App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread (Archiv)

- Ersteller Maack

- Erstellt am

- Tagged users Kein(e)

- Status

- Für weitere Antworten geschlossen.

Nach der US-Wahl

Obama reicht den Republikanern die Hand

07.11.2012

Ende eines harten Wahlkampfes: Barack Obama triumphiert und bekommt eine zweite Amtszeit als US-Präsident. Er will mit seinen Gegnern zusammenzuarbeiten und verspricht: „Die besten Zeiten liegen noch vor uns.“

...

http://www.handelsblatt.com/politik/international/us-wahl-2012/nach-der-us-wahl-obama-reicht-den-republikanern-die-hand/7356002.html

Obama reicht den Republikanern die Hand

07.11.2012

Ende eines harten Wahlkampfes: Barack Obama triumphiert und bekommt eine zweite Amtszeit als US-Präsident. Er will mit seinen Gegnern zusammenzuarbeiten und verspricht: „Die besten Zeiten liegen noch vor uns.“

...

http://www.handelsblatt.com/politik/international/us-wahl-2012/nach-der-us-wahl-obama-reicht-den-republikanern-die-hand/7356002.html

Björn Junker, Goldinvest.de 07 / 11 / 2012

Auf der Suche: China und die Goldakquisitionen

China hat ein Problem. Es konsumiert mehr Gold, als es produziert. Chinesische Unternehmen suchen nach einer passenden Lösung. Rund 360 Tonnen Gold hat China 2011 im eigenen Land produziert, wenn man den offiziellen Statistiken des Staates glauben darf. Der Konsum liegt jedoch deutlich darüber. China könnte im laufenden Jahr Weltmeister bei der Einfuhr von Gold werden und damit Indien ablösen. 800 bis 900 Tonnen könnten so zusätzlich in das Land kommen.

...

http://www.miningscout.de/Kolumnen/Auf_der_Suche_China_und_die_Goldakquisitionen/page_1/_76/__1136

Auf der Suche: China und die Goldakquisitionen

China hat ein Problem. Es konsumiert mehr Gold, als es produziert. Chinesische Unternehmen suchen nach einer passenden Lösung. Rund 360 Tonnen Gold hat China 2011 im eigenen Land produziert, wenn man den offiziellen Statistiken des Staates glauben darf. Der Konsum liegt jedoch deutlich darüber. China könnte im laufenden Jahr Weltmeister bei der Einfuhr von Gold werden und damit Indien ablösen. 800 bis 900 Tonnen könnten so zusätzlich in das Land kommen.

...

http://www.miningscout.de/Kolumnen/Auf_der_Suche_China_und_die_Goldakquisitionen/page_1/_76/__1136

Goldpreis nach US-Wahl auf Wochen-Hoch

Mittwoch, den 07. November 2012

Nach der Wiederwahl von Obama stieg der Goldpreis deutlich an. Und die Höhenflüge dürften in den nächsten Jahren weitergehen, erwarten Händler.

Mit der Wiederwahl Barack Obamas ist auch klar: Der Kurs, den die US-Notenbank fährt, dürfte weitergehen. Weitere expansive Schritte, um die Konjunktur anzufeuern, dürften folgen.

Zuletzt hatte der Offenmarkt-Ausschuss der Fed im September beschlossen mit einer neuen Geldschwemme, dem dritten «Qantitative Easing» oder QE3, den Markt zu fluten.

Ängste vor Inflation

Solche Massnahme steigern die Ängste vor Inflation – Investoren flüchten sich in Gold. Nach der Wiederwahl von Obama stieg der Preis für das Edelmetall denn auch auf ein Wochenhoch von rund 1724 Dollar pro Feinunze, berichtet die Narichtenagentur «Reuters».

«Und der Preis dürfte weiter steigen», prophezeit Yuichi Ikemizu von der Standard Bank in Tokio. Bis zu 1800 Dollar dürfte er aut seinen Einschätzungen klettern.

http://www.finews.ch/news/finanzplatz/9967-goldpreis-obama-wiederwahl-anstieg#Goldpreis-nach-US-Wahl-auf-Wochen-Hoch

Mittwoch, den 07. November 2012

Nach der Wiederwahl von Obama stieg der Goldpreis deutlich an. Und die Höhenflüge dürften in den nächsten Jahren weitergehen, erwarten Händler.

Mit der Wiederwahl Barack Obamas ist auch klar: Der Kurs, den die US-Notenbank fährt, dürfte weitergehen. Weitere expansive Schritte, um die Konjunktur anzufeuern, dürften folgen.

Zuletzt hatte der Offenmarkt-Ausschuss der Fed im September beschlossen mit einer neuen Geldschwemme, dem dritten «Qantitative Easing» oder QE3, den Markt zu fluten.

Ängste vor Inflation

Solche Massnahme steigern die Ängste vor Inflation – Investoren flüchten sich in Gold. Nach der Wiederwahl von Obama stieg der Preis für das Edelmetall denn auch auf ein Wochenhoch von rund 1724 Dollar pro Feinunze, berichtet die Narichtenagentur «Reuters».

«Und der Preis dürfte weiter steigen», prophezeit Yuichi Ikemizu von der Standard Bank in Tokio. Bis zu 1800 Dollar dürfte er aut seinen Einschätzungen klettern.

http://www.finews.ch/news/finanzplatz/9967-goldpreis-obama-wiederwahl-anstieg#Goldpreis-nach-US-Wahl-auf-Wochen-Hoch

Ingrid Heinritzi, Freie Wirtschaftsjournalistin 07 / 11 / 2012

Palladium – äußerst riskant und zyklisch

Palladium, das silberweiß glänzende Metall dient als Katalysator, wird vorwiegend in der Industrie, in der Elektronik, im Schmuckbereich und auch in Brennstoffzellen verwendet.

"Das günstige Platin", wie Palladium auch bezeichnet wird, fällt heute meist als Nebenprodukt bei der Kupfer- und Nickelgewinnung an. Die natürlichen Vorkommen in Australien, Amerika und Äthiopien sind fast gänzlich ausgebeutet. Denn der Bedarf an dem edlem Metall war in den letzten Jahren enorm.

Ein Handel mit Palladium findet am London Buillon Market und an der New York Mercantile Exchange statt. Eine Unze Palladium kostete 1996 etwa 100 US-Dollar, am 26.01.2001 waren es rund 1100 US-Dollar, bedingt durch Panikkäufe. Dann ging der Preis in den folgenden Jahren nach unten.

...

http://www.miningscout.de/Kolumnen/Palladium_aeusserst_riskant_und_zyklisch/page_1/_76/__1135

Palladium – äußerst riskant und zyklisch

Palladium, das silberweiß glänzende Metall dient als Katalysator, wird vorwiegend in der Industrie, in der Elektronik, im Schmuckbereich und auch in Brennstoffzellen verwendet.

"Das günstige Platin", wie Palladium auch bezeichnet wird, fällt heute meist als Nebenprodukt bei der Kupfer- und Nickelgewinnung an. Die natürlichen Vorkommen in Australien, Amerika und Äthiopien sind fast gänzlich ausgebeutet. Denn der Bedarf an dem edlem Metall war in den letzten Jahren enorm.

Ein Handel mit Palladium findet am London Buillon Market und an der New York Mercantile Exchange statt. Eine Unze Palladium kostete 1996 etwa 100 US-Dollar, am 26.01.2001 waren es rund 1100 US-Dollar, bedingt durch Panikkäufe. Dann ging der Preis in den folgenden Jahren nach unten.

...

http://www.miningscout.de/Kolumnen/Palladium_aeusserst_riskant_und_zyklisch/page_1/_76/__1135

Miningscout 07 / 11 / 2012

Goldpreis: Der Markt spielt die Obama-Karte

Der Goldpreis wird derzeit von einer massiven Volatilität geprägt. Nach den US-Arbeitsmarktzahlen ließen Befürchtungen am Markt, dass die Fed ihre Liquiditätsschwemme drosseln könnte, den Preis der Feinunze des Edelmetalls abstürzen. Doch an der Unterstützung bei 1.667/1.672 Dollar hat der Kurs wieder gedreht und gestern hat der Markt bereits die Obama-Karte gespielt.

Fast 1.721 Dollar hat die Feinunze am Dienstag erreicht und heute, nachdem die Wiederwahl des amtierenden US-Präsidenten fest steht, geht es weiter nach oben. Das bisherige Tageshoch ist bei 1.727 Dollar notiert. Wird der hier liegende Widerstandsbereich unterhalb von 1.727/1.736 überwunden, zeigt der Goldpreistrend erneut nach oben.

Nun haben politische Börsen allerdings kurze Beine, wie ein bekanntes Bonmot sagt. Kurzfristig bleibt der Goldpreis natürlich vom Wahlausgang beeinflusst. Die Gold-Trader gehen davon aus, dass unter Barack Obama stärkere Einflüsse der US-Notenbank in geldpolitischer Hinsicht zu sehen sein werden als unter seinem gescheiterten Konkurrenten Mitt Romney.

Und spätestens jetzt ist man bereits wieder beim wichtigsten Einflussfaktor der kommenden Zeit: Der Federal Reserve. Auf den Grad der Stärke der expansiven Geldpolitik wird es maßgeblich ankommen, ob die Feinunze in der kommenden Zeit in Richtung Jahreshoch bei 1.796 Dollar oder sogar in Richtung des Allzeithochs bei 1.921 Dollar durchstarten kann.

http://www.miningscout.de/Rohstoffblog/Goldpreis_Der_Markt_spielt_die_Obama_Karte/theme/Edelmetalle/page_1/_61/__496

Goldpreis: Der Markt spielt die Obama-Karte

Der Goldpreis wird derzeit von einer massiven Volatilität geprägt. Nach den US-Arbeitsmarktzahlen ließen Befürchtungen am Markt, dass die Fed ihre Liquiditätsschwemme drosseln könnte, den Preis der Feinunze des Edelmetalls abstürzen. Doch an der Unterstützung bei 1.667/1.672 Dollar hat der Kurs wieder gedreht und gestern hat der Markt bereits die Obama-Karte gespielt.

Fast 1.721 Dollar hat die Feinunze am Dienstag erreicht und heute, nachdem die Wiederwahl des amtierenden US-Präsidenten fest steht, geht es weiter nach oben. Das bisherige Tageshoch ist bei 1.727 Dollar notiert. Wird der hier liegende Widerstandsbereich unterhalb von 1.727/1.736 überwunden, zeigt der Goldpreistrend erneut nach oben.

Nun haben politische Börsen allerdings kurze Beine, wie ein bekanntes Bonmot sagt. Kurzfristig bleibt der Goldpreis natürlich vom Wahlausgang beeinflusst. Die Gold-Trader gehen davon aus, dass unter Barack Obama stärkere Einflüsse der US-Notenbank in geldpolitischer Hinsicht zu sehen sein werden als unter seinem gescheiterten Konkurrenten Mitt Romney.

Und spätestens jetzt ist man bereits wieder beim wichtigsten Einflussfaktor der kommenden Zeit: Der Federal Reserve. Auf den Grad der Stärke der expansiven Geldpolitik wird es maßgeblich ankommen, ob die Feinunze in der kommenden Zeit in Richtung Jahreshoch bei 1.796 Dollar oder sogar in Richtung des Allzeithochs bei 1.921 Dollar durchstarten kann.

http://www.miningscout.de/Rohstoffblog/Goldpreis_Der_Markt_spielt_die_Obama_Karte/theme/Edelmetalle/page_1/_61/__496

Miningscout 07 / 11 / 2012

Uran: Kanada will Nuklearbann gegen Indien aufheben

Die kanadischen Uran-Unternehmen sind einem großen neuen Absatzmarkt einen entscheidenden Schritt näher gekommen. Kanada hebt den Bann für Nuklearexporte nach Indien auf, den das Land vor rund 36 Jahren in Kraft gesetzt hat. Der Grund waren damals indische Atombombentests, in denen kanadisches Uran genutzt wurde. Künftig aber kann es wieder zum Handel von Uran und Reaktortechnik zwischen den beiden Staaten kommen. Noch seien einige Vorarbeiten zu erledigen, doch der Durchbruch scheint geschafft, womit eine Aufhebung des Banns nur noch eine reine Frage der Zeit ist.

Für die Kanadier ist Indien ein hoch attraktiver Markt mit extremen Wachstumsperspektiven. Die Inder wollen dem stetig steigenden Energiebedarf ihrer stark wachsenden Wirtschaft unter anderem mit einem massiven Ausbau der Atomstromproduktion begegnen. Die Kapazitäten sollen sich von 4.780 Megawatt binnen einer Generation auf 63.000 Megawatt vervielfachen. Das wird natürlich langfristig die Nachfrage nach Uran, dem „Brennstoff“ der Kraftwerke, steigern, sodass nicht nur „big guys“ wie Cameco, sondern auch kleine und junge Explorationsunternehmen wie Fission Energy von den positiven Nachrichten betroffen sind – zumindest indirekt über einen Preiseffekt beim Uran, für das Experten aufgrund einer langfristig wachsenden Nachfrage steigende Kurse erwarten.

http://www.miningscout.de/Rohstoffblog/Uran_Kanada_will_Nuklearbann_gegen_Indien_aufheben/theme/Halbmetalle_und_Nichtmetalle/page_1/_61/__497

Uran: Kanada will Nuklearbann gegen Indien aufheben

Die kanadischen Uran-Unternehmen sind einem großen neuen Absatzmarkt einen entscheidenden Schritt näher gekommen. Kanada hebt den Bann für Nuklearexporte nach Indien auf, den das Land vor rund 36 Jahren in Kraft gesetzt hat. Der Grund waren damals indische Atombombentests, in denen kanadisches Uran genutzt wurde. Künftig aber kann es wieder zum Handel von Uran und Reaktortechnik zwischen den beiden Staaten kommen. Noch seien einige Vorarbeiten zu erledigen, doch der Durchbruch scheint geschafft, womit eine Aufhebung des Banns nur noch eine reine Frage der Zeit ist.

Für die Kanadier ist Indien ein hoch attraktiver Markt mit extremen Wachstumsperspektiven. Die Inder wollen dem stetig steigenden Energiebedarf ihrer stark wachsenden Wirtschaft unter anderem mit einem massiven Ausbau der Atomstromproduktion begegnen. Die Kapazitäten sollen sich von 4.780 Megawatt binnen einer Generation auf 63.000 Megawatt vervielfachen. Das wird natürlich langfristig die Nachfrage nach Uran, dem „Brennstoff“ der Kraftwerke, steigern, sodass nicht nur „big guys“ wie Cameco, sondern auch kleine und junge Explorationsunternehmen wie Fission Energy von den positiven Nachrichten betroffen sind – zumindest indirekt über einen Preiseffekt beim Uran, für das Experten aufgrund einer langfristig wachsenden Nachfrage steigende Kurse erwarten.

http://www.miningscout.de/Rohstoffblog/Uran_Kanada_will_Nuklearbann_gegen_Indien_aufheben/theme/Halbmetalle_und_Nichtmetalle/page_1/_61/__497

Martin Siegel, Goldhotline.de 07 / 11 / 2012

G-20-Finanzminister im Irrflug

Der Goldpreis verbessert sich im gestrigen New Yorker Handel von 1.690 auf 1.717 $/oz. Heute Morgen zieht der Goldpreis weiter auf 1.726 $/oz an und notierte damit um etwa 41 $/oz über dem Vortagesniveau. Die Goldminenaktien steigen weltweit parallel zum Goldpreis an und bestätigen damit die im September und Oktober gewonnene relative Stärke auf den Goldpreis, was als positives Signal für den Gesamtmarkt interpretiert werden kann. Nach dem Abschluss der US-Wahlfarce dürften in den nächsten Wochen an den Finanzmärkten wieder die realen Zahlen in den Mittelpunkt der Wahrnehmung rücken, so dass einem Anstieg des Goldpreises auf neue Allzeithöchstkurse nichts mehr im Wege steht.

...

http://www.miningscout.de/Kolumnen/G_20_Finanzminister_im_Irrflug_/page_1/_76/__1137

G-20-Finanzminister im Irrflug

Der Goldpreis verbessert sich im gestrigen New Yorker Handel von 1.690 auf 1.717 $/oz. Heute Morgen zieht der Goldpreis weiter auf 1.726 $/oz an und notierte damit um etwa 41 $/oz über dem Vortagesniveau. Die Goldminenaktien steigen weltweit parallel zum Goldpreis an und bestätigen damit die im September und Oktober gewonnene relative Stärke auf den Goldpreis, was als positives Signal für den Gesamtmarkt interpretiert werden kann. Nach dem Abschluss der US-Wahlfarce dürften in den nächsten Wochen an den Finanzmärkten wieder die realen Zahlen in den Mittelpunkt der Wahrnehmung rücken, so dass einem Anstieg des Goldpreises auf neue Allzeithöchstkurse nichts mehr im Wege steht.

...

http://www.miningscout.de/Kolumnen/G_20_Finanzminister_im_Irrflug_/page_1/_76/__1137

Frankfurter Rohstofftag

Investieren im Megamarkt der Zukunft –

Investmentchancen in

jungen Rohstoffunternehmen

13.11.2012 | Hotel Maritim | Konferenzraum II

Theodor-Heuss-Allee 3 | 60486 Frankfurt

http://www.yaltaadvisory.de/fileadmin/user/pdfs/2012/Einladung_Rohstofftag_13.11.2012.pdf

Investieren im Megamarkt der Zukunft –

Investmentchancen in

jungen Rohstoffunternehmen

13.11.2012 | Hotel Maritim | Konferenzraum II

Theodor-Heuss-Allee 3 | 60486 Frankfurt

http://www.yaltaadvisory.de/fileadmin/user/pdfs/2012/Einladung_Rohstofftag_13.11.2012.pdf

Stöferle: "Obama und Bernanke sind ein Dream-Team für Goldbesitzer"

07.11.2012 | DAF

Am 4. Oktober 2012 hat der Goldpeis das Zwischenhoch bei knapp 1.800 Dollar markiert. Seitdem befindet sich das Edelmetall auf Konsolidierungskurs. "Derzeit werden natürlich die Wahlen in den USA gespielt, wo viele ein wenig Angst haben, dass Romney vielleicht die Wahlen gewinnt und dass das negativ für Gold sein könnte", so Erste Group-Analyst Ronald-Peter Stöferle im Interview mit DAF-Reporter Sebastian Schick. Seine detaillierte Einschätzung zu den Edelmetallen Gold und Silber erfahren Sie im Interview.

Ronald-Peter Stöferle sieht derzeit gute Einstiegschancen bei Gold und Silber: "Ich denke, dass sich im Laufe der letzten Tage sehr, sehr viel Spekulation abgebaut hat, das Sentiment hat sich deutlich abgekühlt. Also ich glaube, das ist derzeit wieder ein relativ gesunder Boden und ich schätze mal nach den geschlagenen Wahlen dann in den USA so Mitte November sollte dann wieder der Aufwärtstrend losgehen.

Wie lange der aktuelle Goldzyklus noch laufen kann, ob Silber vielleicht sogar den größeren Hebel als Gold hat und welche Minenaktien im Moment sehr aussichtsreich sind, verrät Ronald-Peter Stöferle im Interview.

DAF-Video: http://www.rohstoff-welt.de/news/artikel.php?sid=40412#Stoeferle--22Obama-und-Bernanke-sind-ein-Dream-Team-fuer-Goldbesitzer-22

07.11.2012 | DAF

Am 4. Oktober 2012 hat der Goldpeis das Zwischenhoch bei knapp 1.800 Dollar markiert. Seitdem befindet sich das Edelmetall auf Konsolidierungskurs. "Derzeit werden natürlich die Wahlen in den USA gespielt, wo viele ein wenig Angst haben, dass Romney vielleicht die Wahlen gewinnt und dass das negativ für Gold sein könnte", so Erste Group-Analyst Ronald-Peter Stöferle im Interview mit DAF-Reporter Sebastian Schick. Seine detaillierte Einschätzung zu den Edelmetallen Gold und Silber erfahren Sie im Interview.

Ronald-Peter Stöferle sieht derzeit gute Einstiegschancen bei Gold und Silber: "Ich denke, dass sich im Laufe der letzten Tage sehr, sehr viel Spekulation abgebaut hat, das Sentiment hat sich deutlich abgekühlt. Also ich glaube, das ist derzeit wieder ein relativ gesunder Boden und ich schätze mal nach den geschlagenen Wahlen dann in den USA so Mitte November sollte dann wieder der Aufwärtstrend losgehen.

Wie lange der aktuelle Goldzyklus noch laufen kann, ob Silber vielleicht sogar den größeren Hebel als Gold hat und welche Minenaktien im Moment sehr aussichtsreich sind, verrät Ronald-Peter Stöferle im Interview.

DAF-Video: http://www.rohstoff-welt.de/news/artikel.php?sid=40412#Stoeferle--22Obama-und-Bernanke-sind-ein-Dream-Team-fuer-Goldbesitzer-22

ITH

International Tower Hill Provides an Update on the Livengood Gold Project

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Nov. 7, 2012) - International Tower Hill Mines Ltd. ("ITH" or the "Company") (TSX:ITH)(NYSE MKT:THM)(FRANKFURT:IW9) is pleased to provide an update on its 100% owned Livengood Gold Project.

The Company has successfully completed within budget its critical path 2012 geotechnical drilling program, totaling 199 holes, 15,731 meters utilizing core, sonic, and auger drilling methods. The drilling program evaluated facility sites to obtain the technical information required for use in sub-arctic engineering design. The pump testing of the large diameter water wells required for hydrogeological modeling was also successfully completed. Metallurgical test work and engineering studies are on-going to advance the feasibility study, which is on schedule for release in the first half of 2013.

The Company's recently appointed CEO, Don Ewigleben, stated: "Over the past month I have been very encouraged by the progress being made. We will continue working on engineering for the next several months and we are on-track for completing the Feasibility Study in the first half of 2013. I am extremely pleased that the 16 million ounce plus gold deposit is on schedule for feasibility study completion, permitting and construction due to the world-class project team in place."

The Company is aggressively advancing the Feasibility Study and all scenarios are under consideration to optimize the economics of the project, including considering a future strategic alliance to assist in further development and construction costs while adding value for our shareholders.

About International Tower Hill Mines Ltd.

International Tower Hill Mines Ltd. controls a 100% interest in the world-class Livengood Gold Project; accessible by paved highway 70 miles north of Fairbanks, Alaska.

On behalf of International Tower Hill Mines Ltd.

Donald C. Ewigleben, President & Chief Executive Officer

http://tmx.quotemedia.com/article.php?newsid=55693196&qm_symbol=ITH

International Tower Hill Provides an Update on the Livengood Gold Project

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Nov. 7, 2012) - International Tower Hill Mines Ltd. ("ITH" or the "Company") (TSX:ITH)(NYSE MKT:THM)(FRANKFURT:IW9) is pleased to provide an update on its 100% owned Livengood Gold Project.

The Company has successfully completed within budget its critical path 2012 geotechnical drilling program, totaling 199 holes, 15,731 meters utilizing core, sonic, and auger drilling methods. The drilling program evaluated facility sites to obtain the technical information required for use in sub-arctic engineering design. The pump testing of the large diameter water wells required for hydrogeological modeling was also successfully completed. Metallurgical test work and engineering studies are on-going to advance the feasibility study, which is on schedule for release in the first half of 2013.

The Company's recently appointed CEO, Don Ewigleben, stated: "Over the past month I have been very encouraged by the progress being made. We will continue working on engineering for the next several months and we are on-track for completing the Feasibility Study in the first half of 2013. I am extremely pleased that the 16 million ounce plus gold deposit is on schedule for feasibility study completion, permitting and construction due to the world-class project team in place."

The Company is aggressively advancing the Feasibility Study and all scenarios are under consideration to optimize the economics of the project, including considering a future strategic alliance to assist in further development and construction costs while adding value for our shareholders.

About International Tower Hill Mines Ltd.

International Tower Hill Mines Ltd. controls a 100% interest in the world-class Livengood Gold Project; accessible by paved highway 70 miles north of Fairbanks, Alaska.

On behalf of International Tower Hill Mines Ltd.

Donald C. Ewigleben, President & Chief Executive Officer

http://tmx.quotemedia.com/article.php?newsid=55693196&qm_symbol=ITH

[url=http://peketec.de/trading/viewtopic.php?p=1316707#1316707 schrieb:ixilon. schrieb am 04.11.2012, 02:57 Uhr[/url]"]5 Largest Development-Stage Gold Deposits

http://seekingalpha.com/article/961711-5-largest-development-stage-gold-deposits

[url=http://peketec.de/trading/viewtopic.php?p=1313060#1313060 schrieb:ixilon. schrieb am 24.10.2012, 01:15 Uhr[/url]"]International Tower Hill Mines - Corporate Presentation - October 2012

http://www.ithmines.com/_resources/presentations/ITH_Presentation.pdf

Kleines GAP vom 16. Oktober geschlossen

1 Monatschart

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1308113#1308113 schrieb:ixilon. schrieb am 09.10.2012, 21:39 Uhr[/url]"]Mining News: Tower Hill chairman fills executive void

http://www.petroleumnews.com/pnfriends/661103210.shtml

CDU

Another Interesting Speculation In The Micro Cap Coal Space

November 6, 2012 | about: CDY, includes: AAUKF.PK, BHP, WLT, XSRAY.PK

Disclosure: I am long CDY. (More...)

A few months back, I wrote a piece about a company called CIC Energy (see here) which was acquired two months after publication. While the timing of the article and acquisition was sheer luck, the value was there given how much the stock had been beaten down. While the embers of the coal industry are still smoking, several very interesting speculations among all market capitalizations remain. Another such company is Cardero Resources (CDY.)

Investment thesis:

The days of $200 plus for a ton of coking coal are likely over for some time. That said, what would you pay to own a high quality coking deposit in a very friendly jurisdiction surrounded by the biggest players in the industry? What if I also told you that the proven and probable reserves were recently listed at 121 million tons and that in the last two years alone, there had been a consolidation wave in the area amounting to $5 billion? Well, if you are looking at Cardero Resources, the answer is a current enterprise value of only $66 million (adjusted for recent private placement and debt financing). The fact that the market is currently valuing Cardero Resources at such a low valuation highlights the state of the thermal and metallurgical coal markets.

The big questions remain, though: has the great commodities boom of the last ten years come to an end? Coal stocks have reflected much of the slowdown, but has it been enough? Will China's other shoe drop?

While many unknown variables remain, perhaps the best way to counteract these risks is simply by demanding a lower share price. As it stands today, I believe we are well protected on the downside as current market prices provide us with a considerable margin of safety.

Business

Cardero can best be summed up as a conglomerate of sorts, but rather than having businesses in several different industries, the company's focus has always been in the resource sector. While Cardero can be quite tough to break apart (they have 12 subsidiaries), their main asset is a 75% interest in the Carbon Creek Coal Deposit located in British Columbia's Peace River Coalfield. Carbon Creek remains one of the last remaining assets in the region not controlled by a major. It is quite likely that the many moving parts have played a role in dissuading a potential acquirer from taking them out despite the many operational successes the company has had over the past two years.

Up until just a few months ago, they also had an extensive equity portfolio, but have since sold it down to a current market value of close to $4 million.

Breakdown of assets:

- Carbon Creek Coal Deposit 75% interest

- Sheini Hills Iron Project (Ghana)

- Longnose Iron/Titanium deposit (Minnesota)

As a side note, BHP Billiton (BHP) has stated Longnose is the largest known ilmenite resource in North America.

Peace River Coalfield and Cardero's Carbon Creek Deposit

British Columbia's Peace River Coalfield extends for about 250 miles along the northern part of the Rocky Mountains. The amount of coal in the ground there is estimated to be around 160 billion tons at a depth of about 2000 meters, according to the British Columbia Ministry of Energy and Mines. Coal was first discovered in the region over 200 hundred years ago, but before 1980, only about 100,000 tons was mined due to a lack of infrastructure. Today, several of the big players have a presence in the area, including Xstrata (XSRAY.PK), Anglo American (AAUKF.PK), and Walter Energy (WLT).

Within the Peace River Coalfield lies Cardero's Carbon Creek deposit. The deposit is in fact the oldest in British Columbia, and has been known about since 1909, but, like much of the rest of the Peace River Coalfield, it remained largely undeveloped until the 1970's.

A very important aspect about Peace River and Carbon Creek is that this is an area with ample infrastructure. The coalfield is about 750 miles from the coast, with the Canadian National rail passing by roughly 30 miles from the property giving them access to Vancouver's Ports and Ridley terminals for shipment to Asia. In May, the company did just that, signing a 15 year agreement with Ridley Terminals to export coal beginning in 2014.

It is also a mining-friendly jurisdiction with basically everything a mining company needs to be successful. This is not a region located a million miles from anything with no infrastructure, in a contentious area, with political instability, etc.

As shown in the graphic below, this is a good place to have a coal deposit.

Surrounded by giants

Source: Cardero Resources

Cardero's interest in Carbon Creek goes back to 2010, when the then CEO of Coalhunter Mining and current Cardero CEO Michael Hunter was contemplating taking Coalhunter public. Cardero had purchased a 49.5% stake in Coalhunter, which in turn had its 75% ownership in Carbon Creek. In 2011, the two companies were able to come to the table and work out a deal which saw Coalhunter folded into Cardero, and Michael Hunter being named CEO of the combined entity replacing then CEO Henk van Alphen who now serves as managing director. While management only owns about 3% of the company, they are very experienced coalmen and have proven to be highly capable operators.

2012 - A year of several accomplishments

This year has proven to be a year of several key operational successes as the company accomplished four large goals:

- Signed 15 year agreement with Ridley Terminals

- Hiring of industry heavy-weight Angus Christie as COO (recent experience in the Peace River Coalfield)

- Acceptance of the Environmental baseline for the project

- Received mining license from British Columbia

- Recent release of Prefeasibility Study

Next will be a bankable feasibility study slated for June 2013. Shortly following this, a mine application will be submitted with the likelihood of receiving an operating license by the end of the year. The mine's first coal production is targeted for the second half of 2014.

Most recently, the company announced a private placement of 22.5 million shares and a bridge loan credit facility with Sprott Resource lending for $11 million. While a private placement at the lowest price the stock has been in nine years certainly hurts, this will give them the capital they need to tackle the bankable feasibility study as well as working capital.

121 million tons of proven and probable reserves and an explosion in the measured and indicated resources provides a powerful free option

The company recently released their Prefeasibility Study which showed a tremendous expansion of measured and indicated resources from 166 million tons to 468 million. The pre-production capital also was reduced to around $217 million from $301 million as stated in their PEA. The base case NPV of the project (using an 8% discount rate) is listed as $633 million although this is down from $752 million as listed in their PEA. The decrease in the NPV can be attributed to the drop in met coal prices as well as a decline in mineable coal from 137 million tons (as listed in their PEA) to 121 million. An important distinction must be made in that the NPV of the project is based on the 121 million tons of proven and probable coal reserves and excludes any new mineable tons as a result of the 182% increase in measured and indicated. While the initial drop might seem worrisome, it should be of no concern as the large increase in the measured and indicated category will no doubt raise the amount of mineable coal (perhaps substantially) over time. While we don't know the amount that the increase will yield yet, it serves as a powerful option that a potential acquirer will have to take into account.

On top of this, there is an additional 232 million tons in the inferred category. The mean plant recovery for underground and surface coal was 64%. If this same recovery percentage holds true for the increase in measured and indicated tons and eventually increasing the proven and probable reserves, the value could go up materially. While there is no guarantee of course that they will be able to greatly increase their proven and probable reserves based on the latest increase, I'd say the probability is quite high that they will.

High quality coking coal makes it a prized asset

While the market for coking coal might currently be taking it on the chin (and no doubt could continue to do so), it truly is rare stuff. Around 88 percent of global coal resources are thermal leaving only 12 percent coking coal to fuel the steel plants of the world. The best quality premium coking coal is only known to be accessible in abundance in Canada, Australia, China, Mongolia, the U.S., Russia, and Mozambique. Anglo American has further noted that only three countries (Canada, the U.S., and Australia) together make up 90 percent of the seaborne metallurgical coal market.

Middle volatile hard coking coal makes up the lower seams of the deposit while a combination of (less valuable but still good quality) high volatile semi-soft and PCI coal is found at the upper seams. The remaining 6% consists of lower quality thermal coal close to the surface. While low volatile hard coking coal is the most valuable and fetches the highest price, Carbon Creek's middle volatile hard coking coal is still very high quality stuff coupled with their remaining valuable semi-soft and PCI coal. PCI coal is generally not considered to be coking coal and is used mainly for its heat value by injecting it into a blast furnace to replace expensive coke. Semi-soft and PCI coal normally fetch lower prices on the open market relative to hard coking.

The actual layout of the deposit makes for another positive factor in that the coalfield is basically flat and even as opposed to heavily fractured as many deposits are. This enables both surface and underground mining to take place. The company plans on initially using trucks/shovels for the first few years before transitioning to high-wall mining. About 60% of the resource lies below the surface although the plan is not to mine this until around year seven.

Heavy consolidation in the Peace River Coalfield

It is difficult of course to know if management is 100% set on bringing the mine to production, or if they are going through all the motions in the hopes of being bought out. They have had great operational success the past year, but I suppose if the price were right, anybody could be convinced that selling out to the highest bidder would be the best course of action. There has been over $5 billion in acquisitions the past two years in the area alone as shown in the chart below:

Source: Cardero Resources

Xstrata was leading the charge during this time, acquiring three deposits for roughly $670 million in 2011. Given that met coal was peaking over this time frame, it could also be that the buyout binge has come to an end.

An interesting note as of late is that in their last two investor presentations they have excluded any mention of their other assets. The market would no doubt assign a higher valuation to the company as well as possibly spark interest from a major if they spun off or sold their other assets and became a pure play.

China's worsening cold is giving Australia a non-Foster's fueled headache

In August, iron ore and coking coal prices fell to their lowest levels since 2009, as China's slowdown puts its steel sector under severe pressure. The China Iron & Steel Association (CISA) has stated that the country's steel prices are likely to remain weak over the next few months due to a supply glut. The Association further noted that the nation's steel industry's profits collapsed by 96 percent in the first half of 2012 compared to a year ago. CISA also stated that roughly 40 percent of the country's iron mines have shut because of low prices. Macquarie estimated that 40m tons of annual capacity in the seaborne iron ore market was losing money at current prices.

Despite iron ore and coking coal prices dropping heavily since July (although recovering somewhat), imports of metallurgical coal into China for the June quarter still were around 26 per cent higher than those in the quarter ending in March.

For what it's worth (likely not much), the 2013 forecast for China's coking imports are to increase by 15 percent while India's are estimated to increase by 9 percent to 23 million tons. At this point, it's very hard to imagine that there will be any material increase coming out of China.

Recent activity by the largest players in the industry speaks volumes as to what is happening as well as what they view on the horizon. In September, BHP shelved $6 billion in development in two of their largest Queensland coking coal plants. Further, the company and Xstrata cut some 900 coal mining jobs in the State. BHP will also close its 33 year old Gregory coking mine, stating that it was no longer profitable. Rio Tinto (RIO) has plans to close their Blair Athol coal mine in Queensland by the end of the year.

In the U.S., Consol Energy (CNX) stated in September that it was idling its Buchanan coking coal deposit which accounts for 5 million tons a year for 30-60 days due to the depressed market.

BHP's CEO warned last month that a large amount of thermal and coking coal production on the Eastern seaboard of Australia is unprofitable at today's production costs and prices. It has to be taken into account, though, that the commodities boom experienced in Australia the last ten years has seen expenses skyrocket coupled with the strong Oz dollar (though this may change soon) making some mines simply uneconomical.

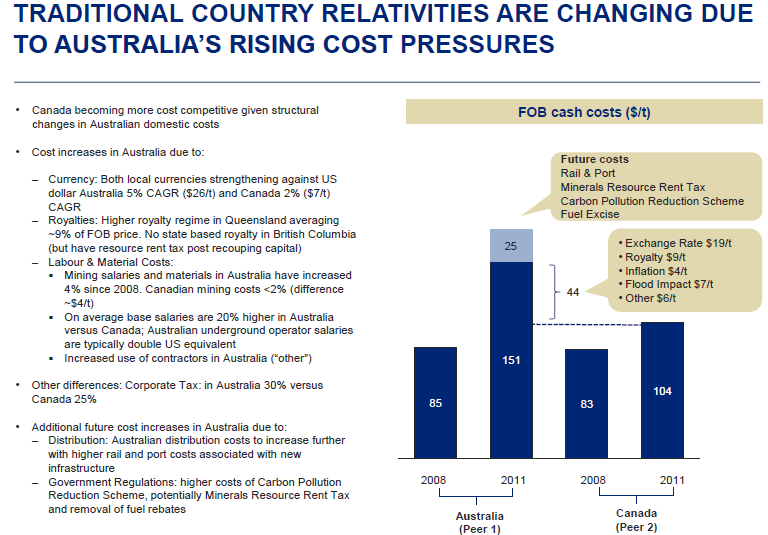

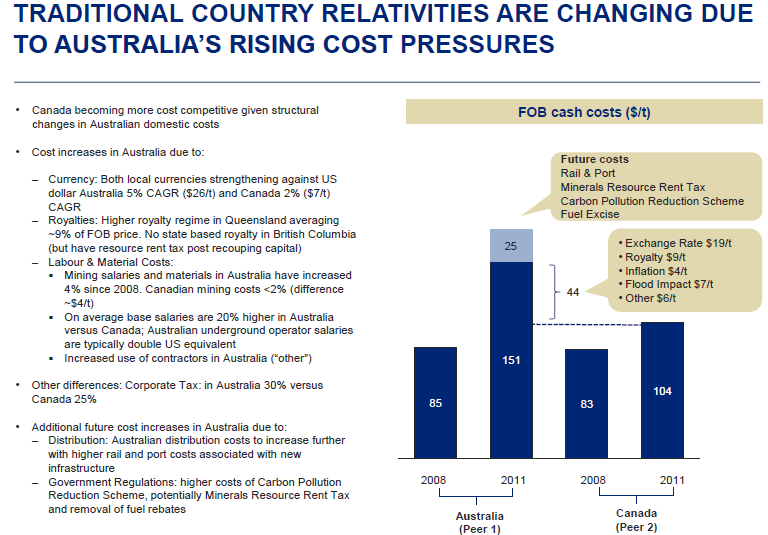

Peace River Coalfield - A Lower Cost Alternative

Given the tremendous boom Australia has experienced, Canada's deposits could begin to take a much greater share of the coking coal market away from Australia due to the high operating costs in Queensland.

In June of this year, Anglo American released a coking coal presentation basically laying out the case for coking coal in Peace River:

Source: Anglo American Metallurgical Coal Investor and Analyst Briefing

Valuation

The current enterprise value is only 14% of the estimated NPV of $633 million, while similar comparable sales transactions on the company's mineable coal reveals a similar discrepancy between price and value. As it stands today, Cardero's stock price is the lowest it has been in 9 years, while the prospects have never been better. We have a company with basically no debt, good management, and presence in a prolific mining region that has undergone heavy consolidation by the big boys in the area.

Valuation was looked at using three methodologies: Proven and Probable Reserves, NPV, and Measured and Indicated resources.

Proven and Probable Reserves

In October of last year, Xstrata bought Cline's Lossan property. The deposit itself contained 186 million tons in the measured and indicated category but of that amount, only 14 million was estimated to be mineable. The Lossan deposit consists of about 41% PCI coal and 59% coking coal. Although there is a mixture of PCI coal at Carbon Creek, it is a mix with higher quality semi-soft coal as opposed to Lossan, of which 41% was classified as PCI.

This is as good a comparable sales transaction as any, considering the coal is of similar quality and both are located in the Peace River Coalfield. When the Lossan deposit was taken out, coking coal prices were around $280 or so, which worked out to roughly $2.86 per mineable ton in the ground for Lossan. Since then, met coal prices have come down close to 40%, making it far from reality as a starting point. Factoring in that the great commodities run of the past 10 years or so could be coming to an end (or at least stalling out), using the current met coal price of around $170 seems like a good place to begin.

Under this scenario, the recent $170 a ton price gives us a per mineable ton value of around $1.70 ($2.80x0.60). If we multiply this figure by Cardero's 75% interest of 121 million proven and probable reserve tons, we end up with a value of about $155 million. Divide this by the company's 131 million shares (after private placement) and we end up with $1.20 per share versus the current share price of $0.53 cents.

Let us make an assumption that demand from China and others really falls off a cliff and the price drops a further 30% before settling at around $1.15 per ton of proven and probable reserves. At this price, we get a valuation of around $105 million or $0.80 per share. Assuming this case, we still have a potential upside of over 50%. As it stands today, Cardero's coal in the ground is being priced at only $0.73 per ton of proven and probable reserves given its enterprise value after adjusting for the soon to be increased share count.

Net present value

If we use Cardero's base case NPV of the project which assumes long-term met coal pricing of $174 a ton and uses a discount rate of 8%, we get $633 million. How much would a potential acquirer offer to take Cardero out? What is an acceptable discount to NPV? 25 percent? 50 percent? If we use a 25 percent discount, this would give us an acquisition price of $356 million (Cardero's 75% interest and the 25% discount) or about $2.70 per share.

If we use the low case NPV for the project, which assumes long-term met coal pricing of $143 a ton and uses a discount rate of 8%, we get $191 million. If we take a 25 percent discount from this, we end up with an acquisition price of $107 million or close to $0.82 a share. Not nearly as attractive but still a potential upside of close to 55%.

Are the discount rates used too low? Are the long-term coal prices too optimistic? You can play around with these numbers until the cows come home but under this method and these assumptions (which I believe are quite conservative) an adequate margin of safety exists considering the enterprise value right now is just 14% of the NPV.

Measured and Indicated Resources

When Xstrata purchased Talisman Energy's Sukunka deposit in March of 2011, it did so at a price of $500 million or $2.12 for each of the project's 236 million tons in measured and indicated resource. If we apply the 40% or so haircut that coking prices have taken since then and multiply it towards Cardero's 75% interest in Carbon Creek's 468 million measured and indicated tons, we get a figure of around $445 million for the deposit or around $3.40 a share.

The simple chart below reveals several of the acquisitions in the Peace River Coal field and the prices paid.

Cardero's current enterprise value is around $66 million, based on their recent private placement of 22.5 million shares and reflecting the recent $11 million in debt financing. The Price/M&I and Price/Reserve are based on the adjusted market capitalization as well as the 75% interest in the coal reserves.

We have to take the figures above with a grain of salt as when these deposits/companies were acquired, coking coal prices were much higher as well as the outlook was much more favorable. Even with these factors taken into account, Cardero's measured and indicated tons are being valued at only $0.19 cents (75% ownership) and its proven and probable reserves at only $0.73.

All told, we end up with a very wide valuation range with these techniques, but if the assumptions used are in the ballpark of reality, an estimated intrinsic value is perhaps between $0.82 on the very low end to $3.40 or so on the high end. I've always liked the Buffett quote that if you actually have to sit down and calculate the value it's just too close. The value should jump up at you.

While market sentiment cannot be ignored entirely, I'm prepared to wait for price and value to come into some sort of equilibrium from the heavily discounted price the shares are currently fetching.

http://seekingalpha.com/article/985141-another-interesting-speculation-in-the-micro-cap-coal-space?source=yahoo

Another Interesting Speculation In The Micro Cap Coal Space

November 6, 2012 | about: CDY, includes: AAUKF.PK, BHP, WLT, XSRAY.PK

Disclosure: I am long CDY. (More...)

A few months back, I wrote a piece about a company called CIC Energy (see here) which was acquired two months after publication. While the timing of the article and acquisition was sheer luck, the value was there given how much the stock had been beaten down. While the embers of the coal industry are still smoking, several very interesting speculations among all market capitalizations remain. Another such company is Cardero Resources (CDY.)

Investment thesis:

The days of $200 plus for a ton of coking coal are likely over for some time. That said, what would you pay to own a high quality coking deposit in a very friendly jurisdiction surrounded by the biggest players in the industry? What if I also told you that the proven and probable reserves were recently listed at 121 million tons and that in the last two years alone, there had been a consolidation wave in the area amounting to $5 billion? Well, if you are looking at Cardero Resources, the answer is a current enterprise value of only $66 million (adjusted for recent private placement and debt financing). The fact that the market is currently valuing Cardero Resources at such a low valuation highlights the state of the thermal and metallurgical coal markets.

The big questions remain, though: has the great commodities boom of the last ten years come to an end? Coal stocks have reflected much of the slowdown, but has it been enough? Will China's other shoe drop?

While many unknown variables remain, perhaps the best way to counteract these risks is simply by demanding a lower share price. As it stands today, I believe we are well protected on the downside as current market prices provide us with a considerable margin of safety.

Business

Cardero can best be summed up as a conglomerate of sorts, but rather than having businesses in several different industries, the company's focus has always been in the resource sector. While Cardero can be quite tough to break apart (they have 12 subsidiaries), their main asset is a 75% interest in the Carbon Creek Coal Deposit located in British Columbia's Peace River Coalfield. Carbon Creek remains one of the last remaining assets in the region not controlled by a major. It is quite likely that the many moving parts have played a role in dissuading a potential acquirer from taking them out despite the many operational successes the company has had over the past two years.

Up until just a few months ago, they also had an extensive equity portfolio, but have since sold it down to a current market value of close to $4 million.

Breakdown of assets:

- Carbon Creek Coal Deposit 75% interest

- Sheini Hills Iron Project (Ghana)

- Longnose Iron/Titanium deposit (Minnesota)

As a side note, BHP Billiton (BHP) has stated Longnose is the largest known ilmenite resource in North America.

Peace River Coalfield and Cardero's Carbon Creek Deposit

British Columbia's Peace River Coalfield extends for about 250 miles along the northern part of the Rocky Mountains. The amount of coal in the ground there is estimated to be around 160 billion tons at a depth of about 2000 meters, according to the British Columbia Ministry of Energy and Mines. Coal was first discovered in the region over 200 hundred years ago, but before 1980, only about 100,000 tons was mined due to a lack of infrastructure. Today, several of the big players have a presence in the area, including Xstrata (XSRAY.PK), Anglo American (AAUKF.PK), and Walter Energy (WLT).

Within the Peace River Coalfield lies Cardero's Carbon Creek deposit. The deposit is in fact the oldest in British Columbia, and has been known about since 1909, but, like much of the rest of the Peace River Coalfield, it remained largely undeveloped until the 1970's.

A very important aspect about Peace River and Carbon Creek is that this is an area with ample infrastructure. The coalfield is about 750 miles from the coast, with the Canadian National rail passing by roughly 30 miles from the property giving them access to Vancouver's Ports and Ridley terminals for shipment to Asia. In May, the company did just that, signing a 15 year agreement with Ridley Terminals to export coal beginning in 2014.

It is also a mining-friendly jurisdiction with basically everything a mining company needs to be successful. This is not a region located a million miles from anything with no infrastructure, in a contentious area, with political instability, etc.

As shown in the graphic below, this is a good place to have a coal deposit.

Surrounded by giants

Source: Cardero Resources

Cardero's interest in Carbon Creek goes back to 2010, when the then CEO of Coalhunter Mining and current Cardero CEO Michael Hunter was contemplating taking Coalhunter public. Cardero had purchased a 49.5% stake in Coalhunter, which in turn had its 75% ownership in Carbon Creek. In 2011, the two companies were able to come to the table and work out a deal which saw Coalhunter folded into Cardero, and Michael Hunter being named CEO of the combined entity replacing then CEO Henk van Alphen who now serves as managing director. While management only owns about 3% of the company, they are very experienced coalmen and have proven to be highly capable operators.

2012 - A year of several accomplishments

This year has proven to be a year of several key operational successes as the company accomplished four large goals:

- Signed 15 year agreement with Ridley Terminals

- Hiring of industry heavy-weight Angus Christie as COO (recent experience in the Peace River Coalfield)

- Acceptance of the Environmental baseline for the project

- Received mining license from British Columbia

- Recent release of Prefeasibility Study

Next will be a bankable feasibility study slated for June 2013. Shortly following this, a mine application will be submitted with the likelihood of receiving an operating license by the end of the year. The mine's first coal production is targeted for the second half of 2014.

Most recently, the company announced a private placement of 22.5 million shares and a bridge loan credit facility with Sprott Resource lending for $11 million. While a private placement at the lowest price the stock has been in nine years certainly hurts, this will give them the capital they need to tackle the bankable feasibility study as well as working capital.

121 million tons of proven and probable reserves and an explosion in the measured and indicated resources provides a powerful free option

The company recently released their Prefeasibility Study which showed a tremendous expansion of measured and indicated resources from 166 million tons to 468 million. The pre-production capital also was reduced to around $217 million from $301 million as stated in their PEA. The base case NPV of the project (using an 8% discount rate) is listed as $633 million although this is down from $752 million as listed in their PEA. The decrease in the NPV can be attributed to the drop in met coal prices as well as a decline in mineable coal from 137 million tons (as listed in their PEA) to 121 million. An important distinction must be made in that the NPV of the project is based on the 121 million tons of proven and probable coal reserves and excludes any new mineable tons as a result of the 182% increase in measured and indicated. While the initial drop might seem worrisome, it should be of no concern as the large increase in the measured and indicated category will no doubt raise the amount of mineable coal (perhaps substantially) over time. While we don't know the amount that the increase will yield yet, it serves as a powerful option that a potential acquirer will have to take into account.

On top of this, there is an additional 232 million tons in the inferred category. The mean plant recovery for underground and surface coal was 64%. If this same recovery percentage holds true for the increase in measured and indicated tons and eventually increasing the proven and probable reserves, the value could go up materially. While there is no guarantee of course that they will be able to greatly increase their proven and probable reserves based on the latest increase, I'd say the probability is quite high that they will.

High quality coking coal makes it a prized asset

While the market for coking coal might currently be taking it on the chin (and no doubt could continue to do so), it truly is rare stuff. Around 88 percent of global coal resources are thermal leaving only 12 percent coking coal to fuel the steel plants of the world. The best quality premium coking coal is only known to be accessible in abundance in Canada, Australia, China, Mongolia, the U.S., Russia, and Mozambique. Anglo American has further noted that only three countries (Canada, the U.S., and Australia) together make up 90 percent of the seaborne metallurgical coal market.

Middle volatile hard coking coal makes up the lower seams of the deposit while a combination of (less valuable but still good quality) high volatile semi-soft and PCI coal is found at the upper seams. The remaining 6% consists of lower quality thermal coal close to the surface. While low volatile hard coking coal is the most valuable and fetches the highest price, Carbon Creek's middle volatile hard coking coal is still very high quality stuff coupled with their remaining valuable semi-soft and PCI coal. PCI coal is generally not considered to be coking coal and is used mainly for its heat value by injecting it into a blast furnace to replace expensive coke. Semi-soft and PCI coal normally fetch lower prices on the open market relative to hard coking.

The actual layout of the deposit makes for another positive factor in that the coalfield is basically flat and even as opposed to heavily fractured as many deposits are. This enables both surface and underground mining to take place. The company plans on initially using trucks/shovels for the first few years before transitioning to high-wall mining. About 60% of the resource lies below the surface although the plan is not to mine this until around year seven.

Heavy consolidation in the Peace River Coalfield

It is difficult of course to know if management is 100% set on bringing the mine to production, or if they are going through all the motions in the hopes of being bought out. They have had great operational success the past year, but I suppose if the price were right, anybody could be convinced that selling out to the highest bidder would be the best course of action. There has been over $5 billion in acquisitions the past two years in the area alone as shown in the chart below:

Source: Cardero Resources

Xstrata was leading the charge during this time, acquiring three deposits for roughly $670 million in 2011. Given that met coal was peaking over this time frame, it could also be that the buyout binge has come to an end.

An interesting note as of late is that in their last two investor presentations they have excluded any mention of their other assets. The market would no doubt assign a higher valuation to the company as well as possibly spark interest from a major if they spun off or sold their other assets and became a pure play.

China's worsening cold is giving Australia a non-Foster's fueled headache

In August, iron ore and coking coal prices fell to their lowest levels since 2009, as China's slowdown puts its steel sector under severe pressure. The China Iron & Steel Association (CISA) has stated that the country's steel prices are likely to remain weak over the next few months due to a supply glut. The Association further noted that the nation's steel industry's profits collapsed by 96 percent in the first half of 2012 compared to a year ago. CISA also stated that roughly 40 percent of the country's iron mines have shut because of low prices. Macquarie estimated that 40m tons of annual capacity in the seaborne iron ore market was losing money at current prices.

Despite iron ore and coking coal prices dropping heavily since July (although recovering somewhat), imports of metallurgical coal into China for the June quarter still were around 26 per cent higher than those in the quarter ending in March.

For what it's worth (likely not much), the 2013 forecast for China's coking imports are to increase by 15 percent while India's are estimated to increase by 9 percent to 23 million tons. At this point, it's very hard to imagine that there will be any material increase coming out of China.

Recent activity by the largest players in the industry speaks volumes as to what is happening as well as what they view on the horizon. In September, BHP shelved $6 billion in development in two of their largest Queensland coking coal plants. Further, the company and Xstrata cut some 900 coal mining jobs in the State. BHP will also close its 33 year old Gregory coking mine, stating that it was no longer profitable. Rio Tinto (RIO) has plans to close their Blair Athol coal mine in Queensland by the end of the year.

In the U.S., Consol Energy (CNX) stated in September that it was idling its Buchanan coking coal deposit which accounts for 5 million tons a year for 30-60 days due to the depressed market.

BHP's CEO warned last month that a large amount of thermal and coking coal production on the Eastern seaboard of Australia is unprofitable at today's production costs and prices. It has to be taken into account, though, that the commodities boom experienced in Australia the last ten years has seen expenses skyrocket coupled with the strong Oz dollar (though this may change soon) making some mines simply uneconomical.

Peace River Coalfield - A Lower Cost Alternative

Given the tremendous boom Australia has experienced, Canada's deposits could begin to take a much greater share of the coking coal market away from Australia due to the high operating costs in Queensland.

In June of this year, Anglo American released a coking coal presentation basically laying out the case for coking coal in Peace River:

Source: Anglo American Metallurgical Coal Investor and Analyst Briefing

Valuation

The current enterprise value is only 14% of the estimated NPV of $633 million, while similar comparable sales transactions on the company's mineable coal reveals a similar discrepancy between price and value. As it stands today, Cardero's stock price is the lowest it has been in 9 years, while the prospects have never been better. We have a company with basically no debt, good management, and presence in a prolific mining region that has undergone heavy consolidation by the big boys in the area.

Valuation was looked at using three methodologies: Proven and Probable Reserves, NPV, and Measured and Indicated resources.

Proven and Probable Reserves

In October of last year, Xstrata bought Cline's Lossan property. The deposit itself contained 186 million tons in the measured and indicated category but of that amount, only 14 million was estimated to be mineable. The Lossan deposit consists of about 41% PCI coal and 59% coking coal. Although there is a mixture of PCI coal at Carbon Creek, it is a mix with higher quality semi-soft coal as opposed to Lossan, of which 41% was classified as PCI.

This is as good a comparable sales transaction as any, considering the coal is of similar quality and both are located in the Peace River Coalfield. When the Lossan deposit was taken out, coking coal prices were around $280 or so, which worked out to roughly $2.86 per mineable ton in the ground for Lossan. Since then, met coal prices have come down close to 40%, making it far from reality as a starting point. Factoring in that the great commodities run of the past 10 years or so could be coming to an end (or at least stalling out), using the current met coal price of around $170 seems like a good place to begin.

Under this scenario, the recent $170 a ton price gives us a per mineable ton value of around $1.70 ($2.80x0.60). If we multiply this figure by Cardero's 75% interest of 121 million proven and probable reserve tons, we end up with a value of about $155 million. Divide this by the company's 131 million shares (after private placement) and we end up with $1.20 per share versus the current share price of $0.53 cents.

Let us make an assumption that demand from China and others really falls off a cliff and the price drops a further 30% before settling at around $1.15 per ton of proven and probable reserves. At this price, we get a valuation of around $105 million or $0.80 per share. Assuming this case, we still have a potential upside of over 50%. As it stands today, Cardero's coal in the ground is being priced at only $0.73 per ton of proven and probable reserves given its enterprise value after adjusting for the soon to be increased share count.

Net present value

If we use Cardero's base case NPV of the project which assumes long-term met coal pricing of $174 a ton and uses a discount rate of 8%, we get $633 million. How much would a potential acquirer offer to take Cardero out? What is an acceptable discount to NPV? 25 percent? 50 percent? If we use a 25 percent discount, this would give us an acquisition price of $356 million (Cardero's 75% interest and the 25% discount) or about $2.70 per share.

If we use the low case NPV for the project, which assumes long-term met coal pricing of $143 a ton and uses a discount rate of 8%, we get $191 million. If we take a 25 percent discount from this, we end up with an acquisition price of $107 million or close to $0.82 a share. Not nearly as attractive but still a potential upside of close to 55%.

Are the discount rates used too low? Are the long-term coal prices too optimistic? You can play around with these numbers until the cows come home but under this method and these assumptions (which I believe are quite conservative) an adequate margin of safety exists considering the enterprise value right now is just 14% of the NPV.

Measured and Indicated Resources

When Xstrata purchased Talisman Energy's Sukunka deposit in March of 2011, it did so at a price of $500 million or $2.12 for each of the project's 236 million tons in measured and indicated resource. If we apply the 40% or so haircut that coking prices have taken since then and multiply it towards Cardero's 75% interest in Carbon Creek's 468 million measured and indicated tons, we get a figure of around $445 million for the deposit or around $3.40 a share.

The simple chart below reveals several of the acquisitions in the Peace River Coal field and the prices paid.

Cardero's current enterprise value is around $66 million, based on their recent private placement of 22.5 million shares and reflecting the recent $11 million in debt financing. The Price/M&I and Price/Reserve are based on the adjusted market capitalization as well as the 75% interest in the coal reserves.

We have to take the figures above with a grain of salt as when these deposits/companies were acquired, coking coal prices were much higher as well as the outlook was much more favorable. Even with these factors taken into account, Cardero's measured and indicated tons are being valued at only $0.19 cents (75% ownership) and its proven and probable reserves at only $0.73.

All told, we end up with a very wide valuation range with these techniques, but if the assumptions used are in the ballpark of reality, an estimated intrinsic value is perhaps between $0.82 on the very low end to $3.40 or so on the high end. I've always liked the Buffett quote that if you actually have to sit down and calculate the value it's just too close. The value should jump up at you.

While market sentiment cannot be ignored entirely, I'm prepared to wait for price and value to come into some sort of equilibrium from the heavily discounted price the shares are currently fetching.

http://seekingalpha.com/article/985141-another-interesting-speculation-in-the-micro-cap-coal-space?source=yahoo

[url=http://peketec.de/trading/viewtopic.php?p=1316712#1316712 schrieb:ixilon. schrieb am 04.11.2012, 04:12 Uhr[/url]"]Jetzt auch auf Chinesisch

Cardero Resource - Corporate Presentation - November 2012

http://www.cardero.com/i/pdf/ppt/Cardero-October-2012-CN2.pdf

[url=http://peketec.de/trading/viewtopic.php?p=1315749#1315749 schrieb:ixilon. schrieb am 01.11.2012, 00:42 Uhr[/url]"]Cardero Increases Non-Brokered Private Placement and Debt Financing

http://tmx.quotemedia.com/article.php?newsid=55485998&qm_symbol=CDU

[url=http://peketec.de/trading/viewtopic.php?p=1314918#1314918 schrieb:ixilon. schrieb am 30.10.2012, 03:36 Uhr[/url]"]Cardero Resource - Corporate Presentation - November 2012

http://www.cardero.com/i/pdf/ppt/CorporatePresentation.pdf

[url=http://peketec.de/trading/viewtopic.php?p=1269587#1269587 schrieb:ixilon. schrieb am 05.07.2012, 02:30 Uhr[/url]"]CDU - Kurzfristchart

» zur Grafik

CDU - Langfristchart

» zur Grafik

KOR

Corvus Gold Gains 100% Control of Chisna Project, Alaska Identifies New Copper Porphyry Discovery at West Green Target

November 7, 2012

Vancouver, B.C……..Corvus Gold Inc. (“Corvus” or the “Company”) - (TSX: KOR; OTCQX: CORVF) announces that follow up mapping and sampling at the Chisna Project during the summer of 2012 identified a new porphyry copper system at the West Green target. This new discovery is the second major porphyry system to be identified in the southern part of the 965 km2 Chisna Project area, underscoring the potential of this underexplored area of Alaska. Corvus’ Chisna Project joint venture partner, Ocean Park Ventures Corp. (“OCP”), has withdrawn from the joint venture and thereby returned 100% of the project to Corvus. Corvus understands that OCP has expended approximately $11M in exploration on the Chisna Project over the past 3 years.

Jeffrey Pontius, Corvus CEO, stated, “The new exploration results on the Chisna Project have confirmed our belief in the potential of this area of Alaska to host world class copper-gold porphyry systems. The scale and grade of the systems that has been discovered to date is very encouraging and we look forward to the next phase of exploration.”

Figure 1. Map showing Jolly Green and West Green targets areas with copper grades for

selected rock grab samples and soil samples.

West Green – Jolly Green Targets

Ridge and spur soil sampling conducted in 2011 revealed significant copper, gold, molybdenum and tungsten anomalies in an area immediately north of a major regional shear zone in the Golden Range target area (Figure 1). Follow-up exploration during 2011 revealed an area of extensive copper staining, high-grade gold, silver, copper and molybdenum mineralization with up to 126 g/t gold, 198 g/t silver, 17% copper and 0.13% molybdenum at the Jolly Green target on the north side of the prominent ridge that runs through the area (Figure 2).

Figure 2: Chip channel sample line locations at the Jolly Green high grade shear-vein zone.

In 2012, the West Green and Jolly Green soil anomalies were followed up with prospecting and mapping. This work indicates that the mineralization in both areas is related to NNW trending structures that terminate in a regional shear to the south. The high-grade structurally controlled copper mineralization at Jolly Green has now been shown to continue for over 700 metres of strike and is related to the West Green target. The mineralization at West Green is typical porphyry copper style mineralization with sheeted veins and vein stockworks as well as chalcopyrite veinlets and disseminations in a strongly potassic altered quartz diorite porphyry surrounded by broad propylitic alteration zone. This newly discovered potassic altered porphyry core zone is associated with weak magnetite mineralization, which has now highlighted a magnetic anomaly 500 metres west of the currently mapped potassic zone, thus significantly enlarging the target.

About the Chisna Project

The Chisna Project is focused on a new and emerging Alaskan gold and copper-gold porphyry belt of deposits with copper and gold mineralization associated with mid-Cretaceous intrusions of similar age to the Pebble deposit to the west and Orange Hill deposit to the east. At present, the Chisna Project consists of approximately 232,000 acres of State of Alaska mining claims and fee land leased from Ahtna Corporation. The Chisna property has good infrastructure, as it sits between two major highways and has access to grid power as well as an extensive winter road network, making this a unique potential development setting in Alaska.

Corvus and its predecessor-in-title, International Tower Hill Mines Ltd., began exploration on the Chisna Project in 2006 and discovered the Grubstake porphyry copper system in 2007. From early 2010 until the beginning of November, 2012, the Chisna Project was operated as a joint venture between Raven Gold Alaska Inc. (a subsidiary of Corvus) and Ocean Park Alaska Corp. (a subsidiary of OCP) (“OCP Alaska”), with OCP Alaska having the right to earn a 51% interest by contributing US$20 million in exploration expenditures over a 5 year period, thereby providing Corvus with a no-cost assessment of this belt. OCP Alaska withdrew from the joint venture at the beginning of November, 2012 and no longer has any interest in the Chisna Project.

Qualified Person and Quality Control/Quality Assurance

The 2012 exploration program was designed by Chris Brown, Corvus’ Alaska Exploration Manager, with oversight by Dr. Russell Myers (CPG 11433), President of Corvus. Russell Myers, a qualified person as defined by National Instrument 43-101, has reviewed and independently verified the information that forms the basis for this news release and has approved the disclosure herein. Mr. Myers is not independent of the Company, as he is the President and holds common shares and incentive stock options.

About Corvus Gold Inc.

Corvus Gold Inc. is a resource exploration company, focused in Nevada, Alaska and Quebec, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% owned Nevada, North Bullfrog project towards a potential development decision and continuing to explore for new major gold discoveries. Corvus is committed to building shareholder value through new discoveries and leveraging noncore assets via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production.

On behalf of

Corvus Gold Inc.

(signed) Jeffrey A. Pontius

Jeffrey A. Pontius,

Chief Executive Officer

Contact Information:

Ryan Ko

Investor Relations

Email: info@corvusgold.com

Phone: 1-888-770-7488 (toll free) or (604) 638-3246 / Fax: (604) 408-7499

http://www.corvusgold.com/news/index.php?&content_id=128

Corvus Gold Gains 100% Control of Chisna Project, Alaska Identifies New Copper Porphyry Discovery at West Green Target

November 7, 2012

Vancouver, B.C……..Corvus Gold Inc. (“Corvus” or the “Company”) - (TSX: KOR; OTCQX: CORVF) announces that follow up mapping and sampling at the Chisna Project during the summer of 2012 identified a new porphyry copper system at the West Green target. This new discovery is the second major porphyry system to be identified in the southern part of the 965 km2 Chisna Project area, underscoring the potential of this underexplored area of Alaska. Corvus’ Chisna Project joint venture partner, Ocean Park Ventures Corp. (“OCP”), has withdrawn from the joint venture and thereby returned 100% of the project to Corvus. Corvus understands that OCP has expended approximately $11M in exploration on the Chisna Project over the past 3 years.

Jeffrey Pontius, Corvus CEO, stated, “The new exploration results on the Chisna Project have confirmed our belief in the potential of this area of Alaska to host world class copper-gold porphyry systems. The scale and grade of the systems that has been discovered to date is very encouraging and we look forward to the next phase of exploration.”

Figure 1. Map showing Jolly Green and West Green targets areas with copper grades for

selected rock grab samples and soil samples.

West Green – Jolly Green Targets

Ridge and spur soil sampling conducted in 2011 revealed significant copper, gold, molybdenum and tungsten anomalies in an area immediately north of a major regional shear zone in the Golden Range target area (Figure 1). Follow-up exploration during 2011 revealed an area of extensive copper staining, high-grade gold, silver, copper and molybdenum mineralization with up to 126 g/t gold, 198 g/t silver, 17% copper and 0.13% molybdenum at the Jolly Green target on the north side of the prominent ridge that runs through the area (Figure 2).

Figure 2: Chip channel sample line locations at the Jolly Green high grade shear-vein zone.

In 2012, the West Green and Jolly Green soil anomalies were followed up with prospecting and mapping. This work indicates that the mineralization in both areas is related to NNW trending structures that terminate in a regional shear to the south. The high-grade structurally controlled copper mineralization at Jolly Green has now been shown to continue for over 700 metres of strike and is related to the West Green target. The mineralization at West Green is typical porphyry copper style mineralization with sheeted veins and vein stockworks as well as chalcopyrite veinlets and disseminations in a strongly potassic altered quartz diorite porphyry surrounded by broad propylitic alteration zone. This newly discovered potassic altered porphyry core zone is associated with weak magnetite mineralization, which has now highlighted a magnetic anomaly 500 metres west of the currently mapped potassic zone, thus significantly enlarging the target.

About the Chisna Project

The Chisna Project is focused on a new and emerging Alaskan gold and copper-gold porphyry belt of deposits with copper and gold mineralization associated with mid-Cretaceous intrusions of similar age to the Pebble deposit to the west and Orange Hill deposit to the east. At present, the Chisna Project consists of approximately 232,000 acres of State of Alaska mining claims and fee land leased from Ahtna Corporation. The Chisna property has good infrastructure, as it sits between two major highways and has access to grid power as well as an extensive winter road network, making this a unique potential development setting in Alaska.

Corvus and its predecessor-in-title, International Tower Hill Mines Ltd., began exploration on the Chisna Project in 2006 and discovered the Grubstake porphyry copper system in 2007. From early 2010 until the beginning of November, 2012, the Chisna Project was operated as a joint venture between Raven Gold Alaska Inc. (a subsidiary of Corvus) and Ocean Park Alaska Corp. (a subsidiary of OCP) (“OCP Alaska”), with OCP Alaska having the right to earn a 51% interest by contributing US$20 million in exploration expenditures over a 5 year period, thereby providing Corvus with a no-cost assessment of this belt. OCP Alaska withdrew from the joint venture at the beginning of November, 2012 and no longer has any interest in the Chisna Project.

Qualified Person and Quality Control/Quality Assurance

The 2012 exploration program was designed by Chris Brown, Corvus’ Alaska Exploration Manager, with oversight by Dr. Russell Myers (CPG 11433), President of Corvus. Russell Myers, a qualified person as defined by National Instrument 43-101, has reviewed and independently verified the information that forms the basis for this news release and has approved the disclosure herein. Mr. Myers is not independent of the Company, as he is the President and holds common shares and incentive stock options.

About Corvus Gold Inc.

Corvus Gold Inc. is a resource exploration company, focused in Nevada, Alaska and Quebec, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% owned Nevada, North Bullfrog project towards a potential development decision and continuing to explore for new major gold discoveries. Corvus is committed to building shareholder value through new discoveries and leveraging noncore assets via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production.

On behalf of

Corvus Gold Inc.

(signed) Jeffrey A. Pontius

Jeffrey A. Pontius,

Chief Executive Officer

Contact Information:

Ryan Ko

Investor Relations

Email: info@corvusgold.com

Phone: 1-888-770-7488 (toll free) or (604) 638-3246 / Fax: (604) 408-7499

http://www.corvusgold.com/news/index.php?&content_id=128

[url=http://peketec.de/trading/viewtopic.php?p=1316715#1316715 schrieb:ixilon. schrieb am 04.11.2012, 04:46 Uhr[/url]"]The Complete Package: Corvus Gold Inc. (TSX: KOR) (OTCQX: CORVF)

http://www.equedia.com/reportarchive/corvusgoldreport/

[url=http://peketec.de/trading/viewtopic.php?p=1316714#1316714 schrieb:ixilon. schrieb am 04.11.2012, 04:31 Uhr[/url]"]Corvus Gold Announces Closing of $3.47M Private Placement for the Advancement of its North Bullfrog Project, Nevada

http://tmx.quotemedia.com/article.php?newsid=55544927&qm_symbol=KOR

[url=http://peketec.de/trading/viewtopic.php?p=1315286#1315286 schrieb:ixilon. schrieb am 30.10.2012, 21:27 Uhr[/url]"]Corvus Gold Discovers New 11 Kilometre Copper and Gold System at Gerfaut Project, Quebec

http://tmx.quotemedia.com/article.php?newsid=55422415&qm_symbol=KOR

1 Jahreschart

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1265219#1265219 schrieb:ixilon. schrieb am 25.06.2012, 02:25 Uhr[/url]"]» zur Grafik

EZB-Chef Draghi lässt Tür für weitere Zinssenkung offen

08.11.2012

Die EZB hat wie erwartet die Zinsen im Euroraum bei 0,75 Prozent belassen. Allerdings hält sich ihr Chef, Mario Draghi, die Tür für eine weitere Zinssenkung offen.

...

http://www.handelsblatt.com/politik/konjunktur/geldpolitik/ratssitzung-ezb-chef-draghi-laesst-tuer-fuer-weitere-zinssenkung-offen/7363804.html

08.11.2012

Die EZB hat wie erwartet die Zinsen im Euroraum bei 0,75 Prozent belassen. Allerdings hält sich ihr Chef, Mario Draghi, die Tür für eine weitere Zinssenkung offen.

...

http://www.handelsblatt.com/politik/konjunktur/geldpolitik/ratssitzung-ezb-chef-draghi-laesst-tuer-fuer-weitere-zinssenkung-offen/7363804.html

Ingrid Heinritzi, Freie Wirtschaftsjournalistin 08 / 11 / 2012

Lithium als Energiespeicher der Zukunft

Der Klimaschutz ist ein Thema, das eng mit Elektroautos verbunden ist und diese brauchen leistungsfähige Batterien, welche auf Lithium basieren. Auch gibt es kein Mobiltelefon oder Notebook ohne Lithium-Akku.