March 22, 2012 07:30 ET

International Tower Hill Announces 2012 Operations Update at the Livengood Gold Project, Alaska

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 22, 2012) - International Tower Hill Mines Ltd. ("ITH" or the "Company") (TSX:ITH)(NYSE Amex:THM)(FRANKFURT:IW9) announces an operations update at the Company's 100% controlled Livengood Gold Project near Fairbanks, Alaska. In addition to advancing its Pre-Feasibility Study towards expected completion in the third quarter of 2012, the Company is carrying out approximately 12,000 metres of drilling in support of permitting activities, engineering design, condemnation of proposed infrastructure sites and district-wide exploration. The Company also announces that it will postpone all further studies for placer gold extraction on its recently acquired placer claims to focus on advancing the Livengood gold deposit towards development and a production decision.

Pre-Feasibility Study Progress

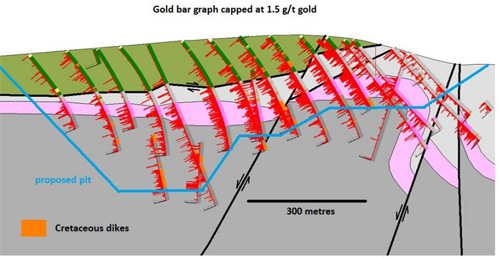

The Pre-Feasibility Study ("PFS") currently underway will incorporate the current mineral resource estimate of 933 million tonnes at an average grade of 0.55 grams per tonne of gold (at a cutoff grade of 0.22 g/t gold) for 16.5 million ounces of gold contained in the Measured and Indicated categories (see news release dated August 23, 2011) together with the results of geotechnical studies, metallurgical testing, updated capital and operating cost estimates and other relevant studies.

While the bulk of engineering studies for the PFS were completed in November 2011, the Company is currently carrying out detailed metallurgical testing after a review of the Preliminary Economic Assessment flow sheet indicated that further optimization is possible. Due to the large amount of testing underway, the publication date for the PFS is now expected in the third quarter of 2012.

2012 Drilling Programs

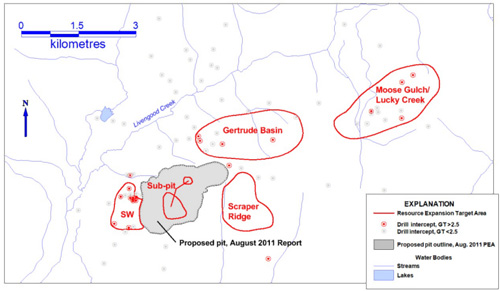

The Company's 2012 Drilling Programs commenced in February and consist of three categories: (1) a $2.1-million, 6,000-metre condemnation drill program; (2) a $5.2 million, 3,000-metre program of geotechnical drilling; and (3) a $1.1 million, 3,000-metre district-wide exploration program. The objectives of the condemnation and geotechnical drill programs are to support permitting efforts and detail site facility locations while the discovery exploration program aims to target potential new gold discoveries along the mineralized trend of the existing Livengood gold deposit. Results from all drill programs are expected throughout the summer and fall of 2012.

To support the completion of these work programs, on March 16, 2012 the ITH Board of Directors approved a budget of CAD 68.3 million for its 2012 fiscal year ending December 31, 2012, subject to raising the necessary additional financing.

Livengood Placer Claims

Following a comprehensive review and internal financial analysis of the Company's placer property, management has opted to postpone all further studies, including an NI 43-101 resource report and Preliminary Economic Assessment, for placer gold extraction.

"Investigating the possibility of placer gold production from our recent placer claims acquisition was a key part of our mandate to explore all opportunities to create value for shareholders in the short-term," stated James Komadina, President and Chief Executive Officer of the Company. "However, the results of our investigations indicate that the greatest benefits will be to optimize site facility locations for the Livengood Project."

"In the past three months, our Manager of Mining and Livengood placer team worked diligently to look at ways of getting into short-term production as quickly as possible," continued Mr. Komadina. "And while we would have relished the opportunity to produce gold as early as 2013, our highest priority remains our 16.5 million-ounce Livengood gold deposit. Postponing development of the placers creates the most synergy with the development of the larger Livengood deposit and this is the route that we must take to ensure the highest possibility of success."

International Tower Hill Announces 2012 Operations Update at the Livengood Gold Project, Alaska

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 22, 2012) - International Tower Hill Mines Ltd. ("ITH" or the "Company") (TSX:ITH)(NYSE Amex:THM)(FRANKFURT:IW9) announces an operations update at the Company's 100% controlled Livengood Gold Project near Fairbanks, Alaska. In addition to advancing its Pre-Feasibility Study towards expected completion in the third quarter of 2012, the Company is carrying out approximately 12,000 metres of drilling in support of permitting activities, engineering design, condemnation of proposed infrastructure sites and district-wide exploration. The Company also announces that it will postpone all further studies for placer gold extraction on its recently acquired placer claims to focus on advancing the Livengood gold deposit towards development and a production decision.

Pre-Feasibility Study Progress

The Pre-Feasibility Study ("PFS") currently underway will incorporate the current mineral resource estimate of 933 million tonnes at an average grade of 0.55 grams per tonne of gold (at a cutoff grade of 0.22 g/t gold) for 16.5 million ounces of gold contained in the Measured and Indicated categories (see news release dated August 23, 2011) together with the results of geotechnical studies, metallurgical testing, updated capital and operating cost estimates and other relevant studies.

While the bulk of engineering studies for the PFS were completed in November 2011, the Company is currently carrying out detailed metallurgical testing after a review of the Preliminary Economic Assessment flow sheet indicated that further optimization is possible. Due to the large amount of testing underway, the publication date for the PFS is now expected in the third quarter of 2012.

2012 Drilling Programs

The Company's 2012 Drilling Programs commenced in February and consist of three categories: (1) a $2.1-million, 6,000-metre condemnation drill program; (2) a $5.2 million, 3,000-metre program of geotechnical drilling; and (3) a $1.1 million, 3,000-metre district-wide exploration program. The objectives of the condemnation and geotechnical drill programs are to support permitting efforts and detail site facility locations while the discovery exploration program aims to target potential new gold discoveries along the mineralized trend of the existing Livengood gold deposit. Results from all drill programs are expected throughout the summer and fall of 2012.

To support the completion of these work programs, on March 16, 2012 the ITH Board of Directors approved a budget of CAD 68.3 million for its 2012 fiscal year ending December 31, 2012, subject to raising the necessary additional financing.

Livengood Placer Claims

Following a comprehensive review and internal financial analysis of the Company's placer property, management has opted to postpone all further studies, including an NI 43-101 resource report and Preliminary Economic Assessment, for placer gold extraction.

"Investigating the possibility of placer gold production from our recent placer claims acquisition was a key part of our mandate to explore all opportunities to create value for shareholders in the short-term," stated James Komadina, President and Chief Executive Officer of the Company. "However, the results of our investigations indicate that the greatest benefits will be to optimize site facility locations for the Livengood Project."

"In the past three months, our Manager of Mining and Livengood placer team worked diligently to look at ways of getting into short-term production as quickly as possible," continued Mr. Komadina. "And while we would have relished the opportunity to produce gold as early as 2013, our highest priority remains our 16.5 million-ounce Livengood gold deposit. Postponing development of the placers creates the most synergy with the development of the larger Livengood deposit and this is the route that we must take to ensure the highest possibility of success."