App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

wieso gerade KSK? erwartest Du demnächst Nachrichten?

Warum sind die eigentlich so schlecht bewertet?

Dachte wenn die in Alaska sind kommen aktuell keine News.

Eine einzige Insider Transaktion 2016, 2015 paar Optionen aber nichts was darauf hindeuten könnte das hier mal was pssiert.

Warum sind die eigentlich so schlecht bewertet?

Dachte wenn die in Alaska sind kommen aktuell keine News.

Eine einzige Insider Transaktion 2016, 2015 paar Optionen aber nichts was darauf hindeuten könnte das hier mal was pssiert.

[url=http://peketec.de/trading/viewtopic.php?p=1721115#1721115 schrieb:600 schrieb am 09.11.2016, 17:48 Uhr[/url]"]KSK mal aufgestockt zu 0,06, MK nun 0,05.

Orderbuch sieht gut aus.

War nur aus dem Grund, dass das Orderbuch sehr gut aussieht. Nach unten gut abgesichert, im ask nur wenig Stücke. Ausserdem klettert KSK seit einiger Zeit immer mal wieder 0,5 cent nach oben. 0,07 halte ich hier auch ohne news für realistisch.[url=http://peketec.de/trading/viewtopic.php?p=1721132#1721132 schrieb:Rooky schrieb am 09.11.2016, 18:28 Uhr[/url]"]wieso gerade KSK? erwartest Du demnächst Nachrichten?

Warum sind die eigentlich so schlecht bewertet?

Dachte wenn die in Alaska sind kommen aktuell keine News.

Eine einzige Insider Transaktion 2016, 2015 paar Optionen aber nichts was darauf hindeuten könnte das hier mal was pssiert.

[url=http://peketec.de/trading/viewtopic.php?p=1721115#1721115 schrieb:600 schrieb am 09.11.2016, 17:48 Uhr[/url]"]KSK mal aufgestockt zu 0,06, MK nun 0,05.

Orderbuch sieht gut aus.

Das Risiko seh ich hier eher gering, zur Not halte ich die länger, hab die schon über ein Jahr.

Raus zu 0,155

[url=http://peketec.de/trading/viewtopic.php?p=1721123#1721123 schrieb:600 schrieb am 09.11.2016, 18:04 Uhr[/url]"]RTM mal ne kleine long zu 0,135

Bah mal wieder gegen meine eigenen Prinzipien versucht schnell Gewinn zu machen und schon im Minus  Man sollte doch meinen das man mit der Zeit schlauer wird.

Man sollte doch meinen das man mit der Zeit schlauer wird.

[url=http://peketec.de/trading/viewtopic.php?p=1720903#1720903 schrieb:Cadrach schrieb am 09.11.2016, 12:51 Uhr[/url]"]Bin jetzt mal vorsichtig long gegangen. So kurzfristigen Trade.

In GRG mal sehen ob es was wird...

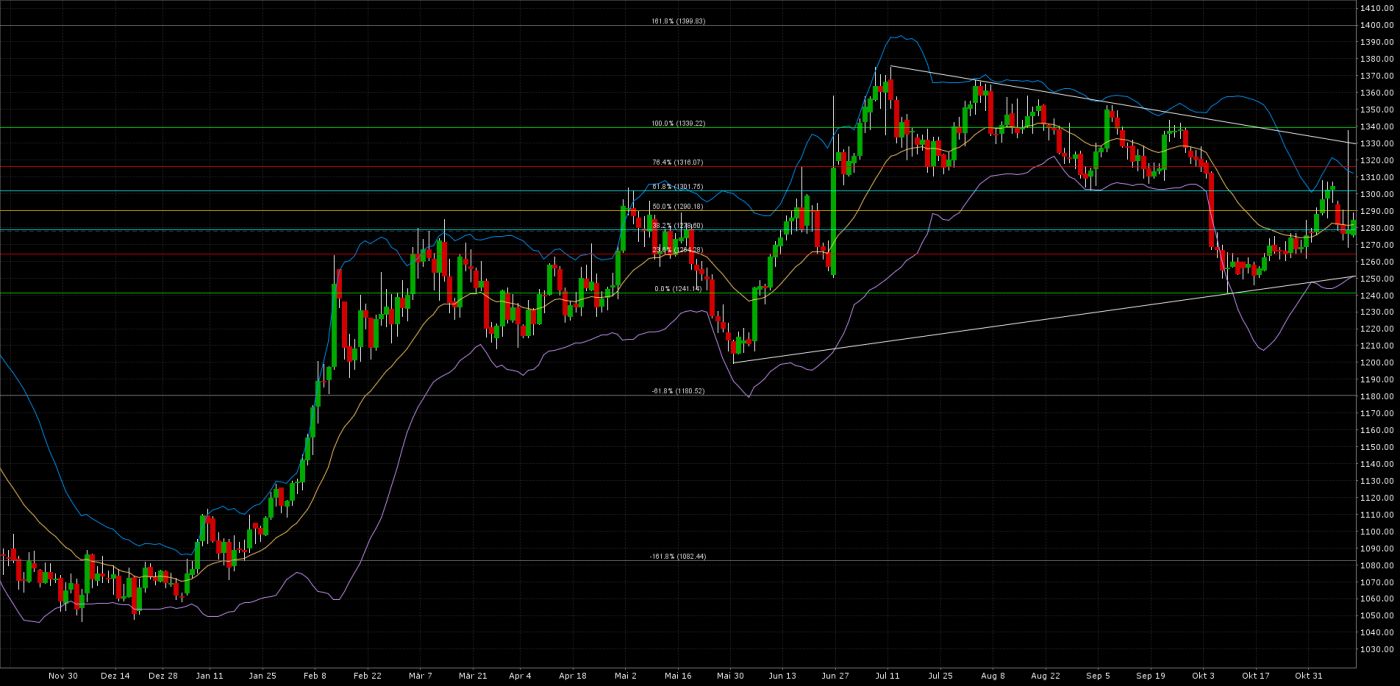

ich rechne sowohl beim Gold als auch beim DAX und Co. bis ende des jahres mit seitlicher bis leicht steigenden Bewegungen.... Anfang 2017 wirds glaube ich im Dax abwärts gehen.... und Gold richtung 1400, so meine Prognose :shock:

[url=http://peketec.de/trading/viewtopic.php?p=1721281#1721281 schrieb:Sltrader schrieb am 10.11.2016, 08:56 Uhr[/url]"]» zur Grafik

A2ANT8 Parlane Resource! Hier mal gekauft. Vor ein paar Minuten diese News:

Parlane confirms the potential for gold at the Old Crow occurrence, Big Bear Property, Nechako Plateau, Central British Columbia

Resampling anomalous soil site returns 35 grams/tonne gold

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Nov. 10, 2016) - Parlane Resource Corp. (TSX VENTURE:PPP) ("Parlane" or the "Company") began exploration in August on its newly acquired block of claims that were added to the Big Bear property (see Parlane news release August 2, 2016). The previous owner of the claim block carried out a soil sample grid around a discovery of mineralization that they named Old Crow. A soil sample that was collected in 2012, located 200 metres north of the exposed mineralization at Old Crow, returned 2.7 g/t gold. Parlane crews resampled the same soil site and the ICP-MS assay returned 35.9 g/t gold and greater than 100 g/t silver (over limit for lab method).

Parlane is encouraged by the results and plans to conduct detailed follow-up sampling in the area of the Old Crow early in 2017. In addition to the work planned for the Old Crow, Parlane will advance exploration work at its newly discovered showing named "The Cub", located within approximately 2 kilometres of Old Crow. (See Parlane news release Oct. 3, 2016). Photographs of the Old Crow mineralization can be found at the Company website www.parlaneresource.com.

Parlane's 273-square kilometre Big Bear mineral claim position is located immediately north of, and adjacent to New Gold Inc.'s Blackwater deposit and east of New Gold's Capoose developed prospect. The Blackwater has proven and probable reserves containing 8.2 million ounces of gold and 60.8 million ounces of silver (www.newgold.com).

Ian Webster P.Geo. is the Qualified Person, as defined by National Instrument 43-101, who has reviewed and approved the technical contents of this release.

ON BEHALF OF THE BOARD

Robert Eadie, President, Chief Executive Officer and Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Parlane Resource Corp.

Robert Eadie

1-604-602-4935

1-604-602-4936

www.parlaneresource.com

Parlane confirms the potential for gold at the Old Crow occurrence, Big Bear Property, Nechako Plateau, Central British Columbia

Resampling anomalous soil site returns 35 grams/tonne gold

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Nov. 10, 2016) - Parlane Resource Corp. (TSX VENTURE:PPP) ("Parlane" or the "Company") began exploration in August on its newly acquired block of claims that were added to the Big Bear property (see Parlane news release August 2, 2016). The previous owner of the claim block carried out a soil sample grid around a discovery of mineralization that they named Old Crow. A soil sample that was collected in 2012, located 200 metres north of the exposed mineralization at Old Crow, returned 2.7 g/t gold. Parlane crews resampled the same soil site and the ICP-MS assay returned 35.9 g/t gold and greater than 100 g/t silver (over limit for lab method).

Parlane is encouraged by the results and plans to conduct detailed follow-up sampling in the area of the Old Crow early in 2017. In addition to the work planned for the Old Crow, Parlane will advance exploration work at its newly discovered showing named "The Cub", located within approximately 2 kilometres of Old Crow. (See Parlane news release Oct. 3, 2016). Photographs of the Old Crow mineralization can be found at the Company website www.parlaneresource.com.

Parlane's 273-square kilometre Big Bear mineral claim position is located immediately north of, and adjacent to New Gold Inc.'s Blackwater deposit and east of New Gold's Capoose developed prospect. The Blackwater has proven and probable reserves containing 8.2 million ounces of gold and 60.8 million ounces of silver (www.newgold.com).

Ian Webster P.Geo. is the Qualified Person, as defined by National Instrument 43-101, who has reviewed and approved the technical contents of this release.

ON BEHALF OF THE BOARD

Robert Eadie, President, Chief Executive Officer and Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Parlane Resource Corp.

Robert Eadie

1-604-602-4935

1-604-602-4936

www.parlaneresource.com

ARG - sollte vom steigenden Kupferpreis profitieren, gestern hohes Handelsvolumen; SK bei 0,19 CAD

2016-11-09 09:36 ET - News Release

Mr. Rob Henderson reports

AMERIGO ANNOUNCES Q3-2016 FINANCIAL RESULTS

Amerigo Resources Ltd. has released financial results for the three months ended Sept. 30, 2016. The company posted revenue of $23.4-million and a net loss of $2.5-million. The company generated cash flow from operations of $1.7-million in the quarter and had a cash balance of $21.1-million at Sept. 30, 2016, including a fully financed debt service reserve account of $7.5-million.

Rob Henderson, Amerigo's president and chief executive officer, stated: "MVC has reported another successful quarter despite the persistent low copper price. Their focus now is to safely sustain the level of copper production and further reduce costs."

Financial results

Gross tolling revenue was $32.5-million (third quarter of 2015: $14.9-million), mainly due to an 88-per-cent increase in copper production. The group's recorded copper tolling price was $2.13 per pound (third quarter of 2015: $2.36 per pound). Molybdenum production was restarted in the third quarter of 2016. Revenue after notional items was $23.4-million (third quarter of 2015: $10.8-million).

Tolling and production costs were $24.3-million (third quarter of 2015: $15.3-million), an increase of 59 per cent, driven by an 88-per-cent increase in copper production.

Cash cost (a non-GAAP (generally accepted accounting principles) measure equal to the aggregate of smelting and refining charges, tolling/production costs net of inventory adjustments and administration costs, net of byproduct credits) before DET notional copper royalties and DET molybdenum royalties decreased to $1.60 per pound (third quarter of 2015: $2.07 per pound) due to higher production.

Total cost (a non-GAAP measure equal to the aggregate of cash cost of $1.60 per pound, DET notional copper royalties and DET molybdenum royalties of 36 cents per pound and depreciation of 22 cents per pound) decreased to $2.18 per pound (third quarter of 2015: $2.62 per pound), due to lower cash cost.

Gross loss was $900,000 (third quarter of 2015: $4.5-million) and net loss was $2.5-million (third quarter of 2015: $6.2-million).

In the third quarter of 2016, the group generated cash flow from operations before changes in non-cash working capital of $1.7-million (third quarter of 2016: used cash flow in operations of $2.5-million).

Production

Third quarter 2016 copper production was 16 million pounds, 88 per cent higher than the 8.5 million pounds produced in the third quarter of 2015.

Third quarter 2016 copper production includes 9.8 million pounds from Cauquenes, 5.6 million pounds from fresh tailings and 700,000 pounds from Maricunga.

The ramp-up in production from Cauquenes has progressed in line with expectations, with tonnage higher than design rates of 60,000 tonnes per day and plant recovery averaging 34.4 per cent in the quarter.

Molybdenum production restarted in August, 2016, with third quarter 2016 production of 138,301 pounds. The operation of the molybdenum plant has been outsourced to a subcontractor which refurbished the plant with a $1-million investment to be paid by MVC over the course of three years.

Cash and working capital

The group's cash balance was $21.1-million at Sept. 30, 2016 (Dec. 31, 2015: $9-million), with a working capital deficiency of $1.1-million (Dec. 31, 2015: working capital deficiency of $6-million).

The group's cash balance at Sept. 30, 2016, includes $13.6-million in operating accounts and $7.5-million in a debt service reserve account.

Outlook

MVC maintains its 2016 production guidance of 55 million to 60 million pounds of copper at an annual cash cost of $1.65 per pound to $1.85 per pound.

MVC's sustaining capex in 2016, excluding capex incurred to refurbish the molybdenum plant, continues to be estimated at $5-million, mostly incurred on extraction sumps at Cauquenes.

MVC expects to complete the production test required under the Cauquenes expansion loan in the fourth quarter of 2016.

Cash and cash equivalents at MVC at Dec. 31, 2016, are expected to be lower than at Sept. 30, 2016, following scheduled debt repayments in December, 2016, and expected changes in other working capital accounts in the fourth quarter of 2016.

2016-11-09 09:36 ET - News Release

Mr. Rob Henderson reports

AMERIGO ANNOUNCES Q3-2016 FINANCIAL RESULTS

Amerigo Resources Ltd. has released financial results for the three months ended Sept. 30, 2016. The company posted revenue of $23.4-million and a net loss of $2.5-million. The company generated cash flow from operations of $1.7-million in the quarter and had a cash balance of $21.1-million at Sept. 30, 2016, including a fully financed debt service reserve account of $7.5-million.

Rob Henderson, Amerigo's president and chief executive officer, stated: "MVC has reported another successful quarter despite the persistent low copper price. Their focus now is to safely sustain the level of copper production and further reduce costs."

Financial results

Gross tolling revenue was $32.5-million (third quarter of 2015: $14.9-million), mainly due to an 88-per-cent increase in copper production. The group's recorded copper tolling price was $2.13 per pound (third quarter of 2015: $2.36 per pound). Molybdenum production was restarted in the third quarter of 2016. Revenue after notional items was $23.4-million (third quarter of 2015: $10.8-million).

Tolling and production costs were $24.3-million (third quarter of 2015: $15.3-million), an increase of 59 per cent, driven by an 88-per-cent increase in copper production.

Cash cost (a non-GAAP (generally accepted accounting principles) measure equal to the aggregate of smelting and refining charges, tolling/production costs net of inventory adjustments and administration costs, net of byproduct credits) before DET notional copper royalties and DET molybdenum royalties decreased to $1.60 per pound (third quarter of 2015: $2.07 per pound) due to higher production.

Total cost (a non-GAAP measure equal to the aggregate of cash cost of $1.60 per pound, DET notional copper royalties and DET molybdenum royalties of 36 cents per pound and depreciation of 22 cents per pound) decreased to $2.18 per pound (third quarter of 2015: $2.62 per pound), due to lower cash cost.

Gross loss was $900,000 (third quarter of 2015: $4.5-million) and net loss was $2.5-million (third quarter of 2015: $6.2-million).

In the third quarter of 2016, the group generated cash flow from operations before changes in non-cash working capital of $1.7-million (third quarter of 2016: used cash flow in operations of $2.5-million).

Production

Third quarter 2016 copper production was 16 million pounds, 88 per cent higher than the 8.5 million pounds produced in the third quarter of 2015.

Third quarter 2016 copper production includes 9.8 million pounds from Cauquenes, 5.6 million pounds from fresh tailings and 700,000 pounds from Maricunga.

The ramp-up in production from Cauquenes has progressed in line with expectations, with tonnage higher than design rates of 60,000 tonnes per day and plant recovery averaging 34.4 per cent in the quarter.

Molybdenum production restarted in August, 2016, with third quarter 2016 production of 138,301 pounds. The operation of the molybdenum plant has been outsourced to a subcontractor which refurbished the plant with a $1-million investment to be paid by MVC over the course of three years.

Cash and working capital

The group's cash balance was $21.1-million at Sept. 30, 2016 (Dec. 31, 2015: $9-million), with a working capital deficiency of $1.1-million (Dec. 31, 2015: working capital deficiency of $6-million).

The group's cash balance at Sept. 30, 2016, includes $13.6-million in operating accounts and $7.5-million in a debt service reserve account.

Outlook

MVC maintains its 2016 production guidance of 55 million to 60 million pounds of copper at an annual cash cost of $1.65 per pound to $1.85 per pound.

MVC's sustaining capex in 2016, excluding capex incurred to refurbish the molybdenum plant, continues to be estimated at $5-million, mostly incurred on extraction sumps at Cauquenes.

MVC expects to complete the production test required under the Cauquenes expansion loan in the fourth quarter of 2016.

Cash and cash equivalents at MVC at Dec. 31, 2016, are expected to be lower than at Sept. 30, 2016, following scheduled debt repayments in December, 2016, and expected changes in other working capital accounts in the fourth quarter of 2016.

[url=http://peketec.de/trading/viewtopic.php?p=1703903#1703903 schrieb:greenhorn schrieb am 10.08.2016, 13:21 Uhr[/url]"]ARG - heute schon die Veröffentlichung der 2Q-Zahlen, wird langsam......

http://www.amerigoresources.com/_resources/news/nr_2016_08_10.pdf

Record production of 14.4 million pounds of copper

Scheduled debt repayments of $10.7 million made in the quarter

[url=http://peketec.de/trading/viewtopic.php?p=1699032#1699032 schrieb:greenhorn schrieb am 15.07.2016, 09:56 Uhr[/url]"]ARG - SK bei 0,17, gutes Volumen! über 0,18/0,20 CAD ist ordenlich Luft

wenn Sie die Ziele für 2016 auch nur annähernd packen (ca. 55-60 Mio Pfund Kupfer) dann sollte es hier mehr als einen Verdoppler geben; nur meine Meinung!!!

bei gleichen Preisen(aktuell bei 2,25/Pfund) + Marge sollten ca. 30 Mio USD Ertrag "hängen" bleiben, MK bei 27 Mio CAD

die neueste Präsentation:

http://amerigoresources.com/_resources/presentations/ARG_June_2016.pdf

[url=http://peketec.de/trading/viewtopic.php?p=1698836#1698836 schrieb:greenhorn schrieb am 14.07.2016, 16:17 Uhr[/url]"]ARG - seit gestern/heute um 0,16/0,165 CAD Long ...edit..

um unseren Majestix zu zitieren - "...der Chart ist aufreizend...."

[url=http://peketec.de/trading/viewtopic.php?p=1698442#1698442 schrieb:greenhorn schrieb am 13.07.2016, 14:27 Uhr[/url]"]ARG - Amerigo, Kupferproduzent, MK bei 27 Mio CAD

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:ARG-2389300&symbol=ARG®ion=C

- nach langer Durststrecke scheint es wieder aufwärts zu gehen, Kupferpreis aktuell bei 2,25/Pfund - Amerigo hat die Kosten auf 1,65 gedrückt

der Weg in die Profitabilität scheint geebnet

ein Nachzügler mit Chancen

» zur Grafik

Läuft sehr gut an! Schöner Umsatz die letzten Minuten.

[url=http://peketec.de/trading/viewtopic.php?p=1721347#1721347 schrieb:ocram_I schrieb am 10.11.2016, 10:04 Uhr[/url]"]A2ANT8 Parlane Resource! Hier mal gekauft. Vor ein paar Minuten diese News:

Parlane confirms the potential for gold at the Old Crow occurrence, Big Bear Property, Nechako Plateau, Central British Columbia

zweite zu 82,10

[url=http://peketec.de/trading/viewtopic.php?p=1721392#1721392 schrieb:

Hoffe auch das wir den Bereich 1330-1340$ noch mal anlaufen. Aber ob es wirklich so kommt.

[url=http://peketec.de/trading/viewtopic.php?p=1721406#1721406 schrieb:Sltrader schrieb am 10.11.2016, 11:54 Uhr[/url]"]zweite zu 82,10

[url=http://peketec.de/trading/viewtopic.php?p=1721392#1721392 schrieb:

damit rechne ich erst anfang 2017, was mich akt aber viel mehr nervt, ist das es zumindest gefühlt keine 2 grüne kerzen am stück mehr gibt

[url=http://peketec.de/trading/viewtopic.php?p=1721413#1721413 schrieb:Cadrach schrieb am 10.11.2016, 12:11 Uhr[/url]"]Hoffe auch das wir den Bereich 1330-1340$ noch mal anlaufen. Aber ob es wirklich so kommt.

[url=http://peketec.de/trading/viewtopic.php?p=1721406#1721406 schrieb:Sltrader schrieb am 10.11.2016, 11:54 Uhr[/url]"]zweite zu 82,10

[url=http://peketec.de/trading/viewtopic.php?p=1721392#1721392 schrieb:

wieder rein zu 4,10

[url=http://peketec.de/trading/viewtopic.php?p=1721345#1721345 schrieb:Sltrader schrieb am 10.11.2016, 10:01 Uhr[/url]"]und raus zu 4,28

[url=http://peketec.de/trading/viewtopic.php?p=1721093#1721093 schrieb:Sltrader schrieb am 09.11.2016, 17:27 Uhr[/url]"]GFI wieder erste zu 4,14 drinnen

und zweite zu 4,05, somit halbe Pos wieder voll

[url=http://peketec.de/trading/viewtopic.php?p=1721418#1721418 schrieb:Sltrader schrieb am 10.11.2016, 12:42 Uhr[/url]"]wieder rein zu 4,10

[url=http://peketec.de/trading/viewtopic.php?p=1721345#1721345 schrieb:Sltrader schrieb am 10.11.2016, 10:01 Uhr[/url]"]und raus zu 4,28

[url=http://peketec.de/trading/viewtopic.php?p=1721093#1721093 schrieb:Sltrader schrieb am 09.11.2016, 17:27 Uhr[/url]"]GFI wieder erste zu 4,14 drinnen

wurde ja auch von bullvestor heute gepushed

[url=http://peketec.de/trading/viewtopic.php?p=1721400#1721400 schrieb:ocram_I schrieb am 10.11.2016, 11:44 Uhr[/url]"]Läuft sehr gut an! Schöner Umsatz die letzten Minuten.

[url=http://peketec.de/trading/viewtopic.php?p=1721347#1721347 schrieb:ocram_I schrieb am 10.11.2016, 10:04 Uhr[/url]"]A2ANT8 Parlane Resource! Hier mal gekauft. Vor ein paar Minuten diese News:

Parlane confirms the potential for gold at the Old Crow occurrence, Big Bear Property, Nechako Plateau, Central British Columbia

Premier extends high grade mineralization at McCoy-Cove

T.PG | 3 hours ago

Canada NewsWire

THUNDER BAY, ON, Nov. 10, 2016

Drill intercepts include 28.64 g/t Au and 7.37 g/t Ag across 12.0 m

Shares Issued: 201,313,187

THUNDER BAY, ON, Nov. 10, 2016 /CNW/ - PREMIER GOLD MINES LIMITED (TSX:PG) ("Premier", "the Company") is pleased to announce additional positive drill results that indicate further extension of the high grade CSD Gap zone at the Company's 100%-owned McCoy-Cove Gold Project, situated along the Battle Mountain-Eureka Trend in Nevada. The results from the ongoing 15,000 metre drill program listed in this release all occur between the Helen Zone and the historic Cove South Deep (CSD) underground zone, and continue to exhibit high-grade mineralization over substantial widths.

The focus of the ongoing drill program is to delineate and expand the zone of the Carlin-style gold and silver system within the CSD Gap, as shown in Figure 1 and Table 1 below. Results from drill-hole PG16-12, a 100m step-out along strike from hole PG16-10 extends high grade mineralization towards the Helen Zone and remains open for expansion along strike to the northwest. Upon completion of the program Premier plans to commence a property-wide mineral resource estimate and a Preliminary Economic Assessment.

Highlights of the recent results include:

PG16-12: 28.64 g/t Au and 7.37 g/t Ag over 12.0m at 599.7m (or 0.84 oz/t Au and 0.21 oz/t Ag over 39.5 ft.) and 27.71 g/t Au and 12.95 g/t Ag over 6.9m at 627.1m (or 0.81 oz/t Au and 0.38 oz/t Ag over 22.5 ft.)

PG16-14: 6.16 g/t Au and 0.86 g/t Ag over 10.8m at 653.9m (or 0.18 oz/t Au and 0.03 oz/t Ag over 35.5 ft.) including 9.48 g/t Au and 0.45 g/t Ag over 3.2m (or 0.0.28 oz/t Au and 0.01 oz/t Ag over 10.5 ft.)

PG16-16: 5.31 g/t Au and 1.20 g/t Ag over 32.3m at 551.7m (or 0.15 oz/t Au and 0.04 oz/t Ag over 106 ft.) including 8.55 g/t Au and 2.41 g/t Ag over 7.6m ( or 0.25 oz/t Au and 0.07 oz/t Ag over 25.0 ft.)

PG14-18: 5.56 g/t Au and 11.93 g/t Ag over 6.0m (or 0.16 oz/t Au and 0.35 oz/t Ag over 19.8 ft.) at 571.1m. This hole was drilled to complete the core tail of a pre-collared hole drilled in 2014

"The 2016 exploration program continues to exceed expectations with PG16-16 further closing the gap with the Helen Zone to the northwest" stated Chad Peters, Nevada Exploration Manager for Premier on the Company's C-Suite Blog (http://www.premiergoldmines.com/news/c-suite-blog). "We currently have four rigs mobilized at McCoy-Cove with the remainder of 2016 focusing on select Helen and CSD Gap infill and expansion drilling to support the upcoming Q1 2017 resource estimate."

The Cove geologic model proposes that the most robust gold and silver mineralization in the Helen deposit, the CSD gap and the 2201 Zones are closely associated with the deep-seated Cove thrust fault and altered mafic sills that acted as both primary structural controls and fluid conduits. The 2016 drill results continue to confirm this model as well as highlight multiple, high-grade silver intercepts outside of the defined CSD Gap horizon. These intercepts are directly adjacent to the Cove thrust and the historically untested CT-1 splay which suggests additional potential remains to define high grade gold and silver mineralization outside of the known mineralized horizon. The ongoing drill program will therefore also target mineralization hosted within the hanging wall of the CT-1 splay as a means to further expand the known footprint of the CSD Gap and Helen deposits.

Read more at http://www.stockhouse.com/news/press-releases/2016/11/10/premier-extends-high-grade-mineralization-at-mccoy-cove#wVurBHXuA6w5ksXp.99

T.PG | 3 hours ago

Canada NewsWire

THUNDER BAY, ON, Nov. 10, 2016

Drill intercepts include 28.64 g/t Au and 7.37 g/t Ag across 12.0 m

Shares Issued: 201,313,187

THUNDER BAY, ON, Nov. 10, 2016 /CNW/ - PREMIER GOLD MINES LIMITED (TSX:PG) ("Premier", "the Company") is pleased to announce additional positive drill results that indicate further extension of the high grade CSD Gap zone at the Company's 100%-owned McCoy-Cove Gold Project, situated along the Battle Mountain-Eureka Trend in Nevada. The results from the ongoing 15,000 metre drill program listed in this release all occur between the Helen Zone and the historic Cove South Deep (CSD) underground zone, and continue to exhibit high-grade mineralization over substantial widths.

The focus of the ongoing drill program is to delineate and expand the zone of the Carlin-style gold and silver system within the CSD Gap, as shown in Figure 1 and Table 1 below. Results from drill-hole PG16-12, a 100m step-out along strike from hole PG16-10 extends high grade mineralization towards the Helen Zone and remains open for expansion along strike to the northwest. Upon completion of the program Premier plans to commence a property-wide mineral resource estimate and a Preliminary Economic Assessment.

Highlights of the recent results include:

PG16-12: 28.64 g/t Au and 7.37 g/t Ag over 12.0m at 599.7m (or 0.84 oz/t Au and 0.21 oz/t Ag over 39.5 ft.) and 27.71 g/t Au and 12.95 g/t Ag over 6.9m at 627.1m (or 0.81 oz/t Au and 0.38 oz/t Ag over 22.5 ft.)

PG16-14: 6.16 g/t Au and 0.86 g/t Ag over 10.8m at 653.9m (or 0.18 oz/t Au and 0.03 oz/t Ag over 35.5 ft.) including 9.48 g/t Au and 0.45 g/t Ag over 3.2m (or 0.0.28 oz/t Au and 0.01 oz/t Ag over 10.5 ft.)

PG16-16: 5.31 g/t Au and 1.20 g/t Ag over 32.3m at 551.7m (or 0.15 oz/t Au and 0.04 oz/t Ag over 106 ft.) including 8.55 g/t Au and 2.41 g/t Ag over 7.6m ( or 0.25 oz/t Au and 0.07 oz/t Ag over 25.0 ft.)

PG14-18: 5.56 g/t Au and 11.93 g/t Ag over 6.0m (or 0.16 oz/t Au and 0.35 oz/t Ag over 19.8 ft.) at 571.1m. This hole was drilled to complete the core tail of a pre-collared hole drilled in 2014

"The 2016 exploration program continues to exceed expectations with PG16-16 further closing the gap with the Helen Zone to the northwest" stated Chad Peters, Nevada Exploration Manager for Premier on the Company's C-Suite Blog (http://www.premiergoldmines.com/news/c-suite-blog). "We currently have four rigs mobilized at McCoy-Cove with the remainder of 2016 focusing on select Helen and CSD Gap infill and expansion drilling to support the upcoming Q1 2017 resource estimate."

The Cove geologic model proposes that the most robust gold and silver mineralization in the Helen deposit, the CSD gap and the 2201 Zones are closely associated with the deep-seated Cove thrust fault and altered mafic sills that acted as both primary structural controls and fluid conduits. The 2016 drill results continue to confirm this model as well as highlight multiple, high-grade silver intercepts outside of the defined CSD Gap horizon. These intercepts are directly adjacent to the Cove thrust and the historically untested CT-1 splay which suggests additional potential remains to define high grade gold and silver mineralization outside of the known mineralized horizon. The ongoing drill program will therefore also target mineralization hosted within the hanging wall of the CT-1 splay as a means to further expand the known footprint of the CSD Gap and Helen deposits.

Read more at http://www.stockhouse.com/news/press-releases/2016/11/10/premier-extends-high-grade-mineralization-at-mccoy-cove#wVurBHXuA6w5ksXp.99

RT Minerals Corp. Reports on Ballard Lake Drilling and New Staking[url=http://peketec.de/trading/viewtopic.php?p=1721499#1721499 schrieb:600 schrieb am 10.11.2016, 15:42 Uhr[/url]"]RTM wieder was long zu 0,125

Vancouver, British Columbia--(Newsfile Corp. - November 10, 2016) - RT Minerals Corp. (TSXV: RTM) (the "Company") reports on core drilling and new staking at its 100% owned Ballard Lake property located approximately 50 kilometres northeast of Wawa, Ontario.

Drill hole BA-16-01 intersected the Ballard Lake Shear Zone ("BLSZ") at 89 metres depth and returned anomalous gold values. Petrology of alkali ultramafic dikes also cut by drilling, show exotic mineralogy with compositions that suggest a deep crustal or mantle magma source.

The BLSZ may tap into deep crustal and mantle structures that could act as conduits for hydrothermal fluids and gold. The BLSZ and adjacent granodiorite/volcanic contact is a large surface structure, with ample room for significant mineralization. The Company has 12 kilometres of the Ballard Lake granodiorite-volcanic contact on its claims.

With potential for deep crustal or mantle tapping conduits, indicated by alkali ultramafic dikes and kimberlites in the area, the Company has staked 64 claim blocks at Ballard Lake to cover the contact and other exploration targets, increasing the property's size to approximately 160 square kilometres (~15,970 hectares). The new claims are subject to a 2% net smelter royalty, with 1% buyback for $1,000,000, as staking is contiguous and surrounds the original property.

RT Minerals Corp.'s Ballard Lake property now includes two historical diamond-bearing kimberlite occurrences: GC1 (16 diamonds from 93.1 kg), and Fletch (6 diamonds from 51.48 kg). Diamond results were reported by Chalice Diamond Corp. ("Chalice") in February 2008.

Chalice completed an exploration program in the Ballard Lake area that included regional kimberlite indicator mineral sampling, prospecting, modern airborne geophysical surveys, and ground geophysical surveys. No drilling was reported. RT Minerals will continue to evaluate these targets and will commence drilling on at least several of these targets in the coming weeks.

The Ballard Lake property lies in the Wawa supracrustal belt of the Superior Craton, which is currently being explored by major and junior exploration companies for both gold and diamonds.

Kevin Kivi, P.Geo., QP for the Company's Ballard Lake property, has explored for diamonds and gold in Canada since 1983, and approves the technical content of this press release.

https://www.ceo.ca/@newsfile/rt-minerals-corp-reports-on-ballard-lake-drilling