App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

Lithium Americas Corp. WUC1:

forciert das gestrige th und liegt heute bei 12.53 $.

forciert das gestrige th und liegt heute bei 12.53 $.

[url=https://peketec.de/trading/viewtopic.php?p=2006166#2006166 schrieb:wicki99 schrieb am 30.09.2020, 22:28 Uhr[/url]"]Lithium Americas Corp. WUC1:

th bei 12.93 $.

[url=https://peketec.de/trading/viewtopic.php?p=2005605#2005605 schrieb:wicki99 schrieb am 28.09.2020, 20:01 Uhr[/url]"]Lithium Americas Corp. WUC1:

explosives teil in den vergangenen tagen, ausbruch-trader könnten die aktie auf dem schirm haben ...

» zur Grafik

Lithium Americas Corp. WUC1:

robbt sich bis auf 6 us-cent an das gestrige hoch an.

robbt sich bis auf 6 us-cent an das gestrige hoch an.

[url=https://peketec.de/trading/viewtopic.php?p=2006359#2006359 schrieb:wicki99 schrieb am 01.10.2020, 15:52 Uhr[/url]"]Lithium Americas Corp. WUC1:

forciert das gestrige th und liegt heute bei 12.53 $.

[url=https://peketec.de/trading/viewtopic.php?p=2006166#2006166 schrieb:wicki99 schrieb am 30.09.2020, 22:28 Uhr[/url]"]Lithium Americas Corp. WUC1:

th bei 12.93 $.

[url=https://peketec.de/trading/viewtopic.php?p=2005605#2005605 schrieb:wicki99 schrieb am 28.09.2020, 20:01 Uhr[/url]"]Lithium Americas Corp. WUC1:

explosives teil in den vergangenen tagen, ausbruch-trader könnten die aktie auf dem schirm haben ...

» zur Grafik

servus miteinand!  und zum tagesabschluss gibt's noch ein kleines "betthupferl"!

und zum tagesabschluss gibt's noch ein kleines "betthupferl"!

https://www.youtube.com/watch?v=NWsSSJ5skx4

https://www.youtube.com/watch?v=NWsSSJ5skx4

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Strategic Metals completes drilling at Mt. Hinton

2020-10-01 10:10 ET - News Release

Mr. Douglas Eaton reports

STRATEGIC METALS COMPLETES DRILL PROGRAM AT ITS MT HINTON GOLD AND SILVER PROJECT, YUKON

Strategic Metals Ltd. has successfully concluded its 2020 drill program at its wholly owned Mt. Hinton gold/silver project. A total of 6,978 metres of diamond drilling was completed in 32 holes, all with HQ diameter core.

Mt. Hinton is a road-accessible project located in the Keno Hill district of the Tintina gold belt, in central Yukon. The property lies immediately southeast of silver/lead mines on Alexco Resources' Keno Hill property, which are expected to resume production before the end of the year, and 35 kilometres southeast of Victoria Gold's Eagle Mine, which was commissioned in June, 2020.

The drill program tested parts of three zones within a six km by 4.5 km area of known mineralization and gold-rich soil geochemistry. The targets in all three zones were vein complexes cutting a west-dipping stratigraphic section comprising thick quartzite beds interlayered with lesser phyllite horizons and gabbro sills. These are the same units that host the mineralized veins on the adjacent Keno Hill property.

The majority of the holes were drilled on a series of section lines across the Granite North zone where surface sampling returned numerous high assays, including a rock sample that graded 2,340 grams per tonne gold and a chip sample of 26.9 g/t over 1.2 m. The section lines cross a number of subparallel, five m to 25 m wide vein/breccia/alteration bands that were mapped in talus and outcrop within the up to 400 m wide zone. Collectively the section lines tested a 425 m strike length along the zone. All of the holes intersected abundant quartz veining of differing types. Many of the veins are limonite stained and contain vuggy cavities. Some veins host residual sulphide minerals, and native gold was observed in a few of them.

Five holes were drilled at the Southwest zone where a chip sample containing visible gold assayed 200 g/t gold over 1.2 m. All five holes intersected strong structures containing quartz veining. Some of the quartz veins host arsenopyrite but most are oxidized. The holes spanned a 330 m strike length along this 1,750 m long zone. On average the holes intersected the zone about 100 m down dip of surface.

Three holes targeted veins in the northern structural corridor. All three holes intersected mineralized veins but all were terminated for various reasons short of their ultimate target depth. The northern structural corridor is a 4 km long, up to 750 m wide zone that was the main focus of earlier work on the Mt. Hinton property. It contains numerous gold and silver rich veins, where historical chip samples assayed more than 10 g/t gold over widths of one m to 2.1 m.

Assay results of core samples from the drill holes have been severely delayed by overloading at the analytical laboratory. Problems related to COVID-19 safety protocols have been compounded by a rapid uptick in drill activity worldwide. Mt. Hinton core processing has been further delayed by the very rigorous sampling, sample preparation and analytical techniques being used to ensure that the results are as reliable as possible given the presence of coarse gold in some veins. To date, assay results are only available for one complete hole and two partial holes. These results are still subject to compilation and quality assurance/quality control review. Ideally, the first news release will be made in about two weeks and will comprise holes spanning the entire width of the first section line across the Granite North zone. A comprehensive section should provide a better idea of the distribution and character of the mineralization. The drilling and sampling programs are designed to evaluate potential for both bulk-tonnage and discrete vein targets.

Technical information in this news release has been approved by Matthew R. Dumala, PEng, a geological engineer with Archer, Cathro & Associates (1981) Ltd., and qualified person for the purpose of National Instrument 43-101.

About Strategic Metals Ltd.

Strategic is a project generator with a portfolio of more than 130 projects that are the product of over 50 years of focused exploration and research by a team with a record of major discoveries. Current projects include more than 80 properties where precious metals are a major component. Projects available for option, joint venture or sale include drill-confirmed prospects and drill-ready targets with high-grade surface showings, geochemical anomalies and geophysical features that resemble those at nearby deposits.

Strategic has a current cash position of over $9-million and large shareholdings in a number of active mineral exploration companies including 46.3 per cent of GGL Resources Corp., 36.3 per cent of Rockhaven Resources Ltd., 19.6 per cent of Precipitate Gold Corp., 18.7 per cent of Silver Range Resources Ltd. and 9.9 per cent of Trifecta Gold Ltd. Strategic also holds a 53.5-per-cent interest in Terra CO2 Technologies Holdings Inc., a private Delaware corporation that is developing an environmentally friendly, cost-effective alternative to Portland cement.

https://www.stockwatch.com/News/Item?bid=Z-C:SMD-2970311&symbol=SMD®ion=C

Der Chart von Canada Nickel gefällt mir

Gestern 1. Tranche vom Bought Deal abgeschlossen aktuell auf TH bei 1,16 Euro

Gestern 1. Tranche vom Bought Deal abgeschlossen aktuell auf TH bei 1,16 Euro

HTML:

https://www.northernontariobusiness.com/industry-news/mining/nickel-hunter-primed-for-step-out-exploration-on-its-timmins-property-2757852

Lithium Americas Corp. WUC1: das war mal ein pfund!  th bei 14.84 $ ...

th bei 14.84 $ ...

[url=https://peketec.de/trading/viewtopic.php?p=2006389#2006389 schrieb:wicki99 schrieb am 01.10.2020, 17:18 Uhr[/url]"]Lithium Americas Corp. WUC1:

robbt sich bis auf 6 us-cent an das gestrige hoch an.

[url=https://peketec.de/trading/viewtopic.php?p=2006359#2006359 schrieb:wicki99 schrieb am 01.10.2020, 15:52 Uhr[/url]"]Lithium Americas Corp. WUC1:

forciert das gestrige th und liegt heute bei 12.53 $.

[url=https://peketec.de/trading/viewtopic.php?p=2006166#2006166 schrieb:wicki99 schrieb am 30.09.2020, 22:28 Uhr[/url]"]Lithium Americas Corp. WUC1:

th bei 12.93 $.

[url=https://peketec.de/trading/viewtopic.php?p=2005605#2005605 schrieb:wicki99 schrieb am 28.09.2020, 20:01 Uhr[/url]"]Lithium Americas Corp. WUC1:

explosives teil in den vergangenen tagen, ausbruch-trader könnten die aktie auf dem schirm haben ...

» zur Grafik

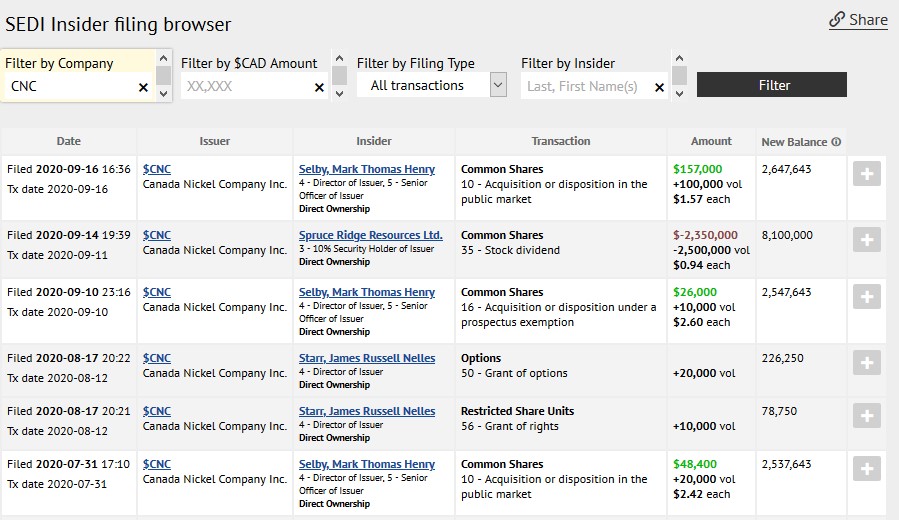

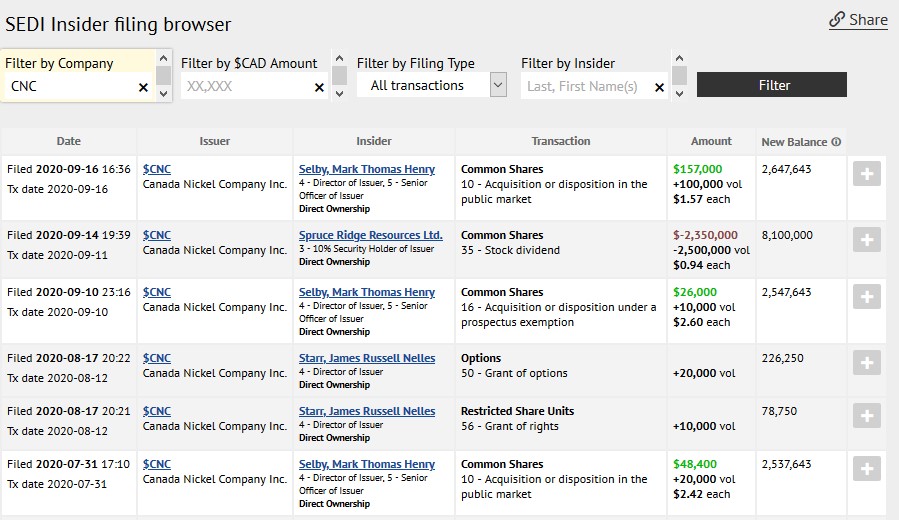

Update zu Canada Nickel CNC

Chart

Insiderkäufe

TV

Billions of dollars of nickel beneath highway near Timmins, Canadian mining company says

WO

Chart

Insiderkäufe

TV

Billions of dollars of nickel beneath highway near Timmins, Canadian mining company says

HTML:

https://northernontario.ctvnews.ca/billions-of-dollars-of-nickel-beneath-highway-near-timmins-canadian-mining-company-says-1.5131024WO

HTML:

https://www.wallstreet-online.de/nachricht/12990598-boom-batterie-metallen-nickelmarkt-kollaps-umweltschonende-minen-her-firma-alles-ruft-tesla-an[url=https://peketec.de/trading/viewtopic.php?p=2006515#2006515 schrieb:IRISH schrieb am 02.10.2020, 09:15 Uhr[/url]"]Der Chart von Canada Nickel gefällt mir

Gestern 1. Tranche vom Bought Deal abgeschlossen aktuell auf TH bei 1,16 Euro

HTML:https://www.northernontariobusiness.com/industry-news/mining/nickel-hunter-primed-for-step-out-exploration-on-its-timmins-property-2757852

» zur Grafik

1,29

Nicht gierig werden SK Canada liegt bei 1,1175

Nicht gierig werden SK Canada liegt bei 1,1175

[url=https://peketec.de/trading/viewtopic.php?p=2006733#2006733 schrieb:IRISH schrieb am 04.10.2020, 18:47 Uhr[/url]"]Update zu Canada Nickel CNC

Chart

» zur Grafik

Insiderkäufe

» zur Grafik

TV

Billions of dollars of nickel beneath highway near Timmins, Canadian mining company says

HTML:https://northernontario.ctvnews.ca/billions-of-dollars-of-nickel-beneath-highway-near-timmins-canadian-mining-company-says-1.5131024

WO

HTML:https://www.wallstreet-online.de/nachricht/12990598-boom-batterie-metallen-nickelmarkt-kollaps-umweltschonende-minen-her-firma-alles-ruft-tesla-an[url=https://peketec.de/trading/viewtopic.php?p=2006515#2006515 schrieb:IRISH schrieb am 02.10.2020, 09:15 Uhr[/url]"]Der Chart von Canada Nickel gefällt mir

Gestern 1. Tranche vom Bought Deal abgeschlossen aktuell auf TH bei 1,16 Euro

HTML:https://www.northernontariobusiness.com/industry-news/mining/nickel-hunter-primed-for-step-out-exploration-on-its-timmins-property-2757852

» zur Grafik

Lithium Americas Corp. WUC1: und weiter gehts. vorbörslich bereits bis 17.47 $ gerannt.

[url=https://peketec.de/trading/viewtopic.php?p=2006663#2006663 schrieb:wicki99 schrieb am 02.10.2020, 16:49 Uhr[/url]"]Lithium Americas Corp. WUC1: das war mal ein pfund!th bei 14.84 $ ...

[url=https://peketec.de/trading/viewtopic.php?p=2006389#2006389 schrieb:wicki99 schrieb am 01.10.2020, 17:18 Uhr[/url]"]Lithium Americas Corp. WUC1:

robbt sich bis auf 6 us-cent an das gestrige hoch an.

[url=https://peketec.de/trading/viewtopic.php?p=2006359#2006359 schrieb:wicki99 schrieb am 01.10.2020, 15:52 Uhr[/url]"]Lithium Americas Corp. WUC1:

forciert das gestrige th und liegt heute bei 12.53 $.

[url=https://peketec.de/trading/viewtopic.php?p=2006166#2006166 schrieb:wicki99 schrieb am 30.09.2020, 22:28 Uhr[/url]"]Lithium Americas Corp. WUC1:

th bei 12.93 $.

[url=https://peketec.de/trading/viewtopic.php?p=2005605#2005605 schrieb:wicki99 schrieb am 28.09.2020, 20:01 Uhr[/url]"]Lithium Americas Corp. WUC1:

explosives teil in den vergangenen tagen, ausbruch-trader könnten die aktie auf dem schirm haben ...

» zur Grafik

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

AU:NMT

06/10/2020 Mt Edwards Nickel - Mineral Resource and Exploration Update

https://www.asx.com.au/asxpdf/20201006/pdf/44ncsmf3k9wgvr.pdf

06/10/2020 Mt Edwards Nickel - Mineral Resource and Exploration Update

https://www.asx.com.au/asxpdf/20201006/pdf/44ncsmf3k9wgvr.pdf

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Anaconda drills 2.5 m of 17.95 g/t Au at Goldboro

2020-10-06 07:09 ET - News Release

Mr. Kevin Bullock reports

ANACONDA MINING REPORTS FURTHER DRILL RESULTS FROM THE GOLDBORO GOLD PROJECT, INCLUDING 17.95 G/T GOLD OVER 2.5 METRES AND 4.16 G/T GOLD OVER 22.8 METRES

Anaconda Mining Inc. has released drill results from a continuing 15,000-metre drill program announced on Sept. 3, 2020, at its 100-per-cent-owned Goldboro gold project in Nova Scotia, Canada. The drill program is designed to convert priority inferred mineral resources, considered proximal to planned development in the feasibility study, into measured and indicated mineral resources of the Goldboro deposit.

The results to date continue to confirm significant high-grade gold zones in key areas being considered in the feasibility study, but excitingly they are being found within much wider zones of gold mineralization. These indications of broader mineralized zones could positively impact the mine planning work currently being carried out as part of the optimized feasibility study by reducing inherent mine dilution and increasing the contained number of near-surface ounces.

Selected composited highlights from the drill program include:

......

https://www.stockwatch.com/News/Item?bid=Z-C:ANX-2971655&symbol=ANX®ion=C

[url=https://peketec.de/trading/viewtopic.php?p=2007229#2007229 schrieb:dukezero schrieb am 06.10.2020, 14:47 Uhr[/url]"]» zur Grafik

https://www.juniorminingnetwork.com/junior-miner-news/press-releases/1084-tsx/kor/85387-north-bullfrog-project-s-preliminary-economic-assessment-corvus-gold-s-detailed-phase-1-standalone-near-term-mine-development-plan-in-the-bullfrog-mining-district-nevada.html?fbclid=IwAR2izz5i40Stc0t0xCypTqlGX0i5qeaHu-pSJ24mPebhAi8Pc-Q3WXx1E6Y

2020-10-08 07:00 ET - News Release

Canada Nickel's Final Three Infill Holes Confirm and Extend Higher Grade Mineralization at Crawford Nickel-Cobalt Sulphide Project

https://www.stockwatch.com/News/Item?bid=Z-C:CNC-2972738&symbol=CNC®ion=C

Canada NewsWire

TORONTO, Oct. 8, 2020

Highlights

Final three infill holes in easternmost end of the Main Zone continue to confirm and extend higher grade mineralization

Hole CR20-64 intersected 0.33% nickel across entire core length of 369 metres including 0.38% nickel across core length of 96 metres within the steeply dipping higher-grade core which varies in true thickness from 40 to 160 m

Easternmost infill hole CR20-65 collared in higher grade mineralization and intersected 0.33% nickel across core length of 126 metres (estimated true width of 51 metres). Hole CR20-63 confirmed depth extension on south side of higher grade mineralization with final core length of 45 metres grading 0.36% nickel ending at a depth of 400 metres.

TORONTO, Oct. 8, 2020 /CNW/ - Canada Nickel Company Inc. (TSXV: CNC) ("Canada Nickel" or the "Company") today announced the final results from infill drilling on the Main Zone at its Crawford Nickel-Cobalt Sulphide project.

"These excellent results conclude our infill program which will be incorporated into our resource update expected to be released in two weeks. With yet another set of promising results, we are looking forward to issuing the updated resource particularly given our ability to substantially extend the higher grade core of the mineralization along strike and at depth." said Mark Selby, Chair and CEO of Canada Nickel.

"Additionally, we are expecting a steady series of assay results from drilling currently underway on prospective geophysical nickel targets on the several kilometres of the Crawford structure including the three follow-up holes on the previously reported PGM results from hole CR20-32 (which yielded three separate intersections including 2.6 g/t PGM over 7.5 metres). Canada Nickel looks forward to continue delivering regular and notable updates through the balance of 2020. We remain on track to deliver a Preliminary Economic Assessment by year-end."

The Crawford Nickel-Cobalt Sulphide Project is located in the heart of the prolific Timmins-Cochrane mining camp in Ontario, Canada, and is adjacent to well-established, major infrastructure associated with over 100 years of regional mining activity.

Canada Nickel's Final Three Infill Holes Confirm and Extend Higher Grade Mineralization at Crawford Nickel-Cobalt Sulphide Project

https://www.stockwatch.com/News/Item?bid=Z-C:CNC-2972738&symbol=CNC®ion=C

Canada NewsWire

TORONTO, Oct. 8, 2020

Highlights

Final three infill holes in easternmost end of the Main Zone continue to confirm and extend higher grade mineralization

Hole CR20-64 intersected 0.33% nickel across entire core length of 369 metres including 0.38% nickel across core length of 96 metres within the steeply dipping higher-grade core which varies in true thickness from 40 to 160 m

Easternmost infill hole CR20-65 collared in higher grade mineralization and intersected 0.33% nickel across core length of 126 metres (estimated true width of 51 metres). Hole CR20-63 confirmed depth extension on south side of higher grade mineralization with final core length of 45 metres grading 0.36% nickel ending at a depth of 400 metres.

TORONTO, Oct. 8, 2020 /CNW/ - Canada Nickel Company Inc. (TSXV: CNC) ("Canada Nickel" or the "Company") today announced the final results from infill drilling on the Main Zone at its Crawford Nickel-Cobalt Sulphide project.

"These excellent results conclude our infill program which will be incorporated into our resource update expected to be released in two weeks. With yet another set of promising results, we are looking forward to issuing the updated resource particularly given our ability to substantially extend the higher grade core of the mineralization along strike and at depth." said Mark Selby, Chair and CEO of Canada Nickel.

"Additionally, we are expecting a steady series of assay results from drilling currently underway on prospective geophysical nickel targets on the several kilometres of the Crawford structure including the three follow-up holes on the previously reported PGM results from hole CR20-32 (which yielded three separate intersections including 2.6 g/t PGM over 7.5 metres). Canada Nickel looks forward to continue delivering regular and notable updates through the balance of 2020. We remain on track to deliver a Preliminary Economic Assessment by year-end."

The Crawford Nickel-Cobalt Sulphide Project is located in the heart of the prolific Timmins-Cochrane mining camp in Ontario, Canada, and is adjacent to well-established, major infrastructure associated with over 100 years of regional mining activity.

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Equinox increases NI 43-101 reserves at Mesquite

2020-10-08 07:42 ET - News Release

Mr. Scott Heffernan reports

EQUINOX GOLD INCREASES MESQUITE RESERVES BY 28% AND MEASURED & INDICATED RESOURCES BY 94%

Exploration success during the first half of 2020 has significantly increased mineral reserves and mineral resources at Equinox Gold Corp.'s Mesquite gold mine in California.

Highlights

Proven and Probable Mineral Reserves increased 28% to 658,000 ounces ("oz") of contained gold net of mining depletion to June 30, 2020 Measured and Indicated ("M&I") Mineral Resources increased 94% to 837,000 oz of contained gold, exclusive of reserves Inferred Mineral Resources increased 38% to 703,000 oz of contained gold Ongoing exploration continues to demonstrate growth potential at the Brownie deposit; initial drilling highlights include: 35.1 metres ("m") at 0.51 grams per tonne ("g/t") gold; 33.5 m at 0.66 g/t gold; 52.6 m at 0.85 g/t gold; and 44.2 m at 0.58 g/t gold

Scott Heffernan, EVP Exploration of Equinox Gold, stated: "Exploration efforts at Mesquite in the first half of 2020 more than replaced mined reserves and significantly increased mineral resources, providing additional mine life at what has been our best-performing mine this year. Drilling in the Brownie deposit also yielded excellent results and points to potential for a multi-year mine life extension from in-situ mineralization and overlying mineralized dumps."

..............

https://www.stockwatch.com/News/Item?bid=Z-C:EQX-2972785&symbol=EQX®ion=C

Global Oil Demand Won't Peak Before 2040, OPEC Says oel/gas

By David Hodari

The world's appetite for crude oil won't reach its apex for another two decades, the Organization of the Petroleum Exporting Countries said Thursday, offering a much more optimistic view of the world's post-coronavirus demand for oil than many other forecasts.

In its annual report on oil's long-term future, OPEC forecast that global oil demand will keep rising until around 2040, when it will plateau at 109.3 million barrels a day -- some 10% above its 2019 level.

The annual report from the Vienna-based cartel offers a far brighter future for the supply and demand of oil and gas than the one offered last month by oil giant BP PLC. The British company is planning to invest heavily in renewable energy over the coming years. Oil demand may already have peaked, it said in September.

Still, OPEC said demand for crude among the relatively wealthy nations of the Organization for Economic Cooperation and Development won't grow any further and is forecast to drop 27% from 2019 levels in the period to 2045. Speaking at a virtual press conference, OPEC Secretary-General Mohammed Barkindo described "an evolutionary shift in demand from developed to developing countries."

The cartel's global 2040 demand figure was more than one million barrels a day below last year's forecast of 110.6 million barrels a day. The coronavirus outbreak "resulted in the sharpest downturn in energy and oil demand in living memory" and led to "the most severe economic downturn since the Great Depression," the report said.

Lockdowns and travel restrictions linked to the pandemic's restrictions resulted in oil market convulsions this year. Forecasters such as OPEC have found it increasingly difficult to predict the short-term future for the amount of energy the world will need this year and next. It will be 2022 before oil demand returns to its pre-coronavirus level, OPEC said.

Oil prices climbed Thursday, Brent crude oil, the global benchmark, rose by 1.9% to $42.79 a barrel. West Texas Intermediate futures, the U.S. benchmark, rose 1.8% to $40.67 a barrel. Prices swung sharply this week on a combination of headlines about U.S. politics, the potential effect of Hurricane Delta, and inventory data.

While global oil demand won't peak for another 20 years, OPEC expects the need for fossil fuels in some regions and sectors to begin shrinking before then. OECD demand and oil consumption in the global electricity-generation sector have already reached their maximum, for example.

However, any early peaks will be outweighed by resilient and growing global requirement for oil in the long term. In 25 years' time, non-OECD oil demand will have increased 43% from last year's levels, partly driven by economic booms in China and India.

With many countries seeking to industrialize and expand -- OPEC expects the global population to hit 9.5 billion by 2045 -- demand for fossil fuels in the global transport and industrial sectors will also continue to grow through 2045.

To meet that demand, oil supply will also rise, climbing around 11% from 2019 levels before peaking in 2040 at around 110 million barrels of oil a day, OPEC said. The cartel also gave its 2045 supply a rosy outlook, putting it almost a third higher than its level last year. It expects U.S. supply to peak around the end of this decade.

That means the outlook for renewable energy may not be as upbeat as some energy majors hope. If the energy transition continues at its current pace, non-fossil fuels such as nuclear, biomass, and renewables such as wind and solar will make up 27.5% of global energy demand by 2045, up from 18.7% in 2019, OPEC said. The cartel added that it expects an increase in energy-related carbon emissions from 34.4 gigatons in 2019 to 36.9 gigatons in 2040.

Some of that increase will come at the expense of oil, but demand for natural gas won't yet have peaked by 2045. Growing urbanization and its competitive economics will make gas the fastest-growing fossil fuel in the coming decades.

If global leaders and businesses accelerate their deployment of renewables, implement a global carbon price, encourage the uptake of electric vehicles, and tighten pollution regulations, global emissions could fall by 54% by 2045 compared with their current trajectory, OPEC said. That, though, would sting oil prices and the economic growth of energy-exporting countries, said the oil cartel.

--Pat Minczeski contributed to this article.

(END) Dow Jones Newswires; October 08, 2020 08:51 ET (12:51 GMT); Copyright (c) 2020 Dow Jones & Company, Inc.

By David Hodari

The world's appetite for crude oil won't reach its apex for another two decades, the Organization of the Petroleum Exporting Countries said Thursday, offering a much more optimistic view of the world's post-coronavirus demand for oil than many other forecasts.

In its annual report on oil's long-term future, OPEC forecast that global oil demand will keep rising until around 2040, when it will plateau at 109.3 million barrels a day -- some 10% above its 2019 level.

The annual report from the Vienna-based cartel offers a far brighter future for the supply and demand of oil and gas than the one offered last month by oil giant BP PLC. The British company is planning to invest heavily in renewable energy over the coming years. Oil demand may already have peaked, it said in September.

Still, OPEC said demand for crude among the relatively wealthy nations of the Organization for Economic Cooperation and Development won't grow any further and is forecast to drop 27% from 2019 levels in the period to 2045. Speaking at a virtual press conference, OPEC Secretary-General Mohammed Barkindo described "an evolutionary shift in demand from developed to developing countries."

The cartel's global 2040 demand figure was more than one million barrels a day below last year's forecast of 110.6 million barrels a day. The coronavirus outbreak "resulted in the sharpest downturn in energy and oil demand in living memory" and led to "the most severe economic downturn since the Great Depression," the report said.

Lockdowns and travel restrictions linked to the pandemic's restrictions resulted in oil market convulsions this year. Forecasters such as OPEC have found it increasingly difficult to predict the short-term future for the amount of energy the world will need this year and next. It will be 2022 before oil demand returns to its pre-coronavirus level, OPEC said.

Oil prices climbed Thursday, Brent crude oil, the global benchmark, rose by 1.9% to $42.79 a barrel. West Texas Intermediate futures, the U.S. benchmark, rose 1.8% to $40.67 a barrel. Prices swung sharply this week on a combination of headlines about U.S. politics, the potential effect of Hurricane Delta, and inventory data.

While global oil demand won't peak for another 20 years, OPEC expects the need for fossil fuels in some regions and sectors to begin shrinking before then. OECD demand and oil consumption in the global electricity-generation sector have already reached their maximum, for example.

However, any early peaks will be outweighed by resilient and growing global requirement for oil in the long term. In 25 years' time, non-OECD oil demand will have increased 43% from last year's levels, partly driven by economic booms in China and India.

With many countries seeking to industrialize and expand -- OPEC expects the global population to hit 9.5 billion by 2045 -- demand for fossil fuels in the global transport and industrial sectors will also continue to grow through 2045.

To meet that demand, oil supply will also rise, climbing around 11% from 2019 levels before peaking in 2040 at around 110 million barrels of oil a day, OPEC said. The cartel also gave its 2045 supply a rosy outlook, putting it almost a third higher than its level last year. It expects U.S. supply to peak around the end of this decade.

That means the outlook for renewable energy may not be as upbeat as some energy majors hope. If the energy transition continues at its current pace, non-fossil fuels such as nuclear, biomass, and renewables such as wind and solar will make up 27.5% of global energy demand by 2045, up from 18.7% in 2019, OPEC said. The cartel added that it expects an increase in energy-related carbon emissions from 34.4 gigatons in 2019 to 36.9 gigatons in 2040.

Some of that increase will come at the expense of oil, but demand for natural gas won't yet have peaked by 2045. Growing urbanization and its competitive economics will make gas the fastest-growing fossil fuel in the coming decades.

If global leaders and businesses accelerate their deployment of renewables, implement a global carbon price, encourage the uptake of electric vehicles, and tighten pollution regulations, global emissions could fall by 54% by 2045 compared with their current trajectory, OPEC said. That, though, would sting oil prices and the economic growth of energy-exporting countries, said the oil cartel.

--Pat Minczeski contributed to this article.

(END) Dow Jones Newswires; October 08, 2020 08:51 ET (12:51 GMT); Copyright (c) 2020 Dow Jones & Company, Inc.

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Nachtrag:

GoGold produces 605,287 AgEq ounces in Sept. 30 quarter

2020-10-07 07:31 ET - News Release

Mr. Brad Langille reports

GOGOLD REPORTS RECORD QUARTER OF 605K AGEQ OZ AND RECORD YEAR 2.3M AGEQ OZ PRODUCTION

GoGold Resources Inc. has provided record production for the quarter ending Sept. 30, 2020, of 605,287 silver equivalent ounces, consisting of 300,740 silver ounces, 3,414 gold ounces and 128 tonnes of copper. Annual production for the company's fiscal year, which ended on Sept. 30, 2020, was 2.3 million silver equivalent ounces, an increase of 29 per cent over 2019 production of 1.8 million.

"Parral continues to perform extremely well for us, with record production in both the quarter and the year. We produced 2.3 million silver equivalent ounces in our fiscal year ending in September, which is an increase of 29 per cent compared to the prior year. Parral generated revenue in excess of $13-million (U.S.) and over $5-million (U.S.) of free cash flow in the quarter, which is covering the total general and administrative and our Los Ricos exploration costs," said Brad Langille, president and chief executive officer. "The company has in excess of $52-million (U.S.) cash in the bank, no debt, a substantial published mineral resource estimate at Los Ricos South and is enjoying exceptional exploration success at Los Ricos North. We will be expanding on our drilling at Los Ricos North to have one of the most active exploration projects in Mexico and plan on completion of the preliminary economic assessment at Los Ricos South before the end of 2020. These are truly exceptional times for GoGold."

........

https://www.stockwatch.com/News/Item?bid=Z-C:GGD-2972224&symbol=GGD®ion=C

GoGold produces 605,287 AgEq ounces in Sept. 30 quarter

2020-10-07 07:31 ET - News Release

Mr. Brad Langille reports

GOGOLD REPORTS RECORD QUARTER OF 605K AGEQ OZ AND RECORD YEAR 2.3M AGEQ OZ PRODUCTION

GoGold Resources Inc. has provided record production for the quarter ending Sept. 30, 2020, of 605,287 silver equivalent ounces, consisting of 300,740 silver ounces, 3,414 gold ounces and 128 tonnes of copper. Annual production for the company's fiscal year, which ended on Sept. 30, 2020, was 2.3 million silver equivalent ounces, an increase of 29 per cent over 2019 production of 1.8 million.

"Parral continues to perform extremely well for us, with record production in both the quarter and the year. We produced 2.3 million silver equivalent ounces in our fiscal year ending in September, which is an increase of 29 per cent compared to the prior year. Parral generated revenue in excess of $13-million (U.S.) and over $5-million (U.S.) of free cash flow in the quarter, which is covering the total general and administrative and our Los Ricos exploration costs," said Brad Langille, president and chief executive officer. "The company has in excess of $52-million (U.S.) cash in the bank, no debt, a substantial published mineral resource estimate at Los Ricos South and is enjoying exceptional exploration success at Los Ricos North. We will be expanding on our drilling at Los Ricos North to have one of the most active exploration projects in Mexico and plan on completion of the preliminary economic assessment at Los Ricos South before the end of 2020. These are truly exceptional times for GoGold."

........

https://www.stockwatch.com/News/Item?bid=Z-C:GGD-2972224&symbol=GGD®ion=C

2 Nieten und 1 Volltreffer

Größte Pos ist inzwischen Vangold, wird bis kommendes Jahr gehalten

Größte Pos ist inzwischen Vangold, wird bis kommendes Jahr gehalten

[url=https://peketec.de/trading/viewtopic.php?p=1973853#1973853 schrieb:PerseusLtd schrieb am 25.05.2020, 16:27 Uhr[/url]"]Hab mir die letzten Tage/Wochen paar Tradingpositionen geholt -> VGDL , LAD und JUGR

Bei LAD soll Hole 2 diese Woche kommen !?

VGDL in 2-3 Wochen mit News zum 1000t Bulk Sample

JUGR mit akt. 2 Mio Cash und per Juli mit neuem Bohrprogramm

Habe ich leider heute Nachmittag verpasst wegen Gartenarbeit

Sehr geehrte Damen und Herren,

nachfolgend ein kurzes Update, das für den Rutil-Sektor und auch unsere SOVEREIGN METALS (A0LEG3, ASX: SVM) sehr wichtig ist!

Wie ich aus gut unterrichteten Kreisen soeben erfahren habe, gab es vor einigen Stunden ein riesiges Feuer in der Mineral-Sand-Separationsanlage von SIERRA RUTILE in Sierra Leone, der größten Rutil-Mine der Welt.

Wie Sie wissen, gehört diese Mine dem australischen Konzern ILUKA (ASX: ILU) und sie gehört zu den größten Rutil-Produzenten der Welt.

Ich habe ein Video gesehen und es sah übel aus. Große Teile der Anlage brannten lichterloh.

Einschätzung:

SIERRA RUTILE produziert einen erheblichen Anteil der Weltproduktion an Rutil und dieses Angebot sollte, je nach Stärke der Schäden, vermutlich für mehrere Monate komplett wegfallen.

Dies geschieht in einem Marktumfeld, in dem natürliches Rutil bereits im Angebotsdefizit ist. Die Preise können unter diesem Gesichtspunkt nur nach oben gehen.

Mögliche Profiteure könnten andere Mineralsandproduzenten sein wie z.B. die australische BASE RESOURCES (ASX: BSE, A0Q7M2), unser Depotwert IMAGE RESOURCES (ASX: IMA. 637106) oder natürlich auch SOVEREIGN METALS (ASX: SVM, A0LEG3).

Noch ist nicht klar, wie stark das Feuer die Anlage beschädigt hat, doch es sah nicht nach einem kleinen Brand aus. Ich rechne mit einer monatelangen Produktionsunterbrechung.

Fazit:

Diese Info ist sozusagen brandaktuell und ILUKA hat dies noch nicht gemeldet. Mögliche Chancen sind genannt. Profi-Anleger können auch über einen Short auf ILUKA spekulieren, soweit die Möglichkeit vorhanden ist.

Sehr geehrte Damen und Herren,

nachfolgend ein kurzes Update, das für den Rutil-Sektor und auch unsere SOVEREIGN METALS (A0LEG3, ASX: SVM) sehr wichtig ist!

Wie ich aus gut unterrichteten Kreisen soeben erfahren habe, gab es vor einigen Stunden ein riesiges Feuer in der Mineral-Sand-Separationsanlage von SIERRA RUTILE in Sierra Leone, der größten Rutil-Mine der Welt.

Wie Sie wissen, gehört diese Mine dem australischen Konzern ILUKA (ASX: ILU) und sie gehört zu den größten Rutil-Produzenten der Welt.

Ich habe ein Video gesehen und es sah übel aus. Große Teile der Anlage brannten lichterloh.

Einschätzung:

SIERRA RUTILE produziert einen erheblichen Anteil der Weltproduktion an Rutil und dieses Angebot sollte, je nach Stärke der Schäden, vermutlich für mehrere Monate komplett wegfallen.

Dies geschieht in einem Marktumfeld, in dem natürliches Rutil bereits im Angebotsdefizit ist. Die Preise können unter diesem Gesichtspunkt nur nach oben gehen.

Mögliche Profiteure könnten andere Mineralsandproduzenten sein wie z.B. die australische BASE RESOURCES (ASX: BSE, A0Q7M2), unser Depotwert IMAGE RESOURCES (ASX: IMA. 637106) oder natürlich auch SOVEREIGN METALS (ASX: SVM, A0LEG3).

Noch ist nicht klar, wie stark das Feuer die Anlage beschädigt hat, doch es sah nicht nach einem kleinen Brand aus. Ich rechne mit einer monatelangen Produktionsunterbrechung.

Fazit:

Diese Info ist sozusagen brandaktuell und ILUKA hat dies noch nicht gemeldet. Mögliche Chancen sind genannt. Profi-Anleger können auch über einen Short auf ILUKA spekulieren, soweit die Möglichkeit vorhanden ist.

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Habe gestern erste Posi FUSE.V aufgebaut.

Nach dem Abverkauf von 0.07 CAD nun mit Bodenbildung bei 0.03CAD.

Gutes Bid auf 0.025 CAD. Ausführungen dauern ewig, aber Potential ist da.

Nach dem Abverkauf von 0.07 CAD nun mit Bodenbildung bei 0.03CAD.

Gutes Bid auf 0.025 CAD. Ausführungen dauern ewig, aber Potential ist da.