Kostolanys Erbe schrieb am 08.11.2018, 22:24 Uhr[/url]"]

Hut 8 Mining loses $11.44-million in Q3 2018

2018-11-08 13:18 ET - News Release

Mr. Andrew Kiguel reports

HUT 8 MINING CORP. REPORTS FINANCIAL RESULTS FOR THIRD QUARTER 2018

Hut 8 Mining Corp. has released its financial results for the third quarter ended Sept. 30, 2018.

Highlights:

Record revenue of $17.7 million for Q3 and $36.4 million for the nine months ended September 30, 2018.

Adjusted EBITDA of $7.1 million for Q3 and $18.7 million for the nine months ended September 30, 2018.

Completion of installation and operation of 56 BlockBoxes in the City of Medicine Hat facility ("CMH"), representing an increase of 67.2 MW of operating capacity.

Closing of US$16 million loan facility with Galaxy Digital.

1,978 bitcoin mined in Q3.

Three months ended Nine months ended

September 30, 2018 September 30, 2018

Revenue $ 17,654,901 $ 36,444,220

Site operating costs (8,727,399 ) (13,736,529 )

Mining profit 8,927,502 22,707,691

Mining profit margin 51 % 62 %

Depreciation (17,440,571 ) (28,981,535 )

Gross profit $ (8,513,069 ) $ (6,273,844 )

Gross profit margin -48 % -17 %

Expenses (2,618,779 ) (7,810,921 )

Net operating loss (11,131,848 ) (14,084,765 )

Fair value loss on re-measurement of digital assets (317,177 ) (6,146,449 )

Foreign exchange gain 251,123 248,673

Net finance expense (245,976 ) (213,661 )

Net loss and comprehensive loss (11,443,878 ) (20,196,202 )

Adjusted EBITDA $ 7,176,479 $ 18,726,896

Adjusted EBITDA margin 41 % 51 %

Net loss per share - basic and diluted $ (0.14 ) $ (0.25 )

Bitcoin mined 1,978 3,581

Cost per bitcoin (USD) $ 3,394 $ 2,977

Q3 2018 was the first quarter for Hut 8 that included the impact of mining operations at our CMH facility, which includes 40 BlockBoxes beginning in July 2018, together with an additional 16 BlockBoxes in September 2018, for an aggregate of 56 BlockBoxes at that site. As a result of this increased capacity,

Hut 8 produced $17.7 million of revenue for the quarter, its largest ever for a single quarter and a 126% increase from the prior quarter revenue of $7.8 million.

The Company also recorded $7.2 million in Adjusted EBITDA, an 86% increase from the prior quarter of $3.9 million, largely as a result of increased revenue from the new facility at CMH. Efficiency of the ASIC chips used to mine bitcoin is expected to increase during the colder months in Alberta, leading to improved performance in Q4 when compared to Q3.

Hut 8's cost for mining a bitcoin in Q3 2018 was US$3,394, which is below the current market bitcoin price of approximately US$6,500, making Hut 8 amongst the lowest-cost miners of bitcoin in the world. This is reflected in the Company's quarterly results, as its mining profit for the quarter was $8.8 million with a mining profit margin of 51%.

Hut 8's mining profit margin and adjusted EBITDA margins were lower during Q3 for two reasons: (i) the price of bitcoin appreciated through the quarter, combined with increased competition from other bitcoin miners (expressed through increased network hash rate); and (ii) to a lesser extent, record setting summer temperatures in Alberta that caused increases in the price of electricity at its Drumheller facility, which facility procures electricity from the Alberta grid. The impact of a hot summer was far less at Hut 8's larger facility in CMH, which purchases the majority of its electricity under contract with fixed prices.

"Our Drumheller facility represents approximately 20% of our operations," said Andrew Kiguel, Chief Executive Officer of Hut 8. "This summer, a record-setting heat wave in the province resulted in increased electricity costs during certain periods. The result was increased electricity costs at the Drumheller site by approximately $0.01 per Kilowatt hour on average. We are actively managing our exposure to market prices through a number of different means. Despite this, Hut 8 achieved record revenue for Q3 and strong overall margins."

A conference call has been scheduled to discuss the Company's third quarter financial results, hosted by CEO Andrew Kiguel and CFO Jimmy Vaiopoulos, starting at 10:00 a.m. ET today.

Date: Thursday, November 8, 2018

Time: 10:00 a.m. ET

Dial-In: 1 (888) 465-5079, Canada 1 (888) 424-8151, US

Passcode: 6281 943#

Hut 8 currently operates a total of 73 BlockBox Data Centers, including 56 BlockBoxes at its facility in CMH, Alberta, each BlockBox with 1.2 MW of capacity, representing an aggregate of 67.2 MW of maximum operating power capacity. Hut 8 is currently operating: (a) approximately 63.2 MW in CMH with a target to reach full capacity of 67.2 MW in Q1 2019; and (b) 17 BlockBoxes at its facility in Drumheller, Alberta, representing an aggregate of 18.7 MW of maximum operating power capacity. Hut 8 has a total maximum operating power capacity of 85.9 MW and an average actual operating hash rate of over 640 Petahashes per second.

This earnings release should be read in conjunction with the Company's Management Discussion & Analysis, Financial Statements and Notes to Financial Statements for Q3 2018, which has been posted under the Company's profile on SEDAR at www.sedar.com and are also available on the Company's website at www.hut8mining.com.

Since beginning its mining operations in December 2017, Hut 8 has mined more than 4,200 bitcoin. As of September 30, 2018, Hut 8 had 85,228,858 shares outstanding, 965,000 options and 2,882,222 warrants.

ABOUT HUT 8 MINING CORP.

Hut 8 Mining Corp., headquartered in Toronto, Canada is a cryptocurrency mining company established through an exclusive arrangement with the Bitfury Group, the world's leading full-service blockchain technology company. Through the Bitfury Group, Hut 8 has access to a world-leading proprietary mix of hardware, software and operational expertise to construct, optimize and manage data centres in low-cost and attractive jurisdictions.

Hut 8 provides investors with direct exposure to bitcoin, without the technical complexity or constraints of purchasing the underlying cryptocurrency. Investors avoid the need to create online wallets, wire money offshore and safely store their bitcoin. Hut 8 provides a secure and simple way to invest.

Key investment highlights and FAQ's: https://www.hut8mining.com/investors.

https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aHUT-2681241&symbol=HUT®ion=C

[url=https://peketec.de/trading/viewtopic.php?p=1864273#1864273 schrieb:

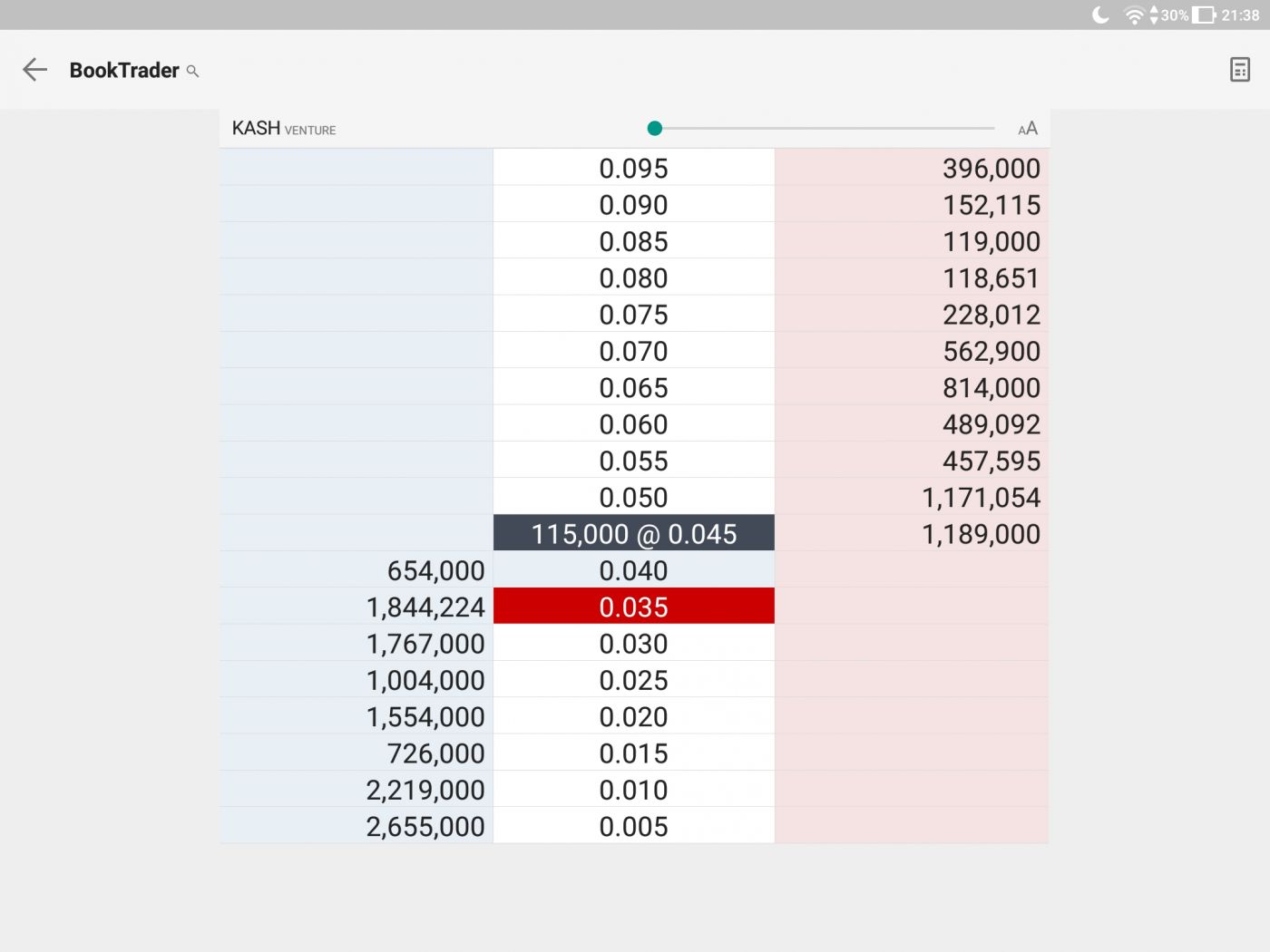

Kostolanys Erbe schrieb am 08.11.2018, 11:45 Uhr[/url]"]Kam zu 0,05 CAN$ nicht mehr rein.

Habe jeden Tag Kash verfolgt....und dachte....schöne Bodenbildung...könnte charttechnisch eine Untertasse werden....

Habe eine Speku-Position Hut 8 Mining gekauft. Heute kommen Q-Zahlen....

https://ceo.ca/@nasdaq/hut-8-completes-construction-at-medicine-hat-facility

[url=https://peketec.de/trading/viewtopic.php?p=1864255#1864255 schrieb:

greenhorn schrieb am 08.11.2018, 10:13 Uhr[/url]"]

1nq

1nq man beachte das Handelsvolumen der letzten beiden Tage........Q3 Ergebnisse voraus

[url=https://peketec.de/trading/viewtopic.php?p=1854536#1854536 schrieb:

greenhorn schrieb am 21.09.2018, 08:37 Uhr[/url]"]

https://www.stockwatch.com/News/Item.aspx?bid=Z-C:KASH-2661634&symbol=KASH®ion=C

Hashchain assigns Node40 debt to Global Crypto

2018-09-20 18:00 ET - News Release

Mr. Patrick Gray reports

HASHCHAIN TECHNOLOGY ANNOUNCES AMENDMENT TO ASSET PURCHASE AGREEMENT WITH NODE40

Hashchain Technology Inc. has entered into a definitive agreement to amend its previously disclosed asset purchase agreement with Node40.

Terms of the original asset purchase agreement with Node40

Under the asset purchase agreement for the acquisition of the Node40 business, Hashchain acquired the Node40 business for a purchase price comprising $8-million (U.S.) in cash, payable as to $4-million (U.S.) at closing (subject to a closing adjustment provision), and $2-million (U.S.) on each of 180 days and one year following the closing date, and a total of 3,144,134 common shares in the capital of Hashchain, to be issued in the following amounts and on the following dates: (i) 1.8 million shares on the closing date, (ii) 700,247 shares on the date that is 180 days following the closing date; and (iii) 643,887 shares on the one-year anniversary of the closing date, subject to the vendor of Node 40's option to receive cash in lieu of up to 30 per cent of the shares issuable pursuant to (ii) and (iii) above to a maximum of $600,000 (U.S.) for (ii) and $600,000 (U.S.) for (iii) above.

Terms of amended asset purchase agreement with Node40

Hashchain assigned to its wholly owned subsidiary Global Crypto Public Accounting Ltd., and Global assumed the cash debt and agreed to discharge such cash debt by paying the vendor $2-million (U.S.) on Feb. 15, 2019. The vendor agreed to cancel 3.6 million shares held by the vendor in exchange for the Masternode rewards and all Dash cryptocurrency paid to Hashchain by customers of the Node40 accounting software.

The vendor elected to be paid $1.2-million (U.S.) by Global and receive an aggregate total of 940,894 shares on Feb. 15, 2019, in satisfaction of the second and third share issuances mentioned above from the APA.

Immediately prior to the spinoff (as defined below), Hashchain agreed to subscribe for 900 Class A common shares of Global for an aggregate purchase price of $400,000, such funds to be used for working capital expenses, and Global will issue the vendor 110 Class A common shares.

Hashchain previously disclosed its intent to separate the company into two independent publicly traded companies: one business focused on cryptocurrency mining (Hashchain) and the other on cryptocurrency accounting and tax compliance software, including other disruptive blockchain technology solutions (Global).

About Hashchain Technology Inc.

HashChain is a blockchain company, and the first publicly traded Canadian cryptocurrency mining company to file a final prospectus supporting highly scalable and flexible mining operations across all major cryptocurrencies. Hashchain taps low-cost North American power, cool climate and high-speed Internet: the trifecta most critical to mining success, to create a competitive position for maximizing the number of mining wins. Hashchain currently operates 100 Dash mining rigs and 8,395 bitcoin rigs with an additional 3,500 rigs to be deployed from its previously announced acquisitions. Once all rigs are operational, Hashchain's mining operations will consist of 11,995 rigs consuming approximately 17.5 megawatts of power.

© 2018 Canjex Publishing Ltd. All rights reserved.