App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

18P

September 10, 2020 - 8:00 AM EDT

https://app.quotemedia.com/quotetoo...LMIN&symbology=null&cp=null&webmasterId=90338

First Cobalt Joins Critical Materials Institute

Canada NewsWire

TORONTO, Sept. 10, 2020

Strengthens the Company's position as an ESG business

TORONTO, Sept. 10, 2020 /CNW/ - First Cobalt Corp. (TSXV: FCC) (OTCQX: FTSSF) (the "Company") is pleased to announce that it has taken steps to strengthen its commitment to becoming a globally competitive player in the North American electric vehicle (EV) supply chain by joining the Critical Materials Institute as a Full Team Member. This development further underscores First Cobalt's commitment to strengthen its Environmental, Social and Corporate Governance (ESG) practices.

First Cobalt Corp. Logo (CNW Group/First Cobalt Corp.)

The Critical Materials Institute (CMI) was launched in 2013 and is a U.S. Department of Energy Innovation Hub led by the Ames National Laboratory supporting early-stage research to advance innovation in U.S. manufacturing. The CMI focuses on technologies that make better use of materials and eliminate the need for materials that are subject to supply disruptions. Cobalt and other critical materials are essential for American competitiveness in clean energy technologies, including wind turbines, solar panels, electric vehicles, and energy-efficient lighting.

In 2017, the U.S. Government added cobalt to a list of "critical minerals" and devised an action plan to specifically address supply chain issues. The U.S. is heavily reliant on foreign sources of cobalt for military and industrial applications, including electric vehicles and aerospace.

There are currently no mines in the U.S. actively producing cobalt. First Cobalt owns a permitted cobalt refinery in Canada as well as a cobalt-copper deposit in the U.S. The deposit, known as Iron Creek, is located within First Cobalt's Idaho property, which is part of a geologic belt that collectively contains the largest cobalt resources in America.

The CMI supports research on expanding domestic supply of critical minerals. Research teams leading projects in the Diversifying Supply focus area are located at Ames Laboratory, Idaho National Laboratory, Oak Ridge National Laboratory, and Colorado School of Mines.

In joining the Critical Minerals Institute, First Cobalt also aligns with Canada's efforts under the Canada–U.S. Joint Action Plan on Critical Minerals Collaboration, advancing North America's mutual interest in securing supply chains for the critical minerals needed for important manufacturing sectors, including communication technology, aerospace and defence, and clean technology.

Trent Mell, First Cobalt President & CEO, commented:

We are honored to be one of the few resource-development companies to have been accepted to the CMI and the only such company focused on producing cobalt in North America. This membership greatly improves our network of companies and research facilities that share our dedication to a clean energy future. The CMI provides access to cutting edge technologies and brilliant people who are improving metal extraction processes to make them more energy efficient, less costly, and reduce the impact to the natural environment.

First Cobalt has partnered with researchers at the Colorado School of Mines on a proposal to fund a project on improving the extraction of cobalt from ore from the Iron Creek cobalt-copper deposit in Idaho. The two-year project is aimed at modifying conventional methods of extraction to reduce the amount of waste material processed and to increase the concentration of cobalt in material to be refined. The methods to be tested will be specifically adapted to reduce energy consumption of mineral processing compared to current practices. The reduction of waste material in processing would minimize the size of tailings compounds. The project is well-aligned with First Cobalt's commitment to provide a green and ethical supply of cobalt to the North American electric vehicle market.

Dr. Frank Santaguida, First Cobalt Vice-President, Exploration will be a guest speaker on the topic of "Establishing Domestic Cobalt Supply Chains" at the CMI Annual Meeting on September 15, 2020. The meeting is being held virtually and will bring together CMI leaders, researchers, partners, and affiliate partners from around the world.

September 10, 2020 - 8:00 AM EDT

https://app.quotemedia.com/quotetoo...LMIN&symbology=null&cp=null&webmasterId=90338

First Cobalt Joins Critical Materials Institute

Canada NewsWire

TORONTO, Sept. 10, 2020

Strengthens the Company's position as an ESG business

TORONTO, Sept. 10, 2020 /CNW/ - First Cobalt Corp. (TSXV: FCC) (OTCQX: FTSSF) (the "Company") is pleased to announce that it has taken steps to strengthen its commitment to becoming a globally competitive player in the North American electric vehicle (EV) supply chain by joining the Critical Materials Institute as a Full Team Member. This development further underscores First Cobalt's commitment to strengthen its Environmental, Social and Corporate Governance (ESG) practices.

First Cobalt Corp. Logo (CNW Group/First Cobalt Corp.)

The Critical Materials Institute (CMI) was launched in 2013 and is a U.S. Department of Energy Innovation Hub led by the Ames National Laboratory supporting early-stage research to advance innovation in U.S. manufacturing. The CMI focuses on technologies that make better use of materials and eliminate the need for materials that are subject to supply disruptions. Cobalt and other critical materials are essential for American competitiveness in clean energy technologies, including wind turbines, solar panels, electric vehicles, and energy-efficient lighting.

In 2017, the U.S. Government added cobalt to a list of "critical minerals" and devised an action plan to specifically address supply chain issues. The U.S. is heavily reliant on foreign sources of cobalt for military and industrial applications, including electric vehicles and aerospace.

There are currently no mines in the U.S. actively producing cobalt. First Cobalt owns a permitted cobalt refinery in Canada as well as a cobalt-copper deposit in the U.S. The deposit, known as Iron Creek, is located within First Cobalt's Idaho property, which is part of a geologic belt that collectively contains the largest cobalt resources in America.

The CMI supports research on expanding domestic supply of critical minerals. Research teams leading projects in the Diversifying Supply focus area are located at Ames Laboratory, Idaho National Laboratory, Oak Ridge National Laboratory, and Colorado School of Mines.

In joining the Critical Minerals Institute, First Cobalt also aligns with Canada's efforts under the Canada–U.S. Joint Action Plan on Critical Minerals Collaboration, advancing North America's mutual interest in securing supply chains for the critical minerals needed for important manufacturing sectors, including communication technology, aerospace and defence, and clean technology.

Trent Mell, First Cobalt President & CEO, commented:

We are honored to be one of the few resource-development companies to have been accepted to the CMI and the only such company focused on producing cobalt in North America. This membership greatly improves our network of companies and research facilities that share our dedication to a clean energy future. The CMI provides access to cutting edge technologies and brilliant people who are improving metal extraction processes to make them more energy efficient, less costly, and reduce the impact to the natural environment.

First Cobalt has partnered with researchers at the Colorado School of Mines on a proposal to fund a project on improving the extraction of cobalt from ore from the Iron Creek cobalt-copper deposit in Idaho. The two-year project is aimed at modifying conventional methods of extraction to reduce the amount of waste material processed and to increase the concentration of cobalt in material to be refined. The methods to be tested will be specifically adapted to reduce energy consumption of mineral processing compared to current practices. The reduction of waste material in processing would minimize the size of tailings compounds. The project is well-aligned with First Cobalt's commitment to provide a green and ethical supply of cobalt to the North American electric vehicle market.

Dr. Frank Santaguida, First Cobalt Vice-President, Exploration will be a guest speaker on the topic of "Establishing Domestic Cobalt Supply Chains" at the CMI Annual Meeting on September 15, 2020. The meeting is being held virtually and will bring together CMI leaders, researchers, partners, and affiliate partners from around the world.

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

AU:TIE

09/09/2020 Abujar Gold Resources to Grow with High-Grade Intercepts

https://www.asx.com.au/asxpdf/20200909/pdf/44mghbxt6fnhgp.pdf

09/09/2020 Abujar Gold Resources to Grow with High-Grade Intercepts

https://www.asx.com.au/asxpdf/20200909/pdf/44mghbxt6fnhgp.pdf

[url=https://peketec.de/trading/viewtopic.php?p=1997677#1997677 schrieb:Kostolanys Erbe schrieb am 22.08.2020, 10:58 Uhr[/url]"]AU:TIE

mal auf Watchlist genommen:

https://www.tietto.com/

Tietto is focused on fast-tracking the development of the Abujar Gold Project in Côte d’Ivoire, West Africa.

The current resource stands at 45.5Mt @ 1.5 g/t Au for 2.15 Moz of contained gold. Four company-owned rigs are currently undertaking a 50,000m drilling program targeting further rapid resource growth:

•Resource definition at AG, AG Deeps and APG

•Drill testing high priority regional targets

The next Mineral Resource Estimate update is planned for Q3 2020.

Aktuelle Präsentation:

https://www.tietto.com/wp-content/uploads/2020/08/02269326.pdf

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

UK:JSE

Jadestone Energy Inc.

10 September 2020

Jadestone Energy Inc.

2020 Half Year Results and Dividend Declaration

September 10, 2020-Singapore: Jadestone Energy Inc. (AIM:JSE) ("Jadestone" or the "Company"), an independent oil and gas production company and its subsidiaries (the "Group"), focused on the Asia Pacific region, reports today its unaudited condensed consolidated interim financial statements (the "Financial Statements"), as at and for the six-month period ended June 30, 2020, and announces its maiden interim dividend. Management will host a conference call today at 9:00 a.m. UK time, details of which can be found in the release below.

Paul Blakeley, President and CEO commented:

"I'm pleased to provide a first half 2020 report that underscores the resilience of our business. Despite one of the most challenging periods our industry has ever faced, we have not compromised on our commitment to sustainability, and all our personnel remain safe with no recorded incidents of COVID-19, and no lapses in safety or environmental responsibility. Against the backdrop of benchmark commodity prices 40% lower than the same period last year, our assets have remained essentially unimpaired. In addition, through quick action in both managing our capital spending commitments and driving deeper efficiencies and cost savings throughout the entire business, we have kept our balance sheet strong. These decisive steps through the first half of 2020, have ensured we maintain our financial strength and preserve our cash for what we expect to be a market recovery through next year. We generated positive operating cash flows of US$57.1 million in H1 2020, we doubled our net cash position to a record high of US$78.3 million, and we are now in the final phase of repayment of our reserves based loan. We expect to be entirely debt free at the end of Q1 2021.

......................

https://www.londonstockexchange.com/news-article/JSE/2020-half-year-results-and-dividend-declaration/14680947

Jadestone Energy Inc.

10 September 2020

Jadestone Energy Inc.

2020 Half Year Results and Dividend Declaration

September 10, 2020-Singapore: Jadestone Energy Inc. (AIM:JSE) ("Jadestone" or the "Company"), an independent oil and gas production company and its subsidiaries (the "Group"), focused on the Asia Pacific region, reports today its unaudited condensed consolidated interim financial statements (the "Financial Statements"), as at and for the six-month period ended June 30, 2020, and announces its maiden interim dividend. Management will host a conference call today at 9:00 a.m. UK time, details of which can be found in the release below.

Paul Blakeley, President and CEO commented:

"I'm pleased to provide a first half 2020 report that underscores the resilience of our business. Despite one of the most challenging periods our industry has ever faced, we have not compromised on our commitment to sustainability, and all our personnel remain safe with no recorded incidents of COVID-19, and no lapses in safety or environmental responsibility. Against the backdrop of benchmark commodity prices 40% lower than the same period last year, our assets have remained essentially unimpaired. In addition, through quick action in both managing our capital spending commitments and driving deeper efficiencies and cost savings throughout the entire business, we have kept our balance sheet strong. These decisive steps through the first half of 2020, have ensured we maintain our financial strength and preserve our cash for what we expect to be a market recovery through next year. We generated positive operating cash flows of US$57.1 million in H1 2020, we doubled our net cash position to a record high of US$78.3 million, and we are now in the final phase of repayment of our reserves based loan. We expect to be entirely debt free at the end of Q1 2021.

......................

https://www.londonstockexchange.com/news-article/JSE/2020-half-year-results-and-dividend-declaration/14680947

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

UK:ARB

9 September 2020

Argo Blockchain Plc

("Argo" or "the Group")

Interim Half Year Results 2020

Directorate Change

Argo Blockchain Plc, the leading UK-based cryptominer (LSE: ARB), is pleased to announce its results for the six months to 30 June 2020.

Financial highlights

● Total number of Bitcoins mined during H1 2020 rose from 306 to 1,669, a 545% increase from H1 2019

● Revenues surge 280% to £11.12m reflecting major ramp-up in production (H1 2019: £2.93m)

● Cash at bank amounted to £1.3m at 30 June 2020, up from £0.16m at 31 December 2019

● EBITDA* increased by 96% to £3.23m (H1 2019: £1.65m)

● Mining margin of 39% (H1 2019: 76%) despite the halving of the Bitcoin mining reward and amid challenging conditions

● Pre-tax profit of £0.52m (H1 2019: £0.95m)

*Earnings before interest, tax, depreciation and amortisation.

Operating highlights

● Appointed new leadership team in January 2020 under executive chairman Ian MacLeod and chief executive Peter Wall to drive Argo's next phase of growth

● Expanded production base by 260% to 18,000 machines (H1 2019: 5,000 machines) making Argo one of the world's largest publicly listed miners with 730 petahash capacity

● Enhanced power consumption efficiencies with proprietary performance optimisation tools developed by Argo's in-house technology team

Commenting on the results, Peter Wall, chief executive, said: "We delivered strong growth while successfully navigating through challenging trading conditions, including the halving of Bitcoin rewards, during the first half of the year. With one of the world's largest and most efficient mining platforms owned by a publicly listed company, the board considers Argo is well positioned to benefit from improving market conditions and rising cryptocurrency prices."

.....

https://www.londonstockexchange.com/news-article/ARB/argo-blockchain-interim-results/14679424

9 September 2020

Argo Blockchain Plc

("Argo" or "the Group")

Interim Half Year Results 2020

Directorate Change

Argo Blockchain Plc, the leading UK-based cryptominer (LSE: ARB), is pleased to announce its results for the six months to 30 June 2020.

Financial highlights

● Total number of Bitcoins mined during H1 2020 rose from 306 to 1,669, a 545% increase from H1 2019

● Revenues surge 280% to £11.12m reflecting major ramp-up in production (H1 2019: £2.93m)

● Cash at bank amounted to £1.3m at 30 June 2020, up from £0.16m at 31 December 2019

● EBITDA* increased by 96% to £3.23m (H1 2019: £1.65m)

● Mining margin of 39% (H1 2019: 76%) despite the halving of the Bitcoin mining reward and amid challenging conditions

● Pre-tax profit of £0.52m (H1 2019: £0.95m)

*Earnings before interest, tax, depreciation and amortisation.

Operating highlights

● Appointed new leadership team in January 2020 under executive chairman Ian MacLeod and chief executive Peter Wall to drive Argo's next phase of growth

● Expanded production base by 260% to 18,000 machines (H1 2019: 5,000 machines) making Argo one of the world's largest publicly listed miners with 730 petahash capacity

● Enhanced power consumption efficiencies with proprietary performance optimisation tools developed by Argo's in-house technology team

Commenting on the results, Peter Wall, chief executive, said: "We delivered strong growth while successfully navigating through challenging trading conditions, including the halving of Bitcoin rewards, during the first half of the year. With one of the world's largest and most efficient mining platforms owned by a publicly listed company, the board considers Argo is well positioned to benefit from improving market conditions and rising cryptocurrency prices."

.....

https://www.londonstockexchange.com/news-article/ARB/argo-blockchain-interim-results/14679424

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

2020-09-10 15:27 ET - News Release

First Majestic Announces CDN$78 Million Bought Deal Investment by Billionaire Eric Sprott

/NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES/

VANCOUVER, BC, Sept. 10, 2020 /CNW/ - FIRST MAJESTIC SILVER CORP. (AG: NYSE; FR: TSX) (the "Company" or "First Majestic") is pleased to announce that it has entered into an agreement with Cormark Securities Inc., as underwriter (the "Underwriter") pursuant to which the Underwriter has agreed to purchase, on a bought deal basis, 5,000,000 common shares of First Majestic (the "Common Shares") at a price of CDN$15.60 per Common Share for gross proceeds of CDN$78,000,000 (the "Offering").

The sole investor under the Offering will be Canadian billionaire businessman, Eric Sprott, through 2176423 Ontario Ltd., a corporation beneficially controlled by him. This investment will result in Mr. Sprott holding approximately 2.3% of First Majestic's issued and outstanding common shares, post-closing.

Mr. Sprott, commented, "We believe there has been a lack of appreciation for First Majestic's equity in 2020 and we are happy to align ourselves with Keith who recognizes the mispricing of silver in the marketplace and has been a stalwart for silver."

Keith Neumeyer, President and CEO of First Majestic Silver, commented, "We are very pleased to welcome Mr. Sprott as a significant shareholder in First Majestic. As a fellow silver bull, Eric has been recognized as one of the most influential leaders within the silver investment community and this deal represents his largest treasury investment in a silver producer, let alone the entire silver space."

.......

https://www.stockwatch.com/News/Item?bid=Z-C:FR-2961756&symbol=FR®ion=C

First Majestic Announces CDN$78 Million Bought Deal Investment by Billionaire Eric Sprott

/NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES/

VANCOUVER, BC, Sept. 10, 2020 /CNW/ - FIRST MAJESTIC SILVER CORP. (AG: NYSE; FR: TSX) (the "Company" or "First Majestic") is pleased to announce that it has entered into an agreement with Cormark Securities Inc., as underwriter (the "Underwriter") pursuant to which the Underwriter has agreed to purchase, on a bought deal basis, 5,000,000 common shares of First Majestic (the "Common Shares") at a price of CDN$15.60 per Common Share for gross proceeds of CDN$78,000,000 (the "Offering").

The sole investor under the Offering will be Canadian billionaire businessman, Eric Sprott, through 2176423 Ontario Ltd., a corporation beneficially controlled by him. This investment will result in Mr. Sprott holding approximately 2.3% of First Majestic's issued and outstanding common shares, post-closing.

Mr. Sprott, commented, "We believe there has been a lack of appreciation for First Majestic's equity in 2020 and we are happy to align ourselves with Keith who recognizes the mispricing of silver in the marketplace and has been a stalwart for silver."

Keith Neumeyer, President and CEO of First Majestic Silver, commented, "We are very pleased to welcome Mr. Sprott as a significant shareholder in First Majestic. As a fellow silver bull, Eric has been recognized as one of the most influential leaders within the silver investment community and this deal represents his largest treasury investment in a silver producer, let alone the entire silver space."

.......

https://www.stockwatch.com/News/Item?bid=Z-C:FR-2961756&symbol=FR®ion=C

RB4  Klasse - bei dem Kurs entspricht das einer Dividendenrendite von 10,5%!

Klasse - bei dem Kurs entspricht das einer Dividendenrendite von 10,5%!

denke da könnte sich heute noch was tun beim Kurs

Robex Resources to pay four-cent dividend Sept. 25

https://www.stockwatch.com/Quote/Detail?C:RBX

2020-09-10 17:35 ET - Dividend Declared

The issuer has declared the following dividend.

Dividend per common share: four cents

Payable date: Sept. 25, 2020

Record date: Sept. 16, 2020

Ex dividend date: Sept. 15, 2020

© 2020 Canjex Publishing Ltd. All rights reserved.

denke da könnte sich heute noch was tun beim Kurs

Robex Resources to pay four-cent dividend Sept. 25

https://www.stockwatch.com/Quote/Detail?C:RBX

2020-09-10 17:35 ET - Dividend Declared

The issuer has declared the following dividend.

Dividend per common share: four cents

Payable date: Sept. 25, 2020

Record date: Sept. 16, 2020

Ex dividend date: Sept. 15, 2020

© 2020 Canjex Publishing Ltd. All rights reserved.

[url=https://peketec.de/trading/viewtopic.php?p=1998049#1998049 schrieb:greenhorn schrieb am 25.08.2020, 09:02 Uhr[/url]"]RB4Robex has operating income of $2.3-million for Q2 sehr gutes Ergebnis......wollen hoffen das die Lage in Mali sich stabilisiert

https://www.stockwatch.com/News/Item?bid=Z-C:RBX-2953070&symbol=RBX®ion=C

2020-08-24 17:16 ET - News Release

Mr. Benjamin Cohen reports

ROBEX RESOURCES INC.: THE NAMPALA MINE CONTINUES ITS GROWTH DESPITE COVID-19

Robex Resources Inc. has released financial results for the quarter ended June 30, 2020.

Highlights of the second quarter of 2020:

GOLD PRODUCTION INCREASED BY 15%

Gold production reached 13,921 ounces compared to 12,089 ounces during the same period in 2019. The 13% increase in the ore processed at the Nampala plant (456,091 tonnes vs. 402,678 tonnes for the second quarter of 2019) and the improved recovery rate (89.5% vs. 86.6% for the same period in 2019) are factors responsible for the industrial production performance.

FOR FINANCIAL SECURITY PURPOSES, TEMPORARY HOLDING OF PART OF THE QUARTERLY PRODUCTION IN GOLD INGOTS

Robex decided to temporarily hold part of the gold produced to prevent potential monetary and banking risks that could arise as a result of the health crisis. During the second quarter of 2020, 6,500 ounces of gold were sold for CAD 15.7 million compared to 11,760 ounces of gold for CAD 20.4 million for the same period in 2019. This decrease is due to the Company temporarily holding gold ingot stocks in Switzerland as of June 30, 2020.

This resulted in a gap between the production of gold ingots and their sale on the market, which delayed the recognition of a portion of net operating income to the third quarter of 2020.

In July, the Company sold all its stock, i.e., 7,831 ounces, for a turnover of approximately CAD 19,4 million.

In practice, this amounts to a theoretical sales figure of CAD 35.1 million for the second quarter of 2020 (CAD 15.7 million in reported sales plus CAD 19.4 million from the sale of gold ingot stocks), representing a 72% increase over the same period in 2019.......

[url=https://peketec.de/trading/viewtopic.php?p=1975113#1975113 schrieb:greenhorn schrieb am 29.05.2020, 10:21 Uhr[/url]"]RB4sehr schöne Entwicklung......... 8)

Robex earns $9.7-million in Q1

https://www.stockwatch.com/News/Item?bid=Z-C:RBX-2912939&symbol=RBX®ion=C

2020-05-28 16:06 ET - News Release

Mr. Benjamin Cohen reports

ROBEX RESOURCES INC. BEGINS YEAR IN STRENGTH WITH FIRST QUARTERLY FINANCIAL RESULTS

Robex Resources Inc. has published its financial results for the quarter ended March 31, 2020.

Highlights for the first quarter of 2020:

32% INCREASE IN GOLD PRODUCTION

The gold production totalled 14,918 ounces compared to 11,291 ounces produced during the same period in 2019. The 12% increase in the quantity of processed ore at the Nampala plant (476,720 tonnes vs 424,561 tonnes for the first quarter of 2019), the improvement of the average recovery rate (88.8% vs 85.0% for the same period in 2019) and the higher average grade of processed ore (1.10 gpt compared to 0.95 gpt for the first quarter of 2019) are all favourable factors for this good quarterly production performance.

The Company is continuing its efforts to optimize its plant in Mali with the objective of reaching a daily production of 5,600 tonnes until the end of 2020. In addition, work is underway to add a crushing circuit to the crusher's milling circuit.

64% INCREASE IN REVENUE

During the first quarter of 2020, 14,646 ounces of gold were sold for CAD 30.9 million compared to 10,935 ounces of gold for CAD 18.9 million for the same period in 2019. The quantity produced being greater than the quantity sold is attributable to the time delay between casting and refining gold ingots.

SIGNIFICANT INCREASE IN NET INCOME ATTRIBUTABLE TO SHAREHOLDERS FOR THIS QUARTER OF CAD 8.9 MILLION

The Company achieved net income attributable to shareholders of CAD 9.7 million (CAD 0.017 per share), including CAD 7.4 million in amortization of the book value of fixed assets for this quarter, compared to CAD 0.8 million (CAD 0.001 per share) for the same period in 2019.

DECREASE IN THE TOTAL CASH COST1 OF 21%, I.E. CAD 560 PER ONCE SOLD FOR THE FIRST QUARTER OF 2020 COMPARED TO CAD 706 PER ONCE SOLD FOR THE SAME PERIOD IN 2019

The constant improvement of the Nampala plant and its organization now allow us, among other things, to integrate preventive maintenance program, thereby reducing costs and unplanned shutdowns and therefore significantly reducing the total cash cost1 of an ounce of gold.

143% INCREASE IN CASH FLOWS FROM OPERATING ACTIVITIES2

The operating activities of the Company generated cash flows of CAD 18.7 million (CAD 0.032 per share3) compared to CAD 7.7 million (CAD 0.013 per share3) for the same period in 2019. Cash flows are 60% higher than overall revenue.

IMPROVEMENT OF THE WORKING CAPITAL OF CAD 2.4 MILLION AS AT MARCH 31, 2020 COMPARED TO DECEMBER 31, 2019, AND THIS, CONSIDERING THE DECLARED DIVIDEND OF CAD 11.6 MILLION AND PAID ON APRIL 7, 2020.

[url=https://peketec.de/trading/viewtopic.php?p=2001541#2001541 schrieb:Kostolanys Erbe schrieb am 10.09.2020, 20:56 Uhr[/url]"]UK:JSE

Jadestone Energy Inc.

10 September 2020

Jadestone Energy Inc.

2020 Half Year Results and Dividend Declaration

September 10, 2020-Singapore: Jadestone Energy Inc. (AIM:JSE) ("Jadestone" or the "Company"), an independent oil and gas production company and its subsidiaries (the "Group"), focused on the Asia Pacific region, reports today its unaudited condensed consolidated interim financial statements (the "Financial Statements"), as at and for the six-month period ended June 30, 2020, and announces its maiden interim dividend. Management will host a conference call today at 9:00 a.m. UK time, details of which can be found in the release below.

Paul Blakeley, President and CEO commented:

"I'm pleased to provide a first half 2020 report that underscores the resilience of our business. Despite one of the most challenging periods our industry has ever faced, we have not compromised on our commitment to sustainability, and all our personnel remain safe with no recorded incidents of COVID-19, and no lapses in safety or environmental responsibility. Against the backdrop of benchmark commodity prices 40% lower than the same period last year, our assets have remained essentially unimpaired. In addition, through quick action in both managing our capital spending commitments and driving deeper efficiencies and cost savings throughout the entire business, we have kept our balance sheet strong. These decisive steps through the first half of 2020, have ensured we maintain our financial strength and preserve our cash for what we expect to be a market recovery through next year. We generated positive operating cash flows of US$57.1 million in H1 2020, we doubled our net cash position to a record high of US$78.3 million, and we are now in the final phase of repayment of our reserves based loan. We expect to be entirely debt free at the end of Q1 2021.

......................

https://www.londonstockexchange.com/news-article/JSE/2020-half-year-results-and-dividend-declaration/14680947

RBX jetzt auch nochmal die News via stockwatch.com mit einer spannenden Ergänzung!

https://www.stockwatch.com/News/Item?bid=Z-C:RBX-2961945&symbol=RBX®ion=C

Robex declares four-cent special dividend

2020-09-11 07:51 ET - News Release

Mr. Benjamin Cohen reports

ROBEX RESOURCES INC.: NEW SPECIAL DIVIDEND OF 4 CENTS PER SHARE AND DOUBLE INDICATED RESOURCES

Robex Resources Inc. has published a progress report on its current exploration campaign.

PROGRESS OF THE CURRENT CAMPAIGN

Robex announced the execution in 2020 of an important exploration campaign on the NAMPALA site. This campaign's operations targeting 8 zones, including 3 for definition, 3 for exploration and 2 for condemnation, have been delayed this year due to the COVID-19 pandemic and the significant rainy season.

For this campaign, 3 drills were planned full time, but 7 drills will now be put into operation on site to make up for the delay. Consequently, our objective of completing the campaign by the end of the year or early in 2021 should be maintained.

A total of 41,280 metres of drilling has already been completed as of September 5, 2020..........

https://www.stockwatch.com/News/Item?bid=Z-C:RBX-2961945&symbol=RBX®ion=C

Robex declares four-cent special dividend

2020-09-11 07:51 ET - News Release

Mr. Benjamin Cohen reports

ROBEX RESOURCES INC.: NEW SPECIAL DIVIDEND OF 4 CENTS PER SHARE AND DOUBLE INDICATED RESOURCES

Robex Resources Inc. has published a progress report on its current exploration campaign.

PROGRESS OF THE CURRENT CAMPAIGN

Robex announced the execution in 2020 of an important exploration campaign on the NAMPALA site. This campaign's operations targeting 8 zones, including 3 for definition, 3 for exploration and 2 for condemnation, have been delayed this year due to the COVID-19 pandemic and the significant rainy season.

For this campaign, 3 drills were planned full time, but 7 drills will now be put into operation on site to make up for the delay. Consequently, our objective of completing the campaign by the end of the year or early in 2021 should be maintained.

A total of 41,280 metres of drilling has already been completed as of September 5, 2020..........

[url=https://peketec.de/trading/viewtopic.php?p=2001618#2001618 schrieb:greenhorn schrieb am 11.09.2020, 09:16 Uhr[/url]"]RB4Klasse - bei dem Kurs entspricht das einer Dividendenrendite von 10,5%!

denke da könnte sich heute noch was tun beim Kurs

Robex Resources to pay four-cent dividend Sept. 25

https://www.stockwatch.com/Quote/Detail?C:RBX

2020-09-10 17:35 ET - Dividend Declared

The issuer has declared the following dividend.

Dividend per common share: four cents

Payable date: Sept. 25, 2020

Record date: Sept. 16, 2020

Ex dividend date: Sept. 15, 2020

© 2020 Canjex Publishing Ltd. All rights reserved.

[url=https://peketec.de/trading/viewtopic.php?p=1998049#1998049 schrieb:greenhorn schrieb am 25.08.2020, 09:02 Uhr[/url]"]RB4Robex has operating income of $2.3-million for Q2 sehr gutes Ergebnis......wollen hoffen das die Lage in Mali sich stabilisiert

https://www.stockwatch.com/News/Item?bid=Z-C:RBX-2953070&symbol=RBX®ion=C

2020-08-24 17:16 ET - News Release

Mr. Benjamin Cohen reports

ROBEX RESOURCES INC.: THE NAMPALA MINE CONTINUES ITS GROWTH DESPITE COVID-19

Robex Resources Inc. has released financial results for the quarter ended June 30, 2020.

Highlights of the second quarter of 2020:

GOLD PRODUCTION INCREASED BY 15%

Gold production reached 13,921 ounces compared to 12,089 ounces during the same period in 2019. The 13% increase in the ore processed at the Nampala plant (456,091 tonnes vs. 402,678 tonnes for the second quarter of 2019) and the improved recovery rate (89.5% vs. 86.6% for the same period in 2019) are factors responsible for the industrial production performance.

FOR FINANCIAL SECURITY PURPOSES, TEMPORARY HOLDING OF PART OF THE QUARTERLY PRODUCTION IN GOLD INGOTS

Robex decided to temporarily hold part of the gold produced to prevent potential monetary and banking risks that could arise as a result of the health crisis. During the second quarter of 2020, 6,500 ounces of gold were sold for CAD 15.7 million compared to 11,760 ounces of gold for CAD 20.4 million for the same period in 2019. This decrease is due to the Company temporarily holding gold ingot stocks in Switzerland as of June 30, 2020.

This resulted in a gap between the production of gold ingots and their sale on the market, which delayed the recognition of a portion of net operating income to the third quarter of 2020.

In July, the Company sold all its stock, i.e., 7,831 ounces, for a turnover of approximately CAD 19,4 million.

In practice, this amounts to a theoretical sales figure of CAD 35.1 million for the second quarter of 2020 (CAD 15.7 million in reported sales plus CAD 19.4 million from the sale of gold ingot stocks), representing a 72% increase over the same period in 2019.......

[url=https://peketec.de/trading/viewtopic.php?p=1975113#1975113 schrieb:greenhorn schrieb am 29.05.2020, 10:21 Uhr[/url]"]RB4sehr schöne Entwicklung......... 8)

Robex earns $9.7-million in Q1

https://www.stockwatch.com/News/Item?bid=Z-C:RBX-2912939&symbol=RBX®ion=C

2020-05-28 16:06 ET - News Release

Mr. Benjamin Cohen reports

ROBEX RESOURCES INC. BEGINS YEAR IN STRENGTH WITH FIRST QUARTERLY FINANCIAL RESULTS

Robex Resources Inc. has published its financial results for the quarter ended March 31, 2020.

Highlights for the first quarter of 2020:

32% INCREASE IN GOLD PRODUCTION

The gold production totalled 14,918 ounces compared to 11,291 ounces produced during the same period in 2019. The 12% increase in the quantity of processed ore at the Nampala plant (476,720 tonnes vs 424,561 tonnes for the first quarter of 2019), the improvement of the average recovery rate (88.8% vs 85.0% for the same period in 2019) and the higher average grade of processed ore (1.10 gpt compared to 0.95 gpt for the first quarter of 2019) are all favourable factors for this good quarterly production performance.

The Company is continuing its efforts to optimize its plant in Mali with the objective of reaching a daily production of 5,600 tonnes until the end of 2020. In addition, work is underway to add a crushing circuit to the crusher's milling circuit.

64% INCREASE IN REVENUE

During the first quarter of 2020, 14,646 ounces of gold were sold for CAD 30.9 million compared to 10,935 ounces of gold for CAD 18.9 million for the same period in 2019. The quantity produced being greater than the quantity sold is attributable to the time delay between casting and refining gold ingots.

SIGNIFICANT INCREASE IN NET INCOME ATTRIBUTABLE TO SHAREHOLDERS FOR THIS QUARTER OF CAD 8.9 MILLION

The Company achieved net income attributable to shareholders of CAD 9.7 million (CAD 0.017 per share), including CAD 7.4 million in amortization of the book value of fixed assets for this quarter, compared to CAD 0.8 million (CAD 0.001 per share) for the same period in 2019.

DECREASE IN THE TOTAL CASH COST1 OF 21%, I.E. CAD 560 PER ONCE SOLD FOR THE FIRST QUARTER OF 2020 COMPARED TO CAD 706 PER ONCE SOLD FOR THE SAME PERIOD IN 2019

The constant improvement of the Nampala plant and its organization now allow us, among other things, to integrate preventive maintenance program, thereby reducing costs and unplanned shutdowns and therefore significantly reducing the total cash cost1 of an ounce of gold.

143% INCREASE IN CASH FLOWS FROM OPERATING ACTIVITIES2

The operating activities of the Company generated cash flows of CAD 18.7 million (CAD 0.032 per share3) compared to CAD 7.7 million (CAD 0.013 per share3) for the same period in 2019. Cash flows are 60% higher than overall revenue.

IMPROVEMENT OF THE WORKING CAPITAL OF CAD 2.4 MILLION AS AT MARCH 31, 2020 COMPARED TO DECEMBER 31, 2019, AND THIS, CONSIDERING THE DECLARED DIVIDEND OF CAD 11.6 MILLION AND PAID ON APRIL 7, 2020.

RB4 - mal ein Kommentar aus Stockhouse.com....alles immer etwas runterschrauben, aber grundsätzlich ist Robex im Vergleich noch mit Potential behaftet....

https://stockhouse.com/companies/bullboard?symbol=v.rbx&postid=31541766

Excellent BUY on Fair value..Dividend is gravy

Very simple analyses of fair value.

AISC is just below $800 US per ounce which ranks in the lowest 10 %.

50,000 ounces per year with excellent production upside

Assuming $1800 POG, RBX is free cash flowing ( $1800 minus $800 ) times 50,000 ounces which equals $50 million US per year or about $68 million cad ( 12 cents cad per share ).

That is, RBX is trading at less than 4 times free cash flows while its peers trade above 12 times free cash flows.

These analyses suggest that RBX is grossly undervalued, with adiscounted fair value approaching $0.90 per share.

Its throwing off so much free cash flow that it can pay out perhaps $50 million per year in dividends...more as production increases

https://stockhouse.com/companies/bullboard?symbol=v.rbx&postid=31541766

Excellent BUY on Fair value..Dividend is gravy

Very simple analyses of fair value.

AISC is just below $800 US per ounce which ranks in the lowest 10 %.

50,000 ounces per year with excellent production upside

Assuming $1800 POG, RBX is free cash flowing ( $1800 minus $800 ) times 50,000 ounces which equals $50 million US per year or about $68 million cad ( 12 cents cad per share ).

That is, RBX is trading at less than 4 times free cash flows while its peers trade above 12 times free cash flows.

These analyses suggest that RBX is grossly undervalued, with adiscounted fair value approaching $0.90 per share.

Its throwing off so much free cash flow that it can pay out perhaps $50 million per year in dividends...more as production increases

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Danke

[url=https://peketec.de/trading/viewtopic.php?p=2001633#2001633 schrieb:greenhorn schrieb am 11.09.2020, 10:10 Uhr[/url]"]Super Vorstellung von Dir.....die haben sich sehr gut enwickelt

[url=https://peketec.de/trading/viewtopic.php?p=2001541#2001541 schrieb:Kostolanys Erbe schrieb am 10.09.2020, 20:56 Uhr[/url]"]UK:JSE

Jadestone Energy Inc.

10 September 2020

Jadestone Energy Inc.

2020 Half Year Results and Dividend Declaration

September 10, 2020-Singapore: Jadestone Energy Inc. (AIM:JSE) ("Jadestone" or the "Company"), an independent oil and gas production company and its subsidiaries (the "Group"), focused on the Asia Pacific region, reports today its unaudited condensed consolidated interim financial statements (the "Financial Statements"), as at and for the six-month period ended June 30, 2020, and announces its maiden interim dividend. Management will host a conference call today at 9:00 a.m. UK time, details of which can be found in the release below.

Paul Blakeley, President and CEO commented:

"I'm pleased to provide a first half 2020 report that underscores the resilience of our business. Despite one of the most challenging periods our industry has ever faced, we have not compromised on our commitment to sustainability, and all our personnel remain safe with no recorded incidents of COVID-19, and no lapses in safety or environmental responsibility. Against the backdrop of benchmark commodity prices 40% lower than the same period last year, our assets have remained essentially unimpaired. In addition, through quick action in both managing our capital spending commitments and driving deeper efficiencies and cost savings throughout the entire business, we have kept our balance sheet strong. These decisive steps through the first half of 2020, have ensured we maintain our financial strength and preserve our cash for what we expect to be a market recovery through next year. We generated positive operating cash flows of US$57.1 million in H1 2020, we doubled our net cash position to a record high of US$78.3 million, and we are now in the final phase of repayment of our reserves based loan. We expect to be entirely debt free at the end of Q1 2021.

......................

https://www.londonstockexchange.com/news-article/JSE/2020-half-year-results-and-dividend-declaration/14680947

V.TAO TAG Oil Ltd

SK: 0,23 CAD

stark unterwegs nach der Divi. Werde mir wohl heute welche gönnen. Chart is ein Traum.

SK: 0,23 CAD

stark unterwegs nach der Divi. Werde mir wohl heute welche gönnen. Chart is ein Traum.

nicht schlecht die Story - Chart im Moment etwas überkauft; ggf. bisschen warten mit Einstieg....

https://stockcharts.com/h-sc/ui?s=TAO.V

https://stockcharts.com/h-sc/ui?s=TAO.V

[url=https://peketec.de/trading/viewtopic.php?p=2002018#2002018 schrieb:Cardioaffin schrieb am 14.09.2020, 11:28 Uhr[/url]"]V.TAO TAG Oil Ltd

SK: 0,23 CAD

stark unterwegs nach der Divi. Werde mir wohl heute welche gönnen. Chart is ein Traum.

löpt weiter heute......... 8)

[url=https://peketec.de/trading/viewtopic.php?p=2001706#2001706 schrieb:greenhorn schrieb am 11.09.2020, 14:06 Uhr[/url]"]RBX jetzt auch nochmal die News via stockwatch.com mit einer spannenden Ergänzung!

https://www.stockwatch.com/News/Item?bid=Z-C:RBX-2961945&symbol=RBX®ion=C

Robex declares four-cent special dividend

2020-09-11 07:51 ET - News Release

Mr. Benjamin Cohen reports

ROBEX RESOURCES INC.: NEW SPECIAL DIVIDEND OF 4 CENTS PER SHARE AND DOUBLE INDICATED RESOURCES

Robex Resources Inc. has published a progress report on its current exploration campaign.

PROGRESS OF THE CURRENT CAMPAIGN

Robex announced the execution in 2020 of an important exploration campaign on the NAMPALA site. This campaign's operations targeting 8 zones, including 3 for definition, 3 for exploration and 2 for condemnation, have been delayed this year due to the COVID-19 pandemic and the significant rainy season.

For this campaign, 3 drills were planned full time, but 7 drills will now be put into operation on site to make up for the delay. Consequently, our objective of completing the campaign by the end of the year or early in 2021 should be maintained.

A total of 41,280 metres of drilling has already been completed as of September 5, 2020..........

[url=https://peketec.de/trading/viewtopic.php?p=2001618#2001618 schrieb:greenhorn schrieb am 11.09.2020, 09:16 Uhr[/url]"]RB4Klasse - bei dem Kurs entspricht das einer Dividendenrendite von 10,5%!

denke da könnte sich heute noch was tun beim Kurs

Robex Resources to pay four-cent dividend Sept. 25

https://www.stockwatch.com/Quote/Detail?C:RBX

2020-09-10 17:35 ET - Dividend Declared

The issuer has declared the following dividend.

Dividend per common share: four cents

Payable date: Sept. 25, 2020

Record date: Sept. 16, 2020

Ex dividend date: Sept. 15, 2020

© 2020 Canjex Publishing Ltd. All rights reserved.

[url=https://peketec.de/trading/viewtopic.php?p=1998049#1998049 schrieb:greenhorn schrieb am 25.08.2020, 09:02 Uhr[/url]"]RB4Robex has operating income of $2.3-million for Q2 sehr gutes Ergebnis......wollen hoffen das die Lage in Mali sich stabilisiert

https://www.stockwatch.com/News/Item?bid=Z-C:RBX-2953070&symbol=RBX®ion=C

2020-08-24 17:16 ET - News Release

Mr. Benjamin Cohen reports

ROBEX RESOURCES INC.: THE NAMPALA MINE CONTINUES ITS GROWTH DESPITE COVID-19

Robex Resources Inc. has released financial results for the quarter ended June 30, 2020.

Highlights of the second quarter of 2020:

GOLD PRODUCTION INCREASED BY 15%

Gold production reached 13,921 ounces compared to 12,089 ounces during the same period in 2019. The 13% increase in the ore processed at the Nampala plant (456,091 tonnes vs. 402,678 tonnes for the second quarter of 2019) and the improved recovery rate (89.5% vs. 86.6% for the same period in 2019) are factors responsible for the industrial production performance.

FOR FINANCIAL SECURITY PURPOSES, TEMPORARY HOLDING OF PART OF THE QUARTERLY PRODUCTION IN GOLD INGOTS

Robex decided to temporarily hold part of the gold produced to prevent potential monetary and banking risks that could arise as a result of the health crisis. During the second quarter of 2020, 6,500 ounces of gold were sold for CAD 15.7 million compared to 11,760 ounces of gold for CAD 20.4 million for the same period in 2019. This decrease is due to the Company temporarily holding gold ingot stocks in Switzerland as of June 30, 2020.

This resulted in a gap between the production of gold ingots and their sale on the market, which delayed the recognition of a portion of net operating income to the third quarter of 2020.

In July, the Company sold all its stock, i.e., 7,831 ounces, for a turnover of approximately CAD 19,4 million.

In practice, this amounts to a theoretical sales figure of CAD 35.1 million for the second quarter of 2020 (CAD 15.7 million in reported sales plus CAD 19.4 million from the sale of gold ingot stocks), representing a 72% increase over the same period in 2019.......

[url=https://peketec.de/trading/viewtopic.php?p=1975113#1975113 schrieb:greenhorn schrieb am 29.05.2020, 10:21 Uhr[/url]"]RB4sehr schöne Entwicklung......... 8)

Robex earns $9.7-million in Q1

https://www.stockwatch.com/News/Item?bid=Z-C:RBX-2912939&symbol=RBX®ion=C

2020-05-28 16:06 ET - News Release

Mr. Benjamin Cohen reports

ROBEX RESOURCES INC. BEGINS YEAR IN STRENGTH WITH FIRST QUARTERLY FINANCIAL RESULTS

Robex Resources Inc. has published its financial results for the quarter ended March 31, 2020.

Highlights for the first quarter of 2020:

32% INCREASE IN GOLD PRODUCTION

The gold production totalled 14,918 ounces compared to 11,291 ounces produced during the same period in 2019. The 12% increase in the quantity of processed ore at the Nampala plant (476,720 tonnes vs 424,561 tonnes for the first quarter of 2019), the improvement of the average recovery rate (88.8% vs 85.0% for the same period in 2019) and the higher average grade of processed ore (1.10 gpt compared to 0.95 gpt for the first quarter of 2019) are all favourable factors for this good quarterly production performance.

The Company is continuing its efforts to optimize its plant in Mali with the objective of reaching a daily production of 5,600 tonnes until the end of 2020. In addition, work is underway to add a crushing circuit to the crusher's milling circuit.

64% INCREASE IN REVENUE

During the first quarter of 2020, 14,646 ounces of gold were sold for CAD 30.9 million compared to 10,935 ounces of gold for CAD 18.9 million for the same period in 2019. The quantity produced being greater than the quantity sold is attributable to the time delay between casting and refining gold ingots.

SIGNIFICANT INCREASE IN NET INCOME ATTRIBUTABLE TO SHAREHOLDERS FOR THIS QUARTER OF CAD 8.9 MILLION

The Company achieved net income attributable to shareholders of CAD 9.7 million (CAD 0.017 per share), including CAD 7.4 million in amortization of the book value of fixed assets for this quarter, compared to CAD 0.8 million (CAD 0.001 per share) for the same period in 2019.

DECREASE IN THE TOTAL CASH COST1 OF 21%, I.E. CAD 560 PER ONCE SOLD FOR THE FIRST QUARTER OF 2020 COMPARED TO CAD 706 PER ONCE SOLD FOR THE SAME PERIOD IN 2019

The constant improvement of the Nampala plant and its organization now allow us, among other things, to integrate preventive maintenance program, thereby reducing costs and unplanned shutdowns and therefore significantly reducing the total cash cost1 of an ounce of gold.

143% INCREASE IN CASH FLOWS FROM OPERATING ACTIVITIES2

The operating activities of the Company generated cash flows of CAD 18.7 million (CAD 0.032 per share3) compared to CAD 7.7 million (CAD 0.013 per share3) for the same period in 2019. Cash flows are 60% higher than overall revenue.

IMPROVEMENT OF THE WORKING CAPITAL OF CAD 2.4 MILLION AS AT MARCH 31, 2020 COMPARED TO DECEMBER 31, 2019, AND THIS, CONSIDERING THE DECLARED DIVIDEND OF CAD 11.6 MILLION AND PAID ON APRIL 7, 2020.

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Hört sich verdammt gut...

Teranga Gold expects to meet 2020 production guidance

2020-09-14 07:30 ET - News Release

Mr. Richard Young reports

TERANGA GOLD PROVIDES CORPORATE UPDATE AND REAFFIRMS 2020 PRODUCTION GUIDANCE

Teranga Gold Corp. has provided an update on the progression of its pipeline of assets and reaffirm 2020 production guidance as it grows into a low-cost, mid-tier West African gold producer. (All amounts are in U.S. dollars unless otherwise stated.)

"We are on track to meet our 2020 companywide production guidance of 375,000 to 400,000 ounces of gold (1) -- a record-breaking number for Teranga as we advance towards mid-tier status. Beginning in 2021, our annual companywide production for the next five years is expected to average 533,000 ounces (1) at an all-in sustaining cost of $785 per ounce, one of the lowest cost profiles in the industry," stated Richard Young, president and chief executive officer.

Added Mr. Young: "At current gold prices, we expect to generate significant cash flows over the next 18 months, which will materially improve our balance sheet. At the end of the second quarter, we had over $350-million in net debt and we expect to be firmly in a net cash position by the end of next year."

....

https://www.stockwatch.com/News/Item?bid=Z-C:TGZ-2962389&symbol=TGZ®ion=C

Teranga Gold expects to meet 2020 production guidance

2020-09-14 07:30 ET - News Release

Mr. Richard Young reports

TERANGA GOLD PROVIDES CORPORATE UPDATE AND REAFFIRMS 2020 PRODUCTION GUIDANCE

Teranga Gold Corp. has provided an update on the progression of its pipeline of assets and reaffirm 2020 production guidance as it grows into a low-cost, mid-tier West African gold producer. (All amounts are in U.S. dollars unless otherwise stated.)

"We are on track to meet our 2020 companywide production guidance of 375,000 to 400,000 ounces of gold (1) -- a record-breaking number for Teranga as we advance towards mid-tier status. Beginning in 2021, our annual companywide production for the next five years is expected to average 533,000 ounces (1) at an all-in sustaining cost of $785 per ounce, one of the lowest cost profiles in the industry," stated Richard Young, president and chief executive officer.

Added Mr. Young: "At current gold prices, we expect to generate significant cash flows over the next 18 months, which will materially improve our balance sheet. At the end of the second quarter, we had over $350-million in net debt and we expect to be firmly in a net cash position by the end of next year."

....

https://www.stockwatch.com/News/Item?bid=Z-C:TGZ-2962389&symbol=TGZ®ion=C

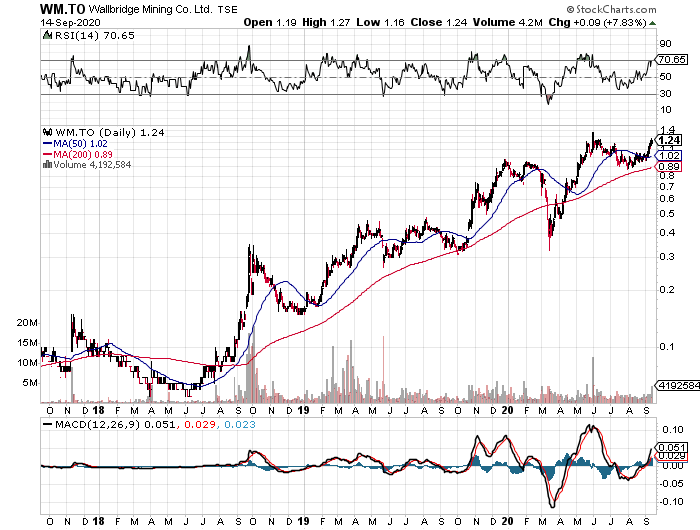

[url=https://peketec.de/trading/viewtopic.php?p=1919161#1919161 schrieb:hitmaxx schrieb am 22.10.2019, 09:03 Uhr[/url]"][url=https://peketec.de/trading/viewtopic.php?p=1901847#1901847 schrieb:hitmaxx schrieb am 20.06.2019, 00:10 Uhr[/url]"]Hallo , ich möchte hier mal auf einen Wert Aufmerksam machen, den ich für sehr vielversprechend halte. Vielleicht kennt der ein oder andere Wallbridge Mining

schon oder führt ihn sogar in seinem Depot. WM ist vom Höchststand von 0,47 Cad

auf 0,265 zurückgekommen und notiert heute bei 0,31 Cad.

lexcon hat im Mai eine eine Fallstudie verfasst, die er auf indexploration.com veröffentlicht hat und die eine hervorragende Zusammenfassung des Unternehmens wiedergibt.

https://insidexploration.com/wallbridge-mining-case-study/

Gruß hitmaxx

Pressemitteilung :

FA-19-086:

27,00 g / t Au (22,17 g / t Au) über 38,39 Meter , einschließlich

75,02 g / t Au (73,71 g / t Au-Schnitt) über 3,83 m und

82,61 g / t Au (58,60 g / t Au-Schnitt) über 7,51 Meter,was weiter umfasst

201,73 g / t Au (130,47 g / t Au-Schnitt) über 2,53 Meter Hinweis:

Bohrloch-Verbundwerkstoffe, die als "geschnitten" gemeldet werden, enthalten höherwertige Proben, die auf 140 g / t Au geschnitten wurden. Derzeit sind nicht genügend Informationen verfügbar, um die tatsächlichen Breiten abzuschätzen. Weitere Untersuchungsergebnisse aus diesem Loch stehen noch aus.

https://ceo.ca/@newswire/wallbridge-exploration-drilling-intersects-2700-gt

Wallbridge Mining seit letztem Jahr sehr gut gelaufen . Wird am Freitag in den GDXJ aufgenommen und die Bergbaugenehmigung dürfte auch alsbald erteilt werden. Hat noch einen schönen Weg bis zu einer Übernahme nach oben vor sich.

Freehold Royalties to pay 1.5-cent dividend Oct. 15

https://www.stockwatch.com/News/Item?bid=Z-C:FRU-2962781&symbol=FRU®ion=C

2020-09-14 17:03 ET - News Release

Mr. Matt Donohue reports

FREEHOLD ROYALTIES LTD. DECLARES DIVIDEND FOR SEPTEMBER 2020

Freehold Royalties Ltd.'s board of directors has declared a dividend of 1.5 cents per common share to be paid on Oct. 15, 2020, to shareholders of record on Sept. 30, 2020.

The dividend is designated as an eligible dividend for Canadian income tax purposes.

Freehold's focus is on acquiring and managing oil and gas royalties. Freehold's common shares trade on the Toronto Stock Exchange in Canada under the symbol FRU.

© 2020 Canjex Publishing Ltd. All rights reserved.

https://www.stockwatch.com/News/Item?bid=Z-C:FRU-2962781&symbol=FRU®ion=C

2020-09-14 17:03 ET - News Release

Mr. Matt Donohue reports

FREEHOLD ROYALTIES LTD. DECLARES DIVIDEND FOR SEPTEMBER 2020

Freehold Royalties Ltd.'s board of directors has declared a dividend of 1.5 cents per common share to be paid on Oct. 15, 2020, to shareholders of record on Sept. 30, 2020.

The dividend is designated as an eligible dividend for Canadian income tax purposes.

Freehold's focus is on acquiring and managing oil and gas royalties. Freehold's common shares trade on the Toronto Stock Exchange in Canada under the symbol FRU.

© 2020 Canjex Publishing Ltd. All rights reserved.

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Blackrock looks into spinout of Silver Cloud property

2020-09-15 09:56 ET - News Release

Mr. Andrew Pollard reports

BLACKROCK ANNOUNCES INTENTION TO SPIN OUT SILVER CLOUD PROPERTY TO NEW COMPANY OWNED BY SHAREHOLDERS

Blackrock Gold Corp.'s board of directors is currently evaluating a proposal for Blackrock to transfer the company's Silver Cloud property located in the northern part of Nevada to a new subsidiary to be formed (SpinCo), provide financing to SpinCo and then spin out the shares of SpinCo to Blackrock's shareholders. Blackrock's shareholders would end up owning shares in both Blackrock and SpinCo in the same proportions.

Andrew Pollard, President & CEO stated: "With gold hovering near all-time highs and our Tonopah West property dominating the show, we see this as the perfect backdrop to unlock value for investors by spinning out what was once our flagship property, Silver Cloud, into a separate, discovery-oriented public company. We don't believe the market is fully valuing the sum of our parts and we see this as the ideal solution to ensure both projects get the attention and command the valuation of which they deserve, with purpose-built teams for each. Not only would this allow Blackrock to streamline its focus towards re-establishing and developing the Tonopah silver district into the tier-one mining complex it once was, it will also allow shareholders to participate in, and benefit from the creation of a new Northern Nevada focused exploration company. With shareholders contemplated to receive one share in the Spinco for every three shares they hold in Blackrock, this creates a compelling new dynamic to our investment thesis as investors will stand to own shares in two public companies that are on two clear paths."

Management of the Company currently contemplates that Blackrock shareholders will receive one SpinCo Share for every three common shares of Blackrock and that the SpinCo Shares will be subject to resale restrictions with 25% of the SpinCo Shares being released from the restrictions at the time of completion of the spinout and a further 25% being released every four months thereafter.

The completion of the proposed spinout transaction and contemplated distribution of SpinCo Shares to Blackrock shareholders are subject to a number of conditions, including the completion of legal and tax structuring analyses, completion of financial analysis, determination of the structure and amount of Blackrock's funding of SpinCo, determination of final details of the transaction, settlement of the Board and management team for SpinCo, required regulatory approvals, any required shareholder approval, and the listing of the SpinCo Shares on the TSX Venture Exchange.

There is no certainty that the spinout transaction will be completed on the terms proposed or at all. The Board of Blackrock may determine to not proceed with the transaction should there be a change in market conditions or investor interest or should another opportunity arise that would similarly enhance value to Blackrock shareholders.

The Company will provide updates when further details of the proposed spinout transaction are determined.

Precious Metals Summit Beaver Creek Webcast

Blackrock Gold's Andrew Pollard will give a live company presentation at the upcoming Precious Metals Summit Beaver Creek on Wednesday, Sept 16th at 10:45 am EDT where he will discuss their recent significant assay results and update on their ongoing maiden drill program at Tonopah West, and the proposed spinout of Silver Cloud into a new company to be owned by Blackrock investors.

About Blackrock Gold Corp.

Blackrock is a junior gold-focused exploration company that is on a quest to make an economic discovery. Anchored by a seasoned Board, the Company is focused on its Nevada portfolio consisting of low-sulfidation epithermal gold & silver projects located along the established Northern Nevada Rift in north-central Nevada, and the Walker Lane trend in western Nevada.

https://www.stockwatch.com/News/Item?bid=Z-C:BRC-2963293&symbol=BRC®ion=C

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

AU:CWX

15/09/2020 New Nickel and Gold Targets Outlined in the Fraser Range

https://www.asx.com.au/asxpdf/20200915/pdf/44mmn0tgh5q0yg.pdf

15/09/2020 New Nickel and Gold Targets Outlined in the Fraser Range

https://www.asx.com.au/asxpdf/20200915/pdf/44mmn0tgh5q0yg.pdf

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

@greeni

Es wurde mal wieder an der Uhr gedreht....

Wir schauen in das Jahr ANNO 1975 zurück, es war ein Dienstag der 16. September!

Unser Michael würde noch zu ANNO hinzufügen: Domini Nostri Iesu Christi

Im römischen Kalender war der September ursprünglich der siebte Monat (lat. septem = sieben). 153 v. Chr. wurde der Jahresbeginn jedoch um zwei Monate vorverlegt!

Persönlich wurde mal vom Geburtstagskind geschrieben, das die Geburt "ein dramatisches Ereignis für alle Beteiligte" war. Nun wahr in diesem Dorf geboren und aufzuwachsen ist etwas ganz Besonderes!

geboren und aufzuwachsen ist etwas ganz Besonderes!

Nun ja Michael, auch wenn Du keine Harfe spielen kannst, gehst Du als Troubadix hier bei peketec.de in die Geschichte ein. Der Mythos bleibt und ich hoffe; Du hast es Deinen Kindern schon mündlich überliefert!!!

hier bei peketec.de in die Geschichte ein. Der Mythos bleibt und ich hoffe; Du hast es Deinen Kindern schon mündlich überliefert!!!

Lieber Michael,

ich wünsche Dir zu Deinem 45. Geburtstag alles Gute, vor allem immer viel Gesundheit!

Vielen Dank für Deine tollen Beiträge hier auf peketec.de und ich hoffe, wir werden hier noch viele gemeinsame Jahre auf peketec.de viele tolle Dinge erleben.

Genieß Deinen Ehrentag mit Deiner Familie und Freunden! Viel Spaß beim feiern!

Viele Grüße

Kosto

PS: Und falls die Luft morgen mal in Berlin dünner werden sollte, dann weiß Du was Du trinken muss!

Und falls @greeni die Harfe mal nicht spielen darf, geht es auch so....

https://www.youtube.com/watch?v=_bMcbiNsMpI

Es wurde mal wieder an der Uhr gedreht....

Wir schauen in das Jahr ANNO 1975 zurück, es war ein Dienstag der 16. September!

Unser Michael würde noch zu ANNO hinzufügen: Domini Nostri Iesu Christi

Im römischen Kalender war der September ursprünglich der siebte Monat (lat. septem = sieben). 153 v. Chr. wurde der Jahresbeginn jedoch um zwei Monate vorverlegt!

Persönlich wurde mal vom Geburtstagskind geschrieben, das die Geburt "ein dramatisches Ereignis für alle Beteiligte" war. Nun wahr in diesem Dorf

Nun ja Michael, auch wenn Du keine Harfe spielen kannst, gehst Du als Troubadix

Lieber Michael,

ich wünsche Dir zu Deinem 45. Geburtstag alles Gute, vor allem immer viel Gesundheit!

Vielen Dank für Deine tollen Beiträge hier auf peketec.de und ich hoffe, wir werden hier noch viele gemeinsame Jahre auf peketec.de viele tolle Dinge erleben.

Genieß Deinen Ehrentag mit Deiner Familie und Freunden! Viel Spaß beim feiern!

Viele Grüße

Kosto

PS: Und falls die Luft morgen mal in Berlin dünner werden sollte, dann weiß Du was Du trinken muss!

Und falls @greeni die Harfe mal nicht spielen darf, geht es auch so....

https://www.youtube.com/watch?v=_bMcbiNsMpI

Happy Birthday Michael!!!

Alles Liebe und Gute zu deinem Geburtstag! Und mega danke für deine Arbeit bei peketec. Ohne Troubadix wäre peketec nicht das gleiche peketec...... :D

Alles Liebe und Gute zu deinem Geburtstag! Und mega danke für deine Arbeit bei peketec. Ohne Troubadix wäre peketec nicht das gleiche peketec...... :D

[url=https://peketec.de/trading/viewtopic.php?p=2002484#2002484 schrieb:Kostolanys Erbe schrieb am 16.09.2020, 00:02 Uhr[/url]"]@greeni

Es wurde mal wieder an der Uhr gedreht....

» zur Grafik

Wir schauen in das Jahr ANNO 1975 zurück, es war ein Dienstag der 16. September!

Unser Michael würde noch zu ANNO hinzufügen: Domini Nostri Iesu Christi

Im römischen Kalender war der September ursprünglich der siebte Monat (lat. septem = sieben). 153 v. Chr. wurde der Jahresbeginn jedoch um zwei Monate vorverlegt!

Persönlich wurde mal vom Geburtstagskind geschrieben, das die Geburt "ein dramatisches Ereignis für alle Beteiligte" war. Nun wahr in diesem Dorfgeboren und aufzuwachsen ist etwas ganz Besonderes!

» zur Grafik

Nun ja Michael, auch wenn Du keine Harfe spielen kannst, gehst Du als Troubadixhier bei peketec.de in die Geschichte ein. Der Mythos bleibt und ich hoffe; Du hast es Deinen Kindern schon mündlich überliefert!!!

» zur Grafik

Lieber Michael,

ich wünsche Dir zu Deinem 45. Geburtstag alles Gute, vor allem immer viel Gesundheit!

Vielen Dank für Deine tollen Beiträge hier auf peketec.de und ich hoffe, wir werden hier noch viele gemeinsame Jahre auf peketec.de viele tolle Dinge erleben.

Genieß Deinen Ehrentag mit Deiner Familie und Freunden! Viel Spaß beim feiern!

Viele Grüße

Kosto

» zur Grafik

PS: Und falls die Luft morgen mal in Berlin dünner werden sollte, dann weiß Du was Du trinken muss!

» zur Grafik

Und falls @greeni die Harfe mal nicht spielen darf, geht es auch so....

https://www.youtube.com/watch?v=_bMcbiNsMpI

[url=https://peketec.de/trading/viewtopic.php?p=2002498#2002498 schrieb:Ollinho schrieb am 16.09.2020, 07:21 Uhr[/url]"]Happy Birthday Michael!!!

Alles Liebe und Gute zu deinem Geburtstag! Und mega danke für deine Arbeit bei peketec. Ohne Troubadix wäre peketec nicht das gleiche peketec...... :D

Glückwunsch Michael,- und Alles Gute!!!

[url=https://peketec.de/trading/viewtopic.php?p=2002511#2002511 schrieb:dukezero schrieb am 16.09.2020, 07:56 Uhr[/url]"][url=https://peketec.de/trading/viewtopic.php?p=2002498#2002498 schrieb:Ollinho schrieb am 16.09.2020, 07:21 Uhr[/url]"]Happy Birthday Michael!!!

Alles Liebe und Gute zu deinem Geburtstag! Und mega danke für deine Arbeit bei peketec. Ohne Troubadix wäre peketec nicht das gleiche peketec...... :D

Glückwunsch Michael,- und Alles Gute!!!

» zur Grafik

Von mir ebenfalls alles erdenklich Gute zum Geburtstag!!!

vor allem was für Details sich Kosto behalten hat........ja, meine Jeburt war in der Tat ein sehr dramatisches Ereignis......mit dem Ergebnis das ich 2 Mama´s haben darf....eine ist schon im Himmel....

Ich danke Euch von Herzen!!!! ihr seid einfach dufte, und ich freu mich jeden Tag aufs neue hier guten Morgen zu schreiben.....

gestern weiter hoch - allerdings nun langsam Obacht; RSI deutlich über 80

[url=https://peketec.de/trading/viewtopic.php?p=2002102#2002102 schrieb:greenhorn schrieb am 14.09.2020, 16:30 Uhr[/url]"]löpt weiter heute......... 8)

[url=https://peketec.de/trading/viewtopic.php?p=2001706#2001706 schrieb:greenhorn schrieb am 11.09.2020, 14:06 Uhr[/url]"]RBX jetzt auch nochmal die News via stockwatch.com mit einer spannenden Ergänzung!

https://www.stockwatch.com/News/Item?bid=Z-C:RBX-2961945&symbol=RBX®ion=C

Robex declares four-cent special dividend

2020-09-11 07:51 ET - News Release

Mr. Benjamin Cohen reports

ROBEX RESOURCES INC.: NEW SPECIAL DIVIDEND OF 4 CENTS PER SHARE AND DOUBLE INDICATED RESOURCES

Robex Resources Inc. has published a progress report on its current exploration campaign.

PROGRESS OF THE CURRENT CAMPAIGN

Robex announced the execution in 2020 of an important exploration campaign on the NAMPALA site. This campaign's operations targeting 8 zones, including 3 for definition, 3 for exploration and 2 for condemnation, have been delayed this year due to the COVID-19 pandemic and the significant rainy season.

For this campaign, 3 drills were planned full time, but 7 drills will now be put into operation on site to make up for the delay. Consequently, our objective of completing the campaign by the end of the year or early in 2021 should be maintained.

A total of 41,280 metres of drilling has already been completed as of September 5, 2020..........

[url=https://peketec.de/trading/viewtopic.php?p=2001618#2001618 schrieb:greenhorn schrieb am 11.09.2020, 09:16 Uhr[/url]"]RB4Klasse - bei dem Kurs entspricht das einer Dividendenrendite von 10,5%!

denke da könnte sich heute noch was tun beim Kurs

Robex Resources to pay four-cent dividend Sept. 25

https://www.stockwatch.com/Quote/Detail?C:RBX

2020-09-10 17:35 ET - Dividend Declared

The issuer has declared the following dividend.

Dividend per common share: four cents

Payable date: Sept. 25, 2020

Record date: Sept. 16, 2020

Ex dividend date: Sept. 15, 2020

© 2020 Canjex Publishing Ltd. All rights reserved.

[url=https://peketec.de/trading/viewtopic.php?p=1998049#1998049 schrieb:greenhorn schrieb am 25.08.2020, 09:02 Uhr[/url]"]RB4Robex has operating income of $2.3-million for Q2 sehr gutes Ergebnis......wollen hoffen das die Lage in Mali sich stabilisiert

https://www.stockwatch.com/News/Item?bid=Z-C:RBX-2953070&symbol=RBX®ion=C

2020-08-24 17:16 ET - News Release

Mr. Benjamin Cohen reports

ROBEX RESOURCES INC.: THE NAMPALA MINE CONTINUES ITS GROWTH DESPITE COVID-19

Robex Resources Inc. has released financial results for the quarter ended June 30, 2020.

Highlights of the second quarter of 2020:

GOLD PRODUCTION INCREASED BY 15%

Gold production reached 13,921 ounces compared to 12,089 ounces during the same period in 2019. The 13% increase in the ore processed at the Nampala plant (456,091 tonnes vs. 402,678 tonnes for the second quarter of 2019) and the improved recovery rate (89.5% vs. 86.6% for the same period in 2019) are factors responsible for the industrial production performance.

FOR FINANCIAL SECURITY PURPOSES, TEMPORARY HOLDING OF PART OF THE QUARTERLY PRODUCTION IN GOLD INGOTS

Robex decided to temporarily hold part of the gold produced to prevent potential monetary and banking risks that could arise as a result of the health crisis. During the second quarter of 2020, 6,500 ounces of gold were sold for CAD 15.7 million compared to 11,760 ounces of gold for CAD 20.4 million for the same period in 2019. This decrease is due to the Company temporarily holding gold ingot stocks in Switzerland as of June 30, 2020.

This resulted in a gap between the production of gold ingots and their sale on the market, which delayed the recognition of a portion of net operating income to the third quarter of 2020.

In July, the Company sold all its stock, i.e., 7,831 ounces, for a turnover of approximately CAD 19,4 million.

In practice, this amounts to a theoretical sales figure of CAD 35.1 million for the second quarter of 2020 (CAD 15.7 million in reported sales plus CAD 19.4 million from the sale of gold ingot stocks), representing a 72% increase over the same period in 2019.......

[url=https://peketec.de/trading/viewtopic.php?p=1975113#1975113 schrieb:greenhorn schrieb am 29.05.2020, 10:21 Uhr[/url]"]RB4sehr schöne Entwicklung......... 8)

Robex earns $9.7-million in Q1

https://www.stockwatch.com/News/Item?bid=Z-C:RBX-2912939&symbol=RBX®ion=C

2020-05-28 16:06 ET - News Release

Mr. Benjamin Cohen reports

ROBEX RESOURCES INC. BEGINS YEAR IN STRENGTH WITH FIRST QUARTERLY FINANCIAL RESULTS

Robex Resources Inc. has published its financial results for the quarter ended March 31, 2020.

Highlights for the first quarter of 2020:

32% INCREASE IN GOLD PRODUCTION

The gold production totalled 14,918 ounces compared to 11,291 ounces produced during the same period in 2019. The 12% increase in the quantity of processed ore at the Nampala plant (476,720 tonnes vs 424,561 tonnes for the first quarter of 2019), the improvement of the average recovery rate (88.8% vs 85.0% for the same period in 2019) and the higher average grade of processed ore (1.10 gpt compared to 0.95 gpt for the first quarter of 2019) are all favourable factors for this good quarterly production performance.

The Company is continuing its efforts to optimize its plant in Mali with the objective of reaching a daily production of 5,600 tonnes until the end of 2020. In addition, work is underway to add a crushing circuit to the crusher's milling circuit.

64% INCREASE IN REVENUE

During the first quarter of 2020, 14,646 ounces of gold were sold for CAD 30.9 million compared to 10,935 ounces of gold for CAD 18.9 million for the same period in 2019. The quantity produced being greater than the quantity sold is attributable to the time delay between casting and refining gold ingots.

SIGNIFICANT INCREASE IN NET INCOME ATTRIBUTABLE TO SHAREHOLDERS FOR THIS QUARTER OF CAD 8.9 MILLION

The Company achieved net income attributable to shareholders of CAD 9.7 million (CAD 0.017 per share), including CAD 7.4 million in amortization of the book value of fixed assets for this quarter, compared to CAD 0.8 million (CAD 0.001 per share) for the same period in 2019.

DECREASE IN THE TOTAL CASH COST1 OF 21%, I.E. CAD 560 PER ONCE SOLD FOR THE FIRST QUARTER OF 2020 COMPARED TO CAD 706 PER ONCE SOLD FOR THE SAME PERIOD IN 2019

The constant improvement of the Nampala plant and its organization now allow us, among other things, to integrate preventive maintenance program, thereby reducing costs and unplanned shutdowns and therefore significantly reducing the total cash cost1 of an ounce of gold.

143% INCREASE IN CASH FLOWS FROM OPERATING ACTIVITIES2

The operating activities of the Company generated cash flows of CAD 18.7 million (CAD 0.032 per share3) compared to CAD 7.7 million (CAD 0.013 per share3) for the same period in 2019. Cash flows are 60% higher than overall revenue.

IMPROVEMENT OF THE WORKING CAPITAL OF CAD 2.4 MILLION AS AT MARCH 31, 2020 COMPARED TO DECEMBER 31, 2019, AND THIS, CONSIDERING THE DECLARED DIVIDEND OF CAD 11.6 MILLION AND PAID ON APRIL 7, 2020.

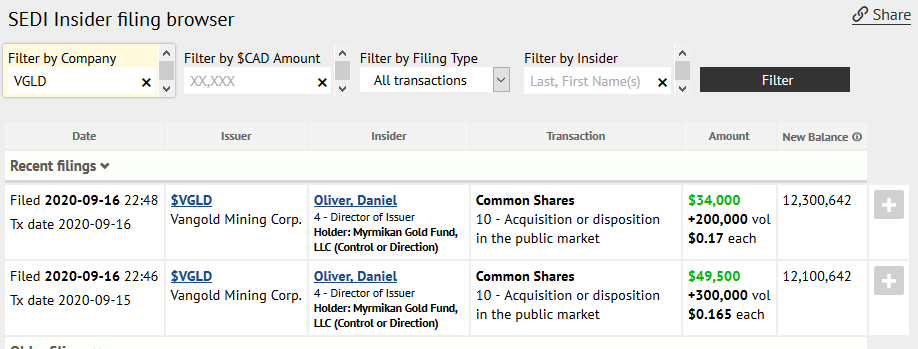

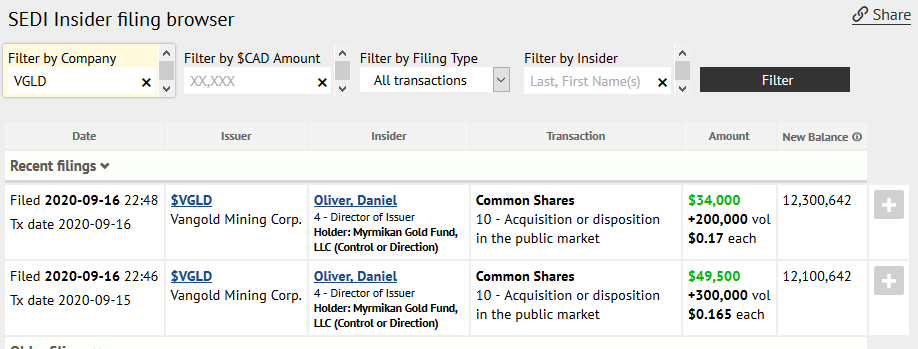

Vangold Mining E35C gestern mit einem ausführlichen Explorations Update und Insiderkäufen (500k).

VanGold Mining Provides Exploration Update

Samples extensive vein exposure

VANCOUVER, BC / ACCESSWIRE / September 16, 2020 / VanGold Mining Corp (the "Company" or "VanGold") (TSXV:VGLD) is providing an update on progress from its on-going exploration of the El Pinguico silver and gold project located 7km south of Guanajuato, Mexico.

El Pinguico Shaft / Sampling of Exposed Vein:

The excavation of the El Pinguico shaft was paused during the week of September 7th to allow crews to safely access and sample material from exposed areas of the El Pinguico vein in the vicinity of the shaft. Crews have observed and sampled approximately 40m of vertical extent of the vein extending from the 4th to the 6th level and in close proximity to the company's underground stockpile (see note at end of release). This vein exposure has now been channel sampled every 4m along the vertical extent of the exposure. Samples are being sent to SGS Labs in Durango, Mexico for analysis; assay results will be released once they are received and interpreted by VanGold geologists and engineers. Excavation of the remaining material that continues to block access to Level 7, where it intersects the El Pinguico shaft, will continue during the week of September 21, 2020. Click here to watch Aug.30 video of the El Pinguico Shaft Excavation.

Clearing Access of #7 Adit Portal:

Access to the #7 adit is also blocked approximately 75m from its portal by what the Company thinks is a relatively superficial rock fall, as it occurs at a mapped fault, and at a change of rock type (andesites to rhyolites). The company is utilizing a mechanized scoop-tram to aid in the removal of this material and will begin to re-enforce the back or ‘roof' of the adit with steel beams at the area of the collapse. Company Director and mining engineer Hernan Dorado commented: "If this cave-in is indeed superficial in nature, and if the #7 adit resembles the #4 adit above it, we may be able to access approximately 1.2km of open adit all the way to the intersection of the #7 adit and the El Pinguico shaft. Accessing this level will also allow greater flexibility in choosing drill targets in the months ahead and would open potential alternatives for the future extraction of the underground stockpile."

Additional Geological Tasks:

Crews have undertaken several other tasks to explore the property and to prepare for underground and surface drilling planned for later in the season. These tasks include: