http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/9368387/Oil-and-gas-are-the-new-African-queens.html

Oil and gas are the new African queens

By Emily Gosden

5:27PM BST 01 Jul 2012

When Royal Dutch Shell proposed a 195p-a-share, £992m offer for Mozambique-focused oil and gas explorer Cove Energy in February, many in the City regarded it as a “full” offer.

“The valuation looks stretched,” wrote one analyst. “The proposed offer is unlikely to face a challenge,” said another. More than four months on, Thailand’s PTT now leads a bidding war with a 240p-a-share agreed bid.

The City now expects Shell – which has so far raised its offer to 220p – to come back and at least match PTT, potentially even upping its bid to above 300p. Cove’s prized asset is its 8.5pc stake in the Rovuma 1 block off the Mozambique coast, where giant gas reserves have been discovered.

The fact that interest in the company has so greatly exceeded expectations is, in large part, due to the astonishing run of further gas discoveries in the block since February. But the bidding war also highlights the importance with which East Africa is regarded by the world’s biggest oil and gas companies – and the premium they are willing to pay .

“In the space of a few years, East Africa has become a feeding ground for most of the world’s oil majors, which have sniffed our resources of oil and gas on a truly gargantuan scale,” wrote Malcolm Graham-Wood, oil analyst at VSA Capital, in a recent note. And in the world of oil and gas where, as he puts it, “if you find it, they will come”, those gargantuan reserves are the key.

“It’s been known there’s oil here for 100 years,” Laurie Hunter, chief executive of explorer Madagascar Oil says. “It actually seeps out on the surface in places.”

But with exploratory drilling consistently exceeding expectations, the geology of East Africa is proving to be even better than once thought.

FTSE 100 explorer Tullow Oil began drilling by Lake Albert in Uganda in 2006 – the first well there since 1938. It has drilled 45 wells to date; 43 of them have hit hydrocarbons. The company says it believes the Lake Albert rift basin is a “a major hydrocarbon province in its own right”, with resources as high as 1.1bn barrels. French oil major Total and Chinese CNOOC have paid $2.9bn to buy into Tullow’s stakes.

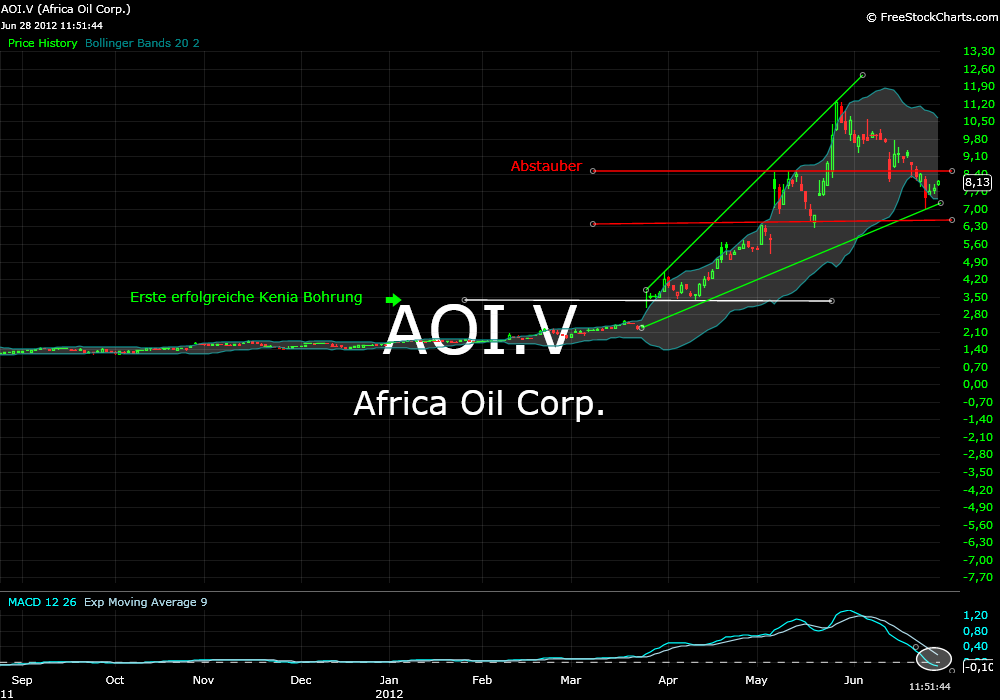

In March, Tullow struck oil in its first exploration well in Kenya, the country’s first ever discovery. After further success, Tullow has already suggested Kenya’s reserves could exceed those in Uganda.

But while the oil discoveries look transformational – for all involved – it is gas that is causing the most excitement. In the balmy waters of the Indian Ocean, off the coasts of Tanzania and Mozambique, gas discoveries are estimated to stand at more than 100 trillion cubic feet (tcf). Potential resources are significantly higher. By way of context, the UK’s entire annual natural gas consumption in 2010 was 3.3tcf.

The discoveries have made Ophir Energy the darling of the UK stock market. Since listing in July 2011 at 250p a share, the explorer has more than doubled in value, closing last week at 580p.

In May Ophir and partner BG Group announced their fifth consecutive gas discovery off Tanzania, taking their estimated reserves there to more than 10tcf. Ophir says its “unusually high success rate” is aided by the fact the basins’ geology is “ideal” for producing 3D seismic data, reducing the exploration risk.

Other major players off the coast of Tanzania include Norway’s Statoil and US giant ExxonMobil, who together have already discovered about 9tcf this year.

Further south, Mozambique’s Prosperidade gas complex in the Rovuma block is thought to contain recoverable reserves of 17tcf to 30tcf of gas – the discovery that brought Shell and PTT to the table for Cove. America’s Anadarko and Italian company ENI have also made giant Mozambique finds.

To date, Mr Graham-Wood says, Mozambique is “undoubtedly the biggest success story in East Africa”.

But it’s not just the geology that makes East Africa so exciting – it’s also the geography. “Conveniently,” Mr Graham-Wood notes, East Africa’s gas “faces the lucrative markets of India and the Far East and is now a truly valuable commodity”.

The gas will be cooled into liquefied natural gas (LNG) so it can be shipped to Asia. Gas consumption jumped 21.5pc in China and 11.6pc in Japan in 2011, according to BP data.

“We believe there is enough gas offshore Tanzania in total for an LNG export project,” says Martin Houston, chief operating officer of BG Group. “Looking at global gas demand growth between 2010 to 2020, supply will actually need to grow by more than 9pc per year – this is roughly equivalent to bringing onstream '20 Norways’ by the end of the decade. LNG is set to increase from just under 10pc of the gas supply mix today to around 14pc in 2025 with Asian demand the engine of this growth.”

“Gas is cheaper than oil, it’s easier to find big supply sources, and it’s cleaner,” explains analyst Stuart Joyner of Investec. “The Japanese nuclear industry has basically shut down, the UK has gone from being a net exporter of gas to a net importer. The growth in the gas market globally is phenomenal. The returns on LNG right now are much much better than they are for oil.”

Exploiting the reserves in East Africa is not without its challenges, as Mr Joyner notes from a recent visit to Mozambique. “There are no roads and you have to fly everywhere on dodgy twin-props.”

There are political challenges, too. Tullow was forced to defend itself against unfounded corruption allegations in Uganda, and has been embroiled in a tax dispute with former partner Heritage Oil.

Madagascar Oil’s shares had to be temporarily suspended in 2010, a month after listing on AIM, amid a tax dispute with the island’s government, now resolved. And Shell’s plans to explore in four “exciting” offshore deepwater blocks have been delayed for a decade by a stand-off between Tanzania and semi-autonomous Zanzibar over production sharing rights.

Yet challenging environments are part and parcel of frontier oil and gas exploration. There is little doubt that East Africa is well on its way to becoming a major new oil and gas exporting province.

No wonder, then, that analysts believe the bidding race for Cove has a long way to go - and is unlikely to be the last.

Shell last week extended its 220p offer, despite having been outbid. Mr Graham-Wood suggests that could be a “cunning ruse to buy time on another deal” – to buy a stake from one of the other partners in Rovuma. Even in February Shell had said it was assessing potential opportunities to build a higher stake in the block.

Mr Joyner agrees that the supermajors are circling. “Ophir is the obvious next target, but I think you could also see consolidation of some of the smaller stakes in the Mozambique projects and ultimately Anadarko and possibly ENI cashing in,” he says. “At the moment, you have a mix of independents and medium-sized companies. Fast-forward five years, you will see a very different picture.”