App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread / CCG-Hauptthread

- Ersteller dukezero

- Erstellt am

- Tagged users Kein(e)

Kostolanys Erbe

RohstoffExperte

Ort:

Im schönsten Bundesland zwischen Nord- und Ostsee.

Beiträge:

11.150

Trades:

4

Monument Reports Third Quarter Fiscal 2024 (“Q3 FY2024”) Results

VANCOUVER, British Columbia, May 28, 2024 (GLOBE NEWSWIRE) -- Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) “Monument” or the “Company” today announced its third quarter of fiscal 2024 production and financial results for the three and nine months ended March 31, 2024. All amounts are expressed in United States dollars (“US$”) unless otherwise indicated (refer to www.sedar.com for full financial results).

President and CEO Cathy Zhai commented, "Q3 FY2024 was a significant quarter at the Selinsing Gold Mine with stabilization of production at the sulphide gold processing plant. The Company focused on the improvement of flotation plant performance at the Selinsing Gold Mine to increase cash flow generation. The cash generation provides a foundation for future exploration, development and corporate growth. In addition, an assessment of a potential production restart at the Murchison Gold Project continues to progress.”

Third Quarter Highlights:

https://www.stockwatch.com/News/Item/Z-C!MMY-3557414/C/MMY

2024-05-28 09:21 ET - News ReleaseVANCOUVER, British Columbia, May 28, 2024 (GLOBE NEWSWIRE) -- Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) “Monument” or the “Company” today announced its third quarter of fiscal 2024 production and financial results for the three and nine months ended March 31, 2024. All amounts are expressed in United States dollars (“US$”) unless otherwise indicated (refer to www.sedar.com for full financial results).

President and CEO Cathy Zhai commented, "Q3 FY2024 was a significant quarter at the Selinsing Gold Mine with stabilization of production at the sulphide gold processing plant. The Company focused on the improvement of flotation plant performance at the Selinsing Gold Mine to increase cash flow generation. The cash generation provides a foundation for future exploration, development and corporate growth. In addition, an assessment of a potential production restart at the Murchison Gold Project continues to progress.”

Third Quarter Highlights:

- Positive cashflow from gold concentrate production of $6.20 million during Q3 2024, compared to $1.35 million in Q3 2023 when gold bullion transitioned to gold concentrate production.

- Gold concentrate production stabilized in Q3 FY 2024 with a total of 5,448 ounces of gold produced, bringing the year to date gold production to 19,539 ounces at cash cost of $878 per ounce and AISC at $1,168 per ounce (YTD FY 2023: a total 6,003 ounces of gold produced, comprised of 2,440 ounce from gold concentrate production and 3,563 ounces from gold bullion production at a cash cost of $1,536 per ounce and AISC at $1,779 per ounce).

- Ongoing upgrades of the filter press through FY 2024 expected to further increase production capacity.

- 5,488 ounces of gold produced (Q3 2023: 2,412 ounces);

- 8,727 ounces of gold sold at a record average realized price of $2,097 per ounce with revenue from concentrate sales of $14.91 million (Q3 2023: 1,400 ounces sold at average realized price of $1,878 per ounce and revenue of $2.63 million from gold bullion sales) (refer to section 14 “Non-IFRS Performance Measures” for further details on the calculation of the average realized gold price in the Q3 FY 2024 Management’s Discussion and Analysis (“MD&A”));

- Cash cost per ounce sold of $882 per ounce (Q3 2023: $1,580 per ounce);

- Gross margin of $7.21 million (Q3 2023: $0.42 million);

- All-in sustaining cost (“AISC”) per ounce sold of $1,273 per ounce (Q3 2023: $1,940 per ounce) (refer to section 14 “Non-IFRS Performance Measures”in the Q3 FY 2024 MD&A).

https://www.stockwatch.com/News/Item/Z-C!MMY-3557414/C/MMY

: der juni verläuft für die bullen suboptimal und charttechnisch gibt es heute einen ordentlichen schlag auf die birne. der kampf um die 30$-marke war ein wilder, aber heute sieht es aus, als würde der zwischenboden um 29$ nun zwischendecke mutieren. theoretisch hat sich nun ein shortziel bis hinunter auf den mehrfach bemühten support um 26.40$ eröffnet (april+mai 2023, dez 2023, mai 2024).

=> good luck 2 all of us!

kupfer

: visualisierung des kupfer-kontraktes im "big pic" des monatscharts. der monströse "mai-spike" ist aktuell als stark bärisches signal zu werten, wobei derzeit das stark überkaufte szenario abgebaut wird. um 4.50$ findet sich die oberkante einer unterstützungszone. nachhaltiges unterschreiten selbiger gäbe den bären die chance, die kreuzunterstützung um 4.04$/4.00$ anzulaufen (untere aufwärtstrendlinie). oberhalb von 4.60$/4.70$ hätten die bullen die oberhand und könnten mit entsprechendem krafteinsatz die obere aufwärtstrendlinie jenseits der 5$-marke anvisieren.

=> ich wünsche euch allen ein schönes wochenende und vorab einen prima em-fußballauftaktabend!

=> ich wünsche euch allen ein schönes wochenende und vorab einen prima em-fußballauftaktabend!

: die zupferei geht weiter. bullenfalle mit zwei tagesspikes richtung 31$ vor knapp einer woche, um jetzt doch wieder bei 29$ herumzulungern.: der juni verläuft für die bullen suboptimal und charttechnisch gibt es heute einen ordentlichen schlag auf die birne. der kampf um die 30$-marke war ein wilder, aber heute sieht es aus, als würde der zwischenboden um 29$ nun zwischendecke mutieren. theoretisch hat sich nun ein shortziel bis hinunter auf den mehrfach bemühten support um 26.40$ eröffnet (april+mai 2023, dez 2023, mai 2024).

=> good luck 2 all of us!

kupfer : testet den zweiten tag einen vorgeschobenen unterstützungsbereich um 4.3200$ und nähert sich damit der unteren aufwärtstrendlinie. auch hier sollten klarere bzw. signifikantere signale abgewartet werden.kupfer : visualisierung des kupfer-kontraktes im "big pic" des monatscharts. der monströse "mai-spike" ist aktuell als stark bärisches signal zu werten, wobei derzeit das stark überkaufte szenario abgebaut wird. um 4.50$ findet sich die oberkante einer unterstützungszone. nachhaltiges unterschreiten selbiger gäbe den bären die chance, die kreuzunterstützung um 4.04$/4.00$ anzulaufen (untere aufwärtstrendlinie). oberhalb von 4.60$/4.70$ hätten die bullen die oberhand und könnten mit entsprechendem krafteinsatz die obere aufwärtstrendlinie jenseits der 5$-marke anvisieren.

=> ich wünsche euch allen ein schönes wochenende und vorab einen prima em-fußballauftaktabend!

habe das gefühl, die märkte driften schon in die "lazy summer time" ab ...

=> einen schönen abend!

natural gas : fällt auf ein tt von 2.410$. fasten your seat belts ....

wow,

zündet heute mal wieder den turbo. der future (sep-24) liegt aktuell bei 30.400$ und damit mit 2.5% im plus. das th war bereits bei 30.490$ markiert worden. intraday könnte der kurs sich aber schon ein wenig er-(über?)hitzt haben. nachtrag: th-test erfolgte mit verbesserung selbigen auf 30.520$.

Zuletzt bearbeitet:

kakao : seit mai 2024 wird hier die zone um 7000 malträtiert und zu einem starken unterstützungsbereich ausgebaut. auf der oberseite liegen aber bei 9k und 10k ordentliche brocken im weg. das wärenfür die bullen die nächsten wegmarken in der erholung. unter 7000 sollten die bären verstärkt agieren und das sagen haben. das szenario ist aktuell als "neutral" einzustufen.kakao : das ist "man" mal 4 wochen nicht vor ort und schon zwirbelt es den kontrakt ordentlich südwärts. die zone um 7.000$ ist im mai 2024 reichlich getestet worden und sollte als stabiler support dienen. allerdings liegt um 9.000$ ein widerstand den bullen im weg. dazwischen ist eine neutrale zone geschaffen worden, in der beide parteien den rohstoff hin und her flippern könnten.kakao : da ist ja ordentlich "both-side-movement" im markt. da muss ich wohl mit dem letzten nutella sparsamer umgehen, wobei hier nur ein untergeodneter anteil des leckeren rohstoffs "verwurstet" wird.kakao : was für ein long-trend. sprung über die marke von 11.000$. buy-and-hold, ohne stress.Mal sehen was davon hier ankommt beim Verbrauchetkakao : das teil ist der hammer. 10k $$ für die tonne. da könnte einem der spaß am schoko-genuss vergehen ...

=> habe derzeit wenig zeit und noch weniger lust auf börseln. wünsche euch allen viel erfolg!

short-lastig unter 7k $, die bullen sollten oberhalb von 9k $, eher noch 10k $, wieder selbstvertrauen tanken können.

=> gute trades!!!!!!!!

bötzkes,

-future zieht wie hechtsuppe. plus 3.3%, th 30.660$. nach den us-arbeitsmarktzahlen sogar auf 30.900$ gespiked und damit das hoch von mitte juni getestet.

Zuletzt bearbeitet:

-future mit th bi 1023.50$. +1.4%

edel- und industriemetalle laufen heute gut.

-future mit aktuellen +4%,

-future mit +2.9%.

kupfer : th 4.6995$. die unterstützung hat sauber gehalten und die longs animiert, auf den bock zu steigen ....kupfer : testet den zweiten tag einen vorgeschobenen unterstützungsbereich um 4.3200$ und nähert sich damit der unteren aufwärtstrendlinie. auch hier sollten klarere bzw. signifikantere signale abgewartet werden.kupfer : visualisierung des kupfer-kontraktes im "big pic" des monatscharts. der monströse "mai-spike" ist aktuell als stark bärisches signal zu werten, wobei derzeit das stark überkaufte szenario abgebaut wird. um 4.50$ findet sich die oberkante einer unterstützungszone. nachhaltiges unterschreiten selbiger gäbe den bären die chance, die kreuzunterstützung um 4.04$/4.00$ anzulaufen (untere aufwärtstrendlinie). oberhalb von 4.60$/4.70$ hätten die bullen die oberhand und könnten mit entsprechendem krafteinsatz die obere aufwärtstrendlinie jenseits der 5$-marke anvisieren.

=> ich wünsche euch allen ein schönes wochenende und vorab einen prima em-fußballauftaktabend!

habe das gefühl, die märkte driften schon in die "lazy summer time" ab ...

=> einen schönen abend!

natural gas : wandert nach süden durch. tt 2.335$.natural gas : fällt auf ein tt von 2.410$. fasten your seat belts ....

-future: th 1048.00$, +3.3%.-future mit th bi 1023.50$. +1.4%

Zuletzt bearbeitet:

der -future zündet den turbo. flagge bullisch aufgelöst, kurs rennt wie die sau, aktuell bei +3.0% und einem th von 31.790$. das ist alles schon wieder erschreckend ....wow, zündet heute mal wieder den turbo. der future (sep-24) liegt aktuell bei 30.400$ und damit mit 2.5% im plus. das th war bereits bei 30.490$ markiert worden. intraday könnte der kurs sich aber schon ein wenig er-(über?)hitzt haben. nachtrag: th-test erfolgte mit verbesserung selbigen auf 30.520$.

Zuletzt bearbeitet:

guten morgen allerseits.der -future zündet den turbo. flagge bullisch aufgelöst, kurs rennt wie die sau, aktuell bei +3.0% und einem th von 31.790$. das ist alles schon wieder erschreckend ....wow, zündet heute mal wieder den turbo. der future (sep-24) liegt aktuell bei 30.400$ und damit mit 2.5% im plus. das th war bereits bei 30.490$ markiert worden. intraday könnte der kurs sich aber schon ein wenig er-(über?)hitzt haben. nachtrag: th-test erfolgte mit verbesserung selbigen auf 30.520$.

zu beginn der neuen woche werden in den rohstoffmärkten gewinne mitgenommen, nachdem in den vergangenen handelstagen vor allem in den edel- und industriemetallmärkten eine gute performance erzielt wurde.

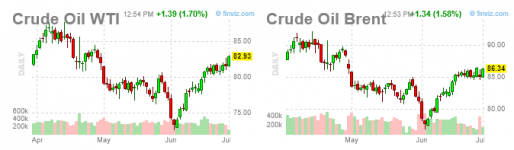

und liegen aktuell mit rund 1% im minus, bei sind es lediglich 0.3%. -0.8%.

der

-future fällt unter die marke von 31$ (tt 30.865$).

-future: der okt-24-kontrakt fällt unter die 1000$-marke. tt bei 992.10$. das th lag noch bei 1024.20$.-future: th 1048.00$, +3.3%.-future mit th bi 1023.50$. +1.4%

Zuletzt bearbeitet:

Video

GOLD - Neue Allzeithochs? Das ist mein Goldaktienfavorit!

https://stock3.com/news/gold-neue-allzeithochs-das-ist-mein-goldaktienfavorit-14966123

GOLD - Neue Allzeithochs? Das ist mein Goldaktienfavorit!

https://stock3.com/news/gold-neue-allzeithochs-das-ist-mein-goldaktienfavorit-14966123

: ich war gerade eben selbst erschrocken, als ich den monatschart des kaffee-futures gesehen habe (anlass waren wirklich die massiven preissteigerungen, die mir beim letzten einkauf ins auge stachen!!!). charttechnisch erreicht der kurs eine beachtenswerte zone. seit herbst 2023 kennt der kurs kein halten mehr und erreicht das verlaufhoch aus dem frühjahr 2022 um 260$. gut unterstützt ist der bereich um 220$. nachhaltige kurse oberhalb der "260" ergäben noch ordentliches long-potenzial. die möglichkeit der bildung einer bullischen und großen "cup und handle formation" ist gegeben.

natural gas : neues tt bei 2.303$. ist das ein short-move ...natural gas : wandert nach süden durch. tt 2.335$.natural gas : fällt auf ein tt von 2.410$. fasten your seat belts ....

bullen-konter im

-future. th bei 32.015$.

natural gas

fällt unter auf ein tt von 2.261$.

Zuletzt bearbeitet: