App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

http://ceo.ca/2016/02/04/as-gold-rallies-from-major-bottom-sabina-set-to-outperform/

[url=http://peketec.de/trading/viewtopic.php?p=1660891#1660891 schrieb:dukezero schrieb am 04.02.2016, 15:03 Uhr[/url]"]GSV + SBB !

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Golden Arrow drills 61 m of 151 g/t Ag at Chinchillas

2016-02-04 09:14 ET - News Release

Mr. Joseph Grosso reports

GOLDEN ARROW REPORTS ADDITIONAL DRILL RESULTS AT CHINCHILLAS SILVER PROJECT

Golden Arrow Resources Corp. has released the results of assaying of an additional 14 drill holes in the phase V drilling program at the Chinchillas silver project in Jujuy province, Argentina. Previous results from the program were reported in news releases dated Dec. 2, 2015, Dec. 16, 2015, Jan. 11, and Jan. 20, 2016. The drilling program is part of the Chinchillas project predevelopment activities, financed by Silver Standard, which are being undertaken to evaluate the feasibility of creating a combined mining business with Silver Standard's Pirquitas mine, as announced Oct. 1, 2015. The drilling program is continuing and additional results will be announced as assays are received.

Selected highlights from these drill holes include:

151 grams per tonne silver, 2.0 per cent lead and 1.3 per cent zinc over 61 metres in CGA-258: Includes 675 g/t silver, 4.4 per cent lead and 3.4 per cent zinc over one metre;

And 403 g/t silver, 3.7 per cent lead and 1.2 per cent zinc over three metres;

And 640 g/t silver, 8.6 per cent lead over two metres;

186 g/t silver, 1.1 per cent lead and 0.5 per cent zinc over 38 metres in CGA-259: Including 347 g/t silver, 0.8 per cent lead and 0.6 per cent zinc over five metres;

And 420 g/t silver, 5.5 per cent lead and 0.7 per cent zinc over two metres;

203 g/t silver, 1.6 per cent lead and 1.0 per cent zinc over 21 metres in CGA-249: Including 388 g/t silver, 2.6 per cent lead and 1.4 per cent zinc over six metres;

245 g/t silver, 0.5 per cent lead and 0.5 per cent zinc over 20 metres in CGA-255: Including 853 g/t silver and 0.6 per cent zinc over two metres.

The phase V drill program started on Oct. 19, 2015, and since then the company has completed over 13,000 metres of drilling, with approximately 2,000 metres of the program remaining. The program comprises mainly infill holes in the silver mantos and mantos basement zones to upgrade the mineral resource categories, plus five geotechnical holes to support slope angle recommendations for the potential future pits, drilling to characterize ground waters in the project area, and condemnation drilling around the deposit.

The associated table includes the assay results from 14 diamond drill holes totalling 1,550 metres in length, including one hole drilled to characterize groundwater. A map of the drill hole locations is available on the Chinchillas map page on the Golden Arrow website.

Chinchillas deposit geology

The Chinchillas deposit is a volcanic vent system in which explosive volcanic activity produced diatreme breccias and tuffs in the upper part of the vent and brecciated the underlying Ordovician basement metasediments. Silver-lead-zinc mineralization in the tuff and tuff breccia units is disseminated within thick mantos (layers) and in the basement is mainly within the fractures of the breccias. Mineralization occurs in four main zones: to the west is situated the silver mantos tuff-hosted zone and the mantos basement zone; to the east is situated the Socavon del Diablo tuff-hosted zone and the Socavon basement zone. The zones are described in detail in the most recent National Instrument 43-101 technical report, filed under Golden Arrow's SEDAR profile dated Nov. 2, 2015.

Drill hole details

Mineralized intercepts greater than 20 g/t silver and 0.5 per cent lead and 0.5 per cent zinc are reported in the associated table.

Holes CGA-248, CGA-249, CGA-250, CGA-251, CGA-252, CGA-254 and CGA-255 were drilled to infill the central-south part of the silver mantos zone. Assays from these holes confirmed near-surface mineralization with several intersections of substantial grade and widths, similar to those reported from earlier holes in the vicinity.

Holes CGA-253 and CGA-256 were drilled to infill the northern portion of the silver mantos and test for an extension of high-grade mineralization from hole CGA-193 (reported on Dec. 16, 2015). CGA-253 returned no significant intercepts and those from CGA-256 were minor.

Holes CGA-258, CGA-259 and CGA-261 were drilled to infill the mantos basement and all encountered mineralization at the expected depth, just below the contact with the tuff unit.

Hole CGA-257 was a twin hole to CGA-40 and confirmed the mineralization with similar widths and grades.

Holes CGA-260W and CGA-262W were located in the Socavon del Diablo area adjacent to the main creek and were drilled to allow the installation of piezometers to monitor groundwater. Hole CGA-260W was drilled with a diamond drill and samples were therefore sent for analysis, with the results reported in the associated table. CGA-262W was drilled with a rotary drill and no samples were recovered or sent for analysis.

................

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aGRG-2344339&symbol=GRG®ion=C

Golden Arrow arranges $1.61-million private placement

2016-02-04 13:06 ET - News Release

Mr. Joseph Grosso reports

GOLDEN ARROW ANNOUNCES NON-BROKERED PRIVATE PLACEMENT

Golden Arrow Resources Corp. has arranged a non-brokered private placement financing of 2,918,000 units at 40 cents per unit for gross proceeds of $1,167,200. Each unit will consist of one common share and one non-transferable common share purchase warrant. Each warrant will entitle the holder thereof to purchase one additional common share in the capital of the company at a price of 30 cents per share for one year from the date of issue. Management appreciates that the subscribers, being seasoned mining professionals, recognize the value in Golden Arrow.

This financing is subject to regulatory approval and securities to be issued pursuant to the financing are subject to a four-month hold period under applicable Canadian securities laws. The company may pay finder's fees on a portion of the offering in accordance with applicable securities laws and the policies of the TSX Venture Exchange. The proceeds of this financing will be used for general working capital.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aGRG-2344391&symbol=GRG®ion=C

2016-02-04 09:14 ET - News Release

Mr. Joseph Grosso reports

GOLDEN ARROW REPORTS ADDITIONAL DRILL RESULTS AT CHINCHILLAS SILVER PROJECT

Golden Arrow Resources Corp. has released the results of assaying of an additional 14 drill holes in the phase V drilling program at the Chinchillas silver project in Jujuy province, Argentina. Previous results from the program were reported in news releases dated Dec. 2, 2015, Dec. 16, 2015, Jan. 11, and Jan. 20, 2016. The drilling program is part of the Chinchillas project predevelopment activities, financed by Silver Standard, which are being undertaken to evaluate the feasibility of creating a combined mining business with Silver Standard's Pirquitas mine, as announced Oct. 1, 2015. The drilling program is continuing and additional results will be announced as assays are received.

Selected highlights from these drill holes include:

151 grams per tonne silver, 2.0 per cent lead and 1.3 per cent zinc over 61 metres in CGA-258: Includes 675 g/t silver, 4.4 per cent lead and 3.4 per cent zinc over one metre;

And 403 g/t silver, 3.7 per cent lead and 1.2 per cent zinc over three metres;

And 640 g/t silver, 8.6 per cent lead over two metres;

186 g/t silver, 1.1 per cent lead and 0.5 per cent zinc over 38 metres in CGA-259: Including 347 g/t silver, 0.8 per cent lead and 0.6 per cent zinc over five metres;

And 420 g/t silver, 5.5 per cent lead and 0.7 per cent zinc over two metres;

203 g/t silver, 1.6 per cent lead and 1.0 per cent zinc over 21 metres in CGA-249: Including 388 g/t silver, 2.6 per cent lead and 1.4 per cent zinc over six metres;

245 g/t silver, 0.5 per cent lead and 0.5 per cent zinc over 20 metres in CGA-255: Including 853 g/t silver and 0.6 per cent zinc over two metres.

The phase V drill program started on Oct. 19, 2015, and since then the company has completed over 13,000 metres of drilling, with approximately 2,000 metres of the program remaining. The program comprises mainly infill holes in the silver mantos and mantos basement zones to upgrade the mineral resource categories, plus five geotechnical holes to support slope angle recommendations for the potential future pits, drilling to characterize ground waters in the project area, and condemnation drilling around the deposit.

The associated table includes the assay results from 14 diamond drill holes totalling 1,550 metres in length, including one hole drilled to characterize groundwater. A map of the drill hole locations is available on the Chinchillas map page on the Golden Arrow website.

Chinchillas deposit geology

The Chinchillas deposit is a volcanic vent system in which explosive volcanic activity produced diatreme breccias and tuffs in the upper part of the vent and brecciated the underlying Ordovician basement metasediments. Silver-lead-zinc mineralization in the tuff and tuff breccia units is disseminated within thick mantos (layers) and in the basement is mainly within the fractures of the breccias. Mineralization occurs in four main zones: to the west is situated the silver mantos tuff-hosted zone and the mantos basement zone; to the east is situated the Socavon del Diablo tuff-hosted zone and the Socavon basement zone. The zones are described in detail in the most recent National Instrument 43-101 technical report, filed under Golden Arrow's SEDAR profile dated Nov. 2, 2015.

Drill hole details

Mineralized intercepts greater than 20 g/t silver and 0.5 per cent lead and 0.5 per cent zinc are reported in the associated table.

Holes CGA-248, CGA-249, CGA-250, CGA-251, CGA-252, CGA-254 and CGA-255 were drilled to infill the central-south part of the silver mantos zone. Assays from these holes confirmed near-surface mineralization with several intersections of substantial grade and widths, similar to those reported from earlier holes in the vicinity.

Holes CGA-253 and CGA-256 were drilled to infill the northern portion of the silver mantos and test for an extension of high-grade mineralization from hole CGA-193 (reported on Dec. 16, 2015). CGA-253 returned no significant intercepts and those from CGA-256 were minor.

Holes CGA-258, CGA-259 and CGA-261 were drilled to infill the mantos basement and all encountered mineralization at the expected depth, just below the contact with the tuff unit.

Hole CGA-257 was a twin hole to CGA-40 and confirmed the mineralization with similar widths and grades.

Holes CGA-260W and CGA-262W were located in the Socavon del Diablo area adjacent to the main creek and were drilled to allow the installation of piezometers to monitor groundwater. Hole CGA-260W was drilled with a diamond drill and samples were therefore sent for analysis, with the results reported in the associated table. CGA-262W was drilled with a rotary drill and no samples were recovered or sent for analysis.

................

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aGRG-2344339&symbol=GRG®ion=C

Golden Arrow arranges $1.61-million private placement

2016-02-04 13:06 ET - News Release

Mr. Joseph Grosso reports

GOLDEN ARROW ANNOUNCES NON-BROKERED PRIVATE PLACEMENT

Golden Arrow Resources Corp. has arranged a non-brokered private placement financing of 2,918,000 units at 40 cents per unit for gross proceeds of $1,167,200. Each unit will consist of one common share and one non-transferable common share purchase warrant. Each warrant will entitle the holder thereof to purchase one additional common share in the capital of the company at a price of 30 cents per share for one year from the date of issue. Management appreciates that the subscribers, being seasoned mining professionals, recognize the value in Golden Arrow.

This financing is subject to regulatory approval and securities to be issued pursuant to the financing are subject to a four-month hold period under applicable Canadian securities laws. The company may pay finder's fees on a portion of the offering in accordance with applicable securities laws and the policies of the TSX Venture Exchange. The proceeds of this financing will be used for general working capital.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aGRG-2344391&symbol=GRG®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Primero receives Mexican tax claim to void pricing deal

2016-02-04 01:17 ET - News Release

Ms. Tamara Brown reports

PRIMERO RECEIVES LEGAL CLAIM FILED BY MEXICAN TAX AUTHORITIES

Primero Mining Corp.'s Mexican subsidiary, Primero Empresa Minera SA de CV (PEM), has received a legal claim from the Mexican tax authorities, Servicio de Administracion Tributaria (SAT), seeking to nullify the advance pricing agreement (APA) issued by SAT in 2012. The APA confirmed the company's basis for paying taxes on realized silver prices for the years 2010 to 2014 and represented SAT's agreement to accept that basis for those years. The legal claim initiated does not identify any different basis for paying taxes. The company believes this legal claim is without merit, and it intends to vigorously defend the validity of its APA. The company's operations continue as usual.

PEM and its legal counsel are in the process of completing a detailed review of the legal claim, which is in excess of 200 pages. The company's Mexican legal and financial advisers have informed the company that SAT's judicial challenge to the validity of an APA is without precedent. The company's advisers maintain that seeking to nullify an APA undermines the function of an APA, which is to assure a taxpayer of certainty. The Mexican Supreme Court of Justice recently concluded that where a tax ruling is challenged by the tax authorities through a legal claim, there can be no retroactive consequences or payments levied against a taxpayer that obtained the ruling in good faith within applicable legal principles. The company, and its Mexican legal and financial advisers, continues to believe that the company has filed its tax returns, and paid all applicable taxes, in compliance with Mexican tax laws.

http://www.stockwatch.com/Quote/Detail.aspx?symbol=P®ion=C

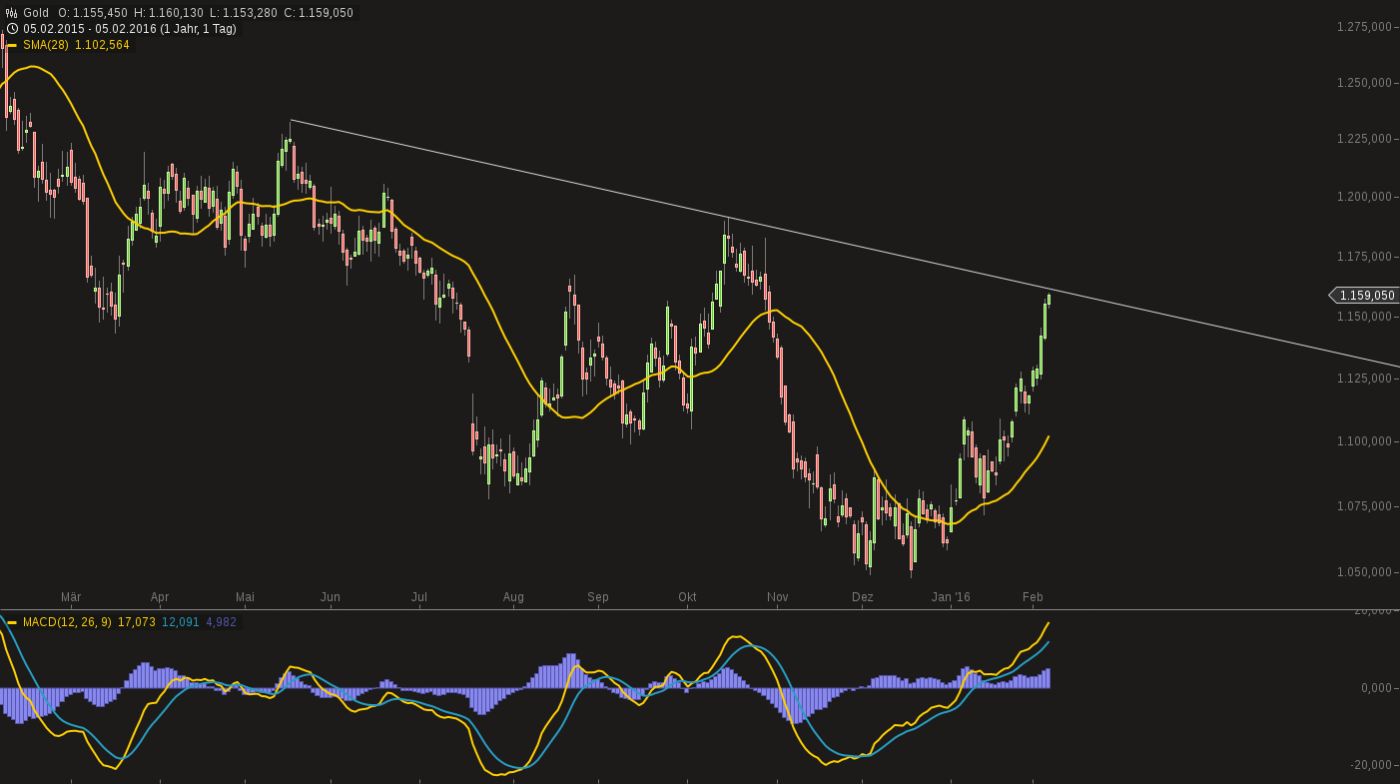

[url=http://peketec.de/trading/viewtopic.php?p=1660882#1660882 schrieb:dukezero schrieb am 04.02.2016, 14:47 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1660602#1660602 schrieb:dukezero schrieb am 03.02.2016, 16:17 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1660234#1660234 schrieb:dukezero schrieb am 02.02.2016, 14:55 Uhr[/url]"]» zur Grafik

1160$ bei Gold wäre ein Signal!

Nachhaltig über 1160 wäre wichtig!

Neue Bilder

http://truegoldmining.com/our-projects/karma#field-project-tab-tab-7

http://truegoldmining.com/our-projects/karma#field-project-tab-tab-7

[url=http://peketec.de/trading/viewtopic.php?p=1660988#1660988 schrieb:Rookie schrieb am 04.02.2016, 18:57 Uhr[/url]"]True gold mining

[url=http://peketec.de/trading/viewtopic.php?p=1660982#1660982 schrieb:600 schrieb am 04.02.2016, 18:33 Uhr[/url]"]Meinst du TCM?[url=http://peketec.de/trading/viewtopic.php?p=1660905#1660905 schrieb:Rookie schrieb am 04.02.2016, 15:43 Uhr[/url]"]TGM und PLB

[url=http://peketec.de/trading/viewtopic.php?p=1660891#1660891 schrieb:dukezero schrieb am 04.02.2016, 15:03 Uhr[/url]"]GSV + SBB !

Da schau ich nur zu, seit die unter 0,2 CAD fiel...

sowas musste ja bei genau 1160 POG kommen ...

U.S. Nonfarm Payrolls: 151K Jobs Created In January, But Unemployment Rate Falls To 4.9%

By Kitco News

Friday February 05, 2016 08:31

(Kitco News) - The shine is starting to come off the one bright spot in the U.S. economy as job growth last month was weaker than expected, according to the latest data from the Labor Department.

Friday, the Bureau of Labor Statistics said 151,000 jobs were created in January, down from December’s revised number of 292,000 -- the initial report had December's job gains pegged at 292,000; the employment gains were well below consensus forecasts, which were expecting to see 192,000 jobs.

November's job data was revised higher to 280,00 from the previous level of 252,000. According to the report jobs gains over the last three months averaged 231,000. Despite the weaker than expected headline number, the unemployment rate fell to 4.9%, lower than consensus forecasts of an unchanged reading at 5.0%. The participation rate came in at 62.7%, little changed from December's level.

In other positive news, January saw a significant increase in wages. The report said that average hourly earnings last month increased 12 cents to $25.39, up 0.5% from December and well above expectations of a 0.3% increase. In the last 12 months the the department said that earnings are up 2.5%.

The mining sector continues to be shed jobs as 7,000 positions were lost last month. The report noted that since peaking in September 2014, the sector has lost 146,000 jobs, or 17%.

Royce Medes, said that although the headline employment number was disappointment, investors can take some solace in the fact that there were some positive highlights in the report.

"Today’s below consensus payroll figure doesn’t change the fact that they’ve been growing at a solid pace recently," he said. "The data today appears to offer something for Fed doves and hawks alike."

By Neils Christensen of Kitco News; nchristensen@kitco.com

Follow Neils Christensen @neils_C

U.S. Nonfarm Payrolls: 151K Jobs Created In January, But Unemployment Rate Falls To 4.9%

By Kitco News

Friday February 05, 2016 08:31

(Kitco News) - The shine is starting to come off the one bright spot in the U.S. economy as job growth last month was weaker than expected, according to the latest data from the Labor Department.

Friday, the Bureau of Labor Statistics said 151,000 jobs were created in January, down from December’s revised number of 292,000 -- the initial report had December's job gains pegged at 292,000; the employment gains were well below consensus forecasts, which were expecting to see 192,000 jobs.

November's job data was revised higher to 280,00 from the previous level of 252,000. According to the report jobs gains over the last three months averaged 231,000. Despite the weaker than expected headline number, the unemployment rate fell to 4.9%, lower than consensus forecasts of an unchanged reading at 5.0%. The participation rate came in at 62.7%, little changed from December's level.

In other positive news, January saw a significant increase in wages. The report said that average hourly earnings last month increased 12 cents to $25.39, up 0.5% from December and well above expectations of a 0.3% increase. In the last 12 months the the department said that earnings are up 2.5%.

The mining sector continues to be shed jobs as 7,000 positions were lost last month. The report noted that since peaking in September 2014, the sector has lost 146,000 jobs, or 17%.

Royce Medes, said that although the headline employment number was disappointment, investors can take some solace in the fact that there were some positive highlights in the report.

"Today’s below consensus payroll figure doesn’t change the fact that they’ve been growing at a solid pace recently," he said. "The data today appears to offer something for Fed doves and hawks alike."

By Neils Christensen of Kitco News; nchristensen@kitco.com

Follow Neils Christensen @neils_C

1146 dürfte sich erledigt haben. Witzigerweise trommeln die bösen Briefe seit gestern. Kontraindikator de luxe!![url=http://peketec.de/trading/viewtopic.php?p=1661205#1661205 schrieb:dukezero schrieb am 05.02.2016, 12:07 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1660882#1660882 schrieb:dukezero schrieb am 04.02.2016, 14:47 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1660602#1660602 schrieb:dukezero schrieb am 03.02.2016, 16:17 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1660234#1660234 schrieb:dukezero schrieb am 02.02.2016, 14:55 Uhr[/url]"]» zur Grafik

1160$ bei Gold wäre ein Signal!

Nachhaltig über 1160 wäre wichtig!

» zur Grafik

RD fast kein Ask mehr

[url=http://peketec.de/trading/viewtopic.php?p=1661373#1661373 schrieb:PerseusLtd schrieb am 05.02.2016, 17:27 Uhr[/url]"]RD fast kein Ask mehr

0,32 / 0,445 letzter 0,35

Rich gold developer Sabina Gold & Silver plans sweet ’16 on permitting, exploration fronts

http://ceo.ca/2016/02/04/rich-gold-developer-sabina-gold-silver-plans-sweet-16-on-permitting-exploration-fronts/

http://ceo.ca/2016/02/04/rich-gold-developer-sabina-gold-silver-plans-sweet-16-on-permitting-exploration-fronts/

[url=http://peketec.de/trading/viewtopic.php?p=1661240#1661240 schrieb:dukezero schrieb am 05.02.2016, 12:52 Uhr[/url]"]RXC über 0,50 Euro

[url=http://peketec.de/trading/viewtopic.php?p=1661289#1661289 schrieb:dukezero schrieb am 05.02.2016, 15:08 Uhr[/url]"]1146 dürfte sich erledigt haben. Witzigerweise trommeln die bösen Briefe seit gestern. Kontraindikator de luxe!![url=http://peketec.de/trading/viewtopic.php?p=1661205#1661205 schrieb:dukezero schrieb am 05.02.2016, 12:07 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1660882#1660882 schrieb:dukezero schrieb am 04.02.2016, 14:47 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1660602#1660602 schrieb:dukezero schrieb am 03.02.2016, 16:17 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1660234#1660234 schrieb:dukezero schrieb am 02.02.2016, 14:55 Uhr[/url]"]» zur Grafik

1160$ bei Gold wäre ein Signal!

Nachhaltig über 1160 wäre wichtig!

» zur Grafik

Verkauf RGL (47,66er Posi) zu 54,60 Can $

47,55er Position läuft mit Stop erstmal weiter.

47,55er Position läuft mit Stop erstmal weiter.

[url=http://peketec.de/trading/viewtopic.php?p=1654160#1654160 schrieb:Ollinho schrieb am 11.01.2016, 20:47 Uhr[/url]"]Trade-Spekus

Kauf RGL 47,66 + 47,55 Can $

Kauf SEA 11,50 Can $

30 Dollar hoch!

[url=http://peketec.de/trading/viewtopic.php?p=1661398#1661398 schrieb:Rookie schrieb am 05.02.2016, 21:53 Uhr[/url]"]

[url=http://peketec.de/trading/viewtopic.php?p=1661289#1661289 schrieb:dukezero schrieb am 05.02.2016, 15:08 Uhr[/url]"]1146 dürfte sich erledigt haben. Witzigerweise trommeln die bösen Briefe seit gestern. Kontraindikator de luxe!![url=http://peketec.de/trading/viewtopic.php?p=1661205#1661205 schrieb:dukezero schrieb am 05.02.2016, 12:07 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1660882#1660882 schrieb:dukezero schrieb am 04.02.2016, 14:47 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1660602#1660602 schrieb:dukezero schrieb am 03.02.2016, 16:17 Uhr[/url]"][url=http://peketec.de/trading/viewtopic.php?p=1660234#1660234 schrieb:dukezero schrieb am 02.02.2016, 14:55 Uhr[/url]"]» zur Grafik

1160$ bei Gold wäre ein Signal!

Nachhaltig über 1160 wäre wichtig!

» zur Grafik

So könnte es weitergehen (hab noch ein Longzerti Gold und ein Shortzerti S&P)

[url=http://peketec.de/trading/viewtopic.php?p=1661421#1661421 schrieb:dukezero schrieb am 06.02.2016, 11:21 Uhr[/url]"]» zur Grafik

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Silvercorp earns $3.91-million (U.S.) in Q3 fiscal 2016

2016-02-05 17:37 ET - News Release

Mr. Alex Zhang reports

SILVERCORP REPORTS Q3 FISCAL 2016 FINANCIAL AND OPERATING RESULTS AND FISCAL 2017 GUIDANCE ISSUED

Silvercorp Metals Inc. has released its financial and operating results for the third quarter ended Dec. 31, 2015. (All amounts are expressed in U.S. dollars.)

Third quarter highlights:

Cash flows from operations of $9.6-million, or six cents per share;

Repurchased 684,700 common shares of the company;

Ended the quarter with $66.8-million in cash and short-term investments;

Net income attributable to equity shareholders of $3.3-million, or two cents per share;

Silver and lead head grades improved by 13 per cent and 14 per cent, respectively, to 287 grams per tonne for silver and 4.1 per cent for lead at the Ying mining district, compared with the prior-year quarter;

Silver sales of 1.4 million ounces, lead sales of 15.1 million pounds and zinc sales of 4.7 million pounds, down 15 per cent, 9 per cent and 33 per cent, respectively, from the prior-year quarter;

Realized selling price for silver, lead and zinc dropped by 12 per cent, 13 per cent and 35 per cent, respectively, compared with the same prior-year quarter;

Sales of $29.1-million, down 28 per cent from the prior-year quarter;

Gross margin of 33 per cent compared with 38 per cent in the prior-year period;

Cash cost per ounce of silver, net of byproduct credits, of 90 cents, compared with 53 cents in the prior-year quarter;

All-in sustaining cost per ounce of silver, net of byproduct credits, of $7.72, compared with $10.91 in the prior-year quarter.

Financials

.....................

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aSVM-2344683&symbol=SVM®ion=C

2016-02-05 17:37 ET - News Release

Mr. Alex Zhang reports

SILVERCORP REPORTS Q3 FISCAL 2016 FINANCIAL AND OPERATING RESULTS AND FISCAL 2017 GUIDANCE ISSUED

Silvercorp Metals Inc. has released its financial and operating results for the third quarter ended Dec. 31, 2015. (All amounts are expressed in U.S. dollars.)

Third quarter highlights:

Cash flows from operations of $9.6-million, or six cents per share;

Repurchased 684,700 common shares of the company;

Ended the quarter with $66.8-million in cash and short-term investments;

Net income attributable to equity shareholders of $3.3-million, or two cents per share;

Silver and lead head grades improved by 13 per cent and 14 per cent, respectively, to 287 grams per tonne for silver and 4.1 per cent for lead at the Ying mining district, compared with the prior-year quarter;

Silver sales of 1.4 million ounces, lead sales of 15.1 million pounds and zinc sales of 4.7 million pounds, down 15 per cent, 9 per cent and 33 per cent, respectively, from the prior-year quarter;

Realized selling price for silver, lead and zinc dropped by 12 per cent, 13 per cent and 35 per cent, respectively, compared with the same prior-year quarter;

Sales of $29.1-million, down 28 per cent from the prior-year quarter;

Gross margin of 33 per cent compared with 38 per cent in the prior-year period;

Cash cost per ounce of silver, net of byproduct credits, of 90 cents, compared with 53 cents in the prior-year quarter;

All-in sustaining cost per ounce of silver, net of byproduct credits, of $7.72, compared with $10.91 in the prior-year quarter.

Financials

.....................

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aSVM-2344683&symbol=SVM®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

NFLX:

GAP aus Mai 2015 geschlossen !

aktueller Kurs OS: 0,86 Euro ! 8)

8)

https://www.boerse-stuttgart.de/de/boersenportal/wertpapiere-und-maerkte/hebelprodukte/optionsscheine/factsheet/?ID_NOTATION=137306538

GAP aus Mai 2015 geschlossen !

aktueller Kurs OS: 0,86 Euro !

https://www.boerse-stuttgart.de/de/boersenportal/wertpapiere-und-maerkte/hebelprodukte/optionsscheine/factsheet/?ID_NOTATION=137306538

[url=http://peketec.de/trading/viewtopic.php?p=1658849#1658849 schrieb:Kostolanys Erbe schrieb am 27.01.2016, 23:18 Uhr[/url]"]aktueller Kurs OS: 0,55 Euro

https://www.boerse-stuttgart.de/de/boersenportal/wertpapiere-und-maerkte/hebelprodukte/optionsscheine/factsheet/?ID_NOTATION=137306538

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1652999#1652999 schrieb:Kostolanys Erbe schrieb am 07.01.2016, 01:05 Uhr[/url]"]So schnell können Gaps geschlossen werden... krass ...News beeinflussen natürlich den Kurs...

Netflix will expand to 190 countries

By Patrick May

Updated: 01/06/2016 03:20:01 PM PST

In a widely anticipated move, streaming-video giant Netflix has launched its service worldwide, hoping to soon send movie buffs in 190 countries into nirvana.

In an announcement made Wednesday on its website, Netflix said it was "simultaneously bringing its Internet TV network to more than 130 new countries around the world," including India for the first time. The new service went live during a keynote by co-founder and CEO Reed Hastings at CES 2016 in Las Vegas.

.......

http://www.mercurynews.com/business/ci_29351520/netflix-announces-huge-global-expansion

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1652296#1652296 schrieb:Kostolanys Erbe schrieb am 04.01.2016, 19:26 Uhr[/url]"]

Immer diese Gaps....

...heute ein Abwärtsgap...

wie bei vielen Werten heute gerissen...

irgendwann wird's wieder geschlossen...

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1648632#1648632 schrieb:Kostolanys Erbe schrieb am 11.12.2015, 22:29 Uhr[/url]"]

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1647279#1647279 schrieb:Kostolanys Erbe schrieb am 09.12.2015, 03:32 Uhr[/url]"]

Sehr schön erklärt...

Netflix stock’s ‘bearish engulfing’ warns that the uptrend may be over

By Tomi Kilgore

Published: Dec 8, 2015 6:58 a.m. ET

http://www.marketwatch.com/story/bearish-engulfing-in-netflixs-stock-warns-that-the-uptrend-may-be-over-2015-12-07?siteid=bigcharts&dist=bigcharts

[url=http://peketec.de/trading/viewtopic.php?p=1643151#1643151 schrieb:Kostolanys Erbe schrieb am 24.11.2015, 22:34 Uhr[/url]"]» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1642850#1642850 schrieb:Kostolanys Erbe schrieb am 24.11.2015, 09:43 Uhr[/url]"]Netflix evtl. Doppel-Top Bildung im Chart

Bin nun Short gegangen ....

NFLX Put gekauft zu 0,38 Euro (UT2HY8)

[url=http://peketec.de/trading/viewtopic.php?p=1635037#1635037 schrieb:Kostolanys Erbe schrieb am 27.10.2015, 22:52 Uhr[/url]"]Nachbörslich aufwärts !

Infinera Corporation Reports Third Quarter 2015 Financial Results

SUNNYVALE, CA, Oct 27, 2015 (Marketwired via COMTEX) -- Infinera Corporation INFN, +8.63% provider of Intelligent Transport Networks, today released financial results for the third quarter of 2015 ended September 26, 2015. Infinera's financial results for the third quarter of 2015 include the operating results of Transmode from the date the acquisition closed on August 20, 2015.

GAAP financial results for the quarter were impacted by certain purchase accounting adjustments and one-time acquisition-related costs related to the Transmode acquisition. Additionally, GAAP results include non-cash stock-based compensation expenses and the amortization of debt discount on Infinera's convertible senior notes. The foregoing items have been excluded from Infinera's non-GAAP results.

GAAP revenue for the quarter was $232.5 million compared to $207.3 million in the second quarter of 2015 and $173.6 million in the third quarter of 2014.

GAAP gross margin for the quarter was 44.2% compared to 46.7% in the second quarter of 2015 and 43.4% in the third quarter of 2014. GAAP operating margin for the quarter was 6.1% compared to 8.0% in the second quarter of 2015 and 4.3% in the third quarter of 2014.

GAAP net income for the quarter was $8.5 million, or $0.06 per diluted share, compared to $17.9 million, or $0.13 per diluted share, in the second quarter of 2015, and $4.8 million, or $0.04 per diluted share, in the third quarter of 2014.

Non-GAAP revenue for the quarter was $233.2 million compared to $207.3 million in the second quarter of 2015 and $173.6 million in the third quarter of 2014.

Non-GAAP gross margin for the quarter was 47.5% compared to 47.4% in the second quarter of 2015 and 44.2% in the third quarter of 2014. Non-GAAP operating margin for the quarter was 14.4% compared to 13.0% in the second quarter of 2015 and 8.6% in the third quarter of 2014.

Non-GAAP net income for the quarter was $32.2 million, or $0.22 per diluted share, compared to $25.7 million, or $0.18 per diluted share, in the second quarter of 2015, and $14.2 million, or $0.11 per diluted share, in the third quarter of 2014.

A further explanation of the use of non-GAAP financial information and a reconciliation of the non-GAAP financial measures to the GAAP equivalents can be found at the end of this release.

"Our excellent third quarter results reflect continued strength across our core business, including growing Cloud Xpress revenues as well as the initial contribution from the new metro business. Adding the recently announced metro core and long haul interconnect products along with Transmode's suite of metro solutions enables Infinera to further enhance the superior experience we deliver to our customers," said Tom Fallon, Infinera's Chief Executive Officer. "As the most vertically integrated transport provider in the world, now armed with a broad end-to-end portfolio, Infinera is in a terrific position to continue to deliver differentiated financial results on both the top and bottom lines."

http://www.marketwatch.com/story/infinera-corporation-reports-third-quarter-2015-financial-results-2015-10-27-161731531?siteid=bigcharts&dist=bigcharts

[url=http://peketec.de/trading/viewtopic.php?p=1634874#1634874 schrieb:Kostolanys Erbe schrieb am 27.10.2015, 12:34 Uhr[/url]"]Nach Börsenschluss kommen heute Zahlen von Infinera!

[url=http://peketec.de/trading/viewtopic.php?p=1632896#1632896 schrieb:Kostolanys Erbe schrieb am 16.10.2015, 21:08 Uhr[/url]"]NFLX nach den Zahlen...

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1631878#1631878 schrieb:Kostolanys Erbe schrieb am 13.10.2015, 22:41 Uhr[/url]"]Nee doch nicht, erstm al hat NFLX das Island-Gap geschlossen... somit keine weiteren Gaps oben zu schliessen

» zur Grafik

Infinera ...auf zum Gap-Close...

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1628175#1628175 schrieb:Kostolanys Erbe schrieb am 29.09.2015, 20:59 Uhr[/url]"]Anscheinend ist der Deckel erst mal nach oben die 100 $ Marke...

» zur Grafik

Infinera an einer wichtigen horizontalen Unterstützungslinie:

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1622038#1622038 schrieb:Kostolanys Erbe schrieb am 09.09.2015, 17:48 Uhr[/url]"]Ein anderer Wert neben NFLX, wo sich charttechnisch eine S-K-S Formation bildet ist INFN und hat um die 14 US-Dollar noch ein Gap zu schliessen!

]» zur Grafik

Sept 9, 2015

Netflix readies for launch in Hong Kong, other Asian markets

Netflix shares jump more than 6% on news of Asia Expansion

http://www.marketwatch.com/story/netflix-readies-for-launch-in-hong-kong-other-asian-markets-2015-09-09?siteid=bigcharts&dist=bigcharts

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1619399#1619399 schrieb:Kostolanys Erbe schrieb am 31.08.2015, 20:51 Uhr[/url]"]Montag, 31.08.2015 - 17:52 Uhr

NETFLIX - Das Gap ruft

http://www.godmode-trader.de/analyse/netflix-das-gap-ruft,4323140

[url=http://peketec.de/trading/viewtopic.php?p=1618671#1618671 schrieb:Kostolanys Erbe schrieb am 27.08.2015, 23:28 Uhr[/url]"]Scheinchen CW2T7E klebt wieder am Lapi...

NFLX könnte charttechnisch um die 117-120 US$ die rechte Schulter einer SKS Formation ausbilden....?! Beobachten !!!

» zur Grafik

CEO hat schnell noch mal schön abgesahnt und seine Aktienoptionen versilbert...

und hält aktuell nicht mal eine Aktie seines Unternehmens !!!Ganz schön traurig... Wieviel Optionen er noch einlösen kann, weiss ich nicht...

» zur Grafik

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1617276#1617276 schrieb:Kostolanys Erbe schrieb am 24.08.2015, 21:16 Uhr[/url]"]@Olli

[url=http://peketec.de/trading/viewtopic.php?p=1616804#1616804 schrieb:Ollinho schrieb am 24.08.2015, 10:24 Uhr[/url]"]GW Kosto!!

[url=http://peketec.de/trading/viewtopic.php?p=1616774#1616774 schrieb:Kostolanys Erbe schrieb am 24.08.2015, 09:40 Uhr[/url]"]Verkauf zu 0,92 € !!!

Börse heisst spekulieren und auch mal Gewinne mitnehmen!

Bin heute Abend mal auf die letzte Handelsstunde in USA gespannt...

[url=http://peketec.de/trading/viewtopic.php?p=1616461#1616461 schrieb:Kostolanys Erbe schrieb am 21.08.2015, 21:30 Uhr[/url]"]Danke @Olli

Scheinchen aktuell bei 0,72 €

https://www.boerse-stuttgart.de/de/boersenportal/wertpapiere-und-maerkte/hebelprodukte/optionsscheine/factsheet/?ID_NOTATION=137310115

NFLX aktuell die 50-Tage-Linie nach unten durchbrochen

Immer noch viel Speck drauf...

Und so langsam werden die die auf Margin debts zocken

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1616040#1616040 schrieb:Ollinho schrieb am 20.08.2015, 22:22 Uhr[/url]"]Sauber Kosto!!!

[url=http://peketec.de/trading/viewtopic.php?p=1616023#1616023 schrieb:Kostolanys Erbe schrieb am 20.08.2015, 21:50 Uhr[/url]"]Mal sehen, ob morgen die Leute Angst haben um ihre Gewinne und der Trend nach unten durchbrochen wird...

200-Tage-Linie bei ca. 75 $ !!!

Scheinchen steht aktuell bei 0,57 €

https://www.boerse-stuttgart.de/de/boersenportal/wertpapiere-und-maerkte/hebelprodukte/optionsscheine/factsheet/?ID_NOTATION=137310115

» zur Grafik

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1615368#1615368 schrieb:Kostolanys Erbe schrieb am 19.08.2015, 11:01 Uhr[/url]"]Kleine Put Speku-Posi CW2T7E zu 0,43€ genommen.

[url=http://peketec.de/trading/viewtopic.php?p=1615208#1615208 schrieb:Kostolanys Erbe schrieb am 18.08.2015, 22:40 Uhr[/url]"]Mich reizt ja irgendwie als Gapi-Freak ein Put (normalen OS / Kein Knock-out-Scheinchen in dieser Situation); Bewertung ist echt krass, irgendwann werden auch mal die von NFLX evtl. ein Quartal enttäuschen

» zur Grafik

SVM - trotz der gesunkenen Preise im letzten Quartal noch profitabel, Kosten gesenkt und die Aussichten nicht so verkehrt

MK 125 Mio CAD; da ist die Cashposi mit 66 Mio $ sehr komfortabel

MK 125 Mio CAD; da ist die Cashposi mit 66 Mio $ sehr komfortabel

[url=http://peketec.de/trading/viewtopic.php?p=1661497#1661497 schrieb:Kostolanys Erbe schrieb am 07.02.2016, 21:00 Uhr[/url]"]Silvercorp earns $3.91-million (U.S.) in Q3 fiscal 2016

2016-02-05 17:37 ET - News Release

Mr. Alex Zhang reports

SILVERCORP REPORTS Q3 FISCAL 2016 FINANCIAL AND OPERATING RESULTS AND FISCAL 2017 GUIDANCE ISSUED

Silvercorp Metals Inc. has released its financial and operating results for the third quarter ended Dec. 31, 2015. (All amounts are expressed in U.S. dollars.)

Third quarter highlights:

Cash flows from operations of $9.6-million, or six cents per share;

Repurchased 684,700 common shares of the company;

Ended the quarter with $66.8-million in cash and short-term investments;

Net income attributable to equity shareholders of $3.3-million, or two cents per share;

Silver and lead head grades improved by 13 per cent and 14 per cent, respectively, to 287 grams per tonne for silver and 4.1 per cent for lead at the Ying mining district, compared with the prior-year quarter;

Silver sales of 1.4 million ounces, lead sales of 15.1 million pounds and zinc sales of 4.7 million pounds, down 15 per cent, 9 per cent and 33 per cent, respectively, from the prior-year quarter;

Realized selling price for silver, lead and zinc dropped by 12 per cent, 13 per cent and 35 per cent, respectively, compared with the same prior-year quarter;

Sales of $29.1-million, down 28 per cent from the prior-year quarter;

Gross margin of 33 per cent compared with 38 per cent in the prior-year period;

Cash cost per ounce of silver, net of byproduct credits, of 90 cents, compared with 53 cents in the prior-year quarter;

All-in sustaining cost per ounce of silver, net of byproduct credits, of $7.72, compared with $10.91 in the prior-year quarter.

Financials

.....................

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aSVM-2344683&symbol=SVM®ion=C

ein Trend - die Großen hinter den Großen fusionieren

http://www.marketwired.com/press-re...unce-business-combination-tsx-lsg-2094599.htm

February 08, 2016 07:00 ET

Tahoe Resources and Lake Shore Gold Announce Business Combination

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Feb. 8, 2016) - Tahoe Resources Inc. ("Tahoe") (TSX:THO) (BVL:THO) (NYSE:TAHO) and Lake Shore Gold Corp. ("Lake Shore Gold") (TSX:LSG) (NYSE MKT:LSG) are pleased to announce that they have entered into a definitive agreement (the "Arrangement Agreement") whereby Tahoe will acquire all of the issued and outstanding shares of Lake Shore Gold (the "Transaction"). Under the terms of the Arrangement Agreement, all of the Lake Shore Gold issued and outstanding common shares will be exchanged on the basis of 0.1467 of a Tahoe common share per each Lake Shore Gold common share (the "Exchange Ratio"). Upon completion of the Transaction, existing Tahoe and Lake Shore Gold shareholders will own approximately 74% and 26% of the pro forma company, respectively, on a fully-diluted in-the-money basis.

The Exchange Ratio implies a consideration of C$1.71 per Lake Shore Gold common share, based on the closing price of Tahoe common shares on the Toronto Stock Exchange (TSX) on February 5, 2016, representing a 14.8% premium to the closing price of Lake Shore Gold on February 5, 2016 and a 28.6% premium to the closing share of Lake Shore Gold on February 4, 2016. Based on each company's 20-day volume weighted average price on the TSX, the Exchange Ratio implies a premium of 25.7% and 30.4% to Lake Shore Gold common shares for the periods ending February 5, 2016 and February 4, 2016, respectively. The implied equity value (assuming the conversion of in-the-money convertible debentures) is equal to C$945 million.

Lake Shore Gold operates the low-cost Timmins West and Bell Creek mines in Timmins, Ontario, Canada. Together with Tahoe's world class Escobal mine in Guatemala and its low-cost La Arena and Shahuindo mines in Peru, the combined company is firmly established as a premier Americas-based precious metals producer. With a diversified suite of low-cost, highly prospective assets and a quality pipeline of new development opportunities, Tahoe is well positioned to sustain and grow its production base. Further, with zero net debt, sector leading operating margins, and moderate capital requirements, the combined company will continue to generate strong free cash flows. Accordingly, following completion of the Transaction, Tahoe intends to continue its dividend of US$0.02 cents per share per month.

http://www.marketwired.com/press-re...unce-business-combination-tsx-lsg-2094599.htm

February 08, 2016 07:00 ET

Tahoe Resources and Lake Shore Gold Announce Business Combination

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Feb. 8, 2016) - Tahoe Resources Inc. ("Tahoe") (TSX:THO) (BVL:THO) (NYSE:TAHO) and Lake Shore Gold Corp. ("Lake Shore Gold") (TSX:LSG) (NYSE MKT:LSG) are pleased to announce that they have entered into a definitive agreement (the "Arrangement Agreement") whereby Tahoe will acquire all of the issued and outstanding shares of Lake Shore Gold (the "Transaction"). Under the terms of the Arrangement Agreement, all of the Lake Shore Gold issued and outstanding common shares will be exchanged on the basis of 0.1467 of a Tahoe common share per each Lake Shore Gold common share (the "Exchange Ratio"). Upon completion of the Transaction, existing Tahoe and Lake Shore Gold shareholders will own approximately 74% and 26% of the pro forma company, respectively, on a fully-diluted in-the-money basis.

The Exchange Ratio implies a consideration of C$1.71 per Lake Shore Gold common share, based on the closing price of Tahoe common shares on the Toronto Stock Exchange (TSX) on February 5, 2016, representing a 14.8% premium to the closing price of Lake Shore Gold on February 5, 2016 and a 28.6% premium to the closing share of Lake Shore Gold on February 4, 2016. Based on each company's 20-day volume weighted average price on the TSX, the Exchange Ratio implies a premium of 25.7% and 30.4% to Lake Shore Gold common shares for the periods ending February 5, 2016 and February 4, 2016, respectively. The implied equity value (assuming the conversion of in-the-money convertible debentures) is equal to C$945 million.

Lake Shore Gold operates the low-cost Timmins West and Bell Creek mines in Timmins, Ontario, Canada. Together with Tahoe's world class Escobal mine in Guatemala and its low-cost La Arena and Shahuindo mines in Peru, the combined company is firmly established as a premier Americas-based precious metals producer. With a diversified suite of low-cost, highly prospective assets and a quality pipeline of new development opportunities, Tahoe is well positioned to sustain and grow its production base. Further, with zero net debt, sector leading operating margins, and moderate capital requirements, the combined company will continue to generate strong free cash flows. Accordingly, following completion of the Transaction, Tahoe intends to continue its dividend of US$0.02 cents per share per month.

Tahoe schlägt zu bevor es richtig teuer wird....

[url=http://peketec.de/trading/viewtopic.php?p=1661674#1661674 schrieb:greenhorn schrieb am 08.02.2016, 13:04 Uhr[/url]"]ein Trend - die Großen hinter den Großen fusionieren

http://www.marketwired.com/press-re...unce-business-combination-tsx-lsg-2094599.htm

February 08, 2016 07:00 ET

Tahoe Resources and Lake Shore Gold Announce Business Combination

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Feb. 8, 2016) - Tahoe Resources Inc. ("Tahoe") (TSX:THO) (BVL:THO) (NYSE:TAHO) and Lake Shore Gold Corp. ("Lake Shore Gold") (TSX:LSG) (NYSE MKT:LSG) are pleased to announce that they have entered into a definitive agreement (the "Arrangement Agreement") whereby Tahoe will acquire all of the issued and outstanding shares of Lake Shore Gold (the "Transaction"). Under the terms of the Arrangement Agreement, all of the Lake Shore Gold issued and outstanding common shares will be exchanged on the basis of 0.1467 of a Tahoe common share per each Lake Shore Gold common share (the "Exchange Ratio"). Upon completion of the Transaction, existing Tahoe and Lake Shore Gold shareholders will own approximately 74% and 26% of the pro forma company, respectively, on a fully-diluted in-the-money basis.

The Exchange Ratio implies a consideration of C$1.71 per Lake Shore Gold common share, based on the closing price of Tahoe common shares on the Toronto Stock Exchange (TSX) on February 5, 2016, representing a 14.8% premium to the closing price of Lake Shore Gold on February 5, 2016 and a 28.6% premium to the closing share of Lake Shore Gold on February 4, 2016. Based on each company's 20-day volume weighted average price on the TSX, the Exchange Ratio implies a premium of 25.7% and 30.4% to Lake Shore Gold common shares for the periods ending February 5, 2016 and February 4, 2016, respectively. The implied equity value (assuming the conversion of in-the-money convertible debentures) is equal to C$945 million.

Lake Shore Gold operates the low-cost Timmins West and Bell Creek mines in Timmins, Ontario, Canada. Together with Tahoe's world class Escobal mine in Guatemala and its low-cost La Arena and Shahuindo mines in Peru, the combined company is firmly established as a premier Americas-based precious metals producer. With a diversified suite of low-cost, highly prospective assets and a quality pipeline of new development opportunities, Tahoe is well positioned to sustain and grow its production base. Further, with zero net debt, sector leading operating margins, and moderate capital requirements, the combined company will continue to generate strong free cash flows. Accordingly, following completion of the Transaction, Tahoe intends to continue its dividend of US$0.02 cents per share per month.

[url=http://peketec.de/trading/viewtopic.php?p=1661421#1661421 schrieb:dukezero schrieb am 06.02.2016, 11:21 Uhr[/url]"]» zur Grafik

GSV - mittlerweile everybodys Darling!

February 08, 2016 09:00 ET

OceanaGold Exercises Right to Increase Ownership Interest in Gold Standard to 19.9%

http://www.marketwired.com/press-re...d-standard-to-199-tsx-venture-gsv-2094698.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Feb. 8, 2016) - Gold Standard Ventures Corp. (TSX VENTURE:GSV) (NYSE MKT:GSV) ("Gold Standard" or the "Company") is pleased to announce that further to its news release of February 1, 2016 a wholly owned subsidiary of OceanaGold Corporation (TSX/ASX/NZX:OGC) ("OceanaGold") has agreed to purchase approximately 12,565,265 common shares (the "Common Shares") of the Company at a price of C$1.00 per Common Share for gross proceeds of C$12,565,265 (the "Financing").

The Financing is expected to close on or about February 10, 2016, following which OceanaGold will own (inclusive of shares held) approximately 19.9% of the Company's issued and outstanding shares on an undiluted basis pursuant to its existing equity participation right (announced May 20, 2015). The net proceeds of the Financing will be used to further advance the Company's Railroad-Pinion project and for general corporate and working capital purposes. Jonathan Awde, President, CEO and Director of Gold Standard commented, "We are pleased that OceanaGold is demonstrating its continued support by increasing their ownership position in Gold Standard."

The Company has applied to list the Common Shares on the TSX Venture Exchange (the "TSXV") and the NYSE MKT LLC (the "NYSE MKT"). Listing will be subject to the Company fulfilling all of the listing requirements of the TSXV and the NYSE MKT. The Financing is not being offered in the United States. Gold Standard will pay a cash commission in connection with the Financing.

February 08, 2016 09:00 ET

OceanaGold Exercises Right to Increase Ownership Interest in Gold Standard to 19.9%

http://www.marketwired.com/press-re...d-standard-to-199-tsx-venture-gsv-2094698.htm

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Feb. 8, 2016) - Gold Standard Ventures Corp. (TSX VENTURE:GSV) (NYSE MKT:GSV) ("Gold Standard" or the "Company") is pleased to announce that further to its news release of February 1, 2016 a wholly owned subsidiary of OceanaGold Corporation (TSX/ASX/NZX:OGC) ("OceanaGold") has agreed to purchase approximately 12,565,265 common shares (the "Common Shares") of the Company at a price of C$1.00 per Common Share for gross proceeds of C$12,565,265 (the "Financing").

The Financing is expected to close on or about February 10, 2016, following which OceanaGold will own (inclusive of shares held) approximately 19.9% of the Company's issued and outstanding shares on an undiluted basis pursuant to its existing equity participation right (announced May 20, 2015). The net proceeds of the Financing will be used to further advance the Company's Railroad-Pinion project and for general corporate and working capital purposes. Jonathan Awde, President, CEO and Director of Gold Standard commented, "We are pleased that OceanaGold is demonstrating its continued support by increasing their ownership position in Gold Standard."

The Company has applied to list the Common Shares on the TSX Venture Exchange (the "TSXV") and the NYSE MKT LLC (the "NYSE MKT"). Listing will be subject to the Company fulfilling all of the listing requirements of the TSXV and the NYSE MKT. The Financing is not being offered in the United States. Gold Standard will pay a cash commission in connection with the Financing.

Verkauf 50 % der 47,55er Position zu 57,57 Can $ :D  Wahnsinn!!

Wahnsinn!!

Rest läuft mit engem Stop weiter.

Rest läuft mit engem Stop weiter.

[url=http://peketec.de/trading/viewtopic.php?p=1661401#1661401 schrieb:Ollinho schrieb am 05.02.2016, 22:04 Uhr[/url]"]Verkauf RGL (47,66er Posi) zu 54,60 Can $

47,55er Position läuft mit Stop erstmal weiter.

[url=http://peketec.de/trading/viewtopic.php?p=1654160#1654160 schrieb:Ollinho schrieb am 11.01.2016, 20:47 Uhr[/url]"]Trade-Spekus

Kauf RGL 47,66 + 47,55 Can $

Kauf SEA 11,50 Can $

Ich bin all-in bei RD und da gabs kein GAP Up

[url=http://peketec.de/trading/viewtopic.php?p=1661730#1661730 schrieb:600 schrieb am 08.02.2016, 15:36 Uhr[/url]"]Da werden heute reihenweise hässliche gaps aufgemacht...