App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread (Archiv)

- Ersteller Maack

- Erstellt am

- Tagged users Kein(e)

- Status

- Für weitere Antworten geschlossen.

9. Oktober 2012

Analysten zuversichtlich: Die Zeit ist fast reif, wieder Goldaktien zu kaufen

Die Analysten von RBC sind der Ansicht, dass die Zeit fast reif ist, wieder Aktien von Goldfirmen zu kaufen. Diese Papiere sind lange Zeit schlechter gelaufen als der Preis des gelben Metalls selbst. Doch die Experten glauben, dass diese Phase sich ihrem Ende nähert.

...

http://bjoernjunker.wordpress.com/2012/10/09/analysten-zuversichtlich-die-zeit-ist-fast-reif-wieder-goldaktien-zu-kaufen/

Analysten zuversichtlich: Die Zeit ist fast reif, wieder Goldaktien zu kaufen

Die Analysten von RBC sind der Ansicht, dass die Zeit fast reif ist, wieder Aktien von Goldfirmen zu kaufen. Diese Papiere sind lange Zeit schlechter gelaufen als der Preis des gelben Metalls selbst. Doch die Experten glauben, dass diese Phase sich ihrem Ende nähert.

...

http://bjoernjunker.wordpress.com/2012/10/09/analysten-zuversichtlich-die-zeit-ist-fast-reif-wieder-goldaktien-zu-kaufen/

9. Oktober 2012

Parteitag steht an

Legt China neue große Konjunkturprogramme auf?

Die chinesischen Kommunisten wählen im nächsten Monat eine neue Führung. In der Rohstoffbranche hofft man, dass diese sich mit großen Konjunkturpaketen ins Amt einführen werden.

...

http://www.goldinvest.de/index.php/legt-china-neue-grosse-konjunkturprogramme-auf-26271

Parteitag steht an

Legt China neue große Konjunkturprogramme auf?

Die chinesischen Kommunisten wählen im nächsten Monat eine neue Führung. In der Rohstoffbranche hofft man, dass diese sich mit großen Konjunkturpaketen ins Amt einführen werden.

...

http://www.goldinvest.de/index.php/legt-china-neue-grosse-konjunkturprogramme-auf-26271

KOR

Corvus Gold Expands High-Grade Gold Mineralization and Completes Resource Definition Drilling at the Mayflower Target, North Bullfrog, Nevada

TSX: KOR OTCQX: CORVF

Highlights include: NB-12-164: 6.1 metres of 9.94 g/t gold from 6m depth

NB-12-161: 28.9 metres of 0.84 g/t gold from 37m depth

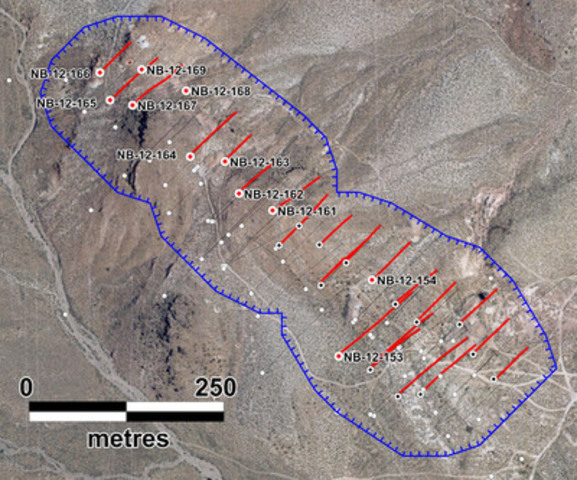

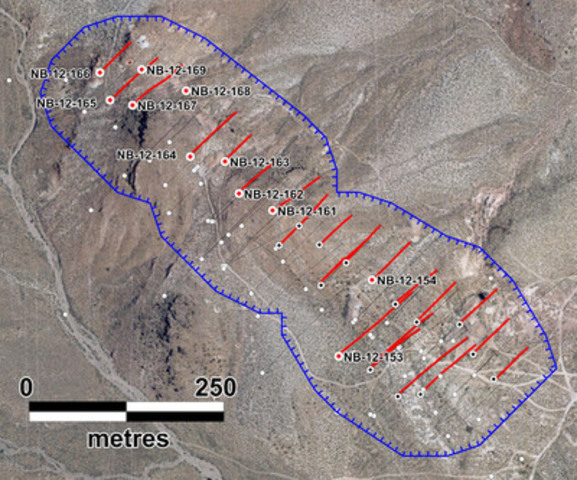

VANCOUVER, Oct. 9, 2012 /CNW/ - Corvus Gold Inc. ("Corvus" or the "Company") - (TSX: KOR, OTCQX: CORVF) announces results from the final 11 holes of the phase II, 26 hole resource expansion and conversion program at Mayflower Deposit, North Bullfrog Project, Nevada (Figure 1). The encouraging higher grade drill results will be incorporated into an updated Preliminary Economic Assessment (PEA) for its two stage mine development strategy at North Bullfrog later this fall and a subsequent feasibility study on the Mayflower mine for Q1 2013. The results to date continue to support the Company's objective of establishing gold production in late 2014.

These most recent Mayflower results include near surface high-grade vein related mineralization (NB-12-164 with 9.94 g/t gold over 6.1 metres) which will be part of the early mining of the Mayflower deposit (Table 1). The high-grade gold and silver mineralization in drill hole NB-12-164 and the moderate grade intervals in holes NB-12-153 (7.6m @ 1.33 g/t gold) and NB-12-161 (12.2m @ 1.58 g/t gold) are related to adularia alteration and veining which may be the upper expression of a multistage high-grade quartz vein system similar to the high-grade mineralization found in the Yellow Jacket system 4 kilometres to the north of Mayflower.

Jeff Pontius, Corvus Gold CEO states: "These new results are highlighting the potential for the Mayflower project to provide a significant near-term financial return to Corvus Gold. In addition, the high-grade vein system that has now been intersected in two areas of the Mayflower deposit could add significant future value to the operation and our Company as we follow it down into what we believe to be a more productive high-grade zone. These results combined with the resumption of drilling at the North Area Yellow Jacket vein system will continue to show the high-grade gold and silver potential of this emerging new Nevada mining project."

About the North Bullfrog Project, Nevada

Corvus controls 100% of its North Bullfrog Project, which covers approximately 43 km² in southern Nevada just north of the historic Bullfrog gold mine formerly operated by Barrick Gold. The property package is made up of a number of leased patented federal mining claims and 461 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor. The Company and its independent consultants completed a robust positive Preliminary Economic Assessment on the existing resource in February 2012.

The project currently includes numerous prospective gold targets with four (Mayflower, Sierra Blanca, Jolly Jane and Connection) containing an NI 43-101 compliant estimated Indicated Resource of 15 Mt at an average grade of 0.37 g/t gold for 182,577 ounces of gold and an Inferred Resource of 156 Mt at 0.28 g/t gold for 1,410,096 ounces of gold (both at a 0.2 g/t cutoff), with appreciable silver credits. Mineralization occurs in two primary forms: (1) broad stratabound bulk-tonnage gold zones such as the Sierra Blanca and Jolly Jane systems; and (2) moderately thick zones of high-grade gold and silver mineralization hosted in structural feeder zones with breccias and quartz-sulphide vein stockworks such as the Mayflower and Yellowjacket targets. The Company is actively pursuing both types of mineralization.

A video of the North Bullfrog project showing location, infrastructure access and 2010 winter drilling is available on the Company's website at http://www.corvusgold.com/investors/video/ .

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information (other than the resource estimate) that form the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options.

Mr. Gary Giroux, M.Sc., P. Eng (B.C.), a consulting geological engineer employed by Giroux Consultants Ltd., has acted as the Qualified Person, as defined in NI 43-101, for the Giroux Consultants Ltd. mineral resource estimate. He has over 30 years of experience in all stages of mineral exploration, development and production. Mr. Giroux specializes in computer applications in ore reserve estimation, and has consulted both nationally and internationally in this field. He has authored many papers on geostatistics and ore reserve estimation and has practiced as a Geological Engineer since 1970 and provided geostatistical services to the industry since 1976. Both Mr. Giroux and Giroux Consultants Ltd. are independent of the Company under NI 43-101.

The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control. McClelland Laboratories Inc. prepared composites from duplicated RC sample splits collected during drilling. Bulk samples were sealed on site and delivered to McClelland Laboratories Inc. by ALS Chemex or Corvus personnel. All metallurgical testing reported here was conducted or managed by McClelland Laboratories Inc.

About Corvus Gold Inc.

Corvus Gold Inc. is a resource exploration company, focused in Nevada, Alaska and Quebec, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% owned Nevada, North Bullfrog project towards a potential development decision and continuing to explore for new major gold discoveries. Corvus is committed to building shareholder value through new discoveries and leveraging noncore assets via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production.

On behalf of

Corvus Gold Inc.

(signed) Jeffrey A. Pontius

Jeffrey A. Pontius,

Chairman and Chief Executive Officer

http://tmx.quotemedia.com/article.php?newsid=54874715&qm_symbol=KOR

Corvus Gold Expands High-Grade Gold Mineralization and Completes Resource Definition Drilling at the Mayflower Target, North Bullfrog, Nevada

TSX: KOR OTCQX: CORVF

Highlights include: NB-12-164: 6.1 metres of 9.94 g/t gold from 6m depth

NB-12-161: 28.9 metres of 0.84 g/t gold from 37m depth

VANCOUVER, Oct. 9, 2012 /CNW/ - Corvus Gold Inc. ("Corvus" or the "Company") - (TSX: KOR, OTCQX: CORVF) announces results from the final 11 holes of the phase II, 26 hole resource expansion and conversion program at Mayflower Deposit, North Bullfrog Project, Nevada (Figure 1). The encouraging higher grade drill results will be incorporated into an updated Preliminary Economic Assessment (PEA) for its two stage mine development strategy at North Bullfrog later this fall and a subsequent feasibility study on the Mayflower mine for Q1 2013. The results to date continue to support the Company's objective of establishing gold production in late 2014.

These most recent Mayflower results include near surface high-grade vein related mineralization (NB-12-164 with 9.94 g/t gold over 6.1 metres) which will be part of the early mining of the Mayflower deposit (Table 1). The high-grade gold and silver mineralization in drill hole NB-12-164 and the moderate grade intervals in holes NB-12-153 (7.6m @ 1.33 g/t gold) and NB-12-161 (12.2m @ 1.58 g/t gold) are related to adularia alteration and veining which may be the upper expression of a multistage high-grade quartz vein system similar to the high-grade mineralization found in the Yellow Jacket system 4 kilometres to the north of Mayflower.

Jeff Pontius, Corvus Gold CEO states: "These new results are highlighting the potential for the Mayflower project to provide a significant near-term financial return to Corvus Gold. In addition, the high-grade vein system that has now been intersected in two areas of the Mayflower deposit could add significant future value to the operation and our Company as we follow it down into what we believe to be a more productive high-grade zone. These results combined with the resumption of drilling at the North Area Yellow Jacket vein system will continue to show the high-grade gold and silver potential of this emerging new Nevada mining project."

About the North Bullfrog Project, Nevada

Corvus controls 100% of its North Bullfrog Project, which covers approximately 43 km² in southern Nevada just north of the historic Bullfrog gold mine formerly operated by Barrick Gold. The property package is made up of a number of leased patented federal mining claims and 461 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor. The Company and its independent consultants completed a robust positive Preliminary Economic Assessment on the existing resource in February 2012.

The project currently includes numerous prospective gold targets with four (Mayflower, Sierra Blanca, Jolly Jane and Connection) containing an NI 43-101 compliant estimated Indicated Resource of 15 Mt at an average grade of 0.37 g/t gold for 182,577 ounces of gold and an Inferred Resource of 156 Mt at 0.28 g/t gold for 1,410,096 ounces of gold (both at a 0.2 g/t cutoff), with appreciable silver credits. Mineralization occurs in two primary forms: (1) broad stratabound bulk-tonnage gold zones such as the Sierra Blanca and Jolly Jane systems; and (2) moderately thick zones of high-grade gold and silver mineralization hosted in structural feeder zones with breccias and quartz-sulphide vein stockworks such as the Mayflower and Yellowjacket targets. The Company is actively pursuing both types of mineralization.

A video of the North Bullfrog project showing location, infrastructure access and 2010 winter drilling is available on the Company's website at http://www.corvusgold.com/investors/video/ .

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information (other than the resource estimate) that form the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options.

Mr. Gary Giroux, M.Sc., P. Eng (B.C.), a consulting geological engineer employed by Giroux Consultants Ltd., has acted as the Qualified Person, as defined in NI 43-101, for the Giroux Consultants Ltd. mineral resource estimate. He has over 30 years of experience in all stages of mineral exploration, development and production. Mr. Giroux specializes in computer applications in ore reserve estimation, and has consulted both nationally and internationally in this field. He has authored many papers on geostatistics and ore reserve estimation and has practiced as a Geological Engineer since 1970 and provided geostatistical services to the industry since 1976. Both Mr. Giroux and Giroux Consultants Ltd. are independent of the Company under NI 43-101.

The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control. McClelland Laboratories Inc. prepared composites from duplicated RC sample splits collected during drilling. Bulk samples were sealed on site and delivered to McClelland Laboratories Inc. by ALS Chemex or Corvus personnel. All metallurgical testing reported here was conducted or managed by McClelland Laboratories Inc.

About Corvus Gold Inc.

Corvus Gold Inc. is a resource exploration company, focused in Nevada, Alaska and Quebec, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% owned Nevada, North Bullfrog project towards a potential development decision and continuing to explore for new major gold discoveries. Corvus is committed to building shareholder value through new discoveries and leveraging noncore assets via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production.

On behalf of

Corvus Gold Inc.

(signed) Jeffrey A. Pontius

Jeffrey A. Pontius,

Chairman and Chief Executive Officer

http://tmx.quotemedia.com/article.php?newsid=54874715&qm_symbol=KOR

[url=http://peketec.de/trading/viewtopic.php?p=1305520#1305520 schrieb:ixilon. schrieb am 02.10.2012, 01:40 Uhr[/url]"]Corvus Gold Begins Follow-up Drilling at the Yellow Jacket High-Grade Gold Target, North Bullfrog, Nevada

http://tmx.quotemedia.com/article.php?newsid=54687383&qm_symbol=KOR

[url=http://peketec.de/trading/viewtopic.php?p=1302592#1302592 schrieb:ixilon. schrieb am 22.09.2012, 04:07 Uhr[/url]"]Netter Anstieg mit hohen Volumen, ohne News

Corvus Gold 1,25 CAD +0,22 CAD +21,36% 609.067

» zur Grafik

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1301228#1301228 schrieb:ixilon. schrieb am 19.09.2012, 03:02 Uhr[/url]"]Corvus Gold's JV Partner Reports Positive Drill Results at West Pogo Project, Alaska

http://tmx.quotemedia.com/article.php?newsid=54375740&qm_symbol=KOR

[url=http://peketec.de/trading/viewtopic.php?p=1265219#1265219 schrieb:ixilon. schrieb am 25.06.2012, 02:25 Uhr[/url]"]» zur Grafik

October 8, 2012

4 Important Catalysts For The Coal Sector

includes: ACI, ANR, BTU, CSX, JRCC, PCXCQ.OB, WLT

Coal stocks (and by extension, their investors), have been battered and bruised to an extraordinary extent since before the 2008/2009 recession. While other sectors were also hit hard by that recession, for the most part they have recovered, as seen by stock market averages returning to the highs set back in 2007. But almost to a name, the damage in coal stocks remains. Will this sector ever return? Is there any reason at all to want to invest in these stocks?

I think the answer is finally yes. There are four broad catalysts which could bring some positive lift to the sector in the near term. They are a massive build of short positions; global economic stimulus; recently announced production curtailments and Mitt Romney's improving stature in the polls.

...

http://seekingalpha.com/article/910621-4-important-catalysts-for-the-coal-sector

4 Important Catalysts For The Coal Sector

includes: ACI, ANR, BTU, CSX, JRCC, PCXCQ.OB, WLT

Coal stocks (and by extension, their investors), have been battered and bruised to an extraordinary extent since before the 2008/2009 recession. While other sectors were also hit hard by that recession, for the most part they have recovered, as seen by stock market averages returning to the highs set back in 2007. But almost to a name, the damage in coal stocks remains. Will this sector ever return? Is there any reason at all to want to invest in these stocks?

I think the answer is finally yes. There are four broad catalysts which could bring some positive lift to the sector in the near term. They are a massive build of short positions; global economic stimulus; recently announced production curtailments and Mitt Romney's improving stature in the polls.

...

http://seekingalpha.com/article/910621-4-important-catalysts-for-the-coal-sector

08.10.2012

"Wenn das Gold redet, schweigt die Welt!"

von Martin Mack und Herwig Weise

Die Überschuldungskrise ist die Folge einer Wirtschaftsideologie, die seit nunmehr 40 Jahren Wachstum auf Pump propagiert. Je länger die Krise andauert, je mehr Rechte gebrochen werden, desto mehr läuft die Gelddrucker-Kolonne dieser Welt Gefahr, das Vertrauen der Bevölkerung in das Papierwährungssystem endgültig zu verlieren. Gold schützt seinen Besitzer vor dem Geldbetrug der Regierungen und bewahrt langfristig seine Kaufkraft - nicht mehr und nicht weniger!

...

http://www.wiwo.de/finanzen/geldanlage/geldanlage-wenn-das-gold-redet-schweigt-die-welt-seite-all/7224412-all.html

"Wenn das Gold redet, schweigt die Welt!"

von Martin Mack und Herwig Weise

Die Überschuldungskrise ist die Folge einer Wirtschaftsideologie, die seit nunmehr 40 Jahren Wachstum auf Pump propagiert. Je länger die Krise andauert, je mehr Rechte gebrochen werden, desto mehr läuft die Gelddrucker-Kolonne dieser Welt Gefahr, das Vertrauen der Bevölkerung in das Papierwährungssystem endgültig zu verlieren. Gold schützt seinen Besitzer vor dem Geldbetrug der Regierungen und bewahrt langfristig seine Kaufkraft - nicht mehr und nicht weniger!

...

http://www.wiwo.de/finanzen/geldanlage/geldanlage-wenn-das-gold-redet-schweigt-die-welt-seite-all/7224412-all.html

Eisenerz- und Stahlpreise in China auf höchstem Stand seit Mitte August bzw. Mitte Juli

09.10.12 12:14

Commerzbank Corp. & Markets

Frankfurt ( www.aktiencheck.de ) - "Totgeglaubte leben länger!" kann man wohl über die Entwicklungen am Stahlmarkt sagen, so die Analysten von Commerzbank Corporates & Markets.

Noch im September seien die fallenden Stahl- und Eisenerzpreise in China oft als Hinweis auf eine sehr schwache Nachfrage bzw. die Konjunkturentwicklung im Reich der Mitte interpretiert worden. Der kräftige Preisanstieg bei Eisenerz und Stahl in den letzten Wochen habe dementsprechend viele Marktteilnehmer überrascht. In China sei der Eisenerzpreis nach einem 27%-igen Anstieg auf den höchsten Stand seit Mitte August gestiegen, der Stahlpreis habe sogar den höchsten Wert seit Mitte Juli erreicht. Ausschlaggebend seien aus Sicht der Analysten neben den "weichen" Faktoren wie dem Optimismus aufgrund der Infrastrukturprogramme und weiterer Liquiditätsspritzen auch die physische Einengung des Marktes.

So würden die Lagerbestände für Baustahl in China schon seit Monaten fallen, auch die für Warmbreitband HRC seien in den letzten Wochen auf Mehrjahrestiefs gefallen. Auch bei Eisenerz zeichne sich eine Bereinigung ab, nachdem ein großer Teil der Produktion in China unprofitabel geworden sei. Für die aktuelle Einengung sei aber nicht allein die Angebotsseite verantwortlich: Die Stahlproduktion im September und Oktober dürfte zwar weiter gefallen sein, nachdem sie schon im August im Monatsvergleich um 4,8% zurückgegangen sei. Auch die robuste Nachfrage dürfte maßgeblich dazu beigetragen haben. Triebfeder sei nach Erachten der Analysten allerdings vor allem die Exportnachfrage wegen der hohen Preisdifferenz zum Weltmarkt gewesen. Damit sei es noch zu früh, um eine Entwarnung für den Stahlmarkt zu geben. (09.10.2012/ac/a/m)

http://www.aktiencheck.de/analysen/Artikel-Eisenerz_und_Stahlpreise_China_auf_hoechstem_Stand_seit_Mitte_August_bzw_Mitte_Juli-4621355

09.10.12 12:14

Commerzbank Corp. & Markets

Frankfurt ( www.aktiencheck.de ) - "Totgeglaubte leben länger!" kann man wohl über die Entwicklungen am Stahlmarkt sagen, so die Analysten von Commerzbank Corporates & Markets.

Noch im September seien die fallenden Stahl- und Eisenerzpreise in China oft als Hinweis auf eine sehr schwache Nachfrage bzw. die Konjunkturentwicklung im Reich der Mitte interpretiert worden. Der kräftige Preisanstieg bei Eisenerz und Stahl in den letzten Wochen habe dementsprechend viele Marktteilnehmer überrascht. In China sei der Eisenerzpreis nach einem 27%-igen Anstieg auf den höchsten Stand seit Mitte August gestiegen, der Stahlpreis habe sogar den höchsten Wert seit Mitte Juli erreicht. Ausschlaggebend seien aus Sicht der Analysten neben den "weichen" Faktoren wie dem Optimismus aufgrund der Infrastrukturprogramme und weiterer Liquiditätsspritzen auch die physische Einengung des Marktes.

So würden die Lagerbestände für Baustahl in China schon seit Monaten fallen, auch die für Warmbreitband HRC seien in den letzten Wochen auf Mehrjahrestiefs gefallen. Auch bei Eisenerz zeichne sich eine Bereinigung ab, nachdem ein großer Teil der Produktion in China unprofitabel geworden sei. Für die aktuelle Einengung sei aber nicht allein die Angebotsseite verantwortlich: Die Stahlproduktion im September und Oktober dürfte zwar weiter gefallen sein, nachdem sie schon im August im Monatsvergleich um 4,8% zurückgegangen sei. Auch die robuste Nachfrage dürfte maßgeblich dazu beigetragen haben. Triebfeder sei nach Erachten der Analysten allerdings vor allem die Exportnachfrage wegen der hohen Preisdifferenz zum Weltmarkt gewesen. Damit sei es noch zu früh, um eine Entwarnung für den Stahlmarkt zu geben. (09.10.2012/ac/a/m)

http://www.aktiencheck.de/analysen/Artikel-Eisenerz_und_Stahlpreise_China_auf_hoechstem_Stand_seit_Mitte_August_bzw_Mitte_Juli-4621355

ITH

Mining News: Tower Hill chairman fills executive void

Ewigleben, Irwin lead efforts to develop 20-million-ounce Livengood gold project; CEO says AngloGold ties do not limit options

Shane Lasley - Mining News - Week of September 30, 2012

Don Ewigleben and Tom Irwin – two figures that played key roles in the development of Kinross Gold Corp.’s Fort Knox Mine – are once again united to develop a world-class gold deposit in Interior Alaska.

Filling a void created by the sudden departure of James Komadina in May, International Tower Hill Mines Ltd. appointed Chairman Ewigleben president and CEO of the company looking to develop the 20-million-ounce Livengood gold project.

Ewigleben, a lawyer who spent 35 years overseeing legal, regulatory environmental and government affairs in the mining industry, was appointed chairman of Tower Hill’s board of directors in November, but his ties to the Livengood deposit date back nearly a decade.

In 2003, Ewigleben ascended to president of AngloGold Ashanti, North America, a position previously held by Komadina. He later assumed the CEO position of that company. During his tenure as AngloGold’s top executive in North America, the South African gold company was investigating a then little-known gold prospect at Livengood.

Leading up to the Sept. 20 appointment as top executive at International Tower Hill, Ewigleben played an increasingly active role in the upper echelons of the company. Upon Komadina’s departure, the day-to-day operations fell upon the shoulders of an executive committee consisting of Ewigleben, who had been serving as chairman for six months, and Tower Hill founder Jeff Pontius.

Ewigleben’s transition from chairman to executive is underscored by a Sept. 7 presentation at the 2012 Precious Metals Summit in Colorado.

“It is a world-class deposit in a world-class jurisdiction, and we have got a world-class team to build it,” was the crux of the message Ewigleben delivered to investors and fellow miners at the gathering.

World-class team

The appointment of Ewigleben to Tower Hill’s top job follows an August promotion of Irwin to the positions of vice president, Alaska, and president of Tower Hill Mines, Inc., a U.S. subsidiary of International Tower Hill Mines.

Prior to joining the Tower Hill team as construction manager of the Livengood project in 2011, Irwin had served as commissioner of Alaska Department of Natural Resources, a public service role he filled under two administrations.

As DNR commissioner, Irwin oversaw the state’s interest in the permitting of resource development projects in Alaska and played a key role in setting up its large mine permitting team.

“Not only do we know what that permit program is, we actually have the guy that invented that permitting path in Tom Irwin,” Ewigleben observed.

Prior to his public service, Irwin spent more than 35 years optimizing, operating and permitting major mining projects, including Amax Gold Inc.’s Climax mine in Colorado and Sleeper mine in Nevada.

Ewigleben, who also worked for Amax Gold at the time, was involved in luring Irwin to help engineer and design the Fort Knox Mine, which is located about 60 miles (100 kilometers) southeast of Livengood.

“I am one of the team members that bought Fort Knox for Amax and had a chance to ask a gentleman … from the Sleeper mine by the name of Tom Irwin to come over and help us build that project,” the soon-to-be Tower Hill CEO told the audience at the Precious Metals Summit.

From 1992 to 1996, Irwin served as vice president of Amax subsidiary, Fairbanks Gold Mining Inc., and was responsible for engineering at Fort Knox during mine design.

He stayed with Fort Knox following Amax’s merger with Kinross, serving as manager and vice president, business development at the mine through 2003.

The recent management vacuum at Tower Hill also has pulled Karl Hanneman up the ranks to serve as Alaska general manager. Hanneman, who has been with International Tower Hill Mines since 2010, was largely responsible for assembling the company’s technical team in Alaska and served as Livengood project manager.

Hanneman earned a bachelor’s of science (honors) degree in mining engineering from the University of Alaska, is exceptionally familiar with what it takes to get a mine permitted in the state.

Prior to joining Tower Hill, he spent 12 years playing a senior role in Teck Resources Ltd.’s project development and permitting in Alaska

From 1998 to 2004, he served as Alaska regional manager during the exploration, development, and permitting of the Pogo Gold Mine.

During the second half of his tenure, he served as director, corporate affairs. In this role Hanneman was Teck’s senior corporate representative in Alaska; providing strategic guidance on governmental, regulatory, permitting, and community issues related to the Red Dog Mine.

“Tom, Karl, and the Alaska-based team have an unparalleled track record of success in permitting and development of mines in Alaska. This exceptional Alaskan team continues to rapidly advance our exciting world-class Livengood gold project toward production,” Ewigleben said.

World-class deposit

During Ewigleben’s tenure as president and CEO of AngloGold, North America, Livengood was one of a number of prospects the South African gold company was exploring in Alaska.

When AngloGold withdrew from the Far North state in 2006, Jeff Pontius, then exploration manager for AngloGold, North America, seized the opportunity.

“When Anglo decided they were going to redirect their exploration funding to different areas of the world in 2006, to me it looked like a great opportunity to do two things: one, to get my hands on Livengood and to start a junior gold exploration company, which is something I always had wanted to do; and two, to get to go through the experience of developing a major gold deposit again. It is a very exhilarating experience to do that. They don’t make anything (else) that provides that kind of thrill and excitement,” Pontius told Mining News.

It did not take Pontius and AngloGold geologists who joined him to launch Tower Hill long to realize they were onto something big at Livengood. Based on the first 39 holes tapped into the intrusion-related deposit, the young company put together an inaugural resource of 1.9 million ounces of gold at a grade of 0.71 grams per metric ton (at a 0.5 g/t cut-off grade) early in 2008.

Three years later, Tower Hill has expanded that initial gold resource estimate for the appropriately named Money Knob deposit by seven-fold.

With an all-in resource of 20.6 million ounces of gold, Money Knob at Livengood ranks as the 14th largest undeveloped deposit of gold on the planet, according to a research report published by Natural Resource Holdings in July.

“It worked out well for them (AngloGold) I think, so it was really a win-win situation for both of us. We got to go forward and do what we like to do best, myself and my exploration team that came with me from Anglo, and Anglo got exposure to a major new discovery,” Pontius explained.

Using a cut-off grade of 0.22 grams of gold per metric ton, which is seen as an economic cut-off for the operation that Tower Hill currently envisions for Livengood, the Money Knob deposit contains a measured and indicated resource of 933 million metric tons averaging 0.55 grams per metric ton gold (16.5 million ounces), plus an inferred resource of 257 million metric tons averaging 0.50 g/t gold (4.1 million ounces).

During his Sept. 7 presentation in Colorado, Ewigleben spent minimal time addressing the upside potential of the 56-square-mile (145 square kilometers) Livengood land package, reflecting Tower Hill’s focus on developing the world-class gold deposit.

He said the company is spending US$1 million to US$2 million per year on reconnaissance drilling on four outlying exploration targets.

“When you have 15-plus-million-ounces, you have a shareholder base that says ‘get on with it’ and that’s what we are doing in our feasibility study work,” Ewigleben said.

Though Tower Hill is not looking for more gold, its geotechnical and condemnation drilling continues to find the precious metal well beyond the confines of the Money Knob deposit – including one hole that cut 3.8 meters grading 6.9 grams per metric ton gold about 1 mile (1.6 kilometers) northeast of the deposit.

MK-12-281, drilled nearly 3,000 meters southwest of Money Knob, cut 2.76 meters averaging 2.75 grams per metric ton gold; MK-12-285, drilled about 1,500 meters east of the deposit, cut 2.01 meters averaging 3.47 g/t gold; MK-12-288, drilled some 1,500 meters west of Money Knob, cut 3.05 meters averaging 2.48 g/t gold; and MK-12-290, drilled about 1,600 meters northeast of the deposit, cut 3.81 meters averaging 6.91 g/t gold.

Tower Hill said the locations of these new gold intercepts do not impact the conceptual plan for developing the mining-related infrastructure contemplated in the feasibility work, the current focus of the company.

Crunching the numbers

Using a preliminary economic assessment completed in 2011 as a starting point, the Tower Hill team is crunching the numbers on the feasibility of building a mine at Livengood.

According to the PEA, a 91,000-metric-ton-per-day mill at Livengood would churn out 12.9 million ounces of gold over 23 years. As part of Tower Hill’s feasibility work, the company is studying different scenarios seeking the appropriate balance of capital expenditures and operating costs.

Ewigleben said the 560,000-ounce-per-year operation anticipated in the PEA is at the low end of various scenarios being contemplated.

While the scope of the operation appears to be growing, the new Tower Hill CEO said the goal is not to build the biggest mine; instead, return on investment is driving the size of the operation that will ultimately be built.

According to Ewigleben, the US$1.6 billion of capital needed to develop the project, a sum that is expected to climb, is the “biggest issue” in front of Tower Hill.

“That means we have to look at every available alternative, and we are doing so,” he said. “We might have some partnership, some strategic alliance or some other application as to how we deal with it.”

AngloGold Ashanti, which gained an equity position in Tower Hill in exchange for Livengood and its other Alaska projects, continues to hold close managerial ties and significant shares of the company. Despite these connections, Ewigleben said Tower Hill’s options remain open.

“AngloGold Ashanti, where Jeff and I both worked, still holds that 11.5 percent equity position but that is the only hold they have on this project, so we have variability as to how we want to move forward with it,” he said.

“We are glad they are our partner as an investor, but generally speaking, they no longer have anybody on our board,” Ewigleben added.

World-class jurisdiction

Located alongside a paved highway about 70 miles (110 kilometers) north of Fairbanks, a town founded on gold mining, the location for the proposed mine at Livengood does not get much better.

“We have exceptional infrastructure on this project: it is on a main paved highway; we are 50 miles from power; we know every aspect of this jurisdiction because many of our team members worked on Fort Knox,” Ewigleben explained to the Colorado crowd.

The proximity to Fairbanks also provides a strong mining work force.

“About the time Fort Knox drops off in production, we are going to be able to pick up some highly qualified employees,” said Ewigleben.

He said the large military bases that anchor the Interior Alaska town provide another large pool of skilled labor.

Leaving the controversial Pebble Project unnamed, the Tower Hill CEO said Livengood’s Interior Alaska location means it does not have the same environmental issues facing projects in other regions of the state.

“With the benefit of my long history with the Livengood project dating back to 2003 and my past association with the development of the Fort Knox project, I am confident Alaska is one of the best mining jurisdictions in the world, and I believe in Livengood as a world-class multi-million-ounce gold project,” Ewigleben said upon being named Tower Hill CEO.

The feasibility study is due to be ready for internal review by Tower Hill management and peer review early in 2013 and made public by mid-year, marking the official launch of permitting.

With a team that understands what it takes to build a mine in Alaska and with minimal opposition expected Ewigleben sees first gold from a mine at Livengood in 2018.

“With Tom Irwin and our strong development and permitting team in place, I believe we are uniquely positioned to move Livengood forward towards production,” added the new Tower Hill CEO.

Daniel Carriere, an International Tower Hill Mines board member since April 2010, replaced Ewigleben as chairman of the company.

http://www.petroleumnews.com/pnfriends/661103210.shtml

Mining News: Tower Hill chairman fills executive void

Ewigleben, Irwin lead efforts to develop 20-million-ounce Livengood gold project; CEO says AngloGold ties do not limit options

Shane Lasley - Mining News - Week of September 30, 2012

Don Ewigleben and Tom Irwin – two figures that played key roles in the development of Kinross Gold Corp.’s Fort Knox Mine – are once again united to develop a world-class gold deposit in Interior Alaska.

Filling a void created by the sudden departure of James Komadina in May, International Tower Hill Mines Ltd. appointed Chairman Ewigleben president and CEO of the company looking to develop the 20-million-ounce Livengood gold project.

Ewigleben, a lawyer who spent 35 years overseeing legal, regulatory environmental and government affairs in the mining industry, was appointed chairman of Tower Hill’s board of directors in November, but his ties to the Livengood deposit date back nearly a decade.

In 2003, Ewigleben ascended to president of AngloGold Ashanti, North America, a position previously held by Komadina. He later assumed the CEO position of that company. During his tenure as AngloGold’s top executive in North America, the South African gold company was investigating a then little-known gold prospect at Livengood.

Leading up to the Sept. 20 appointment as top executive at International Tower Hill, Ewigleben played an increasingly active role in the upper echelons of the company. Upon Komadina’s departure, the day-to-day operations fell upon the shoulders of an executive committee consisting of Ewigleben, who had been serving as chairman for six months, and Tower Hill founder Jeff Pontius.

Ewigleben’s transition from chairman to executive is underscored by a Sept. 7 presentation at the 2012 Precious Metals Summit in Colorado.

“It is a world-class deposit in a world-class jurisdiction, and we have got a world-class team to build it,” was the crux of the message Ewigleben delivered to investors and fellow miners at the gathering.

World-class team

The appointment of Ewigleben to Tower Hill’s top job follows an August promotion of Irwin to the positions of vice president, Alaska, and president of Tower Hill Mines, Inc., a U.S. subsidiary of International Tower Hill Mines.

Prior to joining the Tower Hill team as construction manager of the Livengood project in 2011, Irwin had served as commissioner of Alaska Department of Natural Resources, a public service role he filled under two administrations.

As DNR commissioner, Irwin oversaw the state’s interest in the permitting of resource development projects in Alaska and played a key role in setting up its large mine permitting team.

“Not only do we know what that permit program is, we actually have the guy that invented that permitting path in Tom Irwin,” Ewigleben observed.

Prior to his public service, Irwin spent more than 35 years optimizing, operating and permitting major mining projects, including Amax Gold Inc.’s Climax mine in Colorado and Sleeper mine in Nevada.

Ewigleben, who also worked for Amax Gold at the time, was involved in luring Irwin to help engineer and design the Fort Knox Mine, which is located about 60 miles (100 kilometers) southeast of Livengood.

“I am one of the team members that bought Fort Knox for Amax and had a chance to ask a gentleman … from the Sleeper mine by the name of Tom Irwin to come over and help us build that project,” the soon-to-be Tower Hill CEO told the audience at the Precious Metals Summit.

From 1992 to 1996, Irwin served as vice president of Amax subsidiary, Fairbanks Gold Mining Inc., and was responsible for engineering at Fort Knox during mine design.

He stayed with Fort Knox following Amax’s merger with Kinross, serving as manager and vice president, business development at the mine through 2003.

The recent management vacuum at Tower Hill also has pulled Karl Hanneman up the ranks to serve as Alaska general manager. Hanneman, who has been with International Tower Hill Mines since 2010, was largely responsible for assembling the company’s technical team in Alaska and served as Livengood project manager.

Hanneman earned a bachelor’s of science (honors) degree in mining engineering from the University of Alaska, is exceptionally familiar with what it takes to get a mine permitted in the state.

Prior to joining Tower Hill, he spent 12 years playing a senior role in Teck Resources Ltd.’s project development and permitting in Alaska

From 1998 to 2004, he served as Alaska regional manager during the exploration, development, and permitting of the Pogo Gold Mine.

During the second half of his tenure, he served as director, corporate affairs. In this role Hanneman was Teck’s senior corporate representative in Alaska; providing strategic guidance on governmental, regulatory, permitting, and community issues related to the Red Dog Mine.

“Tom, Karl, and the Alaska-based team have an unparalleled track record of success in permitting and development of mines in Alaska. This exceptional Alaskan team continues to rapidly advance our exciting world-class Livengood gold project toward production,” Ewigleben said.

World-class deposit

During Ewigleben’s tenure as president and CEO of AngloGold, North America, Livengood was one of a number of prospects the South African gold company was exploring in Alaska.

When AngloGold withdrew from the Far North state in 2006, Jeff Pontius, then exploration manager for AngloGold, North America, seized the opportunity.

“When Anglo decided they were going to redirect their exploration funding to different areas of the world in 2006, to me it looked like a great opportunity to do two things: one, to get my hands on Livengood and to start a junior gold exploration company, which is something I always had wanted to do; and two, to get to go through the experience of developing a major gold deposit again. It is a very exhilarating experience to do that. They don’t make anything (else) that provides that kind of thrill and excitement,” Pontius told Mining News.

It did not take Pontius and AngloGold geologists who joined him to launch Tower Hill long to realize they were onto something big at Livengood. Based on the first 39 holes tapped into the intrusion-related deposit, the young company put together an inaugural resource of 1.9 million ounces of gold at a grade of 0.71 grams per metric ton (at a 0.5 g/t cut-off grade) early in 2008.

Three years later, Tower Hill has expanded that initial gold resource estimate for the appropriately named Money Knob deposit by seven-fold.

With an all-in resource of 20.6 million ounces of gold, Money Knob at Livengood ranks as the 14th largest undeveloped deposit of gold on the planet, according to a research report published by Natural Resource Holdings in July.

“It worked out well for them (AngloGold) I think, so it was really a win-win situation for both of us. We got to go forward and do what we like to do best, myself and my exploration team that came with me from Anglo, and Anglo got exposure to a major new discovery,” Pontius explained.

Using a cut-off grade of 0.22 grams of gold per metric ton, which is seen as an economic cut-off for the operation that Tower Hill currently envisions for Livengood, the Money Knob deposit contains a measured and indicated resource of 933 million metric tons averaging 0.55 grams per metric ton gold (16.5 million ounces), plus an inferred resource of 257 million metric tons averaging 0.50 g/t gold (4.1 million ounces).

During his Sept. 7 presentation in Colorado, Ewigleben spent minimal time addressing the upside potential of the 56-square-mile (145 square kilometers) Livengood land package, reflecting Tower Hill’s focus on developing the world-class gold deposit.

He said the company is spending US$1 million to US$2 million per year on reconnaissance drilling on four outlying exploration targets.

“When you have 15-plus-million-ounces, you have a shareholder base that says ‘get on with it’ and that’s what we are doing in our feasibility study work,” Ewigleben said.

Though Tower Hill is not looking for more gold, its geotechnical and condemnation drilling continues to find the precious metal well beyond the confines of the Money Knob deposit – including one hole that cut 3.8 meters grading 6.9 grams per metric ton gold about 1 mile (1.6 kilometers) northeast of the deposit.

MK-12-281, drilled nearly 3,000 meters southwest of Money Knob, cut 2.76 meters averaging 2.75 grams per metric ton gold; MK-12-285, drilled about 1,500 meters east of the deposit, cut 2.01 meters averaging 3.47 g/t gold; MK-12-288, drilled some 1,500 meters west of Money Knob, cut 3.05 meters averaging 2.48 g/t gold; and MK-12-290, drilled about 1,600 meters northeast of the deposit, cut 3.81 meters averaging 6.91 g/t gold.

Tower Hill said the locations of these new gold intercepts do not impact the conceptual plan for developing the mining-related infrastructure contemplated in the feasibility work, the current focus of the company.

Crunching the numbers

Using a preliminary economic assessment completed in 2011 as a starting point, the Tower Hill team is crunching the numbers on the feasibility of building a mine at Livengood.

According to the PEA, a 91,000-metric-ton-per-day mill at Livengood would churn out 12.9 million ounces of gold over 23 years. As part of Tower Hill’s feasibility work, the company is studying different scenarios seeking the appropriate balance of capital expenditures and operating costs.

Ewigleben said the 560,000-ounce-per-year operation anticipated in the PEA is at the low end of various scenarios being contemplated.

While the scope of the operation appears to be growing, the new Tower Hill CEO said the goal is not to build the biggest mine; instead, return on investment is driving the size of the operation that will ultimately be built.

According to Ewigleben, the US$1.6 billion of capital needed to develop the project, a sum that is expected to climb, is the “biggest issue” in front of Tower Hill.

“That means we have to look at every available alternative, and we are doing so,” he said. “We might have some partnership, some strategic alliance or some other application as to how we deal with it.”

AngloGold Ashanti, which gained an equity position in Tower Hill in exchange for Livengood and its other Alaska projects, continues to hold close managerial ties and significant shares of the company. Despite these connections, Ewigleben said Tower Hill’s options remain open.

“AngloGold Ashanti, where Jeff and I both worked, still holds that 11.5 percent equity position but that is the only hold they have on this project, so we have variability as to how we want to move forward with it,” he said.

“We are glad they are our partner as an investor, but generally speaking, they no longer have anybody on our board,” Ewigleben added.

World-class jurisdiction

Located alongside a paved highway about 70 miles (110 kilometers) north of Fairbanks, a town founded on gold mining, the location for the proposed mine at Livengood does not get much better.

“We have exceptional infrastructure on this project: it is on a main paved highway; we are 50 miles from power; we know every aspect of this jurisdiction because many of our team members worked on Fort Knox,” Ewigleben explained to the Colorado crowd.

The proximity to Fairbanks also provides a strong mining work force.

“About the time Fort Knox drops off in production, we are going to be able to pick up some highly qualified employees,” said Ewigleben.

He said the large military bases that anchor the Interior Alaska town provide another large pool of skilled labor.

Leaving the controversial Pebble Project unnamed, the Tower Hill CEO said Livengood’s Interior Alaska location means it does not have the same environmental issues facing projects in other regions of the state.

“With the benefit of my long history with the Livengood project dating back to 2003 and my past association with the development of the Fort Knox project, I am confident Alaska is one of the best mining jurisdictions in the world, and I believe in Livengood as a world-class multi-million-ounce gold project,” Ewigleben said upon being named Tower Hill CEO.

The feasibility study is due to be ready for internal review by Tower Hill management and peer review early in 2013 and made public by mid-year, marking the official launch of permitting.

With a team that understands what it takes to build a mine in Alaska and with minimal opposition expected Ewigleben sees first gold from a mine at Livengood in 2018.

“With Tom Irwin and our strong development and permitting team in place, I believe we are uniquely positioned to move Livengood forward towards production,” added the new Tower Hill CEO.

Daniel Carriere, an International Tower Hill Mines board member since April 2010, replaced Ewigleben as chairman of the company.

http://www.petroleumnews.com/pnfriends/661103210.shtml

[url=http://peketec.de/trading/viewtopic.php?p=1305662#1305662 schrieb:ixilon. schrieb am 02.10.2012, 09:57 Uhr[/url]"]Liberty Gold Corp. Reports On International Tower Hill's New High-Grade Gold Intercepts On Adjoining Livengood Property

http://finance.yahoo.com/news/liberty-gold-corp-reports-international-130000879.html

[url=http://peketec.de/trading/viewtopic.php?p=1302596#1302596 schrieb:ixilon. schrieb am 22.09.2012, 05:29 Uhr[/url]"]ITH International Tower Hill Mines 3,12 CAD +0,29 CAD +10,25% 162.240

THM International Tower Hill Mines 3,10 USD +0,21 USD +7,27% 928.582

» zur Grafik

6 Monatschart

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1301931#1301931 schrieb:ixilon. schrieb am 20.09.2012, 16:19 Uhr[/url]"]International Tower Hill Appoints Don Ewigleben as New Chief Executive Officer

http://tmx.quotemedia.com/article.php?newsid=54441835&qm_symbol=ITH

Allzeit-Hoch

Kalifornien droht der Benzin-Kollaps

09.10.2012

Der Benzinpreis in Kalifornien befindet sich mit 4,66 Dollar pro Gallone (3,79 Liter) zur Zeit auf Rekordniveau. An den Spotmärkten sind die Benzin-Verkäufe zeitweise gestoppt. Produktionsausfälle verknappen das Angebot.

von Axel Postinett

...

http://www.handelsblatt.com/finanzen/rohstoffe-devisen/rohstoffe/allzeit-hoch-kalifornien-droht-der-benzin-kollaps/7230518.html

Kalifornien droht der Benzin-Kollaps

09.10.2012

Der Benzinpreis in Kalifornien befindet sich mit 4,66 Dollar pro Gallone (3,79 Liter) zur Zeit auf Rekordniveau. An den Spotmärkten sind die Benzin-Verkäufe zeitweise gestoppt. Produktionsausfälle verknappen das Angebot.

von Axel Postinett

...

http://www.handelsblatt.com/finanzen/rohstoffe-devisen/rohstoffe/allzeit-hoch-kalifornien-droht-der-benzin-kollaps/7230518.html

Nach einwöchiger Pause

Chinesische Händler treiben Eisenerzpreis in die Höhe

Geschrieben von Björn Junker • 9. Oktober 2012

Der Preis für Eisenerz mit 62% Eisengehalt ging mit 104.20 USD pro Tonne in die chinesischen Ferien. Damit hatte er sich bereits wieder etwas von der schwächsten Quartalsperformance der Geschichte erholt.

Am gestrigen Montag dann wetteten die aus dem einwöchigen Urlaub zurückgekehrten chinesischen Händler darauf, dass die jüngsten Stimulusmaßnahmen für die zweitgrößte Volkswirtschaft der Welt die Nachfrage steigen lassen werden und trieben den Eisenerzpreis um 6% auf 110,40 USD pro Tonne nach oben.

Damit hat der Rohstoff, der hauptsächlich zur Stahlherstellung verwendet wird, mehr als 25% seines Wertes zurück gewonnen, seit er Anfang September bei 86,70 USD den tiefsten Stand seit dreieinhalb Jahren markierte.

Damit folgte der Eisenerzpreis dem aktivsten Stahlkontrakt der Welt - Betonrippenstahl zur Auslieferung im Januar an der Shanghai Futures Exchange -, der am Montag ein Hoch bei 580 USD pro Tonne 3.668 Yuan und damit den höchsten Stand seit sieben Wochen erreichte.

Der Informationsdienst Bloomberg zitierte gestern Paul Gray von Wood Mackenzie mit der Aussage, dass China im kommenden Jahr 45 bis 55 Mio. Tonnen Eisenerz zusätzlich benötigen könnte. Seiner Ansicht nach dürfte die Rohstahlproduktion steigen und die Hüttenwerke ihre Lagerbestände wieder auffüllen.

http://www.goldinvest.de/index.php/chinesische-haendler-treiben-eisenerzpreis-in-die-hoehe-26258

Chinesische Händler treiben Eisenerzpreis in die Höhe

Geschrieben von Björn Junker • 9. Oktober 2012

Der Preis für Eisenerz mit 62% Eisengehalt ging mit 104.20 USD pro Tonne in die chinesischen Ferien. Damit hatte er sich bereits wieder etwas von der schwächsten Quartalsperformance der Geschichte erholt.

Am gestrigen Montag dann wetteten die aus dem einwöchigen Urlaub zurückgekehrten chinesischen Händler darauf, dass die jüngsten Stimulusmaßnahmen für die zweitgrößte Volkswirtschaft der Welt die Nachfrage steigen lassen werden und trieben den Eisenerzpreis um 6% auf 110,40 USD pro Tonne nach oben.

Damit hat der Rohstoff, der hauptsächlich zur Stahlherstellung verwendet wird, mehr als 25% seines Wertes zurück gewonnen, seit er Anfang September bei 86,70 USD den tiefsten Stand seit dreieinhalb Jahren markierte.

Damit folgte der Eisenerzpreis dem aktivsten Stahlkontrakt der Welt - Betonrippenstahl zur Auslieferung im Januar an der Shanghai Futures Exchange -, der am Montag ein Hoch bei 580 USD pro Tonne 3.668 Yuan und damit den höchsten Stand seit sieben Wochen erreichte.

Der Informationsdienst Bloomberg zitierte gestern Paul Gray von Wood Mackenzie mit der Aussage, dass China im kommenden Jahr 45 bis 55 Mio. Tonnen Eisenerz zusätzlich benötigen könnte. Seiner Ansicht nach dürfte die Rohstahlproduktion steigen und die Hüttenwerke ihre Lagerbestände wieder auffüllen.

http://www.goldinvest.de/index.php/chinesische-haendler-treiben-eisenerzpreis-in-die-hoehe-26258

09.10.2012

Zwangsabgabe

Elf EU-Länder wollen Finanzsteuer einführen

Die Finanztransaktionssteuer kann nun doch kommen: Elf EU-Länder haben sich auf die Einführung der Zwangsabgabe geeinigt. Vor allem Deutschland und Frankreich hatten sich dafür eingesetzt.

...

http://www.spiegel.de/wirtschaft/soziales/finanztransaktionssteuer-elf-eu-laender-einigen-sich-auf-einfuehrung-a-860288.html

Zwangsabgabe

Elf EU-Länder wollen Finanzsteuer einführen

Die Finanztransaktionssteuer kann nun doch kommen: Elf EU-Länder haben sich auf die Einführung der Zwangsabgabe geeinigt. Vor allem Deutschland und Frankreich hatten sich dafür eingesetzt.

...

http://www.spiegel.de/wirtschaft/soziales/finanztransaktionssteuer-elf-eu-laender-einigen-sich-auf-einfuehrung-a-860288.html

Kupferpreis - im Seitwärtstrend gefangen

09.10.2012 | DAF

So gibt es für den Zertifikateexperten Peter Bösenberg von der Société Générale genügend Gründe, die für einen steigenden aber auch fallenden Kupferpreis sprechen. Und damit hält Bösenberg das konjunktursensitive Metall für die nächsten Zeit im Seitwärtstrend gefangen.

Zum einen sind es die gesenkten Wachstumsprognosen, so Bösenberg, die dem Kupferpreis zu schaffen machen. Die Weltbank hat z.B. die Wachstumsprognose für die Region Asien und Pazifik auf 7,2 Prozent gesenkt. So langsam ist die Region vor elf Jahren zuletzt gewachsen. Auch das chinesische Wachstum wird auf 7,7 Prozent gesenkt, aber in 2013 dann wieder bei 8,1 Prozent gesehen. Auf der anderen Seite gibt es, so Bösenberg, auch stützende Faktoren für den Kupferpreis.

Die Minenproduktion die zurückgefahren wurde, dürfte sich positiv auf den Preis niederschlagen, sowie die konjunkturstützenden Maßnahmen. Ausserdem noch neu zu emittierende ETFs mit physischer Unterlegung von Kupfer. Ein Trend ist nicht erkennbar und damit erwartet Bösenberg seitwärtslaufende Preise. Eine Chance am Zertifikatemarkt tätig zu werden. Wie man hier eine hohe Rendite erzielen kann, sehen Sie im Video.

DAF-Video: http://www.rohstoff-welt.de/news/artikel.php?sid=39775#Kupferpreis-im-Seitwaertstrend-gefangen

09.10.2012 | DAF

So gibt es für den Zertifikateexperten Peter Bösenberg von der Société Générale genügend Gründe, die für einen steigenden aber auch fallenden Kupferpreis sprechen. Und damit hält Bösenberg das konjunktursensitive Metall für die nächsten Zeit im Seitwärtstrend gefangen.

Zum einen sind es die gesenkten Wachstumsprognosen, so Bösenberg, die dem Kupferpreis zu schaffen machen. Die Weltbank hat z.B. die Wachstumsprognose für die Region Asien und Pazifik auf 7,2 Prozent gesenkt. So langsam ist die Region vor elf Jahren zuletzt gewachsen. Auch das chinesische Wachstum wird auf 7,7 Prozent gesenkt, aber in 2013 dann wieder bei 8,1 Prozent gesehen. Auf der anderen Seite gibt es, so Bösenberg, auch stützende Faktoren für den Kupferpreis.

Die Minenproduktion die zurückgefahren wurde, dürfte sich positiv auf den Preis niederschlagen, sowie die konjunkturstützenden Maßnahmen. Ausserdem noch neu zu emittierende ETFs mit physischer Unterlegung von Kupfer. Ein Trend ist nicht erkennbar und damit erwartet Bösenberg seitwärtslaufende Preise. Eine Chance am Zertifikatemarkt tätig zu werden. Wie man hier eine hohe Rendite erzielen kann, sehen Sie im Video.

DAF-Video: http://www.rohstoff-welt.de/news/artikel.php?sid=39775#Kupferpreis-im-Seitwaertstrend-gefangen

8. Oktober 2012

Bergbaustreik in Südafrika erreicht ArcelorMittal und Xstrata

Von DEVON MAYLIE

JOHANNESBURG--Die Unruhen im südafrikanischen Bergbau ziehen nun auch Xstrata und ArcelorMittal in Mitleidenschaft. Der Rohstoffkonzern Xstrata musste wegen eines illegalen Streiks seine Platinmine Eland schließen. Der Stahlproduzent ArcelorMittal bezieht einen großen Teil seines Bedarfs an Eisenerz von der Sishen-Mine des Bergbaukonzerns Kumba - diese habe wegen eines illegalen Streikes aber schließen und "Force Majeure" anmelden müssen, teilte ArcelorMittal South Africa mit.

...

http://www.wallstreetjournal.de/article/SB10000872396390443982904578044583662458400.html

Bergbaustreik in Südafrika erreicht ArcelorMittal und Xstrata

Von DEVON MAYLIE

JOHANNESBURG--Die Unruhen im südafrikanischen Bergbau ziehen nun auch Xstrata und ArcelorMittal in Mitleidenschaft. Der Rohstoffkonzern Xstrata musste wegen eines illegalen Streiks seine Platinmine Eland schließen. Der Stahlproduzent ArcelorMittal bezieht einen großen Teil seines Bedarfs an Eisenerz von der Sishen-Mine des Bergbaukonzerns Kumba - diese habe wegen eines illegalen Streikes aber schließen und "Force Majeure" anmelden müssen, teilte ArcelorMittal South Africa mit.

...

http://www.wallstreetjournal.de/article/SB10000872396390443982904578044583662458400.html

Oliver Gross, Freier Wirtschaftsjournalist 09 / 10 / 2012

Silberbranche: Boom in Mexiko entfacht Konsolidierungsfantasie

Die mexikanische Edelmetallindustrie befindet sich seit vielen Jahren auf einem starken Wachstumskurs. Letztes Jahr setzte sich Mexiko im Silbersegment auf den ersten Platz der weltweit größten Produzenten und verdrängte Peru von der Spitze. Im Goldsektor gab es ebenfalls beachtenswerte Produktionssteigerungen. Alle Zeichen stehen weiterhin auf grün, dass der dynamische Aufwärtstrend anhalten wird.

...

http://www.miningscout.de/Kolumnen/Silberbranche_Boom_in_Mexiko_entfacht_Konsolidierungsfantasie/page_1/_76/__1033

Silberbranche: Boom in Mexiko entfacht Konsolidierungsfantasie

Die mexikanische Edelmetallindustrie befindet sich seit vielen Jahren auf einem starken Wachstumskurs. Letztes Jahr setzte sich Mexiko im Silbersegment auf den ersten Platz der weltweit größten Produzenten und verdrängte Peru von der Spitze. Im Goldsektor gab es ebenfalls beachtenswerte Produktionssteigerungen. Alle Zeichen stehen weiterhin auf grün, dass der dynamische Aufwärtstrend anhalten wird.

...

http://www.miningscout.de/Kolumnen/Silberbranche_Boom_in_Mexiko_entfacht_Konsolidierungsfantasie/page_1/_76/__1033

Oliver Gross, Freier Wirtschaftsjournalist 09 / 10 / 2012

Eisenerzpreise: BHP und Vale mittelfristig optimistisch

Die Eisenerzpreise haben eine heftige Achterbahnfahrt während der letzten Wochen erlebt. Die Preise für den begehrten Industrierohstoff stürzten am 5. September zunächst auf ein Mehrjahrestief bei 86,70 USD pro Tonne, bevor eine kräftige Erholung eintrat. Zwischenzeitlich hat sich die Tonne Eisenerz um fast 20% auf 104 USD verteuert. Jedoch befinden sich die Branche und die Preise aufgrund der schwächelnden chinesischen Wirtschaft und der Eurokrise seit vielen Monaten auf Sinkflug. Letztes Jahr notierten die Preise noch bei 170 USD/t, die Volatilität hat merklich zugenommen.

...

http://www.miningscout.de/Kolumnen/Eisenerzpreise_BHP_und_Vale_mittelfristig_optimistisch/page_1/_76/__1035

Eisenerzpreise: BHP und Vale mittelfristig optimistisch

Die Eisenerzpreise haben eine heftige Achterbahnfahrt während der letzten Wochen erlebt. Die Preise für den begehrten Industrierohstoff stürzten am 5. September zunächst auf ein Mehrjahrestief bei 86,70 USD pro Tonne, bevor eine kräftige Erholung eintrat. Zwischenzeitlich hat sich die Tonne Eisenerz um fast 20% auf 104 USD verteuert. Jedoch befinden sich die Branche und die Preise aufgrund der schwächelnden chinesischen Wirtschaft und der Eurokrise seit vielen Monaten auf Sinkflug. Letztes Jahr notierten die Preise noch bei 170 USD/t, die Volatilität hat merklich zugenommen.

...

http://www.miningscout.de/Kolumnen/Eisenerzpreise_BHP_und_Vale_mittelfristig_optimistisch/page_1/_76/__1035

Wegen Streik in Südafrika

Platinpreis bleibt weiter hoch

09.10.2012

Der Arbeitskampf in Südafrika drückt den Platinpreis weiterhin nach oben. Rekordmeldungen auch vom Goldmarkt: Die Edelmetall-Bestände aller Gold-ETFs lag heute bei über 74 Millionen Feinunzen und damit so hoch wie nie.

...

http://www.handelsblatt.com/finanzen/rohstoffe-devisen/rohstoffe/wegen-streik-in-suedafrika-platinpreis-bleibt-weiter-hoch/7233022.html#Wegen-Streik-in-Suedafrika-Platinpreis-bleibt-weiter-hoch

Platinpreis bleibt weiter hoch

09.10.2012

Der Arbeitskampf in Südafrika drückt den Platinpreis weiterhin nach oben. Rekordmeldungen auch vom Goldmarkt: Die Edelmetall-Bestände aller Gold-ETFs lag heute bei über 74 Millionen Feinunzen und damit so hoch wie nie.

...

http://www.handelsblatt.com/finanzen/rohstoffe-devisen/rohstoffe/wegen-streik-in-suedafrika-platinpreis-bleibt-weiter-hoch/7233022.html#Wegen-Streik-in-Suedafrika-Platinpreis-bleibt-weiter-hoch

MOSKAU, 09. Oktober (RIA Novosti).

Verdoppelung der Ölförderung im Irak bis 2020 erwartet

Der Irak wird seine Ölförderung bis 2020 voraussichtlich verdoppeln, heißt es in einem auf die Region bezogenen Bericht der Internationalen Energieagentur IEA.

Gegen Ende dieses Jahrzehnts kann die tägliche Ölförderung im Irak laut dem Bericht 6,1 Millionen Barrel erreichen. Bis 2035 soll die Ölförderung bei acht Millionen Barrel pro Tag liegen. Somit kann der Irak zum wichtigsten Lieferanten für die asiatische Region und in erster Linie für China werden.

„Diese Studie bestätigt die zunehmende Wichtigkeit des Iraks für das globale Energiesystem und betont die Rolle, die er für die Befriedigung der wachsenden weltweiten Nachfrage nach Energieträgern spielen wird“, äußerte IEA-Chefin Maria van der Hoeven.

http://de.rian.ru/business/20121009/264654879.html#Verdoppelung-der-Oelfoerderung-im-Irak-bis-2020-erwartet

Verdoppelung der Ölförderung im Irak bis 2020 erwartet

Der Irak wird seine Ölförderung bis 2020 voraussichtlich verdoppeln, heißt es in einem auf die Region bezogenen Bericht der Internationalen Energieagentur IEA.

Gegen Ende dieses Jahrzehnts kann die tägliche Ölförderung im Irak laut dem Bericht 6,1 Millionen Barrel erreichen. Bis 2035 soll die Ölförderung bei acht Millionen Barrel pro Tag liegen. Somit kann der Irak zum wichtigsten Lieferanten für die asiatische Region und in erster Linie für China werden.

„Diese Studie bestätigt die zunehmende Wichtigkeit des Iraks für das globale Energiesystem und betont die Rolle, die er für die Befriedigung der wachsenden weltweiten Nachfrage nach Energieträgern spielen wird“, äußerte IEA-Chefin Maria van der Hoeven.

http://de.rian.ru/business/20121009/264654879.html#Verdoppelung-der-Oelfoerderung-im-Irak-bis-2020-erwartet

09.10.2012

Notenbank schlägt 4,3 Tonnen Gold los

Liquidität. Nach fast genau einem Jahr Pause hat erneut eine Zentralbank der Eurozone eine ungewöhnlich große Menge Gold verkauft. Wie üblich nennt die EZB keine Herkunft.

...

http://wirtschaftsblatt.at/home/boerse/rohstoffe_waehrungen/1299260/Notenbank-schlaegt-43-Tonnen-Gold-los?from=rss

Notenbank schlägt 4,3 Tonnen Gold los

Liquidität. Nach fast genau einem Jahr Pause hat erneut eine Zentralbank der Eurozone eine ungewöhnlich große Menge Gold verkauft. Wie üblich nennt die EZB keine Herkunft.

...

http://wirtschaftsblatt.at/home/boerse/rohstoffe_waehrungen/1299260/Notenbank-schlaegt-43-Tonnen-Gold-los?from=rss

- Status

- Für weitere Antworten geschlossen.