NYMEX OVERVIEW: PETROLEUM MARKETS REBOUND WITH BUYING -- OPIS

17 November 2023, 19:42

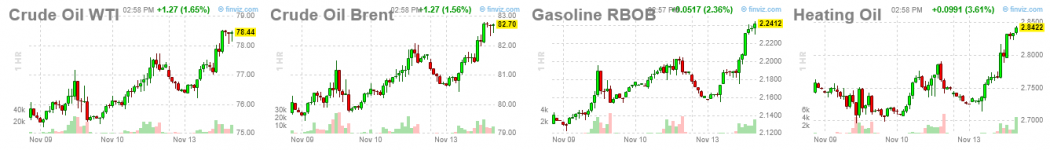

Buying has been the order of the day in the petroleum futures contracts on Friday.

For the time being, refined product futures gains are outpacing the move in

crude oil, with front-month contracts sticking close to the highs of the day. Over the past several days, near term oil has flipped from backwardation to contango. The contango move indicates that for the time being supply concerns are muted.

That remains the case Friday, but some of the outer-month contracts are starting to slip back toward the previous trend. For example, March

West Texas Intermediate settled roughly 20cts higher than January, but today those contracts are essentially flat.

Most of the activity in NYMEX contracts has shifted over to January, but overall volumes appear to be a bit light especially considering Thursday's activity in WTI that saw total volume top 1 million contracts.

More than $2 of increases are being seen in the

WTI and

Brent contracts Friday as both contracts look to bounce back from declines in the $4 area on Thursday. Heading into midday, front-month WTI is up $2.46 at $75.35/bbl with the January contract at $75.57/bbl up by $2.44.

The

January Brent contract is outpacing the move in

WTI, last trading at $80.18/bbl and up $2.76. January Brent has been bouncing on either side of $80 in late morning/early afternoon trading.

Refined product increases are in the 6-7cts range with diesel seeing the stronger move at the moment.

December

ULSD was most recently trading at $2.8195/gal, up 6.92cts, with January at $2.7402/gal, an increase of roughly 6.76cts. As it currently stands, ULSD will be the only contract to post week-to-week gains thanks to a strong front half of the week. The paper strength has lent support to spot markets, but the backwardation from December to January has kept a lid on Los Angeles diesel where current prices are quoted down 15-20cts thanks largely to the shift in reference month.

RBOB futures are also trading up by more than 6cts, with the December contract currently trading higher by 6.26cts at $2.1637/gal and the January contract moving alongside it with similar gain and trading at $2.138/gal.

Futures gains are being reflected in most east of the Rockies markets, with the Gulf Coast and Chicago prices still under the $2/gal level. The West Coast is more mixed. Even with the strong move higher in futures, L.A. CARBOB is up just over a cent while the San Francisco market is off by almost 10cts as premiums continue to narrow for CARBOB.

This content was created by Oil Price Information Service, which is operated by Dow Jones & Co. OPIS is run independently from Dow Jones Newswires and The Wall Street Journal.

--Reporting by Denton Cinquegrana,

dcinquegrana@opisnet.com; Editing by Michael Kelly,

mkelly@opisnet.com (END) Dow Jones Newswires November 17, 2023 12:42 ET (17:42 GMT) Copyright (c) 2023 Dow Jones & Company, Inc.