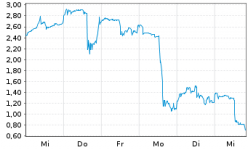

Angst vor PP, die haben ja kein Geld mehr.

Aus dem ceo.ca Board:

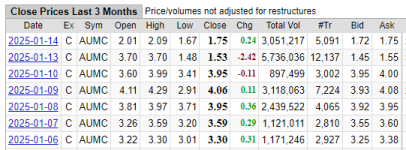

Because Auric is involved in the exploration of mineral properties without any known economic quantities of mineralization, it has not generated any revenue to date and is unlikely to realize revenue in the foreseeable future. Management anticipates that it will incur expenses in connection with the exploration of its mineral properties, compliance with applicable securities rules and continuous disclosure requirements, and general and administrative costs. In the year ended October 31, 2024, the Company incurred a net loss of $179,351 compared to a net loss of $140,059 during the same period in fiscal 2023. The increase in net loss in the most recently completed period is primarily due to filing expenses to the OSC and CSE, legal fees, compensation to the director as well as accounting expenses and auditors’ fees. The Company anticipates that it will incur increasing expenses in fiscal 2024 as it continues filings with the OSC and CSE, and plan to fund exploration and development at the Goodeye property.

Liquidity As at October 31, 2024, the Company had current assets of $67,795 and current liabilities of $84,709, resulting in a negative working capital of $16,914. Total shareholders’ equity was $78,086 as at October 31, 2024. As the Company will not generate funds from operations for the foreseeable future, the Company is primarily reliant upon the sale of equity securities in order to fund operations. Since inception, the Company has funded limited operations through the issuance of equity securities on a private placement basis. This has permitted the Company to carry out limited operations and to commission geological reports Goodeye Property. Capital Resources The Company will require at least US$200,000 to make the property option payment that will be due on October 31, 2025 respecting the Goodeye Property. The Company also anticipates spending $151,347 to cover anticipated general and administrative costs and legal, audit and office overhead expenses for the next 12-month period. At October 31, 2024, the Company had cash of $67,661, which is not sufficient to cover all expected exploration, operations and administrative expenses for the next twelve months. The Company cannot offer any assurance that expenses will not exceed management's expectations. The Company may require additional funds and will be dependent upon its ability to secure equity and/or debt financing, the availability of which cannot be assured. Although the Company currently has limited capital resources, the Company anticipates that additional funding will come from equity financing from the sale of the Company’s shares or through debt financing. The Company may also seek loans.

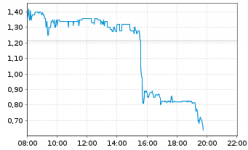

ask wird weiter zugemüllt, da kommen Tonnen von shares auf den Markt, noch keine Trendwende erkennbar

#1R6(A40M0J)

0,106 +0,0%