru. For the three months ending December 31, 2016, approximately 36.8 million payable pounds zinc, 11.3 million payable pounds lead and 409,654 payable ounces of silver was produced (see Table 1).

January 17, 2017 08:48 ET

Trevali reports record Q4-2016 and 2016 annual zinc production

2016 Santander zinc production exceeds annual guidance

http://www.marketwired.com/press-re...016-annual-zinc-production-tsx-tv-2188855.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jan. 17, 2017) - Trevali Mining Corporation ("Trevali" or the "Company") (TSX:TV)(LMA:TV)(OTCQX:TREVF)(FRANKFURT:4TI) reports preliminary fourth quarter ("Q4") 2016 production results from its two operating zinc mines, the Caribou Mine in New Brunswick, Canada and the Santander Mine in Peru. For the three months ending December 31, 2016, approximately 36.8 million payable pounds zinc, 11.3 million payable pounds lead and 409,654 payable ounces of silver was produced (see Table 1).

[url=http://peketec.de/trading/viewtopic.php?p=1722583#1722583 schrieb:greenhorn schrieb am 15.11.2016, 12:47 Uhr[/url]"]TV - läuft..........

November 14, 2016 16:28 ET

Trevali reports Q3-2016 financial results

Record EBITDA(1) of $14.8 million on concentrate sales of $57.5 million; $2.4-million net income

http://www.marketwired.com/press-re...-q3-2016-financial-results-tsx-tv-2175457.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Nov. 14, 2016) - Trevali Mining Corporation ("Trevali" or the "Company") (TSX:TV)(LMA:TV)(OTCQX:TREVF)(FRANKFURT:4TI) has released financial results for the three months and nine months ended September 30, 2016. Third quarter ("Q3") EBITDA(1) increased significantly from the preceding quarter to a record $14.8 million, with income from operations of $10.6 million, and the Company posted a net profit of $2.4-million, or $0.01 per share, for the quarter. Q3 marked a major milestone for Trevali as the Caribou zinc mine in New Brunswick commenced Commercial Production.

This release should be read in conjunction with Trevali's unaudited condensed consolidated financial statements and management's discussion and analysis for the three months and nine months ended September 30, 2016, which is available on Trevali's website and on SEDAR. All financial figures are in Canadian dollar unless otherwise stated.

[url=http://peketec.de/trading/viewtopic.php?p=1704378#1704378 schrieb:greenhorn schrieb am 12.08.2016, 09:51 Uhr[/url]"]TV - Trevali, gestern mit Finanzergebniss 2.Q + neues Jahreshoch bei 0,94 CAD, die Konso fiel kurz aus

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:TV-2397396&symbol=TV®ion=C

Trevali Mining loses $335,000 in Q2 2016

2016-08-11 16:08 ET - News Release

Dr. Mark Cruise reports

TREVALI REPORTS Q2-2016 FINANCIAL RESULTS

Trevali Mining Corp. has released financial results for the three months and six months ended June 30, 2016. Second quarter EBITDA (earnings before interest, taxes, depreciation and amortization) rose from the preceding quarter to $8.2-million and a net loss of $335,000 (nil per share) was posted for the quarter. Santander zinc mine operations income for the second quarter increased from the prior quarter to $5.2-million on strong concentrate sales revenue of $28.9-million. Santander site cash costs in the second quarter were 32 U.S. cents per pound of payable zinc equivalent produced, or $35.64 (U.S.) per tonne milled.

This release should be read in conjunction with Trevali's unaudited condensed consolidated financial statements and management discussion and analysis for the three months and six months ended June 30, 2016, which is available on Trevali's website and on SEDAR. All financial figures are in Canadian dollars unless otherwise stated.

2016 second quarter results highlights:

Santander concentrate sales revenue of $28.9-million, up 7 per cent from the first quarter of 2016;

EBITDA of $8.2-million;

Income from Santander mine operations was $5.2-million, up 25 per cent from the first quarter of 2016;

Net loss of $335,000, or nil per share;

Total cash position of $14.5-million;

Second quarter Santander site cash costs of 32 U.S. cents per pound of payable zinc equivalent produced, or $35.64 (U.S.) per tonne milled, in line with recently revised 2016 cost guidance of $35 (U.S.) to $38 (U.S.) per tonne milled;

Record Santander mill throughput of 219,086 tonnes resulting in quarterly production of 15.2 million payable pounds of zinc, 5.6 million payable pounds of lead and 222,121 payable ounces of silver;

Provisional realized commodity selling prices for Santander 2016 second quarter production was 89 U.S. cents per pound zinc, 79 U.S. cents per pound lead and $17.09 (U.S.) per ounce silver at international benchmark terms under the company's offtake agreement with Glencore;

Santander mill recoveries remain higher than design at 89 per cent for zinc, 87 per cent for lead and 73 per cent for silver.

"Santander delivered yet another strong quarter with record mill throughput and site cash costs remaining in line with the recent recently reduced 2016 cost guidance. Santander remains one of the lowest-cost, most-efficient operating mines in the Central Mineral belt of Peru. Additionally, stronger zinc prices in Q2 versus Q1 benefited the company's operations, and we're also seeing a significantly stronger metal price environment so far in Q3 with zinc prices touching 15-month highs," stated Dr. Mark Cruise, Trevali's president and chief executive officer. "Trevali also recently announced commercial production at its Caribou zinc mine in New Brunswick, where similar optimization initiatives are being applied to boost the efficiencies at the operation. As zinc fundamentals continue to look increasingly bullish, Trevali remains well positioned as the only primary zinc producer on the Toronto Stock Exchange and one of only a few globally."

[url=http://peketec.de/trading/viewtopic.php?p=1699902#1699902 schrieb:Fischlaender schrieb am 20.07.2016, 10:33 Uhr[/url]"]Production at Caribou and Santander Propels Trevali Toward 'Marquee' Status

Source: The Gold Report (7/19/16)

http://www.theaureport.com/pub/na/production-at-caribou-and-santander-propel-trevali-toward-marquee-status

[url=http://peketec.de/trading/viewtopic.php?p=1699880#1699880 schrieb:greenhorn schrieb am 20.07.2016, 09:25 Uhr[/url]"]TV - SK bei 0,83 - großartig, RSI nun aber über 80....also auch mal Gewinne mitnehmen

TKO läuft langsamer

[url=http://peketec.de/trading/viewtopic.php?p=1699023#1699023 schrieb:greenhorn schrieb am 15.07.2016, 09:34 Uhr[/url]"]TV - SK bei 0,79 gestern 8)....aber wie schon geschrieben....RSI jetzt über 80

TKO - gleiche Tendenz, aber noch bissl mehr Luft

[url=http://peketec.de/trading/viewtopic.php?p=1698827#1698827 schrieb:greenhorn schrieb am 14.07.2016, 15:41 Uhr[/url]"]TV - Trevali Sehr schön aktuell - SK gestern bei 0,71....heute positiver Start....nun lauert aber er "überkaufte Bereich".........

[url=http://peketec.de/trading/viewtopic.php?p=1698369#1698369 schrieb:greenhorn schrieb am 13.07.2016, 09:56 Uhr[/url]"]TV - Trevali, SK gestern bei 0,69 CAD, kurzfristig noch Luft bis ca. 0,80/0,84 CAD, dann sicher erstmal im überkauften Bereich....

wird sicher demnächst einige Analystenkommentare geben, mit nun 2 produzierenden Minen ist Trevali keine kleine Nummer mehr und Caribou hat gute ökonomische Parameter

[url=http://peketec.de/trading/viewtopic.php?p=1697987#1697987 schrieb:greenhorn schrieb am 11.07.2016, 14:55 Uhr[/url]"]TV - Trevali, nach Bekanntgabe des offiziellen Starts der Caribou-Mine nun die Zahlen zu bereits bestehenden.....

wenn SK über 0,68 CAD ist der Weg frei

+ neueste Präsentation:

http://www.trevali.com/i/pdf/TrevaliPresentation.pdf

July 11, 2016 08:30 ET

Trevali Reports Q2-2016 Santander Mine Production With Record Zinc Output and Mill Throughput, and Boosts 2016 Zinc Production Guidance

http://www.marketwired.com/press-re...inc-output-mill-throughput-tsx-tv-2141189.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwired - July 11, 2016) - Trevali Mining Corporation ("Trevali" or the "Company") (TSX:TV)(LMA:TV)(OTCQX:TREVF)(FRANKFURT:4TI) reports preliminary Santander Mine production results for its second quarter ("Q2") ending June 30, 2016 of approximately 15.2 million payable pounds zinc (a new quarterly record), 5.6 million payable pounds of lead and 222,121 payable ounces of silver (see Table 1).

Q2-2016 Santander recoveries averaged 89% for zinc, 87% for lead and 73% for silver. Mill throughput for the quarter was 219,086 tonnes, surpassing the site's prior record of 209,188 tonnes set in Q1-2016.

[url=http://peketec.de/trading/viewtopic.php?p=1697350#1697350 schrieb:greenhorn schrieb am 07.07.2016, 15:58 Uhr[/url]"]Trevali reaches commercial production at Caribou mine

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:TV-2388153&symbol=TV®ion=C

2016-07-07 09:49 ET - News Release

Mr. Mark Cruise reports

TREVALI DECLARES COMMERCIAL PRODUCTION AT CARIBOU ZINC MINE FOLLOWING RECORD JUNE PERFORMANCE

Effective as of July 1, 2016, Trevali Mining Corp. has achieved commercial production at its Caribou zinc mine in the Bathurst mining camp of northern New Brunswick. Following a successful commissioning period, Caribou is now operating consistently in a manner intended by the company and as demonstrated in the June results, with mill and underground operations delivering the strongest monthly performance to date with record mine and mill tonnage and throughput, zinc recoveries and concentrate production. A detailed description and discussion is provided below and progress highlights are as follows.

[url=http://peketec.de/trading/viewtopic.php?p=1697293#1697293 schrieb:greenhorn schrieb am 07.07.2016, 12:45 Uhr[/url]"]TV - Trevali gestern auch ein Kaufsignal im Chart gemacht, über 0,65 CAD geht der Zug los

TKO - Taseko sieht auch schick aus

[url=http://peketec.de/trading/viewtopic.php?p=1690854#1690854 schrieb:greenhorn schrieb am 09.06.2016, 15:29 Uhr[/url]"]une 09, 2016 09:03 ET

Trevali Provides Caribou Zinc Mine Commissioning Update - Zinc Recoveries Increase Significantly

http://www.marketwired.com/press-re...ies-increase-significantly-tsx-tv-2132924.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwired - June 9, 2016) - Trevali Mining Corporation ("Trevali" or the "Company") (TSX:TV)(LMA:TV)(OTCQX:TREVF)(FRANKFURT:4TI) provides a mine and mill commissioning update for its Caribou Zinc Mine in the Bathurst Mining Camp of northern New Brunswick. A detailed description and discussion is provided below and progress highlights are as follows:

[url=http://peketec.de/trading/viewtopic.php?p=1689441#1689441 schrieb:greenhorn schrieb am 03.06.2016, 08:52 Uhr[/url]"]June 02, 2016 09:23 ET

Trevali Reports Additional Drill Results From New Oyon Zone at Santander Zinc Mine

http://www.marketwired.com/press-re...one-at-santander-zinc-mine-tsx-tv-2130816.htm

Highlights: 24.5 metres(i) of 5.7% Zn, 4.0% Pb and 6.0 oz/t Ag;

18.9 metres(i) of 4.1% Zn, 3.4% Pb and 3.5 oz/t Ag; and

14.7 metres(i) of 5.2% Zn, 5.8% Pb and 2.1 oz/t Ag

VANCOUVER, BRITISH COLUMBIA--(Marketwired - June 2, 2016) - Trevali Mining Corporation ("Trevali" or the "Company") (TSX:TV)(LMA:TV)(OTCQX:TREVF)(FRANKFURT:4TI) announces results from four new drill holes of its ongoing 2016 underground exploration drill program at the Santander zinc mine in Peru. The aim of the current drilling is to test recently discovered mineralization in the hanging wall of the Magistral North deposit. Drill holes continue to intersect multiple stacked mineralized massive sulphide replacement zones, or mantos, both within the main Magistral North body as well as in the newly discovered Oyon mantos (Table 1). The intercepts are near existing mine infrastructure and will be quickly incorporated into the near-term (2016-2017) mine plan. Mineralization in both the Magistral North deposit and the new Oyon mantos remains open for expansion and further underground drilling is in progress (Figure 1).

[url=http://peketec.de/trading/viewtopic.php?p=1689229#1689229 schrieb:greenhorn schrieb am 02.06.2016, 12:00 Uhr[/url]"]Trevali (TV) und Taseko (TKO) - beide stehen vor einem Kaufsignal nach erfolgter Konso

beides Produzenten

Trevali hatte gestern schon eine erste deutlichere Bewegung

liest sich Top!

[url=http://peketec.de/trading/viewtopic.php?p=1734517#1734517 schrieb:600 schrieb am 17.01.2017, 14:51 Uhr[/url]"]MARL!!!

https://ceo.ca/@nasdaq/mariana-resources-ltd-hot-maden-high-grade-gold-copper