[url=http://peketec.de/trading/viewtopic.php?p=1166093#1166093 schrieb:golden_times schrieb am 03.11.2011, 09:17 Uhr[/url]"]GMP startet V.ATC

ATAC Resources7 (ATC-V) BUY

Last: $4.25 Target: $11.20

Osiris Results and Discovery at Isis East

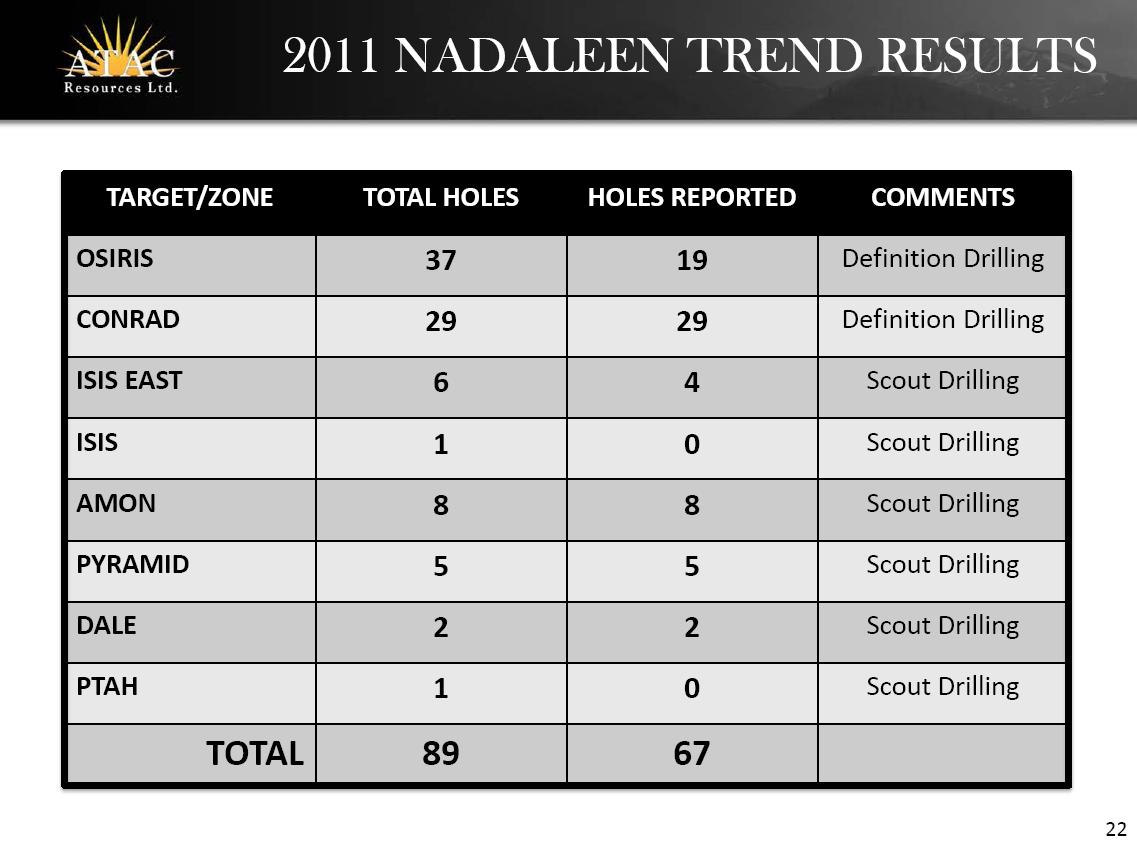

This morning, ATAC released the results of 18 holes from the Osiris and Isis East zones from the

Nadaleen Trend at its 100% owned Rackla gold project in the Yukon. Overall, the results were

positive – the company has increased the size of the Osiris target by 80% on strike and 65%

vertically and discovered a new zone at Isis East.

Osiris Size Increase

At Osiris two mineralized zones were tested: the Osiris shear and near-surface stratabound

mineralization. Results include 18.49m of 3.49g/t from the Osiris shear and 30.98m of 3.09g/t and

22.02m of 4.14g/t from the stratabound mineralization. The Osiris shear is interpreted to be 50 to

100m wide, today?s results extend the strike by 450m (80%) to a total of 1,000m. Vertical extent

has been increased by 200m (65%) to 500m. The stratabound mineralization has been identified

over an area of 50 by 150m and is open to the east and down-dip to the south. Today?s results

continue to expand Osiris and return attractive grades inline with previous results.

There is additional potential for expansion of the Osiris shear – only a third of the 1km strike has

drill results released. Drilling has been completed with results pending over 400m to the north to

connect the Osiris north trench (announced Aug 30 at 1.8m at 80.4g/t and 1m at 63.7g/t). A total

of an additional 18 holes are pending from Osiris.

Osiris Results Confirm Valuation Assumptions

Today?s results reinforce our valuation assumptions – we are currently assuming 4 pods with 75m

of vertical extent, over 750m of strike and 50m wide for a total of 4.9mmoz. Today?s results

suggest 1,000m of strike, 50-100m of width and 500m of depth for Osiris, presenting potential to

exceed our expectations for a first „pod?. The Conrad zone, with 400m of current strike and open

in all directions represents a second likely „pod? target.

Valuation

We consider today?s expansion of Osiris as positive and view it as a step towards meeting or

exceeding our expectations of 4 mineralized pods. We maintain our BUY rating and $11.20 target

based on an unchanged 4.9mmoz target mineralization at a valuation of $200/oz. Results from

approximately 50 holes (18 from Osiris) are in the lab and we will be watching for the assays as

they are made available.

» zur Grafik

App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

ATC - Atac Resources - WKN A0BKZG

- Ersteller golden_times

- Erstellt am

- Tagged users Kein(e)

ATAC Manager Vanessa Pickering on Yukon gold assays including 6.08 g/t over 26.1m

ATAC Resources Ltd TSXV:ATC announced results from its Rackla Gold Project in central Yukon.

Highlights include

6.08 g/t gold over 26.1 metres

3.09 g/t over 31 metres

(including 4.09 g/t over 20.6 metres)

4.14 g/t over 22 metres

(including 7.18 g/t over 10.7 metres)

3.49 g/t over 18.5 metres

(including 7.64 g/t over 6.3 metres)

2.77 g/t over 22.9 metres

(including 3.78 over 9.2 metres)

3.4 g/t over 15.2 metres

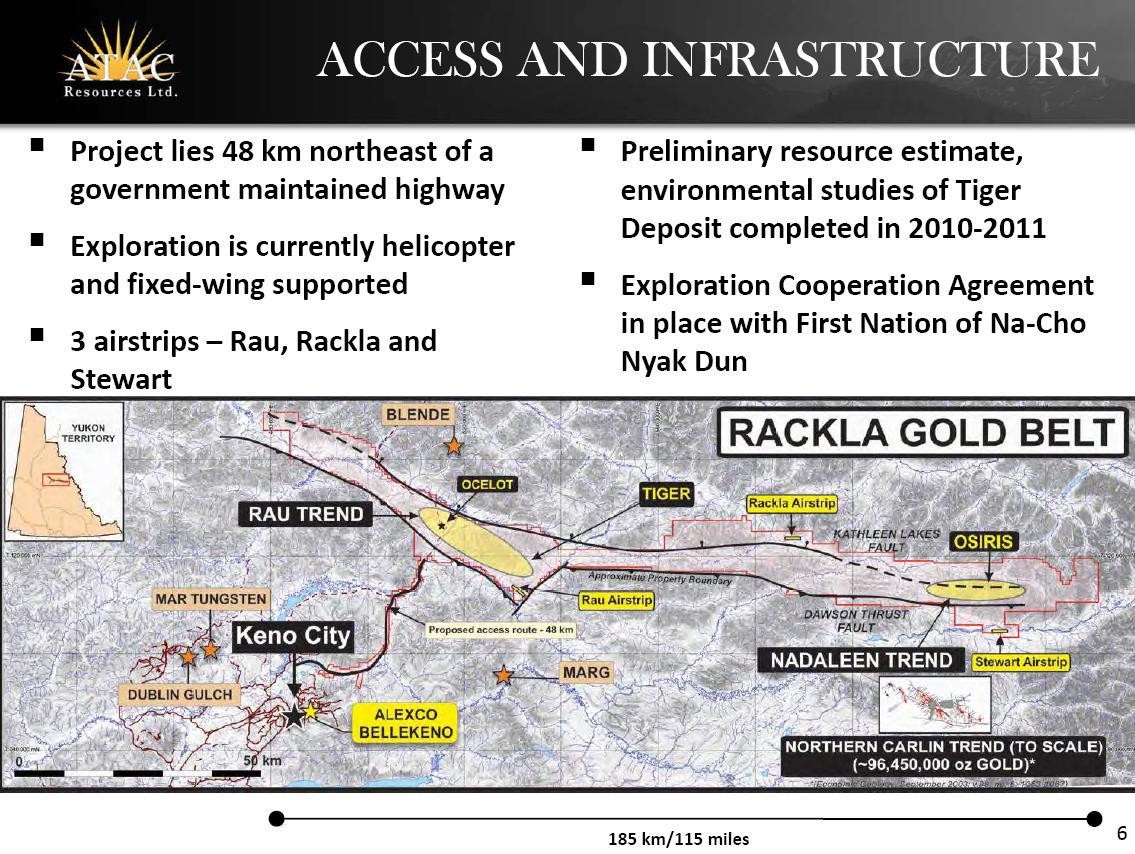

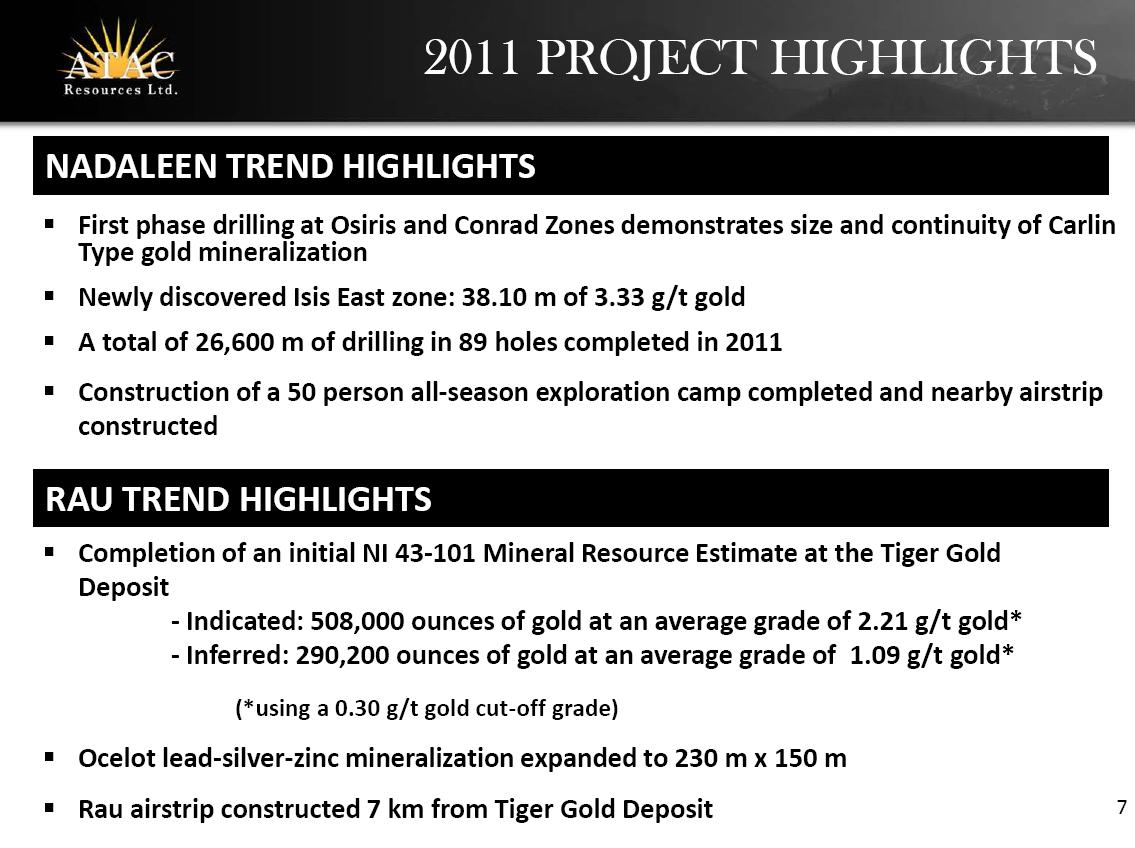

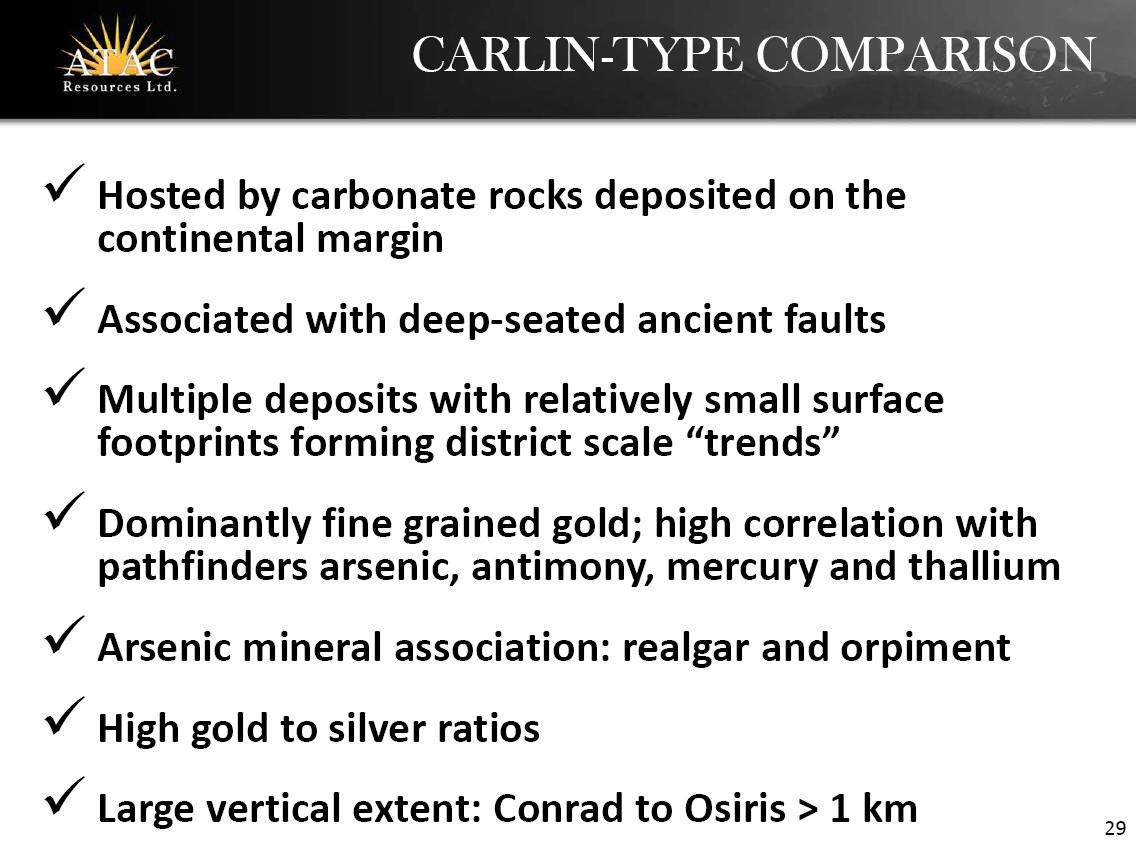

Manager of Corporate Communications Vanessa Pickering tells ResourceClips.com, “The Rackla Gold Belt is 1,600 square kilometres, one of the largest contiguous land packages in the Yukon, if not the largest. It includes the Rau Trend with the Tiger Zone deposit and the Nadaleen Trend, which contains the Osiris area with its Carlin-type mineralization.

“I think today’s results are in line with what we expected, and we’re pleased to see how it’s holding together. We’re quite happy with what we’ve done this year. We expect to do about the same next year.

“We have about 50 holes left to report, and that’s from both sides of the property, the Nadaleen Trend and the Rau Trend. We’ve just done a resource for the west side of the property, and we’d like to know more about the east side, which is where today’s results came from.”

Released October 20, the project’s Tiger Deposit has a resource estimate of 7.1 million tonnes grading 2.21 g/t for 508,000 ounces gold indicated and 8.2 million tonnes grading 1.09 g/t for 290,200 ounces gold inferred.

“A lot of that is high-grade oxide gold, near-surface gold,” Pickering says.

“The Rau Trend, which is the area we worked on from about 2006 to 2010 and a bit this year, is not Carlin-type mineralization. It’s kind of Nevada-esque, we would say, but not Carlin. But it’s completely different from what’s at the east end, 100 kilometres at the Nadaleen Trend, which is the Carlin-type mineralization that we’re chasing. It’s Canada’s only Carlin-type mineralization.

“We’ve also found silver-lead-zinc at the Ocelot Discovery in the Rau Trend,” she adds. “Of course, we’re in the Keno Hill silver-mining district.

“At the west side of the property we’re about 48 or 50 clicks from the government-maintained highway that goes through the Keno Hill Mining District. Infrastructure is a big consideration in what we do. The new discovery, the Carlin-type trend, is about 100 kilometres away from the other area. So that 48-kilometre proposed access route would grow exponentially. For that reason, we’re not chasing a small deposit. It would have to be five-million-plus ounces out on the east end of the property to justify building roads. Right now, we are fixed-wing; we have three airstrips on the property, one at the Rau Trend, one sort of in the middle and one at the Nadaleen Trend. Two of those airstrips were commissioned just this year. So that’s going to take the weight off of being entirely helicopter-supported. This has to have enough ounces to justify building infrastructure out there.

“ATAC is purely an exploration company,” she points out. “That’s what we’re good at—making discoveries, making grassroots discoveries using the technical knowledge of our team. We don’t go into production, it’s not our business focus.”

Looking ahead to next year, Pickering says, “We probably won’t resume drilling until May, when the snow goes. The guys shut down just last week, so the drilling season goes until mid-October or the end of October. This year we’re building a new camp out at the east end, the Carlin trend. We had our guys out there in March to start building. So all they have to do now is go in and flick on the lights. The drills are there now, waiting for them. As soon as the snow goes, they can start drilling.”

by Greg Klein

This article was posted by Ted Niles - Resource Clips on Thursday, November 3rd, 2011 at 8:30 am.

Quelle: http://resourceclips.com/2011/11/03/atac-manager-vanessa-pickering-on-yukon-gold-assays-including-6-08-gt-over-26-1m/

ATAC Resources Ltd TSXV:ATC announced results from its Rackla Gold Project in central Yukon.

Highlights include

6.08 g/t gold over 26.1 metres

3.09 g/t over 31 metres

(including 4.09 g/t over 20.6 metres)

4.14 g/t over 22 metres

(including 7.18 g/t over 10.7 metres)

3.49 g/t over 18.5 metres

(including 7.64 g/t over 6.3 metres)

2.77 g/t over 22.9 metres

(including 3.78 over 9.2 metres)

3.4 g/t over 15.2 metres

Manager of Corporate Communications Vanessa Pickering tells ResourceClips.com, “The Rackla Gold Belt is 1,600 square kilometres, one of the largest contiguous land packages in the Yukon, if not the largest. It includes the Rau Trend with the Tiger Zone deposit and the Nadaleen Trend, which contains the Osiris area with its Carlin-type mineralization.

“I think today’s results are in line with what we expected, and we’re pleased to see how it’s holding together. We’re quite happy with what we’ve done this year. We expect to do about the same next year.

“We have about 50 holes left to report, and that’s from both sides of the property, the Nadaleen Trend and the Rau Trend. We’ve just done a resource for the west side of the property, and we’d like to know more about the east side, which is where today’s results came from.”

Released October 20, the project’s Tiger Deposit has a resource estimate of 7.1 million tonnes grading 2.21 g/t for 508,000 ounces gold indicated and 8.2 million tonnes grading 1.09 g/t for 290,200 ounces gold inferred.

“A lot of that is high-grade oxide gold, near-surface gold,” Pickering says.

“The Rau Trend, which is the area we worked on from about 2006 to 2010 and a bit this year, is not Carlin-type mineralization. It’s kind of Nevada-esque, we would say, but not Carlin. But it’s completely different from what’s at the east end, 100 kilometres at the Nadaleen Trend, which is the Carlin-type mineralization that we’re chasing. It’s Canada’s only Carlin-type mineralization.

“We’ve also found silver-lead-zinc at the Ocelot Discovery in the Rau Trend,” she adds. “Of course, we’re in the Keno Hill silver-mining district.

“At the west side of the property we’re about 48 or 50 clicks from the government-maintained highway that goes through the Keno Hill Mining District. Infrastructure is a big consideration in what we do. The new discovery, the Carlin-type trend, is about 100 kilometres away from the other area. So that 48-kilometre proposed access route would grow exponentially. For that reason, we’re not chasing a small deposit. It would have to be five-million-plus ounces out on the east end of the property to justify building roads. Right now, we are fixed-wing; we have three airstrips on the property, one at the Rau Trend, one sort of in the middle and one at the Nadaleen Trend. Two of those airstrips were commissioned just this year. So that’s going to take the weight off of being entirely helicopter-supported. This has to have enough ounces to justify building infrastructure out there.

“ATAC is purely an exploration company,” she points out. “That’s what we’re good at—making discoveries, making grassroots discoveries using the technical knowledge of our team. We don’t go into production, it’s not our business focus.”

Looking ahead to next year, Pickering says, “We probably won’t resume drilling until May, when the snow goes. The guys shut down just last week, so the drilling season goes until mid-October or the end of October. This year we’re building a new camp out at the east end, the Carlin trend. We had our guys out there in March to start building. So all they have to do now is go in and flick on the lights. The drills are there now, waiting for them. As soon as the snow goes, they can start drilling.”

by Greg Klein

This article was posted by Ted Niles - Resource Clips on Thursday, November 3rd, 2011 at 8:30 am.

Quelle: http://resourceclips.com/2011/11/03/atac-manager-vanessa-pickering-on-yukon-gold-assays-including-6-08-gt-over-26-1m/

November 23, 2011 08:00 ET

ATAC Resources Intersects 41.15 m of 7.33 g/t Gold at Conrad Zone, Rackla Gold Project-Yukon

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Nov. 23, 2011) - ATAC Resources Ltd. (TSX VENTURE:ATC) is pleased to announce assay results for the final eleven diamond drill holes from the Conrad Zone, located within the Nadaleen Trend of ATAC's 100% owned 1,600 sq/km Rackla Gold Project in central Yukon.

News release highlights:

Conrad Zone extended to a 475 m strike length and to 490 m from surface and remains open to expansion in all directions;

All 29 holes drilled to test the Conrad alteration system have intersected gold mineralization and 27 of 29 holes have intersected better than 3 g/t gold over 3 m;

Diamond drilling confirms multiple stacked tabular zones of mineralization that are related to the regional scale Nadaleen Fault;

3D modelling has confirmed excellent continuity between drill intercepts;

Conrad Zone lies 1 km east of the Osiris Zone and 1.5 km east of the new Isis East discovery. The area between these zones exhibit high exploration potential and will be tested with an aggressive drill program in 2012; and,

Drill hole OS-11-070 at the western end of the Conrad drill area confirms mineralization is open to the west along the Nadaleen Fault towards Osiris North area.

http://www.marketwire.com/press-rel....x-venture-atc-1590451.htm

ATAC Resources Intersects 41.15 m of 7.33 g/t Gold at Conrad Zone, Rackla Gold Project-Yukon

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Nov. 23, 2011) - ATAC Resources Ltd. (TSX VENTURE:ATC) is pleased to announce assay results for the final eleven diamond drill holes from the Conrad Zone, located within the Nadaleen Trend of ATAC's 100% owned 1,600 sq/km Rackla Gold Project in central Yukon.

News release highlights:

Conrad Zone extended to a 475 m strike length and to 490 m from surface and remains open to expansion in all directions;

All 29 holes drilled to test the Conrad alteration system have intersected gold mineralization and 27 of 29 holes have intersected better than 3 g/t gold over 3 m;

Diamond drilling confirms multiple stacked tabular zones of mineralization that are related to the regional scale Nadaleen Fault;

3D modelling has confirmed excellent continuity between drill intercepts;

Conrad Zone lies 1 km east of the Osiris Zone and 1.5 km east of the new Isis East discovery. The area between these zones exhibit high exploration potential and will be tested with an aggressive drill program in 2012; and,

Drill hole OS-11-070 at the western end of the Conrad drill area confirms mineralization is open to the west along the Nadaleen Fault towards Osiris North area.

http://www.marketwire.com/press-rel....x-venture-atc-1590451.htm

December 13, 2011 08:30 ET

ATAC Resources Intersects 44.20 m of 4.41 g/t Gold at Osiris and 51.82 m of 3.13 g/t Gold at the Newly Discovered Isis East Zone, Rackla Gold Project-Yukon

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Dec. 13, 2011) - ATAC Resources Ltd. (TSX VENTURE:ATC) has received assays for the final 22 diamond drill holes from the Osiris and Isis East Zones within the Nadaleen Trend and 10 scout holes from the Rau Trend located within ATAC's 100% owned 1,600 sq/km Rackla Gold Project in central Yukon.

News release highlights:

Osiris Shear Zone drilling extends mineralized strike length to 550 m and 350 m depth;

The Osiris Shear system remains open at depth and at the north end for a 700 m distance toward the junction with the Nadaleen Fault - the mineralizing feeder structure for the Conrad Zone;

All 29 drill holes that intersected the Osiris Shear system in 2010 and 2011 encountered gold mineralization with 20 drill holes intersecting better than 3.25 g/t gold across significant widths; and,

Drilling confirms the Isis East discovery with a 50 m step-out hole grading 3.13 g/t gold across 51.82 m, extending and leaving mineralization open along strike and down dip.

http://www.marketwire.com/press-release/atac-resources-intersects-4420-m-441-g-t-gold-osiris-5182-m-313-g-t-gold-newly-discovered-tsx-venture-atc-1597791.htm

ATAC Resources Intersects 44.20 m of 4.41 g/t Gold at Osiris and 51.82 m of 3.13 g/t Gold at the Newly Discovered Isis East Zone, Rackla Gold Project-Yukon

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Dec. 13, 2011) - ATAC Resources Ltd. (TSX VENTURE:ATC) has received assays for the final 22 diamond drill holes from the Osiris and Isis East Zones within the Nadaleen Trend and 10 scout holes from the Rau Trend located within ATAC's 100% owned 1,600 sq/km Rackla Gold Project in central Yukon.

News release highlights:

Osiris Shear Zone drilling extends mineralized strike length to 550 m and 350 m depth;

The Osiris Shear system remains open at depth and at the north end for a 700 m distance toward the junction with the Nadaleen Fault - the mineralizing feeder structure for the Conrad Zone;

All 29 drill holes that intersected the Osiris Shear system in 2010 and 2011 encountered gold mineralization with 20 drill holes intersecting better than 3.25 g/t gold across significant widths; and,

Drilling confirms the Isis East discovery with a 50 m step-out hole grading 3.13 g/t gold across 51.82 m, extending and leaving mineralization open along strike and down dip.

http://www.marketwire.com/press-release/atac-resources-intersects-4420-m-441-g-t-gold-osiris-5182-m-313-g-t-gold-newly-discovered-tsx-venture-atc-1597791.htm

M&A Opportunities Abound: Michael Gray and Shawn Campbell

Source: Brian Sylvester of The Gold Report (12/16/11)

Michael Gray Shawn Campbell Junior explorers may be underperforming the gold price this year,

but Macquarie Capital Markets Equity Analyst Michael Gray is finding opportunities for mergers and

acquisitions within the precious metals space. In this exclusive interview with The Gold Report,

Gray and Research Associate Shawn Campbell talk about the technical aspects that are making a

number of juniors attractive targets.

Companies Mentioned: AngloGold Ashanti Ltd. - ATAC Resources Ltd. - Brett Resources Inc. -

Colossus Minerals Inc. - Continental Gold Ltd. - Eldorado Gold Corp. - Extorre Gold Mines Ltd. -

Goldcorp Inc. - International Tower Hill Mines Ltd. - Midas Gold Corp. - Northern Dynasty Minerals Ltd.

- Rainy River Resources Ltd. - Strategic Metals Ltd. - Tahoe Resources Inc. - Yamana Gold Inc..

http://www.theaureport.com/pub/na/12036

Source: Brian Sylvester of The Gold Report (12/16/11)

Michael Gray Shawn Campbell Junior explorers may be underperforming the gold price this year,

but Macquarie Capital Markets Equity Analyst Michael Gray is finding opportunities for mergers and

acquisitions within the precious metals space. In this exclusive interview with The Gold Report,

Gray and Research Associate Shawn Campbell talk about the technical aspects that are making a

number of juniors attractive targets.

Companies Mentioned: AngloGold Ashanti Ltd. - ATAC Resources Ltd. - Brett Resources Inc. -

Colossus Minerals Inc. - Continental Gold Ltd. - Eldorado Gold Corp. - Extorre Gold Mines Ltd. -

Goldcorp Inc. - International Tower Hill Mines Ltd. - Midas Gold Corp. - Northern Dynasty Minerals Ltd.

- Rainy River Resources Ltd. - Strategic Metals Ltd. - Tahoe Resources Inc. - Yamana Gold Inc..

http://www.theaureport.com/pub/na/12036

There's a fire sale taking place in elite gold stocks

http://www.stockhouse.com/Columnists/2011/Dec/22/There-s-a-fire-sale-taking-place-in-elite-gold-sto

http://www.stockhouse.com/Columnists/2011/Dec/22/There-s-a-fire-sale-taking-place-in-elite-gold-sto

V.ATC

Atac Resources wurde planmäßig in den MJGI (McEwen Junior Gold Index) aufgenommen und kann

folgend von einer erheblich breiteren Masse an institutionellen Investoren und Interesssenten profitieren.

Zusammensetzung des MJGI, Stand 18.12.2011:

.

.

Atac Resources wurde planmäßig in den MJGI (McEwen Junior Gold Index) aufgenommen und kann

folgend von einer erheblich breiteren Masse an institutionellen Investoren und Interesssenten profitieren.

Zusammensetzung des MJGI, Stand 18.12.2011:

neue Unternehmenspräsentation 02/2012:

http://www.atacresources.com/i/pdf/Presentation.pdf

neues Factsheet 01/2012:

http://www.atacresources.com/i/pdf/ATAC_Factsheet_Jan12.pdf

http://www.atacresources.com/i/pdf/Presentation.pdf

neues Factsheet 01/2012:

http://www.atacresources.com/i/pdf/ATAC_Factsheet_Jan12.pdf

ATAC Resources Ltd. Announces 2012 Exploration and Drilling Plans for its Rackla Gold Project, Yukon

March 1, 2012 - Vancouver, BC - (TSX-V:ATC) ATAC Resources Ltd. ("ATAC") is pleased to outline its 2012 exploration and drilling plan for its 100% owned, 1,600 sq/km Rackla Gold Project, which hosts Canada's only Carlin-Type gold discoveries.

The 2012 exploration and drilling program will focus on the continued expansion and definition of the Conrad, Osiris, Isis and Isis East gold discoveries within the Nadaleen Trend. All the gold zones identified to date are distinct and each has the potential for significant expansion and, given their proximity to each other, demonstrate the gold endowment potential characteristic of Carlin Type deposits. The 2012 program will also include additional work on several high-priority property-wide Carlin-Type targets identified in 2011 which appear to be similar to the Conrad, Osiris and Isis East Zones and the Tiger Deposit.

A summary of the 2012 program is detailed below.

2012 Exploration Plans:

30,000 metres of diamond drilling (using six drill rigs) commencing in early June with the majority of drilling to be focused on the Nadaleen Trend where four zones of Carlin-Type mineralization have been confirmed to date;

Expansion and definition diamond drilling on the Conrad, Osiris, Isis and Isis East Zones;

Scout drill testing of structural targets along the Nadaleen feeder fault and other structures that exhibit surface pathfinder element signatures;

Auger drilling to begin in April at the Pyramid target to identify the bedrock source of a 500 by 200 m gold pathfinder arsenic/thallium soil geochemical anomaly coincident with abundant orpiment and realgar cobbles and boulders in glacial till;

Optional early season drilling at the Ocelot silver-lead-zinc discovery within the Rau Trend pending results of spring geophysical surveys; and

Follow up prospecting, geological mapping and detailed soil sampling of 15 high priority gold and pathfinder geochemical anomalies identified in 2011 along the 185 km long Rackla Gold Project claim block.

Nadaleen Trend

The 2012 diamond drilling program will target the four drill confirmed Carlin-Type gold discoveries within the Nadaleen Trend at the east end of the Project. Six drills will begin definition and expansion drilling at the Conrad, Osiris, Isis East and Isis Zones in early June.

Three of the six drills are allocated to further expand and define the Conrad Zone discovery area. The Conrad Zone is characterized by multiple stacked, continuous tabular zones of gold mineralization related to the nearby Nadaleen feeder fault system. It has a current drill confirmed strike length of 475 m and extends to a depth of 490 m. Significant diamond drill results from 2011 drilling at the Conrad Zone include 82.29 m grading 4.08 g/t gold (OS-11-010) and 41.15 m grading 7.33 g/t gold (OS-11-058).

One diamond drill will be used to expand gold mineralization at the Osiris Zone where stratabound gold mineralization is hosted by limestone in the apex and both limbs of a moderately plunging anticline. Drilling will continue testing the steeply dipping western limb of the Osiris limestone unit towards the projected intersection with the Nadaleen feeder fault where the structural setting is similar to the higher grade Conrad Zone. The east limb of the Osiris limestone unit contains an untested 150 by 200 m gold-in-soil geochemical anomaly where a five metre hand trench channel sample returned 25.76 g/t gold. Highlights from 2011 drilling at the Osiris Zone include 32.01 m grading 4.25 g/t gold (OS-11-031) and 26.12 m grading 6.08 g/t gold (OS-11-055).

The Isis East Zone is a new gold discovery located 500 m south of the Osiris Zone in a fault repeat of the Osiris limestone unit. Two holes intersected this zone in late 2011. Hole OS-11-040 intersected 38.10 m of 3.33 g/t gold and OS-11-073 intersected 51.82 m of 3.13 g/t gold. These holes were drilled 75 m apart and lie within a large 450 by 100 m gold-in-soil geochemical anomaly. Two diamond drills will initially test this zone which remains open in all directions.

The Isis Zone is located 800 m northwest of the Isis East zone and is situated in the same unit as the Isis East zone. This zone is marked by a 600 by 200 m gold-in-soil anomaly with associated grab samples from talus that graded from <0.01 to 23.9 g/t gold. Detailed mapping, prospecting and mechanized trenching will be carried out in early 2012 to better define drill targets for later in the year.

Regional stream sediment sampling and follow up grid soil sampling conducted in 2011 identified the Pyramid and Dale gold pathfinder arsenic/thallium anomalies 20 and 10 km west of the Osiris area gold zones. Prospecting at the Pyramid identified a glacially dispersed 150 by 80 m orpiment/realgar (arsenic sulphides) cobble field within a larger 500 by 200 m arsenic/thallium soil anomaly. Follow up drilling of the Pyramid target intersected encouraging alteration and anomalous gold. Approximately 50 auger drill holes will be completed in March 2012 in order to vector in on the bedrock source of the extensive arsenic float train and potential gold mineralization.

Deep-seated, long-lived faults are the plumbing conduits for Carlin-Type mineralizing fluids. Gold is deposited where these faults intersect reactive limestone units. In the Osiris area, the Nadaleen Fault has been identified as a long-lived feeder structure by isotopic age dating and clay mineral alteration studies. Gold mineralization at the Osiris and Conrad Zones is related to this structure. Over 1,700 silt and 12,000 soil samples were collected from the 185 km long Rackla Gold Project in 2011. Geological mapping and satellite surveys identified numerous other fault structures elsewhere on the Project that correspond to pathfinder element geochemical anomalies. Fifteen priority targets have been identified for focussed follow-up work in 2012 in order to develop drill targets from these new areas of interest.

Rau Trend

The Rau Trend lies at the western end of the Rackla Gold Project and hosts the Tiger Gold Deposit as well as the 2011 Ocelot silver-lead-zinc discovery. Several areas of untested gold, gold-pathfinder and silver-lead-zinc geochemical anomalies will receive focussed follow up work in 2012.

Given the high in situ oxide gold grades in the Tiger Zone, ATAC will review different approaches for further development of this discovery in 2012, to maximize its value to the Company and its shareholders.

The Ocelot silver-lead-zinc discovery has received a total of 19 diamond drill holes which defined a mineralized zone measuring 230 by 150 m. Drill hole OC-11-010 from 2011 intersected 63.44 m of 73.81 g/t silver, 2.44% lead and 8.18% zinc. In March 2012, geophysical surveys will be conducted over and along the trend of the Ocelot discovery. Pending favourable results from this survey, a small diamond drill program (1,500 to 3,000 m) will commence in April to evaluate the potential for additional mineralization.

The technical information in this news release has been reviewed by Robert C. Carne, M.Sc., P.Geo., a qualified person for the purposes of National Instrument 43-101.

March 1, 2012 - Vancouver, BC - (TSX-V:ATC) ATAC Resources Ltd. ("ATAC") is pleased to outline its 2012 exploration and drilling plan for its 100% owned, 1,600 sq/km Rackla Gold Project, which hosts Canada's only Carlin-Type gold discoveries.

The 2012 exploration and drilling program will focus on the continued expansion and definition of the Conrad, Osiris, Isis and Isis East gold discoveries within the Nadaleen Trend. All the gold zones identified to date are distinct and each has the potential for significant expansion and, given their proximity to each other, demonstrate the gold endowment potential characteristic of Carlin Type deposits. The 2012 program will also include additional work on several high-priority property-wide Carlin-Type targets identified in 2011 which appear to be similar to the Conrad, Osiris and Isis East Zones and the Tiger Deposit.

A summary of the 2012 program is detailed below.

2012 Exploration Plans:

30,000 metres of diamond drilling (using six drill rigs) commencing in early June with the majority of drilling to be focused on the Nadaleen Trend where four zones of Carlin-Type mineralization have been confirmed to date;

Expansion and definition diamond drilling on the Conrad, Osiris, Isis and Isis East Zones;

Scout drill testing of structural targets along the Nadaleen feeder fault and other structures that exhibit surface pathfinder element signatures;

Auger drilling to begin in April at the Pyramid target to identify the bedrock source of a 500 by 200 m gold pathfinder arsenic/thallium soil geochemical anomaly coincident with abundant orpiment and realgar cobbles and boulders in glacial till;

Optional early season drilling at the Ocelot silver-lead-zinc discovery within the Rau Trend pending results of spring geophysical surveys; and

Follow up prospecting, geological mapping and detailed soil sampling of 15 high priority gold and pathfinder geochemical anomalies identified in 2011 along the 185 km long Rackla Gold Project claim block.

Nadaleen Trend

The 2012 diamond drilling program will target the four drill confirmed Carlin-Type gold discoveries within the Nadaleen Trend at the east end of the Project. Six drills will begin definition and expansion drilling at the Conrad, Osiris, Isis East and Isis Zones in early June.

Three of the six drills are allocated to further expand and define the Conrad Zone discovery area. The Conrad Zone is characterized by multiple stacked, continuous tabular zones of gold mineralization related to the nearby Nadaleen feeder fault system. It has a current drill confirmed strike length of 475 m and extends to a depth of 490 m. Significant diamond drill results from 2011 drilling at the Conrad Zone include 82.29 m grading 4.08 g/t gold (OS-11-010) and 41.15 m grading 7.33 g/t gold (OS-11-058).

One diamond drill will be used to expand gold mineralization at the Osiris Zone where stratabound gold mineralization is hosted by limestone in the apex and both limbs of a moderately plunging anticline. Drilling will continue testing the steeply dipping western limb of the Osiris limestone unit towards the projected intersection with the Nadaleen feeder fault where the structural setting is similar to the higher grade Conrad Zone. The east limb of the Osiris limestone unit contains an untested 150 by 200 m gold-in-soil geochemical anomaly where a five metre hand trench channel sample returned 25.76 g/t gold. Highlights from 2011 drilling at the Osiris Zone include 32.01 m grading 4.25 g/t gold (OS-11-031) and 26.12 m grading 6.08 g/t gold (OS-11-055).

The Isis East Zone is a new gold discovery located 500 m south of the Osiris Zone in a fault repeat of the Osiris limestone unit. Two holes intersected this zone in late 2011. Hole OS-11-040 intersected 38.10 m of 3.33 g/t gold and OS-11-073 intersected 51.82 m of 3.13 g/t gold. These holes were drilled 75 m apart and lie within a large 450 by 100 m gold-in-soil geochemical anomaly. Two diamond drills will initially test this zone which remains open in all directions.

The Isis Zone is located 800 m northwest of the Isis East zone and is situated in the same unit as the Isis East zone. This zone is marked by a 600 by 200 m gold-in-soil anomaly with associated grab samples from talus that graded from <0.01 to 23.9 g/t gold. Detailed mapping, prospecting and mechanized trenching will be carried out in early 2012 to better define drill targets for later in the year.

Regional stream sediment sampling and follow up grid soil sampling conducted in 2011 identified the Pyramid and Dale gold pathfinder arsenic/thallium anomalies 20 and 10 km west of the Osiris area gold zones. Prospecting at the Pyramid identified a glacially dispersed 150 by 80 m orpiment/realgar (arsenic sulphides) cobble field within a larger 500 by 200 m arsenic/thallium soil anomaly. Follow up drilling of the Pyramid target intersected encouraging alteration and anomalous gold. Approximately 50 auger drill holes will be completed in March 2012 in order to vector in on the bedrock source of the extensive arsenic float train and potential gold mineralization.

Deep-seated, long-lived faults are the plumbing conduits for Carlin-Type mineralizing fluids. Gold is deposited where these faults intersect reactive limestone units. In the Osiris area, the Nadaleen Fault has been identified as a long-lived feeder structure by isotopic age dating and clay mineral alteration studies. Gold mineralization at the Osiris and Conrad Zones is related to this structure. Over 1,700 silt and 12,000 soil samples were collected from the 185 km long Rackla Gold Project in 2011. Geological mapping and satellite surveys identified numerous other fault structures elsewhere on the Project that correspond to pathfinder element geochemical anomalies. Fifteen priority targets have been identified for focussed follow-up work in 2012 in order to develop drill targets from these new areas of interest.

Rau Trend

The Rau Trend lies at the western end of the Rackla Gold Project and hosts the Tiger Gold Deposit as well as the 2011 Ocelot silver-lead-zinc discovery. Several areas of untested gold, gold-pathfinder and silver-lead-zinc geochemical anomalies will receive focussed follow up work in 2012.

Given the high in situ oxide gold grades in the Tiger Zone, ATAC will review different approaches for further development of this discovery in 2012, to maximize its value to the Company and its shareholders.

The Ocelot silver-lead-zinc discovery has received a total of 19 diamond drill holes which defined a mineralized zone measuring 230 by 150 m. Drill hole OC-11-010 from 2011 intersected 63.44 m of 73.81 g/t silver, 2.44% lead and 8.18% zinc. In March 2012, geophysical surveys will be conducted over and along the trend of the Ocelot discovery. Pending favourable results from this survey, a small diamond drill program (1,500 to 3,000 m) will commence in April to evaluate the potential for additional mineralization.

The technical information in this news release has been reviewed by Robert C. Carne, M.Sc., P.Geo., a qualified person for the purposes of National Instrument 43-101.

neuste Unternehmens-Präsentation 03/2012:

http://www.atacresources.com/i/pdf/corporate-presentation-march2012.pdf

neustes Factsheet 03/2012:

http://www.atacresources.com/i/pdf/Factsheet.pdf

.

http://www.atacresources.com/i/pdf/corporate-presentation-march2012.pdf

neustes Factsheet 03/2012:

http://www.atacresources.com/i/pdf/Factsheet.pdf

.

May 15, 2012

ATAC Resources Ltd. Announces the Commencement of its 2012 Exploration and Drilling Program at its Rackla Gold Project, Yukon

May 15, 2012 - Vancouver, BC - (TSX-V:ATC) ATAC Resources Ltd. ("ATAC") is pleased to announce that it has begun phase one of a two phase exploration and drilling program at its 100% owned, 1,600 sq/km Rackla Gold Project, which hosts Canada's only Carlin-Type gold discoveries.

Diamond drilling has commenced with one drill on the Isis East Zone, ramping up to three drills there within the month. Drilling at Isis East will continue testing a 450 metre gold in soil geochemical anomaly where initial drilling last year intersected strong Carlin-type gold mineralization of 3.33 g/t gold over 38.10 m (OS-11-040) and 3.13 g/t gold over 51.82 m (OS-11-073).

An additional two diamond drills will begin expanding the Conrad Zone within the week. The Conrad Zone is characterized by multiple stacked, continuous tabular zones of Carlin-type gold mineralization related to the nearby Nadaleen feeder fault system. It has a current drill confirmed strike length of 475 m and has been explored to a depth of 490 m. Significant Conrad results from 2011 include 82.29 m grading 4.08 g/t gold (OS-11-010) and 41.15 m grading 7.33 g/t gold (OS-11-058).

A sixth diamond drill will focus on the Osiris Zone to the north, exploring towards the intersection of the Nadaleen feeder fault system and the Osiris limestone unit. Highlights from 2011 drilling at the Osiris Zone include 32.01 m grading 4.25 g/t gold (OS-11-031) and 26.12 m grading 6.08 g/t gold (OS-11-055).

All the gold zones identified to date are distinct and each has the potential for significant expansion. Given their proximity to each other, they demonstrate the gold endowment potential characteristic of Carlin-type deposits.

Regional Exploration

Auger drilling commenced mid-April at the Pyramid Target which is located 20 km west of the Osiris Zone within the Nadaleen Trend. It is one of over fifteen early-stage gold targets that were identified in 2011. The Pyramid Target is defined by an extensive glacially dispersed orpiment/realgar (arsenic sulphides) cobble field measuring 150 by 80 m that lies within a larger 500 by 200 m arsenic/thallium soil anomaly. Arsenic sulphides and thallium are strong gold pathfinder elements similar to those found at the Conrad, Osiris, Isis and Isis East Zones. Approximately 60 auger holes will be drilled through glacially transported overburden to vector in on the bedrock source of the cobble field float train. Follow up diamond drilling at the Pyramid Target will take place in 2012. Please visit our website for maps and figures on the Pyramid Target.

2012 Exploration Program

15,000 metres of diamond drilling in phase one, with the majority of drilling to be focused on the Nadaleen Trend where four priority zones of Carlin-Type gold mineralization have been confirmed to date - Conrad, Osiris, Isis and Isis East;

Expansion and definition diamond drilling of the Conrad, Osiris, Isis and Isis East Zones;

Scout drill testing of structural targets along the Nadaleen feeder fault and other structures that exhibit surface pathfinder element signatures to evaluate "leakage anomalies" for potential mineralization at depth;

Continued auger drilling at the Pyramid target to identify the bedrock source of a 500 by 200 m gold pathfinder arsenic/thallium soil geochemical anomaly coincident with abundant orpiment and realgar cobbles and boulders in glacial till;

Geophysical surveys on the Ocelot silver-lead-zinc discovery within the Rau Trend; and,

Follow up prospecting, geological mapping and detailed soil sampling of 15 high priority gold and pathfinder geochemical anomalies identified in 2011 along the 185 km long Rackla Gold Project claim block.

The technical information in this news release has been reviewed by Robert C. Carne, M.Sc., P.Geo., a qualified person for the purposes of National Instrument 43-101.

ATAC Resources Ltd. Announces the Commencement of its 2012 Exploration and Drilling Program at its Rackla Gold Project, Yukon

May 15, 2012 - Vancouver, BC - (TSX-V:ATC) ATAC Resources Ltd. ("ATAC") is pleased to announce that it has begun phase one of a two phase exploration and drilling program at its 100% owned, 1,600 sq/km Rackla Gold Project, which hosts Canada's only Carlin-Type gold discoveries.

Diamond drilling has commenced with one drill on the Isis East Zone, ramping up to three drills there within the month. Drilling at Isis East will continue testing a 450 metre gold in soil geochemical anomaly where initial drilling last year intersected strong Carlin-type gold mineralization of 3.33 g/t gold over 38.10 m (OS-11-040) and 3.13 g/t gold over 51.82 m (OS-11-073).

An additional two diamond drills will begin expanding the Conrad Zone within the week. The Conrad Zone is characterized by multiple stacked, continuous tabular zones of Carlin-type gold mineralization related to the nearby Nadaleen feeder fault system. It has a current drill confirmed strike length of 475 m and has been explored to a depth of 490 m. Significant Conrad results from 2011 include 82.29 m grading 4.08 g/t gold (OS-11-010) and 41.15 m grading 7.33 g/t gold (OS-11-058).

A sixth diamond drill will focus on the Osiris Zone to the north, exploring towards the intersection of the Nadaleen feeder fault system and the Osiris limestone unit. Highlights from 2011 drilling at the Osiris Zone include 32.01 m grading 4.25 g/t gold (OS-11-031) and 26.12 m grading 6.08 g/t gold (OS-11-055).

All the gold zones identified to date are distinct and each has the potential for significant expansion. Given their proximity to each other, they demonstrate the gold endowment potential characteristic of Carlin-type deposits.

Regional Exploration

Auger drilling commenced mid-April at the Pyramid Target which is located 20 km west of the Osiris Zone within the Nadaleen Trend. It is one of over fifteen early-stage gold targets that were identified in 2011. The Pyramid Target is defined by an extensive glacially dispersed orpiment/realgar (arsenic sulphides) cobble field measuring 150 by 80 m that lies within a larger 500 by 200 m arsenic/thallium soil anomaly. Arsenic sulphides and thallium are strong gold pathfinder elements similar to those found at the Conrad, Osiris, Isis and Isis East Zones. Approximately 60 auger holes will be drilled through glacially transported overburden to vector in on the bedrock source of the cobble field float train. Follow up diamond drilling at the Pyramid Target will take place in 2012. Please visit our website for maps and figures on the Pyramid Target.

2012 Exploration Program

15,000 metres of diamond drilling in phase one, with the majority of drilling to be focused on the Nadaleen Trend where four priority zones of Carlin-Type gold mineralization have been confirmed to date - Conrad, Osiris, Isis and Isis East;

Expansion and definition diamond drilling of the Conrad, Osiris, Isis and Isis East Zones;

Scout drill testing of structural targets along the Nadaleen feeder fault and other structures that exhibit surface pathfinder element signatures to evaluate "leakage anomalies" for potential mineralization at depth;

Continued auger drilling at the Pyramid target to identify the bedrock source of a 500 by 200 m gold pathfinder arsenic/thallium soil geochemical anomaly coincident with abundant orpiment and realgar cobbles and boulders in glacial till;

Geophysical surveys on the Ocelot silver-lead-zinc discovery within the Rau Trend; and,

Follow up prospecting, geological mapping and detailed soil sampling of 15 high priority gold and pathfinder geochemical anomalies identified in 2011 along the 185 km long Rackla Gold Project claim block.

The technical information in this news release has been reviewed by Robert C. Carne, M.Sc., P.Geo., a qualified person for the purposes of National Instrument 43-101.

[url=http://peketec.de/trading/viewtopic.php?p=1259949#1259949 schrieb:CCG-Redaktion schrieb am 11.06.2012, 11:45 Uhr[/url]"]@ Atac Resources

"..Viele Unternehmen haben erfolgreich vorgesorgt und konnten größere Finanzierungen in den

letzten 3 Jahren stemmen. So sitzt Atac Resources z.B. noch auf Cashreserven von rund 20

Millionen USD. Das diesjährige Explorationsprogramm soll 15.000 Bohrmeter auf dem

Flaggschiffprojekt Rackla Gold betragen. Atac hat für einen Projektteil bereits eine Goldressource

definiert. Sie explorieren auf der riesigen Rackla Liegenschaft aber nicht nur noch Gold. Letztes Jahr

konnte Atac auch eine erste Silber-, Blei- und Zink-Discovery erzielen. Das Rackla Gold Projekt wird

wegen den geologischen Ähnlichkeiten schon längere Zeit als einziger, potentieller Goldbezirk

gehandelt, der einen neuen ‚Carlin District‘ formen könnte (vgl. den ruhmreichen Carlin District in

Nevada). Sollten sich die Spekulationen über einen neuen Carlin Trend aufgrund weiterer,

herausragender Entdeckungen verdichten, könnte Atac Resources auf einem der begehrtesten

Rohstoffprojekte der Welt sitzen.."

[url=http://peketec.de/trading/viewtopic.php?p=1259945#1259945 schrieb:CCG-Redaktion schrieb am 11.06.2012, 11:42 Uhr[/url]"]Der gebeutelte Explorationssektor im Yukon nimmt wieder Fahrt auf

Im kanadischen Yukon ist die Exploration von Rohstoffprojekten aufgrund des langen und harten

Winters lediglich auf ein paar Monate im Jahr begrenzt. Gewöhnlich werden die ersten

Explorationstätigkeiten erst im Mai aufgenommen, die letzten bereits im September beendet. Es gibt

nur wenige Projekte, die ganzjährig exploriert und entwickelt werden können. Meistens liegen diese

Projekte im Süden oder in einer vorteilhaften Region, die den Wetterkonditionen etwas trotzen kann..

http://www.miningscout.de/Kolumnen/Der_gebeutelte_Explorationssektor_im_Yukon_nimmt_wieder_Fahrt_auf/page_1/_76/__603

June 15, 2012 - 08:09:43 AM

ATAC Resources Ltd. to Raise $11.9 Million Through Bought-Deal Private

Placement

VANCOUVER, BRITISH COLUMBIA--(Marketwire - June 15, 2012) -

NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR

DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES

ATAC Resources Ltd. ("ATAC") (TSX VENTURE:ATC) today announced that it has

entered into an agreement with a syndicate of underwriters led by Macquarie

Capital Markets Canada Ltd. (the "Underwriters"), whereby the Underwriters on

a bought-deal private placement basis will purchase for their own account or

arrange for substituted purchasers to purchase a combination of 701,755 common

share units (the "Common Share Units") and 3,000,000 flow-through units (the

"Flow-Through Units") from ATAC, at a price of $2.85 per Common Share Unit and

$3.30 per Flow-Through Unit for aggregate gross proceeds to ATAC of

$11,900,002 (the "Offering").

Each Common Share Unit will be comprised of one common share and one-half of

one common share purchase warrant of the Company (each whole warrant, a

"Warrant"). Each Warrant will entitle the holder thereof to purchase one

additional common share of the Company at a price of $4.50 for a period of 6

months following the Closing Date (as defined below). Each Flow-Through Unit

will be comprised of one flow-through share and one-half of one flow-through

share purchase warrant of the Company (each whole warrant, a "Flow-Through

Warrant"). Each Flow-Through Warrant will entitle the holder thereof to

purchase one additional flow-through share of the Company at a price of $4.50

for a period of 6 months following the Closing Date. The Company may force

conversion of the common share Warrants and Flow-Through Warrants if the

volume-weighted average price of the Company's common shares is above $5.00

over a 10-day period following expiry of the Hold Period (as defined below).

The Underwriters shall also have the option (the "Underwriters' Option") to

purchase from ATAC up to an additional 33% of the number of Common Share Units

and Flow-Through Units sold pursuant to the Offering. The Offering will take

place by way of a private placement to qualified investors in such provinces

of Canada as the Underwriters may designate, and otherwise in those

jurisdictions where the Offering can lawfully be made, including but not

limited to the United States (with respect to the Common Share Units only)

under applicable private placement exemptions. The securities to be issued

under the Offering will have a hold period of four months and one day from

closing (the "Hold Period").

The proceeds raised from the sale of the Common Share Units will be used by

the Company to continue exploration at its 100%-owned Rackla Gold Project, and

for working capital purposes. The proceeds raised from the sale of the

Flow-Through Units will be used by the Company to finance qualified Canadian

exploration expenditures on its Canadian resource properties.

It is expected that the closing of the Offering will occur on or about July 5,

2012 (the "Closing Date") and is subject to the satisfaction of certain

conditions, including receipt of all applicable regulatory approvals including

the approval of the TSX Venture Exchange. In consideration for their services,

the Underwriters will receive a commission equal to 6.0% of the gross proceeds

of the Offering, including any proceeds realized on exercise of the

Underwriters' Option. In addition, Axemen Resource Capital Ltd. will be

entitled to a finder's fee in relation to the Offering.

This press release is not an offer to sell or the solicitation of an offer to

buy the securities, nor shall there be any sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful prior

to qualification or registration under the securities laws of such

jurisdiction. The securities being offered have not been, nor will they be,

registered under the United States Securities Act of 1933, as amended (the

"U.S. Securities Act"), and such securities may not be offered or sold within

the United States or to a U.S. person absent registration or an applicable

exemption from U.S. registration requirements. "United States" and "U.S.

person" have the respective meanings assigned in Regulation S under the U.S.

Securities Act.

On behalf of the Board

Graham Downs, CEO

ATAC Resources Ltd.

ATAC Resources Ltd. to Raise $11.9 Million Through Bought-Deal Private

Placement

VANCOUVER, BRITISH COLUMBIA--(Marketwire - June 15, 2012) -

NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR

DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES

ATAC Resources Ltd. ("ATAC") (TSX VENTURE:ATC) today announced that it has

entered into an agreement with a syndicate of underwriters led by Macquarie

Capital Markets Canada Ltd. (the "Underwriters"), whereby the Underwriters on

a bought-deal private placement basis will purchase for their own account or

arrange for substituted purchasers to purchase a combination of 701,755 common

share units (the "Common Share Units") and 3,000,000 flow-through units (the

"Flow-Through Units") from ATAC, at a price of $2.85 per Common Share Unit and

$3.30 per Flow-Through Unit for aggregate gross proceeds to ATAC of

$11,900,002 (the "Offering").

Each Common Share Unit will be comprised of one common share and one-half of

one common share purchase warrant of the Company (each whole warrant, a

"Warrant"). Each Warrant will entitle the holder thereof to purchase one

additional common share of the Company at a price of $4.50 for a period of 6

months following the Closing Date (as defined below). Each Flow-Through Unit

will be comprised of one flow-through share and one-half of one flow-through

share purchase warrant of the Company (each whole warrant, a "Flow-Through

Warrant"). Each Flow-Through Warrant will entitle the holder thereof to

purchase one additional flow-through share of the Company at a price of $4.50

for a period of 6 months following the Closing Date. The Company may force

conversion of the common share Warrants and Flow-Through Warrants if the

volume-weighted average price of the Company's common shares is above $5.00

over a 10-day period following expiry of the Hold Period (as defined below).

The Underwriters shall also have the option (the "Underwriters' Option") to

purchase from ATAC up to an additional 33% of the number of Common Share Units

and Flow-Through Units sold pursuant to the Offering. The Offering will take

place by way of a private placement to qualified investors in such provinces

of Canada as the Underwriters may designate, and otherwise in those

jurisdictions where the Offering can lawfully be made, including but not

limited to the United States (with respect to the Common Share Units only)

under applicable private placement exemptions. The securities to be issued

under the Offering will have a hold period of four months and one day from

closing (the "Hold Period").

The proceeds raised from the sale of the Common Share Units will be used by

the Company to continue exploration at its 100%-owned Rackla Gold Project, and

for working capital purposes. The proceeds raised from the sale of the

Flow-Through Units will be used by the Company to finance qualified Canadian

exploration expenditures on its Canadian resource properties.

It is expected that the closing of the Offering will occur on or about July 5,

2012 (the "Closing Date") and is subject to the satisfaction of certain

conditions, including receipt of all applicable regulatory approvals including

the approval of the TSX Venture Exchange. In consideration for their services,

the Underwriters will receive a commission equal to 6.0% of the gross proceeds

of the Offering, including any proceeds realized on exercise of the

Underwriters' Option. In addition, Axemen Resource Capital Ltd. will be

entitled to a finder's fee in relation to the Offering.

This press release is not an offer to sell or the solicitation of an offer to

buy the securities, nor shall there be any sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful prior

to qualification or registration under the securities laws of such

jurisdiction. The securities being offered have not been, nor will they be,

registered under the United States Securities Act of 1933, as amended (the

"U.S. Securities Act"), and such securities may not be offered or sold within

the United States or to a U.S. person absent registration or an applicable

exemption from U.S. registration requirements. "United States" and "U.S.

person" have the respective meanings assigned in Regulation S under the U.S.

Securities Act.

On behalf of the Board

Graham Downs, CEO

ATAC Resources Ltd.

July 05, 2012 13:32 ET

ATAC Resources Ltd. Raises $15,661,995 Through Bought-Deal Private Placement

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 5, 2012) -

NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES

ATAC Resources Ltd. ("ATAC" or "the Company") (TSX VENTURE:ATC) is pleased to announce that it has closed the bought-deal private placement through a syndicate of underwriters led by Macquarie Capital Markets Canada Ltd., and including Raymond James Ltd., Scotia Capital Inc., RBC Dominion Securities Inc. and GMP Securities L.P., as originally announced on June 15, 2012.

The private placement consisted of the sale by the Company of 3,980,100 Flow-Through Units at a price of $3.30 per Flow-Through Unit and 886,900 Common Share Units at a price of $2.85 per Common Share Unit, for aggregate gross subscription proceeds of $15,661,995. Commissions totalling $936,117 were paid to the underwriting syndicate in connection with the private placement.

Each Flow-Through Unit consisted of one flow-through share and one-half of one flow-through share purchase warrant (each whole warrant a "Flow-Through Warrant"). Each Flow-Through Warrant entitles the holder to purchase one additional flow-through share of the Company at a price of $4.50 until January 5, 2013, provided that, in the event the volume-weighted average price of the Company's shares is above $5.00 over a consecutive 10 day period following the expiry of the Hold Period (as defined below), the Company may give notice of an earlier expiry of the Flow-Through Warrants, in which case they would expire 10 calendar days from the giving of such notice.

Each Common Share Unit consisted of one common share and one-half of one common share purchase warrant (each whole warrant a "Warrant"). Each Warrant entitles the holder to purchase one additional common share of the Company at a price of $4.50 until January 5, 2013, subject to the same potential earlier expiry as applies to the Flow-Through Warrants.

All of the securities issued pursuant to the private placement are subject to a hold period in Canada which expires on November 6, 2012 (the "Hold Period").

The net proceeds from the private placement will be used by the Company to continue exploration at its 100%-owned Rackla Gold Project in the Yukon, and for working capital purposes. The proceeds raised from the sale of the Flow-Through Units will be used by the Company to finance qualified Canadian exploration expenditures on its Canadian resource properties.

The securities referred to in this news release have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons absent U.S. registration or an applicable exemption from the U.S. registration requirements. This news release does not constitute an offer for sale of securities for sale, nor a solicitation for offers to buy any securities. Any public offering of securities in the United States must be made by means of a prospectus containing detailed information about the company and management, as well as financial statements.

ATAC Resources Ltd. Raises $15,661,995 Through Bought-Deal Private Placement

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 5, 2012) -

NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES

ATAC Resources Ltd. ("ATAC" or "the Company") (TSX VENTURE:ATC) is pleased to announce that it has closed the bought-deal private placement through a syndicate of underwriters led by Macquarie Capital Markets Canada Ltd., and including Raymond James Ltd., Scotia Capital Inc., RBC Dominion Securities Inc. and GMP Securities L.P., as originally announced on June 15, 2012.

The private placement consisted of the sale by the Company of 3,980,100 Flow-Through Units at a price of $3.30 per Flow-Through Unit and 886,900 Common Share Units at a price of $2.85 per Common Share Unit, for aggregate gross subscription proceeds of $15,661,995. Commissions totalling $936,117 were paid to the underwriting syndicate in connection with the private placement.

Each Flow-Through Unit consisted of one flow-through share and one-half of one flow-through share purchase warrant (each whole warrant a "Flow-Through Warrant"). Each Flow-Through Warrant entitles the holder to purchase one additional flow-through share of the Company at a price of $4.50 until January 5, 2013, provided that, in the event the volume-weighted average price of the Company's shares is above $5.00 over a consecutive 10 day period following the expiry of the Hold Period (as defined below), the Company may give notice of an earlier expiry of the Flow-Through Warrants, in which case they would expire 10 calendar days from the giving of such notice.

Each Common Share Unit consisted of one common share and one-half of one common share purchase warrant (each whole warrant a "Warrant"). Each Warrant entitles the holder to purchase one additional common share of the Company at a price of $4.50 until January 5, 2013, subject to the same potential earlier expiry as applies to the Flow-Through Warrants.

All of the securities issued pursuant to the private placement are subject to a hold period in Canada which expires on November 6, 2012 (the "Hold Period").

The net proceeds from the private placement will be used by the Company to continue exploration at its 100%-owned Rackla Gold Project in the Yukon, and for working capital purposes. The proceeds raised from the sale of the Flow-Through Units will be used by the Company to finance qualified Canadian exploration expenditures on its Canadian resource properties.

The securities referred to in this news release have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons absent U.S. registration or an applicable exemption from the U.S. registration requirements. This news release does not constitute an offer for sale of securities for sale, nor a solicitation for offers to buy any securities. Any public offering of securities in the United States must be made by means of a prospectus containing detailed information about the company and management, as well as financial statements.

July 18, 2012 08:30 ET

ATAC Resources Ltd. Intersects 46.06 m of 11.24 g/t Gold at the Conrad Zone, Rackla Gold Project-Yukon

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 18, 2012) - ATAC Resources Ltd. (TSX VENTURE:ATC) is pleased to report the first ten diamond drill hole results of 2012 from the Conrad and Isis East Zones within the Nadaleen Trend at the eastern end of its 100% owned 1,600 sq/km Rackla Gold Project in central Yukon.

News release highlights:

Highest grade gold intersection to date at the Conrad Zone with 46.06 m grading 11.24 g/t gold in hole OS-12-103.

Isis East discovery extended with step-out holes along a 200 m strike length to a depth of 225 m in the crest of an anticlinal fold.

Six drills are operating and 15,000 m in 58 holes have been drilled since the May 22 program start with 4 drills currently on Conrad, and 2 on the Osiris Zone.

"We are very pleased with the developing continuity and the high-grade nature of the first 2012 drill-holes at the Conrad Zone. Holes OS-12-98 and OS-12-103 intersected mineralization near surface with the highest grade intervals that we have encountered to date," states Graham Downs, ATAC's CEO. "The fact that we have also extended gold mineralization at Isis East by stepping-out from the 2011 discovery holes is also encouraging and drilling continues to test for further down-dip and strike extensions."

Five Carlin-type gold exploration targets were outlined in 2011 by wide-spaced diamond drilling within a 3 by 4 km area in the Nadaleen Trend. The 2012 drill program will expand and better define those known areas of mineralization, as well as test a number of undrilled geochemical anomalies.

Conrad Zone

The Conrad Zone has a current strike length of approximately 475 m and extends 490 m below surface. The zone remains open in all directions. Some of the best grades and longest intersections from previous drilling are located at a shallow depth in the crest area of an anticlinal fold at or near the contact of relatively impermeable silty shale with an underlying limestone unit. The potential for additional deep high-grade gold mineralization as encountered in hole OS-11-036 (8.06 g/t gold over 21.34 m starting from 687.32 m down hole) will also be systematically tested in 2012. Drill hole cross-sections and a plan-view map can be viewed on the Company's website at www.atacresources.com. Significant results for the first five 2012 Conrad holes received to date are tabulated below.

.

.

.

http://www.marketwire.com/press-release/atac-resources-ltd-intersects-4606-m-1124-g-t-gold-conrad-zone-rackla-gold-project-yukon-tsx-venture-atc-1681230.htm

ATAC Resources Ltd. Intersects 46.06 m of 11.24 g/t Gold at the Conrad Zone, Rackla Gold Project-Yukon

VANCOUVER, BRITISH COLUMBIA--(Marketwire - July 18, 2012) - ATAC Resources Ltd. (TSX VENTURE:ATC) is pleased to report the first ten diamond drill hole results of 2012 from the Conrad and Isis East Zones within the Nadaleen Trend at the eastern end of its 100% owned 1,600 sq/km Rackla Gold Project in central Yukon.

News release highlights:

Highest grade gold intersection to date at the Conrad Zone with 46.06 m grading 11.24 g/t gold in hole OS-12-103.

Isis East discovery extended with step-out holes along a 200 m strike length to a depth of 225 m in the crest of an anticlinal fold.

Six drills are operating and 15,000 m in 58 holes have been drilled since the May 22 program start with 4 drills currently on Conrad, and 2 on the Osiris Zone.

"We are very pleased with the developing continuity and the high-grade nature of the first 2012 drill-holes at the Conrad Zone. Holes OS-12-98 and OS-12-103 intersected mineralization near surface with the highest grade intervals that we have encountered to date," states Graham Downs, ATAC's CEO. "The fact that we have also extended gold mineralization at Isis East by stepping-out from the 2011 discovery holes is also encouraging and drilling continues to test for further down-dip and strike extensions."

Five Carlin-type gold exploration targets were outlined in 2011 by wide-spaced diamond drilling within a 3 by 4 km area in the Nadaleen Trend. The 2012 drill program will expand and better define those known areas of mineralization, as well as test a number of undrilled geochemical anomalies.

Conrad Zone

The Conrad Zone has a current strike length of approximately 475 m and extends 490 m below surface. The zone remains open in all directions. Some of the best grades and longest intersections from previous drilling are located at a shallow depth in the crest area of an anticlinal fold at or near the contact of relatively impermeable silty shale with an underlying limestone unit. The potential for additional deep high-grade gold mineralization as encountered in hole OS-11-036 (8.06 g/t gold over 21.34 m starting from 687.32 m down hole) will also be systematically tested in 2012. Drill hole cross-sections and a plan-view map can be viewed on the Company's website at www.atacresources.com. Significant results for the first five 2012 Conrad holes received to date are tabulated below.

.

.

.

http://www.marketwire.com/press-release/atac-resources-ltd-intersects-4606-m-1124-g-t-gold-conrad-zone-rackla-gold-project-yukon-tsx-venture-atc-1681230.htm

neue Unternehmens-Präsentation 08/2012:

http://www.atacresources.com/i/pdf/CorporatePresentation-August.pdf

.

http://www.atacresources.com/i/pdf/CorporatePresentation-August.pdf

.

January 23, 2013 07:30 ET

ATAC Resources Provides Summary of Encouraging New Rackla Gold Project; Regional Exploration Results

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Jan. 23, 2013) - ATAC Resources Ltd. (TSX VENTURE:ATC) is pleased to provide a summary of recently compiled results from the Company's 2012 regional-scale exploration program conducted across its 100% owned 1,700 sq/km Rackla Gold Project in central Yukon.

The comprehensive 2012 program consisted of stream sediment and soil geochemical surveys, prospecting, mapping, hand pitting, hand trenching and satellite image structural lineament analyses. Exploration emphasis was directed at previously unexplored areas outside the drilled zones along the 40 km long Nadaleen Trend at the eastern end of the property and within the 35 km long Rau Trend containing the Tiger Deposit at the western end. A total of 19,693 soil samples, 1,219 stream sediment samples and 1,526 rock samples were collected along the 185 km long property. Highlights are listed below:

2012 Regional Exploration Highlights:

Wide spaced soil sampling identifies ten new Tier 1 Carlin-type pathfinder±gold anomalies within the Nadaleen Trend;

Follow-up exploration of two 2011 Nadaleen Trend anomalies late in the 2012 field season resulted in the drill discovery of the Anubis and Sunrise Zones (Anubis discovery hole AN-12-001 intersected 8.51 m of 19.85 g/t gold and Sunrise discovery hole OS-12-114 intersected 14.86 m of 10.54 g/t gold);

Detailed follow-up work at the Pharaoh target 13 km northeast of the Osiris area identified Carlin-type mineralization and quartz veins with visible gold. Grab samples from the quartz vein material returned grades up to 79.40 g/t gold;

Prospecting of a 5.6 km long intermittent gold geochemical anomaly 3 km south of the Tiger Deposit in the Rau Trend resulted in the discovery of the Bengal Showing where outcrop channel samples returned grades greater than 3 g/t gold;

Property-wide stream sediment geochemical surveys have identified 21 anomalous drainages on the property outside the Nadaleen and Rau Trends for follow-up in 2013; and,

Reconnaissance stream silt sampling and geological interpretation beyond the property boundary led to the staking of 84 sq/km of unexplored anomalous drainage basins with favourable Carlin-style geology.

"The ability to consistently make significant new discoveries like Anubis, Pharaoh, Sunrise and Bengal is testimony to the district-scale potential of both trends," states Graham Downs, ATAC's CEO. "With virtually no historical gold exploration along the Rackla Gold Belt and only approximately 16% of the belt having now been geochemically surveyed, we are very optimistic that our ongoing systematic exploration will continue to produce additional discoveries."

http://www.marketwire.com/press-release/atac-resources-provides-summary-encouraging-new-rackla-gold-project-regional-exploration-tsx-venture-atc-1748666.htm

ATAC Resources Provides Summary of Encouraging New Rackla Gold Project; Regional Exploration Results

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Jan. 23, 2013) - ATAC Resources Ltd. (TSX VENTURE:ATC) is pleased to provide a summary of recently compiled results from the Company's 2012 regional-scale exploration program conducted across its 100% owned 1,700 sq/km Rackla Gold Project in central Yukon.

The comprehensive 2012 program consisted of stream sediment and soil geochemical surveys, prospecting, mapping, hand pitting, hand trenching and satellite image structural lineament analyses. Exploration emphasis was directed at previously unexplored areas outside the drilled zones along the 40 km long Nadaleen Trend at the eastern end of the property and within the 35 km long Rau Trend containing the Tiger Deposit at the western end. A total of 19,693 soil samples, 1,219 stream sediment samples and 1,526 rock samples were collected along the 185 km long property. Highlights are listed below:

2012 Regional Exploration Highlights:

Wide spaced soil sampling identifies ten new Tier 1 Carlin-type pathfinder±gold anomalies within the Nadaleen Trend;

Follow-up exploration of two 2011 Nadaleen Trend anomalies late in the 2012 field season resulted in the drill discovery of the Anubis and Sunrise Zones (Anubis discovery hole AN-12-001 intersected 8.51 m of 19.85 g/t gold and Sunrise discovery hole OS-12-114 intersected 14.86 m of 10.54 g/t gold);

Detailed follow-up work at the Pharaoh target 13 km northeast of the Osiris area identified Carlin-type mineralization and quartz veins with visible gold. Grab samples from the quartz vein material returned grades up to 79.40 g/t gold;

Prospecting of a 5.6 km long intermittent gold geochemical anomaly 3 km south of the Tiger Deposit in the Rau Trend resulted in the discovery of the Bengal Showing where outcrop channel samples returned grades greater than 3 g/t gold;

Property-wide stream sediment geochemical surveys have identified 21 anomalous drainages on the property outside the Nadaleen and Rau Trends for follow-up in 2013; and,

Reconnaissance stream silt sampling and geological interpretation beyond the property boundary led to the staking of 84 sq/km of unexplored anomalous drainage basins with favourable Carlin-style geology.

"The ability to consistently make significant new discoveries like Anubis, Pharaoh, Sunrise and Bengal is testimony to the district-scale potential of both trends," states Graham Downs, ATAC's CEO. "With virtually no historical gold exploration along the Rackla Gold Belt and only approximately 16% of the belt having now been geochemically surveyed, we are very optimistic that our ongoing systematic exploration will continue to produce additional discoveries."

http://www.marketwire.com/press-release/atac-resources-provides-summary-encouraging-new-rackla-gold-project-regional-exploration-tsx-venture-atc-1748666.htm

March 19, 2013 07:30 ET

ATAC Resources Ltd. Announces $13 Million Strategic Investment by Agnico-Eagle Mines Limited

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 19, 2013) -

NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES

ATAC Resources Ltd. (TSX VENTURE:ATC) ("ATAC" or "the Company") announces that Agnico-Eagle Mines Limited ("Agnico-Eagle") today entered into a Subscription Agreement with the Company to make an investment of approximately C$13 million in ATAC by way of a non-brokered private placement consisting of Units. Both Boards of Directors have approved the transaction. Upon completion of this transaction, ATAC's cash position will be approximately C$27 million.

Under the terms of the Subscription Agreement Agnico-Eagle will purchase a total of 9,600,000 Units at a price of C$1.35 per Unit. Each Unit will consist of one common share and one-half of one share purchase warrant (each whole share purchase warrant a "Warrant"). Each Warrant will entitle Agnico-Eagle to purchase one additional common share of the Company at a price of $2.10 for a period of 18 months from closing, provided that, in the event the closing price of the Company's shares as traded on the TSX Venture Exchange exceeds $3.00 for a period of 10 consecutive trading days subsequent to the expiry of the applicable four month hold period, the Company may give notice of an earlier expiry of the Warrants, in which case they would expire 30 calendar days from the receipt of such notice. In the event all of the Warrants are exercised, it would generate an additional C$10,080,000 towards ATAC's working capital. Upon the closing of this private placement, which is subject to regulatory acceptance, Agnico-Eagle will own 8.48% of ATAC's outstanding shares on an undiluted basis (12.21% on a partially diluted basis if all Warrants are exercised). The Subscription Agreement also provides Agnico-Eagle with a participation right pursuant to which, during the two-year period following the closing of the acquisition of the common shares reported herein, and provided that Agnico-Eagle at the time owns more than five percent of the then issued and outstanding common shares of the Company, Agnico-Eagle has the right to participate in certain subsequent equity offerings by the Company on the same terms as the other participants in such offerings in order to maintain its pro rata investment in the Company.

Sean Boyd, President and CEO of Agnico-Eagle commented, "We have been actively following ATAC's progress at the Rackla Gold Project for the past three years and recognize their teams' unique skill set and excellent results. Through its investment in ATAC, Agnico-Eagle is pleased to be involved in a project with significant exploration potential in an emerging gold district."

Graham Downs, CEO of ATAC said, "We are very pleased with this strategic investment from Agnico-Eagle, whose commitment to excellence in growth through exploration and development, aligns with ATAC's objective of advancing Canada's first Carlin-type gold discoveries at our 100% owned Rackla Gold Project. Agnico-Eagle's investment in ATAC is a testament to the quality of discoveries made on the project to date, and provides sufficient funds for multiple years of exploration."

The proceeds of the transaction will be used to continue exploration and development of ATAC's Rackla Gold Project in Yukon. The Rackla Gold Project is divided into two distinct trends: the 50 km long Nadaleen Trend which hosts Carlin-type mineralization at the Conrad, Osiris, Isis East, Sunrise and Anubis zones and the Rau Trend which hosts the Tiger Gold Deposit, Ocelot silver-lead-zinc-tin target and the new Bengal gold showing. Property-wide regional exploration has outlined ten Tier 1 Carlin-type pathfinder±gold anomalies within the Nadaleen Trend as well as multiple anomalous targets within the Rau Trend.

ATAC Resources Ltd. Announces $13 Million Strategic Investment by Agnico-Eagle Mines Limited

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 19, 2013) -

NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES

ATAC Resources Ltd. (TSX VENTURE:ATC) ("ATAC" or "the Company") announces that Agnico-Eagle Mines Limited ("Agnico-Eagle") today entered into a Subscription Agreement with the Company to make an investment of approximately C$13 million in ATAC by way of a non-brokered private placement consisting of Units. Both Boards of Directors have approved the transaction. Upon completion of this transaction, ATAC's cash position will be approximately C$27 million.

Under the terms of the Subscription Agreement Agnico-Eagle will purchase a total of 9,600,000 Units at a price of C$1.35 per Unit. Each Unit will consist of one common share and one-half of one share purchase warrant (each whole share purchase warrant a "Warrant"). Each Warrant will entitle Agnico-Eagle to purchase one additional common share of the Company at a price of $2.10 for a period of 18 months from closing, provided that, in the event the closing price of the Company's shares as traded on the TSX Venture Exchange exceeds $3.00 for a period of 10 consecutive trading days subsequent to the expiry of the applicable four month hold period, the Company may give notice of an earlier expiry of the Warrants, in which case they would expire 30 calendar days from the receipt of such notice. In the event all of the Warrants are exercised, it would generate an additional C$10,080,000 towards ATAC's working capital. Upon the closing of this private placement, which is subject to regulatory acceptance, Agnico-Eagle will own 8.48% of ATAC's outstanding shares on an undiluted basis (12.21% on a partially diluted basis if all Warrants are exercised). The Subscription Agreement also provides Agnico-Eagle with a participation right pursuant to which, during the two-year period following the closing of the acquisition of the common shares reported herein, and provided that Agnico-Eagle at the time owns more than five percent of the then issued and outstanding common shares of the Company, Agnico-Eagle has the right to participate in certain subsequent equity offerings by the Company on the same terms as the other participants in such offerings in order to maintain its pro rata investment in the Company.