Azul Real schrieb am 25.12.2014, 13:34 Uhr[/url]"]

Spanish properties prices up 1.15% in third quarter

Tuesday, 09 December 2014

Residential property prices in Spain rose 1.15% in the third quarter of 2014 compared to the same period last year, according to the latest index published by the Property Registrars.

That is the first time this index has edged clearly into positive territory since the Spanish housing bubble burst, and according to real estate expert Mark Stucklin it means the market could be turning.

On a quarterly basis prices were basically stable, with a decline of just 0.08% between June and September and the peak to present fall in house prices is 32.4% according the Registrars’ figures.

It says that these figures paint a picture of stable house prices. The registered number of homes sold also shows a favourable evolution with transactions up 1.4% to 79,561 sales in the third quarter compared to the second. The market bottomed out with 72,560 sales in the fourth quarter of 2013.

The improvement was driven by resale properties with 52,127 sales, practically double those of new builds at 27,434. Resale transactions were up 4,268 on the second quarter, meaning a quarterly rise of 8.92%, against a fall of 10.36% in new builds.

Cumulative sales over 12 months were 313,607, up by 2,743 on the second quarter of the year when a record low of 310,864 was reached. Andalucia saw the most sales with 16,006 transactions, followed by the Valencia at 12,189, Catalonia at 11,975 and Madrid at 10,883.

The data also shows that the proportion of Spanish property sales involving a foreign buyer has hit a new high of 13.1% market share, an annual rise of 19% and year to date, foreign buyers bought 30,708 properties, up 23% on the same period last year.

British buyers were the strongest nationality buying 1,886 Spanish properties in the third quarter, up 37% on the same time last year, followed by the French, Russians, and Germans.

In terms of foreign market share, the British represented 18% of total purchases by foreigners, and 20% of key markets. France was next with 12%, Russia with 8%, and Germany with 7%.

Stucklin pointed out that in the boom years foreign buyers, led by the British, accounted for between 8% and 9% of the market. That fell to a low of 4.24% in 2009, at the nadir of the financial crisis. Since then foreign demand has increased in market share whilst local demand continues to shrink.

‘For the last year or more it has been possible to buy new property in Spain for less than it costs to build, thanks to a housing bust that has forced banks to take over thousands of new developments, and repossess hundreds of thousands of new or recently built homes.

Such low prices are a once in a cycle situation that will not be repeated again, at least not until the next boom and bust, which could take decades,’ he said.

He also explained that there are bargains, especially when it comes to property owned by the Spanish banks. ‘Not only are there thousands of newly built properties for sale in Spain below their replacement costs, but there is further room for price reductions in negotiations. It depends on the bank and the property, but some will give further discounts of 10% or more to close a sale.

He believes this is because deep discounts are the only way to sell much of this property, and after seven years of crisis, banks have written off enough to be able to sell below replacement costs. ‘Also, because banks are so bad at selling property, the only way they know to sell is by discounting. Of course, this is terrible new for private vendors, who have to compete with banks for buyers,’ Stucklin pointed out.

‘Sooner or later most of the stock will have sold, after which we will never again see so much Spanish property for sale at these prices. Once these properties have sold, there will be no new building to replace the supply of new homes on the market until prices more than double to cover building costs, land costs, and a developer’s margin. Nobody is going to build to sell at a loss,’ he added.

‘It also means that, whilst the Spanish property market is flooded with these kind of newly built properties for sale below replacement costs, there will be little or no building of new homes. Now we have an excess of supply, but one day there will be a shortage of new homes, and who knows what price dynamic that will trigger.

When the current stock of distressed Spanish properties is sold I doubt we’ll ever see these prices again,’ he concluded.

[url=http://peketec.de/trading/viewtopic.php?p=1477328#1477328 schrieb:

Azul Real schrieb am 08.05.2014, 05:52 Uhr[/url]"]

More Foreign Buyers in Spain but Less BritsImmobilien

More foreign buyers are buying property in Spain but the traditional purchasers from the UK are in decline, according to new data from property lawyers.

According to a new report published by Spain’s Notaries the number of foreign buyers increased by 9.8% in 2013 but the proportion of British buyers continued to fall.

Foreign purchasers accounted for 21.4% of all Spanish residential sales or 55,187 transactions in 2013 and it also highlights the areas that are popular with overseas buyers.

A breakdown by nationality showed the number of homes purchased by British buyers accounted for 14.7% of foreign purchases compared to 34.3% prior to the financial crisis in 2007.

Instead, French, Russian, German and Belgian buyers increased in number in 2013, rising by 10.9%, 8.2%, 7.8% and 6.9% respectively.

The Spanish Costas saw some of the largest increases in foreign purchases. Valencia came top, recording a 16.9% increase in foreign buyers year on year, the Canary Islands a 15.7% rise, Andalucía a 15.6% rise and Murcia a 15.2% increase.

The northern regions of Galicia, Castilla y Leon and Navarra recorded the largest falls in foreign buyers, each recorded year on year declines in excess of 20%.

Data for the average price paid by foreign buyers shows they are paying less. It fell 3.8% year on year to €1,486 per square meter.

According to a survey by the Urban Land Institute and PwC the real estate industry in Spain is moving into areas that a year ago would have been regarded as unbelievable.

Of the 500 or more expert individuals questioned, 67% agreed or strongly agreed that there are now good buying opportunities in Spain.

[url=http://peketec.de/trading/viewtopic.php?p=1476360#1476360 schrieb:

Azul Real schrieb am 04.05.2014, 12:25 Uhr[/url]"]

Immobilien

Nur mal als Beispiel der spanische Immobilienmarkt.

Nachfolgende statistische Zahlen sind offiziell vom spanischen Bauministerium.

Hier für freie Eigentumswohnungen in Ortschaften über 25.000 Einwohner.

Beispielhaft an der Provinz Andulusien mit ihren jeweiligen Regionen

Quelle:

http://www.fomento.gob.es/MFOM/LANG_CASTELLANO/ATENCION_CIUDADANO/INFORMACION_ESTADISTICA/Vivienda/Estadisticas/Precios/default.htm

Unidades: Euros/m2 / (durchschnittlich)

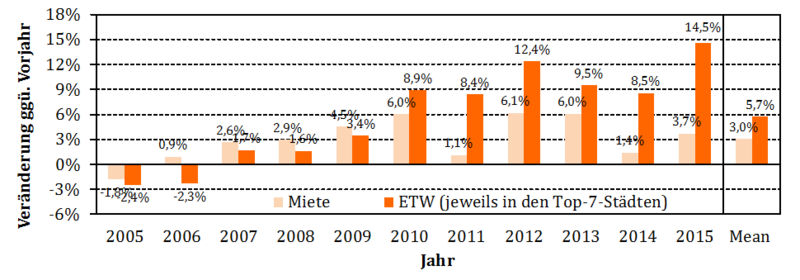

Von 1998 bis Anfang 1.Q. 2008, dem Peak am spanischen Immobilienmarkt und vor dem Einbruch mit der Finanzkrise etc. ,haben sich die durchschnittlichen Preise in der Provinz Andalusien pro qm mehr als verdreifacht.

Seit Anfang 2008 sind die Preise bis zum 4. Quartal 2013 in der Provinz Andalusien und innerhalb 6 Jahren ca. auf das Niveau vom 2/3. Trimester 2004 gefallen

Korrektur ca. 33% Provinz Andalusien

Korrektur ca. 38% Region Malaga

Unabhängig natürlich davon, das in einigen Bereichen und Regionen mehr als 50% Abschlag auf die ursprünglich mal gehandelten Preise pro qm im Vergleich zu 2008 erzielt werden können.

Sollte ein ähnlicher Turnaround wie in den USA möglich sein, hier war die Immokrise schon 2 Jahre vor der eigentlichen Finanzkrise im vollen Gange, (ab 2006), dürften sich die Preis m. E in Spanine bald das Tief in den meisten Regionen erreicht haben. => Ende 2014/bis Mitte 2015.

Einhergehend das sich gleichzeitig die Wirtschaft in Spanien erholt und ausländische Käufer zunehmend wieder den spansichen Immobilienmarkt als attraktiv ansehen. Sowohl private als auch investitionelle Käufer.

Code:

<i>

</i>Año 1998

Trimestres

1º 2º 3º 4º

Andalucía 527.3 537.0 548.1 552.3

Almería 505.0 524.1 538.1 529.2

Cádiz 533.9 545.4 559.9 555.6

Cordoba 470.6 485.7 503.2 504.4

Granada 510.9 527.0 522.4 531.6

Huelva 534.2 547.0 548.3 556.0

Jaén 395.8 395.8 409.3 417.3

Malaga 547.9 568.9 578.5 603.3

Sevilla 532.9 526.0 534.3 544.0

Año 2004

Trimestres

1º 2º 3º 4º

Andalucía 1'179.7 1'261.8 1'303.6 1'362.0

Almería 1'053.3 1'141.1 1'190.7 1'227.6

Cádiz 1'183.5 1'273.2 1'335.4 1'404.8

Cordoba 928.3 980.8 1'015.7 1'075.1

Granada 1'009.2 1'048.2 1'041.3 1'079.2

Huelva 1'156.8 1'226.0 1'242.7 1'263.2

Jaén 730.7 750.7 785.1 813.1

Malaga 1'630.5 1'766.0 1'995.1 1'897.7

Sevilla 1'176.6 1'261.0 1'303.9 1'385.6

MARKTPEAK in 2008

Año 2008

Trimestres

1º 2º 3º 4º

Andalucía 1'800.2 1'805.8 1'780.7 1'740.4

Almería 1'680.4 1'730.1 1'683.0 1'602.8

Cádiz 1'911.2 1'961.9 1'900.2 1'916.0

Cordoba 1'551.5 1'544.5 1'545.7 1'489.8

Granada 1'521.2 1'527.0 1'507.5 1'483.2

Huelva 1'785.4 1'799.0 1'788.7 1'677.1

Jaén 1'113.7 1'139.3 1'124.1 1'073.7

Malaga 2'348.3 2'304.3 2'277.7 2'199.9

Sevilla 1'791.2 1'777.3 1'752.4 1'788.4

2013

Trimestres

1º 2º 3º 4º

Andalucía 1'285.2 1'259.0 1'237.6 1'208.5

Almería 1'173.3 1'173.3 1'181.3 1'119.9

Cádiz 1'408.1 1'357.4 1'315.3 1'281.1

Cordoba 1'234.7 1'200.1 1'208.1 1'163.4

Granada 1'179.6 1'164.3 1'137.5 1'123.9

Huelva 1'284.0 1'228.8 1'167.6 1'123.2

Jaén 865.7 870.9 862.2 826.8

Malaga 1'544.3 1'535.0 1'484.3 1'447.2

Sevilla 1'341.8 1'301.5 1'271.6 1'269.1

[url=http://peketec.de/trading/viewtopic.php?p=1476352#1476352 schrieb:

Azul Real schrieb am 04.05.2014, 10:22 Uhr[/url]"]So langsam mal ein kleines Piso kaufen, bevor ich mich in 10 Jahren ärgere. Preise fallen in einigen Regionen jedoch immer noch

Wiederaufstieg Spaniens

So profitieren deutsche Unternehmen

03.05.2014, 10:17 Uhr

Mittelständler aus Deutschland tun sich bisher schwer damit, von der jüngsten wirtschaftlichen Gesundung Spaniens zu profitieren. Für Mutige bietet der Markt jedoch große Chancen.

„Spanien ist für einen Investor, der günstig einsteigen will, derzeit sehr attraktiv“, sagt Aurelius-Chef Dirk Markus. Das spanische Wirtschaftsministerium zählte 2013 ausländische Netto-Direktinvestitionen von 15,4 Milliarden Euro. 2012 verlor Spanien noch drei Milliarden Euro mehr, als neue Investitionen ins Land kamen.

Rekordzuflüsse erwartet

Doch während internationale Direktinvestoren kräftig auf die wirtschaftliche Gesundung Spaniens setzen, zögern die meisten Deutschen noch. Französische Direktinvestitionen in Spanien stiegen laut Wirtschaftsministerium um mehr als 100 Prozent, britische um 86 Prozent. Die aus Deutschland sanken 2013 um 3,7 Prozent.

http://www.handelsblatt.com/unternehmen/mittelstand/wiederaufstieg-spaniens-so-profitieren-deutsche-unternehmen/9807776.html

» zur Grafik