App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

March 14, 2013 08:00 ET

SilverCrest Announces 2012 Financial Results

Cash Flow from Operations of $40.1 million ($0.44 per share)

Net Earnings $30.5 million ($0.33 per share)

http://www.marketwire.com/press-rel...financial-results-tsx-venture-svl-1767930.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 14, 2013) - SilverCrest Mines Inc. (TSX VENTURE:SVL)(NYSE MKT:SVLC) (the "Company") is pleased to announce its audited consolidated financial results for the year and fourth quarter ended December 31, 2012 (all figures in U.S. dollars unless otherwise specified). The information in this news release should be read in conjunction with the Company's audited consolidated financial statements for the year ended December 31, 2012 and associated management discussion and analysis ("MD&A") which are available from the Company's website at www.silvercrestmines.com and under the Company's profile on SEDAR at www.sedar.com.

CSI ahoi!!

[url=http://peketec.de/trading/viewtopic.php?p=1361398#1361398 schrieb:greenhorn schrieb am 13.03.2013, 17:20 Uhr[/url]"]die 5 Cent komplett auf deine Kappe?!

[url=http://peketec.de/trading/viewtopic.php?p=1361397#1361397 schrieb:dukezero schrieb am 13.03.2013, 17:15 Uhr[/url]"]Was hab ich doch für eine Buying Power!

[url=http://peketec.de/trading/viewtopic.php?p=1361396#1361396 schrieb:dukezero schrieb am 13.03.2013, 17:02 Uhr[/url]"]Da bin ich mal dabei!

[url=http://peketec.de/trading/viewtopic.php?p=1361388#1361388 schrieb:greenhorn schrieb am 13.03.2013, 16:50 Uhr[/url]"]1. kleinere Posi zu 2,80 CAD wieder Long

[url=http://peketec.de/trading/viewtopic.php?p=1361376#1361376 schrieb:dukezero schrieb am 13.03.2013, 16:35 Uhr[/url]"]CSI macht sich für einen Trade wieder schick!

Eisenerz

: „Der Preis könnte auf 120 Dollar je Tonne fallen“

14.03.2013, 13:40 Uhr

Der Eisenerzpreis fällt seit Wochen. Insbesondere die schwache Nachfrage aus China belastet. Analysten sehen beim Preis noch ganz viel Luft nach unten. Dabei hatten die Stahlkocher auf eine Belebung gehofft.

http://www.handelsblatt.com/finanze...e-auf-120-dollar-je-tonne-fallen/7928638.html

: „Der Preis könnte auf 120 Dollar je Tonne fallen“

14.03.2013, 13:40 Uhr

Der Eisenerzpreis fällt seit Wochen. Insbesondere die schwache Nachfrage aus China belastet. Analysten sehen beim Preis noch ganz viel Luft nach unten. Dabei hatten die Stahlkocher auf eine Belebung gehofft.

http://www.handelsblatt.com/finanze...e-auf-120-dollar-je-tonne-fallen/7928638.html

[url=http://peketec.de/trading/viewtopic.php?p=1361745#1361745 schrieb:CCG-Redaktion schrieb am 14.03.2013, 12:19 Uhr[/url]"]» zur Grafik

March 14, 2013 09:29 ET

Zenyatta Ventures Commences Drill Program to Define NI 43-101 Resource at Albany Graphite Deposit

THUNDER BAY, ONTARIO--(Marketwire - March 14, 2013) - Zenyatta Ventures Ltd. ("Zenyatta" or "Company") (TSX VENTURE:ZEN) is pleased to announce that a drill program will commence immediately at its 100% owned Albany Graphite Deposit in northeastern Ontario.

Given the recent metallurgical success, the Company will now focus on defining the size and grade of this rare, 'vein-type' or hydrothermal-style graphite deposit. The goal of the current program will be to expand on a 2012 drilling campaign that intersected a large mineralized zone of graphitic breccia and veining which yielded up to 6.6% Carbon over 170.0 metres ('m') from widely spaced drill holes. This previous nine (9) hole drill program succeeded in establishing widespread graphite mineralization laterally for several hundred metres and to a vertical depth of 400m, where it remains open.

The current drilling will consist of a minimum of 10,000m and will further test the extent of the Geotech VTEM airborne conductor that measures 1400m east-west by 800m north-south. The program will require 40 holes and is expected to continue until August, after which a NI 43-101 resource estimate will be calculated. The Company anticipates a steady flow of information from drilling activities and continued metallurgical work from this fully funded $4 million exploration program for the balance of 2013.

Aubrey Eveleigh, President and CEO stated, "This larger drill campaign will further define the size and shape of the only known 'vein type' or hydrothermal graphite deposit under development in the world. Hydrothermal graphite deposits, like the Albany, are extremely rare and known to offer superior performance in many industrial applications due to its distinctive properties. We believe the Albany graphite deposit is emerging as a very important and unique graphite resource." Eveleigh also stated, "Zenyatta's exploration team headed by Peter Wood, VP Exploration will manage the program over the next 4-6 months. Mr. Wood will focus on defining a resource estimate at the Albany graphite deposit and prepare for a pre-feasibility study in the second half of the year."

Zenyatta initially established the quality of the Albany graphite and recently announced ultra-high purity results from SGS Canada Inc. of 99.96% carbon from a low-cost, conventional processing technique. This is further confirmation of earlier mineralogical studies from Lakehead University that showed the Albany graphite material to be hydrothermal in nature with negligible impurities. The ability to produce a natural graphite product equivalent in purity to the highest grade synthetic graphite using low-cost conventional processing techniques will allow Zenyatta to target the growing market in high value-added graphite applications; especially the new important high technology manufacturing and the emerging "green" industries. Given the ultra-high purity at Zenyatta's Albany project, the Company will be positioning the material to compete in the $13 billion (global production at 1.5 million tonnes annually) synthetic market.

Zenyatta's Albany graphite deposit is located 30km north of the Trans Canada Highway, power line and natural gas pipeline near the communities of Constance Lake First Nation and Hearst. A rail line is located 70km away and an all-weather road approximately 4-5km from the graphite deposit. The deposit is near surface, beneath 20-40 metres of overburden consisting of gravel and a thin veneer of limestone.

Mr. Aubrey Eveleigh, P.Geo., President and CEO, is the "Qualified Person" under NI 43-101 and has reviewed the technical information contained in this news release.

Zenyatta Ventures Commences Drill Program to Define NI 43-101 Resource at Albany Graphite Deposit

THUNDER BAY, ONTARIO--(Marketwire - March 14, 2013) - Zenyatta Ventures Ltd. ("Zenyatta" or "Company") (TSX VENTURE:ZEN) is pleased to announce that a drill program will commence immediately at its 100% owned Albany Graphite Deposit in northeastern Ontario.

Given the recent metallurgical success, the Company will now focus on defining the size and grade of this rare, 'vein-type' or hydrothermal-style graphite deposit. The goal of the current program will be to expand on a 2012 drilling campaign that intersected a large mineralized zone of graphitic breccia and veining which yielded up to 6.6% Carbon over 170.0 metres ('m') from widely spaced drill holes. This previous nine (9) hole drill program succeeded in establishing widespread graphite mineralization laterally for several hundred metres and to a vertical depth of 400m, where it remains open.

The current drilling will consist of a minimum of 10,000m and will further test the extent of the Geotech VTEM airborne conductor that measures 1400m east-west by 800m north-south. The program will require 40 holes and is expected to continue until August, after which a NI 43-101 resource estimate will be calculated. The Company anticipates a steady flow of information from drilling activities and continued metallurgical work from this fully funded $4 million exploration program for the balance of 2013.

Aubrey Eveleigh, President and CEO stated, "This larger drill campaign will further define the size and shape of the only known 'vein type' or hydrothermal graphite deposit under development in the world. Hydrothermal graphite deposits, like the Albany, are extremely rare and known to offer superior performance in many industrial applications due to its distinctive properties. We believe the Albany graphite deposit is emerging as a very important and unique graphite resource." Eveleigh also stated, "Zenyatta's exploration team headed by Peter Wood, VP Exploration will manage the program over the next 4-6 months. Mr. Wood will focus on defining a resource estimate at the Albany graphite deposit and prepare for a pre-feasibility study in the second half of the year."

Zenyatta initially established the quality of the Albany graphite and recently announced ultra-high purity results from SGS Canada Inc. of 99.96% carbon from a low-cost, conventional processing technique. This is further confirmation of earlier mineralogical studies from Lakehead University that showed the Albany graphite material to be hydrothermal in nature with negligible impurities. The ability to produce a natural graphite product equivalent in purity to the highest grade synthetic graphite using low-cost conventional processing techniques will allow Zenyatta to target the growing market in high value-added graphite applications; especially the new important high technology manufacturing and the emerging "green" industries. Given the ultra-high purity at Zenyatta's Albany project, the Company will be positioning the material to compete in the $13 billion (global production at 1.5 million tonnes annually) synthetic market.

Zenyatta's Albany graphite deposit is located 30km north of the Trans Canada Highway, power line and natural gas pipeline near the communities of Constance Lake First Nation and Hearst. A rail line is located 70km away and an all-weather road approximately 4-5km from the graphite deposit. The deposit is near surface, beneath 20-40 metres of overburden consisting of gravel and a thin veneer of limestone.

Mr. Aubrey Eveleigh, P.Geo., President and CEO, is the "Qualified Person" under NI 43-101 and has reviewed the technical information contained in this news release.

Colossus Minerals Inc. (CSI : TSX : C$2.98) - Speculative Buy - Target:C$7.75

De-risking the Serra Pelada project; maintain SPECULATIVE BUY with a target price of C$7.75, down from C$9.00

Investment recommendation We maintain our SPECULATIVE BUY recommendation with a target price of C$7.75, down from C$9.00 previously. Investment highlights Shares of Colossus Minerals bounced up 20.7% on March 12, 2013 on an upward movement in the price of gold and a release by Arias Resource Capital Fund II L.P. that the fund had acquired 10.2% of the outstanding shares of CSI. The shares of CSI have been under significant pressure recently, dropping 50% from January 10, 2013 to March 8, 2013. The shares of CSI were particularly impacted by selling pressure related to its deletion from the S&P/TSX Global Gold Index. Over the past eight trading sessions, 11.4 million shares of CSI have traded, representing an average daily volume roughly 160% higher than the 200-day average volume. We believe that most of the index rebalancing related selling pressure is behind CSI. CSI is working to de-risk the Serra Pelada project with the potential for a significant revaluation as a junior producer. Over the next 3-12 months, we are expecting to see an initial one-year reserve estimate for Serra Pelada (Q2/13), the results from the bulk sample (Q2/13), commissioning of the mine and plant (Q3/13) and initial production (Q4/13). Valuation Based on our discussions with management, we have adjusted our operating cost assumptions for the Serra Pelada project upwards by 18%. After adjusting our model, our estimate of peak gold price NAVPS (10%, US$1,850/oz Au) has dropped to C$10.26, down from C$11.95 previously. We continue to value the shares of CSI based on a 0.75x multiple to our peak gold price estimate of NAVPS (10%, US$1850/oz Au).

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&m=32316746&l=0&r=0&s=CSI&t=LIST#BHub81lDXXOatSlq.99

De-risking the Serra Pelada project; maintain SPECULATIVE BUY with a target price of C$7.75, down from C$9.00

Investment recommendation We maintain our SPECULATIVE BUY recommendation with a target price of C$7.75, down from C$9.00 previously. Investment highlights Shares of Colossus Minerals bounced up 20.7% on March 12, 2013 on an upward movement in the price of gold and a release by Arias Resource Capital Fund II L.P. that the fund had acquired 10.2% of the outstanding shares of CSI. The shares of CSI have been under significant pressure recently, dropping 50% from January 10, 2013 to March 8, 2013. The shares of CSI were particularly impacted by selling pressure related to its deletion from the S&P/TSX Global Gold Index. Over the past eight trading sessions, 11.4 million shares of CSI have traded, representing an average daily volume roughly 160% higher than the 200-day average volume. We believe that most of the index rebalancing related selling pressure is behind CSI. CSI is working to de-risk the Serra Pelada project with the potential for a significant revaluation as a junior producer. Over the next 3-12 months, we are expecting to see an initial one-year reserve estimate for Serra Pelada (Q2/13), the results from the bulk sample (Q2/13), commissioning of the mine and plant (Q3/13) and initial production (Q4/13). Valuation Based on our discussions with management, we have adjusted our operating cost assumptions for the Serra Pelada project upwards by 18%. After adjusting our model, our estimate of peak gold price NAVPS (10%, US$1,850/oz Au) has dropped to C$10.26, down from C$11.95 previously. We continue to value the shares of CSI based on a 0.75x multiple to our peak gold price estimate of NAVPS (10%, US$1850/oz Au).

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&m=32316746&l=0&r=0&s=CSI&t=LIST#BHub81lDXXOatSlq.99

Neuer Manipulationverdacht gegen weltweit agierende Großbanken: Die US-Regulierungsbehörde CFTC untersucht, ob die Institute nicht nur Zinssätze, sondern auch die Preise von Gold und Silber untereinander abgesprochen haben. Der Finanzbranche droht ein weiterer Skandal.

http://www.spiegel.de/wirtschaft/usa-prueft-goldpreis-auf-manipulationen-a-888846.html

http://www.spiegel.de/wirtschaft/usa-prueft-goldpreis-auf-manipulationen-a-888846.html

hab gehofft sie nehmen mal nen jüngeren.......

[url=http://peketec.de/trading/viewtopic.php?p=1361847#1361847 schrieb:Moritz schrieb am 14.03.2013, 15:16 Uhr[/url]"]» zur Grafik

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

McEwen Mining begins PEA work on Los Azules

2013-03-14 19:32 ET - News Release

Mr. Gary Schellenberg reports

TNR GOLD CORP. ADVISES OF MCEWEN MINING'S DEVELOPMENTS AT LOS AZULES COPPER PROJECT

McEwen Mining Inc. has issued a news release dated March 13, 2013, in relation to the Los Azules copper project in San Juan province, Argentina. TNR Gold Corp. holds a 25% back-in right, exercisable upon the completion of a feasibility study, on the northern part of the Los Azules property.

The news release issued by McEwen Mining summarizes recent results of metallurgical tests and the potential for these alternative process methods to have a positive impact on the economics of the project. It is available at http://www.mcewenmining.com and on SEDAR at http://www.sedar.com. TNR encourages its shareholders to read the press release issued by McEwen Mining to gain a better understanding of the work performed and the potential impacts this will have on the project. McEwen Mining's press release appears to be prepared by a qualified person and the procedures, methodology and key assumptions disclosed therein are those adopted and consistently applied in the mining industry, but no Qualified Person engaged by TNR Gold Corp. has done sufficient work to analyze, interpret, classify or verify McEwen Mining's information to determine the current mineral reserve or resource or other information referred to in the press release. Accordingly, the reader is cautioned in placing any reliance on the disclosures therein.

In their news release, McEwen Mining announced positive results from metallurgical studies that focused on:

Flotation optimization.

Pressure oxidation on flotation concentrate.

Testing of low grade material for suitability in a heap leach.

In addition, McEwen Mining announced they have begun work on an updated Preliminary Economic Assessment, which they expect to complete in the third quarter of this year.

Kirill Klip, Non-Executive Chairman of TNR, stated, "Having read the news release issued by McEwen Mining I am particularly pleased with how the reported results reflect efforts being made to improve the economic outlook of the Los Azules project. In time we will see the true value of this remarkable asset revealed and I look forward to that day coming soon."

John Harrop, PGeo, FGS, is a "Qualified Person" as defined under NI 43-101 and has reviewed and approved the technical content of this news release.

About Los Azules

The Los Azules copper project is located in San Juan, Argentina. It is one of the largest undeveloped copper projects in the world. The Los Azules porphyry system occurs within a belt of porphyry copper deposits known as the Andean Porphyry Belt that straddles the Chilean/Argentine border and contains some of the world's largest copper deposits.

TNR Gold retains a "back-in" right on the Los Azules project, currently 100% owned by McEwen Mining. The back-in right is for up to 25% of the equity in certain claims comprising the northern portions of Los Azules. The right is exercisable upon the completion of a feasibility study. TNR must pay two (2) times the expenses attributable to the back in percentage (ie. Paying 2 x 25% all of the costs attributable to the claims comprising the northern portion of the property). If the Company elects to back-in for 5% or less or has its interest diluted to 5% or less, TNR will receive a net smelter royalty of 0.6%.

TNR Gold's back-in right applies to those properties subject to an Exploration and Option Agreement originally signed by Solitario Argentina S.A. (a subsidiary of TNR Gold) and M.I.M. Argentina Exploraciones S.A. on May 15, 2004 (as amended) (the "Property").

The press release issued by McEwen Mining includes [resource estimate, drilling results, etc.]. McEwen's press release appears to be prepared by a qualified person and [the procedures, methodology and key assumptions disclosed therein are those adopted and consistently applied in the mining industry, but no independent qualified person engaged by TNR Gold Corp. has done sufficient work to analyze, interpret, classify or verify McEwen's information to determine any current mineral reserve or resource or other information referred to in the press release. Accordingly, the reader is cautioned in placing any reliance on the above estimates.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aMUX-2049184&symbol=MUX®ion=C

2013-03-14 19:32 ET - News Release

Mr. Gary Schellenberg reports

TNR GOLD CORP. ADVISES OF MCEWEN MINING'S DEVELOPMENTS AT LOS AZULES COPPER PROJECT

McEwen Mining Inc. has issued a news release dated March 13, 2013, in relation to the Los Azules copper project in San Juan province, Argentina. TNR Gold Corp. holds a 25% back-in right, exercisable upon the completion of a feasibility study, on the northern part of the Los Azules property.

The news release issued by McEwen Mining summarizes recent results of metallurgical tests and the potential for these alternative process methods to have a positive impact on the economics of the project. It is available at http://www.mcewenmining.com and on SEDAR at http://www.sedar.com. TNR encourages its shareholders to read the press release issued by McEwen Mining to gain a better understanding of the work performed and the potential impacts this will have on the project. McEwen Mining's press release appears to be prepared by a qualified person and the procedures, methodology and key assumptions disclosed therein are those adopted and consistently applied in the mining industry, but no Qualified Person engaged by TNR Gold Corp. has done sufficient work to analyze, interpret, classify or verify McEwen Mining's information to determine the current mineral reserve or resource or other information referred to in the press release. Accordingly, the reader is cautioned in placing any reliance on the disclosures therein.

In their news release, McEwen Mining announced positive results from metallurgical studies that focused on:

Flotation optimization.

Pressure oxidation on flotation concentrate.

Testing of low grade material for suitability in a heap leach.

In addition, McEwen Mining announced they have begun work on an updated Preliminary Economic Assessment, which they expect to complete in the third quarter of this year.

Kirill Klip, Non-Executive Chairman of TNR, stated, "Having read the news release issued by McEwen Mining I am particularly pleased with how the reported results reflect efforts being made to improve the economic outlook of the Los Azules project. In time we will see the true value of this remarkable asset revealed and I look forward to that day coming soon."

John Harrop, PGeo, FGS, is a "Qualified Person" as defined under NI 43-101 and has reviewed and approved the technical content of this news release.

About Los Azules

The Los Azules copper project is located in San Juan, Argentina. It is one of the largest undeveloped copper projects in the world. The Los Azules porphyry system occurs within a belt of porphyry copper deposits known as the Andean Porphyry Belt that straddles the Chilean/Argentine border and contains some of the world's largest copper deposits.

TNR Gold retains a "back-in" right on the Los Azules project, currently 100% owned by McEwen Mining. The back-in right is for up to 25% of the equity in certain claims comprising the northern portions of Los Azules. The right is exercisable upon the completion of a feasibility study. TNR must pay two (2) times the expenses attributable to the back in percentage (ie. Paying 2 x 25% all of the costs attributable to the claims comprising the northern portion of the property). If the Company elects to back-in for 5% or less or has its interest diluted to 5% or less, TNR will receive a net smelter royalty of 0.6%.

TNR Gold's back-in right applies to those properties subject to an Exploration and Option Agreement originally signed by Solitario Argentina S.A. (a subsidiary of TNR Gold) and M.I.M. Argentina Exploraciones S.A. on May 15, 2004 (as amended) (the "Property").

The press release issued by McEwen Mining includes [resource estimate, drilling results, etc.]. McEwen's press release appears to be prepared by a qualified person and [the procedures, methodology and key assumptions disclosed therein are those adopted and consistently applied in the mining industry, but no independent qualified person engaged by TNR Gold Corp. has done sufficient work to analyze, interpret, classify or verify McEwen's information to determine any current mineral reserve or resource or other information referred to in the press release. Accordingly, the reader is cautioned in placing any reliance on the above estimates.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aMUX-2049184&symbol=MUX®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Bei CBJ immer noch wieder shares im ASK...anscheinend sind einige

noch nicht fertig mit dem Verkauf...

Bei mir auf WL!

noch nicht fertig mit dem Verkauf...

Bei mir auf WL!

Morgäähn

1 Unze Gold in US-$ .............1 Unze Gold in Euro

1 Unze Silber in US-$ .............1 Unze Silber in Euro

1 Unze Gold in US-$ .............1 Unze Gold in Euro

1 Unze Silber in US-$ .............1 Unze Silber in Euro

- ! Großer Verfallstag ("Dreifacher Hexensabbat")

• 08:00 - ! DE Beschäftigte verarb. Gewerbe Januar

• 08:00 - DE Konsumausgaben privater Haushalte

• 08:00 - DE Umsatz Gastgewerbe Januar

• 09:15 - CH Erzeuger- u. Importpreise Februar

• 11:00 - ! EU Inflation Februar

• 13:30 US Verbraucherpreise Februar

• 13:30 - ! US NY Empire State Index März

• 14:00 - US Internationale Kapitalströme Januar

• 14:15 US Industrieproduktion Februar

• 14:15 US Kapazitätsauslastung Februar

• 14:55 - ! US Verbraucherstimmung Uni Michigan März

http://peketec.de/trading/dax-,-mdax-werte-und-internationale-beachtenswerte-werte-t8649desc.html

Hier mal ein Beispiel was ausgefeilte Charttechnik, eines Traderkumpels aus Brasilien,

der bei einer der Top Investmentbanken arbeitet wert ist, Aktie Petrobras. eine Ölbude!

Der Tipp flog hier fast in Echtzeit rein!

Hier mal ein Beispiel was ausgefeilte Charttechnik, eines Traderkumpels aus Brasilien,

der bei einer der Top Investmentbanken arbeitet wert ist, Aktie Petrobras. eine Ölbude!

Der Tipp flog hier fast in Echtzeit rein!

nach MACD aber noch nich so ganz oder täuscht mich mein 14`Zoll Flatscreen

[url=http://peketec.de/trading/viewtopic.php?p=1361821#1361821 schrieb:CCG-Redaktion schrieb am 14.03.2013, 14:52 Uhr[/url]"]ITH hat gerade ein Kaufsignal generiert!

Wir posten ja Tradingchancen, anders wie BB vorher, ob dann vorher Gold nicht mitspielt oder der Markt ist eine andere Baustelle!

[url=http://peketec.de/trading/viewtopic.php?p=1362136#1362136 schrieb:greenhorn schrieb am 15.03.2013, 09:58 Uhr[/url]"]nach MACD aber noch nich so ganz oder täuscht mich mein 14`Zoll Flatscreen

[url=http://peketec.de/trading/viewtopic.php?p=1361821#1361821 schrieb:CCG-Redaktion schrieb am 14.03.2013, 14:52 Uhr[/url]"]ITH hat gerade ein Kaufsignal generiert!

[url=http://peketec.de/trading/viewtopic.php?p=1362140#1362140 schrieb:CCG-Redaktion schrieb am 15.03.2013, 10:01 Uhr[/url]"]ITH hat eine gute geführte Facebook Seite, Alles auf dem Tablett!

Auf gut deutsch: Das Hauptdepot ist in der Tiefe noch garnicht erfasst!

Another target is potential resources below the known ore body.

“Exploration holes in the Money Knob deposit were generally terminated at 200 meters to 300 meters below the surface due to limitations of the drilling technology used,” Ewigleben said in the June 21 press release. “To date, almost all the drill holes in the Money Knob have bottomed out in the gold deposit and six holes extending below the proposed pit bottom at the 300 meter depth penetrated intervals with similar gold grades to the main deposit.”

Additional resources in this area, below the proposed pit bottom, may be identified by drilling done as the mining operation proceeds,” the release said.

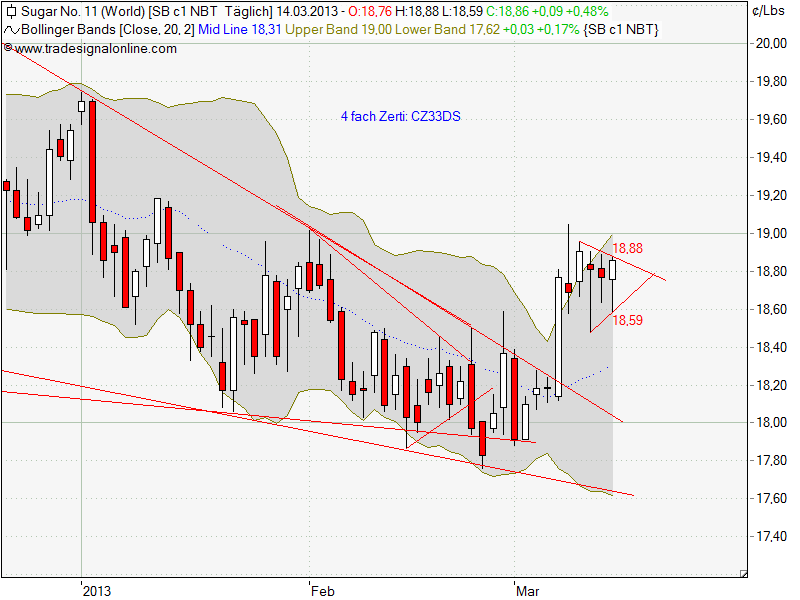

[/quote]» zur Grafik[/quote][url=http://peketec.de/trading/viewtopic.php?p=1360685#1360685 schrieb:CCG-Redaktion schrieb am 12.03.2013, 12:00 Uhr[/url]"]Zuckerzerti bei 6,50E. Beim naechsten Anstieg werden wir den SL nachziehen.

Unten den Chart um zu zeigen, wo wir stehen, bzw. welches Potenzial Zucker hat.

[url=http://peketec.de/trading/viewtopic.php?p=1359871#1359871 schrieb:CCG-Redaktion schrieb am 08.03.2013, 17:51 Uhr[/url]"]Innerhalb von 5 Min. von 19,04 auf 18,72 und wieder hoch.

[url=http://peketec.de/trading/viewtopic.php?p=1359801#1359801 schrieb:CCG-Redaktion schrieb am 08.03.2013, 16:24 Uhr[/url]"]Zucker kratzt an der 19,00

quote="CCG-Redaktion schrieb am 08.03.2013, 09:58 Uhr"]Zucker bei 18,84; 4-fach Zerti bei 6,52 E

Wir ziehen den SL auf Einstand von 5,84 Euro. Somit sind wir aus dem Risiko!

» zur Grafik[url=http://peketec.de/trading/viewtopic.php?p=1359322#1359322 schrieb:CCG-Redaktion schrieb am 07.03.2013, 17:02 Uhr[/url]"]Zucker -18,54 -laeuft schoen an - hat lange gedauert, aber nun ist der Abwaertstrend seit Oktober gebrochen !!

Zerti bei 6,23 E

» zur Grafik[url=http://peketec.de/trading/viewtopic.php?p=1358549#1358549 schrieb:CCG-Redaktion schrieb am 05.03.2013, 17:43 Uhr[/url]"]Sugar: 18,26

- wir muessen die 18,30/40 hinter uns lassen!

[url=http://peketec.de/trading/viewtopic.php?p=1358071#1358071 schrieb:Moritz schrieb am 04.03.2013, 13:07 Uhr[/url]"]Kurs wieder oberhalb der 18,00 !

[url=http://peketec.de/trading/viewtopic.php?p=1357803#1357803 schrieb:Moritz schrieb am 01.03.2013, 19:38 Uhr[/url]"]Zucker hat den Anstieg der letzten 3 Tage in einer Sitzung aufgezehrt

Die 17,91 sollte halten. SL haelt!

[url=http://peketec.de/trading/viewtopic.php?p=1357666#1357666 schrieb:Moritz schrieb am 01.03.2013, 15:14 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1357664#1357664 schrieb:Moritz schrieb am 01.03.2013, 15:11 Uhr[/url]"]Zucker macht immer grosse Ausschlaege! Deshalb SL !

» zur Grafik

quote="spatzemann schrieb am 01.03.2013, 14:19 Uhr"]was war das denn bitte gerade für eine seltsame Kursbewegung beim Zuckerzerti?

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1357454#1357454 schrieb:Moritz schrieb am 01.03.2013, 09:13 Uhr[/url]"]Kauf 250 Zertis zu 5,84 Euro, StopLoss bei 5,20 Euro

[url=http://peketec.de/trading/viewtopic.php?p=1357440#1357440 schrieb:Moritz schrieb am 01.03.2013, 08:52 Uhr[/url]"]Guten Morgen!

Wir werden versuchen heute fuer das Tradingdepot das 4-fach Zuckerzerti CZ33DS unter 6,- Euro zu kaufen. Zerti hat kein KO!

» zur Grafik