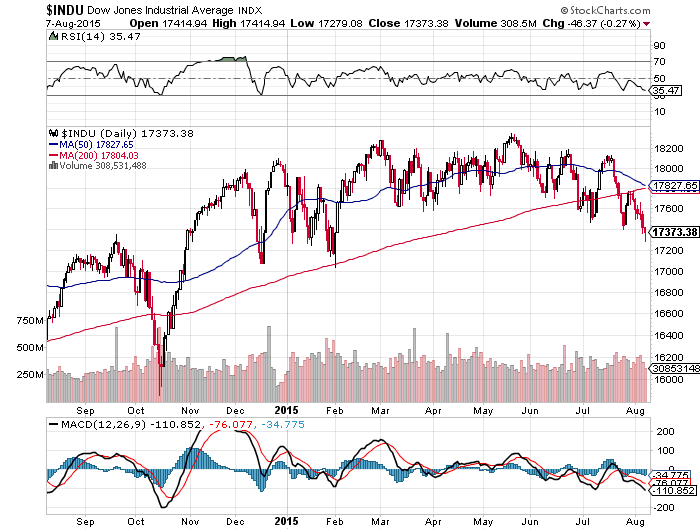

TCM - für mich sieht es nach einem guten Job des Managements aus, Produktion gesteigert, Schuldentilgung geht vorran

kaum vorstellbar wenn es jetzt noch zu einer Preiserholung kommen sollte

Thompson Creek earns $300,000 (U.S.) in Q2

Thompson Creek earns $300,000 (U.S.) in Q2

2015-08-06 17:43 ET - News Release

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:TCM-2300272&symbol=TCM®ion=C

Mr. Jacques Perron reports

THOMPSON CREEK REPORTS SECOND QUARTER 2015 FINANCIAL RESULTS

Thompson Creek Metals Company Inc. has released its financial results for the three and six months ended June 30, 2015, prepared in accordance with U.S. generally accepted accounting principles (GAAP). All dollar amounts are in U.S. dollars unless otherwise indicated.

"During the second quarter, we made significant progress at Mount Milligan mine compared to the first quarter of this year, including improved throughput, recoveries and unit cash costs," said Jacques Perron, president, chief executive officer and director of Thompson Creek. "We are particularly proud of our improving safety performance, which demonstrates the commitment and quality of all of the members of our team. With ongoing volatility in the markets, we will continue to prudently manage our balance sheet and actively pursue company-wide cost reductions."

Mr. Perron continued: "We achieved our highest quarterly average daily mill throughput to date of 44,940 tonnes in the second quarter. As a result of several maintenance shutdowns related to the pebble crushers, primary crusher and ball mills, daily throughput in July averaged 43,302 tonnes, but following completion of the necessary maintenance work, daily mill throughput improved in the latter part of the month and averaged 52,290 between July 26 and Aug. 4. We expect to make additional operational improvements in the second half of this year, including the installation of a second SAG [semi-autogenous grinding] discharge screen deck, which will be instrumental in achieving higher throughput. We believe these improvements, together with continued use of secondary crushed material, will help us to complete the ramp-up of Mount Milligan by year-end."

During the quarter, the company repurchased and retired $34-million of its senior secured notes. Since December, 2014, the company has repurchased and retired approximately $68-million of its outstanding notes, with future interest savings from these repurchases to maturity of approximately $22-million. Mr. Perron said: "These bond repurchases are consistent with our strategy to reduce our debt and strengthen our balance sheet. Since the completion of Mount Milligan mine through June 30, 2015, we have repaid and retired approximately $121-million of our debt or 12 per cent, including the net repayments of our capital lease obligations."

Highlights for the second quarter of 2015

Operating results for the second quarter of 2015 compared with the first quarter of 2015 reflect positive trends, as management targets completion of the Mount Milligan ramp-up by year end. With recent improvements in the mine and mill, together with the utilization of the temporary secondary crushing circuit, during the second quarter of 2015, the company achieved its highest quarterly average daily mill throughput to date of 44,940 tonnes, a 13.6-per-cent improvement over the first quarter of 2015. Recoveries for the second quarter of 2015 steadily increased to 85.5 per cent for copper and 72.7 per cent for gold. With the higher throughput and improved recoveries, payable production for both copper and gold increased by approximately 30 per cent from the first quarter of 2015.

Financial results for the second quarter of 2015 compared with the first quarter of 2015 also improved; operating income more than doubled and cash generated by operating activities more than quadrupled. During the second quarter of 2015, the company also decreased its total debt balance by $41.2-million.

Total cash and cash equivalents at June 30, 2015, were $211.1-million, compared with $265.6-million at Dec. 31, 2014. Total debt, including capital lease obligations, at June 30, 2015, was $897.6-million, compared with $944.7-million at Dec. 31, 2014. During the second quarter of 2015, the company repurchased and retired $34.2-million of the 9.75-per-cent senior secured notes due in 2017.

Cash generated by operating activities was $23.9-million in the second quarter of 2015, compared with cash generated by operating activities of $50.7-million in the second quarter of 2014.

Consolidated revenues for the second quarter of 2015 were $134.1-million, compared with $248.4-million in the second quarter of 2014. Copper and gold sales contributed $105.6-million in revenue in the second quarter of 2015, compared with $118.9-million in the second quarter of 2014. Molybdenum sales for the second quarter of 2015 were $20.9-million, compared with $126.3-million in the second quarter of 2014. During each of the second quarters of 2015 and 2014, the company completed three shipments of copper and gold concentrate and recorded four sales.

Payable production at the Mount Milligan mine for the second quarter of 2015 was 20.2 million pounds of copper and 59,917 ounces of gold, compared with payable production of 16 million pounds of copper and 37,030 ounces of gold for the second quarter of 2014.

Sales volumes and average realized sales prices for copper and gold for the second quarter of 2015 were 21.2 million pounds of copper at an average realized price of $2.63 per pound and 57,920 ounces of gold at an average realized price of $975 per ounce, as compared with 21.9 million pounds of copper at an average realized price of $3.20 per pound and 51,983 ounces of gold at an average realized price of $1,047 per ounce for the second quarter of 2014. Molybdenum sales volumes in the second quarter of 2015, which consisted of the sale of molybdenum inventory produced at the company's mines in 2014 and molybdenum sourced from third parties, were 2.3 million pounds at an average realized price of $9.23 per pound, compared with 9.7 million pounds at an average realized price of $13.03 per pound for the second quarter of 2014.

Consolidated operating income for the second quarter of 2015 was $12.1-million, compared with $57.3-million for the second quarter of 2014. Consolidated operating income for the second quarters of 2015 and 2014 was affected by non-cash lower-of-cost-or-market molybdenum product inventory writedowns of $1.9-million and $1.2-million, respectively. Consolidated operating income for the second quarter of 2015 was also affected by $12.1-million of costs related to idle molybdenum mining operations, including the company's share of severance costs at the Endako mine of $6.7-million.

Net income for the second quarter of 2015 was $300,000, or nil per diluted share, compared with net income of $61.6-million, or 28 cents per diluted share, for the second quarter of 2014. The net income for the second quarter of 2015 and 2014 included non-cash foreign exchange gains of $16.9-million and $42.3-million, respectively, primarily on intercompany notes.

Non-GAAP adjusted net loss for the second quarter of 2015 was $13.5-million, or six cents per diluted share, compared with non-GAAP adjusted net income for the same period of 2014 of $22-million, or 10 cents per share. Non-GAAP adjusted net income (loss) excludes foreign exchange gains and losses, net of related income tax effects.

Non-GAAP unit cash cost per pound of copper produced for the second quarter of 2015 was, on a byproduct basis, 48 cents per pound and was, on a co-product basis, $1.55 per pound of copper and $434 per ounce of gold. Non-GAAP unit cash cost in the second quarter of 2014 was, on a byproduct basis, 33 cents per pound and was, on a co-product basis, $1.97 per pound of copper and $538 per ounce of gold.

Capital expenditures for the second quarter of 2015 were $9.7-million, composed of $9.1-million for the Mount Milligan mine and $600,000 for the Langeloth facility, the Endako mine and corporate combined, compared with $26.7-million for the second quarter of 2014

[url=http://peketec.de/trading/viewtopic.php?p=1604300#1604300 schrieb:

greenhorn schrieb am 16.07.2015, 09:54 Uhr[/url]"]

TCM - gefällt!

Thompson Creek buys back $34.2-million in 9.75% notes

Thompson Creek buys back $34.2-million in 9.75% notes

2015-07-13 17:11 ET - News Release

Mr. Jacques Perron reports

THOMPSON CREEK ANNOUNCES REPURCHASE OF $34-MILLION OF 9.75% SENIOR SECURED NOTES DUE DECEMBER 1, 2017

During the second quarter of 2015, Thompson Creek Metals Company Inc. repurchased and retired $34.2-million principal amount of its 9.75-per-cent senior secured notes due Dec. 1, 2017, at an average purchase price of 1.07 per cent of the note par value. Total cash used was approximately $37.8-million, inclusive of the payment of accrued interest to the repurchase date of $1.2-million. Future interest savings from this repurchase to the December, 2015, call date will be approximately $800,000, representing a net average purchase price of 1.024 per cent of par compared with the call price of 1.04875 per cent of par, with future interest savings to the December, 2017, maturity date of $8.2-million. Since

the completion of the Mount Milligan mine to June 30, 2015, the company has repaid and retired 12 per cent of its debt balance, or approximately $121-million, including the net repayments of its capital lease obligations. The company's target is to reduce its debt over time to approximately three times earnings before income taxes, depreciation and amortization for a 12-month period.

The company's June 30, 2015, cash and cash equivalents balance was approximately $211-million, compared with $238-million at March 31, 2015. Excluding the impact of the note repurchase announced herein, the company's cash balance increased by approximately $10-million during the second quarter of 2015.

Jacques Perron, president and chief executive officer of Thompson Creek, said: "During the second quarter, we saw continual operational improvements at Mount Milligan, which we believe will continue throughout the remainder of the year. Based on this assessment and our strong cash position, we were able to deploy capital for additional bond repurchases as part of our plan to reduce our debt. We believe these additional bond repurchases illustrate our continuing ability to take advantage of opportunities in the financial markets to pro-actively strengthen and delever our balance sheet. We will continue to actively evaluate and execute our debt reduction and refinancing measures to reduce interest costs and to extend the maturities of our bonds."

We seek Safe Harbor.

© 2015 Canjex Publishing Ltd. All rights reserved

[url=http://peketec.de/trading/viewtopic.php?p=1601904#1601904 schrieb:

greenhorn schrieb am 08.07.2015, 14:18 Uhr[/url]"]

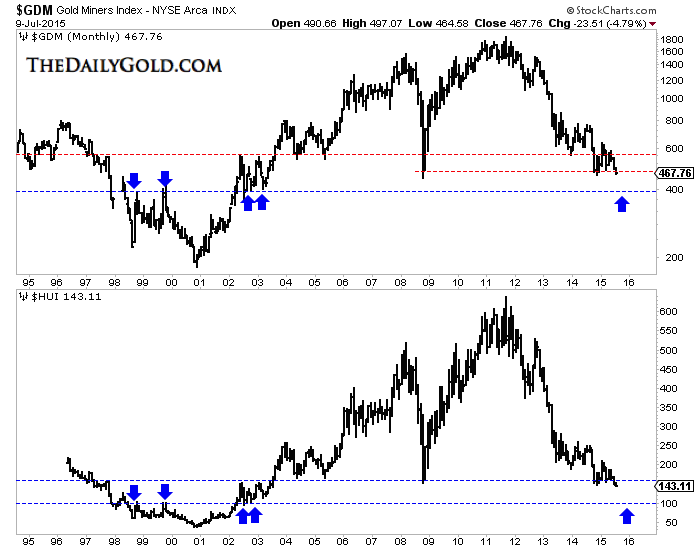

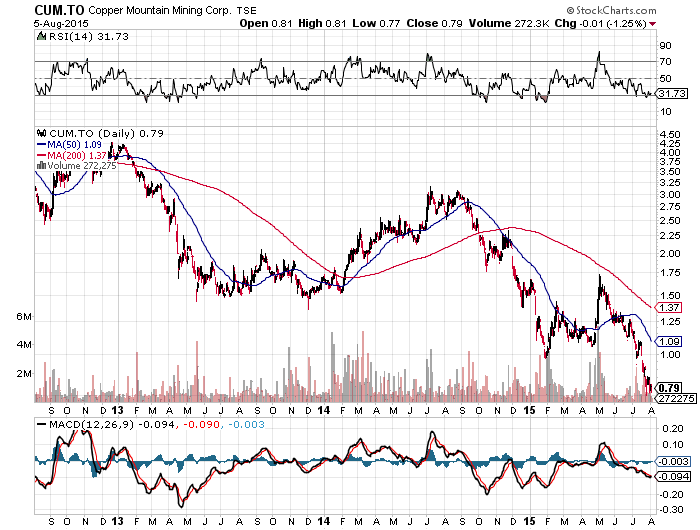

TCM - und dann heute noch überzeugende Produktionsergebnisse für das 2.Q 2015, vom Chart reif für eine Erholung

July 8, 2015 - 7:30 AM EDT

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:TCM-2292812&symbol=TCM®ion=C

Thompson Creek Reports Second Quarter 2015 Production and Sales Results

DENVER, July 8, 2015 /CNW/ - Thompson Creek Metals Company Inc. (NYSE: TC) (TSX: TCM) ("Thompson Creek" or the "Company") announced today production and sales results for the three and six months ended June 30, 2015.

Total concentrate production for Mount Milligan for the quarter ended June 30, 2015 was 39.6 thousand dry tonnes, with 20.2 million pounds of payable copper and 59.9 thousand ounces of payable gold, which represented increases of approximately 26% and 62%, respectively, from payable copper and gold production during the second quarter of 2014. Total concentrate production for Mount Milligan for the six months ended June 30, 2015 was 69.9 thousand dry tonnes, with 35.6 million pounds of payable copper and 106.0 thousand ounces of payable gold, which represented increases of approximately 17% and 39%, respectively, from payable copper and gold production during the first six months of 2014.

..................

Jacques Perron, President and Chief Executive Officer of Thompson Creek, said, "During the second quarter of 2015, we achieved our highest average daily mill throughput on a quarterly basis of 44,940 tonnes, and

for May and June averaged 49,913 tonnes. Recoveries steadily improved during the quarter, averaging 85.5% for copper and 72.7% for gold. Additional operational improvements at Mount Milligan are expected to be made during scheduled maintenance shutdowns later this year, which will impact mill availability. We are confident that we will continue to experience improving performance at the operation through the remainder of the year."

During the three and six months ended June 30, 2015, the Company completed three and seven shipments, respectively, of copper and gold concentrate, and recognized four and seven sales, respectively.

[url=http://peketec.de/trading/viewtopic.php?p=1601779#1601779 schrieb:

greenhorn schrieb am 08.07.2015, 10:34 Uhr[/url]"]TCM - die Nachricht könnte weiter stützen......

July 7, 2015 - 7:14 PM EDT

Thompson Creek Receives Continued Listing Standard Notice from the New York Stock Exchange

DENVER, July 7, 2015 /CNW/ - Thompson Creek Metals Company Inc. (NYSE: TC) (TSX: TCM) ("Thompson Creek" or the "Company") announced today that it received notification on July 6, 2015 from the New York Stock Exchange (the "NYSE") that the price of the Company's common stock has fallen below the NYSE's continued listing standard. The NYSE requires that the average closing price of a listed company's common stock be above $1.00 per share over a consecutive 30-day trading period. As of July 6, 2015, the average closing price per share of the Company's common stock over the preceding 30 trading day period was $0.95.

The Company intends to respond to the NYSE within 10 business days with its intent to cure the deficiency. The Company has six months to regain compliance with the NYSE continued listing requirements and avoid delisting. Management will actively monitor the stock price and evaluate all available options in order to regain compliance within the prescribed timeframe. During the six-month period, the Company's common stock will continue to be listed and traded on the NYSE, subject to compliance with the other listing standards. The NYSE notification does not affect the Company's business operations or its SEC reporting requirements, nor does it conflict with or cause an event of default under any of the instruments governing the Company's debt obligations. The Company's common stock will continue to be listed and traded on the Toronto Stock Exchange.