GASOLINE PRICE JUMP BOOSTED RETAIL SALES IN AUGUST -- UPDATE

14 September 2023, 16:37, By Austen Hufford

Higher gasoline prices drove a solid gain in U.S. retail sales last month as consumers boosted spending modestly on other goods.

Retail sales -- a measure of spending at stores, online and in restaurants -- rose by a seasonally adjusted 0.6% in August from the prior month, the Commerce Department said Thursday, marking the fifth straight month of gains.

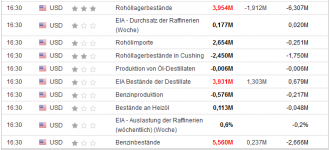

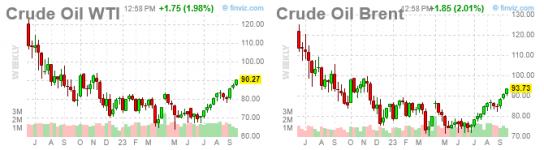

Spending at the pump accounted for most of last month's increase. Excluding gasoline, August retail sales rose 0.2%. The average price of a gallon of regular gasoline was $3.84 in August compared with $3.60 in July, according to OPIS, an energy data and analytics provider. Prices have held nearly steady in September.

Shoppers also boosted spending at electronics and appliance stores and at clothes sellers as students headed back to school. Consumers spent more at car dealerships despite higher interest rates and increased prices, which are straining car buyers.

August's spending increase continued a run of gains that are fueling resilient U.S. economic activity. Job and wage growth remain solid, attracting more people to seek work.A measure of online sales was flat in August, that came after some spending was pulled into July because of Amazon.com's Prime Day promotion, analysts said.

The retail sales figures aren't adjusted for inflation, and so can reflect price changes as well as shifts in consumer demand."With unemployment low, with real wages growing and with household net worth having hit another new record, the American households and consumers are in a pretty good position," said Carl Tannenbaum, the chief economist for wealth-management company Northern Trust.

Continued retail spending comes as Federal Reserve officials remain on course to hold interest rates steady at their meeting next week without resolving a bigger debate over whether they will need to raise them again this year. The Fed raised rates at 11 of its past 12 meetings, most recently in July, putting them at a 22-year high.

The rate increases aim to lower inflation by slowing the economy. Consumer prices rose in August at the fastest pace in more than a year because of a jump in energy costs. Core prices, which exclude food and energy items, rose at a relatively mild pace last month.

More details to come on summer of experiences spending

Retail sales figures primarily capture spending on goods rather than services such as travel, medical appointments and housing. The report does, however, capture spending at restaurants and bars, which rose 0.3% in August compared with 0.8% the prior month.

A broader read of consumer spending climbed rapidly in June and July. The Commerce Department will release more complete August spending figures at the end of this month.

The Transportation Security Administration said it screened more than 75 million passengers for air travel in August, higher than last year and above prepandemic levels in 2019. Moviegoers flocked to "Barbie" and Oppenheimer" in a boost to the summer box office, and women spent big on tickets to major cultural events, including Taylor Swift and Beyoncé concerts.

"The Barbenheimer phenomenon and the Taylor Swift tour demonstrates that consumers are still catching up on experiences they missed during the pandemic," said Bill Adams, the chief economist at Comerica Bank.

Consumers show signs of caution

There are signs that Americans are being more cautious with their spending amid higher prices and the resumption of student-loan payments, analysts said.

Consumers are shopping more at discount stores and buying cheaper store brands instead of name brands, said Corey Tarlowe, a retail analyst at the investment bank Jefferies.

Dollar General

chief executive Jeff Owen on Wednesday told analysts that the discount retailer's customers are "still battling the inflationary pressures, even though it's moderating.

"Dana Gassaway said he recently went to a mall in Silver Spring, Md. to purchase a nightgown for his fiancée at a Ross Dress for Less store.

"Discount stores are a little bit less than other stores but overall prices are going up," he said. "It's not a bad deal but it's not a good deal."

Write to Austen Hufford at

austen.hufford@wsj.com (END) Dow Jones NewswiresSeptember 14, 2023 09:37 ET (13:37 GMT)Copyright (c) 2023 Dow Jones & Company, Inc.