App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

WS - Wildcat Silver - WKN A0J24M

- Ersteller golden_times

- Erstellt am

- Tagged users Kein(e)

[url=http://peketec.de/trading/viewtopic.php?p=1231157#1231157 schrieb:golden_times schrieb am 28.03.2012, 15:32 Uhr[/url]"]Update - Schedule 2012

• 9 Millionen USD sollen in FY 2012 in Explorationsprogramme auf Hermosa investiert werden

• aktuelle Cash Balance beträgt 11 Mio USD, nächste Finanzierung demnach zwischen Q4 2012 und Q1 2013

• sie haben sich dazu entschieden, das PEA-Update auf die größere Ressource zu beziehen (das RE-Update von

Februar umfasste nur 54% der Bohrlöcher), das ist kurzfr. für den SP natürlich nicht so gut, langfristig ist

dieser Schritt aber imho sehr sinnvoll, und zeigt auch in welche Richtung die Verantwortlichen arbeiten

• Manganese Ressource: Sie führen derweil - parallel zu den operativen Tätigkeiten - Gespräche mit

potentiellen Abnehmern aus der Industrie; potentielle off take agreements in Arbeit

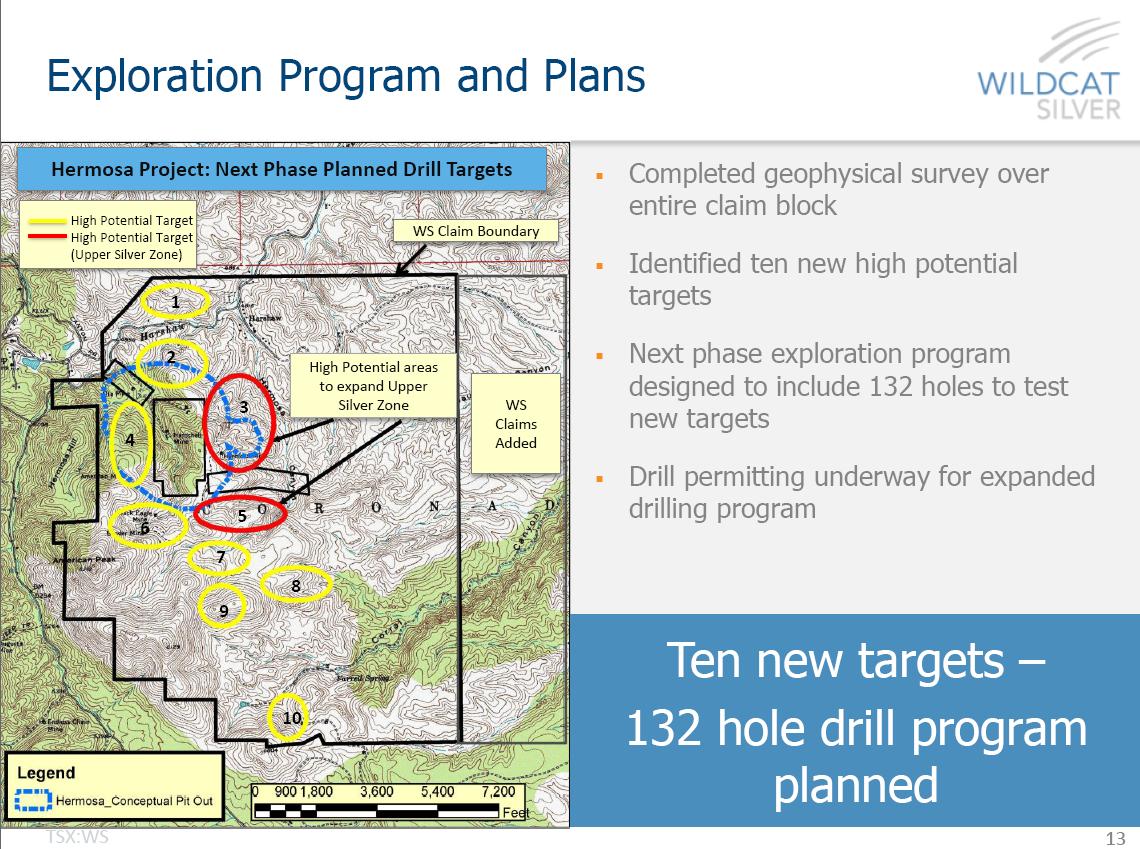

• Wildcat hat etliche weitere high potential targets in den letzten 12 Monaten identifiziert; diese liegen

alle außerhalb der definierten Ressource; HIER liegt imho der nächste komplette game changer;

werden sie auf diesen targets (132 Bohrlöcher geplant) nur annähernd so qualitativ treffen, wie bis

dato; dann wird Hermosa noch viel wertvoller werden - Das Projekt ist jetzt schon eines der größten

unentwickelten Silber-Projekte der Welt; mit diesem Explorationspotential kann Hermosa das größte

Silber-Projekt in Amerika werden; Anfang 2013 soll das wide district Programm starten (!!!)

• Pilot Plant (Testphase Metallverarbeitung) soll in Q2 gestartet werden, sie planen den Test mit

10 Tonnen Erz durchzuführen --> durch diesen Test wollen sie u.a. neue Erkenntnisse bzgl. den

geplanten Verarbeitungsprozessen gewinnen, und neue Erkenntnisse bzgl. der Metallurgie und den

Eigenschaften des Erzes bekommen; bis dato sehen sie keine Probleme im Verarbeitungsprozess

• Reminder: Prime target für Hermosa habe ich vor langer Zeit auf 500 Millionen Unzen Silber gesetzt

(ohne by product credits = Ag Eqs --> reine Ag credits), das werden sie bis Ende 2013 erreichen;

long term hat Wildcat bei diesem raren, weltklasse Projekt das Potential mehr als eine Milliarde Unzen

Silber zu definieren; Silver Wheaton hat sich erst vor Kurzem bzgl. den Wachstumsplänen positiv über

Wildcat ausgesprochen; imho werden sie gar keine Wahl haben, dieses Projekt nicht in Produktion

zu bringen; es ist einfach viel zu groß und wichtig; und hier rede ich nicht nur vom Silber, sondern

vor allem von der Manganese Ressource; die enorm wichtig für die USA in Zukunft werden wird

• wie ich immer sagte, die Augusta Group ist voll auf Kurs: Wildcat hat hier bis dato alles im Griff,

und peilt einen major deal langfristig an (vgl. Ventana); problematisch wird bei Hermosa in Zukunft

auch sicher der permitting Prozess werden, imho werden sie es aber schaffen - wenn diese Männer

das nicht schaffen, dann Niemand! mark my words, vgl. die Situation mit Augusta Resource - be patient!

Wildcat announces additional drill results, extends Upper Silver Zone mineralization

VANCOUVER, April 25, 2012 /CNW/ - Wildcat Silver Corporation (TSX: WS) ("Wildcat" or "the Company") is pleased to announce the results for 21 additional holes completed on the Company's Hermosa property located in Santa Cruz County, Arizona. Results continue to support the expansion and upgrading of the current Hermosa resource, particularly highlighting the potential of the recently discovered Upper Silver Zone.

Highlights

Holes HDS-221, 223, 230, 233 and 234 are located to the southeast of the Hermosa resource area and successfully extended the Upper Silver Zone. Significant Upper Silver Zone mineralization includes HDS-223 which returned 16.8 metres of 92.7 g/t silver and HDS-230 which returned 12.2 metres of 136.8 g/t silver.

Hole HDS-201, located on the northeast corner of the patented claims, extended both the Upper Silver and Manto Zones to the northeast. Holes HDS-195 is also located in the northeast and encountered Upper Silver Zone mineralization intersecting 8.8 metres of 75.8 g /t silver.

Holes HDS-219 and HDS-227, located in the centre of the resource, and Holes HDS-218 and HDS-222, located in the south of the resource, all encountered Upper Silver Zone and Manto Zone mineralization, returning significant silver and manganese values. The best intervals encountered in the Manto Zone include:

Hole 218 returned 19.8 metres of 120.9 g/t silver, 6.58% manganese, 0.32% zinc, 0.66% lead and 0.11% copper.

Hole 219 returned 27.4 metres of 108.0 g/t silver, 15.50% manganese, 1.62% zinc, 1.75% lead and 0.08% copper.

Hole 222 returned 17.7 metres of 189.9 g/t silver, 8.59% manganese, 1.25% zinc, 0.86% lead and 0.06% copper.

Hole 227 returned 21.3 metres of 174.7 g/t silver, 14.43% manganese, 0.90% zinc, 2.79% lead and 0.20% copper.

The Company's most recent drill program, which was initiated in December 2010, was completed in March 2012, having drilled 216 holes for a total of approximately 55,884 metres. A total of 54% of the drill and assay values were included in the February 2012 mineral resource estimate for the Hermosa project. Wildcat expects to provide a further update to the current mineral resource to incorporate all of the drilling in the third quarter of this year.

A summary of the drill results is provided below. Please also see attached map.

.

.

.

http://www.wildcatsilver.com/Theme/Wildcat/files/doc_news/04%2025%202012%20Drill%20Holes%20FINAL_v001_o502t7.pdf

VANCOUVER, April 25, 2012 /CNW/ - Wildcat Silver Corporation (TSX: WS) ("Wildcat" or "the Company") is pleased to announce the results for 21 additional holes completed on the Company's Hermosa property located in Santa Cruz County, Arizona. Results continue to support the expansion and upgrading of the current Hermosa resource, particularly highlighting the potential of the recently discovered Upper Silver Zone.

Highlights

Holes HDS-221, 223, 230, 233 and 234 are located to the southeast of the Hermosa resource area and successfully extended the Upper Silver Zone. Significant Upper Silver Zone mineralization includes HDS-223 which returned 16.8 metres of 92.7 g/t silver and HDS-230 which returned 12.2 metres of 136.8 g/t silver.

Hole HDS-201, located on the northeast corner of the patented claims, extended both the Upper Silver and Manto Zones to the northeast. Holes HDS-195 is also located in the northeast and encountered Upper Silver Zone mineralization intersecting 8.8 metres of 75.8 g /t silver.

Holes HDS-219 and HDS-227, located in the centre of the resource, and Holes HDS-218 and HDS-222, located in the south of the resource, all encountered Upper Silver Zone and Manto Zone mineralization, returning significant silver and manganese values. The best intervals encountered in the Manto Zone include:

Hole 218 returned 19.8 metres of 120.9 g/t silver, 6.58% manganese, 0.32% zinc, 0.66% lead and 0.11% copper.

Hole 219 returned 27.4 metres of 108.0 g/t silver, 15.50% manganese, 1.62% zinc, 1.75% lead and 0.08% copper.

Hole 222 returned 17.7 metres of 189.9 g/t silver, 8.59% manganese, 1.25% zinc, 0.86% lead and 0.06% copper.

Hole 227 returned 21.3 metres of 174.7 g/t silver, 14.43% manganese, 0.90% zinc, 2.79% lead and 0.20% copper.

The Company's most recent drill program, which was initiated in December 2010, was completed in March 2012, having drilled 216 holes for a total of approximately 55,884 metres. A total of 54% of the drill and assay values were included in the February 2012 mineral resource estimate for the Hermosa project. Wildcat expects to provide a further update to the current mineral resource to incorporate all of the drilling in the third quarter of this year.

A summary of the drill results is provided below. Please also see attached map.

.

.

.

http://www.wildcatsilver.com/Theme/Wildcat/files/doc_news/04%2025%202012%20Drill%20Holes%20FINAL_v001_o502t7.pdf

Wildcat announces change in leadership

VANCOUVER, May 7, 2012 /CNW/ - Wildcat Silver Corporation (TSX: WS) ("Wildcat" or "the Company") announces the departure of Christopher M. Jones , President, CEO and Director, effective today. Richard W. Warke , the Company's Executive Chairman, will assume the duties of CEO. Donald R. Taylor , the Company's VP of Exploration will become President and Chief Operating Officer (COO) of Wildcat and will continue as head of exploration.

"The Board would like to thank Mr. Jones for his service to Wildcat for the past four years," said Mr. Warke. "He has stewarded the Company since 2008 during a time of economic uncertainty and market volatility, increasing shareholder value through the development of the Hermosa project. We wish him the best in his future endeavours."

Wildcat is making significant progress on its metallurgical optimization studies and intends to complete pilot plant work mid-year. Under Mr. Warke's and Mr. Taylor's leadership, the Company will complete an updated mineral resource and preliminary economic assessment (PEA) for its Hermosa project in the third quarter of this year. The PEA will include the new mineral resource as well as the updated metallurgical testwork.

Mr. Warke has more than 25 years of experience in corporate finance and marketing in the global resource industry. His endeavours have primarily involved mineral resource operations, but he has been involved with oil and gas, forestry, technology and manufacturing operations. Mr. Warke is also the founder and Chairman of Augusta Resource Corporation, the Chairman and CEO of Riva Gold Corp and Director of Plata Latina Minerals Corporation. In addition, he was the founder and Chairman of Ventana Gold Corp before its acquisition by AUX Canada Acquisitions Inc.

Mr. Taylor has more than 25 years of mineral exploration experience on five continents in precious and base metals, taking projects from exploration to mine development. He has worked extensively for large and small cap companies, including BHP Minerals, Bear Creek Mining, American Copper and Nickel, Doe Run Resources, and Westmont Mining Company. Mr. Taylor has a Bachelor of Science degree in Geology from Southeast Missouri State University and a Master of Science degree from University of Missouri at Rolla. He is a Licensed Professional Geologist in several eastern and western states and a qualified person as defined by National Instrument 43-101.

VANCOUVER, May 7, 2012 /CNW/ - Wildcat Silver Corporation (TSX: WS) ("Wildcat" or "the Company") announces the departure of Christopher M. Jones , President, CEO and Director, effective today. Richard W. Warke , the Company's Executive Chairman, will assume the duties of CEO. Donald R. Taylor , the Company's VP of Exploration will become President and Chief Operating Officer (COO) of Wildcat and will continue as head of exploration.

"The Board would like to thank Mr. Jones for his service to Wildcat for the past four years," said Mr. Warke. "He has stewarded the Company since 2008 during a time of economic uncertainty and market volatility, increasing shareholder value through the development of the Hermosa project. We wish him the best in his future endeavours."

Wildcat is making significant progress on its metallurgical optimization studies and intends to complete pilot plant work mid-year. Under Mr. Warke's and Mr. Taylor's leadership, the Company will complete an updated mineral resource and preliminary economic assessment (PEA) for its Hermosa project in the third quarter of this year. The PEA will include the new mineral resource as well as the updated metallurgical testwork.

Mr. Warke has more than 25 years of experience in corporate finance and marketing in the global resource industry. His endeavours have primarily involved mineral resource operations, but he has been involved with oil and gas, forestry, technology and manufacturing operations. Mr. Warke is also the founder and Chairman of Augusta Resource Corporation, the Chairman and CEO of Riva Gold Corp and Director of Plata Latina Minerals Corporation. In addition, he was the founder and Chairman of Ventana Gold Corp before its acquisition by AUX Canada Acquisitions Inc.

Mr. Taylor has more than 25 years of mineral exploration experience on five continents in precious and base metals, taking projects from exploration to mine development. He has worked extensively for large and small cap companies, including BHP Minerals, Bear Creek Mining, American Copper and Nickel, Doe Run Resources, and Westmont Mining Company. Mr. Taylor has a Bachelor of Science degree in Geology from Southeast Missouri State University and a Master of Science degree from University of Missouri at Rolla. He is a Licensed Professional Geologist in several eastern and western states and a qualified person as defined by National Instrument 43-101.

Wildcat announces additional drill results, expanding Upper Silver Zone mineralization to the southeast

VANCOUVER, May 10, 2012 /CNW/ - Wildcat Silver Corporation (TSX: WS) ("Wildcat" or "the Company") is pleased to announce the results for 31 additional drill holes completed on the Company's Hermosa property located in Santa Cruz County, Arizona. Results were mainly targeted at the expansion of the Upper Silver Zone, southeast of the current Hermosa resource. The majority of the drill holes encountering leachable Upper Silver Zone mineralization intersected thicknesses of up to 39.6 metres with average silver grades ranging from 32.6 g/t to 104.4 g/t.

Highlights

Holes HDS-255, HDS-261, HDS-236 and HDS-256 are located in the patented claim blocks to the southeast of the existing Hermosa resource and all returned significant Upper Silver Zone mineralization.

HDS-255 intersected high grade Upper Silver Zone mineralization over 30.5 metres beginning at the surface which averaged 104.4 g/t silver.

HDS-261 extends and leaves open the possible expansion of the Upper Silver Zone onto the unpatented claims to the north and northeast. This drill hole encountered five zones of Upper Silver Zone mineralization ranging in thickness from 4.6 metres to 14.3 metres with silver grades ranging from 34.5 g/t up to 92.8 g/t.

HDS-236 encountered three zones of Upper Silver Zone mineralization with two zones returning 70.9 g/t silver and 75.7 g/t silver, both over 4.6 metres.

HDS-256, located in close proximity to HDS-255, intersected an extensive interval of Upper Silver Zone mineralization from the surface down 39.6 metres, averaging 49.2 g/t silver.

Hole HDS-240, located in the northern portion of the existing resource, intersected six mineralized intercepts of the Manto Oxide Zone with the best intercept returning 148.9 g/t silver and 11.32% manganese over 16.8 metres. The bottom portion of the drill hole contained four mineralized intersections of Sulfide Skarn Zone, extending mineralization from the previously announced hole HDS-104. These mineralized intercepts contained significant silver, lead, zinc and manganese with one of the best intercepts returning 7.6 metres of 122.7 g/t silver, 8.03% manganese, 6.98% zinc, 5.15% lead and 0.42% copper.

Hole HDS-265, located in the northeast of the Hermosa patented claim block, expands the Upper Silver Zone and the Manto Oxide Zone to the east of the main portion of the Hermosa resource. This hole intersected four zones of Upper Silver Zone mineralization and two zones of Manto Oxide Zone mineralization. The best Upper Silver Zone intercept was 4.9 metres over 91.1 g/t silver and the best Manto Oxide Zone intercept was 21.5 metres of 65.8 g/t silver, 10.56% manganese and 3.68% lead.

The Company's most recent drill program was completed in March 2012, having drilled 212 holes for a total of approximately 55,700 metres. A total of 54% of the drill and assay values were included in the February 2012 mineral resource estimate for the Hermosa project. Wildcat expects to provide a further update to the current mineral resource to incorporate all of the drilling in the third quarter of this year. Following this announcement there are 57 drill holes with assays and analysis still in process, which are expected to be released by the end of this quarter.

The Company is also making significant progress on its metallurgical optimization studies and intends to complete pilot plant work mid-year. As a result, the Company intends to deliver a preliminary economic assessment in the third quarter of this year, which will include the new mineral resource as well as updated metallurgical testwork.

A summary of the drill results is provided below. Please also see attached map.

.

.

.

http://www.wildcatsilver.com/Theme/Wildcat/files/doc_news/05%2010%202012%20Drill%20Results%20(31)%20FINAL%20PDF_v001_r6ng9e.pdf

VANCOUVER, May 10, 2012 /CNW/ - Wildcat Silver Corporation (TSX: WS) ("Wildcat" or "the Company") is pleased to announce the results for 31 additional drill holes completed on the Company's Hermosa property located in Santa Cruz County, Arizona. Results were mainly targeted at the expansion of the Upper Silver Zone, southeast of the current Hermosa resource. The majority of the drill holes encountering leachable Upper Silver Zone mineralization intersected thicknesses of up to 39.6 metres with average silver grades ranging from 32.6 g/t to 104.4 g/t.

Highlights

Holes HDS-255, HDS-261, HDS-236 and HDS-256 are located in the patented claim blocks to the southeast of the existing Hermosa resource and all returned significant Upper Silver Zone mineralization.

HDS-255 intersected high grade Upper Silver Zone mineralization over 30.5 metres beginning at the surface which averaged 104.4 g/t silver.

HDS-261 extends and leaves open the possible expansion of the Upper Silver Zone onto the unpatented claims to the north and northeast. This drill hole encountered five zones of Upper Silver Zone mineralization ranging in thickness from 4.6 metres to 14.3 metres with silver grades ranging from 34.5 g/t up to 92.8 g/t.

HDS-236 encountered three zones of Upper Silver Zone mineralization with two zones returning 70.9 g/t silver and 75.7 g/t silver, both over 4.6 metres.

HDS-256, located in close proximity to HDS-255, intersected an extensive interval of Upper Silver Zone mineralization from the surface down 39.6 metres, averaging 49.2 g/t silver.

Hole HDS-240, located in the northern portion of the existing resource, intersected six mineralized intercepts of the Manto Oxide Zone with the best intercept returning 148.9 g/t silver and 11.32% manganese over 16.8 metres. The bottom portion of the drill hole contained four mineralized intersections of Sulfide Skarn Zone, extending mineralization from the previously announced hole HDS-104. These mineralized intercepts contained significant silver, lead, zinc and manganese with one of the best intercepts returning 7.6 metres of 122.7 g/t silver, 8.03% manganese, 6.98% zinc, 5.15% lead and 0.42% copper.

Hole HDS-265, located in the northeast of the Hermosa patented claim block, expands the Upper Silver Zone and the Manto Oxide Zone to the east of the main portion of the Hermosa resource. This hole intersected four zones of Upper Silver Zone mineralization and two zones of Manto Oxide Zone mineralization. The best Upper Silver Zone intercept was 4.9 metres over 91.1 g/t silver and the best Manto Oxide Zone intercept was 21.5 metres of 65.8 g/t silver, 10.56% manganese and 3.68% lead.

The Company's most recent drill program was completed in March 2012, having drilled 212 holes for a total of approximately 55,700 metres. A total of 54% of the drill and assay values were included in the February 2012 mineral resource estimate for the Hermosa project. Wildcat expects to provide a further update to the current mineral resource to incorporate all of the drilling in the third quarter of this year. Following this announcement there are 57 drill holes with assays and analysis still in process, which are expected to be released by the end of this quarter.

The Company is also making significant progress on its metallurgical optimization studies and intends to complete pilot plant work mid-year. As a result, the Company intends to deliver a preliminary economic assessment in the third quarter of this year, which will include the new mineral resource as well as updated metallurgical testwork.

A summary of the drill results is provided below. Please also see attached map.

.

.

.

http://www.wildcatsilver.com/Theme/Wildcat/files/doc_news/05%2010%202012%20Drill%20Results%20(31)%20FINAL%20PDF_v001_r6ng9e.pdf

neue Unternehmenspräsentation vom 14.05.2012:

http://www.wildcatsilver.com/Theme/Wildcat/files/doc_presentations/WS%20Investor%20Presentation%20May%2014%202012.pdf

neues Factsheet vom 14.05.2012:

http://www.wildcatsilver.com/Theme/Wildcat/files/doc_downloads/WS%20Fact%20Sheet%20May%2014%202012.pdf

.

http://www.wildcatsilver.com/Theme/Wildcat/files/doc_presentations/WS%20Investor%20Presentation%20May%2014%202012.pdf

neues Factsheet vom 14.05.2012:

http://www.wildcatsilver.com/Theme/Wildcat/files/doc_downloads/WS%20Fact%20Sheet%20May%2014%202012.pdf

.

Wildcat announces results for 24 additional drill holes: continues to extend mineralization in both Manto and Upper Silver Zones

VANCOUVER, May 17, 2012 /CNW/ - Wildcat Silver Corporation (TSX: WS) ("Wildcat" or "the Company") is pleased to announce the results for 24 additional drill holes completed on the Company's Hermosa property located in Santa Cruz County, Arizona. The current drill results targeted extensions of the Manto Oxide Zone to the northeast and the Upper Silver Zone southeast of the current Hermosa resource.

Highlights

HDS-289, located on the eastern extent of the patented claim block containing the existing Hermosa resource, intersected three significant mineralized intercepts of the Manto Oxide Zone and three mineralized intercepts of the Upper Silver Zone. This mineralization extends and leaves open the possible expansion of the current Hermosa resource off the patented claim block to the east/northeast. The Manto Oxide Zone intercepts ranged in thickness from 5.8 to 14.0 metres with silver grades up to 152.6 g/t and the Upper Silver Zone intercepts ranged in thickness from 3.0 to 12.3 metres with silver grades up to 50.1 g/t.

HDS-293, located on the south boundary of the southeast patented claim block, intersected two significant zones of mineralization. These intersections leave open the possibility of expansion of the Upper Silver Zone to the south. The top intercept of the Manto Oxide Zone returned 6.1 metres of 227.2 g/t silver and 8.98% manganese.

HDS-275, located on the northern boundary of the southeast patented claim block, intersected five separate horizons of Upper Silver Zone mineralization and leaves open the possible expansion of the Upper Silver Zone off the patented claim block to the north/northeast. Mineralized intervals ranged in thickness from 4.6 to 12.2 metres returning silver grades between 32.9 g/t up to 94.4 g/t.

The Company's most recent drill program completed in March 2012 included 212 drill holes for a total of approximately 55,700 metres. A total of 54% of the drill and assay values were included in the February 2012 mineral resource estimate for the Hermosa project. Wildcat expects to provide a further update to the current mineral resource to incorporate all of the drilling in the third quarter of this year. Following this announcement, 33 drill holes with assays and analysis are still in process and are expected to be released by the end of this quarter.

The Company is also making significant progress on its metallurgical optimization studies and intends to complete pilot plant work mid-year. As a result, the Company intends to deliver a preliminary economic assessment in the third quarter of this year, which will include the new mineral resource as well as updated metallurgical testwork.

A summary of the drill results is provided below. Please also see attached map.

.

.

.

http://www.wildcatsilver.com/Theme/Wildcat/files/doc_news/05%2017%202012%20Drill%20Results%20(24)%20FINAL%20PDF_v001_u5esi9.pdf

VANCOUVER, May 17, 2012 /CNW/ - Wildcat Silver Corporation (TSX: WS) ("Wildcat" or "the Company") is pleased to announce the results for 24 additional drill holes completed on the Company's Hermosa property located in Santa Cruz County, Arizona. The current drill results targeted extensions of the Manto Oxide Zone to the northeast and the Upper Silver Zone southeast of the current Hermosa resource.

Highlights

HDS-289, located on the eastern extent of the patented claim block containing the existing Hermosa resource, intersected three significant mineralized intercepts of the Manto Oxide Zone and three mineralized intercepts of the Upper Silver Zone. This mineralization extends and leaves open the possible expansion of the current Hermosa resource off the patented claim block to the east/northeast. The Manto Oxide Zone intercepts ranged in thickness from 5.8 to 14.0 metres with silver grades up to 152.6 g/t and the Upper Silver Zone intercepts ranged in thickness from 3.0 to 12.3 metres with silver grades up to 50.1 g/t.

HDS-293, located on the south boundary of the southeast patented claim block, intersected two significant zones of mineralization. These intersections leave open the possibility of expansion of the Upper Silver Zone to the south. The top intercept of the Manto Oxide Zone returned 6.1 metres of 227.2 g/t silver and 8.98% manganese.

HDS-275, located on the northern boundary of the southeast patented claim block, intersected five separate horizons of Upper Silver Zone mineralization and leaves open the possible expansion of the Upper Silver Zone off the patented claim block to the north/northeast. Mineralized intervals ranged in thickness from 4.6 to 12.2 metres returning silver grades between 32.9 g/t up to 94.4 g/t.

The Company's most recent drill program completed in March 2012 included 212 drill holes for a total of approximately 55,700 metres. A total of 54% of the drill and assay values were included in the February 2012 mineral resource estimate for the Hermosa project. Wildcat expects to provide a further update to the current mineral resource to incorporate all of the drilling in the third quarter of this year. Following this announcement, 33 drill holes with assays and analysis are still in process and are expected to be released by the end of this quarter.

The Company is also making significant progress on its metallurgical optimization studies and intends to complete pilot plant work mid-year. As a result, the Company intends to deliver a preliminary economic assessment in the third quarter of this year, which will include the new mineral resource as well as updated metallurgical testwork.

A summary of the drill results is provided below. Please also see attached map.

.

.

.

http://www.wildcatsilver.com/Theme/Wildcat/files/doc_news/05%2017%202012%20Drill%20Results%20(24)%20FINAL%20PDF_v001_u5esi9.pdf

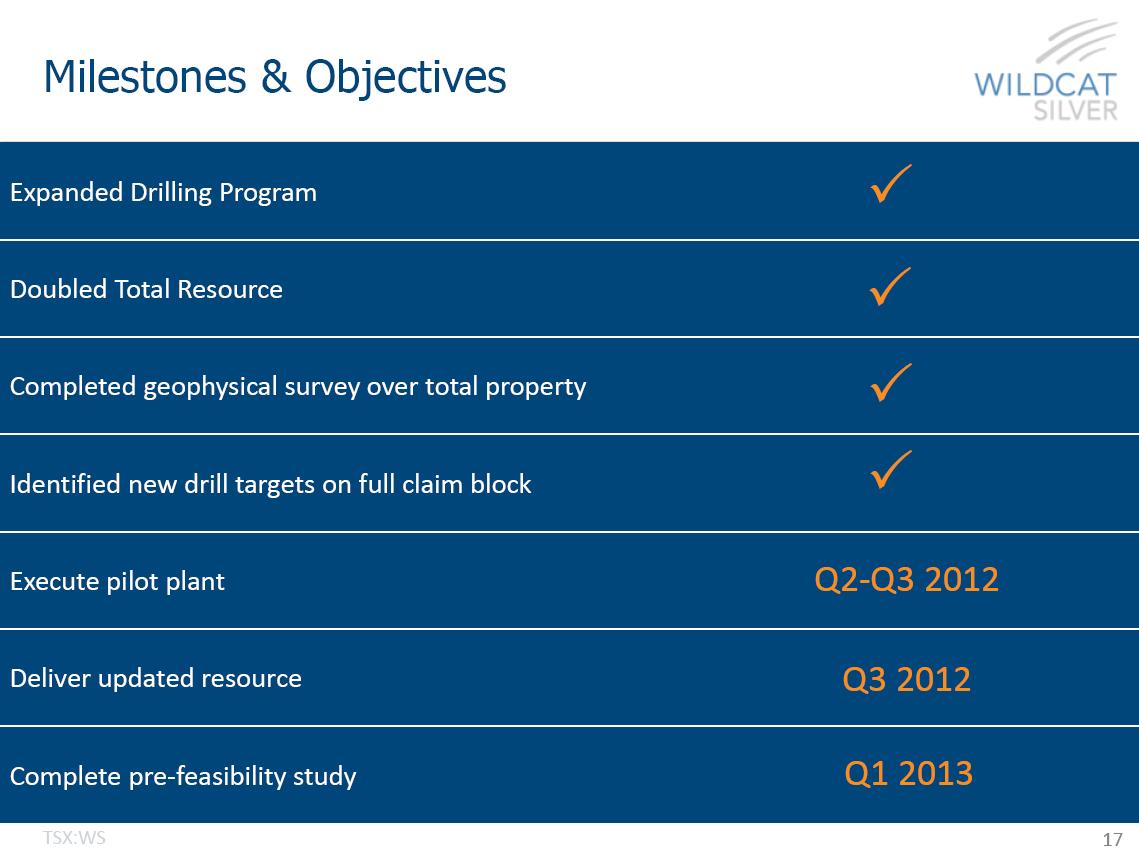

[url=http://peketec.de/trading/viewtopic.php?p=1258601#1258601 schrieb:golden_times schrieb am 06.06.2012, 13:46 Uhr[/url]"]Update Fahrplan:

Execute pilot plant: Q2-Q3 2012 (Testphase Materialverarbeitung >>> metallurgische Analysen, Produktionsszenarien)

Deliver updated mineral resource and Preliminary Economic Assessment (PEA): Q3 2012 (Nächster Meilenstein)

[url=http://peketec.de/trading/viewtopic.php?p=1257228#1257228 schrieb:golden_times schrieb am 04.06.2012, 11:18 Uhr[/url]"]T.WS

Der Wechsel an der Führungsspitze ist keinesfalls negativ zu sehen. Es geht hier ausschließlich um eine

andere Unternehmensstrategie. Donald R. Taylor hat Wildcat durch die Krisenzeiten exzellent geführt,

und wird auch weiterhin seinen Job als Head of Exploration imho ausgezeichnet ausführen. Mr. Taylor

war jedoch auch bekannt dafür, dass er Wildcat eigenständig in Produktion führen wollte, sich lediglich

auf eine Partnerschaft mit Silver Wheaton einlassen.. mehr nicht.. Mr. Warke und Mr. Wares ziehen aber

vor, alle Alternativen offen zu lassen. Diesen Schritt halte ich für sehr wichtig und insbesondere in diesen

schweren Marktphasen für passend. Er bedeutet de facto, dass die Verantwortlichen Wildcat nun hübscher

denn je machen werden - ein Major Sale wird vorbereitet (primär).. sekundär wird man das Ziel verfolgen,

Wildcat ggfs. in Partnerschaft mit Silver Wheaton Richtung Konstruktion vorzupreschen..

T.WS - Update: Hermosa DH Map, Q1 2012

Wildcat announces remaining results from completed drilling program,

includes 9.1 metres of 233.1 g/t silver

For best results when printing this announcement, please click on the link

below:

http://pdf.reuters.com/pdfnews/pdfnews.asp?i=43059c3bf0e37541&u=urn:newsml:reuters.com:20120621:nPnTO377

VANCOUVER, June 21, 2012 /PRNewswire/ - Wildcat Silver Corporation (TSX: WS)

("Wildcat" or "the Company") is pleased to announce the results for the

final 15 drill holes of its most recent drill campaign completed on the

Company's Hermosa property located in Santa Cruz County, Arizona. The

holes covered in this press release were drilled to test extensions of

the Manto Oxide Zone to the north and the Upper Silver Zone to the

southeast of the current Hermosa resource.

Highlights

Drill hole HDS-290, located on the southeastern extent of the current

Hermosa resource, intersected four intervals of significant silver

mineralization. The best intercepts include 9.1 metres of 233.1 g/t silver

from the Manto Oxide Zone and 13.7 metres of 101.5 g/t silver from the Upper

Silver Zone.

Drill hole HDS-313, an infill drill hole targeting the deeper portions

of the northern area of the Hermosa resource, encountered three

distinct intervals of mineralization in the Upper Silver Zone. The

most significant Upper Silver Zone intersection returned 3.0 metres of 171.3

g/t silver.

Drill hole HDS-316, located in the southeastern portion of Hermosa's

patented claim block, encountered two intervals of significant Upper

Silver Zone mineralization. The best intercept returned 13.7 metres of 70.2

g/t silver.

Drill holes HDS-314, HDS-320, HDS-321, HDS-322 and HDS-323 returned no

significant mineralization. It is believed that these holes were

drilled across a northeast trending fault which appears to have offset

the Hermosa mineralization.

Wildcat has now announced all 212 drill holes from its drill program

completed in March 2012 and is currently in the process of updating the

Hermosa mineral resource to include all of the drilling completed to

date. The updated Hermosa mineral resource is on track to be completed

in the third quarter of 2012. The Company is also conducting pilot

plant studies at Hazen Research Inc. in Golden Colorado in preparation

for an updated Preliminary Economic Assessment which is expected to be

completed subsequently in the third quarter of 2012.

includes 9.1 metres of 233.1 g/t silver

For best results when printing this announcement, please click on the link

below:

http://pdf.reuters.com/pdfnews/pdfnews.asp?i=43059c3bf0e37541&u=urn:newsml:reuters.com:20120621:nPnTO377

VANCOUVER, June 21, 2012 /PRNewswire/ - Wildcat Silver Corporation (TSX: WS)

("Wildcat" or "the Company") is pleased to announce the results for the

final 15 drill holes of its most recent drill campaign completed on the

Company's Hermosa property located in Santa Cruz County, Arizona. The

holes covered in this press release were drilled to test extensions of

the Manto Oxide Zone to the north and the Upper Silver Zone to the

southeast of the current Hermosa resource.

Highlights

Drill hole HDS-290, located on the southeastern extent of the current

Hermosa resource, intersected four intervals of significant silver

mineralization. The best intercepts include 9.1 metres of 233.1 g/t silver

from the Manto Oxide Zone and 13.7 metres of 101.5 g/t silver from the Upper

Silver Zone.

Drill hole HDS-313, an infill drill hole targeting the deeper portions

of the northern area of the Hermosa resource, encountered three

distinct intervals of mineralization in the Upper Silver Zone. The

most significant Upper Silver Zone intersection returned 3.0 metres of 171.3

g/t silver.

Drill hole HDS-316, located in the southeastern portion of Hermosa's

patented claim block, encountered two intervals of significant Upper

Silver Zone mineralization. The best intercept returned 13.7 metres of 70.2

g/t silver.

Drill holes HDS-314, HDS-320, HDS-321, HDS-322 and HDS-323 returned no

significant mineralization. It is believed that these holes were

drilled across a northeast trending fault which appears to have offset

the Hermosa mineralization.

Wildcat has now announced all 212 drill holes from its drill program

completed in March 2012 and is currently in the process of updating the

Hermosa mineral resource to include all of the drilling completed to

date. The updated Hermosa mineral resource is on track to be completed

in the third quarter of 2012. The Company is also conducting pilot

plant studies at Hazen Research Inc. in Golden Colorado in preparation

for an updated Preliminary Economic Assessment which is expected to be

completed subsequently in the third quarter of 2012.

Wildcat Silver met tests over 90% at Hermosa

2012-09-05 07:48 ET - News Release

Mr. Don Taylor reports

WILDCAT ANNOUNCES POSITIVE METALLURGICAL RESULTS

Wildcat Silver Corp. has completed pilot-plant-scale testing on a simplified metallurgical process for the recovery of silver and gold from the Hermosa manto oxide and Upper silver zone material.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aWS-1993844&symbol=WS®ion=C

2012-09-05 07:48 ET - News Release

Mr. Don Taylor reports

WILDCAT ANNOUNCES POSITIVE METALLURGICAL RESULTS

Wildcat Silver Corp. has completed pilot-plant-scale testing on a simplified metallurgical process for the recovery of silver and gold from the Hermosa manto oxide and Upper silver zone material.

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aWS-1993844&symbol=WS®ion=C

Wildcat Silver to acquire Riva Gold

VANCOUVER, March 4, 2013

Wildcat Silver Corporation (TSX: WS) ("Wildcat") announces today that it has entered into a letter of intent with Riva Gold Corporation ("Riva") providing for the acquisition by Wildcat of all of the outstanding common shares of Riva in consideration for 4.7 common shares of Riva for one common share of Wildcat. This represents a price of C$0.17 per Riva common share, which is based on the volume weighted average price of the Wildcat common shares for the 20 trading days ending March 1, 2013.

Riva is a Canadian-based mineral exploration company that had been assessing strategic alternatives and evaluating potential opportunities for the last year. Riva trades on the TSX Venture Exchange under the symbol "RIV". Riva currently has a cash balance of approximately C$8.1 million and does not hold any mineral properties.

In connection with the acquisition, Riva also agreed to provide a C$1 million secured term loan to Wildcat, subject to any applicable regulatory approvals. Interest payable on the loan is equal to the prime rate plus 4% and the loan matures on December 31, 2013.

"This transaction is expected to provide Wildcat with sufficient funds to advance the Hermosa project through prefeasibility and into the feasibility stage with the least dilution to our shareholders," said Don Taylor, President and Chief Operating Officer "With this additional cash, we look forward to unlocking additional value and moving our project forward this year."

The proposed acquisition remains subject to, among other things, the negotiation and execution of a definitive agreement and applicable shareholder and regulatory approvals.

VANCOUVER, March 4, 2013

Wildcat Silver Corporation (TSX: WS) ("Wildcat") announces today that it has entered into a letter of intent with Riva Gold Corporation ("Riva") providing for the acquisition by Wildcat of all of the outstanding common shares of Riva in consideration for 4.7 common shares of Riva for one common share of Wildcat. This represents a price of C$0.17 per Riva common share, which is based on the volume weighted average price of the Wildcat common shares for the 20 trading days ending March 1, 2013.

Riva is a Canadian-based mineral exploration company that had been assessing strategic alternatives and evaluating potential opportunities for the last year. Riva trades on the TSX Venture Exchange under the symbol "RIV". Riva currently has a cash balance of approximately C$8.1 million and does not hold any mineral properties.

In connection with the acquisition, Riva also agreed to provide a C$1 million secured term loan to Wildcat, subject to any applicable regulatory approvals. Interest payable on the loan is equal to the prime rate plus 4% and the loan matures on December 31, 2013.

"This transaction is expected to provide Wildcat with sufficient funds to advance the Hermosa project through prefeasibility and into the feasibility stage with the least dilution to our shareholders," said Don Taylor, President and Chief Operating Officer "With this additional cash, we look forward to unlocking additional value and moving our project forward this year."

The proposed acquisition remains subject to, among other things, the negotiation and execution of a definitive agreement and applicable shareholder and regulatory approvals.

Sieht gut aus

[url=http://peketec.de/trading/viewtopic.php?p=1705038#1705038 schrieb: