http://www.iii.co.uk/investment/detail/?display=discussion&code=cotn%3AAOIFF&threshold=0&pageno=2&it=ne

Fri 15:12 My calculations on AOI Jelly Deal 11

View Author's profileAdd to favouritesIgnoreAuthor's posts

Has anyone else done the numbers on possible scenarios for Africa OIl?

1. High Level Tullow comments as reported by Keith Hill:

“In fact, Tullow has been telling the market that Kenya should be conservatively twice as big as Uganda and possibly five times as big as Uganda.”

What does that mean?

AFAIK, Uganda is 1.1 billion barrels discovered and 1.4 billion yet to be discovered = 2.5 billion.

So “conservatively” means 5 billion barrels and “possibly” means 12.5 billion. If we look at AOI’s share, I’m going to take an average of 50%. I know we have less of some blocks and 100% of some, but I’m sure you’ll see us farm those down. KH doesn’t want to take all the risk on Block 9 Kinyonga, so I expect that to be farmed down before Pai-Pai on 10A is drilled. Tullow is keen to farm into the Rift Study Block too. I’m using the current number of shares in issue fully diluted, which I believe to be 228,700,000. I’m taking no account of future dilution. We are lucky in that regard to be a Lundin Company. IMHO, Lukas will not screw us by continually diluting the capital.

Barrels AOI Share AOI Barrels Value @ $6 Value Per Share

"Conservative" 5,000,000,000 50.00% 2,500,000,000 $15,000,000,000 $66

"In Between" 8,750,000,000 50.00% 4,375,000,000 $26,250,000,000 $115

"Optimistic" 12,500,000,000 50.00% 6,250,000,000 $37,500,000,000 $164

2. “Bottom Up” Estimates as calculated by Jelly Deal from figures from AOI, Centric Energy, Denovo and other published data and SEDAR filings.

2.1 Block 13T/10BB – The Lockichar Basin.

It is my understanding that they were hoping that this basin would be as big as Uganda on its own, and that Ngamia-1 wasn’t AOI’s original choice of drill locations. It certainly isn’t the biggest prospect on the block. They expected 17m of net pay in the primary target, being equivalent to 50 million barrels of oil. So far they have more than 6 times that pay in an unexpected layer. This increases Ngamia-1 to well over 300 million barrels prospectively, and the block to being potentially somewhat larger than Uganda.

2.2 South Omo and the Northern String of Pearls.

This is where Tullow believe the real “sweet spot” of the acreage is, according to Keith Hill. Tullow are very keen to drill South Omo. If these come in, 10BA and South OMO could be 3x Uganda.

2.3 Block 9, currently 100% AOI.

If Pai-Pai hits, then the huge Kinyonga prospect becomes a real possibility. If so, Block 9 could be a Uganda all by itself.

2.4 Rift Study Block and Block 12.

Currently no data about these blocks, but Tullow are keen on the Rift Study Block, and it’s easy to see why. For now, no value will be assigned to either, except to remember that if Tullow do farm in, then there will be some $$$$ coming our way to fund further drilling.

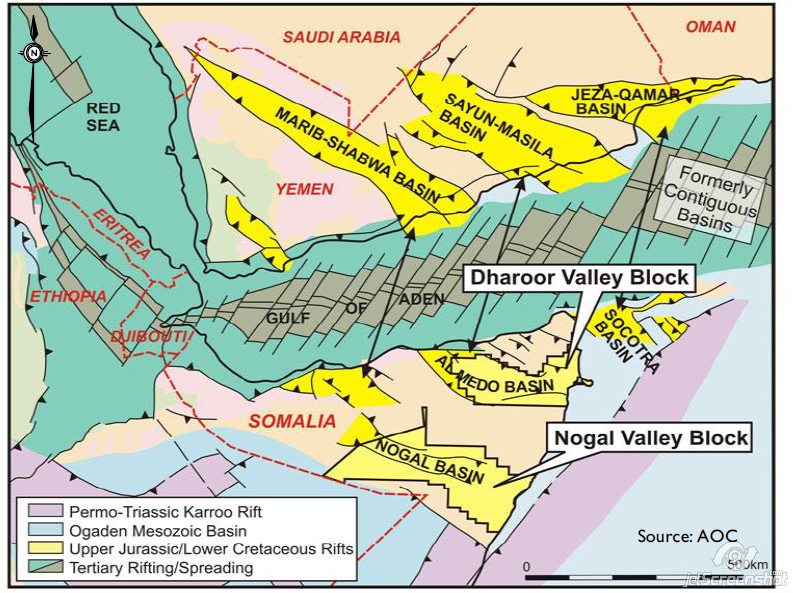

2.5 Block 9 Gas and Puntland. No value being assigned to either in this calculation for the sake of simplicity.

2.6 Bottom up estimate is: 13T/10BB + South Omo/10BA+Block 9 or in barrels 3.5billion+7.5 billion+2.5 billion= 13.5 billion.

2.7 Even this may be conservative, as Keith said that the new CPR due in Q3 would show big increases over the 11 billion barrels or so it shows now.

3. Summary.

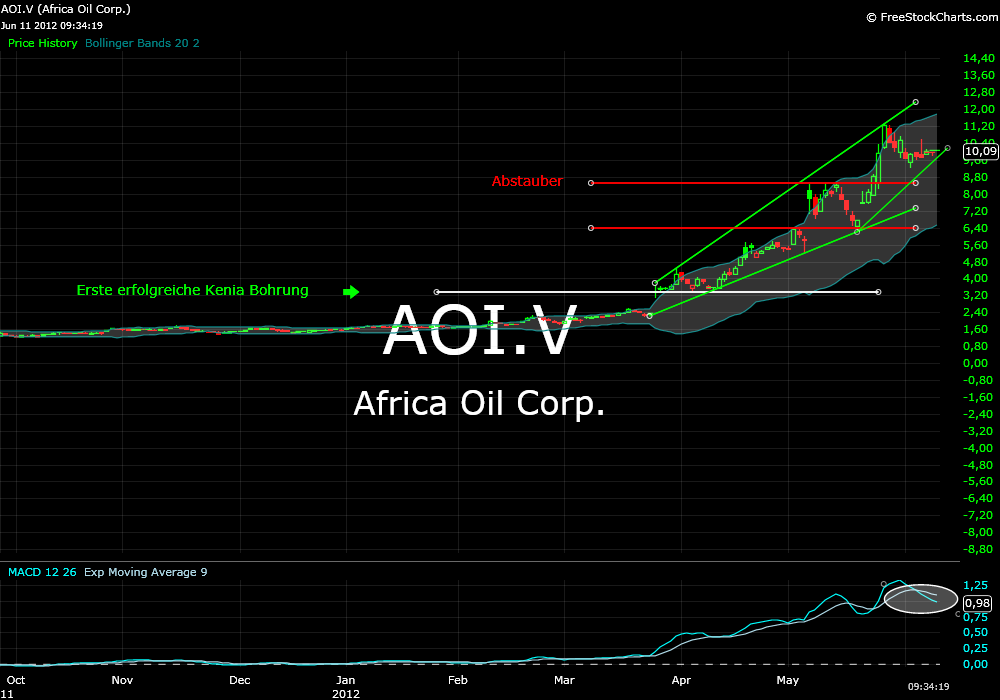

The number of leads and prospect is huge, at least 80 at last count, and that doesn’t include much of the acreage. The success of Ngamia-1 is highly encouraging. The huge increase in oil found compared with expectations is incredible. Lukas Lundin said that he wasn’t interested in selling out, but if someone came along now and opened the bidding with $25 or $50 a share, then he might discuss. Sell out figures of $50 or even $100 per share are not unrealistic at all. If we go into production, then over the years much bigger numbers come into play.

4. Timing. Of course, from AOIs perspective, the timing of the discovery couldn’t have been better. We have enough money to see us to the year end. Had w