[url=http://peketec.de/trading/viewtopic.php?p=733715#733715 schrieb:dukezero schrieb am 12.10.2009, 15:39 Uhr[/url]"]Home » News » Analysen » Artikel [ Druckversion ]

Wie sieht Dr. Doom die Sache?

12.10.2009 | 9:23 Uhr | Autor: Marc Nitzsche

In dieser Woche sind wir auf ein sehr interessantes Interview von Dr. Marc Faber gestoßen, welches auf CNBC, einem amerikanischen Nachrichten- und Wirtschaftssender, veröffentlicht wurde. Marc Faber ist weltweit bekannt für seine Prognosen zu den Anlagemärkten und vor allem seine Expertise für die Emerging Markets. Daher wollen wir Ihnen die wichtigsten Aussagen des Maestro in dieser Kolumne vorstellen.

Anlagemärkte

Marc Faber ist davon überzeugt, dass wir uns in einem inflationären Umfeld befinden. Er glaubt daran, dass die Notenbanken ihre Niedrigzinspolitik nur sehr zögerlich zurücknehmen werden und daher billiges Geld für eine sehr lange Zeit am Markt verfügbar sein wird. Dies wird unweigerlich dazu führen, dass dieses Geld für den Konsum sowie höherverzinsliche Anlagen verwendet werden wird. Vor allem Aktien, Anleihen, Rohstoffe aber auch Anlagemöglichkeiten wie Immobilien oder Kunstobjekte sollten hiervon profitieren. Faber nennt diesen Zustand einen Segen für diese Märkte, der noch eine ganze Zeit lang anhalten wird.

US-Dollar

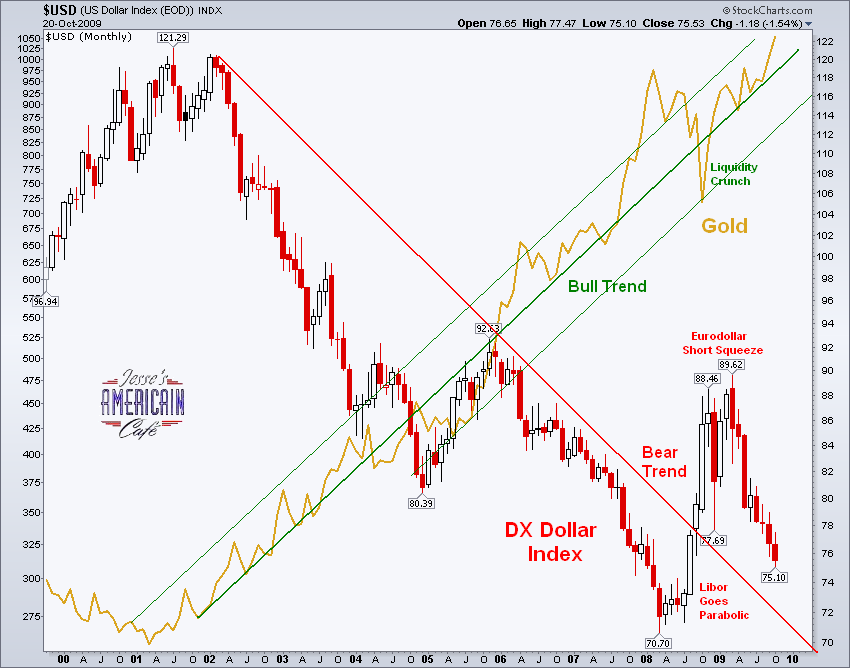

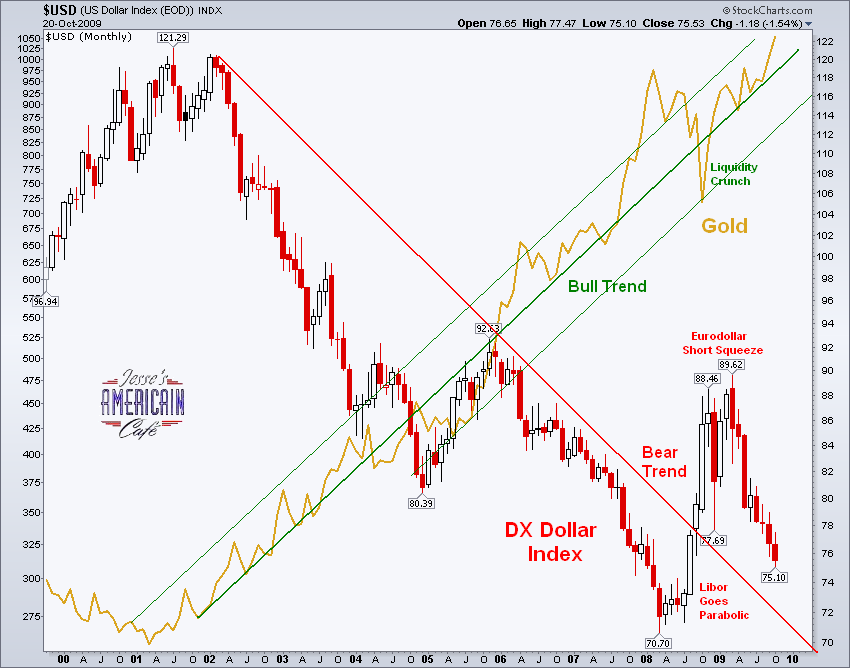

Marc Faber hält den US-Dollar nicht mehr für überbewertet. Mittlerweile gibt es in vielen asiatischen Ländern wie beispielsweise Hongkong Blasen, die dazu führen könnten, dass der US-Dollar kurzfristig zulegen können wird und sich von seinen überverkauften Niveaus erholt. Langfristig sieht Faber jedoch einen fallenden US-Dollar voraus.

Aktienmärkte

Der Experte spricht davon, dass sich die Aktienmärkte überall sehr stark erholen konnten. Obwohl Faber auf den derzeitigen Niveaus nicht mehr einsteigen würde, geht er dennoch davon aus, dass die Aufwärtsbewegung anhalten wird. Dies deckt sich auch mit seinen Aussagen über das billige Geld, welches die Aktienmärkte antreiben sollte, da Investoren auf der Suche nach höheren Renditen sind.

Rohstoffe

Faber zeigt sich langfristig sehr bullisch für Rohöl, da er hier das meiste Potential sieht. Kurzfristig sieht er mögliche Rücksetzer bei den Industriemetallen sowie Gold, da er davon ausgeht, dass China seine Nachfrage abschwächen könnte und zudem den Markt nicht durch künstliche Verknappungsaktionen stützen kann.

Finanzkrise

Marc Faber prangert an, dass sich wenig bei den Verursachern der Finanzkrise geändert hat. Dieselben Akteure seien immer noch am Werk und machen munter neue Schulden. Dies wird laut Faber über kurz oder lang zu einer neuen noch viel massiveren Finanzkrise führen. Kurzfristig kann dies für enorme Gewinne sorgen, jedoch wird am Ende unausweichlich eine neue noch gigantischere Krise stehen.

Erfolgreiche Rohstoff-Trades wünscht

© Marc Nitzsche

Chefredakteur Rohstoff-Trader

App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

The Big Picture

- Ersteller müh

- Erstellt am

- Tagged users Kein(e)

[url=http://peketec.de/trading/viewtopic.php?p=733759#733759 schrieb:dukezero schrieb am 12.10.2009, 16:06 Uhr[/url]"]Dollar fällt wegen Umschichtung von Zentralbanken weiter

Optionen Drucken PDF PDF Bookmark del.icio.us Digg Technorati MisterWong | Schrift vergrößern Schriftgröße zurücksetzen Schrift verkleinern

Autor: Christoph Huber, Redakteur | 14:58 | Copyright BörseGo AG 2000-2009

New York (BoerseGo.de) - Die weltweiten Zentralbanken wenden sich im Rahmen ihrer Strategie, Währungsreserven auf Rekordniveaus hochzufahren zunehmend vom Dollar ab. Wie Bloomberg weiter berichtete, hat die Vorliebe für den Euro und Yen weiter zugenommen. Damit steht die US-Währung nach dem größten Wertverlust innerhalb von zwei Quartalen seit fast zwei Jahrzehnten weiter unter Druck. Der Euro legte zuletzt gegenüber dem Dollar um 0,33 Prozent auf 1,4771 zu.

Die Zentralbanken haben gemäß den von Bloomberg erhobenen Daten ihre Währungsreserven im dritten Quartal um 413 Milliarden Dollar auf 7,3 Billionen Dollar aufgestockt. Dies entspricht der größten Erhöhung seit 2003. 63 Prozent der neuen Bestände seien in den Euro und Yen geflossen. Dies stelle den größten Prozentsatz für Euro und Yen in einem Quartal dar, wo Reserven um mehr als 80 Milliarden Dollar angehoben worden sind. Damit würden die weltweiten Verantwortungsträger gegenüber den zu Dollaranlagen bestehenden Risiken weiter reagieren. Gleichzeitig zeige die US-Regierung Bereitschaft zur Tolerierung einer schwachen Inlandswährung, so lange die Geldgeber des Landes nicht die Flucht antreten.

In den vergangenen sechs Monaten hat der Dollar auf handelsgewichteter Basis 10,3 Prozent verloren und den größten Rückgang seit dem Jahr 1991 eingefahren. Die im Gang befindliche Diversifikation signalisiere, dass mit keiner baldigen Umkehr dieses Trends zu rechnen ist.

Der zur Wertverfolgung des Dollars gegenüber den Euro, Yen, Pfund, kanadischen Dollar, dem Schweizer Franken und der schwedischen Krone herangezogene Dollar-Index ist in der vergangenen Woche auf 75,77 gesunken. Dies entspricht dem niedrigsten Niveau seit August 2008. Das bisherige Jahreshoch vom 4. März lag bei 89,24. Der Index steht heute bei 76,431.

[url=http://peketec.de/trading/viewtopic.php?p=733761#733761 schrieb:dukezero schrieb am 12.10.2009, 16:07 Uhr[/url]"]Golden_Times für Gold!

http://www.godmode-trader.de/nachricht/Bei-148-ist-der-Deckel-drauf-Euro-Dollar,a1910075.html

[url=http://peketec.de/trading/viewtopic.php?p=741273#741273 schrieb:dukezero schrieb am 23.10.2009, 12:35 Uhr[/url]"]Jahreshoch bei Brent, Kupfer & Co.

23.10.2009 | 11:15 Uhr | Autor: Frank Schallenberger Quelle: LBBW

Die chinesische Volkswirtschaft hat weiter an Fahrt aufgenommen. Nachdem im ersten Quartal dieses Jahres die Wachstumsrate im Vergleich zum Vorjahr auf 6,1% zurückgegangen war, kletterte die Rate im zweite Quartal bereits wieder auf 7,9% und für das dritte Quartal wurden jetzt sogar 8,9% bekannt gegeben. Für das Schlussquartal 2009 rechnen viele Volkswirte damit, dass wieder die Schallmauer von 10% durchbrochen wird. Die hohe Wachstumsdynamik spiegelt sich auch in dem ungebrochenen Appetit auf Rohstoffe wider. Im September hielten sich die chinesischen Öl- und Basismetallimporte weiter auf einem hohen Niveau. Und dieser ungebrochene Rohstoffhunger wiederum ist ein wesentlicher Faktor, warum Brent, Kupfer und Co. zuletzt neue Jahreshochs erreicht haben.

Kurzfristig ist nach dem starken Anstieg der Rohstoffpreise seit Jahresbeginn zwar eine Verschnaufpause wahrscheinlich geworden. Mittelfristig dürfte aber eben der China-Faktor weiter steigende Preise garantieren. Die gerade in den letzten Monaten demonstrierte Wachstumsdynamik in einem weltwirtschaftlich trüben Umfeld ist ein weiteres Indiz dafür, dass das Reich der Mitte auch in den nächsten Jahren seinen Wachstumspfad unbeirrt fortsetzen wird.

Die Weltbank hält es für möglich, dass die chinesische Volkswirtschaft in den nächsten 20 Jahren weiter mit durchschnittlich 8% pro Jahr wächst. Im Jahr 2030 wäre dann das chinesische BIP rund 2,5 Mal so groß wie das der USA. Für die Rohstoffnachfrage hätte dies dramatische Auswirkungen.

Sofern sich die chinesische Ölerzeugung und der Ölverbrauch bis 2030 weiter in dem Tempo der letzten 10 Jahre entwickeln, würden sich die Ölimporte von aktuell 4 Mio. Barrel pro Tag auf rund 23 Mio. Barrel pro Tag fast versechsfachen. Dies entspricht momentan den kompletten Exporten Saudi-Arabiens, Russlands, der Vereinigte Arabischen Emirate, Kuwaits und Irans oder gut 40% des gesamten exportierten Öls weltweit. Sollte die Einschätzung der Weltbank bezüglich des chinesischen Wachstums auch nur annähernd zutreffen, wird Brent die Marke von 100 USD in nicht allzu ferner Zukunft wieder überwinden. Und auch an den Basismetallpreisen dürfte der Einfluss des China-Faktors in den nächsten 20 Jahren wohl kaum spurlos vorüber gehen.

© Dr. Frank Schallenberger

Commodity Analyst

Quelle: Landesbank Baden-Württemberg, Stuttgart

[url=http://peketec.de/trading/viewtopic.php?p=741699#741699 schrieb:golden_times schrieb am 25.10.2009, 11:53 Uhr[/url]"]Eine weitere Entscheidung steht bevor, es wird spannend..

[url=http://peketec.de/trading/viewtopic.php?p=741700#741700 schrieb:golden_times schrieb am 25.10.2009, 11:55 Uhr[/url]"]Money owned and money owed

“The study of money, above all other

fields... is one in which complexity is used

to disguise truth or to evade truth, not to

reveal it. . .The process by which banks

create money is so simple that the mind is

repelled.."

http://www.thetwofacesofmoney.com/files/money.pdf

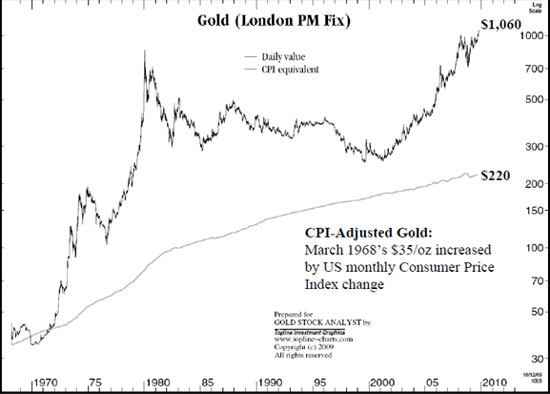

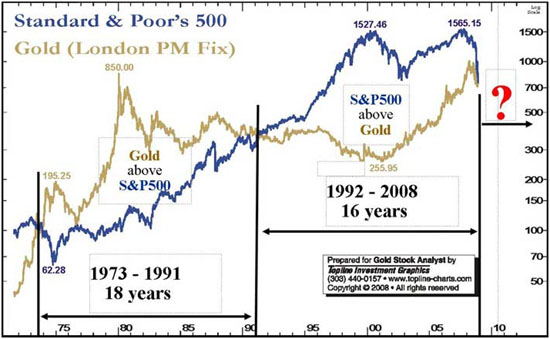

[url=http://peketec.de/trading/viewtopic.php?p=741701#741701 schrieb:golden_times schrieb am 25.10.2009, 12:02 Uhr[/url]"]John Doody: Rising Gold Dances, but Won't Die, with the Dollar

With all the 'strong dollar' rhetoric coming from the Fed and broken-record Bernanke, it's a wonder any investors are making money. But one we know and trust is. . .because he's not listening. "The U.S. will continue to take a laissez faire approach to the dollar," says John Doody, Economics Professor for nearly two decades and current author and publisher of Gold Stock Analyst. In this exclusive interview with The Gold Report, John explains how he measures gold's price performance, why he believes most investors don't have enough gold stocks in their portfolios and which companies he's making money on right now..

http://www.theaureport.com/pub/na/3194

..

..

..

..

[url=http://peketec.de/trading/viewtopic.php?p=741702#741702 schrieb:golden_times schrieb am 25.10.2009, 12:11 Uhr[/url]"]The Big Secret in Gold

by Adrian Ash - BullionVault - Friday, 23 October 2009

The little-known state of the gold market as prices close at a new weekly high...

YOU WON'T read it in your Sunday paper, nor elsewhere online this weekend. But this autumn's gold rush has, in truth, been no such thing at all.

Hedge funds and prop desks have been buying gold futures and options with virtually free finance. Hence the surge in stocks, bonds and commodities too, of course. Because anything traded on margin looks a safe bet when finance costs you 1% or less per year. And especially when your major funding currency – the long mighty but now tired and emotional Dollar – is universally condemned to fall further.

John Hathaway of Tocqueville Asset Management called a similar rush into gold a case of mistaken identity back in late 2006. "Perhaps hundreds of billions of new institutional money has flowed into the commodity sector," he wrote. "Gold was caught in the cross fire..."

Here in late 2009, however, the institutional money is borrowed, not cash, and the prime brokers (formerly known as investment banks) are doing the lending with government-guaranteed finance. Since end-August, open interest in Comex gold contracts has swollen by more than one third...the fastest jump since late 2007, back when the Fed began slashing rates, oil vaulted towards $150 per barrel, and the run on the banks really got started.

And whatever you think about gold-industry players wantonly shorting the market, no one forces speculative funds to take the other side of those trades. Given the jump in prices – up 11% since the start of Sept. – you can see who's making the running.

» zur Grafik

Now we've got zero per cent rates and outright money printing by the big four central banks (a.k.a. "quantitative" and "credit" easing at the Fed, Bank of Japan, ECB and Bank of England). But private investors don't feel the same fear as when their bank accounts threatened to vanish – and their retirement savings dumped half their value – this time last year.

Yes, the doctors and dentists are in ("Fill 'em...drill 'em" as an options broker once put it to me), but it's the large speculators – meaning hedge funds and money managers – who are sitting on a record net long position, holding well over nine bullish bets for every short contract they've got.

» zur Grafik

New routes to cost-effective gold ownership continue to grow (well, they do here at BullionVault, with our users adding 38% to their stock of physical gold so far this year. Client property doubled over the first nine months of '08.) But overall, retail investment in physical metal has weakened sharply from the record demand of Sept. last year to March 2009.

London's GFMS consultancy says investment off-take from the physical market fell by two-thirds in the second quarter from Q1, and everything points to a further sharp drop in Q3. Coin-dealer mark ups on bullion pieces have fallen in half on average, back to 5% above spot from the genuine "gold rush" of this time last year. No one's saying they're sold out today. Big-name dealers were offering 3-week delays and worse in Oct. '08. The best that promoters can say now is "Plenty of stock available..."

Collectible coins face the same hesitation. "Normally aggressive buyers were guarded in their buying," reports Numismaster's Harry Miller from last week's CoinFest convention. "While not stating it openly, I think many feel the premiums on numismatic issues are outdone at current levels, and bullion itself needs a rest."

Amongst the exchange-traded trust funds, the same story – no matter what the minor trusts might have you believe in their PR campaigns. The huge SPDR gold trust, now holding more gold than all but the top five central bank hoards worldwide, swelled 60% in the six months to end-March. It's added barely 8% since. London's incumbent leader, GBS, has shrunk from its April peak. Overall, the total ETF positions that the World Gold Council tracks added barely 2.2% between July and end-Sept.

"Thing is," as a professional wholesale dealer here in London's bullion market told me today, "the ETFs still don't show any signs of shrinking when the price takes a dip. They're as sticky as ever. But no, overall, physical flows at the moment are nowhere as strong as they were. The action's very much in the futures."

Conclusions? For the fees we charge at BullionVault...? Afraid that would be asking too much!

[url=http://peketec.de/trading/viewtopic.php?p=746067#746067 schrieb:golden_times schrieb am 31.10.2009, 01:18 Uhr[/url]"]SCHMIDT’S GOLD THOUGHTS (27 OCTOBER 2009)

http://www.aheadoftheherd.com/Articles/Schmidt - Gold Thoughts - 27 October 2009.pdf

[url=http://peketec.de/trading/viewtopic.php?p=746068#746068 schrieb:golden_times schrieb am 31.10.2009, 01:23 Uhr[/url]"]Querdenker Marc Faber

„Drogenhändler Fed“

Obwohl die Börsen kräftig zugelegt haben, warnen renommierte Anlageprofis vor den Folgen der explodierenden Verschuldung. Der Ökonom Marc Faber schockiert mit provokanten Thesen: Der Schweizer rät von US-Staatsanleihen ab und hält einen „totalen Kollaps“ langfristig für unvermeidbar.

"Wenn Kredite reich machen würden, wäre Simbabwe das reichste Land der Welt", sagt Marc Faber.

» zur Grafik

Quelle: dpa

FRANKFURT. Der Mann nimmt kein Blatt vor den Mund. "Bernanke sollte abdanken", "die Wall Street ist korrupt", "das ganze Finanzsystem war subprime". Solche Sätze sagt er. Und spricht vor Analysten, die das schwer verdaulich finden. Die Zuhörer erleben Marc Faber pur.

Der gebürtige Schweizer gefällt sich als Provokateur. Mit seiner pinkfarbenen Krawatte und dem Zopf, Relikt einer verlorenen Wette, setzt sich der 63-Jährige schon äußerlich vom Establishment ab. Das CFA Institute, die Ausbildungsschmiede für Finanzanalysten, hat ihn zu einer Frankfurter Konferenz geladen. Am Ende des Vortrags ist sogar der CFA-Präsident entmutigt: "Ich bin optimistisch aufgestanden, habe aber jetzt gemerkt, wie dumm das war."

Der Querdenker Faber kreidet die Finanzmalaise dem US-Notenbankchef Alan Greenspan und seinem Nachfolger Ben Bernanke an. Greenspan habe nach dem Platzen der Internetblase zur Jahrtausendwende die Welt mit Liquidität geflutet. "Die Folge waren Blasen in allen Vermögenswerten", erregt er sich.

Für ihn sind Notenbanker Rauschgifthändler, "die der Welt Drogen geben, um sie ruhig zu stellen". Droge heißt hier: Geld zum Null-Zins. In exzessiver Staatsverschuldung sieht der Sammler von Mao-Büsten jedoch keine Lösung der Krise. "Wenn Kredite reich machen würden, wäre Simbabwe das reichste Land der Welt", sagt er zynisch. Tatsächlich ist der afrikanische Staat im Chaos und in der Hyperinflation versunken.

Vorbei sind die Zeiten, in denen die etablierten Analysten Faber verlachten - obwohl er schon mit 24 Jahren seinen Doktor in Wirtschaftswissenschaften gemacht hatte. Manchmal ist er eben unorthodox. Vorträge zu später Abendzeit beendet er schon einmal mit dem Hinweis, dass er jetzt gerne einen Drink nehmen würde. Dann wundert er sich selbst über seine Popularität - außerhalb der Finanzbranche. So geschehen, als ihn eine Tänzerin in einer Bar erkannte ("You must be the famous Marc Faber").

Inzwischen suchen Banken und Anlagehäuser den Rat des Mannes, der in den siebziger Jahren nach Hongkong umsiedelte und dort eine Vermögensverwaltung gründete. Von dort und seinem Wohnsitz in Thailand aus versorgt der Asienliebhaber die Welt mit langfristigen Analysen. Faber begeistert mit seinen Vorträgen das Publikum und schockiert es zugleich. Das liegt daran, dass seine Prognosen mehrfach eingetroffen sind. Der Ökonom sagte den Japan-Crash vor zwei Dekaden, den Börsenkollaps zur Jahrtausendwende und die Finanzkrise voraus.

An einen erneuten Test der Aktientiefstände vom März glaubt Faber nicht. Aber er malt die Folgen einer exzessiven Kreditpolitik und Verschuldung an die Wand. "Ihre Kinder und die in der westlichen Welt werden einen niedrigeren Lebensstandard haben als Sie", warnt Faber seine Zuhörer. Langfristig erwartet er sogar einen "totalen Kollaps", den er nach einem kreditgetriebenen Boom für unvermeidlich hält. "Die finale Krise steht erst noch bevor."

Faber rät zu asiatischen Aktien und Farmland, sieht Rohstoffe im Aufwärtstrend, warnt dagegen vor US-Staatsanleihen. Er geht davon aus, dass die amerikanische Regierung eine Inflation anstreben wird, um die explodierenden Staatsschulden zu entwerten. Deshalb stehen auch Edelmetalle auf seiner Empfehlungsliste.[/i]

[url=http://peketec.de/trading/viewtopic.php?p=746136#746136 schrieb:fantom schrieb am 31.10.2009, 19:40 Uhr[/url]"]Inflation in aller Heimlichkeit

http://www.goldseiten.de/modules/mylinks/visit.php?cid=1&lid=96637

[url=http://peketec.de/trading/viewtopic.php?p=750986#750986 schrieb:dukezero schrieb am 09.11.2009, 12:29 Uhr[/url]"]Thema: Moody´s optimistisch für China, Hongkong und einige China-Banken

Emfis News Am: 09.11.2009 10:44:47 Gelesen: 0 # 1 @

Hongkong 09.11.2009 Moody´s Investors Service hat den Rating-Ausblick für die Verbindlichkeiten Chinas und Hongkongs von "stabil" auf "positiv" angehoben. Die Einstufung der Verbindlichkeiten in heimischer und ausländischer Währung wurde bei "A1" belassen.

Die Ratingagentur erklärte, dass sich Chinas Wirtschaft durch das große Konjunkturprogramm und durch einen starken Anstieg der Kreditvergabe vom Rest der Welt abgekoppelt habe. Das Land sei finanziell in einer hervorragenden Position. Die Kosten der Konjunkturfördermaßnahmen würden sich kaum auf die Haushaltslage auswirken. Daneben halte China Fremdwährungsreserven im Umfang von 2 Billionen Dollar, was rund 36 Prozent des Bruttoinlandsprodukts entspreche.

Zugleich hob die Ratingagentur ihren Ausblick für sieben chinesische Großbanken ebenfalls auf "positiv" an. Betroffen sind ICBC, China Construction Bank, Bank of China, Agricultural Bank of China, China Development Bank, Export-Import Bank of China und Agricultural Development Bank of China.

[url=http://peketec.de/trading/viewtopic.php?p=750995#750995 schrieb:greenhorn schrieb am 09.11.2009, 12:38 Uhr[/url]"]ich glaube mittlerweile das die FED den Banken mit voller Absicht diese bequeme Art der Berreichung auf Staatskosten den Banken eingeräumt hat um Ihnen die Möglichkeit zu geben relativ schnell Gewinne zu realisieren und damit z.T. Ihre Bialnzen aufzuräumen........

wobei mittlerweile relativiert werden muss - ich habs gehant als an dem konstrukt gebastelt wurde

schlimm finde ich nur mit welcher Arroganz z.B. ein GoldmanSachsChef sich hinstellt und verkündet wir göttlich seine Aufgabe iss...........

08.11.2009

Goldman-Sachs-Chef

"Banken verrichten Gottes Werk"

REUTERS

Goldman-Sachs-Chef Blankfein: "Wir helfen den Unternehmen zu wachsen"

Gigantische Boni, riesige Profite - kein Problem für die Gesellschaft, sagt jetzt Goldman-Sachs-Chef Lloyd Blankfein in einem Interview. Tatsächlich sei das nur ein Zeichen für den Aufschwung. Überhaupt hat er ein ganz eigenes Selbstverständnis der Bankenwelt: Diese würden in Wahrheit Göttliches tun.

London - Der Chef der US-Großbank Goldman Sachs hat hohe Profite und Bonuszahlungen als Zeichen für eine Erholung der Weltkonjunktur bewertet. In einem Interview mit der Londoner "Sunday Times" sagte Lloyd Blankfein: "Wir helfen den Unternehmen zu wachsen, indem wir ihnen helfen, Kapital zu bekommen. Unternehmen, die wachsen, schaffen Wohlstand. Und das wiederum ermöglicht es den Menschen, Jobs zu haben, die noch mehr Wachstum und noch mehr Wohlstand schaffen."

Schlussfolgerung: Banken hätten einen gesellschaftlichen Zweck und würden deshalb "Gottes Werk" verrichten, sagte Lloyd Blankfein wörtlich.

Goldman Sachs hatte im dritten Quartal einen Gewinn von drei Milliarden Dollar verbucht und will mehr als 20 Milliarden Dollar als Boni zum Jahresende zahlen. Kritiker werfen den Banken vor, aus der Finanzkrise nichts gelernt zu haben und weiterhin hochriskante Geschäfte abzuwickeln. Ihre jüngsten Gewinne verdankten sie vor allem den Unterstützungsmaßnahmen von Staat und Zentralbank.

Blankfein sagte, er könne verstehen, dass es auch Menschen gebe, die über die Handlungsweise der Banken verärgert seien.

plö/Reuters

[url=http://peketec.de/trading/viewtopic.php?p=746136#746136 schrieb:fantom schrieb am 31.10.2009, 18:40 Uhr[/url]"]Inflation in aller Heimlichkeit

http://www.goldseiten.de/modules/mylinks/visit.php?cid=1&lid=96637

[url=http://peketec.de/trading/viewtopic.php?p=754835#754835 schrieb:golden_times schrieb am 15.11.2009, 13:47 Uhr[/url]"]REVIEW

Credit Bubble Bulletin

The Bear's Lair

Just the Facts

by Doug Noland November 13, 2009

» zur Grafik

@www.prudentbear.com

For the week, the S&P500 gained 2.3% (up 21.1% y-t-d), and the Dow increased 2.5% (up 17.0% y-t-d). The Morgan Stanley Cyclicals surged 4.7% (up 65.1%), and Transports increased 2.8% (up 12.0%). The Morgan Stanley Consumer index gained 2.7% (up 21.3%), and the Utilities added 1.0% (down 1.4%). The Banks increased 0.7% (down 2.7%), and the Broker/Dealers rallied 2.6% (up 51.9%). The S&P 400 Mid-Caps rallied 2.5% (up 29.7%), and the small cap Russell 2000 increased 1.0% (up 17.4%). The Nasdaq100 jumped 3.3% (up 47.6%), and the Morgan Stanley High Tech index gained 3.7% (up 62.4%). The Semiconductors surged 5.2% (up 49.6%). The InteractiveWeek Internet index rose 3.1% (up 69.2%). The Biotechs were little changed (up 37.7%). With bullion jumping $24, the HUI gold index rose 4.1% (up 52.3%).

One-month Treasury bill rates ended the week at 5 bps, and three-month bills closed at 6 bps. Two-year government yields declined 4 bps to 0.81%. Five-year T-note yields fell 4 bps to 2.25%. Ten-year yields were 8 bps lower to 3.42%. Long bond yields declined 4 bps to 4.36%. Benchmark Fannie MBS yields sank 16 bps to 4.13%. The spread between 10-year Treasuries and benchmark MBS yields narrowed 8 to 71 bps. The implied yield on December 2010 eurodollar futures dropped 8 bps to 1.355%. The 10-year dollar swap spread declined 4.25 to 11.5 bps; and the 30-year swap spread declined 3.25 to negative 13.5 bps. Corporate bond spreads were mostly narrower. An index of investment grade bond spreads narrowed 2 bps to 148, and an index of junk spreads narrowed 4 bps to 565 bps.

Investment grade issuers included Cisco Systems $5.0bn, GE Capital $1.5bn, Lockheed Zimmer $1.0bn, Massachusetts Electric $800 million, Quest Diagnostic $750 million, Emerson Electric $600 million, Waste Management $600 million, PG&E $550 million, Raytheon $500 million, Praxair $400 million, NSTAR $350 million, Revlon $330 million, CNA Financial $350 million, HCC Insurance $300 million, Northern States Power $300 million, Cleco Power $295 million, Enogex $250 million, Public Service Oklahoma $250 million, and Amerenenergy $250 million.

Junk bond funds saw inflows of $ million this week. Junk issuers included Capital One $1.0bn, Toys R Us $725 million, Discover Bank $700 million, United Rental $500 million, Pioneer Natural Resources $450 million, Entergy Louisiana $400 million, Antero Resources $375 million, Belo Corp $275 million, Swift Energy $225 million, Viasystems $220 million, and Triumph Group $175 million.

I saw no convert issues this week.

International dollar-denominated debt issuers included Ontario $4.0bn, CBQ Finance $1.6bn, Eksportfinans $1.5bn, Inmarsat $650 million, Commercial Bank Qatar $600 million, Transalta $500 million, and Banco Santander $500 million.

U.K. 10-year gilt yields fell 9 bps to 3.79%, and German bund yields rose 2 bps to 3.38%. The German DAX equities index jumped 3.6% (up 18.2% y-t-d). Japanese 10-year "JGB" yields sank 11 bps to 1.34%. The Nikkei 225 slipped 0.2% (up 10.3%). Emerging markets were higher. Brazil's Bovespa equities index rose 1.3% (up 74.0%), and Mexico's Bolsa jumped 3.8% (up 38.5%). Russia’s RTS equities index increased 0.8% (up 124.6%). India’s Sensex equities index surged 4.3% (up 74.6%). China’s Shanghai Exchange added 0.7%, boosting 2009 gains to 75.1%. Brazil’s benchmark dollar bond yields dropped 18 bps to 5.07%, and Mexico's benchmark bond yields fell 18 bps to 5.20%.

Freddie Mac 30-year fixed mortgage rates dropped 7 bps to a 5-wk low 4.91% (down 123bps y-o-y). Fifteen-year fixed rates declined 4 bps to 4.36% (down 145bps y-o-y). One-year ARMs dipped one basis point to 4.46% (down 87bps y-o-y). Bankrate's survey of jumbo mortgage borrowing costs had 30-yr fixed jumbo rates down 19 bps to 5.91% (down 159bps y-o-y).

Federal Reserve Credit declined $33.2bn last week to $2.116 TN. Fed Credit has declined $131bn y-t-d and $82.5bn over the past 52 weeks. Elsewhere, Fed Foreign Holdings of Treasury, Agency Debt this past week (ended 11/11) increased $6.9bn to a record $2.917 TN. "Custody holdings" have expanded at an 18.4% rate y-t-d, and were up $409bn over the past year, or 16.3%.

M2 (narrow) "money" supply declined $6.5bn to $8.387 TN (week of 11/2). Narrow "money" has expanded at a 2.8% rate y-t-d and 5.7% over the past year. For the week, Currency slipped $0.5bn, while Demand & Checkable Deposits surged $28.4bn. Savings Deposits dropped $22.1bn, and Small Denominated Deposits declined $8.0bn. Retail Money Funds fell $4.3bn.

Total Money Market Fund assets (from Invest Co Inst) slipped $3.8bn to $3.335 TN. Money fund assets have declined $495bn y-t-d, or 14.9% annualized. Money funds declined $302bn, or 8.3%, over the past year.

Total Commercial Paper outstanding slumped $76.7bn (13-wk gain of $164bn) to $1.239 TN. CP has declined $443bn y-t-d (30.4% annualized) and $364bn over the past year (22.7%). Asset-backed CP declined $4.7bn last week to $510bn, with a 52-wk drop of $231bn (31.2%).

International reserve assets (excluding gold) - as accumulated by Bloomberg’s Alex Tanzi – were up $749bn y-o-y to a record $7.517 TN. Reserves have increased $752bn year-to-date.

Global Credit Market Watch:

November 13 – Bloomberg (William Selway): “U.S. state and local governments sold $9.5 billion of bonds this week, led by California, as demand from investors allowed Connecticut to almost double the size of its offering of tax-exempt securities.”

November 10 – Bloomberg (Laura Cochrane and Esteban Duarte): “Islamic bond issues surged this year as offerings from governments and state-related companies fostered a more efficient market, according to Moody’s… Global sales of so-called sukuk that comply with Islamic religious laws increased 40% in the 10 months to October… Moody’s… Faisal Hijazi… wrote…”

November 9 – Bloomberg (John Fraher and Shobhana Chandra): “The International Monetary Fund signalled record low U.S. interest rates are funding global ‘carry trades’ and the dollar is still overvalued as concerns mount that new financial imbalances are forming. ‘There are indications that the U.S. dollar is now serving as the funding currency for carry trades,’ the IMF said… ‘These trades may be contributing to upward pressure on the euro and some emerging-economy currencies.’”

November 11 – Bloomberg (Scott Lanman and Craig Torres): “The Federal Reserve faces the biggest blows to its authority and independence in five decades under legislation championed by its lead overseer in the U.S. Senate. The financial-regulation overhaul proposed yesterday by Senator Christopher Dodd would strip the Fed of its role as a bank supervisor and give Congress a greater voice in naming the officials who set interest rates. The measure opens the door to interference from politicians who might disagree with any move by the Fed to raise rates from record lows, former central bank officials said.”

November 12 – Bloomberg (Alison Vekshin and Robert Schmidt): “Seven Wall Street lobbyists trooped to Capitol Hill on Nov. 9, hoping to convince Representative Paul Kanjorski’s staff that his plan to dismantle large financial firms was a bad idea. They walked out with a sobering conclusion, according to the accounts of two attendees who requested anonymity because the meeting was private. Not only was Kanjorski serious, he planned to offer the legislation as early as next week -- and it just might pass.”

Global Government Finance Bubble Watch:

November 12 – Bloomberg (Mike Gavin): “Germany’s budget deficit will reach 5.1% of gross domestic product in 2010, from 3% this year, according to a forecast by the government’s council of economic advisors…”

November 12 – Bloomberg (Dara Doyle and Ian Guider): “The biggest financial gamble in modern Irish history is about to exit the realms of theory and enter the real world. Lawmakers will today pass a bill creating a so-called bad bank that will pay the country’s biggest banks 54 billion euros ($81 billion), or about a third of gross domestic product, for property loans to free up lending… Real-estate prices have on average dropped 50% since peaking in 2007…”

Currency Watch:

November 13 – Bloomberg (Oliver Biggadike and Matthew Brown): “Brazil, South Korea, Russia and other developing nations are fighting a losing battle to mute gains in their currencies as a falling dollar and economic recovery create more demand for their assets than central banks can handle. South Korea Deputy Finance Minister Shin Je Yoon said… the country will leave the level of its currency to market forces after adding about $63 billion to its foreign exchange reserves this year… Chile Finance Minister Andres Velasco said… that lawmakers approved an increase in local debt sales to finance spending, a move that will allow the government to keep more of its dollar-based savings overseas and slow the peso’s rally. Governments are amassing record foreign-exchange reserves as they direct central banks to buy dollars in an attempt to stem the greenback’s slide…”

November 10 – Bloomberg: “China, rejecting calls from Europe and Japan, will keep the yuan from gaining against the dollar until exports revive, state researchers said. Policy makers are unlikely to allow the currency to resume its appreciation this year after keeping it almost unchanged since July 2008… Zhu Baoliang, the chief economist at the State Information Center, said… China will stick with its ‘tough stance’ on the currency, Zhang Ming, a researcher at the Chinese Academy of Social Sciences, said…”

November 11 – Bloomberg (Rebecca Christie): “U.S. Treasury Secretary Timothy Geithner said a strong dollar is in the nation’s interest and the government recognizes the importance it plays in the global financial system. ‘I believe deeply that it’s very important to the United States, to the economic health of the United States, that we maintain a strong dollar,’ Geithner told reporters…”

The dollar index declined 0.7% to 75.25. For the week on the upside, the Mexican peso increased 2.8%, the New Zealand dollar 2.5%, the Canadian dollar 2.3%, the Swedish krona 2.2%, the South African rand 1.6%, the Australian dollar 1.5%, the Norwegian krone 1.4%, and the Taiwanese dollar 0.9%. On the downside, the Brazilian real declined 0.1%.

Commodities Watch:

November 9 – Bloomberg (Daniel Williams and Mahmoud Kassem): “China promised $10 billion in cheap loans to Africa, pledged to cut customs duties and distributed a newspaper with photos of Chinese leaders among beaming Africans, part of an effort to fight claims it is exploiting the continent’s resources. At the close today of the two-day Forum on China-Africa Cooperation conference in Sharm el-Sheikh, Egypt, China pledged to ‘work within its means to increase aid to Africa, reduce or cancel debts on African countries, in addition to increasing investments in Africa and open more markets,’ Egypt’s state-run Middle East News Agency reported.”

November 9 – Bloomberg (Alan Bjerga and Jeff Wilson): “China’s corn harvest, the world’s second-largest, plunged by a more-than-estimated 13% to a four-year low because of droughts in the main growing regions, a survey of farmers showed.”

The CRB index was little changed this week (up 17.2% y-t-d). The Goldman Sachs Commodities Index (GSCI) increased 1.0% (up 43.8%). Gold jumped 2.2% to close at a record $1,119 (up 26.8%). Silver added 0.4% to $17.45 (up 54.4%). December Crude declined 97 cents to $76.46 (up 71%). December Gasoline declined 0.4% (up 81%), and December Natural Gas dropped 4.2% (down 22%). December Copper added 1.3% (up 112%). December Wheat jumped 8.4% (down 12%), and December Corn rose 6.4% (down 4% y-t-d).

China Bubble Watch:

November 13 – Bloomberg: “China’s President Hu Jintao told Asia-Pacific business leaders the world’s most populous nation will take ‘vigorous’ steps to boost household spending and reduce a reliance on investment and exports for economic growth. ‘Our focus in countering the crisis is to expand domestic demand, especially consumer demand… We want to ‘increase people’s ability to spend,’ he said.”

November 13 – Bloomberg (Shamim Adam): “China is facing the biggest challenge to its currency policy since the start of the global recession as economists warn the peg to the dollar risks causing an asset bubble… China’s sales of yuan to keep it fixed to the dollar contributed to a 29% jump in money supply, and the peg helped spur more than $150 billion in speculative funds from overseas in the past six months, China International Capital Corp. says. Record apartment prices and a 74% climb in the benchmark stock index this year are prompting warnings that the policy is inflating asset prices excessively. ‘If China keeps the peg, it will be powerless to prevent asset bubbles,’ says Hu… Greater China chairman at Goldman Sachs…”

November 9 – Bloomberg: “China’s passenger-car sales rose 76% last month… October sales of cars, sport-utility vehicles and multipurpose vehicles climbed to 946,400 units… Sales in the first 10 months rose 45.2% from a year earlier to 8.19 million.”

November 11 – Dow Jones: “China’s overall automobile sales could reach 13 million units this year, Dong Yang, executive vice president and secretary general of the China Association of Automobile Manufacturers, said… China’s automobile sales totaled 9.38 million units last year…"

November 11 – Bloomberg: “China’s lending growth slowed in October as officials considered more steps to tighten credit standards and avert asset-price bubbles. Banks extended 253 billion yuan ($37bn) of new local- currency loans, compared with 516.7 billion yuan in September… M2… grew a record 29.4% from a year earlier, the central bank said.”

November 11 – Bloomberg: “China’s industrial production and trade surplus climbed in October, indicating a strengthening recovery in the world’s third-largest economy that’s likely to amplify calls to let the yuan appreciate… Production rose 16.1% from a year before, the most since March 2008… Retail sales gained an annual 16.2% in October… The trade surplus almost doubled from September, to $24 billion…”

November 9 – Bloomberg: “China’s central bank and banking regulator may ‘soon’ issue measures to limit the use of debt in real-estate purchases after asset prices climbed, a Shanghai official said. Regulators may reduce ‘leverage ratios,’ Fang Xinghai,

the director-general of Shanghai’s financial services office, said… ‘I would think that soon you will see these measures coming out of the central bank and banking regulatory commission.’”

November 9 – Bloomberg: “China, the world’s second-largest energy user, will raise gasoline, diesel and jet fuel prices by as much as 8% tomorrow, the first increase in more than two months…”

Japan Watch:

November 10 – Bloomberg (Aki Ito): “Japan’s current-account surplus unexpectedly widened in September as worldwide government stimulus spending helped to ease declines in exports. The surplus rose 0.2% to 1.57 trillion yen ($17.5bn) from a year earlier…”

November 11 – Bloomberg (Naoko Fujimura and Junko Hayashi): “Shiseido Co., Japan’s biggest cosmetics maker, aims to accelerate China sales… Sales may grow about 20% in the 12 months ending March 2011, from about 15 percent expected this fiscal year, Chief Financial Officer Yasuhiko Harada said…”

November 9 – Bloomberg (Wes Goodman and Cordell Eddings): “Japanese investors who lived through a decade of deflation and recessions say U.S. Treasuries are a bargain even with yields at about the lowest levels since at least the 1960s. Japan bought a net $105 billion of U.S. government debt through August, exceeding China as the biggest foreign buyer and boosting its holdings to $731 billion…”

India Watch:

November 12 – Bloomberg (Kartik Goyal): “India’s industrial production grew more than economists forecast in September, adding to positive economic signs as policy makers consider when to rein in stimulus measures. Output at factories, utilities and mines rose 9.1% from a year earlier…”

Asia Bubble Watch:

November 13 – Bloomberg (Christopher Anstey and Michael Dwyer): “The Federal Reserve’s policy of keeping interest rates near zero is fueling a wave of speculative capital that may cause the next global crisis, Hong Kong’s leader said. ‘I’m scared and leaders should look out,’ said Donald Tsang, chief executive of the city, said… ‘America is doing exactly what Japan did last time,’ he said, adding that Japan’s zero interest rate policy contributed to the 1997 Asian financial crisis and U.S. mortgage meltdown… ‘We have a U.S. dollar carry trade at the moment,’ Tsang, 65, said… ‘Where is the money going -- it’s where the problem’s going to be: Asia,’ Tsang said. ‘You can see asset prices going up, not only in Korea, in Taiwan, in Singapore and in Hong Kong, going up to levels that are incompatible or inconsistent with the economic fundamentals.”

November 12 – Bloomberg (Seyoon Kim): “South Korea’s central bank kept its benchmark interest rate at a record low for a ninth month, seeking to strengthen the economy’s recovery before increasing borrowing costs. Governor Lee Seong Tae left the seven-day repurchase rate at 2%...”

Latin America Bubble Watch:

November 12 – Bloomberg (Helder Marinho): “Banco do Brasil SA, Latin America’s biggest lender by assets, said third-quarter profit rose 6% as the bank increased lending more than its competitors… The lender’s loan portfolio grew 41% to 285.5 billion reais. Total assets increased 50% to 685.7 billion reais.”

November 9 – Bloomberg (Camila Fontana): “Brazil’s current account deficit may almost double in 2010 and reach the widest since 1998 as a local currency rally boosts imports amid a consumer-led economic recovery, a central bank survey shows. The gap will widen to $33.25 billion next year from an estimated $16.9 billion in 2009, according to the median forecasts from about 100 economists…”

November 12 – Bloomberg (Adriana Brasileiro): “Brazil’s integrated electricity grid leaves it vulnerable to the types of massive outages that occurred this week when 40% of the country was plunged into darkness, according to a government energy research agency. ‘Brazil has the largest integrated power grid in the world; it’s fantastic because it facilitates electricity transmission between regions, but the domino effect that happens when we have a problem is a major inconvenience,’ said Mauricio Tolmasquim, president of Brazil’s Energy Research Agency."

Unbalanced Global Economy Watch:

November 13 – Bloomberg (Simone Meier): “The euro-area economy emerged from its worst recession since World War II in the third quarter as exports from Germany and France helped compensate for households’ reluctance to increase spending. Gross domestic product in the economy of the 16 nations using the euro rose 0.4% from the second quarter, when it fell 0.2%...”

November 13 – Bloomberg (Jana Randow): “Germany’s economic recovery accelerated in the third quarter as government stimulus programs fueled company spending and a rebound in global trade boosted exports. Gross domestic product increased a seasonally adjusted 0.7% from the second quarter…”

November 10 – Bloomberg (Vibeke Laroi and Marianne Stigset): “Norway’s sovereign wealth fund, the world’s second largest, gained a record 13.5% in the third quarter as stocks rallied on signs the global recession ended.”

November 12 – Dow Jones: “Australia reported… an unexpected surge in jobs last month in the latest sign the country’s economy was accelerating quicker than expected… The unemployment rate, meanwhile, rose slightly to 5.8% from 5.7%...”

U.S. Bubble Economy Watch:

November 12 – Bloomberg (Vincent Del Giudice): “The U.S. budget deficit widened in October from a year earlier, reaching a record for that month… The excess of spending over revenue widened to $176.4 billion last month, compared with a deficit of $155.5 billion in the same month a year earlier… Spending for October declined 2.7% from the same month a year earlier to $331.7 billion, and revenue and other income fell 17.9% to $135.3 billion… Individual income tax collections fell 29% to $61.2 billion in October from a year earlier, and corporate tax receipts last month were a negative $4.5 billion on the government’s books… Over the past week, the Treasury auctioned a record $81 billion in its quarterly sales of long-term debt. The Treasury’s debt-management director… told a meeting of bond market participants last week to anticipate another year of government debt sales of $1.5 trillion to $2 trillion…”

November 13 – Bloomberg (Bob Willis): “The trade deficit in the U.S. widened in September by the most in a decade, reflecting rising demand for imported oil and automobiles… The gap grew a larger-than-anticipated 18% to $36.5 billion, the highest level since January… Imports climbed 5.8%, the most since March 1993, to $168.4 billion. The figures reflected a $4.1 billion increase in imported oil as the cost of a barrel of crude climbed to the highest level since October 2008 and volumes also rose… Exports rose 2.9% to $132 billion, the most this year, propelled by sales of civilian aircraft, industrial machines and petroleum products.”

November 9 – Bloomberg (Sonja Franklin): “Former Federal Reserve Chairman Alan Greenspan said a rebound in stocks is ‘re-liquifying’ the U.S. economy and housing prices are showing early indications of ending their decline. ‘We have been very fortunate that the stock markets moved back’ and are ‘re-liquifying the whole process,’ Greenspan said…”

November 12 – Bloomberg (Bob Willis): “Mortgage applications to purchase homes in the U.S. plunged last week to the lowest level in almost nine years… The Mortgage Bankers Association’s index of applications to buy a house dropped 12% in the week ended Nov. 6…”

November 9 – Bloomberg (Daniel Taub): “The number of U.S. homeowners who owe more than their properties are worth fell in the third quarter as values stabilized and some homes were lost to foreclosure, Zillow.com said. About 21% of owners of mortgaged homes were underwater, down from 23% in the second quarter…”

November 12 – Investment News (Jessica Toonkel Marquez): “In an attempt to keep a low profile, The Goldman Sachs Group Inc. has told its employees that it won't be hosting a corporate Christmas party this year. The investment bank is also prohibiting employees from funding their own parties, an insider at the firm told InvestmentNews.”

Real Estate Watch:

November 12 – Bloomberg (Dan Levy): “U.S. foreclosure filings surpassed 300,000 for an eighth straight month as unemployment made it tougher for homeowners to pay their bills, RealtyTrac Inc. said. A total of 332,292 properties received a default or auction notice or were seized by banks in October, up 19% from a year earlier… RealtyTrac said…”

Central Banker Watch:

November 13 – Bloomberg (Steve Matthews and Mark Deen): “Chicago Federal Reserve Bank President Charles Evans commented… ‘In our most recent policy statement we said that we expected rates to be low for an extended period of time. We included different markers that we will be monitoring, in terms of very low resource utilization, very low inflation. We’ll be looking at all of those… Unless there are unusual developments, I think the policy is going to be highly accommodative, as it is now, for quite some period of time.’”

Fiscal Watch:

November 12 – New York Times (David Steitfeld): “The Federal Housing Administration said… that its cash reserves had dwindled dramatically in the last year after a record drop in home prices… The F.H.A., which insures loans made by private lenders, guaranteed more than $360 billion in mortgages in the last year, four times the amount in 2007… ‘As a credit expert, I have seen this movie before, and the ending is always the same,’ said Edward Pinto, a former executive with the government mortgage giant Fannie Mae. The results of the F.H.A.’s annual audit showed the agency’s capital reserves to be 0.53%, far under the 2% minimum mandated by Congress. A year ago, the capital reserves were 3%... Nearly one in five loans made in 2007 are seriously delinquent, the agency said.”

GSE Watch:

November 7 – Wall Street Journal (Nick Timiraos): “Freddie Mac said it didn’t need any additional federal aid for the second straight quarter as it reported a loss of $6.3 billion for the third quarter… But the company said it expected to ask for more handouts from the U.S. Treasury in the future… Together with Fannie Mae, which said… it would need a $15 billion capital injection, the tab for the U.S. government's bailout of both mortgage-finance giants has climbed over the past year to $112 billion, making it one of the costliest government interventions ever to stabilize housing and financial markets.”

Muni Watch:

November 11 – Financial Times (Nicole Bullock): “Some of the same financial troubles that have pushed California toward economic disaster are wreaking havoc in nine other states and posing a threat to the nascent recovery, according to research… ‘California’s fiscal problems are in a league of their own,’ says Susan Urahn, managing director of the Pew Center on the States… ‘but the Golden State is hardly alone.’ Arizona, Florida, Illinois, Michigan, Nevada, New Jersey, Oregon, Rhode Island and Wisconsin join California as the most troubled US states… For residents, fiscal problems have meant higher taxes, layoffs of state workers, longer waits for public services, more crowded classrooms and less support for the poor.”

November 12 – Bloomberg (Darrell Preston): “U.S. states, which are closing $250 billion of budget deficits, will be forced to grapple with diminished revenue until at least 2012, a survey of fiscal officials found. The only thing that kept states from ‘draconian’ spending cuts has been $135 billion of funding under President Barack Obama’s economic stimulus package, according to a report from the National Governors Associations and the National Association of State Budget Officers. Revenue fell 7.5% in fiscal 2009, forcing states to close budget gaps of $72.7 billion. ‘These are the worst numbers we’ve ever seen,’ said Scott Pattison, executive director of the budget directors group… ‘States have been forced to lay off and furlough employees, raise taxes, drain rainy day funds and sharply cut state spending.’”

New York Watch:

November 12 – Bloomberg (Ken Prewitt and Michael Quint): “New York legislators must act quickly to narrow a $10 billion, two-year budget deficit and solve a December cash squeeze, Governor David Paterson told Bloomberg radio. ‘Our actions have to be taken now, they must be stern, they must be swift,’ he said…”

November 11 – Bloomberg (Dan Levy): “Manhattan apartment rents fell as much as 9% in October from a year earlier… according to Citi- Habitats Inc. Average rents dropped for all apartment sizes and the vacancy rate rose 0.15 percentage point to 1.86%, the highest since November 2008…”

California Watch:

November 10 – Bloomberg (Michael Weiss): “California’s tax receipts rose $285 million, or 7.1%, from the prior year, Controller John Chiang said… ‘October’s receipts are a welcome break from a largely negative trend line for the last two years,’ Chiang said, noting the state’s overall cash position was $1.2 billion ahead of state projections.”

Speculation Watch:

November 10 – Bloomberg (Bei Hu): “Hedge fund assets may top the previous $2 trillion high by the end of next year as double-digit average returns lure investors, said Barry Bausano, Deutsche Bank AG’s global co-head of prime finance.”

Crude Liquidity Watch:

November 13 – Bloomberg: “Saudi Arabia… has started to expand and upgrade its oil and gas production and refining business at a cost of $100 billion to tap rising demand in Asia, Oil Minister Ali al-Naimi said. ‘China’s and Asia’s demand are projected to be met mainly from supplies from Saudi Arabia and other Gulf states,’ al- Naimi said…”

November 9 – Bloomberg (Zainab Fattah): “Saudi Arabia will face a ‘substantial’ housing shortage by 2015 as a growing population and rising employment fuel demand, Deutsche Bank AG said. The kingdom will require an estimated 1.2 million additional homes by 2015, compared with a projected supply of just 900,000..”

[url=http://peketec.de/trading/viewtopic.php?p=754836#754836 schrieb:golden_times schrieb am 15.11.2009, 13:50 Uhr[/url]"]Eric Sprott: Gold Momentum's Picking Up Dramatically

Source: The Gold Report,

Interviewed by Karen Roche, Publisher 11/13/2009

Although "quantitative easing" (QE) may be propping up the U.S. economy for the time being, it solves nothing. That's how Eric Sprott, Chief Executive Officer & Portfolio Manager of Sprott Asset Management and Chairman of Sprott Money Ltd., sees it. It's not just that QE shoves problems from the private sector into the public sector. It's worse than that, because as Eric tells The Gold Report readers, QE is "just debasing the currency which will eventually lead to hyperinflation." One upside though: "You can just feel the momentum in gold—it's picking up dramatically" and so too are prospects for a plethora of little-known small and mid-cap gold stocks..

http://www.theaureport.com/pub/na/3280

[url=http://peketec.de/trading/viewtopic.php?p=754842#754842 schrieb:golden_times schrieb am 15.11.2009, 15:07 Uhr[/url]"]Barrick shuts hedge book as world gold supply runs out

Global gold production is in terminal decline despite record prices and Herculean efforts by mining companies to discover fresh sources of ore in remote spots, according to the world's top producer Barrick Gold..

Aaron Regent, president of the Canadian gold giant, said that global output has been falling by roughly 1m ounces a year since the start of the decade. Total mine supply has dropped by 10pc as ore quality erodes, implying that the roaring bull market of the last eight years may have further to run.

"There is a strong case to be made that we are already at 'peak gold'," he told The Daily Telegraph at the RBC's annual gold conference in London.

"Production peaked around 2000 and it has been in decline ever since, and we forecast that decline to continue. It is increasingly difficult to find ore," he said..

http://www.telegraph.co.uk/finance/...hedge-book-as-world-gold-supply-runs-out.html

[url=http://peketec.de/trading/viewtopic.php?p=755758#755758 schrieb:Global_Investor schrieb am 17.11.2009, 13:39 Uhr[/url]"]Die aktuellen COT-Zahlen für Gold

[url=http://peketec.de/trading/viewtopic.php?p=757141#757141 schrieb:dukezero schrieb am 19.11.2009, 14:53 Uhr[/url]"]Bundesbank: Konjunkturelle Erholung gewinnt an Breite

FRANKFURT (dpa-AFX) - Die Erholung der Weltwirtschaft gewinnt nach

Einschätzung der Bundesbank zusehends an Breite. Die Konjunktur habe sich im

dritten Quartal gefestigt, heißt es im jüngsten Monatsbericht der Bundesbank vom

Donnerstag. Diese Entwicklung dürfte sich im Schlussquartal 2009 und zu

Jahresbeginn 2010 fortsetzen. Damit zeichne sich eine fundierte Erholung der

Weltwirtschaft ab.

Die stärksten Impulse kamen laut Bundesbank zuletzt von staatlichen

Konjunkturprogrammen, der expansiven Geldpolitik und dem Lageraufbau der

Unternehmen. Auch das Wachstum der Industrieproduktion habe sich deutlich

verstärkt. "Daneben hat auch der gestiegene Risikoappetit an den Finanzmärkten

die weltwirtschaftliche Dynamik gestützt." Regional seien die stärksten Impulse

aus den Schwellenländern gekommen.

Risiken für die weitere Entwicklung sieht die Bundesbank nicht zuletzt auf

Seiten der Finanzmärkte. Trotz der verbesserten Marktlage blieben Zweifel an der

Nachhaltigkeit der Erholung. So könne die größere Zuversicht der Marktteilnehmer

vor allem durch die milliardenschweren Konjunkturprogramme und die weltweit hohe

Liquidität getrieben sein. "Zur Vorsicht mahnt auch, dass die Volatilität an den

Märkten beiderseits des Atlantiks im Sommer etwas zunahm und gegenwärtig

weiterhin über ihren langjährigen Durchschnittswerten liegt."/bf/tw

[url=http://peketec.de/trading/viewtopic.php?p=758140#758140 schrieb:golden_times schrieb am 21.11.2009, 18:56 Uhr[/url]"]11 Ways To Cash In On Gold

Here's some hope for those who wish we could back to a gold standard.

Physical gold can now be posted as margin collateral with the CME Group for any exchange product..

http://www.businessinsider.com/11-w...09-10#1-enter-as-a-newbie-with-gold-jewelry-1

[url=http://peketec.de/trading/viewtopic.php?p=758141#758141 schrieb:golden_times schrieb am 21.11.2009, 19:02 Uhr[/url]"]

[url=http://peketec.de/trading/viewtopic.php?p=758142#758142 schrieb:golden_times schrieb am 21.11.2009, 19:03 Uhr[/url]"]

http://www.zerohedge.com/sites/default/files/SocGen - worst case debt scenario.pdf

[url=http://peketec.de/trading/viewtopic.php?p=758143#758143 schrieb:golden_times schrieb am 21.11.2009, 19:04 Uhr[/url]"]

[url=http://peketec.de/trading/viewtopic.php?p=758143#758143 schrieb:golden_times schrieb am 21.11.2009, 19:04 Uhr[/url]"]

[url=http://peketec.de/trading/viewtopic.php?p=758177#758177 schrieb:golden_times schrieb am 22.11.2009, 12:00 Uhr[/url]"]

Gold: Supply and Demand Continues to Evolve

Since 2001 gold has been on a bull run. The gold price has had to factor in the results of the credit crunch for the past 2 years. That means for the previous 6 years gold has been rising independent of the worries of investors looking for safe havens. In that time demand has risen from investors, jewellers and industry.

Today we take ourselves away from all the hype, from all the news being fed to us and try and decide whether the price of gold is justified. To weigh the decision we look at the textbook factors - supply and demand.

Has production declined? Well yes according to Barrick Gold's (ABX) president Aaron Regent. He told the the Telegraph recently that the global output had been dropping by 1 percent annually since the start of the decade and that there was "a strong case to be made that we are already at 'peak gold..'"

http://seekingalpha.com/article/174512-gold-supply-and-demand-continues-to-evolve

[url=http://peketec.de/trading/viewtopic.php?p=758180#758180 schrieb:golden_times schrieb am 22.11.2009, 12:03 Uhr[/url]"]Gold & Silver Daily: Marc Faber Says "Sky Will Be The Limit for Gold"

By Ed Steer

Published: November 19, 2009

http://www.gold-speculator.com/ed-s...r-says-sky-will-limit-gold-nov-19-2009-a.html

[url=http://peketec.de/trading/viewtopic.php?p=758181#758181 schrieb:golden_times schrieb am 22.11.2009, 12:07 Uhr[/url]"]Juniors Poised for Historic Bull Run

On October 07 The Gold Report conducted an interview with me just after gold broke out to new news above $1030. During that interview I made the case for $1300 gold by spring next year and advocated to be invested in high quality juniors which are poised for a multi year bull run that could even surprise the staunchest junior investors..

http://www.24hgold.com/english/cont...20&redirect=false&contributor=Eric+Hommelberg

[url=http://peketec.de/trading/viewtopic.php?p=758490#758490 schrieb:dukezero schrieb am 23.11.2009, 13:13 Uhr[/url]"]http://www.boerse-go.de/nachricht/Fed-Bullard-Keine-Zinserhoehung-vor-2012,a2011197.html%5B/img%5D

[url=http://peketec.de/trading/viewtopic.php?p=758495#758495 schrieb:Fischlaender schrieb am 23.11.2009, 13:19 Uhr[/url]"]Northern Miner

EDITOR’S PICKS: TOP STORIES OF WEEK 45

Juniors The Belles Of The Gold Ball

With gold prices hitting new record nominal highs almost daily, the first half of November was a great time to be a gold junior.

• Much like Barrick Gold in the old days, Goldcorp is once again getting a jump on the competition by snapping up a junior with a promising but relatively early stage grassroots gold project.

This time, the target is Canplats Resources and its two-year-old Camino Rojo gold-silver-lead-zinc project in Mexico’s Zacatecas state, and the offer is $238 million in shares. It’s all part of Goldcorp’s far-seeing effort to lock up satellite projects around its huge, new Penasquito polymetallic mine-and-mill complex, located 50 km from Camino Rojo.

• Another junior riding the gold wave is Brian Kiernan’s Moydow Mines International, which struck a deal to sell itself to royalty company Franco-Nevada for US$58 million in cash and shares. Franco is after Moydow’s 2% net smelter return royalty on the Ntotoroso portion of Newmont Mining’s Ahafo open-pit gold-mine complex in Ghana.

Moydow cleverly discovered Ntotoroso’s gold slightly off the main, 2-km-long Yamfo-Sefwi gold trend during the darkest days of the last gold bust. It subsequently sold its half interest in Ntotoroso in 2004 to Newmont for US$40 million, but retained the 2% royalty on any production in excess of 1.2 million oz. gold.

As of Sept. 30, 2009, 850,000 oz. gold had been recovered from the royalty property since production began in 2006, and Franco expects Moydow’s royalty to become payable in 2012.

Newmont had bought its first half-interest in Ntotoroso and its other, more-substantial Ahafo assets through its acquisition of Australia’s Normandy Mining in 2002. The Ahafo assets, situated in what at the time was an undeveloped belt, were almost an afterthought for Newmont, but they evolved over this decade into one of the pillars of the major’s gold-production empire.

• With new money for gold projects sloshing around Howe Street, Gleichen Resources in Vancouver was able to come out of nowhere to quickly close a $241.5-million special warrant financing and buy a 78.8% interest in the budding Morelos gold project in Mexico from Teck Resources.

• In fact, gold’s so hot that people are even throwing money at Gabriel Resources again. The erstwhile mine developer has been bogged down for more than a decade at its Rosia Montana gold project in Romania, but has been able to snag $67.5 million from a subsidiary of the Beny Steinmetz Group. This new investor is already active in other businesses in Eastern Europe and Africa, including diamonds, copper-cobalt, iron ore and bauxite, but this is its first big move into gold.

• There was more good news out of the troublesome Ecuadorian mining scene, with high-profile projects such Kinross Gold’s Fruta del Norte getting governmental approval to resume major exploration and development efforts. But caution is advised as there are still plenty of unknowns left regarding the country’s untested, new mining royalty structure.

• One of the trends in gold these days is that the central banks of more and more non-G7 countries are bulking up the gold content of their foreign-exchange reserves. On Nov. 11, it was Mauritius’ turn, with the central bank of the tiny island nation buying 2 tonnes of gold from the International Monetary Fund for US$71.7 million, and thereby boosting its gold holdings to 5.7% of its total foreign exchange reserves from 2.3% at end of October. The sale is part of the IMF’s third-quarter decision to unload 403.3 tonnes of gold — 200 tonnes of which was recently sold to India’s central bank.

Meanwhile, the IMF’s managing director, Dominique Strauss-Kahn, has reiterated his views that the world can no longer count on the U. S. dollar and that a new global currency might evolve out of the special drawing right — the IMF’s in-house accounting unit.

Consistent with IMF policy, he again urged the Chinese government to revalue the renminbi upwards. The RMB’s been pegged around 6.83 per dollar since July 2008, after having been raised 21% over the previous three years.

• Xstrata’s head honcho Mick Davis keeps on living large. Newly freed from insider-trading restrictions imposed during Xstrata’s recently dropped bid for Anglo American, Davis has cashed in three tranches of stock options first granted in 2001, when he became chief executive. His immediate profit? About US$23.4 million.

Davis reaps the benefit of Xstrata’s share price more than tripling since March, though shares are still off about 75% from pre-crash levels in mid-2008.

[url=http://peketec.de/trading/viewtopic.php?p=774640#774640 schrieb:golden_times schrieb am 26.12.2009, 20:11 Uhr[/url]"]Brent Cook on Successful Exploration Investing

No drill results? No worries. Good geology, good management, a good cash position and a good stock price are good enough to coax renowned exploration analyst (and geologist) Brent Cook into buying junior prospect generators and explorers. He finds his sweet spot being near the top of the batting order. If he waits for drill results to confirm what he expects them to reveal, he may miss the best time to buy. With year-over-year returns on his Exploration Insights portfolio averaging 80%—and one superstar at 10 times that!—Brent's clearly hit a few homers with his strategy. But in this exclusive interview, he cautions Gold Report readers against believing everything you read and hear. He says, "It's really, really critical to evaluate what a company's telling you."

http://www.24hgold.com/english/news...20&redirect=false&contributor=The+Gold+Report

[url=http://peketec.de/trading/viewtopic.php?p=774641#774641 schrieb:golden_times schrieb am 26.12.2009, 20:14 Uhr[/url]"]Fictional Reserve Lending And The Myth Of Excess Reserves

In A Case for the Inflation Camp Robert P. Murphy asks When Will the Inflation Genie Get Out of the Bottle? Murphy's concern is over "excess reserves"..

http://www.24hgold.com/english/news...5719990G10020&redirect=false&contributor=Mish

..

..