App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

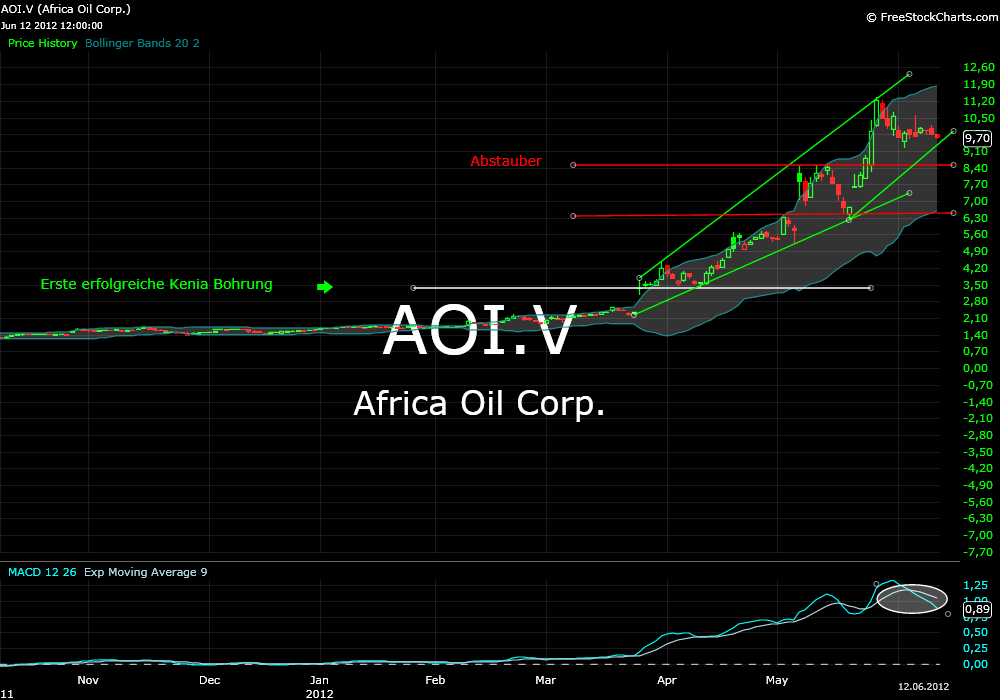

AOI - Africa Oil - WKN A0MZJC

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

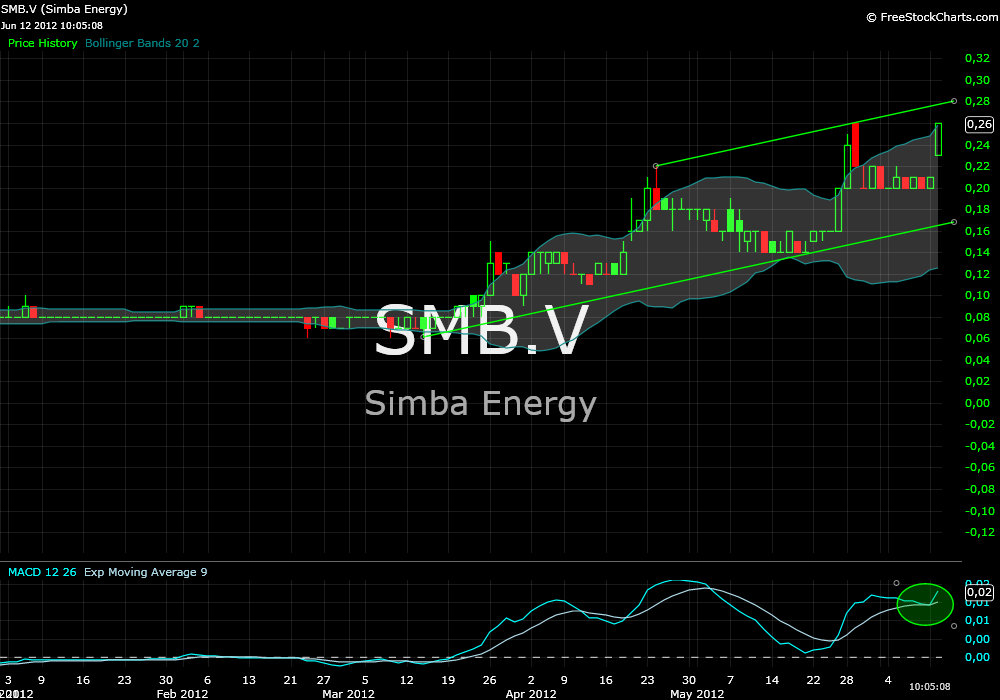

Nachbar von AOI und Moritz sein Pick!

http://www.simbaenergy.ca/news/simba-energy-receives-sproules-resource-assessment-report-for-block-2a-onshore-kenya.aspx

Simba Energy Receives Sproule's Resource Assessment Report For Block 2A - Onshore Kenya

June 12, 2012, Vancouver, B.C., Canada. Simba Energy Inc. ("Simba" or the "Company") (TSXV: SMB, Frankfurt: GDA, OTCQX: SMBZF), is pleased to announce that independent petroleum consultant Sproule Associates Limited (“Sproule”) has completed a technical report compliant to NI 51-101 and CPR (Competent Persons Report) standards in respect of Simba’s holding, a 100% interest in the PSC (Production Sharing Contract) for onshore Block 2A, Kenya, comprising 7,802 sq.km within the Madera-Lugh basin, near the juncture with the Anza basin and Lamu Embayment/Basin.

Utilising the existing 500km of 2D seismic, Sproule’s report has defined three prospective leads at four representative seismic horizons. Five horizons have been carried in the interpretation. For this initial assessment, the Gross Unrisked Undiscovered Petroleum Initially In-Place, (Mean) was 1,927.1MMboe and the Gross Unrisked Prospective Resources (Mean) was 445.3MMboe. The Total Gross Risked Mean Prospective Resources was 26.9MMboe. See also table below.

Table: Initial Resource Assessment of Block 2A - First Three Leads

(Source: Sproule and Associates Ltd.)

dazu eine Stellungnahme aus Stockhouse:

Simba announce Potential 2 biliion mmboe. Similar to Ngamia 1 well AOI/Tullow

http://www.africaoilcorp.com/s/Reserves_Resources.asp

While it is encouraging to have Sproule’s assessment for exploration potential for this area of interest within Block 2A, including a very strong lead, we now also believe it is relevant to note how this same area lies within the junction of two (basin) trends as being geologically similar to the successful Ngamia-1 well, recently drilled by Tullow Oil and Africa Oil, that is also located at the junction of two trends. As a next step we see our passive seismic program as offering a very strong compliment to the existing seismic we have for these leads. We definitely have an exciting, active and funded exploration program now in place for Block 2A and will look forward to the work of proving up our resources in the license."

http://www.simbaenergy.ca/news/simba-energy-receives-sproules-resource-assessment-report-for-block-2a-onshore-kenya.aspx

Simba Energy Receives Sproule's Resource Assessment Report For Block 2A - Onshore Kenya

June 12, 2012, Vancouver, B.C., Canada. Simba Energy Inc. ("Simba" or the "Company") (TSXV: SMB, Frankfurt: GDA, OTCQX: SMBZF), is pleased to announce that independent petroleum consultant Sproule Associates Limited (“Sproule”) has completed a technical report compliant to NI 51-101 and CPR (Competent Persons Report) standards in respect of Simba’s holding, a 100% interest in the PSC (Production Sharing Contract) for onshore Block 2A, Kenya, comprising 7,802 sq.km within the Madera-Lugh basin, near the juncture with the Anza basin and Lamu Embayment/Basin.

Utilising the existing 500km of 2D seismic, Sproule’s report has defined three prospective leads at four representative seismic horizons. Five horizons have been carried in the interpretation. For this initial assessment, the Gross Unrisked Undiscovered Petroleum Initially In-Place, (Mean) was 1,927.1MMboe and the Gross Unrisked Prospective Resources (Mean) was 445.3MMboe. The Total Gross Risked Mean Prospective Resources was 26.9MMboe. See also table below.

Table: Initial Resource Assessment of Block 2A - First Three Leads

(Source: Sproule and Associates Ltd.)

dazu eine Stellungnahme aus Stockhouse:

Simba announce Potential 2 biliion mmboe. Similar to Ngamia 1 well AOI/Tullow

http://www.africaoilcorp.com/s/Reserves_Resources.asp

While it is encouraging to have Sproule’s assessment for exploration potential for this area of interest within Block 2A, including a very strong lead, we now also believe it is relevant to note how this same area lies within the junction of two (basin) trends as being geologically similar to the successful Ngamia-1 well, recently drilled by Tullow Oil and Africa Oil, that is also located at the junction of two trends. As a next step we see our passive seismic program as offering a very strong compliment to the existing seismic we have for these leads. We definitely have an exciting, active and funded exploration program now in place for Block 2A and will look forward to the work of proving up our resources in the license."

[url=http://peketec.de/trading/viewtopic.php?p=1260511#1260511 schrieb:CCG-Redaktion schrieb am 12.06.2012, 16:25 Uhr[/url]"]» zur Grafik

Simba Energy: Hotly anticipated CPR highlights ‘great potential' in Kenya

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&m=31161180&l=0&r=0&s=SMB&t=LIST

Warnado1 aus dem iii Thread

The recent SMB resource assessment report for block 2A by Sproule is very interesting when compared to resource assessment of Lion Petroleum's blocks 1 (Afren also) and 2B which were also prepared by Sproule (Conclusions of NI 51-101 Report Sproule, 2011).

Blocks 1 and 2B sandwich SMB's block 2A and Blocks 2A and 2B are nearly identical in size.

http://www.lionpetroleumcorp.com/operations/acreage-highlights.html

http://www.lionpetroleumcorp.com/fileadmin/user_upload/2012-01-12__High_Res__Lion_Corporate_Presentation.pdf

http://www.afren.com/operations/kenya/block_1/

[url=http://peketec.de/trading/viewtopic.php?p=1261012#1261012 schrieb:CCG-Redaktion schrieb am 13.06.2012, 14:46 Uhr[/url]"]Indikatoren kühlen sich etwas ab. Luftholen.

» zur Grafik

Da haben wohl einige mitgelesen! Long auf der 59 SEK und raus auf der 62.10 SEK.

Shortattacke kurz vor Canadaeröffnung in Stockholm.

Grund:

http://www.affarsvarlden.se/hem/nyheter/article3493220.ece

STOCKHOLM (direct) a local authority in Turkana, Kenya, require that prospecting in Ngamia-1 well, Africa Oil has an ownership interest of 50%, will be stopped until the Government agrees to give the local district of a larger proportion of future oil revenues.It reports the Nairobi newspaper Star, according to Bloomberg News.Municipal Council (Turkana County Council), located in the district where the well is located, to have at least 25 percent of the royalties, according to the newspaper, citing a letter from the authority to the Department of energy.The Government has already agreed to give the District of 15 percent."I don't see a date.

A fresh dispute has erupted over oil exploration by British firm Tullow in Turkana County. The Turkana County Council has written to the government demanding that the exploration be halted until an agreement is reached on how to share oil revenue. Turkana County Counci Chairman Eliud Ekero says in his letter to the Ministry of Energy that the residents should get not less than 25 per cent of the proceeds. "There are issues which as leaders and residents of Turkana, we have to agree on with Tullow and the government so that the exploration exercise can go on smoothly," said Turkana Central MP Ekwe Ethuro.

Tullow discovered the Oil deposits at a location named Ngamia 1 two month ago and the company has been working to expand the exploration in Turkana South after it discovered more deposits in the region. Turkana South DC Joseph Kanyiri says the government has been holding meetings with communities in the region to educate them on the exploration exercise so that facts about the exercise are not distorted.

Tullow and the government has agreed that 15 per cent of the revenues will go the community in the area but the council wants the figures revised. Kanyiri has also confirmed that all necessary procedures were followed before the exploration began. "All the reports on the exercise including the environmental impact assessment details are available for public scrutiny". A section of professions from the county have also threatened to go to court to stop the exploration until the controversies are resolved.

http://allafrica.com/stories/201206131120.html

Tullow discovered the Oil deposits at a location named Ngamia 1 two month ago and the company has been working to expand the exploration in Turkana South after it discovered more deposits in the region. Turkana South DC Joseph Kanyiri says the government has been holding meetings with communities in the region to educate them on the exploration exercise so that facts about the exercise are not distorted.

Tullow and the government has agreed that 15 per cent of the revenues will go the community in the area but the council wants the figures revised. Kanyiri has also confirmed that all necessary procedures were followed before the exploration began. "All the reports on the exercise including the environmental impact assessment details are available for public scrutiny". A section of professions from the county have also threatened to go to court to stop the exploration until the controversies are resolved.

http://allafrica.com/stories/201206131120.html

Von motz1 WO

Was ich als Erklärungsansatz gefunden habe war ein Beitrag von User Warnado1 auf iii mit einem Artikel, wonach die Lokal Community einen größeren Anteil vom Ölgeld abhaben will.

--------------

Kenya: Turkana Wants 25 Percent Share of Oil Wealth

By Mathews Ndanyi, 12 June 2012Comment

A fresh dispute has erupted over oil exploration by British firm Tullow in Turkana County. The Turkana County Council has written to the government demanding that the exploration be halted until an agreement is reached on how to share oil revenue. Turkana County Counci Chairman Eliud Ekero says in his letter to the Ministry of Energy that the residents should get not less than 25 per cent of the proceeds. "There are issues which as leaders and residents of Turkana, we have to agree on with Tullow and the government so that the exploration exercise can go on smoothly," said Turkana Central MP Ekwe Ethuro.

Tullow discovered the Oil deposits at a location named Ngamia 1 two month ago and the company has been working to expand the exploration in Turkana South after it discovered more deposits in the region. Turkana South DC Joseph Kanyiri says the government has been holding meetings with communities in the region to educate them on the exploration exercise so that facts about the exercise are not distorted.

Tullow and the government has agreed that 15 per cent of the revenues will go the community in the area but the council wants the figures revised. Kanyiri has also confirmed that all necessary procedures were followed before the exploration began. "All the reports on the exercise including the environmental impact assessment details are available for public scrutiny". A section of professions from the county have also threatened to go to court to stop the exploration until the controversies are resolved.

http://allafrica.com/stories/201206131120.html

---------

Der selbe User relativierte die Aussage wenig später mit dem Beitrag

"Very pleased to inform you all that I have been very reliably informed there is no truth in the article at all."

User redinvest stellte auf investorshub eine Mail von Sophia Shane (IR von AOI) mit folgendem Inhalt ein:

-----

You deserve to know that I believe this whole thing today was a hoax. Hopefully some heads roll.

" Sophia Shane sophias@namdo.com

Hi!

No truth at all to that article. Nothing has been halted.

Best regards,

Sophia

-----

Ich halte diese beiden User für glaubwürdig.

Ich vermute dass mit der langen Zeit ohne Update eine solche Situation geschaffen (oder zumindest nicht ausgeschlossen) werden sollte um noch den ein oder anderen Eintritt zu versüßen, Belege habe ich aber keine dafür. Auch die fragwürdigen Infos von Cannacord stehen noch unkommentiert im Raum.

Bei HRN war es ähnlich, wobei ich hier kein PP vermute.

Erstaunt hat mich das recht hohe Volumen, insbesondere im Vergleich zu den Vortagen, was aber zur obigen Vermutung passen könnte.

We shall see...

Was ich als Erklärungsansatz gefunden habe war ein Beitrag von User Warnado1 auf iii mit einem Artikel, wonach die Lokal Community einen größeren Anteil vom Ölgeld abhaben will.

--------------

Kenya: Turkana Wants 25 Percent Share of Oil Wealth

By Mathews Ndanyi, 12 June 2012Comment

A fresh dispute has erupted over oil exploration by British firm Tullow in Turkana County. The Turkana County Council has written to the government demanding that the exploration be halted until an agreement is reached on how to share oil revenue. Turkana County Counci Chairman Eliud Ekero says in his letter to the Ministry of Energy that the residents should get not less than 25 per cent of the proceeds. "There are issues which as leaders and residents of Turkana, we have to agree on with Tullow and the government so that the exploration exercise can go on smoothly," said Turkana Central MP Ekwe Ethuro.

Tullow discovered the Oil deposits at a location named Ngamia 1 two month ago and the company has been working to expand the exploration in Turkana South after it discovered more deposits in the region. Turkana South DC Joseph Kanyiri says the government has been holding meetings with communities in the region to educate them on the exploration exercise so that facts about the exercise are not distorted.

Tullow and the government has agreed that 15 per cent of the revenues will go the community in the area but the council wants the figures revised. Kanyiri has also confirmed that all necessary procedures were followed before the exploration began. "All the reports on the exercise including the environmental impact assessment details are available for public scrutiny". A section of professions from the county have also threatened to go to court to stop the exploration until the controversies are resolved.

http://allafrica.com/stories/201206131120.html

---------

Der selbe User relativierte die Aussage wenig später mit dem Beitrag

"Very pleased to inform you all that I have been very reliably informed there is no truth in the article at all."

User redinvest stellte auf investorshub eine Mail von Sophia Shane (IR von AOI) mit folgendem Inhalt ein:

-----

You deserve to know that I believe this whole thing today was a hoax. Hopefully some heads roll.

" Sophia Shane sophias@namdo.com

Hi!

No truth at all to that article. Nothing has been halted.

Best regards,

Sophia

-----

Ich halte diese beiden User für glaubwürdig.

Ich vermute dass mit der langen Zeit ohne Update eine solche Situation geschaffen (oder zumindest nicht ausgeschlossen) werden sollte um noch den ein oder anderen Eintritt zu versüßen, Belege habe ich aber keine dafür. Auch die fragwürdigen Infos von Cannacord stehen noch unkommentiert im Raum.

Bei HRN war es ähnlich, wobei ich hier kein PP vermute.

Erstaunt hat mich das recht hohe Volumen, insbesondere im Vergleich zu den Vortagen, was aber zur obigen Vermutung passen könnte.

We shall see...

"I asked what was going on with the stock today and about the reaching TD... not alot of new info but thought I would share..

Sophia at AOI seems to be very to at responding to investors so koodos to her...

Good afternoon!

It’s an article in a local Nairobi paper that talks about discussions the government of Kenya is having with their local communities regarding revenue sharing once oil production starts. The article was a little dramatic which unfortunately tends to happen down there. In fact, the article said we were going to have to stop drilling because of it (which of course is not true). The markets are so nervous and sensitive right now that it doesn’t take much to have these wild swings – even whiffs of rumours.

The discussions that the government has with their communities is very important and healthy as a new emerging oil industry in the country will have an important positive impact in so many ways for the whole country. I imagine there will be lots of discussions and debates over the course of the next few years that we will read about. But this does not directly impact Africa Oil. In a better market, this article wouldn’t have made a dent in the share price.

I expect we should get some news very soon on the Ngamia well – I haven’t heard yet if they have reached TD but I agree that if they haven’t already it will be very soon. Next step once drilling has finished is to log and test to see what this well is capable of producing and then we move on to the next well.

Best regards,

Sophia"

Sophia at AOI seems to be very to at responding to investors so koodos to her...

Good afternoon!

It’s an article in a local Nairobi paper that talks about discussions the government of Kenya is having with their local communities regarding revenue sharing once oil production starts. The article was a little dramatic which unfortunately tends to happen down there. In fact, the article said we were going to have to stop drilling because of it (which of course is not true). The markets are so nervous and sensitive right now that it doesn’t take much to have these wild swings – even whiffs of rumours.

The discussions that the government has with their communities is very important and healthy as a new emerging oil industry in the country will have an important positive impact in so many ways for the whole country. I imagine there will be lots of discussions and debates over the course of the next few years that we will read about. But this does not directly impact Africa Oil. In a better market, this article wouldn’t have made a dent in the share price.

I expect we should get some news very soon on the Ngamia well – I haven’t heard yet if they have reached TD but I agree that if they haven’t already it will be very soon. Next step once drilling has finished is to log and test to see what this well is capable of producing and then we move on to the next well.

Best regards,

Sophia"

A dispute has erupted between Turkana country council and the Energy Ministry over oil exploration rights and revenue sharing.

The county council wants Tullow Oil, the company behind the discovery of oil in the area, stopped from going on with exploration until community rights are adequately protected.

The controversy raged last week when the council barred contractors hired by Tullow from going on with oil exploration at Twiga 1, the second drilling well after Ngamia 1 at Nakukulas area in Turkana South where the company discovered oil early this year.

“The Ministry of Energy and Tullow exploration company flouted protocol in prospecting of gasoline forcing us to move to court,” Turkana County Council chairman Eliud Kerio Longacha said.

The council officials and Turkana leaders yesterday met ministry officials and the Commissioner of Petroleum on how to resolve the dispute.

“As the custodian of land on behalf of the community, we were not issued with the Environment Impact Assessment report and detailed account on how the locals will benefit from the natural resource,” Mr Longacha said.

The council, he said, had written to the Ministry of Energy to demand a review of the oil exploration and revenue sharing.

The leaders are demanding that the community be awarded 25 per cent instead of 15 per cent of the total revenue generated from oil proceeds.

Tullow, however, argued that the council and local leaders were involved in the entire oil exploration exercise.

“The Ministry of Energy issued prospecting licences and the council and local leaders have been involved in the entire process,” Tullow Oil corporate affairs officer Ann Kibuge said.

Commissioner of Petroleum Martin Heya said the Environmental Impact Assessment report was forwarded to the Turkana South district commissioner’s office and the council before the start of the exploration exercise.

Commercial viability

“It is too early to determine commercial viability of the oil deposits and how revenue generation will be shared out,” Mr Heya said on phone.

The controversy emerges after the Ministry of Energy and Tullow launched an awareness-creation programme on how the local community would benefit from the oil resource.

A team from the ministry comprising geologists and engineers and Tullow Oil officials held a stakeholders meeting on how to prepare the community ahead of commercial drilling at Katilu in Turkana South District two weeks ago.

http://www.nation.co.ke/News/Council+faults+oil+cash+sharing+deal/-/1056/1425690/-/x7cq/-/ind

The county council wants Tullow Oil, the company behind the discovery of oil in the area, stopped from going on with exploration until community rights are adequately protected.

The controversy raged last week when the council barred contractors hired by Tullow from going on with oil exploration at Twiga 1, the second drilling well after Ngamia 1 at Nakukulas area in Turkana South where the company discovered oil early this year.

“The Ministry of Energy and Tullow exploration company flouted protocol in prospecting of gasoline forcing us to move to court,” Turkana County Council chairman Eliud Kerio Longacha said.

The council officials and Turkana leaders yesterday met ministry officials and the Commissioner of Petroleum on how to resolve the dispute.

“As the custodian of land on behalf of the community, we were not issued with the Environment Impact Assessment report and detailed account on how the locals will benefit from the natural resource,” Mr Longacha said.

The council, he said, had written to the Ministry of Energy to demand a review of the oil exploration and revenue sharing.

The leaders are demanding that the community be awarded 25 per cent instead of 15 per cent of the total revenue generated from oil proceeds.

Tullow, however, argued that the council and local leaders were involved in the entire oil exploration exercise.

“The Ministry of Energy issued prospecting licences and the council and local leaders have been involved in the entire process,” Tullow Oil corporate affairs officer Ann Kibuge said.

Commissioner of Petroleum Martin Heya said the Environmental Impact Assessment report was forwarded to the Turkana South district commissioner’s office and the council before the start of the exploration exercise.

Commercial viability

“It is too early to determine commercial viability of the oil deposits and how revenue generation will be shared out,” Mr Heya said on phone.

The controversy emerges after the Ministry of Energy and Tullow launched an awareness-creation programme on how the local community would benefit from the oil resource.

A team from the ministry comprising geologists and engineers and Tullow Oil officials held a stakeholders meeting on how to prepare the community ahead of commercial drilling at Katilu in Turkana South District two weeks ago.

http://www.nation.co.ke/News/Council+faults+oil+cash+sharing+deal/-/1056/1425690/-/x7cq/-/ind

10:13

Scaremongering, misleading

Warnado1

and bullshite articles.

Yesterday the rumour was The Turkana County Council had written to the government demanding that the exploration be halted until an agreement is reached on how to share oil revenue and operations at Ngamia-1 had stopped.

After a few enquiries I was very reliably informed that none of this is true and even Sophia quashed the rumours with an email to many declaring -

Hi!

No truth at all to that article. Nothing has been halted.

Best regards,

Sophia

Although I can not guarantee the authenticity, I have also been forward an email from a contact of mine via a third party in which Sophia supposedly goes on to say -

Hi!

No, it's an article in a local paper Nairobi that talks about discussions the government of Kenya is having their with local communities Regarding revenue sharing once oil production starts. The article was a little dramatic which unfortunately tends to happen down there. In fact, the article said we were going to have to stop drilling because of it (Which of course is not true). The markets are so nervous and sensitive right now That it does not take much to have these wild swings - even whiffs of rumors. The discussions that the government speed with their community is very important and healthy as a new emerging oil industry in the countryside goodwill have an important positive impact in so many ways for the whole country. I imagine there will be lots of discussions and debates over the course of the next few years That we goodwill read about. But this does not Directly Impact Africa Oil. In a better market, this article would not have made ​​a dent in the share price.

Best regards,

Sophia

Personally, I think it is very safe to say operations at Ngaima-1 are continuing as normal and have not been halted.

Now today, although dated 11th June, has presented itself with yet another rumour in which "the council barred contractors hired by Tullow from going on with oil exploration at Twiga 1" and "As the custodian of land on behalf of the community, we were not issued with the Environment Impact Assessment report and detailed account on how the locals will benefit from the natural resource".

Twiga-1 (formerly known as Mbango-A) is located on Block 13T, just across the boarder of 10BB and 31km to the North West of Ngamia-1.

So the new article claims that the Turkana County Council were not issued with the Environment Impact Assessment report?

The EIA for Block 13T was completed by Earth View Geoconsultants Ltd in 2011 -

http://www.earthviewgeoconsultants.com/index.php?option=com_content&view=article&id=82&Itemid=62

Tullow are true professionals so maybe the Turkana County Council have simply misplaced the EIA for 13T while they figure out how to buy cheap shares in AOI with the help of their scaremongering and misleading journalist friends!

Maybe the Ministry of Energy can give the Turkana County Council a copy if the EIA for 13T since they speak so highly of TLW/AOI and I am sure they would hate the Turkana County Council to jeopardise any significant future revenue stream for their needy country-

http://webcache.googleusercontent.com/search?q=cache:VA---v6efAwJ:www.energy.go.ke/%3

Scaremongering, misleading

Warnado1

and bullshite articles.

Yesterday the rumour was The Turkana County Council had written to the government demanding that the exploration be halted until an agreement is reached on how to share oil revenue and operations at Ngamia-1 had stopped.

After a few enquiries I was very reliably informed that none of this is true and even Sophia quashed the rumours with an email to many declaring -

Hi!

No truth at all to that article. Nothing has been halted.

Best regards,

Sophia

Although I can not guarantee the authenticity, I have also been forward an email from a contact of mine via a third party in which Sophia supposedly goes on to say -

Hi!

No, it's an article in a local paper Nairobi that talks about discussions the government of Kenya is having their with local communities Regarding revenue sharing once oil production starts. The article was a little dramatic which unfortunately tends to happen down there. In fact, the article said we were going to have to stop drilling because of it (Which of course is not true). The markets are so nervous and sensitive right now That it does not take much to have these wild swings - even whiffs of rumors. The discussions that the government speed with their community is very important and healthy as a new emerging oil industry in the countryside goodwill have an important positive impact in so many ways for the whole country. I imagine there will be lots of discussions and debates over the course of the next few years That we goodwill read about. But this does not Directly Impact Africa Oil. In a better market, this article would not have made ​​a dent in the share price.

Best regards,

Sophia

Personally, I think it is very safe to say operations at Ngaima-1 are continuing as normal and have not been halted.

Now today, although dated 11th June, has presented itself with yet another rumour in which "the council barred contractors hired by Tullow from going on with oil exploration at Twiga 1" and "As the custodian of land on behalf of the community, we were not issued with the Environment Impact Assessment report and detailed account on how the locals will benefit from the natural resource".

Twiga-1 (formerly known as Mbango-A) is located on Block 13T, just across the boarder of 10BB and 31km to the North West of Ngamia-1.

So the new article claims that the Turkana County Council were not issued with the Environment Impact Assessment report?

The EIA for Block 13T was completed by Earth View Geoconsultants Ltd in 2011 -

http://www.earthviewgeoconsultants.com/index.php?option=com_content&view=article&id=82&Itemid=62

Tullow are true professionals so maybe the Turkana County Council have simply misplaced the EIA for 13T while they figure out how to buy cheap shares in AOI with the help of their scaremongering and misleading journalist friends!

Maybe the Ministry of Energy can give the Turkana County Council a copy if the EIA for 13T since they speak so highly of TLW/AOI and I am sure they would hate the Turkana County Council to jeopardise any significant future revenue stream for their needy country-

http://webcache.googleusercontent.com/search?q=cache:VA---v6efAwJ:www.energy.go.ke/%3

Date/Time Subject Author

10:58

Re: The reason? (Twiga-1)

Warnado1

Again, I have been very reliably informed from the top level that reports on Kenya are incorrect and that operations are progressing well on both the the Ngamia-1 well and preparations to drill the Twiga-1 well.

http://www.iii.co.uk/investment/detail/?display=discussion&code=cotn%3AAOIFF&threshold=0&pageno=1&it=ne

10:58

Re: The reason? (Twiga-1)

Warnado1

Again, I have been very reliably informed from the top level that reports on Kenya are incorrect and that operations are progressing well on both the the Ngamia-1 well and preparations to drill the Twiga-1 well.

http://www.iii.co.uk/investment/detail/?display=discussion&code=cotn%3AAOIFF&threshold=0&pageno=1&it=ne

"Africa Oil Corp. (CVE:AOI) (PINK:AOIFF) stock price got affect by a dispute between the local authorities concerning the distribution of would be royalties from the company's oil sales.

AOI share price collapsed nearly 15% in what seems to be a slightly exaggerated panic. The trading volume wasn't too significant though at 2.2 million, which was only slightly above the daily average of 1.7 million.

Still, troublesome news were out forcing the price down and the bearish effect could continue until the matter is resolved. On June 13 it was disclosed that a local authority in Turkana, Kenya, wants to force a stop of exploration activities on AOI's 50% owned Ngamia-1 well until the local district is provided with a larger portion of future oil revenues.

The municipal council requires at least 25% of the proceeds. The district is currently promised only 15%.

The news originally surfaced in a Nairobi Star newspaper. There wasn't any official press release from Africa Oil, meaning the activities around Ngamia-1 were likely not affected and the dispute between the local and central governments might have no effect on the company's exploration efforts at this moment."

http://ca.hotstocked.com/article/36302/dispute-between-autho…

AOI share price collapsed nearly 15% in what seems to be a slightly exaggerated panic. The trading volume wasn't too significant though at 2.2 million, which was only slightly above the daily average of 1.7 million.

Still, troublesome news were out forcing the price down and the bearish effect could continue until the matter is resolved. On June 13 it was disclosed that a local authority in Turkana, Kenya, wants to force a stop of exploration activities on AOI's 50% owned Ngamia-1 well until the local district is provided with a larger portion of future oil revenues.

The municipal council requires at least 25% of the proceeds. The district is currently promised only 15%.

The news originally surfaced in a Nairobi Star newspaper. There wasn't any official press release from Africa Oil, meaning the activities around Ngamia-1 were likely not affected and the dispute between the local and central governments might have no effect on the company's exploration efforts at this moment."

http://ca.hotstocked.com/article/36302/dispute-between-autho…

US Refuses Comment on Africa Surveillance Report

June 15, 2012

by VOA News

In-Depth Coverage

The U.S. military has confirmed it runs "broad ranging" intelligence operations in Africa, though it stopped short of verifying a report that it has set up small air bases across the continent to keep watch on terrorist groups.

A statement issued Friday said the U.S. military "routinely" works with African partner nations to "counter" those who threaten regional security and stability in Africa.

The U.S. military said it employs its intelligence, surveillance and reconnaissance assets in Africa "based on security threats of mutual concern."

The Washington Post newspaper reported Thursday that the U.S. military has set up about a dozen air bases in Africa to conduct surveillance, in countries that include Burkina Faso, Uganda, Ethiopia, Djibouti, Kenya and the Seychelles.

The paper said the targets of the surveillance include al-Qaida-linked militants in Somalia, Yemen and Africa's Sahel region, and the rebel Lord's Resistance Army in central Africa. U.S. officials have repeatedly warned of the threat to regional stability presented by such groups and others like Nigeria's Boko Haram.

Instead of drones, The Post says the surveillance is conducted by small planes - usually single-engine PC-12s with only a pilot aboard. The report says the unarmed planes are equipped to record video, track infrared heat patterns and catch radio and cellphone signals.

A spokesman for the Kenyan Defense Forces, Colonel Cyrus Oguna, has denied there are U.S. air bases in Kenya, or that U.S. forces are using Kenyan airspace.

According to The Post, U.S. military Special Operations forces supervise the surveillance, but the program relies heavily on private military contractors and support from African troops.

The Washington Post previously reported that the U.S. has a secret program in east Africa and the Arabian peninsula that uses drone airplanes to watch militants in Somalia and Yemen.

The newspaper said its latest report was based on unnamed U.S. military and government officials, African officials, U.S. government contracting documents, unclassified military reports and diplomatic cables released by WikiLeaks.

http://www.globalsecurity.org/intell/library/news/2012/intell-120615-voa01.htm?_m=3n%2e002a%2e532%2elq0ao03dzj%2ehbu

June 15, 2012

by VOA News

In-Depth Coverage

The U.S. military has confirmed it runs "broad ranging" intelligence operations in Africa, though it stopped short of verifying a report that it has set up small air bases across the continent to keep watch on terrorist groups.

A statement issued Friday said the U.S. military "routinely" works with African partner nations to "counter" those who threaten regional security and stability in Africa.

The U.S. military said it employs its intelligence, surveillance and reconnaissance assets in Africa "based on security threats of mutual concern."

The Washington Post newspaper reported Thursday that the U.S. military has set up about a dozen air bases in Africa to conduct surveillance, in countries that include Burkina Faso, Uganda, Ethiopia, Djibouti, Kenya and the Seychelles.

The paper said the targets of the surveillance include al-Qaida-linked militants in Somalia, Yemen and Africa's Sahel region, and the rebel Lord's Resistance Army in central Africa. U.S. officials have repeatedly warned of the threat to regional stability presented by such groups and others like Nigeria's Boko Haram.

Instead of drones, The Post says the surveillance is conducted by small planes - usually single-engine PC-12s with only a pilot aboard. The report says the unarmed planes are equipped to record video, track infrared heat patterns and catch radio and cellphone signals.

A spokesman for the Kenyan Defense Forces, Colonel Cyrus Oguna, has denied there are U.S. air bases in Kenya, or that U.S. forces are using Kenyan airspace.

According to The Post, U.S. military Special Operations forces supervise the surveillance, but the program relies heavily on private military contractors and support from African troops.

The Washington Post previously reported that the U.S. has a secret program in east Africa and the Arabian peninsula that uses drone airplanes to watch militants in Somalia and Yemen.

The newspaper said its latest report was based on unnamed U.S. military and government officials, African officials, U.S. government contracting documents, unclassified military reports and diplomatic cables released by WikiLeaks.

http://www.globalsecurity.org/intell/library/news/2012/intell-120615-voa01.htm?_m=3n%2e002a%2e532%2elq0ao03dzj%2ehbu

Puntland to Export Oil by December 2012

June 17, 2012 16:24

During an open meeting with members of the Puntland Diaspora Forum in Perth, Australia, Range Resources Managing Director Peter Landau stated to the audience of several dozen that Puntland would be exporting oil by December 2012 upon completion of testing in August.

Landau and a Somali support staff highlighted the activities of Range Resources to date. Among the discussed issues was the upcoming flow testing on the Dharoor wells and the spudding of the first well in Nugaal this September.

Range Resources reiterated its support for the Puntland community at home, citing its $250,000 contribution to an air strip in Garowe and $5 Million pledge to the repair and upgrade of another airport in the region.

DissidentNation.com

http://dissidentnation.com/puntland-to-export-oil-by-december-2012/

June 17, 2012 16:24

During an open meeting with members of the Puntland Diaspora Forum in Perth, Australia, Range Resources Managing Director Peter Landau stated to the audience of several dozen that Puntland would be exporting oil by December 2012 upon completion of testing in August.

Landau and a Somali support staff highlighted the activities of Range Resources to date. Among the discussed issues was the upcoming flow testing on the Dharoor wells and the spudding of the first well in Nugaal this September.

Range Resources reiterated its support for the Puntland community at home, citing its $250,000 contribution to an air strip in Garowe and $5 Million pledge to the repair and upgrade of another airport in the region.

DissidentNation.com

http://dissidentnation.com/puntland-to-export-oil-by-december-2012/

Posted: 2012-06-19 10:04

AFRICA OIL: Oil Field in Kenya can be a success for Lundin company Africa Oil. I think Bank of America Merrill Lynch in a new analysis, which highlights Africa Oil's share.

An update on the final phase of the drilling of the Kenyan well Ngamia-1 in Block 10BB, where the operator Tullow Oil and Africa Oil is half owner, considered to be a significant positive news. This was written by Bank of America Merrill Lynch in one-to-date analysis of Tullow Oil.

An update on the final phase of the well is to be expected in about two weeks, according to investment bank.

Bank of America Merrill Lynch points out that the latest update of Kenya well encountered an oil and gaskolumn the gross, 140 feet in depth 1800-1940 m.

A breakdown of the oil and gaskolumnen, in net terms, the right depth of 1800-1940 meters, and drilling deeper down to 2700 meters is assessed collectively constitute a significant positive event for Tullow Oil's shares, according to the analysis.

Bank of America Merrill Lynch has a köprekommendation(buy recommendation) to Tullow Oil.

NEW OFFICE DIRECTLY

redaktionen@placera.nu

More of NEW OFFICE DIRECTLY

https://www.avanza.se/aza/press/press_article.jsp?article=222543

AFRICA OIL: Oil Field in Kenya can be a success for Lundin company Africa Oil. I think Bank of America Merrill Lynch in a new analysis, which highlights Africa Oil's share.

An update on the final phase of the drilling of the Kenyan well Ngamia-1 in Block 10BB, where the operator Tullow Oil and Africa Oil is half owner, considered to be a significant positive news. This was written by Bank of America Merrill Lynch in one-to-date analysis of Tullow Oil.

An update on the final phase of the well is to be expected in about two weeks, according to investment bank.

Bank of America Merrill Lynch points out that the latest update of Kenya well encountered an oil and gaskolumn the gross, 140 feet in depth 1800-1940 m.

A breakdown of the oil and gaskolumnen, in net terms, the right depth of 1800-1940 meters, and drilling deeper down to 2700 meters is assessed collectively constitute a significant positive event for Tullow Oil's shares, according to the analysis.

Bank of America Merrill Lynch has a köprekommendation(buy recommendation) to Tullow Oil.

NEW OFFICE DIRECTLY

redaktionen@placera.nu

More of NEW OFFICE DIRECTLY

https://www.avanza.se/aza/press/press_article.jsp?article=222543

"Meryll Lynch report out says Kenya is worth 1100p per share to Tullow. I am getting this second hand from the Independant in London. If you have access to it, I would appreciate a look at their calculations.

Just bare bones, AOI has a share of all but two of Tullows Kenya assets, and those two are relatively small in area, plus AOI has Block 9 which is massive and has good potential.

So lets say that block 9 makes up for what it doesn't share with Tullow, if Kenya is worth 1100p/share x 905 millionshares outstanding = 9.995 Billion Pounds to Tullow. Being that most of the land is split 50/50 does it not follow that Kenya is worth 9.995 billion pounds to AOI as well? 1 pound = $1.60 Canadian

Therefore Keny is worth 9,995,000,000 x $1.60 = $15,992,000,000 to AOI or $78.46/share if Meryll Lynch is right"

Stockhouse superoilhunter ( Mit der nötigen Distanz zu bewerten!)

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&m=31194209&l=0&r=0&s=AOI&t=LIST

Just bare bones, AOI has a share of all but two of Tullows Kenya assets, and those two are relatively small in area, plus AOI has Block 9 which is massive and has good potential.

So lets say that block 9 makes up for what it doesn't share with Tullow, if Kenya is worth 1100p/share x 905 millionshares outstanding = 9.995 Billion Pounds to Tullow. Being that most of the land is split 50/50 does it not follow that Kenya is worth 9.995 billion pounds to AOI as well? 1 pound = $1.60 Canadian

Therefore Keny is worth 9,995,000,000 x $1.60 = $15,992,000,000 to AOI or $78.46/share if Meryll Lynch is right"

Stockhouse superoilhunter ( Mit der nötigen Distanz zu bewerten!)

http://www.stockhouse.com/Bullboards/MessageDetail.aspx?p=0&m=31194209&l=0&r=0&s=AOI&t=LIST

Morgan Stanley adds Tullow Oil to 'Best Ideas' list

8:02 am by Natasha Barr Production ramp-up at the field in offshore Western Ghana has been slower than expected due to producing infrastructure issues. Heavyweight broker Morgan Stanley added Tullow Oil (LON:TLW) to its ‘Best Ideas’ list after concluding the oil company is likely to overcome infrastructure issues at its Jubilee field in West Africa.

Production ramp-up at the field in offshore Western Ghana has been slower than expected due to producing infrastructure issues.

Morgan Stanley said the issues at the Jubilee field, which accounts for 40 per cent of Tullow’s average daily production in 2012, can be “easily rectified”.

Analyst Jamie Maddock said: “Our proprietary analysis of the Jubilee field, in consultation with a technical expert, and our investigation of fields that have experienced similar issues suggest a favourable outcome is likely, with a decent probability of upside surprise”

He added that if the remediation process works, Jubilee output should rise towards the plateau target of 120,000 barrels of oil equivalent per day.

The broker, however, gives a downgraded target price of 1860 pence from 1907 pence as Morgan Stanley analysts believe uncertainty will prevail for “some time.”

Maddock added: “We retain our overweight rating, with increased conviction that resolution of Jubilee issues will drive upside to the share price.”

http://www.proactiveinvestors.co.uk/companies/news/44386/mor…

8:02 am by Natasha Barr Production ramp-up at the field in offshore Western Ghana has been slower than expected due to producing infrastructure issues. Heavyweight broker Morgan Stanley added Tullow Oil (LON:TLW) to its ‘Best Ideas’ list after concluding the oil company is likely to overcome infrastructure issues at its Jubilee field in West Africa.

Production ramp-up at the field in offshore Western Ghana has been slower than expected due to producing infrastructure issues.

Morgan Stanley said the issues at the Jubilee field, which accounts for 40 per cent of Tullow’s average daily production in 2012, can be “easily rectified”.

Analyst Jamie Maddock said: “Our proprietary analysis of the Jubilee field, in consultation with a technical expert, and our investigation of fields that have experienced similar issues suggest a favourable outcome is likely, with a decent probability of upside surprise”

He added that if the remediation process works, Jubilee output should rise towards the plateau target of 120,000 barrels of oil equivalent per day.

The broker, however, gives a downgraded target price of 1860 pence from 1907 pence as Morgan Stanley analysts believe uncertainty will prevail for “some time.”

Maddock added: “We retain our overweight rating, with increased conviction that resolution of Jubilee issues will drive upside to the share price.”

http://www.proactiveinvestors.co.uk/companies/news/44386/mor…

zu HRN:

Puntland Drilling Update

Red Emperor Resources NL (ASX: RMP | AIM: RMP) is pleased to announce that the

Shabeel North well currently being drilled in Puntland by Joint Venture partner and

operator, Horn Petroleum Corp. (TSXV: HRN), is at a current depth of 984m targeting a

total depth of 2,400m. Drilling operations have progressed smoothly since spudding and

remain on track to reach target depth on time and on budget.

The Shabeel North well is targeting Upper Cretaceous Jesomma sands, which had good

oil and gas shows in the Shabeel‐1 well 3.5 kilometers to the south. Petrophysical

analysis of downhole electrical logs in the Shabeel‐1 well indicated a potential pay zone

in the Jesomma of up to 12 to 20 meters with an average porosity of 18 to 20%. Upon

completion and testing of the Shabeel North well, the rig will move back to Shabeel‐1 to

flow test the identified Jesomma sands.

http://www.rangeresources.com.au/fileadmin/user_upload/asx/A…

Puntland Drilling Update

Red Emperor Resources NL (ASX: RMP | AIM: RMP) is pleased to announce that the

Shabeel North well currently being drilled in Puntland by Joint Venture partner and

operator, Horn Petroleum Corp. (TSXV: HRN), is at a current depth of 984m targeting a

total depth of 2,400m. Drilling operations have progressed smoothly since spudding and

remain on track to reach target depth on time and on budget.

The Shabeel North well is targeting Upper Cretaceous Jesomma sands, which had good

oil and gas shows in the Shabeel‐1 well 3.5 kilometers to the south. Petrophysical

analysis of downhole electrical logs in the Shabeel‐1 well indicated a potential pay zone

in the Jesomma of up to 12 to 20 meters with an average porosity of 18 to 20%. Upon

completion and testing of the Shabeel North well, the rig will move back to Shabeel‐1 to

flow test the identified Jesomma sands.

http://www.rangeresources.com.au/fileadmin/user_upload/asx/A…

Es ist eine Präsentation von Martin Heya (Ministery of Energy in Kenya) im Umlauf.

http://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=5&ved=0CGgQFjAE&url=http%3A%2F%2Fiekenya.org%2Fdownload%2FPRESENTATION%2520%2520TO%2520ENGINEERS%2520-Martin%2520HEYA.ppt&ei=vtfkT-7ZAY6R0QWJieSbCQ&usg=AFQjCNHQoYOKZoxh2Zo592XTw31bcownhQ&sig2=wBi71LBukwPS6DwcgRxIBA

Mit Stand vom 10.05. teilt Mr. Heya mit: "Net oil pay over 100m discovered in a structure about 20km2" (slide 25)

http://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=5&ved=0CGgQFjAE&url=http%3A%2F%2Fiekenya.org%2Fdownload%2FPRESENTATION%2520%2520TO%2520ENGINEERS%2520-Martin%2520HEYA.ppt&ei=vtfkT-7ZAY6R0QWJieSbCQ&usg=AFQjCNHQoYOKZoxh2Zo592XTw31bcownhQ&sig2=wBi71LBukwPS6DwcgRxIBA

Mit Stand vom 10.05. teilt Mr. Heya mit: "Net oil pay over 100m discovered in a structure about 20km2" (slide 25)

The Star (Nairobi)

Email Print Share

Kenya: State Given 21 Days to Respond to Claims

By Francis Mureithi, 22 June 2012

Comment

The government has been given 21 days to explain in Parliament if it is true that a company associated with a Cabinet minister sold the block where oil was found in Turkana. The directive was given yesterday by National Assembly Speaker Kenneth Marende following a petition by the people of Turkana which was read in Parliament by Turkana Central MP Ekwee Ethuro.

The petition has been directed to the Ministry of Environment and Natural Resources. Reports indicate that in 2010, Turkana Drilling Company, associated with a Cabinet minister sold Block 10BB for $10 million (Sh840 million) to Africa Oil. Yesterday, Abdi Nuh MP for Bura complained that the government did not give the true position on the reports. Ethuro said the people of Turkana want a clear statement on the companies licensed to drill oil in Turkana including their ownership and directorship. Including how they will benefit from the oil revenues.

http://allafrica.com/stories/201206221236.html

Email Print Share

Kenya: State Given 21 Days to Respond to Claims

By Francis Mureithi, 22 June 2012

Comment

The government has been given 21 days to explain in Parliament if it is true that a company associated with a Cabinet minister sold the block where oil was found in Turkana. The directive was given yesterday by National Assembly Speaker Kenneth Marende following a petition by the people of Turkana which was read in Parliament by Turkana Central MP Ekwee Ethuro.

The petition has been directed to the Ministry of Environment and Natural Resources. Reports indicate that in 2010, Turkana Drilling Company, associated with a Cabinet minister sold Block 10BB for $10 million (Sh840 million) to Africa Oil. Yesterday, Abdi Nuh MP for Bura complained that the government did not give the true position on the reports. Ethuro said the people of Turkana want a clear statement on the companies licensed to drill oil in Turkana including their ownership and directorship. Including how they will benefit from the oil revenues.

http://allafrica.com/stories/201206221236.html

http://geology.com/articles/east-africa-rift.shtml

Zur Geologie!!!!!!!!!!!!!

http://www.fugro-robertson.com/TellusFRLData/DataCoveragePDFs/EastAfricanRifts.pdf

http://www.geoexpro.com/article/The_East_African_Rift_System_A_View_from_Space/538b9edd.aspx

Zur Geologie!!!!!!!!!!!!!

http://www.fugro-robertson.com/TellusFRLData/DataCoveragePDFs/EastAfricanRifts.pdf

http://www.geoexpro.com/article/The_East_African_Rift_System_A_View_from_Space/538b9edd.aspx