App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

herzlichen Glückwunsch unserem Mojitolix-Majestix!!!

heute halten wir dem Schild ein Stück höher und du brauchst keine Angst haben - der Himmel wird Dir schon nicht auf den Kopf fallen.......

ich hol derweil meine Harfe und zupfe auf dem flotten Darm für Dich ein kurzes Geburtstagslied mit übersichtlichen 65 Strophen......im Anschluß Wildschwein und ein paar Römer!

Besser kann so ein Geburtstag doch nicht sein - im Kreis derer die einen einfach mögen

Alles Jute!

heute halten wir dem Schild ein Stück höher und du brauchst keine Angst haben - der Himmel wird Dir schon nicht auf den Kopf fallen.......

ich hol derweil meine Harfe und zupfe auf dem flotten Darm für Dich ein kurzes Geburtstagslied mit übersichtlichen 65 Strophen......im Anschluß Wildschwein und ein paar Römer!

Besser kann so ein Geburtstag doch nicht sein - im Kreis derer die einen einfach mögen

Alles Jute!

glückwunsch zum geburtstag

Bei Minera Alamos gab es gestern einen dicken Cross mit 40 Mio Aktien über ATS. Somit hat der Verkäufer der letzten Monate, Osisko Development, seine über 70 Mio. Stücke endlich verkauft, womit der "Kursbremser" weg ist. Dies dürfte den Kurs beflügeln. Aktuell um 55 Cents, ich versuche, zwischen 50 und 55 Cents weiter hinzu zu kaufen. Große Unterstützung im Bereich 50 Cents sowohl vom Chartbild als auch Orderbuch, und jetzt durch den Cross vorhanden.

Herzlichen Glückwunsch auch von mir!

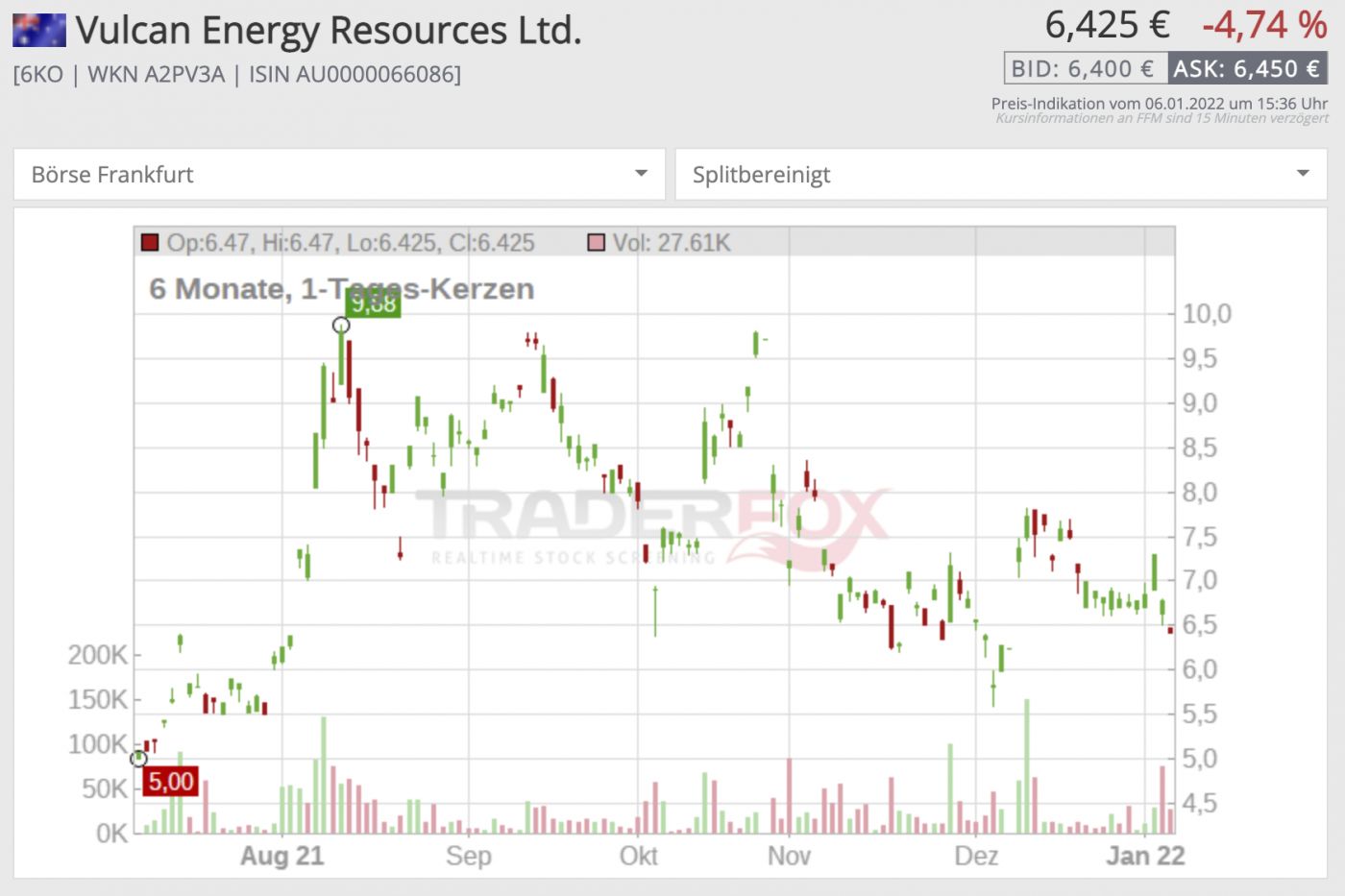

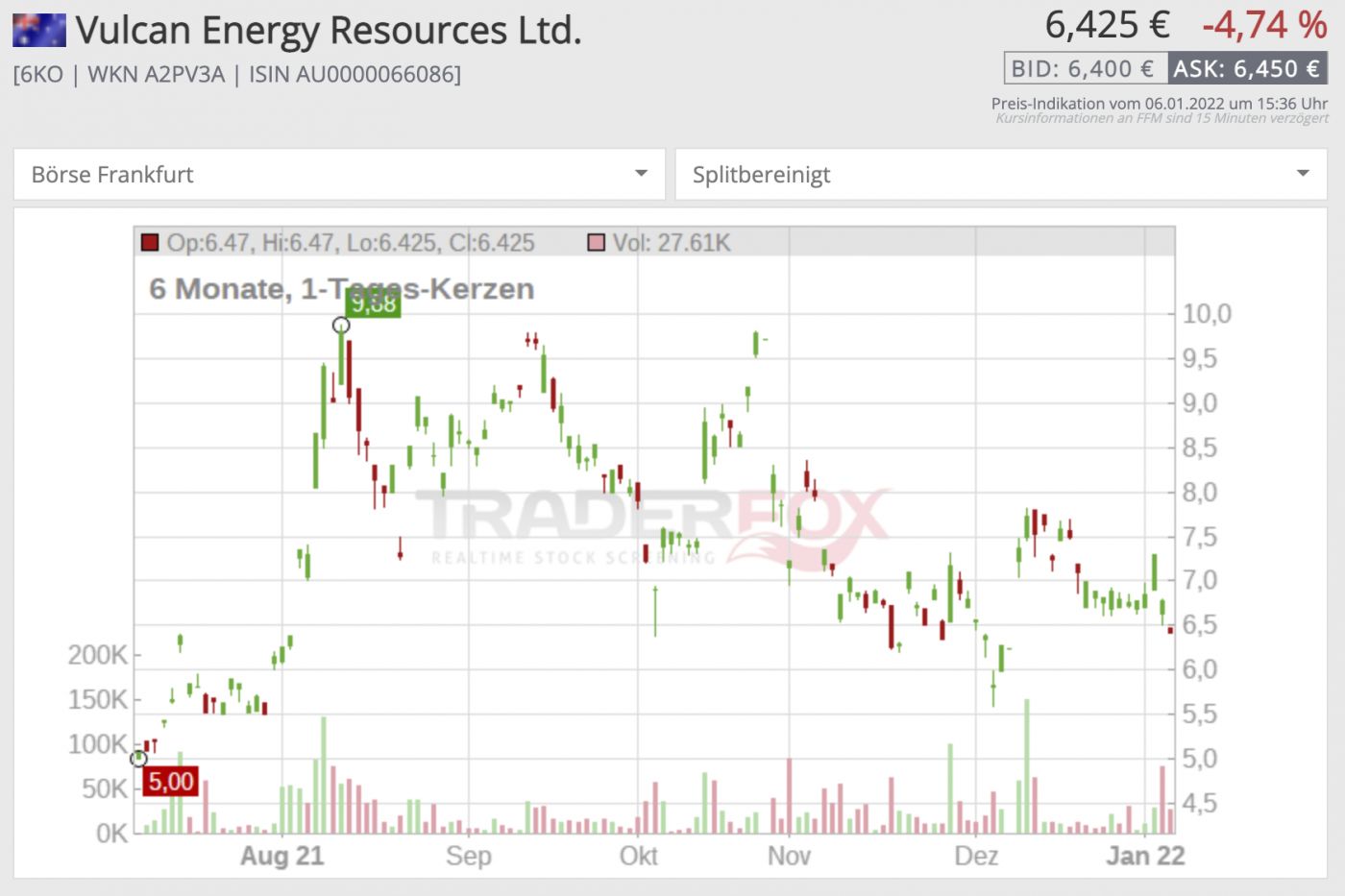

6ko

https://v-er.eu/de/zero-carbon-lithium-de/?fbclid=IwAR3J5BvDQE9-_tf3CceyuC4TCAZBcabrsGMELr97oBjMUFwcay913sc74gk

Langfristig aber nachhaltig! Vulcan Energy Resources aus Deutschland (Australien)+ in Deutschland!

Bei unserem innovativen Verfahren nutzen wir die heißen Thermalwässer des Oberrheingrabens, worin große Mengen an Lithium bereits natürlich gelöst sind. Durch die Stromproduktion aus erneuerbarer geothermischer Energie ist der gesamte Prozess unabhängig von fossilen Brennstoffen und verbraucht nur wenig Wasser und Fläche.

https://www.finanznachrichten.de/nachrichten-2022-01/54898504-vulcan-energy-mit-neuen-lizenzen-deutscher-lithium-player-laeutet-naechste-phase-ein-124.htm

https://www.fool.de/2022/01/06/vulcan-energy-aktie-2022-ist-das-jahr-der-entscheidung-fuer-die-deutsche-lithium-perle/?rss_use_excerpt=1

https://www.spiegel.de/wirtschaft/unternehmen/vulcan-energy-kauft-deutsches-geothermiekraftwerk-fuer-lithium-produktion-a-0641a3aa-ca59-4af0-ab74-0ed9667e48cd

https://v-er.eu/de/zero-carbon-lithium-de/?fbclid=IwAR3J5BvDQE9-_tf3CceyuC4TCAZBcabrsGMELr97oBjMUFwcay913sc74gk

Langfristig aber nachhaltig! Vulcan Energy Resources aus Deutschland (Australien)+ in Deutschland!

Bei unserem innovativen Verfahren nutzen wir die heißen Thermalwässer des Oberrheingrabens, worin große Mengen an Lithium bereits natürlich gelöst sind. Durch die Stromproduktion aus erneuerbarer geothermischer Energie ist der gesamte Prozess unabhängig von fossilen Brennstoffen und verbraucht nur wenig Wasser und Fläche.

https://www.finanznachrichten.de/nachrichten-2022-01/54898504-vulcan-energy-mit-neuen-lizenzen-deutscher-lithium-player-laeutet-naechste-phase-ein-124.htm

https://www.fool.de/2022/01/06/vulcan-energy-aktie-2022-ist-das-jahr-der-entscheidung-fuer-die-deutsche-lithium-perle/?rss_use_excerpt=1

https://www.spiegel.de/wirtschaft/unternehmen/vulcan-energy-kauft-deutsches-geothermiekraftwerk-fuer-lithium-produktion-a-0641a3aa-ca59-4af0-ab74-0ed9667e48cd

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Harfang and LaSalle announce merger and concurrent financing with a strategic investment from Monarch Mining Corporation

2022-01-06 12:17 ET - News Release

MONTRÉAL and VANCOUVER, British Columbia, Jan. 06, 2022 (GLOBE NEWSWIRE) -- Harfang Exploration Inc. (“Harfang”) (TSX.V: HAR) and LaSalle Exploration Corp. (“LaSalle”) (TSX-V: LSX) are pleased to announce that they have entered into a definitive Arrangement Agreement dated January 5, 2022 (the “Agreement”) pursuant to which Harfang will acquire all of the issued and outstanding shares of LaSalle (the “LaSalle Shares”). The transaction will be carried out by way of a plan of arrangement under the Business Corporations Act (British Columbia) (the “Arrangement”).

Under the terms of the Arrangement, LaSalle shareholders will receive, on a pre-consolidation basis (further details on the proposed Harfang share consolidation below), 0.3908 of a Harfang common share (the “Harfang Shares”) for each LaSalle Share. The exchange ratio implies a consideration of $0.0968 per LaSalle Share based on the 30-day volume weighted average price (“VWAP”) of the Harfang Shares and the LaSalle Shares on the TSX Venture Exchange (“TSX-V”) on December 22, 2021. Upon completion of the Arrangement, it is expected that the shareholders of LaSalle will hold approximately 35.5% of Harfang’s issued and outstanding shares (prior to the concurrent Offering).

The LaSalle management and board, representing 5.1% of the LaSalle Shares, are supportive of the transaction and have entered into support agreements with Harfang to vote their LaSalle Shares in favour of the Arrangement. LaSalle’s CEO, Ian Campbell, and VP Corporate Development, Ron Stewart will continue their positions to lead the combined company, which will deliver LaSalle shareholders an exceptional geological and financial team in a much stronger exploration vehicle. See details below.

Dan Innes, Chairman of LaSalle commented, “This transaction represents a compelling opportunity to accelerate the growth strategy of LaSalle in all aspects from exploration, access to capital and additional accretive transactions. It delivers to both LaSalle and Harfang shareholders the platform to create an industry leader guided by an experienced management team, an exceptionally strong board, a highly prospective portfolio of exploration assets, the financial resources and access to capital to advance our projects and realize their full potential.”

André Gaumond, Chairman of Harfang added, “We are delighted to be entering into a transaction between LaSalle and Harfang. It is an excellent strategic and cultural fit for both companies, creating a far stronger platform that has already been embraced by the Quebec institutional funds. The new Harfang will be larger, more relevant and benefit from the significant synergies unlocked by the transaction.”

Transaction Highlights

The transaction will consolidate the contiguous gold exploration assets of Lasalle’s Radisson and Harfang’s Serpent properties, James Bay Region, Québec, both of which will benefit from operational efficiency, synergies and a combined exploration strategy as the projects advance, along with an exploration portfolio of high quality gold assets in Québec and Ontario.

The integration of the Radisson property will add 6 km of strike of potential mineralization to the Serpent gold bearing structures, further solidifying Harfang as the largest mineral claim holder in the region totalling 508.4 km2. Drill-ready targets within the consolidated project portfolio offer compelling value creation potential to shareholders of the combined company.

....

https://www.stockwatch.com/News/Item/Z-C!HAR-3191750/C/HAR

2022-01-06 12:17 ET - News Release

MONTRÉAL and VANCOUVER, British Columbia, Jan. 06, 2022 (GLOBE NEWSWIRE) -- Harfang Exploration Inc. (“Harfang”) (TSX.V: HAR) and LaSalle Exploration Corp. (“LaSalle”) (TSX-V: LSX) are pleased to announce that they have entered into a definitive Arrangement Agreement dated January 5, 2022 (the “Agreement”) pursuant to which Harfang will acquire all of the issued and outstanding shares of LaSalle (the “LaSalle Shares”). The transaction will be carried out by way of a plan of arrangement under the Business Corporations Act (British Columbia) (the “Arrangement”).

Under the terms of the Arrangement, LaSalle shareholders will receive, on a pre-consolidation basis (further details on the proposed Harfang share consolidation below), 0.3908 of a Harfang common share (the “Harfang Shares”) for each LaSalle Share. The exchange ratio implies a consideration of $0.0968 per LaSalle Share based on the 30-day volume weighted average price (“VWAP”) of the Harfang Shares and the LaSalle Shares on the TSX Venture Exchange (“TSX-V”) on December 22, 2021. Upon completion of the Arrangement, it is expected that the shareholders of LaSalle will hold approximately 35.5% of Harfang’s issued and outstanding shares (prior to the concurrent Offering).

The LaSalle management and board, representing 5.1% of the LaSalle Shares, are supportive of the transaction and have entered into support agreements with Harfang to vote their LaSalle Shares in favour of the Arrangement. LaSalle’s CEO, Ian Campbell, and VP Corporate Development, Ron Stewart will continue their positions to lead the combined company, which will deliver LaSalle shareholders an exceptional geological and financial team in a much stronger exploration vehicle. See details below.

Dan Innes, Chairman of LaSalle commented, “This transaction represents a compelling opportunity to accelerate the growth strategy of LaSalle in all aspects from exploration, access to capital and additional accretive transactions. It delivers to both LaSalle and Harfang shareholders the platform to create an industry leader guided by an experienced management team, an exceptionally strong board, a highly prospective portfolio of exploration assets, the financial resources and access to capital to advance our projects and realize their full potential.”

André Gaumond, Chairman of Harfang added, “We are delighted to be entering into a transaction between LaSalle and Harfang. It is an excellent strategic and cultural fit for both companies, creating a far stronger platform that has already been embraced by the Quebec institutional funds. The new Harfang will be larger, more relevant and benefit from the significant synergies unlocked by the transaction.”

Transaction Highlights

The transaction will consolidate the contiguous gold exploration assets of Lasalle’s Radisson and Harfang’s Serpent properties, James Bay Region, Québec, both of which will benefit from operational efficiency, synergies and a combined exploration strategy as the projects advance, along with an exploration portfolio of high quality gold assets in Québec and Ontario.

The integration of the Radisson property will add 6 km of strike of potential mineralization to the Serpent gold bearing structures, further solidifying Harfang as the largest mineral claim holder in the region totalling 508.4 km2. Drill-ready targets within the consolidated project portfolio offer compelling value creation potential to shareholders of the combined company.

....

https://www.stockwatch.com/News/Item/Z-C!HAR-3191750/C/HAR

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

MMY....soll noch das 0,095 CAN$ Gap geschlossen werden...

PRECIOUS-Gold kept in a narrow range by strong U.S. yields

By Seher Dareen

Jan 7 (Reuters) - Gold prices inched up on the back of a weak dollar on Friday, but elevated U.S. Treasury yields set the metal on track for its biggest weekly decline in over a month as traders braced for sooner-than-anticipated U.S. rate hikes.

Spot gold XAU= rose 0.2% to $1,792.13 per ounce by 1028 GMT, trading in a narrow $7 range, and was on course for a weekly drop of about 2%, the biggest since the week of Nov. 26. U.S. gold futures GCv1 rose 0.2% to $1,792.50. ...

https://www.nasdaq.com/articles/precious-gold-kept-in-a-narrow-range-by-strong-u.s.-yields

By Seher Dareen

Jan 7 (Reuters) - Gold prices inched up on the back of a weak dollar on Friday, but elevated U.S. Treasury yields set the metal on track for its biggest weekly decline in over a month as traders braced for sooner-than-anticipated U.S. rate hikes.

Spot gold XAU= rose 0.2% to $1,792.13 per ounce by 1028 GMT, trading in a narrow $7 range, and was on course for a weekly drop of about 2%, the biggest since the week of Nov. 26. U.S. gold futures GCv1 rose 0.2% to $1,792.50. ...

https://www.nasdaq.com/articles/precious-gold-kept-in-a-narrow-range-by-strong-u.s.-yields

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Westhaven releases NI 43-101 estimate on Shovelnose

2022-01-10 07:36 ET - News Release

Mr. Gareth Thomas reports

WESTHAVEN GOLD COMPLETES INITIAL MINERAL RESOURCE ESTIMATE OF 841,000 INDICATED OUNCES AT 2.47 G/T GOLD EQUIVALENT AND 277,000 INFERRED OUNCES AT 0.94 G/T GOLD EQUIVALENT ON THE SHOVELNOSE GOLD PROPERTY

Westhaven Gold Corp. has released the results from its mineral resource estimate (MRE) at its 100-per-cent-owned 17,623-hectare Shovelnose gold property. The Shovelnose gold property is located within the prospective Spences Bridge gold belt (SBGB), which borders the Coquihalla Highway 30 kilometres south of the city of Merritt, B.C.

The initial open-pit-constrained MRE reported in the associated table is of the South zone and was completed by P&E Mining Consultants Inc., based on a total of 145 surface drill holes (56,491 metres), 25,920 drill core analyses, 3,302 bulk density measurements and preliminary metallurgical testwork.

Shovelnose South zone MRE highlights:

791,000 ounces of gold and 3,894,000 ounces of silver indicated;

263,000 ounces of gold and 1,023,000 ounces of silver inferred;

75 per cent of the MRE in the higher confidence indicated classification: 10.60 million tonnes at 2.47 grams per tonne for 841,000 gold equivalent (AuEq) ounces;

Average AuEq grade of indicated MRE is seven times higher than the cut-off grade, demonstrating excellent potential for future economic extraction;

Indicated mineralization is largely associated with the individual vein zones, whereas the inferred is associated with the broader veinlet domain;

This MRE is based on potential open-pit extraction an MRE based on potential underground mining is in preparation and will be reported in the coming months;

South zone is just one of the many known mineralized zones on the Shovelnose gold property;

Shovelnose is situated off a major highway, near grid power, rail and large producing mines, and within easy commuting distance from the city of Merritt.

Westhaven chief executive officer and president Gareth Thomas noted: "This is the first mineral resource estimate on the Shovelnose gold property, and we are pleased to report a starting inventory of over a million ounces of gold from the first of multiple mineralized zones. It is important to highlight that 75 per cent of this mineral resource is in the indicated classification and grades 2.47 g/t AuEq. Our technical team sees significant mineral resource expansion potential along this key trend. The 2022 expansion and exploration drill program will begin shortly, focusing on the FMN zone, where high-grade gold mineralization (15.97 metres of 9.15 g/t Au) was intersected in drilling last year. Targeting new discoveries on undrilled exploration targets within this large, underexplored property will also remain a key focus going forward."

....

https://www.stockwatch.com/News/Item/Z-C!WHN-3192346/C/WHN

2022-01-10 07:36 ET - News Release

Mr. Gareth Thomas reports

WESTHAVEN GOLD COMPLETES INITIAL MINERAL RESOURCE ESTIMATE OF 841,000 INDICATED OUNCES AT 2.47 G/T GOLD EQUIVALENT AND 277,000 INFERRED OUNCES AT 0.94 G/T GOLD EQUIVALENT ON THE SHOVELNOSE GOLD PROPERTY

Westhaven Gold Corp. has released the results from its mineral resource estimate (MRE) at its 100-per-cent-owned 17,623-hectare Shovelnose gold property. The Shovelnose gold property is located within the prospective Spences Bridge gold belt (SBGB), which borders the Coquihalla Highway 30 kilometres south of the city of Merritt, B.C.

The initial open-pit-constrained MRE reported in the associated table is of the South zone and was completed by P&E Mining Consultants Inc., based on a total of 145 surface drill holes (56,491 metres), 25,920 drill core analyses, 3,302 bulk density measurements and preliminary metallurgical testwork.

Shovelnose South zone MRE highlights:

791,000 ounces of gold and 3,894,000 ounces of silver indicated;

263,000 ounces of gold and 1,023,000 ounces of silver inferred;

75 per cent of the MRE in the higher confidence indicated classification: 10.60 million tonnes at 2.47 grams per tonne for 841,000 gold equivalent (AuEq) ounces;

Average AuEq grade of indicated MRE is seven times higher than the cut-off grade, demonstrating excellent potential for future economic extraction;

Indicated mineralization is largely associated with the individual vein zones, whereas the inferred is associated with the broader veinlet domain;

This MRE is based on potential open-pit extraction an MRE based on potential underground mining is in preparation and will be reported in the coming months;

South zone is just one of the many known mineralized zones on the Shovelnose gold property;

Shovelnose is situated off a major highway, near grid power, rail and large producing mines, and within easy commuting distance from the city of Merritt.

Westhaven chief executive officer and president Gareth Thomas noted: "This is the first mineral resource estimate on the Shovelnose gold property, and we are pleased to report a starting inventory of over a million ounces of gold from the first of multiple mineralized zones. It is important to highlight that 75 per cent of this mineral resource is in the indicated classification and grades 2.47 g/t AuEq. Our technical team sees significant mineral resource expansion potential along this key trend. The 2022 expansion and exploration drill program will begin shortly, focusing on the FMN zone, where high-grade gold mineralization (15.97 metres of 9.15 g/t Au) was intersected in drilling last year. Targeting new discoveries on undrilled exploration targets within this large, underexplored property will also remain a key focus going forward."

....

https://www.stockwatch.com/News/Item/Z-C!WHN-3192346/C/WHN

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Arizona Sonoran adds Nikolakakis as CFO, VP, finance

2022-01-10 09:48 ET - News Release

Mr. George Ogilvie reports

ARIZONA SONORAN APPOINTS NICHOLAS NIKOLAKAKIS AS VP FINANCE & CHIEF FINANCIAL OFFICER

Arizona Sonoran Copper Company Inc. has appointed Toronto-based Nicholas Nikolakakis as vice-president of finance and chief financial officer, effective today, and reporting directly to the chief executive officer. Mr. Nikolakakis' capital markets and financing expertise will prove invaluable as ASCU transitions the Cactus Project through the various technical reports and ultimately into a construction and development decision with an ensuing Project Financing. Rodney Prokop, the former CFO, will remain with the Company for a short interim period to ensure a smooth transition and thereafter as a consultant on an "as needed basis."

George Ogilvie, ASCU President and CEO commented, "I'm delighted Nick will be joining me at Arizonan Sonoran Copper Company and will be a key member of the senior management team. We worked well together at Battle North Gold where Nick raised the Company in excess of $200 million over a 4-year period including the Project Financing before it was acquired in the summer of last year. Nick brings a wealth of Corporate Finance and Capital Markets experience to the Company that will be invaluable as we look to grow the Company and build the Cactus Project into a producing Mine in the near term.

He continued, "On behalf of myself and the entire team at Arizona Sonoran, we would like to thank Rod for his contributions to the Company's growth as a private company and to its transition to the public markets. We are also grateful for his commitment to a successful transition of the CFO role."

Mr. Nikolakakis has over 27 years of corporate finance, accounting and senior management experience within the mining sector. Over his career, he has raised over US$2 billion in numerous mining transactions. Most recently he was the Chief Financial Officer for Battle North Corporation (acquired by Evolution Mining in 2021). He was also the former Chief Financial Officer of Rainy River Resources. Prior to Rainy River, Nick was the Vice President of Corporate Finance at Barrick Gold Corporation, where he led a US$1 billion project financing for Barrick's Pueblo Viejo mine in the Dominican Republic and successfully negotiated a US$1.5 billion corporate revolving credit facility. Other previously held positions by Mr. Nikolakakis include, Vice President and Chief Financial Officer of Placer Dome Canada, and Treasurer at North American Palladium Ltd.

Mr. Nikolakakis holds an Applied Science degree in Geological Engineering from the University of Waterloo and a Master of Business Administration from the University of Western Ontario's Ivey School of Business.

About Arizona Sonoran Copper Company

ASCU's objective is to become a mid-tier copper producer in the near term with low operating costs, develop the Cactus Project that could generate robust returns for investors, and provide a long term sustainable and responsible operation for the community and all stakeholders. The Company's principal asset is a 100% interest in the Cactus Project (former ASARCO, Sacaton mine) which is situated on private land in an infrastructure-rich area of Arizona. The Company is led by an executive management team and Board which have a long-standing track record of successful project delivery in North America complemented by global capital markets expertise.

https://www.stockwatch.com/News/Item/Z-C!ASCU-3192484/C/ASCU

2022-01-10 09:48 ET - News Release

Mr. George Ogilvie reports

ARIZONA SONORAN APPOINTS NICHOLAS NIKOLAKAKIS AS VP FINANCE & CHIEF FINANCIAL OFFICER

Arizona Sonoran Copper Company Inc. has appointed Toronto-based Nicholas Nikolakakis as vice-president of finance and chief financial officer, effective today, and reporting directly to the chief executive officer. Mr. Nikolakakis' capital markets and financing expertise will prove invaluable as ASCU transitions the Cactus Project through the various technical reports and ultimately into a construction and development decision with an ensuing Project Financing. Rodney Prokop, the former CFO, will remain with the Company for a short interim period to ensure a smooth transition and thereafter as a consultant on an "as needed basis."

George Ogilvie, ASCU President and CEO commented, "I'm delighted Nick will be joining me at Arizonan Sonoran Copper Company and will be a key member of the senior management team. We worked well together at Battle North Gold where Nick raised the Company in excess of $200 million over a 4-year period including the Project Financing before it was acquired in the summer of last year. Nick brings a wealth of Corporate Finance and Capital Markets experience to the Company that will be invaluable as we look to grow the Company and build the Cactus Project into a producing Mine in the near term.

He continued, "On behalf of myself and the entire team at Arizona Sonoran, we would like to thank Rod for his contributions to the Company's growth as a private company and to its transition to the public markets. We are also grateful for his commitment to a successful transition of the CFO role."

Mr. Nikolakakis has over 27 years of corporate finance, accounting and senior management experience within the mining sector. Over his career, he has raised over US$2 billion in numerous mining transactions. Most recently he was the Chief Financial Officer for Battle North Corporation (acquired by Evolution Mining in 2021). He was also the former Chief Financial Officer of Rainy River Resources. Prior to Rainy River, Nick was the Vice President of Corporate Finance at Barrick Gold Corporation, where he led a US$1 billion project financing for Barrick's Pueblo Viejo mine in the Dominican Republic and successfully negotiated a US$1.5 billion corporate revolving credit facility. Other previously held positions by Mr. Nikolakakis include, Vice President and Chief Financial Officer of Placer Dome Canada, and Treasurer at North American Palladium Ltd.

Mr. Nikolakakis holds an Applied Science degree in Geological Engineering from the University of Waterloo and a Master of Business Administration from the University of Western Ontario's Ivey School of Business.

About Arizona Sonoran Copper Company

ASCU's objective is to become a mid-tier copper producer in the near term with low operating costs, develop the Cactus Project that could generate robust returns for investors, and provide a long term sustainable and responsible operation for the community and all stakeholders. The Company's principal asset is a 100% interest in the Cactus Project (former ASARCO, Sacaton mine) which is situated on private land in an infrastructure-rich area of Arizona. The Company is led by an executive management team and Board which have a long-standing track record of successful project delivery in North America complemented by global capital markets expertise.

https://www.stockwatch.com/News/Item/Z-C!ASCU-3192484/C/ASCU

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Anacortes Mining plans drilling on Tres Cruces

2022-01-10 11:23 ET - News Release

Mr. James Currie reports

ANACORTES MINING TO AGGRESSIVELY ADVANCE TRES CRUCES HIGH-GRADE GOLD DEPOSIT IN 2022

Anacortes Mining Corp. has provided a corporate update, including guidance on its 2022 objectives, as the company advances toward its ambitious goal of becoming a low-cost, mid-tier gold producer.

In 2021, Anacortes was formed through a transformational merger between the CPC company, First Light Capital, and New Oroperu Resources, which owned 100% of the highly-prospective Tres Cruces gold deposit in Northern Peru, 10 km southwest of the past-producing Lagunas Norte mine. As part of the transaction, the Company completed a $22M financing, led by institutional investors and industry executives, built its management team and commenced trading as Anacortes Mining Corp. on the TSX Venture Exchange on October 12, 2021.

Tres Cruces is located within a highly prolific belt of rocks extending for more than 600 km in Northern Peru, where ~100M ounces of gold has been discovered (~50M ounces produced) from long standing operations, including Newmont/Buenaventura's Yanacocha mine (South America's largest and most profitable gold mine), the ~14M ounce past-producing Lagunas Norte operation, and the past-producing ~6M ounce high-grade Pierana gold and silver mine, amongst others.

Tres Cruces is one of the highest-grade oxide deposits globally and hosts oxide plus sulphide indicated resources of 2,474,000 oz at 1.65 g/t gold and inferred resources of 104,000 oz at 1.26 g/t gold, inclusive of 630,000 oz of high-grade leachable gold at 1.28 g/t gold. (The current mineral resource estimate was prepared by Jeffrey D. Rowe, James N. Gray, and Ruperto Castro Ocampo with an effective date of March 16, 2021). Surrounding infrastructure includes the national highway from Trujillo, electricity from the national grid, airstrip, a deep-water port, nearby mining infrastructure from past producing operations and a very skilled workforce in the region.

The Property was under option to Barrick Gold from 2003 to 2020 and the bulk of the exploration work on the Property was performed by Barrick, operating from the nearby Lagunas Norte operation. Barrick's option expired on December 31, 2020 and the property was returned to New Oroperu as Barrick was in the process of selling Lagunas Norte.

Jim Currie, CEO of Anacortes Mining, states, "2022 will prove to be a very exciting year for Anacortes as we advance the Tres Cruces project. The PEA is well underway and will demonstrate the economics of the high-grade heap-leachable oxide resource. We are in the process of preparing an expedited drill permit application to test the depth extension of Tres Cruces, where a number of drill holes ended in mineralization. It's hard to believe that an asset such as Tres Cruces, with 371 drill holes, has never been properly tested below 250 meters from surface when so many holes ended in excellent mineralization. We strongly believe these wide zones of gold mineralization suggest an exceptional exploration opportunity for our shareholders to prove that Tres Cruces can be a world class asset in an excellent mining jurisdiction as we embark on our journey to become a mid-tier gold producer."

.....

https://www.stockwatch.com/News/Item/Z-C!XYZ-3192544/C/XYZ

2022-01-10 11:23 ET - News Release

Mr. James Currie reports

ANACORTES MINING TO AGGRESSIVELY ADVANCE TRES CRUCES HIGH-GRADE GOLD DEPOSIT IN 2022

Anacortes Mining Corp. has provided a corporate update, including guidance on its 2022 objectives, as the company advances toward its ambitious goal of becoming a low-cost, mid-tier gold producer.

In 2021, Anacortes was formed through a transformational merger between the CPC company, First Light Capital, and New Oroperu Resources, which owned 100% of the highly-prospective Tres Cruces gold deposit in Northern Peru, 10 km southwest of the past-producing Lagunas Norte mine. As part of the transaction, the Company completed a $22M financing, led by institutional investors and industry executives, built its management team and commenced trading as Anacortes Mining Corp. on the TSX Venture Exchange on October 12, 2021.

Tres Cruces is located within a highly prolific belt of rocks extending for more than 600 km in Northern Peru, where ~100M ounces of gold has been discovered (~50M ounces produced) from long standing operations, including Newmont/Buenaventura's Yanacocha mine (South America's largest and most profitable gold mine), the ~14M ounce past-producing Lagunas Norte operation, and the past-producing ~6M ounce high-grade Pierana gold and silver mine, amongst others.

Tres Cruces is one of the highest-grade oxide deposits globally and hosts oxide plus sulphide indicated resources of 2,474,000 oz at 1.65 g/t gold and inferred resources of 104,000 oz at 1.26 g/t gold, inclusive of 630,000 oz of high-grade leachable gold at 1.28 g/t gold. (The current mineral resource estimate was prepared by Jeffrey D. Rowe, James N. Gray, and Ruperto Castro Ocampo with an effective date of March 16, 2021). Surrounding infrastructure includes the national highway from Trujillo, electricity from the national grid, airstrip, a deep-water port, nearby mining infrastructure from past producing operations and a very skilled workforce in the region.

The Property was under option to Barrick Gold from 2003 to 2020 and the bulk of the exploration work on the Property was performed by Barrick, operating from the nearby Lagunas Norte operation. Barrick's option expired on December 31, 2020 and the property was returned to New Oroperu as Barrick was in the process of selling Lagunas Norte.

Jim Currie, CEO of Anacortes Mining, states, "2022 will prove to be a very exciting year for Anacortes as we advance the Tres Cruces project. The PEA is well underway and will demonstrate the economics of the high-grade heap-leachable oxide resource. We are in the process of preparing an expedited drill permit application to test the depth extension of Tres Cruces, where a number of drill holes ended in mineralization. It's hard to believe that an asset such as Tres Cruces, with 371 drill holes, has never been properly tested below 250 meters from surface when so many holes ended in excellent mineralization. We strongly believe these wide zones of gold mineralization suggest an exceptional exploration opportunity for our shareholders to prove that Tres Cruces can be a world class asset in an excellent mining jurisdiction as we embark on our journey to become a mid-tier gold producer."

.....

https://www.stockwatch.com/News/Item/Z-C!XYZ-3192544/C/XYZ

[url=https://peketec.de/trading/viewtopic.php?p=2115448#2115448 schrieb:Kostolanys Erbe schrieb am 11.12.2021, 11:05 Uhr[/url]"]Nach dem Zusammenschluss sind sie nun wieder an der Börse unter dem

Kürzel XYZ !

Anacortes Mining Corp.

https://anacortesmining.com/

Präsentation:

https://secureservercdn.net/104.238.68.196/qj3.450.myftpupload.com/wp-content/uploads/2021/10/Anacortes-Investor-Presentation-DRAFT-v5.pdf

» zur Grafik

[url=https://peketec.de/trading/viewtopic.php?p=2081129#2081129 schrieb:Kostolanys Erbe schrieb am 17.06.2021, 21:16 Uhr[/url]"]First Light Capital to merge with New Oroperu

2021-06-17 14:09 ET - News Release

See News Release (C-XYZ) First Light Capital Corp

Mr. Jim Currie of First Light reports

FIRST LIGHT AND NEW OROPERU ANNOUNCE BUSINESS COMBINATION TO CREATE ANACORTES MINING AND C$20M CONCURRENT FINANCING TO ADVANCE TRES CRUCES

First Light Capital Corp. and New Oroperu Resources Inc. have entered into a definitive arrangement agreement dated June 16, 2021, to combine and create Anacortes Mining Corp., a new growth-oriented gold company in the Americas. Anacortes intends to focus on continued exploration and advancement of New Oroperu's Tres Cruces project located in Peru, in addition to seeking further growth opportunities in the Americas. Jim Currie will lead Anacortes as the President and Chief Executive Officer. In connection with the Transaction, First Light intends to complete a concurrent C$20M subscription receipt financing.

Key HighlightsTres Cruces is one of the highest-grade oxide deposits globally and hosts oxide plus sulphide Indicated resources of 2.474 Mozs at 1.65 g/t gold and Inferred resources of 104 kozs at 1.26 g/t gold, inclusive of 630 kozs of high-grade leachable gold at 1.28 g/t gold (see New Oroperu's news release dated March 18, 2021 for further information, a copy of which is available at www.sedar.com) Tres Cruces is strategically located in a highly prospective geological belt that hosts significant gold deposits such as Lagunas Norte, which is located within 10 km, Yanacocha and PierinaAnacortes will be led by a new management team and Board with extensive experience in Latin America and Peru and proven capabilities in all facets of mine development and operationsWell-capitalized post-closing of the $20M Private Placement (as defined below)Underexplored property with oxide and sulphide resource growth potential - Tres Cruces has not been drilled since 2008 when gold prices were approximately US$850/oz, and several of the best drill intercepts from the previous drilling campaign are below and outside of the current pit-constrained mineral resourceAttractive pro forma relative valuation on an enterprise value per Indicated resource ounce basis

Management and Board of Directors

Upon completion of the Transaction, it is expected that the leadership team of Anacortes will be comprised of:Jim Currie (President, Chief Executive Officer and Director)Engineer with over 40 years of senior management, engineering, and operations experienceMost recently Chief Operating Officer of Equinox Gold Corp.Previously Chief Operating Officer of Pretium Resources Inc. and New Gold Inc.Steven Botts (President, Peru)Over 40 years of experience in mining with a focus on the areas of project development, environmental management, stakeholder engagement, and sustainable developmentMost recently Vice President and Managing Director of Tahoe Peru, where he managed both the La Arena and Shahuindo gold heap leach operationsHorng Dih Lee (Chief Financial Officer and Corporate Secretary)Previously Chief Financial Officer, Secretary and VP at Eastern Platinum Ltd., Chief Financial Officer and Secretary of Esrey Resources Ltd., Chief Financial Officer and Vice President at Diamond Fields Resources, Inc. and Chief Financial Officer and Vice President for Northern Orion Resources, Inc.Marshall Koval (Special Advisor)Mining executive with more than 42 years of corporate management, M&A, finance, mineral exploration, mine development, and operations experience globallyCurrently serves as President, CEO and Director of Lumina Gold Corp., CEO and Director of Luminex Resources Corp., Director of Equinox Gold Corp., and Director of Miedzi Copper Corp.Board of Directors to be comprised of four nominees from First Light, including Andy Carstensen, a professional geologist and current Vice President, Exploration, of Luminex Resources Corp., and Wayne Livingstone, current President and Chief Executive Officer of New Oroperu

Jim Currie, President and Chief Executive Office of First Light, stated, "Our team has been aggressively pursuing a foundational asset for Anacortes and Tres Cruces meets several of our investment criteria. The asset provides an established resource base, significant exploration potential for both the oxides and sulphides, and several development opportunities. Through focused efforts on engineering and exploration, we believe we are well-positioned to generate significant value for the stakeholders of both First Light and New Oroperu."

Wayne Livingstone, President and Chief Executive Officer of New Oroperu, stated, "This transaction culminates the hard work and dedication of New Oroperu and its partners since inception. We look forward to seeing Tres Cruces advanced under the expertise of Jim and his team, and we are excited for the next chapter in a prolific gold camp that saw Barrick mine more than 10 million ounces at Lagunas Norte, approximately 10 km away."

Transaction Details

........

https://www.stockwatch.com/News/Item/Z-C!ORO-3099969/C/ORO

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

GoGold drills 36.3 m of 489 g/t AgEq at Los Ricos North

2022-01-12 06:49 ET - News Release

Mr. Brad Langille reports

GOGOLD ANNOUNCES STRONG DRILLING RESULTS AT MOLOLOA IN LOS RICOS NORTH

GoGold Resources Inc. has released the results of 13 drill holes at Mololoa within Los Ricos North. Hole LRGM-21-077 intersected 1.0 metre of 6,675 grams per tonne silver equivalent (AgEq) contained within 36.3 m of 489 g/t AgEq. See the associated table for a breakdown of silver and gold values. These are the first drill holes announced after the release of the initial mineral resource estimate at Los Ricos North on Dec. 7, 2021.

"We are very pleased with these results at Mololoa, as we continue our aggressive resource expansion drilling program at Los Ricos North. This is in addition to the initial mineral resource estimate released in December," said Brad Langille, president and chief executive officer. "We've also commenced drilling at the Gran Cabrera zone, which is our newest target for Los Ricos North, where we see an exploration potential that may be similar to the El Favor deposit."

....

https://www.stockwatch.com/News/Item/Z-C!GGD-3193427/C/GGD

2022-01-12 06:49 ET - News Release

Mr. Brad Langille reports

GOGOLD ANNOUNCES STRONG DRILLING RESULTS AT MOLOLOA IN LOS RICOS NORTH

GoGold Resources Inc. has released the results of 13 drill holes at Mololoa within Los Ricos North. Hole LRGM-21-077 intersected 1.0 metre of 6,675 grams per tonne silver equivalent (AgEq) contained within 36.3 m of 489 g/t AgEq. See the associated table for a breakdown of silver and gold values. These are the first drill holes announced after the release of the initial mineral resource estimate at Los Ricos North on Dec. 7, 2021.

"We are very pleased with these results at Mololoa, as we continue our aggressive resource expansion drilling program at Los Ricos North. This is in addition to the initial mineral resource estimate released in December," said Brad Langille, president and chief executive officer. "We've also commenced drilling at the Gran Cabrera zone, which is our newest target for Los Ricos North, where we see an exploration potential that may be similar to the El Favor deposit."

....

https://www.stockwatch.com/News/Item/Z-C!GGD-3193427/C/GGD

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Freehold to pay six-cent January dividend Feb. 15

2022-01-12 16:07 ET - News Release

Mr. Matt Donohue reports

FREEHOLD ROYALTIES LTD. DECLARES DIVIDEND FOR JANUARY 2022

Freehold Royalties Ltd.'s board of directors has declared a dividend of six cents per common share to be paid on Feb. 15, 2022, to shareholders of record on Jan. 31, 2022.

These dividends are designated as eligible dividends for Canadian income tax purposes.

Freehold's focus is on acquiring and managing oil and gas royalties. Freehold's common shares trade on the Toronto Stock Exchange in Canada under the symbol FRU.

https://www.stockwatch.com/News/Item/Z-C!FRU-3193976/C/FRU

2022-01-12 16:07 ET - News Release

Mr. Matt Donohue reports

FREEHOLD ROYALTIES LTD. DECLARES DIVIDEND FOR JANUARY 2022

Freehold Royalties Ltd.'s board of directors has declared a dividend of six cents per common share to be paid on Feb. 15, 2022, to shareholders of record on Jan. 31, 2022.

These dividends are designated as eligible dividends for Canadian income tax purposes.

Freehold's focus is on acquiring and managing oil and gas royalties. Freehold's common shares trade on the Toronto Stock Exchange in Canada under the symbol FRU.

https://www.stockwatch.com/News/Item/Z-C!FRU-3193976/C/FRU

Sogar verbessert! Die hatten vor dem Ölpreis Schock 0,0525C$ mtl. Dividende... :D

[url=https://peketec.de/trading/viewtopic.php?p=2119682#2119682 schrieb:greenhorn schrieb am 13.01.2022, 08:32 Uhr[/url]"]Guten Morgen!

Perle.......die Divikürzung nach den Einbruch des Ölpreises wieder fast aufgeholt

oha....siehste ich hatte was mit 6,5 im Kopf...aber umso besser!

[url=https://peketec.de/trading/viewtopic.php?p=2119749#2119749 schrieb:Ollinho schrieb am 13.01.2022, 12:38 Uhr[/url]"]Sogar verbessert! Die hatten vor dem Ölpreis Schock 0,0525C$ mtl. Dividende... :D

[url=https://peketec.de/trading/viewtopic.php?p=2119682#2119682 schrieb:greenhorn schrieb am 13.01.2022, 08:32 Uhr[/url]"]Guten Morgen!

Perle.......die Divikürzung nach den Einbruch des Ölpreises wieder fast aufgeholt

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

First Majestic produces 8.6 million AgEq oz in Q4 2021

2022-01-18 10:24 ET - News Release

Mr. Keith Neumeyer reports

FIRST MAJESTIC PRODUCES NEW QUARTERLY RECORD OF 8.6M SILVER EQV. OZ IN Q4 2021 AND ACHIEVES FY2021 GUIDANCE WITH NEW ANNUAL PRODUCTION RECORD OF 26.9M SILVER EQV. OZ; ANNOUNCES 2022 GUIDANCE AND TODAY'S CONFERENCE CALL DETAILS; APPOINTS INTERIM CFO

First Majestic Silver Corp. had fourth quarter production reach a new quarterly record of 8.6 million silver equivalent ounces, consisting of 3.4 million silver ounces and 67,411 gold ounces, representing a 17% increase compared to the prior quarter. Additionally, full year 2021 production reached a new Company record of 26.9 million silver equivalent ounces, consisting of 12.8 million silver ounces and 192,353 gold ounces, or a 32% increase over 2020.

The Company is also pleased to announce its 2022 guidance of producing between 32.2 to 35.8 million silver equivalent ounces, consisting of 12.2 to 13.5 million ounces of silver and 258,000 to 288,000 ounces of gold, with AISC cost guidance of between $16.79 to $18.06 per silver equivalent ounce.

Q4 2021 highlights:

....

https://www.stockwatch.com/News/Item/Z-C!FR-3195985/C/FR

2022-01-18 10:24 ET - News Release

Mr. Keith Neumeyer reports

FIRST MAJESTIC PRODUCES NEW QUARTERLY RECORD OF 8.6M SILVER EQV. OZ IN Q4 2021 AND ACHIEVES FY2021 GUIDANCE WITH NEW ANNUAL PRODUCTION RECORD OF 26.9M SILVER EQV. OZ; ANNOUNCES 2022 GUIDANCE AND TODAY'S CONFERENCE CALL DETAILS; APPOINTS INTERIM CFO

First Majestic Silver Corp. had fourth quarter production reach a new quarterly record of 8.6 million silver equivalent ounces, consisting of 3.4 million silver ounces and 67,411 gold ounces, representing a 17% increase compared to the prior quarter. Additionally, full year 2021 production reached a new Company record of 26.9 million silver equivalent ounces, consisting of 12.8 million silver ounces and 192,353 gold ounces, or a 32% increase over 2020.

The Company is also pleased to announce its 2022 guidance of producing between 32.2 to 35.8 million silver equivalent ounces, consisting of 12.2 to 13.5 million ounces of silver and 258,000 to 288,000 ounces of gold, with AISC cost guidance of between $16.79 to $18.06 per silver equivalent ounce.

Q4 2021 highlights:

....

https://www.stockwatch.com/News/Item/Z-C!FR-3195985/C/FR

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Liberty Gold drills 41.1 m of 1.95 g/t Au at Black Pine

2022-01-18 06:43 ET - News Release

Mr. Cal Everett reports

LIBERTY GOLD DEFINES HIGH-GRADE MINERALIZED CORE AT RANGEFRONT FOCUS AREA, BLACK PINE OXIDE GOLD DEPOSIT

Liberty Gold Corp. has released additional reverse circulation (RC) results from the 2021 drill program in the Rangefront Focus area (RFA) at the Black Pine oxide gold deposit, Idaho.

The RFA is host to a major new oxide gold discovery in the down-faulted southeast portion of the Black Pine gold system and has been a focus of the company's drill campaign since it was discovered in the third quarter of 2021. Results to date confirm the RFA discovery is quickly expanding, with gold mineralization extending over an area of approximately one square kilometre and it remains open for extension in all directions.

Liberty Gold has continued to expand on the D-4 discovery area within the RFA, adding drill sites to the north, south and east, toward the original Rangefront deposit defined by shallow historical drilling. Notably, a northwest-southeast-trending, high-grade mineralized core has now been delineated over a 300-by-400-metre area that remains open along trend to the northwest and southeast. Additionally, of the 46 holes drilled and assayed in the RFA since the third quarter of 2021, virtually all have returned multiple, relatively flat zones of oxide gold mineralization from near surface to a depth of up to 400 m.

Cal Everett, president and chief executive officer of Liberty Gold, stated: "RFA drilling continues to deliver significant oxide gold intercepts in multiple zones over a large surface area. With a high-grade core now defined and open for expansion along trend, we expect a significant upgrade to the mineral resource estimate in 2022."

.....

https://www.stockwatch.com/News/Item/Z-C!LGD-3195727/C/LGD

2022-01-18 06:43 ET - News Release

Mr. Cal Everett reports

LIBERTY GOLD DEFINES HIGH-GRADE MINERALIZED CORE AT RANGEFRONT FOCUS AREA, BLACK PINE OXIDE GOLD DEPOSIT

Liberty Gold Corp. has released additional reverse circulation (RC) results from the 2021 drill program in the Rangefront Focus area (RFA) at the Black Pine oxide gold deposit, Idaho.

The RFA is host to a major new oxide gold discovery in the down-faulted southeast portion of the Black Pine gold system and has been a focus of the company's drill campaign since it was discovered in the third quarter of 2021. Results to date confirm the RFA discovery is quickly expanding, with gold mineralization extending over an area of approximately one square kilometre and it remains open for extension in all directions.

Liberty Gold has continued to expand on the D-4 discovery area within the RFA, adding drill sites to the north, south and east, toward the original Rangefront deposit defined by shallow historical drilling. Notably, a northwest-southeast-trending, high-grade mineralized core has now been delineated over a 300-by-400-metre area that remains open along trend to the northwest and southeast. Additionally, of the 46 holes drilled and assayed in the RFA since the third quarter of 2021, virtually all have returned multiple, relatively flat zones of oxide gold mineralization from near surface to a depth of up to 400 m.

Cal Everett, president and chief executive officer of Liberty Gold, stated: "RFA drilling continues to deliver significant oxide gold intercepts in multiple zones over a large surface area. With a high-grade core now defined and open for expansion along trend, we expect a significant upgrade to the mineral resource estimate in 2022."

.....

https://www.stockwatch.com/News/Item/Z-C!LGD-3195727/C/LGD