App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

July 31, 2012 08:11 ET

GoldQuest Mining Announces $10 Million Bought Private Placement

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 31, 2012) -

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

GoldQuest Mining Corp. (the "Company") (TSX VENTURE:GQC)(FRANKFURT:M1W)(BERLIN:M1W) is pleased to announce that it has entered into an agreement with Dundee Securities Ltd. (the "Lead Underwriter") on behalf of a syndicate of Underwriters including Stifel Nicolaus Canada Inc., Clarus Securities Inc., GMP Securities L.P. and Raymond James Ltd. (the "Underwriters") under which the Underwriters have agreed to purchase, on a bought deal private placement basis, 8,000,000 common shares (the "Shares") at a price per Share of $1.25 for total gross proceeds of $10,000,000 (the "Offering"). The Underwriters have been granted the option (the "Option") to purchase up to an additional $5,000,000 of the Offering, exercisable in whole or in part at any time up to 48 hours before the closing of the Offering (the "Closing Date").

In connection with the Offering, the Underwriters will receive a cash commission equal to 6.0% of the gross proceeds raised under the Offering (inclusive of the Option) and that number of non-transferable broker warrants ("Broker Warrants") as is equal to 6.0% of the number of Offered Securities sold (inclusive of the Option). Each Broker Warrant will be exercisable into one Share of the Company, for a period of 24 months from the Closing Date at a price of $1.25 per Share.

Closing of the Offering is scheduled for on or about August 21, 2012. All securities issued will be subject to a statutory four month hold period. The Offering is subject to a number of conditions, including, without limitation, receipt of all regulatory approvals.

The net proceeds will be used to advance the exploration and development of the Company's gold assets in the Dominican Republic and for general corporate purposes.

About GoldQuest

GoldQuest is a Canadian based mineral exploration company with projects in the Dominican Republic traded on the TSX-V under the symbol GQC.V and in Frankfurt/Berlin with symbol M1W, with 125,525,267 shares outstanding (141,048,601 on a fully diluted basis).

GoldQuest Mining Announces $10 Million Bought Private Placement

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 31, 2012) -

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

GoldQuest Mining Corp. (the "Company") (TSX VENTURE:GQC)(FRANKFURT:M1W)(BERLIN:M1W) is pleased to announce that it has entered into an agreement with Dundee Securities Ltd. (the "Lead Underwriter") on behalf of a syndicate of Underwriters including Stifel Nicolaus Canada Inc., Clarus Securities Inc., GMP Securities L.P. and Raymond James Ltd. (the "Underwriters") under which the Underwriters have agreed to purchase, on a bought deal private placement basis, 8,000,000 common shares (the "Shares") at a price per Share of $1.25 for total gross proceeds of $10,000,000 (the "Offering"). The Underwriters have been granted the option (the "Option") to purchase up to an additional $5,000,000 of the Offering, exercisable in whole or in part at any time up to 48 hours before the closing of the Offering (the "Closing Date").

In connection with the Offering, the Underwriters will receive a cash commission equal to 6.0% of the gross proceeds raised under the Offering (inclusive of the Option) and that number of non-transferable broker warrants ("Broker Warrants") as is equal to 6.0% of the number of Offered Securities sold (inclusive of the Option). Each Broker Warrant will be exercisable into one Share of the Company, for a period of 24 months from the Closing Date at a price of $1.25 per Share.

Closing of the Offering is scheduled for on or about August 21, 2012. All securities issued will be subject to a statutory four month hold period. The Offering is subject to a number of conditions, including, without limitation, receipt of all regulatory approvals.

The net proceeds will be used to advance the exploration and development of the Company's gold assets in the Dominican Republic and for general corporate purposes.

About GoldQuest

GoldQuest is a Canadian based mineral exploration company with projects in the Dominican Republic traded on the TSX-V under the symbol GQC.V and in Frankfurt/Berlin with symbol M1W, with 125,525,267 shares outstanding (141,048,601 on a fully diluted basis).

Sehr clever und schnell geschaltet das Management.

[url=http://peketec.de/trading/viewtopic.php?p=1281103#1281103 schrieb:CCG-Redaktion schrieb am 31.07.2012, 14:15 Uhr[/url]"]July 31, 2012 08:11 ET

GoldQuest Mining Announces $10 Million Bought Private Placement

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 31, 2012) -

...

[url=http://peketec.de/trading/viewtopic.php?p=1280982#1280982 schrieb:

Gold Quest Abstauber!

July 31, 2012 08:15 ET

Timberline Reports First Results from 2012 Exploration and Drilling at Lookout Mountain

COEUR D'ALENE, IDAHO--(Marketwire - July 31, 2012) - Timberline Resources Corporation (TSX VENTURE:TBR)(NYSE MKT:TLR)(NYSE Amex:TLR) ("Timberline" or the "Company") today provided an overview of the 2012 exploration and pre-development program at its Lookout Mountain Gold Project, along with the first drill results of the season. Lookout Mountain is the lead project within Timberline's district-scale South Eureka property, located in Nevada's prolific Battle Mountain - Eureka Trend.

Current exploration at South Eureka is focused primarily at Lookout Mountain, where preparations are underway for a Preliminary Economic Analysis (PEA) planned for later this year. The PEA is expected to support Timberline's positive assessment of the near-term production potential of the project. Highlights of the 2012 exploration and pre-development program include:

Approximately 25,000 feet (7,620 metres) of drilling, with a primary objective of upgrading a substantial portion of the existing resource from the Inferred category into the Measured and Indicated categories.

Continued metallurgical studies, including bottle roll testing and crush size analysis, to optimize gold recovery.

Permitting activities, including geochemistry studies for waste rock analysis, acid base accounting, hydrologic studies, and geotechnical work, in advance of possible submission of a mine plan in conjunction with an operating permit application in the event of a favorable PEA.

http://www.marketwire.com/press-release/timberline-reports-first-results-from-2012-exploration-drilling-lookout-mountain-tsx-venture-tbr-1685459.htm

Timberline Reports First Results from 2012 Exploration and Drilling at Lookout Mountain

COEUR D'ALENE, IDAHO--(Marketwire - July 31, 2012) - Timberline Resources Corporation (TSX VENTURE:TBR)(NYSE MKT:TLR)(NYSE Amex:TLR) ("Timberline" or the "Company") today provided an overview of the 2012 exploration and pre-development program at its Lookout Mountain Gold Project, along with the first drill results of the season. Lookout Mountain is the lead project within Timberline's district-scale South Eureka property, located in Nevada's prolific Battle Mountain - Eureka Trend.

Current exploration at South Eureka is focused primarily at Lookout Mountain, where preparations are underway for a Preliminary Economic Analysis (PEA) planned for later this year. The PEA is expected to support Timberline's positive assessment of the near-term production potential of the project. Highlights of the 2012 exploration and pre-development program include:

Approximately 25,000 feet (7,620 metres) of drilling, with a primary objective of upgrading a substantial portion of the existing resource from the Inferred category into the Measured and Indicated categories.

Continued metallurgical studies, including bottle roll testing and crush size analysis, to optimize gold recovery.

Permitting activities, including geochemistry studies for waste rock analysis, acid base accounting, hydrologic studies, and geotechnical work, in advance of possible submission of a mine plan in conjunction with an operating permit application in the event of a favorable PEA.

http://www.marketwire.com/press-release/timberline-reports-first-results-from-2012-exploration-drilling-lookout-mountain-tsx-venture-tbr-1685459.htm

gold und silber sehr stabil in den letzten tagen. praktische keine rücksetzer mehr,

bleibt spannend.

bleibt spannend.

[url=http://peketec.de/trading/viewtopic.php?p=1281112#1281112 schrieb:spiderwilli schrieb am 31.07.2012, 14:31 Uhr[/url]"]gold und silber sehr stabil in den letzten tagen. praktische keine rücksetzer mehr,

bleibt spannend.

Bringt nur die fetten Hennen nicht nach vorne, das irritiert dann schon.

Positiv allerdings,- auf gute News wird wieder alles reingerammelt!

[url=http://peketec.de/trading/viewtopic.php?p=1281113#1281113 schrieb:dukezero schrieb am 31.07.2012, 14:34 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1281112#1281112 schrieb:spiderwilli schrieb am 31.07.2012, 14:31 Uhr[/url]"]gold und silber sehr stabil in den letzten tagen. praktische keine rücksetzer mehr,

bleibt spannend.

Bringt nur die fetten Hennen nicht nach vorne, das irritiert dann schon.

Positiv allerdings,- auf gute News wird wieder alles reingerammelt!

das vertrauen in die "fetten hennen" kommt er wieder zurück, wenn die edelmetalle nachhaltig nach oben laufen. charttechnisch sollte bald eine entscheidung anstehen.

[url=http://peketec.de/trading/viewtopic.php?p=1281113#1281113 schrieb:dukezero schrieb am 31.07.2012, 14:34 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1281112#1281112 schrieb:spiderwilli schrieb am 31.07.2012, 14:31 Uhr[/url]"]gold und silber sehr stabil in den letzten tagen. praktische keine rücksetzer mehr,

bleibt spannend.

Bringt nur die fetten Hennen nicht nach vorne, das irritiert dann schon.

Positiv allerdings,- auf gute News wird wieder alles reingerammelt!

GOLD ziert sich noch den Widerstand bei 1627-1630 US $ zu überwinden....nun mehrfach abgeprallt aber bisher ohne nennenswerte Rücksetzer!

MIt etwas Glück wird die Zone weiter geschwächt und der Durchbruch gelingt in Kürze. Liefert die Woche weder die EZB noch die FED wirds wieder turbulent....

MIt etwas Glück wird die Zone weiter geschwächt und der Durchbruch gelingt in Kürze. Liefert die Woche weder die EZB noch die FED wirds wieder turbulent....

[url=http://peketec.de/trading/viewtopic.php?p=1279246#1279246 schrieb:Ollinho schrieb am 26.07.2012, 13:28 Uhr[/url]"]Wichtig wäre imho die 1627-1630....wenn wir die Marke nachhaltig nehmen....

[url=http://peketec.de/trading/viewtopic.php?p=1279220#1279220 schrieb:Cadrach schrieb am 26.07.2012, 13:06 Uhr[/url]"]Los jetzt über 1620

[url=http://peketec.de/trading/viewtopic.php?p=1279213#1279213 schrieb:spiderwilli schrieb am 26.07.2012, 13:03 Uhr[/url]"]gold und silber weiter hoch

» zur Grafik

» zur Grafik

Recent Trades - All 0 today[url=http://peketec.de/trading/viewtopic.php?p=1281177#1281177 schrieb:Rookie schrieb am 31.07.2012, 15:39 Uhr[/url]"]Netter Trade bei RIV, die letzten Tage Insider buys, kommt vielleicht bald etwas?

Time ET Ex Price Change Volume Buyer Seller Markers

09:30:56 V 0.20 150 24 Clarus 24 Clarus EX

09:30:56 V 0.20 857,000 24 Clarus 24 Clarus XKL

was für ein beschiss gegen über den kleinaktionären

da könnt ich

erst war 2,20cad geplant und jetzt.....

Prophecy Platinum to Close $7.25 Million Placement July 31

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 31, 2012) - Prophecy Platinum Corp. ("Prophecy" or the "Company") (TSX VENTURE:NKL)(OTCQX:PNIKF)(FRANKFURT:P94P) reports pursuant to press releases dated June 21 and June 25, 2012, the Company has amended and scheduled today to close non-brokered private placement of units (each a "Unit") and flow through shares (each a "FT Share") totaling $7.25 million.

5,067,208 Units will be sold at a price of $1.20 per Unit to generate gross proceeds of approximately $6,080,650. Each Unit comprises of one common share and a half (1/2) share purchase warrant valid for 2 years. One whole warrant will entitle the holder thereof to acquire one additional common share at a price of $1.50 per share in the first year and $2.00 per share in the second year. The warrants are subject to 30 day accelerated conversion if the closing price of the Company's shares on the TSX Venture Exchange is $2.80 or above for a period of 10 consecutive days.

807,655 FT Shares will be sold at a price of $1.45 per FT Share to generate gross proceeds of approximately $1,171,100.

Finder's fees may be payable in connection with the financing in accordance with the policies of the TSX Venture Exchange. The placement is subject to the receipt of TSX Venture Exchange approval and any regulatory approvals.

Proceeds of the placement will be applied to the Company's flagship PGM-Ni-Cu Wellgreen project in the Yukon and its other properties, in addition to general working capital.

About Prophecy Platinum

Prophecy Platinum Corp. is a Canadian based Nickel PGM exploration company with projects in Canada, Argentina and Uruguay. Defining and driving the company is its flagship Wellgreen PGM nickel copper property in Canada's Yukon Territory. Prophecy's further holdings include the fully permitted Shakespeare project in Ontario, the Lynn Lake nickel copper project in Manitoba, the Las Aguilas Nickel PGM deposit in Argentina, as well as five prospective claims in Uruguay. Further information can be found at www.prophecyplat.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Prophecy Platinum Corp.

John Lee, Chairman

This news release does not constitute an offer to sell or a solicitation to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended ("the U.S. Securities Act") or any state securities law and may not be offered or sold in the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

"Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release."

da könnt ich

erst war 2,20cad geplant und jetzt.....

Prophecy Platinum to Close $7.25 Million Placement July 31

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 31, 2012) - Prophecy Platinum Corp. ("Prophecy" or the "Company") (TSX VENTURE:NKL)(OTCQX:PNIKF)(FRANKFURT:P94P) reports pursuant to press releases dated June 21 and June 25, 2012, the Company has amended and scheduled today to close non-brokered private placement of units (each a "Unit") and flow through shares (each a "FT Share") totaling $7.25 million.

5,067,208 Units will be sold at a price of $1.20 per Unit to generate gross proceeds of approximately $6,080,650. Each Unit comprises of one common share and a half (1/2) share purchase warrant valid for 2 years. One whole warrant will entitle the holder thereof to acquire one additional common share at a price of $1.50 per share in the first year and $2.00 per share in the second year. The warrants are subject to 30 day accelerated conversion if the closing price of the Company's shares on the TSX Venture Exchange is $2.80 or above for a period of 10 consecutive days.

807,655 FT Shares will be sold at a price of $1.45 per FT Share to generate gross proceeds of approximately $1,171,100.

Finder's fees may be payable in connection with the financing in accordance with the policies of the TSX Venture Exchange. The placement is subject to the receipt of TSX Venture Exchange approval and any regulatory approvals.

Proceeds of the placement will be applied to the Company's flagship PGM-Ni-Cu Wellgreen project in the Yukon and its other properties, in addition to general working capital.

About Prophecy Platinum

Prophecy Platinum Corp. is a Canadian based Nickel PGM exploration company with projects in Canada, Argentina and Uruguay. Defining and driving the company is its flagship Wellgreen PGM nickel copper property in Canada's Yukon Territory. Prophecy's further holdings include the fully permitted Shakespeare project in Ontario, the Lynn Lake nickel copper project in Manitoba, the Las Aguilas Nickel PGM deposit in Argentina, as well as five prospective claims in Uruguay. Further information can be found at www.prophecyplat.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Prophecy Platinum Corp.

John Lee, Chairman

This news release does not constitute an offer to sell or a solicitation to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended ("the U.S. Securities Act") or any state securities law and may not be offered or sold in the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

"Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release."

[url=http://peketec.de/trading/viewtopic.php?p=1281271#1281271 schrieb:amun71 schrieb am 31.07.2012, 19:25 Uhr[/url]"]was für ein beschiss gegen über den kleinaktionären

da könnt ich

erst war 2,20cad geplant und jetzt.....

Prophecy Platinum to Close $7.25 Million Placement July 31

das ist doch die bude, die pollinger ständig promotet hat.

kann mich an diverse videokonfernzen mit dem CEO der firma erinnern.

[url=http://peketec.de/trading/viewtopic.php?p=1281273#1281273 schrieb:spiderwilli schrieb am 31.07.2012, 19:27 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1281271#1281271 schrieb:amun71 schrieb am 31.07.2012, 19:25 Uhr[/url]"]was für ein beschiss gegen über den kleinaktionären

da könnt ich

erst war 2,20cad geplant und jetzt.....

Prophecy Platinum to Close $7.25 Million Placement July 31

das ist doch die bude, die pollinger ständig promotet hat.

kann mich an diverse videokonfernzen mit dem CEO der firma erinnern.

ja, john lee....der gauner

bin bei dem pp gefasel bei 2cad rein....

fähiger mann siehe sp von pcy

hoffe ich sehe die 2 cad nochmal bevor die bude übernommen wird.

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.149

Trades:

4

[url=http://peketec.de/trading/viewtopic.php?p=1279523#1279523 schrieb:Kostolanys Erbe schrieb am 26.07.2012, 22:44 Uhr[/url]"]Santacruz Silver appoints Prefontaine as director

2012-07-26 09:10 ET - News Release

Mr. Arturo Prestamo reports

MARC PREFONTAINE JOINS SANTACRUZ BOARD OF DIRECTORS

At Santacruz Silver Mining Ltd.'s annual general meeting held July 24, 2012, Marc Prefontaine, MSc, PGeo, was elected to the company's board of directors, joining Arturo Prestamo Elizondo, Francisco Ramos, James Hutton and Craig Angus, who were all re-elected.

Mr. Prefontaine graduated with a BSc in geology from the University of Alberta and an MSc in mineral exploration from Queen's University. He is a professional geologist with over 25 years experience.

Most recently, Mr. Prefontaine served as president and chief executive officer of Grayd Resource Corp. During his eight years as chief executive officer of Grayd, Mr. Prefontaine assembled the land package in Mexico that ultimately became the La India project. He and his geological team made two gold discoveries. During his tenure, Grayd grew from a small exploration company with a market capitalization of $5-million to a successful development-stage company, culminating with its 2011 acquisition by Agnico Eagle Mines, for $275-million.

President Arturo Prestamo stated: "We are very pleased to welcome Mr. Prefontaine to the board and are confident his knowledge and experience in the Mexican mining industry will help us advance our projects going forward. Mr. Prefontaine will be a key contributor to the growth of Santacruz."

In connection with this appointment, the company has authorized the grant of 800,000 stock options to Mr. Prefontaine at a price of 90 cents per share. These options are exercisable for a five-year period.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aSCZ-1979722&symbol=SCZ®ion=C

[url=http://peketec.de/trading/viewtopic.php?p=1274417#1274417 schrieb:Kostolanys Erbe schrieb am 16.07.2012, 23:09 Uhr[/url]"]» zur Grafik

July 16, 2012

Santacruz Announces NI 43-101 Resource at San Felipe

Vancouver, B.C. -- Santacruz Silver Mining Ltd. ("Santacruz" or the "Company") (TSX.V:SCZ) is pleased to announce an update regarding its activities in Mexico at the San Felipe project, including an initial independent National Instrument 43-101 ("NI 43-101") Mineral Resource estimate. The Mineral Resource estimate was completed by Kelsey Zabrusky under the supervision of Zachery Black SME-RM and Donald E. Hulse PE and SME-RM, of Gustavson Associates, LLC, (Gustavson) both of whom are independent "qualified persons" under NI 43-101.

Highlights are as follows:

•Measured and Indicated Resources of 39mm oz AgEq; Inferred Resources of 11mm oz AgEq

•Resources are defined on only 3 of 8 known veins (La Ventana, San Felipe and Las Lamas)

•These three primary veins remain open along strike in at least one direction and to depth.

•Excellent potential to expand resources at Las Lamas, Cornucopia, Artemisa, Santa Rosa and Transversales veins.

* Please see resource categories and further details below.

San Felipe is a late stage exploration project, located in the State of Sonora, approximately 130 kilometers north-west of Hermosillo City, the state capital of Sonora. Previously, Minera Hochschild Mexico SA de CV ("MHM") explored and developed the property from 2001 to 2008, with more than 18,500 meters of diamond drilling and significant development work completed on the project at the La Ventana, San Felipe and Las Lamas veins.

During 2011 Santacruz began conducting an exploration program in the area to confirm and support MHM's previously discovered resources at the La Ventana, San Felipe and Las Lamas veins. Additional resources have been delineated in the Las Lamas, Cornucopia, Artemisa, Santa Rosa and Transversales veins. In addition, to the south-west of the project is a target named Los Locos, which has exploration upside. This has led to new exploration potential on the project.

Gustavson estimates that the San Felipe project contains a Mineral Resource of 3 million metric tons of measured and 900 thousand metric tons of indicated mineralization, containing 31 million and 8 million troy ounces of silver equivalent, respectively, above a cutoff grade of 75g AgEq/t. The report estimates that there is an additional 1.5 million metric tons of inferred mineral resource above the 75 g AgEq/t cutoff containing 11 million troy ounces of silver equivalent. The sulfide mineral contains primarily silver, lead and zinc with associated copper (resource tables are attached). These Mineral Resources are only from the La Ventana, San Felipe and Las Lamas veins.

Gustavson made a site visit on December 8, 2011. While on site, Mr. Hulse verified drill collar locations, inspected underground workings, took structural measurements of altered and mineralized outcrops, examined core, correlated laboratory assay sheets and Santacruz digital database entries with altered and mineralized sections of core, discussed Santacruz's quality assurance, quality control (QA/QC) procedures, and reviewed hard copy project documents. Mr. Hulse concludes that the data quality is adequate and appropriate to develop a Mineral Resource estimate.

The San Felipe project has all necessary permits and agreements for this stage of the project. The community has been historically involved in mining and supports the project, and the state of Sonora has been pro-mining in the past. Gustavson is of the opinion that the legal and political risks of this project are small and comparable with other successful projects in the area.

President, Arturo Préstamo states "This initial NI4 3-101 Mineral Resource estimate on San Felipe has exceeded management's expectations and establishes this project as a significant and major asset of the Company." The following Mineral Resource Tables outline the current NI 43-101 compliant resource estimate as of May 15, 2012. Additional exploration work is planned on the Las Lamas, Cornucopia, Artemisa, Transversales and Santa Rosa veins, and assessment of the additional potential is currently being studied at these five areas.

The following summary tables will be presented in a NI 43-101 Technical Report on Resources. Shareholders and interested parties are encouraged to read this report which will be available on SEDAR (www.sedar.com) and on the Company's website at www.santacruzsilver.com within the next 45 days.

......

Arturo Prestamo, President & CEO of Santacruz stated; "I am very pleased with the results of this initial NI 43-101 Mineral Resource estimate on the San Felipe mine project. While it has exceeded our initial expectations, it also provides us with more confidence that further exploration on the other targets will allow us to significantly expand this resource. We are now positioning San Felipe to be the second producing asset in our portfolio after our Rosario project, which we are targeting to have in commercial production by mid 2013." Mr. Prestamo added, "The Company intends to build upon the previous work done by MHM to advance the project into a significant producing asset."

About Santacruz Silver Mining Ltd. and San Felipe

Santacruz Silver is focused on three silver deposits in Mexico with a corporate objective to reach production by first quarter 2013. The Company aims to become a mid-tier silver producer in Mexico.

Under the terms of an agreement dated August 3, 2011, as amended, between MHM and a subsidiary of the Company, the Company was granted the right to explore the San Felipe project and an option, exercisable until April 1, 2013, to acquire the project, as described in the Company's Filing Statement filed under the Company's profile at www.SEDAR.com.

'signed'

Arturo Prestamo Elizondo,

President, Chief Executive Officer and Director

http://www.santacruzsilver.com/s/news_releases.asp?ReportID=537075

[url=http://peketec.de/trading/viewtopic.php?p=1270721#1270721 schrieb:CCG-Redaktion schrieb am 07.07.2012, 17:24 Uhr[/url]"]Haben 20 Mio.Cash eingesammelt um die Projekte voranzubringen!

http://www.santacruzsilver.com/s/home.asp

http://www.santacruzsilver.com/i/pdf/ppt/corp_presentation.pdf

Erstmal nur Watchlist SCZ:

We are a Canadian Mining Company with a primary focus on silver deposits. SCZ has entered into option agreements to acquire a 100% interest in the Rosario, Gavilanes and San Felipe projects, all located in the historical mining districts of Charcas, San Luis Potosí, San Dimas Durango, and San Felipe, Sonora, Mexico respectively. All properties are considered to be an advanced stage and based on preliminary findings by the Company, offer excellent potential opportunities for mine operations.

http://www.santacruzsilver.com/s/projects.asp

» zur Grafik

» zur Grafik

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.149

Trades:

4

Rare Earths and Graphite—The Critical Factors for Success: Gareth Hatch

TICKERS: ALK, ARU, AVL; AVARF, FDR, FMS, FRO, GWG; GWMGF, GGG, HAS, LYC, MAT; MRHEF, MCP, NGC; NGPHF, QRM, RES; REE, TSM; TAS; TASXF; T61, UCU; UURAF

Source: JT Long of The Critical Metals Report (7/31/12)

http://www.theaureport.com/pub/na/14008

TICKERS: ALK, ARU, AVL; AVARF, FDR, FMS, FRO, GWG; GWMGF, GGG, HAS, LYC, MAT; MRHEF, MCP, NGC; NGPHF, QRM, RES; REE, TSM; TAS; TASXF; T61, UCU; UURAF

Source: JT Long of The Critical Metals Report (7/31/12)

http://www.theaureport.com/pub/na/14008

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.149

Trades:

4

July 31, 2012 16:00 ET

Rye Patch Gold Announces Non-Brokered Private Placement

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 31, 2012) -

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Rye Patch Gold Corp. (TSX VENTURE:RPM)(OTCQX:RPMGF)(FRANKFURT:5TN) ("Rye Patch" or the "Company") announces a non-brokered private placement of up to 7,272,727 units ("Units") at a price of $0.55 per Unit for gross proceeds of up to $4,000,000 (the "Private Placement"). Each Unit will consist of one common share of the Company and one-half of one common share purchase warrant (each whole common share purchase warrant, a "Warrant"). Each Warrant will entitle the holder thereof to purchase one common share of the Company at an exercise price of $0.75 for a period of 24 months from the closing date.

Subject to the approval of the TSX Venture Exchange (the "Exchange") and applicable laws, the Company may pay a finder's fee in cash equal to up to 7% of the gross proceeds of the Private Placement.

The net proceeds from the Private Placement will be used to explore and develop the projects of Rye Patch Gold US Inc., the Company's wholly-owned subsidiary, as well as for the Company's general working capital.

The Private Placement is subject to Exchange approval.

The securities of the Company and the securities to be issued by the Company pursuant to the Private Placement have not and will not be registered under the United States Securities Act of 1933, as amended (the "1933 Act"), or the securities laws of any state of the United States, and may not be offered or sold in the United States absent registration or an applicable exemption therefrom under the 1933 Act and the securities laws of all applicable states.

The Company is a Tier 1, Nevada-focused and discovery-driven company seeking to build a sizeable inventory of gold and silver resource assets in the mining friendly state of Nevada, USA. The Company's seasoned management team is engaged in the acquisition, exploration, and development of quality resource-based gold and silver projects. Rye Patch Gold US Inc. is developing gold and silver resources along the emerging Oreana trend, located in west-central Nevada, and is exploring 66 square kilometres along the Cortez trend near Barrick's two new gold discoveries. The Company has established gold and silver resource milestones and time frames in order to build a premier resource development company. For more information about the Company, please visit our website at www.ryepatchgold.com.

On behalf of the Board of Directors

William C. (Bill) Howald, CEO & President

http://www.marketwire.com/press-release/rye-patch-gold-announces-non-brokered-private-placement-tsx-venture-rpm-1685806.htm

Rye Patch Gold Announces Non-Brokered Private Placement

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 31, 2012) -

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Rye Patch Gold Corp. (TSX VENTURE:RPM)(OTCQX:RPMGF)(FRANKFURT:5TN) ("Rye Patch" or the "Company") announces a non-brokered private placement of up to 7,272,727 units ("Units") at a price of $0.55 per Unit for gross proceeds of up to $4,000,000 (the "Private Placement"). Each Unit will consist of one common share of the Company and one-half of one common share purchase warrant (each whole common share purchase warrant, a "Warrant"). Each Warrant will entitle the holder thereof to purchase one common share of the Company at an exercise price of $0.75 for a period of 24 months from the closing date.

Subject to the approval of the TSX Venture Exchange (the "Exchange") and applicable laws, the Company may pay a finder's fee in cash equal to up to 7% of the gross proceeds of the Private Placement.

The net proceeds from the Private Placement will be used to explore and develop the projects of Rye Patch Gold US Inc., the Company's wholly-owned subsidiary, as well as for the Company's general working capital.

The Private Placement is subject to Exchange approval.

The securities of the Company and the securities to be issued by the Company pursuant to the Private Placement have not and will not be registered under the United States Securities Act of 1933, as amended (the "1933 Act"), or the securities laws of any state of the United States, and may not be offered or sold in the United States absent registration or an applicable exemption therefrom under the 1933 Act and the securities laws of all applicable states.

The Company is a Tier 1, Nevada-focused and discovery-driven company seeking to build a sizeable inventory of gold and silver resource assets in the mining friendly state of Nevada, USA. The Company's seasoned management team is engaged in the acquisition, exploration, and development of quality resource-based gold and silver projects. Rye Patch Gold US Inc. is developing gold and silver resources along the emerging Oreana trend, located in west-central Nevada, and is exploring 66 square kilometres along the Cortez trend near Barrick's two new gold discoveries. The Company has established gold and silver resource milestones and time frames in order to build a premier resource development company. For more information about the Company, please visit our website at www.ryepatchgold.com.

On behalf of the Board of Directors

William C. (Bill) Howald, CEO & President

http://www.marketwire.com/press-release/rye-patch-gold-announces-non-brokered-private-placement-tsx-venture-rpm-1685806.htm

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.149

Trades:

4

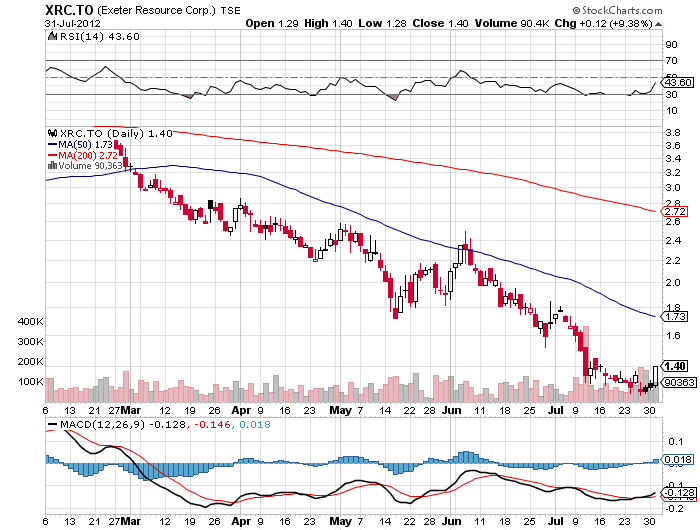

[url=http://peketec.de/trading/viewtopic.php?p=1280366#1280366 schrieb:Kostolanys Erbe schrieb am 29.07.2012, 17:53 Uhr[/url]"]Bei XRC habe ich das Gefühl, das auf diesem Preisniveau => 1,25 CAN$ jemand erst bereit ist, die shares von einem aufzunehmen (bzw. Aktiendeal / Tausch)

Gerade gesehen....

http://www.stockhouse.com/Community-News/2012/July/27/Junior-gold-valuations-average-$38-per-ounce--Stoc

I. Gold valuation update for July – Avg $38/oz ($34 June and $47 Dec/11)

Even as gold (again) broke through $1600 this week, we have seen only marginal improvement in depressed junior gold valuations. This is a direct result of broad-based risk aversion that we have seen since March 2011, in smaller, high-risk equities.

There is another problem affecting these projects, and it goes beyond the frustration of trying to finance in this economy - many of the major gold producers are running into significant operating and capital cost problems.

Just this week gold mining giant Barrick (TSX: T.ABX, Stock Forum) released financials and it is clear they bit off more than they could chew in South America. Its Pascua-Lama project in the Andes Mountains is expected to cost $8 billion (50% more than budgeted). This is not only a massive cost over-run, but in Argentina and Chile where political and country risk are very high.

Barrick stated that they are shifting their strategy away from a focus on growing gold production to improving the rate of return for shareholders. This will help the gold price as it improves the supply/demand fundamentals, but it highlights the problems faced on “many” gold exploration projects – for majors and juniors alike.

Typically the juniors could also depend upon the blue sky potential of a merger or takeover by a major. Right now those are few and far between. Because of this, the blue sky premiums that many of these companies would command in the past, are just not there.

Certain projects will command a higher valuation if the economics are strong - higher grade, shallow, and have low (realistic) capital costs. Without this companies are really struggling with their valuations. Some mining promoters are also able to create a story that attracts momentum traders, but that is typically short lived.

Right now capital and operating costs are the Red Flags of the industry. If there is a hint that they will be high, then institutional money is reluctant to invest, and big banks even more so.

You can clearly see this in the tables below with companies like Exeter (TSX: T.XRC, Stock Forum). Not only do they have over $60 million in the bank but a massive base and precious metals project in South America. In the valuation I give them NO credit for the other metals and yet the gold portion carries a valuation of only $2 per gold ounce!

It is very unfortunate to see this but investors feel the deposit will never be developed and must assume no one will ever have an interest in buying or merging with them. This may not be a realistic assumption, but until the market pays attention, it is deemed worthless. A terrible situation if you are XRC shareholders or management.

The tables contain many very attractive investment opportunities if you have the patience. One in particular that stands out is Victoria Gold (TSX: V.VIT, Stock Forum; 28 cents) but there are many if you do your research and focus on balance sheets, grades and depth.

Standardized monthly notes for our gold tables

We have sorted the same table four ways so you can determine which format is the most useful.

Note: Due to limited space for website presentation, we are not able to display various additional notes for many of the companies. This may include additional copper or silver resources that were not taken into consideration for the valuation. Only resources that were specifically reported in a 43-101 report were included. Many of these companies own various other projects or assets that may add additional value. Almost all companies host a Powerpoint presentation on their website and this is a valuable tool for doing further due diligence.

(Please click on the individual table to see bigger size)

Comparative Chart of Junior Gold Companies - Sorted by EV / Risked Reserves - July 27, 2012

......

[url=http://peketec.de/trading/viewtopic.php?p=1280206#1280206 schrieb:Moritz schrieb am 27.07.2012, 19:51 Uhr[/url]"]XRC :

Recent Trades - Last 10 of 278

Time ET Ex Price Change Volume Buyer Seller Markers

13:32:22 T 1.26 100 39 Merrill Lynch 1 Anonymous K

13:32:22 T 1.26 100 39 Merrill Lynch 1 Anonymous K

13:32:22 T 1.26 100 39 Merrill Lynch 1 Anonymous K

13:32:22 T 1.26 100 39 Merrill Lynch 1 Anonymous K

13:32:22 T 1.26 100 39 Merrill Lynch 1 Anonymous K

13:32:17 T 1.26 100 39 Merrill Lynch 1 Anonymous K

13:32:17 T 1.26 100 39 Merrill Lynch 1 Anonymous K

13:32:17 T 1.26 100 39 Merrill Lynch 1 Anonymous K

13:32:16 T 1.26 100 39 Merrill Lynch 1 Anonymous K

13:32:08 T 1.26 200 39 Merrill Lynch 80 National Bank K

[url=http://peketec.de/trading/viewtopic.php?p=1279487#1279487 schrieb:Kostolanys Erbe schrieb am 26.07.2012, 19:00 Uhr[/url]"]Heute MGP & XRC gesammelt...

Antizyklisch kaufen....Stimmung ist schon sehr mies im Juniorsektor.

In der Vergangenheit eigentlich immer ein guter Kontraindikator....

https://produkte.erstegroup.com/CorporateClients/de/ResearchCenter/Overview/Research_Detail/index.phtml?ID_ENTRY=15352

» zur Grafik

» zur Grafik

Ölpreise geben am Mittwoch nach: Brent-Öl kostet am Morgen $104,52 (-$0,40), WTI-Öl $87,89 (-$0,17) +++ Hoffnungen auf ein entschiedenes Handeln der Notenbanken gesunken.

Morgäähn

1 Unze Gold in US-$ .............1 Unze Gold in Euro

1 Unze Silber in US-$ .............1 Unze Silber in Euro

1 Unze Gold in US-$ .............1 Unze Gold in Euro

1 Unze Silber in US-$ .............1 Unze Silber in Euro

New York (BoerseGo.de) – Die südamerikanischen Bauern könnten vor dem Hintergrund der Dürre in den USA und des dadurch verringerten Angebots mehr Mais als je zuvor anbauen. Einem Bericht von Bloomberg zufolge könnten die argentinischen Bauern in der Saison 2012/13 bis zu 31 Millionen Tonnen Mais einfahren. Brasilien könnte laut dem Forschungsinstitut Agroconsult in der Saison 2012/13 die bisher größte Sojabohnenernte erzielen und so die USA als den weltweit größten Produzenten übertreffen.

"Wir sind in einer großartigen Lage. Wir haben sehr gute Ertragschancen und es gibt eine hohe Wahrscheinlichkeit, dass die Preise sehr hoch bleiben werden. Der Anbau in den USA ist durch die Trockenheit deutlich in Mitleidenschaft gezogen worden“, sagte Martin Otero Hillock von Capital Management, die Farmen in Argentinien und Uruguay besitzen.

Mais stieg gestern auf einen Rekordwert von 8,205 US-Dollar pro Bushel. Die Sojabohnen hatten am 23. Juli bereits ein neues Allzeithoch erreicht. Die US-Maispflanzen und die US-Sojabohnen sind derzeit in dem schlechtesten Zustand seit dem Jahr 1988, was die Preise in die Höhe getrieben hat.

"Wir sind in einer großartigen Lage. Wir haben sehr gute Ertragschancen und es gibt eine hohe Wahrscheinlichkeit, dass die Preise sehr hoch bleiben werden. Der Anbau in den USA ist durch die Trockenheit deutlich in Mitleidenschaft gezogen worden“, sagte Martin Otero Hillock von Capital Management, die Farmen in Argentinien und Uruguay besitzen.

Mais stieg gestern auf einen Rekordwert von 8,205 US-Dollar pro Bushel. Die Sojabohnen hatten am 23. Juli bereits ein neues Allzeithoch erreicht. Die US-Maispflanzen und die US-Sojabohnen sind derzeit in dem schlechtesten Zustand seit dem Jahr 1988, was die Preise in die Höhe getrieben hat.

Kaffee-Preis verharrt (noch) im Abwärtsmodus

von Bernd Raschkowski

Sehr geehrte Leserinnen und Leser,

bei den Agrar-Rohstoffen sind aktuell starke Bewegungen zu verzeichnen. Die Notierungen von Mais, Soja und Weizen sprangen aufgrund der Dürreperiode in einigen Teilen der Erde zuletzt deutlich nach oben. Andere Agrar-Rohstoffe verbuchen dagegen eher fallende Kurse. Zum Beispiel Kaffee: Der Preis für die bitteren Bohnen ist zwischenzeitlich zwar etwas geklettert, befindet sich mittelfristig aber weiterhin im Abwärtstrend.

Südamerika dominiert den Kaffee-Markt

Wichtigste Region für den Kaffee-Anbau ist Südamerika. Die weit verbreitete Kaffee-Sorte Arabica wird fast ausschließlich auf dem amerikanischen Kontinent angebaut. Mit einem Weltmarktanteil von über 25 Prozent ist vor allem das Land Brasilien für den Kaffeemarkt entscheidend. Aber auch in Ländern wie Costa Rica, Guatemala oder Mexiko hat die Kaffee-Produktion eine große Bedeutung eingenommen.

Extreme Regenfälle in Brasilien

Zuletzt bereiteten heftige Regenfälle in Brasilien den Landwirten ordentliche Probleme. Nach Angaben einer Nachrichtenagentur lag die dortige Niederschlagsmenge zeitweise rund 400 Prozent über dem langjährigen Durchschnitt. Die hohe Feuchtigkeit führt höchstwahrscheinlich zu Qualitätseinbußen und teilweise auch zu Ernteausfällen. Aufgrund der befürchteten Angebotsverknappung kletterte der Preis für Kaffee Anfang Juli deutlich aufwärts.

Dieser Preisanstieg ist auch im mittelfristigen Chartbild deutlich zu erkennen. In der folgenden Abbildung ist die Notierung von Kaffee seit Oktober 2011 zu sehen (in US-Cents je Pfund).

Mittelfristiger Abwärtstrend weiterhin intakt

Vom Jahrestief bei rund 150 US-Cents kletterte der Rohstoff aufgrund der Wetterkapriolen in Südamerika bis auf knapp 190 US-Cents pro Pfund. Der Anstieg endete im Bereich des technischen Widerstands aus dem Frühjahr. Auch wenn die kräftigen Regenfälle in Brasilien zu einem kurzzeitigen Preisanstieg geführt haben, macht das Chartbild jedoch eines klar: Der Kaffeepreis verharrt trotz des jüngsten Anstiegs insgesamt gesehen weiterhin im Abwärtstrend (rote Linie der obigen Abbildung).

Bereits seit 2011 befindet sich der Preis für Kaffee im Abwärtssog. Während Kaffee im Jahr 2010 noch stark steigende Preise verzeichnete, drehte sich im Jahr 2011 das Blatt. Ausgehend vom Hoch im Mai 2011 bei rund 300 US-Cents verlor der Agrar-Rohstoff bis zum Juni-Tief rund die Hälfte des Wertes. Solche Schwankungen innerhalb von ca. 14 Monaten sind sicher nichts für schwache Nerven.

Starke Unterstützung sorgt für Stabilität

Die zukünftige Entwicklung bei Kaffee ist nicht ganz leicht abzuschätzen. Auf der einen Seite ist der Abwärtstrend weiterhin intakt - aufgrund dessen sind fallende Notierungen wahrscheinlich. Auf der anderen Seite besteht bei 150 US-Cents eine mächtige Unterstützungszone aus vergangenen Jahren. Diese Chartlinie verleiht dem Kaffee-Preis Stabilität und Auftrieb.

Fazit: Für die nächsten Wochen und Monate dürften diese beiden Gegebenheiten die Kursentwicklung bestimmen. Aus charttechnischer Sicht sollte der Kaffee-Preis zunächst zwischen der Abwärtslinie (aktuell bei rund 185 US-Cents) sowie der Unterstützungslinie bei 150 US-Cents umherpendeln. Erst ein Rutsch unter die Marke von 150 US-Cents würde einen neuen Kursverfall andeuten. Dies halte ich allerdings für unwahrscheinlich. Meiner Meinung nach dürfte Kaffee aufgrund des niedrigen Preisniveaus sowie der weltweit tendenziell anziehenden Nachfrage zumindest langfristig gesehen wieder steigende Notierungen verbuchen.

Freundliche Grüße aus Köln

Ihr

Bernd Raschkowski

von Bernd Raschkowski

Sehr geehrte Leserinnen und Leser,

bei den Agrar-Rohstoffen sind aktuell starke Bewegungen zu verzeichnen. Die Notierungen von Mais, Soja und Weizen sprangen aufgrund der Dürreperiode in einigen Teilen der Erde zuletzt deutlich nach oben. Andere Agrar-Rohstoffe verbuchen dagegen eher fallende Kurse. Zum Beispiel Kaffee: Der Preis für die bitteren Bohnen ist zwischenzeitlich zwar etwas geklettert, befindet sich mittelfristig aber weiterhin im Abwärtstrend.

Südamerika dominiert den Kaffee-Markt

Wichtigste Region für den Kaffee-Anbau ist Südamerika. Die weit verbreitete Kaffee-Sorte Arabica wird fast ausschließlich auf dem amerikanischen Kontinent angebaut. Mit einem Weltmarktanteil von über 25 Prozent ist vor allem das Land Brasilien für den Kaffeemarkt entscheidend. Aber auch in Ländern wie Costa Rica, Guatemala oder Mexiko hat die Kaffee-Produktion eine große Bedeutung eingenommen.

Extreme Regenfälle in Brasilien

Zuletzt bereiteten heftige Regenfälle in Brasilien den Landwirten ordentliche Probleme. Nach Angaben einer Nachrichtenagentur lag die dortige Niederschlagsmenge zeitweise rund 400 Prozent über dem langjährigen Durchschnitt. Die hohe Feuchtigkeit führt höchstwahrscheinlich zu Qualitätseinbußen und teilweise auch zu Ernteausfällen. Aufgrund der befürchteten Angebotsverknappung kletterte der Preis für Kaffee Anfang Juli deutlich aufwärts.

Dieser Preisanstieg ist auch im mittelfristigen Chartbild deutlich zu erkennen. In der folgenden Abbildung ist die Notierung von Kaffee seit Oktober 2011 zu sehen (in US-Cents je Pfund).

Mittelfristiger Abwärtstrend weiterhin intakt

Vom Jahrestief bei rund 150 US-Cents kletterte der Rohstoff aufgrund der Wetterkapriolen in Südamerika bis auf knapp 190 US-Cents pro Pfund. Der Anstieg endete im Bereich des technischen Widerstands aus dem Frühjahr. Auch wenn die kräftigen Regenfälle in Brasilien zu einem kurzzeitigen Preisanstieg geführt haben, macht das Chartbild jedoch eines klar: Der Kaffeepreis verharrt trotz des jüngsten Anstiegs insgesamt gesehen weiterhin im Abwärtstrend (rote Linie der obigen Abbildung).

Bereits seit 2011 befindet sich der Preis für Kaffee im Abwärtssog. Während Kaffee im Jahr 2010 noch stark steigende Preise verzeichnete, drehte sich im Jahr 2011 das Blatt. Ausgehend vom Hoch im Mai 2011 bei rund 300 US-Cents verlor der Agrar-Rohstoff bis zum Juni-Tief rund die Hälfte des Wertes. Solche Schwankungen innerhalb von ca. 14 Monaten sind sicher nichts für schwache Nerven.

Starke Unterstützung sorgt für Stabilität

Die zukünftige Entwicklung bei Kaffee ist nicht ganz leicht abzuschätzen. Auf der einen Seite ist der Abwärtstrend weiterhin intakt - aufgrund dessen sind fallende Notierungen wahrscheinlich. Auf der anderen Seite besteht bei 150 US-Cents eine mächtige Unterstützungszone aus vergangenen Jahren. Diese Chartlinie verleiht dem Kaffee-Preis Stabilität und Auftrieb.

Fazit: Für die nächsten Wochen und Monate dürften diese beiden Gegebenheiten die Kursentwicklung bestimmen. Aus charttechnischer Sicht sollte der Kaffee-Preis zunächst zwischen der Abwärtslinie (aktuell bei rund 185 US-Cents) sowie der Unterstützungslinie bei 150 US-Cents umherpendeln. Erst ein Rutsch unter die Marke von 150 US-Cents würde einen neuen Kursverfall andeuten. Dies halte ich allerdings für unwahrscheinlich. Meiner Meinung nach dürfte Kaffee aufgrund des niedrigen Preisniveaus sowie der weltweit tendenziell anziehenden Nachfrage zumindest langfristig gesehen wieder steigende Notierungen verbuchen.

Freundliche Grüße aus Köln

Ihr

Bernd Raschkowski

Mal ne Frage: Wo ist denn da Paraguay ?

[url=http://peketec.de/trading/viewtopic.php?p=1281513#1281513 schrieb:turboduck schrieb am 01.08.2012, 11:35 Uhr[/url]"]PDQ Präsentation AUG 2012:

http://www.petrodorado.com/corporate/Petrodorado_Aug12.pdf

Verkauft:

Petrodorado sells Peru blocks for $15.2-million (U.S.)

2012-07-12 09:19 ET - News Release

This item is part of Stockwatch's value added news feed and is only available to Stockwatch subscribers.

Here is a sample of this item:

Mr. Krishna Vathyam reports

PETRODORADO DIVESTS PERU BLOCK 135 AND 138, ANNOUNCES SPUD DATE ON TALORA BLOCK, ADOPTS SHAREHOLDER RIGHTS PLAN AND RE-PRICES STOCK OPTIONS

Petrodorado Energy Ltd. has sold its interests in Peru blocks 135 and 138, provided a start date for the Dorados-1X exploration well in the Talora block, adopted a shareholder rights plan, and repriced its outstanding stock options.

Peru 135 and 138

The company has reached an agreement with the operator of these blocks to divest its 45-per-cent beneficial interest for a sum of $15.2-million (U.S.). This transaction is effective immediately.

Petrodorado sells Peru blocks for $15.2-million (U.S.)

2012-07-12 09:19 ET - News Release

This item is part of Stockwatch's value added news feed and is only available to Stockwatch subscribers.

Here is a sample of this item:

Mr. Krishna Vathyam reports

PETRODORADO DIVESTS PERU BLOCK 135 AND 138, ANNOUNCES SPUD DATE ON TALORA BLOCK, ADOPTS SHAREHOLDER RIGHTS PLAN AND RE-PRICES STOCK OPTIONS

Petrodorado Energy Ltd. has sold its interests in Peru blocks 135 and 138, provided a start date for the Dorados-1X exploration well in the Talora block, adopted a shareholder rights plan, and repriced its outstanding stock options.

Peru 135 and 138

The company has reached an agreement with the operator of these blocks to divest its 45-per-cent beneficial interest for a sum of $15.2-million (U.S.). This transaction is effective immediately.

[url=http://peketec.de/trading/viewtopic.php?p=1281556#1281556 schrieb:Cadrach schrieb am 01.08.2012, 12:15 Uhr[/url]"]Mal ne Frage: Wo ist denn da Paraguay ?

[url=http://peketec.de/trading/viewtopic.php?p=1281513#1281513 schrieb:turboduck schrieb am 01.08.2012, 11:35 Uhr[/url]"]PDQ Präsentation AUG 2012:

http://www.petrodorado.com/corporate/Petrodorado_Aug12.pdf

US

14:15 ADP-Arbeitsmarktbericht Juli

Beschäftigung privater Sektor

PROGNOSE: +108.000 Stellen

zuvor: +176.000 Stellen

16:00 ISM-Index verarbeitendes Gewerbe Juli

PROGNOSE: 50,4 Punkte

zuvor: 49,7 Punkte

16:00 US/Bauausgaben Juni

PROGNOSE: +0,4% gg Vm

zuvor: +0,9% gg Vm

20:15 US/Offenmarktausschuss der Notenbank (FOMC),

Ergebnis der Sitzung

Fed-Funds-Zielsatz

PROGNOSE: 0,00% bis 0,25%

zuvor: 0,00% bis 0,25%

14:15 ADP-Arbeitsmarktbericht Juli

Beschäftigung privater Sektor

PROGNOSE: +108.000 Stellen

zuvor: +176.000 Stellen

16:00 ISM-Index verarbeitendes Gewerbe Juli

PROGNOSE: 50,4 Punkte

zuvor: 49,7 Punkte

16:00 US/Bauausgaben Juni

PROGNOSE: +0,4% gg Vm

zuvor: +0,9% gg Vm

20:15 US/Offenmarktausschuss der Notenbank (FOMC),

Ergebnis der Sitzung

Fed-Funds-Zielsatz

PROGNOSE: 0,00% bis 0,25%

zuvor: 0,00% bis 0,25%