Gasoline Prices Expected to Trend Higher -- Market Talk

27 March 2023, 17:24

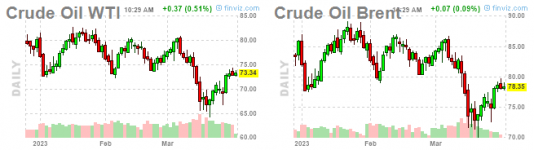

1024 ET - The price of gasoline in the US was basically flat last week, falling just 0.3 cents per gallon, and averages $3.40 today, according to a report by GasBuddy that points to upward pressures stemming from "tight supply and accelerating prices." Last week, gasoline stockpiles showed a higher-than-expected draw. Crude prices also rose and are up 2% today. GasBuddy says its data is compiled from more than 150K gas stations. The firm reports the average gas price in Dallas to have risen 13.4 cents. It says any price drops are likely to be temporary and drivers may get "good news" in some areas and not in others.

(paulo.trevisani@wsj.com; @ptrevisani) (END) Dow Jones Newswires March 27, 2023 10:24 ET (14:24 GMT)Copyright (c) 2023 Dow Jones & Company, Inc.

27 March 2023, 17:24

1024 ET - The price of gasoline in the US was basically flat last week, falling just 0.3 cents per gallon, and averages $3.40 today, according to a report by GasBuddy that points to upward pressures stemming from "tight supply and accelerating prices." Last week, gasoline stockpiles showed a higher-than-expected draw. Crude prices also rose and are up 2% today. GasBuddy says its data is compiled from more than 150K gas stations. The firm reports the average gas price in Dallas to have risen 13.4 cents. It says any price drops are likely to be temporary and drivers may get "good news" in some areas and not in others.

(paulo.trevisani@wsj.com; @ptrevisani) (END) Dow Jones Newswires March 27, 2023 10:24 ET (14:24 GMT)Copyright (c) 2023 Dow Jones & Company, Inc.