App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

V:BMK Verdoppler durchaus möglich. SK 0.07 CAD

https://www.stockwatch.com/News/Item?bid=Z-C%3aBMK-2867179&symbol=BMK®ion=C

https://www.stockwatch.com/News/Item?bid=Z-C%3aBMK-2867179&symbol=BMK®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Westhaven Ventures begins drilling at Shovelnose

2020-02-19 10:34 ET - News Release

Mr. Gareth Thomas reports

WESTHAVEN COMMENCES DRILLING AT SHOVELNOSE GOLD PROPERTY

Westhaven Ventures Inc. has begun drilling at its 17,623-hectare Shovelnose gold property. Shovelnose is located within the prospective Spences Bridge Gold Belt (SBGB), which borders the Coquihalla Highway 30 kilometres south of Merritt, British Columbia.

Shovelnose Outlook for 2020:

Drilling up to 30,000 metres with a focus on exploration external to the South Zone.

Initially stepping out to the southeast of hole SN19-45 to test for the continuation of the vein system.

Subsequently moving towards a high priority exploration target to the east (Target A on target map below).

Drill testing other high priority targets to the southeast.

Gareth Thomas, President and CEO of Westhaven, stated: "Drilling to date in the South Zone has demonstrated that the Shovelnose gold property hosts a significant, high grade gold vein system. The focus for 2020 will be stepping outside of the South Zone to explore for additional vein zones. As a result of systematic exploration completed in 2019, we have identified several target areas that share similar characteristics to the South Zone which have been prioritized for near term drilling. We have a strategic advantage with regards to location as the property is situated off a major highway, in close proximity to power, rail, large producing mines, and within commuting distance from the city of Merritt, which translates into low cost, year round exploration."

The South Zone:

Drilling since late 2018 has outlined substantial epithermal quartz veining over a strike length of 1,300 metres and a vertical range in excess of 300 metres. The South Zone as presently outlined consists of three subparallel quartz veins (Veins 1, 2, & 3) and related zones of sheeted quartz veinlets. The ultimate dimensions of this vein system and other vein systems potentially outside of the South Zone remain to be determined and will require extensive drilling to test the property's full potential.

Multiple phases of veining and brecciation are evident at the South Zone. The first phase consists of a hydrothermal breccia healed by a dark silica-pyrite matrix. This is followed by brown-grey to black variably pyritic chalcedony, occurring in centimetre to metre scale veins that is quite common in Vein 2. This chalcedony is cut by pale grey cryptocrystalline, commonly colloform-crustiform, banded quartz +/- adularia +/- pyrite/marcasite +/- ginguro in centimetre to metre scale veins and breccia veins. This third phase carries significant gold mineralization. Examples of this include hole SN19-01 which intersected 39.30 g/t gold over 12.66 metres in Vein 1 and hole SN19-10, which intersected 5.13 g/t gold over 52.10 metres in Vein 2.

Qualified Person Statement

Peter Fischl, P.Geo., who is a Qualified Person within the context of National Instrument 43-101 has read and takes responsibility for this release.

About Westhaven:

Westhaven is a gold-focused exploration company advancing the high-grade discovery on the Shovelnose project in Canada's newest gold district, the Spences Bridge Gold Belt. Westhaven controls 37,000 hectares (370 square kilometres) with four 100% owned gold properties spread along this underexplored belt. The Shovelnose property is situated off a major highway, in close proximity to power, rail, large producing mines, and within commuting distance from the city of Merritt, which translates into low cost exploration. Westhaven is committed to the highest standards of environmental and social responsibility with a focus on generating positive outcomes and returns to all stakeholders.

https://www.stockwatch.com/News/Item?bid=Z-C:WHN-2867438&symbol=WHN®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Feb 18/20 Feb 14/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 30,000 $0.095

Feb 12/20 Feb 7/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 8,500 $0.095

Jan 30/20 Jan 29/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 10,000 $0.095

Jan 30/20 Jan 28/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 5,000 $0.095

Jan 30/20 Jan 27/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 75,000 $0.095

Jan 26/20 Jan 23/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 12,500 $0.095

Jan 26/20 Jan 22/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 2,000 $0.095

Jan 26/20 Jan 22/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 4,000 $0.095

Jan 26/20 Jan 22/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 4,000 $0.095

Jan 26/20 Jan 22/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 18,000 $0.093

https://www.canadianinsider.com/company?ticker=ANK

Feb 12/20 Feb 7/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 8,500 $0.095

Jan 30/20 Jan 29/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 10,000 $0.095

Jan 30/20 Jan 28/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 5,000 $0.095

Jan 30/20 Jan 27/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 75,000 $0.095

Jan 26/20 Jan 23/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 12,500 $0.095

Jan 26/20 Jan 22/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 2,000 $0.095

Jan 26/20 Jan 22/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 4,000 $0.095

Jan 26/20 Jan 22/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 4,000 $0.095

Jan 26/20 Jan 22/20 Weeks, Delayne Direct Ownership Common Shares 10 - Acquisition in the public market 18,000 $0.093

https://www.canadianinsider.com/company?ticker=ANK

[url=https://peketec.de/trading/viewtopic.php?p=1933432#1933432 schrieb:Kostolanys Erbe schrieb am 13.01.2020, 21:48 Uhr[/url]"]News von ANK:

Angkor to option 70% of Oyadao North for $4.6M (U.S.)

2020-01-13 08:27 ET - News Release

Mr. Stephen Burega reports

ANGKOR SIGNS USD $4.6 MILLION EARN-IN AGREEMENT ON OYADAO LICENSE

Angkor Resources Corp. has signed an earn-in agreement on its Oyadao licence with Canadian development company Hommy Oyadao Inc. to earn up to a 70-per-cent interest in Angkor's Oyadao North licence in exchange for payments totalling $4.6-million (U.S.).

Agreement highlights

Hommy 5 Resources Inc. will return any earned interest in Angkor's Banlung licence in return for Hommy Oyadao Inc. receiving an initial 10-per-cent earn-in interest in Oyadao (see press release dated Sept. 19, 2018).

With the end of the previous agreement with Hommy 5 Resources Inc., the Banlung licence returns to being 100 per cent owned by Angkor.

Hommy may acquire an additional 20-per-cent interest in Oyadao by making an upfront payment to Angkor of $100,000 (U.S.) for past and future work associated with the property, and by paying to Angkor as operator on or before May 30, 2020, an additional $500,000 (U.S.) to be spent on exploration of Oyadao North.

Following that, Hommy will spend a minimum of $100,000 (U.S.) a quarter on Oyadao.

Once Hommy has either spent an additional $4-million (U.S.) on Oyadao in exploration, development and related statutory fees relating to the licence, or has produced more than 300 ounces of gold per month for six consecutive months or an aggregate of 2,000 ounces of gold from the property, whichever is the sooner, then Hommy will be granted a further 40-per-cent participating interest, bringing its total interest in Oyadao North to 70 per cent.

Should Hommy fail to meet any of the above milestones, the property will revert to Angkor with no interest earned by Hommy.

"We are very pleased to be working again with Hommy," said Mike Weeks, executive chairman of Angkor. "They were excellent development partners on Banlung. The proximity of Oyadao to the development at Mesco's Phum Syarung mine site (see press release dated June 25, 2018) is of great interest to us both and we are excited to pursue this initiative together."

Dr. Adrian G. Mann, director of, and technical adviser to, Hommy Oyadao Inc., is optimistic about the company's immediate exploration plans for Oyadao: "Mesco's vertical shaft is about 400 metres from our first drill target which is based on a strong EM conductor that coincides with the line of strike of their main vein. It's a modest but aggressive program on which we can build."

The Oyadao licence is a 222-square-kilometre area near the Vietnam border, running north and east of Mesco's Phum Syarung mine site, the mineral rights of which were sold separately by Angkor to Mesco in 2013 and licensed in 2016 for $1.8-million (U.S.) in cash, with Angkor retaining a sliding scale net smelter return interest ranging from 2.0 per cent to 7.5 per cent on any gold production, as well as 7.5 per cent of the value all other metals produced.

About Angkor Resources Corp.

Angkor Resources is a public company, listed on the TSX Venture Exchange, and is a leading mineral explorer in Cambodia with a large land package. In 2019 it added block VIII, a 7,300-square-kilometre oil and gas exploration licence in Cambodia, to its exploration portfolio.

https://www.stockwatch.com/News/Item?bid=Z-C%3aANK-2853933&symbol=ANK®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

GoGold begins 2nd exploration program at Los Ricos

2020-02-20 13:27 ET - News Release

Mr. Steve Low reports

GOGOLD LAUNCHES SECOND EXPLORATION PROJECT IN THE LOS RICOS DISTRICT

GoGold Resources Inc. has launched a second exploration project in the Los Ricos district called Monte del Favor. The company has consolidated its land position along the 35-kilometre trend with the acquisition of five new concessions in the district, bringing the total number of concessions to 35, covering 22,493 hectares.

The new concessions come with a legacy database of 50 historical drill holes with grades as high as 2,109 g/t silver equivalent (6.4 g/t Au and 1,629 g/t Ag) over 24.4m with further highlight drill holes in the table below. This area is where the Company will begin a drill program in the next 45 days. The Company's technical team has been on the ground at the North Project mapping, trenching and sampling for the past 3 months and are currently preparing the first three drill targets.

"We have a strategic plan for the Los Ricos district which includes consolidation of concessions and drilling for ounces. With the completion of the latest concession acquisitions and our financing, we will be adding drill rigs and accelerating our exploration to showcase the Los Ricos district to be one of the most prospective in Mexico" said Brad Langille, President and CEO. "All the elements are now in place for us to execute on creating more value at Los Ricos for our shareholders."

.....

https://www.stockwatch.com/News/Item?bid=Z-C%3aGGD-2868153&symbol=GGD®ion=C

GOLD - Bis zum nächsten Mal!

Tagesausblick für Freitag, 21. Februar 2020:

Mein kurzes Edelmetall-Intermezzo in dieser Woche hat Spaß gemacht. Der Ausbruch beim Goldpreis ist in vollem Gange. Genießen Sie die Gewinne, bis zum nächsten Mal!

https://www.godmode-trader.de/analyse/gold-bis-zum-naechsten-mal,8133257

Tagesausblick für Freitag, 21. Februar 2020:

Mein kurzes Edelmetall-Intermezzo in dieser Woche hat Spaß gemacht. Der Ausbruch beim Goldpreis ist in vollem Gange. Genießen Sie die Gewinne, bis zum nächsten Mal!

https://www.godmode-trader.de/analyse/gold-bis-zum-naechsten-mal,8133257

[url=https://peketec.de/trading/viewtopic.php?p=1927242#1927242 schrieb:

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Jadestone Energy Inc. Announces Jadestone Energy Capital Markets Event

2020-02-21 02:00 ET - News Release

Jadestone Energy Capital Markets Event

SINGAPORE / ACCESSWIRE / February 21, 2020 / Jadestone Energy Inc. (AIM:JSE) (TSXV:JSE) ("Jadestone" or the "Company"), an independent oil and gas production company focused on the Asia Pacific region, will host a Capital Markets Event on Tuesday, February 25, 2019.

The management team will present an update on its business to an audience in London, and will provide a live webcast of the session, starting at 08:00 (Toronto), 13:00 (London), 21:00 (Singapore), February 25, 2020. Please register for the event approximately 15 minutes prior to the start of the session. Presentation materials will be available on the Company's website at: www.jadestone-energy.com/investor-relations/.

Webcast link: https://webcasting.brrmedia.co.uk/broadcast/5e4eaf986d91c26b10a745eb

Event conference title: Jadestone Energy Inc. - Capital Markets Event 2020

Start time: 08:00 (Toronto), 13:00 (London), 21:00 (Singapore)

Approximate duration: 3 hours

Date: Tuesday, February 25, 2020

https://www.stockwatch.com/News/Item?bid=Z-C%3aJSE-2868482&symbol=JSE®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

AU:SXY

21/02/2020 FY20 half year results presentation

https://www.asx.com.au/asxpdf/20200221/pdf/44f9p5csv6j3r7.pdf

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Langfristchart:

Da ist noch viel Luft nach oben....

[url=https://peketec.de/trading/viewtopic.php?p=1936755#1936755 schrieb:Kostolanys Erbe schrieb am 23.01.2020, 21:20 Uhr[/url]"]UK:POG

Volumen!!!

» zur Grafik

[url=https://peketec.de/trading/viewtopic.php?p=1928190#1928190 schrieb:Kostolanys Erbe schrieb am 09.12.2019, 20:59 Uhr[/url]"]UK:POG

Hält sich sehr gut gegen den allgemeinen Markttrend bei Gold!

» zur Grafik

[url=https://peketec.de/trading/viewtopic.php?p=1905579#1905579 schrieb:Kostolanys Erbe schrieb am 19.07.2019, 10:57 Uhr[/url]"]Heute 1.Kauf Petropavlovsk als Russland-Hardcore-Gold-Zock

> 20 Mio. OZ

Debt: 594 Mio. US$ weiter sinkend

AISC: 1.117 US$

Langfristchart:

» zur Grafik

5-Jahreschart:

» zur Grafik

LUC - Lucara Diamond - scheinen den Boden gefunden zu haben, 4Q lief wieder deutlich besser

2020-02-23 23:00 ET - News Release

Lucara Announces 2019 Annual Results

https://www.stockwatch.com/News/Item?bid=Z-C:LUC-2868880&symbol=LUC®ion=C

Canada NewsWire

VANCOUVER, Feb. 23, 2020

VANCOUVER, Feb. 23, 2020 /CNW/ - (LUC – TSX, LUC – BSE, LUC – Nasdaq Stockholm)

Please view PDF version.

https://mma.prnewswire.com/media/10..._Announces_2019_Annual_Results.pdf?p=original

Lucara Diamond Corp. ("Lucara" or the "Company") today reports its results for the year ended December 31, 2019.

HIGHLIGHTS FOR THE YEAR ENDED DECEMBER 31, 2019

Total revenues of $192.5 million (2018: $176.2 million) or $468 per carat (2018: $502 per carat) during fiscal year 2019 (guidance: $170 million to $180 million).

Strong operational performance at Karowe, including record production through the plant in 2019:

Total tonnes mined of 9.8 million (guidance: 9.5 million to 10.9 million)

Ore and waste mined were 3.3 million tonnes and 6.5 million tonnes respectively

Ore processed totaled 2.8 million tonnes (guidance: 2.5 million to 2.8 million tonnes)

433,060 total carats recovered, including 29,990 carats recovered from previously milled material (guidance: 400,000 to 425,000 carats)

2019 was another strong year for the recovery of Specials (single diamonds in excess of 10.8 carats) from direct milling ore with 786 stones totaling 24,424 carats recovered, including 31 diamonds in excess of 100 carats, of which 2 stones were in excess of 300 carats including the historic 1,758ct Sewelô diamond. Specials were also recovered in treatment of historic, pre-XRT recovery tailings, including a 375 carat stone in Q3 2019. No further treatment of historic recovery tailings is expected.

Operating cash costs for the year ended December 31, 2019 were $31.88 per tonne processed (2018: $39.92 per tonne processed) compared to the full year forecast cash cost of $32-$37 per tonne processed (*Non-IFRS measure). Operating cash cost per tonne processed was positively impacted by a combination of higher tonnes processed and lower overall tonnes mined as planned in 2019 following the completion of a waste stripping campaign in 2018. Cost optimization initiatives and favorable foreign exchange contributed to the lower operating cash cost per tonne compared to guidance. Operating cash costs for 2020 are expected to continue to trend between $32-$36 per tonne processed.

Clara completed its first year of operations with a total of 15 sales, 27 customers and volume transacted of $8.4 million. Development activities were completed under budget at $0.4 million in 2019. Clara is poised to achieve significant growth in 2020 with the addition of further customers and third-party production.

Adjusted EBITDA for the year ended December 31, 2019 was $73.1 million as compared to adjusted EBITDA for the same period in 2018 of $60.5 million, an increase of 21% (*Non-IFRS measure).

Net income for the year ended December 31, 2019 was $12.7 million ($0.03 per share) as compared to net income of $11.7 million ($0.03 per share) in 2018.

As at December 31, 2019, the Company had cash and cash equivalents of $11.2 million and no debt. In 2019, the Company invested $29.0 million in the business, primarily towards the completion of an underground feasibility study, and, improvements to plant and equipment to maximize carat recoveries. The Company's $50 million credit facility was available for use as at December 31, 2019.

During the first three quarters of 2019, the Company paid a CA$0.025 quarterly dividend, returning $22.4 million (CA$0.075 per share) to shareholders in 2019 (2018: $30.3 million or CA$0.10 per share). Since inception in June 2014, the Company has paid dividends of $271 million (CA$349 million).

Eira Thomas, President & CEO commented: "Our strong operating results for 2019 reflect Lucara's continued focus on safe, reliable operations which has delivered increased productivity at lower costs and provides a solid foundation to support our next stage of growth - an underground expansion at Karowe which has the potential extend our mine life to 2040, add net cash flow of $1.22 billion and gross revenues of $5.25 billion. Our second business, Clara, continues to deliver solid results and is on track to steadily grow third party supply to the platform over the course of the coming year. In 2019 Lucara also continued to explore ways and means to maximize the value it receives for its diamonds. Our ground-breaking agreement with Louis Vuitton in January 2020 is another example of how we are delivering on this commitment. Through this agreement, we will demonstrate that greater collaboration within the supply chain can unlock value and increase transparency from mine to consumer."

CHANGE IN DIVIDEND POLICY

In November 2019, the Company announced the results of a positive feasibility study for development of an underground mine at its 100% owned Karowe Diamond Mine. Concurrently with the announcement of the feasibility study, Lucara's Board of Directors determined that it would be in the best interest of the Company and its shareholders to suspend the quarterly dividend payment of C$0.025 per share, effective as of Q4 2019. The feasibility study demonstrated the potential to extend the mine life at Karowe to 2040 while generating significant economic benefits for the Company, its shareholders, employees, the communities surrounding the mine and the country of Botswana. In anticipation of a decision to proceed with construction of an underground mine at Karowe during 2020, the Board of Directors decided to re-direct the Company's available cash to the early works of the underground including detailed engineering, procurement initiatives and project financing. These activities will be funded from operating cash-flow in 2020, under a Board approved budget of up to $53 million.......

2020-02-23 23:00 ET - News Release

Lucara Announces 2019 Annual Results

https://www.stockwatch.com/News/Item?bid=Z-C:LUC-2868880&symbol=LUC®ion=C

Canada NewsWire

VANCOUVER, Feb. 23, 2020

VANCOUVER, Feb. 23, 2020 /CNW/ - (LUC – TSX, LUC – BSE, LUC – Nasdaq Stockholm)

Please view PDF version.

https://mma.prnewswire.com/media/10..._Announces_2019_Annual_Results.pdf?p=original

Lucara Diamond Corp. ("Lucara" or the "Company") today reports its results for the year ended December 31, 2019.

HIGHLIGHTS FOR THE YEAR ENDED DECEMBER 31, 2019

Total revenues of $192.5 million (2018: $176.2 million) or $468 per carat (2018: $502 per carat) during fiscal year 2019 (guidance: $170 million to $180 million).

Strong operational performance at Karowe, including record production through the plant in 2019:

Total tonnes mined of 9.8 million (guidance: 9.5 million to 10.9 million)

Ore and waste mined were 3.3 million tonnes and 6.5 million tonnes respectively

Ore processed totaled 2.8 million tonnes (guidance: 2.5 million to 2.8 million tonnes)

433,060 total carats recovered, including 29,990 carats recovered from previously milled material (guidance: 400,000 to 425,000 carats)

2019 was another strong year for the recovery of Specials (single diamonds in excess of 10.8 carats) from direct milling ore with 786 stones totaling 24,424 carats recovered, including 31 diamonds in excess of 100 carats, of which 2 stones were in excess of 300 carats including the historic 1,758ct Sewelô diamond. Specials were also recovered in treatment of historic, pre-XRT recovery tailings, including a 375 carat stone in Q3 2019. No further treatment of historic recovery tailings is expected.

Operating cash costs for the year ended December 31, 2019 were $31.88 per tonne processed (2018: $39.92 per tonne processed) compared to the full year forecast cash cost of $32-$37 per tonne processed (*Non-IFRS measure). Operating cash cost per tonne processed was positively impacted by a combination of higher tonnes processed and lower overall tonnes mined as planned in 2019 following the completion of a waste stripping campaign in 2018. Cost optimization initiatives and favorable foreign exchange contributed to the lower operating cash cost per tonne compared to guidance. Operating cash costs for 2020 are expected to continue to trend between $32-$36 per tonne processed.

Clara completed its first year of operations with a total of 15 sales, 27 customers and volume transacted of $8.4 million. Development activities were completed under budget at $0.4 million in 2019. Clara is poised to achieve significant growth in 2020 with the addition of further customers and third-party production.

Adjusted EBITDA for the year ended December 31, 2019 was $73.1 million as compared to adjusted EBITDA for the same period in 2018 of $60.5 million, an increase of 21% (*Non-IFRS measure).

Net income for the year ended December 31, 2019 was $12.7 million ($0.03 per share) as compared to net income of $11.7 million ($0.03 per share) in 2018.

As at December 31, 2019, the Company had cash and cash equivalents of $11.2 million and no debt. In 2019, the Company invested $29.0 million in the business, primarily towards the completion of an underground feasibility study, and, improvements to plant and equipment to maximize carat recoveries. The Company's $50 million credit facility was available for use as at December 31, 2019.

During the first three quarters of 2019, the Company paid a CA$0.025 quarterly dividend, returning $22.4 million (CA$0.075 per share) to shareholders in 2019 (2018: $30.3 million or CA$0.10 per share). Since inception in June 2014, the Company has paid dividends of $271 million (CA$349 million).

Eira Thomas, President & CEO commented: "Our strong operating results for 2019 reflect Lucara's continued focus on safe, reliable operations which has delivered increased productivity at lower costs and provides a solid foundation to support our next stage of growth - an underground expansion at Karowe which has the potential extend our mine life to 2040, add net cash flow of $1.22 billion and gross revenues of $5.25 billion. Our second business, Clara, continues to deliver solid results and is on track to steadily grow third party supply to the platform over the course of the coming year. In 2019 Lucara also continued to explore ways and means to maximize the value it receives for its diamonds. Our ground-breaking agreement with Louis Vuitton in January 2020 is another example of how we are delivering on this commitment. Through this agreement, we will demonstrate that greater collaboration within the supply chain can unlock value and increase transparency from mine to consumer."

CHANGE IN DIVIDEND POLICY

In November 2019, the Company announced the results of a positive feasibility study for development of an underground mine at its 100% owned Karowe Diamond Mine. Concurrently with the announcement of the feasibility study, Lucara's Board of Directors determined that it would be in the best interest of the Company and its shareholders to suspend the quarterly dividend payment of C$0.025 per share, effective as of Q4 2019. The feasibility study demonstrated the potential to extend the mine life at Karowe to 2040 while generating significant economic benefits for the Company, its shareholders, employees, the communities surrounding the mine and the country of Botswana. In anticipation of a decision to proceed with construction of an underground mine at Karowe during 2020, the Board of Directors decided to re-direct the Company's available cash to the early works of the underground including detailed engineering, procurement initiatives and project financing. These activities will be funded from operating cash-flow in 2020, under a Board approved budget of up to $53 million.......

Industriemetalle: Die Zahlen verheißen nichts Gutes kupfer

In China schwellen die Metalllagerhäuser massiv an, die Hütten wissen nicht wohin mit ihren Produkten, obwohl die Erzeugung massiv zurückgefahren wurde. Neuesten Daten zufolge ist Chinas Automarkt im Februar zum Erliegen gekommen. Die Metallnachfrage dürfte ebenso eingebrochen sein.

https://www.godmode-trader.de/artikel/industriemetalle-die-zahlen-verheissen-nichts-gutes,8138726

In China schwellen die Metalllagerhäuser massiv an, die Hütten wissen nicht wohin mit ihren Produkten, obwohl die Erzeugung massiv zurückgefahren wurde. Neuesten Daten zufolge ist Chinas Automarkt im Februar zum Erliegen gekommen. Die Metallnachfrage dürfte ebenso eingebrochen sein.

https://www.godmode-trader.de/artikel/industriemetalle-die-zahlen-verheissen-nichts-gutes,8138726

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

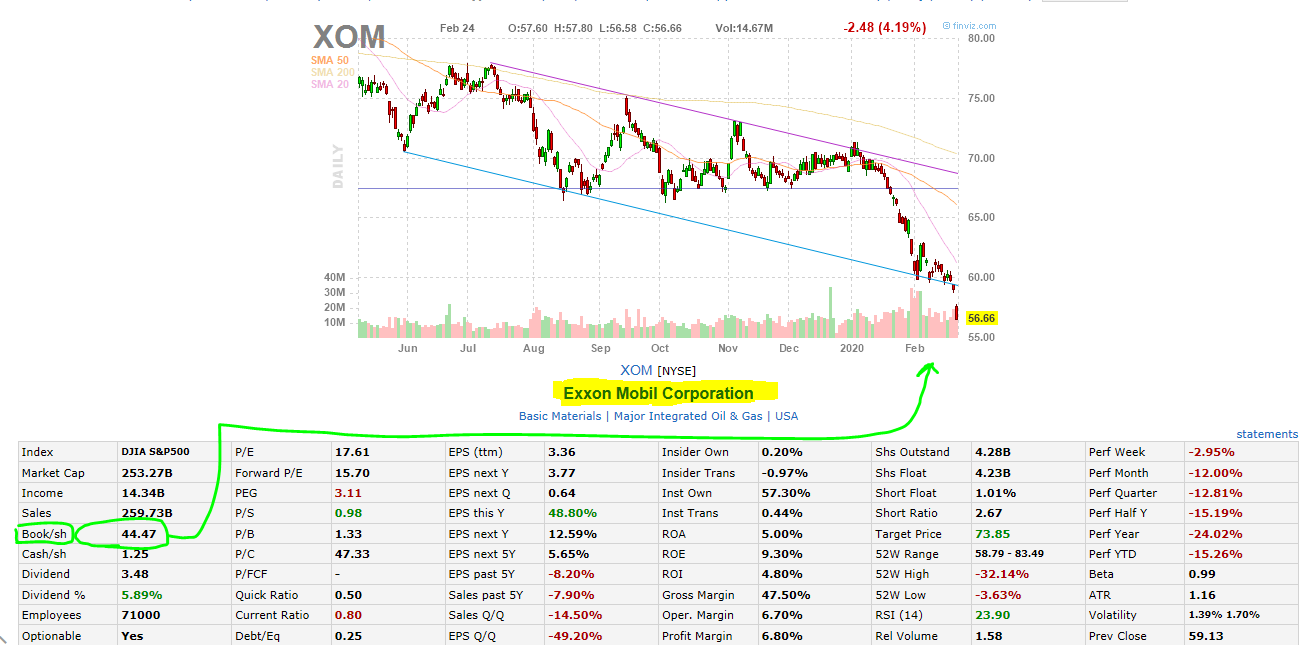

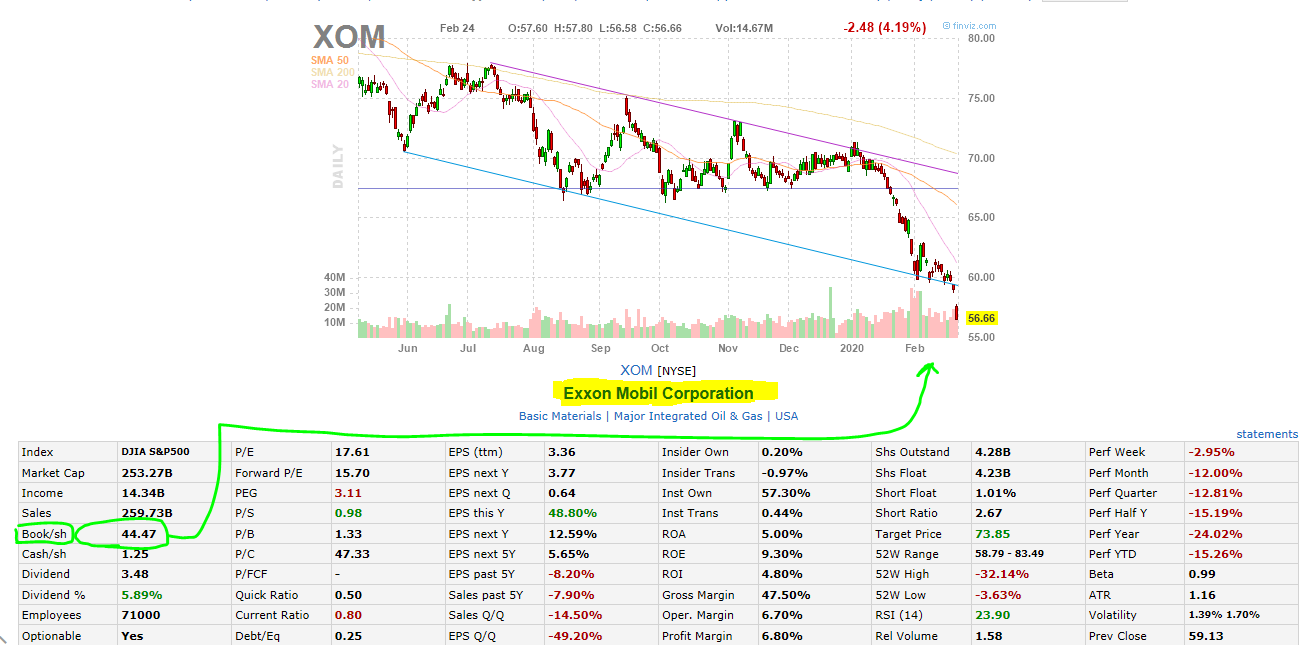

Heute verlieren einige Junior-Ölwerte überproportional.

Denke, ein antizyklischer Einstieg kann sich lohnen, wenn der Ölpreis die 50 $ Marke hält.

Ich mag ja gerne mal solche Übertreibungen nach unten....um billig zu kaufen.

Auch die großen Ölwerte sind zuletzt stärker im Kurs gefallen.

Exxon Mobil :

Royal Dutch Shell:

Denke, ein antizyklischer Einstieg kann sich lohnen, wenn der Ölpreis die 50 $ Marke hält.

Ich mag ja gerne mal solche Übertreibungen nach unten....um billig zu kaufen.

Auch die großen Ölwerte sind zuletzt stärker im Kurs gefallen.

Exxon Mobil :

Royal Dutch Shell:

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

New Gold to sell 46% of New Afton to OTPP for $300M

2020-02-25 06:34 ET - News Release

Mr. Renaud Adams reports

NEW GOLD ANNOUNCES $300 MILLION PARTNERSHIP WITH ONTARIO TEACHERS' PENSION PLAN AT THE NEW AFTON MINE ADDING SIGNIFICANT FINANCIAL FLEXIBILITY

New Gold Inc. has entered into a strategic partnership with Ontario Teachers' Pension Plan. Under the terms of the strategic partnership, Ontario Teachers has agreed to acquire a 46.0-per-cent free cash flow interest in the New Afton mine with an option to convert the interest into a 46.0-per-cent joint venture interest in four years, or have its interest remain as a free cash flow interest at a reduced rate of 42.5 per cent, for upfront cash proceeds of $300-million payable upon closing of the transaction. The proceeds from the transaction will be used to improve New Gold's financial flexibility and to reduce net indebtedness.

Key transaction highlights:

The transaction provides New Gold with immediate cash proceeds of $300-million at an attractive cost of capital, materially reducing New Gold's net indebtedness and increasing financial flexibility.

New Gold retains full operating control over New Afton during development of the C zone as the mine transitions to expand its operating mine life.

OTTP is a world-class financial sponsor whose support of New Afton serves to increase New Gold's visibility and its vision of creating value for all stakeholders.

An overriding buyback option provides New Gold with the flexibility to potentially reacquire 100 per cent of New Afton in the future.

New Gold will retain 100 per cent of the exploration claims outside of the New Afton mining permit area and has granted Ontario Teachers an option to acquire its proportionate share of these claims upon conversion into the joint venture interest.

Summary transaction terms:

Ontario Teachers will initially acquire a 46.0-per-cent free cash flow interest in the New Afton mining claim area with a four-year term for $300-million in upfront proceeds and New Gold will retain 100-per-cent ownership of New Afton.

After four years, Ontario Teachers has an option to convert the interim interest into a 46.0-per-cent partnership interest in New Afton with New Gold holding the remaining 54.0-per-cent partnership interest in a limited partnership New Gold and Ontario Teachers will form at the time of conversion.

If Ontario Teachers does not exercise the JV interest option, Ontario Teachers will continue to hold a free cash flow interest in New Afton, but at a reduced rate of 42.5 per cent.

New Gold will hold (i) an overriding buyback option to repurchase and cancel the interim interest during the JV interest option exercise period and (ii) a right of first offer for the life of the agreements.

"We are pleased to be partnering with Ontario Teachers, one of the world's preeminent and most well-respected investors, in this transformational transaction that provides us with upfront cash allowing us to restructure our balance sheet and lower our level of net indebtedness via a true shared risk and upside partnership focused on free cash flow. This transaction provides New Gold with an attractive cost of capital, further strengthens our financial position, allows us to benefit from the full exploration potential elsewhere on the New Afton land package and provides the opportunity to reacquire 100 per cent of New Afton," said Renaud Adams, president and chief executive officer of New Gold. "Ontario Teachers is known to conduct in-depth due diligence and partner with high-quality management teams that share its values of integrity and operational excellence. We look forward to our partnership with Ontario Teachers as we continue our mission to turn New Gold into Canada's leading intermediate diversified gold producer."

"We are delighted to partner with New Gold, a leading Canadian mining company, in this distinctive transaction. We gain access to a free cash flow interest from a top-quality asset in a stable and well-established mining area, with the ability to convert to a JV interest in four years. Ontario Teachers' natural resources group has a global mandate to pursue investments that provide attractive returns and inflation protection through exposure to a basket of key commodities," said Dale Burgess, senior managing director, infrastructure and natural resources, of Ontario Teachers.

Additional transaction details

Under the terms of the agreement, Ontario Teachers will acquire the interim interest, effective from the closing date of the transaction, with a term of four years for upfront cash proceeds of $300-million payable upon closing. After four years, Ontario Teachers will have the option to convert the interim interest into a 46.0-per-cent JV interest in New Afton, such option to be exercisable during a 60-day period immediately after the fourth anniversary of the effective date of the transaction. Should Ontario Teachers elect to exercise such JV interest option, Ontario Teachers and New Gold will form a limited partnership and Ontario Teachers will contribute the free cash flow interest in exchange for a 46-per-cent JV interest in New Afton. If the JV interest option is not exercised by Ontario Teachers during the exercise period, Ontario Teachers will hold the reduced interest, which provides Ontario Teachers with a 42.5-per-cent free cash flow interest in New Afton. For purposes of calculating the interim interest and the reduced interest, free cash flow is defined as: the greater of (i) gross revenue less treatment and refining costs, operating costs, exploration costs, interest costs, B.C. mining taxes, lease payments and capital costs, inclusive of changes in working capital, and (ii) one dollar. For any new, jointly approved, capital project, which is outside of the current mine plan, which results in free cash flow declining below zero, New Gold is permitted to recover Ontario Teachers' share of that capital expenditure from future free cash flow payments to Ontario Teachers. Under the terms of the agreement, New Gold has also agreed to provide Ontario Teachers with a minimum guarantee of approximately half of Ontario Teachers' expected free cash flow over the interim period, subject to certain adjustments for realized commodity prices and foreign exchange rates.

The agreement provides New Gold with an overriding buyback option to repurchase and cancel the interim interest during the same exercise period described above at the greater of (i) an agreed upon internal rate of return to Ontario Teachers and (ii) the fair market value of the free cash flow interest at that time. The buyback option in favour of New Gold would be exercisable in priority to the JV interest option granted to Ontario Teachers and regardless of Ontario Teachers' exercise or intention to exercise of the JV interest option. The buyback option provides New Gold the opportunity to reacquire 100-per-cent exposure to New Afton's cash flows, at its sole discretion, in four years, allowing New Gold sufficient time to build the necessary balance sheet strength. Both New Gold and Ontario Teachers will have a mutual right of first offer for the life of the agreements.

The transaction agreements set out certain governance rights and protections for Ontario Teachers in relation to the operation of New Afton, including establishment of an advisory committee to assist with operation and budgetary decisions.

The transaction is subject to approval under New Gold's credit facility and is expected to close on or about March 31, 2020.

Scotiabank is acting as financial adviser to New Gold. Cassels Brock & Blackwell LLP and Lawson Lundell LLP are acting as legal counsel to New Gold. BMO Capital Markets is acting as financial adviser to Ontario Teachers. Stikeman Elliott LLP is acting as legal counsel to Ontario Teachers.

New Gold looks forward to working with Ontario Teachers to realize the full potential of New Afton, where both New Gold and Ontario Teachers see significant value creation opportunities. Both New Gold and Ontario Teachers are committed to working with local communities and other partners to ensure New Afton generates value for all of its stakeholders for many years to come.

About New Gold Inc.

New Gold is a Canada-focused intermediate gold mining company with a portfolio of two core producing assets in Canada, the Rainy River and New Afton mines, as well as the 100-per-cent-owned Blackwater development project. The company also operates the Cerro San Pedro mine in Mexico (in reclamation). New Gold's vision is to build a leading diversified intermediate gold company based in Canada that is committed to environment and social responsibility.

https://www.stockwatch.com/News/Item?bid=Z-C%3aNGD-2869487&symbol=NGD®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Jadestone Energy to spend up to $190M in 2020

2020-02-25 07:02 ET - News Release

Mr. Paul Blakeley reports

JADESTONE ENERGY INC ANNOUNCES BUSINESS UPDATE AND 2020 GUIDANCE OUTLOOK

Jadestone Energy Inc. has provided a business update for the year ended Dec. 31, 2019, and an outlook for 2020.

2019 performance

Jadestone achieved its production guidance target for 2019, with full-year production averaging 13,531 barrels of oil per day. The company achieved excellent safety and environmental performance, with no serious injuries, loss of containment or high potential incidents. All eight outstanding enforcement notices at Montara, inherited from the prior operator, were remedied.

Unaudited cash operating expense for the full year 2019 was $22.90 (U.S.) per barrel, after adjusting for non-routine maintenance items and workover activities at Stag.

All major spending projects were executed as planned, with the exception of the Montara H6 infill well and seismic acquisition, which, as previously disclosed, were contingent upon accessing suitable offshore vessels and have been rescheduled for 2020. Total aggregate spend for the year was around $78-million (U.S.) (unaudited), of which approximately $55-million (U.S.) is expected to be booked as capital expenditure. The balance, treated as operating expenditure, was non-routine and largely arises from the riserless light well intervention.

As of Dec. 31, 2019, the company had an unaudited cash balance of $89-million (U.S.), excluding restricted cash of $10-million (U.S.) deposited in support of a bank guarantee. The total principal outstanding on the RBL at year end was $50.1-million (U.S.), a reduction of $11.8-million (U.S.) from Sept. 2019, as the company continued paying down the facility in accordance with its predefined payment schedule. Net cash was therefore $39.3-million (U.S.), or $49.3-million (U.S.) inclusive of restricted cash.

Jadestone is continuing to receive record crude oil price premiums above Brent, with the most recent Montara lifting agreed at $7.60 (U.S.)/bbl and Stag agreed at $21 (U.S.)/bbl.

The company intends to release its full-year financial and operating results, including audited consolidated group financial statements, on April 23, 2020.

2020 outlook

The company announces today its full-year guidance for 2020, including:

Average crude oil production between 13,500 and 15,500 bbl/d;

Average unit production costs of $20.50 (U.S.) to $23.50 (U.S.) per bbl;

Capital spending of $160-million (U.S.) to $190-million (U.S.), including the start of major procurement and construction work in support of the Nam Du and U Minh field development, offshore southwestern Vietnam, and drilling of the H6 infill well at Montara, and the 50H infill well at Stag;

Reaffirmed guidance of a maiden 2020 cash dividend of $7.5-million (U.S.) to $12.5-million (U.S.), payable one-third interim, two-thirds final;

Expected formal acceptance, including all regulatory matters, of Jadestone as operator of the Maari asset, offshore New Zealand, and completion of its acquisition of a 69-per-cent working interest in the second half of 2020;

A 3-D seismic acquisition survey over the Montara blocks, which has already been completed this month.

.....

https://www.stockwatch.com/News/Item?bid=Z-C%3aJSE-2869509&symbol=JSE®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Mason Graphite CEO Gascon to retire

2020-02-25 11:02 ET - News Release

Mr. Paul Carmel reports

MASON GRAPHITE ANNOUNCES BOARD AND MANAGEMENT CHANGES

Mason Graphite Inc.'s Benoit Gascon, president, chief executive officer and director, will retire, effective March 31, 2020.

Paul R. Carmel, chairman of the board of Mason Graphite, commented, "On behalf of the board of directors, I would like to show my gratitude to Benoit who worked tirelessly in recent years to build a strong team and advance the Lac Gueret project."

Mason Graphite has appointed Peter Damouni as director of the corporation. Mr. Damouni has over 18 years of experience in investment banking and capital markets, with expertise in natural resources. Throughout his career, Mr. Damouni has worked on and led equity and debt financings valued over $5-billion. He has comprehensive experience in equity financing, restructuring, corporate valuations and advisory assignments.

Mr. Damouni is a director of a number of companies listed on the Toronto Stock Exchange, TSX Venture Exchange and London Stock Exchange. Mr. Damouni is a graduate of McGill University. He is a Canadian and British citizen, residing in the United Kingdom.

The board has commenced planning discussions to appoint new leadership and has set up a CEO search committee, formed of Mr. Carmel, chairman, Gilles Gingras and Mr. Damouni.

About Mason Graphite Inc.

Mason Graphite is a Canadian mining and processing corporation focused on the development of its 100-per-cent-owned Lac Gueret natural graphite deposit located in northeastern Quebec.

https://www.stockwatch.com/News/Item?bid=Z-C%3aLLG-2869745&symbol=LLG®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Corvus Gold drills 88.4 m of 1.92 g/t Au at Mother Lode

2020-02-25 07:06 ET - News Release

Mr. Jeffrey Pontius reports

CORVUS GOLD EXPANDS MAIN ZONE WITH 88.4M @ 1.92 G/T AU AND CENTRAL INTRUSIVE OXIDE ZONE AT MOTHER LODE DEPOSIT, NEVADA

Corvus Gold Inc. has received additional positive results from its continuing Main zone infill and stepout phase 4 drill program. These latest results are from targets designed to infill unestimated parts of the 2018 mineral resource model, to potentially extend the deposit deeper and probe the eastern side of the property. Results appear to be encouraging for expanding the Mother Lode mineral resource as the grade and thickness of the intervals are higher and broader than previously known. In addition, the latest holes have expanded the new oxide Central Intrusive zone (CIZ) below the Main zone, although drilling conditions remain difficult upon entering the zone and both holes were terminated prematurely (lost) in the upper part of the CIZ.

....

https://www.stockwatch.com/News/Item?bid=Z-C%3aKOR-2869517&symbol=KOR®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Libero Copper arranges $2-million placement

2020-02-26 06:21 ET - News Release

Mr. Ian Slater reports

LIBERO ANNOUNCES PRIVATE PLACEMENT

Libero Copper & Gold Corp. has arranged a non-brokered private placement consisting of up to 20 million units at a price of 10 cents per unit for gross proceeds of up to $2-million.

Each unit consists of one common share and one common share purchase warrant. Each warrant entitles the holder to acquire one common share for a period of 24 months from closing at a price of 15 cents. If the closing price of the common shares is at a price equal to or greater than 20 cents for a period of 10 consecutive trading days, Libero will have the right to accelerate the expiry date of the warrants by giving notice, via a new release, to the holders of the warrants that the warrants will expire on the date that is 30 days after the issuance of said news release.

The net proceeds of the offering will be used for drilling the Ridge high-grade gold target at Big Red and general working capital purposes. Closing of the offering is subject to approval of the TSX Venture Exchange.

About Libero Copper & Gold Corp.

Libero holds a collection of porphyry deposits throughout the Americas in prolific but stable jurisdictions. The portfolio includes both exploration properties such as Big Red, a new gold discovery in the Golden Triangle, Canada, and high-quality deposits with significant resources but without any fatal flaws or significant holding costs. The Tomichi deposit in the United States and the Mocoa deposit in Colombia, both contain large inferred mineral resources. In total, the Mocoa and Tomichi properties contain 7.9 billion pounds of copper and 1.1 billion pounds of molybdenum.

https://www.stockwatch.com/News/Item?bid=Z-C%3aLBC-2870167&symbol=LBC®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Skeena drills 14.33 m of 22.59 g/t AuEq at Eskay Creek

2020-02-26 08:55 ET - News Release

Mr. Walt Coles Jr. reports

SKEENA INTERSECTS 22.59 G/T AUEQ OVER 14.33 METRES AT ESKAY CREEK

Skeena Resources Ltd. has provided the final gold-silver assays from the 2019 phase I surface drilling program at the Eskay Creek project located in the Golden Triangle of British Columbia. Four ground-based surface drill rigs were utilized for the 2019 phase I program in the 21A, 21E and HW zones to in fill and upgrade areas of inferred resources to the indicated classification. A total of 14,266 metres over 209 holes were drilled. Drill hole results reported in this release are from the 21E and HW zones.

.............

https://www.stockwatch.com/News/Item?bid=Z-C%3aSKE-2870359&symbol=SKE®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

GoGold drills 17.3 m of 4.23 g/t AuEq at Los Ricos

2020-02-26 09:24 ET - News Release

Mr. Steve Low reports

GOGOLD INTERSECTS 17.3M AT 317 G/T SILVER EQUIVALENT AT LOS RICOS SOUTH PROJECT

GoGold Resources Inc. has released the assay results from nine diamond drill holes at the South project in the company's Los Ricos district project. Diamond drilling resumed on Jan. 12, 2020, and a fifth drill has been added to the program. Three drills are testing the Los Ricos vein north of the historical stopes and two drills are completing a series of short holes along the el Abra outcrop.

Hole LRGG-20-100 was drilled on section 275N and intersected the up-dip extension of Los Ricos quartz vein from 9.9 metres to 29.1 metres. The vein consisted of white quartz with pyrite box work and black sulphide minerals, and averaged 4.23 grams per tonne gold equivalent or 317.2 g/t silver equivalent, made up of 1.51 g/t gold and 204.3 g/t silver over 17.3 m and included 6.9 m of 6.56 g/t gold equivalent or 492 g/t silver equivalent.

Hole LRGG-20-98 encountered a 7.5 m historical working with the hanging portion of the vein showing four m of 452 g/t silver equivalent, made up of 1.78 g/t gold and 319 g/t silver.

"We are drilling these short holes in order to obtain assay information on the upper 100 m portion of the Los Ricos vein that forms the face of the el Abra hill. This part of the deposit has not been drilled in the past and is essential to complete these drill holes for estimating the resource," said Brad Langille, president and chief executive officer. "We are also very excited to drill below hole 88 (intercepted 647 g/t silver equivalent for 18.9 m, see press release dated Jan. 22, 2020) to further test the down-dip extensions."

....

https://www.stockwatch.com/News/Item?bid=Z-C%3aGGD-2870401&symbol=GGD®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Auch hier heißt es wohl "cash" ist Trumpf!

Bei einigen Crypto-Aktien gibt es noch Gaps zu schliessen!

[url=https://peketec.de/trading/viewtopic.php?p=1944169#1944169 schrieb:Cardioaffin schrieb am 19.02.2020, 13:14 Uhr[/url]"]V:BMK Verdoppler durchaus möglich. SK 0.07 CAD

MacDonald Mines drills 0.96 m of 735.5 g/t Au at SPJ

https://www.stockwatch.com/News/Item?bid=Z-C%3aBMK-2867179&symbol=BMK®ion=C