App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

Der 90 %-Öl-Importstopp aus Brüssel oel/gas

Die EU-Staaten haben sich im Streit um das geplante Öl-Embargo gegen Russland auf einen Kompromiss verständigt. Vorerst sollen nur russische Öl-Lieferungen über den Seeweg unterbunden werden. Per Pipeline erfolgende Transporte werden zunächst weiter möglich sein.

Brüssel/ New York (Godmode-Trader.de) - Nach wochenlangem Stillstand haben sich die Staats- und Regierungschefs der Europäischen Union in der Nacht auf Dienstag darauf geeinigt, den größten Teil des Rohölflusses, den sie aus Russland beziehen, abzuschalten. Während die technischen Details noch ausgehandelt werden müssen, unterbindet die Vereinbarung den Kauf von Rohöl und Ölprodukten, die Russland auf dem Seeweg in die EU-Staaten liefert. ...

https://www.godmode-trader.de/artikel/der-90-oel-importstopp-aus-bruessel,11083917

Die EU-Staaten haben sich im Streit um das geplante Öl-Embargo gegen Russland auf einen Kompromiss verständigt. Vorerst sollen nur russische Öl-Lieferungen über den Seeweg unterbunden werden. Per Pipeline erfolgende Transporte werden zunächst weiter möglich sein.

Brüssel/ New York (Godmode-Trader.de) - Nach wochenlangem Stillstand haben sich die Staats- und Regierungschefs der Europäischen Union in der Nacht auf Dienstag darauf geeinigt, den größten Teil des Rohölflusses, den sie aus Russland beziehen, abzuschalten. Während die technischen Details noch ausgehandelt werden müssen, unterbindet die Vereinbarung den Kauf von Rohöl und Ölprodukten, die Russland auf dem Seeweg in die EU-Staaten liefert. ...

https://www.godmode-trader.de/artikel/der-90-oel-importstopp-aus-bruessel,11083917

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Nachtrag:

Monument Mining loses $2.84-million (U.S.) in fiscal Q3

2022-05-30 15:00 ET - News Release

Ms. Cathy Zhai reports

MONUMENT REPORTS THIRD QUARTER FISCAL 2022 ("Q3 FY2022") RESULTS

Monument Mining Ltd. has released its production and financial results for the third quarter of fiscal 2022 and the nine months ended March 31, 2022. All amounts are expressed in United States dollars ("US$") unless otherwise indicated (refer to www.sedar.com for full financial results).

President and CEO Cathy Zhai commented: "In the third quarter our Murchison Gold Project delivered significant assay results from Phase II RC drilling, these results strengthen our resolve that the NOA structure is highly prospective with the potential to expand and upgrade the existing Mineral Resource, which remains open at depth."

Cathy Zhai continued, "Q3 gold production was improved, and operations brought in more cash with a lean profit margin. It is expected that production continues to be volatile at the end of oxide life of mine. All in sustaining costs ("AISC") are trending higher from cutbacks and pre-striping work to get access to residual ore to keep milling before completion of the flotation construction.

"We are focusing on putting the new life of mine into production to resume our revenue level. The Selinsing flotation plant construction reached a 49% completion by the end of Q3 with major progress on the earth works, foundations of reagent building and other flotation areas during the quarter. A delay however of delivery for several long lead items is anticipated primarily due to the Shanghai shut down. Some components are held up at the manufactory in that region and the Shanghai international port. Initial estimated delay may round up to three months".

Third Quarter Highlights:

Murchison Phase 2 drilling completed a week after quarter end with significant RC assay results received;

Selinsing Flotation Plant construction 49.47% completed as anticipated on budget;

Delivery of certain long lead flotation equipment anticipated be delayed due to Shanghai lockdown and worsened world supply chain movement;

Selinsing mining rates adversely impacted by unexpected monsoon season extension, with surrounding region being heavily flooded:

2,423 ounces ("oz") of gold produced (Q3, FY2021: 1,977oz);

3,270oz of gold sold for $6.16 million (Q3, FY2021: 2,523oz for $4.40million);

Average quarterly gold price realized at $1,911/oz (Q3, FY2021: $1,830/oz);

Cash cost per ounce sold was $1,835/oz (Q3, FY2021: $1,315/oz);

Gross margin decreased by 85% to $0.16 million (Q3, FY2021: $1.08 million);

All-in sustaining cost ("AISC") increased to $2,248/oz :shock: :shock: :shock: (Q3, FY2021: $1,458/oz) (section 15 "Non-IFRS Performance Measures").

.......

https://www.stockwatch.com/News/Item/Z-C!MMY-3260173/C/MMY

Monument Mining drills four m of 32 g/t Au at Burnakura

2022-05-30 15:05 ET - News Release

Ms. Cathy Zhai reports

MONUMENT RECEIVES SIGNIFICANT RC RESULTS FROM PHASE 2 DRILLING PROGRAM AT THE MURCHISON GOLD PROJECT

Monument Mining Ltd. has received significant results from the reverse circulation (RC) drilling as a part of the phase 2 exploration program at Burnakura, one of the primary Murchison gold projects in the Meekatharra area in Western Australia.

As part of a two-year exploration program to test the potential for gold discovery, the phase 2 drilling program commenced in November, 2021, following the completion of the phase 1 program in August, 2021 (refer to news release dated Dec. 15, 2021, and Jan. 19, 2022). The phase 2 RC and DD (diamond drilling) drill program was completed in April, 2022. The remaining assay results from the DD component are anticipated over the coming weeks. The company looks forward to updating the market with a comprehensive announcement incorporating the DD and RC drill results.

...

https://www.stockwatch.com/News/Item/Z-C!MMY-3260174/C/MMY

Monument Mining loses $2.84-million (U.S.) in fiscal Q3

2022-05-30 15:00 ET - News Release

Ms. Cathy Zhai reports

MONUMENT REPORTS THIRD QUARTER FISCAL 2022 ("Q3 FY2022") RESULTS

Monument Mining Ltd. has released its production and financial results for the third quarter of fiscal 2022 and the nine months ended March 31, 2022. All amounts are expressed in United States dollars ("US$") unless otherwise indicated (refer to www.sedar.com for full financial results).

President and CEO Cathy Zhai commented: "In the third quarter our Murchison Gold Project delivered significant assay results from Phase II RC drilling, these results strengthen our resolve that the NOA structure is highly prospective with the potential to expand and upgrade the existing Mineral Resource, which remains open at depth."

Cathy Zhai continued, "Q3 gold production was improved, and operations brought in more cash with a lean profit margin. It is expected that production continues to be volatile at the end of oxide life of mine. All in sustaining costs ("AISC") are trending higher from cutbacks and pre-striping work to get access to residual ore to keep milling before completion of the flotation construction.

"We are focusing on putting the new life of mine into production to resume our revenue level. The Selinsing flotation plant construction reached a 49% completion by the end of Q3 with major progress on the earth works, foundations of reagent building and other flotation areas during the quarter. A delay however of delivery for several long lead items is anticipated primarily due to the Shanghai shut down. Some components are held up at the manufactory in that region and the Shanghai international port. Initial estimated delay may round up to three months".

Third Quarter Highlights:

Murchison Phase 2 drilling completed a week after quarter end with significant RC assay results received;

Selinsing Flotation Plant construction 49.47% completed as anticipated on budget;

Delivery of certain long lead flotation equipment anticipated be delayed due to Shanghai lockdown and worsened world supply chain movement;

Selinsing mining rates adversely impacted by unexpected monsoon season extension, with surrounding region being heavily flooded:

2,423 ounces ("oz") of gold produced (Q3, FY2021: 1,977oz);

3,270oz of gold sold for $6.16 million (Q3, FY2021: 2,523oz for $4.40million);

Average quarterly gold price realized at $1,911/oz (Q3, FY2021: $1,830/oz);

Cash cost per ounce sold was $1,835/oz (Q3, FY2021: $1,315/oz);

Gross margin decreased by 85% to $0.16 million (Q3, FY2021: $1.08 million);

All-in sustaining cost ("AISC") increased to $2,248/oz :shock: :shock: :shock: (Q3, FY2021: $1,458/oz) (section 15 "Non-IFRS Performance Measures").

.......

https://www.stockwatch.com/News/Item/Z-C!MMY-3260173/C/MMY

Monument Mining drills four m of 32 g/t Au at Burnakura

2022-05-30 15:05 ET - News Release

Ms. Cathy Zhai reports

MONUMENT RECEIVES SIGNIFICANT RC RESULTS FROM PHASE 2 DRILLING PROGRAM AT THE MURCHISON GOLD PROJECT

Monument Mining Ltd. has received significant results from the reverse circulation (RC) drilling as a part of the phase 2 exploration program at Burnakura, one of the primary Murchison gold projects in the Meekatharra area in Western Australia.

As part of a two-year exploration program to test the potential for gold discovery, the phase 2 drilling program commenced in November, 2021, following the completion of the phase 1 program in August, 2021 (refer to news release dated Dec. 15, 2021, and Jan. 19, 2022). The phase 2 RC and DD (diamond drilling) drill program was completed in April, 2022. The remaining assay results from the DD component are anticipated over the coming weeks. The company looks forward to updating the market with a comprehensive announcement incorporating the DD and RC drill results.

...

https://www.stockwatch.com/News/Item/Z-C!MMY-3260174/C/MMY

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Discovery Reports Positive Metallurgical Results from Cordero & Provides Project Update

2022-05-31 07:52 ET - News Release

TORONTO, May 31, 2022 (GLOBE NEWSWIRE) -- Discovery Silver Corp. (TSX-V: DSV, OTCQX: DSVSF) ("Discovery" or the "Company") is pleased to provide a project update and to announce the project study team for the Pre-Feasibility Study ("PFS" or "the Study") on its flagship Cordero project ("Cordero" or "the Project") located in Chihuahua State, Mexico. The PFS will be led by Ausenco Engineering Canada Inc. ("Ausenco") and is on schedule for completion in 4Q 2022.

Taj Singh, President & CEO, states: "We are very pleased with the excellent progress we have made on our PFS and to be working with the same industry-leading project team that completed our Preliminary Economic Assessment (PEA). Initial results from the PFS metallurgical testwork programhighlight the exceptional metallurgical performance at Cordero with recoveries typically ranging from 90-95% for Ag, Pb and Zn from the tests completed so far. These recoveries have been achieved at a very coarse grind size and with lower reagent consumption than what was assumed in the 2021 PEA. All other aspects of the PFS are tracking well and we remain on schedule to deliver the Study in the fourth quarter of this year."

PROJECT UPDATE

......

https://www.stockwatch.com/News/Item/Z-C!DSV-3261199/C/DSV

2022-05-31 07:52 ET - News Release

TORONTO, May 31, 2022 (GLOBE NEWSWIRE) -- Discovery Silver Corp. (TSX-V: DSV, OTCQX: DSVSF) ("Discovery" or the "Company") is pleased to provide a project update and to announce the project study team for the Pre-Feasibility Study ("PFS" or "the Study") on its flagship Cordero project ("Cordero" or "the Project") located in Chihuahua State, Mexico. The PFS will be led by Ausenco Engineering Canada Inc. ("Ausenco") and is on schedule for completion in 4Q 2022.

Taj Singh, President & CEO, states: "We are very pleased with the excellent progress we have made on our PFS and to be working with the same industry-leading project team that completed our Preliminary Economic Assessment (PEA). Initial results from the PFS metallurgical testwork programhighlight the exceptional metallurgical performance at Cordero with recoveries typically ranging from 90-95% for Ag, Pb and Zn from the tests completed so far. These recoveries have been achieved at a very coarse grind size and with lower reagent consumption than what was assumed in the 2021 PEA. All other aspects of the PFS are tracking well and we remain on schedule to deliver the Study in the fourth quarter of this year."

PROJECT UPDATE

......

https://www.stockwatch.com/News/Item/Z-C!DSV-3261199/C/DSV

oel/gas gasoline: 3.9200$.

[url=https://peketec.de/trading/viewtopic.php?p=2141023#2141023 schrieb:wicki99 schrieb am 31.05.2022, 18:50 Uhr[/url]"]oel/gas gasoline: th bei 4.0437$. wenn es hier einmal anfängt zu rutschen. starker h1-support um 3.9000$, heutiges tt bei 3.8909$.

» zur Grafik

Natural Gas Prices Rise After 3-Session Skid -- Market Talk oel/gas

1 June 2022, 15:35

0835 ET - US natural gas prices rise 1.4% to $8.261/mmBtu after three consecutive sessions of declines, as investors eye what could be another bullish, below-average weekly storage injection in tomorrow's EIA report. Even after declining for the previous three sessions, natural gas prices still finished May with a 12% monthly rise, marking a third straight monthly gain. Stronger global demand for US LNG has driven most of the gains, although analysts say support is also coming from the fact that despite high prices, natural gas isn't losing much market share to coal because coal prices are high, too, and also because coal capacity has been greatly diminished. (dan.molinski@wsj.com)

(END) Dow Jones Newswires - June 01, 2022 08:35 ET (12:35 GMT) - Copyright (c) 2022 Dow Jones & Company, Inc.

1 June 2022, 15:35

0835 ET - US natural gas prices rise 1.4% to $8.261/mmBtu after three consecutive sessions of declines, as investors eye what could be another bullish, below-average weekly storage injection in tomorrow's EIA report. Even after declining for the previous three sessions, natural gas prices still finished May with a 12% monthly rise, marking a third straight monthly gain. Stronger global demand for US LNG has driven most of the gains, although analysts say support is also coming from the fact that despite high prices, natural gas isn't losing much market share to coal because coal prices are high, too, and also because coal capacity has been greatly diminished. (dan.molinski@wsj.com)

(END) Dow Jones Newswires - June 01, 2022 08:35 ET (12:35 GMT) - Copyright (c) 2022 Dow Jones & Company, Inc.

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

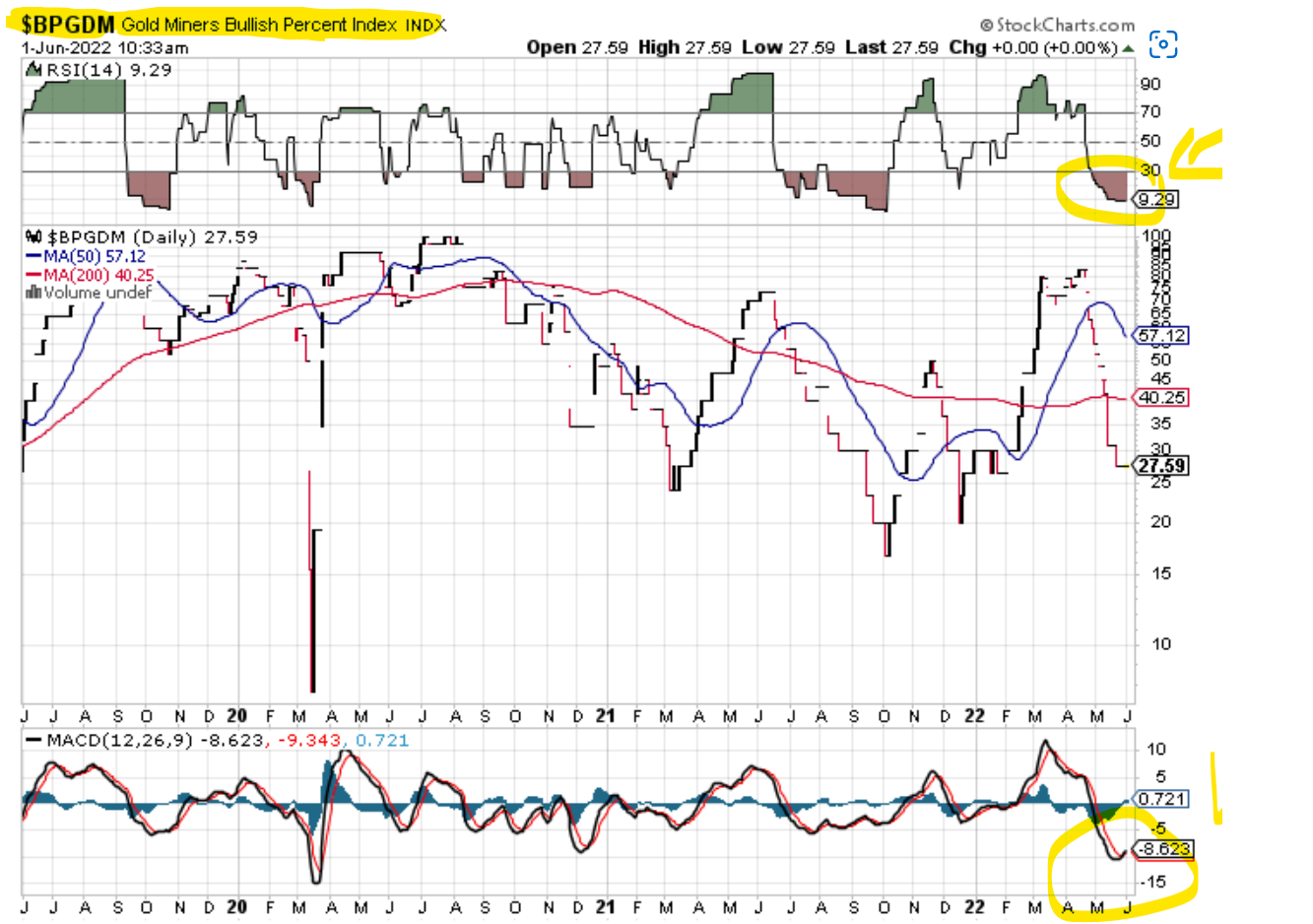

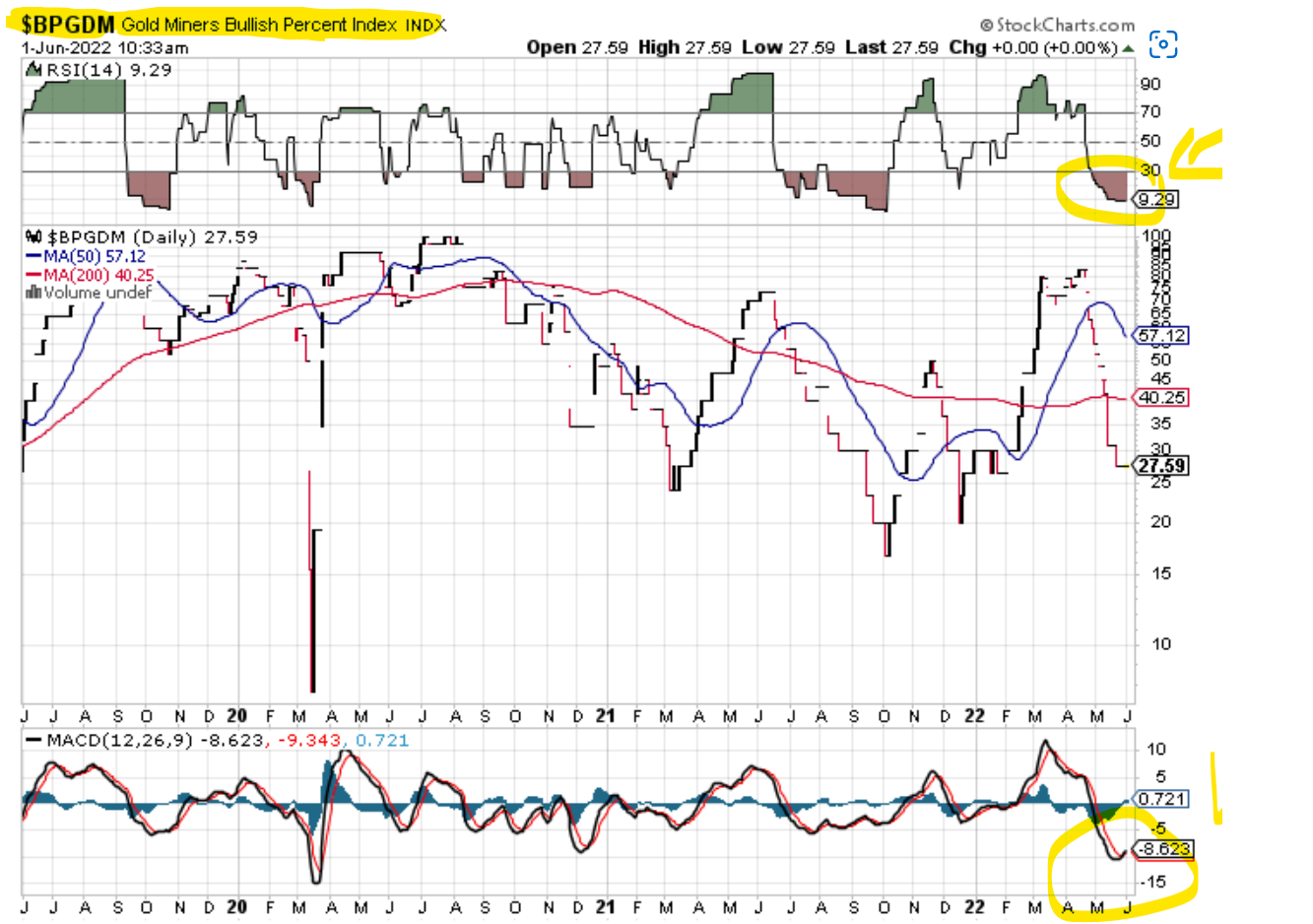

Eigentlich wieder Zeit antizyklisch zu investieren....

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Freehold Royalties appoints Barnes, Mitchell to board

2022-06-01 17:34 ET - News Release

Mr. Marvin Romanow reports

FREEHOLD ROYALTIES LTD. ANNOUNCES NEW BOARD MEMBERS

Freehold Royalties Ltd. has appointed Sylvia Barnes and Valerie Mitchell to the board of directors.

Ms. Barnes is a seasoned Board Director, a business leader and co-founder of Tanda Resources LLC, a privately-held energy advisory firm focused on upstream investments and consulting based in Houston, Texas, where she resides. She currently is a Board Member at StoneBridge Acquisition Corp. (NASDAQ: APACU) and has been a Board Member at Teekay LNG Partners LP, Ultra Petroleum Corporation, Pure Acquisition Corp., SandRidge Energy, Inc. and Halcon Resources Corporation. Her board expertise includes environmental, social and governance (ESG), audit, compensation, risk management and conflict committee matters.

Ms. Barnes has over 30 years' experience in energy investment banking and a background in engineering. As a banker, she successfully executed a variety of mergers, acquisitions, and divestiture transactions, and advised on initial public offerings, public and private equity offerings and private debt and equity placements.

Ms. Barnes is a member of the National Association of Corporate Directors and is Chair of the Santa Mara Hostel Foundation. She has a Bachelor of Science degree in Mechanical Engineering from the University of Manitoba (Dean's Honour List) and a Master of Business Administration from York University (Gulf Canada Scholarship).

Ms. Mitchell is President and Chief Operating Officer of Troy Energy, a private independent oil and gas acquisition, development, and exploration company based in Oklahoma City. She oversees all aspects of company strategy and growth including operations, reserves, acquisitions, human resources, IT and ESG programs. She has over 25 years of experience in the energy industry, most recently as Chief Executive Officer of Corterra Energy, a Mid-Continent operator. Prior to Corterra, she was Vice President with Newfield Exploration. Leading the Mid-Continent Division, she developed and executed a STACK and SCOOP acquisition, exploration, and development strategy.

Ms. Mitchell is a director and member of the Audit Committee of NCS Multistage Holdings Inc., a publicly traded oil field service company with offices in Calgary and Houston (NASDAQ: NCSM). She has a Bachelor of Science (Honours) in Chemical Engineering from the University of Missouri. Ms. Mitchell resides in Tulsa, Oklahoma.

"We are very excited to have Sylvia and Valerie join our Board. Both individuals have a wealth of knowledge and experience to complement the skills and experience of our current Board members," said Marvin Romanow, the Chair of the Board.

Freehold's focus is on acquiring and managing oil and gas royalties. Freehold's common shares trade on the Toronto Stock Exchange in Canada under the symbol FRU.

https://www.stockwatch.com/News/Item/Z-C!FRU-3262958/C/FRU

2022-06-01 17:34 ET - News Release

Mr. Marvin Romanow reports

FREEHOLD ROYALTIES LTD. ANNOUNCES NEW BOARD MEMBERS

Freehold Royalties Ltd. has appointed Sylvia Barnes and Valerie Mitchell to the board of directors.

Ms. Barnes is a seasoned Board Director, a business leader and co-founder of Tanda Resources LLC, a privately-held energy advisory firm focused on upstream investments and consulting based in Houston, Texas, where she resides. She currently is a Board Member at StoneBridge Acquisition Corp. (NASDAQ: APACU) and has been a Board Member at Teekay LNG Partners LP, Ultra Petroleum Corporation, Pure Acquisition Corp., SandRidge Energy, Inc. and Halcon Resources Corporation. Her board expertise includes environmental, social and governance (ESG), audit, compensation, risk management and conflict committee matters.

Ms. Barnes has over 30 years' experience in energy investment banking and a background in engineering. As a banker, she successfully executed a variety of mergers, acquisitions, and divestiture transactions, and advised on initial public offerings, public and private equity offerings and private debt and equity placements.

Ms. Barnes is a member of the National Association of Corporate Directors and is Chair of the Santa Mara Hostel Foundation. She has a Bachelor of Science degree in Mechanical Engineering from the University of Manitoba (Dean's Honour List) and a Master of Business Administration from York University (Gulf Canada Scholarship).

Ms. Mitchell is President and Chief Operating Officer of Troy Energy, a private independent oil and gas acquisition, development, and exploration company based in Oklahoma City. She oversees all aspects of company strategy and growth including operations, reserves, acquisitions, human resources, IT and ESG programs. She has over 25 years of experience in the energy industry, most recently as Chief Executive Officer of Corterra Energy, a Mid-Continent operator. Prior to Corterra, she was Vice President with Newfield Exploration. Leading the Mid-Continent Division, she developed and executed a STACK and SCOOP acquisition, exploration, and development strategy.

Ms. Mitchell is a director and member of the Audit Committee of NCS Multistage Holdings Inc., a publicly traded oil field service company with offices in Calgary and Houston (NASDAQ: NCSM). She has a Bachelor of Science (Honours) in Chemical Engineering from the University of Missouri. Ms. Mitchell resides in Tulsa, Oklahoma.

"We are very excited to have Sylvia and Valerie join our Board. Both individuals have a wealth of knowledge and experience to complement the skills and experience of our current Board members," said Marvin Romanow, the Chair of the Board.

Freehold's focus is on acquiring and managing oil and gas royalties. Freehold's common shares trade on the Toronto Stock Exchange in Canada under the symbol FRU.

https://www.stockwatch.com/News/Item/Z-C!FRU-3262958/C/FRU

oel/gas wti-crude-future:

sehen wir hier im h1-chart einen beginnenden trendwechsel? widerstandszone 114$ bis 116$, support um 112$. je länger der kurs unterhalb des widerstands verharrt, um so mutiger dürften die bären werden. aktuell handelt wti bei 114$.

=> und schon pressen die käufer rein ...

sehen wir hier im h1-chart einen beginnenden trendwechsel? widerstandszone 114$ bis 116$, support um 112$. je länger der kurs unterhalb des widerstands verharrt, um so mutiger dürften die bären werden. aktuell handelt wti bei 114$.

=> und schon pressen die käufer rein ...

platin-th 1014.80$. rücksetzer zum kauf genutzt.

[url=https://peketec.de/trading/viewtopic.php?p=2141128#2141128 schrieb:wicki99 schrieb am 01.06.2022, 15:47 Uhr[/url]"]raketenstart bei platin plus th 4-stellig (1007.50$). :shock:

gold-future: 1873.60$. 8)

[url=https://peketec.de/trading/viewtopic.php?p=2141278#2141278 schrieb:wicki99 schrieb am 02.06.2022, 15:45 Uhr[/url]"]der gold-future erreicht die h1-resist-zone 1868$/1870$ (th 1870.30$).

valero energy corporation: erneuter test des verlaufhochs über 135$.

[url=https://peketec.de/trading/viewtopic.php?p=2140681#2140681 schrieb:wicki99 schrieb am 27.05.2022, 16:57 Uhr[/url]"]valero energy corporation: hoch zu 132.72$.

[url=https://peketec.de/trading/viewtopic.php?p=2140462#2140462 schrieb:wicki99 schrieb am 25.05.2022, 16:01 Uhr[/url]"]valero energy corporation: der support um 120$/118$ hält. mit den gestiegenen oel/gas-preisen auch long gezogen auf ein th von 129.63$.

[url=https://peketec.de/trading/viewtopic.php?p=2137699#2137699 schrieb:wicki99 schrieb am 04.05.2022, 21:00 Uhr[/url]"]valero energy corporation: ding-dong-ath 128.62$. mit mildtätiger unterstützung der fed ...

[url=https://peketec.de/trading/viewtopic.php?p=2137655#2137655 schrieb:wicki99 schrieb am 04.05.2022, 14:08 Uhr[/url]"]valero energy corporation: th bei 125.26$. das ath liegt in schlagweite bei 126.98$ aus mitte 2018.

[url=https://peketec.de/trading/viewtopic.php?p=2137573#2137573 schrieb:wicki99 schrieb am 03.05.2022, 21:56 Uhr[/url]"]valero energy corporation: die bullen geben weiter gas. th kurz vor handelsschluss bei 121.74$.

[url=https://peketec.de/trading/viewtopic.php?p=2137547#2137547 schrieb:wicki99 schrieb am 03.05.2022, 15:40 Uhr[/url]"]valero energy corporation: kommt dem erweiterten long-ziel um 120$ mit dem th von 119.99$ immer näher.

[url=https://peketec.de/trading/viewtopic.php?p=2137369#2137369 schrieb:wicki99 schrieb am 02.05.2022, 16:27 Uhr[/url]"]valero energy corporation: tt 111.01$, th 115.98$.

[url=https://peketec.de/trading/viewtopic.php?p=2137020#2137020 schrieb:wicki99 schrieb am 28.04.2022, 19:24 Uhr[/url]"]valero energy corporation: macht laune am th bei 115.10$.

[url=https://peketec.de/trading/viewtopic.php?p=2136806#2136806 schrieb:wicki99 schrieb am 27.04.2022, 20:10 Uhr[/url]"]valero energy corporation: das anvisierte long-ziel ab 110$ wird mit dem th bei 109.77$ so gut wie erreicht.

[url=https://peketec.de/trading/viewtopic.php?p=2136791#2136791 schrieb:wicki99 schrieb am 27.04.2022, 18:45 Uhr[/url]"]valero energy corporation: th 109.38$.

oel/gas gasoline: th 4.2095$.  irre ...

irre ...

[url=https://peketec.de/trading/viewtopic.php?p=2141023#2141023 schrieb:wicki99 schrieb am 31.05.2022, 18:50 Uhr[/url]"]oel/gas gasoline: th bei 4.0437$. wenn es hier einmal anfängt zu rutschen. starker h1-support um 3.9000$, heutiges tt bei 3.8909$.

» zur Grafik

platin-th 1029.20$.

[url=https://peketec.de/trading/viewtopic.php?p=2141274#2141274 schrieb:wicki99 schrieb am 02.06.2022, 15:30 Uhr[/url]"]platin-th 1014.80$. rücksetzer zum kauf genutzt.

[url=https://peketec.de/trading/viewtopic.php?p=2141128#2141128 schrieb:wicki99 schrieb am 01.06.2022, 15:47 Uhr[/url]"]raketenstart bei platin plus th 4-stellig (1007.50$). :shock:

natural gas oel/gas:

als charttechniker schaue ich nun ein wenig intensiver auf den gas-future, da sich dessen kurskonstallation in eine entscheidungssituation manövriert. das aktuelle chartbild entwickelt sich in richtung einer top-bildungsformation.

zum abschluss selbiger ist es notwendig, den support um 8.000$ nachhaltig zu brechen. damit wäre eine bärisch zu interpretierende sks-formation vollendet, kurzfristige short-ziele lägen dann bei 7.000$ und dem getesteten support um 6.500$. zwischen 8.000$ und 9.000$ (dort die beiden schultern der sks-formation) bewegt sich der markt im neutralen niemandsland. über den 9$ forcieren die bullen das verlaufhoch.

=> euch allen gute trades am heutigen tag und viel erfolg!

als charttechniker schaue ich nun ein wenig intensiver auf den gas-future, da sich dessen kurskonstallation in eine entscheidungssituation manövriert. das aktuelle chartbild entwickelt sich in richtung einer top-bildungsformation.

zum abschluss selbiger ist es notwendig, den support um 8.000$ nachhaltig zu brechen. damit wäre eine bärisch zu interpretierende sks-formation vollendet, kurzfristige short-ziele lägen dann bei 7.000$ und dem getesteten support um 6.500$. zwischen 8.000$ und 9.000$ (dort die beiden schultern der sks-formation) bewegt sich der markt im neutralen niemandsland. über den 9$ forcieren die bullen das verlaufhoch.

=> euch allen gute trades am heutigen tag und viel erfolg!

platin-th 1034.70$.

[url=https://peketec.de/trading/viewtopic.php?p=2141326#2141326 schrieb:wicki99 schrieb am 02.06.2022, 19:55 Uhr[/url]"]platin-th 1029.20$.

[url=https://peketec.de/trading/viewtopic.php?p=2141274#2141274 schrieb:wicki99 schrieb am 02.06.2022, 15:30 Uhr[/url]"]platin-th 1014.80$. rücksetzer zum kauf genutzt.

[url=https://peketec.de/trading/viewtopic.php?p=2141128#2141128 schrieb:wicki99 schrieb am 01.06.2022, 15:47 Uhr[/url]"]raketenstart bei platin plus th 4-stellig (1007.50$). :shock:

oel/gas heizöl: th 4.3269$.

[url=https://peketec.de/trading/viewtopic.php?p=2141402#2141402 schrieb:wicki99 schrieb am 03.06.2022, 12:02 Uhr[/url]"]oel/gas: ich bastle mir ein heizöl-dreieck ...

» zur Grafik

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Monument Mining receives visit from prince at Selinsing

2022-06-03 10:01 ET - News Release

Ms. Cathy Zhai reports

MONUMENT RECEIVES ROYAL VISIT TO THE SELINSING GOLD MINE IN MALAYSIA

Monument Mining Ltd. received the inaugural visit of the crowned Prince of Pahang, Tengku Hassanal Ibrahim Alam Shah ibni Al-Sultan Abdullah Ri'ayatuddin Al-Mustafa Billah Shah to its wholly owned Selinsing gold mine in Pahang state, Malaysia, on May 26, 2022. The Prince is a member of Pahang royal family and currently reigning as regent and fourth crown prince of Pahang state. He is acting Sultan of Pahang during the term when his father Al-Sultan Abdullah Ri'ayatuddin Al-Mustafa Billah Shah Ibni Almarhum Sultan Haji Ahmad Shah Al-Musta'in Billah of Pahang remains as the King of Malaysia.

Among the group accompanying the Prince were VIPs (very important person) and government department representatives, including: Chief Minister Dato' Sri Wan Rosdy Bin Wan Ismail, member of parliament Dato' Ramli Bin Dato' Mohd Nor, State Secretary Dato' Sri Dr. Sallehuddin Bin Ishak, State Financial Officer Dato' Indera Nazri bin Abu Bakar, State Executive Councillor Dato' Sri Ir. Haji Mohd. Soffi bin Tan Sri Abd. Razak, Pahang State Development Corp. chief executive officer Dato' Mohd Faizal Bin Jaafar, Pahang Mining Corp. CEO Ahmad Rizal Ali, Mineral & Geoscience Department director Nurul Huda Bin Romli and Lipis and district officer Dato' Mohd Hafizi Bin Ibrahim.

The royal visit showcased the Selinsing mine operation. A welcome speech and brief introduction of Selinsing gold mine was given by Jimee Shah Bin Saleh, VP (vice-president) of finance and administration of Selinsing on behalf of Cathy Zhai, CEO of Monument, Moses Bosompen, general manager operation of Monument, and Charlie Northfield, general manager of Selinsing gold mine, and the Selinsing staff. The Prince toured a Selinsing display showroom, the mine pit area, the processing plant and observed a gold pour. The Prince asked many questions about the operations at Selinsing during the visit, including geology and gold mineralization, processing rate, gold bullion production, tailings storage, and rehabilitation. The Selinsing gold mine is at the leading edge of the gold industry in Malaysia, a corporate citizen in Pahang state, and has been a strong contributor to Pahang's economy.

President and CEO Ms. Zhai commented: "We are honoured to have hosted the Prince and government representatives at the Selinsing gold mine. This royal visit strengthens the relationship the company has with the state government and I thank the Prince and government representatives for visiting us to learn more about our development and growing plans. We are looking forward to having continuing honourable support from the Pahang state to Selinsing and the mining industry in Pahang."

Additional photos of the Prince's visit can be found at the Company's website under the photo gallery section.

About Monument Mining Ltd.

Monument Mining is an established Canadian gold producer that 100 per cent owns and operates the Selinsing gold mine in Malaysia and the Murchison gold project in the Murchison area of Western Australia. It has a 20-per-cent interest in Tuckanarra gold project jointly owned with Odyssey Gold Ltd. in the same region. The company employs approximately 200 people in both regions and is committed to the highest standards of environmental management, social responsibility, and health and safety for its employees and neighbouring communities.

https://www.stockwatch.com/News/Item/Z-C!MMY-3263654/C/MMY

2022-06-03 10:01 ET - News Release

Ms. Cathy Zhai reports

MONUMENT RECEIVES ROYAL VISIT TO THE SELINSING GOLD MINE IN MALAYSIA

Monument Mining Ltd. received the inaugural visit of the crowned Prince of Pahang, Tengku Hassanal Ibrahim Alam Shah ibni Al-Sultan Abdullah Ri'ayatuddin Al-Mustafa Billah Shah to its wholly owned Selinsing gold mine in Pahang state, Malaysia, on May 26, 2022. The Prince is a member of Pahang royal family and currently reigning as regent and fourth crown prince of Pahang state. He is acting Sultan of Pahang during the term when his father Al-Sultan Abdullah Ri'ayatuddin Al-Mustafa Billah Shah Ibni Almarhum Sultan Haji Ahmad Shah Al-Musta'in Billah of Pahang remains as the King of Malaysia.

Among the group accompanying the Prince were VIPs (very important person) and government department representatives, including: Chief Minister Dato' Sri Wan Rosdy Bin Wan Ismail, member of parliament Dato' Ramli Bin Dato' Mohd Nor, State Secretary Dato' Sri Dr. Sallehuddin Bin Ishak, State Financial Officer Dato' Indera Nazri bin Abu Bakar, State Executive Councillor Dato' Sri Ir. Haji Mohd. Soffi bin Tan Sri Abd. Razak, Pahang State Development Corp. chief executive officer Dato' Mohd Faizal Bin Jaafar, Pahang Mining Corp. CEO Ahmad Rizal Ali, Mineral & Geoscience Department director Nurul Huda Bin Romli and Lipis and district officer Dato' Mohd Hafizi Bin Ibrahim.

The royal visit showcased the Selinsing mine operation. A welcome speech and brief introduction of Selinsing gold mine was given by Jimee Shah Bin Saleh, VP (vice-president) of finance and administration of Selinsing on behalf of Cathy Zhai, CEO of Monument, Moses Bosompen, general manager operation of Monument, and Charlie Northfield, general manager of Selinsing gold mine, and the Selinsing staff. The Prince toured a Selinsing display showroom, the mine pit area, the processing plant and observed a gold pour. The Prince asked many questions about the operations at Selinsing during the visit, including geology and gold mineralization, processing rate, gold bullion production, tailings storage, and rehabilitation. The Selinsing gold mine is at the leading edge of the gold industry in Malaysia, a corporate citizen in Pahang state, and has been a strong contributor to Pahang's economy.

President and CEO Ms. Zhai commented: "We are honoured to have hosted the Prince and government representatives at the Selinsing gold mine. This royal visit strengthens the relationship the company has with the state government and I thank the Prince and government representatives for visiting us to learn more about our development and growing plans. We are looking forward to having continuing honourable support from the Pahang state to Selinsing and the mining industry in Pahang."

Additional photos of the Prince's visit can be found at the Company's website under the photo gallery section.

About Monument Mining Ltd.

Monument Mining is an established Canadian gold producer that 100 per cent owns and operates the Selinsing gold mine in Malaysia and the Murchison gold project in the Murchison area of Western Australia. It has a 20-per-cent interest in Tuckanarra gold project jointly owned with Odyssey Gold Ltd. in the same region. The company employs approximately 200 people in both regions and is committed to the highest standards of environmental management, social responsibility, and health and safety for its employees and neighbouring communities.

https://www.stockwatch.com/News/Item/Z-C!MMY-3263654/C/MMY

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Discovery Silver CEO, president Singh resigns

2022-06-06 10:27 ET - News Release

Mr. Murray John reports

DISCOVERY ANNOUNCES LEADERSHIP TRANSITION; TONY MAKUCH APPOINTED AS INTERIM CHIEF EXECUTIVE OFFICER

Discovery Silver Corp.'s Taj Singh, president and chief executive officer, has stepped down from his position as president and chief executive officer and has resigned from the board of directors for personal reasons. The company wishes to thank Mr. Singh for his efforts during his five-year tenure with the company and wishes him all the best in the future.

Tony Makuch, an independent director of the company, has been appointed interim chief executive officer, effective immediately. Mr. Makuch is a professional engineer with over 35 years of significant industry and leadership experience and is well positioned to advance the company's strategy through this period of transition with the support of the board of directors and the company's management team. Mr. Makuch was most recently chief executive officer of Kirkland Lake Gold Ltd., a leading senior global gold company with operations in Ontario and Australia.

....

https://www.stockwatch.com/News/Item/Z-C!DSV-3264111/C/DSV

valero energy corporation: die aktie sprang gestern erstmals über die marke von 140$ (ath 140.22$).

[url=https://peketec.de/trading/viewtopic.php?p=2141321#2141321 schrieb:wicki99 schrieb am 02.06.2022, 19:02 Uhr[/url]"]valero energy corporation: erneuter test des verlaufhochs über 135$.

........

Goldman Sachs hat seine Ölpreis-Ziel erneut angehoben und sieht jetzt im Hochsommer einen Preis von 140 Dollar nach zuvor "nur" 125 Dollar. Das politisch motivierte Überangebot seit Juni 2020 sei wieder vorbei.

Quelle: Guidants News https://news.guidants.com oel/gas

Quelle: Guidants News https://news.guidants.com oel/gas

valero energy corporation: ath-mover 144.42$.

[url=https://peketec.de/trading/viewtopic.php?p=2141575#2141575 schrieb:wicki99 schrieb am 07.06.2022, 12:38 Uhr[/url]"]valero energy corporation: die aktie sprang gestern erstmals über die marke von 140$ (ath 140.22$).

[url=https://peketec.de/trading/viewtopic.php?p=2141321#2141321 schrieb:wicki99 schrieb am 02.06.2022, 19:02 Uhr[/url]"]valero energy corporation: erneuter test des verlaufhochs über 135$.

........