Technical Trading: Physical Buying, Japan-Demand Seen For Gold

By Kira Brecht of Kitco News

Monday April 08, 2013 8:49 AM

(Kitco News) - Spot gold futures consolidated with a slightly weaker tone overnight in Europe as the market consolidated Friday's big gains. Recent days have triggered physical buying interest as nearby gold prices fell last week to levels not seen since June 2012.

Additionally, gold priced in yen has climbed to multi-year highs in overnight action. In Japan, Tocom six-month gold rallied through the important 5,000 yen a gram ceiling on Monday. Continued weakness in the Japanese yen, following last week's more aggressive than expected monetary easing from the Bank of Japan (BOJ) has heightened interest in gold there.

Gold traders will continue to eye the U.S. stock market. Equity prices stumbled last week following a weaker-than-expected U.S. jobs report, which also triggered speculation that U.S. quantitative easing would stay in place longer than previously expected.

Earnings season begins on Monday for U.S. stocks and if negative surprises trigger additional stock retreat, that could prove gold supportive.

Also Monday evening, gold traders will be eyeing a speech by Federal Reserve Chairman Ben Bernanke at an Atlanta Fed conference.

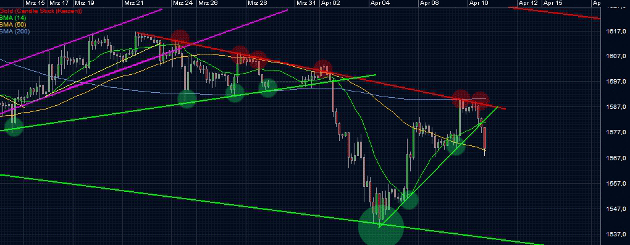

On the chart, New York Comex June gold futures are consolidating in narrow ranges ahead of the New York open. The short-term pattern is encouraging for the bulls. A "hammer" bottom formed on the Japanese candlestick chart at last week's probe down on April 4. That suggests at least a minor low has formed at the $1,539.40 low and that zone is major nearby support for the market. The bulls need that to hold to stabilize the contract.

Daily momentum has turned positive. The customized 9-day relative strength index (RSI), reveals a bullish turn in momentum. The RSI has turned higher from last week's oversold readings, and a potential momentum divergence is also seen with a higher momentum reading versus late February levels. Bullish price action this week would be needed to confirm the divergence.

On the upside, near term, important resistance lies at the $1,618.30-$1,620.60 zone. That represents a ceiling from late February and late March. A potential scenario near term could see the gold market moving into a sideways range trade between that resistance and support around $1,550. Stabilization and sideways range trade would be positive, as that would suggest the market has found a floor for now.

Sustained gains through the $1,620 region, if they were to occur this week, would be a very bullish technical development. But, sideways range trade could be the more likely scenario short-term.

By Kira Brecht of Kitco News

Monday April 08, 2013 8:49 AM

(Kitco News) - Spot gold futures consolidated with a slightly weaker tone overnight in Europe as the market consolidated Friday's big gains. Recent days have triggered physical buying interest as nearby gold prices fell last week to levels not seen since June 2012.

Additionally, gold priced in yen has climbed to multi-year highs in overnight action. In Japan, Tocom six-month gold rallied through the important 5,000 yen a gram ceiling on Monday. Continued weakness in the Japanese yen, following last week's more aggressive than expected monetary easing from the Bank of Japan (BOJ) has heightened interest in gold there.

Gold traders will continue to eye the U.S. stock market. Equity prices stumbled last week following a weaker-than-expected U.S. jobs report, which also triggered speculation that U.S. quantitative easing would stay in place longer than previously expected.

Earnings season begins on Monday for U.S. stocks and if negative surprises trigger additional stock retreat, that could prove gold supportive.

Also Monday evening, gold traders will be eyeing a speech by Federal Reserve Chairman Ben Bernanke at an Atlanta Fed conference.

On the chart, New York Comex June gold futures are consolidating in narrow ranges ahead of the New York open. The short-term pattern is encouraging for the bulls. A "hammer" bottom formed on the Japanese candlestick chart at last week's probe down on April 4. That suggests at least a minor low has formed at the $1,539.40 low and that zone is major nearby support for the market. The bulls need that to hold to stabilize the contract.

Daily momentum has turned positive. The customized 9-day relative strength index (RSI), reveals a bullish turn in momentum. The RSI has turned higher from last week's oversold readings, and a potential momentum divergence is also seen with a higher momentum reading versus late February levels. Bullish price action this week would be needed to confirm the divergence.

On the upside, near term, important resistance lies at the $1,618.30-$1,620.60 zone. That represents a ceiling from late February and late March. A potential scenario near term could see the gold market moving into a sideways range trade between that resistance and support around $1,550. Stabilization and sideways range trade would be positive, as that would suggest the market has found a floor for now.

Sustained gains through the $1,620 region, if they were to occur this week, would be a very bullish technical development. But, sideways range trade could be the more likely scenario short-term.