App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

ITH - Intl. Tower Hill Mines - WKN A1C4CG

- Ersteller Ollinho

- Erstellt am

- Tagged users Kein(e)

International Tower Hill Mines Ltd. (ITH) has the following new filing(s) recently:

YIP, TOM (Chief Financial Officer)

SEDI Insider Relationship:

5 - Senior Officer of Issuer

Acquired 125,000 Options (Direct Ownership) at a price of $2.180 through granting of options on March 14th, 2013 (Holdings Change* of 11.4%)

IRWIN, THOMAS (Vice President, Alaska and President, Tower Hill Mines Inc)

SEDI Insider Relationship:

5 - Senior Officer of Issuer

Acquired 100,000 Options (Direct Ownership) at a price of $2.180 through the public market on March 14th, 2013 (Holdings Change* of 20.0%)

Insider transaction information sourced from SEDI®

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&m=32332894&l=0&r=0&s=ITH&t=LIST#ZrL4ZScsI0wECUUL.99

YIP, TOM (Chief Financial Officer)

SEDI Insider Relationship:

5 - Senior Officer of Issuer

Acquired 125,000 Options (Direct Ownership) at a price of $2.180 through granting of options on March 14th, 2013 (Holdings Change* of 11.4%)

IRWIN, THOMAS (Vice President, Alaska and President, Tower Hill Mines Inc)

SEDI Insider Relationship:

5 - Senior Officer of Issuer

Acquired 100,000 Options (Direct Ownership) at a price of $2.180 through the public market on March 14th, 2013 (Holdings Change* of 20.0%)

Insider transaction information sourced from SEDI®

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&m=32332894&l=0&r=0&s=ITH&t=LIST#ZrL4ZScsI0wECUUL.99

Jeb Handwerger Follows the Smart Money to Undervalued Miners

TICKERS: ABX, LODE, EDW, ITH; THM, LIO; LOMLF; LY1, MAG; MVG, MAD, NEV, NG, NUG, PZG, PLG, PTM; PLG, NKL; PNIKF; P94P

Source: Brian Sylvester of The Gold Report (4/1/13)

Investors unsure of which way to turn in this market need only watch the "smart money," says Jeb Handwerger, the editor and publisher of GoldStockTrades.com. Billionaires like John Paulson and Carlos Slim are plucking up mining investments on the cheap. In this interview with The Gold Report, Handwerger shares his favorite discount buys..

Link: http://www.theaureport.com/pub/na/15117

Companies Mentioned : Barrick Gold Corp. : Comstock Mining Inc. : Edgewater Exploration Ltd. : International Tower Hill Mines Ltd. : Lion One Metals Ltd. : MAG Silver Corp. : Miranda Gold Corp. : Nevada Sunrise Gold Corp. : NOVAGOLD : NuLegacy Gold Corp. : Paramount Gold and Silver Corp. : Pilot Gold Inc. : Platinum Group Metals Ltd. : Prophecy Platinum Corp.

Related Companies : Evolving Gold Corp. : Highvista Gold Corp. : International Northair Mines Ltd. : Lydian International Ltd. : Silver Bull Resources Inc.

TICKERS: ABX, LODE, EDW, ITH; THM, LIO; LOMLF; LY1, MAG; MVG, MAD, NEV, NG, NUG, PZG, PLG, PTM; PLG, NKL; PNIKF; P94P

Source: Brian Sylvester of The Gold Report (4/1/13)

Investors unsure of which way to turn in this market need only watch the "smart money," says Jeb Handwerger, the editor and publisher of GoldStockTrades.com. Billionaires like John Paulson and Carlos Slim are plucking up mining investments on the cheap. In this interview with The Gold Report, Handwerger shares his favorite discount buys..

Link: http://www.theaureport.com/pub/na/15117

Companies Mentioned : Barrick Gold Corp. : Comstock Mining Inc. : Edgewater Exploration Ltd. : International Tower Hill Mines Ltd. : Lion One Metals Ltd. : MAG Silver Corp. : Miranda Gold Corp. : Nevada Sunrise Gold Corp. : NOVAGOLD : NuLegacy Gold Corp. : Paramount Gold and Silver Corp. : Pilot Gold Inc. : Platinum Group Metals Ltd. : Prophecy Platinum Corp.

Related Companies : Evolving Gold Corp. : Highvista Gold Corp. : International Northair Mines Ltd. : Lydian International Ltd. : Silver Bull Resources Inc.

April 24, 2013 08:00 ET

International Tower Hill Mines Comments on Recent Gold Market Activity

VANCOUVER, BRITISH COLUMBIA--(Marketwired - April 24, 2013) - International Tower Hill Mines Ltd. ("ITH" or the "Company") - (TSX:ITH)(NYSE MKT:THM)(FRANKFURT:IW9) wishes to comment on the recent activity in the gold market.

Despite the recent turmoil in the gold market, ITH will continue to strive to bring value to its shareholders by optimizing its world class Livengood Gold Project, which currently has estimated measured and indicated resources of 933 million tonnes at an average grade of 0.55 g/t gold (16.5 million contained ounces) at a 0.22 g/t gold cut-off (see NR11-13, August 23, 2011).

The Company completed drilling for condemnation, geo-hydrological and geotechnical support of the Feasibility Study (FS) for Livengood in 2012. The Company has prepared for the potential of a continuing lower gold price and has developed an alternate work program under which ITH will continue to fund its corporate activities, compliance matters and essential environmental baseline activities to support the permitting process with the capital currently on hand. Accordingly, the Company does not anticipate raising additional capital in the near term and will continue to seek strategic alliances to fund the future development of this project upon the completion of the FS currently underway.

Don Ewigleben, President and CEO, stated, "We recognize that we are entrusted by our shareholders to protect the asset value of the Livengood Gold Project and will continue the development process while limiting the expenditures. ITH has structured its budget and corporate initiatives to bring the highest value to its shareholders and we believe it still remains an attractive long-term investment. The Livengood Project hosts a very large gold resource in a favorable mining jurisdiction. Our current strategies remain the same with completing further development of the project while attracting a strategic alliance partner. Despite the recent drop in gold price, the value of the long life Livengood asset will be judged by factors in addition to today's gold price, including the existing infrastructure, favorable geo-political setting and highly qualified development team."

About International Tower Hill Mines Ltd.

International Tower Hill Mines Ltd. controls a 100% interest in the world-class Livengood Gold Project accessible by paved highway 70 miles northwest of Fairbanks, Alaska.

On behalf of International Tower Hill Mines Ltd.

Donald C. Ewigleben, President & Chief Executive Officer

NR13-04

To view the Cautionary Statements, click the following link: http://media3.marketwire.com/docs/ith424-CS.pdf.

International Tower Hill Mines Comments on Recent Gold Market Activity

VANCOUVER, BRITISH COLUMBIA--(Marketwired - April 24, 2013) - International Tower Hill Mines Ltd. ("ITH" or the "Company") - (TSX:ITH)(NYSE MKT:THM)(FRANKFURT:IW9) wishes to comment on the recent activity in the gold market.

Despite the recent turmoil in the gold market, ITH will continue to strive to bring value to its shareholders by optimizing its world class Livengood Gold Project, which currently has estimated measured and indicated resources of 933 million tonnes at an average grade of 0.55 g/t gold (16.5 million contained ounces) at a 0.22 g/t gold cut-off (see NR11-13, August 23, 2011).

The Company completed drilling for condemnation, geo-hydrological and geotechnical support of the Feasibility Study (FS) for Livengood in 2012. The Company has prepared for the potential of a continuing lower gold price and has developed an alternate work program under which ITH will continue to fund its corporate activities, compliance matters and essential environmental baseline activities to support the permitting process with the capital currently on hand. Accordingly, the Company does not anticipate raising additional capital in the near term and will continue to seek strategic alliances to fund the future development of this project upon the completion of the FS currently underway.

Don Ewigleben, President and CEO, stated, "We recognize that we are entrusted by our shareholders to protect the asset value of the Livengood Gold Project and will continue the development process while limiting the expenditures. ITH has structured its budget and corporate initiatives to bring the highest value to its shareholders and we believe it still remains an attractive long-term investment. The Livengood Project hosts a very large gold resource in a favorable mining jurisdiction. Our current strategies remain the same with completing further development of the project while attracting a strategic alliance partner. Despite the recent drop in gold price, the value of the long life Livengood asset will be judged by factors in addition to today's gold price, including the existing infrastructure, favorable geo-political setting and highly qualified development team."

About International Tower Hill Mines Ltd.

International Tower Hill Mines Ltd. controls a 100% interest in the world-class Livengood Gold Project accessible by paved highway 70 miles northwest of Fairbanks, Alaska.

On behalf of International Tower Hill Mines Ltd.

Donald C. Ewigleben, President & Chief Executive Officer

NR13-04

To view the Cautionary Statements, click the following link: http://media3.marketwire.com/docs/ith424-CS.pdf.

Bei ITH ist der Freefloat noch bei ca.30% ,Optionen die Geld reinspülen werden fällig!

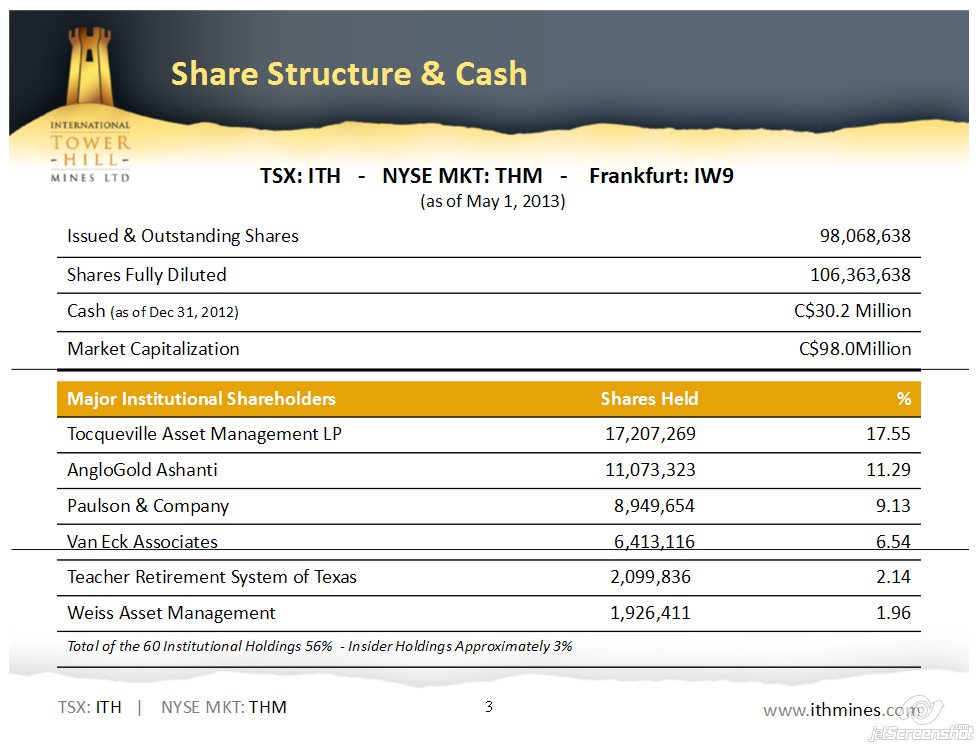

Equity Ownership THM FundsInstitutions

Name Ownership Trend

Previous 8 Qtrs Shares Change % Total

Shares Held % Total

Assets Date

Tocqueville Asset Management L.P. Premium 17,169,469 961,325 17.51 0 04/22/2013

Anglogold Ashanti Limited Premium 11,073,323 0 11.29 0 04/22/2013

Paulson & Company Inc Premium 8,949,654 8,949,654 9.13 0 04/22/2013

Van Eck Associates Corporation Premium 6,413,116 6,413,116 6.54 0 04/22/2013

Teacher Retirement System Of Texas Premium 2,099,836 0 2.13 0.03 03/31/2013

Weiss Asset Management LP Premium 1,407,011 -519,400 1.43 1.51 03/31/2013

Royce & Associates, LLC Premium 1,014,000 0 1.03 0 03/31/2013

Global X Management Company LLC Premium 999,932 999,932 1.02 0.24 03/31/2013

Falcon Private Bank Ltd. Premium 607,000 0 0.62 0.50 03/31/2013

Fidelity Management and Research Company Premium 546,700 0 0.56 0 03/31/2013

Total: Top 10 institutions Premium 50,280,041 16,804,627 51.26%

Equity Ownership THM FundsInstitutions

Name Ownership Trend

Previous 8 Qtrs Shares Change % Total

Shares Held % Total

Assets Date

Tocqueville Gold Premium 7,405,503 0 7.53 0.63 03/31/2013

Market Vectors Junior Gold Miners ETF Premium 6,784,157 -122,545 6.96 0.42 04/30/2013

Van Eck Intl Investors Gold A Premium 1,650,000 0 1.68 0.29 12/31/2012

Royce Micro-Cap Invmt Premium 678,000 0 0.69 0.11 03/31/2013

Global X Gold Explorers ETF Premium 1,073,682 0 0.89 3.28 05/23/2013

Fidelity Select Gold Premium 546,700 0 0.56 0.03 03/31/2013

Invesco Gold & Precious Metals Invstor Premium 522,162 -312,803 0.53 0.19 03/31/2013

Vanguard Total Intl Stock Index Inv Premium 351,425 16,250 0.36 0 03/31/2013

Royce Capital Micro-Cap Inv Premium 329,800 0 0.34 0.09 03/31/2013

Aegis Value Premium 282,749 282,749 0.28 0.23 02/28/2013

Total: Top 10 funds Premium 19,624,178 -136,349 19.82%

Equity Ownership THM FundsInstitutions

Name Ownership Trend

Previous 8 Qtrs Shares Change % Total

Shares Held % Total

Assets Date

Tocqueville Asset Management L.P. Premium 17,169,469 961,325 17.51 0 04/22/2013

Anglogold Ashanti Limited Premium 11,073,323 0 11.29 0 04/22/2013

Paulson & Company Inc Premium 8,949,654 8,949,654 9.13 0 04/22/2013

Van Eck Associates Corporation Premium 6,413,116 6,413,116 6.54 0 04/22/2013

Teacher Retirement System Of Texas Premium 2,099,836 0 2.13 0.03 03/31/2013

Weiss Asset Management LP Premium 1,407,011 -519,400 1.43 1.51 03/31/2013

Royce & Associates, LLC Premium 1,014,000 0 1.03 0 03/31/2013

Global X Management Company LLC Premium 999,932 999,932 1.02 0.24 03/31/2013

Falcon Private Bank Ltd. Premium 607,000 0 0.62 0.50 03/31/2013

Fidelity Management and Research Company Premium 546,700 0 0.56 0 03/31/2013

Total: Top 10 institutions Premium 50,280,041 16,804,627 51.26%

Equity Ownership THM FundsInstitutions

Name Ownership Trend

Previous 8 Qtrs Shares Change % Total

Shares Held % Total

Assets Date

Tocqueville Gold Premium 7,405,503 0 7.53 0.63 03/31/2013

Market Vectors Junior Gold Miners ETF Premium 6,784,157 -122,545 6.96 0.42 04/30/2013

Van Eck Intl Investors Gold A Premium 1,650,000 0 1.68 0.29 12/31/2012

Royce Micro-Cap Invmt Premium 678,000 0 0.69 0.11 03/31/2013

Global X Gold Explorers ETF Premium 1,073,682 0 0.89 3.28 05/23/2013

Fidelity Select Gold Premium 546,700 0 0.56 0.03 03/31/2013

Invesco Gold & Precious Metals Invstor Premium 522,162 -312,803 0.53 0.19 03/31/2013

Vanguard Total Intl Stock Index Inv Premium 351,425 16,250 0.36 0 03/31/2013

Royce Capital Micro-Cap Inv Premium 329,800 0 0.34 0.09 03/31/2013

Aegis Value Premium 282,749 282,749 0.28 0.23 02/28/2013

Total: Top 10 funds Premium 19,624,178 -136,349 19.82%

[url=http://peketec.de/trading/viewtopic.php?p=1386614#1386614 schrieb:CCG-Redaktion schrieb am 27.05.2013, 14:25 Uhr[/url]"]Bei ITH ist der Freefloat noch bei ca.30% ,Optionen die Geld reinspülen werden fällig!

Equity Ownership THM FundsInstitutions

Name Ownership Trend

Previous 8 Qtrs Shares Change % Total

Shares Held % Total

Assets Date

Tocqueville Asset Management L.P. Premium 17,169,469 961,325 17.51 0 04/22/2013

Anglogold Ashanti Limited Premium 11,073,323 0 11.29 0 04/22/2013

Paulson & Company Inc Premium 8,949,654 8,949,654 9.13 0 04/22/2013

Van Eck Associates Corporation Premium 6,413,116 6,413,116 6.54 0 04/22/2013

Teacher Retirement System Of Texas Premium 2,099,836 0 2.13 0.03 03/31/2013

Weiss Asset Management LP Premium 1,407,011 -519,400 1.43 1.51 03/31/2013

Royce & Associates, LLC Premium 1,014,000 0 1.03 0 03/31/2013

Global X Management Company LLC Premium 999,932 999,932 1.02 0.24 03/31/2013

Falcon Private Bank Ltd. Premium 607,000 0 0.62 0.50 03/31/2013

Fidelity Management and Research Company Premium 546,700 0 0.56 0 03/31/2013

Total: Top 10 institutions Premium 50,280,041 16,804,627 51.26%

Equity Ownership THM FundsInstitutions

Name Ownership Trend

Previous 8 Qtrs Shares Change % Total

Shares Held % Total

Assets Date

Tocqueville Gold Premium 7,405,503 0 7.53 0.63 03/31/2013

Market Vectors Junior Gold Miners ETF Premium 6,784,157 -122,545 6.96 0.42 04/30/2013

Van Eck Intl Investors Gold A Premium 1,650,000 0 1.68 0.29 12/31/2012

Royce Micro-Cap Invmt Premium 678,000 0 0.69 0.11 03/31/2013

Global X Gold Explorers ETF Premium 1,073,682 0 0.89 3.28 05/23/2013

Fidelity Select Gold Premium 546,700 0 0.56 0.03 03/31/2013

Invesco Gold & Precious Metals Invstor Premium 522,162 -312,803 0.53 0.19 03/31/2013

Vanguard Total Intl Stock Index Inv Premium 351,425 16,250 0.36 0 03/31/2013

Royce Capital Micro-Cap Inv Premium 329,800 0 0.34 0.09 03/31/2013

Aegis Value Premium 282,749 282,749 0.28 0.23 02/28/2013

Total: Top 10 funds Premium 19,624,178 -136,349 19.82%

http://investors.morningstar.com/ownership/shareholders-overview.html?t=XFRA:1I1®ion=DEU&culture=en-us

Insider je nach welchem Kürzel man sucht. 1.1% .

http://www.northernminer.com/news/livengood-doesnt-look-so-good-for-ith/1002490099/

Low gold price hurts ITH's Livengood project

2013-07-24

It doesn’t look like International Tower Hill’s (TSX: ITH; NYSE: THM) Livengood project will be meeting the construction crew anytime soon.

The company released a feasibility study that shows a future mine would only reach a positive net present value (NPV) if gold climbs back above the US$1,600 per oz. mark.

Until then, investors will have to hope that the company can find a strategic partner that believes in the notion that large scale, low grade deposits will once again come back into favor.

The single most damaging metric to the NPV was rising capex. The company’s preliminary economic assessment (PEA), which was largely done in 2010 and reported in 2011 pegged capex at US$1.6 billion.

The new feasibility study, however, estimates it would cost US$2.7 billion just to build the project. Sustaining capex would add another US$667 million to the tab and reclamation and closure costs are estimated to be another US$353 million.

Two of the main reasons for the jump in initial capex was the realization that a tailing facility would need to be lined and that a camp would have to be built. The original PEA did not outline either of those two relatively sizable costs.

With capex rising and the price of gold falling the poor metrics of the study aren’t surprising, but just how bad things look at current gold prices do come as a bit of a shock.

On July 24th the price of gold was sitting at US$1,319.90 per oz. That is awfully close to the US$1,300 per oz. price that the study says would generate a NPV of negative US$1.336 billion and an internal rate of return of -7.2%. The NPV was calculated using a discount rate of 5%.

Even at a gold price of US$1,600 per oz. the NPV remains underwater at negative US$50 million while the IRR rises to a paltry 4.6%. It isn’t until a gold price of US$1,700 per oz. is used that both NPV and IRR are positive with the NPV rising to US$336 million and the IRR coming in at 7.3%.

With numbers like that, Tower Hill’s CEO and president Donald Ewigleben could do little else but concede that the project is not economic in the current environment. Instead he emphasized the project’s proximity to good infrastructure, its location in a mining friendly region and the scale of the project would be the keys to attracting a strategic partner and one day getting the mine into production.

In the near term, Ewigleben said the company will look to protect its $19.9 million treasury as it looks at ways to drive down the costs of a future mine.

When a questioner on a conference call related to the release asked why the company would not simply sit on the report until it did find a way to drive costs down, Ewigleben said the company felt it owed it to investors to be as transparent as possible.

“We all know in this industry that for years several companies have underestimated the cost of projects,” he said. “We made sure, to the best of our ability, that we have defined every potential cost and used those conservative numbers to avoid that trap.”

As for possible ways that costs could be cut, the most obvious place to start would be scale. The current feasibility study considered a mine that would process 100,000 tonnes of ore per day with gold recoveries of over 80%. Through the first five years the annual production would be 700,000 oz. of gold.

Tower Hill decided to outline such a big project in order to generate economies of scale that could make up for the relatively low grade of the deposit. It will likely now consider a more modest facility.

Livengood has measured resources of 731 million tonne grading 0.61 grams gold for 14.4 million oz; 71 million indicated tonnes grading 0.56 grams gold for 1.3 million oz. and 266 million inferred tonnes grading 0.52 grams for 4.4 million oz.

And while the headgrade at the mill is estimated to average 1.08 grams per tonne in the first year, the number falls to a staggeringly low 0.39 grams per tonne in years 13 and 14.

Livengood, which was acquired from AngloGold Ashanti (NYSE: AU) in 2006, sits 125-km northwest of Fairbanks in Alaska.

Shortly after the acquisition the company began an aggressive drill campaign that had investors believing in a large scale, world class deposit. Those early results turned Tower Hill into a market darling as its stock went from trading in the $1.25 range at the end of 2008 all the way up to $9.98 by the end of 2010. By early 2011, after its PEA was released, the decline had begun. A decline that has now culminated with the release of the feasibility study as the stock dropped 54% or 50¢ in Toronto on July 24th, finishing the day at just 42.5¢ on 2.42 million shares traded.

Low gold price hurts ITH's Livengood project

2013-07-24

It doesn’t look like International Tower Hill’s (TSX: ITH; NYSE: THM) Livengood project will be meeting the construction crew anytime soon.

The company released a feasibility study that shows a future mine would only reach a positive net present value (NPV) if gold climbs back above the US$1,600 per oz. mark.

Until then, investors will have to hope that the company can find a strategic partner that believes in the notion that large scale, low grade deposits will once again come back into favor.

The single most damaging metric to the NPV was rising capex. The company’s preliminary economic assessment (PEA), which was largely done in 2010 and reported in 2011 pegged capex at US$1.6 billion.

The new feasibility study, however, estimates it would cost US$2.7 billion just to build the project. Sustaining capex would add another US$667 million to the tab and reclamation and closure costs are estimated to be another US$353 million.

Two of the main reasons for the jump in initial capex was the realization that a tailing facility would need to be lined and that a camp would have to be built. The original PEA did not outline either of those two relatively sizable costs.

With capex rising and the price of gold falling the poor metrics of the study aren’t surprising, but just how bad things look at current gold prices do come as a bit of a shock.

On July 24th the price of gold was sitting at US$1,319.90 per oz. That is awfully close to the US$1,300 per oz. price that the study says would generate a NPV of negative US$1.336 billion and an internal rate of return of -7.2%. The NPV was calculated using a discount rate of 5%.

Even at a gold price of US$1,600 per oz. the NPV remains underwater at negative US$50 million while the IRR rises to a paltry 4.6%. It isn’t until a gold price of US$1,700 per oz. is used that both NPV and IRR are positive with the NPV rising to US$336 million and the IRR coming in at 7.3%.

With numbers like that, Tower Hill’s CEO and president Donald Ewigleben could do little else but concede that the project is not economic in the current environment. Instead he emphasized the project’s proximity to good infrastructure, its location in a mining friendly region and the scale of the project would be the keys to attracting a strategic partner and one day getting the mine into production.

In the near term, Ewigleben said the company will look to protect its $19.9 million treasury as it looks at ways to drive down the costs of a future mine.

When a questioner on a conference call related to the release asked why the company would not simply sit on the report until it did find a way to drive costs down, Ewigleben said the company felt it owed it to investors to be as transparent as possible.

“We all know in this industry that for years several companies have underestimated the cost of projects,” he said. “We made sure, to the best of our ability, that we have defined every potential cost and used those conservative numbers to avoid that trap.”

As for possible ways that costs could be cut, the most obvious place to start would be scale. The current feasibility study considered a mine that would process 100,000 tonnes of ore per day with gold recoveries of over 80%. Through the first five years the annual production would be 700,000 oz. of gold.

Tower Hill decided to outline such a big project in order to generate economies of scale that could make up for the relatively low grade of the deposit. It will likely now consider a more modest facility.

Livengood has measured resources of 731 million tonne grading 0.61 grams gold for 14.4 million oz; 71 million indicated tonnes grading 0.56 grams gold for 1.3 million oz. and 266 million inferred tonnes grading 0.52 grams for 4.4 million oz.

And while the headgrade at the mill is estimated to average 1.08 grams per tonne in the first year, the number falls to a staggeringly low 0.39 grams per tonne in years 13 and 14.

Livengood, which was acquired from AngloGold Ashanti (NYSE: AU) in 2006, sits 125-km northwest of Fairbanks in Alaska.

Shortly after the acquisition the company began an aggressive drill campaign that had investors believing in a large scale, world class deposit. Those early results turned Tower Hill into a market darling as its stock went from trading in the $1.25 range at the end of 2008 all the way up to $9.98 by the end of 2010. By early 2011, after its PEA was released, the decline had begun. A decline that has now culminated with the release of the feasibility study as the stock dropped 54% or 50¢ in Toronto on July 24th, finishing the day at just 42.5¢ on 2.42 million shares traded.

http://www.alaskajournal.com/Alaska-Journal-of-Commerce/July-Issue-4-2013/Major-mines-advance-toward-development/

Livengood

Another significant gold project in development is the Livengood gold project on the Elliot Highway 70 miles north of Fairbanks. It is in an advanced stage of planning and yet not yet finalized its mine plan, or filed for development permits.

International Tower Hills Mines, the owner, said that its preliminary feasibility study indicates the mine may not be economic, at least at current gold prices of about $1,340 per ounce. A break-even gold price of about $1,500 per ounce is need, the study said.

Project manager Tom Irwin said high energy costs, environmental protection measures and the need to build a worker housing complex at the mine contributed to problems. The capital cost was estimated at $2.79 billion in the study.

The company will continue work on permitting and engineering, Irwin said. International Tower Hills has spent about $250 million to date in exploration, environmental work and pre-development planning.

The latest resource estimate for the project, published in an August 2011 preliminary economic assessment, is 16.5 million ounces in measured and indicated resources with an additional 4.1 million ounces in inferred resources.

In March, ITH said that it has completed a mine design and production schedule and alternatives, with equipment specifications and bids from suppliers.

The mill process design has also been completed and would be similar to that used at the Fort Knox mine, an operating mine northeast of Fairbanks on the Steese Highway.

An important aspect of the Livengood project is that it is located on an all-weather paved highway, which makes the area very accessible. However, infrastructure for power would have to be built. The company’s current plan is to purchase power from Golden Valley Electric Association, the regional utility. Power transmission lines would have to be built to the mine from the Fairbanks area.

Livengood

Another significant gold project in development is the Livengood gold project on the Elliot Highway 70 miles north of Fairbanks. It is in an advanced stage of planning and yet not yet finalized its mine plan, or filed for development permits.

International Tower Hills Mines, the owner, said that its preliminary feasibility study indicates the mine may not be economic, at least at current gold prices of about $1,340 per ounce. A break-even gold price of about $1,500 per ounce is need, the study said.

Project manager Tom Irwin said high energy costs, environmental protection measures and the need to build a worker housing complex at the mine contributed to problems. The capital cost was estimated at $2.79 billion in the study.

The company will continue work on permitting and engineering, Irwin said. International Tower Hills has spent about $250 million to date in exploration, environmental work and pre-development planning.

The latest resource estimate for the project, published in an August 2011 preliminary economic assessment, is 16.5 million ounces in measured and indicated resources with an additional 4.1 million ounces in inferred resources.

In March, ITH said that it has completed a mine design and production schedule and alternatives, with equipment specifications and bids from suppliers.

The mill process design has also been completed and would be similar to that used at the Fort Knox mine, an operating mine northeast of Fairbanks on the Steese Highway.

An important aspect of the Livengood project is that it is located on an all-weather paved highway, which makes the area very accessible. However, infrastructure for power would have to be built. The company’s current plan is to purchase power from Golden Valley Electric Association, the regional utility. Power transmission lines would have to be built to the mine from the Fairbanks area.

August 08, 2013 09:00 ET

International Tower Hill Mines Announces Addition to the Board of Directors

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Aug. 8, 2013) - International Tower Hill Mines Ltd. ("ITH" or the "Company") - (TSX:ITH)(NYSE MKT:THM)(FRANKFURT:IW9) announces the addition of Thomas Weng to its Board of Directors, effective August 5, 2013. The appointment of Mr. Weng increases the number of directors on the ITH board from six to seven. Mr. Weng will serve as an independent director on both the compensation and audit committees.

"Mr. Weng brings a wealth of financial background to the board of International Tower Hill Mines," said Don Ewigleben, President and CEO of ITH. "His extensive experience in equity capital markets and portfolio management, covering the metals and mining space, will be invaluable as we continue to advance the Livengood project and continue discussions with potential strategic partners."

Mr. Weng has over 22 years of experience in the financial services sector. He is currently the Co-Founding Partner of Alta Capital Partners, a provider of investment banking services, globally. Previously, Mr. Weng was a Managing Director at Deutsche Bank and Head of Equity Capital Markets for Metals and Mining throughout the Americas and Latin America, across all industry segments. Mr. Weng has also held various senior positions at Pacific Partners, an alternative investment firm, and Morgan Stanley.

Mr. Weng holds a Bachelors of Arts degree in Economics from Boston University.

About International Tower Hill Mines Ltd.

International Tower Hill Mines Ltd. controls a 100% interest in the world-class Livengood Gold Project accessible by paved highway 70 miles northwest of Fairbanks, Alaska.

On behalf of International Tower Hill Mines Ltd.

Donald C. Ewigleben, President & Chief Executive Officer

http://www.marketwire.com/press-release/international-tower-hill-mines-announces-addition-to-the-board-of-directors-tsx-ith-1819040.htm

International Tower Hill Mines Announces Addition to the Board of Directors

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Aug. 8, 2013) - International Tower Hill Mines Ltd. ("ITH" or the "Company") - (TSX:ITH)(NYSE MKT:THM)(FRANKFURT:IW9) announces the addition of Thomas Weng to its Board of Directors, effective August 5, 2013. The appointment of Mr. Weng increases the number of directors on the ITH board from six to seven. Mr. Weng will serve as an independent director on both the compensation and audit committees.

"Mr. Weng brings a wealth of financial background to the board of International Tower Hill Mines," said Don Ewigleben, President and CEO of ITH. "His extensive experience in equity capital markets and portfolio management, covering the metals and mining space, will be invaluable as we continue to advance the Livengood project and continue discussions with potential strategic partners."

Mr. Weng has over 22 years of experience in the financial services sector. He is currently the Co-Founding Partner of Alta Capital Partners, a provider of investment banking services, globally. Previously, Mr. Weng was a Managing Director at Deutsche Bank and Head of Equity Capital Markets for Metals and Mining throughout the Americas and Latin America, across all industry segments. Mr. Weng has also held various senior positions at Pacific Partners, an alternative investment firm, and Morgan Stanley.

Mr. Weng holds a Bachelors of Arts degree in Economics from Boston University.

About International Tower Hill Mines Ltd.

International Tower Hill Mines Ltd. controls a 100% interest in the world-class Livengood Gold Project accessible by paved highway 70 miles northwest of Fairbanks, Alaska.

On behalf of International Tower Hill Mines Ltd.

Donald C. Ewigleben, President & Chief Executive Officer

http://www.marketwire.com/press-release/international-tower-hill-mines-announces-addition-to-the-board-of-directors-tsx-ith-1819040.htm

[url=http://peketec.de/trading/viewtopic.php?p=1409435#1409435 schrieb:CCG-Redaktion schrieb am 22.08.2013, 19:31 Uhr[/url]"]http://investors.morningstar.com/ownership/shareholders-overview.html?region=USA&welcomePage=true&ops=clear&t=thm

Immer noch gleichstark, aber die Ausrichtung der Investoren hat auf long gedreht=

längerfristig!

Goldman Sachs hat sich über Nasdac ebenfalls eingekauft!

http://www.nasdaq.com/symbol/thm/institutional-holdings/new

Bei ITH gibt es im Übrigen noch ein Scenario, dass noch keiner beschrieben hat!

Kinross mit noch geringeren Grades als ITH betreibt 55 KM nördlich eine Mine, die

nach dem gleichen Prinzip der Goldverwertung wie ITH arbeitet! Es ist vorstellbar

ein Förderband zur Mine zu führen paralell zur Öl Leitung, oder wenn Kinross erschöpft ist das Equipment dort aufzubauen!

Kinross mit noch geringeren Grades als ITH betreibt 55 KM nördlich eine Mine, die

nach dem gleichen Prinzip der Goldverwertung wie ITH arbeitet! Es ist vorstellbar

ein Förderband zur Mine zu führen paralell zur Öl Leitung, oder wenn Kinross erschöpft ist das Equipment dort aufzubauen!