Kostolanys Erbe schrieb am 22.05.2015, 00:55 Uhr[/url]"]

Neuvorstellung & auf meiner Watchlist gelandet:

Algold Resources:

Algold Resources Ltd. – (TMX : ALG) is a mineral exploration company engaged in the acquisition, exploration and development of African mineral properties. ALG is a publicly traded company listed TSX Venture Exchange. The company has recently acquired:

Two valuable properties in close proximity of the Tasiast mine in Mauritania,

Two strategic properties in Burkina Faso,

http://algold.com/

Bekommen in dieser Marktphase schnell mal $$$

Algold Announces Up to $3 Million Overnight Marketed Private Placement Financing

Algold Announces Up to $3 Million Overnight Marketed Private Placement Financing

MONTREAL, May 13, 2015 /CNW/ - Algold Resources Limited (ALG: TSXV – the "Corporation" or "Algold") www.algold.com is pleased to announce that it has appointed a syndicate of agents (the "Agents") led by Beacon Securities Limited and including Paradigm Capital Inc. as its agents to sell, by private placement on an overnight marketed basis, units (the "Units") of Algold at a price (the "Issue Price") to be determined in the context of the market for gross proceeds of up to approximately CDN$3,000,000 (the "Offering"). Each Unit will be comprised of one common share (a "Common Share") in the capital of the Corporation and one common share purchase warrant, each entitling the holder thereof to acquire a Common Share at a price to be determined in the context of the market for a period of 18 months from the closing of the Offering.

The net proceeds from the Offering are intended to be used to advance the Kneivissat and Legouessi properties for working capital and general corporate purposes.

The Company has agreed to pay the Agents a cash fee equal to 7.0% of the gross proceeds from the Offering. As additional compensation, the Agents will be issued compensation options entitling the Agents to purchase that number of Common Shares equal to 7.0% of the number of Units sold under the Offering exercisable at Issue Price for a period of 12 months from the closing date of the offering.

The closing of this equity offering is expected to occur on or the week of May 25, 2015 and is subject to receipt of all necessary regulatory approvals. The Units, including all underlying securities thereof, and the compensation options issued with respect to the Offering will be subject to a four month hold period in accordance with applicable Canadian securities laws.

This news release does not constitute an offer of securities for sale in the United States. The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and such securities may not be offered or sold within the United States absent U.S. registration or an applicable exemption from U.S. registration requirements.

ABOUT ALGOLD

Algold Resources Ltd is focused on the exploration and development of gold deposits in West Africa. The board of directors and management team are seasoned resource industry professionals with extensive experience in the exploration and development of world-class gold projects in Africa.

Algold is the operator on both the Kneivissat and Legouessi Properties. The Kneivissat property is 90% owned by Algold and the Legouessi property is being managed through a 51% earn-in interest agreement with Caracal (Electrum Group Companies). Algold can earn up to a 90% interest in the Legouessi exploration permit (see October 10, 2013 press release for more details), however, Caracal has the right to participate in the joint venture at either 51% or 75%, by funding its share of expenditures.

http://app.quotemedia.com/quotetools/newsStoryPopup.go?storyId=75471293&topic=ALG:CA&symbology=tmx&cp=null&webmasterId=101341

Aktuelle Präsentation:

http://algold.com/wp-content/uploads/2015/05/Presentation-Algold.pdf

Hauptgrund für die Watchlist ist der Typ

Mr. La Salle is the President and CEO of Windiga Energy, a company involved in renewable resource development in Africa. He is also founder of SEMAFO (a TSX-listed company), and a well-known mining entrepreneur in Canada and Africa. Mr. La Salle grew SEMAFO from junior explorer to a +250,000 ounces per year gold producer in West Africa (3 mines). Mr. La Salle is the Chairman of Sama Resources exploring for Nickel in Cote d’Ivoire, and Chairman of Canadian Council on Africa. M La Salla was co-founder in 1980 and a partner until 2004 of Grou, La Salle & Associates CA (“GLA”), based in Montreal (Quebec), an accounting firm offering audit and accounting services, with a strong emphasis on financial and corporate reorganization and the implementation of international corporate structures. The firm grew from two original partners to a staff of over 50.

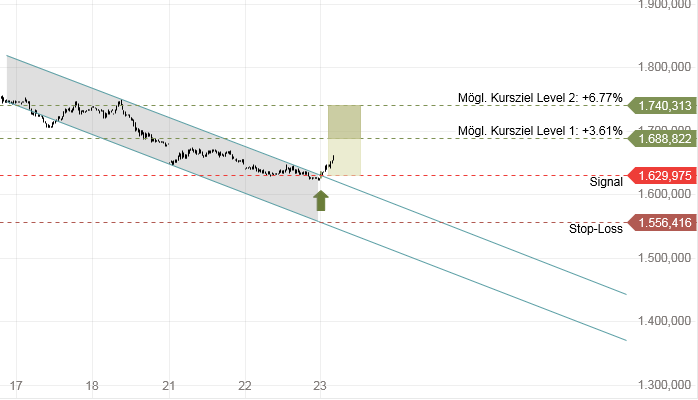

» zur Grafik

» zur Grafik