App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

Taseko notes court ruling in favour of Florence Copper

https://www.stockwatch.com/News/Item/Z-C!TKO-3052264/C/TKO

2021-03-23 19:58 ET - News Release

Mr. Russell Hallbauer reports

TASEKO MINES: COURT OF APPEAL DECIDES IN FAVOR OF FLORENCE COPPER

Taseko Mines Ltd. has noted a decision released today by the Arizona Court of Appeals has confirmed all aspects of the Superior Court of Arizona's (lower court) 2019 decision in favour of Florence Copper, rejected every argument made by the Town of Florence's lawyers in their appeal of the lower court's ruling, upheld Florence Copper's right to mine its private property within the town, and confirmed the awarding of $1.7-million in legal fees and costs to Florence Copper.

"We are certainly happy with the appellate court decision which draws to a close all outstanding litigation brought by the Town," said Stuart McDonald, president of Taseko. "While it is the outcome we expected, the closure this decision brings is important for not only for the company, but for all those who benefit from the social and economic contribution we are making to the region."

Today's decision marks the latest in a series of important milestones:

The legal challenges initiated by previous town councils have run their course with every decision in Florence Copper's favour.

One of the two key permits necessary for commercial operations has been granted by the Arizona Department of Environmental Quality, and the federal Environmental Protection Agency is taking the final steps required to issue the second key operating permit.

The success of the recent bond offering means capital requirements for commercial production are in hand.

Final design and engineering of the commercial in situ production facility as well as procurement of certain critical components are under way.

We seek Safe Harbor.

© 2021 Canjex Publishing Ltd. All rights reserved.

https://www.stockwatch.com/News/Item/Z-C!TKO-3052264/C/TKO

2021-03-23 19:58 ET - News Release

Mr. Russell Hallbauer reports

TASEKO MINES: COURT OF APPEAL DECIDES IN FAVOR OF FLORENCE COPPER

Taseko Mines Ltd. has noted a decision released today by the Arizona Court of Appeals has confirmed all aspects of the Superior Court of Arizona's (lower court) 2019 decision in favour of Florence Copper, rejected every argument made by the Town of Florence's lawyers in their appeal of the lower court's ruling, upheld Florence Copper's right to mine its private property within the town, and confirmed the awarding of $1.7-million in legal fees and costs to Florence Copper.

"We are certainly happy with the appellate court decision which draws to a close all outstanding litigation brought by the Town," said Stuart McDonald, president of Taseko. "While it is the outcome we expected, the closure this decision brings is important for not only for the company, but for all those who benefit from the social and economic contribution we are making to the region."

Today's decision marks the latest in a series of important milestones:

The legal challenges initiated by previous town councils have run their course with every decision in Florence Copper's favour.

One of the two key permits necessary for commercial operations has been granted by the Arizona Department of Environmental Quality, and the federal Environmental Protection Agency is taking the final steps required to issue the second key operating permit.

The success of the recent bond offering means capital requirements for commercial production are in hand.

Final design and engineering of the commercial in situ production facility as well as procurement of certain critical components are under way.

We seek Safe Harbor.

© 2021 Canjex Publishing Ltd. All rights reserved.

MAG Silver Corp. MQ8: gestern noch bis 15.33$ gefallen.

[url=https://peketec.de/trading/viewtopic.php?p=2062270#2062270 schrieb:wicki99 schrieb am 23.03.2021, 15:41 Uhr[/url]"]MAG Silver Corp. MQ8: short-fortsetzung. tt bei 15.67$. kein wunder, gold und silber schwingen auch ab.

[url=https://peketec.de/trading/viewtopic.php?p=2062212#2062212 schrieb:wicki99 schrieb am 23.03.2021, 14:20 Uhr[/url]"]MAG Silver Corp. MQ8: bemüht sich den märz hindurch mit einer bodenbildung. oberhalb der 17$-marke wäre mal platz bis 17.80$ / 18.00$. aktuell noch in der findungsphase, könnte aber auch flott stärker abrauchen, short-ziele dann über 14.80$ bis 14.00$. sma200 um 16.40$ als ergänzender bremsklotz richtung norden.

» zur Grafik

MAG Silver Corp. focuses on the acquisition, exploration, and development of mineral properties primarily in the Americas. The company explores for silver, gold, lead, and zinc deposits. It primarily holds 44% interest in the Juanicipio project located in the Fresnillo District, Zacatecas State, Mexico. The company is headquartered in Vancouver, Canada.

Aemetis, Inc.: gestern und heute mit neuen hochs (th: 27.44$), tageskerzen auch jetzt wieder mit langen dochten (flotter abverkauf der hochkurse). gestern bei 22.55$ im tt. warte hier auf short-gelegenheit, allerdings gut unterstützt zwischen 22$ und 20$. aktueller handel um 26$.

[url=https://peketec.de/trading/viewtopic.php?p=2062252#2062252 schrieb:wicki99 schrieb am 23.03.2021, 15:15 Uhr[/url]"]Aemetis, Inc.: short war nix. support hat gehalten, th bei 25.70$.

[url=https://peketec.de/trading/viewtopic.php?p=2060482#2060482 schrieb:wicki99 schrieb am 16.03.2021, 19:38 Uhr[/url]"]Aemetis, Inc.: Energy | Oil & Gas Refining & Marketing | USA

hat im märz ordentlich gas gegeben. long-trend intakt. allerdings gefallen mir die beiden letzten tageskerzen gar nicht. aktuell fällt der kurs auf ein tt von 18.60$. der kurs ist bis rund 18$ auf tagesbasis gut unterstützt. sollten kurse nachhaltig unter 18$ fallen und verharren, könnten hier schnelle short-$$ bis 14$ drin sein. aber man sollte sich gewahr sein, ich spreche hier von einem antizyklischen short, das risiko daher auch entsprechend gewählt werden (nicht dass man zum bullen-futter gedreht wird).

» zur Grafik

Chart looks very good and will be in my next update, but it might break out before than. A nice wedge pattern and an upside break out could come at any time. Bids look strong around 150k and only 50k on offer under $0.27.

oel/gas-futures: wti-crude lief ein wenig weit (tt: 57.29$), aber dafür kommt phönix aus der asche gestärkt hervor (th: 60.78$).

[url=https://peketec.de/trading/viewtopic.php?p=2062215#2062215 schrieb:wicki99 schrieb am 23.03.2021, 14:29 Uhr[/url]"]oel/gas-futures: bei wti-crude ging es dann flott. tt bei 58.47$. long-chart inzwischen angeschlagen. die shorties gewinnen an kraft. eine neutralisation der lage ergibt sich bei kursen oberhalb von 62.00$ / 62.30$. derzeit handelt der markt den mai-kontrakt um 59.00$.

[url=https://peketec.de/trading/viewtopic.php?p=2061399#2061399 schrieb:wicki99 schrieb am 19.03.2021, 10:31 Uhr[/url]"]oel/gas-futures wurden gestern ja noch ordentlich durchgeschüttelt. wti-crude im tief bei 58.28 $ gelandet (th 64.88 $), satter 10%iger intraday-abschwung. starker support in der zone um 58$ / 59$. darunter eröffnet sich bären-land und eine chance, shorts bis an die nächste unterstützungszone um 54$ zu treiben. derzeit handelt wti um 61$.

=> gute trades und an der stelle schon mal ein schönes wochenende!

[url=https://peketec.de/trading/viewtopic.php?p=2061194#2061194 schrieb:wicki99 schrieb am 18.03.2021, 15:52 Uhr[/url]"]oel/gas-futures im sinkflug ...

» zur Grafik » zur Grafik » zur Grafik

kupfer: in meinen augen kündigt sich hier ein möglicher short-swing an. der erste märz-dip unter die 4.0000$ wurden aufgefangen. danach wurde durch den restlichen märz zwischen 4.1500$ und rund 4.2200$ gemauert. erst darüber mit verstärkten long-avancen. nachhaltige kurse unter 4.0000$ ergeben erste short-ziele bis 3.8500$ und 3.7500$. darunter lacen die 3.5000$. derzeit handelt der future um 4.0400$.

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Jemand FSX auf dem Radar?

Mal sehen, ob der Abverkauf an der 1 CAN$ Marke mal stoppt...

Mal sehen, ob der Abverkauf an der 1 CAN$ Marke mal stoppt...

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Spanish Mountain continues PFS on Spanish

2021-03-24 10:28 ET - News Release

Mr. Larry Yau reports

SPANISH MOUNTAIN PROVIDES PROJECT UPDATE

Spanish Mountain Gold Ltd. has released the latest update on the Spanish Mountain gold project in British Columbia, Canada.

Winter Field Program

As announced in a news release dated January 18, 2021, the Company added a geotechnical drilling program to perform site investigation in areas where winter conditions allow cost-effective access. Under the supervision of the technical team, the drill crew has successfully mobilized and completed six holes planned for two high priority locations. The Company had a contingency plan to proceed with an additional eight holes in other areas in the event that favourable weather conditions were present. As a result of the early arrival of warm weather at the project site, the technical team had suspended the program as the targeted cost advantage no longer existed and will resume the work during a summer field season. There will be no impact on the Project's overall timeline as a result of this schedule change.

As in previous field programs, the health and safety protocol developed and enforced by management has successfully safeguarded the health of staff, consultants and community members. There were no reported cases of COVID diagnosis or transmission throughout the program.

Preliminary Feasibility Study

The Project's consultants and qualified persons are at the final stage of tabulating the results of the Preliminary Feasibility Study (PFS), which will be announced as soon as it is available and in any case no later than the second quarter. The PFS will also delineate a Mineral Reserve for the Project.

.......

https://www.stockwatch.com/News/Item/Z-C!SPA-3052646/C/SPA

Ganz schlimm!

Hab ja noch den Spin out LVX 3 Jahre im Depot. Der Kursverlauf ist ähnlich.

Mir ein Rätsel, wieso die so eingebrochen sind!

Hab ja noch den Spin out LVX 3 Jahre im Depot. Der Kursverlauf ist ähnlich.

Mir ein Rätsel, wieso die so eingebrochen sind!

[url=https://peketec.de/trading/viewtopic.php?p=2062796#2062796 schrieb:Kostolanys Erbe schrieb am 24.03.2021, 20:57 Uhr[/url]"]Jemand FSX auf dem Radar?

Mal sehen, ob der Abverkauf an der 1 CAN$ Marke mal stoppt...

» zur Grafik

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Dabei guten Cashbestand ca. 30 Mio. CAN$

MARKETCAP 77 Mio. CAN$

MARKETCAP 77 Mio. CAN$

[url=https://peketec.de/trading/viewtopic.php?p=2062843#2062843 schrieb:600 schrieb am 25.03.2021, 07:41 Uhr[/url]"]Ganz schlimm!

Hab ja noch den Spin out LVX 3 Jahre im Depot. Der Kursverlauf ist ähnlich.

Mir ein Rätsel, wieso die so eingebrochen sind!

[url=https://peketec.de/trading/viewtopic.php?p=2062796#2062796 schrieb:Kostolanys Erbe schrieb am 24.03.2021, 20:57 Uhr[/url]"]Jemand FSX auf dem Radar?

Mal sehen, ob der Abverkauf an der 1 CAN$ Marke mal stoppt...

» zur Grafik

kupfer: nimmt konturen an. th bei 4.0460$, tt bei 3.9525$. na also, geht doch auch short ...

[url=https://peketec.de/trading/viewtopic.php?p=2062744#2062744 schrieb:wicki99 schrieb am 24.03.2021, 18:56 Uhr[/url]"]kupfer: in meinen augen kündigt sich hier ein möglicher short-swing an. der erste märz-dip unter die 4.0000$ wurden aufgefangen. danach wurde durch den restlichen märz zwischen 4.1500$ und rund 4.2200$ gemauert. erst darüber mit verstärkten long-avancen. nachhaltige kurse unter 4.0000$ ergeben erste short-ziele bis 3.8500$ und 3.7500$. darunter lacen die 3.5000$. derzeit handelt der future um 4.0400$.

» zur Grafik

Resources Technology and Critical Minerals Processing

https://www.industry.gov.au/sites/d...-national-manufacturing-priority-road-map.pdf

https://www.industry.gov.au/sites/d...-national-manufacturing-priority-road-map.pdf

Momentan ist halt noch Saure-Gurken-Zeit bei den Minern.

Warten wir auf die nächste Ausgabe

Warten wir auf die nächste Ausgabe

[url=https://peketec.de/trading/viewtopic.php?p=2062985#2062985 schrieb:Kostolanys Erbe schrieb am 25.03.2021, 12:04 Uhr[/url]"]Dabei guten Cashbestand ca. 30 Mio. CAN$

MARKETCAP 77 Mio. CAN$

[url=https://peketec.de/trading/viewtopic.php?p=2062843#2062843 schrieb:600 schrieb am 25.03.2021, 07:41 Uhr[/url]"]Ganz schlimm!

Hab ja noch den Spin out LVX 3 Jahre im Depot. Der Kursverlauf ist ähnlich.

Mir ein Rätsel, wieso die so eingebrochen sind!

[url=https://peketec.de/trading/viewtopic.php?p=2062796#2062796 schrieb:Kostolanys Erbe schrieb am 24.03.2021, 20:57 Uhr[/url]"]Jemand FSX auf dem Radar?

Mal sehen, ob der Abverkauf an der 1 CAN$ Marke mal stoppt...

» zur Grafik

Aemetis, Inc.: aktuelles tt bei 20.39$.

[url=https://peketec.de/trading/viewtopic.php?p=2062666#2062666 schrieb:wicki99 schrieb am 24.03.2021, 15:13 Uhr[/url]"]Aemetis, Inc.: gestern und heute mit neuen hochs (th: 27.44$), tageskerzen auch jetzt wieder mit langen dochten (flotter abverkauf der hochkurse). gestern bei 22.55$ im tt. warte hier auf short-gelegenheit, allerdings gut unterstützt zwischen 22$ und 20$. aktueller handel um 26$.

[url=https://peketec.de/trading/viewtopic.php?p=2062252#2062252 schrieb:wicki99 schrieb am 23.03.2021, 15:15 Uhr[/url]"]Aemetis, Inc.: short war nix. support hat gehalten, th bei 25.70$.

[url=https://peketec.de/trading/viewtopic.php?p=2060482#2060482 schrieb:wicki99 schrieb am 16.03.2021, 19:38 Uhr[/url]"]Aemetis, Inc.: Energy | Oil & Gas Refining & Marketing | USA

hat im märz ordentlich gas gegeben. long-trend intakt. allerdings gefallen mir die beiden letzten tageskerzen gar nicht. aktuell fällt der kurs auf ein tt von 18.60$. der kurs ist bis rund 18$ auf tagesbasis gut unterstützt. sollten kurse nachhaltig unter 18$ fallen und verharren, könnten hier schnelle short-$$ bis 14$ drin sein. aber man sollte sich gewahr sein, ich spreche hier von einem antizyklischen short, das risiko daher auch entsprechend gewählt werden (nicht dass man zum bullen-futter gedreht wird).

» zur Grafik

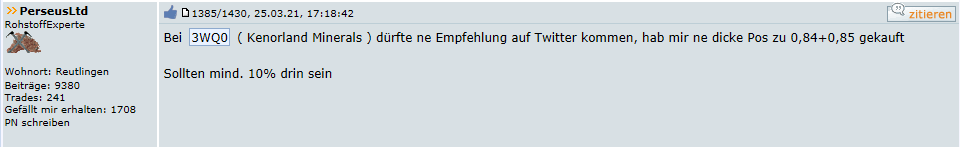

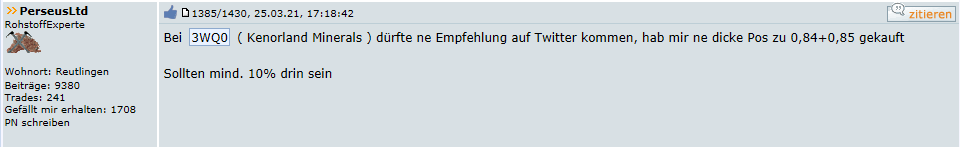

Größere Pos KLD zu 0,84+0,85 gekauft

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

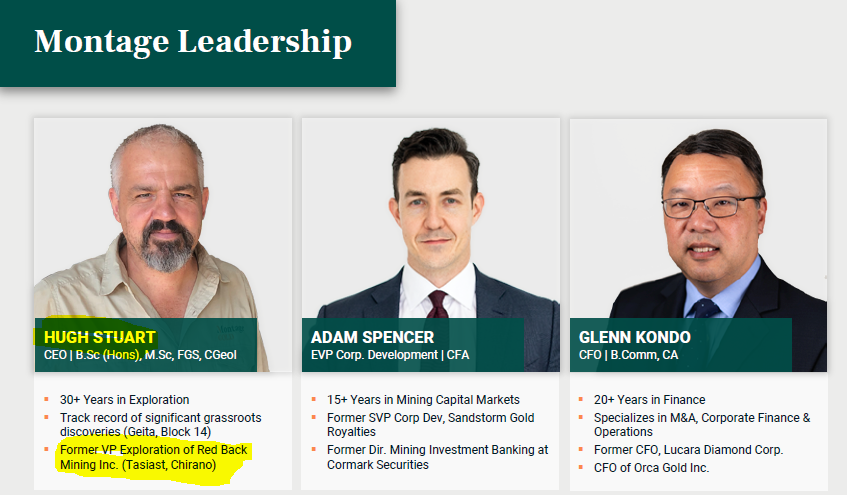

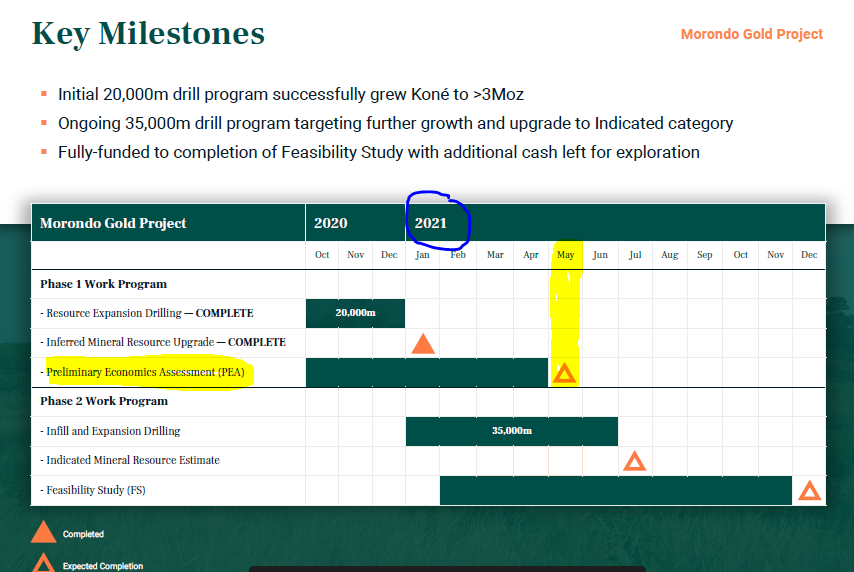

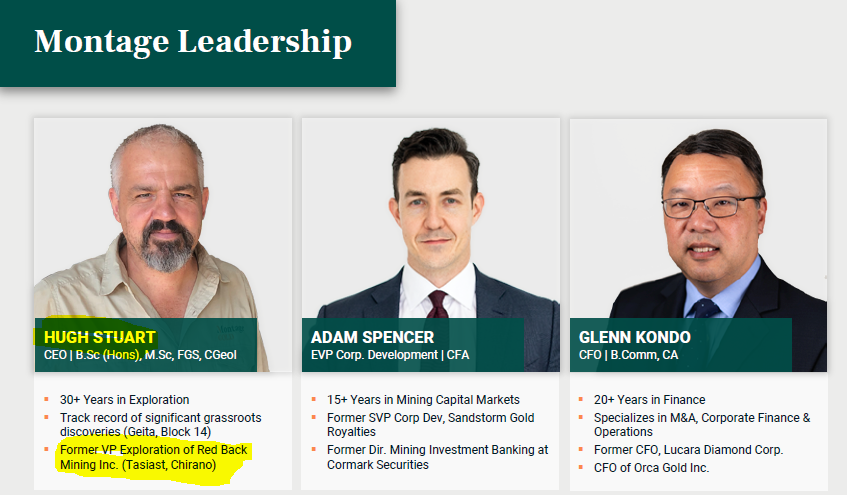

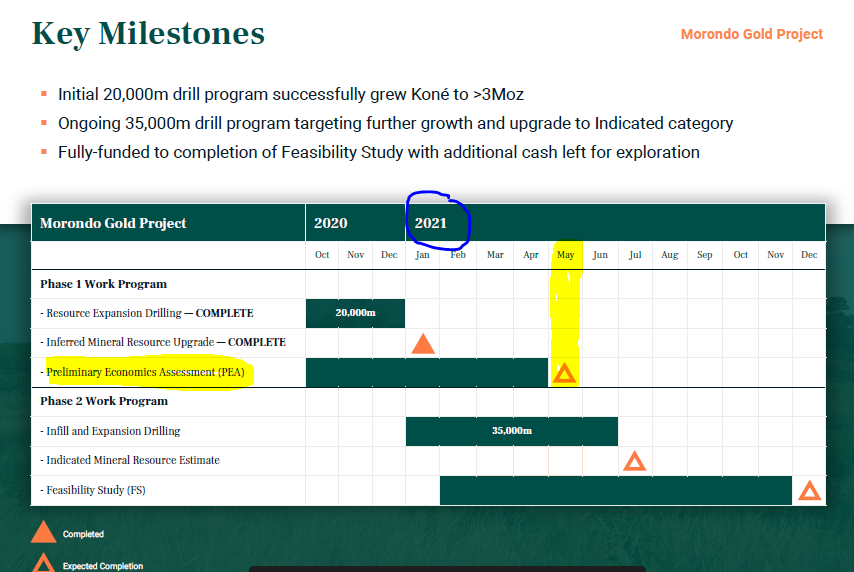

Heute erste Position CA:MAU gekauft.

https://www.montagegoldcorp.com/

Marketcap: 72 Mio. CAN$

Cash: 30 Mio. CAN$

Unzen: Koné Deposit >3Moz with room to grow

Management:

Aktuelle Präsentation:

https://www.montagegoldcorp.com/_resources/presentations/corporate-presentation.pdf?v=0.227

Letzte News:

Montage drills 79.2 m of 1.55 g/t Au at Morondo

2021-03-17 06:48 ET - News Release

Mr. Hugh Stuart reports

MONTAGE REPORTS POSITIVE INFILL DRILL RESULTS INCLUDING 79.2M AT 1.55G/T AND PROVIDES PEA UPDATE

Montage Gold Corp. has released initial results from its continuing 35,000-metre infill drill program at the Morondo gold project (MGP) in Ivory Coast.

https://www.stockwatch.com/News/Item/Z-C!MAU-3048897/C/MAU

Charttechnisch hoffe ich auf eine W-Formation....

https://www.montagegoldcorp.com/

Marketcap: 72 Mio. CAN$

Cash: 30 Mio. CAN$

Unzen: Koné Deposit >3Moz with room to grow

Management:

Aktuelle Präsentation:

https://www.montagegoldcorp.com/_resources/presentations/corporate-presentation.pdf?v=0.227

Letzte News:

Montage drills 79.2 m of 1.55 g/t Au at Morondo

2021-03-17 06:48 ET - News Release

Mr. Hugh Stuart reports

MONTAGE REPORTS POSITIVE INFILL DRILL RESULTS INCLUDING 79.2M AT 1.55G/T AND PROVIDES PEA UPDATE

Montage Gold Corp. has released initial results from its continuing 35,000-metre infill drill program at the Morondo gold project (MGP) in Ivory Coast.

https://www.stockwatch.com/News/Item/Z-C!MAU-3048897/C/MAU

Charttechnisch hoffe ich auf eine W-Formation....

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Im Tradingroom hast Du das gepostet....

Kannst Du mal den link davon einstellen....oder Text...?

Kannst Du mal den link davon einstellen....oder Text...?

[url=https://peketec.de/trading/viewtopic.php?p=2063133#2063133 schrieb:PerseusLtd schrieb am 25.03.2021, 16:32 Uhr[/url]"]Größere Pos KLD zu 0,84+0,85 gekauft

Gibt keinen Link, bin aber durch Zufall auf der Seite des Users GOLDFEVER gewesen und hab gesehen das er heute ne dicke Pos genommen hat. Ist aber bisher nur auf seiner Seite zu sehen. Wenn das über Twitter gespostet wird, dürfte es abgehen ( 42k Follower)...

[url=https://peketec.de/trading/viewtopic.php?p=2063218#2063218 schrieb:Kostolanys Erbe schrieb am 25.03.2021, 18:54 Uhr[/url]"]Im Tradingroom hast Du das gepostet....

» zur Grafik

Kannst Du mal den link davon einstellen....oder Text...?

[url=https://peketec.de/trading/viewtopic.php?p=2063133#2063133 schrieb:PerseusLtd schrieb am 25.03.2021, 16:32 Uhr[/url]"]Größere Pos KLD zu 0,84+0,85 gekauft

18p

2021-03-26 08:07 ET - News Release

https://www.stockwatch.com/News/Item/Z-C!FCC-3053873/C/FCC

Mr. Trent Mell reports

FIRST COBALT TO ISSUE SHARES TO GLENCORE IN REPAYMENT OF LOAN

First Cobalt Corp. has entered into a loan amendment agreement with Glencore AG on March 25, 2021, to repay an existing loan of approximately $5.5-million (U.S.) of debt by issuing common shares of the company. The common shares to be issued to Glencore in connection with the repayment of the loan represents approximately 4.8% of the current outstanding shares of First Cobalt.

In August 2019, First Cobalt entered into a loan agreement with Glencore to fund engineering studies, metallurgical testwork and permitting activities for an expansion of the Company's refinery in Ontario, Canada to produce battery grade cobalt sulfate. The loan bears interest at LIBOR plus 5%, with all accrued interest having been capitalized to date. The loan agreement includes a right (the "conversion right") for Glencore to convert all or a portion of the balance owing into common shares at a discount of 15% of the "market price" of the common shares (determined with reference to the policies of the TSX Venture Exchange) on the maturity date of August 23, 2022. The loan agreement provides the Company with the right to prepay the loan prior to maturity. The amendments expressly permit First Cobalt to repay the loan by issuing common shares on broadly similar terms to the conversion right.

Specifically, under the terms of today's amending agreement, the Company and Glencore have agreed to expressly allow the Company to voluntarily repay all amounts outstanding through the issuance of common shares. Accordingly, the Company and Glencore have agreed that, subject to the terms of the amended loan agreement, the Company may repay the loan representing an outstanding debt of US$5,505,830 by issuing 23,849,737 common shares at a deemed price of $0.29 per share and the Company has provided Glencore with notice that, subject to the terms of the amended loan agreement, the Company intends to repay all such amounts outstanding under the loan by issuing common shares.

The deemed price per common share represents a 15% discount to the closing trading price of the common shares on the TSXV on March 24, 2021, the trading date immediately prior to the agreement date. The U.S. dollar denominated debt was converted from United States dollars into Canadian dollars using an exchange of US$1 = CDN$1.2562, representing the average daily exchange rate for United States dollars in terms of Canadian dollars presented by the Bank of Canada on March 24, 2021.

Trent Mell, President & Chief Executive Officer, commented:

"We are appreciative of Glencore's ongoing support for our strategy of producing the world's most sustainable cobalt and establishing First Cobalt as the only North American producer of cobalt for the EV market. This transaction will eliminate all corporate debt ahead of a financing package that is being negotiated for the refinery expansion and frees up the security package associated with the refinery. Glencore has been a valuable partner and a significant contributor to the success of First Cobalt to date and we are excited to deliver value to them as shareholders of the Company moving forward."

The Company has raised significant funds to date through a $10 million joint investment from the Government of Ontario and Government of Canada, a $10 million equity raise, a $4 million asset sale and more than $7 million in early warrant exercises. The financing process for the debt portion of the refinery financing plan is in progress, remains on schedule, and is expected to provide the remaining funding required for the project to be fully financed.

Completion of the repayment of the loan contemplated by the amendment to the loan agreement and related notice is subject to, among other things, obtaining necessary regulatory approvals, including acceptance of the TSXV under TSXV Policy 4.3 -- Shares for Debt. The Company has entered into this loan amendment agreement to settle outstanding debt for shares in order to preserve cash and reduce the amount of project debt required to fully finance the refinery project.

The Company is in the process of seeking to obtain the necessary regulatory approvals.

2021-03-26 08:07 ET - News Release

https://www.stockwatch.com/News/Item/Z-C!FCC-3053873/C/FCC

Mr. Trent Mell reports

FIRST COBALT TO ISSUE SHARES TO GLENCORE IN REPAYMENT OF LOAN

First Cobalt Corp. has entered into a loan amendment agreement with Glencore AG on March 25, 2021, to repay an existing loan of approximately $5.5-million (U.S.) of debt by issuing common shares of the company. The common shares to be issued to Glencore in connection with the repayment of the loan represents approximately 4.8% of the current outstanding shares of First Cobalt.

In August 2019, First Cobalt entered into a loan agreement with Glencore to fund engineering studies, metallurgical testwork and permitting activities for an expansion of the Company's refinery in Ontario, Canada to produce battery grade cobalt sulfate. The loan bears interest at LIBOR plus 5%, with all accrued interest having been capitalized to date. The loan agreement includes a right (the "conversion right") for Glencore to convert all or a portion of the balance owing into common shares at a discount of 15% of the "market price" of the common shares (determined with reference to the policies of the TSX Venture Exchange) on the maturity date of August 23, 2022. The loan agreement provides the Company with the right to prepay the loan prior to maturity. The amendments expressly permit First Cobalt to repay the loan by issuing common shares on broadly similar terms to the conversion right.

Specifically, under the terms of today's amending agreement, the Company and Glencore have agreed to expressly allow the Company to voluntarily repay all amounts outstanding through the issuance of common shares. Accordingly, the Company and Glencore have agreed that, subject to the terms of the amended loan agreement, the Company may repay the loan representing an outstanding debt of US$5,505,830 by issuing 23,849,737 common shares at a deemed price of $0.29 per share and the Company has provided Glencore with notice that, subject to the terms of the amended loan agreement, the Company intends to repay all such amounts outstanding under the loan by issuing common shares.

The deemed price per common share represents a 15% discount to the closing trading price of the common shares on the TSXV on March 24, 2021, the trading date immediately prior to the agreement date. The U.S. dollar denominated debt was converted from United States dollars into Canadian dollars using an exchange of US$1 = CDN$1.2562, representing the average daily exchange rate for United States dollars in terms of Canadian dollars presented by the Bank of Canada on March 24, 2021.

Trent Mell, President & Chief Executive Officer, commented:

"We are appreciative of Glencore's ongoing support for our strategy of producing the world's most sustainable cobalt and establishing First Cobalt as the only North American producer of cobalt for the EV market. This transaction will eliminate all corporate debt ahead of a financing package that is being negotiated for the refinery expansion and frees up the security package associated with the refinery. Glencore has been a valuable partner and a significant contributor to the success of First Cobalt to date and we are excited to deliver value to them as shareholders of the Company moving forward."

The Company has raised significant funds to date through a $10 million joint investment from the Government of Ontario and Government of Canada, a $10 million equity raise, a $4 million asset sale and more than $7 million in early warrant exercises. The financing process for the debt portion of the refinery financing plan is in progress, remains on schedule, and is expected to provide the remaining funding required for the project to be fully financed.

Completion of the repayment of the loan contemplated by the amendment to the loan agreement and related notice is subject to, among other things, obtaining necessary regulatory approvals, including acceptance of the TSXV under TSXV Policy 4.3 -- Shares for Debt. The Company has entered into this loan amendment agreement to settle outstanding debt for shares in order to preserve cash and reduce the amount of project debt required to fully finance the refinery project.

The Company is in the process of seeking to obtain the necessary regulatory approvals.

Denke da sehen wir kommende Woche Resultate. Mark.cap fast auf Mantelniveau

[url=https://peketec.de/trading/viewtopic.php?p=2061462#2061462 schrieb:PerseusLtd schrieb am 19.03.2021, 13:55 Uhr[/url]"]Hab da gut gesammelt die letzten Wochen, Market.cap gefällt mir

[url=https://peketec.de/trading/viewtopic.php?p=2061459#2061459 schrieb:Fischlaender schrieb am 19.03.2021, 13:42 Uhr[/url]"]DMR

What made me risk a substantial amount is the visual comparison of the due diligence sampling results the company conducted in 2020 http://www.damaragoldcorp.com/uploads/1/0/4/8/104823939/dmrnr101920.pdf .

Key factors are that the very high grades are carried in bull quartz with rusty features Bilddatei

These are all similar features of the core displayed in the February 2021 news http://www.damaragoldcorp.com/2020drillprogram.html so there is a pretty decent chance we see similar grades in the cores. What can also have slowed down the lab return is that if they indeed had similar grades they would probably run control assays.

Deal rückt wohl näher, Talisker diese Woche mit einem PP und somit reichlich Kohle im Sack

Denke zwischen 0,09 - 0,10 wird es ablaufen

Denke zwischen 0,09 - 0,10 wird es ablaufen

[url=https://peketec.de/trading/viewtopic.php?p=2054675#2054675 schrieb:PerseusLtd schrieb am 25.02.2021, 13:54 Uhr[/url]"]Nach Vangold ist New Carolin Gold ( LAD ) meine mittlerweile 2.größte Position.

LAD CEO Ken Holmes und TSK CEO Terry Harbourt wurden vor 10 Tagen bei einem offenbar sehr vergnügten und einvernehmlichen Dinner über mehrere Stunden in einem Nobelrestaurant in Vancouver gesehen. Was es bedeutet, keine Ahnung. Aber LAD's Kursverlauf lässt einiges vermuten.

https://twitter.com/CastleMarkets/status/1364691614405287937?s=20

TKO - für meine Begriffe nicht die schlechteste Entscheidung

2021-03-29 08:30 ET - News Release

Taseko Mines Extends Copper Price Protection Strategy

https://www.stockwatch.com/News/Item/Z-C!TKO-3054611/C/TKO

Canada NewsWire

VANCOUVER, BC, March 29, 2021

VANCOUVER, BC, March 29, 2021 /CNW/ - Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) ("Taseko" or the "Company") announces that it has recently extended its copper price protection strategy by purchasing put options covering 41 million pounds of copper at a strike price of US$3.75 per pound for the second half of this year. The price protection now in place for the next nine months should secure a minimum operating margin of approximately C$165 million* for 2021.

Stuart McDonald, President of Taseko, commented, "With the uncertainty in the world today around the impacts of Covid-19, and ongoing volatility in metal markets caused by a number of global economic and political issues, we felt that it was prudent to extend our price protection strategy. Protecting a significant operating margin in 2021 allows the Company to focus on and advance near-term capital growth plans related to our Florence Copper Project, and also fund ongoing Environmental Assessment work at our Yellowhead Project. This approach to managing copper price volatility does not cap our cash flow should copper prices continue to rise, as many of the world's largest banks and trading entities are indicating could occur."

"Taseko's experienced senior management team, many of whom have been involved with and observed the base metals business for over 40 years, has been consistent in managing the financial performance of the Company. The team's decisions have held the Company in good stead over the past decade and protected shareholder value at all points of the copper price cycle, and we will continue to protect against downside risks while positioning the Company for success in a strong copper market in the years ahead," concluded Mr. McDonald.

Russell Hallbauer

Chief Executive Officer and Director

2021-03-29 08:30 ET - News Release

Taseko Mines Extends Copper Price Protection Strategy

https://www.stockwatch.com/News/Item/Z-C!TKO-3054611/C/TKO

Canada NewsWire

VANCOUVER, BC, March 29, 2021

VANCOUVER, BC, March 29, 2021 /CNW/ - Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) ("Taseko" or the "Company") announces that it has recently extended its copper price protection strategy by purchasing put options covering 41 million pounds of copper at a strike price of US$3.75 per pound for the second half of this year. The price protection now in place for the next nine months should secure a minimum operating margin of approximately C$165 million* for 2021.

Stuart McDonald, President of Taseko, commented, "With the uncertainty in the world today around the impacts of Covid-19, and ongoing volatility in metal markets caused by a number of global economic and political issues, we felt that it was prudent to extend our price protection strategy. Protecting a significant operating margin in 2021 allows the Company to focus on and advance near-term capital growth plans related to our Florence Copper Project, and also fund ongoing Environmental Assessment work at our Yellowhead Project. This approach to managing copper price volatility does not cap our cash flow should copper prices continue to rise, as many of the world's largest banks and trading entities are indicating could occur."

"Taseko's experienced senior management team, many of whom have been involved with and observed the base metals business for over 40 years, has been consistent in managing the financial performance of the Company. The team's decisions have held the Company in good stead over the past decade and protected shareholder value at all points of the copper price cycle, and we will continue to protect against downside risks while positioning the Company for success in a strong copper market in the years ahead," concluded Mr. McDonald.

Russell Hallbauer

Chief Executive Officer and Director

18P

First Cobalt signs offtake deal with Stratton Metal

https://www.stockwatch.com/News/Item/Z-C!FCC-3054517/C/FCC

2021-03-29 07:44 ET - News Release

Mr. Trent Mell reports

FIRST COBALT CONCLUDES LONG TERM OFFTAKE CONTRACT FOR 100% OF PRODUCTION

First Cobalt Corp. has signed a flexible, long-term, offtake agreement with Stratton Metal Resources Ltd. for the sale of future cobalt sulphate production from the First Cobalt refinery located in Ontario, Canada.

Highlights

First Cobalt will have the option to sell up to 100% of its annual cobalt sulfate production to Stratton Metals once its refinery is in production. Quantities will be determined by First Cobalt in advance of each calendar year and are subject to a minimum annual quantity

Provides flexibility for First Cobalt to enter into offtake contracts with OEMs and their suppliers, reducing amounts made available to Stratton Metals

Contract term of five years matches the term of First Cobalt's feed supply agreements and anticipated term of its credit facility

Sale price will be based on prevailing market price at the time of shipment

This announcement is consistent with the Company's strategy of bringing battery grade cobalt to the North American EV market. The ability to elect the annual quantity sold to Stratton Metals will provide the Company with time and flexibility to advance offtake and battery recycling discussions with potential OEM partners.

"Stratton Metals are among the most knowledgeable cobalt traders in the world, with a network of relationships in every major market", said Trent Mell, President and Chief Executive Officer. "This sales arrangement is a key milestone for the Company as firming up commercial arrangements supports the financing process for the refinery expansion. Refinery commissioning remains on schedule for October 2022. We look forward to working with Stratton to supply the world's most sustainable cobalt to the electric vehicle market."

The five-year offtake contract matches the expected term of a project debt facility currently being negotiated as well as long-term arrangements for refinery feedstock. In January 2021, First Cobalt concluded five-year cobalt hydroxide feed purchase arrangements with Glencore AG and IXM SA. The offtake arrangement with Stratton represents a long-term partnership arrangement that will assist First Cobalt as it enters the cobalt sulfate market and qualifies its product with various cathode and battery cell manufacturers. Stratton Metals will be paid a fee relating to the cobalt sulfate sales made under this agreement.

First Cobalt intends to market a premium brand of cobalt that is ethically sourced and has one of the lowest (and potentially the lowest) greenhouse gas emissions in the industry. First Cobalt will continue to partner with leaders in the cobalt industry to produce a premium, sustainable source of cobalt for the rapidly growing EV market.

First Cobalt signs offtake deal with Stratton Metal

https://www.stockwatch.com/News/Item/Z-C!FCC-3054517/C/FCC

2021-03-29 07:44 ET - News Release

Mr. Trent Mell reports

FIRST COBALT CONCLUDES LONG TERM OFFTAKE CONTRACT FOR 100% OF PRODUCTION

First Cobalt Corp. has signed a flexible, long-term, offtake agreement with Stratton Metal Resources Ltd. for the sale of future cobalt sulphate production from the First Cobalt refinery located in Ontario, Canada.

Highlights

First Cobalt will have the option to sell up to 100% of its annual cobalt sulfate production to Stratton Metals once its refinery is in production. Quantities will be determined by First Cobalt in advance of each calendar year and are subject to a minimum annual quantity

Provides flexibility for First Cobalt to enter into offtake contracts with OEMs and their suppliers, reducing amounts made available to Stratton Metals

Contract term of five years matches the term of First Cobalt's feed supply agreements and anticipated term of its credit facility

Sale price will be based on prevailing market price at the time of shipment

This announcement is consistent with the Company's strategy of bringing battery grade cobalt to the North American EV market. The ability to elect the annual quantity sold to Stratton Metals will provide the Company with time and flexibility to advance offtake and battery recycling discussions with potential OEM partners.

"Stratton Metals are among the most knowledgeable cobalt traders in the world, with a network of relationships in every major market", said Trent Mell, President and Chief Executive Officer. "This sales arrangement is a key milestone for the Company as firming up commercial arrangements supports the financing process for the refinery expansion. Refinery commissioning remains on schedule for October 2022. We look forward to working with Stratton to supply the world's most sustainable cobalt to the electric vehicle market."

The five-year offtake contract matches the expected term of a project debt facility currently being negotiated as well as long-term arrangements for refinery feedstock. In January 2021, First Cobalt concluded five-year cobalt hydroxide feed purchase arrangements with Glencore AG and IXM SA. The offtake arrangement with Stratton represents a long-term partnership arrangement that will assist First Cobalt as it enters the cobalt sulfate market and qualifies its product with various cathode and battery cell manufacturers. Stratton Metals will be paid a fee relating to the cobalt sulfate sales made under this agreement.

First Cobalt intends to market a premium brand of cobalt that is ethically sourced and has one of the lowest (and potentially the lowest) greenhouse gas emissions in the industry. First Cobalt will continue to partner with leaders in the cobalt industry to produce a premium, sustainable source of cobalt for the rapidly growing EV market.