P.M. Kitco Metals Roundup: Gold Sees Modest Uptick Following Fed's Beige Book

Wednesday March 6, 2013 2:26 PM

(Kitco News) - Gold futures prices were trading modestly higher in the aftermath of Wednesday afternoon’s release of the Federal Reserve’s “beige” book. The bulls were relieved there were no hints in the report that the U.S. central bank might be putting the brakes on its present path of aggressive monetary policy stimulus. Short covering and some bargain hunting were featured in gold and silver late in the day Wednesday. Most of the day gold prices had not strayed too far from unchanged price levels as traders are looking for fresh news to drive the market. The gold and silver market bears still possess the firm near-term technical advantage, which continues to keep speculative buying interest squelched. April Comex gold last traded up $3.70 at $1,578.60 an ounce. Spot gold was last quoted up $3.90 at $1,580.25. May Comex silver last traded up $0.276 at $28.88 an ounce.

The Fed’s beige book said its reporting districts are seeing moderate to modest economic growth, and not at the pace which would suggest adjusting present U.S. monetary policy.

Arguably the most important U.S. economic report of the month, the employment situation report for February, is due out Friday morning. The key non-farm payroll number is expected to come in at up 157,000, while the unemployment rate is forecast at 7.8%. The European Central Bank also holds its monthly meeting and press conference on Thursday. While the ECB is expected to announce no major changes to its monetary policy, traders will closely scrutinize ECB chief Mario Draghi’s remarks at his press conference following the meeting.

The buzz of the market place Wednesday is the new all-time record high posted by the Dow Jones Industrial Average this week. The general media picked up on that news and featured it heavily Tuesday evening. The “risk-on” trader attitudes that are fueling the stock market rally are a bearish element for safe-haven gold. However, when the general media picks up on a trending market move, it’s an early clue that market move has probably just about run its course.

A German five-year bond auction Wednesday produced the lowest yields so far this year, which shows European investors are still wary regarding a flare-up in the EU sovereign debt crisis following the recent Italian elections that produced no clear victor. Fresh EU economic data released overnight showed EU exports dropped by 0.9% in the fourth quarter, compared to the third quarter. That’s the fastest quarterly drop in almost four years.

Reports overnight said South Korea’s central bank added around 20 metric tons of gold to its official reserves in February. That’s around a 25% increase in holdings by South Korea, as the country’s central bank does some value-buying.

The U.S. dollar index was higher Wednesday and hovering near a six-month high. The U.S. dollar bulls have good technical strength to suggest the dollar index can continue to trend higher in the near term. That’s another bearish underlying factor for gold and silver. Meantime, Nymex crude oil futures prices were weaker Wednesday and hovering near a two-month low. The crude oil bears have the near-term technical advantage, and that’s also a negative for gold and silver prices.

The London P.M. gold fixing is $1,574.00 versus the previous London P.M. fixing of $1,579.75.

Technically, April gold futures prices closed near mid-range Wednesday. Gold prices are still in a six-week-old downtrend on the daily bar chart. The gold bulls’ next upside near-term price breakout objective is to produce a close above solid technical resistance at last week’s high of $1,619.70. Bears' next near-term downside breakout price objective is closing prices below solid technical support at the February low of $1,554.40. First resistance is seen at this week’s high of $1,585.80 and then at $1,590.00. First support is seen at last week’s low of $1,564.00 and then at the February low of $1,554.40. Wyckoff’s Market Rating: 3.0

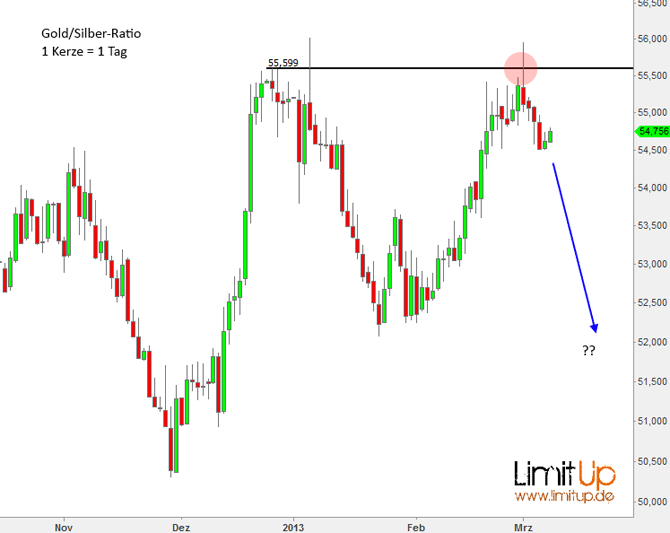

May silver futures prices closed near mid-range Wednesday. May silver bears have the near-term technical advantage. Prices are in a six-week-old downtrend on the daily bar chart. Bulls’ next upside price breakout objective is closing prices above solid technical resistance at last week’s high of $29.495 an ounce. The next downside price breakout objective for the bears is closing prices below solid technical support at last week’s low of $27.925. First resistance is seen at $29.00 and then at $29.19. Next support is seen at Wednesday’s low of $28.52 and then at the February low of $28.315. Wyckoff's Market Rating: 3.0.

May N.Y. copper closed down 200 points at 349.50 cents Wednesday. Prices closed nearer the session low and closed at a fresh four-month low close. Copper bears have the overall near-term technical advantage. Copper bulls' next upside breakout objective is pushing and closing prices above solid technical resistance at 360.00 cents. The next downside price breakout objective for the bears is closing prices below solid technical support at the November low of 343.75 cents. First resistance is seen at 352.50 cents and then at this week’s high of 354.45 cents. First support is seen at Wednesday’s low of 348.70 cents and then at last week’s low of 347.25 cents. Wyckoff's Market Rating: 3.0.

Wednesday March 6, 2013 2:26 PM

(Kitco News) - Gold futures prices were trading modestly higher in the aftermath of Wednesday afternoon’s release of the Federal Reserve’s “beige” book. The bulls were relieved there were no hints in the report that the U.S. central bank might be putting the brakes on its present path of aggressive monetary policy stimulus. Short covering and some bargain hunting were featured in gold and silver late in the day Wednesday. Most of the day gold prices had not strayed too far from unchanged price levels as traders are looking for fresh news to drive the market. The gold and silver market bears still possess the firm near-term technical advantage, which continues to keep speculative buying interest squelched. April Comex gold last traded up $3.70 at $1,578.60 an ounce. Spot gold was last quoted up $3.90 at $1,580.25. May Comex silver last traded up $0.276 at $28.88 an ounce.

The Fed’s beige book said its reporting districts are seeing moderate to modest economic growth, and not at the pace which would suggest adjusting present U.S. monetary policy.

Arguably the most important U.S. economic report of the month, the employment situation report for February, is due out Friday morning. The key non-farm payroll number is expected to come in at up 157,000, while the unemployment rate is forecast at 7.8%. The European Central Bank also holds its monthly meeting and press conference on Thursday. While the ECB is expected to announce no major changes to its monetary policy, traders will closely scrutinize ECB chief Mario Draghi’s remarks at his press conference following the meeting.

The buzz of the market place Wednesday is the new all-time record high posted by the Dow Jones Industrial Average this week. The general media picked up on that news and featured it heavily Tuesday evening. The “risk-on” trader attitudes that are fueling the stock market rally are a bearish element for safe-haven gold. However, when the general media picks up on a trending market move, it’s an early clue that market move has probably just about run its course.

A German five-year bond auction Wednesday produced the lowest yields so far this year, which shows European investors are still wary regarding a flare-up in the EU sovereign debt crisis following the recent Italian elections that produced no clear victor. Fresh EU economic data released overnight showed EU exports dropped by 0.9% in the fourth quarter, compared to the third quarter. That’s the fastest quarterly drop in almost four years.

Reports overnight said South Korea’s central bank added around 20 metric tons of gold to its official reserves in February. That’s around a 25% increase in holdings by South Korea, as the country’s central bank does some value-buying.

The U.S. dollar index was higher Wednesday and hovering near a six-month high. The U.S. dollar bulls have good technical strength to suggest the dollar index can continue to trend higher in the near term. That’s another bearish underlying factor for gold and silver. Meantime, Nymex crude oil futures prices were weaker Wednesday and hovering near a two-month low. The crude oil bears have the near-term technical advantage, and that’s also a negative for gold and silver prices.

The London P.M. gold fixing is $1,574.00 versus the previous London P.M. fixing of $1,579.75.

Technically, April gold futures prices closed near mid-range Wednesday. Gold prices are still in a six-week-old downtrend on the daily bar chart. The gold bulls’ next upside near-term price breakout objective is to produce a close above solid technical resistance at last week’s high of $1,619.70. Bears' next near-term downside breakout price objective is closing prices below solid technical support at the February low of $1,554.40. First resistance is seen at this week’s high of $1,585.80 and then at $1,590.00. First support is seen at last week’s low of $1,564.00 and then at the February low of $1,554.40. Wyckoff’s Market Rating: 3.0

May silver futures prices closed near mid-range Wednesday. May silver bears have the near-term technical advantage. Prices are in a six-week-old downtrend on the daily bar chart. Bulls’ next upside price breakout objective is closing prices above solid technical resistance at last week’s high of $29.495 an ounce. The next downside price breakout objective for the bears is closing prices below solid technical support at last week’s low of $27.925. First resistance is seen at $29.00 and then at $29.19. Next support is seen at Wednesday’s low of $28.52 and then at the February low of $28.315. Wyckoff's Market Rating: 3.0.

May N.Y. copper closed down 200 points at 349.50 cents Wednesday. Prices closed nearer the session low and closed at a fresh four-month low close. Copper bears have the overall near-term technical advantage. Copper bulls' next upside breakout objective is pushing and closing prices above solid technical resistance at 360.00 cents. The next downside price breakout objective for the bears is closing prices below solid technical support at the November low of 343.75 cents. First resistance is seen at 352.50 cents and then at this week’s high of 354.45 cents. First support is seen at Wednesday’s low of 348.70 cents and then at last week’s low of 347.25 cents. Wyckoff's Market Rating: 3.0.