App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

AOI - Africa Oil - WKN A0MZJC

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

Tullow cheers further Kenya hit

Eoin O'Cinneide

25 May 2012 15:00 GMT

Tullow Oil has had more joy at a Kenyan play after a wildcat threw up further oil and gas shows.

The London-listed independent has struck another gross interval of 140 metres while drilling ahead at the Ngamia-1 well on Kenya’s Rift basin block 10BB, it revealed on Friday.

During a Friday morning meeting in Nairobi with “certain investors”, Tullow said “it was inadvertently indicated that the Ngamia-1 well was drilling into the primary target and that initial results appeared to indicate that the well had intersected further oil bearing sands”.

It said that the gross interval was found at a depth of between 1800 metres and 1940 metres.

“The reservoirs are similar to those previously encountered at a shallower depth,” Tullow continued.

“The well will continue to be drilled to a total depth of 2700 metres and then logged and sampled. This is expected to take a further three weeks to complete.”

Before the latest hit, a total pay count greater than 100 metres had been discovered over a gross oil-bearing interval of 650 metres across multiple reservoir zones.

Sampling has recovered oil of 30 degrees API from this last section with similar properties to the light waxy crude encountered in the upper reservoir zone, it was reported in March.

The structure is only the first prospect to be tested as part of a multi-well drilling campaign in Kenya and across the border in Ethiopia’s Omo Valley Basin, with several leads and prospects that are similar to Ngamia, already identified.

The specific basin that Ngamia-1 is similar to is the Albertine Graben, where Tullow and partners Total and China National Offshore Oil Corporation reckon ongoing exploration and production will yield substantially more than earlier estimates of about 2.5 billion barrels.

http://www.upstreamonline.com/live/article1248211.ece

Eoin O'Cinneide

25 May 2012 15:00 GMT

Tullow Oil has had more joy at a Kenyan play after a wildcat threw up further oil and gas shows.

The London-listed independent has struck another gross interval of 140 metres while drilling ahead at the Ngamia-1 well on Kenya’s Rift basin block 10BB, it revealed on Friday.

During a Friday morning meeting in Nairobi with “certain investors”, Tullow said “it was inadvertently indicated that the Ngamia-1 well was drilling into the primary target and that initial results appeared to indicate that the well had intersected further oil bearing sands”.

It said that the gross interval was found at a depth of between 1800 metres and 1940 metres.

“The reservoirs are similar to those previously encountered at a shallower depth,” Tullow continued.

“The well will continue to be drilled to a total depth of 2700 metres and then logged and sampled. This is expected to take a further three weeks to complete.”

Before the latest hit, a total pay count greater than 100 metres had been discovered over a gross oil-bearing interval of 650 metres across multiple reservoir zones.

Sampling has recovered oil of 30 degrees API from this last section with similar properties to the light waxy crude encountered in the upper reservoir zone, it was reported in March.

The structure is only the first prospect to be tested as part of a multi-well drilling campaign in Kenya and across the border in Ethiopia’s Omo Valley Basin, with several leads and prospects that are similar to Ngamia, already identified.

The specific basin that Ngamia-1 is similar to is the Albertine Graben, where Tullow and partners Total and China National Offshore Oil Corporation reckon ongoing exploration and production will yield substantially more than earlier estimates of about 2.5 billion barrels.

http://www.upstreamonline.com/live/article1248211.ece

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?s=AO…

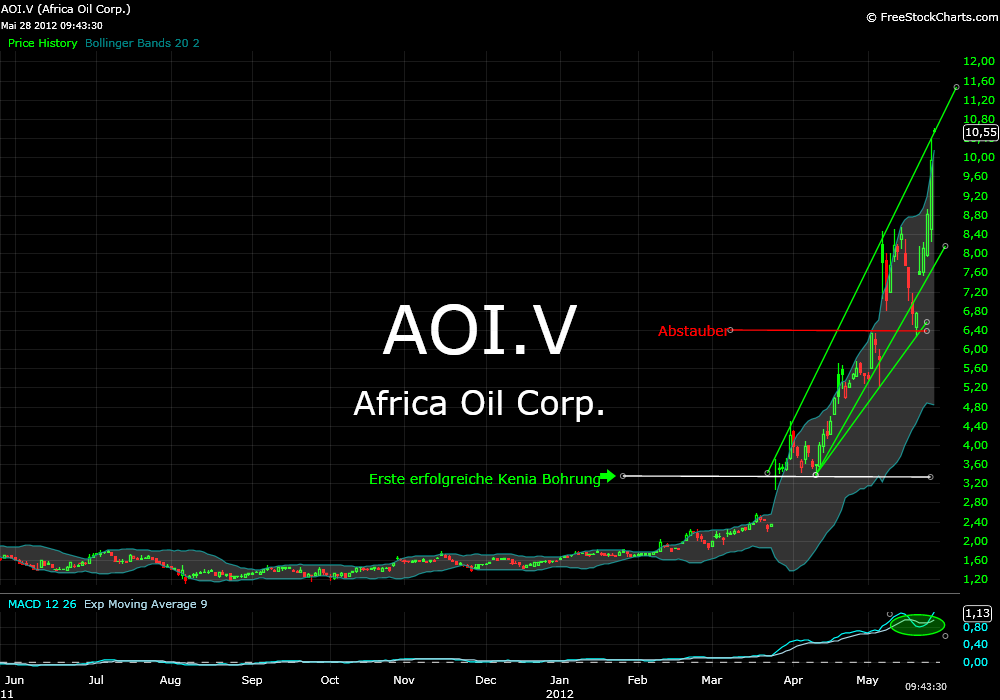

Basically open up the presentation slide on AOIs website and follow along with K.HILL vocal presentation. Some Key points I came away with...

"This is so huge, we will be getting into production" " This is a once in a lifetime opp with basins like this"

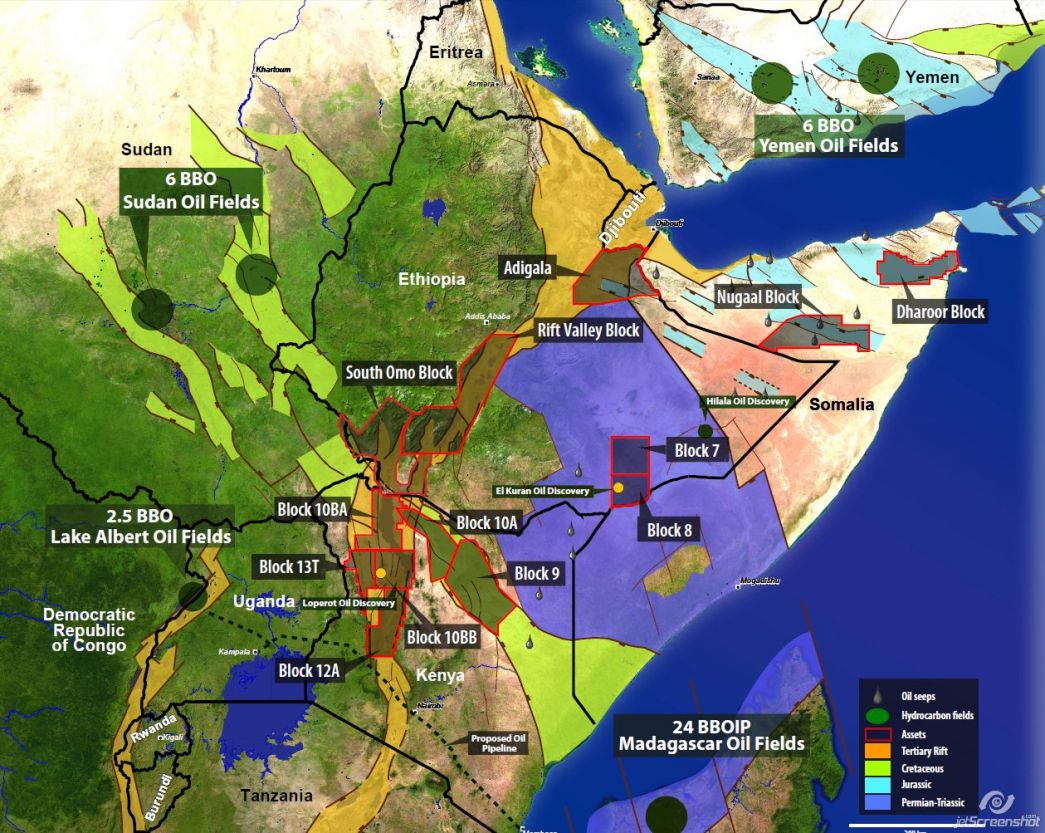

-4 different rift systems independent of one another.

-From Sept 4 rigs full time drilling, expect lots of news flow

-Aggressive drill program, will need to raise money by year end after we drill a few more wells.

-Lucas Lundin likes to raise capital @ 30/share a lot more than 8/share. Wants minimum dilution for shareholders.

-Tullow has a worldwide sucess rate of 88% in africa 90%+ success rate! unbelievable!

-8 identical prospects as Ngambia, from 20% before drill now 75% chance of success on these if Ngambia is proven. ( which it just was)

-Predrill est. 17meters of net pay = 50 million barrels Found was 100 meters net pay in upper well(didn't include fridays news release of over 100 meters of oil/gas shows) Wildly exceeding expectations. 6x as much found SO FAR as predrill estimate for the entire well. So far over 250 million barrels just on the upper section find..( not counting fridays news of more new finds) Commercial is 250million barrels which he said is already there just in upper find.

-Kamba is one of the biggest prospects and they want to drill it asap.

-Tullow was very excited and wants to drill S.OMO, tullow thinks thats the sweet spot. if they find oil, it opens up a entire area.

-NGAMBIA Best well Tullow ever drilled.. best AOI ever seen.

-Only 2/3s done on Ngambia well.. primary target to come!

-They will farm out block 9 for around 25 million for 50% which will cover cost of the well... 15% chance of success there. Tullow was not interested in block 9. Paipai is key to this one, if paipai hits, this is a sure thing.. if not, they won't even drill it.

-AOIs feels that there is so much oil they will find that they will become producers...and be around for a long time.

Basically open up the presentation slide on AOIs website and follow along with K.HILL vocal presentation. Some Key points I came away with...

"This is so huge, we will be getting into production" " This is a once in a lifetime opp with basins like this"

-4 different rift systems independent of one another.

-From Sept 4 rigs full time drilling, expect lots of news flow

-Aggressive drill program, will need to raise money by year end after we drill a few more wells.

-Lucas Lundin likes to raise capital @ 30/share a lot more than 8/share. Wants minimum dilution for shareholders.

-Tullow has a worldwide sucess rate of 88% in africa 90%+ success rate! unbelievable!

-8 identical prospects as Ngambia, from 20% before drill now 75% chance of success on these if Ngambia is proven. ( which it just was)

-Predrill est. 17meters of net pay = 50 million barrels Found was 100 meters net pay in upper well(didn't include fridays news release of over 100 meters of oil/gas shows) Wildly exceeding expectations. 6x as much found SO FAR as predrill estimate for the entire well. So far over 250 million barrels just on the upper section find..( not counting fridays news of more new finds) Commercial is 250million barrels which he said is already there just in upper find.

-Kamba is one of the biggest prospects and they want to drill it asap.

-Tullow was very excited and wants to drill S.OMO, tullow thinks thats the sweet spot. if they find oil, it opens up a entire area.

-NGAMBIA Best well Tullow ever drilled.. best AOI ever seen.

-Only 2/3s done on Ngambia well.. primary target to come!

-They will farm out block 9 for around 25 million for 50% which will cover cost of the well... 15% chance of success there. Tullow was not interested in block 9. Paipai is key to this one, if paipai hits, this is a sure thing.. if not, they won't even drill it.

-AOIs feels that there is so much oil they will find that they will become producers...and be around for a long time.

Tullow’s latest Kenyan success could be the tip of the iceberg, says Morgan Stanley

10:07 am by Jamie Nimmo The broker doesn’t expect the good news to stop here, adding it “has likely only just entered the top of the target reservoir, in our opinion”.The broker doesn’t expect the good news to stop here, adding it “has likely only just entered the top of the target reservoir, in our opinion”.

Tullow Oil (LON:TLW) may have barely scratched the surface in Kenya, heavyweight broker Morgan Stanley said following more successful drilling in the country.

The FTSE 100 explorer revealed on Friday that it had inadvertently struck more oil at its Ngamia-1 well in Kenya.

The latest find showed oil and gas over a gross interval of 140 metres from a depth of 1,800 metres to 1,940 metres.

“This is an important, positive update, as without even having drilled the target reservoir, the well has already encountered oil/gas across sections multiple times the thickness of that seen throughout Uganda, its nearest analogous basin,” Morgan Stanley said.

And the broker doesn’t expect the good news to stop here, adding it “has likely only just entered the top of the target reservoir, in our opinion”.

The size of the discovery is difficult to ascertain without more detailed information and the broker expects a resource estimate in the near future.

“Given the net pay in the shallower horizons and scale of the structure/closure, everything to date suggests multi 100mb, far in excess of our 90mb upside case expectation.”

Morgan Stanley is confident the explorer can replicate the success it has already seen in Kenya, in addition to the regional technical understanding it has gained from Uganda.

The broker is urging investors to buy ahead of what is likely to be “a string of success, unlocking a new East African oil province,” the broker concluded.

Tullow had initially announced the Ngamia discovery back in March, while it revealed another 100-metre interval of light crude earlier this month.

The well will be drilled to a total depth of 2,700 metres and then logged and sampled, which will take a further three weeks to complete.

The find represents another triumph in the highly prospective region of East Africa, where interest from oil majors has intensified lately.

Anglo-Dutch giant Shell (LON:RDSB) has been hitting the headlines lately as its bidding war for Mozambique-focused Cove Energy (LON:COV) hots up.

Fellow big names Exxon (NYSE:XOM) and BG (LON:BG.) have also recently made moves into the area.

Smaller companies in Kenya include Simba Energy (CVE:SMB), which is currently evaluating its earlier stage exploration asset.

The junior explorer has already uncovered two potential targets for further exploration and a new competent person’s report (CPR) will provide expert insight on its acreage.

Shares in Tullow jumped on the back of the news and are still rising today, climbing 37 pence or nearly 3 per cent to 1,432 pence.

http://www.proactiveinvestors.co.uk/companies/news/43396/tullows-latest-kenyan-success-could-be-the-tip-of-the-iceberg-says-morgan-stanley-43396.html%3E

10:07 am by Jamie Nimmo The broker doesn’t expect the good news to stop here, adding it “has likely only just entered the top of the target reservoir, in our opinion”.The broker doesn’t expect the good news to stop here, adding it “has likely only just entered the top of the target reservoir, in our opinion”.

Tullow Oil (LON:TLW) may have barely scratched the surface in Kenya, heavyweight broker Morgan Stanley said following more successful drilling in the country.

The FTSE 100 explorer revealed on Friday that it had inadvertently struck more oil at its Ngamia-1 well in Kenya.

The latest find showed oil and gas over a gross interval of 140 metres from a depth of 1,800 metres to 1,940 metres.

“This is an important, positive update, as without even having drilled the target reservoir, the well has already encountered oil/gas across sections multiple times the thickness of that seen throughout Uganda, its nearest analogous basin,” Morgan Stanley said.

And the broker doesn’t expect the good news to stop here, adding it “has likely only just entered the top of the target reservoir, in our opinion”.

The size of the discovery is difficult to ascertain without more detailed information and the broker expects a resource estimate in the near future.

“Given the net pay in the shallower horizons and scale of the structure/closure, everything to date suggests multi 100mb, far in excess of our 90mb upside case expectation.”

Morgan Stanley is confident the explorer can replicate the success it has already seen in Kenya, in addition to the regional technical understanding it has gained from Uganda.

The broker is urging investors to buy ahead of what is likely to be “a string of success, unlocking a new East African oil province,” the broker concluded.

Tullow had initially announced the Ngamia discovery back in March, while it revealed another 100-metre interval of light crude earlier this month.

The well will be drilled to a total depth of 2,700 metres and then logged and sampled, which will take a further three weeks to complete.

The find represents another triumph in the highly prospective region of East Africa, where interest from oil majors has intensified lately.

Anglo-Dutch giant Shell (LON:RDSB) has been hitting the headlines lately as its bidding war for Mozambique-focused Cove Energy (LON:COV) hots up.

Fellow big names Exxon (NYSE:XOM) and BG (LON:BG.) have also recently made moves into the area.

Smaller companies in Kenya include Simba Energy (CVE:SMB), which is currently evaluating its earlier stage exploration asset.

The junior explorer has already uncovered two potential targets for further exploration and a new competent person’s report (CPR) will provide expert insight on its acreage.

Shares in Tullow jumped on the back of the news and are still rising today, climbing 37 pence or nearly 3 per cent to 1,432 pence.

http://www.proactiveinvestors.co.uk/companies/news/43396/tullows-latest-kenyan-success-could-be-the-tip-of-the-iceberg-says-morgan-stanley-43396.html%3E

Africa Oil Corp. AOI

5/28/2012 10:27:45 PM

Africa Oil First Quarter of 2012 Financial and Operating Results

VANCOUVER, BRITISH COLUMBIA--(Marketwire - May 28, 2012) - Africa Oil Corp. (TSX VENTURE:AOI)(OMX:AOI) ("Africa Oil", "the Company" or "AOC") is pleased to announce its financial and operating results for the three months ended March 31, 2012.

The Company and its operating partner on Block 10BB, Tullow, spudded the partnership's first well, Ngamia-1, on January 24, 2012. The Ngamia-1 exploration well in Kenya has now been deepened to a total depth of approximately 1940 meters. The well has encountered in excess of 100 meters of net oil pay in multiple reservoir zones over a gross interval of 650 meters of the upper Lokhone sandstone (855 meters to 1500 meters). The reservoirs in these sections are composed of good quality Tertiary age sandstones. Moveable oil with an API greater than 30 degrees has been recovered to surface from four representative intervals. This oil has similar properties to the light waxy crude which has been discovered in Uganda by Tullow. Plans are in place for at least two drill stem tests upon completion of drilling operations. The Ngamia-1 well is now being drilled to a depth of approximately 2,700 meters to explore for deeper potential including the lower Lokhone sandstone which was one of the primary objectives of this well. The Ngamia-1 well has encountered additional oil and gas shows over a gross interval of 140 meters from a depth of 1,800 meters to 1,940 meters. The reservoirs are similar to those previously encountered at shallower depths.

In Puntland (Somalia), the Shabeel-1 well has been successfully drilled, reaching a total depth of 3470 meters. Several oil and gas shows were encountered indicating the existence of a working petroleum system. The well encountered metamorphic basement at a depth of 3430 meters and has been suspended for future testing. The well encountered a 355 meter section of Upper Cretaceous sands and shales of the Jesomma Formation at a depth of approximately 1660 meters. The sands in this interval exhibited both oil and gas shows and petrophysical analysis of downhole electrical logs indicates a potential pay zone of between 12 and 20 meters in the section. Attempts to sample formation fluids using a wireline formation tester were not successful and thus the zone will require cased hole testing in the future to confirm whether they are oil bearing. In addition to potential net pay in the Jesomma Formation, the well has encountered additional potential net pay sands in the Jurassic Adigrat Formation at a depth of 3246 to 3430 meters, several of which exhibited oil and gas shows. Petrophysical analysis of the well log data indicates up to 3 meters of potential hydrocarbon pay in several thin sand units. These sands do not warrant testing at this time, but do further indicate the existence of a working petroleum system.

It is anticipated that two additional drilling rigs will be secured and mobilized into the Company's areas of operation during the second half of 2012, bringing the total number of rigs in operation to four before the end of the year. It is anticipated that one additional rig will be utilized in Ethiopia and one additional rig will be utilized in Kenya. In addition to the Shabeel-1 and Ngamia-1 wells, which have completed drilling or are in the process of being drilled, four additional wells are currently planned: the Twiga-1well in Block 13T (Kenya), the Paipai-1 well in Block 10A (Kenya), the Shabeel North well in the Dharoor Block (Puntland (Somalia)), and an additional exploration well in the South Omo Block (Ethiopia). The Company will also continue to actively acquire, process and interpret 2D seismic over Blocks 10BA, 10BB, 12A, 13T and South Omo.

Africa Oil ended the quarter in a strong financial position with cash of $104.1 million and working capital of $82.2 million as compared to cash of $109.6 million and working capital of $90.2 million at December 31, 2011. Of the $104.1 million in cash at December 31, 2011, $21.0 million is cash held by Horn. The Company's liquidity and capital resource position has remained strong throughout the quarter.

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&m=31110701&l=0&r=0&s=AOI&t=LIST

5/28/2012 10:27:45 PM

Africa Oil First Quarter of 2012 Financial and Operating Results

VANCOUVER, BRITISH COLUMBIA--(Marketwire - May 28, 2012) - Africa Oil Corp. (TSX VENTURE:AOI)(OMX:AOI) ("Africa Oil", "the Company" or "AOC") is pleased to announce its financial and operating results for the three months ended March 31, 2012.

The Company and its operating partner on Block 10BB, Tullow, spudded the partnership's first well, Ngamia-1, on January 24, 2012. The Ngamia-1 exploration well in Kenya has now been deepened to a total depth of approximately 1940 meters. The well has encountered in excess of 100 meters of net oil pay in multiple reservoir zones over a gross interval of 650 meters of the upper Lokhone sandstone (855 meters to 1500 meters). The reservoirs in these sections are composed of good quality Tertiary age sandstones. Moveable oil with an API greater than 30 degrees has been recovered to surface from four representative intervals. This oil has similar properties to the light waxy crude which has been discovered in Uganda by Tullow. Plans are in place for at least two drill stem tests upon completion of drilling operations. The Ngamia-1 well is now being drilled to a depth of approximately 2,700 meters to explore for deeper potential including the lower Lokhone sandstone which was one of the primary objectives of this well. The Ngamia-1 well has encountered additional oil and gas shows over a gross interval of 140 meters from a depth of 1,800 meters to 1,940 meters. The reservoirs are similar to those previously encountered at shallower depths.

In Puntland (Somalia), the Shabeel-1 well has been successfully drilled, reaching a total depth of 3470 meters. Several oil and gas shows were encountered indicating the existence of a working petroleum system. The well encountered metamorphic basement at a depth of 3430 meters and has been suspended for future testing. The well encountered a 355 meter section of Upper Cretaceous sands and shales of the Jesomma Formation at a depth of approximately 1660 meters. The sands in this interval exhibited both oil and gas shows and petrophysical analysis of downhole electrical logs indicates a potential pay zone of between 12 and 20 meters in the section. Attempts to sample formation fluids using a wireline formation tester were not successful and thus the zone will require cased hole testing in the future to confirm whether they are oil bearing. In addition to potential net pay in the Jesomma Formation, the well has encountered additional potential net pay sands in the Jurassic Adigrat Formation at a depth of 3246 to 3430 meters, several of which exhibited oil and gas shows. Petrophysical analysis of the well log data indicates up to 3 meters of potential hydrocarbon pay in several thin sand units. These sands do not warrant testing at this time, but do further indicate the existence of a working petroleum system.

It is anticipated that two additional drilling rigs will be secured and mobilized into the Company's areas of operation during the second half of 2012, bringing the total number of rigs in operation to four before the end of the year. It is anticipated that one additional rig will be utilized in Ethiopia and one additional rig will be utilized in Kenya. In addition to the Shabeel-1 and Ngamia-1 wells, which have completed drilling or are in the process of being drilled, four additional wells are currently planned: the Twiga-1well in Block 13T (Kenya), the Paipai-1 well in Block 10A (Kenya), the Shabeel North well in the Dharoor Block (Puntland (Somalia)), and an additional exploration well in the South Omo Block (Ethiopia). The Company will also continue to actively acquire, process and interpret 2D seismic over Blocks 10BA, 10BB, 12A, 13T and South Omo.

Africa Oil ended the quarter in a strong financial position with cash of $104.1 million and working capital of $82.2 million as compared to cash of $109.6 million and working capital of $90.2 million at December 31, 2011. Of the $104.1 million in cash at December 31, 2011, $21.0 million is cash held by Horn. The Company's liquidity and capital resource position has remained strong throughout the quarter.

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&m=31110701&l=0&r=0&s=AOI&t=LIST

Quelle: http://www.iii.co.uk/investment/detail/?display=discussion&c…

Management Discussion & Analysis document (from www.seda.com)

Interesting snippets...

Operations Update

In addition to Shabeel-1 and Ngamia-1 wells, which have complete drilling or are in the process of being drilled, four additional wells are currently planned: the Twinga-1 well in Block 13T (Kenya), the Paipai well in Block 10A (Kenya) , the Shabeel North well in Dharoor Block (Puntland), and an additional exploration well in the South Omo Block (Ethiopia). The Company will also continue to actively acquire process and interpret 2D seismic over Blocks 10BA, 10BB, 12A, 13T and South Omo. (page 3)

Paipai will be drilled to a depth of 4150m. (page 3)

The Weatherford 804 rig used for Ngamia-1 will be moved to Block 13T for Twinga-1. (page 3)

Block 9 (Kenya)

The Company is currently discussing farmout opportunities on this block to bring in one to two partners. (page 4)

South Omo Block (Ethiopia)

One exploratory well is planned in the block before the end of 2012, which will satisfy the remaining work obligations (first period) under the South Omo PSA. (page 4)

Rift Valley Study Block (Ethiopia)

The Company has submitted an application to convert the Rift Valley Block to a formal production sharing agreement. (page 5)

Blocks 7 and 8 (Ethiopia) The Company has applied for a one year extension to the expiry date of the initial exploration period. (page 11)

Blocks 7 and 11 (Mali)

Recent security issues are being closely monitored, but currently the operational areas are not accessible. ... The Company has written off $3.1M of capitalization intangible exploration assets due to security concerns in Mali which has halted operations in the Company’s Blocks. (page 5)

Under the terms of the Block 7 and 11 PSCs, the current exploration periods expire in July 2012 and 2014 respectively. In accordance with the terms of the PSCs, the minimum gross exploration expenditures in the current exploration periods are $11.6 million (Block 7) and $8.0 million (Block 11). In exchange for 75% working interest, our partner has committed to funding all planned seismic, C&G, and drilling costs associated with both blocks. (page 13)

Working Interests

AOC plans to participate in Horn’s private placement which, upon completion, will result in a dilution of AOC’s interest in Horn. (page 2)

Horn Private Placement

AOC plans participate in Horn’s private placement. It is anticipated that AOC will acquire one-third or less of this private placement which, upon completion, will result in a dilution of AOC’s ownership interest in Horn. (page 6)

International Boundary Disputes

In September 2007, AOC was advised that the Ministry of water and Mineral Resources of the Republic of Somaliland was claiming ownership of the Nugaal and AhlMedo Valley basins, including some or all of the areas that comprise the Puntland PSA, granted by the Government of Puntland. That claim was repeated in correspondence received by the Company in February 2012. ... AOC disputes the claims of the Republic of Somaliland, however, the outcome of this dispute cannot be predicted with any certainty. (page 17)

Court Proceedings

The Company is a party to two separate court proceedings in Kenya. These involve a dispute concerning the administrative process that lead to the issuance of exploration permits in respect of, amongst others, Blocks 10BA, 10BB, 12A and 13T. The primary respondents include the Minister and the Ministry of Energy, Republic of Kenya. The Company and its affiliates are named as Interested Parties; the Applicants include Interstate Petroleum Ltd (IPL). (page 6)

Management Discussion & Analysis document (from www.seda.com)

Interesting snippets...

Operations Update

In addition to Shabeel-1 and Ngamia-1 wells, which have complete drilling or are in the process of being drilled, four additional wells are currently planned: the Twinga-1 well in Block 13T (Kenya), the Paipai well in Block 10A (Kenya) , the Shabeel North well in Dharoor Block (Puntland), and an additional exploration well in the South Omo Block (Ethiopia). The Company will also continue to actively acquire process and interpret 2D seismic over Blocks 10BA, 10BB, 12A, 13T and South Omo. (page 3)

Paipai will be drilled to a depth of 4150m. (page 3)

The Weatherford 804 rig used for Ngamia-1 will be moved to Block 13T for Twinga-1. (page 3)

Block 9 (Kenya)

The Company is currently discussing farmout opportunities on this block to bring in one to two partners. (page 4)

South Omo Block (Ethiopia)

One exploratory well is planned in the block before the end of 2012, which will satisfy the remaining work obligations (first period) under the South Omo PSA. (page 4)

Rift Valley Study Block (Ethiopia)

The Company has submitted an application to convert the Rift Valley Block to a formal production sharing agreement. (page 5)

Blocks 7 and 8 (Ethiopia) The Company has applied for a one year extension to the expiry date of the initial exploration period. (page 11)

Blocks 7 and 11 (Mali)

Recent security issues are being closely monitored, but currently the operational areas are not accessible. ... The Company has written off $3.1M of capitalization intangible exploration assets due to security concerns in Mali which has halted operations in the Company’s Blocks. (page 5)

Under the terms of the Block 7 and 11 PSCs, the current exploration periods expire in July 2012 and 2014 respectively. In accordance with the terms of the PSCs, the minimum gross exploration expenditures in the current exploration periods are $11.6 million (Block 7) and $8.0 million (Block 11). In exchange for 75% working interest, our partner has committed to funding all planned seismic, C&G, and drilling costs associated with both blocks. (page 13)

Working Interests

AOC plans to participate in Horn’s private placement which, upon completion, will result in a dilution of AOC’s interest in Horn. (page 2)

Horn Private Placement

AOC plans participate in Horn’s private placement. It is anticipated that AOC will acquire one-third or less of this private placement which, upon completion, will result in a dilution of AOC’s ownership interest in Horn. (page 6)

International Boundary Disputes

In September 2007, AOC was advised that the Ministry of water and Mineral Resources of the Republic of Somaliland was claiming ownership of the Nugaal and AhlMedo Valley basins, including some or all of the areas that comprise the Puntland PSA, granted by the Government of Puntland. That claim was repeated in correspondence received by the Company in February 2012. ... AOC disputes the claims of the Republic of Somaliland, however, the outcome of this dispute cannot be predicted with any certainty. (page 17)

Court Proceedings

The Company is a party to two separate court proceedings in Kenya. These involve a dispute concerning the administrative process that lead to the issuance of exploration permits in respect of, amongst others, Blocks 10BA, 10BB, 12A and 13T. The primary respondents include the Minister and the Ministry of Energy, Republic of Kenya. The Company and its affiliates are named as Interested Parties; the Applicants include Interstate Petroleum Ltd (IPL). (page 6)

Outlook

The Company has recently announced the discovery of over 100 meters of net oil pay in the Ngamia-1 exploration well, located in Block 10BB (Kenya). It is anticipated that drilling of the Ngamia well will be completed and test results announced early in the third quarter of 2012. Upon completion of the Ngamia well, it is anticipated that the rig will commence drilling the Twiga-1 exploration well, located on Block 13T (Kenya). The Twiga-1 well is on trend with the Ngamia well, focusing on a geologic structure similar to Ngamia.

In addition, the Company has recently announced that the Shabeel-1 well, located in the Dharoor Block (Puntland (Somalia)), has encountered a significant zone (12 - 20 meters) of potential hydrocarbon pay in the Upper Cretaceous Jesomma Formation. The Shabeel-1 well has been suspended for future testing. The drilling rig is currently being mobilized to the Shabeel-North location. It is anticipated that the Shabeel-North well will be drilled and potentially tested during the third quarter of 2012.

The Company and its joint venture partner Tullow aim to increase the pace of exploration in East Africa by sourcing an additional two drilling rigs before the end of 2012. One rig is intended to be mobilized to Block 10A (Kenya) and to commence drilling the Pai-Pai prospect and an additional rig is intended to be mobilized to the South Omo Block (Ethiopia) to commence drilling an oil exploration well. This will bring the total number of rigs operating on the Company's East African acreage to four prior to the end of 2012. In addition, the Company plans to continue aggressively acquiring 2D seismic data focused on Blocks 10BA, 10BB, 13T, South Omo and 12A.

The Company has recently announced the discovery of over 100 meters of net oil pay in the Ngamia-1 exploration well, located in Block 10BB (Kenya). It is anticipated that drilling of the Ngamia well will be completed and test results announced early in the third quarter of 2012. Upon completion of the Ngamia well, it is anticipated that the rig will commence drilling the Twiga-1 exploration well, located on Block 13T (Kenya). The Twiga-1 well is on trend with the Ngamia well, focusing on a geologic structure similar to Ngamia.

In addition, the Company has recently announced that the Shabeel-1 well, located in the Dharoor Block (Puntland (Somalia)), has encountered a significant zone (12 - 20 meters) of potential hydrocarbon pay in the Upper Cretaceous Jesomma Formation. The Shabeel-1 well has been suspended for future testing. The drilling rig is currently being mobilized to the Shabeel-North location. It is anticipated that the Shabeel-North well will be drilled and potentially tested during the third quarter of 2012.

The Company and its joint venture partner Tullow aim to increase the pace of exploration in East Africa by sourcing an additional two drilling rigs before the end of 2012. One rig is intended to be mobilized to Block 10A (Kenya) and to commence drilling the Pai-Pai prospect and an additional rig is intended to be mobilized to the South Omo Block (Ethiopia) to commence drilling an oil exploration well. This will bring the total number of rigs operating on the Company's East African acreage to four prior to the end of 2012. In addition, the Company plans to continue aggressively acquiring 2D seismic data focused on Blocks 10BA, 10BB, 13T, South Omo and 12A.

Outlook

The Company has recently announced the discovery of over 100 meters of net oil pay in the Ngamia-1 exploration well, located in Block 10BB (Kenya). It is anticipated that drilling of the Ngamia well will be completed and test results announced early in the third quarter of 2012. Upon completion of the Ngamia well, it is anticipated that the rig will commence drilling the Twiga-1 exploration well, located on Block 13T (Kenya). The Twiga-1 well is on trend with the Ngamia well, focusing on a geologic structure similar to Ngamia.

In addition, the Company has recently announced that the Shabeel-1 well, located in the Dharoor Block (Puntland (Somalia)), has encountered a significant zone (12 - 20 meters) of potential hydrocarbon pay in the Upper Cretaceous Jesomma Formation. The Shabeel-1 well has been suspended for future testing. The drilling rig is currently being mobilized to the Shabeel-North location. It is anticipated that the Shabeel-North well will be drilled and potentially tested during the third quarter of 2012.

The Company and its joint venture partner Tullow aim to increase the pace of exploration in East Africa by sourcing an additional two drilling rigs before the end of 2012. One rig is intended to be mobilized to Block 10A (Kenya) and to commence drilling the Pai-Pai prospect and an additional rig is intended to be mobilized to the South Omo Block (Ethiopia) to commence drilling an oil exploration well. This will bring the total number of rigs operating on the Company's East African acreage to four prior to the end of 2012. In addition, the Company plans to continue aggressively acquiring 2D seismic data focused on Blocks 10BA, 10BB, 13T, South Omo and 12A.

gimo211 WO

The Company has recently announced the discovery of over 100 meters of net oil pay in the Ngamia-1 exploration well, located in Block 10BB (Kenya). It is anticipated that drilling of the Ngamia well will be completed and test results announced early in the third quarter of 2012. Upon completion of the Ngamia well, it is anticipated that the rig will commence drilling the Twiga-1 exploration well, located on Block 13T (Kenya). The Twiga-1 well is on trend with the Ngamia well, focusing on a geologic structure similar to Ngamia.

In addition, the Company has recently announced that the Shabeel-1 well, located in the Dharoor Block (Puntland (Somalia)), has encountered a significant zone (12 - 20 meters) of potential hydrocarbon pay in the Upper Cretaceous Jesomma Formation. The Shabeel-1 well has been suspended for future testing. The drilling rig is currently being mobilized to the Shabeel-North location. It is anticipated that the Shabeel-North well will be drilled and potentially tested during the third quarter of 2012.

The Company and its joint venture partner Tullow aim to increase the pace of exploration in East Africa by sourcing an additional two drilling rigs before the end of 2012. One rig is intended to be mobilized to Block 10A (Kenya) and to commence drilling the Pai-Pai prospect and an additional rig is intended to be mobilized to the South Omo Block (Ethiopia) to commence drilling an oil exploration well. This will bring the total number of rigs operating on the Company's East African acreage to four prior to the end of 2012. In addition, the Company plans to continue aggressively acquiring 2D seismic data focused on Blocks 10BA, 10BB, 13T, South Omo and 12A.

gimo211 WO

Hi aweigh, what I have is the following. Unfortunately I don't have the original source of the following press article about a broker report:

Africa Oil* (AOI : TSX-V : $7.76), Net Change: 0.73, % Change: 10.38%, Volume: 3,752,270

80,000 pound elephant in the room.

Shares of Africa Oil continue to rock and roll, as investor excitement around the name grows. Recent news from 50/50 partner Tullow Oil, which indicated it has encountered 100 metres of net oil pay at its Ngamia-1 well in Kenya, is just the most recent catalyst.

A Bay Street brokerage recently published a bullish report on AOI, noting that the recent results far exceed pre-drill expectations. The report also notes that the scale of success at Ngamia-1 could indicate that the Lokichar sub-basin alone could contain 1 billion barrels of gross recoverable resource. The analyst also commented that the “pre-drill P50 recoverable resource estimate of 45 million barrels was predicated on some 17 m of net oil pay thus, all else being equal, a simple volumetric estimate would suggest that Ngamia could contain over 250 million barrels of recoverable resources within the existing horizons alone, let alone any potential prospectivity within the deeper, primary objective.”

World class oil explorer Tullow Oil also recently had great exploration success at its Albert Lake discovery in Uganda, with all wells not exceeding 50 m of net oil pay. The most prolific well at Albert Lake had 37 m of net oil pay and tested at 14,364 barrels of oil per day. The success at Ngamia-1 appears to be just the tip of the iceberg, as success looks to have de-risked a further 8 wells and prospects within Block 10BB.

As a result, Tullow and Africa Oil plan to drill the Twiga-1 prospect next, once testing at

Ngamia-1 is completed in early June.

To put the figures together:

The P50 to P90 estimates in case of success for Ngamia-1 used the following pre-drill assumptions:

* 17m net pay

* P50 5.0 km2 resp. 1,300 acres equals 45 mmbbls recoverable

* P90 18.0 km2 resp. 4,500 acres equals 180 mmbbls recoverable

Which we actually have from the upper Lokhone Sandstones alone are more then 100m pay which gives us at least a factor of 6 compared with their initial (pre-drill) assumptions.

Therefore we should already have

* P50 270 mmbbls

* P10 1,080 mmbbls

With the new oil and gas shows in the primary target (lower Lokhone sandstones) we have a real chance for more then 1 billion bbls recoverable from our very first Kenya drill!! Unbelievable...

Ngamia-1 is making history - and we longtermers are participating from the start ;o)

aus Stockhouse

Africa Oil* (AOI : TSX-V : $7.76), Net Change: 0.73, % Change: 10.38%, Volume: 3,752,270

80,000 pound elephant in the room.

Shares of Africa Oil continue to rock and roll, as investor excitement around the name grows. Recent news from 50/50 partner Tullow Oil, which indicated it has encountered 100 metres of net oil pay at its Ngamia-1 well in Kenya, is just the most recent catalyst.

A Bay Street brokerage recently published a bullish report on AOI, noting that the recent results far exceed pre-drill expectations. The report also notes that the scale of success at Ngamia-1 could indicate that the Lokichar sub-basin alone could contain 1 billion barrels of gross recoverable resource. The analyst also commented that the “pre-drill P50 recoverable resource estimate of 45 million barrels was predicated on some 17 m of net oil pay thus, all else being equal, a simple volumetric estimate would suggest that Ngamia could contain over 250 million barrels of recoverable resources within the existing horizons alone, let alone any potential prospectivity within the deeper, primary objective.”

World class oil explorer Tullow Oil also recently had great exploration success at its Albert Lake discovery in Uganda, with all wells not exceeding 50 m of net oil pay. The most prolific well at Albert Lake had 37 m of net oil pay and tested at 14,364 barrels of oil per day. The success at Ngamia-1 appears to be just the tip of the iceberg, as success looks to have de-risked a further 8 wells and prospects within Block 10BB.

As a result, Tullow and Africa Oil plan to drill the Twiga-1 prospect next, once testing at

Ngamia-1 is completed in early June.

To put the figures together:

The P50 to P90 estimates in case of success for Ngamia-1 used the following pre-drill assumptions:

* 17m net pay

* P50 5.0 km2 resp. 1,300 acres equals 45 mmbbls recoverable

* P90 18.0 km2 resp. 4,500 acres equals 180 mmbbls recoverable

Which we actually have from the upper Lokhone Sandstones alone are more then 100m pay which gives us at least a factor of 6 compared with their initial (pre-drill) assumptions.

Therefore we should already have

* P50 270 mmbbls

* P10 1,080 mmbbls

With the new oil and gas shows in the primary target (lower Lokhone sandstones) we have a real chance for more then 1 billion bbls recoverable from our very first Kenya drill!! Unbelievable...

Ngamia-1 is making history - and we longtermers are participating from the start ;o)

aus Stockhouse

Von User Warnado1 aus dem iii-Board

Quelle: http://www.iii.co.uk/investment/detail?code=cotn:AOIFF&displ…

Out of interest I conducted a volumetric estimate exercise based on some calculations made earlier in May, around the 9th/10th, by a Bay Street brokerage company.

The firm's analyst commented "pre-drill P50 recoverable resource estimate of 45 million barrels was predicated on some 17 m of net oil pay thus, all else being equal, a simple volumetric estimate would suggest that Ngamia could contain over 250 million barrels of recoverable resources within the existing horizons alone, let alone any potential prospectivity within the deeper, primary objective"

https://research.canaccordgenuity.com/_layouts/researchnotev…

In simple terms AOI's internal estimated resources calculation concluded that for every 17mtrs of net pay oil the P50 recoverable resource estimate would stand at of 45 million barrels of oil. See page 9 of the January/March presentation below -

http://www.africaoilcorp.com/i/pdf/CorporatePresentation_Jan…

http://www.africaoilcorp.com/i/pdf/UBS-March-2012.pdf

You will also notice on pages 9 of both presentations they give P10 recoverable resource estimates which stand at 180 million barrels of oil.

Before we go any further lets have a quick lesson sucking eggs involving 'P' numbers -

P90 = Proven, reasonable certainty of being recoverable (90% confidence).

P50 = Probable, expected to be closest to the true reserves (50% confidence).

P10 = Possible, less likely chance of being recovered than probable reserves (10% confidence).

The initial 45 million barrels of oil was based on P50 estimates for 17mtrs of net pay.

If we take that 17mtrs AOI's internal estimated resources increase to 180 million barrels of oil.

But we now know we have more than 17mtrs of net pay and although the latest news release does not disclose net pay numbers the previous news release does. It declares that we have a "total net oil pay encountered so far has increased to in excess of 100 metres across multiple reservoir zones"

TOTAL NET PAY IN EXCESS OF 100MTRS!

Lets work on this, the Bay Street analyst quoted company internal estimated resources based on definitive parameters. We now know these have increased therefore the 17mtrs of net oil pay now becomes 100mtrs of net oil pay, AT LEAST.

100 / 17 = 5.88

P50 previously 45 million barrels of oil now becomes 264.6 million barrels of oil (45 * 5.88)

P90 previously 180 million barrels of oil now becomes 1,058.4 million barrels of oil (180 * 5.88)

Additional to this we have the most most recent news release which declares "oil and gas shows (NOT NET PAY, SHOWS ONLY) over a gross interval of 140 metres from a depth of 1,800 metres to 1,940 metres". In all probability there will be more again due to drilling in the primary target and another 700mtrs to drill.

We already have IN EXCESS of 100mtrs which can only get bigger and bigger. I did my own little exercise on that amount when the presentation came out and the SHOWS come to much more than 100mtrs. I got them to approx 255mtrs over 29 separate intervals. Obviously I do not expect them all to produce but the evidence is there of their presence.

http://www.iii.co.uk/reg/profile/public/?threshold=0&pageno=…

The is very much to look forward to and all my shares will be staying securely within my firm grip for the foreseeable future without any doubt.

Quelle: http://www.iii.co.uk/investment/detail?code=cotn:AOIFF&displ…

Out of interest I conducted a volumetric estimate exercise based on some calculations made earlier in May, around the 9th/10th, by a Bay Street brokerage company.

The firm's analyst commented "pre-drill P50 recoverable resource estimate of 45 million barrels was predicated on some 17 m of net oil pay thus, all else being equal, a simple volumetric estimate would suggest that Ngamia could contain over 250 million barrels of recoverable resources within the existing horizons alone, let alone any potential prospectivity within the deeper, primary objective"

https://research.canaccordgenuity.com/_layouts/researchnotev…

In simple terms AOI's internal estimated resources calculation concluded that for every 17mtrs of net pay oil the P50 recoverable resource estimate would stand at of 45 million barrels of oil. See page 9 of the January/March presentation below -

http://www.africaoilcorp.com/i/pdf/CorporatePresentation_Jan…

http://www.africaoilcorp.com/i/pdf/UBS-March-2012.pdf

You will also notice on pages 9 of both presentations they give P10 recoverable resource estimates which stand at 180 million barrels of oil.

Before we go any further lets have a quick lesson sucking eggs involving 'P' numbers -

P90 = Proven, reasonable certainty of being recoverable (90% confidence).

P50 = Probable, expected to be closest to the true reserves (50% confidence).

P10 = Possible, less likely chance of being recovered than probable reserves (10% confidence).

The initial 45 million barrels of oil was based on P50 estimates for 17mtrs of net pay.

If we take that 17mtrs AOI's internal estimated resources increase to 180 million barrels of oil.

But we now know we have more than 17mtrs of net pay and although the latest news release does not disclose net pay numbers the previous news release does. It declares that we have a "total net oil pay encountered so far has increased to in excess of 100 metres across multiple reservoir zones"

TOTAL NET PAY IN EXCESS OF 100MTRS!

Lets work on this, the Bay Street analyst quoted company internal estimated resources based on definitive parameters. We now know these have increased therefore the 17mtrs of net oil pay now becomes 100mtrs of net oil pay, AT LEAST.

100 / 17 = 5.88

P50 previously 45 million barrels of oil now becomes 264.6 million barrels of oil (45 * 5.88)

P90 previously 180 million barrels of oil now becomes 1,058.4 million barrels of oil (180 * 5.88)

Additional to this we have the most most recent news release which declares "oil and gas shows (NOT NET PAY, SHOWS ONLY) over a gross interval of 140 metres from a depth of 1,800 metres to 1,940 metres". In all probability there will be more again due to drilling in the primary target and another 700mtrs to drill.

We already have IN EXCESS of 100mtrs which can only get bigger and bigger. I did my own little exercise on that amount when the presentation came out and the SHOWS come to much more than 100mtrs. I got them to approx 255mtrs over 29 separate intervals. Obviously I do not expect them all to produce but the evidence is there of their presence.

http://www.iii.co.uk/reg/profile/public/?threshold=0&pageno=…

The is very much to look forward to and all my shares will be staying securely within my firm grip for the foreseeable future without any doubt.

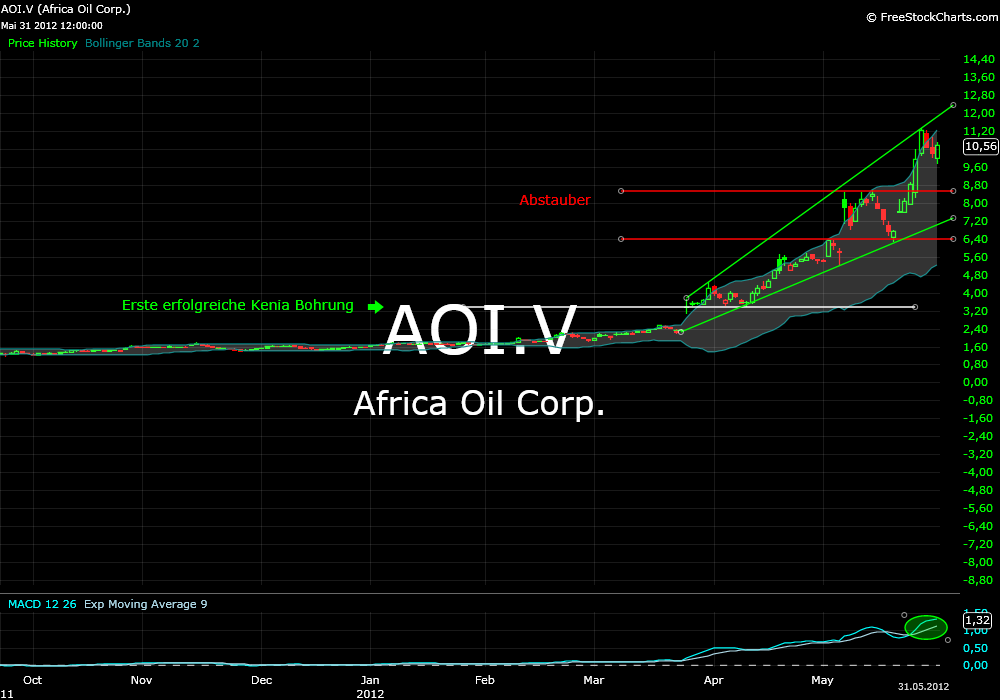

BRIEF-RESEARCH ALERT-Dundee raises Africa Oil price target

May 30 (Reuters) - Africa Oil Corp <AOI.V>:

* Dundee raises Africa Oil Corp <AOI.V> price target to C$13.30 from C$12;

rating buy

For a summary of rating and price target changes on U.S. companies:

Reuters Eikon users, click on [RCH/US]

Reuters 3000Xtra users, double-click [RCH/US]

Reuters Station users, click .1568

For a summary of rating and price target changes on Canadian companies:

Reuters Eikon users, click on [RCH/CA]

Reuters 3000Xtra users, double-click [RCH/CA]

Reuters Station users, click .4899

((Bangalore Equities Newsdesk +91 80 4135 5800; within U.S. +1 646 223 8780))

May 30 (Reuters) - Africa Oil Corp <AOI.V>:

* Dundee raises Africa Oil Corp <AOI.V> price target to C$13.30 from C$12;

rating buy

For a summary of rating and price target changes on U.S. companies:

Reuters Eikon users, click on [RCH/US]

Reuters 3000Xtra users, double-click [RCH/US]

Reuters Station users, click .1568

For a summary of rating and price target changes on Canadian companies:

Reuters Eikon users, click on [RCH/CA]

Reuters 3000Xtra users, double-click [RCH/CA]

Reuters Station users, click .4899

((Bangalore Equities Newsdesk +91 80 4135 5800; within U.S. +1 646 223 8780))

AFRICA OIL: CANACCORD RECOMMENDS speculative BUY (Bloomberg)

2012-05-30 09:42

(Bloomberg) Canaccord puts speculative buy recommendation on Africa Oil and target price 13:50 Canadian dollars.

This was written by Bloomberg News.

Exchange Editorial +46 8 5191 7910

Direkt

https://www.avanza.se/aza/press/news.jsp?newsArticleId=N1907476

2012-05-30 09:42

(Bloomberg) Canaccord puts speculative buy recommendation on Africa Oil and target price 13:50 Canadian dollars.

This was written by Bloomberg News.

Exchange Editorial +46 8 5191 7910

Direkt

https://www.avanza.se/aza/press/news.jsp?newsArticleId=N1907476

Good afternoon!

Please find enclosed a news release issued this afternoon. If you have any questions or require further information, please do not hesitate to call.

Best regards,

Sophia Shane

Ph. 604 689 7842

AFRICA OIL ANNUAL MEETING RESULTS

May 31, 2012 (AOI–TSXV, AOI–NASDAQ OMX) … Africa Oil Corp. (“Africa Oil” or the “Corporation”) is pleased to report that at the Corporation’s Annual General Meeting held today in Vancouver, shareholders approved all of the resolutions put forward at the meeting, namely:

· Approved the consolidated audited financial statements of the Corporation for the year ended December 31, 2011, together with the report of the auditors thereon;

· Fixed the number of directors at five (5);

· Elected the following directors to hold office until the next Annual General Meeting of the Corporation: Keith Hill, Cameron Bailey, Gary Guidry, Bryan Benitz and John Craig;

· Appointed PricewaterhouseCoopers, LLP as auditor of the Corporation to hold office until the next Annual General Meeting, at a remuneration to be fixed by the directors of the Corporation;

· Approved an ordinary resolution ratifying and confirming the Corporation’s existing 10% Rolling Stock Option Plan, and related matters;

About Africa Oil

Africa Oil Corp. is a Canadian oil and gas company with assets in Kenya, Ethiopia and Mali as well as Puntland (Somalia) through its 51% equity interest in Horn Petroleum Corporation. Africa Oil's East African holdings are in within a world-class exploration play fairway with a total gross land package in this prolific region in excess of 300,000 square kilometers. The East African Rift Basin system is one of the last of the great rift basins to be explored. New discoveries have been announced on all sides of Africa Oil's virtually unexplored land position including the major Albert Graben oil discovery in neighbouring Uganda. The Company is listed on the TSX Venture Exchange and on First North at NASDAQ OMX-Stockholm under the symbol "AOI".

ON BEHALF OF THE BOARD

“Keith C. Hill”

President and CEO

Please find enclosed a news release issued this afternoon. If you have any questions or require further information, please do not hesitate to call.

Best regards,

Sophia Shane

Ph. 604 689 7842

AFRICA OIL ANNUAL MEETING RESULTS

May 31, 2012 (AOI–TSXV, AOI–NASDAQ OMX) … Africa Oil Corp. (“Africa Oil” or the “Corporation”) is pleased to report that at the Corporation’s Annual General Meeting held today in Vancouver, shareholders approved all of the resolutions put forward at the meeting, namely:

· Approved the consolidated audited financial statements of the Corporation for the year ended December 31, 2011, together with the report of the auditors thereon;

· Fixed the number of directors at five (5);

· Elected the following directors to hold office until the next Annual General Meeting of the Corporation: Keith Hill, Cameron Bailey, Gary Guidry, Bryan Benitz and John Craig;

· Appointed PricewaterhouseCoopers, LLP as auditor of the Corporation to hold office until the next Annual General Meeting, at a remuneration to be fixed by the directors of the Corporation;

· Approved an ordinary resolution ratifying and confirming the Corporation’s existing 10% Rolling Stock Option Plan, and related matters;

About Africa Oil

Africa Oil Corp. is a Canadian oil and gas company with assets in Kenya, Ethiopia and Mali as well as Puntland (Somalia) through its 51% equity interest in Horn Petroleum Corporation. Africa Oil's East African holdings are in within a world-class exploration play fairway with a total gross land package in this prolific region in excess of 300,000 square kilometers. The East African Rift Basin system is one of the last of the great rift basins to be explored. New discoveries have been announced on all sides of Africa Oil's virtually unexplored land position including the major Albert Graben oil discovery in neighbouring Uganda. The Company is listed on the TSX Venture Exchange and on First North at NASDAQ OMX-Stockholm under the symbol "AOI".

ON BEHALF OF THE BOARD

“Keith C. Hill”

President and CEO

Intel on the AGM starting to roll in.

From SH :

" I attended AOI'S Annual Meeting In Vancouver

NorthSun15/31/2012 4:34:32 PM |

I just got back home after attending AOI's annual meeting, being in person was far better then hearing it on the Internet. VERY, VERY, IMPRESSIVE!! AOI's excellent land package in East Africa is the size of the United Kingdom, One part is as big as all the Oil and Natural Gas areas combined in the North Sea.

CEO Keith Hill said being early in the area enabled them to obtain the best properties. He when over in great deal each slide he put on the screen VERY IMPRESSIVE.

This is only the beginning for AOI, besides building a pipe line they are even considering building a refinery.

When will I sell is when the Lundin's sell. In 9 years they have turn about $200 million into $22 billion, the average company they have created has 29X itself for shareholders. Keith Hill feels this will be their most successful company. He said In all the years he has been in the petroleum industry, he has never been involve with company that has such potential as AOI.

If I didn't already have a sizable amount of shares in AOI or didn't have any I would be adding to my position or initiating one. To see AOI up on a day when most of my other oil stocks in my portfolio were down was very gratifying.

I hope they have a web cast of the meeting on the their web site, it is worth listening to, especially for shareholders in AOI.

http://www.africaoilcorp.com/s/Home.asp "

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=76149819

From SH :

" I attended AOI'S Annual Meeting In Vancouver

NorthSun15/31/2012 4:34:32 PM |

I just got back home after attending AOI's annual meeting, being in person was far better then hearing it on the Internet. VERY, VERY, IMPRESSIVE!! AOI's excellent land package in East Africa is the size of the United Kingdom, One part is as big as all the Oil and Natural Gas areas combined in the North Sea.

CEO Keith Hill said being early in the area enabled them to obtain the best properties. He when over in great deal each slide he put on the screen VERY IMPRESSIVE.

This is only the beginning for AOI, besides building a pipe line they are even considering building a refinery.

When will I sell is when the Lundin's sell. In 9 years they have turn about $200 million into $22 billion, the average company they have created has 29X itself for shareholders. Keith Hill feels this will be their most successful company. He said In all the years he has been in the petroleum industry, he has never been involve with company that has such potential as AOI.

If I didn't already have a sizable amount of shares in AOI or didn't have any I would be adding to my position or initiating one. To see AOI up on a day when most of my other oil stocks in my portfolio were down was very gratifying.

I hope they have a web cast of the meeting on the their web site, it is worth listening to, especially for shareholders in AOI.

http://www.africaoilcorp.com/s/Home.asp "

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=76149819

Horn Meeting:

The AGM was short and sweet to say.

Some items discussed, likely flowable oil in first well. Equipment used to test was inadequite and was possibly from a subcontractor of a subcontractor etc. No mention of time of arrival of new testing equipment.

Reason given is getting the " charges " into Somalia requires rigorous paperwork.

Substantial risk in Somalia operation. Geo political and drilling related.

Majority of Nuggal block is contested by Connoco although they have not done any work for 23 years and were sent info from government that they would lose block

15 million dollar finance was required for next well and testing. Know one asked about the timing as it did seem like very poor timing, that said friends and family need to make some easier money.

KH says some mornings when he wakes up and checks the market and sees HRN swinging up or down he sometimes phones the rig to see if there is something he should know.

Next well will spud in 7 - 10 days , is on site of well 2.

The level of industry experts and resources in Somalia are of general low quality so things are difficult, nonetheless improving and moving forward.

Commercial production at least a couple years out as a pipeline to Bosasso will be required, some trucking of oil may be available but limited.

That 's from my notes, anything i got wrong or missed?

He was pretty comical.

A couple things to add. They need 70 mil barrels of oil between the 2 wells to be commercially viable.

He inferred that the amount of oil found so far is about 1/3 what was best case scenario.

vendy 007

The AGM was short and sweet to say.

Some items discussed, likely flowable oil in first well. Equipment used to test was inadequite and was possibly from a subcontractor of a subcontractor etc. No mention of time of arrival of new testing equipment.

Reason given is getting the " charges " into Somalia requires rigorous paperwork.

Substantial risk in Somalia operation. Geo political and drilling related.

Majority of Nuggal block is contested by Connoco although they have not done any work for 23 years and were sent info from government that they would lose block

15 million dollar finance was required for next well and testing. Know one asked about the timing as it did seem like very poor timing, that said friends and family need to make some easier money.

KH says some mornings when he wakes up and checks the market and sees HRN swinging up or down he sometimes phones the rig to see if there is something he should know.

Next well will spud in 7 - 10 days , is on site of well 2.

The level of industry experts and resources in Somalia are of general low quality so things are difficult, nonetheless improving and moving forward.

Commercial production at least a couple years out as a pipeline to Bosasso will be required, some trucking of oil may be available but limited.

That 's from my notes, anything i got wrong or missed?

He was pretty comical.

A couple things to add. They need 70 mil barrels of oil between the 2 wells to be commercially viable.

He inferred that the amount of oil found so far is about 1/3 what was best case scenario.

vendy 007

Tullow Oil (LON:TLW) may have barely scratched the surface in Kenya, heavyweight broker Morgan Stanley said following more successful drilling in the country.

The FTSE 100 explorer revealed on Friday that it had inadvertently struck more oil at its Ngamia-1 well in Kenya.

The latest find showed oil and gas over a gross interval of 140 metres from a depth of 1,800 metres to 1,940 metres.

“This is an important, positive update, as without even having drilled the target reservoir, the well has already encountered oil/gas across sections multiple times the thickness of that seen throughout Uganda, its nearest analogous basin,” Morgan Stanley said.

And the broker doesn’t expect the good news to stop here, adding it “has likely only just entered the top of the target reservoir, in our opinion”.

The size of the discovery is difficult to ascertain without more detailed information and the broker expects a resource estimate in the near future.

“Given the net pay in the shallower horizons and scale of the structure/closure, everything to date suggests multi 100mb, far in excess of our 90mb upside case expectation.”

Morgan Stanley is confident the explorer can replicate the success it has already seen in Kenya, in addition to the regional technical understanding it has gained from Uganda.

The broker is urging investors to buy ahead of what is likely to be “a string of success, unlocking a new East African oil province,” the broker concluded.

Tullow had initially announced the Ngamia discovery back in March, while it revealed another 100-metre interval of light crude earlier this month.

The well will be drilled to a total depth of 2,700 metres and then logged and sampled, which will take a further three weeks to complete.

The find represents another triumph in the highly prospective region of East Africa, where interest from oil majors has intensified lately.

Anglo-Dutch giant Shell (LON:RDSB) has been hitting the headlines lately as its bidding war for Mozambique-focused Cove Energy (LON:COV) hots up.

Fellow big names Exxon (NYSE:XOM) and BG (LON:BG.) have also recently made moves into the area.

Smaller companies in Kenya include Simba Energy (CVE:SMB), which is currently evaluating its earlier stage exploration asset.

The junior explorer has already uncovered two potential targets for further exploration and a new competent person’s report (CPR) will provide expert insight on its acreage.

The FTSE 100 explorer revealed on Friday that it had inadvertently struck more oil at its Ngamia-1 well in Kenya.

The latest find showed oil and gas over a gross interval of 140 metres from a depth of 1,800 metres to 1,940 metres.

“This is an important, positive update, as without even having drilled the target reservoir, the well has already encountered oil/gas across sections multiple times the thickness of that seen throughout Uganda, its nearest analogous basin,” Morgan Stanley said.

And the broker doesn’t expect the good news to stop here, adding it “has likely only just entered the top of the target reservoir, in our opinion”.

The size of the discovery is difficult to ascertain without more detailed information and the broker expects a resource estimate in the near future.

“Given the net pay in the shallower horizons and scale of the structure/closure, everything to date suggests multi 100mb, far in excess of our 90mb upside case expectation.”

Morgan Stanley is confident the explorer can replicate the success it has already seen in Kenya, in addition to the regional technical understanding it has gained from Uganda.

The broker is urging investors to buy ahead of what is likely to be “a string of success, unlocking a new East African oil province,” the broker concluded.

Tullow had initially announced the Ngamia discovery back in March, while it revealed another 100-metre interval of light crude earlier this month.

The well will be drilled to a total depth of 2,700 metres and then logged and sampled, which will take a further three weeks to complete.

The find represents another triumph in the highly prospective region of East Africa, where interest from oil majors has intensified lately.

Anglo-Dutch giant Shell (LON:RDSB) has been hitting the headlines lately as its bidding war for Mozambique-focused Cove Energy (LON:COV) hots up.

Fellow big names Exxon (NYSE:XOM) and BG (LON:BG.) have also recently made moves into the area.

Smaller companies in Kenya include Simba Energy (CVE:SMB), which is currently evaluating its earlier stage exploration asset.

The junior explorer has already uncovered two potential targets for further exploration and a new competent person’s report (CPR) will provide expert insight on its acreage.