[url=https://peketec.de/trading/viewtopic.php?p=2129230#2129230 schrieb:dukezero schrieb am 04.03.2022, 14:40 Uhr[/url]"][url=https://peketec.de/trading/viewtopic.php?p=2129051#2129051 schrieb:dukezero schrieb am 03.03.2022, 15:47 Uhr[/url]"][url=https://peketec.de/trading/viewtopic.php?p=2123991#2123991 schrieb:dukezero schrieb am 04.02.2022, 15:53 Uhr[/url]"]0,60 Cad

https://stockhouse.com/companies/bullboard?symbol=v.bcu&postid=34393109

http://www.kereport.com/2022/02/03/erik-wetterling-new-discoveries-discussing-different-stages-of-discoveries-and-investing-strategies/

» zur Grafik

plus 40%

https://ceo.ca/@newsfile/bell-copper-keeps-drilling-copper-in-porphyry-at-big

https://stockhouse.com/companies/bullboard?symbol=v.bcu&postid=34437628

Das sichtbare Orderbuch hat Luft bis 0,70 cad .

App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Alles verkauft zu 49,03 €

[url=https://peketec.de/trading/viewtopic.php?p=2128199#2128199 schrieb:Kostolanys Erbe schrieb am 28.02.2022, 15:24 Uhr[/url]"]2k AEM im Schnitt 47,19 € geladen...

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Ja, echt merkwürdig. Als ob der Goldpreis unten gehalten wird...

[url=https://peketec.de/trading/viewtopic.php?p=2129260#2129260 schrieb:wicki99 schrieb am 04.03.2022, 16:11 Uhr[/url]"]gold kurvt ja auch ordentlich im chart hoch und runter ...

vielleicht verkauft der Zar auch einiges um an Geld zu kommen....

[url=https://peketec.de/trading/viewtopic.php?p=2129262#2129262 schrieb:Kostolanys Erbe schrieb am 04.03.2022, 16:14 Uhr[/url]"]Ja, echt merkwürdig. Als ob der Goldpreis unten gehalten wird...

[url=https://peketec.de/trading/viewtopic.php?p=2129260#2129260 schrieb:wicki99 schrieb am 04.03.2022, 16:11 Uhr[/url]"]gold kurvt ja auch ordentlich im chart hoch und runter ...

[url=https://peketec.de/trading/viewtopic.php?p=2129248#2129248 schrieb:dukezero schrieb am 04.03.2022, 15:39 Uhr[/url]"][url=https://peketec.de/trading/viewtopic.php?p=2129230#2129230 schrieb:dukezero schrieb am 04.03.2022, 14:40 Uhr[/url]"][url=https://peketec.de/trading/viewtopic.php?p=2129051#2129051 schrieb:dukezero schrieb am 03.03.2022, 15:47 Uhr[/url]"][url=https://peketec.de/trading/viewtopic.php?p=2123991#2123991 schrieb:dukezero schrieb am 04.02.2022, 15:53 Uhr[/url]"]0,60 Cad

https://stockhouse.com/companies/bullboard?symbol=v.bcu&postid=34393109

http://www.kereport.com/2022/02/03/erik-wetterling-new-discoveries-discussing-different-stages-of-discoveries-and-investing-strategies/

» zur Grafik

plus 40%

https://ceo.ca/@newsfile/bell-copper-keeps-drilling-copper-in-porphyry-at-big

https://stockhouse.com/companies/bullboard?symbol=v.bcu&postid=34437628

Das sichtbare Orderbuch hat Luft bis 0,70 cad .

plus 14.5% 0.71 Cad

Kaufsignal ahoi !! Trotz Weihnachtsbaum Chart!

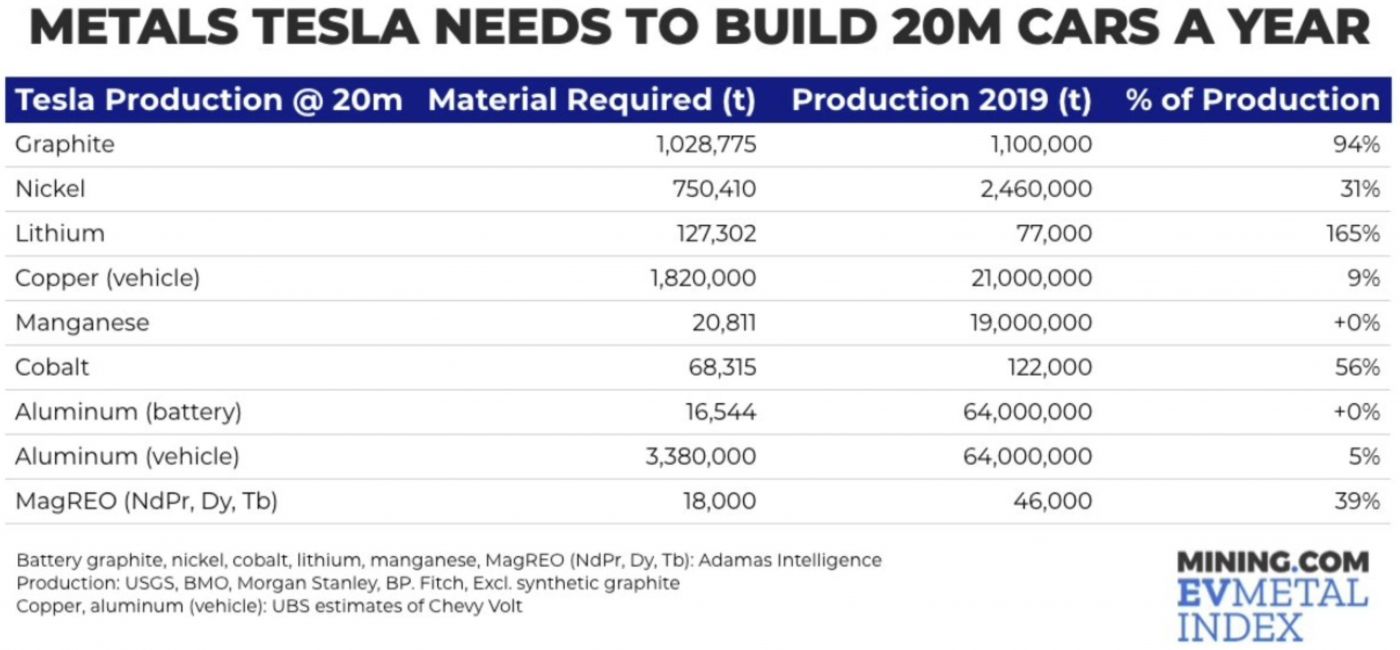

China will Seltene Erden verbilligen

China will durch Druck auf Bergwerkfirmen den Preisanstieg sogenannter Seltener Erden bremsen. Die Unternehmen sollten den Nachschub dieser Mineralien, die unter anderem zum Bau von Elektroauto-Batterien benötigt werden, sicherstellen, teilte das Industrieministerium.

Daher seien führende Bergbaukonzerne - China Rare Earth, China Northern Rare Earth und Shenghe Resources - aufgefordert worden, den Handel zu regulieren und Marktspekulationen oder das Horten von Beständen zu verhindern, hieß es. Außerdem sollten durch einen gemeinsamen Mechanismus die Preise auf ein "vernünftiges" Maß gesenkt werden.

https://www.n-tv.de/wirtschaft/der_...Tag-Freitag-4-Maerz-2022-article23172022.html

China will durch Druck auf Bergwerkfirmen den Preisanstieg sogenannter Seltener Erden bremsen. Die Unternehmen sollten den Nachschub dieser Mineralien, die unter anderem zum Bau von Elektroauto-Batterien benötigt werden, sicherstellen, teilte das Industrieministerium.

Daher seien führende Bergbaukonzerne - China Rare Earth, China Northern Rare Earth und Shenghe Resources - aufgefordert worden, den Handel zu regulieren und Marktspekulationen oder das Horten von Beständen zu verhindern, hieß es. Außerdem sollten durch einen gemeinsamen Mechanismus die Preise auf ein "vernünftiges" Maß gesenkt werden.

https://www.n-tv.de/wirtschaft/der_...Tag-Freitag-4-Maerz-2022-article23172022.html

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Anacortes to release Tres Cruces PEA March 8

2022-03-04 10:02 ET - News Release

Mr. Jim Currie reports

ANACORTES MINING TO RELEASE PRELIMINARY ECONOMIC ASSESSMENT ON TRES CRUCES HIGH GRADE OXIDE GOLD CAP, PRE-MARKET TUESDAY MARCH 8, 2022

Anacortes Mining Corp. will be releasing its inaugural preliminary economic assessment (PEA) premarket Tuesday, March 8, 2022, and will be hosting a conference call to discuss the results on the same day at 4:30 p.m. EST (1:30 p.m. PST).

As stated in the March 2021 National Instrument 43-101 report, indicated mineral resources at Tres Cruces are estimated to contain 46.5 million tonnes grading 1.65 grams per tonne gold for a total of 2,474,000 ounces of contained gold. Inferred mineral resources are estimated at 2.6 million tonnes grading 1.26 g/t gold for 104,000 ounces of contained gold. The near-surface indicated mineral resource comprises 9.64 million tonnes of oxide mineralization grading 1.37 g/t gold for 425,000 contained ounces of gold, and the immediately underlying leachable sulphides of 5.71 million tonnes grading 1.12 g/t gold for 205,000 contained ounces form the basis for a reasonably sized heap leach operation.

PEA conference call details

Tuesday, March 8, 2022, at 4:30 p.m. EST (1:30 p.m. PST)

OTC listing

The company's common shares will commence trading on the OTCQB on March 4, 2022, under the symbol XYZFF. The common shares will continue to trade on the TSX Venture Exchange under the symbol XYZ.

Jim Currie, chief executive officer of Anacortes Mining, states: "We have several major milestones planned for 2022 and are looking to continue to carry this momentum as we execute on delivering the PEA for Tres Cruces, initiate drilling and commence a feasibility study on the oxide resources shortly thereafter. The United States represents a large audience of potential shareholders, and we believe it is important to give these prospective investors a more accessible opportunity to take part in our growth. We look forward to discussing the PEA results on Tuesday after market with industry participants, analysts and investors."

Grant of options

On Feb. 2, 2022, the company granted 150,000 stock options to three officers of the company and 75,000 stock options to an employee of the company. All of these options vest immediately and entitle the holder to purchase one common share of the company at an exercise price of $2.40 per share for a period of five years from the date of grant.

Mr. Currie, PEng, is a qualified person as that term is defined in National Instrument 43-101. Mr. Currie has read this news release and takes responsibility for the technical disclosure contained in this news release.

About Anacortes Mining Corp.

Anacortes is a new growth-oriented gold company in the Americas, which owns a 100-per-cent interest in the Tres Cruces gold project located in Peru. Tres Cruces is one of the highest-grade oxide deposits globally and hosts oxide plus sulphide indicated resources of 2,474,000 ounces at 1.65 grams per tonne gold and inferred resources of 104,000 oz at 1.26 g/t gold, inclusive of 630,000 oz of high-grade leachable gold at 1.28 g/t gold. Anacortes is well capitalized and intends to aggressively advance Tres Cruces through feasibility and to production under a heap leach open-pit scenario. Additionally, Anacortes will continue to seek further growth opportunities in the Americas, with the goal of creating the next mid-tier multiasset gold producer.

https://www.stockwatch.com/News/Item/Z-C!XYZ-3217055/C/XYZ

[url=https://peketec.de/trading/viewtopic.php?p=2119216#2119216 schrieb:Kostolanys Erbe schrieb am 10.01.2022, 19:04 Uhr[/url]"]Anacortes Mining plans drilling on Tres Cruces

2022-01-10 11:23 ET - News Release

Mr. James Currie reports

ANACORTES MINING TO AGGRESSIVELY ADVANCE TRES CRUCES HIGH-GRADE GOLD DEPOSIT IN 2022

Anacortes Mining Corp. has provided a corporate update, including guidance on its 2022 objectives, as the company advances toward its ambitious goal of becoming a low-cost, mid-tier gold producer.

In 2021, Anacortes was formed through a transformational merger between the CPC company, First Light Capital, and New Oroperu Resources, which owned 100% of the highly-prospective Tres Cruces gold deposit in Northern Peru, 10 km southwest of the past-producing Lagunas Norte mine. As part of the transaction, the Company completed a $22M financing, led by institutional investors and industry executives, built its management team and commenced trading as Anacortes Mining Corp. on the TSX Venture Exchange on October 12, 2021.

Tres Cruces is located within a highly prolific belt of rocks extending for more than 600 km in Northern Peru, where ~100M ounces of gold has been discovered (~50M ounces produced) from long standing operations, including Newmont/Buenaventura's Yanacocha mine (South America's largest and most profitable gold mine), the ~14M ounce past-producing Lagunas Norte operation, and the past-producing ~6M ounce high-grade Pierana gold and silver mine, amongst others.

Tres Cruces is one of the highest-grade oxide deposits globally and hosts oxide plus sulphide indicated resources of 2,474,000 oz at 1.65 g/t gold and inferred resources of 104,000 oz at 1.26 g/t gold, inclusive of 630,000 oz of high-grade leachable gold at 1.28 g/t gold. (The current mineral resource estimate was prepared by Jeffrey D. Rowe, James N. Gray, and Ruperto Castro Ocampo with an effective date of March 16, 2021). Surrounding infrastructure includes the national highway from Trujillo, electricity from the national grid, airstrip, a deep-water port, nearby mining infrastructure from past producing operations and a very skilled workforce in the region.

The Property was under option to Barrick Gold from 2003 to 2020 and the bulk of the exploration work on the Property was performed by Barrick, operating from the nearby Lagunas Norte operation. Barrick's option expired on December 31, 2020 and the property was returned to New Oroperu as Barrick was in the process of selling Lagunas Norte.

Jim Currie, CEO of Anacortes Mining, states, "2022 will prove to be a very exciting year for Anacortes as we advance the Tres Cruces project. The PEA is well underway and will demonstrate the economics of the high-grade heap-leachable oxide resource. We are in the process of preparing an expedited drill permit application to test the depth extension of Tres Cruces, where a number of drill holes ended in mineralization. It's hard to believe that an asset such as Tres Cruces, with 371 drill holes, has never been properly tested below 250 meters from surface when so many holes ended in excellent mineralization. We strongly believe these wide zones of gold mineralization suggest an exceptional exploration opportunity for our shareholders to prove that Tres Cruces can be a world class asset in an excellent mining jurisdiction as we embark on our journey to become a mid-tier gold producer."

.....

https://www.stockwatch.com/News/Item/Z-C!XYZ-3192544/C/XYZ

[url=https://peketec.de/trading/viewtopic.php?p=2115448#2115448 schrieb:Kostolanys Erbe schrieb am 11.12.2021, 11:05 Uhr[/url]"]Nach dem Zusammenschluss sind sie nun wieder an der Börse unter dem

Kürzel XYZ !

Anacortes Mining Corp.

https://anacortesmining.com/

Präsentation:

https://secureservercdn.net/104.238.68.196/qj3.450.myftpupload.com/wp-content/uploads/2021/10/Anacortes-Investor-Presentation-DRAFT-v5.pdf

» zur Grafik

[url=https://peketec.de/trading/viewtopic.php?p=2081129#2081129 schrieb:Kostolanys Erbe schrieb am 17.06.2021, 21:16 Uhr[/url]"]First Light Capital to merge with New Oroperu

2021-06-17 14:09 ET - News Release

See News Release (C-XYZ) First Light Capital Corp

Mr. Jim Currie of First Light reports

FIRST LIGHT AND NEW OROPERU ANNOUNCE BUSINESS COMBINATION TO CREATE ANACORTES MINING AND C$20M CONCURRENT FINANCING TO ADVANCE TRES CRUCES

First Light Capital Corp. and New Oroperu Resources Inc. have entered into a definitive arrangement agreement dated June 16, 2021, to combine and create Anacortes Mining Corp., a new growth-oriented gold company in the Americas. Anacortes intends to focus on continued exploration and advancement of New Oroperu's Tres Cruces project located in Peru, in addition to seeking further growth opportunities in the Americas. Jim Currie will lead Anacortes as the President and Chief Executive Officer. In connection with the Transaction, First Light intends to complete a concurrent C$20M subscription receipt financing.

Key HighlightsTres Cruces is one of the highest-grade oxide deposits globally and hosts oxide plus sulphide Indicated resources of 2.474 Mozs at 1.65 g/t gold and Inferred resources of 104 kozs at 1.26 g/t gold, inclusive of 630 kozs of high-grade leachable gold at 1.28 g/t gold (see New Oroperu's news release dated March 18, 2021 for further information, a copy of which is available at www.sedar.com) Tres Cruces is strategically located in a highly prospective geological belt that hosts significant gold deposits such as Lagunas Norte, which is located within 10 km, Yanacocha and PierinaAnacortes will be led by a new management team and Board with extensive experience in Latin America and Peru and proven capabilities in all facets of mine development and operationsWell-capitalized post-closing of the $20M Private Placement (as defined below)Underexplored property with oxide and sulphide resource growth potential - Tres Cruces has not been drilled since 2008 when gold prices were approximately US$850/oz, and several of the best drill intercepts from the previous drilling campaign are below and outside of the current pit-constrained mineral resourceAttractive pro forma relative valuation on an enterprise value per Indicated resource ounce basis

Management and Board of Directors

Upon completion of the Transaction, it is expected that the leadership team of Anacortes will be comprised of:Jim Currie (President, Chief Executive Officer and Director)Engineer with over 40 years of senior management, engineering, and operations experienceMost recently Chief Operating Officer of Equinox Gold Corp.Previously Chief Operating Officer of Pretium Resources Inc. and New Gold Inc.Steven Botts (President, Peru)Over 40 years of experience in mining with a focus on the areas of project development, environmental management, stakeholder engagement, and sustainable developmentMost recently Vice President and Managing Director of Tahoe Peru, where he managed both the La Arena and Shahuindo gold heap leach operationsHorng Dih Lee (Chief Financial Officer and Corporate Secretary)Previously Chief Financial Officer, Secretary and VP at Eastern Platinum Ltd., Chief Financial Officer and Secretary of Esrey Resources Ltd., Chief Financial Officer and Vice President at Diamond Fields Resources, Inc. and Chief Financial Officer and Vice President for Northern Orion Resources, Inc.Marshall Koval (Special Advisor)Mining executive with more than 42 years of corporate management, M&A, finance, mineral exploration, mine development, and operations experience globallyCurrently serves as President, CEO and Director of Lumina Gold Corp., CEO and Director of Luminex Resources Corp., Director of Equinox Gold Corp., and Director of Miedzi Copper Corp.Board of Directors to be comprised of four nominees from First Light, including Andy Carstensen, a professional geologist and current Vice President, Exploration, of Luminex Resources Corp., and Wayne Livingstone, current President and Chief Executive Officer of New Oroperu

Jim Currie, President and Chief Executive Office of First Light, stated, "Our team has been aggressively pursuing a foundational asset for Anacortes and Tres Cruces meets several of our investment criteria. The asset provides an established resource base, significant exploration potential for both the oxides and sulphides, and several development opportunities. Through focused efforts on engineering and exploration, we believe we are well-positioned to generate significant value for the stakeholders of both First Light and New Oroperu."

Wayne Livingstone, President and Chief Executive Officer of New Oroperu, stated, "This transaction culminates the hard work and dedication of New Oroperu and its partners since inception. We look forward to seeing Tres Cruces advanced under the expertise of Jim and his team, and we are excited for the next chapter in a prolific gold camp that saw Barrick mine more than 10 million ounces at Lagunas Norte, approximately 10 km away."

Transaction Details

........

https://www.stockwatch.com/News/Item/Z-C!ORO-3099969/C/ORO

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Nachtrag:

Freehold earns $72.08M in 2021, increases dividend

2022-03-02 16:29 ET - News Release

Mr. David Spyker reports

FREEHOLD ROYALTIES LTD. ANNOUNCES FOURTH QUARTER & 2021 RESULTS AND INCREASES DIVIDEND BY 33%

Freehold Royalties Ltd. has released fourth quarter and 2021 results for the period ended Dec. 31, 2021.

President's message

"Two thousand twenty-one was a very active year for Freehold -- a year in which we added to and established royalty positions in some of the best oil and gas basins across North America, with our fourth quarter results showcasing the acquisition work completed largely in the second half of the year. Through our efforts, we have strengthened Freehold's asset base, balance sheet and the long-term sustainability of our business.

"Achieved record average production levels in Q4 2021 of 14,005 barrels of oil equivalent per day. This was driven by strong activity levels and acquisitions completed throughout our North American portfolio.

"Canadian oil and gas royalty volumes grew 4 per cent [third quarter] 2021 to Q4 2021, averaging 9,930 boe/d. Growth in the portfolio was driven by focused royalty optimization activities, compliance initiatives and increased third party drilling.

"U.S. oil and gas royalty production averaged 4,075 boe/d in Q4 2021, up from 257 boe/d in Q4 2020. Increased volumes were the result of acquisitions completed throughout the year and strong third party activity levels.

"Seventy-six-per-cent increase in gross wells drilled on Freehold's royalty lands in 2021 versus 2020. In total, Freehold had 655 gross (17.5 net) wells drilled in 2021, with the expectation to see continued strong momentum in activity into 2022.

"Recorded a netback (1) of $53.58 per boe in Q4 2021, showcasing the quality of assets in the portfolio, particularly the U.S. portfolio, which benefits from Gulf Coast pricing premiums for both oil and natural gas.

"Funds from operations in Q4 2021 of $68.8-million (46 cents per share) is the highest total amount in our 25-year history.

"Increased our monthly dividend every quarter in 2021. As part of today's results, the monthly dividend will be increased to eight cents per share (96 cents annualized), the highest dividend level since late 2015.

"Net debt (1) of $101.2-million at year-end 2021, representing 0.5 times trailing funds from operations.

"Two thousand twenty-one proved plus probable reserves growth of 69 per cent and 34 per cent on a per-share measure."

(1) A non-generally accepted accounting principle financial ratio and other financial measure.

"Freehold is well positioned to participate in a higher commodity price environment. Based on the midpoint of production guidance and $75 (U.S.) per barrel West Texas Intermediate and $4 (U.S.) NYMEX [New York Mercantile Exchange], 2022 funds from operations are expected to range between $230-million and $250-million. Enhanced business strength within the portfolio provides significant optionality for Freehold to: (i) reduce company net debt to zero by year-end 2022 (in the absence of further acquisition work); (ii) continue our measured pace of dividend growth toward a 60-per-cent payout ratio; and (iii) continued disciplined acquisition work to grow our company ahead of the drill bit across North America.

"Our team is energized and are looking forward to 2022. I would like to thank our shareholders for their support in our repositioning and restructuring initiatives over the past year and thank our board and employees for the contribution of ideas and inspiration as we continue to build this great company."

David M. Spyker, president and chief executive officer

....

https://www.stockwatch.com/News/Item/Z-C!FRU-3215972/C/FRU

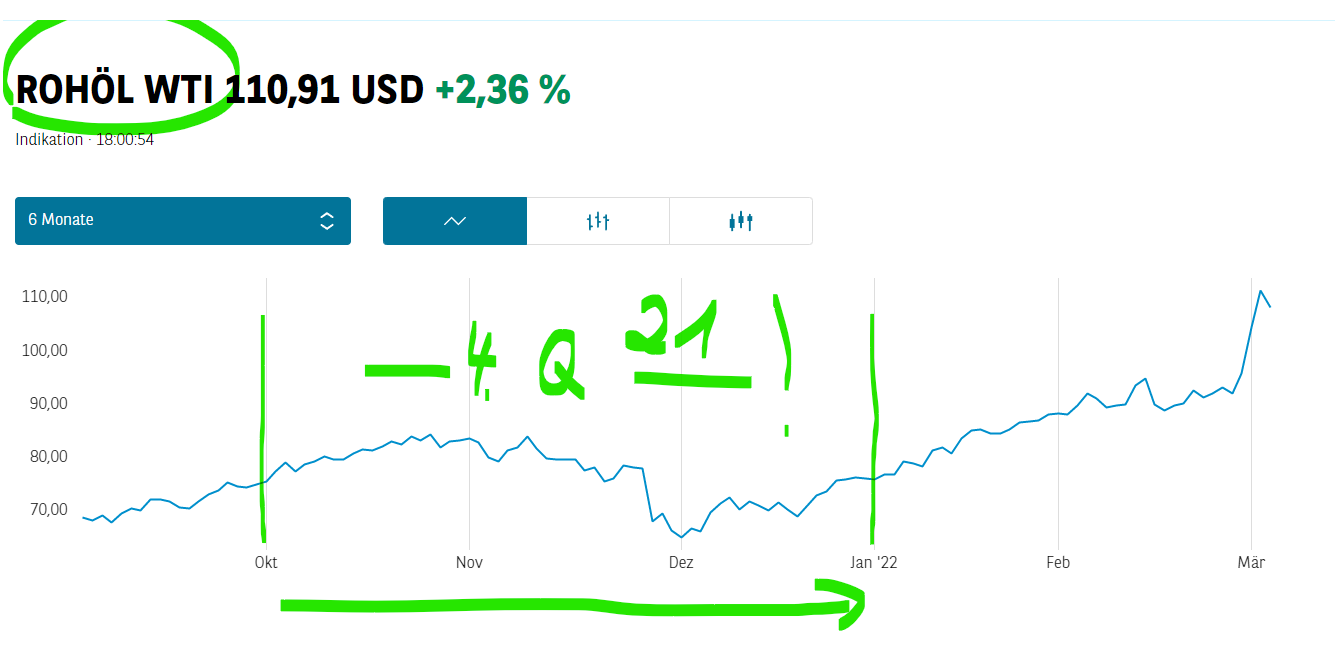

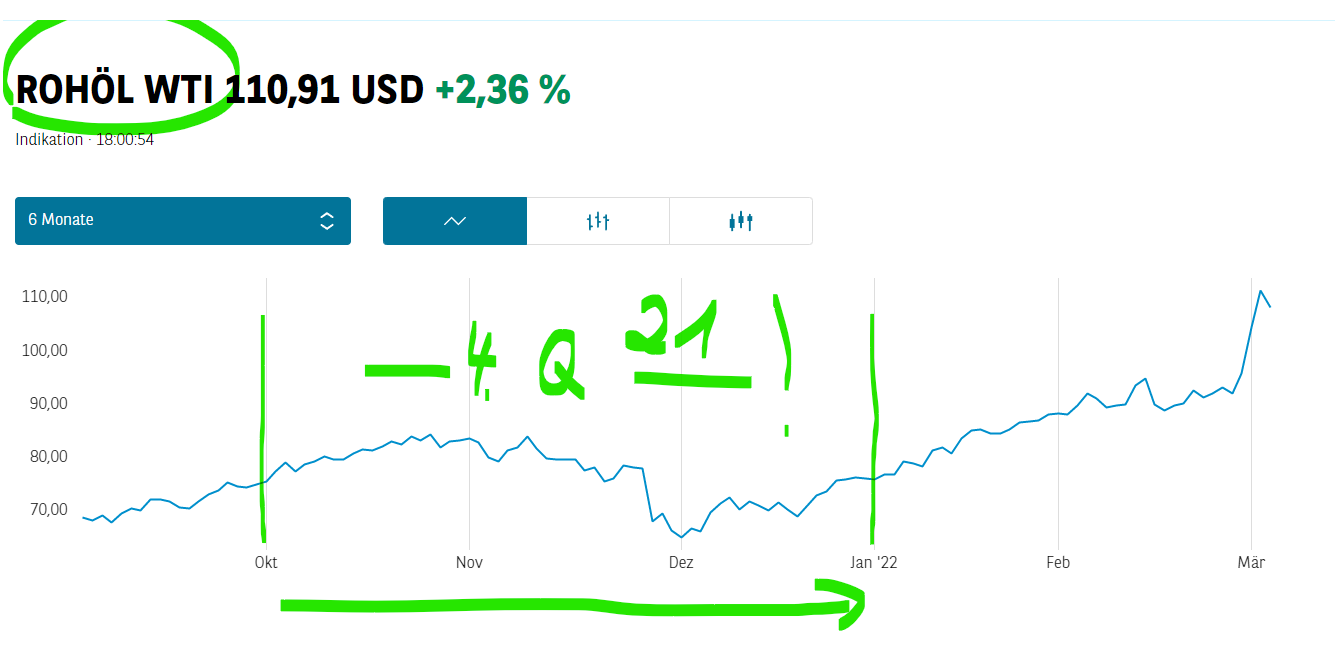

Chart 4. Quartal Ölpreis:

Freehold earns $72.08M in 2021, increases dividend

2022-03-02 16:29 ET - News Release

Mr. David Spyker reports

FREEHOLD ROYALTIES LTD. ANNOUNCES FOURTH QUARTER & 2021 RESULTS AND INCREASES DIVIDEND BY 33%

Freehold Royalties Ltd. has released fourth quarter and 2021 results for the period ended Dec. 31, 2021.

President's message

"Two thousand twenty-one was a very active year for Freehold -- a year in which we added to and established royalty positions in some of the best oil and gas basins across North America, with our fourth quarter results showcasing the acquisition work completed largely in the second half of the year. Through our efforts, we have strengthened Freehold's asset base, balance sheet and the long-term sustainability of our business.

"Achieved record average production levels in Q4 2021 of 14,005 barrels of oil equivalent per day. This was driven by strong activity levels and acquisitions completed throughout our North American portfolio.

"Canadian oil and gas royalty volumes grew 4 per cent [third quarter] 2021 to Q4 2021, averaging 9,930 boe/d. Growth in the portfolio was driven by focused royalty optimization activities, compliance initiatives and increased third party drilling.

"U.S. oil and gas royalty production averaged 4,075 boe/d in Q4 2021, up from 257 boe/d in Q4 2020. Increased volumes were the result of acquisitions completed throughout the year and strong third party activity levels.

"Seventy-six-per-cent increase in gross wells drilled on Freehold's royalty lands in 2021 versus 2020. In total, Freehold had 655 gross (17.5 net) wells drilled in 2021, with the expectation to see continued strong momentum in activity into 2022.

"Recorded a netback (1) of $53.58 per boe in Q4 2021, showcasing the quality of assets in the portfolio, particularly the U.S. portfolio, which benefits from Gulf Coast pricing premiums for both oil and natural gas.

"Funds from operations in Q4 2021 of $68.8-million (46 cents per share) is the highest total amount in our 25-year history.

"Increased our monthly dividend every quarter in 2021. As part of today's results, the monthly dividend will be increased to eight cents per share (96 cents annualized), the highest dividend level since late 2015.

"Net debt (1) of $101.2-million at year-end 2021, representing 0.5 times trailing funds from operations.

"Two thousand twenty-one proved plus probable reserves growth of 69 per cent and 34 per cent on a per-share measure."

(1) A non-generally accepted accounting principle financial ratio and other financial measure.

"Freehold is well positioned to participate in a higher commodity price environment. Based on the midpoint of production guidance and $75 (U.S.) per barrel West Texas Intermediate and $4 (U.S.) NYMEX [New York Mercantile Exchange], 2022 funds from operations are expected to range between $230-million and $250-million. Enhanced business strength within the portfolio provides significant optionality for Freehold to: (i) reduce company net debt to zero by year-end 2022 (in the absence of further acquisition work); (ii) continue our measured pace of dividend growth toward a 60-per-cent payout ratio; and (iii) continued disciplined acquisition work to grow our company ahead of the drill bit across North America.

"Our team is energized and are looking forward to 2022. I would like to thank our shareholders for their support in our repositioning and restructuring initiatives over the past year and thank our board and employees for the contribution of ideas and inspiration as we continue to build this great company."

David M. Spyker, president and chief executive officer

....

https://www.stockwatch.com/News/Item/Z-C!FRU-3215972/C/FRU

Chart 4. Quartal Ölpreis:

gold: sprachs und ging in die knie ...

[url=https://peketec.de/trading/viewtopic.php?p=2129297#2129297 schrieb:wicki99 schrieb am 04.03.2022, 18:15 Uhr[/url]"]so, ich bin mal gespannt, ob zum wochenende hin noch long-posis im gold glattgestellt werden. der future klemmt sich gerade am mehrfach getesteten widerstandsbereich um 1965$/1967$ fest. wer weiß, was über das wochenende alles passiert!?

palladium: th 2990$ und der sofortige rücksetzer an 2950$.

[url=https://peketec.de/trading/viewtopic.php?p=2129250#2129250 schrieb:wicki99 schrieb am 04.03.2022, 15:43 Uhr[/url]"]palladium: habe mir noch den monats-chart angesehen. das hoch erreicht die jahershöchststände 2021. vielleicht ergeben sich an diesem widerstand möglichkeiten zumindest kleine rücksetzer mit zu shorten.

» zur Grafik

...und raus zu 0,105 / 0,115 CAD in mehreren Teilausführungen 8)

- Tax Loss Ziel erreicht, auch wenn sie angesichts der Explosion des Nickel-Preises weiterlaufen könnte

- Deposit braucht aber noch einige Zeit bis zur Mine, da kann auch noch viel dazwischen kommen ...

- Tax Loss Ziel erreicht, auch wenn sie angesichts der Explosion des Nickel-Preises weiterlaufen könnte

- Deposit braucht aber noch einige Zeit bis zur Mine, da kann auch noch viel dazwischen kommen ...

[url=https://peketec.de/trading/viewtopic.php?p=2117123#2117123 schrieb:metahase schrieb am 21.12.2021, 22:02 Uhr[/url]"]NCP zu 0,07 CAD

sind mir soeben ins Depot gefallen

(Tax Loss Fishing)

Um dann abzufliegen!  2.074,00 Dolores

2.074,00 Dolores

[url=https://peketec.de/trading/viewtopic.php?p=2129299#2129299 schrieb:wicki99 schrieb am 04.03.2022, 18:18 Uhr[/url]"]gold: sprachs und ging in die knie ...

[url=https://peketec.de/trading/viewtopic.php?p=2129297#2129297 schrieb:wicki99 schrieb am 04.03.2022, 18:15 Uhr[/url]"]so, ich bin mal gespannt, ob zum wochenende hin noch long-posis im gold glattgestellt werden. der future klemmt sich gerade am mehrfach getesteten widerstandsbereich um 1965$/1967$ fest. wer weiß, was über das wochenende alles passiert!?

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Montage Gold Launches Project Finance Mandate with HCF International Advisers

2022-03-09 06:36 ET - News Release

VANCOUVER, BC, March 9, 2022 /PRNewswire/ - Montage Gold Corp. ("Montage" or the "Company") (TSXV: MAU) (OTCPK: MAUTF) is pleased to announce the appointment of HCF International Advisers Ltd. to assist in the raising of project finance for the development of the Kone Gold Project in Cote d'Ivoire ("KGP" or the "Project").

Hugh Stuart, CEO of Montage, commented, "Montage has made significant progress since its initial public offering in October 2020 to transition from an exploration stage company with a 1.5M ounce Inferred Resource to a development stage company with a 3.4M ounce Probable Mineral Reserve. The release of our Definitive Feasibility Study ("DFS") results on February 14, 2022, illustrated the expected robust economics of the KGP with a long potential mine life of 14.8 years, producing an estimated average of 207koz/year at all-in sustaining costs (non-GAAP) of $933/oz. During the first 5 years of production, the Project is expected to produce 272koz/year with a payback period of 2.7 years at a gold price of $1,600/oz. Investment interest in the Project has increased significantly following the release of the DFS and we look forward to commencing the project financing mandate which will run in parallel with our ongoing permitting efforts."

HCF International Advisers Ltd. ("HCF") is a leading independent corporate finance advisory boutique based in London, UK with a primary focus on the global mining and metals sector. HCF provides strategic and financial advice across the complete life cycle of a project with an extensive track record of securing the funding required to bring the project into operations. In particular, it has a strong history of securing funding for projects in Africa. HCF is comprised of professionals who have extensive financing and technical experience as well as expertise in the funding of gold projects.

ABOUT MONTAGE GOLD CORP.

Montage is a Canadian-based precious metals exploration and development company focused on opportunities in Cote d'Ivoire. The Company's flagship property is the Kone Gold Project, located in northwest Cote d'Ivoire, which currently hosts a Probable Mineral Reserve of 161.1Mt grading 0.66g/t for 3.42M ounces of gold. The Company released the results of a DFS on the Kone Gold Project on February 14, 2022, outlining a 15-year gold project estimated to produce 3.06M ounces of gold at AISC (non-GAAP) of $933 per ounce over life of mine, with average annual production of 207koz, and peak production of 320koz. Montage has a management team and Board with significant experience in discovering and developing gold deposits in Africa.

....

https://www.stockwatch.com/News/Item/Z-C!MAU-3218589/C/MAU

2022-03-09 06:36 ET - News Release

VANCOUVER, BC, March 9, 2022 /PRNewswire/ - Montage Gold Corp. ("Montage" or the "Company") (TSXV: MAU) (OTCPK: MAUTF) is pleased to announce the appointment of HCF International Advisers Ltd. to assist in the raising of project finance for the development of the Kone Gold Project in Cote d'Ivoire ("KGP" or the "Project").

Hugh Stuart, CEO of Montage, commented, "Montage has made significant progress since its initial public offering in October 2020 to transition from an exploration stage company with a 1.5M ounce Inferred Resource to a development stage company with a 3.4M ounce Probable Mineral Reserve. The release of our Definitive Feasibility Study ("DFS") results on February 14, 2022, illustrated the expected robust economics of the KGP with a long potential mine life of 14.8 years, producing an estimated average of 207koz/year at all-in sustaining costs (non-GAAP) of $933/oz. During the first 5 years of production, the Project is expected to produce 272koz/year with a payback period of 2.7 years at a gold price of $1,600/oz. Investment interest in the Project has increased significantly following the release of the DFS and we look forward to commencing the project financing mandate which will run in parallel with our ongoing permitting efforts."

HCF International Advisers Ltd. ("HCF") is a leading independent corporate finance advisory boutique based in London, UK with a primary focus on the global mining and metals sector. HCF provides strategic and financial advice across the complete life cycle of a project with an extensive track record of securing the funding required to bring the project into operations. In particular, it has a strong history of securing funding for projects in Africa. HCF is comprised of professionals who have extensive financing and technical experience as well as expertise in the funding of gold projects.

ABOUT MONTAGE GOLD CORP.

Montage is a Canadian-based precious metals exploration and development company focused on opportunities in Cote d'Ivoire. The Company's flagship property is the Kone Gold Project, located in northwest Cote d'Ivoire, which currently hosts a Probable Mineral Reserve of 161.1Mt grading 0.66g/t for 3.42M ounces of gold. The Company released the results of a DFS on the Kone Gold Project on February 14, 2022, outlining a 15-year gold project estimated to produce 3.06M ounces of gold at AISC (non-GAAP) of $933 per ounce over life of mine, with average annual production of 207koz, and peak production of 320koz. Montage has a management team and Board with significant experience in discovering and developing gold deposits in Africa.

....

https://www.stockwatch.com/News/Item/Z-C!MAU-3218589/C/MAU

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Monument Announces Ground-breaking Ceremony Held at Selinsing For Flotation Construction in Malaysia

2022-03-09 09:30 ET - News Release

VANCOUVER, British Columbia, March 09, 2022 (GLOBE NEWSWIRE) -- Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) ("Monument" or the "Company") is pleased to report the progress of the flotation plant at the Selinsing Gold Mine in Malaysia, and to announce that a ground-breaking ceremony (Figure 1) has been held at the mine site to herald the return of the principal contractor Seong Henng Engineering Works Sdn Bhd ("Seong Henng") to carry out the construction of the flotation plant.

President and CEO Cathy Zhai commented, "We are very happy to report the progress of the flotation plant construction at Selinsing; our on-site team is managing the project and is overseeing the principal contractor Seong Henng. Together we are working to complete the construction of the flotation plant to a high standard, safely, diligently, on time and on budget ready for dry commissioning at the end of June 2022."

Figure 1: Ground-breaking Ceremony Ribbon Cutting at Selinsing Gold Mine is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2093b803-17fa-495e-9167-279f895ed6c6

Charlie Northfield, General Manager and the project sponsor at the Selinsing Gold Mine commented: "It is a great pleasure to see the return of Seong Henng, our long-standing principal contractor partner, to play a major role in the construction of the flotation plant. Seong Henng is a local Malaysia-based manufacturing Company, and had historically constructed the Selinsing Gold plant and its expansion successfully."

The flotation plant construction includes project management, project validation, flotation design and engineering, procurement, construction and commissioning. The flotation plant construction project is 50% complete to date.

....

https://www.stockwatch.com/News/Item/Z-C!MMY-3218793/C/MMY

2022-03-09 09:30 ET - News Release

VANCOUVER, British Columbia, March 09, 2022 (GLOBE NEWSWIRE) -- Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) ("Monument" or the "Company") is pleased to report the progress of the flotation plant at the Selinsing Gold Mine in Malaysia, and to announce that a ground-breaking ceremony (Figure 1) has been held at the mine site to herald the return of the principal contractor Seong Henng Engineering Works Sdn Bhd ("Seong Henng") to carry out the construction of the flotation plant.

President and CEO Cathy Zhai commented, "We are very happy to report the progress of the flotation plant construction at Selinsing; our on-site team is managing the project and is overseeing the principal contractor Seong Henng. Together we are working to complete the construction of the flotation plant to a high standard, safely, diligently, on time and on budget ready for dry commissioning at the end of June 2022."

Figure 1: Ground-breaking Ceremony Ribbon Cutting at Selinsing Gold Mine is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2093b803-17fa-495e-9167-279f895ed6c6

Charlie Northfield, General Manager and the project sponsor at the Selinsing Gold Mine commented: "It is a great pleasure to see the return of Seong Henng, our long-standing principal contractor partner, to play a major role in the construction of the flotation plant. Seong Henng is a local Malaysia-based manufacturing Company, and had historically constructed the Selinsing Gold plant and its expansion successfully."

The flotation plant construction includes project management, project validation, flotation design and engineering, procurement, construction and commissioning. The flotation plant construction project is 50% complete to date.

....

https://www.stockwatch.com/News/Item/Z-C!MMY-3218793/C/MMY

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Nachtrag:

Anacortes PEA pegs Tres Cruces NPV at $165.9M (U.S.)

2022-03-08 10:07 ET - News Release

Mr. Jim Currie reports

TRES CRUCES PRELIMINARY ECONOMIC ASSESSMENT ESTIMATES AFTER-TAX NPV (5%) OF US$165.9 MILLION AT $1,700 GOLD

Anacortes Mining Corp. has released the results of a preliminary economic assessment (PEA) on its Tres Cruces gold oxide project, located in northern Peru, in the heart of Peru's premier gold mining district.

Anacortes will be hosting a conference call to discuss the results of the PEA, today Tuesday, March 8, 2022, at 4:30 p.m. EST (1:30 p.m. PST).

PEA highlights -- Tres Cruces oxide project:

Pretax net present value at a 5-per-cent discount rate of $294.3-million (U.S.);

After-tax NPV (5 per cent) of $165.9-million (U.S.);

After-tax internal rate of return of 33 per cent; 2.1-year payback at $1,700 (U.S.) per ounce;

Average gold production of 68,000 ounces annually over an initial oxide mine life of seven years. Peak gold production of 81,000 ounces in year 2;

Initial capital expenditure of $125.2-million (U.S.);

Average daily throughput: 5,800 tonnes per day over initial mine life;

588,000 ounces of gold mined over the initial mine life of seven years;

Recovered gold is estimated at 481,000 ounces over the initial mine life.

Jim Currie, chief executive officer of Anacortes Mining, states: "The Tres Cruces oxide project PEA shows excellent economics for the proposed heap leach operation, located in one of the world's most prolific gold mining belts. We intend to aggressively advance the development of the oxide resource to deliver shareholder value in a timely and environmentally and socially responsible manner, and we continue to emphasize that Tres Cruces has exceptional exploration potential at depth. The existing 1.8-million-ounce sulphide gold resource below the oxide cap will be further evaluated with our upcoming drill program. This program will deepen holes that ended in wide zones of higher-grade mineralization to test the extent of the deposit and include infill drilling to increase the confidence in the resource as we move Tres Cruces forward. This mineralization includes 173 metres averaging 3.118 grams per tonne Au from 92 m to 265 m in hole RTC-255, which ended in mineralization."

.....

https://www.stockwatch.com/News/Item/Z-C!XYZ-3218139/C/XYZ

Anacortes PEA pegs Tres Cruces NPV at $165.9M (U.S.)

2022-03-08 10:07 ET - News Release

Mr. Jim Currie reports

TRES CRUCES PRELIMINARY ECONOMIC ASSESSMENT ESTIMATES AFTER-TAX NPV (5%) OF US$165.9 MILLION AT $1,700 GOLD

Anacortes Mining Corp. has released the results of a preliminary economic assessment (PEA) on its Tres Cruces gold oxide project, located in northern Peru, in the heart of Peru's premier gold mining district.

Anacortes will be hosting a conference call to discuss the results of the PEA, today Tuesday, March 8, 2022, at 4:30 p.m. EST (1:30 p.m. PST).

PEA highlights -- Tres Cruces oxide project:

Pretax net present value at a 5-per-cent discount rate of $294.3-million (U.S.);

After-tax NPV (5 per cent) of $165.9-million (U.S.);

After-tax internal rate of return of 33 per cent; 2.1-year payback at $1,700 (U.S.) per ounce;

Average gold production of 68,000 ounces annually over an initial oxide mine life of seven years. Peak gold production of 81,000 ounces in year 2;

Initial capital expenditure of $125.2-million (U.S.);

Average daily throughput: 5,800 tonnes per day over initial mine life;

588,000 ounces of gold mined over the initial mine life of seven years;

Recovered gold is estimated at 481,000 ounces over the initial mine life.

Jim Currie, chief executive officer of Anacortes Mining, states: "The Tres Cruces oxide project PEA shows excellent economics for the proposed heap leach operation, located in one of the world's most prolific gold mining belts. We intend to aggressively advance the development of the oxide resource to deliver shareholder value in a timely and environmentally and socially responsible manner, and we continue to emphasize that Tres Cruces has exceptional exploration potential at depth. The existing 1.8-million-ounce sulphide gold resource below the oxide cap will be further evaluated with our upcoming drill program. This program will deepen holes that ended in wide zones of higher-grade mineralization to test the extent of the deposit and include infill drilling to increase the confidence in the resource as we move Tres Cruces forward. This mineralization includes 173 metres averaging 3.118 grams per tonne Au from 92 m to 265 m in hole RTC-255, which ended in mineralization."

.....

https://www.stockwatch.com/News/Item/Z-C!XYZ-3218139/C/XYZ

[url=https://peketec.de/trading/viewtopic.php?p=2129288#2129288 schrieb:Kostolanys Erbe schrieb am 04.03.2022, 17:56 Uhr[/url]"]

Anacortes to release Tres Cruces PEA March 8

2022-03-04 10:02 ET - News Release

Mr. Jim Currie reports

ANACORTES MINING TO RELEASE PRELIMINARY ECONOMIC ASSESSMENT ON TRES CRUCES HIGH GRADE OXIDE GOLD CAP, PRE-MARKET TUESDAY MARCH 8, 2022

Anacortes Mining Corp. will be releasing its inaugural preliminary economic assessment (PEA) premarket Tuesday, March 8, 2022, and will be hosting a conference call to discuss the results on the same day at 4:30 p.m. EST (1:30 p.m. PST).

[...]

https://www.stockwatch.com/News/Item/Z-C!XYZ-3217055/C/XYZ

[url=https://peketec.de/trading/viewtopic.php?p=2119216#2119216 schrieb:Kostolanys Erbe schrieb am 10.01.2022, 19:04 Uhr[/url]"]Anacortes Mining plans drilling on Tres Cruces

2022-01-10 11:23 ET - News Release

Mr. James Currie reports

ANACORTES MINING TO AGGRESSIVELY ADVANCE TRES CRUCES HIGH-GRADE GOLD DEPOSIT IN 2022

Anacortes Mining Corp. has provided a corporate update, including guidance on its 2022 objectives, as the company advances toward its ambitious goal of becoming a low-cost, mid-tier gold producer.

.....

https://www.stockwatch.com/News/Item/Z-C!XYZ-3192544/C/XYZ

[url=https://peketec.de/trading/viewtopic.php?p=2115448#2115448 schrieb:Kostolanys Erbe schrieb am 11.12.2021, 11:05 Uhr[/url]"]Nach dem Zusammenschluss sind sie nun wieder an der Börse unter dem

Kürzel XYZ !

Anacortes Mining Corp.

https://anacortesmining.com/

Präsentation:

https://secureservercdn.net/104.238.68.196/qj3.450.myftpupload.com/wp-content/uploads/2021/10/Anacortes-Investor-Presentation-DRAFT-v5.pdf

» zur Grafik

[url=https://peketec.de/trading/viewtopic.php?p=2081129#2081129 schrieb:Kostolanys Erbe schrieb am 17.06.2021, 21:16 Uhr[/url]"]First Light Capital to merge with New Oroperu

2021-06-17 14:09 ET - News Release

See News Release (C-XYZ) First Light Capital Corp

Mr. Jim Currie of First Light reports

FIRST LIGHT AND NEW OROPERU ANNOUNCE BUSINESS COMBINATION TO CREATE ANACORTES MINING AND C$20M CONCURRENT FINANCING TO ADVANCE TRES CRUCES

........

https://www.stockwatch.com/News/Item/Z-C!ORO-3099969/C/ORO

Alpha Metallurgical Resources, Inc.: th 132.88$.

[url=https://peketec.de/trading/viewtopic.php?p=2129190#2129190 schrieb:wicki99 schrieb am 04.03.2022, 11:12 Uhr[/url]"]Alpha Metallurgical Resources, Inc.:

kommt auf die allgemeine wl. aber jeder trend endet einmal, obwohl es hier im politischen umfeld auch noch deutlich weitergehen kann.

» zur Grafik

gold: da ist man mal für 5 tage auswärts auf urlaub und schon springt die gold-kante nordwärts ...

[url=https://peketec.de/trading/viewtopic.php?p=2129774#2129774 schrieb:dukezero schrieb am 08.03.2022, 16:55 Uhr[/url]"]Um dann abzufliegen!2.074,00 Dolores

[url=https://peketec.de/trading/viewtopic.php?p=2129299#2129299 schrieb:wicki99 schrieb am 04.03.2022, 18:18 Uhr[/url]"]gold: sprachs und ging in die knie ...

[url=https://peketec.de/trading/viewtopic.php?p=2129297#2129297 schrieb:wicki99 schrieb am 04.03.2022, 18:15 Uhr[/url]"]so, ich bin mal gespannt, ob zum wochenende hin noch long-posis im gold glattgestellt werden. der future klemmt sich gerade am mehrfach getesteten widerstandsbereich um 1965$/1967$ fest. wer weiß, was über das wochenende alles passiert!?

palladium: irre bewegungen hier. da wundert es mich nicht, dass IB als ersteinschuss 280.184,54$ als margin für den handl eines kontrakts verlangt ...

[url=https://peketec.de/trading/viewtopic.php?p=2129304#2129304 schrieb:wicki99 schrieb am 04.03.2022, 18:59 Uhr[/url]"]palladium: th 2990$ und der sofortige rücksetzer an 2950$.

[url=https://peketec.de/trading/viewtopic.php?p=2129250#2129250 schrieb:wicki99 schrieb am 04.03.2022, 15:43 Uhr[/url]"]palladium: habe mir noch den monats-chart angesehen. das hoch erreicht die jahershöchststände 2021. vielleicht ergeben sich an diesem widerstand möglichkeiten zumindest kleine rücksetzer mit zu shorten.

» zur Grafik

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Habe mich mal heute an die buy the dips Strategie orientiert...

Heute 50k DSV zu @ 1,4365 € geladen.

Wenn der Gold marschiert, sollte der kleine Bruder Silber auch irgendwann stärker davon profitieren.

auch irgendwann stärker davon profitieren.

Aus meiner Sicht hat DSV ein sehr gutes Projekt in Mexiko.

Aktuelle Präsentation:

https://discoverysilver.com/site/assets/files/5120/dsv_corp_deck_-_feb_2022_v1.pdf

Charttechnisch hat Silver Kaufsignal generiert:

Heute 50k DSV zu @ 1,4365 € geladen.

Wenn der Gold marschiert, sollte der kleine Bruder Silber

Aus meiner Sicht hat DSV ein sehr gutes Projekt in Mexiko.

Aktuelle Präsentation:

https://discoverysilver.com/site/assets/files/5120/dsv_corp_deck_-_feb_2022_v1.pdf

Charttechnisch hat Silver Kaufsignal generiert:

Corn Higher as More Eyes Turn to Ethanol -- Market Talk mais

10 March 2022, 19:10

12:10 ET - Corn futures rise, with some traders turning more of their focus towards ethanol, amid bans of Russian oil, natural gas, and coal--which are pushing energy prices higher and prompted Russia to respond with its own export bans. The pullback of Russian energy from the US market has investors looking for energy alternatives, one of which being ethanol. "You will hear more from the ethanol industry as this self-inflicted food and energy crisis continues," Daniel Flynn of Price Futures Group says. The EIA reported yesterday that daily ethanol production in the US rose over the past week, as did inventories. Most active corn futures gain 2.2%. (kirk.maltais@wsj.com, @kirkmaltais)

(END) Dow Jones Newswires

March 10, 2022 12:10 ET (17:10 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

10 March 2022, 19:10

12:10 ET - Corn futures rise, with some traders turning more of their focus towards ethanol, amid bans of Russian oil, natural gas, and coal--which are pushing energy prices higher and prompted Russia to respond with its own export bans. The pullback of Russian energy from the US market has investors looking for energy alternatives, one of which being ethanol. "You will hear more from the ethanol industry as this self-inflicted food and energy crisis continues," Daniel Flynn of Price Futures Group says. The EIA reported yesterday that daily ethanol production in the US rose over the past week, as did inventories. Most active corn futures gain 2.2%. (kirk.maltais@wsj.com, @kirkmaltais)

(END) Dow Jones Newswires

March 10, 2022 12:10 ET (17:10 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

Alpha Metallurgical Resources, Inc.: läuft vom th bei 137.00$ zurück auf 127.19$.

[url=https://peketec.de/trading/viewtopic.php?p=2130183#2130183 schrieb:wicki99 schrieb am 10.03.2022, 16:16 Uhr[/url]"]Alpha Metallurgical Resources, Inc.: th 132.88$.

[url=https://peketec.de/trading/viewtopic.php?p=2129190#2129190 schrieb:wicki99 schrieb am 04.03.2022, 11:12 Uhr[/url]"]Alpha Metallurgical Resources, Inc.:

kommt auf die allgemeine wl. aber jeder trend endet einmal, obwohl es hier im politischen umfeld auch noch deutlich weitergehen kann.

» zur Grafik