App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

[url=http://peketec.de/trading/viewtopic.php?p=1142835#1142835 schrieb:CCG-Redaktion schrieb am 16.09.2011, 12:47 Uhr[/url]"]Friday, September 16, 2011

Galway Intersects 14.0M of 21.6 G/T Au And 475.7 G/T Ag and 8.0M Of 43.4 G/T Au, Bridging The Gap From Pie De Gall to San Celestino!!!!!!

--------------------------------------------------------------------------------

..........

Goldaktien bauen relative Stärke auf, Analyse: Newmont

von Martin Siegel

Freitag 16.09.2011, 10:20 Uhr

Aktuelle Goldpreisentwicklung

Der Goldpreis verliert im gestrigen New Yorker Handel von 1.803 bis auf 1.773 $/oz, kann sich aber bis zum Handelsschluss wieder auf 1.790 $/oz befestigen. Heute Morgen nimmt der Goldpreis den Abwärtstrend im Handel in Sydney und Hongkong wieder auf und notiert aktuell mit 1.771 $/oz um etwa 41 $/oz unter dem Vortagesniveau. Die Goldminenaktien entwickeln sich seitwärts und bauen eine vorsichtige relative Stärke zum Goldpreis auf.

...

>>> http://www.godmode-trader.de/nachricht/Goldaktien-bauen-relative-Staerke-auf-Analyse-Newmont,a2643472,b127.html

von Martin Siegel

Freitag 16.09.2011, 10:20 Uhr

Aktuelle Goldpreisentwicklung

Der Goldpreis verliert im gestrigen New Yorker Handel von 1.803 bis auf 1.773 $/oz, kann sich aber bis zum Handelsschluss wieder auf 1.790 $/oz befestigen. Heute Morgen nimmt der Goldpreis den Abwärtstrend im Handel in Sydney und Hongkong wieder auf und notiert aktuell mit 1.771 $/oz um etwa 41 $/oz unter dem Vortagesniveau. Die Goldminenaktien entwickeln sich seitwärts und bauen eine vorsichtige relative Stärke zum Goldpreis auf.

...

>>> http://www.godmode-trader.de/nachricht/Goldaktien-bauen-relative-Staerke-auf-Analyse-Newmont,a2643472,b127.html

Carpathian Receives Government Go-Ahead To Build the RDM Mine, Brazil

http://www.stockhouse.com/News/CanadianReleasesDetail.aspx?n=8310350

Carpathian Gold Inc CPN 9/16/2011 8:01:12 AMTORONTO, ONTARIO, Sep 16, 2011 (MARKETWIRE via COMTEX News Network) --

Carpathian Gold Inc. (TSX: CPN) (the "Corporation" or "Carpathian") is pleased to report that it has received the Ad Referendum ("AR") for the Licenca Instalacao ("LI") thereby enabling it to proceed with the overall construction of its 100% owned Riacho dos Machados ("RDM") Gold Project, located in Minas Gerais State, Brazil. The Corporation will expedite the construction of the project with the targeted goal for the commencement of gold production in late 2012/early 2013 at a nominal anticipated production rate averaging + 94,000 ounces per annum for an initial eight year period.

The Corporation is also pleased to announce that for its mining fleet it has selected Caterpillar ("CAT") equipment for the life of the mine operation. The initial order of mining equipment has been requisitioned and it is anticipated that it will be delivered to the project by second quarter of 2012. A contract mining group has been selected to commence the pre-stripping of the deposit prior to the arrival of the CAT equipment.

Earlier this year, the Corporation announced that it had already acquired the secondary and tertiary crushers, and the ball mill and ancillary grinding equipment, that has a capacity of 9,000 tpd, which will be shipped to the project site this fall. The project currently calls for a 7,000 tpd milling operation.

There are numerous exploration targets on strike of the RDM mine site and exploration drilling will commence on these targets to further enhance both the mine life and annual production rate.

http://www.stockhouse.com/News/CanadianReleasesDetail.aspx?n=8310350

Carpathian Gold Inc CPN 9/16/2011 8:01:12 AMTORONTO, ONTARIO, Sep 16, 2011 (MARKETWIRE via COMTEX News Network) --

Carpathian Gold Inc. (TSX: CPN) (the "Corporation" or "Carpathian") is pleased to report that it has received the Ad Referendum ("AR") for the Licenca Instalacao ("LI") thereby enabling it to proceed with the overall construction of its 100% owned Riacho dos Machados ("RDM") Gold Project, located in Minas Gerais State, Brazil. The Corporation will expedite the construction of the project with the targeted goal for the commencement of gold production in late 2012/early 2013 at a nominal anticipated production rate averaging + 94,000 ounces per annum for an initial eight year period.

The Corporation is also pleased to announce that for its mining fleet it has selected Caterpillar ("CAT") equipment for the life of the mine operation. The initial order of mining equipment has been requisitioned and it is anticipated that it will be delivered to the project by second quarter of 2012. A contract mining group has been selected to commence the pre-stripping of the deposit prior to the arrival of the CAT equipment.

Earlier this year, the Corporation announced that it had already acquired the secondary and tertiary crushers, and the ball mill and ancillary grinding equipment, that has a capacity of 9,000 tpd, which will be shipped to the project site this fall. The project currently calls for a 7,000 tpd milling operation.

There are numerous exploration targets on strike of the RDM mine site and exploration drilling will commence on these targets to further enhance both the mine life and annual production rate.

kann das sicherlich nicht ganz so wie golden_times beschreiben - aber die Formulierung das man ein Lücke zwischen 2 großen Veins schließen konnte und darüber sehr erfreut ist - das erfreut!

die Gehalte hochgradig....sowohl Gold als auch Silber

"In much the same way that Galway has been successful in bridging the gap between the Pie de Gallo and Northeast Zones, the high grade intersections seen in holes 117 and 120 help to bridge the gap between the Pie de Gallo and San Celestino Zones. Moreover, the strong mineralization seen in these two holes are actually contained within two different mineralized veins, which align well with other previously reported intersects along strike and dip. Also noteworthy is that, with several very high grade intersects, silver continues to represent a significant by-product credit in Galway's California property," cites Robert Hinchcliffe, President and CEO of Galway Resources.

die Gehalte hochgradig....sowohl Gold als auch Silber

"In much the same way that Galway has been successful in bridging the gap between the Pie de Gallo and Northeast Zones, the high grade intersections seen in holes 117 and 120 help to bridge the gap between the Pie de Gallo and San Celestino Zones. Moreover, the strong mineralization seen in these two holes are actually contained within two different mineralized veins, which align well with other previously reported intersects along strike and dip. Also noteworthy is that, with several very high grade intersects, silver continues to represent a significant by-product credit in Galway's California property," cites Robert Hinchcliffe, President and CEO of Galway Resources.

[url=http://peketec.de/trading/viewtopic.php?p=1142854#1142854 schrieb:greenhorn schrieb am 16.09.2011, 13:11 Uhr[/url]"]Top!

[url=http://peketec.de/trading/viewtopic.php?p=1142835#1142835 schrieb:CCG-Redaktion schrieb am 16.09.2011, 12:47 Uhr[/url]"]Friday, September 16, 2011

Galway Intersects 14.0M of 21.6 G/T Au And 475.7 G/T Ag and 8.0M Of 43.4 G/T Au, Bridging The Gap From Pie De Gall to San Celestino!!!!!!

--------------------------------------------------------------------------------

..........

gute News, Minenbau in Brasilien geht weiter, könnte heute/nächsten Tage die alten Hochs überwinden

Carpathian Receives Government Go-Ahead To Build the RDM Mine, Brazil

http://www.stockhouse.com/News/CanadianReleasesDetail.aspx?n=8310350

Carpathian Gold Inc CPN 9/16/2011 8:01:12 AMTORONTO, ONTARIO, Sep 16, 2011 (MARKETWIRE via COMTEX News Network) --

Carpathian Gold Inc. (TSX: CPN) (the "Corporation" or "Carpathian") is pleased to report that it has received the Ad Referendum ("AR") for the Licenca Instalacao ("LI") thereby enabling it to proceed with the overall construction of its 100% owned Riacho dos Machados ("RDM") Gold Project, located in Minas Gerais State, Brazil. The Corporation will expedite the construction of the project with the targeted goal for the commencement of gold production in late 2012/early 2013 at a nominal anticipated production rate averaging + 94,000 ounces per annum for an initial eight year period.

The Corporation is also pleased to announce that for its mining fleet it has selected Caterpillar ("CAT") equipment for the life of the mine operation. The initial order of mining equipment has been requisitioned and it is anticipated that it will be delivered to the project by second quarter of 2012. A contract mining group has been selected to commence the pre-stripping of the deposit prior to the arrival of the CAT equipment.

Earlier this year, the Corporation announced that it had already acquired the secondary and tertiary crushers, and the ball mill and ancillary grinding equipment, that has a capacity of 9,000 tpd, which will be shipped to the project site this fall. The project currently calls for a 7,000 tpd milling operation.

There are numerous exploration targets on strike of the RDM mine site and exploration drilling will commence on these targets to further enhance both the mine life and annual production rate.

Carpathian Receives Government Go-Ahead To Build the RDM Mine, Brazil

http://www.stockhouse.com/News/CanadianReleasesDetail.aspx?n=8310350

Carpathian Gold Inc CPN 9/16/2011 8:01:12 AMTORONTO, ONTARIO, Sep 16, 2011 (MARKETWIRE via COMTEX News Network) --

Carpathian Gold Inc. (TSX: CPN) (the "Corporation" or "Carpathian") is pleased to report that it has received the Ad Referendum ("AR") for the Licenca Instalacao ("LI") thereby enabling it to proceed with the overall construction of its 100% owned Riacho dos Machados ("RDM") Gold Project, located in Minas Gerais State, Brazil. The Corporation will expedite the construction of the project with the targeted goal for the commencement of gold production in late 2012/early 2013 at a nominal anticipated production rate averaging + 94,000 ounces per annum for an initial eight year period.

The Corporation is also pleased to announce that for its mining fleet it has selected Caterpillar ("CAT") equipment for the life of the mine operation. The initial order of mining equipment has been requisitioned and it is anticipated that it will be delivered to the project by second quarter of 2012. A contract mining group has been selected to commence the pre-stripping of the deposit prior to the arrival of the CAT equipment.

Earlier this year, the Corporation announced that it had already acquired the secondary and tertiary crushers, and the ball mill and ancillary grinding equipment, that has a capacity of 9,000 tpd, which will be shipped to the project site this fall. The project currently calls for a 7,000 tpd milling operation.

There are numerous exploration targets on strike of the RDM mine site and exploration drilling will commence on these targets to further enhance both the mine life and annual production rate.

[url=http://peketec.de/trading/viewtopic.php?p=1142911#1142911 schrieb:greenhorn schrieb am 16.09.2011, 14:29 Uhr[/url]"]kann das sicherlich nicht ganz so wie golden_times beschreiben - aber die Formulierung das man ein Lücke zwischen 2 großen Veins schließen konnte und darüber sehr erfreut ist - das erfreut!

die Gehalte hochgradig....sowohl Gold als auch Silber

"In much the same way that Galway has been successful in bridging the gap between the Pie de Gallo and Northeast Zones, the high grade intersections seen in holes 117 and 120 help to bridge the gap between the Pie de Gallo and San Celestino Zones. Moreover, the strong mineralization seen in these two holes are actually contained within two different mineralized veins, which align well with other previously reported intersects along strike and dip. Also noteworthy is that, with several very high grade intersects, silver continues to represent a significant by-product credit in Galway's California property," cites Robert Hinchcliffe, President and CEO of Galway Resources.

[url=http://peketec.de/trading/viewtopic.php?p=1142854#1142854 schrieb:greenhorn schrieb am 16.09.2011, 13:11 Uhr[/url]"]Top!

[url=http://peketec.de/trading/viewtopic.php?p=1142835#1142835 schrieb:CCG-Redaktion schrieb am 16.09.2011, 12:47 Uhr[/url]"]Friday, September 16, 2011

Galway Intersects 14.0M of 21.6 G/T Au And 475.7 G/T Ag and 8.0M Of 43.4 G/T Au, Bridging The Gap From Pie De Gall to San Celestino!!!!!!

--------------------------------------------------------------------------------

..........

also, ist schon wahnsinn der kursverlauf , news verpufft bis jetzt

[url=http://peketec.de/trading/viewtopic.php?p=1142970#1142970 schrieb:amun71 schrieb am 16.09.2011, 15:47 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1142911#1142911 schrieb:greenhorn schrieb am 16.09.2011, 14:29 Uhr[/url]"]kann das sicherlich nicht ganz so wie golden_times beschreiben - aber die Formulierung das man ein Lücke zwischen 2 großen Veins schließen konnte und darüber sehr erfreut ist - das erfreut!

die Gehalte hochgradig....sowohl Gold als auch Silber

"In much the same way that Galway has been successful in bridging the gap between the Pie de Gallo and Northeast Zones, the high grade intersections seen in holes 117 and 120 help to bridge the gap between the Pie de Gallo and San Celestino Zones. Moreover, the strong mineralization seen in these two holes are actually contained within two different mineralized veins, which align well with other previously reported intersects along strike and dip. Also noteworthy is that, with several very high grade intersects, silver continues to represent a significant by-product credit in Galway's California property," cites Robert Hinchcliffe, President and CEO of Galway Resources.

[url=http://peketec.de/trading/viewtopic.php?p=1142854#1142854 schrieb:greenhorn schrieb am 16.09.2011, 13:11 Uhr[/url]"]Top!

[url=http://peketec.de/trading/viewtopic.php?p=1142835#1142835 schrieb:CCG-Redaktion schrieb am 16.09.2011, 12:47 Uhr[/url]"]Friday, September 16, 2011

Galway Intersects 14.0M of 21.6 G/T Au And 475.7 G/T Ag and 8.0M Of 43.4 G/T Au, Bridging The Gap From Pie De Gall to San Celestino!!!!!!

--------------------------------------------------------------------------------

..........

also, ist schon wahnsinn der kursverlauf , news verpufft bis jetzt

sind aber schon vorher gut gelaufen. außerdem, der tag ist noch lang.

Stephen Leeb - Gold, Minimal Downside, $12,000 Upside

>>> http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/9/15_Stephen_Leeb_-_Gold,_Minimal_Downside,_$12,000_Upside.html

Peter Schiff - Expect More Inflation, Printing & Higher Gold

>>> http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/9/16_Peter_Schiff_-_Expect_More_Inflation,_Printing_%26_Higher_Gold.html

>>> http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/9/15_Stephen_Leeb_-_Gold,_Minimal_Downside,_$12,000_Upside.html

Peter Schiff - Expect More Inflation, Printing & Higher Gold

>>> http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/9/16_Peter_Schiff_-_Expect_More_Inflation,_Printing_%26_Higher_Gold.html

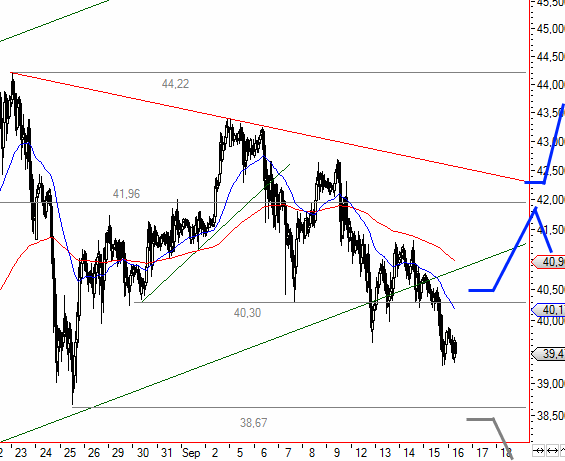

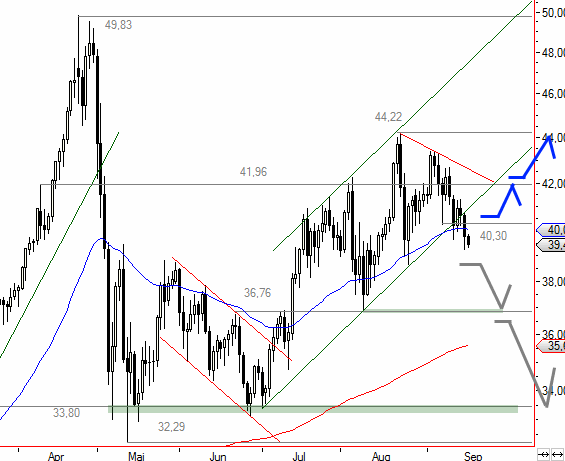

[url=http://peketec.de/trading/viewtopic.php?p=1142816#1142816 schrieb:CCG-Redaktion schrieb am 16.09.2011, 11:56 Uhr[/url]"]» zur Grafik

COMEX voraus! Gold

Gold(aktien) - Verpassen Sie nicht diese Chance!

16.09.2011 | 14:29 Uhr | TORNEY, MARCEL, ROHSTOFFJOURNAL

Nach einer furiosen Rally musste das Edelmetall nun in den letzten Handelstagen ordentlich Federn lassen. Wir hatten ja unseren Standpunkt in diversen Artikeln an dieser Stelle immer wieder deutlich gemacht und man kann ihn so zusammenfassen: "Die aktuell zu beobachtende Rally ist aus unserer Sicht nur der Anfang. Mittel- und langfristig ist das Potential des Goldpreises weiterhin immens. Kurzfristig - und darauf muss verwiesen werden - kann es immer wieder zu (initiierten) Rücksetzern kommen. Doch diese sind unverändert Kaufchancen."

Nun ist einer dieser Rücksetzer also Realität geworden und mit ihm kommen unserer Einschätzung nach unweigerlich die Kaufchancen. All diejenigen, die noch vorhatten, ihre Bestände an diversen Goldinvestments und Goldaktien aufzustocken, sollten sich in der nächsten Zeit bereithalten und sich bietende Chancen prüfen. Zum Thema Goldaktien haben wir im Übrigen kürzlich einen umfangreichen Themenreport veröffentlicht. Dieser kann von interessierten Lesern unter RohstoffJournal.de angefordert werden.

Aufgrund des Medienechos und der Rally an den Aktienmärkten könnte man ja bereits den Eindruck bekommen, dass Griechenland (und mit ihm Europa) gerettet ist und dass die Probleme in den USA sich ebenfalls in Luft aufgelöst haben. Doch dem ist natürlich nicht so. Die politischen Durchhalteparolen dürften nun wahrlich keinen mehr überraschen. Die kürzlich geäußerten Absichtserklärungen aus Berlin, Paris und Athen zur Rettung Griechenlands förderten nichts Neues zu Tage. Tragfähige Lösungen für die Schuldenproblematik gibt es weder auf dieser Seite des Atlantiks noch auf der anderen.

Der aktuelle Preisrückgang beim Goldpreis wurde durch eine abgesprochene Aktion der Notenbanken ausgelöst (herbeigeführt). Das Bankensystem drohte mal wieder in einen Liquiditätsengpass zu geraten. Die Notenbanken sahen sich so gezwungen, den Banken neue Liquidität zur Verfügung stellen zu müssen. Die Risikoaversion sank daraufhin (vorerst) und der Goldpreis mit ihr. Nun ist zwar nicht leicht zu sehen, wie das Edelmetall innerhalb kürzester Zeit deutlich an Boden verliert, doch Hektik verstellt den Blick auf das Wesentliche. Und bei Gold heißt das: Der Aufwärtstrend ist intakt! Und so sollten sich Anleger immer vor Augen führen, dass die mittel- und langfristigen Perspektiven für Gold und Goldaktien unverändert exzellent sind.

Die nächsten Tage könnten nun die Entscheidung darüber bringen, ob sich die Konsolidierung kurzfristig weiter ausdehnen wird oder ob das Edelmetall den Rückgang rasch wieder wettmachen kann. Von Bedeutung ist hier die Marke von 1.700 US-Dollar. Insgesamt gilt: Rücksetzer dürften aufgrund der Risiken aus der Schuldenproblematik, der hohen physischen Nachfrage und der Saisonalität (Hochzeits- und Festivalsaison in Indien läuft an) aber begrenzt ausfallen. Die nächsten Tage werden sicherlich noch Chancen bereithalten, in Gold und Goldaktien zu kommen, doch sie werden wahrscheinlich nicht sehr zahlreich sein.

Weitere Details und konkrete Handelsempfehlungen zu Gold(aktien) und Silber(aktien) finden interessierte Leser in unseren börsentäglichen Publikationen und in unseren aktuellen Strategiepapieren zu Gold und Silber sowie im Gold- und Silberaktienjournal. Diese können unter RohstoffJournal.de angefordert werden.

© Marcel Torney

www.rohstoffjournal.de

16.09.2011 | 14:29 Uhr | TORNEY, MARCEL, ROHSTOFFJOURNAL

Nach einer furiosen Rally musste das Edelmetall nun in den letzten Handelstagen ordentlich Federn lassen. Wir hatten ja unseren Standpunkt in diversen Artikeln an dieser Stelle immer wieder deutlich gemacht und man kann ihn so zusammenfassen: "Die aktuell zu beobachtende Rally ist aus unserer Sicht nur der Anfang. Mittel- und langfristig ist das Potential des Goldpreises weiterhin immens. Kurzfristig - und darauf muss verwiesen werden - kann es immer wieder zu (initiierten) Rücksetzern kommen. Doch diese sind unverändert Kaufchancen."

Nun ist einer dieser Rücksetzer also Realität geworden und mit ihm kommen unserer Einschätzung nach unweigerlich die Kaufchancen. All diejenigen, die noch vorhatten, ihre Bestände an diversen Goldinvestments und Goldaktien aufzustocken, sollten sich in der nächsten Zeit bereithalten und sich bietende Chancen prüfen. Zum Thema Goldaktien haben wir im Übrigen kürzlich einen umfangreichen Themenreport veröffentlicht. Dieser kann von interessierten Lesern unter RohstoffJournal.de angefordert werden.

Aufgrund des Medienechos und der Rally an den Aktienmärkten könnte man ja bereits den Eindruck bekommen, dass Griechenland (und mit ihm Europa) gerettet ist und dass die Probleme in den USA sich ebenfalls in Luft aufgelöst haben. Doch dem ist natürlich nicht so. Die politischen Durchhalteparolen dürften nun wahrlich keinen mehr überraschen. Die kürzlich geäußerten Absichtserklärungen aus Berlin, Paris und Athen zur Rettung Griechenlands förderten nichts Neues zu Tage. Tragfähige Lösungen für die Schuldenproblematik gibt es weder auf dieser Seite des Atlantiks noch auf der anderen.

Der aktuelle Preisrückgang beim Goldpreis wurde durch eine abgesprochene Aktion der Notenbanken ausgelöst (herbeigeführt). Das Bankensystem drohte mal wieder in einen Liquiditätsengpass zu geraten. Die Notenbanken sahen sich so gezwungen, den Banken neue Liquidität zur Verfügung stellen zu müssen. Die Risikoaversion sank daraufhin (vorerst) und der Goldpreis mit ihr. Nun ist zwar nicht leicht zu sehen, wie das Edelmetall innerhalb kürzester Zeit deutlich an Boden verliert, doch Hektik verstellt den Blick auf das Wesentliche. Und bei Gold heißt das: Der Aufwärtstrend ist intakt! Und so sollten sich Anleger immer vor Augen führen, dass die mittel- und langfristigen Perspektiven für Gold und Goldaktien unverändert exzellent sind.

Die nächsten Tage könnten nun die Entscheidung darüber bringen, ob sich die Konsolidierung kurzfristig weiter ausdehnen wird oder ob das Edelmetall den Rückgang rasch wieder wettmachen kann. Von Bedeutung ist hier die Marke von 1.700 US-Dollar. Insgesamt gilt: Rücksetzer dürften aufgrund der Risiken aus der Schuldenproblematik, der hohen physischen Nachfrage und der Saisonalität (Hochzeits- und Festivalsaison in Indien läuft an) aber begrenzt ausfallen. Die nächsten Tage werden sicherlich noch Chancen bereithalten, in Gold und Goldaktien zu kommen, doch sie werden wahrscheinlich nicht sehr zahlreich sein.

Weitere Details und konkrete Handelsempfehlungen zu Gold(aktien) und Silber(aktien) finden interessierte Leser in unseren börsentäglichen Publikationen und in unseren aktuellen Strategiepapieren zu Gold und Silber sowie im Gold- und Silberaktienjournal. Diese können unter RohstoffJournal.de angefordert werden.

© Marcel Torney

www.rohstoffjournal.de

Baumwolle: Chinesische Importe steigen

von Tomke Hansmann

Freitag 16.09.2011, 17:46 Uhr

Frankfurt (BoerseGo.de) – Baumwolle gibt zum Wochenschluss leicht nach. Der am 26. Juli am Tief bei 93,61 aufgenommene Aufwärtstrend ist jedoch nach wie vor intakt. Gegen 17:45 Uhr MESZ notiert Baumwolle bei 109,91.

Die chinesischen Baumwollimporte sind im August um 13,8 Prozent auf 207.000 Tonnen gestiegen. „Eine üppige Ernte in Indien kann zwar die Liefersituation entspannen. Wir glauben aber, dass der Baumwollpreis auf dem gegenwärtigen Niveau durch eine robuste Nachfrage und eine schwächere Ernte beim Top-Exporteur USA gut unterstützt wird“, schreiben die Rohstoffanalysten der Commerzbank in ihrem heutigen „TagesInfo Rohstoffe“.

von Tomke Hansmann

Freitag 16.09.2011, 17:46 Uhr

Frankfurt (BoerseGo.de) – Baumwolle gibt zum Wochenschluss leicht nach. Der am 26. Juli am Tief bei 93,61 aufgenommene Aufwärtstrend ist jedoch nach wie vor intakt. Gegen 17:45 Uhr MESZ notiert Baumwolle bei 109,91.

Die chinesischen Baumwollimporte sind im August um 13,8 Prozent auf 207.000 Tonnen gestiegen. „Eine üppige Ernte in Indien kann zwar die Liefersituation entspannen. Wir glauben aber, dass der Baumwollpreis auf dem gegenwärtigen Niveau durch eine robuste Nachfrage und eine schwächere Ernte beim Top-Exporteur USA gut unterstützt wird“, schreiben die Rohstoffanalysten der Commerzbank in ihrem heutigen „TagesInfo Rohstoffe“.

ITH und SBB beide fast gleichzeitig mit heftigem schlussspurt mit hohen umsätzen. :shock:

September 16, 2011 08:00 ET

Apogee to Acquire the Balance of its Chilean Venture

TORONTO, ONTARIO--(Marketwire - Sept. 16, 2011) - Apogee Silver Ltd. ("Apogee" or the "Company") (TSX VENTURE:APE) provides the following update with respect to its agreement with Valencia Ventures Inc. ("Valencia"). Further to previous news releases issued by the Company (October 5, 2009 and December 21, 2010), the parties have now agreed that Apogee will purchase all of Valencia's participating interest in Compania Minera Valencia Ventures – Chile Limitada ("Compania Minera"). Compania Minera holds Valencia's entire 80% participation interest in each of the Cachinal Property and the Nueva Juncal Silver Property, both located in northern Chile, (Figure 1), for an aggregate purchase price of $500,000 in cash and 3,000,000 common shares of Apogee.

Cachinal Property

The Cachinal property is an advanced silver property hosting mineral resources supported by a Technical Report that is compliant with the requirements of Canadian National Instrument NI 43-101, filed by Apogee on February 9, 2010. The resource contains 18.41 million ounces of silver in the indicated resource category and an additional 3.02 million ounces of silver in the inferred resource category (see table below and refer to technical report filed on SEDAR). The Cachinal deposit is a low-sulfidation epithermal system which has had past production of 32 million ounces of silver. Apogee believes there is good potential to expand the estimated resource.

Table 1 Mineral Resource Statement for the Cachinal Silver Deposit, Chile, SRK Consulting, March 4, 2008.

.

.

.

http://www.marketwire.com/press-release/apogee-to-acquire-the-balance-of-its-chilean-venture-tsx-venture-ape-1562022.htm

Apogee to Acquire the Balance of its Chilean Venture

TORONTO, ONTARIO--(Marketwire - Sept. 16, 2011) - Apogee Silver Ltd. ("Apogee" or the "Company") (TSX VENTURE:APE) provides the following update with respect to its agreement with Valencia Ventures Inc. ("Valencia"). Further to previous news releases issued by the Company (October 5, 2009 and December 21, 2010), the parties have now agreed that Apogee will purchase all of Valencia's participating interest in Compania Minera Valencia Ventures – Chile Limitada ("Compania Minera"). Compania Minera holds Valencia's entire 80% participation interest in each of the Cachinal Property and the Nueva Juncal Silver Property, both located in northern Chile, (Figure 1), for an aggregate purchase price of $500,000 in cash and 3,000,000 common shares of Apogee.

Cachinal Property

The Cachinal property is an advanced silver property hosting mineral resources supported by a Technical Report that is compliant with the requirements of Canadian National Instrument NI 43-101, filed by Apogee on February 9, 2010. The resource contains 18.41 million ounces of silver in the indicated resource category and an additional 3.02 million ounces of silver in the inferred resource category (see table below and refer to technical report filed on SEDAR). The Cachinal deposit is a low-sulfidation epithermal system which has had past production of 32 million ounces of silver. Apogee believes there is good potential to expand the estimated resource.

Table 1 Mineral Resource Statement for the Cachinal Silver Deposit, Chile, SRK Consulting, March 4, 2008.

.

.

.

http://www.marketwire.com/press-release/apogee-to-acquire-the-balance-of-its-chilean-venture-tsx-venture-ape-1562022.htm

September 16, 2011 09:30 ET

Opawica (TSX VENTURE:OPW) Intersects Significant Gold and Copper Mineralization From Complete Results From Two Separate Holes in Maybrun Zone and New Footwall Zone, Rainy River Area, Ont.

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Sept. 16, 2011) - Opawica Explorations Inc. (TSX VENTURE:OPW) (the "Company" / "Opawica") announces that further to partial assays released on August 11, 2011 the Company has intersected further significant gold and copper mineralization in the first two holes of the current drill program at its 100% owned Atikwa Lake property southeast of Kenora, Ontario. Complete assay results for all of these first two holes are outlined in the table below along with assays from the third hole (AT-11-03) of the current program which was drilled about 900m north of the first two holes. Assays are pending for the fourth hole of the program which is hole AT-11-04.

Assay Results Received For Opawica 2011 Drilling — Atikwa Lake Property (New and Complete assay results)

.

.

.

http://www.marketwire.com/press-release/opawica-tsx-venture-opw-intersects-significant-gold-copper-mineralization-from-complete-tsx-venture-opw-1562097.htm

Opawica (TSX VENTURE:OPW) Intersects Significant Gold and Copper Mineralization From Complete Results From Two Separate Holes in Maybrun Zone and New Footwall Zone, Rainy River Area, Ont.

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Sept. 16, 2011) - Opawica Explorations Inc. (TSX VENTURE:OPW) (the "Company" / "Opawica") announces that further to partial assays released on August 11, 2011 the Company has intersected further significant gold and copper mineralization in the first two holes of the current drill program at its 100% owned Atikwa Lake property southeast of Kenora, Ontario. Complete assay results for all of these first two holes are outlined in the table below along with assays from the third hole (AT-11-03) of the current program which was drilled about 900m north of the first two holes. Assays are pending for the fourth hole of the program which is hole AT-11-04.

Assay Results Received For Opawica 2011 Drilling — Atikwa Lake Property (New and Complete assay results)

.

.

.

http://www.marketwire.com/press-release/opawica-tsx-venture-opw-intersects-significant-gold-copper-mineralization-from-complete-tsx-venture-opw-1562097.htm

African Gold President Mike Nikiforuk on Mali assays of 1.02 g/t gold over 52m

African Gold Group Inc TSXV:AGG announced results from its Kobada Gold Project in Mali. Highlights include 1.02 g/t gold over 52 metres (including 10.14 g/t over 1 metre), 3.08 g/t over 14 metres (including 25.44 g/t over 1 metre), 0.77 g/t over 47 metres, 1.56 g/t over 24 metres (including 17.52 g/t over 1 metre), 0.9 g/t over 35 metres and 6.99 g/t over 3 metres (including 19.08 g/t over 1 metre).

President/Director Mike Nikiforuk tells ResourceClips.com, “We think the news is most encouraging. The simple fact of the matter is, as we compile and analyze the results, we are seeing a corridor evolve that is approximately 100-linear metres in width. Our program is focused entirely on the oxide profile which averages 100-vertical metres from surface, and you can see that several of these holes have ended in mineralization, so our depth potential remains open. To move 600 metres and be in mineralization is most encouraging. As we move south and north along strike the object of the exercise is to ultimately expand the extent of mineralization which would impact on the extent of tonnage and therefore ounces.

“We want to emphasize that those lines that were drilled were roughly 200 metres apart, so this is a fairly wide step-out. We’re probing here. We don’t know if we’re going to be successful, but we know we’re spending money. We’re not going to drill on a tight grid and increase that burden without knowing that the mineralization is there. So it is exceedingly rewarding to still be encountering this extent of mineralization so far away from the known deposit. One of the things that we attempted to convey in the corrected release this morning was that those holes should not be viewed in isolation. They are part of a larger package of holes, and there will be further holes coming from that same region. However, we were getting a very clear sense that the market was getting frustrated with our lack of follow-up drill holes, so we put out what we had.

“When we started with this project in 2006,” Nikiforuk continues, “we had a known strike length of 1.1 kilometres. We just published a preliminary economic assessment July 13, and that resource is calculated over 1.7 kilometres: an increase of 600 metres. The focus shifted from the initial resource of a deeper fresh-rock resource to primarily an oxide resource. The first resource went to a depth of 260 vertical metres. This resource is now to a depth of only 160 metres. The reason we did that is because there are troughs within the deposit that are in oxide as deep as 160 metres. So we’re quite excited about the project’s potential to grow. We just have no doubt in our minds that the project has the ability to grow.

“We announced in our August 23 press release that the Minister of Mines for Mali has granted us a one-year extension to complete our feasibility study. Based on the positive PEA, the feasibility process is underway. Bumigeme Inc—the engineering group who did the PEA—has been engaged to prepare the feasibility. Roche Ltd is going to be involved in the preparation of the environmental study and the mine planning. Through the engineering groups we will be speaking with rePlan to commence the move into the village and things of that nature.

“There is a bit of a reprieve in the work initiative for weather conditions—which is an annual event that hits all of West Africa. We closed camp on July 27 for the annual rains. Our senior geologists will be departing Toronto October 19 to get back to Mali. So we will be resuming late October, early November, depending on access and so forth. We have a second drill rig planned to come on site in January 2012. One rig will be dedicated to geotechnical drilling, the other rig will continue with the exploration initiative. But the goal is to push this thing through feasibility and have that study on the minister’s desk on or about June 2012 with an application for an exploitation or mining license.

“I think I can state with a great degree of confidence that we should be breaking ground not more than 30 months from today. I would venture that we can improve on that; that is the goal. I just want to be reasonably conservative now, because it is a target that is a bit out there, and there are things that need to be done. But I think 30 months is at the outside of that time frame.”

Nikiforuk concludes, “One thing that’s incredibly important to the entire process moving forward is that we are contracting to bring in a pilot plant that will be capable of processing up to one tonne per hour. Our goal is to increase the diameter of the RC holes that we are drilling to generate up to 100 kilograms of material per metre drilled. So we will hive off two kilograms of that for lab analysis using LeachWELL as the protocol, and the balance of 98 kilograms will be processed through the pilot plant. We are contending that the larger the sample size—the larger the aliquot that’s being processed—the higher the grade. This is a nuggety deposit. All the work we’ve done to date clearly indicates that if you are analyzing a bigger sample, you have a better shot at capturing that nugget effect, and your grade will go up. When we announced the PEA we said this is a bulk-mining model, and everything in the mineralized corridor is going through the gravity plant, even that which is defined currently as waste. Because we do not believe it is waste.”

by Greg Klein and Ted Niles

This article was posted by Ted Niles on Friday, September 16th, 2011 at 12:12 pm.

Quelle: http://resourceclips.com/2011/09/16/african-gold-president-mike-nikiforuk-on-mali-assays-of-1-02-gt-gold-over-52m/

African Gold Group Inc TSXV:AGG announced results from its Kobada Gold Project in Mali. Highlights include 1.02 g/t gold over 52 metres (including 10.14 g/t over 1 metre), 3.08 g/t over 14 metres (including 25.44 g/t over 1 metre), 0.77 g/t over 47 metres, 1.56 g/t over 24 metres (including 17.52 g/t over 1 metre), 0.9 g/t over 35 metres and 6.99 g/t over 3 metres (including 19.08 g/t over 1 metre).

President/Director Mike Nikiforuk tells ResourceClips.com, “We think the news is most encouraging. The simple fact of the matter is, as we compile and analyze the results, we are seeing a corridor evolve that is approximately 100-linear metres in width. Our program is focused entirely on the oxide profile which averages 100-vertical metres from surface, and you can see that several of these holes have ended in mineralization, so our depth potential remains open. To move 600 metres and be in mineralization is most encouraging. As we move south and north along strike the object of the exercise is to ultimately expand the extent of mineralization which would impact on the extent of tonnage and therefore ounces.

“We want to emphasize that those lines that were drilled were roughly 200 metres apart, so this is a fairly wide step-out. We’re probing here. We don’t know if we’re going to be successful, but we know we’re spending money. We’re not going to drill on a tight grid and increase that burden without knowing that the mineralization is there. So it is exceedingly rewarding to still be encountering this extent of mineralization so far away from the known deposit. One of the things that we attempted to convey in the corrected release this morning was that those holes should not be viewed in isolation. They are part of a larger package of holes, and there will be further holes coming from that same region. However, we were getting a very clear sense that the market was getting frustrated with our lack of follow-up drill holes, so we put out what we had.

“When we started with this project in 2006,” Nikiforuk continues, “we had a known strike length of 1.1 kilometres. We just published a preliminary economic assessment July 13, and that resource is calculated over 1.7 kilometres: an increase of 600 metres. The focus shifted from the initial resource of a deeper fresh-rock resource to primarily an oxide resource. The first resource went to a depth of 260 vertical metres. This resource is now to a depth of only 160 metres. The reason we did that is because there are troughs within the deposit that are in oxide as deep as 160 metres. So we’re quite excited about the project’s potential to grow. We just have no doubt in our minds that the project has the ability to grow.

“We announced in our August 23 press release that the Minister of Mines for Mali has granted us a one-year extension to complete our feasibility study. Based on the positive PEA, the feasibility process is underway. Bumigeme Inc—the engineering group who did the PEA—has been engaged to prepare the feasibility. Roche Ltd is going to be involved in the preparation of the environmental study and the mine planning. Through the engineering groups we will be speaking with rePlan to commence the move into the village and things of that nature.

“There is a bit of a reprieve in the work initiative for weather conditions—which is an annual event that hits all of West Africa. We closed camp on July 27 for the annual rains. Our senior geologists will be departing Toronto October 19 to get back to Mali. So we will be resuming late October, early November, depending on access and so forth. We have a second drill rig planned to come on site in January 2012. One rig will be dedicated to geotechnical drilling, the other rig will continue with the exploration initiative. But the goal is to push this thing through feasibility and have that study on the minister’s desk on or about June 2012 with an application for an exploitation or mining license.

“I think I can state with a great degree of confidence that we should be breaking ground not more than 30 months from today. I would venture that we can improve on that; that is the goal. I just want to be reasonably conservative now, because it is a target that is a bit out there, and there are things that need to be done. But I think 30 months is at the outside of that time frame.”

Nikiforuk concludes, “One thing that’s incredibly important to the entire process moving forward is that we are contracting to bring in a pilot plant that will be capable of processing up to one tonne per hour. Our goal is to increase the diameter of the RC holes that we are drilling to generate up to 100 kilograms of material per metre drilled. So we will hive off two kilograms of that for lab analysis using LeachWELL as the protocol, and the balance of 98 kilograms will be processed through the pilot plant. We are contending that the larger the sample size—the larger the aliquot that’s being processed—the higher the grade. This is a nuggety deposit. All the work we’ve done to date clearly indicates that if you are analyzing a bigger sample, you have a better shot at capturing that nugget effect, and your grade will go up. When we announced the PEA we said this is a bulk-mining model, and everything in the mineralized corridor is going through the gravity plant, even that which is defined currently as waste. Because we do not believe it is waste.”

by Greg Klein and Ted Niles

This article was posted by Ted Niles on Friday, September 16th, 2011 at 12:12 pm.

Quelle: http://resourceclips.com/2011/09/16/african-gold-president-mike-nikiforuk-on-mali-assays-of-1-02-gt-gold-over-52m/

[url=http://peketec.de/trading/viewtopic.php?p=1141454#1141454 schrieb:CCG-Redaktion schrieb am 14.09.2011, 15:05 Uhr[/url]"]Unser Tradingdepot-Wert AGG mit News:

September 14, 2011 09:00 ET

African Gold Group, Inc. Southern Step-Out Hole KBRC11-043 Intercepts 52 Meters at 1.02 g/t Au. Step-Out Drilling Extends Gold Mineralization A Further 600 Meters South of Zone 1 Resource

TORONTO, ONTARIO--(Marketwire - Sept. 14, 2011) - African Gold Group, Inc., (TSX VENTURE:AGG)("AGG" or the "Company") is pleased to report the analytical results for 38 near surface (oxide), reverse circulation (RC), step-out drill holes. All 38 step-out drill holes being reported in this release represent step-out drilling to the south of AGG's Zone 1, 43-101 resources estimate. All southern step-out holes, reported in this release, were collared between section 2700S and section 3400S. Step-out holes drilled on Section 3400S, represent the most southerly collared holes being reported in this release and are situated approximately 600 meters south of the Zone 1, 43-101 inferred resources estimate. Step-out drilling was patterned on widely spaced lines that measured approximately 200 meters apart with the sole objective of determining if gold mineralization continued beyond section 2800S, the most southern extent or border of the current 43-101 resources estimate.

Near Surface (Oxide) Drill Highlights Include:

KBRC11-043: 52 m at 1.02 g/t Au, incl 1 m at 10.14 g/t Au and 1 m at 10.96 g/t Au, ended in mineralization

KBRC11-103: 24 m at 1.56 g/t Au, incl 1 m at 17.52 g/t Au, ended in mineralization

KBRC11-045: 47 m at 0.77 g/t Au

KBRC11-055: 35 m at 0.9 g/t Au, ended in mineralization,

KBRC11-056: 18 m at 1.18 g/t Au, incl 1 m at 13.16 g/t Au, hole ended in mineralization

KBRC11-058: 21 m at 0.7 g/t Au

KBRC11-059: 14 m at 3.08, incl 1 m at 25.44 g/t Au, hole ended in mineralization

Please activate the link to view drill collar and trace for Section 2800S area plan map:

http://media3.marketwire.com/docs/913aggmap.pdf

The assay results depicting the 38 near surface, (oxide) southern step-out RC holes are listed in Table 1 below:

.

.

.

http://www.marketwire.com/press-release/african-gold-group-inc-southern-step-out-hole-kbrc11-043-intercepts-52-meters-102-g-tsx-venture-agg-1560953.htm

Continental Gold Ltd.: Kaufempfehlung von Dundee Capital Markets

Continental Gold Ltd. Continental Gold Limited gab jüngst die erste Ressourcenschätzungen für das Buriticá-Projekts in Kolumbien bekannt. Die Ressource wird auf 3,1 Mio. oz Gold geschätzt: gemessene und angezeigte Ressourcen von 630.000 oz Gold und abgeleitete Ressourcen von 2,5 Mio. oz Gold.

Die Ressource liegt im oberen Bereich der Schätzung von Dundee Capital Markets, die bei 2,5 - 3 Mio. oz gelegen hatte. Zudem erfolgte die Veröffentlichung drei bis vier Monate früher als im Zeitplan vorgesehen.

Die Analysten sehen diese Ressourcenschätzung als sehr positiven Meilenstein in der potenziellen Entwicklung von Buriticá in eine hochgradige Untergrundmine. Zudem glauben sie, dass die Ressource durch weitere Bohrungen mittelfristig auf über 5 Mio. oz Gold erweitert werden kann.

Dundee empfiehlt Continental Gold weiterhin zum Kauf.

© Redaktion MinenPortal.de

Redaktion, 17.09.11 - 11:01 Uhr

Continental Gold Ltd. Continental Gold Limited gab jüngst die erste Ressourcenschätzungen für das Buriticá-Projekts in Kolumbien bekannt. Die Ressource wird auf 3,1 Mio. oz Gold geschätzt: gemessene und angezeigte Ressourcen von 630.000 oz Gold und abgeleitete Ressourcen von 2,5 Mio. oz Gold.

Die Ressource liegt im oberen Bereich der Schätzung von Dundee Capital Markets, die bei 2,5 - 3 Mio. oz gelegen hatte. Zudem erfolgte die Veröffentlichung drei bis vier Monate früher als im Zeitplan vorgesehen.

Die Analysten sehen diese Ressourcenschätzung als sehr positiven Meilenstein in der potenziellen Entwicklung von Buriticá in eine hochgradige Untergrundmine. Zudem glauben sie, dass die Ressource durch weitere Bohrungen mittelfristig auf über 5 Mio. oz Gold erweitert werden kann.

Dundee empfiehlt Continental Gold weiterhin zum Kauf.

© Redaktion MinenPortal.de

Redaktion, 17.09.11 - 11:01 Uhr

2 Stocks For Rising Silver Prices

September 17, 2011 | includes: AXU, FVITF.PK, GPL, PSLV, SLV, SLW

In my previous article on silver, I highlighted silver's schizophrenic personality: it is both an industrial commodity and a monetary asset. This dual role makes it a trickier commodity to trade because it responds to conflicting market events. However, I've identified two scenarios that, if combined, should be bullish for silver prices going forward.

The Perfect Storm for Silver Prices

1) The North Atlantic Central Banks Keeps Printing Money

The North Atlantic Economies (Europe and the United States) are far from getting their financial houses in order. With several European countries on the brink of an economic meltdown, the central banks are throwing everything they can to prevent such a catastrophic event. This includes putting the printing presses on overdrive.

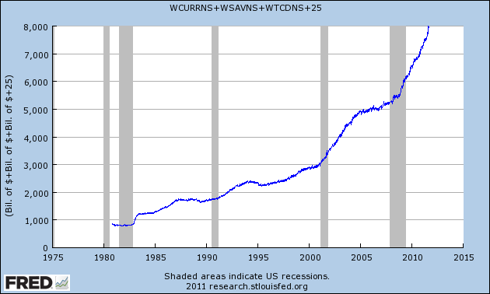

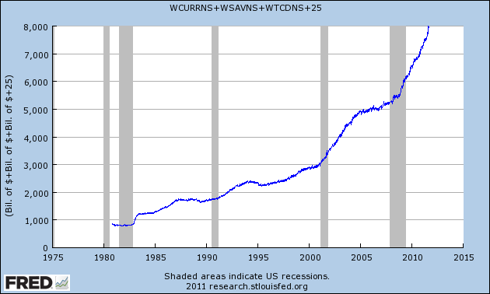

Total Money Supply in the United States. Source: The Federal Reserve of St Louis (Thanks to hyperinflation for sharing)

Both the Federal Reserve and the European Central Bank seem to have an insatiable appetite to keep printing money, as can be seen by the Fed's increase in total money supply in recent years. This increase in money supply is directly correlated to increases in precious metals, specifically gold and silver, as investors seek hard assets from these inflationary pressures.

Therefore, if the central banks in the North Atlantic economies keep a loose monetary policy, that is bullish for silver (and gold) as investors seek to protect themselves from inflation.

2) Asian Economic Growth and Industrial Demand Continues

The majority of silver demand (51%) comes from industrial applications. Of this quadrant, demand from Asian economies (particularly Chindia) is a main driver, with estimates varying from 40%-60% of total industrial demand. If Asian economies don't fall into a recession and maintain their growth (as is expected), that is another bullish sign for silver.

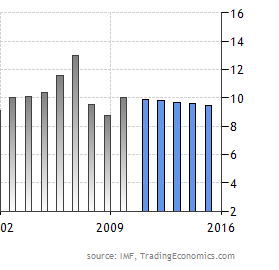

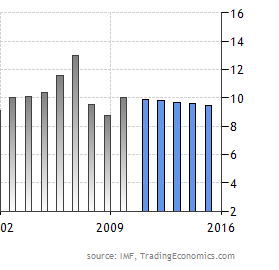

Chinese Percentage GDP Growth in Constant Prices

The IMF predicts Chinese GDP to remain within a 9-10% range over the next 5 years. While China won't determine silver prices, Asian industrial growth in general--and Chinese growth in particular--will provide major support for silver prices going forward.

Top Recommendations for Rising Silver Prices

1) Silver Wheaton

One of my favorite names in the silver space remains Silver Wheaton (NYSE: SLW). SLW is a certifiable cash cow. Part mining company, part bank, its modus operandi is to help mining operators finance large-scale projects. In exchange for an upfront cash payment, SLW buys the right to purchase the mine's silver output at a fixed price of $4/ounce for the life of the mine.

With no additional capital cost, SLW is able to generate tremendous amounts of cash flow since its costs are fixed at $4/ounce. Everything above that flows to the company's bottom line. That's how it's able to generate operating margins of 77%! While it's not a bargain right now at $40 I believe its long-term prospects are bright. If it dips to $35-37/share it's a good buy in my opinion.

2) Fortuna Silver Mines

It's no secret that the biggest silver producers out there are Mexico and Peru. Fortuna Silver Mines (FVITF.PK)--soon to be uplsited to the NYSE (09/19/2011) under the symbol FSM--has two quality silver assets in both countries: the Caylomma mine in Peru is already producing and has over 4.1 million ounces of Proven & Probable Reserves (including some gold); and the San Jose mine in Mexico with 3.7 million ounces PPR.

Since cash costs are extremely low, coming in at about $4/ounce, Fortuna is able to generate operating margins above 40% (YTD figures). And I expect future value generation to come from an aggressive exploration program: Fortuna owns 12,000 hectares in one of the richest metal deposit areas in Peru. Exploration is already underway, and I expect a big boost for the stock price if large deposits are discovered. The common is already up 101% yoy and I expect even more upside, especially if Asian industry keeps growing and Western central bankers keep printing money.

I'm also keeping my eye on Alexco Resources (AMEX: AXU) which has operations in the Canadian Yukon, and Great Panther Silver (AMEX:GPL) which has some great assets in Mexico.

Of course, outside of equities you can always invest in the ETFs: the iShares Silver Trust (SLV) and the Sprott Physical Silver Trust (PSLV).

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in FVITF.PK, AXU, GPL over the next 72 hours.

Quelle: http://seekingalpha.com/article/294235-2-stocks-for-rising-silver-prices?

September 17, 2011 | includes: AXU, FVITF.PK, GPL, PSLV, SLV, SLW

In my previous article on silver, I highlighted silver's schizophrenic personality: it is both an industrial commodity and a monetary asset. This dual role makes it a trickier commodity to trade because it responds to conflicting market events. However, I've identified two scenarios that, if combined, should be bullish for silver prices going forward.

The Perfect Storm for Silver Prices

1) The North Atlantic Central Banks Keeps Printing Money

The North Atlantic Economies (Europe and the United States) are far from getting their financial houses in order. With several European countries on the brink of an economic meltdown, the central banks are throwing everything they can to prevent such a catastrophic event. This includes putting the printing presses on overdrive.

Total Money Supply in the United States. Source: The Federal Reserve of St Louis (Thanks to hyperinflation for sharing)

Both the Federal Reserve and the European Central Bank seem to have an insatiable appetite to keep printing money, as can be seen by the Fed's increase in total money supply in recent years. This increase in money supply is directly correlated to increases in precious metals, specifically gold and silver, as investors seek hard assets from these inflationary pressures.

Therefore, if the central banks in the North Atlantic economies keep a loose monetary policy, that is bullish for silver (and gold) as investors seek to protect themselves from inflation.

2) Asian Economic Growth and Industrial Demand Continues

The majority of silver demand (51%) comes from industrial applications. Of this quadrant, demand from Asian economies (particularly Chindia) is a main driver, with estimates varying from 40%-60% of total industrial demand. If Asian economies don't fall into a recession and maintain their growth (as is expected), that is another bullish sign for silver.

Chinese Percentage GDP Growth in Constant Prices

The IMF predicts Chinese GDP to remain within a 9-10% range over the next 5 years. While China won't determine silver prices, Asian industrial growth in general--and Chinese growth in particular--will provide major support for silver prices going forward.

Top Recommendations for Rising Silver Prices

1) Silver Wheaton

One of my favorite names in the silver space remains Silver Wheaton (NYSE: SLW). SLW is a certifiable cash cow. Part mining company, part bank, its modus operandi is to help mining operators finance large-scale projects. In exchange for an upfront cash payment, SLW buys the right to purchase the mine's silver output at a fixed price of $4/ounce for the life of the mine.

With no additional capital cost, SLW is able to generate tremendous amounts of cash flow since its costs are fixed at $4/ounce. Everything above that flows to the company's bottom line. That's how it's able to generate operating margins of 77%! While it's not a bargain right now at $40 I believe its long-term prospects are bright. If it dips to $35-37/share it's a good buy in my opinion.

2) Fortuna Silver Mines

It's no secret that the biggest silver producers out there are Mexico and Peru. Fortuna Silver Mines (FVITF.PK)--soon to be uplsited to the NYSE (09/19/2011) under the symbol FSM--has two quality silver assets in both countries: the Caylomma mine in Peru is already producing and has over 4.1 million ounces of Proven & Probable Reserves (including some gold); and the San Jose mine in Mexico with 3.7 million ounces PPR.

Since cash costs are extremely low, coming in at about $4/ounce, Fortuna is able to generate operating margins above 40% (YTD figures). And I expect future value generation to come from an aggressive exploration program: Fortuna owns 12,000 hectares in one of the richest metal deposit areas in Peru. Exploration is already underway, and I expect a big boost for the stock price if large deposits are discovered. The common is already up 101% yoy and I expect even more upside, especially if Asian industry keeps growing and Western central bankers keep printing money.

I'm also keeping my eye on Alexco Resources (AMEX: AXU) which has operations in the Canadian Yukon, and Great Panther Silver (AMEX:GPL) which has some great assets in Mexico.

Of course, outside of equities you can always invest in the ETFs: the iShares Silver Trust (SLV) and the Sprott Physical Silver Trust (PSLV).

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in FVITF.PK, AXU, GPL over the next 72 hours.

Quelle: http://seekingalpha.com/article/294235-2-stocks-for-rising-silver-prices?

So ein hohes Volumen wie gestern dürfte es bei SLW noch niemals zuvor gegeben haben...krass!

SLX mit Kaufsignal im MACD!

Könnte Montag weiterlaufen...

Könnte Montag weiterlaufen...

Dale Mah: Gold Companies to Watch from the Yukon to Colombia

Source: Brian Sylvester of The Gold Report (9/16/11)

From the Yukon to Colombia, with stops in Nevada and Mexico, Dale Mah, an equity research analyst

with Mackie Research, covers the map looking for exciting exploration plays. Mah, a trained geologist

with 14 years of experience, shares his calculations and insights into how early-stage exploration plays

can be safe and satisfying in this exclusive Gold Report interview..

http://www.theaureport.com/pub/na/10915

Source: Brian Sylvester of The Gold Report (9/16/11)

From the Yukon to Colombia, with stops in Nevada and Mexico, Dale Mah, an equity research analyst

with Mackie Research, covers the map looking for exciting exploration plays. Mah, a trained geologist

with 14 years of experience, shares his calculations and insights into how early-stage exploration plays

can be safe and satisfying in this exclusive Gold Report interview..

http://www.theaureport.com/pub/na/10915

Mickey Fulp: Looking Past the Summer Uranium Doldrums

Source: JT Long of The Energy Report (9/15/11)

There have been few catalysts driving uranium stocks this summer. But Mickey Fulp, the "Mercenary

Geologist," believes that this market funk resembles the period that preceded one of the best junior

resource bull markets ever seen. In this exclusive interview with The Energy Report, Fulp tells us why

he's "hopefully optimistic" about the coming months..

http://www.theenergyreport.com/pub/na/10852

Source: JT Long of The Energy Report (9/15/11)

There have been few catalysts driving uranium stocks this summer. But Mickey Fulp, the "Mercenary

Geologist," believes that this market funk resembles the period that preceded one of the best junior

resource bull markets ever seen. In this exclusive interview with The Energy Report, Fulp tells us why

he's "hopefully optimistic" about the coming months..

http://www.theenergyreport.com/pub/na/10852