App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

Wie gewonnen, so zerronnen

http://www.rohstoff-welt.de/news/artikel.php?sid=30348#Wie-gewonnen-2C-so-zerronnen

http://www.rohstoff-welt.de/news/artikel.php?sid=30348#Wie-gewonnen-2C-so-zerronnen

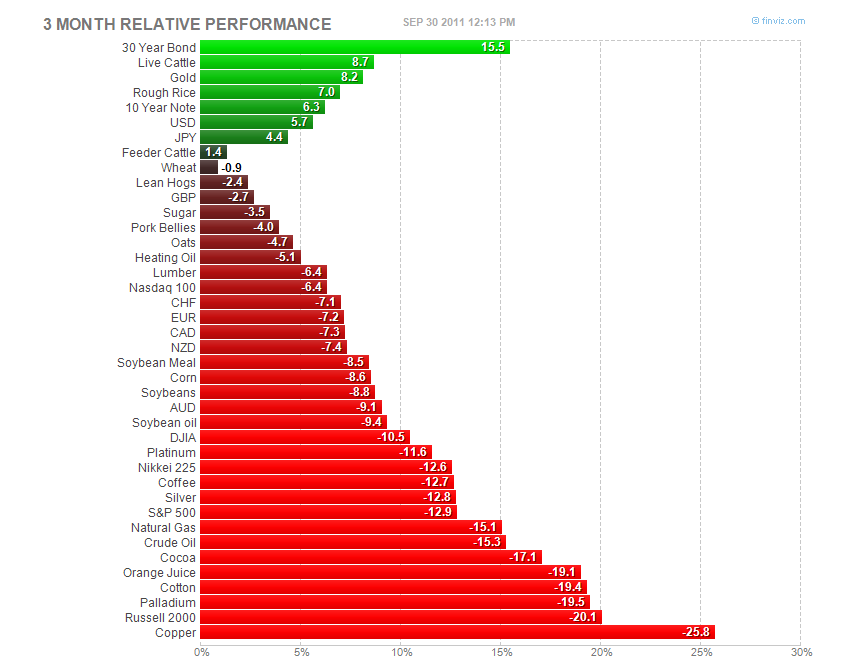

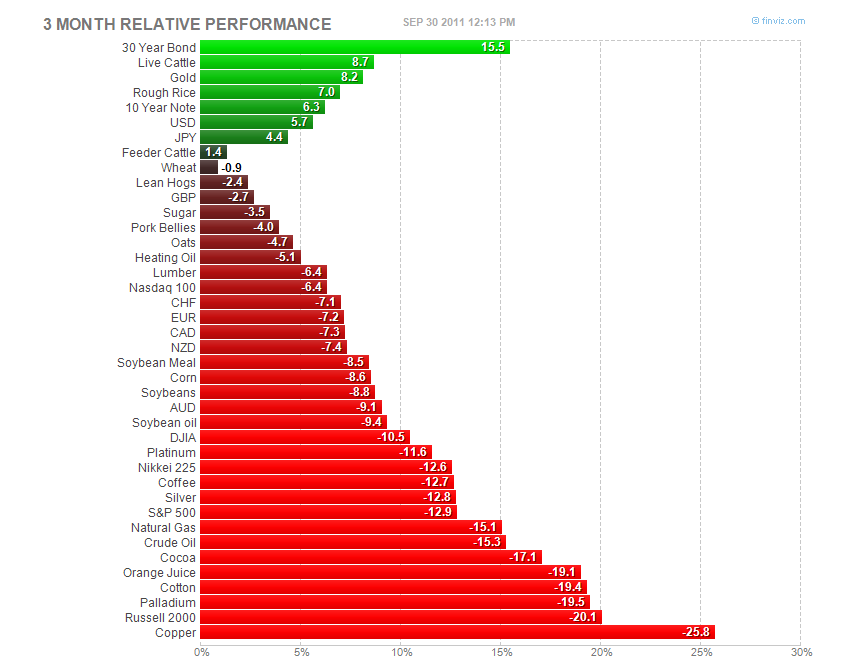

Q3 A Horror Show For Commodities

While the S&P 500 (SPY) is down low double digits for the quarter, the real damage was elsewhere.

Small caps have been obliterated, as the Russell 2000 is down well over 20%, and commodities have

simply been decimated. Below is the quarterly performance in the group with a few hours to go. You

eeked out some small gains in gold and ...err, rough rice and live cattle. Otherwise, it's a sea of

double digit red.

While the S&P 500 (SPY) is down low double digits for the quarter, the real damage was elsewhere.

Small caps have been obliterated, as the Russell 2000 is down well over 20%, and commodities have

simply been decimated. Below is the quarterly performance in the group with a few hours to go. You

eeked out some small gains in gold and ...err, rough rice and live cattle. Otherwise, it's a sea of

double digit red.

Medium Rare

Friday’s market action in precious metals got off to a bit of a mixed and rocky start as the US dollar

continued its ascent on the trade-weighted index and as traders began to square books and close the

trading logs on a quarter that will still go down in the record books as the worst one since 2008. The

yellow metal has lost about 11% on the month in a negative performance reminiscent of October of

that somber year..

http://www.kitco.com/ind/Nadler/sep302011.html

Friday’s market action in precious metals got off to a bit of a mixed and rocky start as the US dollar

continued its ascent on the trade-weighted index and as traders began to square books and close the

trading logs on a quarter that will still go down in the record books as the worst one since 2008. The

yellow metal has lost about 11% on the month in a negative performance reminiscent of October of

that somber year..

http://www.kitco.com/ind/Nadler/sep302011.html

US-Benzinnachfrage auf 11-Jahrestief gefallen

http://www.rohstoff-welt.de/news/artikel.php?sid=30383#US-Benzinnachfrage-auf-11-Jahrestief-gefallen

http://www.rohstoff-welt.de/news/artikel.php?sid=30383#US-Benzinnachfrage-auf-11-Jahrestief-gefallen

It's Time To Buy Gold At Its 'V' Market Bottom

http://seekingalpha.com/article/296890-it-s-time-to-buy-gold-at-its-v-market-bottom

http://seekingalpha.com/article/296890-it-s-time-to-buy-gold-at-its-v-market-bottom

Gold wurde diese Woche exakt zur unteren Trendkanallinie im Cluster mit der EMA 50 verkauft und traf dort wieder verstärkt auf Käufer, welche für ein intraweek-​Reversal mit Hammer-​Charakter sorgen. Ein nächstes Ziel aus diesem Kaufsignal lässt sich vorerst bei 1.702 Dollar finden und beim Break darüber an der inneren gestrichelten Kanallinie.

http://chartsandtrades.de/

http://chartsandtrades.de/

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Gold startet heute morgen positiv...

Thema: Eisenerzproduzenten Vale und Rio Tinto erwarten ein weiterhin stabiles Geschäft

Emfis News Am: 30.09.2011 18:38:03 Gelesen: 14 # 1 @

Melbourne/ Peking/ Rio de Janeiro 30.09.2011 (<a href="http://www.emfis.com/">;http://www.emfis.com</a>) Die weltweit größten Eisenerzproduzenten sehen keine Verlangsamung der Exporte. Jedoch sitze China bereits auf erheblichen Beständen.

Wie Manager von brasiliens Vale und der britisch-australischen Rio Tinto mitteilten, seien die Orderbücher für Eisenerz immer noch prall gefüllt. Es gebe keine Stornierungen oder Anfragen, die Lieferungen später auszuführen. Jedoch sehe man die weltwirtschaftliche Abschwächung wohl als bedeutend an. Auch der Rückgang des Eisenerzpreises im September von beinahe fünf Prozent sei als auffällig registriert worden. Noch bestehe aber kein Anlaß zur Sorge. Auch ein Sprecher von Fortescue Metals fügte hinzu, einen weiterhin stabilen Geschäftsverlauf vorweisen zu können.

China hat bereits Vorräte für fünf Wochen

Wie zudem weiterhin von dem Vize-Vorsitzenden der chinesischen Eisen- und Stahlvereinigung, Zhang Changfu, mitgeteilt wurde, würden chinesische Stahlproduzenten eventuell in naher Zukunft die Importe von Eisenerz verringern, sollte die Auftragslage sich nicht wieder verbessern. China habe bereits hohe Lagervorräte aufgebaut, die nun schon für 35 Produktionstage ausreichen würden.

Emfis News Am: 30.09.2011 18:38:03 Gelesen: 14 # 1 @

Melbourne/ Peking/ Rio de Janeiro 30.09.2011 (<a href="http://www.emfis.com/">;http://www.emfis.com</a>) Die weltweit größten Eisenerzproduzenten sehen keine Verlangsamung der Exporte. Jedoch sitze China bereits auf erheblichen Beständen.

Wie Manager von brasiliens Vale und der britisch-australischen Rio Tinto mitteilten, seien die Orderbücher für Eisenerz immer noch prall gefüllt. Es gebe keine Stornierungen oder Anfragen, die Lieferungen später auszuführen. Jedoch sehe man die weltwirtschaftliche Abschwächung wohl als bedeutend an. Auch der Rückgang des Eisenerzpreises im September von beinahe fünf Prozent sei als auffällig registriert worden. Noch bestehe aber kein Anlaß zur Sorge. Auch ein Sprecher von Fortescue Metals fügte hinzu, einen weiterhin stabilen Geschäftsverlauf vorweisen zu können.

China hat bereits Vorräte für fünf Wochen

Wie zudem weiterhin von dem Vize-Vorsitzenden der chinesischen Eisen- und Stahlvereinigung, Zhang Changfu, mitgeteilt wurde, würden chinesische Stahlproduzenten eventuell in naher Zukunft die Importe von Eisenerz verringern, sollte die Auftragslage sich nicht wieder verbessern. China habe bereits hohe Lagervorräte aufgebaut, die nun schon für 35 Produktionstage ausreichen würden.

http://www.rohstoff-spiegel.de/abo_count.php?url=rs_2011-20.…

Dieses Mal erwarten Sie folgende Inhalte:

» RohstoffAktien "Potenzial mit Öl, Gas und Helium" von Tim Roedel

» RohstoffAktien "Arriba Aviva!" von Tim Roedel

» RohstoffAktien "Brazil mit exzellenten Aussichten" von Tim Roedel

» RohstoffAktien "Top Gelegenheit bei U.S. Silver!" von Jan Kneist

» RohstoffAktien "Cardero legt gleich voll los" von Tim Roedel

» RohstoffAktien "Elemental Minerals mit Urgewalt!" - Interview mit Elemental Minerals

» RohstoffAktien "AktienCheck" - Die aktuelle Bestandsaufnahme

» RundUmschlag "Kein Rückweg" von Jan Kneist

» RohstoffMarkt "Lukrative Chance oder Hausse-Ende?" von Gerd Ewert

» FinanzMarkt "Amerika rettet den Euro" von Walter K. Eichelburg

» MarktTechnik "Aktienscreening" - Relative Stärke Ranking

» MarktDaten “LME-Lagerbestände” - Bestände im System der London Metal Exchange

» MarktDaten “Marktübersicht”- Alle Rohstoffe auf einen Blick!

Dieses Mal erwarten Sie folgende Inhalte:

» RohstoffAktien "Potenzial mit Öl, Gas und Helium" von Tim Roedel

» RohstoffAktien "Arriba Aviva!" von Tim Roedel

» RohstoffAktien "Brazil mit exzellenten Aussichten" von Tim Roedel

» RohstoffAktien "Top Gelegenheit bei U.S. Silver!" von Jan Kneist

» RohstoffAktien "Cardero legt gleich voll los" von Tim Roedel

» RohstoffAktien "Elemental Minerals mit Urgewalt!" - Interview mit Elemental Minerals

» RohstoffAktien "AktienCheck" - Die aktuelle Bestandsaufnahme

» RundUmschlag "Kein Rückweg" von Jan Kneist

» RohstoffMarkt "Lukrative Chance oder Hausse-Ende?" von Gerd Ewert

» FinanzMarkt "Amerika rettet den Euro" von Walter K. Eichelburg

» MarktTechnik "Aktienscreening" - Relative Stärke Ranking

» MarktDaten “LME-Lagerbestände” - Bestände im System der London Metal Exchange

» MarktDaten “Marktübersicht”- Alle Rohstoffe auf einen Blick!

Says may double previous resource estimate at Hermosa

* Expects to go to market at some time for funds - CEO

* No immediate plans to buy 20 pct of project it doesn't own

By Gowri Jayakumar

Sept 30 (Reuters) - Canadian junior mineral explorer Wildcat Silver wants to develop its sole asset, the Hermosa high-grade silver deposit in Arizona, into production by 2017, and does not see itself as up for sale, its chief executive told Reuters.

The project still has at least 5 years before it starts bringing in revenue, and Wildcat needs $337 million to start producing.

"In terms of capex to construct the mine and the plant later, we'll have to go to the market somehow to get money. That will be some blend of offtake agreement, cash, debt and equity, yet to be decided on," Christopher Jones said in a telephone interview.

The company's stock jumped 20 percent on Tuesday on high-grade silver finds.

"There's quite a bit of scope yet to get through exploration drilling. We think there is potential for doubling the resource from our last estimate," Jones said.

That previous assessment, last year, set indicated resources at 36 million ounces and inferred resources at 85 million ounces of silver.

Typically, junior explorers sitting on substantial potential resources are takeover targets for bigger metals and mineral producers.

"We don't presently believe ourselves to be for sale. Our objective is to develop this project to its fullest potential and that includes production," said Jones.

The company, which plans to list its shares on NYSE Amex, said the project has increased its net present value to about $900 million.

Vancouver-based Wildcat, which has a market value of around $171 million, is also keen to explore and develop the sizeable property it owns surrounding Hermosa.

"Hermosa is part of a much larger land package we have in Arizona that includes around 3,100 acres ... this deposit is still open in all four points of the compass," said Jones.

Wildcat, which bought its 80 percent stake in the property for $6 million, doesn't immediately plan to buy the remaining 20 percent stake from Arizona Minerals Inc.

"The other 20 percent is in friendly hands, so there's no rush," said Jones, who has served as CEO since 2008.

The miner expects the net cost of silver production at the project, which is at the center of the Arizona copper belt where companies like Freeport McMoran operate, will be negative $1.86 an ounce.

"We sell not just silver, but manganese, copper and zinc for the plant. The net revenue from all those other metals gets charged against the cost of making silver," Jones said.

Silver prices have been volatile this month, and look set to end the month down 25 percent but, with a low cost of production and an 18-year mine life, Jones isn't too worried.

"Any contemplated silver price is good for Hermosa. With a very low cost of making silver, even in the greatest and worst of markets, it's a great project." (Reporting by Gowri Jayakumar in Bangalore, Editing by Ian Geoghegan)

* Expects to go to market at some time for funds - CEO

* No immediate plans to buy 20 pct of project it doesn't own

By Gowri Jayakumar

Sept 30 (Reuters) - Canadian junior mineral explorer Wildcat Silver wants to develop its sole asset, the Hermosa high-grade silver deposit in Arizona, into production by 2017, and does not see itself as up for sale, its chief executive told Reuters.

The project still has at least 5 years before it starts bringing in revenue, and Wildcat needs $337 million to start producing.

"In terms of capex to construct the mine and the plant later, we'll have to go to the market somehow to get money. That will be some blend of offtake agreement, cash, debt and equity, yet to be decided on," Christopher Jones said in a telephone interview.

The company's stock jumped 20 percent on Tuesday on high-grade silver finds.

"There's quite a bit of scope yet to get through exploration drilling. We think there is potential for doubling the resource from our last estimate," Jones said.

That previous assessment, last year, set indicated resources at 36 million ounces and inferred resources at 85 million ounces of silver.

Typically, junior explorers sitting on substantial potential resources are takeover targets for bigger metals and mineral producers.

"We don't presently believe ourselves to be for sale. Our objective is to develop this project to its fullest potential and that includes production," said Jones.

The company, which plans to list its shares on NYSE Amex, said the project has increased its net present value to about $900 million.

Vancouver-based Wildcat, which has a market value of around $171 million, is also keen to explore and develop the sizeable property it owns surrounding Hermosa.

"Hermosa is part of a much larger land package we have in Arizona that includes around 3,100 acres ... this deposit is still open in all four points of the compass," said Jones.

Wildcat, which bought its 80 percent stake in the property for $6 million, doesn't immediately plan to buy the remaining 20 percent stake from Arizona Minerals Inc.

"The other 20 percent is in friendly hands, so there's no rush," said Jones, who has served as CEO since 2008.

The miner expects the net cost of silver production at the project, which is at the center of the Arizona copper belt where companies like Freeport McMoran operate, will be negative $1.86 an ounce.

"We sell not just silver, but manganese, copper and zinc for the plant. The net revenue from all those other metals gets charged against the cost of making silver," Jones said.

Silver prices have been volatile this month, and look set to end the month down 25 percent but, with a low cost of production and an 18-year mine life, Jones isn't too worried.

"Any contemplated silver price is good for Hermosa. With a very low cost of making silver, even in the greatest and worst of markets, it's a great project." (Reporting by Gowri Jayakumar in Bangalore, Editing by Ian Geoghegan)

Valuation

Our 2012E NAV for Sandspring is $6.12/share using our gold price forecasts and discount rate

assumptions. We are increasing our 12-month target price from $4.50 to $5.00 per share, which is

based on the average of fair values generated using P/NAV and forward-looking P/CF multiples, as well

as AMC/oz and Takeover analysis. For Sandspring, we employ 1.0x NAV and 10x forward P/CF target

multiples, which are toward the middle of our target ranges for Emerging Golds (0.75-1.5x P/NAV and

7.5-15x P/CF), reflecting the execution risk to become a Tier III producer by 2015.

Our 2012E NAV for Sandspring is $6.12/share using our gold price forecasts and discount rate

assumptions. We are increasing our 12-month target price from $4.50 to $5.00 per share, which is

based on the average of fair values generated using P/NAV and forward-looking P/CF multiples, as well

as AMC/oz and Takeover analysis. For Sandspring, we employ 1.0x NAV and 10x forward P/CF target

multiples, which are toward the middle of our target ranges for Emerging Golds (0.75-1.5x P/NAV and

7.5-15x P/CF), reflecting the execution risk to become a Tier III producer by 2015.

aktuell:

Der deutsche Einkaufsmanagerindex für September notiert bei 50,3. Erwartet wurde der deutsche Index mit einem Stand von 50,0. Das Vormonatsniveau hatte bei 50,9 gelegen.

aktuell:

Der Einkaufsmanagerindex für die Eurozone notiert im September bei 48,5. Damit wurde die erste Veröffentlichung nach oben revidiert. Im Vorfeld war mit einer Bestätigung der Erstschätzung gerechnet worden. Im Vormonat hatte der Index bei 49,0 notiert

Der deutsche Einkaufsmanagerindex für September notiert bei 50,3. Erwartet wurde der deutsche Index mit einem Stand von 50,0. Das Vormonatsniveau hatte bei 50,9 gelegen.

aktuell:

Der Einkaufsmanagerindex für die Eurozone notiert im September bei 48,5. Damit wurde die erste Veröffentlichung nach oben revidiert. Im Vorfeld war mit einer Bestätigung der Erstschätzung gerechnet worden. Im Vormonat hatte der Index bei 49,0 notiert

October 03, 2011 07:00 ET

Avion Intersects Additional Gold Mineralization at the Betea Zone, Kofi Property, Mali Including 13.01 g/t Au Over 7.0 Metres and 3.46 g/t Au Over 15.0 Metres

Avion Increases the 2011 Exploration Budget by an Additional US$ 3 Million to Total US$ 16 Million

TORONTO, ONTARIO--(Marketwire - Oct. 3, 2011) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the 'Company') is pleased to announce the results from an additional 28 reverse circulation drill holes totaling approximately 4,716 metres completed. These holes were completed over a 900 metre strike of the Betea Central zone's interpreted strike length which has been established over approximately 1,000 metres.

http://www.marketwire.com/press-rel...i-property-mali-including-tsx-avr-1567861.htm

The Betea Central zone contains an historic National Instrument 43-101 compliant estimated indicated mineral resource of 1,154,000 tonnes grading 2.30 g/t Au totaling 111,000 ounces and an inferred mineral resource of 981,000 tonnes grading 1.60 g/t Au totaling 52,000 ounces (Roberts, 20081). Note that a qualified person has not carried out the work required to classify the historical estimate as current mineral resources or mineral reserves for Avion and therefore Avion is not treating the historical estimate as current mineral resources or mineral reserves. Avion intends to update the resources for the Kofi property in late Q4, 2011.

Significant new results include the following:

•2.16 g/t Au over 20.0 metres

•3.46 g/t Au over 15.0 metres

•2.12 g/t Au over 24.0 metres

•4.48 g/t Au over 10.0 metres

•13.01 g/t Au over 7.0 metres

•1.92 g/t Au over 35.0 metres

•16.75 g/t Au over 2.0 metres

Avion Intersects Additional Gold Mineralization at the Betea Zone, Kofi Property, Mali Including 13.01 g/t Au Over 7.0 Metres and 3.46 g/t Au Over 15.0 Metres

Avion Increases the 2011 Exploration Budget by an Additional US$ 3 Million to Total US$ 16 Million

TORONTO, ONTARIO--(Marketwire - Oct. 3, 2011) - Avion Gold Corporation (TSX:AVR)(OTCQX:AVGCF) ("Avion" or the 'Company') is pleased to announce the results from an additional 28 reverse circulation drill holes totaling approximately 4,716 metres completed. These holes were completed over a 900 metre strike of the Betea Central zone's interpreted strike length which has been established over approximately 1,000 metres.

http://www.marketwire.com/press-rel...i-property-mali-including-tsx-avr-1567861.htm

The Betea Central zone contains an historic National Instrument 43-101 compliant estimated indicated mineral resource of 1,154,000 tonnes grading 2.30 g/t Au totaling 111,000 ounces and an inferred mineral resource of 981,000 tonnes grading 1.60 g/t Au totaling 52,000 ounces (Roberts, 20081). Note that a qualified person has not carried out the work required to classify the historical estimate as current mineral resources or mineral reserves for Avion and therefore Avion is not treating the historical estimate as current mineral resources or mineral reserves. Avion intends to update the resources for the Kofi property in late Q4, 2011.

Significant new results include the following:

•2.16 g/t Au over 20.0 metres

•3.46 g/t Au over 15.0 metres

•2.12 g/t Au over 24.0 metres

•4.48 g/t Au over 10.0 metres

•13.01 g/t Au over 7.0 metres

•1.92 g/t Au over 35.0 metres

•16.75 g/t Au over 2.0 metres

October 03, 2011 07:30 ET

Champion Minerals Increases NI 43-101 Resources at the Fire Lake North Project to Over One Billion Tonnes

- Measured & Indicated Resources Total 400.1 Million Tonnes grading 30.6% Total Iron

- Inferred Resources Total 661.2 Million Tonnes grading 27.7% Total Iron

TORONTO, ONTARIO--(Marketwire - Oct. 3, 2011) - CHAMPION MINERALS INC. (TSX:CHM)(FRANKFURT:P02) ("Champion", or the "Company") is pleased to provide results of the updated National Instrument ("NI") 43-101 Mineral Resource Estimate completed on the Fire Lake North Project in Fermont, Quebec. Table 1 presents the current NI 43-101 categorized Mineral Resource Estimate1 at a 15% Total Iron ("FeT") cut-off grade for each of the three coarser grained specular-hematite rich deposits and provides the category totals for the Fire Lake North Project as validated by P&E Mining Consultants Inc. of Brampton, Ontario ("P&E").

http://www.marketwire.com/press-release/champion-minerals-increases-ni-43-101-resources-fire-lake-north-project-over-one-billion-tsx-chm-1567873.htm

Champion Minerals Increases NI 43-101 Resources at the Fire Lake North Project to Over One Billion Tonnes

- Measured & Indicated Resources Total 400.1 Million Tonnes grading 30.6% Total Iron

- Inferred Resources Total 661.2 Million Tonnes grading 27.7% Total Iron

TORONTO, ONTARIO--(Marketwire - Oct. 3, 2011) - CHAMPION MINERALS INC. (TSX:CHM)(FRANKFURT:P02) ("Champion", or the "Company") is pleased to provide results of the updated National Instrument ("NI") 43-101 Mineral Resource Estimate completed on the Fire Lake North Project in Fermont, Quebec. Table 1 presents the current NI 43-101 categorized Mineral Resource Estimate1 at a 15% Total Iron ("FeT") cut-off grade for each of the three coarser grained specular-hematite rich deposits and provides the category totals for the Fire Lake North Project as validated by P&E Mining Consultants Inc. of Brampton, Ontario ("P&E").

http://www.marketwire.com/press-release/champion-minerals-increases-ni-43-101-resources-fire-lake-north-project-over-one-billion-tsx-chm-1567873.htm

ATAC Resources Extends Strike Length of Gold Mineralization at Conrad Zone to 400 Metres and Intersects Multiple Zones of High-Grade Gold Mineralization

ATAC Resources Ltd ATC

10/3/2011 8:00:23 AM

VANCOUVER, BRITISH COLUMBIA, Oct 3, 2011 (Marketwire via COMTEX News Network) --

ATAC Resources Ltd. (TSX VENTURE:ATC) is pleased to provide the following drilling and exploration update for its 100% owned 1,600 sq/km Rackla Gold Project in central Yukon.

News release highlights:

-- Conrad Zone extended to 400 metre strike length and remains open in all

directions;

-- Diamond drilling confirms gold mineralization at the Conrad and Eaton

Zones coalesce into a larger Conrad Zone;

-- Total vertical extent of drilled gold mineralization between Conrad and

Osiris is now in excess of 1 km;

-- Six diamond drills will continue exploring Osiris, Conrad, Isis and Isis

East into mid-October;

-- Surface orpiment and realgar showings have been identified at Dale and

Pyramid Zones located 12 km and 24 km west of the Osiris Zone, and the

Ptah Zone located 1.25 km northwest of the Conrad Zone; and,

-- 15 of 19 released drill holes at Conrad have intersected significant

widths of gold mineralization in excess of 3 g/t gold.

http://www.stockhouse.com/News/CanadianReleasesDetail.aspx?n=8326218

ATAC Resources Ltd ATC

10/3/2011 8:00:23 AM

VANCOUVER, BRITISH COLUMBIA, Oct 3, 2011 (Marketwire via COMTEX News Network) --

ATAC Resources Ltd. (TSX VENTURE:ATC) is pleased to provide the following drilling and exploration update for its 100% owned 1,600 sq/km Rackla Gold Project in central Yukon.

News release highlights:

-- Conrad Zone extended to 400 metre strike length and remains open in all

directions;

-- Diamond drilling confirms gold mineralization at the Conrad and Eaton

Zones coalesce into a larger Conrad Zone;

-- Total vertical extent of drilled gold mineralization between Conrad and

Osiris is now in excess of 1 km;

-- Six diamond drills will continue exploring Osiris, Conrad, Isis and Isis

East into mid-October;

-- Surface orpiment and realgar showings have been identified at Dale and

Pyramid Zones located 12 km and 24 km west of the Osiris Zone, and the

Ptah Zone located 1.25 km northwest of the Conrad Zone; and,

-- 15 of 19 released drill holes at Conrad have intersected significant

widths of gold mineralization in excess of 3 g/t gold.

http://www.stockhouse.com/News/CanadianReleasesDetail.aspx?n=8326218

:shock: mal aufgrund der News die Charts mir angeschaut.............unglaublich, waren eigentlich immer eine "sichere Bank"....... von über 45 $ dieses Jahr.......

hab aber nicht kontinuierlich verfolgt.......

PetroBakken Provides Operational Update Highlighted by Production of Over 43,000 boepd at the End of September 2011, A 22% Increase Over Q2 2011

http://www.stockhouse.com/News/CanadianReleasesDetail.aspx?n=8326208

Petrobank Energy and Resources Ltd PBG 10/3/2011 8:00:25 AMCALGARY, ALBERTA, Oct 3, 2011 (Marketwire via COMTEX News Network) --

PetroBakken Energy Ltd. ("PetroBakken" or the "Company") (TSX:PBN), a 59% owned subsidiary of Petrobank Energy and Resources Ltd. (TSX:PBG), is pleased to report drilling and operating results for the third quarter of 2011.

Production at the end of September exceeded 43,000 barrels of oil equivalent per day ("boepd") (87% light oil and NGLs), a 22% increase over second quarter 2011 production levels, based on field estimates. Our Bakken business unit production is again over 20,000 boepd while our Cardium business unit production now exceeds 14,000 boepd, with the remainder of the production generated by our southeast Saskatchewan Conventional and AB/BC business units. We estimate that we have approximately 3,000 boepd of additional productive capacity currently down due to well maintenance, site access constraints (primarily related to flooding originating in the second quarter) and facility maintenance.

hab aber nicht kontinuierlich verfolgt.......

PetroBakken Provides Operational Update Highlighted by Production of Over 43,000 boepd at the End of September 2011, A 22% Increase Over Q2 2011

http://www.stockhouse.com/News/CanadianReleasesDetail.aspx?n=8326208

Petrobank Energy and Resources Ltd PBG 10/3/2011 8:00:25 AMCALGARY, ALBERTA, Oct 3, 2011 (Marketwire via COMTEX News Network) --

PetroBakken Energy Ltd. ("PetroBakken" or the "Company") (TSX:PBN), a 59% owned subsidiary of Petrobank Energy and Resources Ltd. (TSX:PBG), is pleased to report drilling and operating results for the third quarter of 2011.

Production at the end of September exceeded 43,000 barrels of oil equivalent per day ("boepd") (87% light oil and NGLs), a 22% increase over second quarter 2011 production levels, based on field estimates. Our Bakken business unit production is again over 20,000 boepd while our Cardium business unit production now exceeds 14,000 boepd, with the remainder of the production generated by our southeast Saskatchewan Conventional and AB/BC business units. We estimate that we have approximately 3,000 boepd of additional productive capacity currently down due to well maintenance, site access constraints (primarily related to flooding originating in the second quarter) and facility maintenance.

Cardero legt gleich voll los

von Tim Roedel

Im Juli 2011 hatten wir Ihnen Cardero Resource zum ersten

Mal vorgestellt. Das Unternehmen besitzt eines der wohl aussichtsreichsten

Kohleprojekte Kanadas und ein weiteres, hochgradiges Eisen-Titan-Projekt im

US-Bundesstaat Minnesota.

Carbon Creek mit Company-

Maker-Potenzial

Cardero Resources absolutes Aushängeschild ist das Carbon

Creek Kohleprojekt in der kanadischen Provinz British Columbia.

Es umfasst mehr als 17.000 Hektar Land und liegt im nördlichen

Teil einer ganzen Kette von produzierenden Kohleminen.

Carbon Creek besitzt bereits eine measured & indicated Ressource

von 114 Millionen Tonne Kohle und weitere 89 Millionen Tonnen

in der Kategorie inferred. Davon liegen etwa 25 Millionen Tonnen

direkt an der Erdoberfläche, während sich der Rest auf 12 bekannte

Kohleflöze, mit Mächtigkeiten von 1,30 bis 3,30 Metern

aufteilt.Für weitere vier Areale existiert noch überhaupt keine

NI43-101-konforme Ressourcenschätzung. Eine Schätzung aus

dem Jahr 1943 geht davon aus, dass Carbon Creek bis zu 2,7 Milliarden

Tonnen Kohle beherbergen könnte. Das wäre dann

schon mal eine Hausnummer, zumal die für eine Produktion

benötigte Infrastruktur entweder schon vorhanden ist oder sich

relativ einfach installieren ließe. Nicht nur allein deswegen besitzt

das Carbon Creek Kohle-Projekt durchaus das Potenzial, für Cardero

Resource zu einem echten „Company-Maker“ zu werden.

Umfangreiches Explorationsprogramm gestartet

Obwohl Cardero Resource den früheren Eigentümer von Carbon

Creek, Coalhunter Mining erst im Mai 2011 übernommen hatte,

konnte man bereits im August mit einem umfangreichen Explorationsprogramm

beginnen. Dieses beinhaltet insgesamt 14.000

Meter an Kern- und Rotationsbohrungen und hat zum Ziel, alle

bisherigen Lagerstätten-Daten auf ein Machbarkeitsniveau zu

heben. Im Detail bedeutet das, dass alte Ressourcen in die Kategorien

measured & indicated hochgestuft und zusätzliche Ressourcen

von bisher kaum betrachteten Arealen neu hinzugewonnen

werden sollen. Außerdem wird dabei das gesamte

geologische Modell des Projekts neu definiert und aktualisiert.

Die durch die Bohrarbeiten erhaltene Kohle wird noch im

Laufe des Jahres hinsichtlich ihrer Qualität untersucht, um

unter anderem einen genauen Eindruck von einem zukünftig zu

erzielenden Verkaufspreis zu erhalten. Weiterhin werden geotechnische

und hydrogeologische Studien durchgeführt,

die die Möglichkeit von Übertage- und Untertage-Abbau beleuchten

und dabei auch die Grundwassersituation und Verwerfungen

mit einschließen sollen. Außerdem will man innerhalb

von 12 Monaten alle notwendigen Informationen zum

Erhalt einer Umweltunbedenklichkeitsbescheinigung

sammeln. Abgerundet wird das Ganze durch Gespräche und Verhandlungen

mit den Landbesitzern und den zuständigen Ureinwohnern.

Erste Wirtschaftlichkeitsstudie im Gange

Neben den eigentlichen Explorationsarbeiten will man bei Cardero

Resource so bald wie möglich eine erste Wirtschaftlichkeitseinschätzung

für Carbon Creek erarbeiten. Dazu wurde bereits Norwest Corporation beauftragt,

alle notwendigen Informationen zur Erstellung einer

ersten Wirtschaftlichkeitsstudie für die Carbon Creek Metallurgical

Coal Lagerstätte zu sammeln und entsprechend auszuwerten.

Dabei wird man sich vor allem auf die ersten 43-101-Ressourcen

stützen und daraus erste potenzielle Wirtschaftlichkeitsberechnungen

anstellen. Diese erste Einschätzung soll noch im vierten Quartal 2011

fertiggestellt sein und unter anderem auch Daten, die von Utah Mines Ltd.

zwischen 1970 und 1981 gesammelt wurden, beinhalten.

Es handelt sich dabei um Daten von 296 Rotations- und

Diamantbohrungen sowie weiteren acht Bohrlöchern, die noch

in 2010 von Coalhunter eingebracht wurden.

TiTac/Longnose besitzt Weltklasse-Potenzial

Neben Carbon Creek besitzt Cardero Resource noch das TiTacund

Longnose-Ferro-Titanium Project, welches im US-Bundesstaat

Minnesota liegt und eine Eisen-Titan-Lagerstätte beherbergt.

Dass das Projekt eine hochgradige Eisen-Titan-Oxid-

Lagerstätte besitzt, steht außer Frage, immerhin existiert eine

Aussage von BHP Billiton, wonach Longnose mitunter die

größte und hochgradigste Eisen-Titan-Oxid-Lagerstätte Nordamerikas

beherbergen könnte. BHP führte dort in der Vergangenheit

Bohrungen durch und stieß dabei auf bis zu 46%

FeTiO3.

Eigene Ressourcenschätzung in Kürze verfügbar

Jetzt konnte auch Cardero Resource neuerliche Bohrergebnisse

für Longnose vorlegen. Dabei zeigten alle vier Bohrlöcher,

die das 2011er-Bohrprogramm abschlossen, signifikante

Eisen-, Titan- und Kupfergehalte auf. Darunter auch eine durchgehende,

rund 110 Meter lange Mineralisation mit 20,2% TiO2,

31,3% Fe2O3 und 0,2% Cu. Bereits im Januar 2011 stieß

man auf dem Kerngebiet TiTac auf fast schon unglaubliche 462

Meter mit 20,1% TiO2, 33,2% Fe2O3 und 0,4% Cu.

All diese Bohrergebnisse fließen jetzt in eine erste eigene Ressourcenschätzung

ein, die noch im vierten Quartal 2011 fertiggestellt

wird und die Basis für eine erste Projektstudie darstellen soll.

Kohle-Übernahme in BC heizt Spekulationen an

Mitte August 2011 gab Anglo American bekannt, dass man

sich mit NEMI Northern Energy & Mining und Hillsborough Resources

Ltd darauf geeinigt hat, dass man deren Minderheitsanteile

(zusammen über 25%) an Peace River Coal übernehmen

und sich Peace River Coal damit zu 100% einverleiben werde.

Was hat das nun mit Cardero Resource zu tun? – Nun, Peace

River Coals Hauptprojekte liegen nur etwa 100 Kilometer südöstlich

vom Carbon Creek Projekt. Dort produziert Peace River Coal

schon seit einiger Zeit erfolgreich Kohle. Die Übernahme der Minderheitsanteile

an Peace River Coal offenbart einen gesamten Unternehmenswert von mehr als

600 Millionen CAD. Und wie gesagt: Carbon Creek liegt auf

demselben geologischen Trend wie Peace River Coals produzierendes

Projektgebiet. Zudem weist Carbon Creek ja bereits

eine beachtliche Ressource auf, könnte also durchaus auch in

den Fokus von Anglo American gelangen, denn die suchen weiter

nach hochwertigen Kohlevorkommen in der Nähe ihrer

bestehenden Produktionsanlagen. Sollte Cardero Resource in

der Lage sein, seine alten Ressourcen zu bestätigen, aufzuwerten

und die Basis gleichzeitig noch zu vergrößern, so dürfte

für Anglo American fast schon kein Weg mehr an Carbon Creek

vorbeiführen.

Kursziel: 3 CAD!

Die Entwicklungen innerhalb des Kohlesektors sind natürlich auch

an den nordamerikanischen Investmenthäusern nicht spurlos

vorbeigegangen. Auch wenn deren Betrachtungen zumeist

auf Fundamentaldaten und weniger auf Spekulation beruhen,

so dürften auch mögliche Partnerschafts- und Übernahmeszenarien

einen Einfluss auf eine wahre Coverage-Welle für Cardero

Resource genommen haben.

So nahmen seit unserem letzten Update nicht weniger als drei renommierte

Analystenhäuser Cardero Resource auf ihre Watchlist

und das mit 12-Monats- Kurszielen zwischen 2,50 und 3,00 CAD!

So rechnet etwa Jennings Capital mit einer Produktion

ab 2014 und einem Umsatz von mehr als 170 Millionen CAD

gleich im ersten Jahr, was sich bis 2016 auf über 500 Millionen

CAD oder knapp 230 Millionen CAD EBIT jährlich steigern könnte.

Fazit und Ausblick

Es ist schon erstaunlich, was man als Explorationsgesellschaft

in einem derart schlechten Marktumfeld, wie wir es in den

vergangenen Monaten erleben mussten, dennoch erreichen

kann. Cardero Resource besitzt gleich zwei Hauptprojekte, die

beide ein Ressourcenpotenzial besitzen, wie man es nicht jeden

Tag sieht. Noch dazu in Gegenden, die sehr gut infrastrukturell

angebunden sind und bereits produzierende Minen in der

Nachbarschaft haben. Die Explorationsprogramme konnten mit

Top-Resultaten aufwarten und dürften dies im Falle von Carbon

Creek auch im weiteren Verlauf des Jahres noch tun. Zudem

steht die Veröffentlichung von Ressourcenschätzungen und ersten

Wirtschaftlichkeitseinschätzungen an. Dies zusammen

unter Berücksichtigung, dass sowohl führende Analystenhäuser

als auch Major-Bergbauunternehmen bereits ein Auge auf

Cardero Resource geworfen haben (könnten), könnte für das

Unternehmen und dessen Share-Preis durchaus zu einer explosiven

Mischung werden.

Quelle: http://www.rohstoff-spiegel.de/abo_count.php?url=rs_2011-20.pdf

von Tim Roedel

Im Juli 2011 hatten wir Ihnen Cardero Resource zum ersten

Mal vorgestellt. Das Unternehmen besitzt eines der wohl aussichtsreichsten

Kohleprojekte Kanadas und ein weiteres, hochgradiges Eisen-Titan-Projekt im

US-Bundesstaat Minnesota.

Carbon Creek mit Company-

Maker-Potenzial

Cardero Resources absolutes Aushängeschild ist das Carbon

Creek Kohleprojekt in der kanadischen Provinz British Columbia.

Es umfasst mehr als 17.000 Hektar Land und liegt im nördlichen

Teil einer ganzen Kette von produzierenden Kohleminen.

Carbon Creek besitzt bereits eine measured & indicated Ressource

von 114 Millionen Tonne Kohle und weitere 89 Millionen Tonnen

in der Kategorie inferred. Davon liegen etwa 25 Millionen Tonnen

direkt an der Erdoberfläche, während sich der Rest auf 12 bekannte

Kohleflöze, mit Mächtigkeiten von 1,30 bis 3,30 Metern

aufteilt.Für weitere vier Areale existiert noch überhaupt keine

NI43-101-konforme Ressourcenschätzung. Eine Schätzung aus

dem Jahr 1943 geht davon aus, dass Carbon Creek bis zu 2,7 Milliarden

Tonnen Kohle beherbergen könnte. Das wäre dann

schon mal eine Hausnummer, zumal die für eine Produktion

benötigte Infrastruktur entweder schon vorhanden ist oder sich

relativ einfach installieren ließe. Nicht nur allein deswegen besitzt

das Carbon Creek Kohle-Projekt durchaus das Potenzial, für Cardero

Resource zu einem echten „Company-Maker“ zu werden.

Umfangreiches Explorationsprogramm gestartet

Obwohl Cardero Resource den früheren Eigentümer von Carbon

Creek, Coalhunter Mining erst im Mai 2011 übernommen hatte,

konnte man bereits im August mit einem umfangreichen Explorationsprogramm

beginnen. Dieses beinhaltet insgesamt 14.000

Meter an Kern- und Rotationsbohrungen und hat zum Ziel, alle

bisherigen Lagerstätten-Daten auf ein Machbarkeitsniveau zu

heben. Im Detail bedeutet das, dass alte Ressourcen in die Kategorien

measured & indicated hochgestuft und zusätzliche Ressourcen

von bisher kaum betrachteten Arealen neu hinzugewonnen

werden sollen. Außerdem wird dabei das gesamte

geologische Modell des Projekts neu definiert und aktualisiert.

Die durch die Bohrarbeiten erhaltene Kohle wird noch im

Laufe des Jahres hinsichtlich ihrer Qualität untersucht, um

unter anderem einen genauen Eindruck von einem zukünftig zu

erzielenden Verkaufspreis zu erhalten. Weiterhin werden geotechnische

und hydrogeologische Studien durchgeführt,

die die Möglichkeit von Übertage- und Untertage-Abbau beleuchten

und dabei auch die Grundwassersituation und Verwerfungen

mit einschließen sollen. Außerdem will man innerhalb

von 12 Monaten alle notwendigen Informationen zum

Erhalt einer Umweltunbedenklichkeitsbescheinigung

sammeln. Abgerundet wird das Ganze durch Gespräche und Verhandlungen

mit den Landbesitzern und den zuständigen Ureinwohnern.

Erste Wirtschaftlichkeitsstudie im Gange

Neben den eigentlichen Explorationsarbeiten will man bei Cardero

Resource so bald wie möglich eine erste Wirtschaftlichkeitseinschätzung

für Carbon Creek erarbeiten. Dazu wurde bereits Norwest Corporation beauftragt,

alle notwendigen Informationen zur Erstellung einer

ersten Wirtschaftlichkeitsstudie für die Carbon Creek Metallurgical

Coal Lagerstätte zu sammeln und entsprechend auszuwerten.

Dabei wird man sich vor allem auf die ersten 43-101-Ressourcen

stützen und daraus erste potenzielle Wirtschaftlichkeitsberechnungen

anstellen. Diese erste Einschätzung soll noch im vierten Quartal 2011

fertiggestellt sein und unter anderem auch Daten, die von Utah Mines Ltd.

zwischen 1970 und 1981 gesammelt wurden, beinhalten.

Es handelt sich dabei um Daten von 296 Rotations- und

Diamantbohrungen sowie weiteren acht Bohrlöchern, die noch

in 2010 von Coalhunter eingebracht wurden.

TiTac/Longnose besitzt Weltklasse-Potenzial

Neben Carbon Creek besitzt Cardero Resource noch das TiTacund

Longnose-Ferro-Titanium Project, welches im US-Bundesstaat

Minnesota liegt und eine Eisen-Titan-Lagerstätte beherbergt.

Dass das Projekt eine hochgradige Eisen-Titan-Oxid-

Lagerstätte besitzt, steht außer Frage, immerhin existiert eine

Aussage von BHP Billiton, wonach Longnose mitunter die

größte und hochgradigste Eisen-Titan-Oxid-Lagerstätte Nordamerikas

beherbergen könnte. BHP führte dort in der Vergangenheit

Bohrungen durch und stieß dabei auf bis zu 46%

FeTiO3.

Eigene Ressourcenschätzung in Kürze verfügbar

Jetzt konnte auch Cardero Resource neuerliche Bohrergebnisse

für Longnose vorlegen. Dabei zeigten alle vier Bohrlöcher,

die das 2011er-Bohrprogramm abschlossen, signifikante

Eisen-, Titan- und Kupfergehalte auf. Darunter auch eine durchgehende,

rund 110 Meter lange Mineralisation mit 20,2% TiO2,

31,3% Fe2O3 und 0,2% Cu. Bereits im Januar 2011 stieß

man auf dem Kerngebiet TiTac auf fast schon unglaubliche 462

Meter mit 20,1% TiO2, 33,2% Fe2O3 und 0,4% Cu.

All diese Bohrergebnisse fließen jetzt in eine erste eigene Ressourcenschätzung

ein, die noch im vierten Quartal 2011 fertiggestellt

wird und die Basis für eine erste Projektstudie darstellen soll.

Kohle-Übernahme in BC heizt Spekulationen an

Mitte August 2011 gab Anglo American bekannt, dass man

sich mit NEMI Northern Energy & Mining und Hillsborough Resources

Ltd darauf geeinigt hat, dass man deren Minderheitsanteile

(zusammen über 25%) an Peace River Coal übernehmen

und sich Peace River Coal damit zu 100% einverleiben werde.

Was hat das nun mit Cardero Resource zu tun? – Nun, Peace

River Coals Hauptprojekte liegen nur etwa 100 Kilometer südöstlich

vom Carbon Creek Projekt. Dort produziert Peace River Coal

schon seit einiger Zeit erfolgreich Kohle. Die Übernahme der Minderheitsanteile

an Peace River Coal offenbart einen gesamten Unternehmenswert von mehr als

600 Millionen CAD. Und wie gesagt: Carbon Creek liegt auf

demselben geologischen Trend wie Peace River Coals produzierendes

Projektgebiet. Zudem weist Carbon Creek ja bereits

eine beachtliche Ressource auf, könnte also durchaus auch in

den Fokus von Anglo American gelangen, denn die suchen weiter

nach hochwertigen Kohlevorkommen in der Nähe ihrer

bestehenden Produktionsanlagen. Sollte Cardero Resource in

der Lage sein, seine alten Ressourcen zu bestätigen, aufzuwerten

und die Basis gleichzeitig noch zu vergrößern, so dürfte

für Anglo American fast schon kein Weg mehr an Carbon Creek

vorbeiführen.

Kursziel: 3 CAD!

Die Entwicklungen innerhalb des Kohlesektors sind natürlich auch

an den nordamerikanischen Investmenthäusern nicht spurlos

vorbeigegangen. Auch wenn deren Betrachtungen zumeist

auf Fundamentaldaten und weniger auf Spekulation beruhen,

so dürften auch mögliche Partnerschafts- und Übernahmeszenarien

einen Einfluss auf eine wahre Coverage-Welle für Cardero

Resource genommen haben.

So nahmen seit unserem letzten Update nicht weniger als drei renommierte

Analystenhäuser Cardero Resource auf ihre Watchlist

und das mit 12-Monats- Kurszielen zwischen 2,50 und 3,00 CAD!

So rechnet etwa Jennings Capital mit einer Produktion

ab 2014 und einem Umsatz von mehr als 170 Millionen CAD

gleich im ersten Jahr, was sich bis 2016 auf über 500 Millionen

CAD oder knapp 230 Millionen CAD EBIT jährlich steigern könnte.

Fazit und Ausblick

Es ist schon erstaunlich, was man als Explorationsgesellschaft

in einem derart schlechten Marktumfeld, wie wir es in den

vergangenen Monaten erleben mussten, dennoch erreichen

kann. Cardero Resource besitzt gleich zwei Hauptprojekte, die

beide ein Ressourcenpotenzial besitzen, wie man es nicht jeden

Tag sieht. Noch dazu in Gegenden, die sehr gut infrastrukturell

angebunden sind und bereits produzierende Minen in der

Nachbarschaft haben. Die Explorationsprogramme konnten mit

Top-Resultaten aufwarten und dürften dies im Falle von Carbon

Creek auch im weiteren Verlauf des Jahres noch tun. Zudem

steht die Veröffentlichung von Ressourcenschätzungen und ersten

Wirtschaftlichkeitseinschätzungen an. Dies zusammen

unter Berücksichtigung, dass sowohl führende Analystenhäuser

als auch Major-Bergbauunternehmen bereits ein Auge auf

Cardero Resource geworfen haben (könnten), könnte für das

Unternehmen und dessen Share-Preis durchaus zu einer explosiven

Mischung werden.

Quelle: http://www.rohstoff-spiegel.de/abo_count.php?url=rs_2011-20.pdf

[url=http://peketec.de/trading/viewtopic.php?p=1150178#1150178 schrieb:

October 03, 2011 09:00 ET

Corvus Gold Announces Major Resource Expansion at North Bullfrog Project, Nevada

0.2 Million ounces Indicated in 15Mt at 0.37 g/t Gold

1.4 Million ounces Inferred in 156Mt at 0.28 g/t Gold

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 3, 2011) - Corvus Gold Inc. (TSX:KOR)(OTCQX:CORVF)(PINK SHEETS:CORVF) ("Corvus" or the "Company") announces the results from its follow-up resource expansion program on its North Bullfrog project near Beatty, Nevada. The updated independent estimate has expanded the District wide Indicated gold resource to 182,000 contained ounces at an average grade of 0.37 g/t, plus an additional Inferred gold resource of 1,410,000 contained ounces at an average grade of 0.28 g/t, both at a cutoff grade of 0.20 g/t gold (see Table 1). This new, much larger resource reflects a major new discovery in the northern part of the Company's land area which is composed of three deposits separated by large undrilled areas. In addition, some of the resource areas contain higher grade resources as well as high-grade vein systems which could be targets for early mining (see Table 2). The Company has began acquiring the necessary information required for completion of a Preliminary Economic Assessment, as well as designing and permitting a major follow up grid drilling resource expansion program which will focus on both the bulk tonnage and high-grade vein potential of the area.

Table 1: North Bullfrog Estimated Indicated & Inferred Resource

(using a 0.20 g/t gold cut-off grade)*

.

.

.

http://www.marketwire.com/press-release/corvus-gold-announces-major-resource-expansion-at-north-bullfrog-project-nevada-tsx-kor-1568027.htm

Corvus Gold Announces Major Resource Expansion at North Bullfrog Project, Nevada

0.2 Million ounces Indicated in 15Mt at 0.37 g/t Gold

1.4 Million ounces Inferred in 156Mt at 0.28 g/t Gold

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 3, 2011) - Corvus Gold Inc. (TSX:KOR)(OTCQX:CORVF)(PINK SHEETS:CORVF) ("Corvus" or the "Company") announces the results from its follow-up resource expansion program on its North Bullfrog project near Beatty, Nevada. The updated independent estimate has expanded the District wide Indicated gold resource to 182,000 contained ounces at an average grade of 0.37 g/t, plus an additional Inferred gold resource of 1,410,000 contained ounces at an average grade of 0.28 g/t, both at a cutoff grade of 0.20 g/t gold (see Table 1). This new, much larger resource reflects a major new discovery in the northern part of the Company's land area which is composed of three deposits separated by large undrilled areas. In addition, some of the resource areas contain higher grade resources as well as high-grade vein systems which could be targets for early mining (see Table 2). The Company has began acquiring the necessary information required for completion of a Preliminary Economic Assessment, as well as designing and permitting a major follow up grid drilling resource expansion program which will focus on both the bulk tonnage and high-grade vein potential of the area.

Table 1: North Bullfrog Estimated Indicated & Inferred Resource

(using a 0.20 g/t gold cut-off grade)*

.

.

.

http://www.marketwire.com/press-release/corvus-gold-announces-major-resource-expansion-at-north-bullfrog-project-nevada-tsx-kor-1568027.htm

October 03, 2011 09:00 ET

Rye Patch Finds New High-Grade Gold and Silver Zones at Lincoln Hill

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 3, 2011) - Rye Patch Gold Corp. (TSX VENTURE:RPM)(OTCQX:RPMGF) ("Rye Patch" or the "Company") announces the results of a soil geochemical sampling program. The survey identified two new target zones (Roosevelt and North Anomaly) and extends the Washington zone on the Company's 100% owned and controlled Lincoln Hill project.

HIGHLIGHTS:

34.79 g/t Au and 779 g/t Ag; 14 g/t Au and 183 g/t Ag; 97.92 g/t Au and 1527 g/t Ag; and 97.5 g/t Au and 1303 g/t Ag along a high-grade structural trend associated with the new Roosevelt target;

Quartz stockwork zone, geologically similar to the Lincoln Hill resource area, found in the new North Anomaly target; and

Gold-in-soil shows the Washington zone extends 500 metres to the northeast.

A total of 1,600 soil samples were collected for a soil geochemical survey on the Lincoln Hill property. The survey identified two new targets and extended the Washington zone 500 metres to the northeast. A follow-up rock-chip sampling program was completed over the newly identified Roosevelt target. The Roosevelt target has dimensions of 400-metres by 50-metres with gold-in-soil values ranging from 25 ppb to 200 ppb. The Roosevelt zone is located 500 metres southeast of Lincoln Hill resource area, and has a north-south orientation dipping 30 degrees to the west. The south end of the anomaly is covered by thick colluvium.

Upon field checking the Roosevelt zone, several old workings were identified. The historic mines are within a silicified rhyolite overlying intensely oxidised andesite. Grab rock-chip samples returned high-grade gold and silver values from this zone up to 34.79 g/t Au and 779 g/t Ag, 14 g/t Au and 183 g/t Ag, 97.92 g/t Au and 1527 g/t Ag and 97.5 g/t Au and 1303 g/t Ag along the rhyolite/andesite contact. A lower grade gold halo in the surrounding altered rhyolite returned gold values ranging from 0.11 g/t gold to 2.77g/t gold.

Additional mapping and sampling are required to fully understand the Roosevelt zone before drilling can begin.

At the North Anomaly, the second new zone, gold-in-soil values greater than 25 ppb define a zone 300-metres by 250-metres in dimension. The soil anomaly outlines a zone of stockwork quartz veining within altered rhyolite lithologies. Mapping shows the mineralization is associated with a mafic dike (lamprophyre dike). The newly identified target is located just north of High Grade canyon and has similar geologic characteristics to the Lincoln Hill resource. Additional work is required to follow up on the North Anomaly to assess its potential.

A soil grid along the strike extension of the Washington zone was completed and shows the zone extends 500 metres to the northeast under the colluvium. The soil anomaly has dimension of 500-metres by 100-metres as defined by the 25-ppb gold contour with a 150-metre long core defined by the 100-ppb gold contour. The Washington extension warrants immediate follow up.

"We are very pleased with the soil and rock-chip geochemical results at Lincoln Hill. The two newly identified gold zones and the extension of the Washington zone shows the upside potential of project remains high," stated William C. (Bill) Howald, the Company's President and CEO.

As announced on May 18, 2010, May 11, 2009, and June 2, 2009, in respect of the Lincoln Hill, Wilco, and Jessup projects, Rye Patch Gold's resource inventory along the Oreana trend now totals 1,182,780 ounces of gold and gold equivalent in the measured and indicated category plus 2,727,100 ounces of gold and gold equivalent in the inferred category. Table 2 summarizes Rye Patch Gold's precious metal inventory in Nevada, USA.

Rye Patch Finds New High-Grade Gold and Silver Zones at Lincoln Hill

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 3, 2011) - Rye Patch Gold Corp. (TSX VENTURE:RPM)(OTCQX:RPMGF) ("Rye Patch" or the "Company") announces the results of a soil geochemical sampling program. The survey identified two new target zones (Roosevelt and North Anomaly) and extends the Washington zone on the Company's 100% owned and controlled Lincoln Hill project.

HIGHLIGHTS:

34.79 g/t Au and 779 g/t Ag; 14 g/t Au and 183 g/t Ag; 97.92 g/t Au and 1527 g/t Ag; and 97.5 g/t Au and 1303 g/t Ag along a high-grade structural trend associated with the new Roosevelt target;

Quartz stockwork zone, geologically similar to the Lincoln Hill resource area, found in the new North Anomaly target; and

Gold-in-soil shows the Washington zone extends 500 metres to the northeast.

A total of 1,600 soil samples were collected for a soil geochemical survey on the Lincoln Hill property. The survey identified two new targets and extended the Washington zone 500 metres to the northeast. A follow-up rock-chip sampling program was completed over the newly identified Roosevelt target. The Roosevelt target has dimensions of 400-metres by 50-metres with gold-in-soil values ranging from 25 ppb to 200 ppb. The Roosevelt zone is located 500 metres southeast of Lincoln Hill resource area, and has a north-south orientation dipping 30 degrees to the west. The south end of the anomaly is covered by thick colluvium.

Upon field checking the Roosevelt zone, several old workings were identified. The historic mines are within a silicified rhyolite overlying intensely oxidised andesite. Grab rock-chip samples returned high-grade gold and silver values from this zone up to 34.79 g/t Au and 779 g/t Ag, 14 g/t Au and 183 g/t Ag, 97.92 g/t Au and 1527 g/t Ag and 97.5 g/t Au and 1303 g/t Ag along the rhyolite/andesite contact. A lower grade gold halo in the surrounding altered rhyolite returned gold values ranging from 0.11 g/t gold to 2.77g/t gold.

Additional mapping and sampling are required to fully understand the Roosevelt zone before drilling can begin.

At the North Anomaly, the second new zone, gold-in-soil values greater than 25 ppb define a zone 300-metres by 250-metres in dimension. The soil anomaly outlines a zone of stockwork quartz veining within altered rhyolite lithologies. Mapping shows the mineralization is associated with a mafic dike (lamprophyre dike). The newly identified target is located just north of High Grade canyon and has similar geologic characteristics to the Lincoln Hill resource. Additional work is required to follow up on the North Anomaly to assess its potential.

A soil grid along the strike extension of the Washington zone was completed and shows the zone extends 500 metres to the northeast under the colluvium. The soil anomaly has dimension of 500-metres by 100-metres as defined by the 25-ppb gold contour with a 150-metre long core defined by the 100-ppb gold contour. The Washington extension warrants immediate follow up.

"We are very pleased with the soil and rock-chip geochemical results at Lincoln Hill. The two newly identified gold zones and the extension of the Washington zone shows the upside potential of project remains high," stated William C. (Bill) Howald, the Company's President and CEO.

As announced on May 18, 2010, May 11, 2009, and June 2, 2009, in respect of the Lincoln Hill, Wilco, and Jessup projects, Rye Patch Gold's resource inventory along the Oreana trend now totals 1,182,780 ounces of gold and gold equivalent in the measured and indicated category plus 2,727,100 ounces of gold and gold equivalent in the inferred category. Table 2 summarizes Rye Patch Gold's precious metal inventory in Nevada, USA.

Anglo buys out PRC minorities read across for Cardero Resources

http://dl.dropbox.com/u/14478453/CDU/Anglo%20buys%20out%20PRC%20minorities%20read%20across%20for%20Cardero%20Resources%20~%20OEL%20comment%20250811.pdf

http://dl.dropbox.com/u/14478453/CDU/Anglo%20buys%20out%20PRC%20minorities%20read%20across%20for%20Cardero%20Resources%20~%20OEL%20comment%20250811.pdf

[url=http://peketec.de/trading/viewtopic.php?p=1150309#1150309 schrieb:CCG-Redaktion schrieb am 03.10.2011, 15:00 Uhr[/url]"]Cardero legt gleich voll los

von Tim Roedel

Im Juli 2011 hatten wir Ihnen Cardero Resource zum ersten

Mal vorgestellt. Das Unternehmen besitzt eines der wohl aussichtsreichsten

Kohleprojekte Kanadas und ein weiteres, hochgradiges Eisen-Titan-Projekt im

US-Bundesstaat Minnesota.

Carbon Creek mit Company-

Maker-Potenzial

[...]

Quelle: http://www.rohstoff-spiegel.de/abo_count.php?url=rs_2011-20.pdf

[url=http://peketec.de/trading/viewtopic.php?p=1150178#1150178 schrieb:

October 03, 2011 09:20 ET

Lydian Receives Land Status Change Approval for Amulsar Gold Project; Armenia

Significant Step in Mine Permitting Process Concluded

TORONTO, ONTARIO--(Marketwire - Oct. 3, 2011) - Lydian International Ltd. (TSX:LYD) ("Lydian" or "the Company"), a gold-focused mineral exploration and development company, today announced that the Armenian authorities have approved the change of land status from agricultural to industrial at its Amulsar gold project in Armenia. Amulsar is a high-sulfidation style gold project which currently hosts a CIM compliant combined Indicated and Inferred Category Resource of 2.5 million ounces at 1.0g/t gold (1.1 million ounces at 1.1 g/t gold in the Indicated Category and 1.4 million ounces at 0.9 g/t gold in the Inferred Category).

The change of land status from agricultural to industrial is a significant step in Armenia's mine permitting process. Two regional governors and eight separate government ministries were involved and cleared the Company's land status change application, submitting this to the Prime Minister's office. The application was duly approved under the new regulation of the Cabinet promulgated in April of this year.

The land status change at Amulsar applies to the Company's current mining license surface allocation area which incorporates the proposed open pit area at Tigranes and Artavasdes and also covers pit extension areas at Erato and Arshak.

"This is a major event for us and an indication of Armenia's willingness to support foreign investment" said Tim Coughlin, Lydian's President and CEO "We remain on schedule with our aim to be in production in 2014 and this approval means the Company can commence construction, pre-stripping and stockpiling of run of mine ore as scheduled in 2012".

About Lydian International

Lydian is a gold-focused mineral exploration and development company with expertise employing "first mover" strategies in emerging exploration environments. Currently Lydian is focused on Eastern Europe and on developing its flagship Amulsar gold project in Armenia. The Amulsar group of licenses is wholly owned by Lydian's Armenian subsidiary (Geoteam CJSC). Lydian also has a pipeline of promising early-stage gold and base metal exploration projects in the Caucasus regions.

Lydian's management team has a track record of success in grassroots discovery, in acquiring and developing undervalued assets, and in building companies. Lydian has a strong social agenda and a unique understanding of the complex social and political issues that characterize emerging environments. The Company's significant shareholders include the International Finance Corporation (IFC) which is a member of the World Bank Group and the European Bank for Reconstruction and Development (EBRD). More information can be found on Lydian's web site at www.lydianinternational.co.uk.

Dr Tim Coughlin, BSc, MSc (Exploration and Mining), PhD, MAusIMM; is the Qualified Person overseeing Lydian's exploration programs. Dr. Coughlin has supervised the preparation of the technical information contained in this press release.

Lydian employees are instructed to follow standard operating and quality assurance procedures intended to ensure that all sampling techniques and sample results meet international reporting standards. All assay work for the released results was carried out by ALS Chemex analytical laboratory in Rosia Montana, Romania. More information can be found on Lydian's web site at www.lydianinternational.co.uk.

Lydian Receives Land Status Change Approval for Amulsar Gold Project; Armenia

Significant Step in Mine Permitting Process Concluded

TORONTO, ONTARIO--(Marketwire - Oct. 3, 2011) - Lydian International Ltd. (TSX:LYD) ("Lydian" or "the Company"), a gold-focused mineral exploration and development company, today announced that the Armenian authorities have approved the change of land status from agricultural to industrial at its Amulsar gold project in Armenia. Amulsar is a high-sulfidation style gold project which currently hosts a CIM compliant combined Indicated and Inferred Category Resource of 2.5 million ounces at 1.0g/t gold (1.1 million ounces at 1.1 g/t gold in the Indicated Category and 1.4 million ounces at 0.9 g/t gold in the Inferred Category).

The change of land status from agricultural to industrial is a significant step in Armenia's mine permitting process. Two regional governors and eight separate government ministries were involved and cleared the Company's land status change application, submitting this to the Prime Minister's office. The application was duly approved under the new regulation of the Cabinet promulgated in April of this year.

The land status change at Amulsar applies to the Company's current mining license surface allocation area which incorporates the proposed open pit area at Tigranes and Artavasdes and also covers pit extension areas at Erato and Arshak.

"This is a major event for us and an indication of Armenia's willingness to support foreign investment" said Tim Coughlin, Lydian's President and CEO "We remain on schedule with our aim to be in production in 2014 and this approval means the Company can commence construction, pre-stripping and stockpiling of run of mine ore as scheduled in 2012".

About Lydian International

Lydian is a gold-focused mineral exploration and development company with expertise employing "first mover" strategies in emerging exploration environments. Currently Lydian is focused on Eastern Europe and on developing its flagship Amulsar gold project in Armenia. The Amulsar group of licenses is wholly owned by Lydian's Armenian subsidiary (Geoteam CJSC). Lydian also has a pipeline of promising early-stage gold and base metal exploration projects in the Caucasus regions.

Lydian's management team has a track record of success in grassroots discovery, in acquiring and developing undervalued assets, and in building companies. Lydian has a strong social agenda and a unique understanding of the complex social and political issues that characterize emerging environments. The Company's significant shareholders include the International Finance Corporation (IFC) which is a member of the World Bank Group and the European Bank for Reconstruction and Development (EBRD). More information can be found on Lydian's web site at www.lydianinternational.co.uk.

Dr Tim Coughlin, BSc, MSc (Exploration and Mining), PhD, MAusIMM; is the Qualified Person overseeing Lydian's exploration programs. Dr. Coughlin has supervised the preparation of the technical information contained in this press release.

Lydian employees are instructed to follow standard operating and quality assurance procedures intended to ensure that all sampling techniques and sample results meet international reporting standards. All assay work for the released results was carried out by ALS Chemex analytical laboratory in Rosia Montana, Romania. More information can be found on Lydian's web site at www.lydianinternational.co.uk.

10/3/2011 12:11:11 AM | Dr. David Eifrig, DailyWealth

aus Stockhouse: http://www.stockhouse.com/Columnists/2011/Oct/3/Here-s-what-to-do-about-the-big-drop-in-silver

“I wouldn't be surprised if readers who take my advice make another hundred percent gain in the next few years”

I'm an unusual silver owner.

I'm excited the metal just suffered one of its biggest drops in 10 years. And this makes me an "odd man out" in the advisory business.

For the past several years, I've encouraged everyone I know to own silver as a "crisis hedge" asset. Precious metals like gold and silver tend to soar during times of economic turmoil.

I even produced a special report on the simplest, easiest, best way to own silver, which I made available to Retirement Millionaire readers two years ago. I wouldn't be surprised if readers who take my advice make another hundred percent gain in the next few years.

But here's where I differ from most advisory writers...

I don't think there's going to be a big crisis in America soon. I'm no "doom and gloom" analyst. I don't think the dollar is going to collapse. And I don't think you need to stock up on bottled water, bullets, and live in a bomb shelter. I own plenty of U.S. stocks and bonds, and I recommend you do the same.

But I also believe in insurance. I believe in staying "hedged." For many years, my job at Wall Street bank Goldman Sachs was to develop and implement advanced hedging strategies for wealthy clients and corporations. The goal with these strategies was to protect jobs, wealth, and profits from unforeseen events.

During those years, I learned a big difference between wealthy people and poor people. Wealthy people almost always own plenty of hedges and insurance. They consider what could happen in worst-case scenarios and take steps to protect themselves. Poor people tend to live with "blinders" on. They do things like keep their retirement fund in just one or two stocks... which is incredibly risky.

Fortunately, for most investors, you don't need a complicated set of hedges. You simply need to own gold and silver. As I showed you last month, keeping 5%-10% of your portfolio in silver can make a huge difference in a broad market decline. So while most folks see silver as a wildly volatile asset, I actually see it as a risk-reducing "sleep well at night" asset.

But for most silver owners, the past few weeks have brought "stay UP all night" action...

As you can see from the chart below, owning silver has been a wealth loser for the past month. Silver traded for $42 per ounce in August. It has fallen down to $30 in September... a decline of 28.5%. This big decline has a lot of silver owners worried.

As I mentioned, I'm actually happy to see lower silver prices. I'm happy for two reasons:

1) It gives my readers a chance to buy this "crisis insurance" at a discount. Silver is 38% cheaper than where it was at its peak in April.

And...

2) Silver and gold are a sort of temperature gauge for the global financial system. Soaring gold and silver prices are an indication that something is wrong with the world's credit and banking system.

If gold and silver were to collapse 50%, it would be one heck of a sign that politicians are taking the right steps to get our economy on track. This would create a fantastic environment for owning stocks, bonds, and real estate. I wouldn't mind losing money on my silver if the other investments are improving...

But I'm not holding my breath and waiting for politicians to become saints and geniuses. Mind you, I believe America has much brighter days ahead of it. The American system is still an incredible producer of wealth. America is still THE place to get rich. American corporations like Coke, Johnson & Johnson, and Apple are the best in the world.

That's why I still own U.S. stocks and bonds. But just like I wear my seat belt while driving, I own silver and gold – just in case. And due to the drop of the past few weeks, these "crisis hedge" assets are on sale at great prices.

If you don't own silver and gold yet, I recommend putting at least 3%-4% of your overall portfolio into them immediately.

ABOUT THE AUTHOR

Dr. David Eifrig, DailyWealth

DailyWealth is free daily investment newsletter focused on the best contrarian investment opportunities in the world. We write with a simple belief in mind: You don't have to take big risks to make big money with your investments. http://www.dailywealth.com/

aus Stockhouse: http://www.stockhouse.com/Columnists/2011/Oct/3/Here-s-what-to-do-about-the-big-drop-in-silver

“I wouldn't be surprised if readers who take my advice make another hundred percent gain in the next few years”

I'm an unusual silver owner.

I'm excited the metal just suffered one of its biggest drops in 10 years. And this makes me an "odd man out" in the advisory business.

For the past several years, I've encouraged everyone I know to own silver as a "crisis hedge" asset. Precious metals like gold and silver tend to soar during times of economic turmoil.

I even produced a special report on the simplest, easiest, best way to own silver, which I made available to Retirement Millionaire readers two years ago. I wouldn't be surprised if readers who take my advice make another hundred percent gain in the next few years.

But here's where I differ from most advisory writers...

I don't think there's going to be a big crisis in America soon. I'm no "doom and gloom" analyst. I don't think the dollar is going to collapse. And I don't think you need to stock up on bottled water, bullets, and live in a bomb shelter. I own plenty of U.S. stocks and bonds, and I recommend you do the same.

But I also believe in insurance. I believe in staying "hedged." For many years, my job at Wall Street bank Goldman Sachs was to develop and implement advanced hedging strategies for wealthy clients and corporations. The goal with these strategies was to protect jobs, wealth, and profits from unforeseen events.

During those years, I learned a big difference between wealthy people and poor people. Wealthy people almost always own plenty of hedges and insurance. They consider what could happen in worst-case scenarios and take steps to protect themselves. Poor people tend to live with "blinders" on. They do things like keep their retirement fund in just one or two stocks... which is incredibly risky.

Fortunately, for most investors, you don't need a complicated set of hedges. You simply need to own gold and silver. As I showed you last month, keeping 5%-10% of your portfolio in silver can make a huge difference in a broad market decline. So while most folks see silver as a wildly volatile asset, I actually see it as a risk-reducing "sleep well at night" asset.

But for most silver owners, the past few weeks have brought "stay UP all night" action...

As you can see from the chart below, owning silver has been a wealth loser for the past month. Silver traded for $42 per ounce in August. It has fallen down to $30 in September... a decline of 28.5%. This big decline has a lot of silver owners worried.

As I mentioned, I'm actually happy to see lower silver prices. I'm happy for two reasons:

1) It gives my readers a chance to buy this "crisis insurance" at a discount. Silver is 38% cheaper than where it was at its peak in April.

And...

2) Silver and gold are a sort of temperature gauge for the global financial system. Soaring gold and silver prices are an indication that something is wrong with the world's credit and banking system.

If gold and silver were to collapse 50%, it would be one heck of a sign that politicians are taking the right steps to get our economy on track. This would create a fantastic environment for owning stocks, bonds, and real estate. I wouldn't mind losing money on my silver if the other investments are improving...

But I'm not holding my breath and waiting for politicians to become saints and geniuses. Mind you, I believe America has much brighter days ahead of it. The American system is still an incredible producer of wealth. America is still THE place to get rich. American corporations like Coke, Johnson & Johnson, and Apple are the best in the world.

That's why I still own U.S. stocks and bonds. But just like I wear my seat belt while driving, I own silver and gold – just in case. And due to the drop of the past few weeks, these "crisis hedge" assets are on sale at great prices.

If you don't own silver and gold yet, I recommend putting at least 3%-4% of your overall portfolio into them immediately.

ABOUT THE AUTHOR

Dr. David Eifrig, DailyWealth

DailyWealth is free daily investment newsletter focused on the best contrarian investment opportunities in the world. We write with a simple belief in mind: You don't have to take big risks to make big money with your investments. http://www.dailywealth.com/

October 03, 2011 09:22 ET

Balmoral More Than Doubles Strike Extent of High-Grade Martiniere West Gold Zone, Detour Gold Trend, Quebec

- Highlights Include High Grade Gold Intercepts of 23.57 g/t Gold Over 3.74 Metres; 18.66 g/t Gold Over 3.15 Metres

- Zone Remains Open in All Directions

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 3, 2011) - Balmoral Resources Ltd. ("Balmoral" or the "Company") (TSX VENTURE:BAR) reported today that the high-grade Martiniere West Gold Zone continues to expand and demonstrate excellent continuity. Results from 10 holes reported more than double the strike extent of the Zone and indicate that the high-grade gold mineralization remains open in all directions at shallow depths.

Over 90% of the holes targeting the West Zone have been successful in intersecting high-grade gold mineralization. Highlights of the current drill program include gold intercepts of 23.57 g/t gold over 3.74 metres (MDW-11-24); 18.66 g/t gold over 3.15 metres (MDW-11-25) and 22.57 g/t gold over 2.22 metres (MDW-11-29). An updated long section of the Martiniere West Zone is available on the Company's website at www.balmoralresources.com.

"The Martiniere West Zone is demonstrating excellent continuity and very good gold grades throughout." said Darin Wagner, President and CEO of Balmoral Resources Ltd. "We have progressed from target testing, through exploration, to the early stages of defining a high-grade gold resource at Martiniere West."

.

.

.

http://www.marketwire.com/press-release/balmoral-more-than-doubles-strike-extent-high-grade-martiniere-west-gold-zone-detour-tsx-venture-bar-1568094.htm

Balmoral More Than Doubles Strike Extent of High-Grade Martiniere West Gold Zone, Detour Gold Trend, Quebec

- Highlights Include High Grade Gold Intercepts of 23.57 g/t Gold Over 3.74 Metres; 18.66 g/t Gold Over 3.15 Metres

- Zone Remains Open in All Directions

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 3, 2011) - Balmoral Resources Ltd. ("Balmoral" or the "Company") (TSX VENTURE:BAR) reported today that the high-grade Martiniere West Gold Zone continues to expand and demonstrate excellent continuity. Results from 10 holes reported more than double the strike extent of the Zone and indicate that the high-grade gold mineralization remains open in all directions at shallow depths.

Over 90% of the holes targeting the West Zone have been successful in intersecting high-grade gold mineralization. Highlights of the current drill program include gold intercepts of 23.57 g/t gold over 3.74 metres (MDW-11-24); 18.66 g/t gold over 3.15 metres (MDW-11-25) and 22.57 g/t gold over 2.22 metres (MDW-11-29). An updated long section of the Martiniere West Zone is available on the Company's website at www.balmoralresources.com.

"The Martiniere West Zone is demonstrating excellent continuity and very good gold grades throughout." said Darin Wagner, President and CEO of Balmoral Resources Ltd. "We have progressed from target testing, through exploration, to the early stages of defining a high-grade gold resource at Martiniere West."

.

.

.

http://www.marketwire.com/press-release/balmoral-more-than-doubles-strike-extent-high-grade-martiniere-west-gold-zone-detour-tsx-venture-bar-1568094.htm

<i></i>[url=http://peketec.de/trading/viewtopic.php?p=1149700#1149700 schrieb:Moritz schrieb am 30.09.2011, 13:35 Uhr[/url]"]DUN bei Smartstox: http://www.smartstox.com/interviews/dun/

(hat auch nichts genutzt!)

[url=http://peketec.de/trading/viewtopic.php?p=1149153#1149153 schrieb:Moritz schrieb am 29.09.2011, 16:03 Uhr[/url]"]ja der Preis ist immer relativ

[url=http://peketec.de/trading/viewtopic.php?p=1149138#1149138 schrieb:golden_times schrieb am 29.09.2011, 15:52 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1149136#1149136 schrieb:Steines schrieb am 29.09.2011, 15:51 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1149123#1149123 schrieb:

Datum : 28/09/2011 @ 17h18

Duncastle Reports Ubiquitous Mineralization at Sultana, Porphyry Creek

http://de.advfn.com/nachrichten/Duncastle-Reports-Ubiquitous-Mineralization-at-Sul_49338695.html

imho unökonomische Längen und grades, demnach sehe ich bis dato kein Handlungsbedarf