See weak June gold ETF demand; invest 5-15% in it: Goldman

On the back of the rupee weakness, Sanjiv Shah of Goldman Sachs Asset Management sees the demand for gold ETFs falling in June.

Sanjiv Shah, Executive Director ,Goldman Sachs

More about the Expert...

Gold has slid the most among all asset classes in the past one year and gave negative returns of -9.44 percent. The rupee's steep weakening against the dollar has taken the shine off from gold ETF as an investment option; it will lack demand in June as well, says Sanjiv Shah of Goldman Sachs Asset Management.

"There are a couple of issues why people are redeeming from ETFs. Firstly, because the gold sentiment in the world is coming down and now, people are seeing what has happened to the gold price worldwide. The other issue is because the rupee is depreciating,” adds Shah in an interview to CNBC-TV18.

Additionally, Shah recommends investors to allocate between 5 to15 percent of their portfolio in the yellow metal given the rupee weakness and gold’s price volatility.

Below is the edited transcript of Shah’s interview to CNBC-TV18.

Q: In terms of data, can you give us either a monthly or a quarterly break-up of fresh money flowing into gold ETFs- if you could compare January-February-March up until June. Is there a trend of receding, increasing?

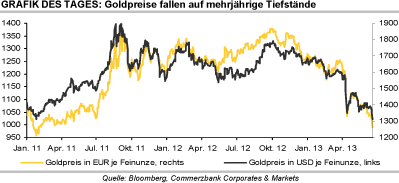

A: One has seen global ETFs, gold ETFs actually redeeming. We have seen what has happened to the gold prices around the world. But given the fact that the rupee is depreciating, the gold prices in India have not come down so substantially. They have come down, but if one looks in the last six months, the fall in gold is not as much as on the gold prices outside because of the rupee depreciation.

In India, in our festival- Akshaya Tritiya which was in May so, we saw a huge spike up in terms of demand around that time because most of the Indians buy their gold around this time. We see the highest month where the consumption of gold really increases. But if one looks at pre and post that, we have seen certain amount of people not buying into the gold market.

There is couple of issues why this is happening. One is obviously the fact that the gold sentiment in the world is coming down. People are seeing what has happened to the gold price worldwide. The second issue is that rupee is depreciating, fine, but one of the big reasons why Indian buy gold is the fact that basically it is a kind of a hedge against the rupee and hedge against inflation.

Q: Why don’t you give us some numbers or how the assets under management (AUM) or fresh inflows moved any two months that you can compare January and May?

A: If one looks at AUMs as in rupees it is very similar, it will be very similar because of the fact that there is fresh inflows.

Q: AUMs would be distorted by the current price of gold- but if you only looked at inflows how was it?

A: Inflows have not been. If one looks at January to now, they will be positive but if one looks at end of May to now, it will be negative because of the fact that post Akshaya Tritiya we have seen some amount of inflows come down.

Q: If you compare on a year-on-year basis have you started seeing some inflows?

A: Last year there was a huge inflow in gold. I would say 2011 and 2012 were the years where one saw huge amount of money coming in to the gold market- the ETFs, physical gold. But I think 2013 has tempered the flow of investment in gold.

Q: Any percentages in terms of ETFs?

A: ETFs is a very small aspect of the market. So, when one looks at ETFs, it kind of distorted because one sees flows coming into ETFs. That is also because of the fact that one sees people who are buying physical jewellery and physical coins, not buying it and coming to ETFs.

I wouldn’t compare it and say that it is a very large market. I would be careful about seeing positive flows into ETF saying that, that is a trend in the gold market. But if one looks at what is happening in terms of the gold investments, most of the people have gold investments and that has actually risen as compared to the equity markets. So, the percentage of gold in their portfolio has gone up quite substantially.

One of the advices that one would give is that one should have gold to a certain extent. If one’s portfolio is already high up on gold, then maybe they have started thinking that they have to diversify their investments into other assets.

Q: Could you give us some figures about what the redemption could be in the gold ETFs say in the month of April-May and any kind of trend that you are expecting on redemption size as gold perhaps stays stable at these levels of Rs 28,000? Wouldn’t net asset value (NAV) have fallen- can you chart the NAVs from a year ago to now?

A: NAVs would have fallen but they have not fallen as much as the gold prices have fallen internationally. If one looks at the international prices, they have fallen about 25-30 percent- because of the rupee depreciation, the NAVs have fallen in India about 15 percent.

On the back of the rupee weakness, Sanjiv Shah of Goldman Sachs Asset Management sees the demand for gold ETFs falling in June.

Sanjiv Shah, Executive Director ,Goldman Sachs

More about the Expert...

Gold has slid the most among all asset classes in the past one year and gave negative returns of -9.44 percent. The rupee's steep weakening against the dollar has taken the shine off from gold ETF as an investment option; it will lack demand in June as well, says Sanjiv Shah of Goldman Sachs Asset Management.

"There are a couple of issues why people are redeeming from ETFs. Firstly, because the gold sentiment in the world is coming down and now, people are seeing what has happened to the gold price worldwide. The other issue is because the rupee is depreciating,” adds Shah in an interview to CNBC-TV18.

Additionally, Shah recommends investors to allocate between 5 to15 percent of their portfolio in the yellow metal given the rupee weakness and gold’s price volatility.

Below is the edited transcript of Shah’s interview to CNBC-TV18.

Q: In terms of data, can you give us either a monthly or a quarterly break-up of fresh money flowing into gold ETFs- if you could compare January-February-March up until June. Is there a trend of receding, increasing?

A: One has seen global ETFs, gold ETFs actually redeeming. We have seen what has happened to the gold prices around the world. But given the fact that the rupee is depreciating, the gold prices in India have not come down so substantially. They have come down, but if one looks in the last six months, the fall in gold is not as much as on the gold prices outside because of the rupee depreciation.

In India, in our festival- Akshaya Tritiya which was in May so, we saw a huge spike up in terms of demand around that time because most of the Indians buy their gold around this time. We see the highest month where the consumption of gold really increases. But if one looks at pre and post that, we have seen certain amount of people not buying into the gold market.

There is couple of issues why this is happening. One is obviously the fact that the gold sentiment in the world is coming down. People are seeing what has happened to the gold price worldwide. The second issue is that rupee is depreciating, fine, but one of the big reasons why Indian buy gold is the fact that basically it is a kind of a hedge against the rupee and hedge against inflation.

Q: Why don’t you give us some numbers or how the assets under management (AUM) or fresh inflows moved any two months that you can compare January and May?

A: If one looks at AUMs as in rupees it is very similar, it will be very similar because of the fact that there is fresh inflows.

Q: AUMs would be distorted by the current price of gold- but if you only looked at inflows how was it?

A: Inflows have not been. If one looks at January to now, they will be positive but if one looks at end of May to now, it will be negative because of the fact that post Akshaya Tritiya we have seen some amount of inflows come down.

Q: If you compare on a year-on-year basis have you started seeing some inflows?

A: Last year there was a huge inflow in gold. I would say 2011 and 2012 were the years where one saw huge amount of money coming in to the gold market- the ETFs, physical gold. But I think 2013 has tempered the flow of investment in gold.

Q: Any percentages in terms of ETFs?

A: ETFs is a very small aspect of the market. So, when one looks at ETFs, it kind of distorted because one sees flows coming into ETFs. That is also because of the fact that one sees people who are buying physical jewellery and physical coins, not buying it and coming to ETFs.

I wouldn’t compare it and say that it is a very large market. I would be careful about seeing positive flows into ETF saying that, that is a trend in the gold market. But if one looks at what is happening in terms of the gold investments, most of the people have gold investments and that has actually risen as compared to the equity markets. So, the percentage of gold in their portfolio has gone up quite substantially.

One of the advices that one would give is that one should have gold to a certain extent. If one’s portfolio is already high up on gold, then maybe they have started thinking that they have to diversify their investments into other assets.

Q: Could you give us some figures about what the redemption could be in the gold ETFs say in the month of April-May and any kind of trend that you are expecting on redemption size as gold perhaps stays stable at these levels of Rs 28,000? Wouldn’t net asset value (NAV) have fallen- can you chart the NAVs from a year ago to now?

A: NAVs would have fallen but they have not fallen as much as the gold prices have fallen internationally. If one looks at the international prices, they have fallen about 25-30 percent- because of the rupee depreciation, the NAVs have fallen in India about 15 percent.