CDU

September 04, 2012: NR12-23

Cardero Provides Update on Pre-Feasibility Study & 2012 Drill Program at Carbon Creek Metallurgical Coal Deposit

Appoints Resource Manager

Cardero Resource Corp. ("Cardero" or the "Company") - (TSX: CDU, NYSE-MKT: CDY, Frankfurt: CR5) announces the appointment of David Thompson as Resource Manager for Cardero Coal Ltd. (a wholly owned subsidiary of Cardero) and provides an update on the Prefeasibility Study and 2012 exploration program at the Company's flagship Carbon Creek metallurgical coal deposit, located in the Peace River coalfield on northeastern BC.

Appointment of Resource Manager

The Company announces the appointment of David Thompson as Resource Manager for Cardero Coal Ltd. David is a geologist with 15 years' experience in exploration and mining, mostly in metallurgical coal. Most recently, David was Exploration Manager for Anglo American, responsible for coal exploration in the Peace River Coalfield, British Columbia. David's experience includes all aspects of metallurgical coal exploration, coal quality analysis and resource definition. In addition, he has operational experience, having been responsible for significant in-pit coal recovery improvement at the Trend Mine, BC. David will be responsible for all aspects of exploration, resource definition and conversion to reserves as Cardero Coal completes its final drill campaign before the anticipated publication of a feasibility study in 2013.

In recent months, Cardero has been building management capacity in support of feasibility work and, ultimately, anticipated mine development at the Company's flagship Carbon Creek metallurgical coal deposit in northeast BC. Following on from the appointment of Angus Christie as Chief Operating Officer, the appointment of David Thompson is the first in a series of intended management appointments. The Company is currently accepting applications for a senior Mining Engineer and Project Engineer.

Prefeasibility Study Update

Current work at Carbon Creek is focused on an intended Q3 announcement of results from a Prefeasibility Study ("PFS") and filing of the NI43-101 Technical Report within 45 days thereafter (early Q4). The PFS will provide significant detail on key mine-development considerations, including a new resource estimate, mine design, coal product specifications, and production schedule, processing plant design, site infrastructure, product transportation options and a detailed financial assessment. The PFS aims to provide go-forward decisions, which will be fully assessed in the follow-up Feasibility Study planned for completion in Q2 2013.

Key aspects of the PFS work are summarized below:

-

Resource Calculation - completion of a new geological model and resource calculation, including drill data from the 2011 drill program.

-

Mine Design - optionality with respect to mine design, methodology and seam selection as well as mine sequencing and scheduling.

-

Production Rate - annual planned coal production rates and mine life.

-

Coal Qualities & Product Specification - the 2011 drill program included bulk sampling (large diameter core drilling) of 11 coal seams. This work will provide a good indication of coal product potential.

- Marketing Report - independent assessment of coal product marketability based on potential clean coal products.

-

Processing Plant - the Company assessed several coal processing options and plant designs, and will present a go-forward decision in the PFS.

-

Surface Facilities - preliminary designs for all surface facilities, coal handling systems, and on-site power, including new options to streamline the location of coal processing facilities with proposed mine areas, coal handling and transportation options.

-

Transportation Study - the company is currently assessing two transportation options to take clean coal from the mine site to the rail head.

-

Lease versus purchase of mining equipment - Environmental Assessment - environmental work is ongoing at site and the PFS will include important information about potential impacts, mitigation and reclamation planning as well as an update on baseline data collection.

-

Economic Assessment - the PFS will include a revised and detailed discounted cash flow model and indicative mine project valuation.

2012 Field Program

The recent approval of coal license application 414152 (see News Release NR12-14 June 19th, 2012) will allow the remaining coal seams to be drilled during the 2012 program, with final product specification feeding into the full Feasibility Study ("FS"). The 2012 drill program is the last major drill program prior to completion of the Feasibility Study. The program currently includes 5,600 metres of diamond drilling, 3,335 metres of rotary drilling and a significant large-diameter drill program. The objectives of the program are summarized below:

-

Infill Drilling; New License - the licenses issued recently on approval of the 414152 application will now require infill drilling. This program is aimed at upgrading resource classification across the remainder of the deposit.

-

Infill Drilling; Initial Production - the current PFS work has identified areas where underground and surface production could commence, based on mineability and prioritization of highest quality seams. The 2012 program will ensure these areas are adequately assessed to support mining commencement.

-

Resource Expansion - targeted drilling to expand areas already defined as potentially mineable and included in the PFS. These additional resources may be incorporated into the 2013 FS.

-

Engineering Studies - feasibility-level engineering studies, including mine geotechnical and hydrogeological analysis, will be completed in 2012.

Qualified Person

EurGeol Keith Henderson, PGeo, Cardero's Executive Vice President and a qualified person as defined by National Instrument 43-101, has reviewed the scientific and technical information that forms the basis for portions of this news release, and has approved the disclosure herein. Mr. Henderson is not independent of the Company, as he is an officer and shareholder.

About Carbon Creek

The Carbon Creek Metallurgical Coal Deposit is the Company's flagship asset. Carbon Creek is an advanced metallurgical coal development project located in the Peace River Coal District of northeast British Columbia, Canada. The project has a current (October 1, 2011) resource estimate of 166.7 million tonnes of measured and indicated, with an additional 167.1 million tonnes of inferred, ASTM Coal Rank mvB coal. Having completed acquisition of the project in June 2011, the Company released results of an independent PEA, including an updated resource estimate) in December 2011, which estimates a post-tax, undiscounted cash flow of $3.1 billion (on a 75% basis). The PEA contemplates production of 2.9 million tonnes of saleable metallurgical coal products per annum (NR11-20, December 12, 2011).

The Company cautions that the PEA is preliminary in nature, and is based on technical and economic assumptions which will be evaluated in further studies. The PEA is based on the current (as at October 1, 2011) Carbon Creek estimated resource model, which consists of material in both the measured/indicated and inferred classifications. Inferred mineral resources are considered too speculative geologically to have technical and economic considerations applied to them. The current basis of project information is not sufficient to convert the mineral resources to mineral reserves, and mineral resources that are not mineral reserves do not have demonstrated economic viability. Accordingly, there can be no certainty that the results estimated in the PEA will be realized.

About Cardero Resource Corp.

The common shares of the Company are currently listed on the Toronto Stock Exchange (symbol CDU), the NYSE-MKT (symbol CDY) and the Frankfurt Stock Exchange (symbol CR5). For further details on the Company readers are referred to the Company's web site (

www.cardero.com), Canadian regulatory filings on SEDAR at

www.sedar.com and United States regulatory filings on EDGAR at

www.sec.gov.

On Behalf of the Board of Directors of

CARDERO RESOURCE CORP.

"Michael Hunter" (signed)

Michael Hunter, CEO and President

Contact Information:

Nancy Curry, Corporate Communications

Telephone: (604) 408-7488

General Contact:

Email: info@cardero.com

Toll Free: 1-888-770-7488

Tel: 604 408-7488

Fax: 604 408-7499

http://www.cardero.com/s/news_releases.asp?ReportID=545303

[url=http://peketec.de/trading/viewtopic.php?p=1293674#1293674 schrieb:

ixilon. schrieb am 30.08.2012, 19:03 Uhr[/url]"]

Cardero Announces Further Positive Results from Ferricrete Reverse Circulation Drilling, Sheini Hills Iron Project, Ghana

http://www.cardero.com/s/news_releases.asp?ReportID=544709

[url=http://peketec.de/trading/viewtopic.php?p=1292087#1292087 schrieb:

ixilon. schrieb am 27.08.2012, 17:33 Uhr[/url]"]

Cardero Announces Positive Initial Results from Ferricrete Reverse Circulation Drilling, Sheini Hills Iron Project, Ghana

http://www.cardero.com/s/news_releases.asp?ReportID=543789

[url=http://peketec.de/trading/viewtopic.php?p=1269587#1269587 schrieb:

ixilon. schrieb am 05.07.2012, 02:30 Uhr[/url]"]

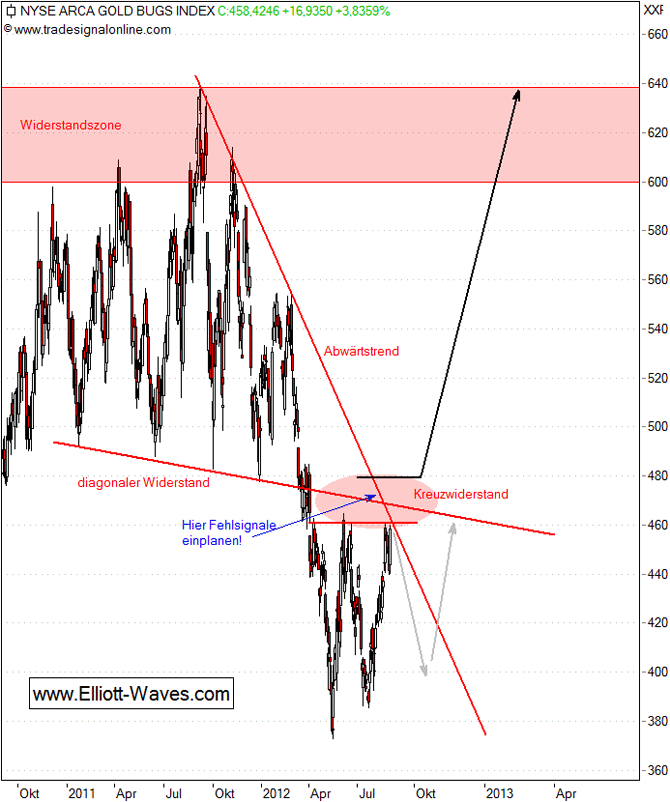

CDU - Kurzfristchart

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1267898#1267898 schrieb:

ixilon. schrieb am 01.07.2012, 22:19 Uhr[/url]"]

CDU - Mittelfristiger Chart

» zur Grafik

[url=http://peketec.de/trading/viewtopic.php?p=1267897#1267897 schrieb:

ixilon. schrieb am 01.07.2012, 22:10 Uhr[/url]"]

CDU - Langfristchart

» zur Grafik