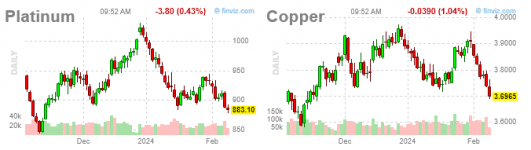

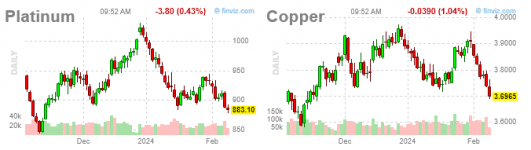

das dachte ich mir auch. alles geht long, wirtschaft brummt (oder soll brummen), die indizes rennen sich zu tode und die industriemetalle schmieren ab. ich kenne mich nicht mehr aus. der ki-hype ist mir ebenso unverständlich wie die eben beschriebenen indizes.Kupfer war eigentlich immer ein Indikator für die wirtschaftliche Entwicklung.....na mal schauen was da kommt....platin und kupfer im blick: beide futures haben im gegensatz zu vielen anderen märkten im jahr 2024 negativ performt. kupfer vollendet mit dem heutigen ein triple-top und auch platin erreicht einen wichtigen unterstützungsbereich um 885$/880$. beide sehen nicht wirklich gut aus ...

=> gute trades euch allen!

App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

die klassischen Ansätze funktionieren gefühlt sein Jahren nicht mehr richtig.das dachte ich mir auch. alles geht long, wirtschaft brummt (oder soll brummen), die indizes rennen sich zu tode und die industriemetalle schmieren ab. ich kenne mich nicht mehr aus. der ki-hype ist mir ebenso unverständlich wie die eben beschriebenen indizes.Kupfer war eigentlich immer ein Indikator für die wirtschaftliche Entwicklung.....na mal schauen was da kommt....platin und kupfer im blick: beide futures haben im gegensatz zu vielen anderen märkten im jahr 2024 negativ performt. kupfer vollendet mit dem heutigen ein triple-top und auch platin erreicht einen wichtigen unterstützungsbereich um 885$/880$. beide sehen nicht wirklich gut aus ...

=> gute trades euch allen!

Allerdings muss man zur Kenntnis nehmen das durch Information und KI offenbar deutlich mehr an Wertschöpfung entsteht als vor 10 Jahren - in USA sind ja genau diese Aktien und Finanzen die Zugpferde......und soviel Kupfer braucht es wohl anscheinend nicht für Chips, als für Autos, Maschinen etc.

ist auf der einen seite für mich die größte künstlich aufgepumpte blase, zum anderen auch ein maximales risiko im gebrauch. ich denke, dass der einsatz solch gestützter software schlicht nicht handhabbar sein wird. es mögen potenzielle einsatzbereiche existieren, aber wir hatten auch schon firmenintern die frage erörtert, was passiert, wenn solche informationssysteme beginnen, nicht mehr nur "echte" tatsachen zu verarbeiten, sondern schlicht info-beziehungen herstellen, die, um es salopp zu formulieren, "an den haaren herbeigezogen" sind!

natural gas : neues tt bei 1.878$. -4.4%.natural gas : der future etabliert sich unter der 2$-marke. wow ...

natural gas : tt bei 1.661$.natural gas : neues tt bei 1.878$. -4.4%.natural gas : der future etabliert sich unter der 2$-marke. wow ...

Inflation: Verbraucherpreise in den USA steigen stärker als erwartet https://de.investing.com/news/econo...-den-usa-steigen-starker-als-erwartet-2551766Irgendwie unverständlich, Inflation ist nicht mehr gesunken in USA

Investing.com - Die Verbraucherpreise in den USA stiegen im Januar stärker als gedacht, hauptsächlich aufgrund gestiegener Unterbringungs- und Gesundheitskosten. ...

=> ich muss ehrlich sagen, dass ich selbst die wirtschaftssituation (global betrachtet) nicht verstehe. die us-indizes werden von wenigen, stark gewichteten aktien zu immer neuen ath gewuchtet, die breite basis fehlt hier (so bilde ich mir das ein). der ki-ballon ist in meinen augen zudem aufgepumpt ohne ende (und damit möchte ich einen bestimmten wert an der künftigen wertschöpfung nicht absprechen). als (ehemalige) wirtschaftsgroßmacht schwächelt. der us-arbeitsmarkt ist darüberhinaus stark und stabil, die lohnentwicklung dürfte auch bei den amis sich an den verbraucherpreisen orientieren.

und ganz allgemein gesprochen - und das kann man ja auch im netz lesen (ich werte das nicht) - verstehen nicht wenige marktakteure den seit oktober vergangenen jahres rennende börsen-hausse, die quasi aus dem stand eine 180°-wende vollzogen hat. ich vergleiche die situation mit einem, nur in der theorie funktionierendem, perpetuum mobile. keine ahnung wie lange diese hausse noch laufen mag, die noch engagierten shorties haben jedenfalls mit dazu beigetragen, dass der bullenlauf weiter genährt wurde. bin gespannt, ob bzw. wann einmal eine konsolidierung einsetzt, die den namen auc verdient.

=> genug gefaselt. punkt. also, ich bin bekennender nichtsblicker, und wünsche allseits einen schönen abend.

natural gas : tt 1.590$.natural gas : tt bei 1.661$.natural gas : neues tt bei 1.878$. -4.4%.natural gas : der future etabliert sich unter der 2$-marke. wow ...

Zuletzt bearbeitet:

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Integra drills 134.11 m of 1.46 g/t AuEq at DeLamar

INTEGRA INTERSECTS 1.46 G/T AUEQ OVER 134 M IN METALLURGICAL DRILL PROGRAM AT DELAMAR

Integra Resources Corp. has released the second set of drill results from the 4,597-metre 2023 high-wall geotechnical and metallurgical drill program at the DeLamar project, located in southwestern Idaho. The results announced today include 20 drill holes representing 2,290 m from the highwall geotechnical and metallurgical drill program which was completed in November 2023.

The core samples from the drill program will be used for comprehensive mineralogical analysis, Crusher Work Index ("CWI") testing and additional heap leach recovery analysis, including bottle roll, permeability and column leach testwork. The metallurgical drill results from the program will be used to develop an advanced geo-metallurgical model that will support future economic studies at the Project. Geotechnical drilling was also completed in the proposed open pits at the Project to further bolster the 3D geotechnical model and to provide additional data for the Draft Mine Plan of Operations ("MPO"), which was submitted to the U.S. Bureau of Land Management ("BLM") in December 2023.

Drilling Highlights :

....

https://www.stockwatch.com/News/Item/Z-C!ITR-3512882/C/ITR

2024-02-15 10:15 ET - News ReleaseINTEGRA INTERSECTS 1.46 G/T AUEQ OVER 134 M IN METALLURGICAL DRILL PROGRAM AT DELAMAR

Integra Resources Corp. has released the second set of drill results from the 4,597-metre 2023 high-wall geotechnical and metallurgical drill program at the DeLamar project, located in southwestern Idaho. The results announced today include 20 drill holes representing 2,290 m from the highwall geotechnical and metallurgical drill program which was completed in November 2023.

The core samples from the drill program will be used for comprehensive mineralogical analysis, Crusher Work Index ("CWI") testing and additional heap leach recovery analysis, including bottle roll, permeability and column leach testwork. The metallurgical drill results from the program will be used to develop an advanced geo-metallurgical model that will support future economic studies at the Project. Geotechnical drilling was also completed in the proposed open pits at the Project to further bolster the 3D geotechnical model and to provide additional data for the Draft Mine Plan of Operations ("MPO"), which was submitted to the U.S. Bureau of Land Management ("BLM") in December 2023.

Drilling Highlights :

....

https://www.stockwatch.com/News/Item/Z-C!ITR-3512882/C/ITR

https://www.globenewswire.com/news-...eading-Development-Stage-Silver-Projects.html

Positive Feasibility Results Establish Cordero as One of the World’s Leading Development-Stage Silver ProjectsFebruary 20, 2024 06:00 ET|

Source: Discovery Silver Corp

nicht überwältigend, aber solide

Positive Feasibility Results Establish Cordero as One of the World’s Leading Development-Stage Silver ProjectsFebruary 20, 2024 06:00 ET|

Source: Discovery Silver Corp

nicht überwältigend, aber solide

Zuletzt bearbeitet:

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Hab mir schon Mal nen short zurechtgelegt. Aber abwarten, da ist big Money (hf) am Start, ich warte auf Umkehrsignale. Sollte aber nicht mehr allzu lang dauern, heute schon irre moves gesehen, Trend aber noch intakt. saisonalität ab März spricht für short, Wetter hin oder her nach dem parabolischen Anstieg.

Wie beim Osaft die letzten Wochen, da geht auch noch was.

Good nicht, and good luck!

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

https://integraresources.com/site/assets/files/2835/itr_corporate_presentation_-_january_2024_vf.pdf

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Läuft anHab mir schon Mal nen short zurechtgelegt. Aber abwarten, da ist big Money (hf) am Start, ich warte auf Umkehrsignale. Sollte aber nicht mehr allzu lang dauern, heute schon irre moves gesehen, Trend aber noch intakt. saisonalität ab März spricht für short, Wetter hin oder her nach dem parabolischen Anstieg.

Wie beim Osaft die letzten Wochen, da geht auch noch was.

Good nicht, and good luck!

Evtl. Retest 6500?

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Freehold earns $34.3-million in Q4

Mr. David Spyker reports

FREEHOLD ROYALTIES ANNOUNCES FOURTH QUARTER AND FULL YEAR 2023 RESULTS, RESERVES AND GUIDANCE FOR 2024

Freehold Royalties Ltd. has released fourth quarter and year-end results for the period ended Dec. 31, 2023.

President's Message

Freehold showcased the strength of our unique North American portfolio in 2023, with exposure to a stable production base in Canada, and growing oil weighted volumes in the U.S. Over the last four years we have structurally improved our business through exposure to the top-tier basins across North America, enhancing the sustainability of drilling on our lands and returns to our shareholders. We achieved 100% organic reserves replacement in 2023, demonstrating the strength of our asset base. This evolution has resulted in $163 million in dividends returned to our shareholders, while maintaining conservative debt levels (0.4 times net debt to trailing funds from operations).

2023 and Fourth Quarter Highlights included:

https://www.stockwatch.com/News/Item/Z-C!FRU-3518121/C/FRU

2024-02-28 16:30 ET - News ReleaseMr. David Spyker reports

FREEHOLD ROYALTIES ANNOUNCES FOURTH QUARTER AND FULL YEAR 2023 RESULTS, RESERVES AND GUIDANCE FOR 2024

Freehold Royalties Ltd. has released fourth quarter and year-end results for the period ended Dec. 31, 2023.

President's Message

Freehold showcased the strength of our unique North American portfolio in 2023, with exposure to a stable production base in Canada, and growing oil weighted volumes in the U.S. Over the last four years we have structurally improved our business through exposure to the top-tier basins across North America, enhancing the sustainability of drilling on our lands and returns to our shareholders. We achieved 100% organic reserves replacement in 2023, demonstrating the strength of our asset base. This evolution has resulted in $163 million in dividends returned to our shareholders, while maintaining conservative debt levels (0.4 times net debt to trailing funds from operations).

2023 and Fourth Quarter Highlights included:

- $315 million in revenue; $80 million during the fourth quarter;

- $240 million in funds from operations ($1.59/share( 1)); $63 million ($0.42/share(1)) during the fourth quarter;

- $163 million ($1.08/share) in dividends paid in 2023, at record levels of dividends paid and up 15% versus 2022;

- $115 million in core Permian basin acquisitions announced late 2023, closed in January 2024;

- Record leasing in Canada with 122 agreements signed through 2023; up 53% versus 2022;

- Record U.S. annual average production of 5,102 boe/d, a 16% increase over 2022;

- Canadian annual production averaged 9,612 boe/d, flat versus 2022;

- 993 gross wells drilled, 466 wells in Canada and 527 wells in the U.S.;

- $57.65/boe average annual realized price ($70.50/boe in the U.S. and $50.82/boe in Canada);

- Proved and probable reserves totalled 54.5 MMboe as at Dec. 31, 2023;

- Proved developed producing reserves totalled 26.3 MMboe as at year-end 2023, a 2% improvement versus 2022. The reserve additions were the result of infill drilling and improved recovery within Freehold's portfolio;

- Freehold replaced 115% of proved developed producing reserves and 128% of proved reserves; reserve replacement ratios were consistent with 2022, with 115% of proved reserves replaced organically.

https://www.stockwatch.com/News/Item/Z-C!FRU-3518121/C/FRU

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Monument Reports Second Quarter Fiscal 2024 (“Q2 FY2024”) Results

VANCOUVER, British Columbia, March 01, 2024 (GLOBE NEWSWIRE) -- Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) “Monument” or the “Company” today announced its second quarter of fiscal 2024 production and financial results for the three and six months ended December 31, 2023. All amounts are expressed in United States dollars (“US$”) unless otherwise indicated (refer to www.sedar.com for full financial results).

President and CEO Cathy Zhai commented, “Q2 FY2024 was a strong quarter at the Selinsing Gold Mine with sulphide gold processing plant performance optimization and improvements resulting in greater feed rates and a more streamlined sales process. We are working hard on corporate development and development of the Murchison Gold Project and be prepared for the move.”

Second Quarter Highlights:

https://www.stockwatch.com/News/Item/Z-C!MMY-3519627/C/MMY

2024-03-01 02:14 ET - News ReleaseVANCOUVER, British Columbia, March 01, 2024 (GLOBE NEWSWIRE) -- Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) “Monument” or the “Company” today announced its second quarter of fiscal 2024 production and financial results for the three and six months ended December 31, 2023. All amounts are expressed in United States dollars (“US$”) unless otherwise indicated (refer to www.sedar.com for full financial results).

President and CEO Cathy Zhai commented, “Q2 FY2024 was a strong quarter at the Selinsing Gold Mine with sulphide gold processing plant performance optimization and improvements resulting in greater feed rates and a more streamlined sales process. We are working hard on corporate development and development of the Murchison Gold Project and be prepared for the move.”

Second Quarter Highlights:

- Overall Q2 2024 and YTD 2024 gold production exceeded production in the same quarter and the year to date in FY 2023. Significant increase in mining rate resulting in a sustained ore delivery on the stockpile target ahead of the rainy season.

- Continued improvement of the gold flotation plant with greater feed rates and lower downtime.

- Positive cash flow from stabilized sulphide gold production of $2.41 million during Q2 2024 compared to $2.75 million in Q2 2023 when the oxide production was in transition to the sulphide production:

- Main quarterly operating metrics:

- 6,809 ounces (“oz”) of gold produced (Q2 FY2023: 1,526 oz);

- 6,967 oz gold sold at average realized price of $1,946/oz and revenue from concentrate sales of $11.00 million (Q2 FY2023: 3,350 oz sold at average realized price of $1,753/oz and revenue of $5.87 million) (refer to section 15 “Non-IFRS Performance Measures” of the MD&A for more details on the calculation of the average realized gold price);

- Cash cost per ounce for gold sold at $894/oz (Q2 FY2023: $1,507/oz);

- Gross margin of $4.77 million (Q2 FY2023: $0.82 million);

- All-in sustaining cost (“AISC”) per ounce sold decreased to $1,175/oz (Q2 FY2023: $1,627/oz) (refer to section 15 “Non-IFRS Performance Measures” of the MD&A).

https://www.stockwatch.com/News/Item/Z-C!MMY-3519627/C/MMY

an der 6300 mal mit Hebel 5 noch bissl was short , bei 6500 würd ich noch was nehmenLäuft anHab mir schon Mal nen short zurechtgelegt. Aber abwarten, da ist big Money (hf) am Start, ich warte auf Umkehrsignale. Sollte aber nicht mehr allzu lang dauern, heute schon irre moves gesehen, Trend aber noch intakt. saisonalität ab März spricht für short, Wetter hin oder her nach dem parabolischen Anstieg.

Wie beim Osaft die letzten Wochen, da geht auch noch was.

Good nicht, and good luck!

Evtl. Retest 6500?

Läuft anHab mir schon Mal nen short zurechtgelegt. Aber abwarten, da ist big Money (hf) am Start, ich warte auf Umkehrsignale. Sollte aber nicht mehr allzu lang dauern, heute schon irre moves gesehen, Trend aber noch intakt. saisonalität ab März spricht für short, Wetter hin oder her nach dem parabolischen Anstieg.

Wie beim Osaft die letzten Wochen, da geht auch noch was.

Good nicht, and good luck!

Evtl. Retest 6500?

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Integra arranges $10-million bought-deal offeringhttps://integraresources.com/site/assets/files/2835/itr_corporate_presentation_-_january_2024_vf.pdf

2024-03-05 17:46 ET - News ReleaseMr. Jason Kosec reports

INTEGRA ANNOUNCES C$10 MILLION BOUGHT DEAL PUBLIC OFFERING

Integra Resources Corp. has entered into an agreement with a syndicate of underwriters, pursuant to which the underwriters have agreed to purchase, on a bought-deal basis, 11,112,000 units of the company at a price of 90 cents per unit for gross proceeds of approximately $10-million.

Each unit will consist of one common share of the company and one-half of one common share purchase warrant. Each warrant will entitle the holder thereof to purchase one common share at an exercise price of $1.20 for a period of 36 months from the closing of the offering.

The underwriters also have an option to purchase that number of additional units equal to 15 per cent of the number of units sold pursuant to the offering at offering price, for market stabilization purposes and to cover overallotments for a period expiring 30 days after the date of closing.

The company intends to use the net proceeds from the offering to finance exploration and development expenditures at the DeLamar project and the Nevada North project, and for working capital and general corporate purposes.

The offering will be qualified by way of a prospectus supplement to the company's existing base shelf prospectus in each of the provinces and territories of Canada (other than the province of Quebec). The prospectus supplement (together with the base shelf prospectus) will be available on SEDAR+.

Closing is expected on or about March 13, 2024, and is subject to TSX Venture Exchange and other necessary regulatory approvals. The company will also use its best efforts to list the warrants on the TSX-V.

https://www.stockwatch.com/News/Item/Z-C!ITR-3521163/C/ITR

kakao

ist der hammer. seit jahresbeginn über 50% draufgesattelt. und ein ende nicht in sicht. auch hier gilt nach wie vor: buy the dips.

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.152

Trades:

4

Integra arranges $10-million bought-deal offeringhttps://integraresources.com/site/assets/files/2835/itr_corporate_presentation_-_january_2024_vf.pdf

2024-03-05 17:46 ET - News Release

Mr. Jason Kosec reports

INTEGRA ANNOUNCES C$10 MILLION BOUGHT DEAL PUBLIC OFFERING

Integra Resources Corp. has entered into an agreement with a syndicate of underwriters, pursuant to which the underwriters have agreed to purchase, on a bought-deal basis, 11,112,000 units of the company at a price of 90 cents per unit for gross proceeds of approximately $10-million.

Each unit will consist of one common share of the company and one-half of one common share purchase warrant. Each warrant will entitle the holder thereof to purchase one common share at an exercise price of $1.20 for a period of 36 months from the closing of the offering.

The underwriters also have an option to purchase that number of additional units equal to 15 per cent of the number of units sold pursuant to the offering at offering price, for market stabilization purposes and to cover overallotments for a period expiring 30 days after the date of closing.

The company intends to use the net proceeds from the offering to finance exploration and development expenditures at the DeLamar project and the Nevada North project, and for working capital and general corporate purposes.

The offering will be qualified by way of a prospectus supplement to the company's existing base shelf prospectus in each of the provinces and territories of Canada (other than the province of Quebec). The prospectus supplement (together with the base shelf prospectus) will be available on SEDAR+.

Closing is expected on or about March 13, 2024, and is subject to TSX Venture Exchange and other necessary regulatory approvals. The company will also use its best efforts to list the warrants on the TSX-V.

https://www.stockwatch.com/News/Item/Z-C!ITR-3521163/C/ITR

2024-03-06 10:41 ET - News Release

INTEGRA ANNOUNCES UPSIZE IN BOUGHT DEAL PUBLIC OFFERING TO C$13 MILLIONCanada NewsWireVANCOUVER, BC, March 6, 2024

........

https://www.stockwatch.com/News/Item/Z-C!ITR-3521480/C/ITR

kakao : der future rennt sich die letzten tage im bereich um 6660/6670 fest. rücksetzer bis 6000/5800 sind aber für einen intakten long-trend, vor allem nach diesem ansturm, aber unschädlcih.kakao ist der hammer. seit jahresbeginn über 50% draufgesattelt. und ein ende nicht in sicht. auch hier gilt nach wie vor: buy the dips.

NYMEX OVERVIEW: ULTRA-LOW-SULFUR DIESEL LEADS REVERSAL -- OPIS

7 March 2024, 19:38

After a slow start in petroleum futures a turnaround in ULSD futures prices has lifted the entire complex and turned losses into gains shortly after midday.

The move in diesel has been enough to reverse the rest of the market at a time of year when ULSD is typically the laggard. Not only has diesel reversed, but the strong move higher is now getting to the point where back to back days of increases are largely offsetting the losses at the beginning of the week.

Not only is the front month diesel contract moving higher, it is doing so at a pace that is not being met by outer contracts and, as a result, the April contract holds nearly 6cts above the May contract. After being down some 2cts earlier, April ULSD futures are now up 3.19cts at $2.6941/gal. Trade sources note that some buying was triggered after the contract got back above $2.66/gal and that brought ULSD briefly above the $2.70/gal level.

Losses in RBOB are now gains in the 1.25-1.5cts range for second-quarter contracts, led by May which was last printing at $2.5674/gal and just fractions of a cent off the earlier highs.

While futures have moved higher, physical markets are a bit more mixed with the Chicago and New York markets seeing increases in the 1.5-2.5cts range at midday.

April WTI has not jumped back across the $79/bbl level, trading at $79.28/bbl and topping out at $79.36/bbl recently. While the contract has spent some time above $80/bbl, a settlement above that level has continued to be elusive. The Brent contract is also moving higher and increases there are a bit more than WTI with May Brent last trading up 29cts at $83.25/bbl.

This content was created by Oil Price Information Service, which is operated by Dow Jones & Co. OPIS is run independently from Dow Jones Newswires and The Wall Street Journal.

--Reporting by Denton Cinquegrana, dcinquegrana@opisnet.com; Editing by Andrew Atwal, aatwal@opisnet.com

(END) Dow Jones Newswires March 07, 2024 12:38 ET (17:38 GMT) Copyright (c) 2024 Dow Jones & Company, Inc.

7 March 2024, 19:38

After a slow start in petroleum futures a turnaround in ULSD futures prices has lifted the entire complex and turned losses into gains shortly after midday.

The move in diesel has been enough to reverse the rest of the market at a time of year when ULSD is typically the laggard. Not only has diesel reversed, but the strong move higher is now getting to the point where back to back days of increases are largely offsetting the losses at the beginning of the week.

Not only is the front month diesel contract moving higher, it is doing so at a pace that is not being met by outer contracts and, as a result, the April contract holds nearly 6cts above the May contract. After being down some 2cts earlier, April ULSD futures are now up 3.19cts at $2.6941/gal. Trade sources note that some buying was triggered after the contract got back above $2.66/gal and that brought ULSD briefly above the $2.70/gal level.

Losses in RBOB are now gains in the 1.25-1.5cts range for second-quarter contracts, led by May which was last printing at $2.5674/gal and just fractions of a cent off the earlier highs.

While futures have moved higher, physical markets are a bit more mixed with the Chicago and New York markets seeing increases in the 1.5-2.5cts range at midday.

April WTI has not jumped back across the $79/bbl level, trading at $79.28/bbl and topping out at $79.36/bbl recently. While the contract has spent some time above $80/bbl, a settlement above that level has continued to be elusive. The Brent contract is also moving higher and increases there are a bit more than WTI with May Brent last trading up 29cts at $83.25/bbl.

This content was created by Oil Price Information Service, which is operated by Dow Jones & Co. OPIS is run independently from Dow Jones Newswires and The Wall Street Journal.

--Reporting by Denton Cinquegrana, dcinquegrana@opisnet.com; Editing by Andrew Atwal, aatwal@opisnet.com

(END) Dow Jones Newswires March 07, 2024 12:38 ET (17:38 GMT) Copyright (c) 2024 Dow Jones & Company, Inc.