App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread (Archiv)

- Ersteller Maack

- Erstellt am

- Tagged users Kein(e)

- Status

- Für weitere Antworten geschlossen.

CDU

Insider Overview :: Cardero Resource Corp. (T:CDU)

Oct 2/12 Oct 2/12 Hunter, Michael Leslie Direct Ownership Common Shares 10 - Acquisition in the public market 5,500 $0.670

Oct 2/12 Sep 28/12 Hunter, Michael Leslie Direct Ownership Common Shares 10 - Acquisition in the public market 15,000 $0.729

Oct 2/12 Sep 28/12 Hunter, Michael Leslie Direct Ownership Common Shares 10 - Acquisition in the public market 10,000 $0.720

Oct 2/12 Sep 28/12 Hunter, Michael Leslie Direct Ownership Common Shares 10 - Acquisition in the public market 1,000 $0.730

Oct 2/12 Sep 28/12 Hunter, Michael Leslie Direct Ownership Common Shares 10 - Acquisition in the public market 14,000 $0.735

Oct 2/12 Sep 28/12 Hunter, Michael Leslie Direct Ownership Common Shares 10 - Acquisition in the public market 5,000 $0.710

Oct 1/12 Sep 27/12 Bailey, Blaine Direct Ownership Options 50 - Grant of options 250,000 $0.780

Sep 28/12 Sep 27/12 Harris, Leonard Direct Ownership Options 50 - Grant of options 150,000 $0.780

Sep 28/12 Sep 27/12 Gilron, Guy Direct Ownership Options 50 - Grant of options 100,000 $0.780

Sep 28/12 Sep 27/12 Hunter, Michael Leslie Direct Ownership Options 50 - Grant of options 250,000 $0.780

Sep 28/12 Sep 27/12 Fitch, Stephan Andrew Direct Ownership Options 50 - Grant of options 160,000 $0.780

Sep 28/12 Sep 27/12 Henderson, Keith J. Direct Ownership Options 50 - Grant of options 250,000 $0.780

Sep 28/12 Sep 27/12 Van Alphen, Hendrik Direct Ownership Options 50 - Grant of options 250,000 $0.780

Sep 28/12 Sep 27/12 Matysek, Paul Frank Direct Ownership Options 50 - Grant of options 200,000 $0.780

http://www.canadianinsider.com/node/7?menu_tickersearch=cdu

Insider Overview :: Cardero Resource Corp. (T:CDU)

Oct 2/12 Oct 2/12 Hunter, Michael Leslie Direct Ownership Common Shares 10 - Acquisition in the public market 5,500 $0.670

Oct 2/12 Sep 28/12 Hunter, Michael Leslie Direct Ownership Common Shares 10 - Acquisition in the public market 15,000 $0.729

Oct 2/12 Sep 28/12 Hunter, Michael Leslie Direct Ownership Common Shares 10 - Acquisition in the public market 10,000 $0.720

Oct 2/12 Sep 28/12 Hunter, Michael Leslie Direct Ownership Common Shares 10 - Acquisition in the public market 1,000 $0.730

Oct 2/12 Sep 28/12 Hunter, Michael Leslie Direct Ownership Common Shares 10 - Acquisition in the public market 14,000 $0.735

Oct 2/12 Sep 28/12 Hunter, Michael Leslie Direct Ownership Common Shares 10 - Acquisition in the public market 5,000 $0.710

Oct 1/12 Sep 27/12 Bailey, Blaine Direct Ownership Options 50 - Grant of options 250,000 $0.780

Sep 28/12 Sep 27/12 Harris, Leonard Direct Ownership Options 50 - Grant of options 150,000 $0.780

Sep 28/12 Sep 27/12 Gilron, Guy Direct Ownership Options 50 - Grant of options 100,000 $0.780

Sep 28/12 Sep 27/12 Hunter, Michael Leslie Direct Ownership Options 50 - Grant of options 250,000 $0.780

Sep 28/12 Sep 27/12 Fitch, Stephan Andrew Direct Ownership Options 50 - Grant of options 160,000 $0.780

Sep 28/12 Sep 27/12 Henderson, Keith J. Direct Ownership Options 50 - Grant of options 250,000 $0.780

Sep 28/12 Sep 27/12 Van Alphen, Hendrik Direct Ownership Options 50 - Grant of options 250,000 $0.780

Sep 28/12 Sep 27/12 Matysek, Paul Frank Direct Ownership Options 50 - Grant of options 200,000 $0.780

http://www.canadianinsider.com/node/7?menu_tickersearch=cdu

[url=http://peketec.de/trading/viewtopic.php?p=1303054#1303054 schrieb:ixilon. schrieb am 24.09.2012, 18:15 Uhr[/url]"]Cardero Resource Reports Final High-Grade Results from Sheini Hills Iron Project

http://www.azomining.com/news.aspx?newsID=7201

6 Monatschart

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1303034#1303034 schrieb:ixilon. schrieb am 24.09.2012, 17:52 Uhr[/url]"]Ridley to get millions of tonnes of coal from new BC mine

http://www.thenorthernview.com/news/170905111.html

[url=http://peketec.de/trading/viewtopic.php?p=1269587#1269587 schrieb:ixilon. schrieb am 05.07.2012, 02:30 Uhr[/url]"]CDU - Kurzfristchart

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1267898#1267898 schrieb:ixilon. schrieb am 01.07.2012, 22:19 Uhr[/url]"]CDU - Mittelfristiger Chart

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1267897#1267897 schrieb:ixilon. schrieb am 01.07.2012, 22:10 Uhr[/url]"]CDU - Langfristchart

» zur Grafik

ABS

Abzu Gold Announces the Signing of its $2.5 Million Strategic Investment Proposal

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 3, 2012) -

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Abzu Gold Ltd. (TSX VENTURE:ABS)(OTCQX:ABZUF) ("Abzu" or the "Company") announces that, further to its news releases of September 27, 2012, September 18, 2012 and July 23, 2012, it has signed a definitive share purchase agreement ("SPA") with Stonehouse Construction Pte Ltd. ("SHC"). The terms of the SPA have been modified from the terms of the strategic investment proposal disclosed in the Company's July 23, 2012 news release.

Pursuant to the SPA and subject to certain conditions precedent including TSX Venture Exchange and shareholder approval, SHC or SHC and affiliated persons will purchase 22,727,273 units (the "Units") of Abzu at $0.11 per Unit. Each Unit will consist of one common share and one common share purchase warrant, with each warrant exercisable into an additional common share for a period of 12 months from the date of closing at $0.125 per share. All securities issued will be subject to a standard four month hold period. The proceeds from SHC's investment will be used by the Company for the advancement of the Company's Nangodi Project in Ghana, and for general corporate purposes.

Pursuant to the SPA the parties have agreed that SHC will assume operational management of Abzu's Nangodi project, which Abzu is earning an interest in pursuant to an option agreement with Kinross Gold.

All other terms of the SPA are the same as previously announced on July 23, 2012.

Tim McCutcheon, CEO, states: "With the combined SHC investment and concurrent private placement we intend to close on $3 million, our original target for this financing. Market conditions have been extremely challenging, and I am glad to report that despite this, Abzu's team has been able to raise the necessary funds to advance the Company."

On behalf of the board of directors of ABZU GOLD LTD.

Tim McCutcheon, Chief Executive Officer

http://tmx.quotemedia.com/article.php?newsid=54762423&qm_symbol=ABS

Abzu Gold Announces the Signing of its $2.5 Million Strategic Investment Proposal

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 3, 2012) -

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Abzu Gold Ltd. (TSX VENTURE:ABS)(OTCQX:ABZUF) ("Abzu" or the "Company") announces that, further to its news releases of September 27, 2012, September 18, 2012 and July 23, 2012, it has signed a definitive share purchase agreement ("SPA") with Stonehouse Construction Pte Ltd. ("SHC"). The terms of the SPA have been modified from the terms of the strategic investment proposal disclosed in the Company's July 23, 2012 news release.

Pursuant to the SPA and subject to certain conditions precedent including TSX Venture Exchange and shareholder approval, SHC or SHC and affiliated persons will purchase 22,727,273 units (the "Units") of Abzu at $0.11 per Unit. Each Unit will consist of one common share and one common share purchase warrant, with each warrant exercisable into an additional common share for a period of 12 months from the date of closing at $0.125 per share. All securities issued will be subject to a standard four month hold period. The proceeds from SHC's investment will be used by the Company for the advancement of the Company's Nangodi Project in Ghana, and for general corporate purposes.

Pursuant to the SPA the parties have agreed that SHC will assume operational management of Abzu's Nangodi project, which Abzu is earning an interest in pursuant to an option agreement with Kinross Gold.

All other terms of the SPA are the same as previously announced on July 23, 2012.

Tim McCutcheon, CEO, states: "With the combined SHC investment and concurrent private placement we intend to close on $3 million, our original target for this financing. Market conditions have been extremely challenging, and I am glad to report that despite this, Abzu's team has been able to raise the necessary funds to advance the Company."

On behalf of the board of directors of ABZU GOLD LTD.

Tim McCutcheon, Chief Executive Officer

http://tmx.quotemedia.com/article.php?newsid=54762423&qm_symbol=ABS

[url=http://peketec.de/trading/viewtopic.php?p=1304906#1304906 schrieb:ixilon. schrieb am 28.09.2012, 19:23 Uhr[/url]"]Abzu Gold Further Amends Non-Brokered Private Placement

http://tmx.quotemedia.com/article.php?newsid=54614307&qm_symbol=ABS

1 Jahreschart

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1301230#1301230 schrieb:ixilon. schrieb am 19.09.2012, 03:33 Uhr[/url]"]Abzu Gold Announces Update to Stonehouse Investment Proposal

http://tmx.quotemedia.com/article.php?newsid=54370749&qm_symbol=ABS

[url=http://peketec.de/trading/viewtopic.php?p=1279556#1279556 schrieb:ixilon. schrieb am 27.07.2012, 03:34 Uhr[/url]"]Insider Overview :: Abzu Gold Ltd. (V:ABS)

» zur Grafik

http://www.canadianinsider.com/node/7?menu_tickersearch=ABS+|+Abzu+Gold

4 Jahreschart

» zur Grafik

BAR

Balmoral Intersects 15.09 g/t (0.44 oz/t) Gold Over 5.18 Metres (16.99 Feet) in Bug Lake Zone, Martiniere Property, Quebec

- Gold Mineralization Confirmed Over 400 Metre Strike Length at Bug Lake - Hanging Wall Structure Returns 195.50 g/t (5.71 oz/t) Gold over 0.97 Metres (3.18 Feet)

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 3, 2012) - Balmoral Resources Ltd. ("Balmoral" or the "Company") (TSX VENTURE:BAR)(OTCQX:BALMF) today reported results from 9 drill holes which extend the strike length of the Bug Lake Zone to 400 metres and confirm the presence of significant high-grade gold mineralization along the length of the Bug Lake structure. The Zone remains open in all directions with additional drill results pending. The Martiniere Property forms part of the Company's Detour Gold Trend Project which spans over 82 kilometres along the Sunday Lake Deformation Zone in Quebec. Balmoral's holdings adjoin those of Detour Gold who are in the final phases of construction of what will be, according to Detour's commentary, Canada's largest gold mine.

Drill results were highlighted by drill hole MDE-12-46, which returned an intercept of 15.09 g/t gold over 5.18 metres including, 1.58 metres grading 44.27 g/t gold (see Table below) from the central portion of the Bug Lake Zone. Hole MDE-12-46 was drilled 61 metres up-dip of hole MDE-11-14 which returned an intercept of 3.60 g/t gold over 7.25 metres (see NR11-31; Dec. 5, 2011). Six of the nine holes included in today's release returned at least one assay result > 20 g/t gold.

Hole MDE-12-39 intersected a bonanza grade structure, which returned an intercept of 195.50 g/t gold over 0.97 metres, in the hanging wall above the Bug Lake Zone at less than 30 metres vertical depth. This structure may be similar to the recent announced bonanza grade Footwall discovery (which returned 273 g/t gold over 3.88 metres; see NR12-19; Aug. 16, 2012). Additional drilling will be necessary to determine the continuity of this new structure.

"Our understanding of the Bug Lake Gold Zone continues to evolve as we expand this new, open-ended gold discovery to the north, to the south and to depth," said Darin Wagner, President and CEO of Balmoral Resources. "We are obviously pleased to see a number of high to bonanza grade gold intercepts from the Zone which suggests potential similar to that observed in the nearby West Zone and Footwall discovery."

Details

The Bug Lake Zone is roughly 350 degree striking, 30 to 70 metre wide zone of faulting, silica-sulphide alteration and quartz-carbonate veining which cross-cuts the principal northeast-trending Martiniere mineralized shear system (see Figure 1 below). The Bug Lake Zone dips to the east and appears to exhibit a sigmoidal dip surface. Initial interpretation suggests that increasing widths of anomalous gold mineralization are related to steeper dipping sections of Zone. These broader gold mineralized intervals appear to demonstrate a shallow southerly plunge. Several previously reported "Martiniere East" intercepts appear to lie along down-dip projects of the Bug Lake Zone or in immediately adjacent structures. On-going interpretation of results from recently completed drilling along the Bug Lake Zone will be incorporated in future releases and on sections/plans on the Company's website (www.balmoralresources.com) as they become available.

Guidance

Analytical results from an additional 24 drill holes completed on the Martiniere Property remain pending at this time. These include additional results from the Bug Lake Zone as well as holes testing the high-grade ME-16 and ME-23 discoveries and a series of holes testing the recent bonanza grade Footwall discovery.

Drilling is now anticipated to resume at Martiniere within the next 3-5 days with initial testing focused on expansion of the Bug Lake, new Hanging Wall and Footwall discoveries. Drilling will continue into the fall as conditions permit before a brief hiatus during freeze-up.

Drilling continues on the Company's Northshore Property near Schreiber, Ontario with 14 holes now completed during the current program being conducted on the Property by funding partner GTA Resources and Mining.

Quality Control

Mr. Darin Wagner (P.Geo.), President and CEO of the Company, is the non-independent qualified person for the technical disclosure contained in this news release. Mr. Wagner has supervised the work programs on the Martiniere Property, visited the property on multiple occasions, examined photographs of the drill core from the holes summarized in this release, reviewed the results with the on-site project geologists and reviewed the available analytical and quality control results.

Balmoral has implemented a quality control program for all of its drill programs, to ensure best practice in the sampling and analysis of the drill core, which includes the insertion of blind blanks, duplicates and certified standards into sample stream. NQ sized drill core is saw cut with half of the drill core sampled at intervals based on geological criteria including lithology, visual mineralization and alteration. The remaining half of the core is stored on-site at the Company's Martiniere field camp in Central Quebec. Drill core samples are transported in sealed bags to ALS Minerals Val d'Or, Quebec analytical facilities. Gold analyses are obtained via industry standard fire assay with atomic absorption finish using 30 g aliquots. For samples returning greater than 5.00 g/t gold follow-up fire assay analysis with a gravimetric finish is completed. The Company has also requested that any samples returning greater than 10.00 g/t gold undergo screen metallic fire assay. Following receipt of assays visual analysis of mineralized intercepts is conducted and additional analysis may be requested to ensure the accurate representation of mineralized zones. ALS Minerals is ISO 9001:2008 certified and the Val d'Or facilities are ISO 17025 certified for gold analysis.

About Balmoral Resources Ltd. - www.balmoralresources.com

Balmoral is a Vancouver-based precious metal exploration and development company focused on district scale gold opportunities in North America. With a philosophy of creating value through the drill bit and with a focus on proven productive precious metal belts, Balmoral is following an established formula with a goal of maximizing shareholder value through discovery.

On behalf of the board of directors of BALMORAL RESOURCES LTD.

Darin Wagner, President and CEO

http://tmx.quotemedia.com/article.php?newsid=54764772&qm_symbol=BAR

Balmoral Intersects 15.09 g/t (0.44 oz/t) Gold Over 5.18 Metres (16.99 Feet) in Bug Lake Zone, Martiniere Property, Quebec

- Gold Mineralization Confirmed Over 400 Metre Strike Length at Bug Lake - Hanging Wall Structure Returns 195.50 g/t (5.71 oz/t) Gold over 0.97 Metres (3.18 Feet)

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 3, 2012) - Balmoral Resources Ltd. ("Balmoral" or the "Company") (TSX VENTURE:BAR)(OTCQX:BALMF) today reported results from 9 drill holes which extend the strike length of the Bug Lake Zone to 400 metres and confirm the presence of significant high-grade gold mineralization along the length of the Bug Lake structure. The Zone remains open in all directions with additional drill results pending. The Martiniere Property forms part of the Company's Detour Gold Trend Project which spans over 82 kilometres along the Sunday Lake Deformation Zone in Quebec. Balmoral's holdings adjoin those of Detour Gold who are in the final phases of construction of what will be, according to Detour's commentary, Canada's largest gold mine.

Drill results were highlighted by drill hole MDE-12-46, which returned an intercept of 15.09 g/t gold over 5.18 metres including, 1.58 metres grading 44.27 g/t gold (see Table below) from the central portion of the Bug Lake Zone. Hole MDE-12-46 was drilled 61 metres up-dip of hole MDE-11-14 which returned an intercept of 3.60 g/t gold over 7.25 metres (see NR11-31; Dec. 5, 2011). Six of the nine holes included in today's release returned at least one assay result > 20 g/t gold.

Hole MDE-12-39 intersected a bonanza grade structure, which returned an intercept of 195.50 g/t gold over 0.97 metres, in the hanging wall above the Bug Lake Zone at less than 30 metres vertical depth. This structure may be similar to the recent announced bonanza grade Footwall discovery (which returned 273 g/t gold over 3.88 metres; see NR12-19; Aug. 16, 2012). Additional drilling will be necessary to determine the continuity of this new structure.

"Our understanding of the Bug Lake Gold Zone continues to evolve as we expand this new, open-ended gold discovery to the north, to the south and to depth," said Darin Wagner, President and CEO of Balmoral Resources. "We are obviously pleased to see a number of high to bonanza grade gold intercepts from the Zone which suggests potential similar to that observed in the nearby West Zone and Footwall discovery."

Details

The Bug Lake Zone is roughly 350 degree striking, 30 to 70 metre wide zone of faulting, silica-sulphide alteration and quartz-carbonate veining which cross-cuts the principal northeast-trending Martiniere mineralized shear system (see Figure 1 below). The Bug Lake Zone dips to the east and appears to exhibit a sigmoidal dip surface. Initial interpretation suggests that increasing widths of anomalous gold mineralization are related to steeper dipping sections of Zone. These broader gold mineralized intervals appear to demonstrate a shallow southerly plunge. Several previously reported "Martiniere East" intercepts appear to lie along down-dip projects of the Bug Lake Zone or in immediately adjacent structures. On-going interpretation of results from recently completed drilling along the Bug Lake Zone will be incorporated in future releases and on sections/plans on the Company's website (www.balmoralresources.com) as they become available.

Guidance

Analytical results from an additional 24 drill holes completed on the Martiniere Property remain pending at this time. These include additional results from the Bug Lake Zone as well as holes testing the high-grade ME-16 and ME-23 discoveries and a series of holes testing the recent bonanza grade Footwall discovery.

Drilling is now anticipated to resume at Martiniere within the next 3-5 days with initial testing focused on expansion of the Bug Lake, new Hanging Wall and Footwall discoveries. Drilling will continue into the fall as conditions permit before a brief hiatus during freeze-up.

Drilling continues on the Company's Northshore Property near Schreiber, Ontario with 14 holes now completed during the current program being conducted on the Property by funding partner GTA Resources and Mining.

Quality Control

Mr. Darin Wagner (P.Geo.), President and CEO of the Company, is the non-independent qualified person for the technical disclosure contained in this news release. Mr. Wagner has supervised the work programs on the Martiniere Property, visited the property on multiple occasions, examined photographs of the drill core from the holes summarized in this release, reviewed the results with the on-site project geologists and reviewed the available analytical and quality control results.

Balmoral has implemented a quality control program for all of its drill programs, to ensure best practice in the sampling and analysis of the drill core, which includes the insertion of blind blanks, duplicates and certified standards into sample stream. NQ sized drill core is saw cut with half of the drill core sampled at intervals based on geological criteria including lithology, visual mineralization and alteration. The remaining half of the core is stored on-site at the Company's Martiniere field camp in Central Quebec. Drill core samples are transported in sealed bags to ALS Minerals Val d'Or, Quebec analytical facilities. Gold analyses are obtained via industry standard fire assay with atomic absorption finish using 30 g aliquots. For samples returning greater than 5.00 g/t gold follow-up fire assay analysis with a gravimetric finish is completed. The Company has also requested that any samples returning greater than 10.00 g/t gold undergo screen metallic fire assay. Following receipt of assays visual analysis of mineralized intercepts is conducted and additional analysis may be requested to ensure the accurate representation of mineralized zones. ALS Minerals is ISO 9001:2008 certified and the Val d'Or facilities are ISO 17025 certified for gold analysis.

About Balmoral Resources Ltd. - www.balmoralresources.com

Balmoral is a Vancouver-based precious metal exploration and development company focused on district scale gold opportunities in North America. With a philosophy of creating value through the drill bit and with a focus on proven productive precious metal belts, Balmoral is following an established formula with a goal of maximizing shareholder value through discovery.

On behalf of the board of directors of BALMORAL RESOURCES LTD.

Darin Wagner, President and CEO

http://tmx.quotemedia.com/article.php?newsid=54764772&qm_symbol=BAR

[url=http://peketec.de/trading/viewtopic.php?p=1303114#1303114 schrieb:ixilon. schrieb am 24.09.2012, 22:45 Uhr[/url]"]Balmoral Intersects 8.08 g/t Gold Over 7.95 Metres in Deepest Hole to Date at Martiniere West

http://tmx.quotemedia.com/article.php?newsid=54514033&qm_symbol=BAR

[url=http://peketec.de/trading/viewtopic.php?p=1298995#1298995 schrieb:ixilon. schrieb am 13.09.2012, 04:06 Uhr[/url]"]Balmoral Announces Increase to Previously Announced Equity Financing

http://tmx.quotemedia.com/article.php?newsid=54241514&qm_symbol=BAR

[url=http://peketec.de/trading/viewtopic.php?p=1298789#1298789 schrieb:ixilon. schrieb am 12.09.2012, 16:09 Uhr[/url]"]Balmoral Announces $5.0 Million Bought Deal, Flow-Through Private Placement

http://tmx.quotemedia.com/article.php?newsid=54222887&qm_symbol=BAR

All Data

» zur Grafik

BAR

Balmoral Resources - Macht sich Spitz !

6 Monatschart

Balmoral Resources - Macht sich Spitz !

6 Monatschart

[url=http://peketec.de/trading/viewtopic.php?p=1306312#1306312 schrieb:ixilon. schrieb am 04.10.2012, 01:33 Uhr[/url]"]Balmoral Intersects 15.09 g/t (0.44 oz/t) Gold Over 5.18 Metres (16.99 Feet) in Bug Lake Zone, Martiniere Property, Quebec

http://tmx.quotemedia.com/article.php?newsid=54764772&qm_symbol=BAR

[url=http://peketec.de/trading/viewtopic.php?p=1303114#1303114 schrieb:ixilon. schrieb am 24.09.2012, 22:45 Uhr[/url]"]Balmoral Intersects 8.08 g/t Gold Over 7.95 Metres in Deepest Hole to Date at Martiniere West

http://tmx.quotemedia.com/article.php?newsid=54514033&qm_symbol=BAR

[url=http://peketec.de/trading/viewtopic.php?p=1298995#1298995 schrieb:ixilon. schrieb am 13.09.2012, 04:06 Uhr[/url]"]Balmoral Announces Increase to Previously Announced Equity Financing

http://tmx.quotemedia.com/article.php?newsid=54241514&qm_symbol=BAR

[url=http://peketec.de/trading/viewtopic.php?p=1298789#1298789 schrieb:ixilon. schrieb am 12.09.2012, 16:09 Uhr[/url]"]Balmoral Announces $5.0 Million Bought Deal, Flow-Through Private Placement

http://tmx.quotemedia.com/article.php?newsid=54222887&qm_symbol=BAR

All Data

» zur Grafik

04.10.2012

ThyssenKrupp: Südkoreaner vor Kauf von Steel Americas?

Thomas Bergmann

Die Aktie von ThyssenKrupp steht am Donnerstag unter besonderer Beobachtung. Einem Pressebericht zufolge soll der koreanische Wettbewerber Posco sein Kaufinteresse für Steel Americas bekundet haben.

Laut einem Bericht des Magazins Money Today hat Konkurrent Posco einen sogenannten Letter of Intent, eine Art Absichtserklärung, an den deutschen Stahlkonzern geschickt. Darin sollen die Südkoreaner ihr grundsätzliches Interesse an einem Kauf von Steel Americas bekundet haben. ThyssenKrupp wäre für einen Abnehmer dankbar.

Umbau zum Technologiekonzern

Wie Money Today schreibt, soll die Schweizer Bank Credit Suisse als Berater engagiert worden sein. Posco hatte schon einmal Interesse signalisiert, weshalb dieser Schritt nicht überrascht. Neben den Koreanern gelten der brasilianische Stahlhersteller CSN sowie die chinesischen Konzerne Baosteel und Hebei als potenzielle Käufer für die Werke in Brasilien und in den USA.

ThyssenKrupp will sich von Steel Americas trennen, um damit den Konzernumbau zum Technologiekonzern voranzutreiben. Die amerikanischen Werke haben sich bislang als Milliardengrab erwiesen - ein Verkauf sei die einzige verbliebene Option.

Trendfortsetzung möglich

Zwar gibt es erste Zweifel, ob der koreanische Stahlhersteller schon so weit sei, eine Absichtserklärung zu unterzeichnen, doch sollte die Nachricht den Thyssen-Kurs beflügeln können. DER AKTIONÄR hält an seiner positiven Einschätzung zu ThyssenKrupp fest.

mit Material von dpa-AFX

http://www.deraktionaer.de/aktien-deutschland/thyssenkrupp--suedkoreaner-an-steel-americas-interessiert--18762589.htm

ThyssenKrupp: Südkoreaner vor Kauf von Steel Americas?

Thomas Bergmann

Die Aktie von ThyssenKrupp steht am Donnerstag unter besonderer Beobachtung. Einem Pressebericht zufolge soll der koreanische Wettbewerber Posco sein Kaufinteresse für Steel Americas bekundet haben.

Laut einem Bericht des Magazins Money Today hat Konkurrent Posco einen sogenannten Letter of Intent, eine Art Absichtserklärung, an den deutschen Stahlkonzern geschickt. Darin sollen die Südkoreaner ihr grundsätzliches Interesse an einem Kauf von Steel Americas bekundet haben. ThyssenKrupp wäre für einen Abnehmer dankbar.

Umbau zum Technologiekonzern

Wie Money Today schreibt, soll die Schweizer Bank Credit Suisse als Berater engagiert worden sein. Posco hatte schon einmal Interesse signalisiert, weshalb dieser Schritt nicht überrascht. Neben den Koreanern gelten der brasilianische Stahlhersteller CSN sowie die chinesischen Konzerne Baosteel und Hebei als potenzielle Käufer für die Werke in Brasilien und in den USA.

ThyssenKrupp will sich von Steel Americas trennen, um damit den Konzernumbau zum Technologiekonzern voranzutreiben. Die amerikanischen Werke haben sich bislang als Milliardengrab erwiesen - ein Verkauf sei die einzige verbliebene Option.

Trendfortsetzung möglich

Zwar gibt es erste Zweifel, ob der koreanische Stahlhersteller schon so weit sei, eine Absichtserklärung zu unterzeichnen, doch sollte die Nachricht den Thyssen-Kurs beflügeln können. DER AKTIONÄR hält an seiner positiven Einschätzung zu ThyssenKrupp fest.

mit Material von dpa-AFX

http://www.deraktionaer.de/aktien-deutschland/thyssenkrupp--suedkoreaner-an-steel-americas-interessiert--18762589.htm

Gold: Geht die Rallye in eine neue Runde?

04.10.2012 | DAF

Der Goldpreis hat sich in den letzten Wochen glänzend entwickelt. Geht da noch mehr oder geht dem Edelmetall jetzt mal die Luft aus? Was hat den Goldpreis eigentlich bis hierher getrieben, nachdem er noch im Frühsommer eher vor sich hin dümpelte? Mehr dazu von Michael Blumenroth von db-X markets.

"Das Inflationsthema ist schon länger im Markt, aber allmählich beginnt es, etwas virulenter zu werden", so Blumenroth zu einem Faktor, der den Goldpreis mit ansteigen liess. "Das ist definitiv einer der Hauptgründe dafür, dass in Gold investiert wird. Es fehlen Alternativen, wie man sich gegen Inflation absichern kann", so der Rohstoffexperte. "Wir denken, dass der Markt nach unten hin ganz gut supportet ist", so Blumenroth weiter.

Nächstes Jahr sollte man hier Kurse über 2.000 USD sehen, also eher weiter steigende Kurse, so die Einschätzung des Rohstoffexperten. Wo er den Goldpreis am Jahresende 2012 sieht und wie Anleger auf dem aktuellen Preisniveau agieren können, erfahren Sie im vollständigen Interview.

DAF-Video: http://www.rohstoff-welt.de/news/artikel.php?sid=39634#Gold-Geht-die-Rallye-in-eine-neue-Runde

04.10.2012 | DAF

Der Goldpreis hat sich in den letzten Wochen glänzend entwickelt. Geht da noch mehr oder geht dem Edelmetall jetzt mal die Luft aus? Was hat den Goldpreis eigentlich bis hierher getrieben, nachdem er noch im Frühsommer eher vor sich hin dümpelte? Mehr dazu von Michael Blumenroth von db-X markets.

"Das Inflationsthema ist schon länger im Markt, aber allmählich beginnt es, etwas virulenter zu werden", so Blumenroth zu einem Faktor, der den Goldpreis mit ansteigen liess. "Das ist definitiv einer der Hauptgründe dafür, dass in Gold investiert wird. Es fehlen Alternativen, wie man sich gegen Inflation absichern kann", so der Rohstoffexperte. "Wir denken, dass der Markt nach unten hin ganz gut supportet ist", so Blumenroth weiter.

Nächstes Jahr sollte man hier Kurse über 2.000 USD sehen, also eher weiter steigende Kurse, so die Einschätzung des Rohstoffexperten. Wo er den Goldpreis am Jahresende 2012 sieht und wie Anleger auf dem aktuellen Preisniveau agieren können, erfahren Sie im vollständigen Interview.

DAF-Video: http://www.rohstoff-welt.de/news/artikel.php?sid=39634#Gold-Geht-die-Rallye-in-eine-neue-Runde

Australische Zentralbank mit von der Partie

04.10.2012 | GoldMoney

Dieser Artikel wurde ursprünglich von GoldMoney veröffentlicht.

Gold kämpft weiter an der 1.780 Dollar-Marke; in den letzten Tagen wurde jeder Vorstoß in den Bereich zwischen 1.780 - 1.800 Dollar durch Verkäufe zurückgeschlagen. Am frühen Nachmittag sah es noch so aus, als würden die "Bullen" Oberhand gewinnen, Gold konnte bis auf 1.790 Dollar klettern. Wir dürfen aber davongehen, dass die kräftigen Leerverkäufe der Commercials an der COMEX den Goldpreis wieder unter die Marke von 1.780 Dollar geschickt haben.

...

http://www.rohstoff-welt.de/news/artikel.php?sid=39661#Australische-Zentralbank-mit-von-der-Partie

04.10.2012 | GoldMoney

Dieser Artikel wurde ursprünglich von GoldMoney veröffentlicht.

Gold kämpft weiter an der 1.780 Dollar-Marke; in den letzten Tagen wurde jeder Vorstoß in den Bereich zwischen 1.780 - 1.800 Dollar durch Verkäufe zurückgeschlagen. Am frühen Nachmittag sah es noch so aus, als würden die "Bullen" Oberhand gewinnen, Gold konnte bis auf 1.790 Dollar klettern. Wir dürfen aber davongehen, dass die kräftigen Leerverkäufe der Commercials an der COMEX den Goldpreis wieder unter die Marke von 1.780 Dollar geschickt haben.

...

http://www.rohstoff-welt.de/news/artikel.php?sid=39661#Australische-Zentralbank-mit-von-der-Partie

Miningscout 04 / 10 / 2012

Gold: 1.900 Dollar sind das Ziel

Bis zum Jahresende soll der Goldpreis auf 1.825 Dollar je Unze ansteigen. Das ist die Erwartungen der Analysten der Postbank. Über zwölf Monate hinweg sind die Bonner Experten noch etwas optimistischer. Bis dahin sehen sie einen Goldpreis von 1.900 Dollar je Unze voraus. Drei Gründe sprechen nach Ansicht der Analysten für den weiter steigenden Kurs: Investoren haben Angst vor Inflation, die Zinsen bleiben niedrig und eine Reihe von Notenbanken kauft kräftig Gold ein.

...

http://www.miningscout.de/Rohstoffblog/Gold_1_900_Dollar_sind_das_Ziel/theme/Edelmetalle/page_1/_61/__445

Gold: 1.900 Dollar sind das Ziel

Bis zum Jahresende soll der Goldpreis auf 1.825 Dollar je Unze ansteigen. Das ist die Erwartungen der Analysten der Postbank. Über zwölf Monate hinweg sind die Bonner Experten noch etwas optimistischer. Bis dahin sehen sie einen Goldpreis von 1.900 Dollar je Unze voraus. Drei Gründe sprechen nach Ansicht der Analysten für den weiter steigenden Kurs: Investoren haben Angst vor Inflation, die Zinsen bleiben niedrig und eine Reihe von Notenbanken kauft kräftig Gold ein.

...

http://www.miningscout.de/Rohstoffblog/Gold_1_900_Dollar_sind_das_Ziel/theme/Edelmetalle/page_1/_61/__445

Miningscout 04 / 10 / 2012

Nickel-Markt droht wachsendes Überangebot

Es sind keine guten Nachrichten, die da aus Japan für den Nickel-Markt kommen. Der japanische Konzern Sumitomo Metal Mining geht davon aus, dass sich das Überangebot an Nickel im kommenden Jahr weiter vergrößern wird. Die hinzu kommende Produktion aus neuen Bergwerken werde größer als der Anstieg der Nachfrage ausfallen, glaubt Japans wichtigster Produzent.

Der Überschuss beim Angebot soll damit auf ein neues Mehrjahreshoch klettern. Von 22.000 Tonnen im vergangenen Jahr soll sich das Überangebot über 40.000 Tonnen im laufenden Jahr auf 60.000 Tonnen im Jahr 2013 erhöhen. Binnen zwei Jahren hätte sich das Ungleichgewicht am Markt damit beinahe verdreifacht.

Dass die Nachfrage nicht Schritt hält, liegt allerdings nicht nur an neuen Bergwerksprojekten im Nickel-Sektor wie Ambatovy auf Madagaskar oder Koniambo in Neukaledonien – auf der Inselgruppe im Pazifik finden sich größere Anteile der weltweiten Nickelreserven. Die Nachfrage entwickelt sich angesichts der kriselnden Weltwirtschaft in den meisten Ländern rückläufig. Eine Ausnahme hiervon ist China, für das Land wird ein neuer Nickel-Importrekord erwartet. Doch das schwächer werdende Wirtschaftswachstum in dem asiatischen Boomland beeinträchtigt die Stahlnachfrage und damit auch den Nickel-Bedarf: Das Metall wird vor allem für Stahllegierungen genutzt.

http://www.miningscout.de/Rohstoffblog/Nickel_Markt_droht_wachsendes_Ueberangebot/theme/Basismetalle/page_1/_61/__446

Nickel-Markt droht wachsendes Überangebot

Es sind keine guten Nachrichten, die da aus Japan für den Nickel-Markt kommen. Der japanische Konzern Sumitomo Metal Mining geht davon aus, dass sich das Überangebot an Nickel im kommenden Jahr weiter vergrößern wird. Die hinzu kommende Produktion aus neuen Bergwerken werde größer als der Anstieg der Nachfrage ausfallen, glaubt Japans wichtigster Produzent.

Der Überschuss beim Angebot soll damit auf ein neues Mehrjahreshoch klettern. Von 22.000 Tonnen im vergangenen Jahr soll sich das Überangebot über 40.000 Tonnen im laufenden Jahr auf 60.000 Tonnen im Jahr 2013 erhöhen. Binnen zwei Jahren hätte sich das Ungleichgewicht am Markt damit beinahe verdreifacht.

Dass die Nachfrage nicht Schritt hält, liegt allerdings nicht nur an neuen Bergwerksprojekten im Nickel-Sektor wie Ambatovy auf Madagaskar oder Koniambo in Neukaledonien – auf der Inselgruppe im Pazifik finden sich größere Anteile der weltweiten Nickelreserven. Die Nachfrage entwickelt sich angesichts der kriselnden Weltwirtschaft in den meisten Ländern rückläufig. Eine Ausnahme hiervon ist China, für das Land wird ein neuer Nickel-Importrekord erwartet. Doch das schwächer werdende Wirtschaftswachstum in dem asiatischen Boomland beeinträchtigt die Stahlnachfrage und damit auch den Nickel-Bedarf: Das Metall wird vor allem für Stahllegierungen genutzt.

http://www.miningscout.de/Rohstoffblog/Nickel_Markt_droht_wachsendes_Ueberangebot/theme/Basismetalle/page_1/_61/__446

TV

Trevali Appoints Mr. David Huberman to Board of Directors

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 4, 2012) - Trevali Mining Corporation (TSX:TV)(TSX:TV.WT)(OTCQX:TREVF)(LMA:TV)(FRANKFURT:4TI) ("Trevali" or the "Company") announces the appointment of David Huberman to the Board of Directors of the Company.

Mr. Huberman was appointed to the Board of Directors of Ivanhoe Mines Ltd. (recently renamed as Turquoise Hill Resources (NYSE, NASDAQ & TSX)) in September, 2003 and served as its Lead Independent Director from 2003 until May, 2011 when he was appointed as Chairman of the company. He also served as Chairman of this company's Corporate Governance & Nominating Committee (2003 - 2012) and as Chairman of the company's Compensation & Benefits Committee in (2003 - 2008). He also served as a member of this company's Executive Committee from its formation in March, 2005 until March, 2012. Mr. Huberman is a member of the Institute of Corporate Directors.

He is the President of Coda Consulting Corp., a business consulting firm, and has practiced business law from 1972 until 1996 as a senior partner of a Canadian business law firm, specializing in corporate, commercial, banking, securities, regulatory and mining law. From 1997 to 1999, he also served as Executive Vice President and General Counsel of Lions Gate Entertainment Corp.

Mr. Huberman received his B.A. and LL.B. from the University of British Columbia and his LL.M. from Harvard Law School. He was called to the British Columbia Bar in 1960 and was a full time member of the Faculty of Law at the University of British Columbia from 1960 to 1972, specializing in corporate, securities and administrative law.

"I am extremely pleased to welcome David onto Trevali's Board," said Tony Holler, Trevali's Chairman. "His extensive experience as a senior Director with Ivanhoe Mines Ltd. in the development of its world-class Oyu Tolgoi mine in Mongolia and his corporate and business law background will be valuable assets as we build Trevali into a significant zinc producer."

ABOUT TREVALI MINING CORPORATION

Trevali is a zinc-focused base metals development company with operations in Canada and Peru - the Halfmile and Santander mines respectively. In Canada, Trevali owns the Halfmile zinc-lead-silver mine and Stratmat polymetallic deposit, and has entered into a definitive agreement to acquire the Caribou Mine and Mill, all located in the Bathurst Mining Camp of northern New Brunswick. The Company also has the past-producing Ruttan copper-zinc mine in northern Manitoba. Initial production from the Halfmile mine commenced in early 2012 and underground development is ramping up to achieve a planned production rate of approximately 3,000-tonnes-per-day to feed planned operations at the Company's Caribou Mill Complex (subject to closure of its acquisition).

In Peru, the Company has the Santander zinc-lead-silver mine and the former-producing Huampar silver mine, both located in the Central Peruvian Polymetallic Belt. Mine commissioning is anticipated to commence at the Santander operation in Q4-2012 with ramp up to full 2,000-tonnes-per-day production to follow shortly thereafter. Additionally through its wholly-owned subsidiary, Trevali Renewable Energy Inc., Trevali is undertaking a significant upgrade of its wholly-owned Tingo run-of-river hydroelectric generating facility along with transmission line upgrades and extensions to allow, in addition to supplying power to the mining operation on the property, the potential sale of surplus power into the Peruvian National Energy Grid.

The common shares of Trevali are listed on the TSX (symbol TV), the OTCQX (symbol TREVF) and on the Lima Stock Exchange (symbol TV). Warrants to purchase common shares of Trevali are listed on the TSX (symbol TV.WT). For further details on Trevali, readers are referred to the Company's web site ( www.trevali.com ) and to Canadian regulatory filings on SEDAR at www.sedar.com .

On Behalf of the Board of Directors of TREVALI MINING CORPORATION

Mark D. Cruise, President

http://tmx.quotemedia.com/article.php?newsid=54785956&qm_symbol=TV

Trevali Appoints Mr. David Huberman to Board of Directors

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Oct. 4, 2012) - Trevali Mining Corporation (TSX:TV)(TSX:TV.WT)(OTCQX:TREVF)(LMA:TV)(FRANKFURT:4TI) ("Trevali" or the "Company") announces the appointment of David Huberman to the Board of Directors of the Company.

Mr. Huberman was appointed to the Board of Directors of Ivanhoe Mines Ltd. (recently renamed as Turquoise Hill Resources (NYSE, NASDAQ & TSX)) in September, 2003 and served as its Lead Independent Director from 2003 until May, 2011 when he was appointed as Chairman of the company. He also served as Chairman of this company's Corporate Governance & Nominating Committee (2003 - 2012) and as Chairman of the company's Compensation & Benefits Committee in (2003 - 2008). He also served as a member of this company's Executive Committee from its formation in March, 2005 until March, 2012. Mr. Huberman is a member of the Institute of Corporate Directors.

He is the President of Coda Consulting Corp., a business consulting firm, and has practiced business law from 1972 until 1996 as a senior partner of a Canadian business law firm, specializing in corporate, commercial, banking, securities, regulatory and mining law. From 1997 to 1999, he also served as Executive Vice President and General Counsel of Lions Gate Entertainment Corp.

Mr. Huberman received his B.A. and LL.B. from the University of British Columbia and his LL.M. from Harvard Law School. He was called to the British Columbia Bar in 1960 and was a full time member of the Faculty of Law at the University of British Columbia from 1960 to 1972, specializing in corporate, securities and administrative law.

"I am extremely pleased to welcome David onto Trevali's Board," said Tony Holler, Trevali's Chairman. "His extensive experience as a senior Director with Ivanhoe Mines Ltd. in the development of its world-class Oyu Tolgoi mine in Mongolia and his corporate and business law background will be valuable assets as we build Trevali into a significant zinc producer."

ABOUT TREVALI MINING CORPORATION

Trevali is a zinc-focused base metals development company with operations in Canada and Peru - the Halfmile and Santander mines respectively. In Canada, Trevali owns the Halfmile zinc-lead-silver mine and Stratmat polymetallic deposit, and has entered into a definitive agreement to acquire the Caribou Mine and Mill, all located in the Bathurst Mining Camp of northern New Brunswick. The Company also has the past-producing Ruttan copper-zinc mine in northern Manitoba. Initial production from the Halfmile mine commenced in early 2012 and underground development is ramping up to achieve a planned production rate of approximately 3,000-tonnes-per-day to feed planned operations at the Company's Caribou Mill Complex (subject to closure of its acquisition).

In Peru, the Company has the Santander zinc-lead-silver mine and the former-producing Huampar silver mine, both located in the Central Peruvian Polymetallic Belt. Mine commissioning is anticipated to commence at the Santander operation in Q4-2012 with ramp up to full 2,000-tonnes-per-day production to follow shortly thereafter. Additionally through its wholly-owned subsidiary, Trevali Renewable Energy Inc., Trevali is undertaking a significant upgrade of its wholly-owned Tingo run-of-river hydroelectric generating facility along with transmission line upgrades and extensions to allow, in addition to supplying power to the mining operation on the property, the potential sale of surplus power into the Peruvian National Energy Grid.

The common shares of Trevali are listed on the TSX (symbol TV), the OTCQX (symbol TREVF) and on the Lima Stock Exchange (symbol TV). Warrants to purchase common shares of Trevali are listed on the TSX (symbol TV.WT). For further details on Trevali, readers are referred to the Company's web site ( www.trevali.com ) and to Canadian regulatory filings on SEDAR at www.sedar.com .

On Behalf of the Board of Directors of TREVALI MINING CORPORATION

Mark D. Cruise, President

http://tmx.quotemedia.com/article.php?newsid=54785956&qm_symbol=TV

[url=http://peketec.de/trading/viewtopic.php?p=1304435#1304435 schrieb:ixilon. schrieb am 27.09.2012, 19:16 Uhr[/url]"]Raymond James Ltd.

Target Price (6-12 mths) C$1.85

» zur Grafik» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1304006#1304006 schrieb:ixilon. schrieb am 27.09.2012, 04:19 Uhr[/url]"]Trade Resumption

http://tmx.quotemedia.com/article.php?newsid=54588203&qm_symbol=TV

---------------------------------------------------------------------------------------

Trevali Signs USD$60-million Senior Debt and Prepaid Precious Metals Facility with RMB Resources

http://tmx.quotemedia.com/article.php?newsid=54587189&qm_symbol=TV

---------------------------------------------------------------------------------------

Trading Halt

http://tmx.quotemedia.com/article.php?newsid=54585520&qm_symbol=TV

[url=http://peketec.de/trading/viewtopic.php?p=1298993#1298993 schrieb:ixilon. schrieb am 13.09.2012, 03:35 Uhr[/url]"]2 Jahreschart

» zur Grafik

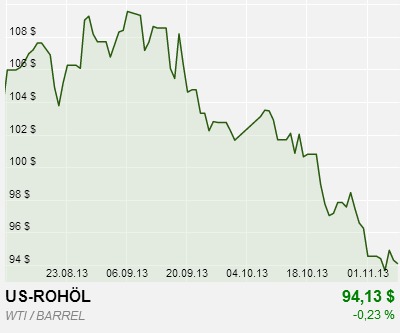

Deutlicher Rückgang der Ölpreise gibt Rätsel auf

04.10.2012 | Weinberg, Eugen, Commerzbank AG

Energie

Die Ölpreise sind gestern deutlich unter Druck geraten. Sowohl Brent als auch WTI gaben jeweils drei US-Dollar nach. Brent fiel im Zuge dessen auf 108 USD je Barrel, den niedrigsten Stand seit zwei Wochen. WTI verzeichnete mit 88 USD je Barrel sogar ein 2-Monatstief. Der Preisrückgang wird u.a. mit Konjunktursorgen begründet. Davon hätten allerdings auch die konjunktursensiblen Metallpreise betroffen sein müssen. Diese blieben aber weitgehend stabil. Eine weitere Begründung für den Preisverfall ist das Überangebot auf dem Ölmarkt. Neue Nachrichten hierzu gab es gestern allerdings nicht. Im Gegenteil, die US-Rohöllagerbestände sind in der vergangenen Woche sogar überraschend um 482 Tsd. Barrel gefallen.

...

http://www.rohstoff-welt.de/news/artikel.php?sid=39677#Deutlicher-Rueckgang-der-Oelpreise-gibt-Raetsel-auf

04.10.2012 | Weinberg, Eugen, Commerzbank AG

Energie

Die Ölpreise sind gestern deutlich unter Druck geraten. Sowohl Brent als auch WTI gaben jeweils drei US-Dollar nach. Brent fiel im Zuge dessen auf 108 USD je Barrel, den niedrigsten Stand seit zwei Wochen. WTI verzeichnete mit 88 USD je Barrel sogar ein 2-Monatstief. Der Preisrückgang wird u.a. mit Konjunktursorgen begründet. Davon hätten allerdings auch die konjunktursensiblen Metallpreise betroffen sein müssen. Diese blieben aber weitgehend stabil. Eine weitere Begründung für den Preisverfall ist das Überangebot auf dem Ölmarkt. Neue Nachrichten hierzu gab es gestern allerdings nicht. Im Gegenteil, die US-Rohöllagerbestände sind in der vergangenen Woche sogar überraschend um 482 Tsd. Barrel gefallen.

...

http://www.rohstoff-welt.de/news/artikel.php?sid=39677#Deutlicher-Rueckgang-der-Oelpreise-gibt-Raetsel-auf

BAR

Balmoral announces closing of $8,004,000 flow-through offering

VANCOUVER, Oct. 4, 2012 /CNW/ - Balmoral Resources Ltd. ("Balmoral" or the "Company") (TSXV: BAR) announces that it has closed the previously announced (see NR12-22 and NR12-23 both dated September 12, 2012) flow-through bought deal private placement with a syndicate of underwriters led by Canaccord Genuity Corp. and including Cormark Securities Inc. and Laurentian Bank Securities Inc. (collectively, the "Underwriters"). With full subscription of the over-allotment option granted to the Underwriters, the Company has issued 6,960,000 flow-through common shares at a price of $1.15 per flow-through common share for gross proceeds $8,004,000.

The proceeds raised from the Offering will be used to accelerate the exploration on the Company's Detour Gold Trend Project, including additional drill testing of the Company's Martiniere West, Bug Lake and recent high-grade Footwall discovery on the Martiniere Property and testing of high priority targets on the other Detour Gold Trend Properties.

In consideration of the Underwriters' services, the Company has agreed to pay the Underwriters a cash commission of 6.0% of the gross proceeds of the Offering and to issue in favour of the Underwriters Warrants ("Broker Warrants") equal to 5% of the common shares issued through the Offering. Each Broker Warrant shall be exercisable to acquire one common share of the Company at an exercise price of $1.15 for a period of 12 months from closing. Securities issued under the Offering are subject to a hold period which will expire four months and one day from the date of closing, being February 5, 2013.

This news release does not constitute an offer to sell or a solicitation to buy the securities described herein in the United States. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States or to the benefit of a U.S. person absent an exemption from the registration requirements of such Act.

About Balmoral Resources - www.balmoralresources.com

Balmoral is a Vancouver-based precious metal exploration and development company focused on district scale gold opportunities in North America. With a philosophy of creating value through the drill bit and with a focus on proven productive precious metal belts, Balmoral is following an established formula with a goal of maximizing shareholder value through discovery.

On behalf of the board of directors of

BALMORAL RESOURCES LTD.

"Darin Wagner"

President and CEO

http://tmx.quotemedia.com/article.php?newsid=54788121&qm_symbol=BAR

Balmoral announces closing of $8,004,000 flow-through offering

VANCOUVER, Oct. 4, 2012 /CNW/ - Balmoral Resources Ltd. ("Balmoral" or the "Company") (TSXV: BAR) announces that it has closed the previously announced (see NR12-22 and NR12-23 both dated September 12, 2012) flow-through bought deal private placement with a syndicate of underwriters led by Canaccord Genuity Corp. and including Cormark Securities Inc. and Laurentian Bank Securities Inc. (collectively, the "Underwriters"). With full subscription of the over-allotment option granted to the Underwriters, the Company has issued 6,960,000 flow-through common shares at a price of $1.15 per flow-through common share for gross proceeds $8,004,000.

The proceeds raised from the Offering will be used to accelerate the exploration on the Company's Detour Gold Trend Project, including additional drill testing of the Company's Martiniere West, Bug Lake and recent high-grade Footwall discovery on the Martiniere Property and testing of high priority targets on the other Detour Gold Trend Properties.

In consideration of the Underwriters' services, the Company has agreed to pay the Underwriters a cash commission of 6.0% of the gross proceeds of the Offering and to issue in favour of the Underwriters Warrants ("Broker Warrants") equal to 5% of the common shares issued through the Offering. Each Broker Warrant shall be exercisable to acquire one common share of the Company at an exercise price of $1.15 for a period of 12 months from closing. Securities issued under the Offering are subject to a hold period which will expire four months and one day from the date of closing, being February 5, 2013.

This news release does not constitute an offer to sell or a solicitation to buy the securities described herein in the United States. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States or to the benefit of a U.S. person absent an exemption from the registration requirements of such Act.

About Balmoral Resources - www.balmoralresources.com

Balmoral is a Vancouver-based precious metal exploration and development company focused on district scale gold opportunities in North America. With a philosophy of creating value through the drill bit and with a focus on proven productive precious metal belts, Balmoral is following an established formula with a goal of maximizing shareholder value through discovery.

On behalf of the board of directors of

BALMORAL RESOURCES LTD.

"Darin Wagner"

President and CEO

http://tmx.quotemedia.com/article.php?newsid=54788121&qm_symbol=BAR

[url=http://peketec.de/trading/viewtopic.php?p=1306313#1306313 schrieb:ixilon. schrieb am 04.10.2012, 01:48 Uhr[/url]"]Balmoral Resources - Macht sich Spitz !

6 Monatschart

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1306312#1306312 schrieb:ixilon. schrieb am 04.10.2012, 01:33 Uhr[/url]"]Balmoral Intersects 15.09 g/t (0.44 oz/t) Gold Over 5.18 Metres (16.99 Feet) in Bug Lake Zone, Martiniere Property, Quebec

http://tmx.quotemedia.com/article.php?newsid=54764772&qm_symbol=BAR

[url=http://peketec.de/trading/viewtopic.php?p=1298789#1298789 schrieb:ixilon. schrieb am 12.09.2012, 16:09 Uhr[/url]"]All Data

» zur Grafik

5. Oktober 2012

Trendwenderisiken steigen: Industriemetallpreise zeigen charttechnische Bremsspuren

Die Markttechnik spielt bei den oftmals stark von spekulativen Motiven geprägten Rohstoffmärkten eine größere Rolle, als viele Anleger denken. Daher nehmen wir an dieser Stelle immer wieder die Kursverläufe einiger Rohstoffe aus charttechnischen Gesichtspunkten unter die Lupe. Heute: Industriell geprägte Metalle.

...

http://bjoernjunker.wordpress.com/2012/10/05/trendwenderisiken-steigen-industriemetallpreise-zeigen-charttechnische-bremsspuren/

Trendwenderisiken steigen: Industriemetallpreise zeigen charttechnische Bremsspuren

Die Markttechnik spielt bei den oftmals stark von spekulativen Motiven geprägten Rohstoffmärkten eine größere Rolle, als viele Anleger denken. Daher nehmen wir an dieser Stelle immer wieder die Kursverläufe einiger Rohstoffe aus charttechnischen Gesichtspunkten unter die Lupe. Heute: Industriell geprägte Metalle.

...

http://bjoernjunker.wordpress.com/2012/10/05/trendwenderisiken-steigen-industriemetallpreise-zeigen-charttechnische-bremsspuren/

5. Oktober 2012

Unternehmensvertreter schlagen Alarm: Australischer Rohstoffinvestitionen gehen nach Übersee

Australische Beobachter sprechen eine deutliche Warnung aus. Man sorgt sich um die Zukunft des australischen Bergbaus – nicht ganz ohne Grund.

...

http://bjoernjunker.wordpress.com/2012/10/05/unternehmensvertreter-schlagen-alarm-australischer-rohstoffinvestitionen-gehen-nach-ubersee/

Unternehmensvertreter schlagen Alarm: Australischer Rohstoffinvestitionen gehen nach Übersee

Australische Beobachter sprechen eine deutliche Warnung aus. Man sorgt sich um die Zukunft des australischen Bergbaus – nicht ganz ohne Grund.

...

http://bjoernjunker.wordpress.com/2012/10/05/unternehmensvertreter-schlagen-alarm-australischer-rohstoffinvestitionen-gehen-nach-ubersee/

- Status

- Für weitere Antworten geschlossen.